P. 24

Staying Sharp Behind the Wheel

P. 34

Investing With Purpose

A NARFE PUBLICATION FOR FEDERAL EMPLOYEES AND RETIREES June/July 2023 VOLUME 99 ★ NUMBER 5

Applicable to all discounts: Residents under a Life Care Agreement are not eligible for the discounts. These discounts do not apply to any room, board or services which are paid for all or in part by any state or federally funded program. Discounts are available to members and their family members, including spouse, adult children, siblings, parents, grandparents, and corresponding in-law or step adult children, siblings, parents, and grandparents through current spouse. Subject to availability. Further restrictions may apply.

*Discount is only applicable to new residents of a Brookdale independent living, assisted living, or memory care community admitting under an executed residency agreement. Discount applies only to the monthly fee/basic service rate, excluding care costs and other fees and is calculated based on the initial monthly fee/basic service rate.

**Discount is only applicable to new clients of personal assistance services by a Brookdale agency under an executed service agreement.

***Discount is only applicable to new residents of a Brookdale assisted living or memory care community admitting under an executed respite agreement. Discount applies to the daily rate.

brookdale.com A great m e for NARFE members Experience a senior living lifestyle that features restaurant-style dining, housekeeping, 712925 HVS monthly fee/basic service rate* 7.5 OFF SENIOR LIVING: % OFF 10 service rate** % IN-HOME SERVICES: DISCOUNTED RATES VARY BY COMMUNITY*** SHORT-TERM STAY: For more information, call (866) 787-9775 or visit brookdale.com/NARFE. ©2022 Brookdale Senior Living Inc. All rights reserved. BROOKDALE SENIOR LIVING is a registered trademark of Brookdale Senior Living Inc.

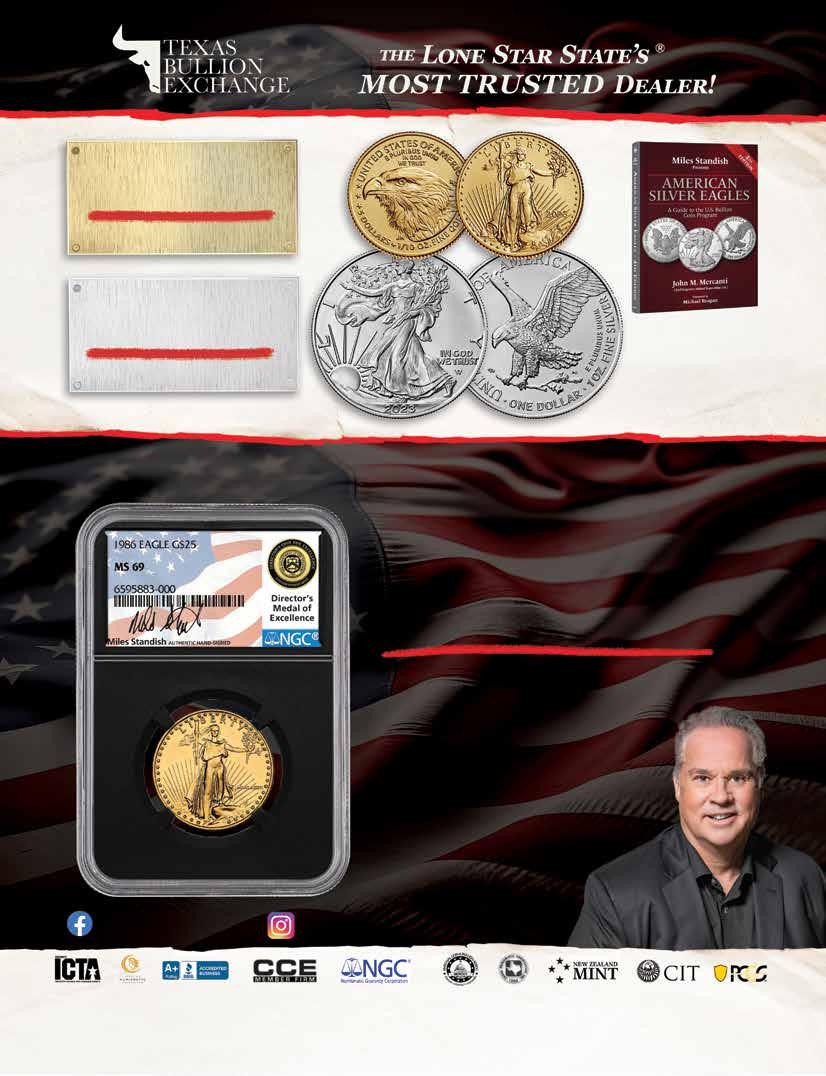

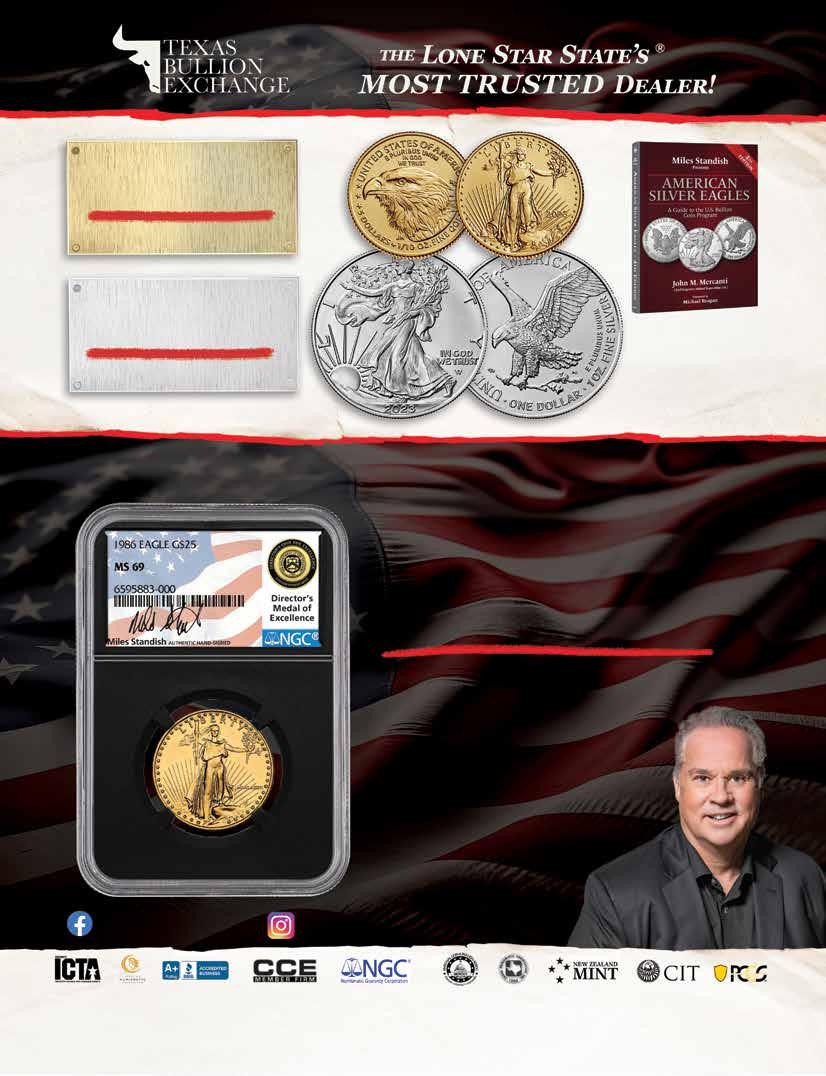

NARFE MAGAZINE www.NARFE.org 1 P. 24 Staying Sharp Behind the Wheel P. 34 Investing With Purpose Contents JUNE/JULY 2023 PAGE 24 COVER STORY FEATURE PAGE 34 Washington Watch 8 Biden FY24 Budget Includes Pay Raise, OPM Customer Service Improvements 9 OPM Director Testifies Before House Oversight Committee 10 Be a Voice for the Federal Employee and Retiree Community 12 WEP/GPO Repeal Bill Secures Majority Support in House, Introduced in Senate 12 NARFE Urges OPM to Reevaluate Verification of Life Process for Annuitants 13 Bill Tracker Columns 4 From the President 22 Benefits Brief 42 Managing Money 44 Alzheimer’s Update Departments 6 NARFE Online 18 Questions & Answers 19 Countdown to COLA 46 NARFE News 50 NARFE Perks 52 The Way We Worked ON THE COVER Illustration by TGD A NARFE PUBLICATION June/July 2023 P. 24 Staying Sharp Behind the Wheel P. 34 Investing With Purpose INVESTING WITH PURPOSE If you are interested in environmental, social, governance (ESG) funds, which focus on socially responsible investments and investing strategies, there’s a lot to consider. STAYING SHARP BEHIND THE WHEEL What older drivers need to know about driving safely, what to look for in a new car, how to save money on car insurance—and when to turn over the keys. Connect with us! Visit us online at www.narfe.org Like us on Facebook NARFE National Headquarters Follow us on Twitter @narfehq Follow us on LinkedIn NARFE

EDITORIAL DIRECTOR

Jenn Rafael

CREATIVE SERVICES MANAGER

Beth Bedard

ADDITIONAL GRAPHIC DESIGN TGD

EDITORIAL BOARD

William Shackelford, Kathryn E. Hensley, Johann De Castro

CONTACT US

NARFE Magazine

606 North Washington St. Alexandria, VA 22314-1914 Phone: 703-838-7760 Fax: 703-838-7781

Editorial: communications@narfe.org

Advertising Sales: Francine Garner advertising@narfe.org

NARFE FOR THE VISUALLY IMPAIRED

ON THE TELEPHONE: This publication can be heard on the telephone by persons who have trouble seeing or reading the print edition. For more information, contact the National Federation of the Blind NFBNEWSLINE® service at 866-504-7300 or go to www.nfbnewsline.org.

