Our intuitive software uses advanced technology for simplified trust accounting. Backed by our dedicated support team.

The ultimate solution for streamlined management rights and holiday letting.

Our intuitive software uses advanced technology for simplified trust accounting. Backed by our dedicated support team.

The ultimate solution for streamlined management rights and holiday letting.

The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, it’s employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its’ agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties.

2024 Multimedia Pty Ltd. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent

Welcome to the September edition of Resort News!

With the weather heating up and the colourful, creative buzz from Brisbane’s incredible Riverfire event still lingering in the air, spring is definitely making its presence felt. It’s that time of year when everything seems to come alive, and our industry is no exception. Just like Riverfire, the changes in Queensland’s management rights sector are sparking plenty of excitement and new possibilities.

This month’s edition is especially close to my heart as we dive into the shifts happening on the Sunshine Coast—a place I was fortunate to call home for 16 years. I still remember arriving in Noosa for a holiday when I was 13; it was just a sleepy, quirky little beach town, and wow, hasn’t it grown up. But even with all the

Mandy Clarke, Editor editor@accomnews.com.au

development, it’s still managed to hold on to that special charm. Whether it’s the stunning beaches of Noosa, the laid-back vibe of the seaside towns along the coast, or the peaceful beauty of the hinterland mountains, the Sunshine Coast has always had

a special place in my heart.

Now, seeing the management rights industry there evolve is fascinating. Rising real estate prices and changing business models are stirring things up. Grantlee Kieza has captured this transformation perfectly, bringing us insights from key players in sales, finance, and valuation to explore what’s next for the region.

Also in this edition, we are spotlighting StayCo, a rising star on the Gold Coast that’s making waves in the management rights space. Despite launching during the challenging times of the pandemic, they’ve quickly expanded to manage some of the region’s top resorts. Melissa Pearson, their general manager, is at the helm, driving innovation with a fresh and dynamic approach.

And let’s not forget the winners of last month’s ARAMA TOP Awards!

We had the pleasure of catching up with a few of them, and their stories are sure to inspire.

On another note, the Paralympics has officially begun in Paris, and it’s a timely reminder of the incredible resilience and determination that define these athletes. The event not only showcases their extraordinary capabilities but also highlights the importance of inclusivity and accessibility – values that should resonate strongly within our own industry. As we watch the world’s best compete on such a grand stage, it’s a great opportunity to reflect on how we can continue to improve accessibility and inclusivity within our resorts and accommodations.

As always, a huge thank you to all our readers. Your support means the world to us and keeps us going.

Warm regards, Mandy

Australia’s foremost management rights sales agency, with 15 years of expertise and a dynamic team of over 15 agents strategically positioned along the vibrant expanse of the east coast, we bring unparalleled expertise and dedication to every client interaction. mrsales.com.au | 1300 928 556

National coverage and expertise in the sale of motels, hotels, caravan parks, pubs & MHEs tourismbrokers.com.au | 1300 512 566 Working together, working for you

By Trevor Rawnsley, CEO, ARAMA

The Management and Letting Rights (MLR) industry is blessed with extraordinary managers who save their schemes significant money and increase profits for their owners. At the same time, they work hard to make the schemes better places for all residents.

The value of our industry’s leading managers was never more evident than at the 2024 TOP Awards at Sea World on the Gold Coast on July 23. On a stunning gala evening, ARAMA honoured the most outstanding achievers in the MLR field from a huge array of stellar entrants.

The best of the best in our business showed how effective and diligent management can benefit both their schemes and the entire MLR industry.

Hamish and Jess Watts from the Glen Eden Beach Resort at Peregian Beach won a new award for Resort Management Team of the Year. They received a glowing endorsement from their strata treasurer and body corporate manager, having saved their complex more than $600,000 in a driveway project. Hamish and Jess had not long returned home after 22 years living abroad, where, among other things, Hamish was a general manager with Hilton.

They came back to Australia in December 2022 and, in July 2023, landed at Glen Eden, the place where Hamish’s parents took him for holidays when he was a child.

Almost as soon as the couple arrived at Glen Eden, the body corporate treasurer mentioned a renovation project for the crumbling driveway. The resort is 40 years old, and the concrete pavers that had been there since day one were uneven, lifted in some parts by tree roots and sunken in others by shifting sand.

The previous management had suggested pulling up the pavers and resealing the driveway with either concrete or bitumen.

The renovation plan involved asking each of the 40 owners to contribute an additional $20,000 as a special levy to fund it. That was going to be a huge ask because Glen Eden has many older owners and owneroccupiers on pensions who simply did not have the funds. Hamish was sure he could find a cheaper solution, and like a dog with a bone, he wouldn’t let go.

Through sheer tenacity, Hamish found a tradesman already contracted to Noosa Shire Council to maintain the pavement in Hastings Street. The contractor was pretty much tied up with his regular council work, but Hamish called him religiously every couple of days for about a month until he finally cracked. Just to get Hamish off his back, the contractor came out to Glen Eden and showed how he could level the driveway for a very reasonable price. Then Hamish found another contractor who could resurface all the pavers after rain damage had made them very coarse underfoot. He made them smooth enough to walk on with bare feet for people coming up from the beach.

The initial budget for the driveway renovation was $750,000. Through Hamish’s persistence, all the work was carried out for $120,000.

For similar doggedness in bringing improvements to their scheme, Stuart and Nicole Morris from the Azure Sea Resort in Airlie Beach won the TOP Award for Resident Manager of the Year (Short Term Stay).

The property is their first venture into management rights, and when Stuart and Nicole arrived at Azure Sea in December 2022, they had to hit the ground running, having taken over a resort that was quite rundown. A lot of the gardens had no plants, and they had two pools that were falling apart, with little glass tiles constantly coming off.

Stuart and Nicole had never owned a pool in their lives, let alone done major repairs, but $189,000 was raised for the work. They had to rely on the weather, organising contractors to work between two school holiday periods to minimise the effect on guests. The contractors were given the timeline of August 1, to September 15, 2023.

In Airlie Beach, tradespeople are very hard to find, but Stuart and Nicole organised two contractors who managed to replace all the tiles within six weeks. On September 15, 2023, the pool was ready for holiday guests.

The couple also negotiated a good price of $5000 to have black mould removed from large parts of the complex that had fallen into neglect. To save the scheme even more money, Nicole and Stuart successfully re-propagated all the gardens, creating new plants from cuttings so that the body corporate was not hit with further expenses.

Azure Sea comprises a 30-apartment holiday complex and another area designated for townhouses, and Nicole and Stuart had to do the renovation work while negotiating with three separate bodies corporates. On top of that, they maintained a very successful marketing campaign, which assisted in increasing returns for their investors substantially, and they started a newsletter to keep all their owners – in Australia and overseas – up to date.

Since Nicole and Stuart took over the complex, their letting pool has increased by 25 percent, and in recent months their holiday sales are up by more than 20 percent. Their TOP

Award serves as an example for managers everywhere to provide excellent service for their schemes and assist in every way possible to improve life for owners and residents.

