simplified team.

05 Editor’s Note: A bold move from NHS to MLR publishing Industry

06 ARAMA Report: 2024 TOP Awards – A magnificent display of excellence

10 Industry News: NSW announces strata management industry reforms amid scandal

11 State Report: Can open. Worms everywhere!

12 BCCM Report: Committee meetings

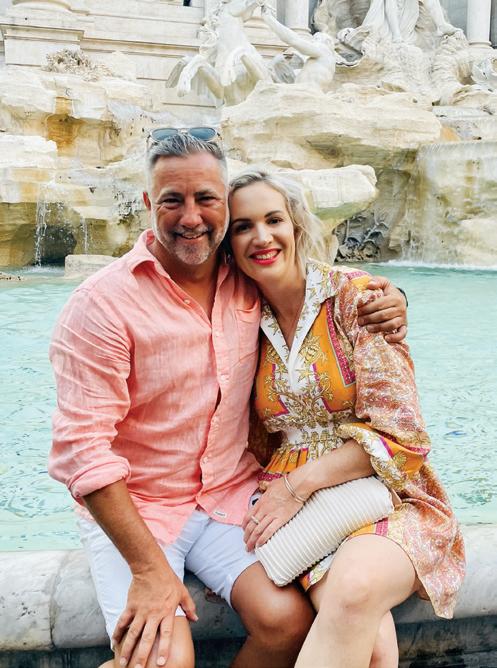

14 Person of Interest: Nathan Eades – A career in high gear, from Red Bull to Ras360 Management

16 Legal Ease: They just don’t give up!

18 By All Accounts: ATO & myGov scams on the rise – 5 scams to watch out for

19 Motel Market: Fit for purpose

20 Thinking MR: Don’t ask me

22 Strata Insights: Understanding body corporate management agreements in Queensland

23 Mike’s Corner: Relationships in business

24 Good Governance: Combustible cladding – The critical importance of addressing combustible cladding in Queensland buildings

Embracing pet-friendly accommodations: A new market for resorts?

Building Relationships: Give, give, give. Then ask

Rights Reality: From Botswana to the Gold Coast – My journey to management rights

Tourism Round-up: Tropical North Queensland rebounds – Business travellers and sporting events drive recovery

Niche Travel: Travel Insurance – Your ticket to peace of mind abroad

& Appointments

North Queensland 2024 Management Rights Sales Report

Sanctuary Lake Apartments: Great Strides see boost at Sanctuary Lake

The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, it’s employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its’ agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties.

© 2024 Multimedia Pty Ltd. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent of the publisher.

KEY

Commercially funded supplier profi le or supplier case study

Supplier information or content

Suppliers share their views in one-o topical pieces

General editorial. Case studies and features may cite or quote suppliers, please be aware that we have a strict ‘no commercial content’ guideline for all magazine editorial, so this is not part of any commercially funded advertorial but may be included as relevant opinion. Happy reading!

Welcome to the August edition of Resort News!

Well, that was an unexpected honour! Patrick and I were completely floored to receive recognition at the 2024 TOP Awards for our publishing work in the management rights industry. Being invited to join the ranks of lifetime ARAMA members alongside MLR statesmen was something we never anticipated. It’s incredible how life can bring you full circle. When I first landed in Noosa in the early 1980s, to visit my “Ten Pound Pom” brother, I was fresh from the grey, industrial streets of Coventry, and I never imagined that years later, I’d return to this paradise and make a life and career here. I spent my 13th birthday with my new Aussie family at a property in Cooroy and vowed to return for good someday. Twenty years later, with

Mandy Clarke, Editor editor@accomnews.com.au

Patrick and our four little Clarkes, we arrived in Noosa and dived headfirst into a new adventure.

Patrick and I started as NHS nurses with a knack for entrepreneurship, building a successful care business in the UK. Looking back, uprooting

our lives, moving halfway around the world, and buying Resort News was a bold move, but we were ready for a new chapter. Like many of you MLR operators who’ve taken that brave leap into a new career, we found our footing, worked hard, and built something we’re proud of. Despite a few shaky moments for our magazines, like the Christchurch earthquakes (where we lost our New Zealand HQ - twice), COVID-19, and witnessing the loss of many other print publications, we have persevered. Thanks to solid advice, a fantastic team, and the support of this vibrant industry, we are busier and more inspired than ever. We are incredibly grateful to the management rights industry we now love; your support for our magazines has been invaluable, and we are committed to continuing this journey.

This month we sent Grantlee Kieza up north for an in-depth report on the management rights industry in Tropical North Queensland. He got the scoop from some of the major players in sales, finance, and valuation. Plus, he sat down with Nathan Eades, the national director at Ras360, to give us a closer look at his journey and insights. Don’t miss our feature, highlighting Jon and Leah Stride, who have just celebrated two years of managing the Sanctuary Lake Apartment complex at Currumbin. I am also excited to welcome our two new columnists: MLR expert and operator Mike O’Farrell and award-winning manager Marion Simon. Finally, a heartfelt thank you to our readers – you all make this journey worthwhile. Warm regards, Mandy

By Trevor Rawnsley, CEO, ARAMA

All of us involved in the business of management and letting rights (MLR) were excited about the greatest celebration our industry has ever hosted. The 2024 TOP Awards at Sea World on the Gold Coast on July 23 showcased everything wonderful our industry offers and recognised the most outstanding achievers in the MLR field from a vast array of stellar entrants.

The night honoured the best in our business, and the work displayed by all our winners, finalists, and nominees can only inspire everyone involved in management and letting rights.

We all work in a service industry, and those who reached the peak of the TOP Awards show what can be achieved by going that extra mile to provide award-winning service.

It was especially gratifying for everyone at the TOP Awards to see Mandy and Patrick Clarke, the publishers of our industry bibles Resort News and AccomNews, honoured with life membership of ARAMA for their extraordinary support and promotion of the management and letting rights industry over many years. Mandy and Patrick had successful careers in healthcare in Britain before making their home in Queensland, and the MLR industry is in wonderful health, thanks in large part to their care and hard work on our behalf.

Among the special guests at the TOP Awards this year were Shadow Attorney General Tim Nicholls and the

Member for Surfers Paradise

John Paul Langbroek. The celebration surrounded them with nearly 300 guests, and the magnificent gala event night showcased everything great about our industry.

It was the biggest and best TOP Awards ever, with more eyes on the event and the entrants than ever before.

This year, we also introduced a new set of award categories after partnering with Nick Buick and his team at The Onsite Manager to institute The People’s Choice Awards. These four new categories involve a popular vote component, much like television’s Logies.

At previous TOP Awards, our Service Provider of the Year and Sales Broker of the Year were decided based on the number of membership connections they made – the number of people they recommended to ARAMA. Now, we are combining those referrals with a popular vote.

We also have The Onsite Manager of the Year Award, which is determined directly from interactions with clients of The

Onsite Manager and prospective tenants. People making inquiries for accommodation are surveyed about the service levels of the onsite managers they dealt with, and Nick measures the positive responses for each manager, deducting any negative responses for a net score. So, The Onsite Manager of the Year is decided by a combination of popularity and merit, based on customer surveys.

Overall, we received five times the number of votes in the People’s Choice Awards than in previous years, and because of their success, we think these awards will go viral next year. Companies are running campaigns to get votes, creating great interest in the industry.

