Our intuitive software uses advanced technology for simplified trust accounting. Backed by our dedicated support team.

The ultimate solution for streamlined management rights and holiday letting.

Our intuitive software uses advanced technology for simplified trust accounting. Backed by our dedicated support team.

The ultimate solution for streamlined management rights and holiday letting.

The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, it’s employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/ or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its’ agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent of the publisher. © 2024 Multimedia

Welcome to the October edition of Resort News.

I’m sure many of you were as shocked as I was after watching the Four Corners investigation on the ABC last month. It revealed widespread overcharging and dubious, unethical practices in strata. The Strata Community Association (SCA) has since responded by releasing guidelines to improve insurance transparency. We reached out to Trevor Rawnsley, CEO of ARAMA, and he shares his insights on page 6. He highlights the important role of resident managers in promoting transparency, and advocates for fixed fees in strata insurance brokerage.

This month, we caught up with more ARAMA TOP Award winners, including Hamish Watts from Glen Eden Beach, Stuart and Nicole Morris from Azure Sea Whitsunday Resort, Maree and Ian Smith who took home two awards, and industry veteran Mike O’Farrell. Their stories of success are sure to inspire.

Mandy Clarke, Editor editor@accomnews.com.au

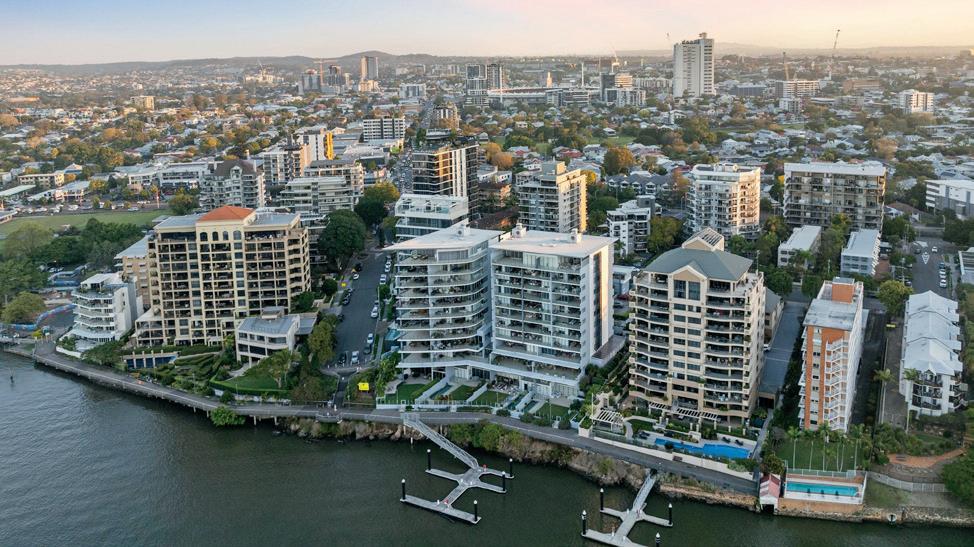

Our Brisbane 2024 Management Rights Sales Report, is a must read, packed with insights on the current market, economic challenges, rising rents and reduced supply.

September was a whirlwind, for our team. We headed to Sydney for this year’s NoVacancy Hotel + Accommodation Expo. As the multi-day extravaganza wrapped up, I reflected on our journey

We’ll also be attending ASTRA’s Here to Stay Conference 2024 in Brisbane – it’s another one to look forward to.

as media partners with the event since its inception, and how exciting it’s been to watch it grow into Australia’s largest industry expo. It was fantastic to reconnect with so many of you there – our readers and industry colleagues – and to explore the latest trends and innovations in hospitality. If you didn’t make it this year, mark your calendar for next, and we will be back!

Speaking of events, October is shaping up to be just as dynamic. We’re heading to the Gold Coast

for the second year of Resly’s AccomCon and The Best of Tourism Awards. Once again, we are supporting the event as media partners and it will be fascinating to watch it evolve. Later in the month, we’ll also be attending ASTRA’s Here to Stay Conference 2024 in Brisbane – it’s another one to look forward to.

Until next time, happy reading, and I look forward to seeing you at an event soon!

Warm regards, Mandy

Experts in management rights sales

Australia’s foremost management rights sales agency, with 15 years of expertise and a dynamic team of over 15 agents strategically positioned along the vibrant expanse of the east coast, we bring unparalleled expertise and dedication to every client interaction. mrsales.com.au | 1300 928 556

Experts in accommodation sales

National coverage and expertise in the sale of motels, hotels, caravan parks, pubs & MHEs tourismbrokers.com.au | 1300 512 566 Working together, working for you

Keep reading for more listings... Surfers Paradise QLD ID: 9154 Mixed Management Rights Net: $333,723 Price: $2,290,000

Buying or selling?

By Grantlee Kieza OAM, Industry Reporter

Overcharging in the world of strata is endemic and highlights the important role that diligent management rights operators play in safeguarding the accommodation industry.

That’s the opinion of Trevor Rawnsley, the CEO of the Australian Resident Accommodation Managers Association (ARAMA), following what he called a “bombshell” investigation into the strata industry by ABC program Four Corners

“We’ve suspected dodgy dealings in the strata industry for some time,” Mr Rawnsley said.

“And as Four Corners showed, overcharging is now on an industrial scale. Service should be provided for a fee that is fully disclosed, not hidden and loaded onto other things.

“ARAMA has always promoted the idea of a fair day’s pay for a fair day’s work, and our resident managers in the management and letting rights industry provide full disclosure about their work and fees. They protect the rights of unit owners.

“Their payment is set out in the agreement when they take on a business, and it has been proven time and again that, because of the amount of work they do and the multitasking their role involves, they actually save a complex a great deal of money.

“On the other hand, though, some strata management companies have been employing hidden fees and rewards built into their charges.”

Mr Rawnsley said the work of resident managers is tightly governed, and it’s not even possible for them to gain kickbacks or favours in the way some strata management companies have.

“If our members ever charge a complex above what is in their agreement, they can lose their licence and ultimately their business,” he said.

“So, it just doesn’t happen.

“There is more scrutiny on our resident managers than on politicians.

“But sadly, that has not been the case with some strata management companies, and that has led to the problems exposed by the Four Corners program.”

More than 2.5 million Australians now live in apartments, and that number is set to soar over the next 10 years.

Four Corners showed how the multibillion-dollar strata industry – which is supposed to protect homeowners’ interests – is cashing in.

After thousands of Australians wrote to the ABC with shocking stories of financial abuse, Four Corners reporter Linton Besser’s program, “The Strata Trap,” exposed the unethical practices of some, draining huge amounts of money from the pockets of apartment owners, through hidden charges, phantom fees, and suspect kickback deals with contractors.

Even the former NSW president of the industry’s peak body, the Strata Community Association (SCA), Stephen Brell, was forced to stand down following an ABC interview in which he admitted his company, Netstrata, had failed to disclose a raft of kickbacks.

Among the complaints to the ABC about different strata management companies, one unit owner, Michael Bluwol, found his building was charged twice for the same building report.

In Melbourne, Alison Parkes discovered the company responsible for her building had twice charged the owners

corporation $101.48 for chasing debts of 60 cents.

Dr Parkes calculated the strata company overcharged her building $3802.65 for debt notices in nine months alone.

