To improve the quality of life of our members and their families, through the provision of personalized financial solutions and advice

EduCom Co-operative Credit Union is a member-centric, financially-sound and technologically enhanced employer of choice; and is the top Credit Union in Jamaica in member value, compliance and satisfaction.

Lord, make me an instrument of thy peace;

Where there is hatred, let me sow love;

Where there is injury, pardon;

Where there is doubt, faith;

Where there is despair, hope;

Where there is darkness, light;

And where there is sadness, joy.

Oh Divine Master, grant that I may not So much seek to be consoled as to console;

To be understood as to understand;

To be loved as to love;

For it is in giving that we receive;

It is pardoning that we are pardoned; And it is in dying that we are born to eternal life.

Chief Executive Officer’s Message

Minutes of the Previous Annual General Meeting

Directors’ Profiles

Board of Directors’ Report

Treasurer’s Report

Supervisory Committee’s Report

Credit Committee’s Report

Nomination Committee’s Report

Management Team

Management and Staff - Names & Positions list

NOTICE IS HEREBY GIVEN that the 6th Annual General Meeting of EduCom Co-operative Credit Union Limited will be held virtually on Wednesday, the 28th day of April 2021, commencing at 1:00 p.m.

The purpose of the meeting is to examine the operations of the Credit Union for Year 2020 and to pass appropriate Resolutions.

Members will be able to register online by visiting the link below: www.educomco-op.com/agm

In order to comply with the measures entailed in the Disaster Risk Management Orders issued by the Government, and with respect to the Department of Co-operatives and Friendly Societies (DCFS) and Jamaica Co-operative Credit Union Limited (JCCUL), the Annual General Meeting will be held virtually. As such, members will be able to join the meeting live via Zoom Conference. The link will be made available prior to the meeting.

BY ORDER OF THE BOARD

Sonia Bennett Secretary

Dated this 28th day of March 2021

1. Ascertaining that a quorum is present

Authority to Convene and Notice of Meeting 7. Apologies for Absence 8. Welcome and Opening Remarks

9. Minutes of the last Annual General Meeting 10. Reports of:

(a) Board of Directors

(b) Treasurer and Auditor

(c) Supervisory Committee

(d) Credit Committee

(e) Nominations Committee

11. Election to:

(a) Board of Directors

(b) Credit Committee

(c) Supervisory Committee

12. 11. Appropriation of Surplus

13. Fixing a Maximum Liability

You will agree with me that since early 2020, what we considered our normal lives has changed drastically and we are now living in extraordinary times. The outbreak of the COVID-19 virus is rollercoasting the international community, and Jamaica and the financial sector have not been spared. For the first time in our Credit Union’s history, the loan portfolio declined. In previous years, we had to strategize on how to curb borrowing, while in 2020 we watched as our liquidity increased month over month – loan repayment in successive months outperformed loans disbursed. Members shied away from borrowing as they, understandably, adopted a conservative approach rather than committing themselves to credit. The result was that our loan portfolio declined by 1.7% when compared with 2019. The challenges of the pandemic were indeed real to EduCom and were reflected in our overall performance in 2020.

Notwithstanding the challenges of the time, we exceeded our internal growth target in assets, grew savings by 10.9% and kept delinquency below the 5% standard of the industry. We were particularly pleased with the choices we made in relation to our members who fell on hard times during the

peak of the pandemic, which eventually led to the country being locked down. At the height of the pandemic, we had more than 1,300 loan accounts that were on moratoria. Members were made aware of the opportunity to write to us and share their experiences on how the pandemic was negatively impacting their income. This enabled us to make the necessary adjustments to their repayment schedule, so that there was one less thing for them to worry about at a time when there would have been many. Though this came at a price to the Credit Union, in terms of deferred interest income, we remained buoyant that this strategic choice was one that was consistent with our mission, “to improve the quality of life of our members and their families, through the provision of personalized financial solutions and advice”, and was therefore warranted.

As we prepare for the years ahead (both short and long-term), there are lessons that we have learnt from 2020. These lessons will prepare us for an immediate future that will remain challenging, but having had the 2020 experience, we are in a better position to make the necessary adjustments that will allow us to seize on the opportunities available. You should continue to expect consistency in our strategy, transparency in our communications, and for us to deliver on commitments we have given you. We have embraced our current position and have challenged management to place a

greater emphasis on Return on Assets (ROA) for 2021. This is Year 1 in a transitional period in which we want to see the returns that the Credit Union is making being more in line with standards in the industry. I am confident that management will rise to the occasion. We remain focused on our mission and vision, to work hard at creating value for you our members, by pursuing what we believe will continue to be a rewarding business proposition. We will continue to strive to provide you with competitive returns on your invested funds and simultaneously offer a suite of loan products that are not only tailored to your needs, but offered to you at prevailing market-driven rates.

I thank you for the opportunity to serve in this capacity and encourage you to continue to support our Credit Union.

President Ian McNaughton

Like most of you, I consider 2020 to be a year that is incomparable in our lifetime. With the coronavirus pandemic, everyone has had to adapt and evolve through very uncertain times, and we certainly were no different. Although the year was significantly challenging, not least in such a small economy, where many of our members were particularly hard-hit by the coronavirus, lockdowns and economic limitations, we were pleased to have a year in which we showed positive results in most of the Key Performing Indicators (KPIs).

We are particularly proud of all of our team members who showed tremendous dedication, commitment and adaptability in striving to deliver for our members under unusual and difficult circumstances. My thanks and appreciation go out to you, as well as to all our valued members with whom we worked throughout the year to make their experience with us better, even in these trying times. In acknowledgement of the pandemic and the challenges it represents, we were quick to identify the team members who could function effectively from home and provided the resources so that they could do just that.

There is no question that increasingly, there is a growing gap between shifting members’ needs and the services that we currently offer. Nearly half of our members surveyed during our 2020 Member Satisfaction Survey, believe that there is the need for greater online services. We are determined to address this concern, knowing that if we are unable to do so, members will eventually take their business elsewhere, when given a better, more relevant offer. This service gap has been recognized as an increasing

opportunity to improve the service delivery through digital transformation. The thrust is toward deepening existing relationships with our members, acknowledging that this will be determined by how well we are able to identify, understand, and respond to your needs throughout your full life cycle. We know that our members would prefer to work with a financial institution that understands what’s currently happening in their lives and we are bent on working closely with you, having nurtured the data and secured the information to do so.

As we embrace 2021 and beyond, and whilst the future of the global economy continues to be uncertain, one strategic choice that we are looking forward to is the implementation of our new banking software. As the financial sector continues to grow and evolve, we continue to relish the chance to provide our members with market driven products and services to enhance the member experience. In recognition of the competitiveness of the market and the drive to serve our members, we know that we will not be able to do so without a more advance banking platform.

The purpose of this digital banking transformation strategy is to leverage technology and improved processes to deliver an exceptional member user experience. At its optimum level, the deployment of this strategy will equally concede that the end-users will include both members and employees. In acknowledgement of this fact, we are getting representation from the end users from the outset, with the intention that the interests of both internal and external constituencies are addressed in the development and deployment

of the digital banking transformation roadmap.

We are cognizant that digital banking transformation does not have an endpoint, since the process is evolutionary, with new technologies, processes, member expectations, and competition impacting what is required to succeed. We are also aware that there is a direct link between digital banking maturity and improved financial performance and recognize that this correlation requires that we go beyond deploying new technology. The emphasis on this digital transformation, while it begins with a new banking platform, will include digital-focused data and analytics, business strategy, organizational structure, talent management, culture, and leadership that are all aligned. We look forward to working together, with you our members, to achieve our goals.

Finally, I would like to again thank the EduCom team for their ongoing commitment to providing quality service to our members. In so doing, we are building relationships with our members, enhancing their trust and confidence, enabling growth in the key performance indicators, that assures value creation for our members. I would also like to thank our members for your continued support of EduCom, and our volunteers for their selflessness. It is indeed my great pleasure, privilege and pride to stay the course with you, as we build upon the EduCom brand. Do continue to shape your financial future with us. Thank you.

Elvis King Chief Executive Officer

Minutes of the 5th Annual General meeting of the Educom Co-operative Credit Union Limited held on Monday, November 2, 2020 at the Kenneth Rattray Conference Room, Jamaica Conference Centre, Kingston.