The TOP Awards are a tremendous public relations event and a way to recognise and reward the people who create such positive stories for management rights. We are able to recognise and reward the best performers in our industry and push forward with so many inspiring stories about the dedicated professionals who are our lifeblood.

This is particularly true for Maree and Ian Smith from the Hidden Vista group, just north of Brisbane, who are model ARAMA members. Maree and Ian won the awards for both Resident Manager of the Year – Long Stay and Building Managers of the Year. They became the first three-time TOP Award winners, and later in the night, the first four-time winners, highlighting what a brilliant job they do running five properties incorporating some 400 lots.

In the category of Resident Manager of the Year - Long Stay, the ARAMA judge noted that all the finalists should be

proud of their extraordinary achievements. But what set Maree and Ian apart was the wonderful culture and sense of community they had created among owners and tenants in their complex, backed by several outstanding testimonials from unit owners, body corporate managers, and tenants – the triangle of management.

“They received many positive accolades for their hard work, sense of service to the community, and personable approach. They have been on the

spot to extinguish life-threatening fires, have helped reduce crime, and have made their scheme safer for all through their actions and careful attention,” the judge said. “They managed to achieve this result while expanding their business operations.”

Maree and Ian are a proactive couple who create real harmony at their properties.

On a separate occasion, ARAMA also received correspondence from a tenant who wrote to us unsolicited after seeing an ARAMA sticker in a window at

their complex, telling us how wonderful Maree and Ian were. Other tenants commented on how safe and secure the couple had made their complex. In the last year, they saved a unit from catching fire with quick action and are always on the lookout for strangers to prevent any threat of crime. As a result, they are preventing property loss, stopping crime, and winning awards.

In the category of Building Managers of the Year, the judge said Maree and Ian were able to expand their portfolio of buildings during difficult times, including changes to legislation, rising interest rates, increasing living costs, and an epidemic of crime in the surrounding area.

“One of the difficult issues a building manager faces when also operating a letting pool in the current environment is the loss of rental units to owner/ occupiers,” the judge said, “but Maree and Ian have managed to maintain their rental pool even though there have been many sales in their complexes.”

Stuart and Nicole Morris from the Azure Sea Resort in Airlie Beach won the award for Resident Manager of the Year – Short Term Stay. Stuart and Nicole, despite their recent entry into management rights in Queensland, have shown excellent results. They have greatly improved the resort’s facilities through personal efforts, won the appreciation and respect of lot owners, both in their letting pool and others, particularly the committee members, been integral to body corporate management, and, very importantly, lifted returns to the investors in their letting pool.

Paul Parrant, the general manager of the Oaks Port Douglas, won the award for Resident Manager of the Year – Mixed Stay.

ARAMA opened this award to include corporate and multi-building members this year. Paul and all finalists were well supported by the Minor Group, who booked two tables for the awards night.

The ARAMA judge described Paul as “a true leader who exhibits an excellent skill set and clearly can motivate staff.” The judge particularly noted Paul’s leadership style in response to natural disasters like flooding and cyclones. “The tenacity and perseverance shown to apply for and fully utilise available government grants and achieve local council assistance should serve as a guide for other managers impacted by these issues,” the judge said.

Hamish and Jess Watts from the Glen Eden Beach Resort at Peregian Beach

won a new award for Resort Management Team of the Year.

What stood out for this team was the glowing endorsement by their strata treasurer and strata manager. This is not easy to achieve, but it demonstrates the value of focusing on the triangle of management.

Their website is professional, clear, and concise, making it easy to book directly. It also features many complimentary comments from guests.

Gary Baskin and his colleagues at the beautiful Oaks Sydney Goldsborough Suites won another new award for Building Management Team of the Year.

The judge said, “This team’s demonstrated abilities in enhancing the efficiency and sustainability of the facilities at the complex have included reductions in energy consumption and operational costs, upgrading all lighting to LED, introducing variable speed drives to all pumps and air

conditioning plants, installing rooftop solar panels, and more.

“To be an outstanding team requires the skill of an outstanding leader, and this team’s leader has also networked with the City of Sydney to secure resources like water-saving devices and negotiated beneficial bulk rates for services.” The judge noted that Gary and his Oaks team go “above and beyond for their guests, owners, and renters at the complex,” turning their Goldsborough building into a leader in sustainability for the benefit of all lot owners.

While ARAMA has known for decades the advantages and benefits of a small, familyowned business operating an MLR business on site, it is immensely satisfying that our corporate members receive the same accolades.

Our Sales Broker of the Year was Jessie Shi from ResortBrokers, while Property Bridge, run by Bobo Qi and Darren Brent, was

named the Sales Brokerage of the Year. Bobo, Darren, and Jessie demonstrated the excellence delivered by industry leaders in the Chinese-Australian community and the popularity they have created for their businesses within the industry.

Mike O’Farrell, a life member of ARAMA, won the award for Service Provider of the Year for his business, MLR Services. ARAMA is privileged to have many life members still actively engaged in the business and continuing to give back.

The Onsite Manager of the Year was Shay Harrison from Terraces on the Park, described by one of her many satisfied clients as “friendly, honest, courteous, knowledgeable, experienced, and definitely a real estate agent with a difference.”

It was especially pleasing that this year’s winners came from such a wide geographical spectrum: Port Douglas, Airlie Beach, Sydney, Brisbane, the Sunshine Coast, and Gold Coast, and included major corporate players and mum-and-dad operators.

Management and letting rights businesses work well in a great variety of locations and with both big teams and small businesses. The 2024 TOP Awards was a magnificent night showcasing the strength and resilience of our industry and the popularity of our members, as well as the diligence, determination, and great service provided by our top operators, professionals, suppliers, and service providers. Nice to see you at the TOP!

By Mandy Clarke, Editor

In response to a significant scandal within the strata management industry, the NSW government has announced stringent reforms aimed at cleaning up the sector and restoring public confidence.

The new strata laws that promise to “rise to the challenge of living in higher-density homes” follow an extensive ABC investigation in March this year that exposed systemic exploitation and undisclosed kickbacks, particularly spotlighting the prominent firm Netstrata.

The investigation revealed that Netstrata had been charging exorbitant insurance fees and accepting hidden commissions, leading to the resignation of Stephen Brell, the former NSW president of the Strata Community Association (SCA).

According to the ABC, Brell admitted that Netstrata had accepted “referral fees” from various contractors, including debt collectors, without disclosing the amounts to clients, despite promises in annual reports.

Minister for Better Regulation and Fair Trading Anoulack Chanthivong emphasised the necessity of these reforms to “stamp out bad behaviour” within the industry.

NSW Fair Trading said it’s received almost 1000 complaints about strata agents in the five years to 2023

In a statement, Chanthivong highlighted that the actions of a few managing agents had severely impacted public confidence in apartment living.

“NSW Fair Trading received more than 965 complaints about strata agents in the five years to 2023, with over half concerning rules of conduct or financial matters,” he noted.

The proposed changes include:

• Increasing the maximum penalties and penalty infringement notice

- SELLERS - DEVELOPERS

Our team of legal experts, led by Col Myers, has over 40 years’ experience in this area and will get you the best possible outcome.