Four Corners claimed that one of the country’s largest strata firms, which has almost 5000 buildings under management, receives kickbacks from a variety of companies contracted with clients’ funds.

The company received a referral fee of up to 15 percent each from two providers of power and hot water. It also received up to 75 percent of the brokerage fee when insurance was purchased.

Another resident found his strata company had engaged an insurance brokerage firm – Collective Insurance Brokers (CIB) – controlled by a multibillion-dollar public company called Steadfast Group.

Not only does Steadfast own the insurance company recommended by the broker, but it also holds a stake in Johns Lyng – the very company hired to make repairs at the property.

Mr Rawnsley described the Four Corners program as “a much-needed spotlight … on unethical practices within the strata management industry.”

“Unfortunately, apathy runs rife in strata,” Mr Rawnsley said.

“It’s important for lot owners to be on committees, but many buy an investment unit, and they don’t care what happens so long as they’re getting a return. That is until they get a special levy notice for something.

“At ARAMA, we are always trying to demonstrate value, and a resident manager actually saves a building money. That can be proven quite easily by getting a market review.

“Hopefully, after this Four Corners program, more unit owners will take more notice of what’s

happening in their building and the fees that are being charged.”

He said insurance brokerage in strata should be charged at a fixed fee.

“Sometimes, body corporate managers are getting a fee of $30,000 when they should be paid for their time at an hourly rate, not a percentage.

“ARAMA represents more unit owners than any other group, with around 4000 buildings across Australia under our members’ care.

“Many of our members are also unit owners, meaning they are directly impacted by rising insurance premiums and inflated strata levies driven by hidden commissions and kickbacks.”

Mr Rawnsley acknowledged that while it’s not illegal for insurance companies or strata management companies to make a profit, the hidden nature of these commissions is particularly frustrating for ARAMA members, who, like all other unit owners, ultimately bear the cost through higher levies.

He acknowledged the many ethical body corporate managers who work in the best interests of unit owners and expressed sympathy for those managers unfairly impacted by the fallout from the investigation’s revelations.

The Strata Community Association (SCA) released its Strata Insurance Disclosure Best Practice Guide last month, setting out what it called “necessary and critical changes to how SCA members disclose strata insurance practices.”

It said some of the intentions of the new best practice guide were to “eliminate some of the poor insurance practices and bad actors who undermine confidence” and “build and improve relationships between strata managers, committees, and consumers.”

According to section 184(2) of the Act, a body corporate can only lodge a dispute application to enforce the bylaws if it has given the owner or occupier a contravention notice for the breach that is the subject of the dispute.

A contravention notice must:

Body corporate by-laws are an essential element for regulating the use and enjoyment of common areas and lots within strata title complexes.

All owners and occupiers are bound to follow their scheme’s by-laws, while a body corporate must enforce them and act reasonably in doing so.

Although it’s a two-way street, owners and occupiers in the scheme can also take action.

While most dispute applications simply require evidence of attempts at self-resolution, an applicant seeking to enforce the by-laws must comply with the mandatory procedure stipulated in the Body Corporate and Community Management Act 1997 (the Act) before lodging an application with our office.

This article explains the preliminary procedure for bylaw enforcement applications and highlights some of the common things to avoid.

Preliminary procedure where the dispute is brought by the body corporate

• state that the body corporate believes the person is breaching a by-law

• identify the by-law the body corporate believes has been breached

• explain how the by-law has been breached

• explain that not complying with the notice allows the body corporate to:

- lodge a conciliation application through the Office of the Commissioner for Body Corporate and Community Management

- commence proceedings in the Magistrates Court.

There are two types of contravention notices – a continuing contravention notice and a future contravention notice. Both types of contravention notices must contain the information outlined above.

The only difference between the two is:

• the continuing contravention notice requires the body corporate to set a timeframe for the person to rectify the issue

• the future contravention notice tells the person not to repeat the breach for the length of time the notice is in effect, which cannot be more than three months.

Which contravention notice the body corporate chooses to issue depends on the nature of the breach.

For instance, if an owner has changed the appearance of their lot without approval, a continuing contravention notice would normally be issued, as the breach is ongoing and likely to continue.

On the other hand, if someone has hosted disorderly parties, the body corporate would typically issue a future contravention notice, as they do not want the past behaviour to be repeated.

The body corporate can use the BCCM Form 10 (continuing contravention notice) or BCCM Form 11 (future contravention notice). However, these are not prescribed forms.

If the body corporate wishes to send their own contravention notice, all the information above must be included in the notice.

Bodies corporate must remember that failing to properly issue a contravention notice can potentially derail an otherwise strong application.

In Mountainview [2016] QBCCMCmr 345, a dispute arose about whether the respondent was keeping a boat on their lot in breach of the by-laws.

A contravention notice was not given to the respondent about the boat, as the body corporate manager had inadvertently omitted from the contravention notice (which dealt with other breaches in dispute) the relevant by-law that had been breached.

The adjudicator observed that the body corporate had only given the respondent a letter

regarding the boat issue, which did not appear to be intended as a contravention notice.

Although the adjudicator accepted that the by-law had been breached, they determined that “the application in respect of the boat was not properly made” and that there was therefore “no jurisdiction to make an order in respect of the boat”.

Similarly, in Victoria Cove [2024] QBCCMCmr 17, the body corporate sought an order that all owners and occupiers of Lot 31 stop parking on common property.

However, the body corporate only named one co-owner as the respondent in the application form. The other co-owner and occupiers (family members) were only listed in the application as ‘affected persons.’

Also, a contravention notice was only sent to the two co-owners about the alleged by-law breach.

In the interests of natural justice, the adjudicator determined that they “can only contemplate making an order against the respondent named in the application”.

The adjudicator also observed that even if the body corporate intended to make the ‘affected persons’ respondents to the application, the application was not properly made, as the body corporate had not complied with the mandatory procedure for lodging an application to enforce the by-laws.

As demonstrated by the two cases above, it is prudent for bodies corporate to ensure that the contravention notice issued, matches the proposed application.

According to section 185(2) of the Act, an owner or occupier (the complainant) can lodge a dispute application to enforce the by-laws only if:

• the complainant has first asked the body corporate (using an approved BCCM Form 1) to give the accused person a contravention notice for the by-law breach that is the subject of the dispute; and

• within 14 days of receiving the BCCM Form 1, the body corporate does not advise the complainant that a contravention notice has been issued.

Unlike the optional BCCM Forms 10 and 11 that the body corporate can use for a contravention notice, BCCM Form 1, used by owners and occupiers to notify the body corporate of a by-law breach, is a prescribed form.

Owners and occupiers must be mindful that including

incorrect details on a BCCM Form 1 can obstruct a by-law enforcement application.

In Horizons [2023] QBCCMCmr 204, the applicant owner claimed that noise was caused by the respondent owner’s flooring not being properly soundproofed.

Although the applicant had given two approved forms to the body corporate, an accused person was not named in the forms –they only referred to “Unit 31”.

The approved forms also appeared to relate to breaches of the former occupier regarding noise and the behaviour of invitees, rather than the current dispute about the respondent owner’s flooring.

Consequently, the adjudicator determined that the applicant had not complied with section 185(2) of the Act, which requires the by-law breach identified in the BCCM Form 1 to be the subject of the dispute.

The above case serves as a reminder to owners and occupiers to be vigilant about checking information in the BCCM Form 1 matches their application before lodging it.

