Senior Training &

Manager

Information provided is general information presented in a summary format as at 26 August 2022, and is therefore not necessarily complete. This presentation is for informational purposes only and is not to be relied upon as advice to investors or potential investors. This presentation does not take into consideration the investment objectives, financial situation or particular needs of any particular investor. Investors should not rely on this presentation to make any investment decision, and should make their own assessment, conduct their own research of Netwealth and the Netwealth Group and consider these factors with their legal, tax, business and/or financial adviser before making any investment decision.

This presentation may contain certain forward - looking statements with respect to the financial condition, operations and business of the Netwealth Group and certain plans and objectives of the management of Netwealth. Forward looking statements can be identified by the use of forward looking terminology, including, without limitation, the terms “believes”, “estimates”, “anticipates”, “expects, “predicts”, “intends”, “plans”, “goals”, “targets”, “aims”, “outlook”, “guidance”, “forecasts”, “may”, “will”, “would”, “could” or “should” or, in each case, their negative or other variations or comparable terminology. These forward looking statements include all matters that are not historical facts. Such forward looking statements involve known and unknown risks, uncertainties and other factors which because of their nature may cause the actual results or performance of the Netwealth Group to be materially different from the results or performance expressed or implied by such forward looking statements. Such forward looking statements are based on numerous assumptions regarding the Netwealth Group’s present and future business strategies, the political and economic environment in which the Netwealth Group will operate in the future and financial market conditions, which may not be reasonable, and are not guarantees or predictions of future performance.

No representation is made that any of these statements or forecasts will come to pass or that any forecast result will be achieved, or that there is a reasonable basis for any of these statements or forecasts. Forward - looking statements speak only as at the date of this presentation and to the full extent permitted by law, Netwealth, the Netwealth Group, and their respective affiliates and related bodies corporate and each of their respective related parties and intermediaries disclaim any obligation or undertaking to release any updates or revisions to information to reflect any change in any of the information contained in this presentation (including, but not limited to, any assumptions or expectations set out in the presentation).

Past performance information given in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance.

All figures in the presentation are provided in Australian dollars. Financial data may be subject to rounding. For further information please contact:

Grant Boyle, Chief Financial Officer grant@netwealth.com.au

• Senior

• Bev provides ongoing support and education on the newly released and existing Netwealth platform enhancements, helping create efficiencies for advisers.

Netwealth is your partner in change, enabling a brighter future for you and your clients

A focus on technology and platform innovation

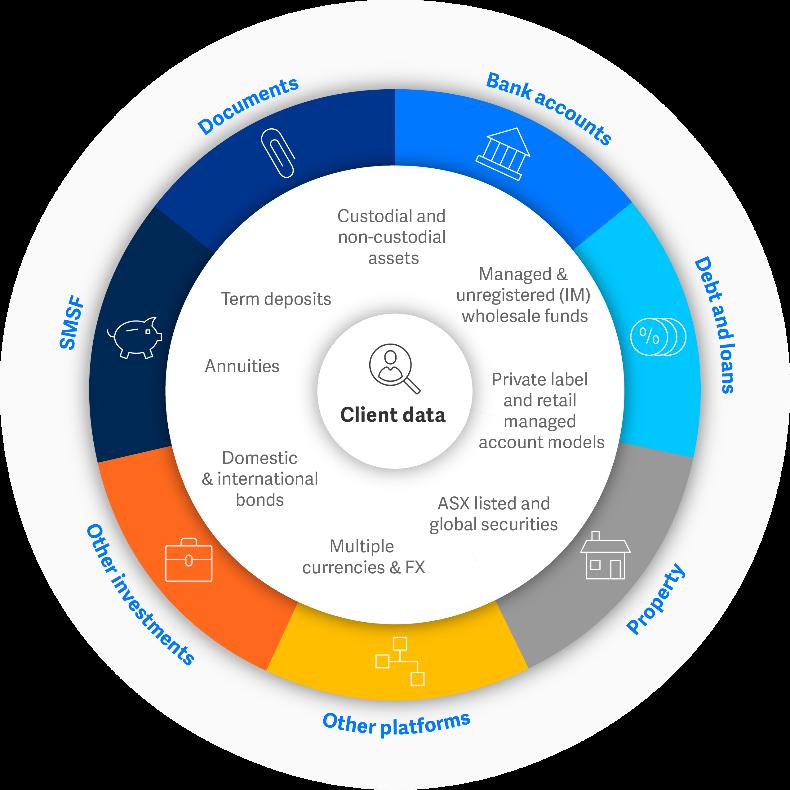

We have a home grown market leading investment platform that connects clients and advisers. It is agile and flexible to provide choice and remove barriers.

200+ IT staff dedicated to platform development, accounting for ~25% of headcount expenses.

A values-driven team focused on customer support and service

We are real people who are guides by our values and understand the critical importance of client service and support.

We provide deep insights to help you see your world in a new light, to help you spot the changes that matter today and tomorrow.

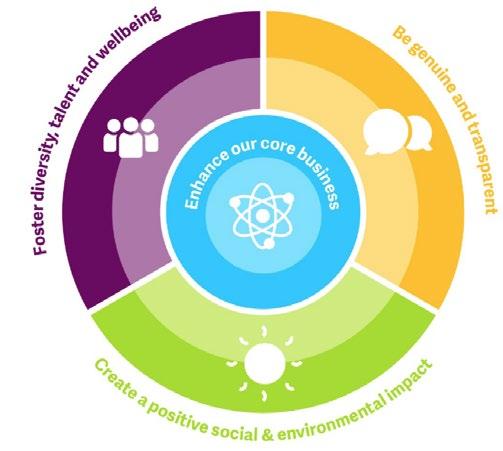

A focus on sustainability and social impact

Wealth takes time to accumulate. Being sustainable and here for the long term custody of our clients’ assets is very important to us. We have a range of initiatives that support this vision.

https://www.netwealth.com.au/web/aboutnetwealth/corporate sustainability/announcements/

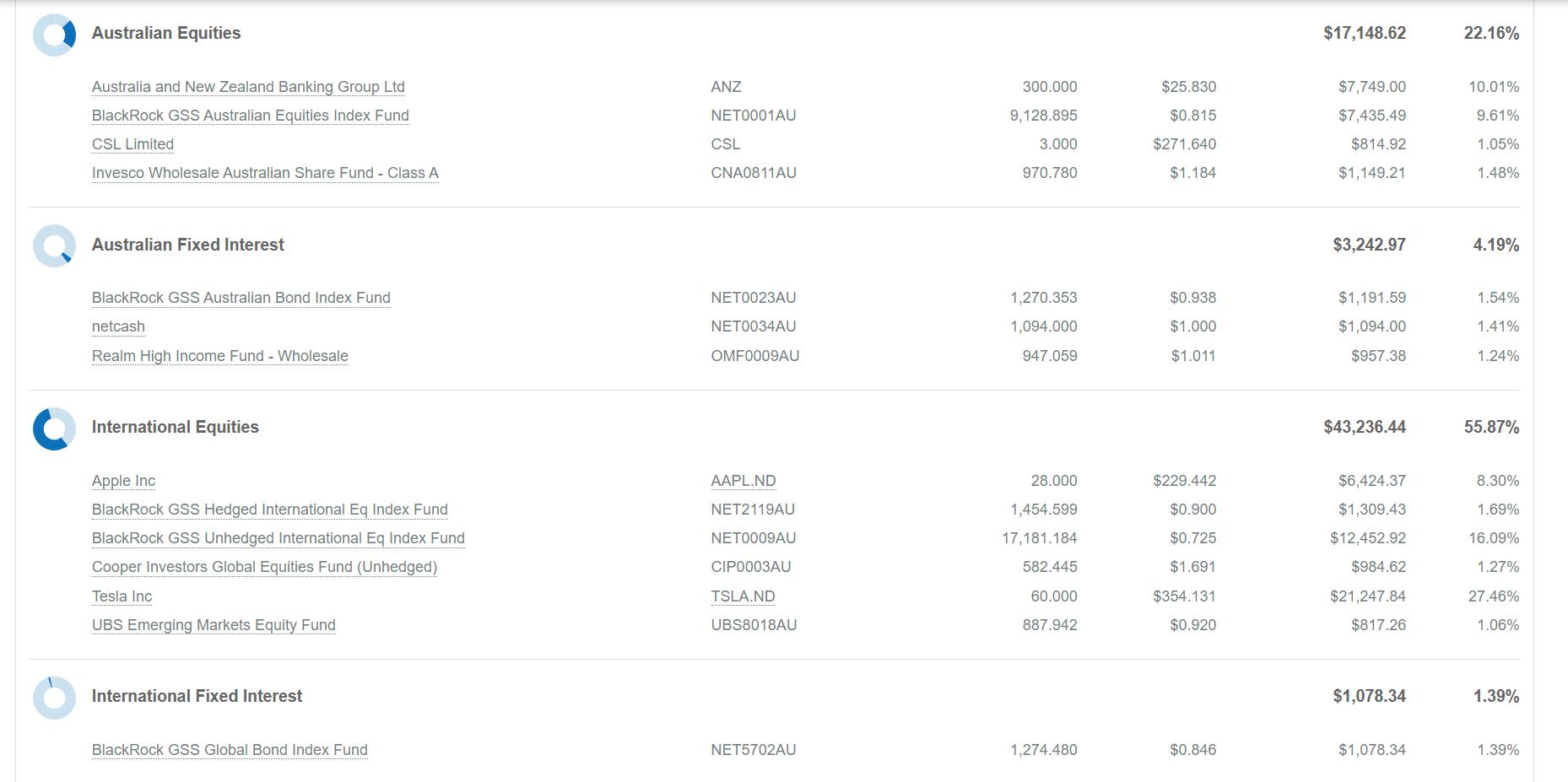

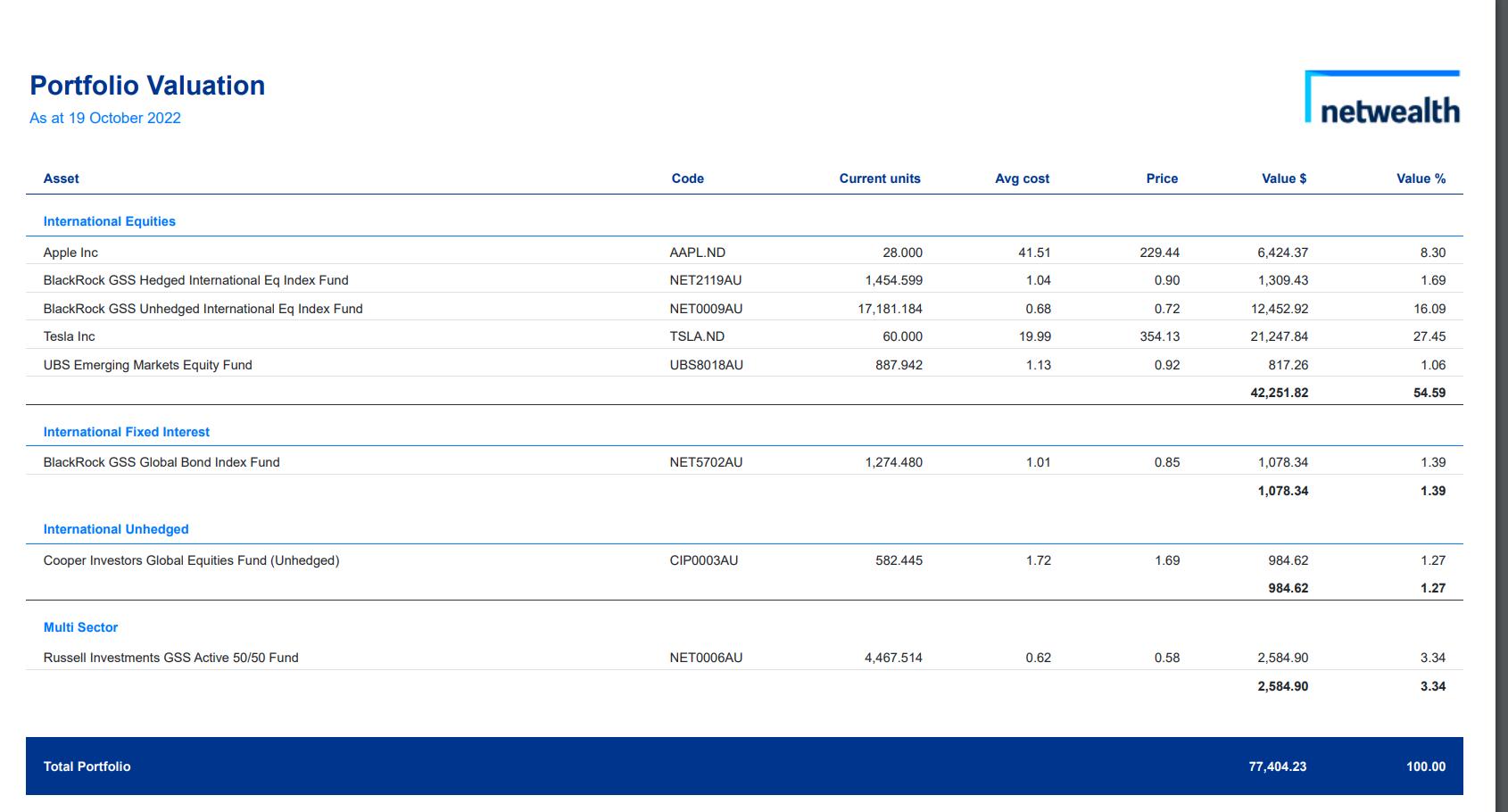

A cost-effective option with a range of index & diversified investment options.

Build diversified investment portfolios that are cost-effective using Netwealth’s GSS funds and managed account models. Access professionally managed multi-sector, diversified and international investment portfolios run by quality managers with strong track records.

Investment choice from local and global opportunities plus premium options.

Invest in ASX listed securities, including Exchange Traded Funds (ETFs), AREITs and listed investment companies. Also access international listed securities, managed funds,

account models, term deposits and annuities. Plus, multi currency trading, bonds and

products.