Tel: +61 (0)7 5552 6666

M: +61 (0)417 620 516

E: cmyers@smh.net.au W: www.smh.net.au

amounts for existing agent obligations to disclose information about commissions;

• strengthening the conflictof-interest disclosure requirements;

• banning agents from receiving a commission on insurance products when they don’t play a role in finding the best deal for residents; and

• strengthening NSW Fair Trading’s enforcement and compliance powers.

The higher penalties, greater transparency, and new enforcement powers follow an $8.4 million investment in more resources for the Strata and Property Services Commissioner in this year’s budget.

The government will consult with key stakeholders such as the Owners Corporation Network and Strata Community Association on the draft laws in the coming weeks. Parliament will consider the new laws later this year.

“These reforms are critical to supporting confidence in

investing and living in strata schemes,” Chanthivong said. “We want to change the perception that strata managing agents easily take advantage of owners by significantly increasing the consequences for those who do the wrong thing.”

The ABC investigation uncovered that Netstrata’s insurance arm was charging fees up to 110 percent of the insurance policy’s base premium, far above the typical brokerage fee of about 20 percent, without disclosing these fees to owners.

This revelation sparked widespread demand for reform, with figures like Chris Irons, former Queensland Body Corporate Commissioner, and Trevor Rawnsley, CEO of the Australian Resident Accommodation Managers Association (ARAMA), advocating for greater regulation and transparency.

Following Brell’s resignation, the SCA announced an “independent review” into Netstrata and a “formal complaints management process” against the firm, alongside an investigation by NSW Fair Trading. Alisha Fisher, CEO of SCA Australasia, reiterated the industry’s commitment to raising standards and improving practices among its members. These reforms are seen as a critical step towards ensuring that unit owners receive value for money and that strata management companies operate transparently and ethically.

The government will consult with the industry ahead of introducing legislation in August.

As the NSW government moves forward with these reforms, it’s hoped that the interests of unit owners will be better protected and the whole industry will operate with more integrity and fairness. The new legislation is expected to make a lasting impact on the strata management sector, setting a precedent for other states to follow.

By Ben Ashworth, Senior Associate, Small Myers Hughes Lawyers

It’s human nature to avoid problems and leave them for another day. And it’s even easier to avoid a problem if you don’t even know it exists.

Generally speaking, significant strata law changes occur at a sedate glacial speed. It is for this reason that people can be forgiven for assuming nothing much has changed in the strata law over a decade or two and therefore don’t take any action to fix problems they aren’t aware have been created when laws change. Why waste time and effort checking to see if the law has changed in a way that affects you when simply doing things the same way they have always been done is an option?

The status quo makes a very convincing argument.

I am not surprised when I encounter buildings where the managers go about their day simply doing everything the same way that the manager before them did. The same can be said for owner corporations, where you can find committees that have little to no motivation to do anything differently from year to year and are content to rubber stamp everything that was done last year with a new date on it. When everyone is happy, it’s hard to justify rocking the boat or be seen as

encouraging change for change’s sake. All things considered, a random building or business here or there that slips through the cracks when there hasn’t been much change in the owners and new people are not coming into the mix is not surprising.

What has surprised me though, over the years is discovering that there are whole regions in country New South Wales where there are several owners corporations and management rights businesses that all appear to have missed the last twenty years of strata law evolution. I have encountered buildings where the manager, the owners corporation and even the local strata managers and lawyers have all perpetuated processes that were correct and appropriate years ago but are fundamentally flawed under the current laws. What this means is that when an outsider (who is aware of the changes in law) comes along looking to buy a lot or the manager’s business, it shines a light on a whole spectrum of issues. And with each issue that is unearthed, it can lead to more.

The caretaking and letting agreements aren’t valid or enforceable (and haven’t been for years). The manager is doing duties that they aren’t authorised or allowed to do. The manager’s income is significantly under/ over the market rate. The letting appointments are a ticket to the office of Fair Trading and/ or ASIC waiting to happen. The owners corporation levies aren’t enough to meet the owners corporation expenditure. The sinking fund is well and truly at the bottom of the ocean. The manager has no business to sell and an overpriced lot.

How can you create a worst-case scenario?

As easy as copying and pasting what was used the last time.

Owners corporation meetings, management agreements and letting appointments are all mistakes waiting to happen when changes in the law are not considered and applied.

Although it may seem convenient, easier or cheaper to turn a blind eye to adopting new ways and doing things the long way, there is a real risk that all you are gaining is a guaranteed problem in the long term. Unfortunately, some problems don’t have easy or desirable solutions and only a lesser of two evils might be available. But at least by being proactive, you have the potential

to find a solution before the sky is falling and you have deadlines that are out of your control.

If “rinse and repeat” has been the mantra of your business or owners corporation for more than five years, I strongly recommend you stop and take a moment to consider what is being repeated – as there is a very good chance that in one way or another the law has changed.

Liability limited by a scheme approved under Professional Standards Legislation.

Disclaimer – This article is provided for information purposes only and should not be regarded as legal advice.

specifically allow for informal committee meetings, there’s nothing preventing committee members from informally discussing body corporate issues.

Committee meetings and their decisions are centred around transparency and accountability which is why there are legislative requirements to be adhered to.

Keep in mind that committees are a group of owners, or their representatives, who volunteer their time and are entrusted with managing the operation and decisions of a scheme.

In this article, we will break down the different types of committee meetings and the processes that need to be followed.

This information does not apply to Two-Lot Scheme Modules or Small Scheme Modules. More information on these modules is on our website.

Our office is often asked if committees can hold informal meetings. While the law doesn’t

However, during any informal discussions, no decisions can be made, because several important legislated steps for calling a formal committee meeting must be adhered to.

The following steps must be taken to ensure the committee is transparent about decisions.

For a committee to make decisions, a formal process must be followed. Committee decisions can be made:

• physically at a formal meeting or;

• by a vote outside of a committee meeting (commonly referred to as VOCM or Flying Minute).

Several rules must be followed to convene a ‘properly called’ meeting. Committee meetings can be called by:

• the secretary;

• chairperson, or;

• any committee member with the agreement of enough members to make a quorum

The secretary or, in their absence, the chairperson, must call a committee meeting if enough members (to form a quorum) make a written request. The meeting must be called within 21 days of receiving the written request.

Owners must be informed of an upcoming meeting because this will allow owners to make plans to attend and make them aware decisions will be made.

The notice and the agenda of the meeting must be sent to all owners and committee members at least seven days before the meeting.

As little as two days’ notice can be given, providing the committee had previously voted to shorten the notice period, or enough members agreed in writing before the meeting was called.

The committee is allowed to choose where the meeting is held, however, objections can be raised if it is more than 15 kilometres from the scheme’s land. It is important that as many members as possible can attend, so conducting a meeting near the scheme’s land would optimise attendance.

A quorum is at least half of the voting members, and it is needed for a meeting to proceed.

If lot owners or their representatives want to attend a committee meeting, they need to give at least 24 hours written notice to the secretary and can only watch the meeting and only speak if invited.

The committee can ask a lot owner to leave a meeting for certain items on the agenda.

Committee members are busy people and many investors/ owners live remotely from the scheme, which can make it difficult for them to attend a physical meeting. Therefore, voting outside a committee meeting is a popular decisionmaking method. This process is more efficient because decisions are made in writing and do not require a physical presence.