If the body corporate issues a contravention notice in response to a BCCM Form 1, it effectively blocks the owner or occupier from pursuing by-law enforcement directly against the accused person.

In the same matter of Horizons, the body corporate applied for conciliation against the respondent owner after issuing a contravention notice in relation to the flooring. As the issue was still unresolved after conciliation, the applicant owner lodged an adjudication application directly against the respondent owner.

It was determined that the body corporate had assumed responsibility for enforcing the alleged by-law breach by issuing a contravention notice.

The adjudicator remarked that even if the body corporate decided not to pursue enforcement further, this “does not then allow the applicant owner to take it upon herself to enforce the by-laws by lodging her own application against the respondent. This is

particularly so in circumstances where the applicant has not first issued the body corporate with an appropriate Form 1 for the alleged contraventions”.

Likewise, in Carefree [2019] QBCCMCmr 22, the adjudicator was unable to consider the by-law breaches alleged by the applicant owner, as the body corporate had already issued a contravention notice to the respondents.

Where the body corporate issues a contravention notice in response to a BCCM Form 1 from an owner or occupier, it is only open to that owner or occupier to lodge an application against the body corporate to enforce the by-laws.

Understandably, pursuing the body corporate is often viewed as a roundabout and uncertain way of dealing with breaches. The general preference of owners and occupiers is to tackle the breach directly with the accused person.

Therefore, where the body corporate has issued a contravention notice and does not intend to pursue the breach further, a possible solution may be for the owner or occupier to ask the body corporate to rescind the contravention notice.

When deciding whether to rescind the contravention notice, the body corporate and its committee are obliged to act reasonably under the Act. Rescinding the contravention notice would most likely clear the path for the owner or occupier who initially gave the BCCM Form 1 to pursue the accused person directly.

There is a common misconception that bodies corporate must issue a contravention notice after receiving a BCCM Form 1 from an owner or occupier – this is not the case.

Sections 182 and 183 of the Act expressly provide that if the body corporate ‘reasonably believes’ that an owner or occupier is breaching a by-law, the body corporate may give the person a contravention notice.

We strongly advise bodies corporate not to issue a contravention notice if they do not reasonably believe that a person is breaching the by-laws.

As discussed earlier, issuing a contravention notice means:

• the body corporate takes on responsibility for enforcement

• the owner or occupier who gave the BCCM Form 1 is prevented from pursuing the accused person directly (unless the body corporate rescinds the contravention notice).

It is also important to recognise that issuing a contravention notice does not automatically resolve the issue. On the contrary, issuing a contravention notice is the body corporate’s first formal step towards enforcing the by-laws.

In Marlin Cove [2008] QBCCMCmr 121, an application was lodged against the body corporate for failing to enforce a contravention notice regarding noise and the use of common property.

The body corporate issued a contravention notice due to a mistaken belief that that they were required to do so under the Act.

The adjudicator noted: “I find nothing in section 185 that requires the Body Corporate to issue a contravention notice just because a complainant asks them to. In fact I consider it inappropriate for the Body Corporate to issue a notice if they did not believe a breach had occurred or was likely to occur.”

The adjudicator ultimately voided the contravention notice, noting that this action “will leave the way open to the applicants to lodge an application directly against the Owner of Lot 43 if they wish”.

Likewise, in Calypso Bay Residential Land [2023] QBCCMCmr 317, an application was lodged against the body corporate for failing to enforce a contravention notice regarding the location of a clothesline.

The adjudicator determined that “the committee’s decision not to take further enforcement action… is a constructive withdrawal of the contravention notices”.

Therefore, the adjudicator considered the preliminary procedure in section 185(2)(b) of the Act to have “effectively been fulfilled”, clearing the path for the applicants to pursue the accused person directly in a future application.

It is apparent from the cases discussed in this article that the mandatory procedure for by-law enforcement has the potential to trip up applicants. In view of the considerable time and effort invested in the dispute application process, we understand that it would be vexing for non-compliance with preliminary procedure to negatively impact an application.

As discussed, the preliminary procedure that must be fulfilled differs depending on whether the applicant is the body corporate, or an owner or occupier. Therefore, bodies corporate, owners and occupiers must familiarise themselves with the relevant process before lodging an application.

We hope that highlighting the common pitfalls will help future applicants to steer clear of them.

By Trevor Rawnsley, CEO, ARAMA

There are new, complex and severe Federal Industrial Relations laws that have huge penalties for breaches. So, it’s vital that ARAMA members understand and comply with them.

Breaches of the regulations can incur a penalty of up to $96,000 per person, while that penalty is up to $900,000 for corporations. Unless ARAMA members make themselves fully aware of these new laws, they could fall foul of them.

Sadly, these new regulations, in many ways, pit employees against employers.

Even the name of the new laws, the Closing Loopholes Act 2023, implies that employers are shonks looking for loopholes to take advantage of their staff, when everyone in management and letting rights understands that a great working relationship between management and staff is the key to good customer service and a successful business.

The new regulations severely restrict casualisation, and the enforced disconnection between bosses and their staff. You are no longer allowed to contact your staff outside of their working hours.

Changes to the IR laws are real blows to small businesses, especially MLR. But if

Unless ARAMA members make themselves fully aware of these new laws, they could fall foul of them

bosses get them wrong, they could get fined heavily.

So, I urge all ARAMA members to study the webinar on our website relating to IR laws. It could save you an absolute fortune.

No one in small business is ever happy with more restrictions and more costs, but the growing restriction of casualisation and the right for employees to now disconnect outside their rostered hours puts employers in the MLR sectors in a very tough spot.

I consider the penalties attached to these laws as extreme and extraordinary, especially when you consider the reason that most people get them wrong is simply because the regulations are just so complicated.

The simplest way to go wrong with these laws in the management and lettings rights industry is to treat a worker like a contractor when they should be classified as an employee.

The laws imply that misclassifying staff as contractors rather than employees is a rort designed to save money so as to avoid paying

tax, workers compensation, superannuation and sick leave. This is far from the case.

The new legislation has not only considerably increased the quantum of fines but introduced the term “wage theft” AND made this a criminal offence which may result in jail time.

“Wage theft” is really an obscene term that is offensive to small business operators, most of whom are hard-working people relying on a good reputation to stay in business. It’s a term that is stacked against business operators.

“Wage theft” is never used to describe the other side of the equation – when a worker takes a sickie when they’re not really sick, or when a worker bludges on the job while getting paid a full wage. On August 26 this year the Federal Government made changes to the definition of casual employees. It said it would create pathways to full-time and part-time employment. Instead, it is creating a much more inflexible workplace for both worker and employer.

It also brought in the “right to disconnect”, meaning employees have the right to refuse to monitor, read or respond to contact from their employer outside of normal working hours.

These new laws can create real problems for residential managers.

Texting employees is often easier than giving them a phone call and sometimes in management rights, resident managers would organise group chats with their housekeeping team.

If someone called in sick, group chats were an easy way to let everyone know that the business needed someone to fill in for another staff member if there was someone free.

If employees decide not to acknowledge these messages, this will make staffing issues much harder for the employer.

Under the law reforms, repeated breaches of the Act by calling staff members on rostered days off may result in a $96,000 fine for an individual, when really there are many cases when staff would have been happy to pick up extra shifts if they were aware that was possible.

In MLR, casual shifts have been beneficial to both employee and employer, rather than a source of strife.

