The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, it’s employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/ or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its’ agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent of the publisher.

2024 Multimedia Pty Ltd

Welcome to the November edition of Resort News.

Living in a scheme myself, I know first-hand how essential a strong sense of community is – and how quickly things can unravel without good communication. As Trevor Rawnsley says, “The better you are at communicating, the stronger the relationship, and the more successful your business will become as a result.” Residential managers have a unique opportunity to build thriving communities by fostering trust, establishing systems, and nurturing relationships with owners, investors, body corporate, and residents alike. Why invest millions if you’re not also investing in people? Good communication can transform a challenging role into one

Mandy Clarke, Editor editor@accomnews.com.au

that’s truly rewarding and keeps your lett ing pool in-house. Importantly, as Sam Steel, Co-Founder, Resly highlights, community support is vital for mental health, especially for managers who may feel isolated. This issue is packed with

insights from industry leaders who embody this approach. We’re excited to feature Alison Sun from AccomValuers, who brings nearly two decades of expertise in management and lett ing rights. We’re also celebrating Mike Phipps’s 15year journey with Mike Phipps Finance, where he reflects on his rise from a backroom startup to a trusted name in finance. Mike’s story underscores the value of relationships and personalised service.

A recent industry highlight was Resly’s AccomCon. at The Star Gold Coast, where tourism and property management pros gathered for two days of networking and celebration. It was a privilege to join a panel with such talented peers, and keynote speaker Shaynna Blaze captivated the room with her creative wisdom. Congratulations to all the

award winners who shone at the whimsical “Secret Garden” gala, which also raised funds for the Tara Brown Foundation and the Royal Brisbane and Women's Hospital Foundation. Also in this issue is our Gold Coast MLR Special Report , covering recent shift s in the market as rising property values and growing interest from owner-occupiers reshape the landscape. Finally, meet Anita and Michael Heien from Paradise Grove, who are two and a half years into their journey of building a strong community and a home.

I hope you find inspiration in these stories of growth and community spirit. Thanks for reading and here’s to building great relationships and making the most of what we do!

Warm regards, Mandy

By Trevor Rawnsley, CEO, ARAMA

Residential managers can achieve great things in this industry if they push the right buttons with people and communicate effectively with their community.

The Management and Letting Rights industry (MLR) is a people business, and it’s all about relationships. The better you are at communicating, the stronger the relationship, and the more successful your business will become as a result.

ARAMA has produced what we call the Community Connect Toolkit along with an instructional

webinar on how to use it. This provides great assistance for anyone in the MLR industry to make themselves better communicators and therefore better managers. The Community Connect Toolkit is a day-today guide of the who, why and how you can communicate with your community.

There are different communities within the management rights industry – there’s the community of investor owners that are in your letting pool, there's a community of owners that reside on site at the scheme, there’s a community of tenants and there is the staff team community if you're in a larger business.

The Community Connect Toolkit will help you communicate with all of them in a really positive and beneficial way.

Successful managers understand

and accept that with the nurturing and maintenance of positive relationships they can achieve everything they want in management rights. As a residential manager, your daily efforts are crucial to maintaining a well-functioning and harmonious community. And it’s vital for your business that lot owners and residents are made aware of your efforts and recognise and appreciate the hard work you put in every day.

Some people entering the MLR field just look at a balance sheet or they look at the tasks and think they're buying a cleaning business or they're buying a real estate business. Some of them don’t realise they are buying a people business and the success of that business largely depends on the relationships they build with the people in their residential community. Some operators still

overlook this and don’t see the most obvious keys to success.

I can tell you without exception that every one of this year’s TOP Award winners have successfully connected with their communities, otherwise they wouldn't get the glowing endorsements, and they wouldn't have the confidence to put themselves up for nomination or perhaps rejection.

Hamish and Jess Watts from the Glen Eden Beach Resort at Peregian Beach took out this year’s award for Resort Management Team of the Year and received a glowing endorsement from their strata treasurer and manager, having saved the complex more than $600,000 in a driveway project. They communicated effectively with their committee and residents throughout the process, letting everyone at Glen Eden know what was happening and what Hamish and Jess were doing on their behalf.

In a similar way Stuart and Nicole Morris from the Azure Sea Resort in Airlie Beach took out the TOP Award for Resident Manager of the Year (Short Term Stay), after organising major pool repairs, finding a great price for

the removal of black mould in the complex, and propagating all the gardens – creating new plants from cuttings – so that the body corporate was not hit with further expenses. They had to negotiate with three separate body corporates but increased the returns for their investors substantially. All the time they communicated effectively with everyone involved.

One of the best tools that Stuart and Nicole had for creating good relationships within their community and keeping everyone on the same page was a comprehensive newsletter to keep all of their owners – in Australia and overseas – up to date. In a similar way, Maree and Ian Smith from the Hidden Vista group, just north of Brisbane, our record-breaking TOP Award winners with four titles, have done a brilliant job in making everyone among the 230 lots they manage feel a sense of inclusion. They have used simple techniques such as a Facebook page covering residents at all four complexes they manage.

Ian and Maree are brilliant communicators and their success is, to a large part, based on honest, open dialogue with everyone in their community.

On the flip side though, I’ve heard horror stories of residents at other schemes who were too scared to go to their residential manager in case they copped a gobful. I’ve heard of residential managers who rarely venture out of their office. And I’ve heard of managers who get angry at kids playing in a resort pool. The sort of communication they produce in these situations only wrecks their business.

In response to our survey of residential managers and their needs, we identified that many of you wanted help and advice on how to create better communication within your community and therefore build stronger cohesion between the manager, residents, and body corporate.

That led to the birth of the Community Connect toolkit.

The toolkit includes a poster as a daily reminder of how residential managers can connect with your community – ensuring your contributions are visible and valued by everybody involved in the scheme. We stress in

Community Connect that managers have to make their community aware of all the great things you are doing on behalf of the complex – that’s so important because if your community isn’t aware of the work you are doing, how can you expect their support?