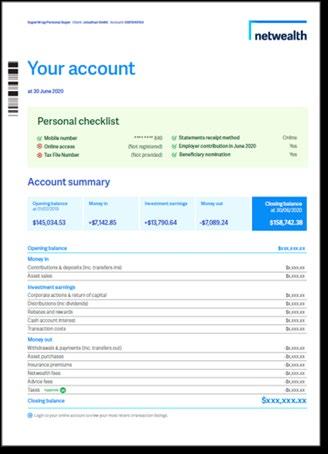

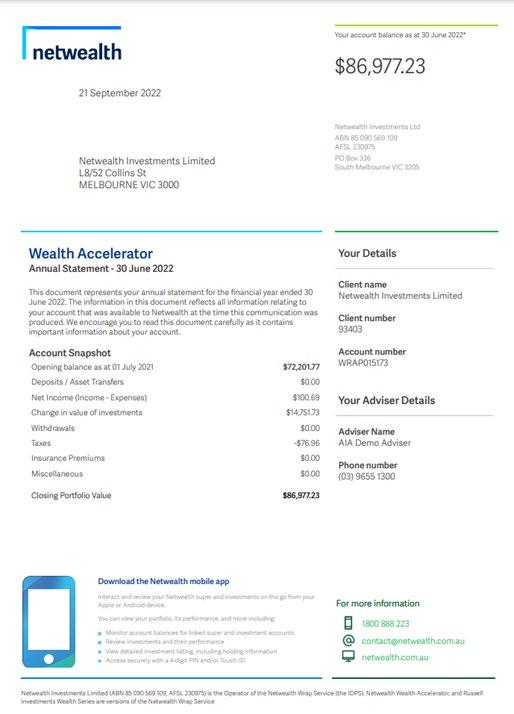

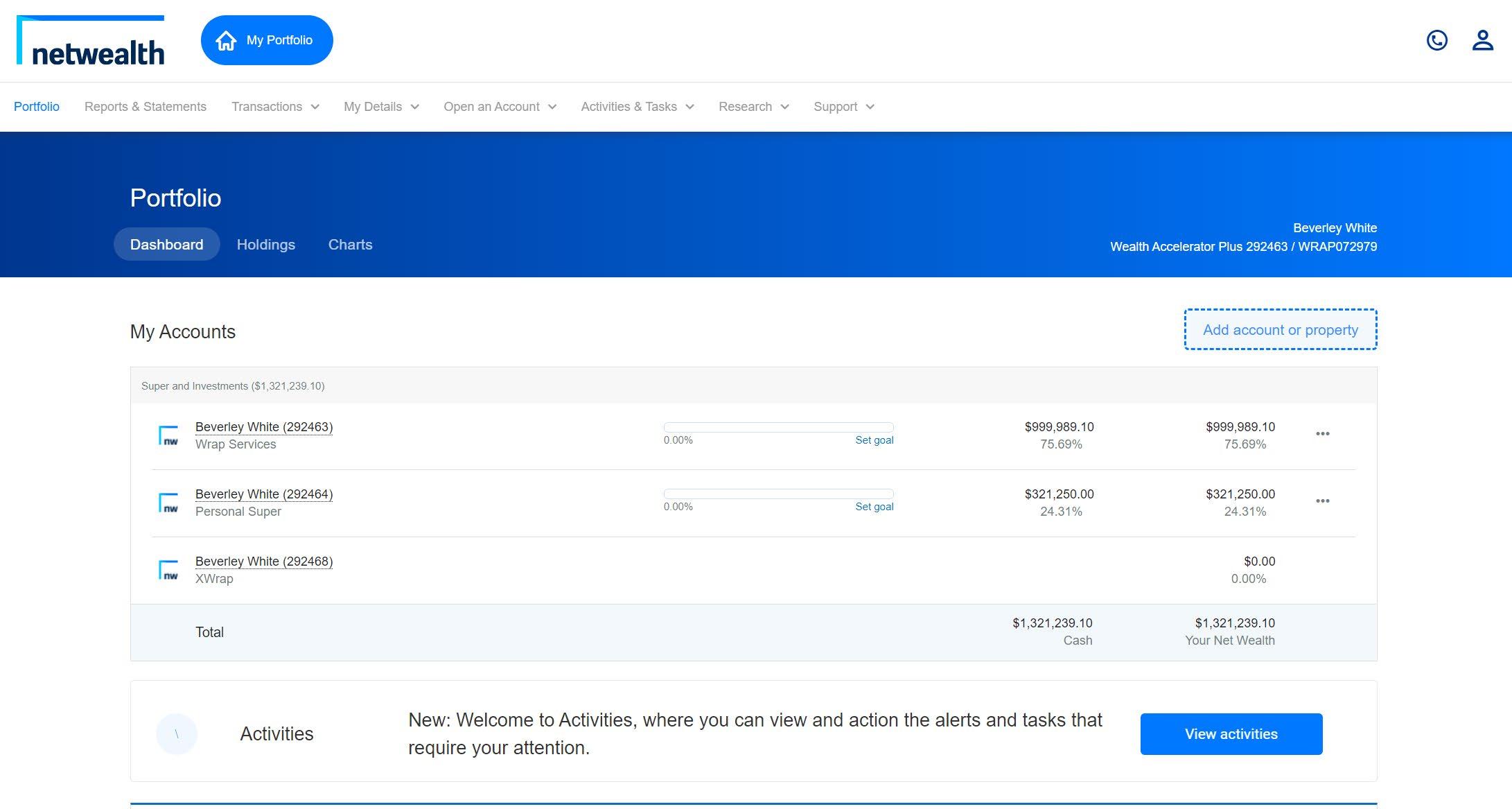

For investors looking for a centralised account and reporting solution.

For Wealth Accelerator accounts access an outsourced administration solution for assets which cannot be held in custody. Appointed under an LPOA, Netwealth will facilitate your client’s investments, be registered as the mail house and administer the assets for reporting and tax statement purposes.

For wholesale or sophisticated investors, a Wealth Accelerator account will provide them access to:

• Term deposits

• Managed funds

• Managed accounts

• ASX & international listed securities

• Unlisted Managed Investment Schemes

• Unlisted domestic & international bonds

• Foreign currency accounts

As part of your client’s Wealth Accelerator account they can appoint Netwealth as their administrator for non custodial investments. In signing an LPOA, the client provides Netwealth will permission to:

• Arrange investment applications on their behalf (in their registered name) using cash from the client’s platform cash account.

• Become the registered mailing address for the investments.

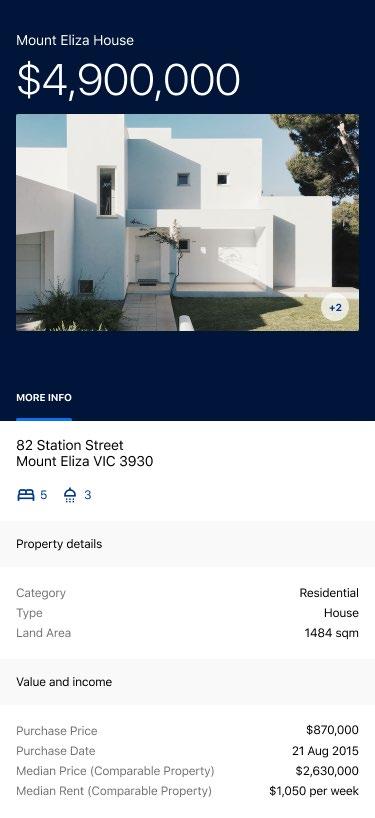

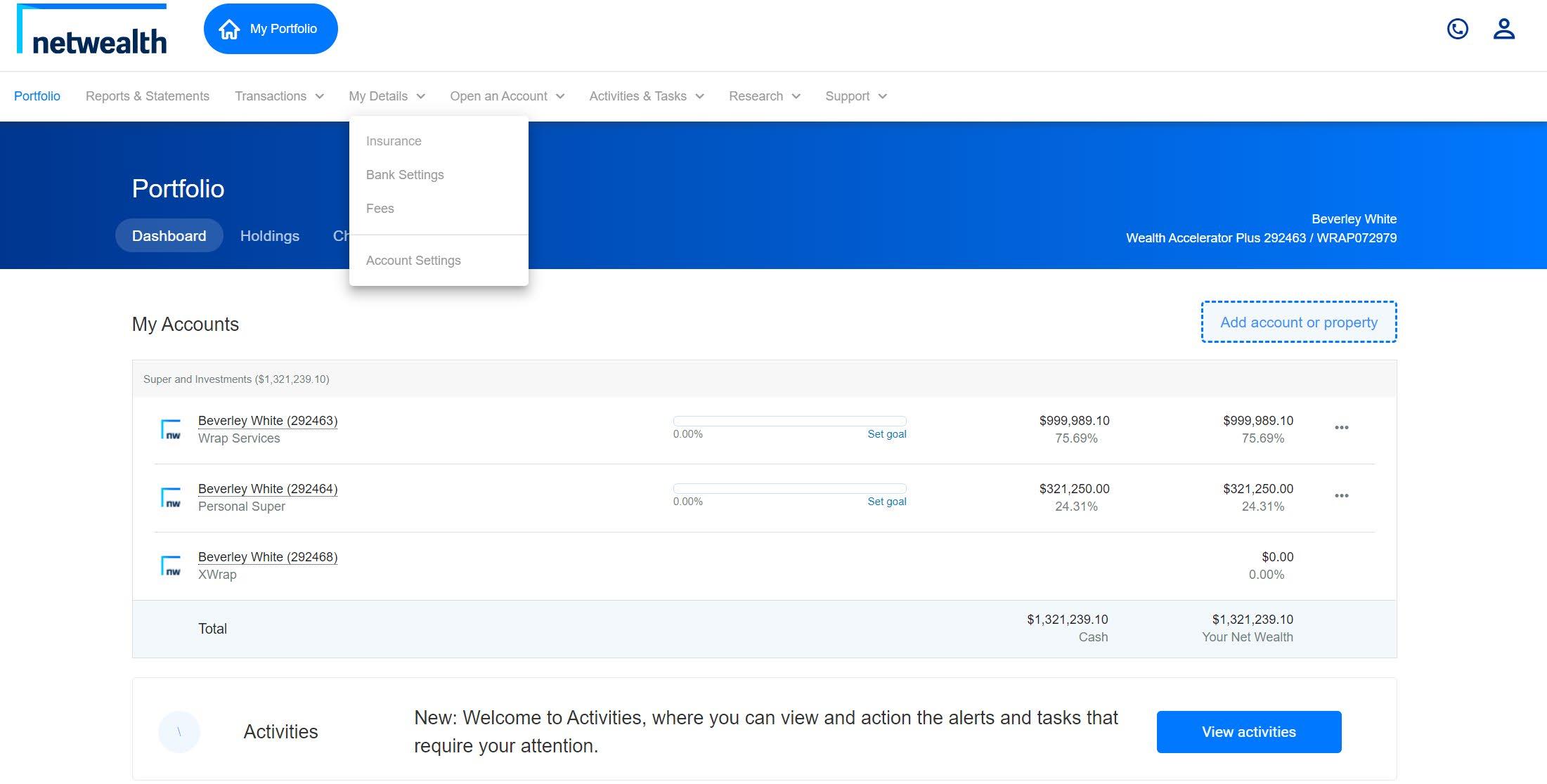

Where the adviser wishes to maintain the administration of non custodial assets or the client owns commercial or investment properties, XWrap can be used to incorporate for both onscreen viewing and reporting.

The adviser is responsible for creating the stand alone XWrap account and entering the assets and related transactions and prices. This can be entered as individual transactions or via a bulk upload.

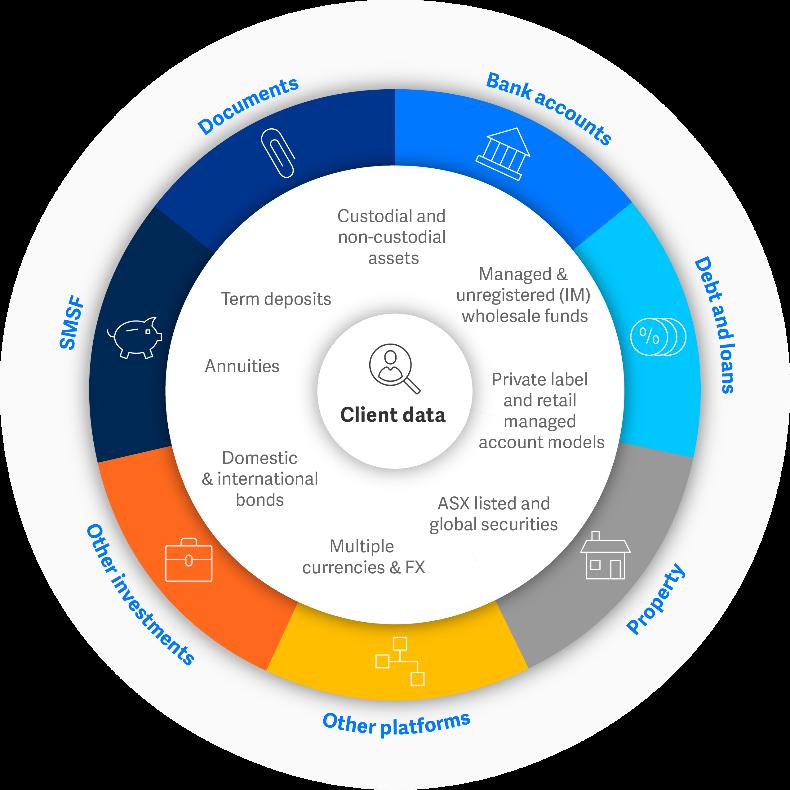

Access a range of data feeds ranging from bank, property, SMSF and business-related from a variety of data providers and integrations partners.