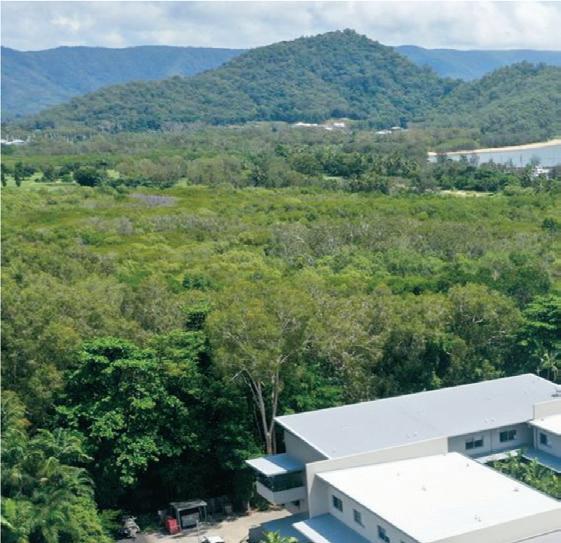

Paul Parrant, the general manager of the Oaks Port Douglas, who won the TOP Award for Resident Manager of the Year (Mixed Stay), demonstrated great tenacity and perseverance in applying for and fully utilising government grants and local council assistance in the wake of Severe Tropical Cyclone Jasper, the wettest tropical cyclone in Australian history.

Last December, Jasper devastated Far North Queensland with high winds and floods, but Paul was a light out of the darkness for his scheme.

In a similar vein, Gary Baskin and his colleagues at the Oaks Sydney Goldsborough Suites, who won the TOP Award for Building Management Team of the Year, were relentless in improving their complex by enhancing its efficiency and sustainability with reductions in energy consumption and operational costs.

Among their improvements were upgrading all lighting to LED, introducing variable speed drives to all pumps and air conditioning plants, and installing rooftop solar panels. Gary and his Oaks team go above and beyond at the complex and have turned their Goldsborough building into a leader in sustainability for the benefit of all lot owners.

Maree and Ian Smith from the Hidden Vista group, just north of Brisbane, are recordbreaking TOP Award winners. They won the TOP Awards this year for both Resident Manager of the Year (Long Stay) and Building Managers of the Year, becoming the first three-time

TOP Award winners, and then the first four-time winners.

The couple manage 230 townhouses across four complexes as well as five other properties. In the four years since they bought into their first MLR business, they have shown the way for the whole industry to deal positively with tenants, owners, and bodies corporate.

Maree says she and Ian have done their best to make everyone at their properties feel a sense of inclusion, using simple techniques such as a Facebook page covering residents at all four complexes they manage. Owners and

residents are encouraged to post “buy, swap, and sell” messages as well as community alerts for incidents like the power going out or if anything, or anyone, strange is around their townhouse. Ian and Maree encourage all the residents to look out for each other.

They have created a wonderful culture and sense of community among owners and tenants in their complexes and have received outstanding testimonials from unit owners, body corporate managers, and tenants – the triangle of management. They truly are TOP performers.

By Ben Ashworth, Senior Associate, Small Myers Hughes Lawyers

The Strata Schemes Management Act in NSW was updated on April 10, 2020, and included a new provision allowing owners corporations to create a by-law that could prohibit short term accommodation in strata schemes.

For many managers operating short term lettings, this

appeared to be another “sky is falling” moment on top of all the other anti-Airbnb legislation that has been creating problems for management rights operators in NSW.

By passing a special resolution in accordance with Section 137A of the Act, an owners corporation can prohibit the use of a lot in accordance with a “short term rental accommodation arrangement.” At first, a plain English reading of Section 137A might lead you (and a committee of owners) to believe that this means passing a special resolution that allows the owners corporation to prevent all kinds of short term accommodation. However, this is not the case.

Section 137A specifically uses the phrase “short term rental accommodation arrangement” when describing the type of short term accommodation that can be prohibited under the by-laws. This phrase is not just a general description but has a specific meaning defined in the Fair Trading Act. It does

not simply refer to any and all arrangements that might be made with a guest to stay short term in a lot. Furthermore, what is or isn’t a “short term rental accommodation arrangement” is subject to exceptions found in Section 11C of the Fair Trading Regulations.

So, after wading through three different pieces of legislation, you can discover that Section 137A gives the owners corporation the right to create a by-law that prohibits short term accommodation, provided the lot being used for short term accommodation is not “tourist and visitor accommodation.”

What is significant about the phrase “tourist and visitor accommodation”? This term is defined in the Standard Instrument (Local Environmental Plans) Order and is used to describe the types of buildings that have council development approval for short term use (among other things). This includes buildings approved for use as

hotel or motel accommodation or serviced apartments.

What this means is that if a lot in a strata scheme has development approval to be used as a form of tourist or visitor accommodation, the arrangements an owner enters into with guests to use that lot on a short term basis do not fall into the definition of a “short term rental accommodation arrangement” and therefore are not captured by by-laws made under Section 137A of the Act

If you operate short term lettings in NSW and your building is approved for short term letting in the Council development approval, rest assured that the owners corporation cannot simply pass a special resolution to prohibit shortterm letting in your building. Liability limited by a scheme approved under Professional Standards Legislation.

Disclaimer – This article is provided for information purposes only and should not be regarded as legal advice.

The night-time doesn’t just bring quieter streets and dimmed lights; it also brings a unique set of opportunities and challenges that can test the limits of any property’s commitment to guest satisfaction.

For many accommodation providers, from cosy bed and breakfasts to sprawling five-star resorts, ensuring consistent, high-quality guest support afterhours can be a daunting task. The question is simple – How can any accommodation provider maintain the same level of service during offpeak hours as they do during the day? Guests may arrive late, encounter issues, or need assistance after standard

business hours. The quality of support they receive during these off-peak hours can significantly impact their overall experience and, ultimately, their loyalty to your brand.

The answer is the inclusion of a professional after-hours service, which can elevate a property’s reputation. Guests appreciate the assurance that no matter when they need assistance, a friendly and knowledgeable professional is just a phone call away. This level of service is now

a standard guests expect as part of their basic amenities.

True value, however, lies in a partner who can replicate the attentive, knowledgeable and personalised service your guests expect during the day. A generic answering service might manage basic enquiries, but often falls short when it comes to delivering the nuanced and comprehensive support that fosters guest satisfaction, mirroring your daytime standards.

A high-quality after-hours service like OPUS’s After-Hours Concierge not only enhances guest experiences but also significantly reduces the need for night-time interventions by the building management and their team. By effectively handling guest inquiries and issues, OPUS minimises disturbances to your staff, ensuring that you and your team can truly disconnect after hours, trusting that guest needs are expertly managed. We tailor our solutions to meet the unique needs of each property, ensuring that every guest feels valued, their concerns are promptly addressed, and their experiences are enriched, regardless of the time they call.

OPUS is not just another service provider; we’re your partners in redefining hospitality standards, ensuring that every night is as good as your day.

Keeping pets in community title schemes has never been easier following recent amendments to the Body Corporate and Community Management Act 1997 (the Act) and its regulation modules.

The changes have reduced the obstacles to keeping animals in community title schemes and increased the likelihood of securing body corporate approval. This article explains the reforms relating to keeping pets, which commenced on May 1, 2024, and offers tips to assist bodies corporate in managing these changes.

A request to keep an animal is automatically deemed approved if:

• The committee can decide the request; and

• the committee does not decide the request within 21 days after it was made – called the “prescribed period,” or the “relevant period” for a vote outside a committee meeting (VOCM).