Even in important situations now such as end-of-day banking when you might have to check things with staff members you can get into trouble by contacting them out of work hours.

Most staff members I believe would be happy to be contacted, but if one staff member doesn’t want to cooperate or complains about being contacted that’s when problems begin – and they can be very expensive problems.

Disengagement will impact the work of a residential manager but what will impact it even more is the end of casualisation.

Residential managers would typically hire cleaners as

By Ben Ashworth, Senior Associate, Small Myers Hughes Lawyers

A common element of the quintessential management rights business model is the manager living in and owning a lot in the complex.

For some complexes, the extra services that the owners receive from an onsite manager can be the deciding factor in why there is an onsite manager at all, as opposed to simply using a handful of contractors engaged for specific tasks.

In most circumstances, the obligation for a manager to own a lot or live in the complex is stated as a duty in the caretaking agreement between

contractors but now that they don't have a choice on this, if they’re not hiring a cleaning company then they have to hire cleaners as employees.

Some workers prefer the flexibility of being treated as a casual worker. They may only want to do a few hours here and there or they may want more hours depending on their own personal circumstances. They would understand that they might have to work Friday, Saturday and Sunday one week, but if they could get a few days off the next week or the one after that, they felt that was a fair

the manager and the body corporate. The exact nature of the obligation can vary, but will generally fall into one of three scenarios. Either: the manager must own a lot and live in it; the manager must own a lot and someone performing the caretaking duties must live in it; or someone associated with the manager must own a lot and someone performing the caretaking duties must live in it.

In an ideal situation where a manager owns a lot in the complex, the by-laws for the complex will also include special rights that att ach to that lot. These types of by-laws can provide an extra layer of protection for the manager’s business and prevent competition from other owners and occupiers within the complex.

For a variety of reasons, it is becoming more common for complexes to have an external manager who does not own a lot or live in the complex. As property values have increased over the years the value of the manager’s lot can be disproportionate to the value of the management rights business. This has resulted in situations where it can be unaff ordable for

thing so long as you let them know what the roster looked like a week or two in advance.

Previously if things got busy the boss might ask staff to stay on for a few extra hours or “we need someone to come in tomorrow but don't worry about it next week because we're covered”.

So, both employers and employees could be flexible depending on demand. Bosses can't do that anymore.

After 12 months, workers must be placed on a permanent roster and that permanent roster must have the same hours every week.

the manager to own a lot in the complex and this can make it very hard to sell the management rights business.

Although a complex may have started its life with a live in manager, it does not mean that it must have a live in manager forever after.

If you are a manager and wish to restructure your management rights business so that you do not own or live in a lot in your complex, here is a list of things you will need to consider:

• What rights and special advantages will you lose if you no longer live in the complex?

• Will the majority of the owners in your complex agree with you no longer living in the complex?

• Do your agreements with the body corporate need to be amended to allow you to live off site?

• Does the remuneration you receive for caretaking the complex include payment for afterhours services?

• Do your by-laws need to be amended to ensure that the manager

It makes it inflexible for both the employee and the employer in MLR where things have to be flexible depending on the needs of the individual staff members, the customers and the seasons.

The entire Industrial Relations framework has evolved steadily in favour of workers at the expense of business over the last few years, and there are more dramatic changes coming from the beginning of 2025.

But ARAMA has good news for you. The ARAMA website contains important information to help you navigate these changes. Plus, our recently conducted educational

retains exclusive rights regardless of where the manager lives?

• Do your by-laws need to be amended to ensure that you aren’t accidentally giving special rights to the new owners of your lot when you sell it?

Ultimately your ability to restructure your business and become a manager who doesn’t live in the complex will come down to the opinion of the majority of the owners. You will need owners to agree that the complex doesn’t need a live in manager and/or that the level of service the owners will receive will not go down if the manager no longer lives in the complex.

If you are considering going through this process speak to your lawyer sooner rather than later as the process requires a general meeting of the body corporate and usually will take at least two months to complete.

Liability limited by a scheme approved under Professional Standards Legislation.

Disclaimer – This article is provided for information purposes only and should not be regarded as legal advice.

webinar called “Industry Impacts of IR Reforms” can really help members to understand the updated IR laws. This information is available exclusively to ARAMA members via our website. www.arama.com.au

It’s a good starting point to help members avoid the risks involved in these complex IR laws. Members are, however, encouraged to engage with an expert in workplace relations. Failing to do so can be extremely expensive with penalties of up to $96,000 for bosses up to $900,000 for corporations or maybe even jail time.

By Sarah Davison, Industry Reporter

Glen Eden Beach Resort's management team was named the Resort Management Team of the Year at this year’s ARAMA TOP Awards.

“It was an incredible honour,” owner and director Hamish Watts said. “This award is a testament to the hard work, dedication, and passion that our team brings to Glen Eden Beach Resort every day. It’s truly rewarding to see our efforts acknowledged in this way, and it motivates us to continue striving for excellence.”

Hamish’s journey began over three decades ago as an apprentice chef at Tattersalls Club in Brisbane. His hospitality career eventually led to managerial roles in the Caribbean and the Asia Pacific region, however when the opportunity arose to take over the management rights at Glen Eden Beach Resort, he knew it was the perfect next step.

“Returning to the Sunshine Coast has been a fantastic experience, allowing me to apply my extensive background in a more intimate, community-focused setting.”

Among the many highlights of his time at Glen Eden, Hamish said he was particularly proud of the successful restoration of the original paved driveway. However, Hamish’s success has not come without challenges. Navigating the ever-changing tourism industry and the increasing focus on sustainability has required innovation and adaptability.

“The shift towards ecotourism has been both a challenge and an opportunity, pushing us to continually evolve our practices to meet the growing expectations of environmentally conscious

travellers,” Hamish said. As for advice for others looking to enter the management rights industry, he had some words of wisdom to share.

“Building strong relationships with your team and guests is key to long-term success.

Stay adaptable, keep an open mind, and most importantly, never lose sight of the guest experience.”

At the heart of any thriving MLR business lies a genuine passion for community. For Stuart and Nicole Morris from Azure Sea Whitsunday Resort Airlie Beach, this passion is the cornerstone of their success at the ARAMA TOP Awards. Taking home the award for Resident Managers

of the Year, Short-Term Stay, Nicole and Stuart said looking after the guests was the most rewarding aspect of the job.

“We love the guests. They come happy, ready for a holiday, and when they leave happy as well, it’s the best feeling.”

The couple's commitment extends beyond the basics of hospitality, with Azure Sea Whitsunday Resort Airlie Beach greeting guests with a personalised welcome letter.

As their welcome letter states:

“There are no strangers, just friends you have not met yet.”

Stuart and Nicole’s approach is also reflected in their community involvement.

“We are very conscientious individuals. We desire to make a difference,” they shared. “We proudly consider ourselves integral members of the vibrant Azure Sea community. Through our exclusive monthly newsletter, we actively engage our community members, fostering a strong sense of belonging and connection.

“We believe that this not only creates a profound sense of unity within our community but also leaves a lasting impact on our visitors.”

This year, Maree and Ian achieved an extraordinary mileston – winning awards for both Resident Manager of the Year, Long Stay, and Building Managers of the Year.

This year marked the third year in a row that the couple took home the award for Resident Manager of the Year.

“It was lovely to receive the award again. However, we certainly did not expect to

be nominated and receive the Building Manager of the Year award. This was a complete shock. To win both was amazing,” Maree told Resort News

The past year presented unique challenges, making the recognition even more meaningful.