ON DIGITAL AUDIO: Issues of NARFE Magazine are also available in audio format through the National Library Service for the Blind and Physically Handicapped (NLS). For availability, call 202-727-2142 or your local NLS service provider.

The Association, since July 1970, has been classified by the IRS as a tax-exempt labor organization [not a union]; however, dues and gifts or contributions to the Association are not deductible as charitable contributions for income tax purposes.

NATIONAL OFFICERS

WILLIAM SHACKELFORD

President; natpres@narfe.org

KATHRYN E. HENSLEY Secretary/Treasurer; natsectreas@narfe.org

ACTING CHIEF OF STAFF

JOHANN DE CASTRO jdecastro@narfe.org

REGIONAL VICE PRESIDENTS

REGION I Jeff Anliker (Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island and Vermont)

Tel: 413-813-8136

Email: jeff.anliker@outlook.com

REGION II Larry Walton (Delaware, District of Columbia, Maryland, New Jersey and Pennsylvania)

Tel: 443-831-1791

Email: rvp2@narfe.org

REGION III Lynn Harper (Alabama, Florida, Georgia, Mississippi, South Carolina and Puerto Rico)

Tel: 478-951-3260

Email: lynn_harper@msn.com

REGION IV Robert L. Helfrich

(Illinois, Indiana, Michigan, Ohio and Wisconsin)

Tel: 317-501-1700

Email: rlhelfrich@yahoo.com

REGION V Cindy Reneé Blythe (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota)

TO JOIN NARFE, RENEW YOUR MEMBERSHIP OR FIND A LOCAL CHAPTER: CALL (TOLL-FREE) 800-456-8410 OR GO TO www.narfe.org

TO CHANGE YOUR ADDRESS, PHONE NUMBER OR EMAIL LISTING: CALL (TOLL-FREE) 800-456-8410 EMAIL memberrecords@narfe.org OR GO TO www.narfe.org, log in and click on “My Account”

TO REACH A FEDERAL BENEFITS SPECIALIST: EMAIL fedbenefits@narfe.org

NARFE HEADQUARTERS

606 N. Washington St. Alexandria, VA 22314

703-838-7760

Hours of operation: Monday-Friday, 8 a.m.-5 p.m. ET

Tel: 785-256-1450

Email: mrsdocbusyb@yahoo.com

REGION VI Marshall L. Richards (Arkansas, Louisiana, Oklahoma, Republic of Panama and Texas)

Tel: 903-660-2784

Email: pappysdad@cobridge.tv

REGION VII Sharon Reese (Arizona, Colorado, New Mexico, Utah and Wyoming)

Tel: 575-649-6035

Email: rvp7@narfe.org

REGION VIII Robert H. Ruskamp (California, Hawaii, Nevada and Republic of Philippines)

Tel: 703-628-3234

Email: ruskampr@gmail.com

REGION IX Steven Roy (Alaska, Idaho, Montana, Oregon and Washington)

Tel: 425-344-3926

Email: stevenroy1@yahoo.com

REGION X Robert Allen (Kentucky, North Carolina, Tennessee, Virginia and West Virginia)

Tel: 757-404-3880

Email: rvp10@narfe.org

NARFE Magazine (ISSN 1948-4453) is published monthly except in February and July by the National Active and Retired Federal Employees Association (NARFE), 606 N. Washington St., Alexandria, VA 22314. Periodicals postage paid at Alexandria, VA, and additional mailing offices. Members: Annual dues includes subscription. Nonmember subscription rate $48. Postmaster: Send address change to: NARFE Attn: Member Records, 606 N. Washington St., Alexandria, VA 22314. To ensure prompt delivery, members should also forward changes of address without delay. Because of the volume involved, NARFE cannot acknowledge nor be responsible for unsolicited pictures and manuscripts, although every reasonable precaution is taken. All submissions become the property of NARFE. Copyright © 2023, NARFE. Advertisements in the magazine are not endorsements of products and/or services by NARFE, unless officially stated in the ad. We shall accept advertising on the same basis as other reputable publications: that is, we shall not knowingly permit a dishonest advertisement to appear in NARFE Magazine, but at the same time we will not undertake to guarantee the reliability of our advertisers.

2 NARFE MAGAZINE JUNE/JULY 2023 JUNE/JULY 2023 VOLUME 99 ★ NUMBER 5

You plan for your tomorrow, but have you planned for the possibility of a tomorrow without you in it?

At a time when your loved ones should be focused on memories of you, they shouldn’t be troubled with thoughts of financial burdens.

The NARFE Senior Term Life Insurance Plan

This plan, specifically designed for our members ages 50–74, offers coverage amounts between $5,000 and $25,000* for members ages 50–64 or coverage amounts of $5,000 or $10,000* for ages 65–74. Plus, coverage is available with no medical exam required.

Economical Group Rates negotiated with our insurance partners exclusively for our members. • No Medical exam required! It’s that easy.

Program Offered by Association Member Benefits Advisors, LLC. In CA d/b/a Association Member Benefits & Insurance Agency CA Insurance License #0I96562 AR Insurance License #100114462

age 80, coverage, if greater than $5,000, will reduce to $5,000 with an appropriate adjustment in premium. All benefits are subject to the terms and conditions of the policy.

underwritten

Hartford Life and Accident Insurance Company

of

terms under

not be

in all states. The Hartford Financial Services Group, Inc., (NYSE: HIG) operates through its subsidiaries, including Hartford Life and Accident Insurance Company under the brand name, The Hartford®, and is headquartered at One Hartford Plaza, Hartford, CT 06155. For additional details, please read The Hartford’s legal notice at www.thehartford.com. Life Form Series includes GBD-1000, GBD-1100, or state equivalent. 99795 (6/23) Copyright 2023 AMBA. All rights reserved.

Spouse Coverage

to

you and your loved one

may need.

of

financial

To learn more or enroll in the NARFE Senior Term Life Insurance Plan, call 1-800-233-5764 or visit us at www.narfeinsurance.com

Available to NARFE members and spouses age 50–74. No medical exam

CONTROL WHAT YOU CAN. INSURE WHAT YOU CAN’T.

Benefits include:

*At

Policies

by

detail exclusions, limitations, reduction

benefits and

which the policies may be continued in force or discontinued. Coverage may vary and may

available

•

Available

help provide both

with the protection you

• Choice

Coverage Amounts to custom fit your

needs and budget.

•

required.

NARFE’S MISSION STATEMENT

To support legislation and regulations beneficial to federal civilian employees and annuitants and potential annuitants under any federal civilian retirement system and to oppose those detrimental to their interests.

To promote the general welfare of federal civilian employees and annuitants and potential annuitants, to advise and assist them with respect to their rights under retirement, health and other employee and retiree benefits laws and regulations, and to represent their interests before appropriate authorities.

To cooperate with other organizations and associations in furtherance of these general objectives.

Decisions Ahead About NARFE’s Structure

As most NARFE members know, the peak travel time for NARFE national officers has been during the months of April and May, when most of the federations convene their conventions/conferences. This year was no different from previous years, with 27 federations requesting a national officer to address attendees.

Members of the Panama Federation were beyond gracious in welcoming me and Region VI Vice President Marshall Richards and his wife, Linda. My travel concluded with a “virtual” visit to the Georgia Federation. As tiring as it might seem, interacting with members is fun, worthwhile and highly educational. Many of the federation visits were easy, as federations have adapted to the use of electronic meetings; out of the 21 that I participated in, only seven were in-person meetings.

Frequently, I’m asked why NARFE doesn’t reach out more to other organizations with similar interests. The simple answer is that NARFE is unique: There are no other organizations whose mission is devoted to protecting federal retirement benefits. However, NARFE does not work in a vacuum. We do work very closely with Federally Employed Women (FEW) and Blacks In Government (BIG), but I have learned that there are other organizations with interests similar to NARFE’s and also have membership issues. I have asked NARFE Membership Engagement Director Nora MacDonald to explore the development of a plan that will allow these smaller organizations to benefit from the 102-year-old NARFE legacy.

An organizational change that has been suggested by members over the years would be to implement a 501(c)3 model for NARFE. This change

needs to be examined in detail to determine the best avenue to move NARFE forward.

There are different classifications for nonprofit organizations such as NARFE. Currently, we are classified as a 501(c)(5), which provides for the exemption from federal income tax of labor, agricultural or horticultural organizations. Under this provision, NARFE-PAC is maintained as a separate and segregated 527 fund, and this continued maintenance would be required; a 501(c) (3) organization may not contribute to a political organization such as a candidate committee, political party committee or political action committee.