Members of the Board present were:

Dr. Mark Nicely - President

Stacy-Ann Farquharson* - 1st Vice President

Ian McNaughton - 2nd Vice President

Hector Stephenson - Secretary

Ruel Nelson - Treasurer

Charles O’Connor - Director

Ian Sutherland* - Director

Hilton Blenman* - Director

Sonia Bennett - Director

Janice Green - Director

Coleen Lewis - Director

Also present were:

Kurt Vaz - Chairman, Credit Committee

Deloris Mollison - Secretary, Credit Committee

Rachelle McKenzie - Member, Credit Committee

Shashu Payne* - Member, Credit Committee

Hopeton Newell - Member, Credit Committee

Tasha Manley - Chairman, Sup. Committee

Erica Haughton* - Secretary, Sup. Committee

Clive McLean - Member, Sup. Committee

Andrew Smith* - Member, Sup. Committee

Loraine Gordon-Pinnock - Member, Sup. Committee

*Members attended via zoom platform.

The Chairman advised that the meeting required 100 persons to be present to be duly constituted. He reported that at 1:05 p.m. there were 140 persons registered, as such the meeting was quorate.

The meeting was called to order at 1:05 p.m. by the President, Dr. Mark Nicely, presiding as Chairman.

The Chairman, Dr. Mark Nicely invited the meeting to read the Prayer of St. Francis of Assisi, also called the Credit Union Prayer, which was to be found at the front of the booklet. The Chairman led the meeting in the invocation.

The Secretary, Mr. Hector Stephenson informed the meeting of an adjustment on the Agenda.

The Secretary, Mr. Hector Stephenson read the authority to convene the meeting that was received from the Registrar of Co-operatives and Friendly Societies. This was to be found on page 71 of the Annual Report.

He then proceeded to read the notice convening the meeting.

Apologies were tendered on behalf of the following persons:

Mr. Ian Sutherland, Mr. Hilton Blenman and Ms. Stacey-Ann Farquharson who attended the meeting virtually.

The Secretary, Mr. Hector Stephenson directed the meeting’s attention to the passing of fellow co-operators of our Credit Union list, which was to be found on page 160 of the Annual Report. The Secretary reported that several of our valued members made their transition since the last Annual General Meeting. He expressed deepest sympathies to the members' families, to those husbands, wives, children and friends who have suffered such loss. He also mentioned that a former volunteer, who served on the Supervisory Committee, Ms. Gurleydean Watson passed on in 2019. The Secretary acknowledged the many years of valiant service and the sacrifices she made during her tenure. Other members who had passed during the year were also noted.

The meeting was invited to observe a minute of silence as a mark of respect.

The Chairman extended a warm welcome to those present physically and virtually by way of utilising the zoom platform at the Annual General Meeting.

The Chairman commented on the new time in our history, and how our vocabulary has had to be adjusted with some common words like "lockdown", "postponed", "cancelled" and "quarantine". Also, members were being told to wear a mask, sanitize, and to maintain physical distance.

He stated that EduCom was mindful of the times it was operating in. Even though the Credit Union was in a pandemic, having to deal with COVID-19, there was also the significant levels of crime and violence in our country. He noted the weather system that had modified

our roadways and caused severe flooding for many persons. He added, that just as Educom was currently in a trying period, persons outside of the Credit Union were also facing difficult times.

Continuing, the Chairman stated that EduCom was aware that there were persons who had lost their jobs, and the Credit Union is responding. He noted that even persons who retained their jobs were finding it difficult to cope.

Despite the pandemic, the other reality was the fact that members had to be off the road by a certain time. Hence effort would be made to get through the business efficiently so that all could get home safely.

The Minutes of the 4th Annual General Meeting held on May 4, 2019 having been circulated, was taken as read on a motion by Mr. Ray Howell, and were duly seconded by Ms. Janice Green and carried.

AMENDMENTS TO THE MINUTES

Page 7, under the heading attendance, the name ‘Mrs. Janice Green’ was missing from the list of Board Members. The Secretary asked that the name ‘Mrs. Janice Green’ be added thereto.

Page 9, in the right column, second paragraph, “The Credit Union had performed well organically, … to close at $6.700M moving from $6.124B recorded …” to read “$6.700B moving from $6.12B recorded …”.

CONFIRMATION OF THE MINUTES

The Minutes was confirmed on a motion by Mr. Ray Howell, were duly seconded by Mr. Hopeton Newell and carried.

MATTERS ARISING

There were no matters arising from the Minutes.

The Chairman, at this stage, paused to extend special welcome to a number of individuals as follows:

Mr. Alvin Williams and Ms. Karen Lyttle (Department of Co-operatives and Friendly Societies), Mrs. Jennifer Hibbert and Mr. Ricardo Laird (External Auditors, BDO), and Mr. Ray Howell (President, TIP Friendly Society).

The Chairman presented the above-mentioned report and highlighted the following:

The Chairman acknowledged that EduCom was operating in difficult times and as a Credit Union, the Board and Management continue to do their best, to serve our members efficiently.

The 2019 calendar year ended with the Statistical Institute of Jamaica (STATIN) reporting that inflation closed at 6.2% compared with 2.4% in 2018, Gross Domestic Product grew at an estimated 0.9% compared with 1.2% in 2018, and unemployment closed the year at 7.2% compared with 8.7% experienced in 2018. The Jamaican Dollar depreciated by 3.8% against the US dollar, to close at J$132.57 to US$1.00 over the period.

Continuing, the Chairman stated that the year under review had been unpredictable and unstable as the 90 Day Treasury Bill started at 2.27% and closed the year at a low of 1.32%. Also, the year 2019 could be assumed as a turbulent year. As such, Management and the Board collectively had to be very prudent

and cautious in terms of how it conducted the investment arm of the business.

EduCom continued to be in preparation mode ahead of the Bank of Jamaica (BOJ) becoming the regulators. The Board had empowered a committee to take charge and to monitor that portfolio responsibility. The Chairman said he was particularly pleased to report on the progress being made to conform with most of the requirements, and that the reports that had been submitted had all been received as satisfactory. The Chairman informed that the Credit Union Regulations would be established as the Bank of Jamaica (Credit Union) Act.

The Chairman proceeded to report on the key indicators that were used to measure the Credit Union’s performance in 2019, which were as follows: -

EduCom had performed well once more, reflecting growth of 8.7% in total assets over 2018’s performance, moving from $9.064B to $9.850B, savings closed at $8.055B reflecting an increase of 9.03% over the $7.388B recorded the previous year. Net loans increased by 15.9% to close at $7.763B, moving from $6.694B recorded in 2018.

The Chairman proceeded to report that EduCom continued to perform well in its delinquency levels, despite delinquency increasing to 3.5%, moving from 3.0% in 2018, given the Credit Union Movement’s standard of 5.0%. He emphasized that the Credit Union should not take comfort with a 3.5% achievement. He stated that the Board took the matter of delinquency very seriously and was extremely strident in terms of treating with this issue. He remarked that EduCom has a

robust system in place to assist members, and help them overcome these kinds of difficulties.

Operating Income for the period under review, closed at $914.3M, a growth of 2.1% over the performance of $895.5M in 2018. The marginal increase in operating income reflected declining interest rates experienced throughout the year.

The Chairman was pleased to report that in 2019, EduCom was awarded the coveted prize of ‘Mega Credit Union of the Year’, an accomplishment of which we are most proud. He declared that without the loyal support of our members, coupled with the hardworking staff and volunteers, EduCom could not have achieved that highly regarded industry recognition.

Enterprise Risk Management

The Chairman proceeded to state that risk management has become extremely important in the industry. He announced that EduCom’s achievements were demonstrated in the following areas:

• The implementation of its Enterprise Risk Management (ERM) framework

• Development of a Corporate Compliance Programme

• Development of Anti-Money Laundering/ Combating the Financing of Terrorism (AML/CFT)

• Increased training in corporate governance

Strategy Statement

EduCom would continue its strategic focus for the organization over the next three-year planning cycle with a view to:

• Expanding membership through target marketing and direct recruitment of untapped businesses within the existing bond.

• Increasing member utilization of services through effective public education.

• Increasing Member Value by understanding individual needs and providing personalized financial solutions.

• Increasing effectiveness, by engendering a culture of analytics and risk and researchbased decision-making.

• Increasing operational efficiencies and service delivery

• Strengthening our execution capabilities, through alignment and networking.

The Chairman proceeded to report on the high-level performance indicators and targets that the Credit Union had achieved during the year under review:

• Member Value – The Board focused its efforts on improving member value by understanding individual needs and providing personalized financial solutions. The Board also decided that the factors pertinent were interest paid to the members, interest rate charged on loans, dividends paid, and fees charged. EduCom compared its fees, rates, and dividends to that of the market and were pleased to report that the Credit Union had surpassed its first-year target on this strategic metric.