“The last 12 months have been the most challenging, taking on an off-the-plan complex. We now have 70 new properties and have hired two

employees,” Maree said. The couple’s journey in the MLR industry began in March 2020, managing 150 townhouses across Hidden Grove and Vista on Brays. Reflecting on the “crazy” early days, Maree recalls: “Even though I knew how to manage properties, I was certainly not experienced in running a business.”

They had to manage difficult tenants but as they moved on, they began to reap rewards and receive positive recognition from the wider community.

“Receiving thanks from the excellent tenants who remained was the rewarding part. This is why we do this job and why it makes the battles worth it.”

This experience led Ian and Maree to set high standards from the outset.

Maree explained: “Expectations are clear from the beginning: we provide safety, community, and a sense of respect in the complex.”

When it was announced that Mike, a life member of ARAMA and key figure in the management rights industry, had won the Service Provider of the Year TOP Award for MLR Services, he said he felt "very humbled".

“It’s a very prestigious award and one I have cherished,” he said. “I cannot believe the calls and best wishes I have had since the award. I am always proud of being an ARAMA member and appreciate all that our organisation achieves.”

With nearly 30 years of experience, Mike remains deeply involved in MLR and continues to give back. Known for his practical, no-nonsense advice, he has owned several MR businesses and navigated the industry's complexities, including caretaking agreements and disputes.

Born in Brisbane in 1951, Mike’s career began in retail with Grace Brothers before moving into finance with AGC, where he became WA state manager. In 1991, he and his wife, Sue, purchased their first MR business, Biarritz Surfers Paradise on the Gold Coast, later acquiring the Riverside Hotel in Brisbane’s South Bank, which they still own today.

Beyond running MR businesses, Mike founded MLR Services, assisting building managers, committees and bodies corporate with dispute resolution. His deep understanding of the Australian Building Management Accreditation (ABMA) code and mediation skills make him a soughtafter industry consultant.

A long-standing ARAMA member and former Brisbane president, Mike is dedicated to safeguarding MLR legislation. He also serves on the ABMA independent review panel, ensuring the maintenance of industry standards.

Mike’s "10 Commandments" for management rights guide his work, with his final rule especially relevant today: “The road to success is always under construction.”

By Roland Franz, General Manager, Body Corporate Headquarters Strata Consulting Services (Qld)

Strata management is an essential service for many property owners, ensuring that buildings and communities are well-maintained and compliant with regulations. However, one aspect that often causes friction between strata managers and property owners is the issue of additional service charges and commissions.

Additional services and applicable charges, which are above and beyond the core services included in the strata management agreement as included services, can be a source of frustration and confusion. This article explores the necessity of these additional charges, the challenges they present, and potential strategies to reduce, limit, or remove them altogether.

Strata management agreements typically cover a range of core services, such as administrative tasks, financial management, and maintenance coordination. However, every strata community is different, with its own set of circumstances and needs that may require services beyond the standard agreement. These additional services can include emergency repairs, legal consultations, contractor engagement, quote requests, work orders, attending to compliance obligations, by-law reviews and enforcement, major works, special projects and; the list goes on.

It is unreasonable to expect that these additional services would not incur extra fees. Just as in other service industries, unforeseen or requested additional work comes at an additional cost. For example, if you hire a contractor or service professional to undertake a certain task or scope of work and then change or increase the scope of work requested, you expect to pay more. Similarly, if a strata community requires extra services, it is fair that these are provided at an additional cost applicable to the work performed.

Despite the logical basis for additional service charges, many committees and owners feel blindsided by these costs. This often stems from a lack of transparency and communication from strata management firms. These firms may appear to be reluctant to discuss additional services and their associated costs upfront, as these are typically stated in their agreements, and it may not occur to them that there is a need to justify the cost for additional work requested or performed.

However, this lack of communication can lead to misunderstandings and frustration when unexpected bills arrive. Apart from a lack of service delivery due to fluctuating workloads at a specific time requiring prioritisation over other tasks, additional service costs is a significant factor that can erode an otherwise harmonious relationship with your strata manager.

It is common practice for strata managers to be compensated for additional work performed based on a percentage of the revenue received by the company. This commission-based structure helps keep base salaries lower, whilst remunerating the person directly undertaking the additional work. This remuneration structure permits the strata management firm to lower the fixed fees and be more competitive in the market.

There is a risk with discretionary charging for additional services. While many strata managers don’t charge for many additional services that could be charged under their agreements, others are less accommodating as a result of financial pressure born by lower administration fees.

A cynic would also suggest that there is an opportunity for incentivised payments for work performed to be abused. However, it is my experience that most strata managers are more likely to suggest ways of reducing costs and the potential for additional charges being incurred.

To understand the dynamics of additional service charges in strata management, it is helpful to look at other service industries. In healthcare, for example, patients often pay a base fee for a consultation, but additional tests, treatments, or specialist consultations incur extra costs.

Similarly, in the insurance industry, different levels of cover come with corresponding premiums, and additional services or claims can lead to higher charges. These industries illustrate that it is standard practice to charge for additional services. The key difference is that these charges are often more transparent and better communicated to the customer, reducing the likelihood of surprise bills.

Given the challenges associated with additional service charges, what can strata communities and management firms do to address the issue?

1. Transparency and communication: Strata management firms should prioritise clear communication about potential additional services and their costs. This includes providing detailed estimates and obtaining approval from the committee before proceeding with any extra work.

2. All-inclusive packages: Some progressive companies are now offering all-inclusive packages or bespoke strata services. These packages come with a higher base fee but cover a broader range of services, reducing the likelihood of additional charges. This approach is similar to comprehensive insurance policies that cover a wide array of potential needs.

3. Regular reviews: Committees should regularly review their strata management agreements, and the services provided. Regularly reviewing the scheme's financials can help identify any unnecessary or unauthorised additional charges and ensure that the community is only paying for what it truly needs, and additional services that have been approved either within the strata managers agreement or by instruction from the committee.

4. Competitive tendering: When selecting a strata management firm, committees should consider multiple proposals and compare the scope of services and fee structures. This competitive process can help identify firms that offer better value for money and more transparent pricing.

5. Education and training: Providing education and training for committee members can empower them to better understand the strata management process and the necessity of certain additional services. This knowledge can lead to more informed decisionmaking and better oversight of the scheme’s finances.

What might the

The strata management industry is evolving, and the issue of additional service charges and commissions is driving some of this change. As owners and committees become more

frustrated with unexpected costs, there is a growing demand for more transparent and predictable fee structures. The move towards all-inclusive packages or bespoke services is one potential solution. By offering a higher base fee that covers a wider range of services, strata management firms can provide more certainty and reduce the likelihood of additional charges. This approach mirrors trends in other industries, such as healthcare and insurance, where comprehensive coverage is offered at a higher premium.

Another potential future direction is the increased use of technology to streamline strata management processes and reduce costs. Automated systems for maintenance requests, financial management, and communication can help lower the overall cost of management, potentially reducing the need for additional service charges.

The issue of additional service charges and commissions in strata management is a complex and often contentious one. While these charges are necessary to cover the unique needs of each strata community, the lack of transparency and communication can lead to frustration and mistrust. By adopting strategies such as all-inclusive packages, regular reviews, and better communication, strata management firms can address these concerns and provide more predictable and fair pricing for their services.