To ensure owners know what is occurring and the motions being considered, a copy of the notice must be simultaneously circulated to lot owners and committee members.

Contrary to a common misconception, there is no provision within the legislation that allows a body corporate to pass the costs of a VOCM onto an owner or occupier, even if the motion for consideration may solely benefit that person.

In the matter of Lenvilla [2018] QBCCMCmr 146, where a lot owner was charged a fee for a pet application to be considered by the committee, the adjudicator upheld that the lot owner should not be liable for this charge.

The body corporate manager at the time stated, “The $65 fee has been charged to the application as it is not a body corporate expense but an individual owner expense”.

The adjudicator determined that the applicant was asking for a decision of the committee as per a by-law and was not wishing to purchase a service or product from the body corporate manager. In emergencies, verbal or other appropriate communication methods can be used for notice and voting. The decided motion must be shared with all committee members and lot owners as soon as practicable.

A record of the outcomes of the VOCM, including any emergency votes, must be confirmed at the next physical committee meeting and included in the minutes.

When an owner wants the committee to make a decision, they must submit a motion for consideration. The legislation requires that the committee need to consider a motion within six weeks of receiving it.

If the committee needs more time, it must inform the owner but cannot take longer than another six weeks to decide. If the owner does not receive a response and the decision period has lapsed, the motion is deemed to have not been passed.

For pet applications the timeframe for a decision is only 21 days from when the committee receives the request for an animal. If the applicant does not hear back from the committee the animal is deemed to have been approved.

Each committee member, whether executive or ordinary, only has one vote – even if a member holds multiple executive positions. For a motion to pass at a committee meeting, the majority of the votes cast by those who are present must be in favour of the motion.

For VOCM, committee members must return votes within 21 days.

Committees are a group of owners, or their representatives, who volunteer their time

For a motion to pass at a VOCM, the majority of voting members on the committee must agree to the motion. If a majority of votes have not been received and no decision has been made within 21 days, the motion is considered not to have passed.

If there are seven committee members and five attend a meeting a quorum has been achieved. The meeting can proceed.

In the instance where a motion is being considered and one committee member declares a conflict of interest and abstains and another member owes a debt to the body corporate and is unable to vote, a motion can be passed by a majority of votes (2-1) of the remaining three committee members.

However, VOCM votes are counted differently and the threshold for passing a motion is much higher than a physical meeting. If we take the same motion, but this time it is

considered by VOCM and two members don’t return a vote, two members can’t vote because of a debt and a conflict of interest, leaving three voting members who vote two for and one against. In this case, the motion does not pass.

This is because there is a higher threshold to pass motions by VOCM.

The minutes, or record, of any committee decision, must be completed and circulated to all owners within 21 days of the decision, regardless of how the decision was made.

The minutes need to be a true and accurate reflection of what occurred and are usually sent by the secretary or the body corporate manager. Minutes do not need to include a word-forword transcript of the meeting. The information that the minutes and records of VOCMs must contain are in section 71 of the Standard Module

regulation and include, but are not limited to, the time and date of the meeting, names of those present, words of motions to be decided and the number of votes for and against a motion.

Under the Standard Module, once the minutes are sent to all owners the notice of opposition period commences. The opposition period gives owners seven days to oppose a decision.

To oppose a decision, at least half of the owners of the scheme must submit their opposition in writing to the committee. The committee should not act on any decision until the opposition period has ended.

Committee decisions can have a significant impact on a body corporate, lot owners and occupiers. Therefore, complete transparency with all members of the body corporate is recommended.

Remember that our information service is here to answer your questions. Call us at 1800 060 119 or submit your question through our online enquiry form found on our website.

This article is general information only and not a substitute for legal advice.

For more details on bodies corporate in Queensland, visit our website.

By Grantlee Kieza, OAM Industry Reporter

Nathan Eades entered the workforce in the early 1990s with a part-time job serving up cheese toast and potato skins at the Kenmore Sizzler in Brisbane’s west. He was in Year 10 then, but many years after starting at the familyfriendly restaurant chain, he developed a keen interest in big deals in management rights. He is now the National Director at Ras360.

After eight years at ResortBrokers, Nathan joined Ras360 in April, heading the company’s accommodation division and overseeing sales of management rights, hotels, motels, pubs, and holiday parks. He is a two-time winner of ARAMA’s Broker of the Year Award. Among the properties he is marketing is the leasehold interest and franchise sale of the highly successful Quest Breakfast Creek for $6.975 million, with a reported net profit of $1,809,623 for the 12 months ending in May 2024, plus an additional net profit of $31,501 from permanent letting. At Alexandra Headland, Nathan offers the prime shortterm, holiday management rights at the renowned Alex Seaside Resort for $2.89 million and the management rights at the Park Edge View at Springfield for $2.23 million. His executive role in property is a far cry from his days filling the salad bowl at Sizzler, but it comes after three decades of significant sales and

“I am steadfast in my belief in the strength of the industry...”

marketing roles in Australia and overseas. Nathan joined Ras360 following an approach from the company’s Managing Director, Chris Jones.

“Chris spent the last four or five years getting the residential business thriving at Ras360, and while the management rights business had been steady, he wanted a complete refresh, to take on the world, as it were. It’s an exciting opportunity in a great industry,” Nathan said.

Nathan was born in Sydney and moved to Albury at age eight before relocating to Brisbane at 13. “I call Brisbane home because I spent my teen years here,” he said. “I worked in hospitality for many years before joining the energy drink company Red Bull in 2002. I worked for the company for about 10 years in various roles throughout Australia and overseas. I probably had eight jobs at Red Bull, but they were all within the same company, which kept things fresh and exciting for me.

“In 2005, I was sent to Japan with Red Bull to launch the product there. My boss, appointed as the launch manager, called me late on a Tuesday night to tell me to pack, and I was on a plane to Japan by Sunday.

I didn’t know how long I would be staying, but I was there for about two years before returning home for national roles in the Sydney office. I look back with fantastic memories from my time in Japan, but every day was a grind, and I felt isolated and disconnected. However, from a business perspective, I learned more in those two years than I probably ever will.”

Queensland, the Darling Downs, Tara, Miles, and Chinchilla.

I got to know Ian Crooks through that. I had probably just exhausted myself in the liquor industry, and it was time for me to try something completely new. So, I signed on at ResortBrokers. I loved my

too much and started aff ecting my work and everything else because the training takes up so much time. I’ve put the bike away and am now a golfer, playing at the Brisbane Golf Club in Yeerongpilly as often as I can.”

When Nathan wanted to return to Brisbane in 2010, there was no opportunity with Red Bull, so he joined Lion Nathan (brewers of XXXX among other brands) as a state manager. “It was a senior role and a big step up for me, but I loved it,” he said. “Then I got a call from Rekorderlig (a cider company) who off ered me more money to manage their business as Queensland state manager for 12 months. Coca-Cola had already purchased the rights to the business, so I headed that up before working at Coke as Queensland sales manager.”

Then, over a red wine or two on a State of Origin night, Nathan reconnected with a team member from ResortBrokers. Many years earlier, Nathan had met the Crooks family, owners of ResortBrokers, through a charity bike ride in western Queensland. “My father and a couple of other businessmen in Brisbane used to organise this bike ride, and I got roped into riding one year through western

time there and won the ARAMA Broker of the Year twice, which was a thrill. I spent eight and a half years at ResortBrokers, and now I’m excited about the new challenge at Ras360. This role is incredible, and I’m thoroughly enjoying every moment.”