• Member Satisfaction - EduCom’s objective is to improve member satisfaction to 90%

satisfaction level by 2021. At the end of 2019, EduCom had surpassed the first-year target with a weighted satisfaction score of 75%.

• Employee Engagement - The areas of focus were; the team's satisfaction with place of work and teamwork. The score received reflected that 75% of the team members felt proud to tell people that they work at EduCom; 73% of the team believed that teamwork was valued at EduCom and 63% reported that they would recommend EduCom as a great place to work.

The Chairman told the meeting that EduCom had begun the process of procuring a new Information Technology banking platform to; enhance its operational efficiencies, providing greater convenience, securing members’ savings, and improving the turnaround time to our members.

The Credit Union continued to engage its members by providing meaningful assistance to several institutions, charitable organizations, and individuals. Notwithstanding COVID-19, EduCom remained focused on that programme. Worthy of note, was the support the Credit Union continued to give to the Albert Street Basic School, an institution it has adopted and over the years, has improved on a sustained basis.

a) Business Process Review and Optimization

Mr. Ray Howell sought an update on the funds/capital to undertake the project.

The CEO, Mr. Elvis King informed that EduCom intends to come to the membership with a share offer at very competitive rate.

b) Mega Credit Union of the Year Award

A member asked the Chairman to inform the meeting of the requirements EduCom had to meet to achieve the Mega Credit Union of the Year Award.

Mr. Elvis King explained that the Jamaica Co-operative Credit Union League (JCCUL) used the PEARLS Ratios to assess the Credit Unions financial performance, also the audited financial report must be ready on time and submitted by the 31st of March each year.

In closing, the Chairman introduced the members of the Board of Directors, Credit and Supervisory Committees to the meeting.

There being no further questions on the Board report, it was adopted on a motion by Mr. Clive McLean, duly seconded by Ms. Pauline Richards and carried.

Continuing, the Chairman proceeded to invite the Treasurer, Mr. Ruel Nelson to lead the meeting through the following reports:

• Registrar’s Report

• Auditor’s Report

• Treasurer’s Report

REGISTRAR’S REPORT

The Registrar’s report was tabled and noted.

TREASURER AND AUDITOR’S REPORT

The Treasurer invited the External Auditor from BDO, Mrs. Jennifer Hibbert to present their findings of their assessment of the Credit Union’s financial affairs.

AUDITOR’S REPORT

Mrs. Jennifer Hibbert read the Independent Auditor’s report on the Credit Union’s financial affairs for the year ended December 2019.

TREASURER’S REPORT

The Treasurer’s report was taken as read on a motion by Mr. Ian McNaughton, duly seconded by Mr. Kurt Vaz and carried.

Mr. Ruel Nelson, Treasurer, reported that EduCom had another challenging but good year. The Credit Union produced fairly good results in terms of its overall financial performance when compared to the previous year’s financial outturn. The Credit Union’s financial performance was achieved against the background of significant changes in the financial market and the entrance of new players. Despite this, the Credit Union performed creditably in terms of its core business – that of disbursement of loans to members. This resulted in an increase of 15.9% in the net loan portfolio over the previous year. This was achieved despite the competitive pressures by other players in the industry. Albeit the challenges encountered, EduCom’s performance met and, in most cases, exceeded the key financial indicators as measured against the PEARLS standards used by the Jamaica Co-operative Credit Union League (JCCUL), as a means of assessment.

Mr. Ruel Nelson then proceeded to give an abridged version of the financial performance for the year 2019 as follows:

Operating Performance

Surplus - Despite another challenging year, EduCom achieved a successful performance with a surplus of $104.8M compared to $126.6M recorded in the corresponding period 2018. EduCom was able to achieve that level of surplus as it focused on; expanding the ‘bond’, utlilizing a direct sales thrust through the Business Development Officers (BDO), and the implementation of a direct marketing and sales culture.

Loans – The net total loans increased by approximately $1.06B, closing the year at $7.76B to represent a 15.9% increase in the loan portfolio.

During the year under review, EduCom continued its drive to try to defray some of its costs that it would previously have absorbed, by adding non-interest income to its earnings, using a transactional based approach that would affect members who utilized the services. With this initiative, EduCom realized total non-interest income of $177.5M from loan processing, ATM, and management fees on scheme loans, when compared to $148.1M earned in 2018.

Operating Expenses increased to $788.6M in 2019 from $727.5M in 2018. This reflected an 8.4% increase or $61.1M. The main contributing factors of this increase were the additional costs from inflationary factors.

Performance

Total Assets – Total Assets increased to $9.850B in 2019, an overall increase of $785.6M or 8.7% compared to $9.064B in 2018.

Delinquency - Management continued to be successful in its objective to keep the delinquency rate low, through the measures that were implemented to combat the very high delinquency rate of 7.7% experienced in 2016. The Credit Union achieved a delinquency rate of 3.50%, which was below the established benchmark of 5%, even though it compared unfavourably to 2018 - 3.04%.

Members’ Savings increased to $8.06B, a 9.0% growth over the period, when compared to $7.39B in 2018. EduCom however, did not achieve its objective to satisfy its loan demand from members’ savings. Our Credit Union would continue to offer attractive rates on

savings products to maintain the gap between the total loan portfolio and the total members’ savings.

a) Lay offs

Mr. Michael Gentles enquired of the Treasurer the reason for laying off staff.

The CEO, Mr. Elvis King informed that the Credit Union had done some restructuring in 2019, and having examined a number of positions, found that they would not be in line with the Credit Union’s strategic focus, hence the reason for some staff being laid off.

b) Non-Interest Income

Ms. Patricia Reid-Waugh noted that there was a significant decrease in rental income, which moved from $6.0M in 2018 to $2.7M in 2019.

The Treasurer informed that there was a sale of the Old Harbour property, and as such, EduCom was no longer receiving that income.

The Treasurer’s report was accepted on a motion by Mr. Charles O’Connor, duly seconded by Mr. Hopeton Newell and unanimously carried.

The Chairman invited Mr. Kurt Vaz, Chairman of the Committee to present the Committee’s Report.

Mr. Vaz reported that the Credit Union loan portfolio at the end of December 2019 was $7.78B, which represented a net increase of 15.9% over the corresponding financial period. Total loans disbursed during the period under review was $4.57B, which represented a net increase of $0.69B or 17.9% over the

corresponding period 2018. The lead products in the portfolio mix were Secured Loans which represented 42%, Mortgage Loan and Unsecured Loans 18% each and Within Savings Loans 14.05%. These were followed by Scheme Loans 4% and Staff Loans - Concessionary Rate 2%.

The Committee expressed appreciation and thanks to Mrs. Sandra Smith-Dockery for her commitment to the Credit Union and the late Mr. Clayton McEwan, who also served the Credit Committee with apt direction before being promoted to the Board of Directors in February 2020.

There being no questions on the report, the Committee’s Report was adopted on a motion by Ms. Sonia Bennett, duly seconded by Ms. Janice Green and carried.

The Chairman proceeded to invite Ms. Tasha Manley, Chairman of the Supervisory Committee, to present the Committee’s Report. On a motion by Mr. Rohan Wilson and seconded by Ms. Andrea Lawrence Burke, the Supervisory Committee’s Report was taken as read.

There being no questions on the Supervisory Committee’s report, it was accepted on a motion by Mr. Hopeton Newell, duly seconded by Ms. Coleen Lewis and carried.

Ms. Sonia Bennett, Chairman of the Nomination Committee, presented the Committee’s Report. On a motion by Mr. Ray Howell, duly seconded by Ms. Tasha Manley and carried, the report was taken as read.

The Chairman proceeded with the report by first recognizing the other members of the Committee:

Mr. Michael Brydson

Mr. Frederick Mills

Mr. Tanjay Holmes

Mr. Hilton Blenman

The following Directors retired at the Annual General Meeting:

Ms. Coleen Lewis*

Dr. Mark Nicely

Ms. Stacey-Ann Farquharson

Mr. Charles O’Connor

Mr. Ian Sutherland

*Ms. Coleen Lewis was appointed to the Board effective August 22, 2020 to fill a casual vacancy, which arose from the death of Mr. Clayton McEwan on June 29, 2020.

The late Director Clayton McEwan had been appointed to the Board to fill a vacancy which arose from the resignation of the former President, Mr. Clide Nesbeth on February 10, 2020.

