ON

010 2022 PULSE

THE FUTURE CRYPTO WORLDWIDE READINESS COUNTRIES THAT ARE MOST PREPARED FOR CRYPTOCURRENCY ADOPTION P.14 ANALYSIS SCAN TO SEE HIGHLIGHTS OF THE FIRST GB TECH WEB3 AWARDS HELD IN SEPTEMBER VIA A SPECIAL AUGMENTED REALITY EXPERIENCE In partnership with Crypto Oasis CRYPTO MEHDI CHERIF, CO-FOUNDER AND CEO OF PULSE MUSIC, ON HOW BLOCKCHAIN TECHNOLOGY IS REVOLUTIONISING THE MUSIC INDUSTRY P.26 CRYPTO OASIS ECOSYSTEM REPORT 2022 An in-depth showcase of the region’s current Web3 landscape P.48 COOL CRYPTO TOYS Fab collectibles for your crypto collection

gbtechawards.gulfbusiness.com Honouring the trailblazers of the tech community in the Middle East and Africa SUPPORTED BY BROUGHT TO YOU BYSPONSORED BY PRESENTED BYHOSPITALITY PARTNER Nominations close on October 14th, 2022

METAVERSE: THE NEXT-GEN

How the metaverse is becoming

our physical

2022

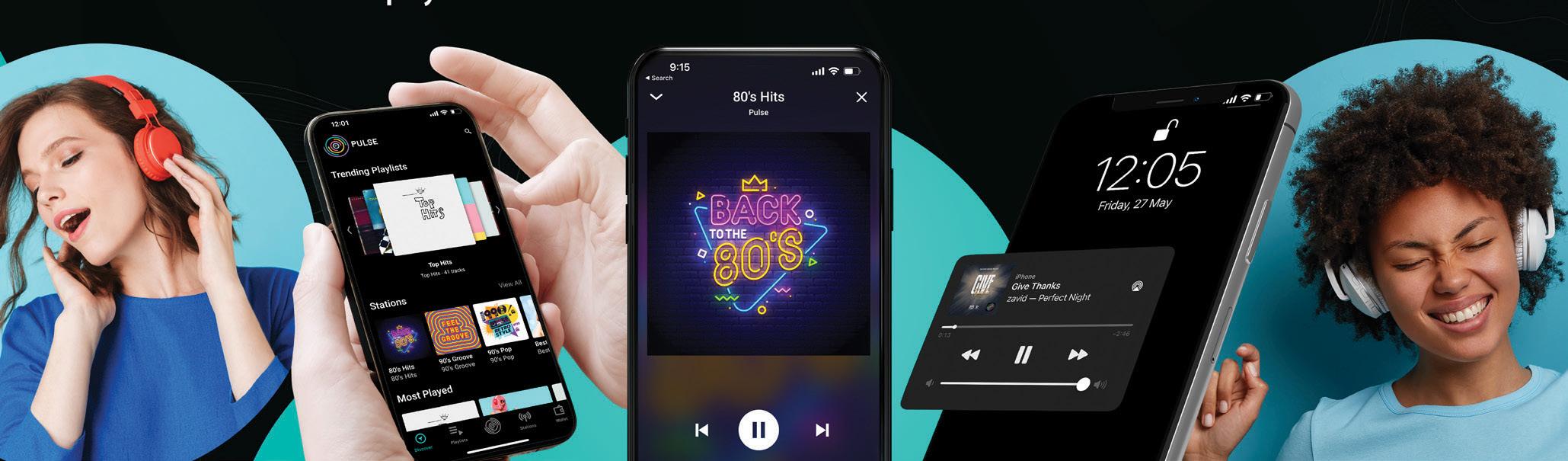

MOVING TO THE BEAT

Music streaming platform Pulse is using the power of blockchain to disrupt the music industry

Here are the top six emerging developments

Arte, the Web3 meta-community initiative by Crypto Oasis offers a platform for local and international communities and individuals to come together to collaborate, create and connect”

—RALF GLABISCHNIG Founder, Crypto Oasis

10 2022 3

INTERNET

a seamless extension of

world WHAT ARE THE LATEST TRENDS IN THE METAVERSE?

32 08 16 CONTENTS 10

In Association with THE LARGEST AND MOST IMMERSIVE BLOCKCHAIN, CRYPTO, AND WEB3.0 EVENT IN THE MENA REGION SHOW TIMINGS Monday, 10 October | 11am to 5pm Tuesday, 11 October to Thursday, 13 October | 10am to 5pm 10-13 OCT 2022 10-14 OCT 2022 ZABEEL HALL 4 DUBAI WORLD TRADE CENTRE FUTUREBLOCKCHAINSUMMIT.COM Headline Sponsor Gold Sponsors Silver Sponsors Strategic Sponsors

BLOCKCHAIN TRENDS

Blockchain advocates have long been excited about distributed ledger technology’s potential for cybersecurity, financial ser vices, internet-of-things (IoT), real estate and supply-chain management. As we look ahead to 2023, some other interesting markets are worth watching for the latest trends in block chain use. Here are four industries I believe will accelerate blockchain adoption to their great advantage.

CLOUD SERVICES

The worldwide public cloud services market, including infrastructure-as-a-service, plat form-as-a-service, and software-as-a-service, generated $408.6bn in 2021 revenues, accord ing to International Data Corporation. While the cloud services industry is still young, this tremendous growth drive innovation. For example, “cloud storage is another sector that blockchain can electrify and change. Traditionally, cloud storage companies allow users to purchase a certain amount of storage that is generally sold by the terabyte,” explains a recent article on InvestmentBank.com. It also stated that “blockchain technology provides users with a means to store information on a peer-to-peer network. A cloud storage platform could be run by the nodes that help facilitate transactions. The nodes would be giving up

BLOCKCHAIN TRENDS TO LOOK FOR IN 2023

FROM IT TO FINANCIAL SERVICES, GOVERNMENT, HEALTHCARE AND OTHER

HOW WE

6 10 2022 FEATURES

INDUSTRIES, BLOCKCHAIN IS CHANGING

DO BUSINESS AND SHARE INFORMATION

storage on their computers to the consumer, but the node owners would be compensated by the consumers for storing their data”.

More broadly, for cloud services, blockchain brings greater privacy and security capabilities. When cloud computing is integrated with blockchain technology, the main problem, security and privacy get addressed. Data deletion from one computer does not erase data stored on other devices on a blockchain network. As a result, there is no danger of data loss or alteration. Data on a blockchain is irremovable.

Such elevated privacy, security and automation can quickly advance cloud computing – not only delivering greater benefits to consumers but potentially lowering costs and overhead for providers.

GOVERNMENT

Governments are likely to begin implementing distributed ledger technology (DLT) systems that will replace traditional paper-based systems. The migration to digital data systems has been going on for quite some time, but DLT has greater advantages that provide better trust, transparency and security via encryption and validation features.

Government organisations can readily improve constituent communications and administration with the innovative adoption of blockchains. For example, blockchain can improve:

• Form processing and chain-ofcustody tracking of government documents

• Identification and elimination of

errors in government documents, plus reduce tampering and detect forgery.

• Operational e ciency by eliminating paper-based records.

• Cost controls by reducing the expense of manually processing applications, forms and documentation of all kinds and instead implementing digital records stored on the blockchain.

LAW

As blockchain transforms government, so it will transform the law and legal services. There are many ways blockchain technology is already transforming legal services. Smart contracts, dispute resolution, IP rights...where the blockchain can support evidence of creation, first use and rights management, and can track distribution. This ultimately prevents copyright infringement and enforces mitigation via time-stamped copies of work, aiding plainti s if appearing before a court.

Meanwhile, contract lifecycle management solutions help attorneys to manage the complex and evolving nature of contracts – making them more e cient at producing, executing and upholding contractual agreements. As transactions and records

move to digital workflows, digital signing ceremonies and digital storage, blockchain will be a boon to law firms and legal department in 2023 and beyond.

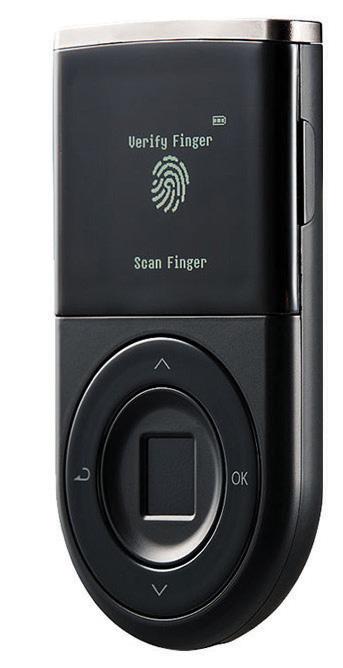

IDENTITY

Finally, with the move to digital commerce and communications, our individual identity – as mapped to digital worlds – becomes increasingly important to control and authenticate.

Identity systems are currently flawed in a number of ways. They are porous, operate in isolation and are prone to error. Blockchain systems can solve these problems and provide a single source to verify identity and assets. Blockchain identity can also o er a type of ‘self-sovereignty’ that hasn’t existed before.

This desire for control over one’s personal information – and digital data across platforms – lies at the heart of Web3. While Web3 starts with blockchain, its ambition and scope will spread far across the Internet, metaverses and shared networks.

IDENTITY SYSTEMS ARE CURRENTLY FLAWED IN A NUMBER OF WAYS

From cloud services, cybersecurity, and IT to financial services, government, healthcare, legal services, real estate, supply chains and other industries, blockchain is changing how we do business, share information, and identify ourselves.

These trends are just the start, and the opportunities for blockchain to improve the privacy and security of our digital data will flourish in the years ahead.

