BY MOSS BRENNAN

No matter the season, High Country towns are special in many ways. There’s something for everyone from Newland and Banner Elk in Avery County, Boone and Blowing Rock in Watauga County, and West Jefferson and Lansing in Ashe County.

In the fall, expect busy roads — especially in early to mid-October — as the High Country is a hot spot for leaf-lookers who come to see the vibrant fall colors, which can be seen from all over the various towns and communities that make up the High Country.

Jefferson, the county seat of Ashe County, is home to roughly 1,600 residents within the town limits. The town was first founded in 1799 and was named after then-Vice President Thomas Jefferson. The town was originally called “Jeffersonton” for a short period and encompassed approximately 50 acres of land.

Now, Jefferson is home to the Ashe County Courthouse, Ashe County Park, the Ashe County Law Enforcement Center, and numerous restaurants, shops, and stores. The town also has the restored 1904 Courthouse listed in the National Register of Historic Places. The old courthouse is currently home to the Museum of Ashe County History, right next door to the Jefferson Police Department.

The bustling downtown area of West Jefferson is one of the most popular destinations in Ashe County. West Jefferson currently has around 1,300 residents who live within the town limits and has a wide variety of shops, art galleries, local restaurants, and much more that bring tourists to the area. The Ashe County Arts Council calls West Jefferson home, as does the Ashe County Cheese Plant, West Jefferson Park, and the local office of the New River Conservancy.

West Jefferson was first incorporated in 1909 and originally saw much of its growth and popularity increase due to the Virginia Creeper Railroad that passed through downtown.

West Jefferson has numerous events in the downtown area that take place throughout the year. In addition to concerts throughout the spring and summer months, the Christmas in July festival and the Olde Time Antiques Fair in September are two of the largest annual events that take place in Ashe County.

Lansing was the third and final town in Ashe County to be incorporated officially. The town of about 130 residents was first incorporated in 1928 and was another major stop along the Virginia Creeper railroad along with West Jefferson, Todd, and the community of White Oak. The town has major historical significance to the area as there are currently five places in the town that are included in the National Register of Historic Places: The Old Lansing School, Perry-Shepherd Farm, Miller Homestead, Clark-Miller Mill and the Lansing Historical District.

The population of Lansing within its town limits has dropped throughout the years after the railroad industry ceased in the county. The 1960 census showed 278 people lived in the town, while the most recent census in 2020 showed just 126 town residents.

Located just off of the Blue Ridge Parkway, Glendale Springs is most wellknown for the fresco painting at Holy Trinity Episcopal Church and the Glendale Springs Inn & Restaurant, where President Bill Clinton and Vice President Al Gore once dined after a visit to Ashe County in 1998. The Glendale Springs Inn was also added to the National Register of Historic Places in 1979. In addition to its easy access to the Blue Ridge Parkway, Glendale Springs is near the New River and offers some beautiful opportunities for enjoying nature.

Fleetwood is located between West Jefferson and Deep Gap and is another of the many small communities in Ashe County that offer easy access to the New River. Whether you want to kayak, canoe or float down the river, areas between Fleetwood and Todd off of Railroad Grade Road are popular places to get into the water. Fleetwood is also home to a brand new fire department right off of U.S. 221.

The community of Grassy Creek lies right on the state line between North Carolina and Virginia. Grassy Creek is home to The Old Store and features the Grassy Creek Historic District that is part of the National Register of Historic Places. The historic district was added to the registry in 1976. As you will notice driving through the area, much of the land in Grassy Creek is used for growing Christmas trees.

Creston township can be found in the northwest corner of Ashe County. It is home to Worth’s Chapel, a church that was constructed in the early 1900s and added to the National Register of Historic Places in 1976. A drive through Creston brings you close to the Tennessee state line in one direction. Creston is also home to the Riverview Community Center, which holds numerous community events throughout the year, and is home to a local fish fry every other week.

The town of Laurel Springs is right on the border of Ashe, Alleghany and Wilkes counties. The town offers quick and easy access to the Blue Ridge Parkway and is home to several family-owned businesses and the Thistle Meadow Winery that is open in the spring, summer and fall months. Thistle Meadow Winery offers tours and tasting events and an online store where you can order products if you live outside of the area.

Todd is a small town shared by Watauga and Ashe counties, nestled in a bend of the South Fork of the New River.

Todd is an area with a rich history, one dating back to nearly 6,000 years ago. According to the Todd Community Preservation Organization, that is when the earliest human activity in the area occurred.

As for recreation, the New River — one of only a few rivers in the U.S. to flow North — is the main attraction in Todd, especially in the summer.

Go fly fishing, kayaking or tubing with one of the several river outfitters in the Todd area, such as RiverGirl or Wahoo’s.

Anyone wanting to explore on their own should check out Green Valley Community Park. The park features playground equipment, playing fields, a paved walking track, a picnic shelter, restrooms, a canoe ramp, hiking trails and access to the New River.

Being one of the smaller towns in the High Country, Todd is a close-knit community. To connect with nature (and friendly locals), be sure to check it out.

The mountain town of Banner Elk lies between two major ski attractions, and has grown from a tiny hamlet to a town offering year-round amenities and memorable vacations for the entire family.

Banner Elk is home to Lees-McRae College, a small, private, four-year coeducational liberal arts college founded in 1900 and is affiliated with Presbyterian Church U.S.A., with more than 900 students from more than 20 states and countries. The old stone buildings, some of which are currently being renovated and restored, are nestled across campus to make for a photographer’s delight.

The town hosts numerous shops and restaurants and stays abuzz with activities and events.

Visitors can picnic or walk in the town park, hear live music in the town park during summer or within various venues in all seasons, enjoy exquisite shopping or simply relax by the Mill Pond and stay in one of the inns after dinner in a fine restaurant.

Banner Elk is in the heart of the High Country’s many attractions, and just a short drive will take you to numerous natural settings where you can relax and revel in nature’s beauty, from slopes to hiking trails to wineries and waterfalls.

Visitors are encouraged to return to Banner Elk in the fall each year for its Woolly Worm Festival, which attracts close to 20,000 people annually on every third weekend in October.

Cutting between the peaks of Sugar Mountain, Beech Mountain and Grandfather Mountain, the topography of the town provides natural definition and gentle undulation through the town’s boundaries.

For more information or a calendar of events, call Banner Elk Chamber of

At 5,506 feet, Beech Mountain is the highest town in Eastern North America. That means two things: When summer comes, it’s a great place to go biking as the ski resort offers a bike park. Even on the hottest day of the summer, it’s cool atop the peaks of the mountain.

Even when it’s steamy in the “lowlands” of 3,000-plus feet, the temperature stays comfortable.

The rest of the world seems distant when you settle down on the front porch of a rental condominium and survey the magnificent view that is one of Beech Mountain’s trademarks.

Beech Mountain is a four-season resort, with more than 5,000 beds available on top of the mountain. These range from rustic cabins to mountain chalets to luxury condominiums.

When it’s time to eat, you can enjoy anything from a deli sandwich to pizza to a gourmet meal by candlelight.

There’s another good thing about Beech Mountain: The mountain is so large that much of it remains in a natural state, with rich forests dotted by rolling farmland. Not to mention, it’s only a short drive from the “downtown” area to the country or resorts. Take your pick.

Our guess is if you spend some time in Beech Mountain, you’ll want to come back to do some real estate shopping or at least book a slopeside condo for the ski season.

For more information, visit www.beechmtn.com.

Crossnore is a town steeped in educational history. The town is home to Marjorie Williams Academy, founded by doctors Eustace and Mary Martin Sloop.

The Sloops traveled steep dirt trails in isolated mountain valleys to bring medicine to the people and convince farmers to let their children go to school. Because of poverty and distance, the Sloops school in Crossnore eventually took

in boarders and built dormitories to accommodate them.

It gained a national reputation for effectiveness in changing lives and in breaking the cycle of poverty, moonshine and child marriages of mountain families. Mary Martin Sloop eventually put these tales to paper in her autobiography “Miracle in the Hills,” which has since been used as the basis for a drama of the same name that takes place each summer in present-day Crossnore.

The Sloops built a school, hospital, dental clinic, and, eventually, a boarding school to give children the basis for an improved life. They brought to Avery County the first electricity, telephones, paved roads, and boarding schools. Through the Sloops’ advocacy, public schools flourished in Avery County. Crossnore is famous for its Independence Day parade and celebration, and the town’s Meeting House is home to the Crossnore Jam, a series of gatherings and concerts by local musicians on the first Friday night through the summer and fall months.