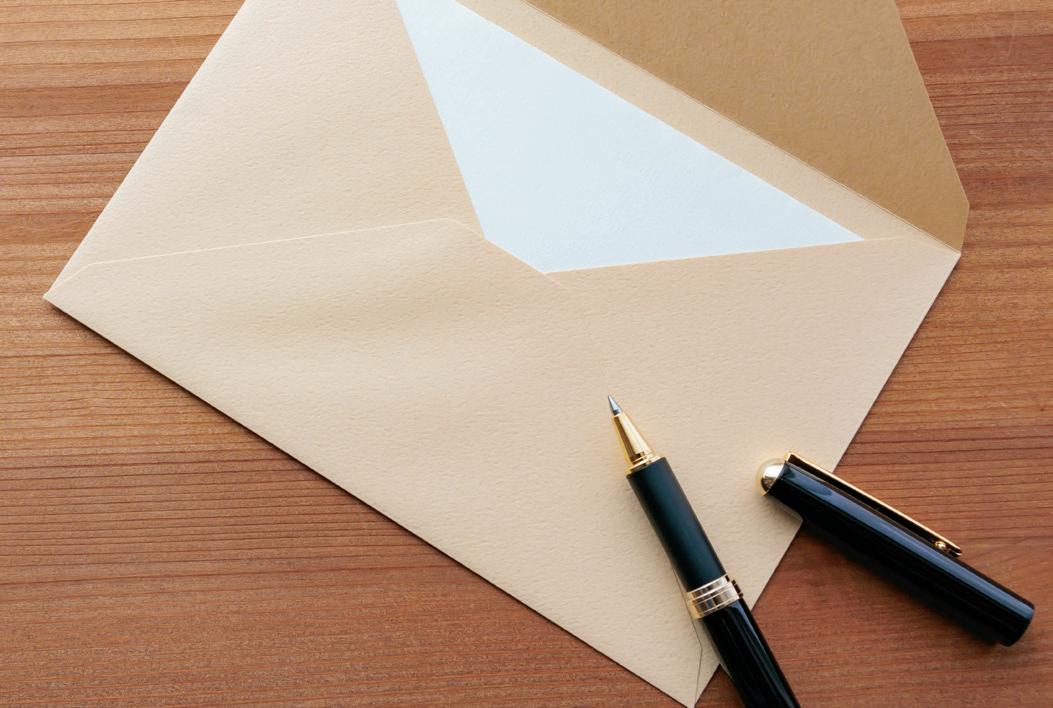

One of the most important things a new residential manager can do when arriving at a complex is to send out a friendly letter to all the residents and lot owners, simply saying: “Hi my name is so and so, I’m the new manager and these are all things I can do for you. If you need anything else, please let me know because I am here to help.”

That’s a great way to start a good relationship from the get-go, and we have produced a template letter that is easy to follow and helps you do this.

We have another template in the Community Connect toolkit that informs everyone in the complex of all the work you are doing. It starts by saying: “We love being your residential manager and we love this community. Our greatest asset is the relationship we have with owners and tenants. It’s a relationship built on community and trust, and we always look forward to chatting to you and assisting you where we can. From time to time, we like to remind you about what we do as residential managers, so that we can continue to serve you as members of our community.”

Community Connect is a simple and effective tool that is so important to strengthen bonds with everyone in the scheme.

You can point out what you do in such areas as:

Security: How your business operates onsite and that you are on-call 24 hours a day to help facilitate community safety – how this provides residents with security that many other complexes don’t have.

Service: How you have a financial and vested interest in the proper management and operation of the complex. Not only do you own and run your business but like the residents, you want this to be a great place to live and invest. You can then list all the work you do: How you are contactable for emergencies 24/7, how you are able to organise and meet contractors, and how you work closely with the body corporate

committee and provide regular reports on the operation and maintenance of the complex.

All this is in our template letter including our advice that you let residents know that if they have any questions or concerns “Please talk to us immediately. We are here to help you understand our role and provide answers to your questions and solutions to your problems if possible.”

Just about everything that we have on the ARAMA website has come from the feedback of our members, and Community Connect articulates best practice from people who have followed those exact principles and succeeded in doing it.

Our Community Connect webinar includes proven advice from our own communication experts, Lyall Mercer from CRC Public Relations, and Caitlin Dillon from Focused Marketing.

Community Connect explains how effective communication builds trust and why people do business with people they trust, and especially ones they like. Good communication empowers everyone in the community to

contribute and it might include simple but highly effective things like organising regular coffee mornings or a barbecue every couple of months.

By being honest, hospitable and providing a great service, residential managers can demonstrate the real value of your service and hard work and prove that you are the invaluable go-to person at the complex.

By building these open lines of communication, a residential manager can go a long way to protecting, defending and growing their letting pool.

You can improve the net profit and capital value of your business and maximise your clients’ rental returns. Good communication and trust foster a real sense of collaboration and drive business growth through extensions in service agreements.

Community Connect is not just great for your business, but it also makes your community a fantastic place for everyone to live.

By using the tools contained with the Community Connect toolkit you can get whatever you want without even trying.

By Ben Ashworth, Senior Associate, Small Myers Hughes Lawyers

One of the most common duties you will find in a caretaking agreement is an obligation on the manager to keep safe all the keys (fobs, swipe cards etc.) needed to access the complex.

The manager is required to store the keys securely and only share them with persons authorised to use them from time to time. For many complexes this is a set and forget duty for the manager that draws litt le of their attention or time.

Although a duty to protect keys may seem straightforward, there can be much expected of the manager when performing this duty that isn’t stated in the caretaking agreement, such as:

• At all times the manager should know exactly how many keys there are.

• At any given time, the manager should know who holds a key when not in the manager’s possession.

• The manager should only allow someone else to use a key to access a lot when approved by the owner of that lot or use a key to access common property when approved by the committee.

• The manager should follow up to ensure keys are returned on time.

• The manager should inform owners when a key is missing and help arrange a replacement.

• The manager should help arrange the changing of locks when required.

If you are a manager, how do you prove to the owners corporation that you have performed everything that is expected of you? Is pointing at a box of keys sitt ing in your safe good enough?

Some caretaking agreements will specifically state that the manager must keep a register or log for the keys they hold, for example, a record of when each key is given out and then returned. This is an eff ective way of tracking how many keys there are and where they are at all times. Although many caretaking agreements don’t specifically state that the manager must keep a register, it is difficult to imagine how the manager could prove they know how many keys they are meant to be holding and where they are if they do not keep a written record.

Is pointing at a box of keys sitting in your safe good enough?

Whether specifically required or not, maintaining an accurate key register is a relatively simple way for a manager to instil confidence in their ability to pay attention to detail and prove the performance of their duty. Apart from tracking the number and locations of the keys, a register can be used to record why each key leaves the manager’s possession and the authority that was given at the time. The act of filling in a register can also act as a reminder to the manager that they need to check that the person taking a key has the correct authority and that any keys previously issued have been returned.

Being able to prove to owners that you have performed your duties well is important to maintaining a successful

ongoing relationship with the owners corporation. It is also relevant when it comes time to sell your business and you need to prove to the buyer that you are not in breach of any of your duties as the manager.

If you don’t have a key register already it is strongly recommended that you start one. Using the excuse that the last manager didn’t need to have a key register, or that you will need to “find” it, doesn’t look good and is an own goal that can be easily prevented.

Liability limited by a scheme approved under Professional Standards Legislation.

Disclaimer – This article is provided for information purposes only and should not be regarded as legal advice.

Delivered & Installed

Disposal of Old Equipment

Lifetime on Repairs

The choice to self-manage a body corporate can be difficult

The rising cost of living has Queensland lot owners wondering how far their budgets can stretch and whether bodies corporate can save on premiums through self-management.

To begin with, bodies corporate are not required to engage a body corporate manager to assist with administrative services. They can self-manage and it may save money, but it is likely to cost time, and for that reason there are many key factors to weigh up before going down the self-management path.

We will outline here some important considerations for bodies corporate contemplating self-management and the benefits and pitfalls.

Self-management is not as popular in larger schemes where there is a caretaking service contractor, so it is important to support your body

corporate committee should they choose to self-manage. This article is only a guide in self-management, and a body corporate should carefully consider what other factors might be at play if they choose to self-manage.

While this is not a necessity, a body corporate that is exploring the idea of self-management would benefit from encouraging committee members and lot owners to complete the online training provided by our office.

This training offers a foundational understanding of body corporate and community management legislation. It covers essential aspects of the legislation relevant to many bodies corporate in Queensland.

Along with this, we strongly encourage lot owners to understand what regulation module and format plan applies to their body corporate.