As the industry continues to

evolve, it is likely that we will see more innovative approaches to strata management remuneration, with a focus on transparency, predictability, and value for money. Whether through comprehensive service packages or the use of technology, the goal should be to create a more equitable and sustainable model for both strata managers and the communities they serve.

The experience (outcome) directly reflects the quality of the decision

Whether your strata community seeks a lower cost agreement with a higher probability of additional service costs, a bespoke service that limits, controls or removes the likelihood of additional service costs or a fixed (all inclusive) agreement with your strata management company, it is fundamental that the fixed cost for the included services will directly reflect the service delivery and contracted inclusions.

“Don’t be penny wise and pound foolish” when selecting your strata management firm.

Making informed decisions by understanding strata management agreements and the potential for additional services and applicable cost, will ensure that your strata community can avoid nasty surprises or hidden costs that could eventually tarnish the ongoing relationship with your strata manager and continuity of management for the scheme.

Suggested topics for future comment are welcome contact via editor@resortnews.com.au

By Ben Seccombe, Partner, Mahoneys

In a win for the management rights and strata industry, Mahoneys, supported by the Australian Resident Accommodation Manager's Association (ARAMA) and EBM Insurance, has successfully defeated a challenge to the validity of extending caretaking agreements.

In recent years, it has been suggested by some practitioners in the industry that caretaking agreements can only be extended ("topped up") once and never for a term exceeding the maximum allowed in aggregate.

To illustrate the potential consequences of the "one-time top-up" misconception, consider the following scenario: A caretaking agreement is initially entered into for a five-year term. This is subsequently extended by another five years. Under the incorrect understanding of a single, cumulative "top-up,"

this agreement could not be further extended, even if it had less than 10 years remaining.

While Mahoneys did not consider there to be any merit to the "one-time top-up" myth, there had not previously been an opportunity to obtain a ruling on this issue from an adjudicator.

The Adjudicator's Order, Atlantis West [2024] QBCCMCmr 340, finally puts any uncertainty to bed, in that the adjudicator clarified the position that caretaking agreements can be extended any number of times, provided the cumulative term does not exceed the maximum term permitted under the module and the individual extensions do not exceed five years.

The application was filed by an owner in the Atlantis West community titles scheme who sought a declaration that the body corporate's resolution to extend the existing caretaking agreement was invalid. He argued that the extension exceeded the statutory term limit for such agreements and was therefore unreasonable.

The crux of the matter lies in the interpretation of Sections 140 and 141 of the Standard Module, which governs the term limit of service contracts and letting authorisations, respectively.

The applicant argued that the module restricts the number of times a caretaking agreement can be "topped up," or extended.

The applicant further claimed that the body corporate failed to obtain legal advice before approving the extension, which he deemed unreasonable.

The adjudicator, however, dismissed the application, upholding the body corporate's decision to extend the caretaking agreement. He concluded that Section 140(2) of the Standard Module allows for multiple extensions as long as the total term does not exceed 10 years at any given point in time (the maximum permitted under that module), and the extensions do not exceed five years in length.

This interpretation is consistent with the “orthodox construction" of the provision, which prioritises the text of the statute over extrinsic materials.

The significance of this decision cannot be overstated. Had the adjudicator ruled in favour of the applicant, the ramifications for management rights holders and bodies corporate would have been substantial and costly as most agreements have been extended more than once, or their aggregate terms have exceeded the maximum allowed under the relevant regulation module.

A ruling in favour of the applicant would have created significant uncertainty and legal challenges for management rights holders, potentially leading to the termination of their agreements and significant financial losses. It is also an excellent result for our caretaker client, whose pending sale had been delayed while this issue progressed through the dispute resolution process.

The Adjudicator's Order also serves as a timely reminder to bodies corporate and owners that, while it is advisable to

obtain legal advice before approving any significant amendments to caretaking agreements, a decision to extend the term of such agreements is not necessarily unreasonable or illegal. The critical factor is whether the proposed extension adheres to the statutory term limits and procedural requirements outlined in the relevant module.

Mahoneys would like to recognise ARAMA and EBM Insurance for their support in relation to this matter. Their commitment to supporting management rights owners is invaluable and greatly appreciated.

This case serves as a powerful reminder for management rights operators of the role ARAMA plays in supporting the industry and the specialist insurance provided by EBM Insurance (via the A-Legal Insurance Membership Benefits exclusive to ARAMA members).

Mahoneys team was led by industry commercial litigator Ben Seccombe. He was supported by Gavin Handran KC and Mitchell Downes. Their status as barristers practising in body corporate law is widely recognised, and their expertise was instrumental in navigating the complexities of this dispute and the excellent outcome achieved for our client and the industry.

UPDATE: The applicant has appealed the Adjudicators decision. Mahoneys will provide an update after the appeal has been heard and ruled on.

Anyone involved in the accommodation industry enjoys hearing stories of high occupancy rates being achieved. So when considering a motel investment, occupancy rate seems like a logical question to ask.

The perception is that it reflects how well the business is performing. But how important is the occupancy rate for this assessment? Does it paint the real picture, or can it lead to an inaccurate determination of the motel’s actual performance?

In a recent article of mine, occupancy rates were outlined as one of the few useful tools to make a quick early assessment of the reliability of a motel’s revenue, along with other pieces of information for the calculation. That was for a quick assessment though, not a complete determination. It does form a part of the puzzle, but can also lead to inaccuracy if not considered with the other parts of that puzzle. Many people do not ask early on about occupancy rates as it is not high on their agenda as far as making a complete assessment of the overall business. Why would this be?

I have heard commentary very recently, but it also dates to as early as 1995 when I first started in the industry, where I was hearing, “it’s the best motel in

The number of cars in the car park does not tell the full story

town, the carpark is always full” because it ran at an occupancy rate more than 90 percent. My inexperience at the time caused me to believe a lot of things I was told that I absolutely would not believe today. I wondered how this could be the “best”, as its presentation was less than good, to be polite. In discussions with the owners about offering that business to the market, I perused the financial statements. It did not take long to work out that the motel ran at a very high occupancy of over 90 percent, confirming the rumours. Thereafter, it became evident that the average tariff the motel was achieving was approximately 30 percent below similar motels in the area. Others were averaging occupancy rates of 65 percent with a room rate 30 percent higher. It was clear that by underselling the product, they were able to sell more rooms. Therefore, the badge of honour of being ‘the best motel in town’ was a façade. Just because the carpark was full every night, it was not the result of ‘good business practices’. Below is a very simplified table showing the effect of a higher occupancy rate with a reduced average nightly tariff.

Note the numbers will vary with individual motel businesses and required assumptions. All amounts exclude GST. The cost to rent a unit does not account for rent or loan repayments. Fixed costs are not a reflection of any particular motel or location and will vary depending on each.

The cost to operate Motel A at 90 percent occupancy compared to Motel B at 65 percent and Motel C at 40 percent is high. The two types of expenses –fixed costs and variable costs – can help to explain this. Some of the fixed costs of renting a room may include property rates, insurance, accounting fees, and rent (in the case of a lease). These fixed costs will always remain and will not vary whether a room is rented or not.

However, the variable costs will increase the more times a room is rented. This is where Motel A does not look all that good, by discounting room rates. Some of the variable costs of renting a room may include electricity, linen, repair and maintenance (which will be very high at 90 percent), and wages. There is a compounding effect, with the increased number of rooms rented multiplied by

the variable cost to rent those rooms, all at lower than market room rates. This table has not allowed for a possibly higher variable cost than the other motels, particularly regarding repair and maintenance costs growing as a result.