The long and winding road through western Queensland inspired Nathan to train for Ironman events. “I played Aussie rules when I was living in Sydney, and I was a keen athlete doing Ironman for a few years,” he said. “I pushed my body to its limits and was proud of my achievements, but it became

and parks in my previous

in management rights, so there, and every deal is unique. fascinating

something new that you encountered

Nathan is making his biggest drive, though, in management rights. “I own a couple of small caretaking-only management rights businesses myself, so I am steadfast in my belief in the strength of the industry,” he said. “They are secure investments – there’s not much that can go wrong. I’m lucky to have sold hotels, motels, role at ResortBrokers, so I’ve experienced diff erent asset classes. There’s a big turnover in management rights, so there is always business out there, and every deal is unique. It’s fascinating because no matter how long you’ve been around, every deal will involve haven’t encountered before.

“I’ve learned that knowledge and experience are your biggest assets, but in management rights, you’re always learning.”

A few years ago our industry repelled an attack from certain academics and lawyers with an anti-management rights agenda who had been pushing a disingenuous theory that any management rights agreement can only ever be “topped up” once.

That of course is contrary to the long-established industry practice for managers to top-up the term of their management rights agreements every five years or so, and even more often in the case of agreements subject to the Standard Module’s 10 term limitation.

Regrettably, the issue has raised its ugly head again in a complex on the Gold Coast where our protagonists, the Unit Owners Association of Queensland (UOAQ) through one of its executives who owns a unit in the complex, has applied to the Body Corporate Commissioners Office seeking an order that a top-up is invalid. Once again, we find ourselves having to defend against this attack that seeks to cause confusion and disputation. As before, those who are pushing the argument do not seem capable of accepting the will of the owners. After all, any top-up can only ever happen if a majority of voters at a general meeting

vote for it and if that is what the majority want, why not accept it?

The proponents of the theory rely on a misconceived interpretation of a particular section of the particular wording is:

The body corporate may subsequently amend the engagement to include a right or option of extension or renewal (a subsequent right or option) only if…. the subsequent right or option is for not longer than five years…

The argument is that the right to include “a” right or option means that there can only ever be one such right or option, and no more. Part of their argument relies on reference in the previous sub-section of the regulation which allows for multiple rights or options of extension or renewal in the initial agreement, in contrast to reference to “a” right or option for top-ups. However, in the context of statutory interpretation such contrast is inconsequential.

It is a principle of statutory interpretation that the words of a statute ought to be given the meaning which the legislator intended them to have. This requires consideration of the actual wording and its context and purpose – not just the Act and Regulations but any extrinsic material.

In considering the actual wording

the Acts Interpretation Act 1954 provides that in any legislation there is a presumption (which may only be displaced by a contrary intention appearing in the legislation) that words in the singular include the plural and vice versa.

The relevant section in the Regulation Modules cannot be interpreted as imposing a singular cap on the number of top-ups, as the substance and tenor of the legislation, as a whole, is not capable of displacing the presumption that singular includes the plural.

It is reasonable to expect that if there was a legislative intention to cap the number of top-ups permitted, it would appear with reasonable clarity from the terms of the legislation itself. By way of example section 130 of the Act (which deals with the statutory review regarding the terms and remuneration of a management rights agreement) states: The contract may be reviewed under this division only once.

If there was a legislative intention to impose a similar cap on “topups,” then arguably a similarly phrased provision would have been included in the regulations. Further, the cap on “top-ups” is inconsistent with the operation of those sections of the modules which preclude top-up motions from being included on the

agenda of a general meeting more than once in any financial year. If a manager was only able to “top-up” their management rights agreement once, then only one motion would ever be able to be considered. If that were the case, there would be no need for these provisions.

The one only top-up concept cannot be reconciled with the purposive and extrinsic material related to the BCCM Act and Regulation Modules. Explanatory notes to the 2003 amendments include these words: However, at any time, the body corporate may grant an extension of the term of the agreement, up to a maximum equivalent to the term limitation. Explanatory notes to the 2020 Module changes are also consistent with the concept of multiple top-ups.

Whilst the issue has not until now been tested by the Queensland courts and tribunals, comments by adjudicators have recognised without question current industry practice. Whilst I cannot envisage the Commissioner’s Office accepting the argument that there can only ever be one top-up, it is unfortunate that this particular manager has been put to the trauma and expense of having to fend off what I am confident would be a futile and unsuccessful attack.

By Lel Parnis, Principal, Holmans

ATO tax scams are targeting hard-working Australians via emails, phone calls, and SMS. Here’s how to protect yourself.

ATO tax scams have soared in recent years, targeting hardworking Australians through various channels. Here’s how to spot ATO refund scams and what you need to do if you think you might have fallen victim to scammers.

Scammers have been sending unsuspecting Australians ATObranded emails urging them to click a link to receive a tax refund. In one particular scam, members of the public received phishing emails with the phrase

“You are due to receive an ATO Direct refund.” The ATO issued a reminder to the public that it would never send an SMS or email with a link to access online services. These services should instead be accessed directly by going to ato.gov.au.

A scam targeting myGov users has been circulating, prompting a warning from the ATO and Services Australia for the public to be aware of scammers impersonating government agencies. Scammers sent ATO-branded emails to users, telling them, “You have a new message in your myGov inbox – click here to view.”

The ATO has reported an increase in scammers impersonating the ATO and emailing the public to falsely advise them of security updates requiring an update to the multi-factor authentication on their ATO account. The scam email includes a QR code that takes the user to a fake myGov sign-in page, designed to steal their myGov sign-in details. The ATO issued a reminder

that it would never send an email with a QR code or a link to log in to online services.

The ATO has previously warned taxpayers to look out for tax-time SMS and email scams. Scammers use different phrases to try and trick recipients into opening the dodgy links, such as:

• “You are due to receive an ATO Direct refund”.

• “You have an ATO notification”.

• “You need to update your details to allow your tax return to be processed”.

• “We need to verify your incoming tax deposit”.

• “ATO refund failed due to incorrect BSB/ account number”.

• “Due to receive a refund, click here to receive a rebate”.

Scammers have also created fake social media accounts impersonating the ATO across Facebook, Twitter, TikTok, Instagram, and other platforms.

The ATO has previously warned the public about these fake accounts, which ask users to send them a direct message so they can help with their ATO query, in a bid to steal personal details, including phone numbers, email addresses, and bank account information. The ATO reminded users that its only official accounts are on Facebook, X, and LinkedIn. It urged the public to follow only verified accounts and ensure any email addresses provided end with ‘.gov.au’.

The ATO urges the public to always be aware of what information they share. Scammers can use personal identifying information to steal money from bank accounts and commit fraud in an unsuspecting person’s name. The ATO advises that people should never share personal information such as myGov details, tax file numbers, or bank account information.

If you suspect that your personal information, such as your tax file number, has been stolen, misused, or compromised, the ATO advises you to phone 1800 467 033. The ATO will then investigate and place extra protection on your ATO account. For privacy reasons, the ATO may not leave a message unless your voicemail identifies who you are.