The regulation module applying to a scheme lays out specific rules and procedures required of the body corporate. The format plan, among other things, dictates the insurance that is required and maintenance responsibilities.

Most people who own a lot in a community titles scheme are probably aware a body corporate must keep certain records and make them readily available for inspection or provide copies to interested persons.

While the legislation does not provide the specific location that records must be kept, if a body corporate did self-manage, someone needs to store physical and digital copies of records.

As mentioned above, there are also legislative requirements to provide copies of these records when requested. Ensuring accurate records are kept allows for the smooth distribution of these records when required.

Many disputes managed by our office relate to the mismanagement of body corporate records, including bodies corporate refusing access to documents or not keeping up to date and accurate records.

A body corporate considering self-management must understand the importance of record keeping and their obligations under the legislation.

This is a topic that hits close to home for many Queenslanders. Besides rising insurance

premiums, some companies are unable to offer coverage due to several factors, and yet a body corporate has specific insurance obligations that must be met.

A body corporate must have public risk insurance for the common property and for assets such as gym equipment as well as common property insurance for full replacement value.

The body corporate must insure, for full replacement value, the following buildings, if lots included in the scheme are created:

• under a building format plan of subdivision or volumetric format plan of subdivision - each building that contains an owner’s lot (e.g. a unit or apartment); or

• under a standard format plan of subdivision if each building on a lot has a common wall with a building on an adjoining lot.

The owner is responsible for insuring buildings that do not share a common wall if the scheme is registered under a standard format plan of subdivision, unless the body corporate has set up a voluntary insurance scheme and the owner has opted in.

A body corporate considering self-management should be aware of their format plan and the associated insurance requirements.

When engaged with a committee, a body corporate

manager has no decisionmaking powers, but they generally have a deep understanding of self-resolution requirements and the processes to resolve disputes, such as by-law contraventions.

If a body corporate chooses to self-manage, lot owners and committee members should ensure they understand the processes to resolve disputes within their body corporate and how they may be able to address this through our office.

Issue 42 of Common Ground does a deep dive into the dispute resolution processes.

While your body corporate committee may be happy to self-manage, they may engage businesses to complete tasks that may be out of their skillset. There is nothing preventing a body corporate from selfmanaging while engaging an accountant to oversee their finances or engaging a broker to assist in obtaining insurance.

Committee members are volunteers and may not possess all the skills required and, therefore, outsourcing certain responsibilities can ensure that tasks are completed efficiently and correctly, provided they are approved by the body corporate.

Effective meeting processes are crucial for the smooth day-to-day running of a body corporate. Our office has

provided information on this topic in prior issues of Common Ground; however its importance outweighs our repetitiveness.

A body corporate must ensure they follow correct processes within the legislation when making decisions. Not following these processes, especially if an applicant can demonstrate a difference in the outcome, could result in the decisions being ruled invalid through our office.

While some committee members may think that it is okay to skip sending out notices of committee meetings or to have 10 days’ notice for a general meeting instead of the required 21, this does not change the requirements under the legislation and leaves decisions open to be challenged.

You may wish to refer to issues 45 and 46 of Common Ground, which discuss body corporate decisions and the processes for committee meetings.

The choice to self-manage a body corporate can be difficult. The members of the body corporate must understand their roles and responsibilities under the legislation before taking on this role.

Remember that our information service is here to answer your questions. Call us at 1800 060 119 or submit your question through our online inquiry form. This article is general information only and not a substitute for legal advice.

For more details on bodies corporate in Queensland, visit our website.

By Grantlee Kieza OAM, Industry Reporter

Alison Sun, from AccomValuers, has been a property valuer since 2003, spending nearly two decades honing her expertise in the specialised field of Management and Letting Rights (MLR). Her work takes her all over Australia, and since relocating to Queensland in 2006, she has witnessed the exponential growth in the value of MLR businesses.

When she’s not immersed in renovations with her husband or keeping up with their two young boys, Alison is applying her expert eye to everything from multimilliondollar businesses to smaller mum-and-dad operations.

A cornerstone of the MLR industry, Alison’s work is vital. She’s well-versed in all aspects of valuation and consultancy for both short- and long-term lett ing MLR businesses, including off-the-plan complexes.

Her valuation reports serve many purposes: MLR acquisitions, mortgage security, family law matters, legal proceedings, receiverships, and strategic advice for buyers and sellers alike.

AccomValuers was established in 2018, with Alison as the sole director. By 2020, an opportunity arose to expand the business through a partnership with Alex McCowan, a veteran in the valuation industry who has been working with MLR and motels since 1995.

Specialising in MLR business valuations since 2008, Alex brings a wealth of experience to the partnership. Together, Alison and Alex have conducted over 650 MLR valuations in the past six years, off ering clients unparalleled industry knowledge.

Alison’s journey into property valuation began in 2003 after completing a master’s degree in property development at the University of Technology, Sydney. She initially focused on residential valuations in Sydney before pivoting to MLRs.

“I believe my master’s degree was key to my career development,” Alison shared. “When I started, I was a bit

of a spring chicken, showing up to value what were often people’s life savings.

Having that master’s degree opened a lot of doors.

“But after the Sydney 2000 Olympics, there was a bit of a slowdown in residential valuations, so I decided to explore opportunities in other states.”

In 2006, Alison moved to Brisbane, where she happened to meet Greg Jorgensen, a specialist in MLR valuations.

“I worked with Greg for over 10 years, and I really enjoyed the field,” Alison recalled.

“Greg now runs a management rights brokerage, but working with him was the start of my 18 years in this industry. Over the years, I’ve built strong relationships and worked with some of the best in the business.”

Valuing MLR businesses requires a high level of expertise, with careful analysis and market comparisons.

“With any property valuation, it all comes down to finding and gathering comparable sales evidence,” Alison explained.

“For MLR businesses, you look for sales evidence that matches the management business in terms of location, type of lett ing business, size of the net operating profi t (NOP), and the terms remaining on the Caretaking & Lett ing agreement.

“You also have to consider the real estate component – like the manager’s unit or office – and find similar sales for comparison. The process is the same whether it’s short term or long term lett ing: you compare like with like.”

Alison noted that the value of MLR businesses has risen dramatically since she started in the industry.

“When I began, the highest multiplier on the Gold Coast was around 5 times, and that was considered a record,” she said. “Now, long term lett ing businesses nett ing more than $600,000 in profi t are att racting multipliers of 6 to 6.9.”

Shortly after entering the industry, the Global Financial Crisis (GFC) hit, creating significant challenges.

“The GFC was tough on everyone,” Alison said.

“Sales volumes were down, and businesses that sold were often stressed sales. Even those that weren’t stressed had to compete in a tough market. It was a difficult time, not just in management rights but across the real estate sector.

“The thing that sets management rights apart is the security of the body corporate salary. In long term lett ing, that salary typically

accounts for around 50 percent of the business cash flow.

“In short term lett ing, it’s a smaller component, maybe 20 to 25 percent, but it still helps with cash flow. During COVID, that guaranteed income helped many businesses survive, and it even made MLR businesses more appealing to buyers, boosting demand and pushing multipliers higher.”

Alison and Alex work with clients who own portfolios

of more than 10 properties.

“The highest business I’ve valued this year was a management rights operation for a single building, valued at $13 million,” she said.

“This year alone, we’ve valued eight businesses over $10 million, including one in Melbourne and several on the Gold Coast and in Brisbane. Most were short term lett ing businesses.”