The table shows that Motels B and C are far more profitable and therefore more successful accommodation operations with superior profit margins. A higher tariff and lower occupancy (within reason) is preferred in sustaining a strong underlying business as opposed to relying on a budget driven clientele that will move to the next motel if they discount their rates as well. Under selling the product to this market does not create a loyal, returning client base.

The situation for Motel C’s occupancy rate at the nightly tariff was only 40 percent, indicating that their nightly room rate was probably too high, and not meeting the market at the opposite end of the scale. This is on the proviso that the motel’s competitors are trading at higher occupancy rates. Looking at the profit, though, it would seem the result is still very good.

Motel A may be turning each room over almost every night at 90 percent occupancy and appearing on the outside to be the more successful, however the number of cars in the car park does not tell the full story and has little bearing on whether the motel is a strong and sustainable business.

By Lel Parnis, Principal, Holmans

The thresholds for depreciation limits have changed over recent years. There were no immediate write-off limits for the 2023 financial year, allowing for a more substantial immediate deduction. The recent changes to depreciation rules, such as the reduction of the immediate asset write-off thresholds to $20,000 for the 2024 financial year onward, mean that deductions for new vehicles (and other assets) are less favourable than before.

If you purchase a new vehicle that is above the $20,000 threshold and you have turnover of less than $10 million, the vehicle will

now have to be depreciated over several years or added into the small business depreciation pool. The small business depreciation pool allows you to depreciate the asset at 15 percent for the first year, and 30 percent thereafter. Once the pool written down value is below $20,000, you can write off the pool and claim the balance as a tax deduction. Adding the vehicle to the small business pool is much more tax effective than depreciating the asset over its effective life.

Example:

See below a calculation which shows it is a much larger tax deduction by allocating the asset to the small business pool vs depreciation of the asset over its effective life:

When a vehicle is sold and there is a closing written down value (WDV), the transaction impacts both the depreciation calculations and taxable income. The WDV represents the vehicle’s remaining value for tax purposes after previous depreciation deductions have been claimed. If the sale price of the vehicle exceeds the WDV (i.e. profit), the difference is treated as a taxable income. In contrast, if the vehicle is sold at a loss, then the difference can generally be claimed as a deduction which reduces your taxable income.

Due to the previous small business immediate asset write off rules, a lot of small businesses made use of the temporary full expensing method, purchased vehicles (and other assets) and fully depreciated these for tax purposes and received a tax deduction for the full amount. Once a vehicle is fully depreciated, its taxwritten-down value is nil. Once you sell a vehicle which has been fully depreciated for tax purposes, the sale proceeds will be added to your taxable income, leading to a potential tax liability in the year of sale.

Example:

• If the vehicle was fully depreciated and you sell the vehicle for $20,000, that

$20,000 will be included in your taxable income, increasing your overall tax obligation for that year.

• If the vehicle was not fully depreciated and had a WDV of $15,000, and you sell the vehicle for $20,000, that $5,000 will be included in your taxable income.

Note if you are registered for GST, you generally have to account for GST when you dispose of a motor vehicle.

If you are looking at selling a vehicle that has been fully depreciated, it is important to be aware of the potential tax consequences.

For the 2024-25 financial year, the car limit is $69,674. This means if you purchase a car for business purposes, the maximum value you can use to calculate the depreciation and GST credits is $69,674, even if the car costs more. Any amount above this limit cannot be depreciated or claimed as a tax deduction.

For luxury or high-cost vehicles, this can significantly limit the tax benefits that would otherwise apply, making the purchase less tax-effective.

Further, if a vehicle is subject to Fringe Benefits Tax (FBT), the full original cost, including any amount over the luxury limit, is used as the FBT cost base. Deemed depreciation is then applied to calculate FBT reimbursements, representing the reduction in the vehicle's value over time. For high-cost or luxury cars, the deemed depreciation may be higher, which can lead to a less tax-effective reimbursement. This is because the substantial original cost combined with significant depreciation can increase the overall FBT liability,

By Kelley Rigby, Managing Director, Lett s Group

“Kelley,

I need your help! I just received an email from an owner saying they’re taking their investment to another agency. What do I do?”

I have to admit that I receive calls like this more frequently than I would like. These conversations truly break my heart, as I can hear the distress in the voice of the manager on the other end. My initial question is always about the strength of their relationship with that owner. More often than I care to admit, the response is, “Well, I haven’t really spoken to them in a while, but I always send their reports on time.” My reply, as difficult as it is to say, is: “Well, that really isn’t good enough.”

potentially diminishing the tax benefits of providing the vehicle.

If the vehicle is used for both business and private purposes, the tax deductions you can claim for depreciation will need to be adjusted to reflect the proportion of private use. Only the business use percentage will be deductible, which may reduce the overall tax benefit of purchasing the vehicle in the business’s name.

Example:

It is indeed much more challenging to regain someone's business and trust than to retain it in the first place. When you acquire your management rights, you essentially pay thousands of dollars for the privilege of looking after an investor's property. Therefore, one of your top priorities should be to keep them happier than a pig in …. Well you know.

Let’s explore how to prevent these distressing phone calls from occurring in the first place. Grab a pen and prepare to take some notes; these strategies will help you build solid and loyal relationships with your investors.

First, export your list of investors and highlight five names each morning. Make it a priority to call these investors to introduce yourself or to touch base and strengthen your relationship. Ensure you have a good understanding of their unit before making the call.

Remember: Prior preparation prevents poor performance.

Review previous reports, research the tenants, and be prepared to answer any questions they may have. During the conversation, jot down any notes so that you

• If the vehicle is used 60 percent for business and 40 percent for private purposes, only 60 percent of the depreciation and related expenses (such as fuel, maintenance, and insurance) will be deductible.

If the vehicle is owned by the business, it's also important to keep in mind that any private use of a business vehicle may trigger FBT obligations, further reducing the tax effectiveness of the purchase.

Purchasing a vehicle in the business’s name may seem like a good strategy to maximise tax deductions, but if the vehicle is not predominantly used for business purposes,

can refer back to them next time you chat. This outreach should happen at least quarterly, if not more frequently.

In addition to these regular check-ins, it’s crucial to keep the lines of communication open in between. For instance, let’s say a tenant comes into your office on a Friday afternoon about a leaking tap. If you take the initiative to fix the issue right away, don’t let that act go unnoticed. Later that evening, perhaps around 5 pm., send a quick email to the owner explaining what occurred and how you resolved the problem immediately. Investors cannot appreciate your value unless you communicate it to them. Be proactive in informing them about the little things you do, which an outside agent wouldn’t, or more importantly, couldn’t do.

Here are my two top tips to help ensure that you will never have to make that desperate phone call to me:

1. Build relationships: Get to know your investors personally. Understand their expectations and strive to exceed them. Remember, you paid a significant amount of money for their

the overall tax effectiveness should be carefully considered.

In particular:

• Depreciation limitations: If the vehicle is used more for private purposes, the depreciation deductions will be significantly limited.

• FBT implications: As mentioned, substantial private use can result in an FBT liability, which can offset any tax savings from claiming depreciation and running costs.