10 2022 | 7 GULF BUSINESS CRYPTO

Shamsh Hadi, CEO and co-founder, ZorroSign

Identification and credentials are easier for everyone to work with when they’re digital: vaccination cards, academic qualifications, occupational licences, employee ID and more. But this highly personal information must remain private and secure”

BOLD ERA

W

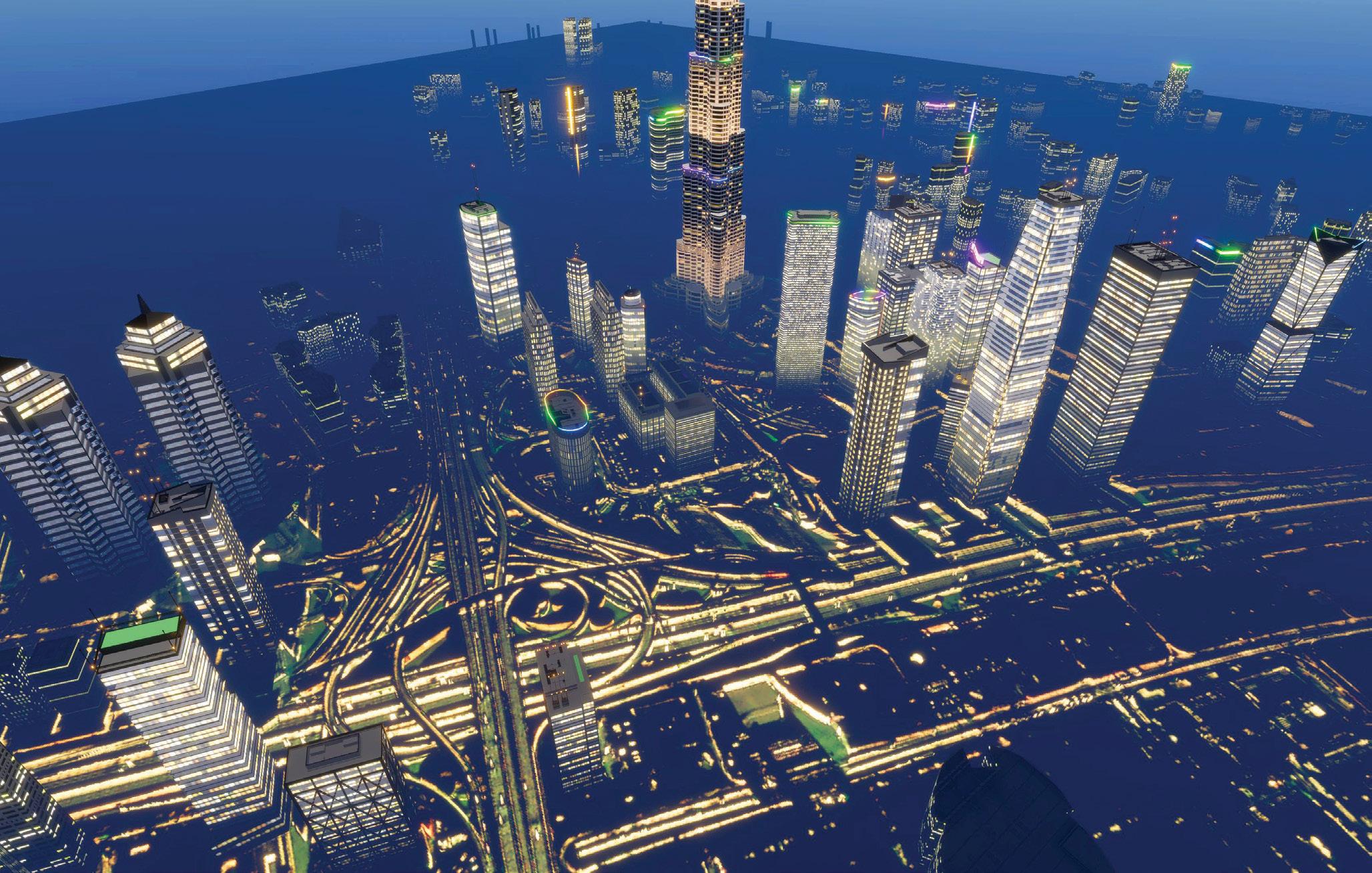

e live in an era of change where the Internet as we know is being entirely reshaped. In the next iteration of the Internet – Web3, users are not just viewers – they can engage in an immersive multi-dimensional experiences, the so called ‘metaverse’.

But what exactly is Web3 and metaverse? In simple words, we are moving towards an immersive web – instead of creating a website, businesses will have to create virtual expe riences to engage with their customers and provide an online immersive virtual workplace for their employees.

Web3 is the third generation of the Internet, and it’s built on the philosophy that the Internet should be a decentralised network of computers rather than a centralised one. This means that there is no single point of failure and no central authority controlling the flow of information.

The metaverse is not to be confused with Web3, which is the third stage of development of the World Wide Web. The metaverse refers to many three-dimensional, immersive virtual

8 10 2022 FEATURES THE NEW ERA OF INTERNET

NAVIGATING THE NEW,

OF 3D INTERNET AS THE TECHNOLOGY MATURES, THE METAVERSE WILL BECOME A SEAMLESS EXTENTION OF OUR PHYSICAL WORLD, GIVING US NEW METHODS TO CARRY OUT ALL OF OUR DAILY ACTIVITIES

worlds where people can create avatars to represent themselves, buy and sell virtual land, build them, create games and organise concerts and events or virtual stores to sell digital assets and interact with other users in real-time.

The open metaverse is a decentralised and interoperable multiverse, where users will be able to own and use their digital assets, identity and personal data in a frictionless way across multiple platforms.

The metaverse allows people to have real-time interactions and experiences across distance and is quickly becoming the next digital frontier that everyone want to conquer.

So far companies are exploring the metaverse to improve customer experience through the creating of interactive immersive experiences, and generate revenue growth by setting up virtual stores and selling digital assets tied to a physical one or any other utility.

For example Nikeland, which is the sporting goods brand’s micro metaverse built in Roblox, has attracted 6.7 million people from 224 countries since its launch in November. The space allows users to try on virtual products and buy them as NFTs.

STRENGTHENING ONLINE PRESENCE

To enter the metaverse first buisnesses must start by strengthening their online presence and then choose the right metaverse depending on their target audience.

The questions that brands should start with as they explore metaverse opportunities include: What is my purpose? Who are my customers, and what do they value?

If the brands are looking to target younger audiences for example, using platform like Roblox there are several aspects to keep in mind, namely if the brand is innovative, culturally relevant and aligned with the needs of these communities. It’s equally important to focus on entertainment, authenticity, and creativity as core selling points.

Businesses must do a thorough research of the top metaverses and have a deep understanding of the audiences they attract, the products or services that are most needed there and how their business can fit into the virtual world.

DUBAI METAVERSE STRATEGY

Companies are exploring Web3 and the metaverse to achieve revenue growth, competitive advantage, and improved customer experience. Governments are leveraging the metaverse to create virtual twin cities that will enhance their citizens well-being and help create eco friendly smart cities.

The Dubai Metaverse Strategy aims to turn Dubai into one the world’s top 10 metaverse economies as well as a global hub for the metaverse community. The strategy seeks to attract more

THE DUBAI METAVERSE STRATEGY AIMS TO TURN DUBAI INTO ONE THE WORLD’S

TOP 10 METAVERSE ECONOMIES

Leila Hurstel, chief metaverse officer, Verse Estate and founder, AllStarsWomen DAO

than 1,000 companies in the fields of blockchain and metaverse, to support more than 40,000 virtual jobs by 2030 and supports development of Web3 technology and its applications to create new governmental work models and growth in vital sectors including tourism, education, retail, remote work, healthcare, and the legal sector.

Governments can leverage the metaverse to upgrade the e ciency and quality of public services. The metaverse has the potential to make available seamless and frictionless citizen services and applications 24×7 anywhere and everywhere. Also, it can enable enhanced communication and engagement between the government and its people.

The metaverse o ers as well novel ways to generate employment, impart education, deliver healthcare and map urban planning.

THE WAY FORWARD

As the technology matures, the metaverse will become a seamless extention of our physical world and will allow us beyond gaming to find new and enhanced ways to do all our current activities, including commerce, entertainment and media, education and training, manufacturing and enterprise in general. Enterprise use cases of the metaverse in the coming years will likely include internal collaboration, client contact, events and conference, engineering and design, and workforce training.

10 2022 | 9 GULF BUSINESS CRYPTO

Businesses must do a thorough research of the top metaverses and have a deep understanding of the audiences they attract, the products or services that are most needed there and how their business can fi t into the virtual world”

WHAT DO THEY DO ALL DAY?

esque digital avatar.

While Leon isn’t human, companies are increasingly hiring real people to help them navigate the so-called “meta-jungle.” Firms as varied as consumer-products giant Procter & Gamble Co., talent manager Creative Artists Agency, Spanish telecom carrier Telefonica, luxury-goods maker LVMH and wedding-registry retailer Crate & Barrel have all decided they need a chief metaverse officer.

Though a recent tech-sector downturn has hit metaverse stalwarts like Meta Platforms and Roblox particularly hard, it hasn’t stopped firms from doling out million-dollar pay days to new executives as a down payment to secure their digital future.

10 | 10 2022 FEATURES METAVERSE C-SUITE

APPEARED AT VIDEOGAME MAKERS, WHERE IMMERSION IN A DIGITAL UNIVERSE IS CENTRAL TO THE PRODUCTS

CHIEF METAVERSE OFFICERS:

DIGITAL FOMO

Chief metaverse officers first appeared at video-game makers, where immer sion in a digital universe is central to the products. But the role has been popping up at more staid institutions dipping their toes into Web3.