Over the years, I’ve built strong relationships and worked with some of the best in the business

Do people ever challenge valuations?

“Oh, absolutely,” Alison said with a smile.

“When it’s time for a finance review or someone is looking to borrow for their next venture, there can be disagreements.

“People always want to maximise their asset’s value, and that’s when disputes arise.

“When a contract is involved, if I can’t support a contract price because it’s above the sales evidence, I’ll get pushback from selling agents. They have their commission on the line.

“I tell them, ‘Show me the sales evidence to value it otherwise.’”

AccomValuers has built strong relationships in the MLR industry, and Alison’s work takes her all over Australia.

“I just got back from Sydney, but recently I’ve been to Airlie Beach, and I have valued businesses in Perth,” she said.

“I find the work rewarding, it’s an honour to be referred work and that’s what keeps me going.”

How does Alison unwind when she’s not immersed in MLR valuations?

“My husband and I are in the middle of a 'renovators delight', which keeps us prett y busy,” she said.

“I also play tennis and volleyball, but nothing keeps me on my toes like our two energetic boys.

“They’re almost three and fi ve, and we’re renovating with them in mind, but it’s worth it.

The things you do for kids.”

By Frank Higginson, Hynes Legal

This year will witness the biggest global exercise in democracy in modern history, with more than a billion people voting in general elections around the world, including polls in India, Indonesia and the United States.

Now, the sheer volume of voters may make the turnout at the annual general meeting of your strata scheme look prett y lame by comparison, but the general principle is the same. Namely: the world is run by those who show up. Unlike in Australia’s elections, voting at scheme AGMs is not compulsory. Everyone who is financial has the right to participate, but they are not obliged to participate.

In other words, if you have an important motion coming up at an AGM about a new management rights agreement, you would be well advised to hit the hustings early to lobby for some support.

In America, they call it ‘get out the vote’, encouraging a distracted electorate about the importance of turning up on election day and ticking the right box.

Things are no diff erent in strata-land.

Your greatest challenge will be overcoming what appears to be owner apathy.

Those of us inside the industry often talk about owner apathy. I have used that phrase for decades. Most find it extraordinary that general meetings will be adjourned where there might only be 10 percent of people participating in the decision-making over the future of a major asset.

But I’ve had a bit of a revelation. I think it’s not so much about apathy these days, but priorities.

A new management rights agreement may be vital to the future of your business, but for many of the lot owners in your scheme it’s just another matter among a blizzard of competing issues.

Family, kids, grandkids, parents, mortgage, the cost of living. It might even be worries about the Middle East or what’s going on in Ukraine. It’s not really apathy about voting at the AGM – it’s just that people have multiple other issues dominating their attention and many of those are more important than your motion.

So, when you need support from lot owners for your motion, it’s important that not be the first time you’ve spoken to them.

Just like in big politics, it’s all about relationships.

Strata is a people business. You need to build those links to give you a fighting chance of gaining votes when you need them.

And since it’s no longer legal to ‘unfairly’ influence the outcome of a body corporate decision through commercial incentives – the old days truly were the wild west – a good resident manager will be able to fall back on the favour bank.

You let them in to their unit when they locked themselves out.

You looked after their dog while they went away for the weekend.

You signed for a courier package and took it up to their door.

You arranged a tradie for some much-needed repairs.

Basically, you were a good neighbour who people like having around.

So, when it comes time to ask for their vote at an AGM, the response is far more likely to be ‘yes’ than if that’s the first time you learn their name.

It may be a challenge to elevate your needs to the top of other people’s priority list, but it’s a skill worth honing when what’s at stake is the future value of your business.

By Jonathan Hanaghan, Principal, Count Gold Coast

With the festive season kicking off I thought I would discuss some of the fringe benefits tax implications for Christmas parties and staff gifts and review some of the common fringe benefits associated with the accommodation industry generally.

If you provide certain benefits to your staff, or their associates, you may be up for fringe benefits tax (FBT). It is important to note that the benefit must be as a result of employment and not business ownership, for example, a benefit provided to a shareholder of a private company who is not and never has been an employee or officeholder does not constitute a benefit for fringe benefits tax purposes.

This tax is separate from income tax and is based on a 'taxable value' of the benefits provided, which is calculated according to the categories the benefits fall into. The Australian Tax Office (ATO) has even given FBT its own tax year, from April 1 to March 31. The upside for your staff is that they do not then have to pay income tax on the value of the benefits and payment of the FBT is tax deductible to the employer.

This is a common benefit provided for the typical work Christmas party, usually by way of food, drink or recreation. Generally, the more elaborate the meal and the inclusion of alcohol the more likely the meal becomes entertainment. Also, where the food or drink is provided also affects the classification. Provision of the meals and drinks off your business premises, for example, at a restaurant is more likely to be entertainment and subject to fringe benefits tax.

One major consideration is the “less than $300” minor benefit exemption and the now recognised fact that the ATO will accept that different benefits provided (for example gift and Christmas party) at the same time are not added together when applying the threshold. Essentially this means that both

the gift and Christmas party entertainment may be exempt from FBT even if provided at the same time, as long as each cost less than $300.

If you make a car you own or lease available for the private use of your employee, you may provide a car fringe benefit.

For FBT purposes, a car is any of the following:

• a sedan or station wagon,

• any other goods-carrying vehicle with a carrying capacity of less than one tonne, for example a panel van or utility (including four-wheel drive vehicles),

• any other passengercarrying vehicle designed to carry fewer than nine passengers.

A car is taken to be available for the private use of an employee if the place of business and residence are the same, that is, a standard management rights business.

There are some circumstances where use of the car is exempt from FBT. For example, an employee’s private use of a taxi, panel van or utility designed to carry less than one tonne, is exempt from FBT if its private use is limited to:

• travel between home and work,

• incidental travel in the course of performing employment-related travel,

• non-work-related use that is minor, infrequent and irregular (for example, occasional use of the vehicle to remove domestic rubbish).

The most important message to reduce any potential car FBT is to seek advice from your accountant to see whether it is worthwhile completing a logbook for at least 12 concurrent weeks.

This will depend on the value of the car and the expected business use percentage.

A housing fringe benefit may arise when you provide accommodation to your employee rent-free, or at a reduced rent where that accommodation is their usual place of residence.

A unit of accommodation includes any of the following:

• a house, flat or home unit,

• accommodation in a hotel, motel, guesthouse, bunkhouse or other living quarters,

• a caravan or mobile home,

• accommodation on a ship or other floating structure.

This is a common benefit provided to managers within the accommodation industry and in particular to businesses that are operated through modern corporate partnerships. It is clear the ATO does not care that the accommodation may be attached to a busy office that is open seven days a week with the managers being on call 24 hours a day. The ATO still have an opinion that a housing benefit is being provided. Generally speaking, the benefit will be calculated at 75 percent of the market rental for the dwelling in question, that is if a manager's unit would ordinarily rent for $600 per week, then the annual benefit is calculated at $600 x 52 x 75% = $23,400. This amount can be reduced by payments made to the employer by the employee or associate for use of the accommodation.

In summary if you are providing any benefits to employees it is important to seek advice from your accountant as the ATO is reviewing more of these arrangements every year and as the saying goes … “there is no such thing as a free lunch”.