• GST credits: If the business is registered for GST, you may be able to claim GST credits on the purchase of the vehicle, but only to the

business, but that does not entitle you to it forever. You must continually work hard to maintain their trust and satisfaction.

2. Communicate your efforts: Whenever you go above and beyond, no matter how small the task may seem, make sure to inform your investors. They cannot read your mind or know about all the fantastic things you do unless you share that information. Be proactive in showcasing yourself and your business; this will help solidify those important relationships.

Retaining your investors is far more manageable than regaining them after a loss. Investing time and effort into fostering strong relationships, being proactive in communication, and consistently exceeding expectations will ultimately pay off. By focusing on these strategies, you can not only prevent those heart-wrenching calls but also create a thriving partnership that benefits both you and your investors for years to come. Remember, a little effort can go a long way in the world of management rights.

extent that the vehicle is used for business purposes. If private use is substantial, the GST credit will be proportionately reduced.

In cases where the vehicle is not predominantly used for business purposes, purchasing in a personal capacity and using it for some business purposes (with appropriate recordkeeping like a valid logbook) might prove more tax efficient. Ultimately, a thorough analysis of the vehicle’s usage and the associated tax implications should guide your decision. Always consult with a tax professional to ensure you make the most tax-effective choice for your situation.

By Mike Phipps, Mike Phipps Finance

– Ferris Bueller during his day off.

“Life moves pretty fast. If you don’t stop and look around, you could miss it.”

“Time is on my side, yes it is.”

– Jagger and Richards years before it became apparent that, in Keith’s case and against all odds, the lyric was indeed prophetic.

We get our timing right, have the time of our lives, sing in time, run out of time, do time… hell, some people even two time which can lead to a time out. Talk about poor timing. But time is money and time waits for no one, two lessons the aforementioned two-timer will no doubt learn.

Time. Surely the greatest invisible force in our lives and the most prevailing influencer. For me, the great mystery is that time foretells our arrival and departure from this life, ticking toward the inevitable end and yet we mostly fail to appreciate its essence. The choices we make and the lives we lead are all measured in time. Time to bed, time to

rise, hours at work, birthdays, wedding anniversaries, car registration dates and perhaps most importantly, our priorities.

I’ve written about this before, but I think time is such an integral part of our existence it’s worth revisiting afresh. either that or my advancing years are making me paranoid regarding the inevitable end of my time.

It’s our priorities and the challenges in managing them that has spawned the many time management tomes, courses, gurus and associated seminars that exist today. But I have a

Expectations are higher, demands are tougher, and as a result, preparation is more crucial than ever

small problem with all this. Time can’t, of itself, be managed. The clock marches on regardless of your circumstances, plans and priorities. It’s a bit like money, which I’ve long argued is, of itself, worthless. It’s only what you can do with it that counts and so it is with time.

When we say we don’t have time to do something, the fact is that unless a bus is about to run over us, we do have time. We just choose to do something else with it. Time management is really task and outcome management which

are skills that can be mastered. Effective business operators know this and develop habits to maximise positive outcomes and future-proof themselves from heart attacks and stress.

As an eternal procrastinator, I’ve spent a good chunk of my time on earth thus far observing and trying to adopt the best practices of my clients and colleagues. I’ve even thought about buying a self-help book for procrastinators, but I can’t decide which one.

In no particular order here are some things I’ve learnt…

Attack the most dreaded task first. Human nature will put off stuff we don’t want to do. It has been so since cavemen preferred to dabble in a bit of rock art and cuddle his cave lady rather than hunt down a sabre-toothed tiger for a feed. Get the tiger hunt out of the way and the cave cuddles will be that much more enjoyable.

Leave time and mental energy for emergencies. Surprises happen. We can’t control them, that’s why they are called surprises. We can control how we react of course. I don’t recommend the spitting of dummies or removal of toys from cots, albeit I’m guilty of both. The MD tells me to grow up which rarely achieves the desired result, but I digress.

In my experience and on the very rare occasion when I react maturely to urgent surprises, it’s best to drop everything, spend all energy addressing the issue and then return to the task at hand. You’ll lose some momentum for sure but maybe little emotional energy. I suspect you’ll also feel good about yourself and there’s not much that’s more important than that.

Prioritise importance. A fun job is not necessarily a priority. The natural enemy of the terminally disorganised procrastinator, the enjoyable noncritical task lies waiting like a tempting dry white at a mid-week lunch. You know you’ll enjoy it but once it’s over the real work needs to begin. Have fun for sure but know that the heavy lifting awaits.

Use “to do” lists, they work. Of course, the managing director is the exception and likes to leave all relevant items and documents on full display as her reminder “to do” system. It works for her but for most people a crowded and untidy desk or workplace leads to a crowded and untidy mind where every task is in full view and crying for attention. Better to have a little list and enjoy the satisfaction of ticking off jobs as they are completed.

The “to do” regimen requires an organised filing system, either real or virtual, and a one job at time approach. This takes real discipline but make no mistake, you can’t do two jobs at once and complete either effectively. In trying I can guarantee increased levels of stress and sub optimal outcomes.

If “to do” stress is the goal, I recommend an international flight with the MD and an airline that runs out of champers, at which stage the list becomes quite focused, reduced in fact to life and death primeval urges … find a chilled bottle of Moet or a parachute and jump.

I jest, but here’s the thing. Some people thrive on stress and perform amazingly when time is running out or outcomes are deadly serious. If you are one of the few, bless you. Please become an ambo or emergency room doctor (or, God forbid, a lawyer). For the rest of us, a methodical approach with appropriate time frames and deadlines allocated is recommended.

Know when your brain is at its best. For me it’s nearly always after a very long liquid lunch at which point I am miraculously transformed and able to solve every issue, challenge, and task on my horizon. More often than not my dining companions agree most vigorously with my suggestions and usually add value by offering their own.

Sadly, these visions desert me while sleeping and by the next morning there is little recall. Requests to colleagues for a summary of discussions go unanswered as they display similar signs of amnesia.

But seriously, some people work well in the early hours and some in the evening. Very few hit their straps immediately after lunch and almost no one is effective at the end of a 12-hour day with no breaks. My own experience suggests that exercise unlocks capacity to complete complicated tasks almost like a wonder drug. Not as good as real drugs of course, but beggars can’t be choosers.

We are all busy, so it takes a bit of discipline to walk away from the “to do” list and go for a swim, a walk or a ride. I reckon not only do you return to the job at hand with a refreshed mindset, but often the problem task comes into sharp focus during exercise. I think I’ve solved way more problems in the middle of some form of vigorous exercise than I have sitting at my desk. Get your minds out of the gutter you lot!!

So that’s it. Hard tasks first. One job at a time. To do lists. Exercise. Reasoned approaches to emergencies.

And if all else fails, may I strongly recommend the long lunch. It will solve nothing, but you won’t care.

BTW… I usually try and find a sage and life changing quote to end articles like this. In the case of time, there are just too many great ones to choose. Instead, I thought I’d share this medical quote regarding the outcomes of exercise.

“Endorphins are chemicals (hormones) your body releases when it feels pain or stress. They're released during pleasurable activities such as exercise, massage, eating, and sex too. Endorphins help relieve pain, reduce stress and improve your sense of well-being”

I will leave it to you, dear readers, to create your “to do” list as you wish.

BTW #2… if you are old enough you will know why this article is titled as it is.

By Mike O’Farrell, MLR Services

I would like to mention the hot topic of ‘Top Ups’