Many big companies moved too slowly to embrace other technology, and history isn’t kind to latecomers. At Walmart in the late ’90s, e-commerce wasn’t taken seriously. Its website was initially set up under a stand-alone company. Store managers blanched at putting the site’s URL on shopping bags, for fear of sacrificing in-person sales. Such dismissal and delay opened a window that Amazon.com Inc. exploited to become a giant.

Call it metaverse FOMO. Bosses feel it. Crate & Barrel Holdings CEO Janet Hayes said it’s “essential” that the com pany has “an impactful presence in the metaverse.” Walt Disney chief Bob Chapek said the metaverse will “create an entirely new paradigm for how audiences experience and engage with our stories.” At CAA, it will influence “shifts in content creation, distribution and community engagement that drive significant opportunity for our clients,” President Jim Burtson said.

Translating that talk into action is the job of executives like P&G’s Ioana Matei, whose title is head of emerg ing and immersive technologies, and LVMH’s Nelly Mensah, vice president of digital innovation and emerging solutions at the home of Fendi and Bul gari. Disney’s man in the metaverse,

Shifts in content creation, distribution and community engagement that drive significant opportunity for our clients”

Mike White, is senior vice president in charge of next-generation storytelling and consumer experiences. At Publicis, Leon the avatar acts as an “ambas sador and guide” in the metaverse, a spokeswoman said, while in real ity the company has more than 1,000 employees creating Web3 experiences for clients.

WINNING OVER METAVERSE SKEPTICS

The ideal metaverse chief can speak as fluently about AR and VR as she can about sales and marketing, according to Cathy Hackl, who helps compa nies set up their meta-business units and claims to be the “world’s first chief metaverse officer” — a title she bestowed upon herself.

Metaverse chiefs need to forge external partnerships and win over internal skeptics, adds Wendy Doul ton, managing partner at Katalyst Group, a consumer tech recruitment firm. Joanna Popper is one example: The newly minted chief metaverse officer at Creative Artists Agency hails from HP, where she ran its virtual-real ity efforts, working with studios like Disney and Paramount. Earlier, she held roles in marketing, consulting and investment banking. CAA, whose Hol lywood clients include actors Tom Hanks and Reese Wither spoon, also represents NFT artists like Micah Johnson and, through a separate partner ship, has invested in metaverse entities such as NFT market place OpenSea.

Popper said her role is to “build a metaverse strategy” by making invest ments, partnerships

and content on behalf of clients. Pop per’s unique skill set is the reason why chief metaverse officers can attract compensation packages upwards of $1.5m, say those with knowledge of their contracts.

Another approach is to simply tap someone internally who gives the organisation a bit of credibility in the metaverse, as Crate & Barrel did.

EARLY INNINGS OF THE METAVERSE

Meta, the tech giant formerly known as Facebook that rebranded to emphasise its pivot to what CEO Mark Zuckerberg calls “the next frontier,” is slowing the pace of long-term investments after the company’s first-ever quarterly rev enue decline.

Shares of computer-graphics chipmaker Nvidia, which wants its omniverse platform to undergird the metaverse, have fallen by more than half this year as demand for PCs declines. Roblox, the video-game platform that houses immersive expe riences for brands including Gucci, Chipotle and Ralph Lauren, also deliv ered disappointing results, with daily users falling short of expectations.

Crypto winter is upon us, purchases of NFTs have slowed, and increas ingly cost-conscious companies need to focus on what will actually make them money. CAA’s Popper said the down turn actually creates an “opportune time” to build. “This is early innings in a long extra-inning game.”

Whether these early evangelists will still be there in the later innings is unclear. Just because they got the role “does not mean they are prepared to lead it for the next 5 to 10 years,” said Nada Usina, an executive adviser and recruiter at Russell Reynolds Associ ates. In other words, Leon better watch his virtual back. It’s a jungle out there.

Bloomberg

10 2022 11 GULF BUSINESS CRYPTO

IS THE CRYPTO CRISIS GOOD FOR THE SYSTEM?

W

ith digital assets, we are witnessing the rise of a new and nascent asset class built on a technology that has the potential to revolutionise the global financial system. This year, both topdown macroeconomic and bottom-up crypto-specific headwinds have been blowing strongly for digital assets resulting in the biggest ever drawdown in terms of the level of value destruction we have seen in the space.

CENTRAL BANKS

Since the initial announcement from the US Federal Reserve in November 2021 to taper their asset purchases and tighten monetary policy, risk assets have su ered from strong selling pressure. As a high volatility asset class, digital assets were not immune to this pivot away from risk assets, which ultimately saw the total market capitalisation fall by around two-thirds from the peak. Therefore, during the first few months of this year, top-down macroeconomic factors rather than token-specific factors were thus in the

12 10 2022 FEATURES DIGITAL ASSETS

Top-down macroeconomic and bottom-up crypto-specific headwinds have been blowing strongly for digital assets resulting in the biggest ever drawdown

driving seat for cryptos. As the crosscrypto correlation have remained elevated since the initial tapering announcement, there was no place to hide as almost all tokens moved lower in lockstep. Furthermore, we believe that these elevated correlations amongst the leading tokens suggests a currently low level of sophistication and di erentiation between the value propositions of di erent digital assets.

STABLECOIN SHAKEDOWN

Stablecoins initially attracted investors with the touted benefits of decentralisation and blockchain technology, while mitigating the infamous volatility of freefloating cryptos such as Bitcoin and Ethereum. While there are many di erent types of stablecoins, one of the increasingly popular methods of construction became algorithmic stablecoins. These instruments rely on complex automated mechanisms and incentive structures to maintain their 1:1 peg with the underlying fiat currency, without holding fiat-denominated cash or near cash securities.

THE DEFI LIQUIDITY CRISIS

a very big chunk of their TVL drop as investors were spooked by the TerraUSD collapse, driving them to exchange tokens held in lending pools into stablecoins, with the ultimate intention to cash out into more secure fiat currencies.

WALL STREET SPILLOVER

With digital assets becoming increasingly accepted as a new asset class, the last months and years have seen an increasing number of institutional investors warming up to digital assets. This push by institutional investors such as hedge funds and other asset managers into digital assets has not gone unnoticed by the Wall Street, with several high-profile banks rapidly building up their digital asset’s expertise and capabilities.

$3.5bn

The total value of crypto assets locked into DeFi protocols, so called TVL, is one of the main metrics that investors use to gauge the level of activity and overall value in the DeFi ecosystem. In this regard, we have seen a dramatic decline in values since the beginning of the year, with the overall TVL falling from over $250bn to well below the $100bn level at present. Lending protocols in particular saw

Three Arrows Capital was the first high-profile name to report significant losses from their crypto trading activities. In mid-June, with significant exposure to the Terra/Luna ecosystem and other leading crypto assets, reports started to emerge that the hedge fund had failed to meet a series of margin calls. As the fund filed for bankruptcy, records indicating creditor claims of $3.5bn, as well as estimated losses running into billions of US dollars over the 2021-22 period, marking one of the largest hedge fund trading losses of all time.

DOES IT MAKE SENSE TO HOLD CRYPTO IN A PORTFOLIO?

When considering the recent crypto crisis and its multiple episodes, the

question now arises: Is there still merit in holding cryptos and, if so, what proportion of a portfolio should be allocated to digital assets? Due to the nascent nature of the asset class, we have based our analysis on Bitcoin, which is the largest, most established, and most mature crypto coin.

CONCLUSION

All in all, we continue to see crypto primarily as a return enhancer in a portfolio. Historically, this assessment is backed by the fact that the addition of cryptos to a portfolio beyond a small weight of 1 per cent or less has caused an increase in realised returns as well as realised volatility. Allocations up to 5 per cent may be appropriate for risk seeking investors, while higher allocations would cause a significant change in the portfolio’s characteristics and may ultimately result in lower riskadjusted returns.

We thus maintain our view that cryptos are only suited for investors who have the ability and willingness to bear the related risks. However, these risks could be rewarded with very appealing returns due to the potential disruptive power that we see primarily in the world of decentralised finance. Risk seekers should also exercise caution, as digital assets are still a very unregulated area. Rising regulation should instill trust in the asset class and ultimately foster adoption. Due diligence is key: if something seems too good to be true, it probably is.

10 2022 13 GULF BUSINESS CRYPTO

Sipho Arntzen, next generation research analyst, Julius Baer

AS THE FUND FILED FOR BANKRUPTCY, RECORDS INDICATING CREDITOR CLAIMS OF

As the cross-crypto correlation have remained elevated since the initial tapering announcement, there was no place to hide as almost all tokens moved lower in lockstep”

14 10 2022 WORLDWIDE CRYPTO READINESS WHICH COUNTRIES ARE THE MOST PREPARED FOR CRYPTOCURRENCY ADOPTION? THE COUNTRIES WITH THE MOST BLOCKCHAIN STARTUPS THE COUNTRIES WITH THE MOST INTEREST IN CRYPTO AUSTRALIA IRELAND UNITED KINGDOM UAE CANADA UNITED STATES CROATIA HONG KONG MALAYSIA 1,266 3,472 3,409 3,342 3,010 2,573 1,941 1,581 PER 100,000 PEOPLE PER 100,000 PEOPLE PER 100,000 PEOPLE 3.0 Hong Kong has long been the financial hub of Asia, playing a key role in the development of now widespread blockchain technologies The UAE is an ideal location for blockchain startups, thanks to its existing business networks and connections to North Africa, India and the West Switzerland can be crowned the country with the most blockchain startups, boasting 12.9 per 100,000 residents, or 1,128 in total 12.9 1.2 INFOGRAPHICS 4,579