Some of the advantages of the 501(c)3 classification primarily benefit our fundraising activities, but there are other considerations as well. A value-added aspect of membership would be that donations would become tax-deductible for donors, thereby allowing for a more robust fundraising operation that could include major and planned gifts.

Even if we change classifications, we must preserve NARFE-PAC, which provides financial contributions to campaigns of candidates for congressional office and to other campaign committees. This is a vital part of NARFE’s advocacy strategy and political activity. NARFE representatives must be permitted to lobby members of Congress on members’ behalf. This is not available to a 501(c)3.

Another possible solution would be to convert to a 501(c)4 or (c)6. With this solution NARFE-PAC could remain separate and segregated.

I look forward to hearing from members on this important matter.

WILLIAM SHACKELFORD NARFE NATIONAL PRESIDENT natpres@narfe.org

4 NARFE MAGAZINE JUNE/JULY 2023 From the President

There are great savings options for federal retirees

Can you switch and save?

If you didn’t change your health plan when you became eligible for Medicare, now could be the time to switch and save. Contact us to learn more about Aetna® plans designed for federal retirees

Plans o�ered through the Federal Employees Health Bene�ts (FEHB) Program:

Aetna Medicare Advantage

• $0 deductibles and copays

• Prescriptions for as little as $2 from our preferred pharmacies

• Low premiums

• $1200 annual reduction in Medicare Part B premium for each eligible member

• SilverSneakers® at no extra cost

Aetna Direct

• A fund to help pay prescription costs or your Medicare Part B premium

• $0 deductibles and copays

• $6 generic prescriptions from our preferred pharmacies

Why not connect live with us and learn more about your health plan options? Connect with our team at AetnaFedsLive.com and you can:

Or use our retiree portal at AetnaFeds.com/retireeplans to explore at your own pace.

Ready to enroll? If you’re eligible:

Enroll online at RetireeFEHB.OPM.gov Or call the O �ce of Personnel Management (OPM) Retirement Information Center at 1- 88 8-767-6738 (TTY: 711).

Aetna Medicare is a PPO plan with a Medicare contract. Enrollment in our plans depends on contract renewal. See Evidence of Coverage for a complete description of plan bene�ts, exclusions, limitations and conditions of coverage. Plan features and availability may vary by ser vice area. SilverSneakers is a registered trademark of Tivity Health, Inc. ©2021 Tivity Health, Inc. All rights reserved. Health insurance plans are o�ered and /or underwritten by Aetna Life Insurance Company (Aetna). This is a brief description of the features of this Aetna health insurance plan. Before making a decision, please read the plan’s applicable federal brochure(s). All bene�ts are subject to the de�nitions, limitations and exclusions set forth in the federal brochure. Plan features and availability may vary by location and are subject to change. Aetna does not provide care or guarantee access to health services. For more information about Aetna plans, refer to AetnaFeds.com/RetireePlans ©202

3 Aetna Inc. Y00 01_GRP_4009_3488_2021_M 19.12.345.1 A (9/21)

Chat online Schedule a one-on-one consultation Attend live webinars

MISS A WEBINAR?

CATCH UP on past NARFE Federal Benefits Institute presentations in NARFE’s webinar archive, where you’ll find videos, slides and transcripts of question-and-answer sessions for webinars dating back to January 2019. View them at www.narfe.org/webinar-archive.

Share the Number of Feds in Your State With Lawmakers

An important part of grassroots advocacy is ensuring that a member of Congress is aware of the number of federal employees, retirees and annuitants who reside in the district. This

enables your representative or senator to better understand how pressing issues impact their constituents, as well as educate them about the size and influence of the federal and postal communities.

Share this information— and other issue briefs and fact sheets—whenever you meet with legislators and their staffs. To find out the population of federal employees and retirees for your state, visit www.narfe.org/states

READ NARFE MAGAZINE ONLINE

NARFE’s website now offers a digital flipbook of this and previous issues at www.narfe. org/magazine-issues. Read the magazine online on your computer, phone or tablet, or download it to peruse later.

ORIGINS OF JUNETEENTH

On June 19, 1865, 250,000 still-enslaved Texans learned from Union soldiers that they were free—months after the Civil War’s end, and more than two years after President Abraham Lincoln issued the Emancipation Proclamation. Read about how Juneteenth became a federal holiday at www.narfe.org/juneteenth.

FIND A CHAPTER NEAR YOU

A NARFE chapter is your local connection to NARFE. With nearly 800 chapters, there’s a good chance you’ll find one close to home, wherever you are. To locate a chapter near you, visit www.narfe.org/chapters .

SAVE MORE WITH NARFE PERKS

Whether you are planning your next vacation, buying a gift or planning for retirement, members can save money on everyday purchases with special discounts from our Affinity Partners. Taking advantage of just one offer could more than pay for your annual membership. Visit www.narfe.org/narfe-perks-formembers (or see p. 50) to see how your savings could add up.

6 NARFE MAGAZINE JUNE/JULY 2023

NARFE Online

May 2023 P. 26 Feds on Film P. 34 NARFE’s Guide to Buying Hearing Aids

Smile, you’re covered

GEHA provides access to almost 400,000 dental provider locations and comprehensive services. And with no in-network deductibles, we’re making sure federal retirees have everything they need to start their next chapter with a smile.

DENTAL BENEFITS for Federal Retirees Explore which plan works best for you at geha.com/Dental © 2023 Government Employees Health Association, Inc. All rights reserved. SP-ADS-0423-001

Biden FY24 Budget Includes Pay Raise, OPM Customer Service Improvements

The Biden Administration released its Fiscal Year 2024 (FY24) budget proposal on March 9. It seeks funds to improve OPM customer service to annuitants, proposes a 5.2 percent average pay raise for federal employees and more.

The White House highlighted its request for “$6.6 million for the Office of Personnel Management (OPM) to help reduce processing times and improve customer satisfaction, expand a pilot for online retirement application, and begin to fund additional IT modernization initiatives akin to a case management system.” This focus came as welcome news to NARFE, as NARFE National President William Shackelford urged the administration to focus on customer service improvements via adequate funding and improved technology in his January letter to President Biden.

The budget proposes a 5.2 percent average pay raise for federal employees, in line with the requested military pay raise and recent changes in privatesector wages. Shackelford urged the administration to support this amount in his January letter and applauded the announcement in a media statement. If Congress does not block the raise, the president may authorize it based on

existing statutory law. While the budget does not specify this, if the administration follows past precedent, the raise will come via a 4.7 percent across-the-board increase and a 0.5 percent average increase in locality pay rates.

The administration also outlined the budget’s support for the President’s Management Agenda priority to strengthen and empower the federal workforce via various initiatives, notably efforts to improve federal hiring processes. It focuses on advancing “Talent Teams,” promoting pooled hiring actions, and quality employee

assessments by including subject matter experts in the qualification process, among other strategies.

In addition to these provisions, the budget also indicates support for:

• Legislation to prevent a return of Schedule F, a broad new exception to merit-based civil service rules.

• Legislation to require coverage of three primary care visits and three behavioral health visits without cost-sharing for all Federal Employees Health Benefits (FEHB) plans.

• Legislation to limit costsharing for insulin for all FEHB plans.

• Legislation to allow disabled children of Civil Service Retirement System (CSRS) annuitants who are incapable of self-support to reinstate

JUNE/JULY ACTION ALERT: WEP/GPO

Visit NARFE’s Legislative Action Center at www.narfe.org to send a message to your lawmakers urging them to cosponsor the Social Security Fairness Act of 2023, H.R. 82/S. 597. This bill would repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) policies, which unfairly reduce Social Security benefits for federal, state and local government retirees who earned a pension from their civil service career separate from benefits earned from employment covered by Social Security.

8 NARFE MAGAZINE JUNE/JULY 2023 Washington Watch

survivor annuities when the annuity had previously been terminated due to substantial employment income, as is permitted under the Federal Employees Retirement System (FERS).

These are just some of the highlights of the budget as it pertains to the federal

MYTH VS. REALITY

MYTH: Federal salaries and annuities will still be paid even in the event of a default due to the debt limit not being raised.

REALITY: A failure to raise the debt limit could delay payment of federal wages and retirement annuities until the federal government has enough cash on hand to pay them. If the crisis dragged on, the duration of any delays would increase.

workforce and NARFE’s issues. But the entire budget contains an extensive set of proposals, from the annual agency budget requests to support for changes in law related to taxes, prescription drug pricing and more. It represents the opening salvo in the back and forth between the administration and

congressional leaders on larger budget negotiations and annual appropriations bills. Look for the weekly NARFE NewsLine and other updates from NARFE to learn more about what comes next as it relates to federal workforce and benefits issues.

—JOHN HATTON, STAFF VICE PRESIDENT, POLICY AND PROGRAMS

OPM Director Testifies Before House Oversight Committee

In March, the House Committee on Oversight and Accountability held a hearing on the Office of Personnel Management (OPM), calling Director Kiran Ahuja before the panel to testify about federal personnel policy and issues affecting the agency.

Chairman James Comer, R-KY, opened by questioning Ahuja about federal employees returning to in-person work. Comer also focused on workforce accountability and fostering a federal personnel system that runs efficiently and attracts workers. Rep. Gerry Connolly, D-VA, followed, emphasizing that more than 80 percent of the federal workforce lives outside of the Washington, DC, area and thanking federal employees for their work during the pandemic.