For more information, visit www.crossnorenc.com.

The town of Elk Park borders the state of Tennessee and offers a unique visiting experience. From the old-time feel of Brinkley’s Hardware Store to the additional Lower Street antique shops and classic mural wall, Elk Park takes visitors back to a simpler time.

The town’s original thoroughfare, Lower Street, and many businesses originated when Elk Park hosted a train depot for the old East Tennessee and Western North Carolina Railroad, better known as Tweetsie. Elk Park thrived due to the industry and remained vibrant after the trains stopped running through town.

Elk Park is also the home of Trosly Farm and The Liar’s Table Restaurant. Owners Amos and Kaci Nidiffer were named 2020 North Carolina Small Farmers of the Year by NC A&T State University Cooperative Extension.

For more information, call Elk Park Town Hall at (828) 733-9573.

The community of Linville is located just south of the intersection of U.S. 221 and N.C. 105 in Avery County. The community was founded in 1883, designed by Samuel T. Kelsey of Kansas and named for William and John Linville, who were reportedly killed by Cherokees in 1766.

Linville has three country clubs in the area: Eseeola, Grandfather Golf and Country Club and Linville Ridge, all open late spring to early fall.

A number of local tourist areas within a short drive share the Linville name, including the Linville River and majestic Linville Falls, Linville Caverns on U.S. 221 and the Linville Gorge wilderness area.

For visitors considering making Linville a part- or full-time home, they can visit Linville Land Harbor, where units are available for sale or rent in a cozy community featuring its own golf course, tennis and pickleball courts and amenities.

During the winter months, Linville is only a short drive to nearby ski slopes at Sugar Mountain and Beech Mountain, popular skiing and snow-tubing destinations.

Perhaps the most popular tourist attraction housed in Linville is Grandfather Mountain.

The Grandfather Mountain attraction offers picturesque views during all four seasons, animal habitats and the famous Mile High Swinging Bridge.

The highest county seat east of the Mississippi River at 3,589 feet, the town of Newland was incorporated in 1913 as the county seat of the newly formed Avery County.

Its original name was “Old Fields of Toe,” because it is located in a broad flat valley and is at the headwaters of the Toe River.

Newland was a mustering place for Civil War troops. Toe is short for “Estatoe,” an Indian chief’s daughter who drowned herself in the river in despair because she could not marry a brave from another tribe.

A town of approximately 700 residents, Newland succeeded over three other areas for the honor of county seat. The recently renovated courthouse, originally constructed in 1913, overlooks a classic town square, bordered by shops and churches and complete with a memorial to Avery County veterans.

Adjacent to the courthouse building is the original jail, which has been converted into the Avery County Historical Museum. Exhibits in the museum, which is free to visit, include the original jail cells, numerous artifacts and information about the history of Avery County.

Newland hosts an annual Christmas parade downtown, with decorations adorning the town reflecting the area’s rich Christmas tree industry.

With a number of restaurants and boutiques downtown, Newland is a prime destination for dining and shopping or just to stop in on a visit to nearby Roan Mountain, Tenn., or Grandfather Mountain.

For more information, visit www.townofnewland.com.

If outdoor activity is your thing, look no further than the village of Sugar Mountain.

Offering more than just great skiing, Sugar Mountain also provides its visitors with an array of ways to get outside and enjoy the beauty of the High Country.

Their public golf and tennis club, owned and operated by the village, is a local’s favorite. Voted the No. 2 short course in the U.S.A., the 18-hole golf course has immaculate greens and plenty of mountain views. Green fees start at just $15. The friendly pro shop and Caddyshack Café rounds out the perfect golf day.

Located adjacent to Grandfather Mountain and surrounded by Pisgah National Forest, the Village of Sugar Mountain provides plenty of other adventures including the alpine coaster, gem mining, whitewater rafting and hiking. Unwind at 25 restaurants within five miles, along with plenty of galleries and boutiques to browse.

Whether you come for a day or stay in one of the many comfortable lodgings the village has to offer, Sugar Mountain will soon become your destination for great outdoor fun.

For more information, visit www.seesugar.com.

Boone

Boone is the county seat of Watauga County and is affectionately known as “The Heart of the High Country.”

Boone is the hometown of Appalachian State University, the sixth-largest school in the N.C. public university system with more than 20,000 students. With the mix of students, tourists and easy-going locals, there’s something for

A drone’s-eye view of the town of Newland and its many fall colors.

everyone in Boone.

Downtown Boone hosts a unique collection of local boutiques and businesses. For funky handpicked second-hand clothes, head over to Anna Bananas on King Street. For a unique shopping experience at a family owned and operated business since 1924, check out The Shoppes at Farmers. There, you can find anything from jewelry to art, toys, and more.

Tired of shopping? Kick back at one of Boone’s many breweries, many of which host live music and events in the evenings. Appalachian Mountain Brewery, Booneshine, and Lost Province Brewing Co. are a few local favorites for a brew and a bite to eat.

For those interested in Boone’s bluegrass traditions, check out the Doc Watson “Man of the People” statue located on King Street. Doc Watson was a famous guitarist and bluegrass musician local to Boone. Watson won seven Grammy awards and a Grammy Lifetime Achievement award during his active years. Though he passed away in 2012, his celebrity and spirit is alive and well in Boone.

Boone is the place to be for shopping, good food, good music, and definitely

good times.

For more information, visit www.townofboone.net.

Don’t be fooled by the small size of Blowing Rock — there’s enough natural beauty for a lifetime in the just three-square-mile town.

The town’s name comes from the rocky cliff overlooking Johns River Gorge where it is said the winds blow in such a way that light objects falling from the rock float back up, almost like a boomerang.

Anyone wishing to experience the phenomenon and learn some of the rich Indigenous history of the town can visit the attraction located on The Rock Road.

The small portion of the Blue Ridge Parkway that falls into the town’s limits includes beautiful hikes and views like those at Moses Cone Manor and Julian Price Park. Visitors can find the same beauty off of the Parkway at Bass Lake Trail and Broyhill Park.

For those seeking educational enrichment, the Blowing Rock Art and History Museum is a year-round museum that houses exhibitions and programs celebrating and remembering the culture, history and traditions of the Appalachian region displayed throughout time in the High Country. The museum is just moments away from the bustling sidewalks of downtown Blowing Rock. From hiking to gallery viewing to enjoying a spa day at the hotel, Blowing Rock crams a lot into its small stature.

For more information, visit www.blowingrock.com.

Seven Devils sits between Banner Elk and Boone. Moments away from Boone, Blowing Rock, Banner Elk and Valle Crucis, it is the perfect place to stop and rest amidst the mountains.

How did it get its name? According to the Seven Devils website, “The founders wanted a catchy, unique name that would bring attention to the mountain. They noticed the repeated appearance of the number seven, including the seven predominant rocky peaks surrounding Valley Creek, as well as the many coincidental references to ‘devils.’ ‘Seven Devils’ seemed to suggest a frivolous, mischievous resort where people could experience the temptation of Seven Devils.” Sugar Mountain, Grandfather Mountain, and Beech Mountain surround the elevated town. For those looking to adventure, take a trek to Otter Falls. The trail is a 0.6-mile hike to the falls, in total the hike is 1.2 miles, including the way back. The trail encourages those going to the falls to bring furry friends to hike alongside.

The town of Seven Devils was established in the 1960s, the town has continued to adapt and grow while maintaining a commitment to their community.

For more information, visit www.sevendevils.net/.

Just off N.C. 105 south of Boone, Valle Crucis offers simplicity and serenity in a pastoral riverside community. The valley contains the site of the only known Native American village in the immediate area. The first European settler of Watauga County, Samuel Hicks, also built a fort in the area during the American Revolution.

Today, the community offers several historic inns, restaurants, art galleries, farms and churches that provide service and comfort to all who enter. The Episcopal Church has played a role throughout the community’s history. An

Episcopal bishop entered the community in 1842 and provided its name, which is Latin for “Vale of the Cross.”

The Valle Crucis Conference Center, on the National Register of Historic Places, stays busy with retreats for numerous groups, and Crab Orchard Falls is a short hike from the conference center. The original Mast General Store provides a central gathering space in the community, as it has since 1883. Just down the road is the Mast Store Annex, which opened about 25 years later. Behind the annex is a gravel road to the Valle Crucis Park, a recreational area with walking paths, riverfront, picnic areas, sports fields and live music during the summer. For more information, visit www.vallecrucis.com.