The ATO will NEVER send texts or emails with links to services. It will also NEVER ask you for your tax file number or bank details via return email, SMS, or social media. If you’re uncertain about any communication regarding myGov or the ATO, check with your accountant. Better safe than sorry.

The purchase of any business, including accommodation businesses, is predominantly a financial decision rather than an emotive one. When buying a house, the decision is more likely the opposite, largely emotive rather than financial. Yes, there is a hope that the value of the property will appreciate over time, but this generally does not drive the buying decision. Also, a house is considered a home for a family, or at its most basic level, shelter, rather than a moneymaking enterprise.

Most of those interested in buying a business do so intending to gain financial benefit, make a capital gain, or provide cash flow and/or to give themselves something to do while gaining financial benefit. This financial decision

therefore relies on the trading of the business itself. It may be the case that a certain level of profit needs to be achieved to make it viable, or perhaps that it simply needs to be able to pay for itself while providing self-employment. The financial decision will rely heavily on the trading level the business is producing and the financial data available. Therefore, the most important piece of information to a purchaser is the financial data.

The physical presentation of the property and many other factors play a role, but the first consideration is how the financial data looks. Historical data is what first comes to mind, and many love to look at it on a “trending” basis. Does the line graph track upwards or downwards? The financial status of any business plays the largest role when determining its value. Financial data that legitimately confirms the income, gross profit, expenses, and profitability performance of any business is crucial. Without this in an acceptable format, there’s no reason to worry about anything else; close the book on it. “ABC Motel is the best motel in town. The car park is always full.” So, people say. This may be true on the surface, but if the financial data cannot confirm it, then it may not be the best or most lucrative, or even worth the value it should be in the market. Perception is reality until the financial data comes under the microscope. The presentation of financial data includes how the numbers physically present and the actual dollar amounts. Firstly, presentation seems simple,

but I’ve seen many calculation errors over the years, where the numbers simply do not compute. The total expense amount is less than what the individual expenses total, thereby inflating the profit. Are the seller’s accountant’s supporting documents also attached to the profit and loss statements? Is the spelling of each entry correct? People react to spelling mistakes on a profit and loss statement as they do with an email. If an email has spelling mistakes in the subject line or text, we immediately think the email is spam and discredit it. The same goes for financial statements. We start to question who prepared this profit and loss statement; surely it was not the seller’s accountant? We then question the validity of the statements and the credibility of who prepared them.

Secondly, there are the actual dollar amounts. The income and net profit must be as high as they can be to achieve the highest possible sale value in the market. Therefore, I suggest to every seller that they have their accountant prepare an abridged profit and loss statement. This will present the profit as it should for sale purposes, not for taxation purposes. It will have removed all income and expense items that are particular to the current owner and not part of the business. For example, an owner choosing to pay themselves a wage of $50,000 per annum compared to another paying themselves $5000 per annum has nothing to do with the business; this is generally a taxation or ownership structure-based decision. Simply

put, one purpose of preparation is to write down the profit; the other is to maximise it.

The financial statements prepared for sale must be fit for purpose. Profit and loss statements are generally prepared for taxation return purposes and to that end, include expenses and tax deductions which inevitably present the lowest profit possible, or preferably a loss depending on each party’s individual tax position. Adjustments will then be completed so the abridged profit and loss statement can be utilised for sale, refinancing, or other purposes. If not, a true representation of the profitability of the motel business compared to other motel businesses would not be possible. Conversely, it is also important to ensure that no legitimate operational income and expenses of the business have been removed. Even the most basic due diligence of the financial statements will determine this.

Aside from the profit and loss statements being required by a potential buyer, other financial data will be required. Monthly income reports that include GST will not match the profit and loss statement. If there is consistency in the difference in the GST, the issue can be cleared up quickly. However, if this is not the case, this will create questions about the accuracy and legitimacy of the data. If there are anomalies for a particular reason, it is always best to be upfront and explain why this is the case. Trying to sweep it under the carpet and hoping that the issue goes away will result in trouble.

By Mike Phipps, Mike Phipps Finance

These days, as I contemplate the ride into retirement, I seem to be spending more and more time dispensing wise counsel. Of course, the ‘Managing Director’ and I have agreed to differ on my definition of wise. She posits that, like Joe Biden, if you hang around long enough, some people will assume an age and wisdom convergence while ignoring demonstrable cognitive decline. I counter that my ability to write the previous sentence is testimony enough to my undiminished mental faculties. It took me two days to finish that sentence, and at some point, it included a reference to a fishing trip, but I digress.

While those receiving said counsel sometimes seem to think I’ve come down from the mountain with a third tablet, mostly it’s just sounding board stuff with a bit of common sense thrown in. These conversations invariably centre around challenges within the accommodation management and strata sectors, with advice

provided pro bono on an allcare, no-responsibility basis. Unlike those who leave their rubbish on the footpath hoping someone will see opportunity in a freebie, I think it’s possible to add real value by simply having conversations grounded in years of industry experience.

When thinking about a problem or challenge, I like the old consulting ploy of stealing someone’s watch and then asking them the time. Most people already have the answers; they just need to go on the journey – unpacking the truth, preparing for the future, acting in the fullness of time, and all those other corporate clichés. The trick is to avoid giving people answers, as there is invariably more than one way to skin the proverbial feline. In fact, I’m working on a book for pet lovers titled “100 Ways to Skin a Cat.” Advance copies will be available soon through quality pet shops.

Recently, I was approached by an owner of a residential strata unit with a topical dilemma. The building had no letting pool, with a resident caretaker manager in place. His unit is valued at around $1.8 million, and the body corporate salary is around $70,000. He’s asked the body corporate to approve the separation of the unit from the caretaking agreement so he can sell the business and

remain residing in his unit. This situation is an example of the increasing requests for conversations we are receiving from committee members and owners in residential strata schemes. These requests usually centre on either the situation I’ve described or the merits of approving agreement top-ups. Alarmingly, many discussions reveal a fundamental lack of knowledge about management rights and, in a disturbing number of cases, even how strata schemes work. That doesn’t appear to be the case in the example I’m going to discuss, albeit the varying views of owners in the scheme suggest a need to think more broadly about the caretaker’s request. It appears that the scheme in question is harmonious, and the caretaker is well-regarded. He has maintained a high standard within the complex and, of his own volition, has created an Operations and Procedures Manual. Interestingly, it appears some owners believe he is an employee and that the intellectual property contained in the manual is owned by the body corporate. Needless to say, we’ve put that one to bed, albeit as an example of a need to better educate owners about management rights contracts. Some owners wish to compel the caretaker to continue;

some want him to surrender the agreement; some seem to think they can resell the agreement; and some are looking at outside month-tomonth contractor options. Based on the information at hand, I think the body corporate should approve the severance of the unit from the agreement and allow the current caretaker to remain as a resident while selling his business. Here’s why:

• The caretaker is held in high regard and is an asset to the strata community in the building. He sounds like the sort of person one might be predisposed to helping.

• The caretaker is wellqualified in maintenance and systems and has agreed to assist a new external caretaker.

• Selling the caretaking business involves someone paying for it. In my experience, paying for the business will create a level of focus and commitment that is unlikely to be achieved by a monthto-month contractor granted the gig for free.

• In the current market, the only likely buyer for a $1.8 million unit with a $70,000 income is someone who wants to live in the

building, not someone who wants to offer caretaking services. The chances are that the outcome will be a fall in standards and disharmony in the scheme.