Committee members inquired about federal teleworking policy and specific personnel matters within OPM. However, there was also

discussion of issues surrounding OPM’s Retirement Services (RS) division, prompting the director to reply that addressing the division was a priority.

In her written testimony, Ahuja wrote that OPM “must continue to improve our customer service and call center to provide the experience our customers deserve.” Specifically, the agency will focus on enhancing staffing and capacity, increasing information available online and increasing proactive communications from OPM to customers regarding their applications.

Notably during the hearing, Rep. Andy Biggs, R-AZ, questioned Ahuja about retirement processing delays, providing direct stories from constituents negatively impacted by delays in receiving their federal annuities. Processing delays are of great concern to NARFE, with many members contacting headquarters sharing similar experiences of hardship.

Before the hearing, NARFE National President William “Bill” Shackelford submitted a statement for the record outlining NARFE’s concerns with OPM and current federal benefit programs, along with the association’s support for a meritbased civil service.

Shackelford’s statement urged the committee to increase oversight of OPM RS, highlighting concerns with lengthy delays in receiving retirement and survivor payments, updating health benefits and making other changes that require the agency’s involvement. Additionally, Shackelford raised concerns about the expected premium increases for the Federal Long Term Care Insurance Program (FLTCIP) and equitable solutions for enrollees. Those solutions include a partial refund of premiums and tax relief for those who wish to continue their FLTCIP coverage. SEE

NARFE MAGAZINE www.NARFE.org 9

P. 13

OPM ON

NARFE GRASSROOTS ADVOCACY

LEARN MORE about how you can take action to protect your earned pay and benefits by reviewing NARFE Grassroots materials at www.narfe.org/advocacy

Be a Voice for the Federal Employee and Retiree Community

Now is the time to be an advocate to protect your earned pay and benefits. As negotiations heat up to raise the debt limit and set a budget for the next two years, federal employee and retiree benefits are gaining unwanted attention. Congress needs to hear from those affected – you – to make sure they keep your hardearned earned benefits off the negotiating table.?

Whether it is sending a letter through NARFE’s Legislative Action Center, making a phone call or meeting with a lawmaker, you are putting a face on an otherwise faceless issue. Your advocacy helps decision-makers make better connections between the laws and policies they act on to how they affect the people they came to Congress to represent. This is why grassroots advocacy is so vital for advancing NARFE’s legislative and policy priorities, and it is a responsibility we all share.

At NARFE, we encourage members to advocate in ways that are comfortable for them. For some, sending a letter through NARFE’s Legislative Action Center might be easier than making a phone call or engaging in a one-on-one meeting with the lawmaker. Whichever way you prefer to advocate, NARFE thanks you for your support and encourages you to continue speaking up on behalf of the federal community. And for those

who would like to participate in advocacy activities but are unsure how to get started, visit the grassroots webpage located on NARFE’s website at www. narfe.org/grassroots-advocacy to access how-to guides and other tools to do so.

In just a few weeks, hundreds of members will come together online for NARFE’s virtual LEGcon23, which will occur June 20-22. The three-day program includes advocacy skill-building training and congressional briefings culminating with participants organized in state groups to meet virtually with their members of Congress.

The conference’s virtual format is a welcome opportunity for those who have been unable to participate in past years’ in-person conferences in Washington, DC. This virtual format will offer the same high-quality programming members have come to love and expect, but in the comfort and convenience of their homes. The conference is developed to meet the needs of members at all advocacy experience levels and would be a great opportunity for firsttime participants who can be a part of group meetings with lawmakers. It is not too late to register for LEGcon23. Visit the conference webpage at http://legcon.narfe.org and register today!

In August, members will engage in NARFE’s Grassroots Advocacy Month campaign. This advocacy campaign is held in conjunction with the August congressional recess, when members of Congress travel back to their states and districts to interact with constituents. Since this year’s August campaign follows LEGcon23, it gives participants of the conference an opportunity to execute a follow-up strategy to continue discussing the issues with the lawmaker at the local level. But most importantly, these discussions would help keep federal community issues fresh on lawmakers’ minds as they interact with other constituents who are also eager to discuss other issues and concerns.

NARFE’s advocacy team is currently developing activities for member engagement and will send out a notification before the start of the recess. However, members should prepare in advance by scheduling meetings with their lawmakers and planning to participate in local congressional events.

NARFE’s Advocacy webpage at www.narfe.org/advocacy includes the latest on key priorities, issue briefs and fact sheets, and additional resources to help prepare members to engage successfully during the August recess and throughout the year.

—NARFE ADVOCACY STAFF

10 NARFE MAGAZINE JUNE/JULY 2023 Washington Watch

NARFE-PAC goals for the 2023-2024 election cycle:

Disburse $1.2 million in political contributions

Raise $1.6 million $236,186

$151,500 Send NARFE members to 125 local fundraisers

12 Goal progress from 1/1/23 to 3/31/23

CONTRIBUTE TO

Contribute monthly through your annuity or by credit card. Get started at narfe.org/pac-sustainer

OR

Make a one-time contribution:

q $25 – Basic lapel pin

q $50 – Bronze lapel pin

q $100 – Silver lapel pin

q $250 – Gold lapel pin

q $500 – Platinum lapel pin

q Other: _________

Contribution totals are cumulative for the 2023-2024 election cycle

n No pin for me. I’d like 100 percent of my contribution to go to NARFE-PAC.

We need your assistance to achieve these, so please consider contributing to NARFE-PAC today.

NARFE Member #:

Name: Address: City: State: ZIP: Occupation: Employer:

q Charge my credit card

q MasterCard q VISA q Discover q AMEX

Card #:

Exp. Date: _____ /_________ mm yyyy

Name on Card:

Signature:

Date:

To comply with federal law, we must use our best efforts to obtain, maintain and submit the name, mailing address, occupation and name of employer of individuals whose contributions exceed $200 each calendar year. NARFE-PAC is for the benefit of political candidates and activities on a national level. NARFE members have the right to refuse to contribute without reprisal, and NARFE will neither favor nor disadvantage anyone based on the amount of a contribution or failure to make a voluntary contribution. The suggested amounts are only suggestions and not enforceable. Only members of NARFE may contribute to the PAC. Contributions from non-members will be returned. NARFE-PAC contributions are not deductible for federal income tax purposes.

NARFE MAGAZINE www.NARFE.org 11

Monthly contributors of $10 or more receive a sustainer lapel pin

NARFE-PAC to: NARFE-PAC Budget & Finance | 606 North Washington St. | Alexandria, VA 22314

Mail coupon and/or check payable to

LEGISLATIVE RESOURCES

NARFE NewsLine – A weekly newsletter that goes out to NARFE members on Tuesdays and includes weekly recaps of legislative news, compiled by NARFE’s advocacy and communications teams.

LEGISLATIVE ACTION CENTER – A one-stop site to send a letter to Congress, and more, at www.narfe.org.

WEP/GPO Repeal Bill Secures Majority Support in House, Introduced in Senate

In March, Sen. Sherrod Brown, D-OH, alongside Sen. Susan Collins, R-ME, reintroduced the Senate version of the Social Security Fairness Act, S. 597, a bill that would fully repeal the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). As of press time, the Senate bill had amassed 38 bipartisan cosponsors in just three weeks.

The 118th Congress has thus far been a productive one for the bill, amassing significant bipartisan support from Congress in record time since its initial introduction in the

House of Representatives in January 2023.

As of press time, the House bill, H.R. 82, had already garnered 232 cosponsors, achieving majority support, and 58 shy of the 290 cosponsors needed to trigger the House Consensus Calendar rule process that would require either committee advancement or a floor vote. At the same time in the 117th Congress, the bill had just 134 cosponsors. As of April 21, H.R. 82 had the second most cosponsors of any bill in Congress. With such strong support this early in the new Congress,

NARFE and its allies inside and outside of Congress have the benefit of more time to work on increasing cosponsors, which puts increasing pressure on congressional leaders to act. NARFE needs the continued support of its members to advance this legislation and hopefully come to a solution on WEP and GPO during this session of Congress. As such, we encourage NARFE members to visit our Legislative Action Center to send a message to their legislators in support of the bill: https://www.narfe.org/action

—BY SETH ICKES, POLITICAL ASSOCIATE

NARFE Urges OPM to Reevaluate Verification of Life Process for Annuitants

On March 7, NARFE

National President William Shackelford wrote to the associate director of the Office of Personnel Management’s (OPM) Retirement Services (RS) division, Margaret Pearson, urging OPM to reevaluate how it is implementing an initiative to reduce improper payments. Shackelford explained that NARFE’s concern is that “OPM RS is unfairly shifting the burden to verify/prove life onto annuitants when OPM RS possesses insufficient evidence of death.” This process results in living federal annuitants

receiving “letters from OPM RS asking them to return a notarized form confirming their current information – in essence providing a notarized form to prove they are still alive.”

The letter cited OPM’s Inspector General’s audit report on the use of the Department of Treasury’s Do Not Pay portal, which provides data indicating possible deaths. As Shackelford explained: “While we do not object to OPM RS’ use of Treasury’s DNP Portal to help reduce improper payments to deceased annuitants, we do not believe it is appropriate for

OPM RS to shift the burden to annuitants to prove they are still alive when OPM RS ‘does not find a death record,’ especially when it’s clear there are multiple reasons for why the Treasury DNP Portal data may provide an erroneous match, including referring ‘to a person with the same name as a retirement annuitant, but who is not the annuitant.’ Such a process appears ripe for the potential to provide false positives, imposing unnecessary burdens and costs on living federal annuitants.”