Tucked between Boone and Banner Elk is the unincorporated community of Foscoe. Although small, the community is packed with opportunities to shop, dine and explore.

Shopping includes antiques at Front Porch Antique Marker, souvenirs and sundry at Bear Creek Traders, ceramics and porcelain at Maggie Black Pottery and custom blades at Winkler Knives. Interested in outdoor fun? Check out Foscoe Fishing Company, or pan for gold with the Greater Foscoe Mining Company.

Soups, sandwiches, sweets and more are on offer at The Dog House Cafe, while at Country Retreat Family Billiards burgers and shooting pool is on the menu. Foscoe is also home to some of the most gorgeous mountain scenery in the High Country, including the famous profile views of Grandfather Mountain. For more information, visit www.foscoenc.com.

BY CHRISTIAN GARDNER

Cool temperatures, a rural atmosphere, and beautiful vistas are just a few of the many reasons why more and more people choose to move to the High Country. Whether you are searching for a permanent home or a vacation spot, the High Country has everything you need and more.

In the spring, the cool mountain air meets the beautiful greens, purples, and white colors that flourish around the High Country, with new life being presented. In the summertime, the lush green forests and the cool, refreshing rivers welcome visitors and locals to enjoy Appalachia’s natural beauty.

From hiking to whitewater rafting to cruising the Parkway, spending a summer in the High Country is a unique experience. Autumn holds a special place in many’s hearts as the rich oranges, reds, and yellows burst onto the scene, making the mountains a canvas of never-ending inspiration. Along with the winter, the barren mountains are powdered with snow and resorts are ready for skiers and snowboarders alike. If visitors are prepared to bear the cold, winter hikes offer empty trails and one-of-a-kind views.

The High Country offers enough activities to keep people busy year-round. The open mountains draw people from the city to experience a slower pace of

Mike Lacey of Lacey Realty noted that most people buying homes travel from the Piedmont region of North Carolina, specifically Charlotte, with other buyers often traveling from Florida, South Carolina, or Georgia. According to Lacey, the past three and a half years have been hectic for the real estate business.

With COVID-19, many people were looking to find places to live outside the city to get away from the dense populations. Since many people could work from home, they were looking to find their hideaway in the mountains. This brought in a new market of homebuyers from New York and New Jersey. The housing market has since slowed back down to a somewhat normal pace, said Lacey. But the High Country remains a desirable place to live.

From Blowing Rock to Boone, Valle Crucis to Banner Elk, and Newland to Crossnore, there is no wrong choice.

“You’ve got the urban amenities tucked into the rural atmosphere,” Lacey said. This area offers both ample access to restaurants and activities as well as the seclusion most folks are looking for coming up to the mountains.

If you are ready for the commitment of being a homeowner, purchasing a house is a great way to have a stable living situation.

BY NATHAN HAM

Deciding to buy or rent a home can be exciting and stressful. The time and energy spent searching for a place to live can lead to a rewarding outcome once you decide whether to make the long-term financial commitment to purchasing a home or the flexibility that comes with renting a home.

Many adults dream of becoming homeowners as they grow up, enter the workforce, and start a family. The “American Dream” might have changed

over the years, but the perks of owning a home remain the same.

Buying a home is one of the easiest investments you can ever make. Property values rarely decline, and homes in good shape often appreciate. So,

if you do decide to sell a home, you will often be able to make a profit on it and take that extra money to put toward purchasing an even nicer and newer home. By purchasing a home and the property that comes with it, you have the opportunity to personalize everything so that it fits what you want your home to be. You can upgrade and renovate anything you want, whether it be simple things like a fresh coat of paint or larger upgrades like HVAC systems or electrical work.

One of the most popular reasons people buy their homes is for the stability that comes with it. You can go to bed each night without worrying about your rental property potentially being sold or your landlord deciding to do something different with the property after your lease ends. That sense of stability eases a lot of doubt and stress for residents.

Renting’s greatest reward is the immense amount of flexibility that comes with it. If you are in the early stages of a career that might offer job promotions in other locations, it is much easier to leave a rental property than to deal with selling a home and finding a new home to buy in a new location. Maybe you like to travel or your job requires a lot of travel, then renting a home makes a lot more sense than paying a mortgage for a property you do not stay at every day.

Another positive aspect of renting a home is the upkeep of the property. The landlord is typically responsible for most repairs, especially costly ones that would be a major unexpected bill to pay if it occurred at your home. Even small things such as lawn maintenance or trash pick up can often be covered by the landlord as part of rent or property fees.

It is often easier to budget the expenses in your life if you rent a home instead of owning one. Your rent will be the same for the length of the lease you signed, and you do not have to pay property taxes or budget for unexpected repairs if you are a renter.

As you consider buying or renting a home, consider your financial situation,

long-term plans, and personal preferences. Renting might be ideal if you value flexibility and avoid costly repairs. Buying could be the best choice if you’re looking for stability and the importance of a long-term investment.

BY NICK FOGLEMAN

Buying a home for the first time is an important milestone that can be both liberating and frustrating. There are many things to consider when entering the real estate market, and it’s important to be well-informed before making such a decision.

The first step to making any large purchase should be a full assessment of your finances. Understanding how much money comes in and goes out each month will help you budget for the costs and mortgage payments associated with a home purchase.

Getting preapproved for a loan will also give you a clear idea of how much money a lender is willing to offer, making it a great tool for showing sellers that you’re a serious buyer.

David Laughter, a real estate agent in Blowing Rock with 25 years of experience, said getting preapproved is a good first step.

“It’s very important to the buyer and seller,” Laughter said. “It shows that someone is qualified to buy their property before they get to the negotiations.”

Once you know how much house you can afford, the next step is to find a location that fits your budget, needs, and future plans.

It’s important to familiarize yourself with the neighborhoods you’re interested in and consider factors that matter to you, like school districts, crime rates, and commute times to work and activities.

This is a good time to contact a real estate professional who can answer many of these questions.

“It helps buyers decide where they want to be,” Laughter said. “You can ask the agent where they think the best value is and where the best schools are.”

Creating a wishlist will help narrow down your choices and reduce the overwhelming number of choices in an area.

A wish list should include non-negotiables, such as the number of bedrooms, location and cost. Next, list things important to you but aren’t must-haves, like a home office (unless you work from home) or a modern kitchen (unless you love to cook). Finally, have things that you would like to have but can be flexible on. Most people don’t want a fixer-upper, but if you know how to replace cabinets and paint walls, things like no minor renovations or adjustments can be on this list. Everyone’s wish list will be different because of your individual needs and circumstances. Prioritize your needs, wants and must-haves to find the best fit for you.

After you’ve found an area that provides the things you want, take a look at the real estate market in the area and ask yourself a couple of questions. Are prices rising or falling? How long are homes on the market before selling? What are the property taxes in the area? How do homes in the area maintain their value?

It’s important to note that a professional real estate agent with experience in the area will be invaluable in answering these questions and knowing what is on the market.

After you have found a house to move forward with it is important to conduct inspections by hiring a professional inspector. Real estate agents can help find a trustworthy and thorough inspector in the area.

This process is important because it allows you to look beyond the house’s aesthetics and focus on the integrity and systems that the house relies on. The inspector will check the structure, safety, grounds, exterior and equipment like plumbing, HVAC and electrical, among other things.

If any problems arise it is important to look past the idea of a dream home and understand that problems with these systems can be very expensive and damaging to a property. Speak with your real estate agent and inspector to understand the cost any repairs may require and speak with the seller to make sure they understand these and act accordingly.

“Everything is negotiable,” Laughter said. “If there is something real serious,

the buyer may say, ‘I don’t want to bother with that.’ But if it’s an easy fix, it’s up to the buyer to decide what they want the seller to do, either fix it or get a credit for it.”

Even if it is your dream house, if there are serious problems, make sure you understand the costs and risks associated with owning the property. If a deal cannot be made, walk away.

It’s important to understand the other costs associated with purchasing a house as well. Taxes, attorney fees, insurance, and future homeowners’ associations should all be spelled out in the closing statements and are important considerations for your budget.

Also, consider any future needs. Will you need additional bedrooms in the future or workspace for a job transition or hobby? Planning for these events before you purchase a house will save you a headache down the line.