It’s important to note that deemed approvals and “21 days to make a decision” only apply to requests to keep an animal. A body corporate should bear in mind that it can ask for any further documents or details about an animal after a request is made. This does not extend the period to decide the request. The timeframe before a request is deemed to be approved starts directly after it is submitted.

Alternatively, if the body

corporate has previously voted at a general meeting to make approving animals an issue reserved for decision by ordinary resolution, it becomes a restricted issue for the committee. Where an animal request must be decided at a general meeting, it is automatically deemed approved if either:

1. A general meeting is not called within 21 days after the request is made (the “relevant period”); or

2. a general meeting is called within the relevant period, but a decision is not made within six weeks after the general meeting notice is circulated to owners (the “prescribed period”).

In view of the time and expense usually involved in organising a general meeting, we recommend taking steps to enable the committee to decide animal requests unless they do so already. This may require the body corporate to:

• Change the wording of a bylaw if it specifies that a “general meeting” is needed; or

• revoke a prior general meeting decision to make animal requests an issue

reserved for decision by ordinary resolution.

Any decisions deemed to be approved must be ratified at the next committee meeting (if it is not a restricted issue) or general meeting.

Whether the decision to keep an animal is voted on by the body corporate or it is deemed approved, the regulation modules now require written notice of the body corporate’s decision. This must be provided to the person who submitted the request as soon as practicable after the approval. Our office has created a form for Notice of Body Corporate Response to Request to Keep or Bring an Animal on Scheme Land (BCCM Form 32) to ensure this requirement is met. To clarify, this requirement is in addition to the body corporate’s normal obligation to send meeting minutes (or a record of motions for a VOCM) to all owners within 21 days after the meeting or decision.

We strongly encourage the body corporate to keep the lines of communication open when someone submits an animal

request. This may include acknowledging receipt of the request and explaining how the body corporate intends to handle it. It might be beneficial to provide a copy of our animal request flowchart to the person making the request. Appropriate communication is especially important in the case of requests from occupiers who are not typically kept abreast of body corporate decisions. For instance, if approving animals is a restricted issue for the committee and the request must be decided at a general meeting, the legislation only requires notice of the meeting to be given to owners. If an occupier’s request is on the general meeting agenda, they may not know if the body corporate does not notify them. Failure to communicate appropriately in the above situation could lead to an occupier mistakenly assuming that the request has been deemed approved by the committee and bringing an unauthorised animal into the scheme.

Before the recent amendments, bodies corporate could generally impose reasonable conditions when approving an animal. The

new section 169B of the Act clarifies this by specifying that a body corporate can grant the approval subject to conditions that are, in the circumstances, reasonable and appropriate. Conditions are an integral means of managing the impact animals may have on other residents in the scheme. If conditions of approval are not complied with, the body corporate can ask for the animal to be removed.

A body corporate should be mindful that if an animal request is automatically deemed approved because it was not decided within the required timeframe, there may not be an opportunity to impose conditions. A possible safeguard against deemed approvals slipping through condition-free may be to update the bylaws to include standard conditions regulating the keeping of animals. As the case example below demonstrates, what is considered a “reasonable and appropriate” condition may vary considerably depending on factors such as the animal, its owner’s physical capacity, or the scheme’s configuration.

In the above order, a portion of the scheme’s bylaw required all animals to be carried or otherwise transported to avoid contact with common property. This meant that an animal could not be walked on a lead over common property under any circumstances. The adjudicator noted that the bylaw did not give the body corporate “any discretion to consider whether such a condition is necessary or is overly onerous when the genuine risks of nuisance from the pet in question are weighed against other factors, such as actual physical limitations, inconvenience, or expense to the pet owner.” The adjudicator also remarked that if approval was given for an elderly owner to keep a small dog, such an approval would be “meaningless if the owner cannot physically carry the animal, or lift it in and out of a trolley, to transport it over the common property.”

The layout of the scheme was also considered. The adjudicator commented on the limited exit points suitable for trolley

access and observed that flatly prohibiting pets being walked on any part of the common property at any time was unreasonable, as “it does not take into account the physical parameters of the scheme, including limited ramps and basement carparking.” The committee contended that the condition was there to avoid animal waste fouling the common property. While the adjudicator acknowledged that it was a legitimate concern, it was observed that other avenues were already available to manage it (such as an existing condition in the bylaws dealing with animal waste). The adjudicator ultimately determined that the portion of the bylaw imposing a transport condition was unreasonable and therefore invalid.

Bylaws that do not allow any animals in the scheme or prohibit animals of a particular breed or weight are known as “prohibitive bylaws.” Before the recent amendments, adjudicators generally determined that prohibitive animal bylaws were unreasonable. These decisions were based on section 180 of the Act, which specifies that a bylaw must not be unreasonable. The new section 169B of the Act has confirmed this longstanding position – it now expressly states that a bylaw must not prohibit animals or restrict the number, type, or size of animals. Instead of being reactive and waiting for a dispute to arise, we encourage bodies corporate to take a proactive stance to change prohibitive animal bylaws.

A motion to change the bylaws must be agreed to by a special resolution at a general meeting.

Sections 94 and 100 of the Act require bodies corporate and their committees to make reasonable decisions. Based on these sections, adjudicators typically found that it was unreasonable for a body corporate to refuse an animal request (unless there were special circumstances). Section 169B of the Act has replaced the more general question of reasonableness with a clear list of reasons for validly refusing an animal. Specifically, the body corporate can only refuse a request for an animal where:

• Keeping the animal poses an unacceptable risk to the health and safety of other owners or occupiers because either: The owner of the animal is unwilling or unable to keep the animal according to reasonable conditions; or the risk cannot reasonably be managed by conditions.

• Keeping the animal is not permitted under other laws, such as a local council law that prohibits the type or number of animals to be kept.

• The animal is a regulated dog under the Animal Management (Cats and Dogs) Act 2008

• Keeping the animal would unreasonably interfere with:

Another owner or occupier’s use and enjoyment of the lot or common property, and the interference cannot reasonably be managed by conditions; or native fauna that live on, or visit, the scheme land, and the interference cannot reasonably be managed by conditions.

• The occupier does not agree to the reasonable conditions proposed by the body corporate.

These limited reasons for refusal, together with the new “deemed decisions” provisions in the regulation modules, place a positive obligation on bodies corporate to allow animals if requested. Consequently, if a body corporate is considering rejecting a request, it must ensure its reasons for refusal are within the parameters set by section 169B. Failure to observe these reasons is likely to result in unnecessary disputes. These reforms are welcome news for many residents in community title schemes, prospective purchasers, and renters with animals. While the changes to the Act have mostly confirmed and clarified what was already in practice, the changes to the regulation modules regarding deemed approvals will significantly impact body corporate decision-making in relation to animal requests.

If you would like further information about animals in community title schemes, you can access our detailed guide and our website page about animal bylaws.

By Sarah Davison, Industry Reporter

Popular Property Bridge triumphs: Co-Founders, Bobo Qi, Darren Brent and their team won Sales Brokerage of the Year at the 2024 ARAMA TOP Awards.

Bobo, originally from Harbin, China, and Darren, with a banking background across the Asia Pacific region, including China, have established themselves as highly respected brokers in Queensland’s management rights industry.