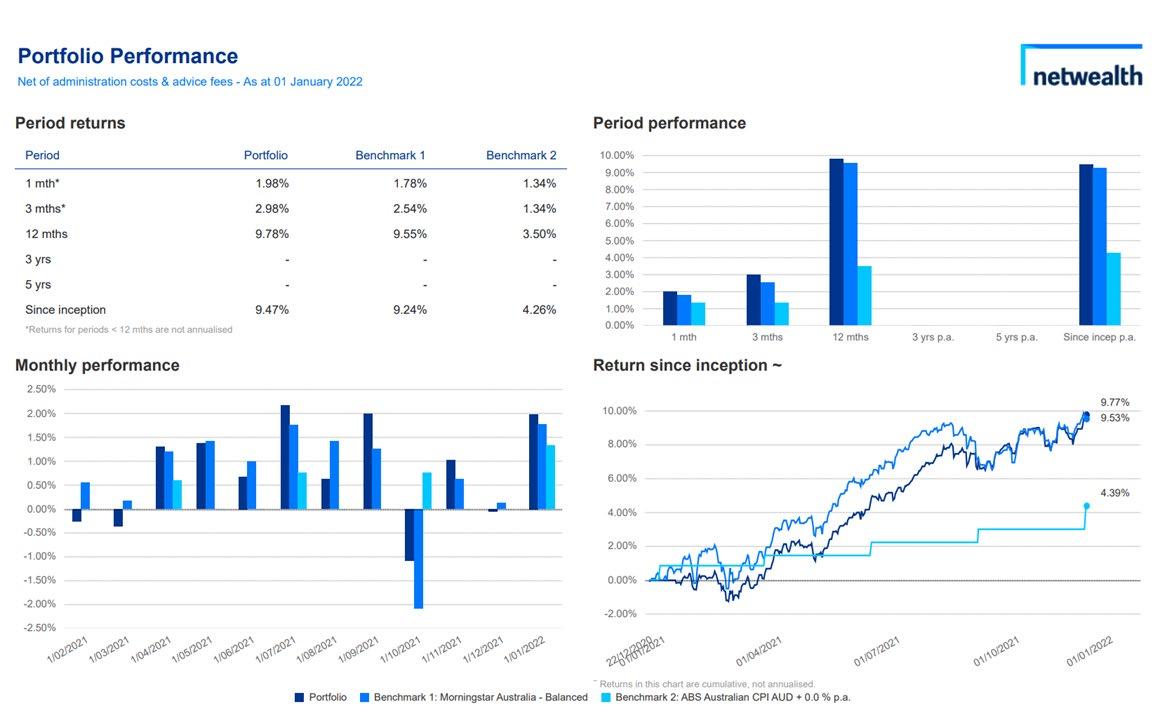

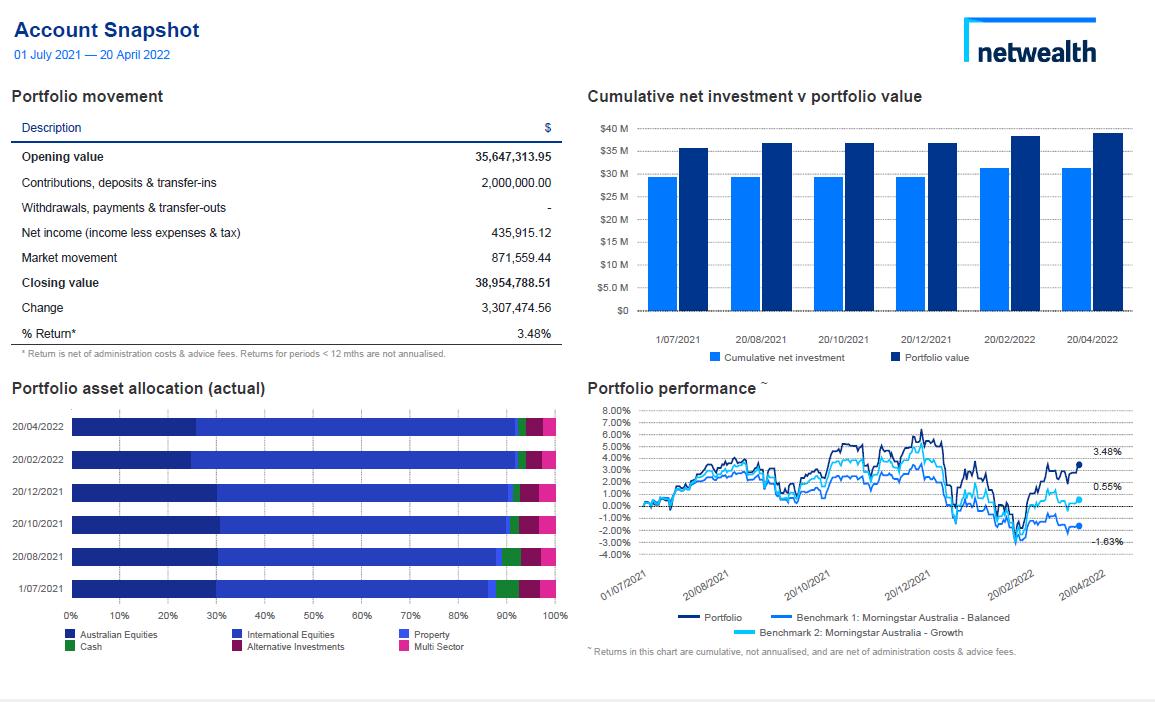

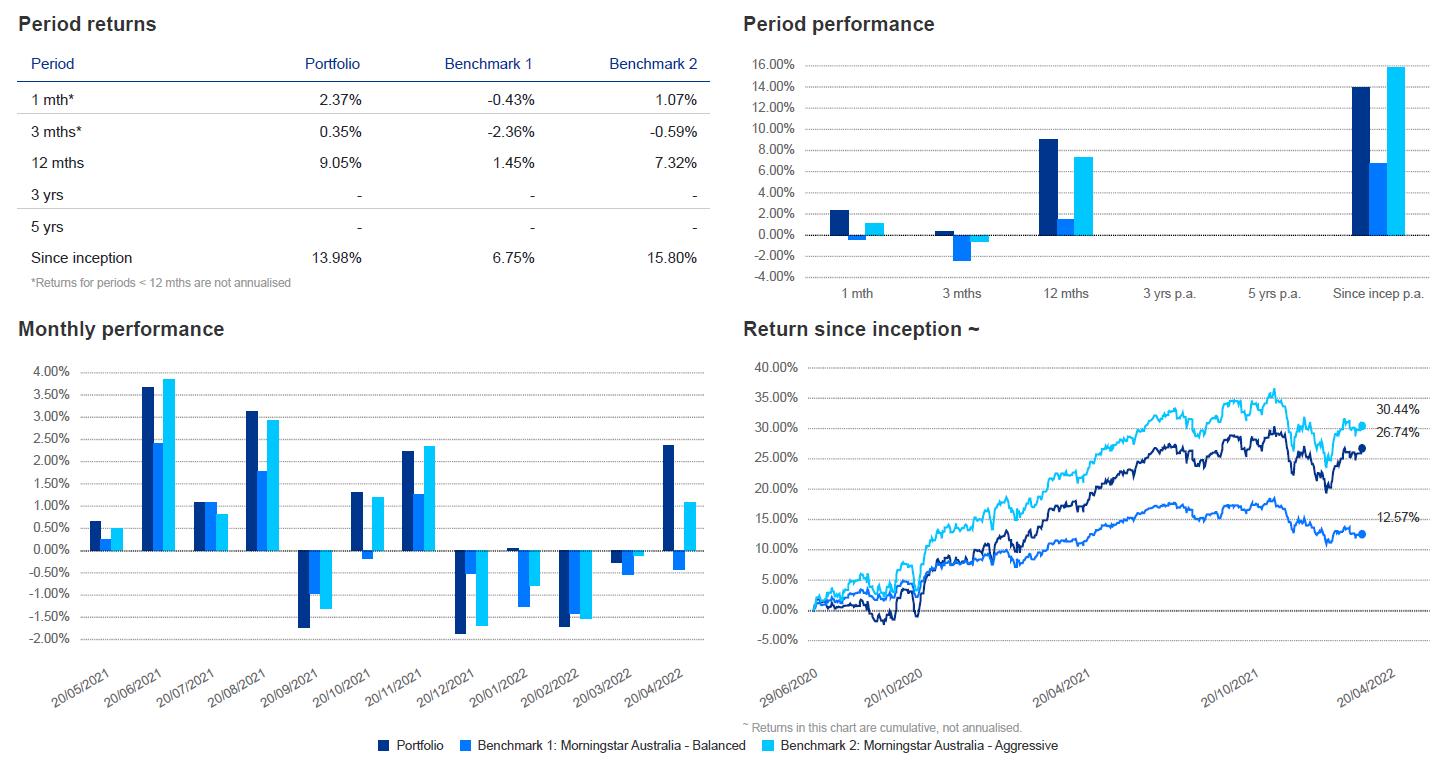

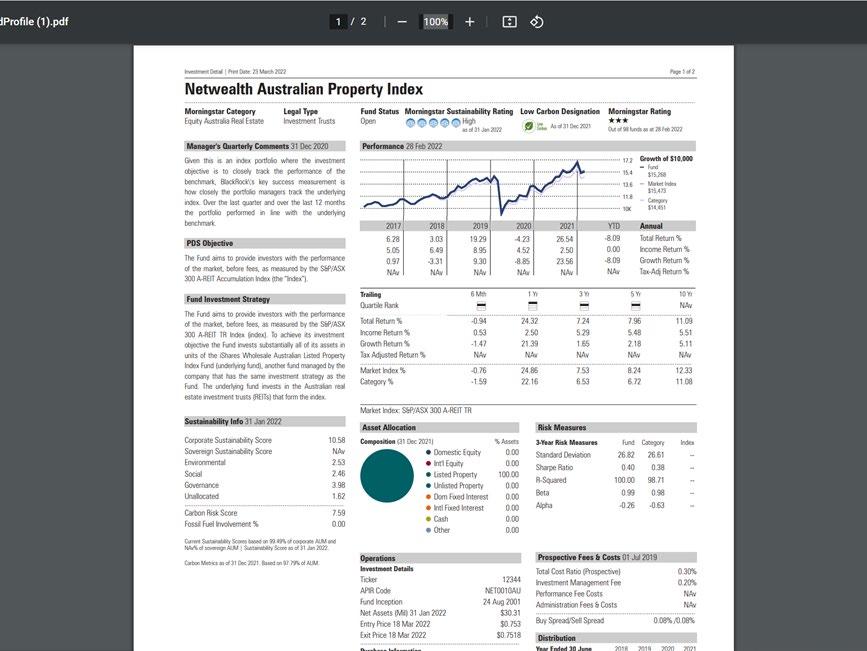

The ability to benchmark performance of client portfolios against the Morningstar, CPI+ and Cash Rate+

•

•

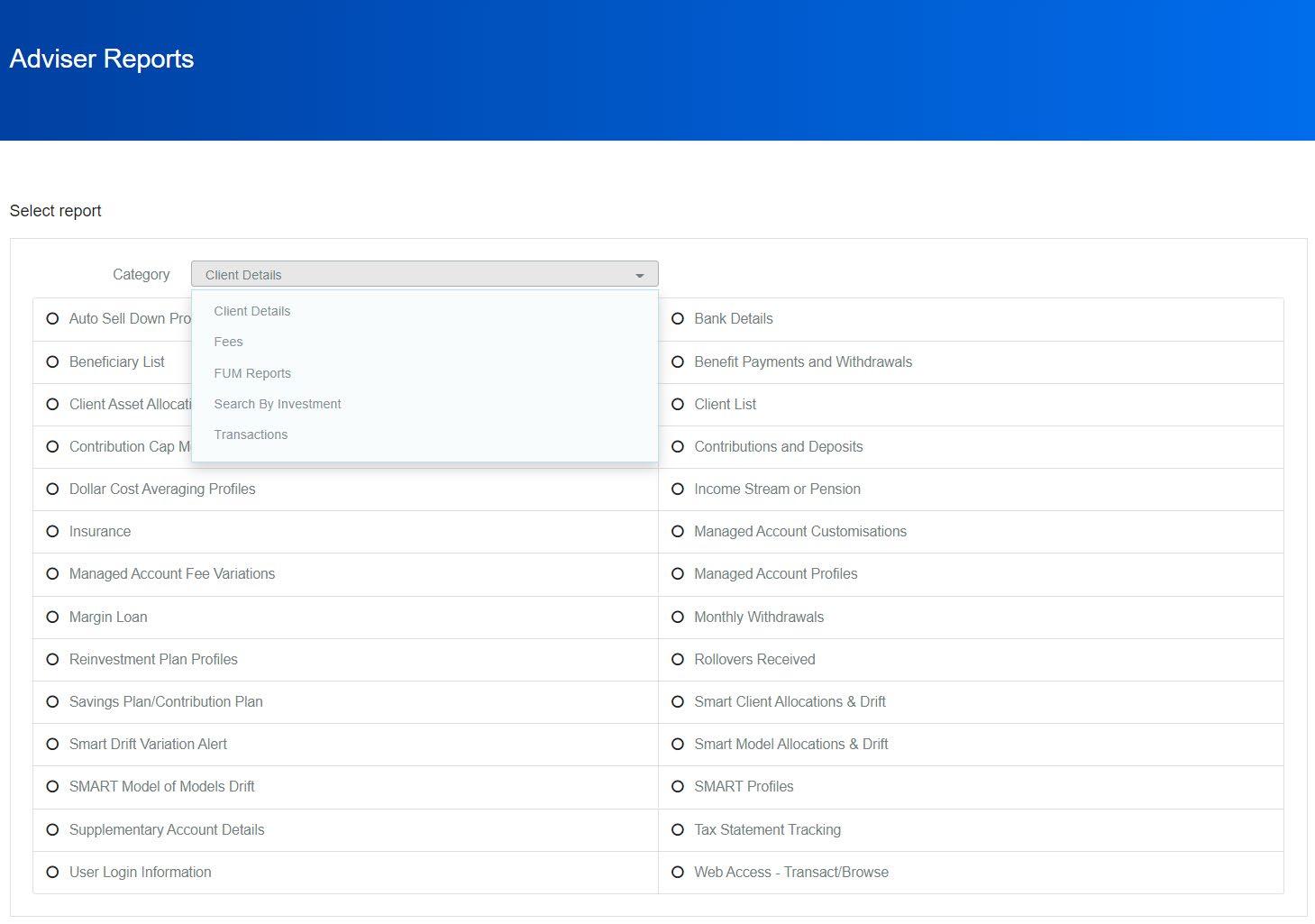

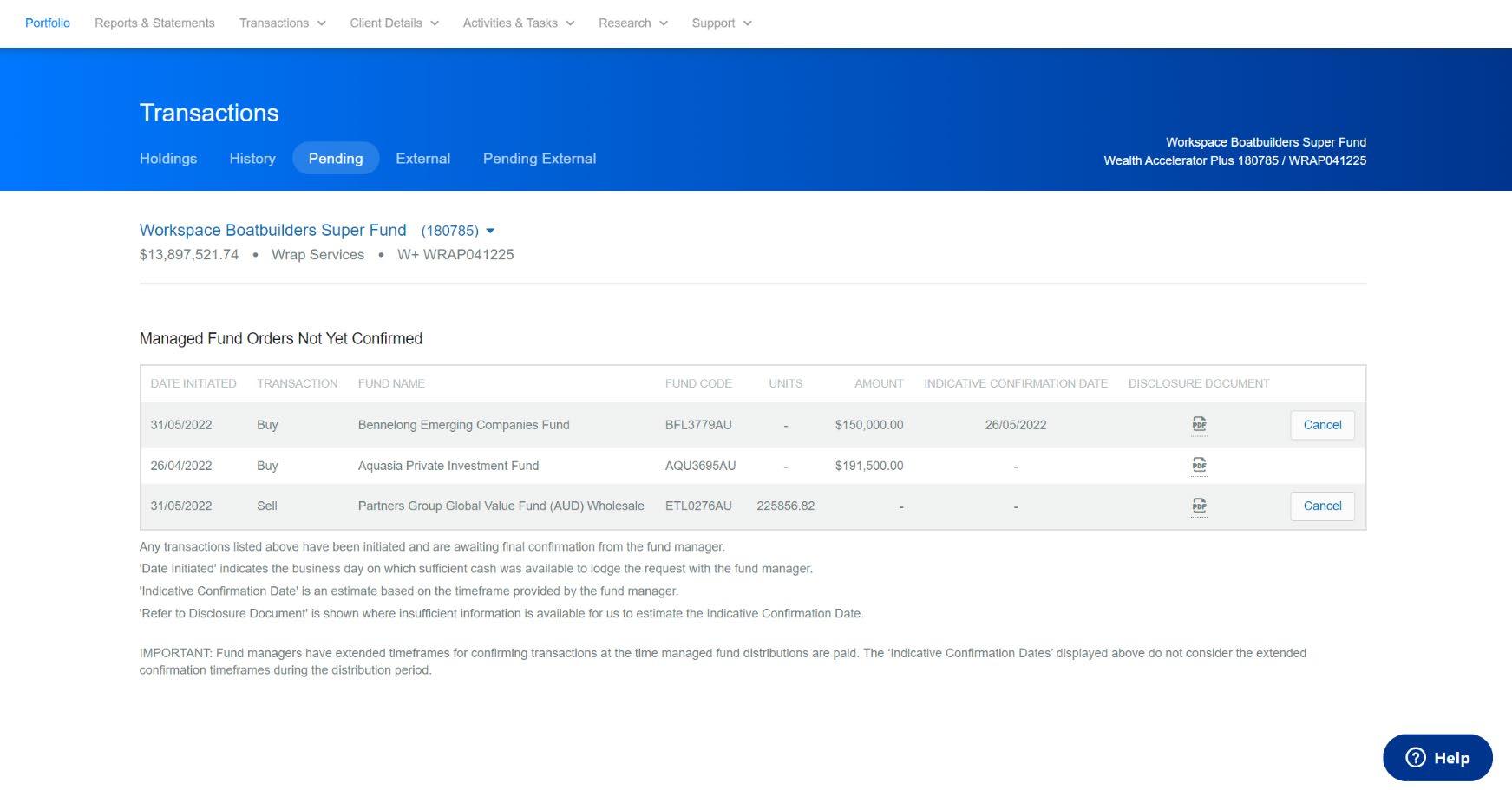

Numerous ‘housekeeping’ type reports can assist with keeping clients accounts up to date including:

•

• Contributions and deposits

• Client fees (including fee consent, anniversary dates)

• Rollovers received

profiles

statement tracking

•

•

•

•

According to our latest research, 45% of Australian's aged 18+ say that socially responsible investing is an important consideration in their investment strategy or that they are willing to sacrifice returns / pay more for socially responsible investments. The challenge for them and for like-minded investors is to validate the authenticity of the investments they choose.