The Committee acknowledged the sterling contribution of the late director Clayton McEwan for his commitment and dedication to his responsibilities as director on the Board and in his other capacities while he served on the Credit Committee.

A recommendation was made for the following persons to serve: Dr. Mark Nicely, Messrs. Charles O’Connor and Ian Sutherland, Misses Stacey-Ann Farquharson and Coleen Lewis would serve for a term of three (3) years. The other proposed members of the Board and their respective tenures were as follows:

• Mr. Hector Stephenson - two (2) years

• Mr. Hilton Blenman - two (2) years

• Mr. Ruel Nelson - two (2) years

• Ms. Janice Green - one (1) year

• Mr. Ian McNaughton - two (2) years

• Ms. Sonia Bennett - one (1) year

Credit Committee

Members of the Credit Committee retiring were:

• Mr. Hopeton Newell

• Ms. Shashu Payne*

• Ms. Rachelle McKenzie**

*Ms. Shashu Payne was appointed to the Credit Committee effective January 11, 2020 to fill the casual vacancy which arose as a result of Mrs. Sandra Smith-Dockery’s resignation on August 14, 2019.

** Ms. Rachelle McKenzie was appointed to the Credit Committee on August 2, 2020 to fill the casual vacancy which arose due to the appointment of the late Director Clayton McEwan to the Board of Directors on February 15, 2020.

The Committee recommended the following persons to serve for another two (2) years:

• Mr. Hopeton Newell, Ms. Shashu Payne and Ms. Rachelle McKenzie.

The other proposed members of the Credit Committee and their respective tenures were as follows:

• Mr. Kurt Vaz - one (1) year

• Ms. Deloris Mollison - one (1) year

Supervisory Committee

The members of the Supervisory Committee serve for one (1) year, and as such, all members were due for retirement.

The Committee recommended the following persons to serve for a period of (one) 1 year:

• Ms. Tasha Manley

• Ms. Erica Haughton

• Mr. Andrew Smith

• Mr. Clive McLean

• Mrs. Loraine Gordon-Pinnock

Ms. Bennett implored the membership to get involved and volunteer their services to the Credit Union as she would welcome new persons.

She sought a motion for the Nominations Committee to be accepted. This was accepted on a motion by Mr. Ian McNaughton and seconded by Mr. Clive McLean.

Ms. Sonia Bennett, at this stage, invited Ms. Karen Lyttle from the Department of Cooperatives and Friendly Societies to formally ratify the nominations.

Ms. Lyttle sought a motion to accept the elected nominees en bloc.

The motion by Mr. Ray Howell, was duly seconded by Ms. Pauline Richards.

The newly elected Board Members and Committee Members were:

NAME

Dr.

Mr.

Mr.

Ms. Sonia Bennett

Mr.

Ms.

Supervisory Committee

Ms. Tasha Manley

Ms. Erica Haughton

Mr. Andrew Smith

Mr. Clive McLean

Mrs. Loraine Gordon Pinnock

The Chairman, Dr. Mark Nicely invited the Treasurer, Mr. Ruel Nelson to present the Appropriation of Surplus and the Fixing of the Rule of Maximum Liability.

Mr. Ruel Nelson sought the meeting’s permission for the fixing of maximum liability. He informed the gathering that the rule states that the Credit Union can borrow 16 times its capital in the event of a significant emergency. As such, he recommended that the Maximum Liability be set at $12B. This was approved on a motion by Mrs. Michell Dixon-Samuels, duly seconded by Mrs. Loraine Gordon-Pinnock and unanimously carried.

The Chairman stated that the Appropriation of Surplus should have been taken along with the Treasurer’s Report. He invited Mr. Ruel Nelson, Treasurer, to present the proposed Appropriation of Surplus. The breakdown was as follows:

On a motion by Mr. Lloyd Wilson and seconded by Ms. Paulette Phillips, the Appropriation of Surplus was unanimously approved.

The Chairman, at this stage, invited Mr. Hector Stephenson, Secretary, to lead the meeting through the proposed Rule changes.

Mr. Hector Stephenson informed the meeting that there were two (2) resolutions tabled in relation to amendments to the rules of the Society. The amendments to the rules were presented to the meeting as follows:

WHEREAS the Board of Directors of EduCom

Co-operative Credit Union is mandated to elect an executive after each AGM consisting of President, Treasurer, Secretary, one or more Vice President(s) in accordance with Article VIII, Rule 66.

And Whereas the Executive Committee shall hold office until their successors are elected.

And whereas the current Article IX Rule 37 states that no member of the Executive Committee shall be allowed to serve more than four years.

And whereas the Vice-President may be next in line to be elected President to ensure continuity and stability in the leadership based on the Credit Union succession plan.

And whereas the current rule 37 does not allow enough time for the Vice President to serve as President, as both President and Vice President may be elected to the Executive at the same time.

And whereas this would result in both President and Vice President demitting office at the same time, thereby creating a gap in continuity.

BE IT RESOLVED THAT the current Article IX Rule 37 be amended to allow for the President ONLY, to serve for a period of a maximum of six (6) years to allow for his successor to serve for a minimum of two (2) years as President.

Be it further resolved that all other members of the executive will serve for four (4) years ONLY, as stated in the current Rule 37.

The Executive Committee of the Credit Union shall be a President, one or more Vice President(s), a Treasurer and a Secretary, all of whom shall be elected by the Board of Directors in accordance with Article XIII, Rule 66, and the said Executive Committee shall hold office until their successors are elected, provided that no member of the Executive Committee shall be allowed to serve more than four (4) years.

Amendment – Article IX, Rule 37

The Executive Committee of the Credit Union shall be a President, one or more Vice President(s), a Treasurer and a Secretary, all of whom shall be elected by the Board of Directors in accordance with Article XIII, Rule 66, and the said Executive Committee shall hold office until their successors are elected, provided that no member of the Executive Committee shall be allowed to serve more than four (4) CONSECUTIVE YEARS except for the President who may serve for a period not exceeding six (6) CONSECUTIVE YEARS.

Mr. Ray Howell observed that the resolution had targeted the entire executive and not the position, which he believed did not necessarily lead to better governance or stability. He sought clarification for a background on justification for that rule change.

Dr. Nicely stated that the Credit Union currently has an eleven (11) member Board and of that number there were five (5) persons who comprised the executive. Mr. Howell stated that the original intent could have been that persons could be rotated within the executive. Notwithstanding the flaw in the initial change stage, there would continue to be a challenge. However, he would be willing to support the resolution.

Continuing, Dr. Nicely mentioned that EduCom was one of the most progressive Credit Unions when it came to the term of the executive. EduCom, considering the need to transform and to modernize had put in that restriction. He added that the restriction was not replicated throughout the Movement.

Ms. Patricia Reid-Waugh stated that she would also support the resolution reluctantly, since the executive retains the right to remove the President.

The Chairman invited Ms. Karen Lyttle from the Department of Co-operatives and Friendly Societies to preside over the voting procedures. Ms. Lyttle ascertained the number of members who were present in the meeting room prior to voting. She informed that there were 128 members present.

The Presiding Officer asked the meeting for a show of hands for persons wishing to vote on the resolution to amend Article IX Rule 37 resulting in:

• Number voted for: 65

• Number voted against: 5

• Number abstentions: 58

• Number of members present at voting 128

The Presiding Officer announced that the rule was not passed as a total of 96 members were required for the resolution to have passed.

Dr. Nicely, Chairman, proceeded to state that the second rule change was in relation to approval for loans for volunteers, and that was to ensure that EduCom was efficient in the process of approving loans for volunteers. He stated that all loans above shares had to come to the attention of the Board of Directors for approval, and that was based on industry standard and in regulations that govern Credit Unions. He proceeded to read the resolution seeking approval to amend Article VII, Rule 26.

WHEREAS the current Article VII, Rule 26 states that “No Officer shall be allowed to borrow from the Society a total amount in excess of his shareholdings, and, unless approved by the unanimous decision of the joint membership of the Board of Directors, Credit and Supervisory Committees through electronic medium or at a meeting at which two-thirds of the members of the Board of Directors, Credit Committee and Supervisory Committee is present”.

AND WHEREAS the rule in its current form is ambiguous as it speaks to the unanimous decision of the joint membership of the volunteer core as well as two-thirds of the said volunteer core.

And whereas as such ambiguity could lead to some confusion and misinterpretation.