When considering purchasing your first home, it’s important to consider the future, as many people don’t stay in their first home forever. Consider the resale value of the house and trends in the local market. If conditions are right, homes can be an excellent investment opportunity to build wealth in the future.

“Location is the biggest factor in the real estate market,” Laughter said. “If you want to buy a house as an investment you have to have a house where people want to be.”

As always, buying a home takes time; do not rush the project.

“If the agent is doing their job, they should be able to smooth out the process,” Laughter said.

BY HAILEY SACKEWITZ

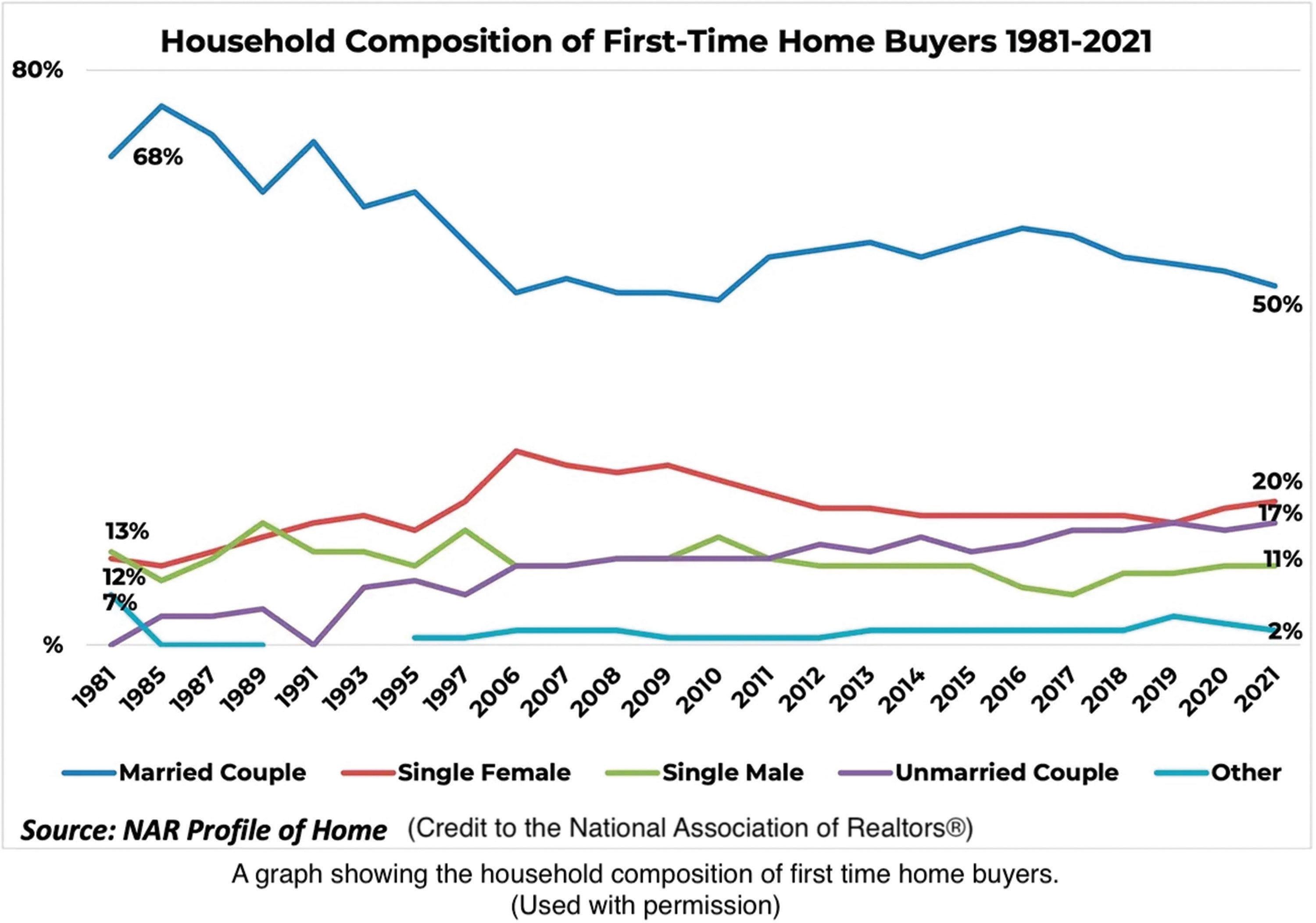

According to the North Carolina Association of County Commissioners, portions of the High Country have experienced dramatic increases in median listing prices over the last five years. Many credit this high inflation to the COVID-19 pandemic. The low interest rates and increase in demand for homes during early 2020 have resulted in a national average of 3040% increase in home prices.

The surge in home prices has put additional pressure on buyers, particularly first-time homebuyers, who are facing steeper competition. As more potential buyers enter the market, many find it harder to secure homes at reasonable prices, forcing them to act quickly.

Additionally, rising property values in portions of the High Country are reshaping the local market, making affordability a growing concern for residents. Keith Dowdy, a real estate agent with eXp Realty, states, “With rates coming down, one thing I’m saying to clients is to expect more competition from other buyers as they come back into the market.”

However, buyers do not have to lose hope, as Dowdy has some advice for future buyers. He

recommends that buyers get a house “when rates are a little higher so they can refinance their rate as the rates come down, rather than jumping into the market with a slew of new buyers who are also getting into the market.

“With rates expected to come down even more, I expect the ultimate sales prices to be closer to the original asking price now that rates are coming down,” Dowdy added.

Housing costs have risen, and new rules are reshaping the real estate process. The recent settlement with the National Association of Realtors will pose changes within the real estate industry. Two key changes have been introduced. The first is that the Buyer Agency Agreement must now be signed before showing a property. The second is that the realtor’s compensation, previously publicly displayed on MLS, will no longer be. These shifts are expected to impact how both realtors and clients approach future transactions.

•TREE

e Consumer Federation of America has proposed criteria for evaluating new home buyer contract forms, including:

• Brokers have the right to terminate contracts at any time.

• Buyers should have the same right with no fees charged.

• The contract should state prominently that the broker’s fee is not set by law and is fully negotiable.

• The broker’s fee should always be clearly stated as a dollar figure or as an hourly rate. It should also state that the buyer’s broker can receive no additional compensation for facilitating the sale.

• Any seller concessions should be approved by and paid to buyers, not their brokers, then used by buyers.

Contact one of the many local realtors in the area for more information on existing or potential changes to real estate laws.

BY LUKE BARBER

While the Blue Ridge Parkway attracts leaf lookers from across the country during the second and third weeks of October, locals are able to enjoy the views on a more permanent basis. Oftentimes, a week day drive may provide a an opportunity to have the views all to oneself.

The High Country real estate market is known for the many snowbirds who migrate back and forth between the mountain’s crisp climate in the summer and warmer regions in the winter. But for those who decide to nest here year-round, there is no shortage of amenities to make the High Country your forever home.

In the summertime, lush, sweeping vistas such as those of Grandfather Mountain, Elk Knob, Mount Jefferson, Seven Devils, Paddy Mountain and others provide epic backdrops for the many homes and communities scattered throughout Ashe, Avery and Watauga counties.

Springtime beckons homeowners, renters, and vacationers to the seemingly innumerable hiking trails and waterways for outdoor activities. Meanwhile, the Blue Ridge Parkway offers countless jumping-off points for outdoor adventures for locals and newcomers alike across the Smoky Mountains and Shenandoah connector.

In autumn, homeowners need not worry about the thousands of onlookers who venture to the High Country to behold the fall colors. Front porches, open windows and neighborhood strolls offer ample opportunities to enjoy the fall

colors from the comfort of one’s own home.

Moreover, the advantages of High Country living do not end during the winter time. In fact, planting roots in the High Country helps provide access to the three ski resorts across the region: Appalachian Ski Mountain, Beech Mountain Ski Resort, and Sugar Mountain Resort. During the winter, residents often have the High Country all to themselves.

Many newcomers are attracted to the region due to its rural culture and slower pace of life. Many travel and relocate from the Piedmont region of North Carolina, particularly Charlotte, while others travel from Florida, South Carolina, and Georgia to buy homes, vacation and rental properties.