• The target buyer is likely close at hand. The property is in a popular tourist location with other quality high-rise schemes nearby. One might expect that a resident management rights operator nearby would already have the scale and capacity to offer caretaking services to a neighbour and add a relatively inexpensive cash flow to an existing business.

My views on this dilemma should not be taken as broader support for business-only management rights. The traditional model of a manager residing onsite as part of the strata community has stood the test of time, is highly regarded by lenders, and has underpinned the value of the industry. However, I don’t think we can hide from the fact that rising unit values, increased operating costs, and higher interest rates have made some management rights virtually impossible to sell. In this situation, bodies

corporate need to decide what’s best for the scheme: a stressedout resident manager trapped in a business they no longer want, or a non-resident manager who’s paid good money for a business and is focused on succeeding. By succeeding, I mean doing an outstanding job, impressing the body corporate, and never getting breached.

In closing, I sometimes get the vibe that owners don’t support unit severance because it may result in some financial benefit to the manager. This seems an odd way to assess the situation, as it reflects a desire to somehow punish the manager rather than do the best thing for the scheme. In a perfect world, we’d all like to have a manager living onsite. Owners just need to be pragmatic and look at the whole picture.

Disclaimer: I refer to the catchall word “strata” throughout this article. That’s because we all know what I’m talking about.

A thought: How do we as an industry work to better educate owners and committees in strata schemes?

By Roland Franz, General Manager, Body Corporate Headquarters Strata Consulting Services (Qld)

What’s included? What are additional costs, and how can you avoid them?

Owners in bodies corporate (strata) often assume that their body corporate levies are paying the body corporate manager to provide all their services. Conversely, the body corporate (strata) manager is one of the lesser costs in the body corporate budget.

In Queensland, the most common form of engagement is a standard agreement provided to members of the Strata Communities Association (Qld). The SCA agreement varies by each strata company, and each company presents itself differently regarding included and additional services and third-party charges.

The core duties of the strata manager are clearly identified within the engagement agreement’s reference schedule, categorised as secretarial, financial, and administrative duties.

What is included?

Secretarial duties typically include calling, convening, and attending the AGM and a specified number of committee meetings for an agreed duration. These duties also include producing minutes of those meetings and, when applicable, arranging for the

Your body corporate (strata) management company generally costs an owner less than a cup of coffee a week

attendance of a returning officer if a secret ballot/vote is on the agenda of a general meeting.

Included financial duties encompass opening bank accounts for the administration and sinking funds, preparing statements of accounts for each financial year, preparing draft budgets for committee approval to be included on the AGM agenda, issuing notices to owners for payment of contributions (levies), receipt and banking of income, processing and paying accounts, and preparing the scheme’s financial records and statements as required by the regulation module applicable to the scheme.

General administrative duties include paying insurance premiums, obtaining quotations for insurance renewal, establishing and maintaining the scheme’s rolls and registers, and maintaining and making the body corporate records available for inspection.

In summary, included services are the core services every scheme must undertake to comply with the BCCM Act and subordinate legislation

applicable to the scheme. They provide effective operation and record keeping of the body corporate and ensure that the body corporate meets its financial obligations.

All other duties undertaken by your body corporate (strata) manager that are not listed as an included service could be additional services and may incur additional service fees or third-party charges. These potential costs are stated in, but not limited to, the services identified in the engagement agreement with your strata management company.

Additional services include actions such as additional or after-hours meetings beyond those stated as an included service. Preparation, attendance, minutes, and the cost of distributing the notices and minutes will likely be additional costs incurred by the body corporate.

Reminder notices to levy and other debtors and debt recovery services are generally billed to the respective debtor and not usually a cost incurred by the

body corporate unless a debt or fees are forgiven as part of the debt recovery negotiations.

Circulars to owners and residents, compliance inspection notifications, other reminders, non-routine correspondence, newsletters, and legally required correspondence, such as government land valuations, voting outside of a committee meeting notices, and minutes, insurance valuations, etc., are typically additional costs for attendance and distribution to owners.

Additional service fees are identified within the engagement agreement and are in addition to the disbursement fees, which are often a predetermined fixed fee known as recoveries related to undertaking included services.

Other costs often associated with and forming part of a body corporate management agreement of engagement are third-party costs incurred by the body corporate company and passed on as recoveries. For instance, software licensing fees are often invoiced directly to the body corporate by the third-party

By Mike O’Farrell, MLR Services

As this is my first edition of “Mike’s Corner”, I thought I would start with the obvious… our industry is challenging!

As caretaking managers, we face an ever-increasing expectation to deliver more to our main client – the body corporate. Old agreements often result in lopsided remuneration compared to the body corporate’s expectations. Interest rates and staff costs are a real issue, and as profit margins are squeezed, our return on investment (ROI) is challenged. Many managers

provider based on a minimum fee and/or a fee per lot basis. These fees include management and voting platforms and an online portal providing owners with access to the body corporate records and other information relevant to their lot. Online voting and owners’ portal access have become an industry standard and an expectation of owners.

A building manager working in a proactive and collaborative relationship with the committee can significantly reduce the occurrence of additional fees. For instance, site inspections, quote requests, work orders, voting outside of committee meetings, property inspections, and attendance with contractors might be additional expenses incurred by the body corporate. These potential costs can be avoided if a building manager or a proactive committee attends

wanting to sell are finding the value of the real estate within the deal is now an impediment to sale. Phenomena such as “decoupling” are now a reality. Top-ups, once a reward for hard work, are now not so easy. And on it goes…

Am I negative? Well, I do live in the industry and spend a considerable amount of time handling stressful situations, so you might think I am. But I’m not.

to these actions rather than engaging a strata manager.

Similarly, liaison with consultants, engineers, contractors, and facilitating tenders are all potential additional costs that could be avoided or reduced by proactive management by the building manager or the committee.

Attending to non-routine correspondence is often a discretionary action where additional services may be incurred. Strata management agreements generally do not identify what is routine or non-routine correspondence but rather allow the strata manager to apply their discretion regarding a fee for services provided. Some strata management agreements include a fixed fee for attending to all correspondence, while others charge, at their discretion, for non-routine or arduous correspondence. Understanding how and what

These challenges have always existed in some form or another. No matter what industry you are in today, there is pressure on small businesses. The main takeaway is that you are not alone; there is always a helping hand that can work with you and guide you through these times.

Our industry body, ARAMA, has been the go-to when times are tough. Nothing has changed. It never ceases to amaze me why all managers are not

correspondence may incur additional fees presents an opportunity for further savings.

Hint: Clarify with your strata manager and obtain a written agreement detailing how and when additional fees may be incurred, and approved, and options available to the committee to reduce these costs.

The core services of a body corporate management agreement ensure the body corporate meets its legislative and financial obligations.

All other actions undertaken by your body corporate manager could incur additional costs. However, additional fees can, in many cases, be managed by the committee. The committee should clarify with

members of the organisation. Even if, by some bizarre thought, you cannot see the benefits of belonging to the industry body, you can engage with specialists who can and will guide you through the rigours of management rights.

I always talk about the triangle of management (or the triangle of hope and peace). In the illustration left, the three stakeholders are joined at the hip, and each relies on the other to ensure you have a strong scheme.