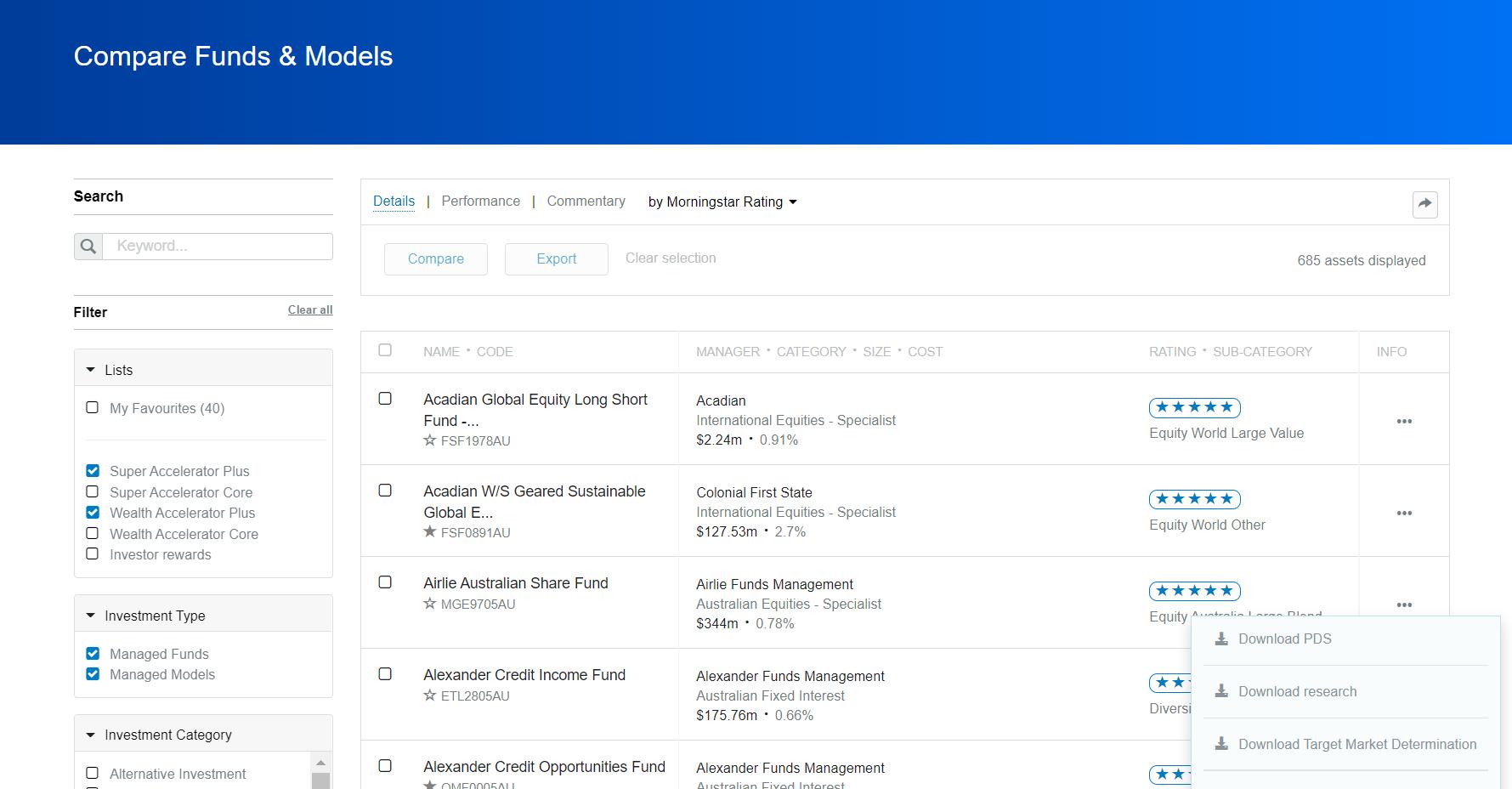

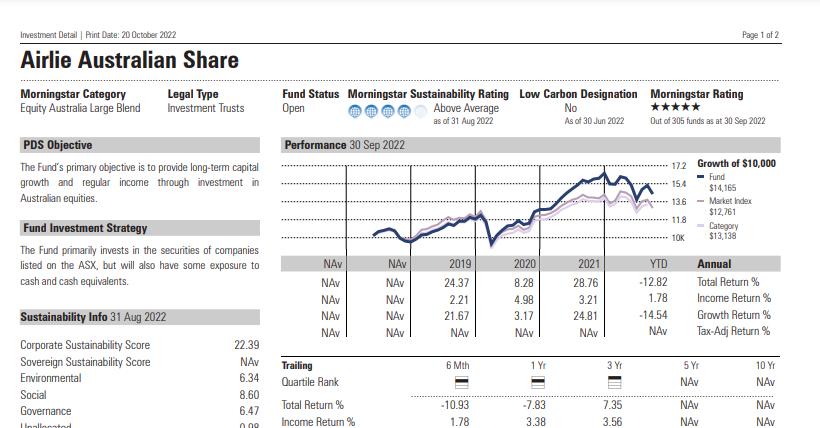

With this in mind, we are pleased to introduce ESG research and ratings on managed funds from Morningstar. The new ESG ratings available on our Compare Funds & Models page

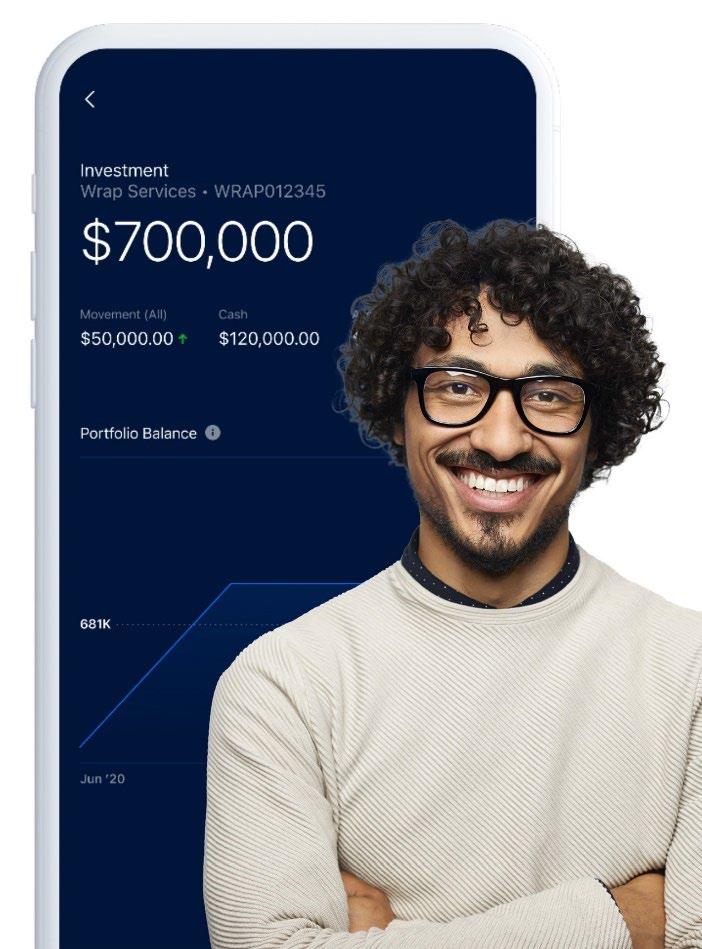

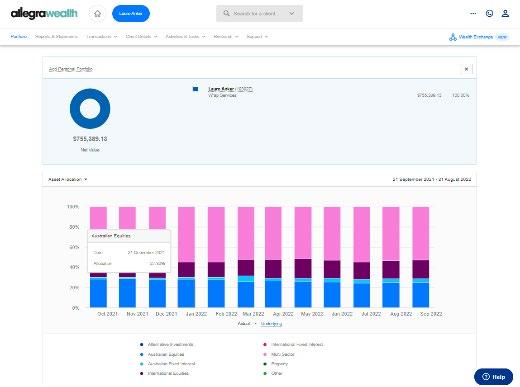

Get a complete view of your asset allocation across your entire portfolio

Bank and property feeds plus integration with Xeppo data.