—BY JOHN HATTON, STAFF VICE PRESIDENT, POLICY AND PROGRAMS

12 NARFE MAGAZINE

2023 Washington Watch

JUNE/JULY

The statement also mentioned safeguarding and improving the Federal Employees Health Benefit (FEHB) program, including a call to provide some or additional reimbursement for Medicare premiums and ensuring FEHB gained access to lower prescription drug

pricing available to Medicare. These efforts could help lower overall FEHB premiums. Finally, the statement praised the committee’s bipartisan effort to advance the Chance to Compete Act, H.R. 159, and warned the committee of attempts to politicize federal service through the reintroduction of Schedule F.

NARFE appreciates the attention Congress is giving to OPM and will continue to work with lawmakers and the administration to address concerns, quicken processing times and improve the overall customer experience.

—BY ROSS APTER, DIRECTOR, LEGISLATIVE AND POLITICAL AFFAIRS

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R.159/S.59: Chance to Compete Act of 2023 / Rep. Virginia Foxx, R-NC / Sen. Kyrsten Sinema, I-AZ

Cosponsors: H.R. 159: 3 (D) 2 (R)

S. 59 1 (D) 2 (R)

H.R. 1002/S. 399: Saving the Civil Service Act / Rep. Gerry Connolly, D-VA / Sen. Tim Kaine, D-VA

Cosponsors: H.R. 1002: 10 (D) 1 (R) S. 399: 14 (D) 1 (I)

Implements merit-based reforms to the civil service hiring system that replace degree-based hiring with skills- and competencybased hiring.

Passed the House under suspension of the rules 1/24/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/24/2023

FEDERAL PERSONNEL POLICY

H.R. 1487: The Strengthening the Office of Personnel Management Reform Act / Rep. Gerry Connolly, D-VA

Cosponsors:

H.R. 1487: 1 (D)

Prevents any position in the federal competitive service, created after September 30, 2020, from being reclassified into the excepted service, outside the protection of merit system rules without the express consent of Congress. The bill also requires the consent of an employee to be reclassified, mandates reporting of conversions to the Office of Personnel Management, and places caps on the number of employees converted to the excepted service via Schedule C.

Codifies several recommendations for OPM by the National Academy of Public Administration (NAPA), such as clarifying that OPM stands at the center of federal civilian human resource management and ensuring the director of OPM possesses human capital and leadership expertise.

Referred to the House Committee on Oversight and Accountability 2/15/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/14/2023

Referred to the House Committee on Oversight and Accountability 3/9/2023

NARFE’s Position: Support Oppose No position

NARFE MAGAZINE www.NARFE.org 13

OPM FROM P.9

ISSUE BILL NUMBER / NAME / SPONSOR WHAT BILL WOULD DO LATEST ACTION(S)

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R. 82/S. 597: The Social Security Fairness Act / Rep. Garret Graves, R-LA / Sen. Sherrod Brown, D-OH

Repeals both the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP).

SOCIAL SECURITY

Cosponsors:

H.R. 82: 165 (D) 67 (R)

S. 597: 31 (D) 4 (R) 3 (I)

H.R. 716: The Fair COLA for Seniors Act / Rep. John Garamendi, D-CA

Cosponsors:

H.R. 716: 24 (D) 0 (R)

Requires Social Security and federal retirement programs to use the Consumer Price Index for the Elderly (CPI-E) to calculate cost-of-living adjustments (COLAs) to retirement benefits.

Referred to the House Committee on Ways and Means. 1/9/2023

Referred to the Senate Committee on Finance 3/1/2023

FEDERAL ANNUITIES

H.R. 866: The Equal COLA Act / Rep. Gerry Connolly, D-VA

Cosponsors:

H.R. 866: 16 (D) 1 (R)

H.R. 536/ S. 124: The Federal Adjustment of Income Rates (FAIR) Act / Rep. Gerry Connolly, D-VA / Sen. Brian Schatz, D-HI

Cosponsors:

H.R. 536: 54 (D) 1(R) S. 124: 19 (D) 1 (I)

Provides Federal Employees Retirement System (FERS) retirees with the same annual cost-of-living adjustment (COLA) as Civil Serve Retirement System (CSRS) retirees.

Provides federal employees with an 8.7 percent average pay raise in 2024.

Referred to the House Committees on Ways and Means, Veterans’ Affairs, Oversight and Accountability, and Armed Services 2/1/2023

FEDERAL COMPENSATION

H.R. 856/ S. 274: Comprehensive Paid Leave for Federal Employees Act / Rep. Don Beyer, D-VA / Sen Brian Schatz, D-HI

Cosponsors:

H.R. 856: 28 (D) 1 (R) S.274: 9 (D) 0 (R) 1 (I)

H.R. 1301/ S. 640: Federal Employees Civil Relief Act / Rep. Derek Kilmer, D-WA / Sen. Brian Schatz, D-HI

Cosponsors: H.R. 1301: 2 (D) S. 640 15 (D) 1 (I)

Extends paid leave to federal and postal employees for all conditions covered by the Family and Medical Leave Act (FMLA).

Referred to the House Committee on Oversight and Accountability 2/8/2023

Referred to the House Committee on Oversight and Accountability 1/26/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/26/2023

Referred to the House Committee on Oversight and Accountability, Veteran’s Affairs and House Administration 2/7/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/7/2023

Protects federal workers and contractors from a variety of civil financial penalties during a lapse in appropriations or a breach of the debt ceiling.

Referred to the House Committees on Oversight and Accountability, Financial Services, Ways and Means, Judiciary, Education and Workforce, and House Administration. 3/1/2023

Referred to the Senate Committee on Finance 3/2/2023

NARFE’s Position: Support Oppose No position

14 NARFE MAGAZINE JUNE/JULY 2023

ISSUE BILL NUMBER / NAME / SPONSOR WHAT BILL WOULD DO LATEST ACTION(S)

✓ First walk-in tub available with a customizable shower

✓ Fixed rainfall shower head is adjustable for your height and pivots to offer a seated shower option

✓ High-quality tub complete with a comprehensive lifetime warranty on the entire tub

✓ Top-of-the-line installation and service, all included at one low, affordable price Now

1-800-937-7239 Call Today for Your Free Shower Package FINANCING AVAILABLE WITH APPROVED CREDIT FREE SHOWER PACKAGE PLUS $1500 OFF FOR A LIMITED TIME ONLY Call Toll-Free 1-800-937-7239 www.BuySafeStep.com With purchase of a new Safe Step Walk-In Tub. Not applicable with any previous walk-in tub purchase. Offer available while supplies last. No cash value. Must present offer at time of purchase. Scan me Now you can finally have all of the soothing benefits of a relaxing warm bath, or enjoy a convenient refreshing

while

or

with Safe Step Walk-In Tub’s

Shower

shower

seated

standing

FREE

Package!

can have the best of both worlds–there isn’t a better, more aff ordable walk-in tub! CSLB 1082165 NSCB 0082999 0083445 SPECIAL OFFER for NARFE Readers NORTH AMERICA’S #1 Selling Featuring our Free Shower Package BackbyPopularDemand! FREESHOWERPACKAGE!

you

Find this and other great deals on www.fepblue.org/blue365

More Than Just Hearing Aids

Blue Cross and Blue Shield Service Benefit Plan members get a full hearing care package when they use their allowance through TruHearing®

The TruHearing Program Includes:

Personalized Care

Guidance and assistance from a TruHearing Hearing Consultant

Professional exam from a local, licensed provider

1 year of follow-up visits for fitting and adjustments to ensure you’re completely satisfied with your hearing aids

Next-Generation Sound Devices for Your Lifestyle

The latest chips and algorithms combine to make speech clearer, even in the most challenging environments

Advanced sensors automatically adjust to the noise around you for better clarity and natural sound

New models include sound enhancement technology to make your voice sound more natural to you

1 The Service Benefit Plan will pay a hearing aid benefit for Standard and Basic Options up to $2,500 total every 5 calendar years for adults age 22 and over, and up to $2,500 total per calendar year for members up to age 22. FEP Blue Focus does not have a hearing aid benefit. Do not rely on this communication piece alone for complete benefit information. All benefits are subject to the definitions, limitations, and exclusions in the Blue Cross and Blue Shield Service Benefit Plan brochure. The Blue365® Discount Program offers access to savings on items that you may purchase directly from independent vendors, which may be different from items covered under the Service Benefit Plan or any other applicable federal healthcare program. For hearing aids, acupuncture, chiropractic and vision services, you must exhaust your Service Benefit Plan benefit first before accessing the savings of the Blue365®

Bluetooth connectivity for streaming your favorite music, TV and phone calls straight to your ears3

A wide variety of rechargeable models that keep a charge for an entire day4

Options to match your lifestyle including virtually undetectable devices

Discount Program. To find out what is covered under your policy, contact the customer service number on the back of your member ID card. The products and services described herein are neither offered nor guaranteed under any local Blue company’s contract with the Medicare program. These items are not subject to the Medicare appeal process. Any disputes regarding these products and services are not subject to the Disputed Claims process. Blue Cross Blue Shield Association (BCBSA) may receive payments from Blue365 vendors. Neither the Service Benefit Plan, nor any local Blue company recommends, endorses, warrants or guarantees any specific Blue365 vendor or item. The Service Benefit Plan reserves the right to change, modify, or terminate any item and vendors made available through Blue365, at any time.