BE IT RESOLVED THAT Article VII, Rule 26 be amended to read “No Officer shall be allowed to borrow from the Society a total amount in excess of his savings, and, unless approved by a majority decision of the joint membership

of the Board of Directors, Credit and Supervisory Committees through electronic medium or at a face-to-face meeting, provided that each arm of the volunteer corps is represented by at least one member.

A member sought clarification on the difference between the approval of loans for volunteers and regular members. Dr. Mark Nicely explained that the Board does not have to scrutinize the loan of a regular member as that loan was approved by the In-house Committee or Credit Committee. However, if the loan was at a certain size or there were concerns about that loan, it might be referred to the Board for approval. On the other hand, if loans for volunteers (i.e., Board of Directors, Credit and Supervisory Committees) exceeded shares it must be subjected to the rule.

Ms. Roshain Watson asked about the minimum number of persons required at a meeting for a loan to be approved. Dr. Nicely advised that at least 14 persons would be required or two thirds of the volunteer corps, as the current volunteer corps is 21. He added that when those 14 persons met, at a minimum, at least one member of each group must be represented.

Mr. Andrew Smith commented that the Supervisory Committee should not be approving loans and then turn around and audit them. The Chairman responded that the comment would be taken for future consideration.

Mr. Ray Howell was also of the view that the Supervisory Committee should be removed from taking part in loan approvals, citing that the Supervisory Committee is a part of the regulatory arm and should not have been allowed to participate. He asked that the

proposed rule be amended to the decision agreed upon by the joint membership of the Board of Directors and the Credit Committee.

The Chairman stated that while he acknowledged and appreciated the comment, that would be a major rule change that the Board would have to consider and deliberate on because that has been the practice for decades. He further stated that the request for an amendment to that rule would be considered in the next set of resolutions in the near future. This resulted in Mr. Ray Howell withdrawing his request for an amendment to the rule.

Continuing, the Chairman invited Ms. Karen Lyttle to preside over the voting process for the rule amendment. The Presiding Officer invited the meeting for a show of hands for persons wishing to vote on the resolution to amend Article VII Rule 26 resulting in:

• Number voted for: 100

• Number voted against: 1

• Number abstentions: 27

• Number of members present at voting 128

The Presiding Officer declared that the resolution to amend Article VII Rule 26 was passed.

Mr. Elvis King CEO announced that there were two (2) gift baskets for the first two (2) members who were duly registered. He invited Mrs. Paulette Anderson-Phillips and Ms. Donna Greenwood to accept their gifts courtesy of CUNA Caribbean Insurance, Jamaica.

The Chairman, at this stage, invited the meeting to stand for the closing prayers.

There being no other business, the meeting was terminated at 4:39 p.m. on a motion by Ms. Janet McTaggart and seconded by Mr. Ray Howell.

Confirmed on motion by:

Seconded by:

Chairman

Be kind. Be brave. Be inspirational Simply Topaz

IAN MCNAUGHTON PRESIDENT

Mr. McNaughton is a consultant with a demonstrated history of working in both the financial services and manufacturing, sales and distribution sectors. He has over thirty years of professional experience in business planning, financial operations, capital structure, corporate governance and human resource development. He has served as the Managing Director and Company Secretary of Barita Investments Limited, the Finance Director and Company Secretary of Goodyear Jamaica Limited and Chief Financial Officer and Company Secretary of Berger Paints Jamaica Limited.

Additionally, he served as Chairman of the Jamaica Stock Exchange (JSE) and Treasurer of the Jamaica Cooperative Credit Union League (JCCUL) Board. He has an MBA (Finance) from Nova South Eastern University and a BSc. in Management Studies from the University of the West Indies, Mona. An avid footballer, Mr. McNaughton also sits on the board of the Harbour View Football Club.

Mr. Ian Sutherland is a Senior Manager at the University of the West Indies (Mona) with responsibility for Enterprise Applications at the Mona Information Technology Services. His experience in the field of Computer Science and Information Technology spans over thirty (30) years, and includes, but is not limited to the areas of Data Management, Application Development, Reporting Solutions, Process Engineering and Systems Integration.

With a wide appreciation of Management and Information and Communication Technology (ICT), he is capable of representing a range of matters and has provided consulting services to several industries including financial institutions, insurance, education and medical. He holds a BSc. (Computer Science, Chemistry and Math), a Post-graduate Diploma in Management Studies, a MSc. Computer Based Management Information Systems from the University of the West Indies and a professional certificate in Project Management (PMP) from the Project Management Institute. Mr. Sutherland currently serves as director on the boards of EduCom Co-operative Credit Union Limited (EDUCOM) and Quality Network Limited (QNET). During his tenure, he has contributed to various committees and special projects of EDUCOM, including the ICT (chairman), Policy, Risk and Compliance, Marketing, Business Process Review and Optimization and Delinquency Committees.

Ms. Farquharson is an Attorney-at-Law and a senior human resource practitioner who is presently employed as Senior Director in the Human Resource Division of the Bank of Jamaica where she heads the Bank's organization development and human resource planning and strategy function. She currently serves as Director of EduCom and is the 2nd Vice President. Ms. Farquharson is an ardent believer in the spirit of volunteerism and has served various organizations including the Jamaica Cancer Society, Dress for Success, Jamaica, the National Youth Service and Youth Opportunities Unlimited.

Ms. Farquharson holds several qualifications and certifications including a Bachelor of Laws Degree, a Master of Science Degree in Governance, a Diploma in Human Resource Management and is a Certified Senior Professional in Human Resource Management from the Society for Human Resource Management.

HILTON

BLENMAN TREASURER

Mr. Blenman is a Fellow of the Institute of Chartered Accountants of Jamaica who holds a Master of Science (M.Sc.) Degree in Accounting and a Bachelor of Science (B.Sc.) Degree in Management of Business from the University of the West Indies, Mona Campus.

Mr. Blenman has spent over 40 years in the field of accounting where he started as an External Auditor with Touche Ross and later, served as Assistant Vice-President Finance and Accounting, and Chief Internal Auditor at the Jamaica Mutual Life Assurance Society.

He served as Managing Director at Edward Gayle and Company and as the Director of Internal Audit at the Jamaica Public Service Limited for one year. He also served the banking sector as Manager, Accounting at CIBC First Caribbean Bank. In recent years he has been a consultant to various firms. Mr. Blenman has served as a past Treasurer and is a current member of the Board of Directors of the Jamaica Child Evangelism Fellowship Limited.

SONIA BENNETT BOARD SECRETARY

Ms. Sonia Bennett is the Publishing Manager/ Educational Technologist at Carlong Publishers (Caribbean) Limited. Sonia has over 25 years’ experience in the field of education, from classroom teacher of English and Literature to Principal at the tertiary level, serving as Director/Principal of the Vocational Training Development Institute (VTDI), a tertiary institution funded by the HEART Trust National Training Agency.

She is a graduate of Pepperdine University in California with a MA in Educational Technology. She holds a BA in Arts and General Studies –Social Sciences with Language and Literature from the University of the West Indies; a Certificate in Teacher Education majoring in English Language, Literature, Social Studies from Mico Teachers’ College (now Mico University College) and a certificate in Theatre Arts from the Jamaica School of Drama. Sonia has also begun work at the doctoral level in Curriculum and Instruction.

CHARLES O’CONNOR DIRECTOR

Charles O’Connor is the Chief Executive Officer of Charles O’Connor Consulting Network Limited (COCN), a professional services company with emphasis on Business Process Outsourcing, Web Based/Cloud Accounting Solution, Tax Planning and Business Advisory Services. Mr. O’Connor is a Fellow of the Institute of Chartered Accountants of Jamaica (ICAJ) and the Association of Chartered Certified Accountants (ACCA) in the UK. He has been a Registered Public Accountant since 2000. He received training in Fixed Income Securities at the New York Institute of Finance, Treasury Control within banks at The Bank of Jamaica in association with Crown Agents-UK, and Project Management with the University of New Orleans.

Over the last 25 years, Mr. O’Connor has held senior executive positions in both the Public and Private Sectors. He distinguished himself as General Manager of Finance and Planning at the Transport Authority of Jamaica (20062010) and Director - Securities Management in the Debt Management Division of the Ministry of Finance and Planning (1998-2001). In 2018, he successfully completed the Insolvency Practitioner Course at the Council of Legal Education, Norman Manley Law School, and is now licensed to practise in Jamaica as an Insolvency Trustee.