However, those who miss urban and city life may feel right at home amidst the hustle and bustle of Boone, especially when school at Appalachian State University is in session. For those enjoying life in the countryside, the amenities of Boone, such as dining, healthcare services, vehicle services and its thriving arts and entertainment culture, are simply a scenic drive into town.

Furthermore, for those who need to travel to a larger city, Johnson City, Tenn., is an hour and a half away, Charlotte is two hours away, Asheville is two

hours away, Raleigh is three hours away, and Atlanta, Georgia, is four hours away.

While the area has seen unprecedented growth in recent years due to people moving from larger cities during the pandemic, the housing market has since

slowed to its normal pace.

From Blowing Rock to Boone, Valle Crucis to Banner Elk, Newland to Crossnore or from Lansing to West Jefferson, you can’t go wrong when choosing your new mountain home in the High Country.

The real estate market in the High Country is constantly evolving. In 2023, realtors had 2,000 residential sales closed in Watauga, Ashe, Avery, and Alleghany counties for more than $1 billion in sales, according to the High Country Association of Realtors.

The median sales price for all those sales for the year was $450,000. The maximum sale price for a residential property for the year was $4,700,000. Most recently in August of this year, the High Country real estate market of Alleghany, Ashe, Avery, and Watauga counties saw sales down 8.7%, and inventory climbed 23.9% during August compared to August 2023, according to the High Country Association of Realtors monthly report.

In August, 210 closed sales were on single-family and condo/townhouse properties, for a combined closing total of $135 million and a combined median sales price of $469,500.

Inventory: Alleghany, Ashe, Avery, and Watauga Counties had 789 active single-family and condo/townhouse listings during August, with 283 new listings coming onto the market. That is a 3.8 supply of inventory, down 8.6% compared to July 2024.

Land: The four counties had 1,484 active land listings during August, a 21.5-month supply of local land inventory. That is slightly up compared to July 2024. Land sales for August were $12.9 Million, with the largest sale in Watauga County, which was $3 million.

Commercial: Currently reported to the High Country Multiple Listing Service, 43 commercial properties are listed, and five commercial sales within the four counties combined in August for $1.5 million.

Watauga County: Realtors closed on 91 residential properties in August, and that median sales price was the largest in the four counties, at $525,000. There are 340 active residential properties in the county. There were 31 land sales, and the median sales price was $150,000. There are currently 509 active listings for land in Watauga County.

Ashe County: Realtors closed on 51 residential sales for August, and that median sales price came in at $375,000. There are 119 active residen-

tial properties in the county. There were 22 land sales for August, and the median sales price was $50,000. There are currently 423 active land listings in Ashe County.

Avery County: Realtors closed on 53 residential properties during the month, with a median sales price of $405,000 for August. There are 259 active residential properties currently. Avery County had 10 land sale closings in August, with a median sales price of $111,250. There are 299 active listings for land in Avery County.

Alleghany County: Realtors closed on 15 total residential sales. The county’s median sales price for August was $385,000. There are currently 71 active residential listings in the county. Six land closings came in August, with a median sales price of $14,750. There are currently 253 active land listings in Alleghany County.

Nationally: According to a recent report from National Association of Realtors® President Kevin Sears, “The Federal Reserve’s revised Basel III proposal is a win for the housing market, Realtors®, and consumers. By making it easier for banks to support low down payment loans, these changes should ensure continued access to affordable home financing. The proposal laid out by the Federal Reserve also recognizes the strength of changes made more than a decade ago to regulation and oversight of the housing-finance industry in the wake of the subprime crisis. We applaud the Fed for this thoughtful adjustment, which ultimately reflects a commitment to a healthy housing market and reinforces the stability we’ve worked hard to achieve.”

For more information about HCAR, visit www.highcountryrealtors.org/.

BY FRANCISCO HERNANDEZ

Beverly Black, owner and broker-in-charge of Ashe County Realty, knows all about what to keep in mind when looking for, purchasing, and maintaining a vacation home in the High Country.

Location and Accessibility

Location is important when deciding on a vacation home. A buyer needs to con-

SEE VACATION PAGE 25

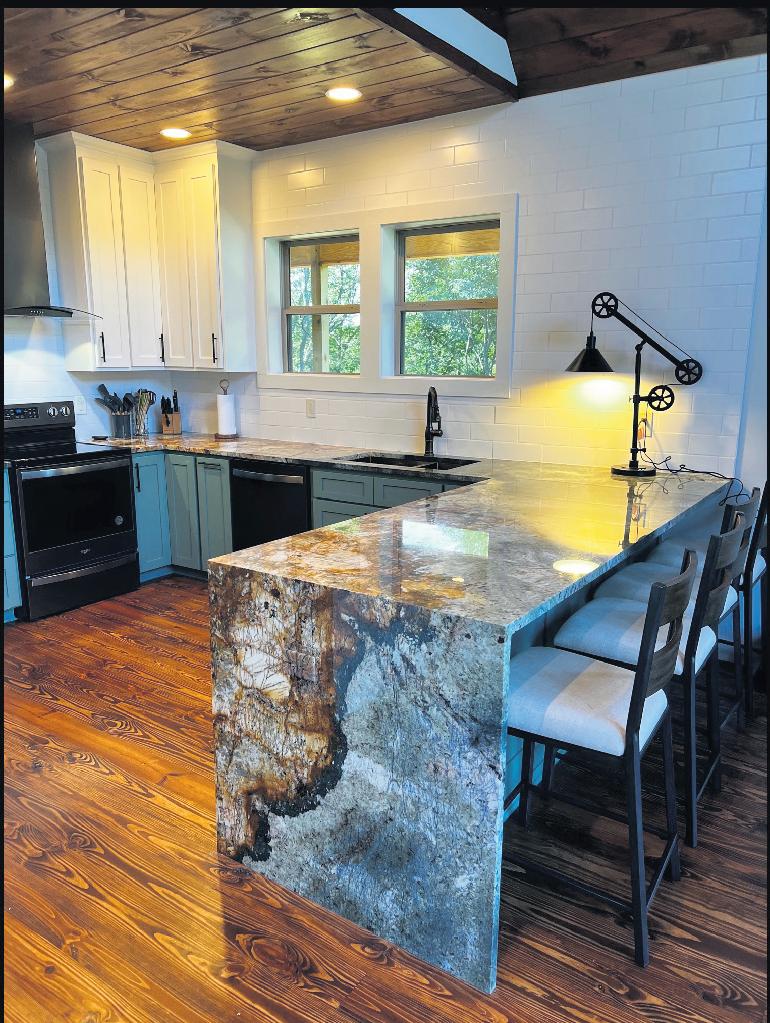

COURTESY OF ASHE COUNTY REALTY 1581 River Front Dr., Je erson NC 28640. If you’re in the market for a riverfront property with easy access to the water, consider this charming 2-bedroom, 2-bath home that boasts a level yard leading to the New River. The property provides a serene setting with river frontage, ideal for kayaking, tubing, fishing, and swimming.

BY ZACH COLBURN

It is not uncommon for people who work in big or medium-sized cities to live in rural areas, and there are several reasons for that.

In North Carolina, rents for the same size units with the same amenities are 37% higher in urban North Carolina than in rural North Carolina.

According to a report by North Carolina State University, in 2019, North Carolina was listed as the 19th-lowest-cost state in the country.

All those make living in the Tar Heel State appealing, and with the recent COVID-19 pandemic, working from home, or even remotely, has become more common.

Despite those factors, there are many other things to consider when looking for housing in a rural area, and Scott Warren, the broker in charge with Boone Realty, stated that an agent can certainly help with that.

“I recommend that they find a transparent and knowledgeable buyer’s agent who really knows the area,” said Warren. “A solid agent will really earn their keep on items like wells, springs, septic systems, radon, underground fuel storage, subdivision regulations, private roads, shared driveways, easements,

drainage, structural issues, etc.

“We are not the Wild West, but it can feel like it at times — having someone on their side is paramount,” Warren said.

In addition to housing, it is vital to look at the availability and quality of schooling. Rural areas tend to have fewer options for schools and those may be smaller and not have as many resources as schools in urban areas.

At the same time, some rural areas have top schools with smaller class sizes, which can lead to better interactions and connections between students and educators.

Another factor to consider when moving to a rural area is access to healthcare. With fewer people than in urban areas, there tends to be less demand and funding for hospitals and medical facilities.

There are several benefits and drawbacks to living in a rural area.

Benefits include a quieter, slower pace of life, a strong sense of community with many organizations, such as churches, clubs and town events. And if residing within a short distance of bigger cities, commutes are manageable.