Having met in Auckland, New Zealand, a mutual desire for a career change then brought them to Queensland. Bobo’s early experiences in a businessoriented family honed her sales and customer service skills, while Darren brought management expertise to the partnership. Since founding Property Bridge, it is now widely recognised as one of the most trusted and dedicated specialist management rights broking firms in the industry. With prior hands-on experience as onsite managers, Bobo and Darren possess a unique ability to navigate the complexities of management rights and communicate effectively across cultures.

Being nominated three times before for an ARAMA TOP Award, they were completely unprepared this year when Property Bridge was announced as the winner.

“It blew our minds,” they told Resort News. “It was an absolute honour for our younger business, which we built from scratch, to be nominated alongside brokerages that have been around for generations. We were floored to win, and winning the People’s Choice Award made it even more special.

“We can honestly say it’s the highlight of our career so far.”

Despite economic challenges and concerns about the return on investment for smaller management rights businesses, 2024 has been a recordbreaking year for Property Bridge sales, Bobo revealed.

“Larger MLR businesses are selling well,” she said. “We have had significant transactions in Brisbane and the Gold Coast. Many of our buyers are returning clients – experienced managers who are expanding

their portfolios. Smaller MLRs are also selling if the price is right. We’ve just sold a complex in Surfers Paradise for the third time, as buyers become sellers and return to us.”

Darren emphasised the importance of trust in their business: “The trust factor is crucial to our success. We have a loyal customer base, which has a snowball effect.”

Although currently the market is slower than usual, Bobo

observed an uptick in enquiries in recent weeks. “Buyers are more confident, and sellers are more willing, with hopes that interest rates may come down.”

Both Bobo and Darren remain passionate about management rights and optimistic about the future of the business model, particularly in Queensland. Darren commented: “We have a good feeling about the future. The sector is evolving, and more opportunities are opening up as the industry finds ways to navigate challenges. Good operators will always succeed.”

Bobo agreed: “We’ve seen the management rights sector grow up, especially on the Gold Coast and Brisbane, and now a younger generation is entering the sector. They’re enthusiastic, eager to collaborate, learn and build on the business and we are here for it!”

Jessie Shi, from ResortBrokers was also recognised at the ARAMA TOP Awards. She took home the coveted trophy for Sales Broker of the Year and told Resort News that receiving the award was a “huge honour” and recognition for her nearly decade-long career in the sector, including five years as an operator before transitioning to the role of sales broker.

“To be recognised by ARAMA, our industry’s peak body, and by my peers in the industry who voted for me, was a huge honour,” she said. “It feels rewarding to know that my efforts have made a meaningful impact in the industry, and it motivates me to continue striving for excellence.

“I love being an MLR sales broker because it allows me to be a pivotal part of peoples’ journeys as they navigate significant life and business decisions. The role is incredibly dynamic, blending the analytical aspects of evaluating businesses with the personal touch of understanding my clients’ unique needs and aspirations.”

She credits her prior experience as an operator for her success, saying it has proven invaluable in her work in sales.

“It’s helped me to help my clients as I understand what it’s like to run a management rights business

and the process involved in buying and selling one.”

Reflecting on the evolving industry, Jessie noted the increasing sophistication of operators, a trend she attributes to ARAMA.

“Operators are more sophisticated compared to five years ago. ARAMA has led the way,” she said. “Its focus on support and education has given us an industry that is increasingly mature.”

As for advice for those considering a career in MLR, Jessie emphasised the importance of professionalism and interpersonal skills.

“Ultimately, this is a people’s business... having good interpersonal skills and being able to engage with people constructively is the foundation of success in this business,” she said.

Oaks Port Douglas General Manager Paul Parrant was surprised to be presented

with the Resident Manager of the Year, Mixed Stay, Award.

“It was overwhelming. I had no idea we were even in the running!” Paul told us.

“It’s a fantastic honour to receive such recognition in an industry I’ve been working in for over 34 years.”

For Paul, the award is not just a personal achievement. He said: “It’s great for my

team, number one! It’s also a significant achievement for the company and the region I work in. My team’s support, along with the company’s backing, was instrumental in earning this award. I couldn’t have achieved it without them.”

Paul’s career began in New Zealand, where he first dipped his toes in the hospitality industry as a teenager. After earning a diploma in hospitality, he embarked on a career that would take him around the world.

“I’ve worked in New Zealand, the UK, and Australia, in a variety of roles across three, four and five-star hotels, resorts, and island sectors. I have been in senior leadership roles for over 15 years, and I love doing what I do.”

Beyond his professional accomplishments, Paul has also been a driving force in building connections between the resort and the local Port Douglas community. One notable example of this outreach was the resort’s response in the aftermath of Tropical Cyclone Jasper.

“The resort had portaloos available; we also let people shower at the resort and ensured invitations were sent out to our locals that food was available when food couldn’t get delivered,” he said.

“We will always be here for our region – that’s how we overcome difficult times together.”

“I could not have hoped to have achieved such success on my own without him working tirelessly at my side throughout,” she said.

Reflecting on her time as an onsite manager, Shay said the relationships forged with owners and residents were a highlight.

Shay Harrison walked away with the title of Onsite Manager of the Year for her work at Terraces on the Park. Although Shay has since gone on to establish her own multi-faceted property business, All 4 Property, using her experience and connections gained through her time in MLR, she said taking home an ARAMA TOP Award was “the cherry on top of her nearly decade-long career in management rights”.

“It felt wonderful to be recognised,” she said. “You work so hard and are required to manage or resolve such an array of issues, all while dealing with diff ering personalities. To receive such acknowledgement and to know that your eff orts have not gone unnoticed is very gratifying.”

Shay’s journey in MLR spans nearly ten years, beginning in 2015. Her initial experience, working a few days a week with another MLR operator, proved invaluable. She also credits her partner, Chris, for his unwavering support.

“We have met many wonderful owners and residents at Terraces over the years. We were alongside the owners and residents during all the highs and lows, assisting with property issues and even racing to assist during emergencies and disaster events. The relationships we fostered enriched our time at the complex and provided many happy memories.”

However, her tenure was not without challenges. Emergency incidents such as fires and severe weather damage proved difficult, but she noted the importance of eff ective communication to problem-solving.

She said: “You need to be a ‘people person,’ and communication is key. Navigating difficult situations with clear and considerate communication builds trust, essential for business success.”

To be continued…Resort News will catch up with more TOP award winners next month!

Shay Harrison

By

Whether you’re buying or selling, investing in a management rights business requires a tailored approach. The strata industry is a complex maze of laws, regulations and personalities. Even experienced operators can stumble when it comes to buying and selling those businesses, leaving money on the table for a seller or over-paying for a buyer.

Drawing on our decades of deep experience in the strata industry, here are our Top 10 Tips for a more seamless (and hopefully less stressful) transaction.

1. Get your business in order

Buyers don’t like surprises. A seller needs to make sure they have secured all the authorities they require to be able to sell the operation at a fair and agreed valuation. Failure to obtain written lett ing authority from all the relevant lot owners can delay or even kill a sale.

2. Have the books up to date

There is litt le point assessing a deal on figures that are out of date. If you want to maximise the sale price, make sure the revenue figures are up to date.

3. Vet your buyer

There is nothing worse than making progress on a sale

only for it to get the wobbles because the body corporate has an issue with the buyer. We have seen more refusals to consent to assignments in the last few years than we saw in the prior two decades. Make sure you help the buyer to present themselves in the best light possible.

4. Know the term on your MLR agreement

You may need to top up your agreements as part of the sale to make the term att ractive to a buyer. Make sure you have exercised your options and documented those with the body corporate. Be warned: sett ing false expectations for a buyer on term can be fatal to a transaction.