By Andrew Morgan, Motel Broker/Partner, Qld Tourism & Hospitality Brokers

Those genuinely looking to acquire an accommodation business or property right now know how challenging it is to find good opportunities. There is strong buyer demand in the market for motels and caravan parks, with limited supply available. It’s supply and demand at work!

The main reason is high demand, with more genuine buyers than sellers. By “genuine buyers”, I mean those who are motivated and ready to commit, as opposed to those just starting to look. The heightened level of competitive bidding in the market is driving these buyers to act sooner than they might otherwise need to.

Another factor is that many accommodation business owners are choosing to hold rather than sell, resulting in fewer businesses available and contributing to the tight market. This may be partly because businesses are experiencing solid occupancy rates and income. When things are busy, selling is usually not a priority. Conversely, when business slows down, owners may start considering a sale. However, when trading is good, it’s easy to fall into the mindset that “this will last forever.”

The high volume of recent sales over the past couple of years has

In this market, there are often more businesses for sale than it appears

also contributed to the scarcity of opportunities now. Demand for motels and caravan parks has been strong for some time, with many properties that were on the market for a short or extended period now no longer available.

With that context, the question is how to find opportunities moving forward.

In this market, there are often more businesses for sale than it appears. Many recent sales have occurred off-market, meaning the businesses and properties are listed but not actively marketed. They won’t show up on websites because they aren’t advertised publicly. Instead, the listing broker

offers them directly to existing clients and prospective buyers already in their database.

Off-market opportunities arise for various reasons and provide an excellent way to maintain a level of confidentiality around the business and its sale. Often, businesses listed offmarket are sold before most people even know they are available. While this type of sale process does not suit all properties, it can be an excellent method for certain types of businesses and properties.

Another obvious way to source accommodation businesses and properties for sale is through websites. Many people start their

search here, with everything accessible at the click of a button. There are numerous websites to broaden one’s search, but relying solely on them may not provide a comprehensive view of the market.

Finally, maintaining regular contact with brokers is essential to see what’s available or coming soon. Work closely with those who are trusted and experienced in the accommodation sector. By making oneself known to specific brokers and working with them to find a suitable business or property, buyers gain access to more opportunities. If the broker knows exactly what a buyer is looking for (and what they want to avoid), it greatly helps in finding the right investment.

To conclude, here’s a real example of a client who was searching for over a year without success. They say patience is a virtue, and that was certainly true in this case.

A long-time client of mine reached out about 18 months ago, wanting to discuss acquiring another freehold going concern motel. They provided their criteria for what they were looking for and what they wanted to avoid. At the time, there was nothing on the market that met their needs, so I asked them to be patient while we worked to find the right property.

As time passed, it did test their patience, but to their credit, they stayed focused. A few opportunities arose, but for various reasons, they didn’t work out. Finally, we were able to source an off-market opportunity that was a perfect fit. They had all their ducks in line and were ready to proceed, which made the entire process go relatively smoothly.

At the end of the day, the buyer found the right property, and the seller was pleased that the business and its details were kept confidential and the sale concluded without fuss. Happy days for all involved!

By Marion Simon, MLR Manager, Boulevard North Holiday Apartments

I can hear the comments and imagine the thoughts as you read the above heading… but a very interesting Facebook posting by respected and legendary management rights and motel owner, Stuart McMullan discussed this subject, and really got my brain ticking! So, to help you understand this article, let me share Stuart’s post, with his gracious permission:

“My wife and I are involved in various management rights and motels, and I post few responses now and again with a bit of humour.

“I must firstly confess I am very passionate about our industry and believe it is one of the best $$$ returning businesses you can purchase.

“It’s taken me a long time to feel comfortable in deciding that most things need to be black and white in relation to the caretaking and management rights agreements.

“I’ve heard and seen it all.

“Have you heard of being chicken??

“Chicken is when you feel awkward about doing something you don’t really want to do but probably need to do.

“We get chicken to follow through with phone calls and emails to our owners to action our Form 6 CPI increases.

“We get chicken to apply for a Variation to our Top Up of our agreements as we think it’s best not to rock the boat.

“We get chicken to not upgrade and maintain our owners’ apartments because we think our owners can’t afford it.

“We get chicken about standing up for our rights in case we upset the other side.

“We don’t get chicken about running to the fire panel after hours because it triggers an evacuation for owners who may complain in the morning. We should just pretend we don’t hear it and let them evacuate during the night.

“We get chicken for everything that we do that’s not in our agreements and subsequently don’t get paid for.

“We get chicken and sell for less than what we are worth because we are chicken.

“STOP being chicken.

“You bought your business today to sell tomorrow.

“This means every day you must better your business processes and procedures so when you decide you need to sell you don’t have to do 12 months of hard yakka to get your best sales figures.

“Top up every couple of years.”

This article underlines the many, many discussions and debates that I constantly have with other owners and managers about the expectations that body corporate committees, owners and strata management companies have.

The “we’ll just do it to keep the peace” jobs that are added to our already overburdened program, that fall outside our agreements and that we are not paid for.

So many of us are running off contracts that were penned in the 1980s and 1990s, that are so outdated and financially biased in favour of the owners.

Not wanting to “rock the boat” and “being chickens” means the body corporate and owners sit pretty while the management rights owners stress daily about delivering the often-unrealistic

expectations within the very fine break-even line that is offered.

Perhaps it is time, that we in the industry unite to offer a professional service at an affordable and realistic rate, an industry that stands united, proud and tall, and that is respected for the amazing job that most of its members do? This will remain a dream until we “stop being chicken” and realise the value of the service we offer, and expect the same level of respect, pay and acknowledgement that other industries receive, without having to beg and plead for.

Does your complex put up Christmas decorations? If yes, please send me an e-mail answering the following:

Who pays for these decorations?

Who puts them up and takes them down?

Is this work paid for, and if yes, by whom?

Any other comments and thoughts on Christmas décor are welcome. I will share the responses (without mentioning names) in my next article.

As always, I would love to receive your feedback and thoughts, especially about the Christmas décor! marion@ boulevardnorth.com.au

By Sam Steel, Co-Founder, Resly

As we end Mental Health Awareness Month here in NSW, it's the perfect time to reflect on the importance of community within our industry.

In the often solitary world of management rights and short-term rentals, where the responsibilities can be overwhelming, the need for a strong sense of community has never been greater. Too often, managers find themselves isolated, bearing the weight of endless tasks and decisions without the support they need. This isolation can take a toll not only on their professional lives but on their mental health as well. Tragically, we have seen too many instances where managers have been pushed to the brink, with some taking their own lives. It's a heartbreaking reality, but it doesn't have to be this way.

The power of community in our industry cannot be understated. While we all deal with different properties, guests, and unique circumstances, at the core we are all experiencing the same pressures and challenges. Whether navigating complex trust accounting, handling guest disputes, managing owners, or

staying on top of ever-changing regulations, we know firsthand the immense responsibility that comes with the job. Yet, despite these shared experiences, too many face them alone.

By fostering a strong, engaged community within the industry, we create a much-needed space for managers to connect, share insights, and, most importantly, support one another. It's about coming together to provide the advice, reassurance, and camaraderie that can make all the difference on those tough days.

During Mental Health Awareness Month, we've heard stories of managers feeling overwhelmed, stressed, and isolated, and these feelings are often compounded by the high expectations placed on them. It's time we acknowledge the mental health struggles within our ranks and actively work to provide better support. By creating and engaging in a community, we offer more than just professional advice; we offer a lifeline.