10 2022 15 Source: Worldwide Crypto Readiness Report – Forex Suggest COUNTRY HONG KONG 149 2.0 7 2 0.00% 3.0 1,581 8.6 UNITED STATES 33,720 10.1 271 2 10.00% 0.6 2,573 7.7 SWITZERLAND 152 1.7 260 1 0.00% 12.9 710 7.5 GEORGIA 45 1.1 1,544 1 10.00% 0.4 758 6.2 UAE 4 0.0 17,755 2 9.00% 1.2 3,342 6.2 ROMANIA 131 0.7 1,756 2 10.0% 0.2 923 6.2 CROATIA 12 0.3 4,716 2 12.00% 0.8 1,941 6.2 IRELAND 43 0.9 1,602 1 33.00% 1.2 3,742 6.1 CZECH REPUBLIC 76 0.7 1,016 2 15.00% 0.4 423 6.1 SLOVAKIA 58 1.1 829 2 19.00% 0.3 379 5.8 THE MOST CRYPTO-READY COUNTRIES COUNTRIES WITH THE MOST CRYPTO ATMs PER 100,000 PEOPLE COUNTRIES WITH THE LOWEST CRYPTO TAXES *Number of crypto ATMs *Area per crypto ATM (km) *Legislation *Minimum capital gains tax rate for individuals *Number of crypto ATMs• *Number of blockchain start ups• *Crypto seasrches• *Crypto readiness score / 10 • PER 100,000 PEOPLE CRYPTOCURRENCY ADOPTION has exploded over the last five years 0 2 4 6 8 10 12 United States Canada Hong Kong • HONG KONG • SWITZERLAND • PANAMA • PORTUGAL • GERMANY • MALAYSIA • TURKEY Seven countries share the top spot for the lowest crypto taxes as profits made from cryptocurrency trading are exempt from capital gains taxes for individuals INDONESIA CHILE 01 02 03 GULF BUSINESS CRYPTO CRYPTOCURRENCY ADOPTION HAS EXPLODED OVER THE LAST FIVE YEARS. ONCE ONLY REGARDED AS A SPECULATIVE ASSET, MANY COMPANIES, GOVERNMENTS AND INDIVIDUALS HAVE REALISED ITS POTENTIAL AND EMBRACED IT AS THE FUTURE OF FINANCIAL TECHNOLOGY 10.1 6.5 2.0

TO

PULSE MUSIC CO-FOUNDER AND CEO MEHDI CHERIF DISCUSSES HOW DECENTRALISED TECHNOLOGY IS DISRUPTING THE MUSIC INDUSTRY MOVING

THE BEAT 16 10 2022 WORDS: DIVSHA BHAT COVER STORY

The history of the music industry is inevitably also the story of the development of technology. From the player piano to the vinyl disc, from reelto-reel tape to the cassette, from the CD to the digital download, these formats and devices changed not only the way music was consumed, but the very way artists created it,” said American entrepreneur, Edgar Bronfman, Jr.

Truly, from vinyl to CDs to digital downloads and now to digital streaming, the music industry has seen substantial shi ts in the last two decades. Artists now use streaming services and social media to promote their tracks, changing the way people listen to music.

The surge in streaming contributed to a 20 per cent increase in global music industry revenues last year. This accounted for 65 per cent of industry revenues according to the annual IFPI Global Music report, the organisation that represents the recorded music industry worldwide.

Meanwhile, over 70 per cent of the revenue generated comes from the top five countries – the US, Japan, UK, Germany and France. These countries represent a little over 8 per cent of the global population.

It has also been estimated that the penetration rate for digital service providers in emerging markets is approximately 3 per cent, and it is expected that that figure will increase to 18 per cent by 2030, according to Goldman Sachs. This is primarily due to the paid subscription model.

10 2022 17 GULF BUSINESS CRYPTO

18 COVER STORY 10 2022

As unbanked younger generations in emerging markets have limited or no access to online payments in most territories, they use unauthorised or illegal ways to access music. For instance, last year in India, it was estimated that 68 per cent of people used unlicenced services.

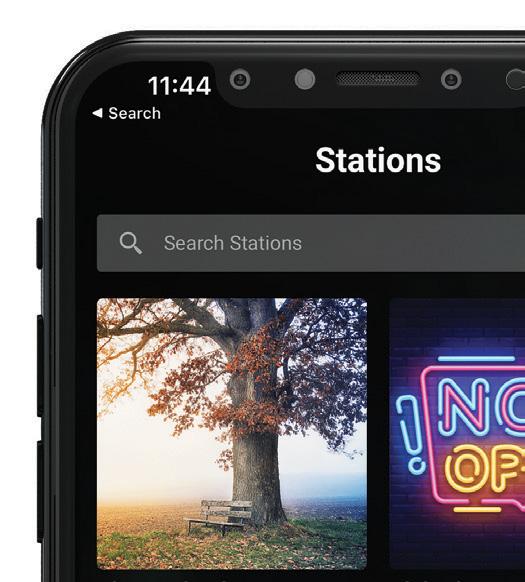

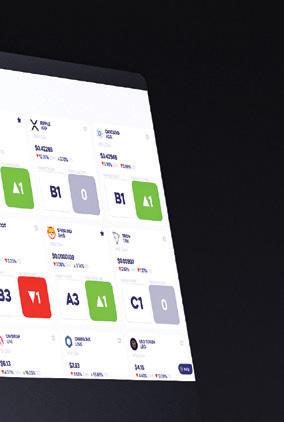

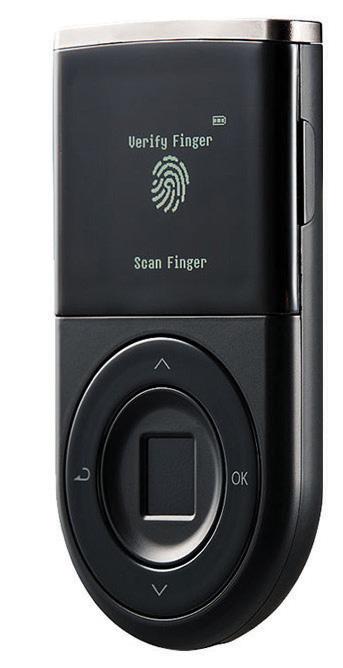

With the aim of di erentiating itself in the market and catering to the needs of its general consumers and content creators, Pulse Music, the Dubai-based music streaming platform, has implemented a “self-sovereign” identity, which allows all actors within the platform to manage and control their own data. Additionally, the platform integrates smart contracts to simplify the licensing of content and intellectual property.

“The emerging markets are where we want to focus our e orts. We strongly believe that we can o er a solution to the issues that these markets are facing. Examples of key challenges are the lack of bank fiat accounts for payments for subscription models, the inability of music collecting societies to e ectively and transparently collect rightful income to musicians, di culties in accessing otherwise available global content due to localised copyright legislation and regional economy limitations,” explains Mehdi Cherif, co-founder and CEO at Pulse Music.

THE IDEA BEHIND PULSE

Pulse uses the power of blockchain to disrupt how brands use music to engage with supporters. “The idea of Pulse was a long process that has taken a few years, with many hours of research, study and peer-to-peer review to validate what we wanted to build as a product,” states Cherif.

Having spent the last decade managing and operating diverse end-to-end streaming services, Cherif has been involved in various operational aspects — from managing Virgin MENA’s music buying operations to founding and managing a music streaming service of his own. He explains that the experiences he has gained has given him a great deal of insight into not only the obstacles which the industry needs to overcome, but also opportunities where those challenges can be addressed.

Music industry growth has been hindered by five main challenges that are preventing it from progressing, Cherif notes. “To begin with, the complexity of IP (intellectual property) makes it di cult for any party to deal with the music industry. Additionally, there is an excess of existing supply chains and intermediaries. These increase the time of the process. Thirdly, current business models that favour intermediaries in terms of revenue and royalty splits. This means that artists take home an average of only 12 to 15 per cent of their generated revenue. Fourthly, artists wait between three months to nine months to get paid. And finally, the inherent lack of transparency and traceability limiting the access and control of data.”

By tackling these challenges, Cherif hopes to change the status quo within the music industry. In order to simplify content licencing, Pulse uses a proprietary digital right management system and a copyright ontology based on semantic data

THE PENETRATION RATE FOR DIGITAL SERVICE PROVIDERS IN EMERGING MARKETS IS APPROXIMATELY

PER CENT, AND IT IS EXPECTED THAT

FIGURE WILL INCREASE TO

PER CENT

modelling. It empowers artists with a “do it yourself” model and simplifies their IP to allow a fairer royalty split. Furthermore, by using a micropayment system, it allows for instant payment as opposed to the traditional and inconvenient elongated waiting period. And finally, the blockchain being a fully decentralised database brings transparency and highly accurate reporting.

Furthermore, the company is also constantly trying to enhance all aspects of the business from internal processes to its products. “Everything we do is with our end users in mind. Not rushing our product launches while systematically reviewing and learning all the time will put us in good shape for the future,” comments Cherif.

REVOLUTIONISING MUSIC

Pulse has an ambitious plan to revolutionise the way they do business with the use of blockchain technology. The new modules that have been added to the platform make all of the metadata associated with the content accessible to everyone at any given point in time. Thereby, artists and copyright owners are assured they get a fair share of the profits.

3

THE

18

BY 2030 10 2022 19 GULF BUSINESS CRYPTO

Pulse is a social music platform that leverages decentralised technology such as self-sovereign identity, smart contracts and micro payments to tackle major challenges that we see within today’s music industry along with the challenges of current social media platforms”

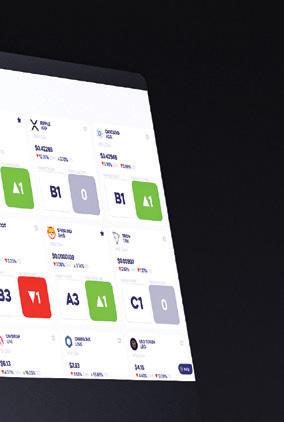

“Pulse is an ad-supported service that doesn’t have any subscriptions. There are four main services Pulse offers are our own metaverse, music streaming, social engagement and the NFT marketplace.