5. Know what you can spend

The starting point for any potential management rights buyer is to determine a comfortable purchase price in terms of what you can, or want, to borrow. The ability to service a loan in a volatile interest rate environment needs to be faced with a cold-hearted realism that may require walking away from a potential deal.

6. Structure your business before purchase

Structuring your prospective purchasing entities is best worked through with your lawyer and accountant before you find the strata complex that suits you. That way, when you do find the right management rights business, you are ready to sign contracts straight away.

7. Understand the financial fundamentals

Understand the sale multiples that apply to the type of business you’re buying. Find out how many owners are in the lett ing pool. Ask about owners who are not in the lett ing pool. Understand the remaining time left on the management rights agreements. Review

the remuneration paid to the manager by the body corporate. Is the manager’s office included in the title to the unit or is it part of the common property?

8. Approach ‘off the plan’ with an open eye

Buying an existing business provides certainty. Buying off the plan means you are buying the management rights business from a developer as part of the development itself, meaning less visibility on what the business will look like when it is created. This requires more thorough due diligence from a buyer’s perspective, but that is usually compensated by a lower purchase price.

9. Understand who’s who in the zoo

Brokers, accountants, lawyers, bankers, valuers, body corporate managers – there seems to be an endless stream of people involved in a sale or purchase. It’s important to understand what role they all play and when they will join the process.

10. Ask for testimonials

Many advisors call themselves experts. Don’t be afraid to ask for testimonials from other management rights clients. Ask them how many management rights transactions they are currently working on, or how many management rights clients they have advised over the last few months. Ask the other industry professionals you are working with how often they have dealt with your advisors.

By Jonathan Hanaghan, Principal, Count Gold Coast

This article is aimed at first-time buyers entering the industry. I’ll go through a basic staged plan to assist with the process. This list is by no means exhaustive but serves as a general guide. Some of you may require a more detailed approach, or if you’re lucky enough, maybe even a simpler one.

Step 1: Do your homework

Review as many businesses as you can. Get a feel for the type of complex that ideally suits you. You may want a permanent business with minimal office and garden hours, or you may be chasing a dollar and looking to purchase a larger shortterm complex, or perhaps something that has been run down and in need of some TLC.

Step 2: Find out what your budget is

Seek advice from an industry specialist financier or finance broker to determine how much you can borrow and what your budget is.

Step 3: Find the right complex and negotiate the price

This will depend on your

circumstances. Discuss your offer with the applicable agent, and hopefully, you will reach a verbal agreement. It’s not uncommon for the offer and acceptance process to take some time.

Step 4: Engage an industry specialist accountant and lawyer

You will need both to assist you with the process, but the immediate priority needs to be the establishment of a business ownership structure. This can be either as a sole trader, partnership, company, or trust, or a combination depending on your circumstances. Taxation and asset protection generally weigh heavily in this choice as they greatly vary. Typically, your accountant will establish the structure, then your lawyer will document the contract and advise you on the details.

Step 5: Sign the contract

Generally speaking, the contract will contain three major conditions: income verification, finance, and legal due diligence (which also covers

body corporate approval).

Making sure you understand each is crucial. In essence, this gives you three ‘get out of jail free’ cards should you need them or if your circumstances change during the process.

Step 6: Income verification

Your accountant will complete the income verification in accordance with the contract for sale. This will be for a recent 12-month period (or projection if off the plan) with the view to verifying an actual net operating profit figure as specified in the contract. This profit figure is usually the number the vendor’s accountant has calculated for the same or similar period. Owner letting agreements are also checked, and any variances in letting pool numbers during the verification period are reported.

Step 7: Obtain finance

Your financier will require a copy of the income verification report and various other documents. Your financier may also require amendments to the body corporate caretaking agreement.

Step 8: Follow your solicitor’s advice

Your solicitor will guide you through legal due diligence, including obtaining body corporate approval.

Step 9: Statutory and licensing requirements

Ensure all applicable ATO registrations are in place, as Australian Business Numbers can take up to 28 days to be processed. OFT licensing can also take longer than expected, so make sure this process is well advanced.

Step 10: Record keeping

Careful consideration needs to be given to record keeping for the trust and general bank accounts. We recommend specialised software be purchased or leased. Advice from your industry-recognised accountant should be sought before simply going with “what the vendor was using.”

Step 11: Handover process

You will need to negotiate the handover process with the vendor, which commonly is one week before and one-week following settlement. Try to extract as much knowledge from the vendor as possible during the agreed period. I also recommend having a coffee or similar with the chair of the body corporate as soon as possible following the settlement. After all, the body corporate committee can be your strongest advocate or your worst nightmare.

In summary, always stick to and take advice from your industry-experienced accountant, financier, solicitor, and sales agent, and the purchase process should run as smoothly as possible.

Good luck to all those readers looking to purchase soon!

By Andrew

When it comes to investing in a business, there are many factors to consider. High returns, lifestyle benefits, and growth potential often dominate the conversation. However, there’s one compelling reason to invest in motels that often flies under the radar: simplicity. Unlike many other businesses, motels are straightforward to understand, making the decision-making process far less daunting. In this article, I will focus on that unique advantage—how motels, as a business model, offer transparency and clarity from the outset. At their core, motels are not difficult businesses to understand. Success hinges on one simple principle: occupancy, or, as it’s often phrased more colourfully, “backsides in beds.” The more occupied rooms, the more successful the motel. To that end, they are largely an open book; one doesn’t need a deep dive analysis to determine their accuracy or legitimacy. This means that practical and important information to determine the general status of the business is easily accessible in the initial stages of consideration.

For potential investors, this accessibility is invaluable. Of course, every investor will complete due diligence to their satisfaction, but the point here with motels, is that getting to the heart of the matter is very easy when confirming that what is being presented is truly accurate. This goes beyond just the numbers, it extends to the sources of that data and the physical assets themselves.

The entire process of buying a motel business starts with the initial information that has been presented, such as an information memorandum (IM). Following this, you might review the financial statements of the business. At this step, there are some quick items to look at to gauge the legitimacy of the financial data being presented. It can be a simple comparison of numbers between expenses presented, income produced, and industry standards. Some entries of interest include laundry/linen, electricity, wages, and cost of goods sold. These items immediately provide a lot of comparable information without having to dig too deep for answers. Additionally, a simple calculation of the presented income or revenue against the property’s characteristics (size, quality, location) will indicate whether the figures are realistic for a motel given its size, quality, location, and so on. Reconciling that with some of the variable costs mentioned will provide clarity. Ultimately, usage determines these variable costs and provides answers. If units are being occupied, they must use linen and electricity, and cleaning is required.

Next is a physical inspection of the property. While a detailed building inspection by a qualified professional is ideal, even a preliminary visit can offer valuable insights. Common sense items should stand out upon inspection. Let me qualify this by saying I am not a builder, but I have some quick ‘tells’

regarding the integrity of the structure, from cracks in the block or brickwork, the state of the roof, joints or windows that are not square, wood rot to beams, and signs of water damage. For example, block and brick cracks are common and can be easily determined as either superficial or requiring further investigation.

Beyond the structural side of things, maintenance issues and repair items also tell a story. Walls that have been poorly painted and cut incorrectly should raise an eyebrow, suggesting a lack of attention to detail. Clearly, a professional painter would not have completed such a job?