Mr. O’Connor has served on various boards and is currently a member of the Dispute Resolution Tribunal of the Jamaica Consumer Affairs Commission. He is also a member of the Tax Committee of the Institute of Chartered Accountants of Jamaica.

JANICE GREEN DIRECTOR

Mrs. Janice Green is a Certified Safety Professional (CSP) of the Board of Certified Safety Professionals (BCSP), USA; and a Human Resource Practitioner. She is the National Secretary of the International Commission on Occupational Health (ICOH).

A past president of the Jamaica Occupational Health & Safety Professionals Association of Jamaica, she was formerly the Occupational Health and Safety Officer at the Jamaica National Group. Mrs. Green completed her Master in Occupational Safety and Health at the International Labour Organization (ILO)/ University of Turin, Italy. At the Mona School of Business, University of the West Indies, Jamaica, she completed post graduate studies where she attained a Master in Business Administration. She completed her undergraduate studies at the University of Technology, Jamaica and holds a Bachelor of Science degree in Human Resources Management.

Mrs. Green is a Justice of the Peace and is a part of the mentorship programme at the University of Technology, Jamaica. She is a member of the Society for Human Resources Management (SHRM); and a member and trainer for the Human Resources Management Association of Jamaica (HRMAJ). She holds membership in the International Society for Indoor Air Quality and Climate (ISIAQ). As a member of the International Commission on Occupational Health (ICOH), she serves on the Scientific Committees Accident Prevention, Work Organization and Psychological Factors, and Musculoskeletal Disorders.

A Board Member and Board Secretary for the former St. Catherine Co-operative Credit Union, she now serves on the Board of EduCom Cooperative Credit Union and its sub committees where she is the Chairperson for the Human Resources (HR) Committee and the Marketing Committee. Mrs. Green is a sponsor Trustee for the UWI (MONA) & Community Co-operative Credit Union Limited Pension Plan.

COLEEN LEWIS DIRECTOR

Ms. Coleen Lewis, Attorney-at-law is a fulltime lecturer at the Faculty of Law, the University of the West Indies with over 20 years of legal experience. As a lawyer, she has worked in the areas of Offshore Law, Corporate and Commercial Law, Media Law, Intellectual Property Law, Conveyancing and Corporate Administration in law firms across the Commonwealth Caribbean as well as in the Legal Department of Jamaica’s biggest and oldest newspaper, The Gleaner Company.

She is presently employed to the University of the West Indies where she has served as the Deputy Dean, Undergraduate Affairs Teaching and Learning at the Faculty of Law.

RUEL NELSON DIRECTOR

Mr. Nelson is a management professional with over 20 years of financial management and accounting experience. He is currently employed as a Financial Manager at the University of the West Indies, Mona Campus.

He holds an MBA from the University of the West Indies, Mona School of Business and is a Fellow of the Association of Chartered Certified Accountants (FCCA). He is also a Fellow of the Institute of Chartered Accountants of Jamaica. He recently completed his Bachelor's of Law Degree from the University of the West Indies and is pursuing the Legal Education Certificate at the Norman Manley Law School.

Mr. Nelson has served in the capacity of Treasurer and 2nd Vice President on the Board of Directors. In addition, he served as a member of the Supervisory Committee of EduCom Co-operative Credit Union and the Jamaica Co-operative Credit Union League Limited. He was also a former Chairman of the Supervisory Committee for UWI (Mona) & Community Co-operative Credit Union Limited.

His competencies include strategic planning, internal and external auditing, business process reengineering, and financial analysis.

MARK NICELY DIRECTOR

Dr. Mark Nicely is a seasoned educator with over twenty (20) years of service in the Jamaican Education Sector. He served as principal at the Hayes Primary and Junior High School in Clarendon, and the Jamaica Baptist Union, William Knibb Memorial High School in Trelawny from 2004- 2011 and 2011 - 2015 respectively. As a crowning achievement of his professional career, Dr. Nicely became the 49th President of the Jamaica Teachers’ Association and served in other notable roles such as Board Chairman at the One Way Group of Schools, External Examiner for the Joint Board of Teacher Education, Lecturer at The Mico University College, Northern Caribbean University, Heart Trust/NTA and the International University of the Caribbean. He also worked with the Ministry of Education to empanel several schools across the country and assisted with the training of new principals in school management and record keeping. In his current role he occupies the post of Deputy Secretary General at the Jamaica Teachers’ Association with portfolio responsibility for Member Services and Industrial Relations, while extending his time to civic duties as a Justice of the Peace for the parish of Kingston. He also volunteers at the EduCom Co-operative Credit Union where he is Former President and current Director on the Board; is a member of the Teachers’ Services Commission and a Director on the E-Learning Jamaica Company Limited Board.

Dr. Nicely is adept at resolving problems and making timely decisions, as a result of his intuitive ability to assimilate challenging situations. His operational knowledge and practice of psychology, enables him to demonstrate people skills and execute emotional intelligence, in galvanizing harmony among stakeholders. This commendable leader continues to maximize his skills to maintain efficiency and proficiency. He possesses high standards of performance and uses analytical approaches and strategic networking; which transitions into an in-depth understanding of life experiences. He is the founder and CEO of “Rise, Counselling and Empowerment Services Ja. Ltd and Rise with Hope Ministries Ja. Ltd.”

Dr. Nicely is a proud single parent of two girls, Abbigel and Amiya, who he considers to be part of life’s greatest blessings. They are a source of inspiration and treasured ingredients in living an amazing life. His mother, Jennie Webb –Connor, remains his mentor, spiritual mother, example setter, motivator and holds him accountable to acceptable moral values and ethical standards. He remains a patriotic Jamaican who is keen on giving back to the land of his birth.

HECTOR STEPHENSON DIRECTOR

Mr. Stephenson began his professional career as a teacher of Integrated Science at St. Georges College in 1983 after completing his studies in Double Option Science at The Mico College (now Mico University College). During his sojourn at St Georges, he served as Grade Supervisor and Dean of Discipline before being awarded The Peter Hans Kolvenbach Scholarship to pursue a Master’s Degree in Secondary School Supervision and Administration at Boston College University in Massachusetts, USA. While at Boston College, he worked as a Graduate Assistant in the School of Education where he supervised undergraduate student-teachers who were seeking to gain professional teaching certification in the state of Massachusetts.

After returning to Jamaica in 1989, Mr. Stephenson was named Dean of Students at St. Georges College, before being promoted to the position of Vice-Principal in 1991 and Principal the following year becoming the first Non-Catholic permanently appointed Headmaster of St. Georges College. During his tenure as Headmaster, Mr. Stephenson also completed diplomas in Human Resources Development and Management Studies at the Institute of Management and Production (IMP) and Jamaica Institute Management respectively. Subsequent to joining the staff of the Overseas Examinations Office as Deputy Director, he served as Acting Executive Director before he was appointed Executive Director and Caribbean Examinations Council (CXC) Local Registrar in 2003.

Mr. Stephenson has served on several boards and committees including the Boards of the Excellence Coalition on Scholastic Aptitude Test; Edwin Allen High School, St. Hugh’s High School and Clan Carthy Primary School. He has been an active member of the Edwin Allen Past Students Association and a Past President of that body.

He is currently a board member of EduCom Co-operative Credit Union and Chairman of the Rules & Policy Committee. Mr. Stephenson was elected to serve as a Director on the Board of the Jamaica Co-operative Credit Union League (JCCUL) in 2020 and is a member of the Stabilization Fund Committee.

He is also a member of the Caribbean Examinations Council (CXC) National Committee, the CXC Final Awards Committee and a member of the National Qualifications Framework Committee of Jamaica.

To the 6th annual general meeting for the year ended December 31, 2020.

Given the global pandemic, as expected, the economy suffered a steep contraction in 2020, but the projection is that it will rebound for 2021, as both domestic and foreign demand strengthen. The 2020 calendar year ended with the Statistical Institute of Jamaica (STATIN) reporting that inflation closed at 5.1%. The inflation rate recorded for the year represented a reduction from the previous year’s 6.2%. The Jamaican dollar continued to depreciate against its major trading partner, USA. At the beginning of the year, the dollar was trading at J$132.57 to US$1.00, but closed the year at J$142.65 to represent a 7.6% depreciation over the period.

The graph below depicts some of the key economic variables over the past three years.