“Pulse is a social music platform that leverages decentralised technology such as self-sovereign identity, smart contracts and micro payments to tackle major challenges that we see within today’s music industry along with the challenges of current social media platforms. Our platform allows artists to manage, control and monetise their data. Fans can discover new artists and engage with them via a unique user experience. It also offers brands to connect with artists, create meaningful engagement and generate return on investment from a unique revenue source.”

Meanwhile, the social aspect of the platform is interesting. Through the use of messages and video chat, users will be able

to communicate with their friends. It is also possible for them to upload photos and videos, share interests and hobbies, connect with brands they like, and earn tokens in the process.

At the NFT marketplace, Pulse users can find rare and exclusive items. It is also possible for these users to launch their own NFT and showcase their collections to the Pulse community and get rewarded for it in exchange.

Pulse also helps brand reach their target audience. “We try to understand not only our existing community, but also our potential new audience by listening to what

20 | 10 2022 COVER STORY

they have to say. We also have to understand the brands that we work with, making sure they are matched with the audiences.

“We further put a lot of effort into understanding and analysing the regional, and local market landscape, market trends, economic shi ts and user motivations.”

BUILDING ON BLOCKCHAIN

The UAE has embraced blockchain technology and is working to position itself as a global leader in the space. The country has launched several initiatives to promote blockchain adoption, including a blockchain strategy, a blockchain academy, and a multi-billion blockchain investment fund Dubai is becoming a major hub for companies, startups and key players within the

space. Having aligned its vision with that of the UAE, Cherif states: “I believe that blockchain has the potential to transform the way we interact with the world around us. “We are aware there are plenty of social media platforms that one can choose to use and approximately over 150 digital services platforms in the market where you can stream your music. However, no platform available either social or music combines them both and addresses the challenges of today’s music industry. This is why Pulse is unique and we believe the future is bright for all.”

He adds: “We are focused on emerging markets where penetration rates for digital service providers are low due to limitations in accessing payment and connectivity. Young people who can’t a ord subscriptions struggle with finding accommodation, food or transportation so they turn towards social media which provides an easy platform that doesn’t require any investment of time/money from them - this has been our target demographic up until now.

“As technology becomes increasingly sophisticated, there will come another shi t as these same users become more demanding; we aim to capitalise by providing quality content across all platforms while maintaining enthusiasm through constant innovation.”

APPROXIMATELY OVER 150 DIGITAL SERVICES PLATFORMS IN THE MARKET WHERE YOU CAN STREAM YOUR MUSIC HOWEVER, NO PLATFORM AVAILABLE EITHER SOCIAL OR MUSIC COMBINES THEM BOTH AND ADDRESSES THE CHALLENGES OF TODAY’S MUSIC INDUSTRY. THIS IS WHY PULSE IS UNIQUE AND WE BELIEVE THE FUTURE IS BRIGHT FOR ALL 10 2022 21 GULF BUSINESS CRYPTO

Our platform allows artists to manage, control and monetise their data. Fans can discover new artists and engage with them via a unique user experience. It also offers brands to connect with artists, create meaningful engagement and generate return on investment from a unique revenue source”

GB TECH WEB3 AWARDS MOTIVATE MEDIA GROUP RECOGNISED THE REGIONAL WEB3 COMMUNITY’S MOST INFLUENTIAL LEADERS, COMPANIES AND STARTUPS AT THE FIRST EDITION OF GB TECH WEB3 AWARDS HELD ON SEPTEMBER 23 2 0 2 2

The term “Web3”, which describes the idea of a new version of the web made up of blockchainbased platforms and services fuelled by cryptocurrency, is being touted as the future of the Internet.

The Middle East has witnessed tremendous growth in the adoption of Web3 technologies, with UAE recently launching the Dubai Metaverse Strategy. The move consolidates Dubai’s status as a global capital of advanced technologies such as Web3. The city is already home to over 1,000 companies in the metaverse and the blockchain sectors. As the city attracts new players, the metaverse’ current contribution of $500m to the UAE’s economy is estimated to increase significantly.

In line with the country’s growth and vision, the region’s leading media house, Motivate Media Group and GB Tech Talk (a Gulf Business brand), in collaboration with Arte by Crypto Oasis, launched the GB Tech Web3 Awards 2022.

The ceremony was held on Friday, September 23, at Social Distrikt, The Pointe at The Palm Jumeirah in Dubai to celebrate the influential and trailblazing leaders, companies and startups of the region’s Web3

ecosystem. The event attracted over 100 key decision makers and organisations within the Web3 and blockchain space.

Ian Fairservice, managing partner and group editor-in-chief of Motivate Media Group, said: “The future of technology is Web3, and we are privileged to host the first edition of the GB Tech Web3 Awards that aim to celebrate the success and achievements of the leaders across the Web3 landscape.”

HOW TO SUCCEED IN THE WEB3 SPACE

At the awards, an engaging panel discussion on how to succeed in Web3 was held. The debate featured Amrita Sethi, a UAE-based NFT artist, Saqr Ereiqat, co-founder and CCO at Crypto Oasis, Mehdi Cherif, co-founder and CEO at Pulse Music, and Gaurav Dubey, CEO at TDefi.

Saed Ereiqat, ecosystem manager at Crypto Oasis, moderated the discussion. The experts spoke about how organisations and startups are on the cusp of transformation, as the world continues to adopt Web3.

Dubey shed light on how they are incubating Web3 startups. “We are precisely looking at the ground level value. In the crypto communities, most of

them are solving problems created by crypto. It goes well with six months, a one-year curve and all that is great. People make money and lose money. I’ve been there for both equities and inventory since 2015. As Peter Schi says, ‘you are wrong the moment you think it’s di erent this time.’ The markets and patterns are always the same. The philosophies will always be the same. And the core philosophy is value. So, to sum it up, we look for the value they’re creating in the long term at a ground level.”

Ereiqat explained what has driven the UAE to be at the forefront of the revolution of Web3 today. “It breaks down to three elements, plus an X Factor. The elements are capital, talent and infrastructure – the base of any ecosystem. The X Factor is what gave us the extra edge.”

Meanwhile, Sethi shed light on the measures of success for an artist to be able to enter the Web3 space and be successful. “I think it’s three things –innovation, authenticity and bravery.” Explaining innovation, she said, “One of the most amazing things about what the Web3, metaverse and NFTs has done is it’s unlocked, like an unlimited amount of possibilities. The only thing that stops you in the metaverse and in

10 2022 | 23

Panellists receive a token of appreciation

Saqr Ereiqat

A full house at the event

10 2022 25 DEFI – Palmswap BEST PUBLIC SECTOR PROJECT – Nifty Orient META COMPANY OF THE YEAR – Everdome WEB3 FINTECH – KMMRCE WEB3 STARTUP OF THE YEAR – Pulse Music WEB3 MARKETER OF THE YEAR – Melanie Mohr INNOVATION OF THE YEAR – Evai BEST NFT DESIGN AND UTILITY – Queen Mode NFT PROJECT OF THE YEAR – EX-Sports

AN IN-DEPTH INSIGHT

The inaugural edition of the Crypto Oasis Ecosystem Report 2022 highlights the confluence of blockchain activities in the UAE and the progress of its key players

Crypto Oasis, the region’s leading blockchain ecosystem, has been expanding at an unprecedented rate over the past year. Crypto Oasis, which was named to stand out against the likes of Silicon Valley and Crypto Valley, was launched in Dubai, in April 2021.

Today, it is home to more than 1,300 organisations in the UAE alone. The forecast is to identify over 1,500 established organisations across the region by the end of 2022. The ecosystem is a collaborative platform for investors and collectors, startups and projects, corporates, science and research institutions, service providers and government entities and associations who recognise blockchain as

a potentially transformative technology with the ability to improve returns and disrupt existing business models.

Crypto Oasis — in partnership with Roland Berger — recently launched a comprehensive report to share valuable insights into some of the notable blockchain initiatives in UAE, and highlights its key pillars, including talent, capital and infrastructure. The inaugural Crypto Oasis Ecosystem Report highlights the confluence of blockchain activities in the UAE, underpinning Crypto Oasis’ role as a regional and key hub for blockchain and fintech innovation.

The Crypto Oasis Ecosystem Report is a periodic report, which will be published bi-annually, focusing on market

development and emerging technologies such as blockchain, IoT (internet-ofthings), AI, Web3, the metaverse and many more.

This report established the first quantitative and qualitative ecosystem study of the Crypto Oasis blockchain ecosystem and identifies its various stakeholders. It incorporates articles from major players in the industry like State Street, Securrency, Phoenix, Virtua, DIFC, DMCC, Ripple, Simmons and Simmons, Crypto 1, Tokengate, TDEFI and many more.

The Crypto Oasis Ecosystem Report will help set the baseline from which growth can be identified in the following years as the Crypto Oasis looks to become a centre of blockchain excellence.

In a strategic partnership with the Dubai Multi Commodities Centre (DMCC), Crypto Oasis has helped numerous blockchain organisations get licences to operate in the UAE. The DMCC has a long history as a global hotspot for

26 10 2022 FEATURES CRYPTO OASIS ECOSYSTEM REPORT 2022

INVESTING IN CRYPTO OASIS

Dubai is known for its thirst for innovation and continues pushing the limits of new technologies to engineer a competitive economy. In the couple of years that followed, major banks and companies in Dubai and the whole UAE can be seen to have started exploring the capabilities of the technology. For instance, UAE’s Rakbank teamed up with top crypto platform Kraken to o er dirham-based digital asset trading. Kraken was the first global crypto exchange platform to get a licence by UAE regulator Abu Dhabi Global Market.