A couple of drawbacks tend to be fewer job opportunities and not as many amenities.

sider how close amenities, recreational activities, and attractions are to the home. For instance, if a potential buyer enjoys recreational activities often, they may want to look at homes in areas that can accommodate that.

In conjunction with location, accessibility is a detail buyers need to bear in mind. The High Country varies in transportation options, proximity to airports and ease of travel.

Ashe County Realty recommends examining the community where the potential vacation home is located. Visiting the area and connecting with the residents is a good way to determine the location’s suitability.

Buying a vacation home can be exciting and delightful, but a potential buyer should determine if adding a second home to their budget makes financial sense. Many financial factors to consider include the purchase price, property taxes, insurance, and maintenance.

If one decides to purchase a vacation home, the home could potentially be a source of income through renting. If renting the home out is considered, Ashe County Realty recommends evaluating the area’s rental potential. Research local vacation rental markets, occupancy rates, and rental income potential to assess whether the property can generate sufficient income to offset expenses.

Purchasing a vacation home and/or renting one out can have some tax implications.Consulting with a tax advisor regarding the potential tax implications is a great way to understand the financial impact owning a vacation home can have.

Much like a primary residence, a vacation home requires upkeep which can look different depending on how it is approached. If a potential buyer uses the home frequently, the buyer may opt to oversee the property themselves.

However, if the home is often unoccupied, the buyer may opt to hire a property manager to oversee and maintain the home. Things such as pest control, clean up after a storm, security, and more need to be taken into consideration when deciding on a vacation home.

Selling a home in the winter can be tough at times.

High Country winters can be tough, and they can be even tougher if you are trying to sell your house, as it’s not typically an ideal time to put a home on the market.

There are ways, however, to wake up to a sold sign in the yard. Here are some hints from the National Association of Realtors for getting a house deal done in the winter.

Buyers can’t see the house if it’s covered in snow, and they can’t safely navi-

gate the outdoors with slick sidewalks and driveways. Clear out snow quickly and sprinkle rock salt or sand on walkways so agents and buyers can use them safely.

Winter days are short, so try to let in as much natural light as possible. Failing that, turn on lights everywhere and place accent lighting to brighten up dark corners. Make sure everything is sparkling clean to magnify the effect.

Don’t make it comfortable for you but for potential buyers. Set the thermostat to between 68 to 70 degrees. And amp up the cozy to create a welcoming vibe. Lay a blanket across the arm of a chair or the back of a sofa. Set the table. Create a reading nook.

Think about your favorite retail shopping experience. It probably includes some soothing background music, a common tactic to encourage people to spend more money. You can do the same by opting for a commercial-free streaming station with music that encourages relaxation.

Don’t overwhelm potential buyers and agents with strong smells. Go for a natural approach over candles and simmer some apple cider or lemon peels on the stove before a showing. Pop popcorn or bake cookies in the oven, especially if you want to draw attention to new appliances in addition to making your home more welcoming.

We get it, you love Christmas. But celebrating the holiday on every surface may be a little much for potential buyers. You want them to see the potential of your house, not a 115-piece Christmas village. Keep your holiday decor down this season. (Don’t worry, you can celebrate more fully in your new home.)

BY JERRY SNOW

Ahome is the biggest purchase most Americans make, so maintaining this investment is as important to their financial success as the foundation is to their house. Home maintenance is perpetual. It requires discipline and diligence from ownership.

Ignoring a leaky roof is probably a homeowner’s biggest mistake; it can lead to a cascade of expensive repairs.

In addition to roof leaks, clogged gutters and busted pipes can lead to water damage. Catching problems early can save a homeowner thousands of dollars.

The penalty of poor home maintenance tends to cost the owner a lot of money when it’s time to sell.

Replacing the roof, and heating ventilation and air conditioning (HVAC) are often among the biggest expenses a homeowner will face. So prolonging the life of a roof and HVAC can save a lot of money.

According to homelight.com, dirty filters shorten the lifespan of your furnace; roughly 45% of Americans don’t attend to home repairs right away.

Homelight also emphasizes the importance of cleaning exhaust fans in the bathroom and kitchen once a year.

Fans in the home are a good way to limit moisture buildup, reducing the likelihood of mold growing in the home. Homelight recommends re-grouting around tubs, showers, and bathroom fixtures. It’s important to address slow drains before they clog. Snaking with a wire hanger is better for the pipes than using a drain cleaner.

Inspecting the foundation of the home after winter is worth the trouble. Cracks in the foundation of a home can reduce its value by as much as 15%, according to Homelight. Large cracks in the foundation of a house should be inspected by a structural engineer.

Pressure washing outside the home annually is a worthwhile project in the warmer months. Touching up exterior paint is also recommended after winter. Chipped paint on the exterior can lead to wood rot.

Driveway cracks will lead to a bigger problem if ignored. Resurfacing cracks early will give a concrete driveway a longer life.

Cleaning and removing debris from the outdoor air conditioning unit should be done at least twice a year. Mini-splits have become a popular way to heat and cool cabins and finished basements. Just like an HVAC, mini-splits should be serviced professionally one to two times per year.

Big branches that land on the house can cause major damage to the roof

Mini-splits are a popular way to heat and cool cabins and finished basements

and, in extreme cases, death, so keeping trees trimmed is a must. According to Homelight, fallen tree branches cause more than a billion dollars worth of damage annually in the U.S.

Removing lint from dryer vents keeps dryers running more efficiently and reduces the risk of them sparking a fire. According to the U.S. Fire Administration, nearly 30,000 homes catch fire annually.

Every homeowner should inspect windows and door seals regularly, multiple times per year. Being airtight reduces the electric bill year round and helps the ventilation system operate more efficiently.

Travelers.com recommends replacing the batteries in smoke and carbon monoxide detectors twice a year and checking the expiration date of the home’s fire extinguishers.

Travelers recommend walking the entire property monthly to look for insects, rodents, rot, leaks, and any developing problems.

Making a monthly checklist that caters specifically to maintenance is recommended for all homeowners.

For ideas on what your homeowner’s checklist should include, consult Better Homes & Garden (bhg.com), HomeLight.com, Travelers.com, and the Homeowner’s Maintenance Checklist (HSH.com).

Blue Ridge Energy recommends considering whether it’s time to replace the HVAC or some of the appliances. Because newer appliances are usually more energy efficient, Blue Ridge offers a rebate for major purchases to help ease the financial burden. For example, Blue Ridge offers a $150 rebate for a new heat pump or mini-split with stipulations.

For more information about energy efficiency, go to www.blueridgeenergy. com

Real estate transactions can seem more complicated than they really are if you don’t understand how they work. There are lots of decisions to be made and lots of paperwork to read and sign. But in the end, your closing will come down to a few critical elements that are somewhat complex but very common:

We arealwayshumbled to have theoppor tunity to work for theoutstanding folk sofAvery and Watauga Counties!Ser vicesinclude: newhomewiring,remodels, hot tubwiring, EV chargers , home standbygenerators , troubleshooting/repairs, residential and commercial.

You will be provided with two numbers from a lending institution when you secure a loan: an interest rate and an annual percentage rate, commonly referred to as an APR. The interest rate is the amount you pay annually in order to borrow. The APR is everything else that is added to your principal, including points and mortgage broker fees, among other things. Buying points allow a buyer to pay more upfront in order to get a better interest rate, thus lowering their monthly payments.

The title company works as an intermediary between the seller and the buyer, gathering legal documents and recording them to ensure that the property title has no easements or liens. They also hold escrow money, file the deed with local government officials and oversee the signing of everything by both parties.

Closing costs run about 3 to 5% of the property’s total cost, along with fees charged by the assessor and lender appraiser. The cost also includes title service fees that account for title search, title insurance policy premiums, and other title company costs. The final total also includes processing fees for the lender, prepayment of insurance, property tax and mortgage insurance, homeowner association fees, any charges for credit reports, and any other additional processing fees. These costs are typically paid at closing, though prospective buyers can negotiate for the seller to pay. Just be aware that the overall cost of the purchase may increase.

Private mortgage insurance, or PMI, helps lower a lender’s risk when a potential homeowner puts down less than 20% of their down payment. Those who can’t afford to meet the full down payment are considered higher-risk borrowers. Rates for this insurance are set based on credit scores and the down-payment amount, but the number is a percentage of your loan. The bill comes due monthly. PMI is typically required for USDA and FHA loans.