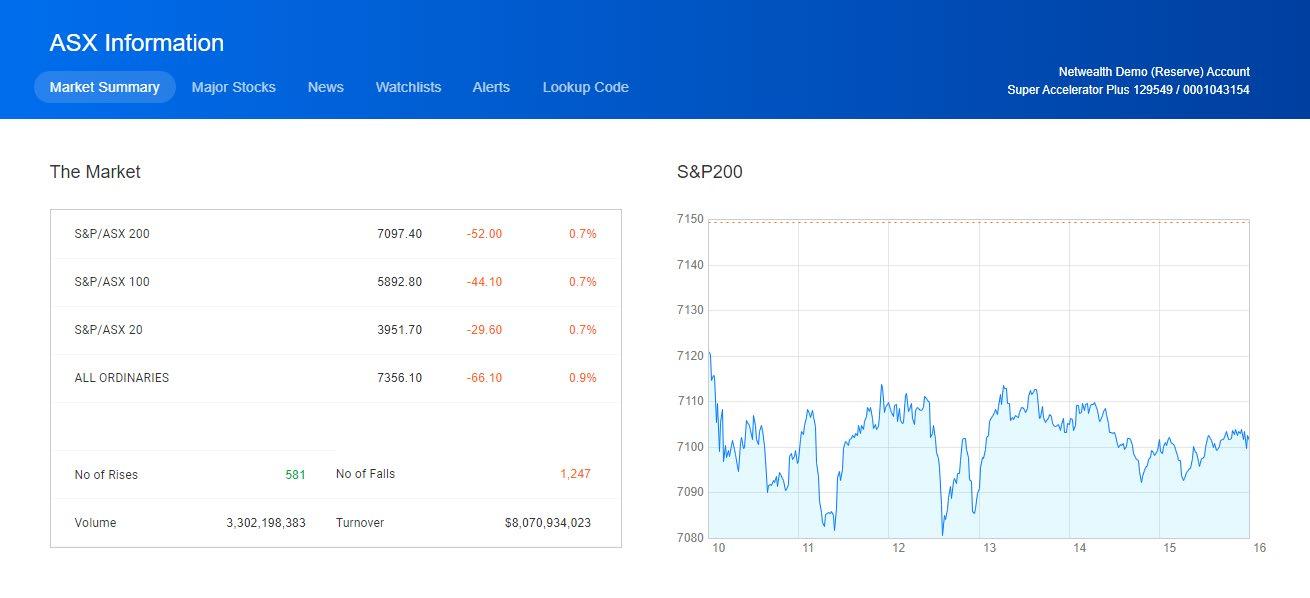

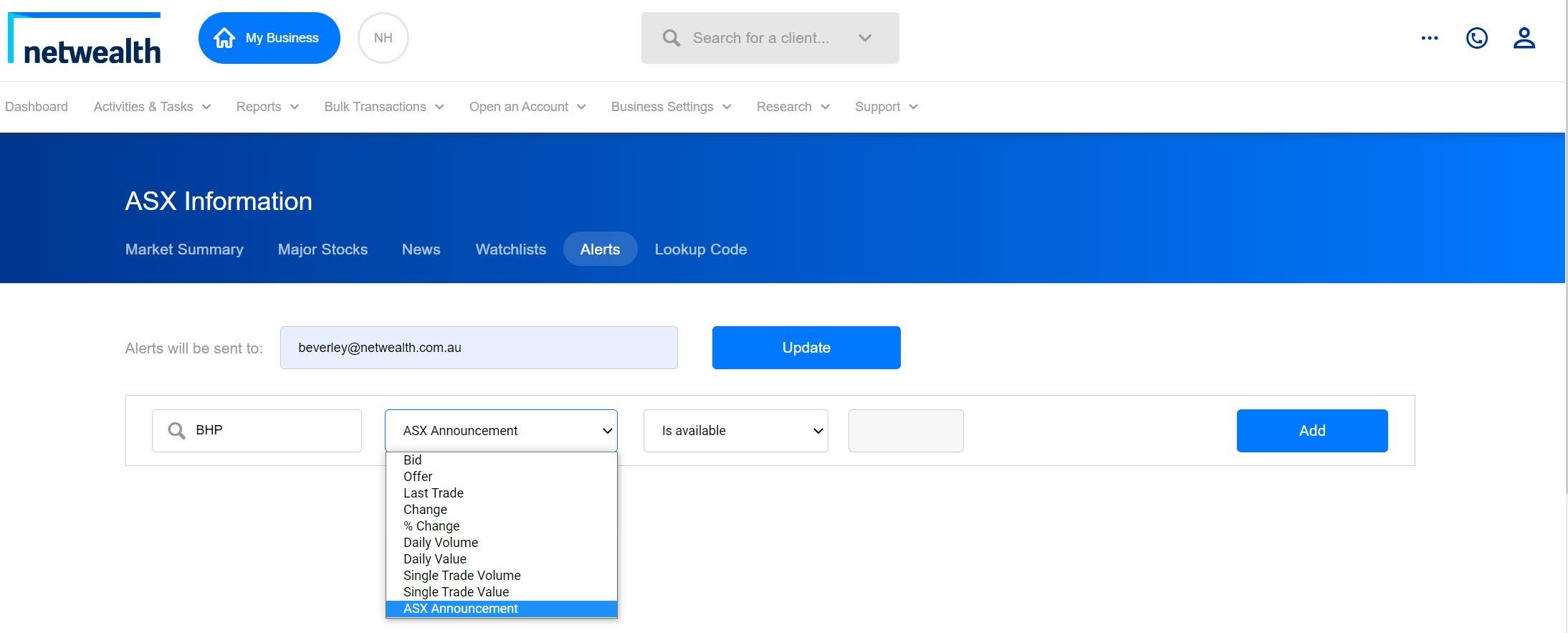

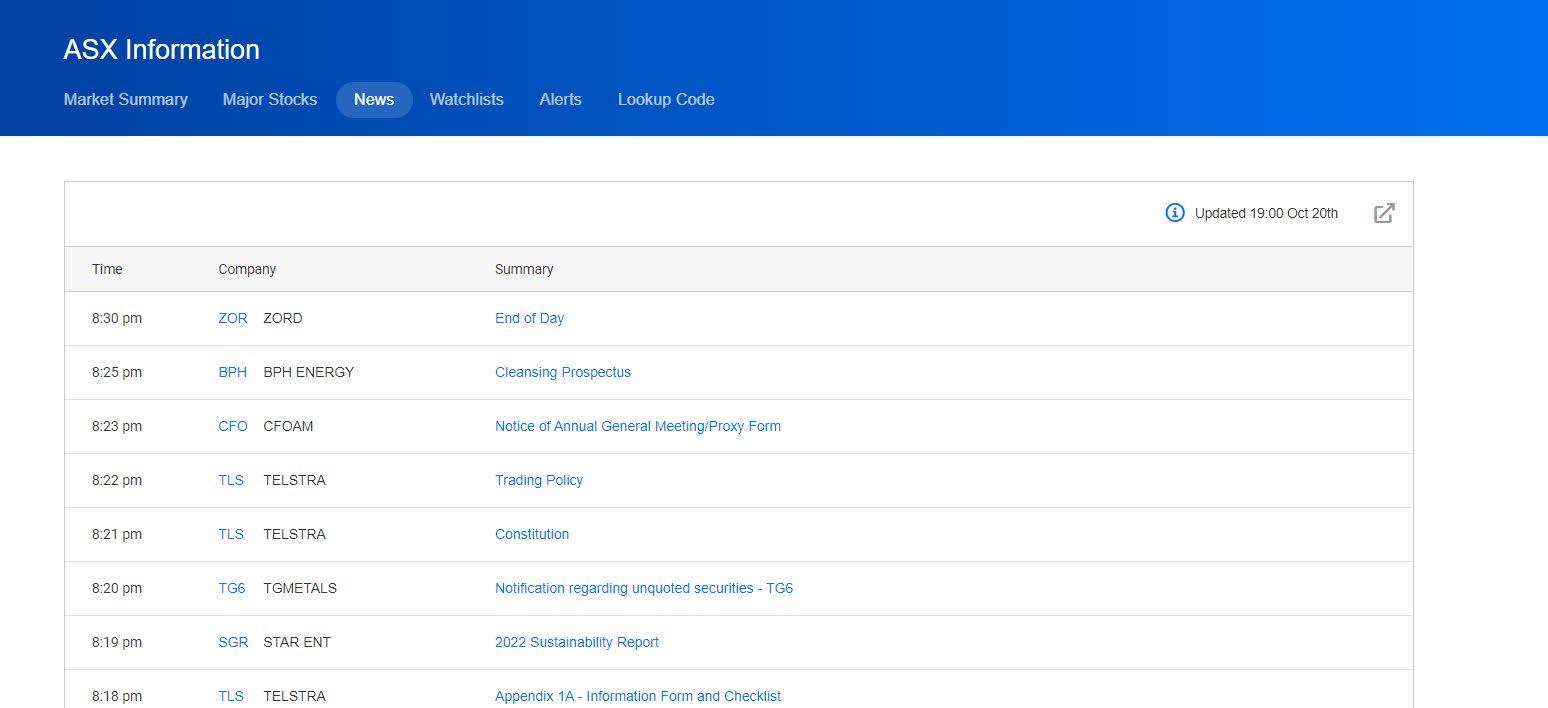

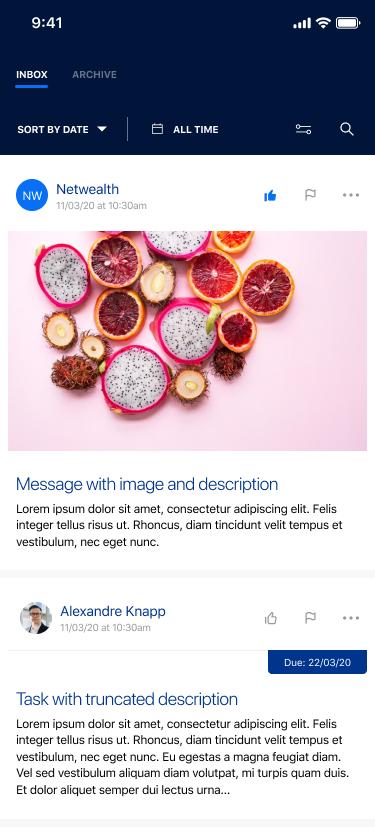

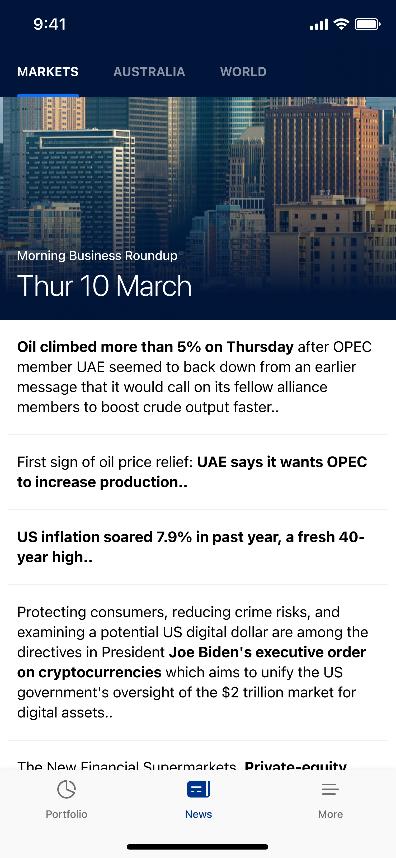

Daily business & finance news

A daily feed of our morning business roundup business and finance news.

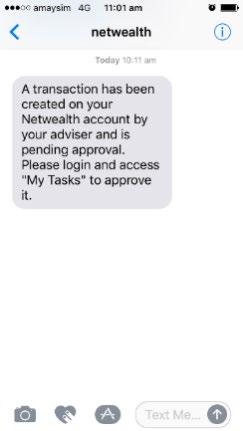

Clients can view tasks and approve or action Netwealth or adviser originated activities, e.g. fee proposals.

Mobile app plus browser based desktop configured to your brand.

• Add your logo and branding to the login

• Ad your logo to the desktop portal and reports for both adviser and clients

• For mobile: change the colour theme to your brand, in both normal and dark modes

Extensive list of investment types including listed domestic and international securities, ETF's, listed debt and hybrid securities, and managed funds. In addition, a comprehensive range of corporate actions can be supported including placements and IPO.

For each model, set up flat or tiered across all fee types (RE fee, investment management fee, and model fee). Apply fee variations at dealer or adviser level (tiered or flat).

Transfer

into and out of the

a fully integrated transfer tool

detailed transaction reporting and CGT modelling.

At a client level, create custom trading rules to exclude, substitute assets. Establish minimum trades and holding levels, and direct how unallocated cash and income is used.

Netwealth’s team are hands on in the daily rebalancing process for all model, monitoring trades, ensuring they are fulfilled by working closely with model managers and market makers.

account

of

of those that use them?

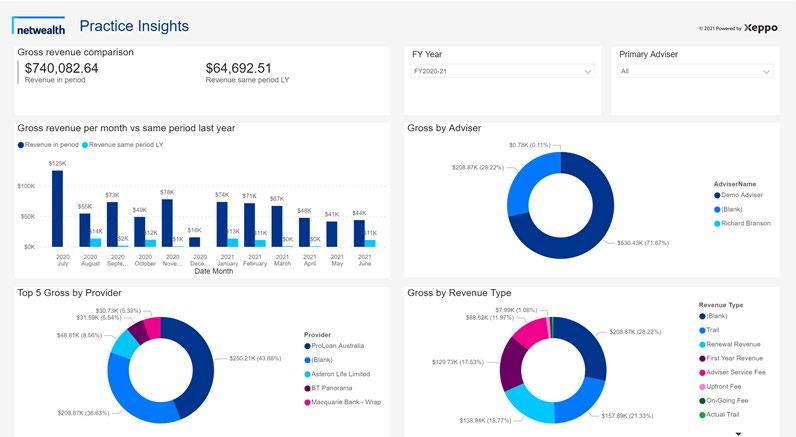

The new Netwealth + Xeppo connector allows you to connect your Netwealth client data with Xeppo's intuitive data warehouse, and also their CRM and rich reporting capabilities.

Netwealth have provided another $2.5M of growth funding to support Xeppo’s strategy

Using Practice Insights and Xeppo to consolidate and clean data across disparate data sets (e.g. Netwealth, Commpay or Xplan) for analysis and insights about your clients. Save valuable time using pre-configured dashboards.

Identify data gaps across key client topics, including details, advice and FDS

Understand clients revenue and fees better

With PowerBI access data visualisations of FUA and revenue across different dimensions, inc. client groups, source of revenue, adviser (and for different periods)

With Practice Insights and Xeppo

you will have access to a range of important client KPIs, including:

• Fee for no service

• Excessive fees

• No FDS

• Investment outside risk profile

• ROA with no SOA

• Insurance policies with no fees

• And more…

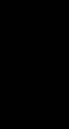

We now permanently accept Digitally generated e-signatures for many Netwealth documents, in addition to accepting drawn electronic signatures from any provider.

To take advantage of this:

• Check what signature method is accepted for the document you are looking to sign

• Use our secure online 'Document upload' facility to send us the electronically signed document together with the Docusign Summary Certificate.

• Now accepting applications

• Please upload a copy of certified ID

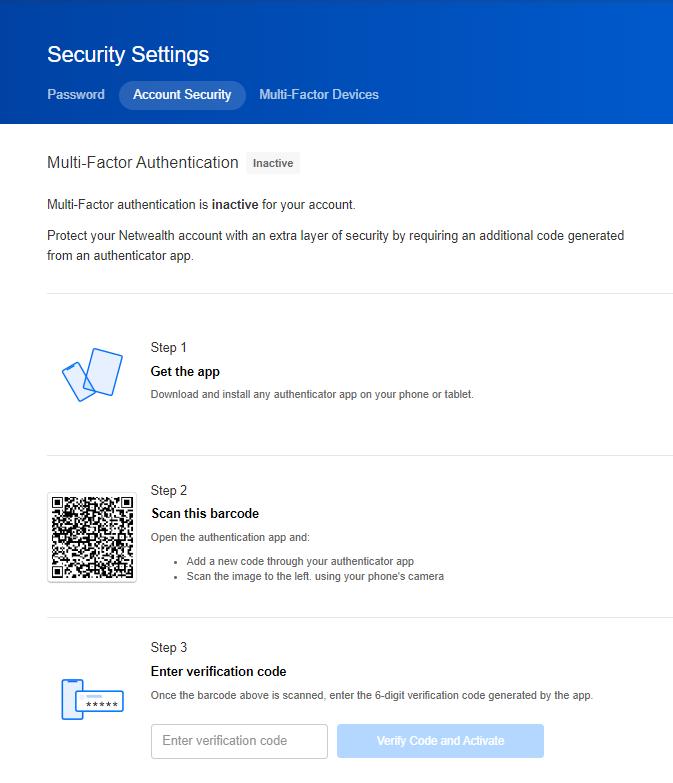

• We have enhanced our Multi-factor Authentication process:

• Link multiple trusted devices

• Trusted devices will not require a code each time, keeping you secure and saving you a step in the process

• Process managed entirely online with your Netwealth login & mobile phone

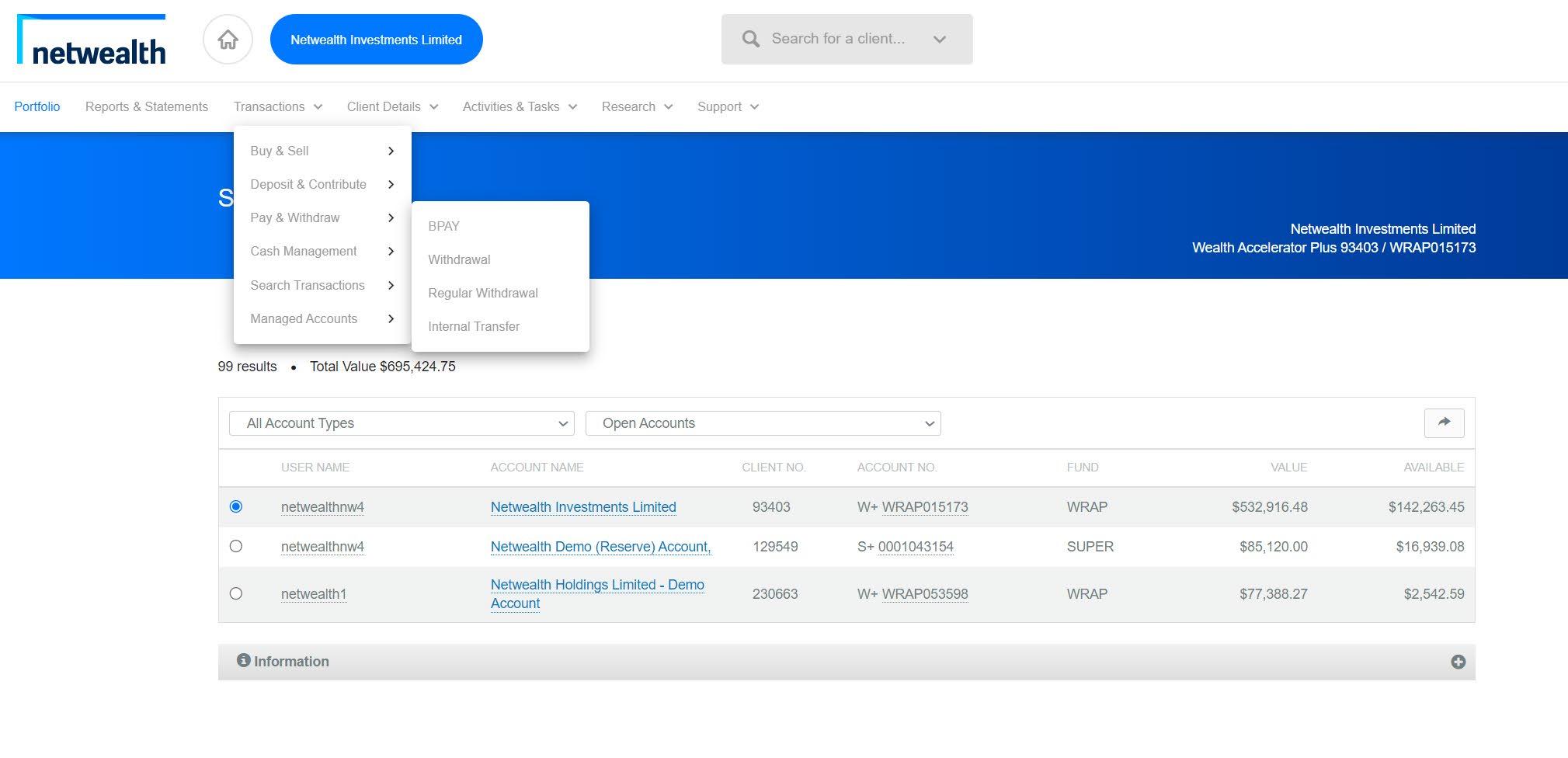

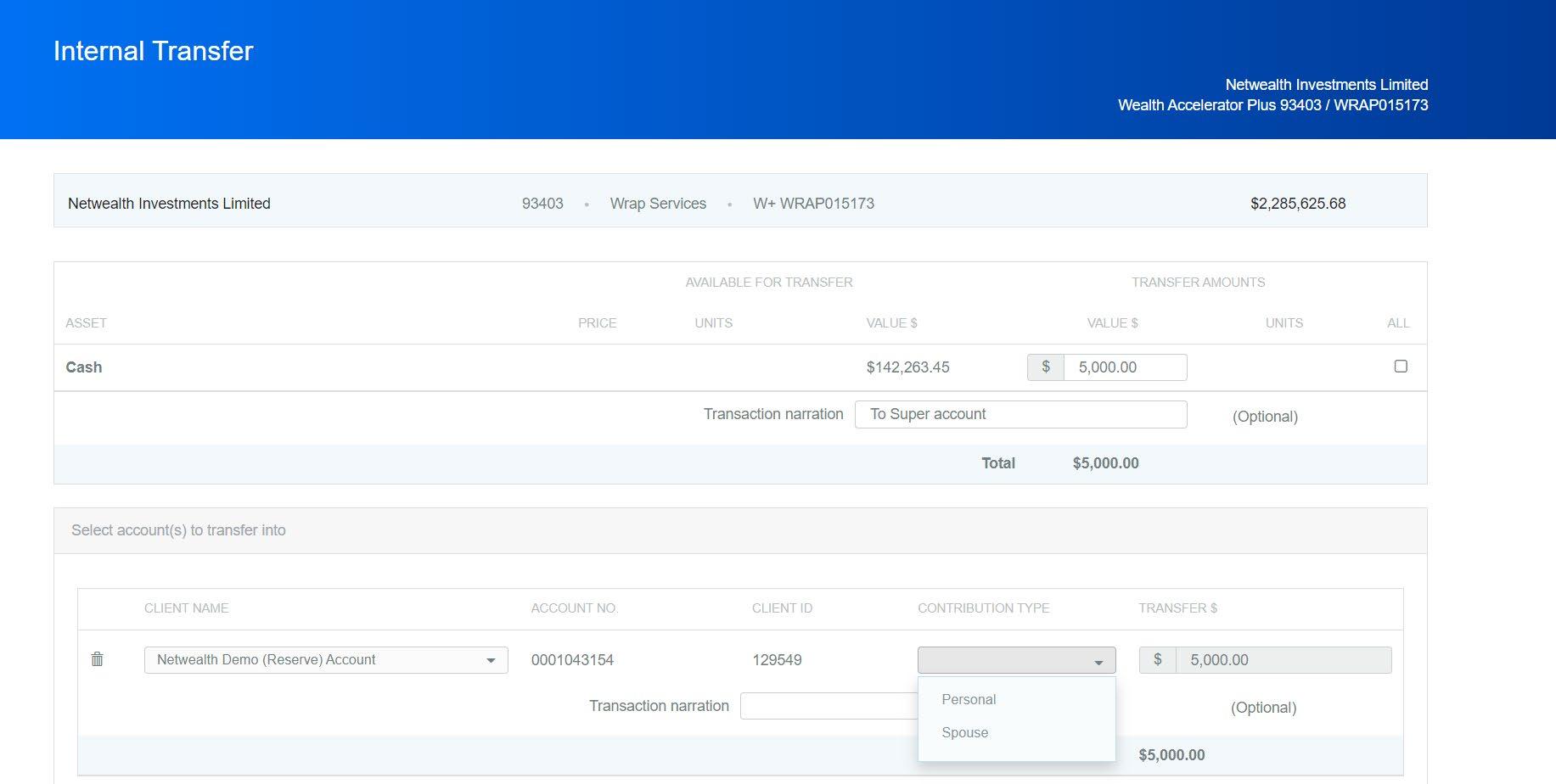

Netwealth has built the functionality that will allow an adviser user to move cash between linked accounts instantly.