Moreover, the zeal for cryptocurrency trading globally amid the health crisis also permeated the UAE. According to a PwC report, the country’s share in the global crypto market is around $25bn in transactions, which increased by 500 per

REGION’S TOP

cent between July 2020 and June 2021. By the second half of 2021, cryptocurrency trading appears to be one step closer to legitimacy within the Dubai World Trade Centre Authority (DWTCA) free zone. The DWTCA and UAE’s Securities and Commodities Authority reached an agreement that establishes a framework, allowing the regulation, o ering, issuance, listing, and trading of crypto

assets within the free zone. This has led to the number of well-known crypto exchanges setting up shop in the emirate.

In Dubai, the number of visitors increased by 183 per cent to 7.1 million in the first half of 2022 compared to the same period last year. Notably, Henley & Partners forecast the UAE to lead the world in attracting a uent people by the end of 2022, with a 4,000 projected net inflow of high-net-worth individuals.

The flow of capital in the country has noticeably increased as well. This is evidenced by its 46 per cent share of the total venture capital received in the MENA region and the over 26 per cent share of the total transactions in 2021. According to the Ministry of Economy, venture capital investments in the UAE actually increased by 12 per cent in 2021 compared to 2020.

The Abu Dhabi Global Market (ADGM), the International Financial Centre in Abu Dhabi, announced its framework to control operations involving spot crypto assets in 2018, including those carried out by exchanges, custodians and other intermediaries in ADGM. Meanwhile, with the launch of Virtual Assets Regulatory Authority this year, Dubai has strengthened its commitment to blockchain and cryptocurrencies.

Then, there are also venture capitalists that have shown interest in Dubai’s Blockchain climate in 2022, such as Draper Goren Holm, Woodstock Capital, and True Global Ventures. Some UAEbased venture firms have also committed significant funds to blockchain startups. One such example is the launch of Cypher Capital’s $100m blockchain-focused fund in March 2022.

“Crypto Oasis Sentio, Crypto Oasis’s investment arm is also helping to cultivate a robust blockchain ecosystem in the Middle East. It aims to invest in early-stage startups that come from the Crypto Oasis ecosystem and currently has a growing portfolio, with projects such as Grizzlyfi, UFO Gaming, MetaMall, Ex-Sports, Safle and others,” states Saqr Ereiqat co-founder and managing partner at Crypto Oasis Sentio.

28 | 10 2022 FEATURES CRYPTO OASIS ECOSYSTEM REPORT 2022 • Binance • Bybit • Coinmetro • Crypto.com • Fasset • FTX • Kraken • OKX • Rain • DIFX • BitOasis • CoinMena

CRYPTO EXCHANGES FIAT payments and multi-chain choices for NFT minting widely available broadens the appeal immensely,” he adds.

NATIVE ORGANISATIONS ACCOUNT FOR 53 PER CENT AND NON-NATIVE ORGANISATIONS 47 PER CENT OF THE TOTAL NUMBER THAT HAVE ADOPTED BLOCKCHAIN To download the report, please visit: www.cryptooasis.ae/ecosystem-report-2022/Credits: Crypto Oasis Ecosystem Report 2022

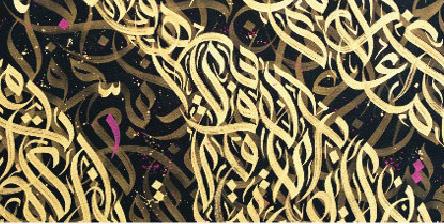

10 2022 29 02 TOP 20 NFT PROJECTS CRYPTO ARABS by Haidar Mohammad 01 GLOBAL PILLARS by Sacha Jafri DUBAI PEEPS by PRM 03 EVERYDAYS by Gigi Gorlova 04 FROM DESERT TO MARS by UAE.nft 05 ELVEN by The Art of Yasmeen 06 CRYPTO CAMELS CLUB NFT 08 FANANEES GENESIS COLLECTION by MBC Group 07 GLOW IN THE DARK by Chef Sperxos 09 LAYERS by Diaa 10 MOWJOOD by Waleed Shah 11 GYRFALCON 12 MONTES NFTS by his Daddy - Dean Munro 13 QUEEN MODE by Alejandra Michel Munguia 15 MUSEUM OF THE FUTURE NFT 14 THE ALPHABYTES by Amrita Sethi 16 THE SUFI DARWEESH by Aisha Juma 17 REVIVAL OF AESTHETICS by Orkhan Mammadov 18 THE CELESTIAL COLLECTION by Bored Puma 19 URBANBALL by EX Sports 20 Credits: Crypto Oasis Ecosystem Report 2022

MAKING A MARK

SAQR EREIQAT, CO-FOUNDER CRYPTO OASIS

Q:

TELL US ABOUT THE GROWTH OF BLOCKCHAIN OVER THE LAST DECADE.

The concept of blockchain was considered a hype in the early days, but it has now become a reality. Back in 2015, we were writing strategies, giving presentations and discussing the ways in which we could implement them. The inception of this technology has only been a few years ago, but now we’ve seen it evolve into a valuebased conversation. It is still a long way to go before we join the mainstream, but I believe that any innovation passes through di erent stages along the way.

DO YOU SEE ANY MYTHS AROUND BLOCKCHAIN?

Of course! As a matter of fact, one of the biggest concerns is that blockchain, Bitcoin and other cryptocurrencies use massive electricity. Factually, it is correct. They use electricity but then what doesn’t use electricity? There are certain networks that use electricity, for example, the banking and the telecommunication network. There are many things we need in our lives that depend on electricity. However, it is estimated that Bitcoin consumes less energy than both banking and gold, according to a study by Galaxy Digital. There is an estimate that the annual electricity consumption of Bitcoin is 113.89TWh/year, which is less than the consumption of gold (240.TWh/ year) and banking (238.92TWh/year), respectively.

The other misconception is that everything is going to be on the blockchain. People think that in the future, everything that has value attached to it, will be on blockchain. So, we call this the Internet of values. Since they think everything has value, they assume everything needs to be put in blockchain and convert it into Bitcoins which will replace dollar as a means of payment. Although, Bitcoin and cryptocurrencies allow us to create a new financial system, I firmly believe banks will not fade away.

HOW READY IS THE REGION TO ADOPT BLOCKCHAIN AND WEB3?

We are much more advanced than other countries around the world, with UAE being the most futuristic in the region. The country has taken significant steps to promote and adopt blockchain and digital assets. Earlier this year, UAE issued a Dubai Virtual Asset Regulation Law to establish a legal framework to protect investors and implement international standards for virtual assets industry governance.

The Dubai Virtual Asset Regulatory Authority is responsible for licencing and regulating the sector across Dubai mainland and free zone authorities. As early as 2018, Abu Dhabi Global Market, the International Financial Centre in Abu Dhabi, launched its framework to regulate spot crypto asset activities. Last but not least, freezones are working towards creating a vibrant ecosystem for non-regulated Web3 activities.

HOW IS CRYPTO OASIS MAKING ITS MARK IN THE REGION?

The Crypto Oasis is a Middle East focused blockchain ecosystem that is supported by thought leaders in the space. We have identified over 1,300 organisations in the UAE alone. These are entities active in the blockchain, NFT, metaverse or Web3 space. We have defined two categories for these entities: native – meaning entities that are incepted to capture the new business model, this emerging technology presents, and nonnative – meaning entities that would exist with, or without this technology, but are active in that area. The forecast is to identify over 1,500 established firms across the region by the end of this year.

The significance of blockchain lies in its inherent transparency, trust and immutability. In order to achieve these characteristics, we have built an ecosystem that o ers unique value to our partners.

30 | 10 2022

INTERVIEW BLOCKCHAIN

In order to achieve inherent transparency, trust and immutability, Crypto Oasis has built an ecosystem that offers unique value to its partners

RALF GLABISCHNIG

FOUNDER,

FOUNDER,

FOSTERING BLOCKCHAIN ADOPTION

Oasis estimates

will identify over

established organisations across the region by

of

HOW IS CRYPTO OASIS LOOKING TO BOOST BLOCKCHAIN DEVELOPMENT IN THE MIDDLE EAST?

Crypto Oasis is fully focusing on connecting crypto enthusiasts to our ecosystem and growing the wider Inacta Group with Venture Capital and Venture Building structures in the UAE. Inacta is also one of the founding members of the Crypto Valley Association and believes the time is ripe for this collaboration to bring the two regions closer together and bridge the geographic distance. Crypto Oasis is building the ecosystem for organisations in the Web3, non-fungible token and metaverse space.

Arte is the Web3 meta-community initiative by Crypto Oasis. It brings together Web3 communities and individuals worldwide to create an environment that enables them in the art and technology worlds. It o ers a foundation and platform for local and international communities and individuals to come together to collaborate, create and connect.

WHAT VALUE DOES CRYPTO OASIS OFFER TO ITS PARTNERS?

Crypto Oasis catalyses the growth of organisations in

the crypto space and like the Crypto Valley Association, it brings together investors, startups, corporates, researchers and government entities. The Crypto Oasis is growing at such a fast pace that it has outgrown Switzerland in just two years.

EXPLAIN IN BRIEF THE ROLES OF BOTH ENTITIES. HOW DO YOU SEE THE GROWTH OF YOUR ECOSYSTEM BY THE END OF THE YEAR?

The Crypto Valley Association is based out of Zug. The association was founded to benefit from Switzerland’s strengths to connect startups and established enterprises and foster blockchain and cryptographic tech innovation and adoption. Crypto Oasis will lead the Crypto Valley Association chapter for the Middle East as we are connecting two of the most active areas in the crypto industry.

The two entities will play complementary roles and expedite our mutual aim to establish a global blockchain ecosystem. This alliance will connect a fragmented blockchain world with the Middle East which already has become the new hub for crypto and blockchain.

The Crypto Oasis is a Middle East focused blockchain ecosystem that is the fastest growing, with more than 1,000 organisations in the UAE alone. The forecast is to identify over 1,500 established organisations across the region by the end of 2022.