BY JAMIE SHELL

etween the chilly mountain winters and the heat of summer, area homeowners are always seeking to save money when it comes to their monthly energy bill. Blue Ridge Energy, which serves residents of Alleghany, Ashe, Avery Burke, Caldwell, Catawba and Watauga counties, offers a number of ideas and steps that residents can take to help lower costs of heating and cooling their homes.

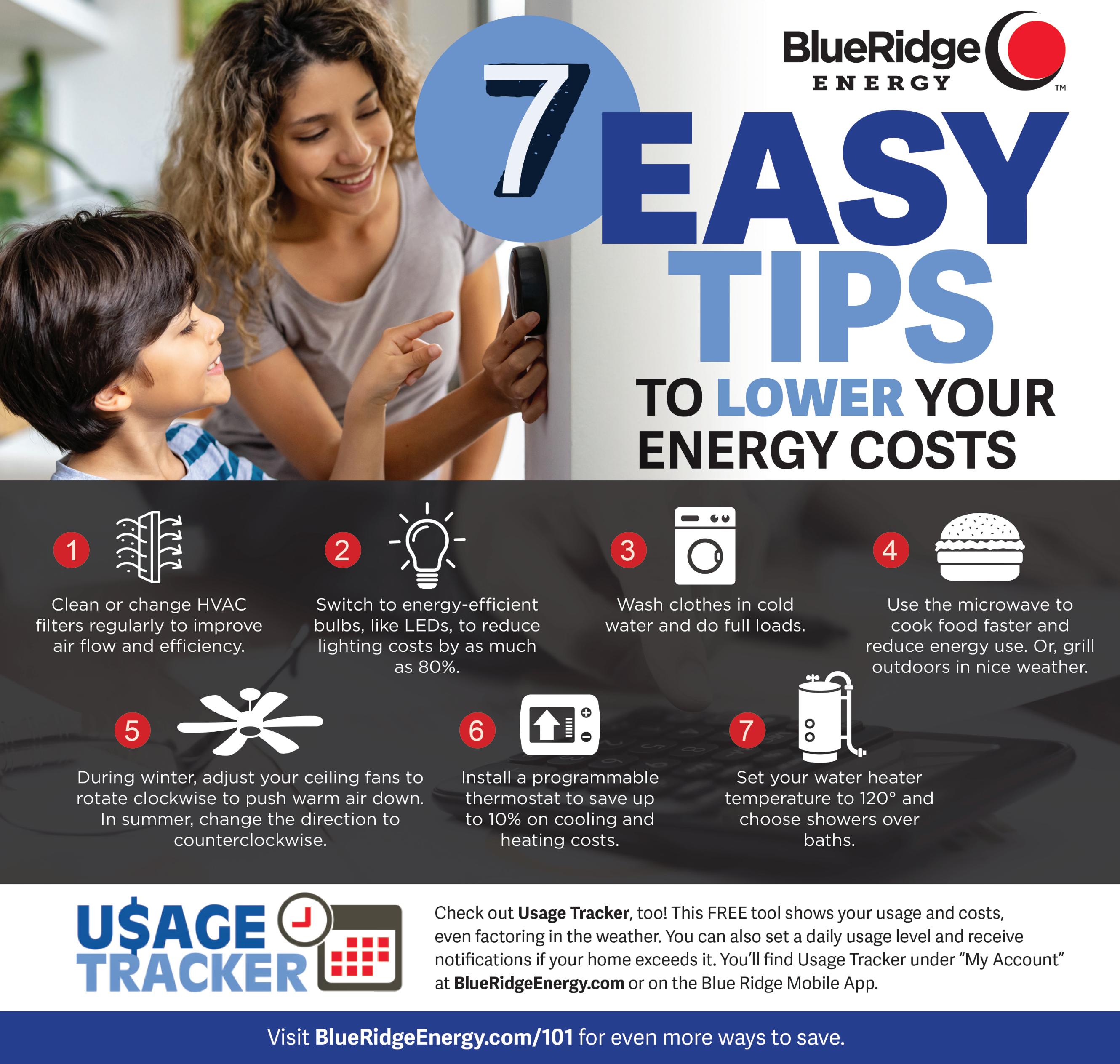

First, home residents can make small changes in everyday life to conserve energy and save a few bucks. BRE offers several suggestions, including:

• Wash clothes in cold water when possible and save approximately $63 per year.

• Take advantage of the sunny days of winter by opening your drapes during the day and closing them at night to naturally heat the home. In the summer months, overworking a heat pump or air conditioning unit can be prevented by keeping drapes closed during the day to allow less sunlight and heat in.

• Install a programmable thermostat to save up to 10% on cooling and heating costs.

• In the bathroom, BRE suggests taking short showers rather than full tub baths. A normal tub bath will use up to twice as much hot water. You’ll save on total water consumption as well.

• Rather than using the conventional oven, the microwave oven reduces energy consumption and cooks food in about one fourth the time. Additionally, if the kitchen oven is used for cooking, it is recommended to bake several dishes that can be cooked at equal temperatures together in the oven.

• Pool pumps can use significant amounts of electricity. If pumps operate by a time clock, check to make sure it is operating properly.

• Well pumps average around 50 kWh per month. However, a faulty check valve, pressure switch, or leaks in lines can quickly double the electrical usage, so it is suggested to check the equipment on a regular basis.

• Change to new and improved light bulbs. Reduce energy use from about a third to as much as 80% with today’s increasing number of energy-efficient halogen incandescents, CFLs and LEDs.

• Clean or change filters regularly. A dirty furnace or A/C filter will slow down airflow and make the system work harder to keep you warm or cool.

• Schedule service for your heating system. Find out what maintenance is

required to keep your heating system operating efficiently.

• Seal air leaks and properly insulate to save up to 20% on heating and cooling bills, while also increasing home comfort.

Additionally, the Smart Energy Consumer Collaborative shares no- and lowcost solutions to save money while also staying preferably warm or cool.

• Take advantage of air circulation from ceiling fans.

• Circulating the air in a room can make a major difference in comfort while limiting energy use. In the summer, use the switch on your fan to rotate the blades counterclockwise and push cool air down. In the winter, switch to clockwise to push the warmer air near the ceiling down along the walls into the main area of the room. Also, turn the ceiling fan off when you leave a room to save energy; you can only feel the effect when you’re in the room.

• Stop the draft with weather-stripping and caulking.

• A drafty home can cause your heating and cooling costs to skyrocket, but fortunately, there’s a lot you can do to improve the situation. Weather-stripping and caulk can be purchased at any home improvement store for a quick, inexpensive weekend project. Use weatherstripping on any movable part of your home (windows, doors, etc.) and caulk for filling cracks and gaps. According to the Department of Energy, air sealing a drafty home can save you 20% or more on heating and cooling!

• Check with your power company for a free Energy Saving Kit.

• Power companies have many reasons for supporting their customers’ energy efficiency efforts, so if you’re trying to reduce your overall energy use, a good starting place is just checking with your power company. Many utilities offer free Energy Saving Kits to get their customers started down the path of saving energy. These can include free LED light bulbs, advanced power strips and other energy-saving measures. Your utility may also have other free programs or advice for helping you save.

• Make better energy-related buying decisions.

• When you need to replace an appliance around your home, like a washing machine, water heater or TV, avoid making an energy-inefficient purchase. By using an online tool to compare products, you can find the most energy-efficient appliance for your needs. Even if it costs a little more upfront, you’ll likely save quite a bit over the appliance’s lifetime. You can also look for the ENERGY STAR® label, a government-backed symbol that lets you know a product is more energy efficient than others you might choose.

• Turn off your lights and unplug unused appliances.

• The old adage “Turn off the lights when you leave a room” is great advice for being more energy efficient, but did you know that appliances like coffee makers and gaming consoles can also be major sources of wasted energy? Many appliances, like your cable box or TV, still draw some power while turned off or in standby mode. Some sources estimate that these “energy vampires” account for 10 to 20% of a home’s total energy use! Consider adding appliances and devices to a power strip to conveniently turn them on and off, and you should start seeing a decrease in your bill.