2 Price shown does not include cost of comprehensive hearing exam. Examination and testing for prescribing of hearing aids is covered under the Service Benefit Plan. The member should confirm that the provider rendering the hearing exam is a Preferred provider. If the provider is Non-preferred, the member may be charged a maximum fee of $45 for the exam, and the member may need to submit a claim for reimbursement. Must be a Service Benefit Plan member to access TruHearing discounted pricing. TruHearing is offered through Blue365, which provides exclusive health and wellness deals and is a program of Blue Cross Blue Shield Association, an association of independent Blue Cross and Blue Shield companies. The Blue Cross® and Blue Shield® words and symbols, Federal Employee Program®, FEP® and Blue365® are all trademarks owned by Blue Cross Blue Shield Association.

3 Smartphone compatible hearing aids connect directly to iPhone®, iPad®, and iPod® Touch devices. Connectivity also available to many Android® phones with use of an accessory. 4 Rechargeable features may not be available in all models and styles. All content ©2021 TruHearing, Inc. All Rights Reserved. TruHearing® is a registered trademark of TruHearing, Inc. All other trademarks, product names, and company names are the property of their respective owners. Listed benefit amount may differ from customer's actual benefit. Actual customer payment will vary. Follow-up provider visits included for one year following hearing aid purchase. Hearing aid repairs, and replacements subject to provider and manufacturer fees. For questions regarding fees, contact TruHearing customer

service. FEP_NARFE_AD_0221 TruHearing is an independent company that provides discounts on hearing aids. Prices and products subject to change. For more information, visit TruHearing.com Rechargeable | Listed products are smartphone compatible3 SAMPLE PRODUCT AVERAGE RETAIL PRICE TRUHEARING PRICE ALLOWANCE (UP TO $2,500)1 YOU PAY2 TruHearing® Advanced $5,440 $2,500 –$2,500 $0 Widex Moment® 220 $3,320 $2,500 –$2,500 $0 ReSound ONE™ 5 $3,496 $2,590 –$2,500 $90 Signia® Styletto® 3X $5,166 $2,700 –$2,500 $200 Oticon More® 3 $6,750 $3,050 –$2,500 $550 Starkey® Livio® 2400 $5,704 $4,100 –$2,500 $1,600 Phonak® P-R90 $7,328 $4,390 –$2,500 $1,890 Call TruHearing today and start saving! Call 1-877-360-2432 | For TTY, dial 711 Example Savings (per pair) Made Available Through:

Q&A

THE FOLLOWING QUESTIONS & ANSWERS were compiled by NARFE’s Federal Benefits Institute experts. NARFE does not provide legal, financial planning or tax advice or assistance.

DEFERRED RETIREMENT

QI’ve attended a couple of retirement classes and have received conflicting information regarding a postponed retirement. I plan to resign in about five years when I am 58 with 24 years of service, then delay the application for my retirement until I turn 60. Will my unused sick leave count? Will I be able to receive the FERS Special Retirement Supplement? What happens with my health and life insurance? When could I receive the COLA? Am I eligible for any retirement benefits if I left federal service now, at age 53 with 19 years of service?

AThere are two main ways to receive your FERS basic retirement benefit. The first is a deferred retirement which is available if you separate from federal employment before meeting the minimum age and/ or service requirements for an immediate retirement benefit. To qualify for a deferred retirement benefit, you must have performed a minimum of five years of creditable civilian service and be under age 62 prior to separation or have at least 10 years of service and under the Minimum Retirement Age or “MRA.” Your MRA is between age 55 and 57 (57 if you were born in 1970 or later).

You can apply for a deferred retirement at age 62 – or as early as your MRA if you separated with at least 10 years of creditable service. A deferred retirement does not allow credit for unused sick leave and is not entitled to receive the FERS Special Retirement Supplement (SRS). Deferred retirement applicants are not eligible to reinstate their insurance (FEHB, FEGLI, or FEDVIP) in retirement. The other way to receive your FERS retirement benefit is an immediate retirement. This means you are eligible to begin receiving your retirement benefit within 30 days of your

separation. This could be an “early” retirement or a disability retirement, but in most cases, an immediate retirement is considered “optional” because the employee has reached their MRA and minimum service requirements while employed and may choose to retire on any date. Although you must have a minimum of five years of creditable civilian service, the additional service may be a combination of civilian service and military active duty. Military service requires a paid service credit deposit to be creditable. Here are the minimum age and service requirements to qualify for an optional immediate retirement:

• MRA with 30 years

• 60 with 20 years

• 62 with 5 years

• MRA with 10 years (benefit is reduced 5% for each year under age 62 unless one of the other age and service requirements are met)

◊ You may choose to postpone receiving the MRA + 10 retirement benefit to avoid some or all the age reduction. An immediate retirement receives credit for unused sick

18 NARFE MAGAZINE JUNE/JULY 2023

EMPLOYMENT

leave even if the application is postponed to avoid the age reduction. This pamphlet provides the conversion chart to convert your hours of sick leave to months and days of service credit: https://www.opm.gov/ retirement-center/publicationsforms/pamphlets/ri83-8.pdf.

Continuation of health and life insurance is an additional benefit of retiring with an immediate retirement if you also meet the “five-year” test of having that coverage for the five years immediately preceding your retirement. Your health benefits (FEHB) coverage can be reinstated for a postponed MRA + 10 retirement once you begin to receive your annuity if the five-year test was met prior to leaving Federal service. Your life insurance (FEGLI) may also be reinstated based on the level of coverage you had that met the five-year test prior to your separation. You will also be able to elect supplemental dental and/ or vision coverage under FEDVIP as there is no five-year test for this enrollment.

If you are eligible for an immediate, unreduced retirement under FERS, you will be entitled to a FERS SRS which is an additional payment to “bridge” the time between your retirement and qualifying for Social Security at age 62. An MRA + 10 retirement is not entitled to the FERS SRS, even if you choose to postpone your application.

If you plan to apply for a deferred or postponed retirement, it is advisable to review the Application for a Postponed or Deferred Annuity application, RI 92-19 https://www.opm.gov/ forms/pdf_fill/ri92-19.pdf to be sure you understand how to complete this form. You will later submit the completed application directly to the Office of Personnel Management. Before resigning, and if permitted, it is a good idea

to save a paper or electronic copy of your entire eOPF (electronic Official Personnel Folder). It is important to maintain copies of your service history that show the beginning and ending dates of each appointment, along with any changes in work schedule or retirement coverage. Maintain your final leave and earnings statement to document your sick leave balance and CSRS or FERS retirement contributions for this appointment. If you wish to maintain your health insurance while you delay your application for retirement, you will have the opportunity to elect Temporary Continuation of Coverage (TCC) for up to 18 months. You will pay the employee and employer share of the premium plus an extra 2% administrative fee while covered. You may begin taking Thrift Savings Plan distributions once your payroll provider has notified the TSP of your separation; this typically takes about 30 days. Your retirement benefit will be computed using your high-3 average salary at the time you

COUNTDOWN TO COLA

separate and your total length of creditable service. Your FERS benefit will not receive any cost-ofliving adjustments until after you reach age 62.

To learn more about your retirement, visit https://www. opm.gov/retirement-center/. The NARFE Federal Benefits Institute has a webinar, Understanding Deferred/Postponed Retirements Options, archived at https:// www.narfe.org/federal-benefitsinstitute/narfe-webinars/ webinar-archive/

RETIREMENT

MEDICARE

QHow can I pay for Medicare Part B premiums if I am not receiving Social Security retirement benefits?

AThere are several ways to pay for Medicare Part B:

• Online through a secure Medicare account at https://

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.33%in March 2023. To calculate the 2024 cost-of-living adjustment (COLA), the 2023 third-quarter indices will be averaged and compared with the 2022 third-quarter average of 291.901.

The percentage increase determines the COLA. March’s index, 296.021, is up 1.40% from the base.

The CPI represents purchases of food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services.

For FECA COLA updates, visit narfe.org and search for FECA.

NARFE MAGAZINE www.NARFE.org 19

MONTH CPI-W Monthly % Change % Change from 291.901 OCTOBER 2022 293.003 0.40 0.38 NOVEMBER 292.495 -0.17 0.20 DECEMBER 291.051 -0.49 -0.29 JANUARY 2023 293.565 0.90 0.57 FEBRUARY 295.057 0.50 1.10 MARCH 296.021 0.33 1.40 APRIL MAY JUNE JULY AUGUST SEPTEMBER

Questions & Answers

www.medicare.gov/account/ login

• Medicare Easy Pay: This free service allows automatic deduction of your premium payments from your savings or checking account each month. More details visit https://www.medicare.gov/ basics/costs/pay-premiums/ medicare-easy-pay

• Mail your payment (check, money order, credit, or debit card) to Medicare using a coupon and the provided return envelope. For more details visit https://www. medicare.gov/basics/costs/ pay-premiums

Medicare Premium Collection Center/PO Box 790355

St. Louis, MO 63179-0355

If you retired under CSRS and are not entitled to Social Security retirement benefits, then you can have Medicare premiums withheld from your OPM annuity payments. OPM must receive a request for the withholding from Centers for Medicare and Medicaid Services. OPM cannot withhold premiums based on your direct request or even one from the Social Security Administration. Call Medicare with any billing of premiums questions at 1-800-MEDICARE (1-800-633-4227) or TTY: 1-877-486-2048.