WHAT ARE YOUR PLANS FOR THE NEXT TWO YEARS FOR SWITZERLAND AND THE MIDDLE EAST?

The collaboration between Crypto Valley Association and Crypto Oasis will enable knowledge share and the exchange between crypto-passionate in Switzerland and in the Middle East. Crypto Oasis has launched directory that cements our position as thought leaders in the industry.

We will host several events which will bring everyone together through events and roundtable discussions where ideas can be exchanged and put into action. We are excited about the future and look forward to fostering blockchain adoption on a global scale.

10 2022 31 GULF BUSINESS CRYPTO

Q: Crypto

it

1,500

the end

2022

,

CRYPTO OASIS

TRENDS THAT WILL DRIVE THE IMPACT OF THE METAVERSE ON THE VIRTUAL AND REAL WORLD

The metaverse is still in its infancy and despite the revolutionary concept, it is a turning point with limitless opportunities for making money, networking and brand growth

T

he world was first introduced to the notion of the metaverse in American writer Neal Stephenson’s 1992 book, Snow Crash. A speculative fiction writer, Stephenson wrote about a virtual world that had the potential to extend the physical world. Actions in the virtual world could possibly impact the physical world. The technology in the book was imaginary but based on the technological advancements of the 20th century which brings us to the hyped metaverse of today.

32 10 2022 FEATURES METAVERSE TRENDS

TOP SIX TRENDS

The socio-economic impact of a fully functional persistent cross platform metaverse is still being studied. Research and consultancy company, Gartner, has found that the following six trends will drive wide scale adoption of metaverse technologies over the next three to five years:

GAMING

Games are the most popular and perhaps the oldest application in the metaverse. More immersive gaming and fantasy worlds that are complex will be easier to develop using metaverse technologies. Using game theory, storytelling, training simulation, the applications of gaming will move beyond just entertainment. This ‘serious games’ market will grow by 25 per cent because of the impact of the metaverse.

DIGITAL HUMANS

Our virtual selves in the metaverse will interact with AI-driven digital characters that will have the personality, knowledge and mindset similar to us. Our digital twins, or humanoid robots will be able to interpret speech, gestures and images and use that information to generate their own speech, tone and reaction. This will help create a conversational experience. As we move towards the metaverse, digital humans will be brand-embodied avatars, virtual influencers or digitised celebrities.

VIRTUAL SPACE

The virtual world will soon be populated with more people than ever before and not just gamers. Gartner predicts that by 2025, 10 per cent of workers will use virtual spaces for activities such as sales, customer engagement, remote teams collaboration and onboarding.

possibility to change the perception of physical spaces. Spatial computing that is broadly synonymous with extended reality, creates the power of place, of physicality with digital together. Spatial computing is an important part of the coming economic change and it will use physical space as a computer interface. By 2026, spatial computing glasses will be in their second or third iteration and help create a more pervasive metaverse experience.

MAKING THE METAVERSE MAINSTREAM

SHARED EXPERIENCES

Virtual environments can be used in silos for your individual fashion or gaming experience, but it’s true potential will be realised with public events that will o er participation in the metaverse. By 2028, 10 per cent of public events in sports or the performing arts will allow people to have a shared experience virtually and create more opportunities to commercialise the metaverse and also create immersive experiences.

TOKENISED ASSETS

The token economy has created an asset class that is transforming capital markets and creating new economic models. The metaverse will allow people to own tokenised assets which will mostly be NFTs. Creators of the NFTs will be able to retain most of their revenue and by 2027, it is predicted that 25 per cent of e-commerce retail organisations will have at least one proof of concept for tokenised assets in the metaverse.

SPATIAL COMPUTING

When a virtual world exists in parallel to the physical world, there is also the

As fascinating as the future of the metaverse looks, mainstream adoption requires forging utility for the common man. The main barrier today is that gaming is central to metaverse technologies. Most investments and technological breakthroughs are in the gaming universe. Other challenges for mass adoption start with form. State-ofthe-art hardware that is cumbersome and is extremely expensive creates a clunky experience. These have generally been prohibitive for wider VR adoption and could be a roadblock for the metaverse. Once the barrier for flowing in and out of the metaverse becomes invisible, the adoption rates will naturally soar.

THE METAVERSE IS HERE TO STAY

Despite the concerns of substantiality, the metaverse is the future we’re living through. To truly recognise its potential, we have to redefine our vision for the world and sell that to make it mainstream. We need a metaverse that is ethical, safe and inclusive. Stakeholders need to ensure their metaverse roadmaps do not just acknowledge and tackle the barrier listed above but also ensure data privacy and security.

The metaverse is still in its infancy and despite the revolutionary concept, it is a turning point with limitless opportunities for networking and brand growth. This is not a technology that will fade out, the hype is real and demands earnest attention. The revolution is here and it brings possibilities to develop communities in ways we could not fathom before.

10 2022 33 GULF BUSINESS CRYPTO

As we move towards the metaverse, digital humans will be brand-embodied avatars, virtual infl uencers or digitised celebrities”

Faisal Zaidi, co-founder and CMO, Crypto Oasis

NFTS BEYOND ART

When people think of NFTs, they associate them with art both physical and digital, but there’s more to them

I

n early 2021, I heard the acronym NFT (non-fungible token) for the first time and asked myself, what is an NFT? As it turns out, I quickly found, I wasn’t the only one asking that question. The truth is, it is not mainstream. Not yet, anway. And if they have heard of an NFT, they o ten have trouble defining what it is. So, to help frame this conversation it is worth defining what an NFT is.

An NFT is a record on a blockchain that is associated with and/or represents ownership rights to a digital or physical asset. To break that down, the non-fungible part means that it is unique and cannot be replaced with something else. In other words, it’s theoretically one-of-one and the NFT proves it. The token part comes in because the record of production, transaction and ownership has been recorded on a blockchain. In industry terms it is called ‘tokenisation’.

Many people when they think of NFTs, associate it with art, both physical and digital. This is driven by several factors. Art provides the perfect use case for NFTs – it is an industry that has long needed a way to truly identify the production, authenticity and ownership of pieces of artwork. Estimates vary but on an annual basis fraudulent or illicit art transactions run about $6bn. The other factors are the media and marketing coverage surrounding NFTs for art. But in this writer’s opinion the biggest fanning of the flame came from the sheer economics of it. The exponential increase in both the number of transactions and prices of NFTs during the crypto boom, headlined by Beeple and Bored Ape Yacht Club (BAYC), understandably grabbed people’s attention.

But art is just one use case for NFTs. It is important, even critical, to understand that NFT

34 10 2022 FEATURES DIGITAL ART AND TECH

ESTIMATES VARY BUT ON AN ANNUAL BASIS FRAUDULENT OR ILLICIT ART TRANSACTIONS TOUCH ABOUT $6bn

use cases exist beyond art. We are still very early in the technology life cycle of NFTs and related blockchain technolo gies, but the reality is they will have a significant impact on many industries.

The following is a non-exhaustive list of current use cases that are being imple mented by companies across multiple industries – supply chain management, real estate, digital and self-sovereign identification, event ticketing, fractional ownership rights, membership cards, collectibles trading, food production and digital twinning of fashion items.

The actual application of NFTs across the various industries will be differ ent. But some of the common core challenges that are trying to be solved include traceability, transparency, clear chain of custody and ownership rights. At Metamall Group, the use case for NFTs, through our metaverse retail marketplace, is the twinning of fashion items. This breaks out into NFTs get ting created for specific items that are purchased and traded through our plat form; and being able to provide relevant data insights to our partners that can have a real impact on how they operate their business.

There will be other use cases that will emerge as the adoption rate of NFT utilisation increases. There are too many problems it can help solve for it not to. And when there are many problems to solve it means there are

massive opportunities to capture. But for NFTs to realise their full potential and impact it needs a strong ecosystem to support its evolution and growth. At a minimum, the ecosys tem includes future forward thinking founders and their companies, the investment community, educators and government organisations.

This is where some cities in the Gulf region, specifically Dubai, are at the forefront. Dubai has made it clear they plan to be one of the major hubs, if not the epicentre of the metaverse, NFT and blockchain ecosystem. A key driver of this has not just been the government’s endorsement, but its support through investments, enacting business friendly legislation and infrastructure and the creation of organisations such as the Dubai Blockchain Center and Dubai Future Foundation. The signalling is, we see the sizable opportunity and we are all in on building the future through blockchain related technologies and cre ating a truly digital economy.

This has helped to create the perfect storm of conditions to accelerate the growth of the blockchain technologies ecosystem in the region. It is shown in massive capital flowing into the region, major companies – both blockchain and non-blockchain related – either setting up a regional office or relocating their headquarters, global talent inflow and accelerators that are helping companies get launched. Even amidst concerns about the global economy and the impact of the correction in the crypto market, the expectation is that the future is extremely bright and it is being built here in the region.

10 2022 35 GULF BUSINESS CRYPTO

Keo Sar, co-founder and CRO, Metamall Group

But for NFTs to realise their full potential and impact it needs a strong ecosystem to support its evolution and growth. At a minimum, the ecosystem includes future forward thinking founders and their companies, the investment community, educators and government organisations”

HARNESS THE POWER OF AI IN WEB3

Artificial intelligence brings value to organisations to better understand their customers, and monetise interactions in the virtual world

VALERIE HAWLEY,

AFFILIATE FOUNDING PARTNER, TRUE GLOBAL VENTURES

HOW DO YOU SEE THE GROWTH OF ARTIFICIAL INTELLIGENCE IN THE MIDDLE EAST?

The Middle East region has always delivered on ambitious visions. This region has realised that artificial intelligence (AI) will be ubiquitous in every part of life in the next five to 10 years, will bring huge cost savings and/or e ciency gains and the governments are looking at harnessing the power of AI as quickly as possible.