As was expected with the global pandemic, the Jamaican economy contracted in 2020, recording a decline of 10.2%, substantially down from the 0.9 percent growth experienced in 2019. The estimated out-turn for the contraction of the economy reflected the negative impact of the prevalence of COVID-19 cases globally and locally. This has negatively impacted economic activities through reduced demand and a slowing in the pace of the re-opening of the economy. The implementation of measures to manage the spread of the COVID-19 pandemic, which began impacting the island in March 2020, was another factor, along with a weakened business and consumer confidence, associated with uncertainties regarding the duration and impact of the

pandemic. Finally, the weakened demand associated with lower disposable income, due to job losses and reduced work hours, have all contributed to the downturn in the economy in 2020.

Unemployment rose to 10.7%, up from the previous year’s 7.2%, reversing the positive trend of the past two years.

Interest Rates

Figure 1 – Average Yield Government of Jamaica Treasury Bill (90 – Day Instrument) January –December 2020

The figure above provides a graphical representation of interest rates over the past year. During the 12-month period, the 90 Day T-Bill showed a 38.4% reduction, to close at a low of 0.77%.

The key indicators used to measure the Credit Union’s performance are savings, loans, total assets and gross income. The table below shows our performance in the key performance indicators for the three years, 2018 - 2020.

3-YEAR COMPARATIVE PERFORMANCE

The 2020 performance was again centered around organic growth, as there were no mergers during the year under review. Despite the challenges of the pandemic and the competitive nature of the financial landscape, the Credit Union performed reasonably well, compared to the Movement, as shown in the table above. These results reflect the success of our continued emphasis on performance, our dedication to serving you in the most challenging times, and the commitment of the leadership to anticipate and respond to the changing needs of our members.

We closed the year with savings of $8.986B, reflecting growth of 10.9% over the previous year’s $8.103B. This compares favourably to the Movement's growth of 9% for the year. Loans closed at $7.601B, a reduction of 1.7% from 2019’s $7.728B, while the Movement experienced a comparative increase of 2.8%. The decline in loans was a result of the wait-and-see approach taken by our members, as the country goes through the COVID-19 trauma. Despite the pandemic, total assets grew by 11.5% over 2019’s performance to close the year at $10.888B. The Movement’s assets grew by 9.2% for the period under consideration.

The figure below shows graphically our performance in another key indicator, namely, delinquency.

The Delinquency Ratio, year-over-year, has increased by 0.32 percentage points, having increased from 3.46% at the end of 2019 to close at 3.78% in 2020.

We continue to implore our members to communicate with us whenever there are challenges. At the peak of the pandemic, we had 9% of the borrowing members applying and getting approval for moratoria. During the period of the moratoria, we opted to freeze the interest on the loans so that members were not faced with a massive interest cost when payments resumed. The result of this initiative was that our interest income was negatively affected to the tune of Twenty-Three Million Dollars ($23M). We are indeed pleased that we made these decisions to assist our members in their time of need.

The figure below shows the comparative revenues generated over the four years, 2017-2020.

Operating Income for the period closed at $1.121B, a growth of 2.7% over the performance of 2019. The marginal increase in our Operating Income reflects the challenges we had convincing our members to borrow in 2020, as the pandemic took a toll on operations.

The specific driver or overarching objective of the 2021-2023 strategic plan is the attainment of a surplus of 2% of the value of total assets.

Strategy Statement

Our strategy statement is revised each year to reflect our strategic focus and guide our actions over the next three-year planning cycle. Our emphasis continues to be to improve the quality of lives for our members and their families by:

1. Expanding membership through target marketing, sales initiatives and direct recruitment of untapped businesses within the existing bond

2. Increasing member engagement, and utilizing existing products and services through improved service delivery and relationship building

3. Promoting transparency and feedback, recognizing top performers, upholding core values and holding team members accountable

4. Improving credit administration processes and improving pricing strategies

5. Aligning governance, leadership, and organizational culture to fixation of purpose

6. Establishing a reactivation program and an individual campaign focusing on early engagement and strong win-back to reengage members

Information and Communication Technology (ICT)

Our biggest strategic imperative of this planning horizon is to replace our current banking platform and select and install an alternative, modern and agile solution by the fourth quarter of 2021. The core banking system is the engine that drives the Credit Union. With the advent of digital banking, Cloud, and Application Programming Interfaces, we have seen a significant shift in the way products and services are delivered to members. We are

expected to release new products and services frequently, scale our infrastructure needs and be readily able to execute on mergers and acquisitions where possible.

The current legacy core banking system (Clareti), although very reliable, consists of a closed architecture (no integration with other software) which limits the progress that can be made in a constantly changing market environment. We intend to install a new core banking system which should allow us to:

• Grow product offerings to keep abreast with the market

• Minimize paper-related processes

• Automate processes

• Improve integration and remove duplications

• Deliver better support and integrated reporting

• Provide improved online member service

• Have faster set-up of ecosystems

The growth strategies that will be pursued over the next three years include:

• Penetration of the Bond

• Increased Member Engagement

• Loans and savings growth

• Marketing of existing products

• Improving our processes to enhance the Member Experience

Our marketing strategy is geared to provide opportunities to grow the loan portfolio, increase revenue and savings, boost fee income from value-added products and expand the membership base. We will seek to expand and deepen our organization's roots in traditional markets as well as attract new members from the wider market, including the unbanked. The main objectives of the marketing strategy are as follows:

• Significantly exploit the membership base through greater member engagement

• Expand personal banking and relationship selling opportunities

• Ensure robust member solutions selling by frontline staff and Business Development Officers; increase wallet share through Business Development Leaders

• Host community-based sales promotion events by targeting the unbanked and under-banked

• Increase sales productivity through intensive sales training of management and staff

• Train internal trainers to coach frontline staff

• Increase online meetings, targeting professionals, self-employed and millennials

• Deepen and widen social media footprints to get more qualified sales leads

The Key Performance Indicators (KPIs) devised at the corporate level that underscore the level of value creation to be facilitated by the organization over the strategic period are highlighted below.

At our 2019 strategic retreat, we decided to focus our efforts on improving member value by understanding individual needs and providing personalized financial solutions from an expanded suite of products. In determining member value, we decided that the pertinent factors are interest paid to the members, interest rate charged on loans, dividend paid, and fees charged. We compared our fees, rates and dividend to that of the market and are pleased to report that we have exceeded the first two years’ target on this strategic metric.

Member satisfaction is extremely high on our

list of priorities, and based on the weighted satisfaction assessment for 2020, the overall satisfaction score was 74%. This was four percentage points below that which we attained in 2019 and therefore showed that we had regressed in 2020. Our objective is to improve to a 92.5% satisfaction level by the end of 2023. Through additional training and greater member engagement, the objective is to attain an 81% satisfaction rating by the end of 2021.

Regulatory compliance refers to the goals that we aspire to achieve to ensure that we comply with relevant laws, policies, and regulations. The focus on compliance is not restricted to completing reports and submitting them on time to regulatory agencies, but more importantly, that the established standards are met on a consistent basis. The emphasis on standards require that management reports each month to the Board of Directors on the percentage adherence to compliance and regulatory requirements. In addition, management must provide information on what would have caused them to fall below expectations by identifying the contributing factors and then showing the corrective measures being put in place to remedy the situation. The aim is to have 100% compliance by the end of 2023. We are pleased to report a 91.3% compliance at the end of 2020, with the objective of increasing this to a 95% compliance by the end of 2021.

Another component of our strategic focus for 2020 was to grow the membership. The 3-year target is to increase membership to a minimum of 100,000. At the end of 2020, we closed at 78,000 and have set our sights on achieving 9.2% growth in 2021. We will continue to target family members and relatives of our

current membership but will deepen our involvement in the communities and widen our reach, as we purposefully focus on this deliverable, acknowledging that we have to grow membership to remain viable.

Another strategic initiative that we will pursue over the next three years will be to reduce the number of dormant accounts, substantially, through reactivation. At the end of 2020, a whopping 57% of the membership had not done a transaction with us over the last twelve (12) months, rendering their accounts dormant. The goal is to reduce this to below 50% in year 1, and to a maximum of 35% over the 3-year horizon.

Effective corporate governance includes establishing a robust and effective risk management and internal control systems and culture. EduCom Co-operative Credit Union recognises that risk management is an integral part of good management practice and necessary if the Credit Union is to achieve its strategic objectives. With this in mind, EduCom implemented an Enterprise Risk Management (ERM) framework that identifies, measures, monitors, reports and controls the spectrum of risks to which the Credit Union is exposed. Additionally, compliance with regulatory requirements and internal policies and procedures set by the Board of Directors is an essential foundation for setting a firm tone of compliance. Consequently, a robust and effective compliance programme has been established throughout the Credit Union. This programme provides reasonable assurance to members and all other stakeholders that EduCom is effectively meeting regulatory compliance obligation, adhering to the policies and procedures approved by the Board of

Directors and adopting international standards of best practice in compliance.