• The action is from a Wealth Accelerator account, to another Wealth or Super Accelerator account.

• The accounts must be linked to the same username.

• The movement of cash is instant and is completely online driven by the adviser user.

• Simply select the account, navigate to Transactions>Pay & Withdraw> Internal transfer

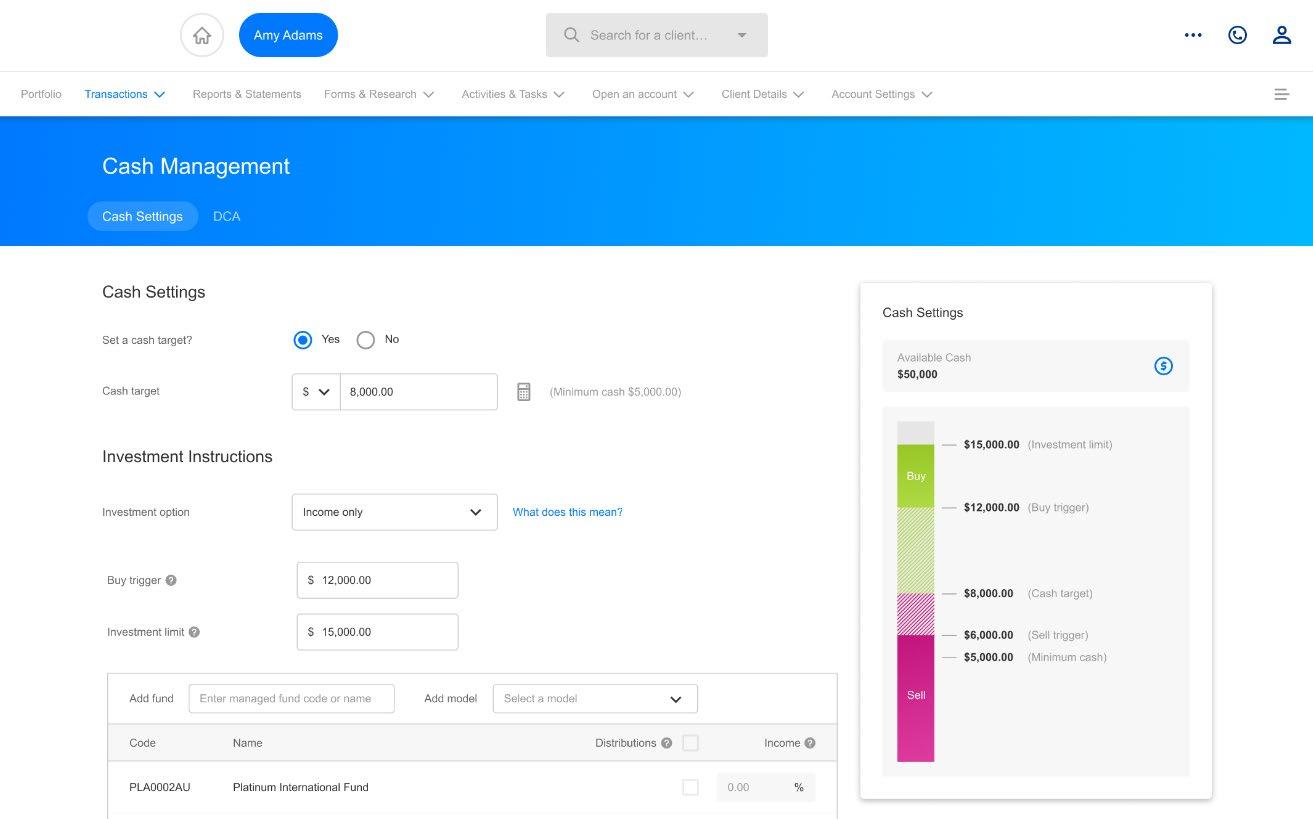

•

•

•

•

minimum

–

amount

trigger to auto sell

top up cash

trigger amount

cash into

invest

limit

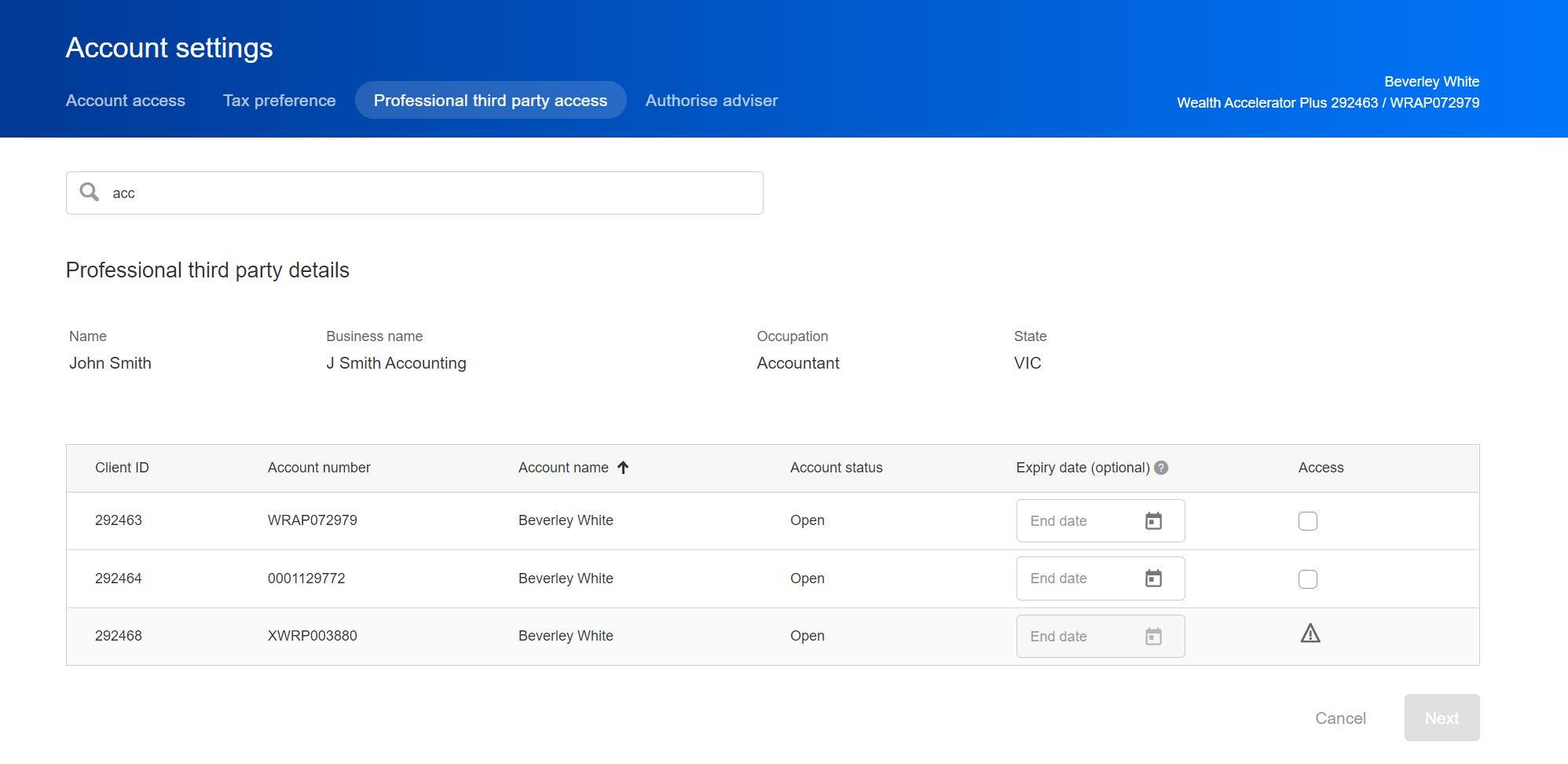

Provide a better client experience and service offering by sharing account information with your clients' professional support network.

Professionals such as accountants, stockbrokers, and mortgage brokers can now create a Netwealth Professional Third Party account and be given permission to view the details of your clients' accounts online. Providing them with a range of benefits including:

• Manage multiple accounts - Read-only online access to view client account balances and portfolio holdings.

• Download tax statements Download past tax statements and use our tracker tool to view the latest updates for pending statements.

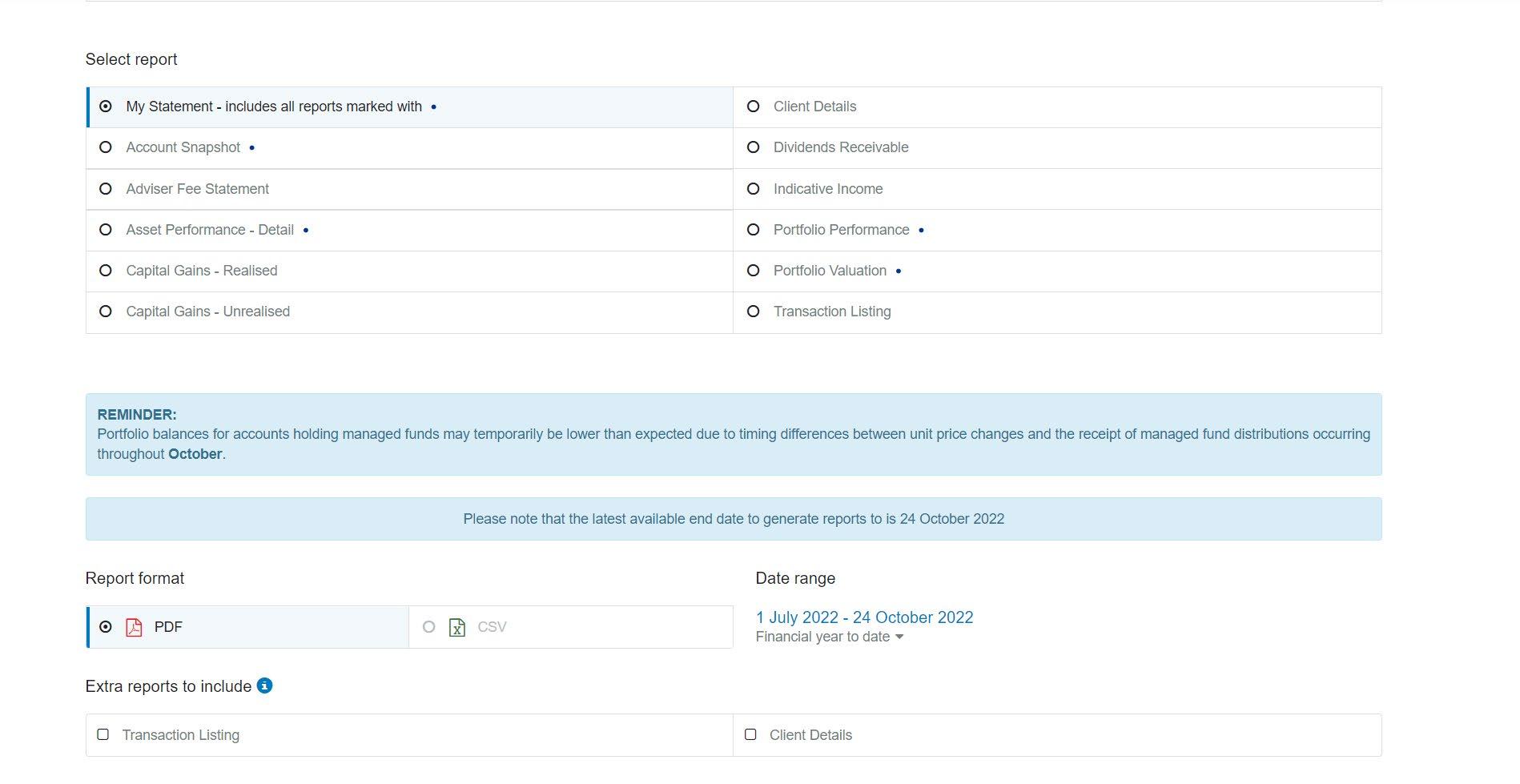

• Run detailed reports Generate a range of custom reports, including cash transaction history, unrealised capital gains, and performance reports.

•

•

•

•

•

•

•

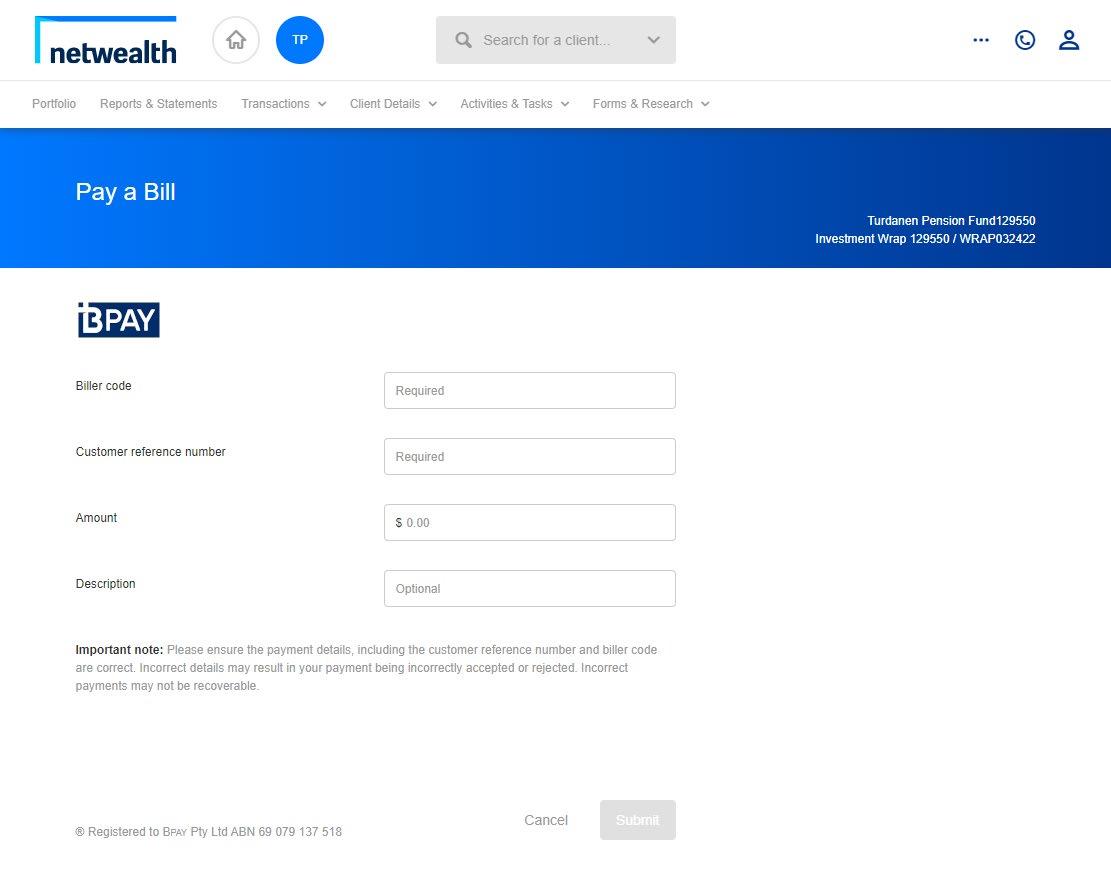

• Pay any amount to nominated account/s

• Pay to any Australian bank account*

• Once off and regular BPAY payments*

*payments over $5,000 require client approval with the exception of BPay payments to the ATO