Repairs that have been carried out in a less than professional manner should set off an alarm to dig deeper. Cleanliness is another quick and telling indicator of how a property has been looked after and whether or not you may find other issues. External back or side areas of any motel can reveal a lot about how the property is maintained. If the spaces behind the buildings where the public generally do not go are an overgrown forest or dumping ground, it is a huge

red flag. If these areas are clean and tidy, and the public can access them without issue, it is highly likely the entire property will be well looked after.

Finally, completing the due diligence process under contractual arrangements allows the seller to provide access to any additional information required to confirm all the data and bottom-line profit that has been presented. This may or may not require a deeper dive depending on how the initial investigations went.

No one involved in the sale and purchase process wants a contract to collapse, especially because of the due diligence process. The result is wasted time and cost to both buyer and seller, not to mention the loss of credibility of both parties, notwithstanding who was at fault. Therefore, being able to minimise the risk of a contract being terminated well into the contractual process by making relatively accurate determinations early on is very valuable.

By Mike Phipps, Mike Phipps Finance

I’m sure we can all think of a product where the designers clearly forgot –or ignored – the primary needs of the user. The focus on form (the look and feel of the thing) has completely eclipsed the function (the usability of it). In my ruminations on this matter, I am indebted to proto-modernist architect Louis Sullivan, who stated in 1896 that “form ever follows function.” In other words, for any given design, it’s got to actually work, and then let’s worry about how it looks.

And so it is in some sectors of the accommodation industry.

The hotel design trend these days seems to favour groovy and edgy architectural and fit-out signatures, clearly aimed at the groovy and edgy Instagram generation. We might call them Gen I, with only a touch of irony.

When done right with a bit of class, both new and renovated hotels can be very special places to spend a night or two. In the spirit of embracing these trends, the managing director and I recently decided to give one such property a test run. Sadly, to our expectations, this relatively new hotel on the Brisbane CBD fringe misses the mark—and by some distance.

We arrive by car, and first impressions suggest a relatively

professional, if casual, process. Valet parking is recommended at $75 a day because selfparking will be more expensive. OK, it’s been a long day, so we choose not to debate this apparent paradox. Valet it is.

The entry and reception lobby have a kind of industrial minimalist feel, combined with jarring wall art we suspect is intended to suggest graffiti. Banksy, it ain’t! The check-in staff is friendly but doesn’t understand that Apple Pay will generate a different card reference number on receipts than the actual physical card we booked with. We try to explain it’s the same card and hit a stone wall with apparently no wriggle room to accommodate such a scenario.

After a spirited debate and a supervisor intervention, we proceed. To be fair, we didn’t know about the Apple Pay card ID thing either, so lesson learned.

The property is serviced by two banks of lifts with limited signage to direct the hapless guest. A less-than-thrilling ride to nowhere ensues until we work out where we are and finally alight on our floor. I guess if you are a 1970s nightclub aficionado, the décor might work, but to our tastes, attempts at creating a vibe with dark corridor colours end up feeling like a step back in time to dark and dodgy recesses, sticky carpet, and the occasional mirror ball. I exaggerate for effect, but you get the picture.

We opted for a corner room with views of the river and across to the South Bank precinct. The room fit-out is a study in form over function, and to our taste, an uncoordinated mess of disparate design cues, textures, and colours. It suggests the room decorators stayed in a lot of different hotels, took what they liked from each, and jammed them all into one space with scant regard for overall design integrity. The fact that no one had thought to provide two chairs and a small table says it all.

All lighting and electrical functions are accessed by the latest tech touch pads, which would be fine if you could find them in the dark. Likewise, the TV allows many streaming and connectivity options but manages to make accessing an actual TV channel nearly impossible.

The coffee mugs (we think) positioned next to the coffee machine look very cool but have a bit of a problem. They are metal and have no handle. By the time you can actually pick up your coffee without sustaining third-degree burns,

it’s gone cold. Maybe they were meant for cold drinks only, but who knows? No other hot beverage receptacles of any consequence were evident.

We decided that the no-doubt groovy, but sort of unliveable room must surely be an aberration and decided to go exploring. The deck bar and pool area were described as very enticing. Sadly, the pool is indoors, and the bar outdoors but adjacent. If you like your beverages provided by largely untrained staff and served with a strong whiff of chlorine, this might be just your spot. Otherwise, maybe not!

Throughout the property, from bars to lobby, repetitive, unimaginative doof music assaults the ears. Not the sort of jazz-tinged happy vibe that could be achieved if the venue took the time to curate a more nuanced soundtrack. Instead, multiple DJs manage to do the impossible and clear the hotel bars by 8 pm on a Friday night. We give up and retire for the evening. Loud air conditioning resembling the rumbling of a coming thunderstorm was only

distracted by the constant on and off of the fridge motor and the traffic noise below. If the builder paid for double glazing, I’d be demanding a refund. On a positive note, a request for pillows not filled with rocks was hastily addressed, the bed was comfortable enough, and the shower nice and hot. Maybe that’s all we can expect after the budget gets blown on stuff that doesn’t work.

At corner room rates north of $500 a night, the hotel in question simply didn’t do it for us. It tries too hard and would have benefited from a more subtle and stylish approach, better-trained staff, and a quieter room. What I’m sure the designers intended as the last word in cool has turned out tacky, soulless, and gauche. If the place had been full of beautiful people taking selfies all weekend, I’d be inclined to conclude that I’m out of touch. It wasn’t.

Maybe we’re just too old to match the target audience. Maybe not.

I’ll leave you with a short quote from a genius:

“Simplicity is the ultimate sophistication.” —Leonardo da Vinci, 1452-1519

An aside... The reference to beautiful people above got me thinking about the phrase. Readers of my vintage will recall an Australian Crawl song of that title. I decided to revisit the lyrics. Suffice it to say, other than the cost of a good push bike, nothing much has changed. I guess that’s what happens when you can’t find the light switch and the décor is most definitely a sonic boom. Here’s a sample:

“I said beautiful people

They ride two-hundred-dollar pushbikes in the park

Beautiful people

They won’t admit it

But they make love in the dark

Beautiful people

Snap frozen potted palms

In the corner of the living room

Beautiful people

The art-decor sonic boom”

– James Reyne & Mark Hudson, 1979, EMI

MANAGEMENT

By Chris de Closey, Director, Switch Hotel Solutions

In the world of hotels, the data and tools we have at our fingertips seem to be increasing each and every day. Experienced revenue managers will tell you this is a blessing, but if you are new to the industry or running a smaller scale business, you might find this as a curse! All this information just gives you more to look at and can lead to what I call “pricing paralysis”.

You have so much to look at, where do you start?

How do you interpret the data and how do you price your

product accordingly? Fear not and stress less! I am here to break it down in the easiest way for you to take back control of your revenue life.

Pricing decisions all start from YOUR data. What are your current occupancy holdings, where are your needs periods and where is your occupancy fl ying? How is your revenue tracking year on year? What about your average daily rate? Regardless if your ADR, revenue and occupancy are up or down – this is your starting point. You need to identify and understand the trends of your business.

Your PMS (at least the good ones) should have a pace report, that shows you how your property is tracking this year compared to the same time last year (on the same day). This will help you identify if you are tracking ahead or behind for the period you are reviewing. This data is invaluable to you as it helps to gauge how your holdings are stacking up currently against last year.