WHAT ARE THE NEW TRENDS THAT YOU HAVE SEEN?

We have seen the following trends:

Upskilling

Industry wide upskilling programmes to have the basic mathematical skills of data science to understand AI. Government wide programmes are rolled out to make sure every civil servant understands what AI is, the potential and the limitations of the technology.

Developing innovation

The innovation ecosystem has grown massively in the last five years with the development of innovation hubs everywhere. To support the growth of this ecosystem Abu Dhabi Global Market, Dubai International Financial Centre have eased the process of doing business for startups and have attracted many venture capitals funds. The region

is attracting talents externally as well as developing their internal capabilities through education and various innovation programmes.

Enhancing regulations

There is a large e ort to understand and regulate the nascent technologies and the regulator in Abu Dhabi and in Dubai are already working closely with the tech and innovation eco system. They have set up sandboxes to support and observe the development of startups. VARA, the Virtual Assets Regulatory Authority is a good example with about 50 Web3 companies in their sandbox.

TELL US ABOUT THE ROLE OF AI AND BLOCKCHAIN IN WEB3.

AI and especially computer vision is the underlying technology that enables virtual reality and augmented reality. Meanwhile, blockchain is the technology that enables smart contracts and records to be kept and traced immutably and in full transparency. The technology is a big leap in terms of data collection and data quality. Therefore, these blockchain enabled datasets are prime input for AI algorithms.

Blockchain also enables fast and scalable transactions, providing reliable real time data.

AI is the only tool able to analyse this data, detects fraud in large number of crypto transactions. As more people and organisations move into the metaverse, AI enabled toolkits will bring value to organisations to better understand their customers, derive value for NFTs and monetise interactions in the virtual world.

THE INNOVATION ECOSYSTEM HAS GROWN MASSIVELY IN THE LAST FIVE YEARS WITH THE DEVELOPMENT OF INNOVATION HUBS EVERYWHERE

36 10 2022

INTERVIEW Q:

YIFAN HE, CEO, RED DATE TECHNOLOGY

BLOCKCHAIN: POWERING TECHNOLOGICAL TRANSFORMATION

Increasing digitisation, the global pandemic and decline in cash usage have contributed to the growing interest in central bank digital currencies

Q:

ELABORATE ON THE GROWTH OF BLOCKCHAIN TECHNOLOGY IN THE REGION AND ITS TRENDS

Middle Eastern countries are, in many areas are leading the way in adopting blockchain technology. In recent years, the blockchain industry in the region has seen rapid growth, which is also a result of the government support.

Regarding trends, we see Central bank digital currencies (CBDCs) as a major trend. The number of countries researching CBDCs is more than double of what we saw in 2021. Major countries like China, Australia, France, Japan and Malaysia, are currently conducting pilot projects. Increasing digitisation, the global pandemic and decline in cash usage have all contributed to the growing interest in CBDCs.

Another trend we are seeing is interest from traditional businesses in public blockchain technology, although they are still wary of public blockchains because they force businesses to be involved with cryptocurrencies. Many traditional IT companies are investing heavily in the blockchain industry but are skeptical about adopting it on large-scale. Public blockchains are popular with large enterprises but heavy and di cult to scale. In contrast, public blockchains o er open, transparent and decentralised solutions, but cryptocurrencies are expensive and volatile. Non-cryptocurrency public blockchains can be the solution that includes all the advantages of public blockchain technologies while removing the constraints imposed by cryptocurrencies.

WHAT DOES BSN DO?

The blockchain-based service network (BSN) aims to build a ‘one-stop shop’ for businesses to deploy blockchain applications easily and cost-e ectively. It provides decentralised infrastructure for all IT systems to build the next generation of the Internet together.

WHAT ARE THE CHALLENGES YOU AIM TO RESOLVE IN THE LARGER BLOCKCHAIN ECOSYSTEM?

The majority of IT systems today are private back-end systems, which are controlled by a single organisation. However, since businesses and individuals have become more demanding of systems that provide easy connectivity, data ownership control and transparency, private systems can no longer meet their needs. This is where public IT Systems are needed. With blockchain technology, we are building public IT systems that can be managed and controlled by a group of users instead of a single entity. Users will be able to control their own data and decide if and when they want to share personal information with third parties.

10 2022 37 GULF BUSINESS CRYPTO

REDEFINING THE CRYPTO LANDSCAPE

Here’s how the future of Web3 continues to play out, especially with the world constantly moving towards a more decentralised mode of operation

There’s no denying that the crypto market has grown from strength to strength over the last few years. This is best made evident because, by Q4 2021, the total capitalisation of this yet nascent sector had risen to a staggering $3tn. And while bears have been in control of the sector over the last eight odd months, prominent venture capital (VC) funds have continued to pour money into this space. To this point, studies suggest that over $1tn could make its way into this rapidly evolving ecosystem over the next five years. That said, TDeFi is a Web3-focused incubation platform aiming to spur the development of promising projects operating within this space by assisting them in many di erent ways.

TO THE MOON…

In addition to helping raise funds for its clients, the company o ers the community of backers access to a pool of experienced entrepreneurs, advisors, developers and investors. It also provides mentorship to startups, with experts from di erent crypto domains assisting projects during the various phases of the incubation period.

Expounding his views on the importance of crypto launchpads, Gaurav Dubey, CEO of TDeFi, recently noted in an interview:

“Mentoring comes in varied forms. Apart from ideation, incubators assist in designing utility-based, growth-oriented tokenomics, which is necessary for attracting investors. A well-networked incubator always finds strategic investors for startups even in a bear market.”

THE METAVERSE AND TDEFI

The idea underlying the metaverse has gained a lot of ground over the last few years, especially with the growth of domains such as augmented and virtual reality.

Companies like TDeFi have been actively working within the metaverse, having incubated several prominent projects over the last couple of years. Some of the firm’s success stories include MYTH, an alliance consisting of various metaverse-style ecosystems, blockchain games, global publishing houses, and artists; Metamazonia, a 3D, real-time, gamified crowdfunding platform that allows users to purchase a 1:1 virtual replica of the Amazonian forest land and Vulcan Forged, an NFT gaming studio that comes with its very own dApp platform, allowing developers to bring their ideas to life.

HERE’S WHY CRYPTO ACCELERATORS MATTER

In recent years, accelerators/incubators have become one-stop shops for

quality crypto projects since they come with the backing of entrepreneurs, venture capitalists, marketing experts, and tech advisors who are well equipped to chart out a clear success route for their clients. To elaborate, incubators provide clients with assistance in regard to strategy, tech development, marketing, funding and community building.

Also, it bears mentioning that fundraising can be a big challenge for emerging businesses, especially those operating within the realm of blockchain and crypto tech. Incubatorbacked projects have a proven track record of accruing funds easily from venture capitalists and angel investors. Lastly, crypto incubators come backed by a community of supporters that allow incubates to foster their respective client bases seamlessly.

LOOKING AHEAD

There’s no denying the fact that the blockchain and crypto industry is currently at a crossroads in its evolution, one that stands to define its future for the long haul. While in years past, most individuals associated with this space were interested in short-term gains, the landscape seems to have changed quite drastically .

Global accelerators are tasked with the critical duty of not only recognising businesses with potential but also a ording them various on-ramp solutions to ensure their continued future success. It will be interesting to see how the future of Web3 continues to play out from here on end, especially with the world continuously moving towards a more decentralised mode of operation.

38 10 2022

Gaurav Dubey, CEO, TDeFi

FEATURES WEB3

ARTIFICIAL INTELLIGENCE IN THE METAVERSE

The correct use of AI and its adoption is pivotal to maintaining the best practice and stepping into the future with metaverse

It is widely accepted that the “metaverse” is the future of our interactivity on the web. Thanks to the significant rationalisation occurring in the decentralised finance and blockchain space, we can now talk about it as an ecosystem of commer cial potential driven by creators and occupied by all of us.

We have seen metaverses before, from Sony Playstation home to Secon dLife. However, something is different now. We have a decentralisation occurring – a way to change the typical Web2-centric approach to ownership on the web. This change of owner ship structure means that more people have more power over what they see, what they do and what they buy online. Understanding this power and

Dr Eva-Marie Muller-Stuler, partner – Data and AI, Ernst & Young

its potential has become a hotbed of political, philosophical and technical jargon, lending itself to raised eye brows more often than not.

What we need to do, is to under stand what is necessary to lift the project “metaverse” to reach its lofty potential. So, to this end, let’s try to break down a use-case for the metaverse. It is a ‘Web3,’ multi-tenant

Andrew Schumer, director –Technology Advisory, Grant Thornton

platform allowing curated content, e-commerce, interactive gaming and social-fi. We envision it working by selling virtual land with specific tools to build content or e-commerce. This is all connected through a massive interactive space, where your avatar can engage other avatars while shop ping, gaming or just hanging out.

So how can this all come together?

Well, it turns out that we not only need hardware, developers and blockchain to enable this ‘Web3’ masterpieces, but we will also need artificial intel ligence (AI). Imagine going from a game to an NFT marketplace to an interactive store without curating your preferences. It would be like navigat ing multiple significant cities without a map. With each ‘content creator’ need ing to provide services, offer payment solutions, drive e-commerce or engage with a broader social audience, various levels of AI will need to be involved.

AI will ensure a smooth operation connecting all the decentralised ser vices to their respective nodes to work correctly. This multi-service-enabled metaverse must use transparent AI by design as financial services, and complex decisions will be based on its output. The tokenisation of these services would impossible to manage without the AI working in the back ground to balance supply and demand.

We don’t have to look far ahead to see how these technologies are suited for each other. Fundamentally, we need to realise that as the metaverse becomes a cross-border phenomenon, the need for compliances is imperative.