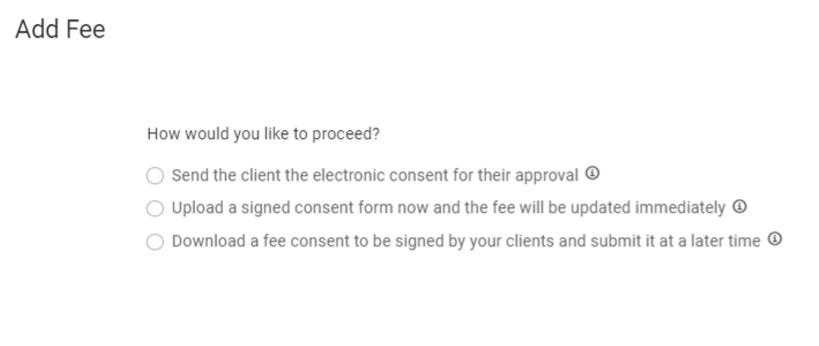

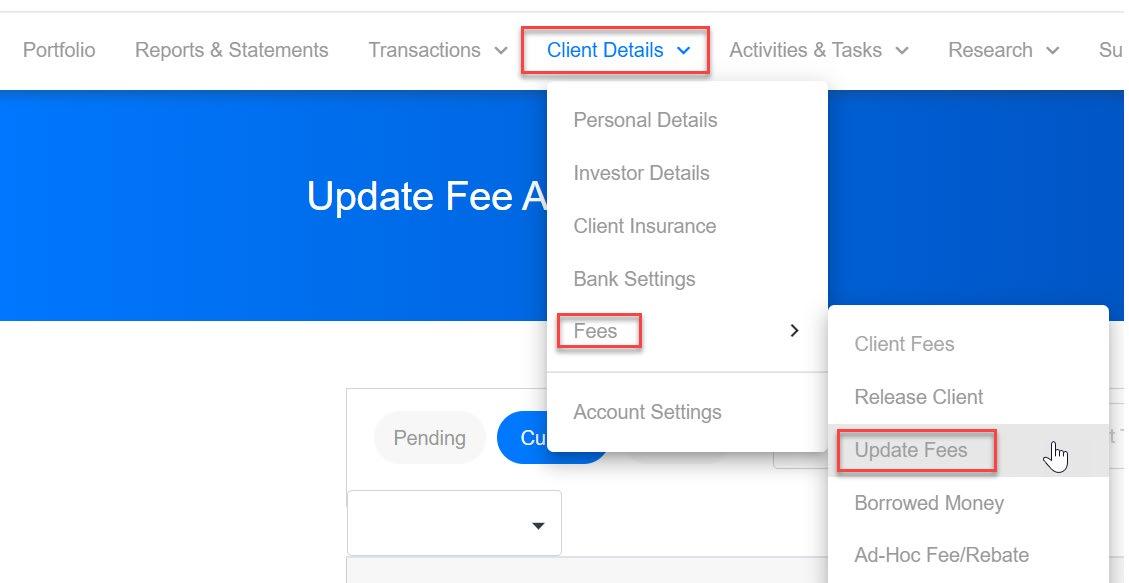

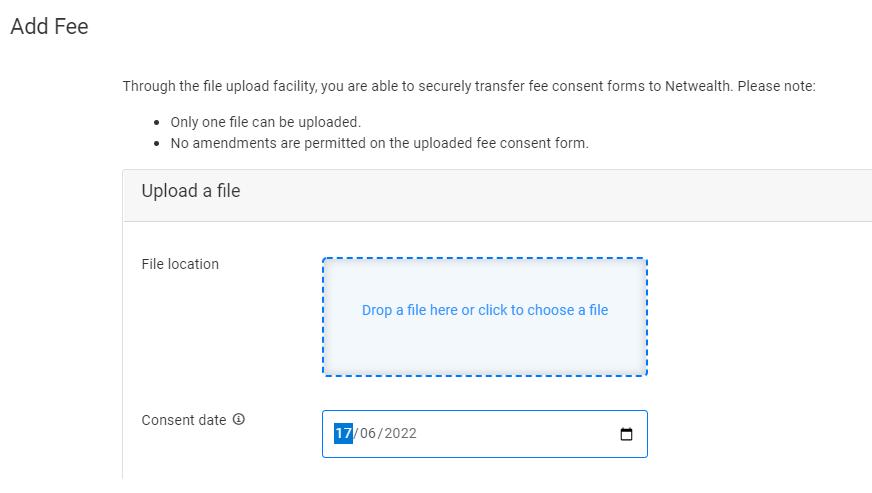

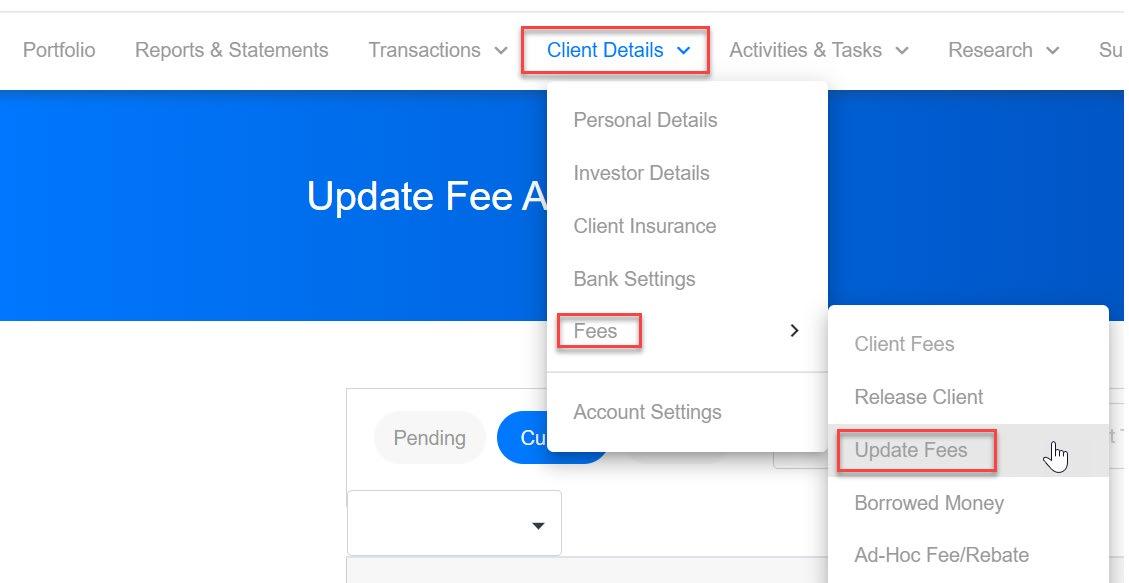

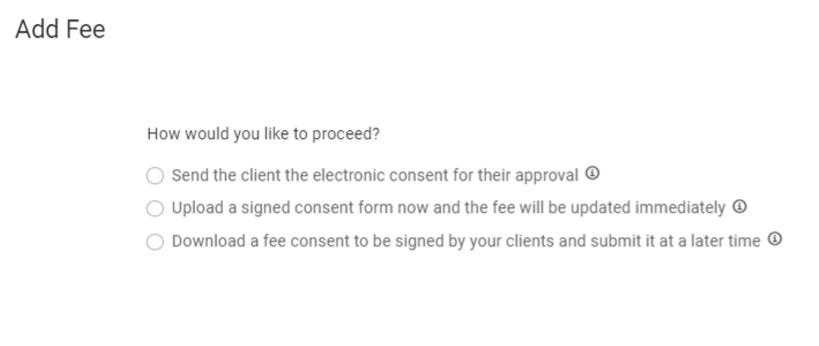

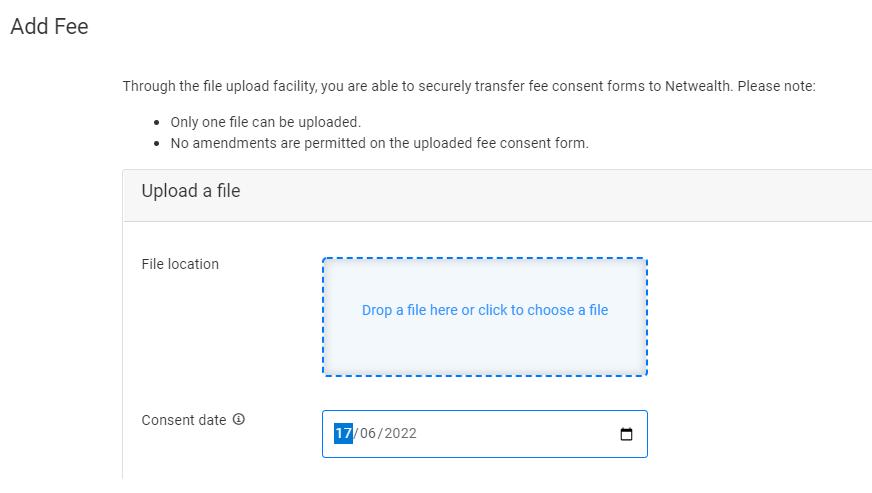

Pre-populate, renew and upload signed ongoing fee consents onto a clients account

Pre-populate, renew and upload signed fixed term fees consents onto a clients account instantly.

• Enter the total dollar amount to be deducted for the fixed term.

• The Total fixed dollar amount is divided by the number of days in the fixed term to determine a daily fee rate. The amount deducted per period is based on a pro rata calculation: daily fee rate * number of days in the period

• Fees will be deducted at the end of the period. If you elect an annual frequency, the fixed dollar amount will be charged at the end of the term.

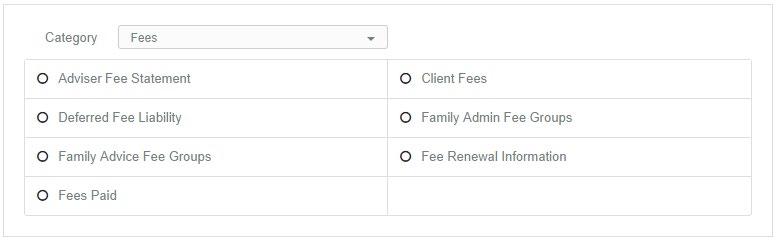

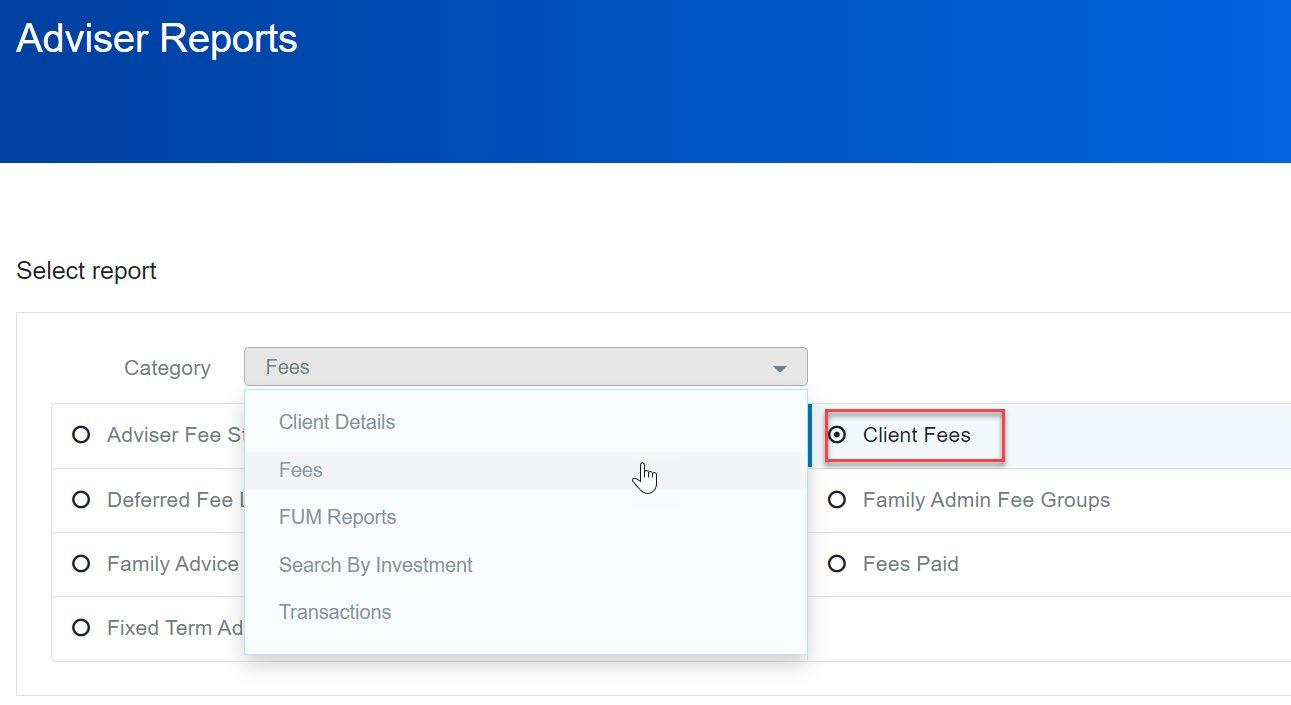

The ability to identify your wholesale clients in the client fees report

View family fee, anniversary dates, wholesale status and dates in one report

The Client Fees report has been updated to include a column for you to easily identify your Wholesale clients in one report.