The Credit Union’s risk management strategy is designed to support its strategic plans and objectives by ensuring prioritization and adequate management of any identified risks that could affect the achievement of the strategic objectives. It includes the development and approval of the Risk Appetite Statement and risk tolerance limits.

It also provides a structured approach to the risk management process of identifying, assessing and managing risk and will take into account both the inherent and residual risks to which the Credit Union is exposed. It requires the use of a common language to assess the risks, documentation of the current risk controls that are in place, as well as potential future risk response measures. It also requires regular updating and reviewing of the Credit Union’s overall risk assessment profile based on emerging risks identified, and new developments or response actions taken.

The categories of risks managed through EduCom’s Enterprise Risk Management (ERM) framework include financial, credit, strategic, operational, human resources, reputational and regulatory, and money laundering and terror financing risks.

EduCom’s Compliance Programme utilizes a risk-based approach to identify, assess, monitor and report compliance risks within the Credit Union. Compliance activities include implementation and review of specific policies and procedures, compliance risk assessment, compliance testing, and education of staff on compliance matters. In this context, compliance

risk can be used interchangeably with integrity risk, because EduCom’s reputation is closely connected with its adherence to principles of integrity and fair dealing and embraces a broader standard of integrity and ethical conduct. As such, EduCom’s compliance function will ensure strict observance of all statutory guidelines issued through various legislations.

EduCom’s compliance programme also establishes a strong, holistic and sustainable approach to preventing, detecting and deterring money laundering, terrorist financing and economic sanctions violations. In keeping with this mandate, EduCom has acquired an AML/CFT solution, that integrates with existing core systems and provides modules for transaction monitoring, customer due diligence, sanction screening, risk profiling and advanced analytics.

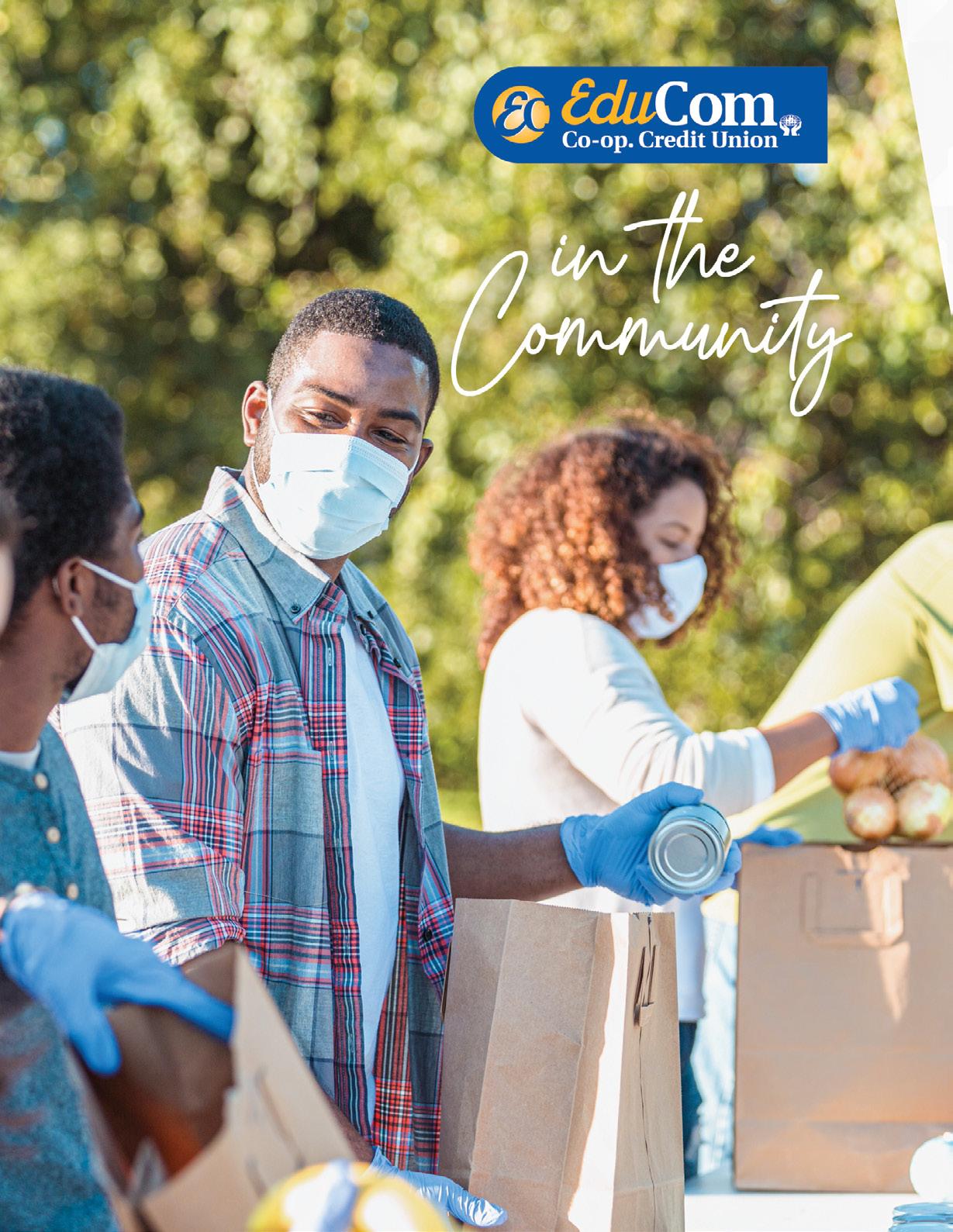

We continue to follow the principle of recognizing that helping others is not only a good thing to do but might be considered the right thing to do. In recognition of our commitment to being a good corporate citizen and in line with our policy, we continue our focus on assisting those in greater need. Despite the pandemic, the assistance to our members, charitable organizations, other institutions and individuals during 2020 was no less. In line with our emphasis on education over the years, our Annual Scholarship programme and the support given to the Albert Street Basic School, were the major benefactors from our budget allocation for outreach initiatives.

The Wealth Creator, Diamond Reserve and Executive Note continue to be the saving products that are of the highest demand among our members. The competitiveness of the rates offered on these products, along with their features (which are more geared toward the building of resources for specific purposes in the medium- to long-term), make these products prevalent among our membership. The competitive rates offered on these products continue to be unmatched in the industry. As it relates to loans, our Loan Consolidation and the Line of Credit are in high demand. We continue to respond to the members’ feedback from our surveys and have used the information to meet your needs. We also continue to welcome your feedback on how we can further improve our product offerings.

We also want to use this opportunity to remind our members of the very competitive saving instruments that your Credit Union has on offer. Good financial management requires that you maximize the returns that you get on your savings. We encourage you always to be mindful of the rates offered at your Credit Union before considering investing elsewhere. Here are some tips on how you can plan, save and minimize your expenses as you build your wealth over the next few years:

• Make a monthly budget and stick to it by providing a snapshot of where your money is going.

• Find ways to cut back on expenses by prioritizing what must be done rather than conforming to social pressures.

• View and understand your credit score. Do not do this often, however, as this can impact your score negatively.

• Keep an eye on your investment accounts and the trends in interest rates.

• Monitor the market to find the best offerings on similar accounts and credit cards to ensure that you get the most competitive interest rate or earn more benefits. Below is a list of our product offerings. Kindly visit our website, call and speak with one of our Member Care Representatives, or visit our offices to learn more and benefit from these superior products.

• Permanent Share Account - dividend

• Regular Deposits - competitive interest rate

• Executive Note - competitive interest rate

• Diamond Reserve - interest credited monthly

• Special/Fixed Deposits - competitive interest returns

• Wealth Creator - long-term savings and investment, insured with monthly interest returns

• Christmas Savings Club - monthly savings and interest Christmas encashment

• T.E.A.C.H. - Share account for Trainee Teachers

• Y.S.C. (Youth Savers Club) - Savings for children of members with competitive interest returns

• Personal

• Debt Consolidation

• EduCom Special

• Line of Credit

• Productive/ Business

• Educational

• Home Acquisition & Improvement

• Motor Vehicle

• Standing Order

• Family Indemnity Plan (F.I.P)

• Health Insurance

• Internet Banking

• Access Plus debit card

• Financial Counseling