QI need to learn more about becoming eligible and applying for Medicare. What resources are available?

AMost people sign up for Part A (hospital insurance) and Part B (medical insurance) when they’re first eligible, typically at age 65. If you’re working and covered

through an employer group health plan such as FEHB, you may delay Part B without a late enrollment penalty. This is also true if your spouse is working, and you are covered under their “current employment” health insurance. If you are age 65 or older and receive Social Security benefits, you will be automatically enrolled in Part A and Part B. If you don’t want Part B, follow the instructions that come with the card, and send the card back. There is no premium for Part A for most people since you paid the 1.45 percent payroll tax during your career. Part B has a standard premium of $164.90 / month / person in 2023 and for those with higher income, the premium will include a surcharge or “Income Related Monthly Adjustment Amount” that can substantially increase the cost of Part B. Part A covers inpatient care such as room and board during an inpatient hospitalization. Part B is medical insurance for outpatient medical expenses such as services from doctors and other health care providers, durable medical equipment (like wheelchairs, walkers, etc.), and some preventive services. To learn more about Medicare enrollment, see CMS Publication, available at https://www.medicare.gov/ Pubs/pdf/11036-EnrollingMedicare-Part-A-Part-B.pdf. To learn about the basics of Medicare Parts A, B, C, and D, visit: https:// www.medicare.gov/basics/ get-started-with-medicare

The NARFE Federal Benefits Institute has webinars archived on the topic of coordination of Medicare and FEHB: https:// www.narfe.org/federal-benefitsinstitute/narfe-webinars/ webinar-archive/. Check out Section 9 of your FEHB plan

brochure or your plan website for an explanation of how your plan coordinates with other insurance, including Medicare. Find links to your plan’s website and brochures: https://www. opm.gov/healthcare-insurance/ healthcare/plan-information/ plans/.

QHow can I change my dental or vision plan?

AYou may change your Federal Employees Dental or Vision plan at www.benefeds.com during the annual open season periods or when you have a Qualifying Life Event. The number to contact Benefeds is 1-877-888-3337, TTY 1-877-889-5680 or International +1-571-730-5942.

SURVIVOR BENEFITS

QI retired a few years ago and am getting married soon. Can I add my new spouse to my insurance? How can I elect a survivor benefit?

ACongratulations! You can add your new spouse to health, dental, and/ or vision coverage up to 31 days before or up to 60 days after the date of your marriage. You may also make changes during annual open seasons or other Qualified Life Event (QLE). For FEHB changes, use the Health Benefits Election Form, OPM form 2809: https://www.opm.gov/forms/pdf_ fill/opm2809.pdf. Submit form to OPM using the address provided on the form to change your FEHB coverage or enrollment. To add your new spouse to your dental or vision supplement under FEDVIP, you must first check your eligibility and create a My BENEFEDS

20 NARFE MAGAZINE

2023

JUNE/JULY

account. Then, select “Enroll” in dental or vision coverage from your account dashboard to answer a few questions to determine what QLE you experienced and if it allows you to enroll outside of open season. Retirees are not eligible to increase their life insurance coverage under the Federal Employees Group Life Insurance (FEGLI) program. You may provide a survivor benefit to a spouse that you marry after retirement within two years of the date of marriage. If you retired under the Civil Service Retirement System (CSRS) or CSRS Offset, you may elect to provide 55% of any amount up to the amount of your unreduced retirement benefit. Under the Federal Employees Retirement System (FERS) you may elect either the maximum survivor benefits equal to 50% of your unreduced FERS benefit or a partial survivor benefit equal to 25% of your FERS benefit. If you happen to remarry the same person to whom you were married at retirement, you cannot elect a survivor annuity greater than the one you elected at retirement. For a post-retirement survivor election, there will be two reductions in your annuity:

1. The normal reduction to provide the survivor benefit:

• The reduction for FERS depends on the election of the maximum or partial survivor benefit. The reduction is either:

◊ 10% of your basic annuity for the max or

◊ 5% of your basic annuity for the partial

• The reduction for CSRS depends on the base selected for the survivor election. The reduction to your benefit will be computed as:

◊ 2.5% of the first $3600 of your basic annuity, then 10% of the remainder up to the amount you have chosen as the base for the survivor benefit. For example, if you elect to provide a survivor benefit equal to 55% of $10,000 (which provides $5,500 / year or $458 / month to your surviving spouse), the reduction would be $730 / year or $60.80 monthly (2.5% of $3,600 + 10% of $6,400).

2. A permanent actuarial reduction equal to the difference between the new annuity rate with the survivor benefit and the old one without the survivor benefit since your retirement, plus 6 percent interest. The actuarial reduction continues even if the marriage ends.

When you write to OPM, include a copy of your marriage certificate, your full name, the name of your new spouse, your CSA number, and signature.

OPM will send you specific information on the cost of the benefit and ask you to confirm your election. OPM, Remarriage after Retirement, Retirement Operations Center, P.O. Box 45 Boyers, PA 16017-0045.

You may also want to update your beneficiary designations:

• Federal Employees Group Life Insurance (FEGLI) https:// www.opm.gov/forms/pdf_ fill/sf2823.pdf

• Civil Service Retirement System (CSRS) and/or Federal Employees Retirement System (FERS) https://www.opm.gov/ forms/pdf_fill/sf3102.pdf

OPM must receive the forms before your death to be valid. You can email retire@opm.gov and/or call OPM at 1-888-767-

6738 to request the forms or complete them online at www. opm.gov/forms and mail them to OPM as directed on the form. To learn more about designating beneficiaries for your Thrift Savings Plan account, you will need to log into your My TSP account. Learn more by reading the TSP Death Benefits Booklet, Publication 31, https://www.tsp. gov/publications/tspbk31.pdf

OPM CONTACT INFO

QWhat and when is the best way to contact OPM?

AWe all know what it is like to call for customer service only to be told, “Our lines our busy, please wait for the next available representative” or worse, “Please try again later.” To avoid this situation, try using OPM Services Online at https:// www.servicesonline.opm.gov/ This is an online service allowing retirees the ability to make many changes electronically. You may also find your question answered at the Customer Support Center available at https://www.opm. gov/support/retirement/. Other ways to contact OPM are by email or phone. Email at retire@ opm.gov. To call, use 1-888-7676738 or TTY: 711. The lines are open Monday through Friday, 7:40 a.m. to 5:00 p.m. ET, closed on federal holidays. The busiest time is between 10:30 a.m. and 1:30 p.m. ET.

To obtain an answer to a federal benefits question, NARFE members should call 800-456-8410 and select option 2 for the Federal Benefits Institute; send the question by postal mail to NARFE Headquarters, ATTN: Federal Benefits; or submit it by email to fedbenefits@narfe.org.

NARFE MAGAZINE www.NARFE.org 21

Moving to an Encore Federal Career

Retirement may provide a new and exciting adventure or a chance to do something familiar. In some cases, federal employees retire only to begin a period federal reemployment. It is possible to become reemployed in federal service while receiving a CSRS or FERS retirement benefit. Here are some of the ways to become reemployed in federal service along with a few considerations before you begin an “encore” federal career.

REEMPLOYED ANNUITANT

CSRS and FERS retirees may return to federal service under a temporary (temporary or term) or a permanent appointment (career, career-conditional, excepted, etc.). Your work schedule may be fulltime, part-time or intermittent.

Positives:

• While reemployed, you continue to share your knowledge and expertise.

• If hired under a position that conveys health insurance, you may participate in premium conversion (paying premiums pre-tax) if you re-enroll as an employee.

• Reemployed Annuitants may be reemployed in a position that conveys eligibility for health benefits and life insurance.

• Depending on the length of reemployment, you may qualify for a supplemental or a redetermined annuity when you retire from your second career. This requires a minimum of one year of full-time service to earn a supplemental annuity benefit or five years to earn a full recomputation.

• If a reemployed annuitant is performing service covered by FERS or CSRS, the reemployed annuitant is eligible to participate in the TSP. If you are facing IRS RMDs (Required Minimum Distributions), these may be postponed while you are contributing to the TSP.

• Continuing employment may allow you to delay filing for Social Security while your benefit continues to grow.

Negative:

• You may be working only for the difference between your new salary and the amount of your CSRS or

FERS annuity, as your salary may be offset by the amount of annuity (prorated on an hourly basis), depending on the type of retirement you are receiving. Note that a retiree’s annuity is terminated upon reemployment in the Federal service when based on an involuntary separation, disability or when the annuitant receives a presidential appointment subject to retirement deductions. For more information, visit www.narfe. org/opm-ri90-18.