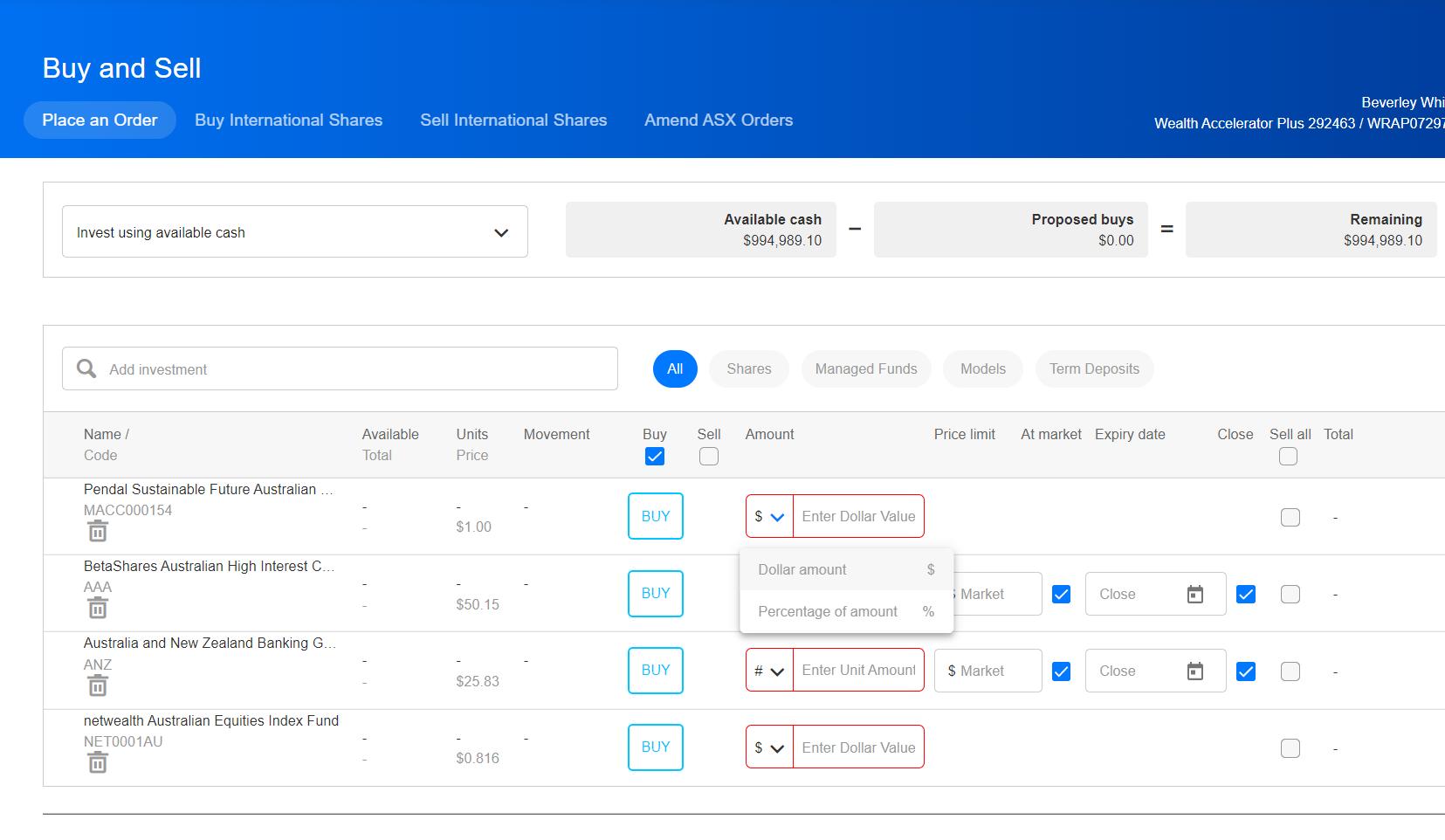

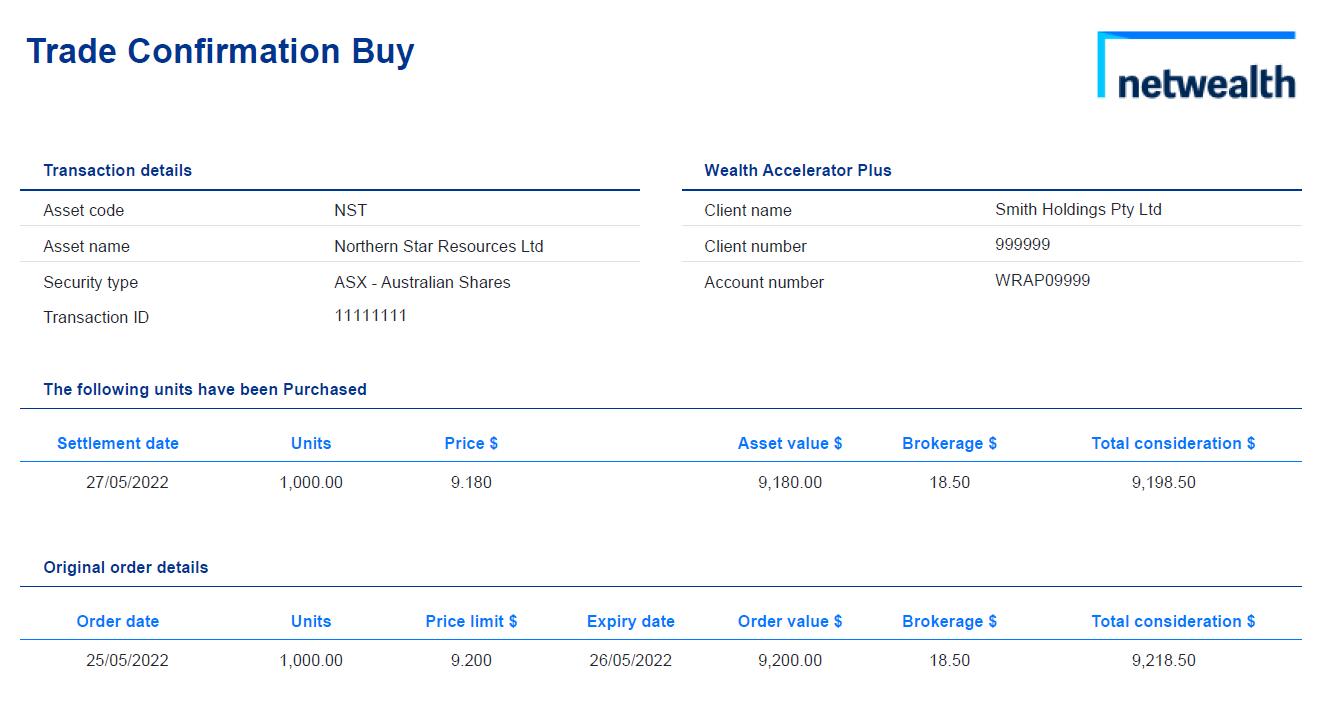

An adviser or client who has transact authority is able to Buy and Sell investments online using:

• available cash

• a specified $ amount

• the proceeds of sale

• the combination of available cash and the proceeds of sale

• Sell a pro rata amount

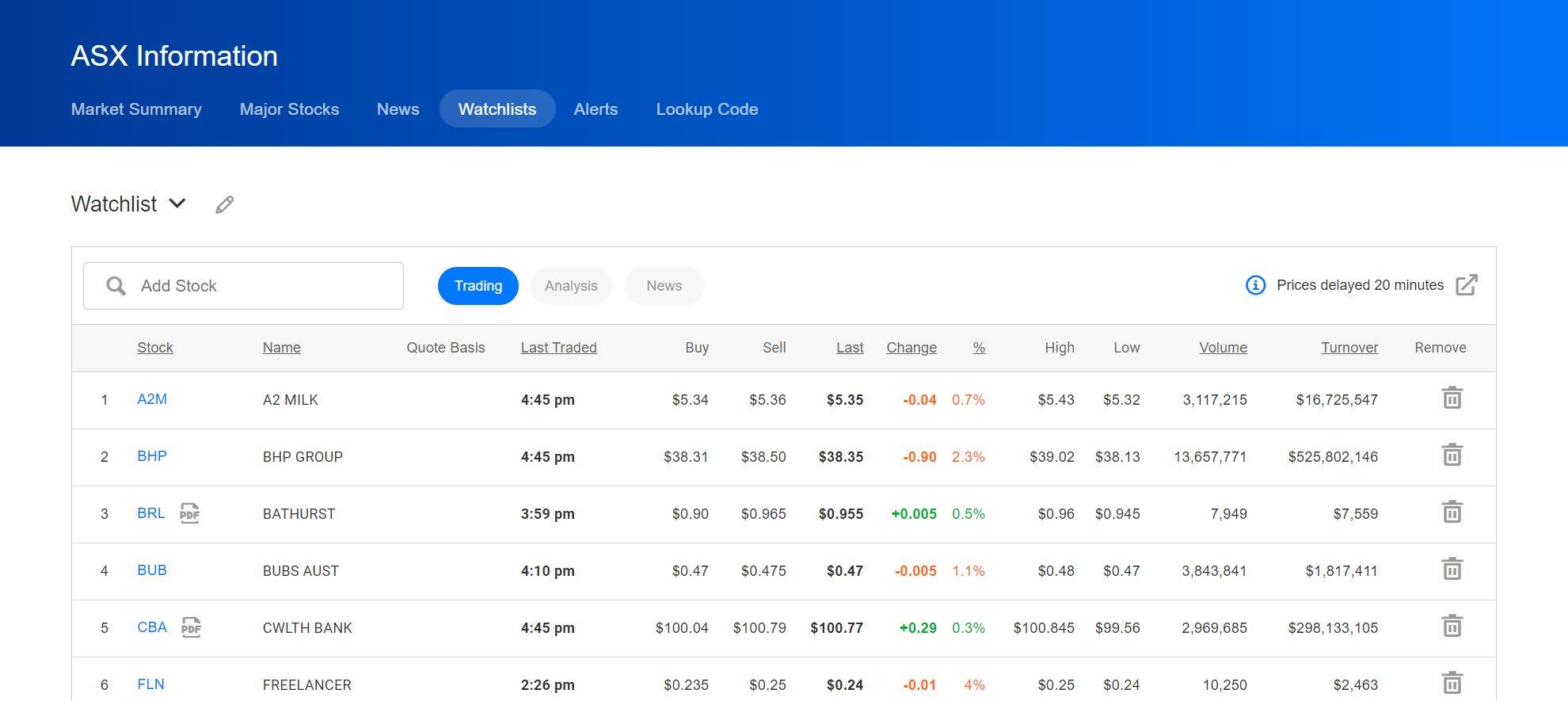

When trading ASX listed securities you are able to invest:

• a dollar amount

• percentage of an amount

• a specific number of units

• at market or at price limit

• with an expiry date (no more than 60 days)

•

•

•

Enables

•

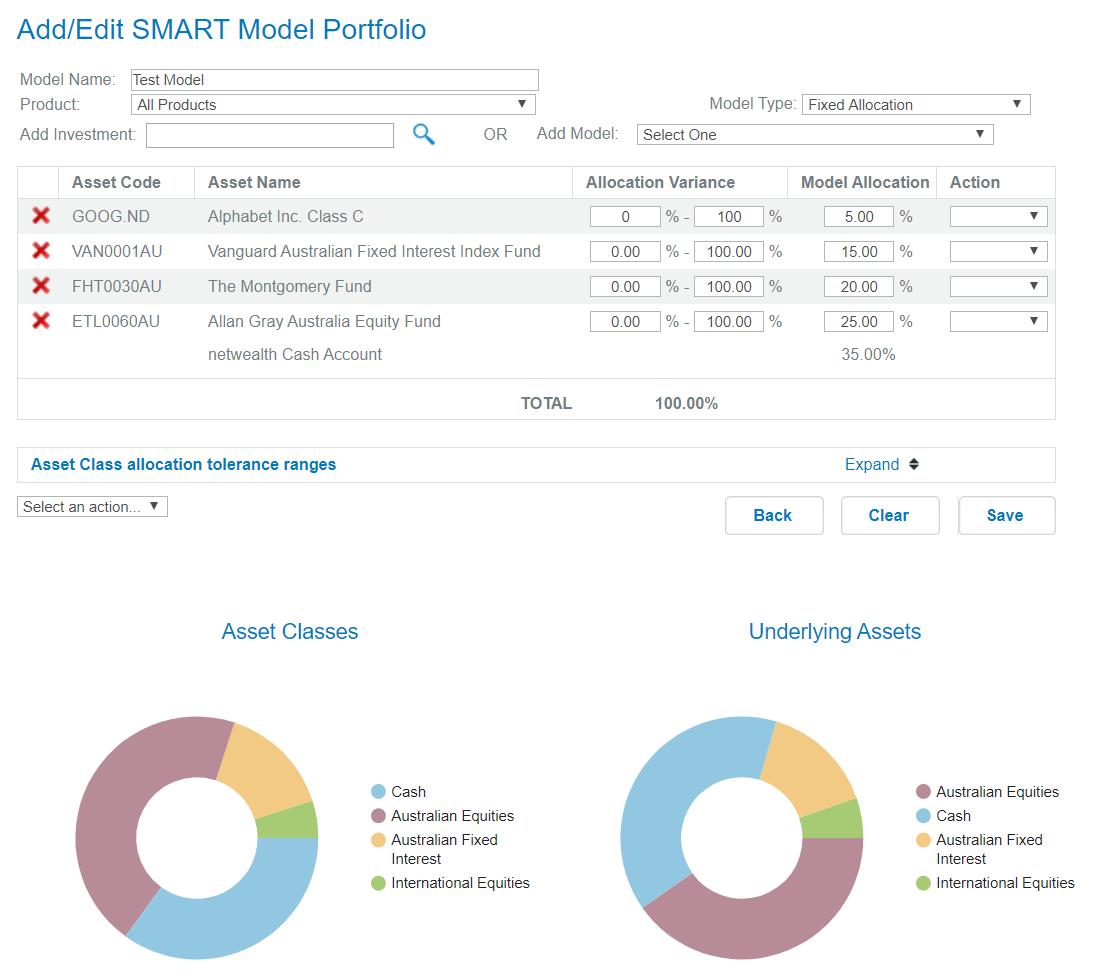

Features:

•

•

•

•

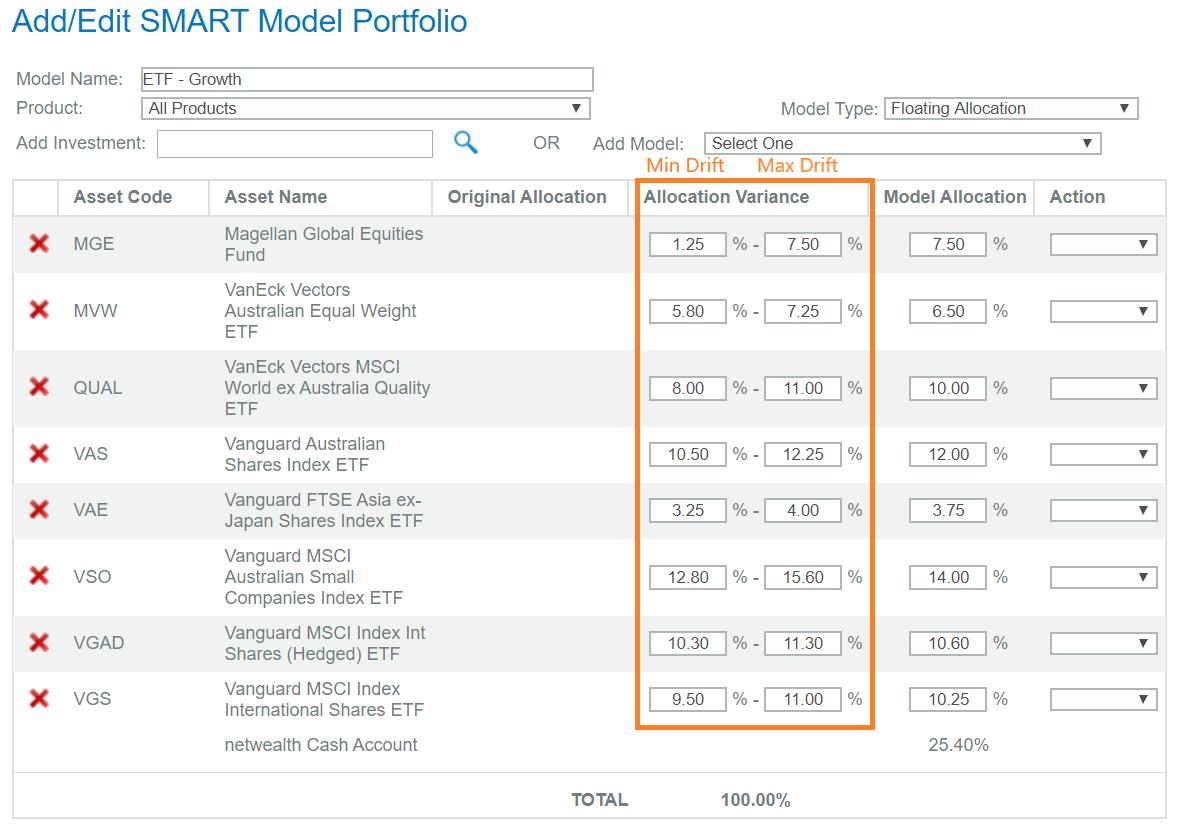

• Variance ranges can be set to suit the way you construct portfolios.

• Set min and max drift tolerances at an asset level or asset class level when creating floating SMART models.

• Ability to monitor client’s allocation to each underlying model to identify drift outside of the applied ranges.

• Specifically, when an underlying model moves outside of its internal rebalance range, and also when an asset class moves out of the overall portfolio’s rebalance range.

This document is for general use.

The views expressed in this presentation are those of the author and presenter and do not necessarily reflect those of Netwealth Investments Limited’s. It is general summary only and contains opinions on public available information and services. It’s not advice nor an endorsement of any product or service.

This information has been prepared by Netwealth. Whilst reasonable care has been taken in the preparation of this presentation using sources believed to be reliable and accurate, to the maximum extent permitted by law, Netwealth and its related parties, employees and directors and not responsible for, and will not accept liability in connection with any loss or damage suffered by any person arising from reliance on this information.

Netwealth Investments Limited (Netwealth) (ABN 85 090 569 109, AFS Licence No. 230975) and Netwealth Superannuation Services Pty Ltd (ABN 80 636 951 310), AFS Licence No. 528032, RSE Licence No. L0003483 as the trustee of the Netwealth Superannuation Master Fund, is a provider of superannuation and investment products and services, and information contained within this presentation about Netwealth’s products or services is of a general nature which does not take into account your individual objectives, financial situation or needs. Any person considering a financial product or service from Netwealth should obtain the relevant disclosure document at www.netwealth.com.au and consider consulting a financial adviser before making a decision before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.