Sharing your experiences with someone who understands exactly what you're going through can provide immense relief. It validates your feelings and reminds you that you're not alone in this struggle. Whether it's through industry events, online forums, or local meetups, these interactions can significantly reduce feelings of isolation and help managers develop coping strategies before stress becomes too overwhelming.

Engaging with industry peers allows us to learn from each

other's experiences, but more importantly, it builds a safety net for when times get tough. These connections are crucial, offering a sense of belonging and mutual understanding. It's about having someone to call when you need advice or support from people who genuinely understand the pressures you're facing.

Creating this community also helps destigmatise the conversation around mental health. The more we talk about it, the more we realise that many of us are struggling with the same issues. By rallying around one another, we can reduce the sense of isolation and begin to address mental health concerns openly and with empathy.

Beyond emotional support, engaging with industry peers is an incredible opportunity for learning and growth. We are constantly facing new challenges, whether it's technological advancements, changes in guest expectations, or evolving regulations. By working together, we can share insights and best practices that improve our operations and strengthen the entire industry.

Our industry is better when we all succeed. Collaborative problem-solving and shared experiences allow us to stay on top of the latest trends and developments, ensuring that we are not only surviving but thriving in an increasingly competitive market.

It's essential that we create regular opportunities for managers to connect. Conferences, workshops, and industry meetups provide great environments for face-to-face

interactions, but we must also look at building yearround support through online platforms and regional groups. The beauty of our community is that we are scattered across diverse regions, yet we can all come together through shared platforms to foster meaningful connections.

It's vital that we create inclusive and welcoming spaces for managers to connect, encouraging open dialogue about both professional and personal challenges. By making it easier for managers to reach out, we reduce the stigma surrounding asking for help and create an industry culture rooted in mutual support.

The reality is that we all experience the same challenges in this industry, whether we're running a small rental property or managing a large complex. So what better way to navigate these challenges than by leaning on those who know exactly what we're dealing with? Through community, we can break down the walls of isolation and make our industry a place where no one has to face the difficulties alone.

In the end, the strength of our industry comes from the strength of our community. By engaging with each other, sharing our struggles and successes, and offering support when it's needed most, we can build a more resilient, connected, and compassionate industry. Now more than ever, it's time to come together, rally around each other, and ensure that no one feels they must carry the weight of this job on their own.

Let's embrace the power of community – because we are stronger together.

By Chris de Closey, Director, Switch Hotel Solutions

Outsourcing some (or many) tasks at your property can save you money in the long run.

Now, I know what you're thinking – that I'm just here to drum up business for what we do – but that's not entirely correct. There is much more that can be outsourced than just what we offer. If you put your thinking cap on and dive deep into what can be outsourced, you'll find various ways to optimise your business. An optimised business should mean more profit, and let’s face it, as much as we love the industry, everyone is in it to make a buck.

There are various tasks and roles you can outsource, including:

1. Revenue management

Developing a revenue strategy is an ongoing process for your property. There are some

excellent software options available, but nothing you purchase is 100 percent “set and forget.” You need to constantly review and iterate the process to ensure the best results. Outsourcing this allows you to bring in an expert to develop and continually revisit strategies.

2.

The social media world is an ever-evolving beast, with new platforms emerging and demanding constant attention to achieve the best results. The rise of video content requires even more time investment than ever before. If you’re not skilled in this area, it’s a great idea to pass it on to a professional.

3.

Like revenue management, your sales and marketing strategies need regular updates. A key aspect of sales is having the contacts to leverage for new distribution, but often you don’t know these contacts until you’re introduced. Outsourcing can accelerate this process and help foster growth with suppliers.

4. Housekeeping

Managing an internal housekeeping team can be daunting and costly if you’re not tracking or benchmarking expenses. Many in the industry favour in-house housekeeping, but if it’s hurting your profitability, it may be time to reassess. While keeping it in-house can be more profitable if managed correctly, outsourcing your housekeeping team can

standardise costs per clean, providing a clear understanding of your profit margins. Though some may argue it sacrifices cleanliness standards, the right contractor and formal internal procedures can mitigate this.

5. Reception/reservations duties

Many caretaking and letting agreements are starting to eliminate the requirement for office hours. This is not always the case for motels and hotels, but if it applies to you, consider outsourcing your reception and reservations duties, leaving just a small portion of the tasks to be handled onsite by yourself. While some view outsourcing as potentially compromising control over the customer journey, as with housekeeping, choosing the right professional team is essential. You could opt for a local company or take it offshore.

6. Caretaking duties

This one’s a no-brainer. In a management rights space, outsourcing caretaking duties allows you to focus on other areas of your business. Think pools, gardens, cleaning, and more. Conduct a cost analysis comparing the time it takes you to complete these tasks versus hiring a professional contractor to determine if outsourcing is the more profitable choice.

Here are some key reasons properties choose to outsource:

1. Time

One of the biggest factors in

deciding to outsource. You wear many hats during your daily work life, and you may not have time to focus on revenue, sales, marketing, social media, or managing internal teams.

2. Professional and skilled teams

Assigning tasks to a team who lives and breathes these duties daily means you should achieve superior results compared to doing it yourself. If you outsource reservations or reception, for example, you could choose an agency with dedicated and well-trained teams. Even offshore teams are trained to high standards.

3. Cost savings

Hiring a full-time revenue manager or marketing team can be expensive. You might not need someone full-time, or you may simply be unable to afford it. Outsourcing provides a fixed cost for your business, giving you expert-level support at a fraction of the cost of hiring internally.

When considering outsourcing, research which agency will be the best fit for you. You may need to invest in upgraded technology to ensure seamless integration with outsourced agencies. Make sure to ask about their exact requirements when working with them. I recommend looking for agencies without fixed contracts, allowing you to trial their services without long-term commitment. Find what fits your business needs and allows you to focus on what you do best.

By Roland Franz, General Manager, Body Corporate Headquarters Strata Consulting Services (Qld)

Body corporate meetings are essential for the smooth operation of strata properties, and crucial for transparency of decisions and maintaining harmony and efficiency within the strata community.

This article explores the types of meetings, their timing, who calls and runs them, how decisions are made, and how to ensure they are efficient and conflictfree. Additionally, it emphasises the importance of prior planning, obtaining quotes in advance, and effective communication.

Annual General Meeting (AGM): Held once a year, the AGM approves the prior financial year accounts, approves proposed budgets and planned expenditure, acknowledges insurance policies, considers

motions submitted by the committee and owners, and elects the committee that will manage the affairs of the body corporate until the next AGM.

Committee Meetings: These occur more frequently, often quarterly, and focus on ongoing management issues and the day to day running of the body corporate. At these meetings, actions of the body corporate are determined, and requests of owners are considered.

Extraordinary General Meetings (EGM): Called as needed to address urgent matters that cannot wait until the next AGM.

AGM and EGM: Typically called by the committee providing instructions to the body corporate manager. However, if there is no committee, and the body corporate manager is engaged under a Chapter 3, Part 5 – Administrator appointment, the body corporate manager, will call the meeting.

Committee Meetings: Usually called by the committee under instructions provided to the body corporate manager by the chairperson or secretary.