REEMPLOYMENT OF CIVILIAN RETIREES TO MEET EXCEPTIONAL EMPLOYMENT NEEDS/ DUAL COMPENSATION WAIVER

This is a temporary appointment with a limitation on the number of hours you may work and a limit on the period of reemployment. Reemployment is granted under four categories of case-by-case waivers: emergency hiring need; severe recruiting difficulty; need to retain a particular individual uniquely qualified for a specific project; and requests based on other unusual circumstances not rising to the level of an emergency.

Positives:

• You will receive your annuity and full salary without an offset.

• Earn both annual and sick leave during the period of reemployment.

22 NARFE MAGAZINE JUNE/JULY 2023 Benefits Brief

IT IS POSSIBLE TO BECOME REEMPLOYED IN FEDERAL SERVICE WHILE RECEIVING A CSRS OR FERS RETIREMENT BENEFIT.

• If the reemployment is for more than one year, health benefits coverage is available.

Negative:

• This type of reemployment does not provide coverage under CSRS or FERS; therefore, there is no increase to your existing annuity and no contributions to TSP are permitted. For more information visit www.narfe.org/ opm-dual-waiver.

PHASED RETIREMENT

This is a two-step retirement process. Step one is a period of partial retirement and partial employment. During this period, you will receive 50 percent of your earned retirement benefit while working 50 percent of a full-time work schedule. Step two is entry into full retirement with an increase to the initial retirement benefit based on the period of “phased retirement.”

Positives:

• Mentor and train the next generation of federal employees who will be moving into senior-level positions.

• Continue health and/or life insurance coverage as a full-time employee without paying any of the government share of the premiums.

• Allow time to transition from full time work to full retirement, while increasing your final retirement benefit.

Negative:

• Phased retirement is not available for all positions or at all agencies. For more information visit www.narfe.org/opmphased-retirement

NARFE MAGAZINE www.NARFE.org 23

$300 discount for NARFE members Call TODAY for a complimentary meeting Advisory services offered through Strategic Blueprint, LLC. Securities offered through The Strategic Financial Alliance, Inc. (SFA), member FINRA/SIPC. Strategic Blueprint and SFA are affiliated through common ownership but otherwise unaffiliated with Keen & Pocock. Proper Asset Allocation Asset Allocation Social Security claiming strategies Roth conversion strategies Stealth taxes Beneficiary designations FEHB and FEGLI in retirement Retirement income projections Tax-efficient investing & withdrawal strategies 703-691-9200 KEENPOCOCK.COM INFO@KEENPOCOCK.COM FEDERAL RETIREMENT BOOTCAMP Learn how to maximize YOUR federal benefits

—MICHELE BOLLIER FEDERAL.

Staying Sharp Behind the Wheel

24 NARFE MAGAZINE JUNE/JULY 2023

What older drivers need to know about driving safely, what to look for in a new car, how to save money on car insurance— and when to turn

BY EVERETT A. CHASEN

over the keys

NARFE MAGAZINE www.NARFE.org 25

In 2020, there were almost 48 million licensed drivers age 65 or older in the United States, a 68% increase since 2000, according to the US Centers for Disease Control and Prevention (CDC).

While driving helps older adults stay mobile and independent, the risk of being injured or killed in a traffic crash increases as people age. This is true even though seniors have extensive experience behind the wheel.

“Senior drivers are among the safest on the road, especially compared to teen drivers,” says Rhonda Shah, Manager, Traffic Safety Advocacy and Community Impact for the Automobile Association of America (AAA)’s Public Affairs Office. “They often reduce their risk of injury by wearing seat belts; they don’t drink and drive; they observe speed limits; and they don’t drive distracted.”

If that’s the case, why are seniors more likely to be hurt or killed in traffic injuries? “Age-related fragility,” Shah explains. “With the exception of teens, seniors have the highest crash death rate per mile driven. As we age, our ability to drive safely is affected by natural changes to our bodies over time.”

What steps can older adults take to stay safer on the roads?

How to Stay Safe

In 2020, about 7,500 older adults were killed in traffic crashes, according to the CDC, and 200,000 were treated in emergency departments for crash injuries. This means that on average, 20 older adults are killed and nearly 540 are injured in crashes each day.

“Our ability to drive requires not only knowledge and experience but healthy vision, plus physical and cognitive ability,” Shah tells NARFE. “While our knowledge and experience expand with age, changes to vision, physical health and mental capabilities require adjustments to help us remain safe drivers. Natural age-related changes occur so subtly we often don’t notice them progressing.”

CDC offers a number of tips to help older drivers stay safe on the road. Foremost among these are to always wear a seat belt as a driver or passenger; to drive when conditions are safest, during daylight and

in good weather; and, of course, to never drink and drive. Here are a few additional steps that can help:

• Follow a regular activity program to increase strength and flexibility.

• Ask your doctor or pharmacist to review medicines—both prescription and over-the counter—to reduce side effects and interactions. CDC offers a fact sheet on its website called Are Your Medicines Increasing Your Risk of a Fall or a Car Crash.

• Have your eyes checked by an eye doctor at least once a year. Wear glasses and corrective lenses as required.

• Plan your route before you drive.

• Find the safest route with well-lit streets, intersections with left-turn signals and easy parking.

• Leave a large following distance between your car and the car in front of you.

• Avoid distractions in your car, such as listening to a loud radio, talking or texting on your phone, and eating.

• Consider potential alternatives to driving, such as riding with a friend, using ride share services or taking public transit.

Make a driver planning agreement with your family

26 NARFE MAGAZINE JUNE/JULY 2023

While our knowledge and experience expand with age, changes to vision, physical health and mental capabilities require adjustments to help us remain safe drivers.

Have your eyes checked by an eye doctor at least once a year.

Insurance Issues

“Young drivers under the age of 25 tend to pay by far the most for auto insurance, as their lack of driving experience makes them more likely to file a claim [following an accident],” explains Chase Gardner, data journalist at Insurify, a company that helps insurance buyers get the best deal available by simplifying the process of comparing costs.

“However, buyers over the age of 70 also pay a little more than middle-aged drivers, since drivers in these older age groups are also slightly more likely to file a claim, ” he continues. According to Gardner, drivers over the age of 70 still pay much less for car insurance on average than drivers under 25.

Gardner suggests that if your premium is starting to rise, “it never hurts to shop around for a new policy.” Insurance companies calculate risk differently, so one company may give you a better rate than another for being the exact same driver. By comparing rates from four to five different companies, you can be sure you’re getting the best policy. “Sometimes,” he adds, “staying with your current company and taking advantage of loyalty

discounts will still be the cheapest option, but it’s always a good idea to check.”

He believes if older drivers have changed their driving habits significantly, it could be worthwhile to explore usage-based insurance policies. These plans track your habits and overall mileage, charging you only for the miles you drive and rewarding drivers who show caution behind the wheel.

Insurify encourages older drivers who believe they are careful motorists and don’t drive as often as they did in the past to speak with an agent to see if a usage-based policy is right for them. “The savings could be significant,” Gardner tells NARFE.

Finally, Gardner recommends older drivers consider senior driving safety courses; some insurers reward completion of the course with a sizable discount. AAA, for example, offers a Roadwise Driver Course online ( https://exchange. aaa.com/safety/senior-driver-safety-mobility/ aaa-roadwise-driver/) geared toward helping older drivers understand age-related changes they may experience, and explaining ways they can adjust their driving accordingly. Interactive exercises that are part of the course include brain training and assessments.

Get a professional

driving assessment

Choose a vehicle with the right features that you understand how to use properly

NARFE MAGAZINE www.NARFE.org 27

Explore a usagebased insurance policy

Insurify has found that, on average, drivers eligible to receive a senior driver safety course discount save 15 percent on their policies.

Car Buying Tips for Seniors

If you’re looking for a new car, how do you determine what type “fits” you? Shah explains that “choosing a vehicle with the right features that you understand how to use properly is key.” More and more, drivers are recognizing the value in having vehicles with advanced driver assistance systems like blind-spot monitoring, forward collision warning and lane-keeping assist.

Other valuable technologies available on many cars include forward automatic emergency braking, advanced cruise control, adaptive headlights (which direct your headlights slightly in the same direction as the steering wheel when entering a curve, thereby projecting additional light onto your path of travel), automatic crash notification and parking assistance.

While many of these options are offered in newer vehicles, some drivers are unaware of the safety limitations of these systems. Lack of

understanding or confusion about the proper function of these technologies can lead to misuse or over-reliance on the technology, which can result in a deadly crash. In addition, some people find these new systems distracting instead of helpful.

Keep in mind that while new vehicle safety technologies can improve your comfort and safety behind the wheel, they are not perfect. You must remain engaged and attentive at all times, no matter what technologies are in your vehicle.

Some AAA clubs across the nation offer a CarFit program—an educational program offering older adults the opportunity to see how well their personal vehicles fit them. The program also provides information and materials on communityspecific resources that could enhance their safety as drivers and increase their mobility.

Options for Older Drivers

AAA also provides a driver planning agreement online ( https://exchange.aaa.com/wp-content/ uploads/2021/03/Driver-Planning-Agreement.pdf ) to help families plan together for continued, safe mobility. The agreement requires family members

28 NARFE MAGAZINE JUNE/JULY 2023

If older drivers have changed their driving habits significantly, it could be worthwhile to explore usage-based insurance policies

Watch for These Signs