If you have a crack in the lines of communication, chances are you will have a dispute. The B4B stands for “Best For Building.” That is often the pacifier when a dispute occurs –always bring the point back to what is best for the scheme. Don’t be the manager who thinks negatively and wonders why the world is against you. If you are, then seek help. I can and will direct you to the right people.

their strata manager options to lessen these costs and identify an agreed approval process for any additional fees that may be incurred. Regardless, additional fees are unlikely to amount to a significant expense unless there is an extraordinary issue being addressed. A general guide would be that all fees payable to a body corporate management firm for the general day-to-day operations, included services, disbursements, recoveries, and typical additional fees, would likely amount to $300 to $400 per lot per annum for schemes over 30 lots. This equates to nominally $7 per lot owner per week or less.

Your body corporate (strata) management company generally costs an owner less than a cup of coffee a week at your favourite coffee shop.

Suggested topics for future comment are welcome contact via editor@resortnews.com.au

By

Cladding is the external lining of a building, intended to provide essential functions such as weather resistance, security, privacy, and aesthetic appeal. However, some types of cladding, particularly those that are combustible, pose significant risks to building occupants. Materials like combustible aluminium composite panels (ACP) and expanded polystyrene (EPS) can exacerbate fires, turning what might otherwise be a manageable situation into a devastating event.

In response to these dangers, the state of Queensland has taken significant steps to regulate and manage the use of hazardous cladding materials. One of the critical regulatory measures is the prohibition of ACP with a polyethylene (PE) core exceeding 30 percent by mass in any new building construction. This ban is part of a broader legislative effort, encapsulated in the Building and Construction Legislation (Nonconforming Building Products – Chain of Responsibility and Other Matters) Amendment Act 2017. This Act aims to eliminate the use of unsafe building products and establishes a “chain of responsibility,” ensuring that non-conforming products are reported and restricted throughout the construction process.

To further bolster building safety, Queensland established the Safer Buildings Taskforce in 2019. The task force’s mandate is to provide the government with advice on policies and actions needed to ensure the safety of buildings across the state. This includes addressing the presence of combustible cladding and offering support to building owners throughout the rectification process. The taskforce’s recommendations are

currently under consideration by the Queensland government, particularly concerning private buildings.

A critical component of Queensland’s strategy to manage combustible cladding is the implementation of the Combustible Cladding Checklist.

This checklist mandates a systematic approach across three distinct stages:

• Cladding Identification

Phase: Private building owners were required to register their buildings by May 31, 2021, identifying whether their properties were at risk due to cladding. By May 2024, over 18,000 buildings had been listed, with approximately 1000 identified as needing fire risk mitigation measures. Note: If your building failed to register by the due date, you can still register now.

• Fire Risk Mitigation

Phase: In this stage, private building owners must implement fire safety risk mitigation measures as outlined in the Building Fire Safety Risk Assessment report provided by fire engineers. These measures must be applied during

the period between identifying the cladding fire risk and completing the necessary rectification. This includes prominently displaying the Form 42 Affected Private Building notice, which informs occupants and visitors of the building’s fire risk status.

• Cladding Rectification

Phase: This phase requires building owners to take concrete steps to rectify the presence of combustible cladding on their properties. The process involves either the complete removal and replacement of hazardous cladding materials or the application of a fireengineered performance solution. This solution must demonstrate that any retained combustible cladding complies with the Building Code of Australia. The rectification work necessitates the involvement of a private certifier, along with various approvals and mandatory certificates. Additionally, referral to Queensland Fire and Emergency Services is required to ensure comprehensive safety compliance.

The Queensland government strongly encourages private building owners to undertake these rectifications to mitigate fire risks and ensure the safety of their buildings. Further information can be found at www.housing.qld.gov.au.

Cladding rectification works involving combustible materials are subject to stringent regulations. It’s imperative for bodies corporate or building owners to engage properly insured consultants for such tasks. At the outset of any rectification project, securing a private certifier during the planning stage is crucial to ensure the works are managed appropriately and comply with all regulatory requirements.

The rectification process not only involves removing combustible cladding and replacing it with non-combustible alternatives but also certifying the underlying structural framework and water and smoke sealing systems. Every building works contract for cladding replacement must explicitly include framing certification to guarantee regulatory compliance.

Before requesting quotations, it is important to ensure the full scope of works is documented for the tendering contractors. You will start with the Building Fire Safety Risk Assessment report, which will contain details on the type and extent of combustible cladding that has been identified on the complex.

The building owner or body corporate will also need to provide the As Constructed plans for the complex at the tender and planning stage, along with the Certificate of Classification and Survey Plan. As these documents may take some time to procure if not already on file, the committee for the body corporate is encouraged to take steps to obtain these important documents proactively before any urgent action may be required down the track.

Choosing the right contractor

Building owners often fall

into the trap of selecting the contractor with the lowest bid, only to encounter numerous unforeseen variations postcontract. To avoid such pitfalls, it’s advisable to engage a professional project manager. This individual will oversee the tender process, supervise the works, and coordinate the certification process, ensuring everything runs smoothly. Furthermore, the Private Certifier will provide essential guidance on the necessary trade contractor licenses. For buildings classified under Class 2-9 with Type A-B construction work, an Open Builders License is mandatory.

Increasingly, bodies corporate are realising that insurers impose specific conditions on policy renewals when combustible cladding is present on the property. Insurers may issue ultimatums to remove the cladding within a set timeframe, and such mandates appear to occur more frequently as time goes by.

The presence of combustible cladding may significantly affect the sale price or purchaser desirability of units in affected buildings. Mortgage insurers have notified the finance sector that they will no longer underwrite mortgage insurance for properties identified as Affected Private Buildings. Consequently, owners of such units may face even more challenges when trying to sell, as prospective buyers would need at least a 20 percent deposit to bypass mortgage insurance requirements.

A pressing concern for building owners is determining who bears the financial responsibility for rectification. Private building owners are advised to seek legal counsel regarding their property, commercial, and contractual matters, as well as their compensation and litigation rights. Engaging a lawyer with specialised skills

in strata or body corporate law, rather than a generalist, can provide more targeted and effective representation.

By understanding these critical aspects, building owners and bodies corporate can navigate the complexities of cladding rectification works more effectively, ensuring compliance, risk mitigation, and optimal safeguarding of their investments.

By Chris de Closey, Director,

Direct is best! We’ve all heard it and no doubt most agree that commission-free bookings are favourable. We won’t jump into a direct vs Online Travel Agent discussion in this thread here but we will discuss how to cultivate ongoing, longlasting relationships with your customers.

Understanding

Email marketing allows you to present a personalised approach to the customer. It allows you

Email marketing allows you to present a personalised approach to the customer

to communicate with past, present and potential customers and deliver a message that resonates with them, and helps to encourage bookings. When done right, these campaigns not only boost direct bookings but strengthen your guest loyalty, turning one-time guests into repeat visitors.

The first step in a successful email marketing strategy is segmenting your audience. This involves dividing your email list into smaller, more focused groups based on specific criteria, such as:

• Past booking behaviour: Distinguishing between frequent visitors, occasional guests, and first-timers. If they spend big or stay regularly, they might LOVE the campaign you are offering them.

• Demographic information: Age, location, and interests can dictate the type of offers