The body corporate manager is prohibited under the BCCM Act from chairing the meetings unless there is no chairperson at the meeting and eligible voters at the meeting appoint the body corporate manager to run the meeting.

The role of the body corporate manager is to assist the chairperson and provide advice regarding procedural correctness and compliance with the BCCM Act. The body corporate manager also assists the meeting to run smoothly and efficiently by keeping the attendance record, advising on eligibility to vote, and preparing the draft minutes for approval of the secretary. They act as advisors, facilitators and on occasions mediators, guiding the discussion and ensuring that reasonable decisions are made in the best interests of all owners and in compliance with legislation.

AGM and EGM: At all general meetings, only the motions appearing on the meeting agenda and voting paper can be determined (resolved / decided) at the meeting. These are determined by the vote cast by members of the body corporate (owners, representatives, or nominees) that are financial and eligible to vote on the motions.

Members may vote, in person at the meeting, by paper or electronic vote prior to the meeting or by proxy to another owner – however certain motions are determined without proxy votes being counted.

Each motion will state the type of resolution required being either an ordinary resolution, special resolution, majority resolution or resolution without dissent.

Although owners may want to bring up matters for consideration at the meeting, these discussions may only be held at the end of the meeting if the chairperson allows for general business or general discussion at the meeting. However, this simply serves to provide owners with an opportunity to table matters for future consideration of the committee as only the motions on the general meeting agenda can be determined at that meeting.

Committee meetings: Decisions are made collaboratively with the elected committee in attendance, the building manager, and the body corporate manager, and determined by majority vote. However, the building manager and the body corporate manager are non-voting members of the committee and only the elected committee members can vote to determine the outcome of any motion in consideration at the meeting.

Owners are encouraged to submit applications, requests, and motions for consideration of the committee at the next committee meeting.

Voting Outside of Committee meetings (VOCM): VOCM or VOC / flying minute as it is commonly referred, provides the committee with the ability to make decisions without calling a formal committee meeting. VOCMs are typically used to determine urgent matters or matters that cannot wait for the next committee

meeting, for example, approving insurance renewals, pet applications, minor owners’ improvement, or other requests.

For matters requiring discussion amongst the committee members, the committee may meet quickly via video-link and/or in person to discuss the matter before a VOCM is circulated to determine the committee’s decision. Often urgent matters are discussed via email unless the matter is complex and, in these cases, an informal meeting or site inspection may be necessary to occur followed by a VOCM to ratify the decisions reached by the committee.

1. Prior planning: Agendas should be sent out well in advance. general meetings typically require a minimum of 21 days clear notice and committee meetings, at least seven days of notice to all owners in the strata community. This gives everyone time to vote at General Meetings or prepare for committee meetings.

2. Stick to the agenda: Avoid going off on tangents. If someone starts discussing unrelated topics, gently steer them back to the agenda.

3. Time management: Allocate specific times for each agenda item and adhere to them. This keeps the meeting focused and prevents it from dragging on unnecessarily.

Stay calm: Maintaining composure is essential when tempers flare. A calm demeanour can defuse many situations.

Be understanding: Often disputes escalate and become emotionally charged because the person conveying the message feels they are not being considered or their position heard.

Engage your body corporate manager: The body corporate manager is the one person in the room that is emotionally detached from the outcome. Their primary focus is providing advice and guidance in the best interests of all owners. At times of conflict or disputes,

this guidance is invaluable and can often defuse an otherwise emotionally charged discussion.

Mediation: If disputes cannot be resolved during the meeting, mediation should be suggested as a next step.

Declare conflicts of interest:

The BCCM Act requires that all conflicts of interest be disclosed. Anyone with a personal or corporate interest or relationship in a matter should declare it and abstain from voting on that issue.

A well-prepared building manager’s report is crucial for a productive meeting. It provides a clear overview of maintenance undertaken and pending issues to be addressed. It is beneficial if the building manager includes recommendations and quotes where applicable.

A written building manager's report helps everyone stay informed and makes maintenance and facilities management and decisionmaking easier, and the meeting to run more efficiently and be more outcome driven.

This is the backbone of any successful meeting. Here are some tips to promote successful meetings.

Active listening: Paying attention to what others are saying without interrupting shows respect and can assist your understanding.

Clarifying questions: If something is not clear, asking questions prevents misunderstandings and promotes informed decision making.

Summarise key points: Periodically summarising the discussion ensures everyone is of the same understanding.

Stay on topic: Gently redirecting the conversation if it starts to veer off course keeps the meeting focused and efficient.

Provide informative minutes: Providing succinct yet informative minutes clarifies the matters considered and formalises the outcomes reached at the meeting.

HINT: Minutes that include some preamble to the outcomes reached assists owners not in attendance to be better informed.

Owners have the right to submit motions for consideration at general meetings. These motions must be submitted in writing to the body corporate secretary or body corporate manager. For AGMs, owners can submit motions at any time before the end of the body corporate’s financial year. For EGMs, motions can be submitted at any time, provided there is enough time to include them in the meeting agenda.

Whether it is a general meeting (AGM or EGM) or committee meeting, it is advisable to notify

the body corporate manager in advance if you plan to raise a matter at the meeting so that the chairperson and committee can consider your request and, if appropriate, they may be able to answer your question prior to the meeting or address the matter raised at the meeting for the benefit of all in attendance.

Note: It is a matter for the chairperson if general discussion occurs at a meeting, however any matter raised in advance for a committee meeting ought to be listed on the agenda for consideration by the committee.

There is no point holding meetings for meetings sake! Or is there?

Other than the AGM, there is no legislated requirement determining the number of committee meetings that may occur each year.

Although the primary purpose of meetings is to determine outcomes, do not underestimate the value and benefit from the occasional social gathering of the community to enhance the strata living experience.

It is crucial to remember that living in a strata community is about fostering a positive living environment for everyone. The focus should always be on the collective benefit rather than personal agendas. This approach promotes harmony and cooperation, essential elements for productive meetings and a positive strata experience for all.

By Kelley Rigby, Managing Director, Lett s Group

Communicating with your clients is essential for building and nurturing relationships.

It’s amusing to observe today’s youth — yes, at 37, the “kids of today” label applies to them. When asked to pick up a pen and write a letter, their confusion suggests they’ve

been transported to another time. Phone calls? According to my teenage stepdaughters, that’s “so old school.” This brings us to the title of this piece: let's revive traditional communication methods. They were effective before, and they continue to be relevant today.

Consider your local coffee shop, restaurant, or any other establishment where you are a regular patron. Imagine walking in one day and receiving a handwritten card from the

owner that reads, “Thank you for your loyalty and for being our customer.” How would that make you feel? For me, it would take some really terrible coffee to even consider going elsewhere. The impact of such a small gesture is profound –it’s something to share with friends, family, colleagues, and anyone willing to listen. While the business of management rights operates on a much larger scale than a café, the essence remains the same: it’s about how clients feel at the end of the day. Sometimes this can even be above monetary values. Phone calls offer another excellent way to connect. Why not dedicate an afternoon to check in with investors? It’s an opportunity to enquire about their mental well-being and their financial stability without being intrusive, and to just have a general chit-chat. Times are tough right now, with interest rates and the cost of living, some investors might be feeling the pinch (yes, I know they are getting great rent), but unless you give them a call and open the door to conversations you never know where they are sitting.