Next – look at your total occupancy and revenue reports, how are your total holdings compared to the full period last year?

The crux of making informed

pricing decisions sits with understanding the data you’ve gathered. Once you’ve established how your property is tracking compared to previous periods, you can begin to make strategic pricing adjustments.

Consider the following steps:

1. Benchmark against competitors: It’s not just your historical data that’s important. Benchmarking against your competitors gives you a critical edge. Use tools like rate shoppers or manually search online to see how competitors are pricing their rooms for the same periods. This doesn’t mean you have to match or undercut their prices, but it helps to know where you stand in the market landscape.

2. Understand the market: Leverage market benchmarking tools like STR or use free tools provided by the Online Travel Agents. These tools allow you to understand the market trends, what the demand is like and what is the lead time on this demand.

3. Implement dynamic pricing: Utilise dynamic pricing models that adjust rates based on real-time supply and demand. Tools that integrate with your PMS can automate this process, ensuring your prices are always optimised for maximum revenue.

4. Monitor and adjust regularly: The market never stays the same – so why should your

pricing? Regularly review your pricing strategies and the data. This means weekly at a minimum, we aim for daily checks to ensure your rates reflect current market conditions and upcoming demand surges or dips.

The more informed you are, the better you can analyse the data and make savvy pricing decisions. If your competitors are cheaper than you, this could explain why your booking production is slow. If you’re cheaper than your competitors, this could explain why your booking production is significantly ahead. You might be priced appropriately, and the market might just be suff ering from a drop in demand.

Saving yourself from pricing paralysis involves a mix of understanding your data, knowing the market and using the right tools to make informed decisions. By focusing on these areas, you can ensure your pricing strategy is informed, responsive, and most importantly, makes you more money through driving revenue. The goal is to make data-driven decisions that align with your business objectives and market conditions, allowing you to regain control and confidently navigate the complex world of hotel pricing.

By Sam Steel, Co-Founder, Resly

In today’s interconnected world, security isn’t just a technical requirement; it’s a fundamental necessity for maintaining trust and protecting the integrity of your business. As operators/ managers, we handle a significant amount of sensitive information, from guest data to financial records and ensuring this information is secure should be at the forefront of our operational priorities.

With cyber threats becoming increasingly sophisticated,

reviewing and implementing best practices for securing your accounts and data is not just advisable; it’s essential. Recent scams targeting our industry are more sophisticated and harder to spot than ever. However, implementing the following steps can make it significantly more difficult for scammers to access your data. Consider this a timely reminder to review your security practices.

1. Two-factor authentication (2FA): An extra layer of security

Two-factor authentication (2FA) is one of the most eff ective ways to protect your accounts. By requiring a password and a second form of identification (such as a code sent to your phone), 2FA significantly reduces the risk of unauthorised access. Ensure that 2FA is enabled for all systems and encourage staff to activate it for their accounts.

2. Strong passwords: Your first line of defence

Weak passwords are an open invitation to hackers. It’s crucial to use strong, unique passwords for all accounts. A strong password typically includes letters, numbers, and special characters and avoids easily guessable information like birthdays or common words. Consider using a password

manager, like OnePassword, to help generate and store complex passwords securely.

3. Antivirus soft ware: Protecting against malicious threats

Antivirus soft ware is a vital tool in your security arsenal. It can detect and remove malware, viruses, and other threats that might otherwise compromise your systems. Ensure that all your computers and servers are regularly updated with reliable antivirus soft ware.

4. Phishing awareness: Guarding against deceptive emails

Educate your staff on how to recognise phishing attempts. Look for suspicious email addresses, unexpected att achments, or urgent requests for personal information. Encourage everyone to think before clicking and to report any suspicious emails immediately.

5. Regular training: Keeping your team informed

Regular training sessions for your staff on the latest security practices are essential. These sessions should cover topics like recognising phishing attempts, safe browsing habits, and not sharing passwords.

6. Periodic security audits: Staying ahead of threats

Regular security audits are an excellent way to ensure that your security measures are up to date. Bring in a cybersecurity expert to review your security protocols, identify potential vulnerabilities, and recommend improvements.

7. Review and update policies: Adapting to new challenges

Review and update your security policies regularly to ensure that all soft ware is up to date, remove unused accounts, and deactivate access for former employees.

Security is not a one-time task but an ongoing commitment. By implementing these best practices and regularly reviewing your security measures, you protect not just your business but the trust your guests place in you. In an era where a single breach can have far-reaching consequences, a proactive approach to security is more important than ever. Make security a priority today, and ensure your hotel remains a safe haven for your data and your guests.

This monthly column is designed for YOU – every single person involved in the maze called management rights! I want to share moments of laughter, disbelief, sadness, emotion, and anger. I would love to hear your stories, experiences, and dreams.

Somehow, sharing these with others and hearing their stories makes life in the industry more bearable and plausible. Let’s laugh, cry, dream, grow, and share together – almost like an agony aunt column.

As stated in last month’s column, being a management rights owner or operator requires the stealth of a cat, the resilience of an oak tree, and the agility

of a tightrope walker. You also need the armour of a tank. People advise that you should not take what others say, write, or how they react personally. This is sound advice, but it’s so very difficult to do when you’ve paid a heap of money to buy your management rights, and someone pulls apart everything you’ve done without a second thought.

Today I want to share a little story that recently happened at Rigby Property Group. This isn’t a plug; it’s a wake-up call. If you are not selling or working with a sales agent who understands the importance of finding the RIGHT owners for your community, things can go bad very quickly.

By Kelley Rigby, Managing Director, Lett s Group

The managers of a building in Surfers Paradise entrusted us with selling a property in their building. Before listing the property, Scott helped rearrange furniture and assisted the owner in preparing the property for the market. During our first open house, we connected with 10 groups.

Among the buyers, one couple caught my attention because their comments about living in a community raised some warning signals. As I spoke more with the husband, I realised I had encountered individuals like him before in my work dealing with disputes. I could foresee his future behaviour: getting on the committee or (worst case), becoming chair, constantly opposing motions, making mountains out of molehills, and causing much upset for the scheme and the managers. For those who have been through any kind of dispute, you know the hurt an owner like this can cause a community.

My first experience of not taking anything personally was during my first week of owning management rights. A guest arrived at Boulevard North and immediately announced that she normally stayed at other businesses near our building. However, as they were full, she had no option but to book with us, loudly proclaiming that we were actually her “third choice”. I responded with positivity, hoping her number three choice would quickly change to number one. In retrospect, this was positive thinking at its best.

The guest checked in and proceeded to her allocated apartment, only to return five minutes later with a broad smile on her face and a dance in her step. I was thrilled, thinking we had been elevated to the first position on her choice list. No, she was thrilled to announce that

One of his comments about managers being overpaid and unproductive made me see red, but I maintained professionalism and tried to explain the complexities of the management rights industry to him. Unfortunately, he appeared dismissive and simply saw me as an ignorant real estate agent who knew nothing about anything.

Despite my efforts to explain that I did not believe they would enjoy the lifestyle of living in this building, the wife was smitten with the property. It goes without saying that I did not sleep that night worrying about this couple possibly placing an offer on the property. The following morning, I discovered their offer on my laptop. Feeling nauseous, I called my seller to give her the news. During our chat, I gave my honest opinion that these people were not our buyers and did not see the value in her unit as we did.

her first choice accommodation had just called to say they had a cancellation, and she was free to move to that building. She was not impressed when I referred her to our no-refund policy. She proceeded to paint the air blue with profanities and personal attacks on me, the staff, the building, and anything else in her view. Realising that we were not going to be bullied, she threatened revenge and strode off.