For more information on home energy conservation, click to www.blueridgeenergy.com/residential/ energy-saving-tips

BY NORTH CAROLINA DEPARTMENT OF COMMERCE

The way the economy has evolved since the onset of the COVID-19 pandemic has been unusual in many respects, starting with a historically deep (but brief) recession and eventually leading to the worst price inflation and the steepest rise in interest rates since the 1980s. In these turbulent times, few areas of the COVID-era economy have proven more unusual than the housing market.

The Federal Reserve hiked interest rates in early 2022 to reduce consumers’ red-hot demand for goods and services and keep a lid on rising prices. Higher interest rates typically cause declines in residential building activity as more expensive mortgages make homes less appealing to buyers. This time around, higher interest rates led to a stall in homebuilding, but not a collapse. For example, in North Carolina, the number of monthly resi-

John Linkous has been in the industr yfor approximately 10 years work ing forothers. “I decided to take my Nor th Carolina contractors exam so Icould provide an honest approach to my customers’needs.Idislike the cook ie -cutter approach to commission sales and ser vicepricing.Iwantto take the market back to thedaysofintegrity and dependability. We areafull-ser viceprovider.Whether youneed aroutine maintenancecheck or 24/7 emergenc yrepair on aheating and cooling unit,weare available to handle all of your heating and cooling needs.”

John Linkous -Owner

dential building permits declined 10% from their peak in 2022, barely a drop in the bucket compared to the 70% decline we saw during the Great Recession. Since then, residential building activity has returned its 2022 peak, demonstrating resilience in the face of persistently elevated interest rates.

More expensive mortgages and slower homebuilding would usually

That’s why we work so hard to buildthe right loan for you.Every step of the way, we’re here to help -with awide varietyof loantypes to fit yourunique circumstances. We’dlove to lend youahand.

Land/Lot Loans

Construction Loans

Conventional Loans

Home Equity Loans

Home Equity Lines of Credit (HELOC)

lead to a decline in construction employment, but this time around, higher interest rates have turned out to be no match for a growing construction sector. Construction employment in North Carolina has continued its unrelenting growth over the past several years, in sharp contrast to the Great Recession, when a devastating housing crash wiped out over one-third of all construction jobs in our state.

Of course, these trends aren’t limited to North Carolina; we’ve seen similar trends play out across the country. So, what’s going on here? Why have things turned out differently compared to previous instances of high interest rates?

• We are still dealing with the consequences of the housing crash that occurred during the Great Recession. Home construction has failed to keep up with our growing population over the past 15 years, leaving us with a depleted inventory of available housing units.

• Meanwhile, most homeowners and consumers have remained in relatively healthy financial shape. A shortage of housing amid relentless demand for homes has bolstered home values, and a strong labor market, rising stock market, and trillions of dollars in federal COVID relief have supported households and prevented the waves of foreclosures and bankruptcies that accompanied the Great Recession.

• Ongoing homebuilding activity, along with a surge of investment in manufacturing and public works projects, has kept construction workers busy and helped avoid the types of mass layoffs that typically occur when interest rates rise.

That said, although we’ve so far managed to avoid the worst-case scenario of a recession, recent developments in the housing market have been far from painless. Housing has represented yet one more piece of the “two-track economy” that has seen some Americans flourish while others struggle. Inflated home values have helped keep homeowners financially solvent, but they’ve also prevented many individuals from being able to afford a new home. The Atlanta Fed’s Home Ownership Affordability Monitor indicates that homes are less affordable now than they’ve been in at least 18 years due to both high prices and high interest rates.

The Federal Reserve is widely expected to start lowering their benchmark interest rate this month, which could help bring down mortgage rates and provide some degree of relief for homebuyers. However, mortgage rates are unlikely to return to the rock-bottom levels we saw back in 2020, and home prices could remain near an alltime high for the foreseeable future.

It might take a dramatic new turn of events, such as a massive increase in the supply of housing, or a deep recession that lowers the demand for housing, before we see a return to pre-2021 levels of home affordability. Another path to improved affordability that is likelier than a residential building boom, and more desirable than a recession, would be a continued rise in wages that helps home buyers catch up to the high price of housing. As we’ve learned so many times over the past several years, the future of our economy will depend largely on our ability to maintain a healthy, balanced, and growing labor market.

BY KATE WOOD

On Wednesday, Sept. 18, the Federal Reserve announced a 50-basis-point cut to the federal funds rate, while projecting a comparable reduction through the rest of the year. (A basis point is one one-hundredth of one percent.) That was roughly what markets had priced in. Mortgage lenders have also already baked that assumption into mortgage interest rates: Since peaking over 7% in spring, rates have fallen more than a full percentage point. If lower mortgage interest rates are finally here, what does that portend for potential home buyers, refinancers and sellers?

Generally, when rates fall, buyer demand rises — but that didn’t happen as mortgage rates dropped this summer, according to Chen Zhao, head of economic research at Redfin. She speculates this Federal Reserve announcement will bring more buyers to the market. “They’re waiting to see the Fed take action, not realizing that this gets priced in early.”

According to a recent NerdWallet survey conducted by the Harris Poll, 15% of Americans say they plan to buy a house once rates decrease. If you’re in that 15%, now’s probably a good time to start looking.

At the press conference following the Federal Reserve’s announcement, chair Jerome Powell cautioned against expecting the kind of ultra-low interest rates we saw not only during the pandemic, but more generally throughout the 2010s. “I would say we’re probably not going back to that era,” Powell said.

“The Fed’s decision was pretty aligned with market pricing,” Zhao notes, so a major drop in mortgage rates is highly unlikely. But if the Federal Reserve were to make further cuts more slowly than markets are currently predicting, she says “rates have a little bit of room to potentially come up.”

Even if rates don’t rise, lower mortgage rates can only go so far in the face of consistently high prices. In August, the median price of an existing home was $416,700, according to the National Association of Realtors. With a 10% down payment and a 7% mortgage rate, the monthly principal and interest on a home loan of that size would be about $2,500. The same loan at a 6% rate would have a roughly $2,300 monthly principal and interest payment. It’s a savings of $200 per month, but still a sizable payment — and that amount doesn’t include property taxes, homeowners insurance or

other expenses.

For buyers, it’s going to come down to timing. Not timing the market, but whether it’s the right time for you. If you’re ready to buy and find an affordable home that’ll work for you, take the plunge.

Folks who bought homes at higher mortgage rates have also been anxiously awaiting a rate cut. And with mortgage rates already at lower levels, some homeowners could benefit from refinancing. With 30-year interest rates near 6%, roughly 4.7 million homeowners could lower their interest rates at least 75 basis points, according to data from real estate tech firm ICE Mortgage Technology.

The usual rate-and-term refi math is to figure out how much refinancing will cost you, which is generally 2% to 6% of the loan amount, and compare that with how much you’ll save on a monthly basis with that new interest rate. Dividing the cost of the refi by the monthly savings tells you the number of months — or more often, years — it’ll take for you to break even and see real savings.

Homeowners considering a refinance should think about how this math works for their budgets and goals. “Be fully aware of where your break-even point is and ask yourself that question of how long do you think you might be in a property,” says Leo Pareja, CEO of brokerage eXp Realty. For some homeowners, he points out, lowering your interest rate might be incentive enough. “You may not care about the break-even point, because on a cashflow basis, that’s more important. It’s a personal decision of what to do.”

There’s an even larger number of homeowners on the opposite end of the mortgage rate scale, with mortgage rates that are well below even today’s lower rates. As of the second quarter of this year, more than half of U.S.

mortgage borrowers have interest rates that are below 4%, according to data from the Federal Housing Finance Agency.

This gap between borrowers’ rates and current rates creates a “lock in” effect, where homeowners are reluctant — or in some cases, can’t afford — to give up that lower interest rate by selling their home. FHFA researchers estimate that for every percentage point that prevailing rates exceed a homeowner’s mortgage rate, there’s a more than 18% decrease in the probability that the owner will sell.

“Right now, we’re in a market for have-to-move,” Pareja says, noting that major and sometimes unforeseeable life events, like divorce or a job loss, will force home sales regardless of interest rates. But as rates lower, other factors like wanting an upgrade, or a new location or more (or less) space may become strong enough motivators to sell a home. “I think there’s a threshold that people are going to, and that threshold will be very different for each household,” Zhao says. Current homeowners may need to decide whether the perks of a new place outweigh a higher monthly mortgage payment. For some, finding a home that’s a better fit will be well worth the price.

e article ‘What the Fed’s Rate Cutting Plans Mean for the Housing Market’ originally appeared on NerdWallet.