Quick Story: I have a client who is currently working with us to stabilise their business and get back in the driver’s seat. Essentially, we’re helping them regain control and become the go-to person in their community. One of the key steps was to reach out to their owner-occupiers, and under our guidance, they made some impactful phone calls. One call stood out – one owner opened up about needing to sell due to financial stress and mentioned moving back in with his parents. After a few conversations and a referral to a finance guy, the managers were able to work with him to keep the unit as an investment. Not only did he hand over the management to them, but also referred them to a friend in the complex who was looking to build their portfolio. All of this came from what my client initially thought would be a waste of time!

A small act of gratitude –thanking them for choosing you to manage their investment – coupled with a call to see how they are doing, can elevate both your business and personal relationships with clients to new heights.

Let’s embrace the old-school approach and take the time needed to cultivate strong, healthy relationships in business. Not only is this beneficial for business, but it also nourishes the soul.

By Stephen West, Business Development Manager, Interline Travel

Embarking on a cruise to the polar regions offers travellers a unique opportunity to experience some of the most breathtaking and remote landscapes on Earth. The Arctic and Antarctica, each with their own distinct charm and challenges, provide adventurers with unparalleled wildlife encounters, stunning ice formations, and the chance to witness the effects of climate change firsthand.

The Arctic encompasses parts of several countries, including Canada, Greenland, Norway, Russia, and the United States. Known for its vast ice sheets, glacial landscapes, and unique wildlife such as polar bears, walruses, and migratory birds, the Arctic is a region of extreme beauty and harsh conditions.

Antarctica is the southernmost continent, entirely covered by ice. It is renowned for its dramatic icebergs, rich biodiversity, and the unique opportunity to see species like emperor penguins and seals. When planning a polar cruise, selecting the right cruise line

is crucial. You will be offered the opportunity to see the region, sailing past and possibly departing Buenos Aires/ Santiago for Antarctica –Celebrity Cruise Lines offers a wide range of these cruises. But for those who want to touch the ground or ice, there are a variety of soft to medium expedition cruises with a ship ranked from comfortable to luxury, and with your industry discount, the price is considerably below that of retail.

Quark Expeditions: Specialises in polar adventures, focusing on small-group excursions.

Silversea Cruises: Offers ultraluxury cruises with exceptional service and exclusive excursions.

Itinerary highlights of the Arctic include Svalbard with breathtaking views of glaciers and the chance to see polar bears in their natural habitat.

Greenland, known for its dramatic fjords and Inuit culture, this destination combines adventure with a rich history (I am just back from there and cannot speak highly enough of this region).

The Antarctic itineraries are broken into a Peninsula Cruise – this is the most popular route,

offering close encounters with wildlife and stunning landscapes.

You can choose to depart from Chile and the fares often include the return charter flight to the southern tip of Chile before boarding your ship in Puerto Williams or Ushuaia.

If the Drakes Passage is not on your list, you can fly and within two hours be on the Antarctic Peninsula to pick up your ship and immediately dive into expedition life.

South Georgia and the Falklands: Rich in biodiversity, these islands offer unique landscapes and wildlife encounters.

The cruise lines provide thermal jackets, usually yours to keep, and will either provide or suggest the correct rubber boot to take — it is all about layering your clothes.

Bring a quality camera with zoom capabilities to capture wildlife from a distance and binoculars, essential for spotting wildlife and appreciating the vast landscapes.

Travel Insurance is mandatory, due to the remote nature of these regions.

Budget: With Antarctica a luxury cruise will be around $7000 to $10,000 per person including any charter flight within Chile, your expeditions, and often a pre- and post-night stay in Buenos Aires.

Prices do vary greatly, so get quotes.

With the Arctic – you will depart from Scotland or Scandinavia – Iceland, Greenland or possibly Canada if you are crossing the top.

Rates vary but are much less than in Antarctica due to the locality of the region, but the adventure is no less dramatic.

Do your research, ask us the questions and be prepared to tick this off the big list!

In a conversation with Mandy Clarke for Resort News, Mike Phipps, founder of Mike Phipps Finance (MPF), shares the journey from starting his business in a back bedroom to becoming a nationally recognised finance broker. Celebrating 15 years of success, Mike discusses lessons learned, the importance of personal service, and what’s next for his growing team.

By Mandy Clarke, Editor

So Mike, 15 years. Who would have thought?

Very true. When I left the bank and set up Mike Phipps Finance (MPF) in our back bedroom, the grand plan was to pay the mortgage and hopefully not go broke. It’s worked out okay then. The master plan has come together?

To be honest, there was no master plan, and if there was, I certainly didn’t envisage where we are today. If you’d told me back then that I’d need to buy office space and hire staff, I’d have had a heart att ack. I guess sometimes it’s better to evolve organically than have some rigid idea of what a business might look like. How did things come together, Mike? It seems to have been an evolutionary process. Exactly. From the get-go, we have been very fortunate to have had great support across the management rights and motel industries.

The sales agents and other industry professionals have been wonderful to us, and we certainly feel a responsibility to provide the best possible service to their buyers. It’s the service ethic that has informed how we operate and allowed us to avoid the temptation to run a profi t-focused business at the expense of service. It’s kind of a “build it, and they will come” approach, and it’s worked well.

In a digital age, what’s your take on how service should be perceived?

I’m not ashamed to say that we are mostly analogue in a digital age. That doesn’t mean we don’t run the latest technology; it simply means that we place personal service above all else. We don’t off shore any of our processes, and we have our business staff ed to ensure multiple people manage every file.

We’ve acquired additional office space to avoid the need to use open office workstations, and we pride ourselves on a happy and constructive work environment.

You mention great work environment. Tell me about your team

The business now has eight staff, including me. Paul Grant and Cameron Wicking are the Senior Brokers, and they take ultimate responsibility for every file.

Josh Haylen is also a Finance Broker who has partnered with Paul to work alongside him on all of his transactions.

Simone Kennedy and Tayla Phipps are Senior Client

Managers, and Tom Keable is a Client Manager.

Christine de Ville is an Assistant Client Manager and also manages most of our broader operational and marketing needs in conjunction with Tayla. On any one file, three of these staff will be across the detail and actively involved.

It’s not a cheap model, but it ensures a level of professionalism and reliability that can be lacking in a more traditional finance broker business.

Quite the team! Any lessons learned as it has grown?

Yes, many lessons for sure. The most important was learned by accident. We thought as we grew, we needed to hire experienced bankers. It turned out that we were much better off engaging with people who had a strong desire to work in finance and had great att itudes. Put simply, better to build your own than try to hire in a skill set that might not fi t your culture. No disrespect to the bankers

out there, of course. It’s just a very diff erent gig acting as an intermediary and requires a prett y unique mindset.

I know your main offices are on the Sunshine Coast. What does your client base look like?

We are proud to have clients in all states and territories.

This is one area where modern digital tech and conferencing has certainly helped us build the business. But nothing beats personal contact, and our senior team travels far and wide to

ensure the human face of the business is top of mind for our clients and business partners.

MPF is recognised as a management rights and motel specialist. Is that all you guys do?

To be honest, the plan was to do nothing but management rights. As luck would have it, the sales agents who sell both MLRs and motels started asking us to do motels and caravan parks, and this seemed like a great fi t for the business. We

owe those agents a huge debt of gratitude for introducing us to opportunities that have helped us grow into the preeminent finance broker nationally in our chosen field. The other happy accident was home and property loans.