The photographs and ‘faults’ streamed in via email, messenger, and the online booking agent. She claimed to have found dirty socks in the bed, dirty laundry in the washing machine, lipstick on the coffee cups, bugs, hair, and a filthy apartment. She demanded a full refund and claimed she had no option but to leave immediately. She left of her own accord, and strangely, so did the dirty socks and dirty laundry! This was followed up with dreadful reviews, a complaint to the Office of Fair Trading, the advertising board, and every review page. Fortunately, we

Did I mention he already told me it was overpriced?

Although their offer was good, I knew we could do better, not only for our seller but also for our managers. Through our established trust with the owner, she agreed with my assessment, and we declined the offer. Thank goodness, a bullet had been dodged! After three more open homes, we finally found our buyers: a lovely mother and daughter who understood management rights and demonstrated a love for living in a management rights building, as they had done so before. If you sell to an owner, these are the people you want in your community. Did I also mention we were able to obtain $25,000 more for our seller?

For those out there saying, “But it wasn’t an investor,”

had recorded every event, and once the authorities were given this information, she was silenced. However, the bad reviews remain to this day.

How do you recover from an experience like this? A small ‘mom-and-pop’ business truly wanting to offer the best possible service, to provide every guest with an amazing experience, and to serve the industry in the best possible way. My motto was, and still is, to “put on my big girl panties and face the challenges head-on,” realising that I will never make everyone happy, but being content knowing that I have given it my very best shot and worked hard to be our guests’ number one choice.

We all have stories worth sharing, our experiences with body corporate, body corporate managers, guests, owners, the public, and so the list continues…

Sharing is caring, please share your stories with me. They will be posted without reference to yourself or your building.

Send to marion@ boulevardnorth.com.au

you’re right; it wasn’t. That would have been ideal, but having a collaborative owner, given the situations I have seen in our industry of late, this was a WIN!

I’m sure you can see why it is so important to have an agent who works with a “Best for Building” attitude. If you sell, amazing! But do you sell them all? It might be time to find an agent to pick up the sales that you may miss. Like I said before, those who have been through disputes or are going through one right now, know the heartache this can bring.

Our mission and objective are to minimise disputes to the greatest extent possible. The heartache and mental strain we have witnessed others endure serve as the driving force behind our commitment to supporting managers.

Preparation is everything:

The critical role of the

By Mike O’Farrell, MLR Services

If there’s one thing we’ve all noticed, it’s that our industry never sits still. The days when you could simply step into a new scheme, sign on the dotted line, and get straight to work are long gone. Today, expectations are higher, demands are tougher, and as a result, preparation is more crucial than ever.

From where I sit at MLR Services, I’ve seen the landscape shift under our feet. The role of a building manager isn’t just about keeping things running smoothly anymore. Now, bodies corporate and committees want more than competence – they expect exceptional performance from day one. This is exactly why an Assignment Package isn’t just helpful; it’s essential. Think of it as your toolkit for success, a roadmap that sets you up before you even step into your new scheme.

Let me break it down for you: an Assignment Package should be a carefully crafted plan. It should include everything you need, from a tailored business plan to WH&S templates, which are a big tick on the body corporate lawyer’s checklist. And because we know the assignment interview can be nerve-wracking; you need to know the types of questions that may be asked. Industry has developed a questionnaire of over 40 questions that are likely to be asked, alongside those you should be asking. This kind of preparation isn’t just about ticking boxes; it’s about showing the body corporate that you’re the right person for the job –someone who’s ready to take on the responsibility with confidence and know-how.

I know it can feel overwhelming (these new demands in our industry) but with the right preparation, you can face them head-on with confidence. The truth is, that the assignment process has become more rigorous, with a bigger emphasis on due diligence and forward planning. That’s where an Assignment Package can make all the diff erence.

So, if you’re gearing up to step into a new scheme, don’t do it alone. The industry may be more demanding, but with the right preparation, those demands can be met with confidence.

Expectations are higher, demands are tougher, and as a result, preparation is more crucial than ever

By Grantlee Kieza, OAM Industry Reporter

The Australian accommodation industry has become a devil’s playground for online scammers, with a disturbing surge in internet fraudsters exploiting fake Booking.com links to swindle both guests and providers. This alarming trend has transformed what should be a trusted digital marketplace into a breeding ground for financial loss and reputational damage.

According to the Australian Competition and Consumer Commission (ACCC), reports of scams linked to Booking.com skyrocketed in 2023, resulting in Australians losing more than $337,000. The scale of these scams is unprecedented, and the consequences are devastating.

Cybercriminals have infiltrated the Booking.com accounts of some accommodation providers, using their access to send fraudulent messages to guests, demanding sensitive credit card information. These scammers are not just targeting individual bookings; they’re creating fake listings for legitimate properties, siphoning off funds directly into their own accounts.

Sam Steel, co-founder of leading accommodation software

Resly, warns that the Australian accommodation industry must unite to combat this escalating threat. “If all Australian accommodation providers adopt robust security measures, we can fight back against these relentless attacks,” Mr Steel said. “A coordinated defence could make Australia a fortress too tough for scammers to breach, forcing them to move on.”

The National Anti-Scam Centre’s tips to stay safe from online scams include:

• Independently verify emails by contacting the property directly.

• Contact the organisation using a phone number you have sourced yourself – never one provided in an email or text.

• Use the organisation’s app to securely access your account, verify messages, and enable two-factor authentication.

• Be aware that customer service representatives will never ask for your account password or credit card information over the phone.

The tactics employed by these fraudsters are alarmingly sophisticated. “I’ve seen landing pages that look identical to Booking.com or Agoda, sent via email or text to guests, claiming their payment was declined,” Mr Steel said. “If I weren’t familiar with these scams, I could easily fall victim and hand over my details.”

For scammers to execute these deceptions, they need access to the hotel’s systems—whether it’s the reception desk computer or other internal networks.

“Protecting your systems is the first and most crucial step in safeguarding both your business and your guests from these attacks,” Mr Steel said.

Fortunately, there are straightforward yet powerful measures that every accommodation provider can implement to bolster their defences. “One of the simplest is two-factor authentication,” Mr Steel advised. “This adds an additional layer of security, making it nearly impossible for someone to access your systems without also having your mobile phone.”

Despite its effectiveness, twofactor authentication is often met with resistance. “We hear complaints about the extra 10 seconds it takes to receive a text message with a code,”

Mr Steel said. “But that minor inconvenience is a small price to pay for the security of your brand, your business, and your guests.”

Another common vulnerability is phishing emails, which often target generic info or reception inboxes. “These emails may prompt users to ‘reset your password’ or ‘download a file,’ tricking unsuspecting staff into granting access to the system,” Mr Steel explained. “It’s critical that staff are trained to pause and question the legitimacy of these requests.”

The consequences of falling victim to these scams can be catastrophic. “Once scammers gain access to your system, they can cause irreparable damage—often without you even knowing until it’s too late,” Mr Steel warned. “These scams are not only draining guests’ bank accounts but also threatening the very survival of accommodation businesses across Australia.”