Issue 2 | Volume 12 | 2024 SAPMA Chair calls all industry stakeholders to stand together Coatings for Africa Preview Bargaining Council to make impact BUILDING Y OURHARDWAREBUSINES S AND INDUSTRIAL TRADE NEWS 22 6 8

FOR ALL YOUR TINTING AND PAINT TESTING REQUIREMENTS JOHANNESBURG: 011 452 0223 | DURBAN: 031 702 9234 | info@lejn.co.za | www.lejn.co.za Service Centres in CAPE TOWN - PORT ELIZABETH - EAST LONDON - BLOEMFONTEIN AGENTS & SUPPLIERS 20 Years of Reliable Service to the Paint Industry SK 350 Harbil HA 480 X - ProTint

EDITORIAL

EDITOR Johann Gerber

Tel: 011-713-9042

Email: johann.gerber@newmedia.co.za

SUB EDITOR Gill Abrahams

Email: gill.abrahams@newmedia.co.za

LAYOUT & DESIGN Kyle Martin

Email: kyle.martin@newmedia.co.za

ADVERTISING

ADVERTISING EXECUTIVES

Natalie Sanders

Tel: 082-450-2317

Email: natalie.sanders@newmedia.co.za

PHOTOGRAPHS

Unless previously agreed in writing, Coatings SA owns all rights to all contributions, whether image or text.

SOURCES

Shutterstock, supplied images, editorial staff.

DISTRIBUTION & SUBSCRIPTIONS

Felicity Garbers

Email: felicity.garbers@newmedia.co.za

UPDATE YOUR DETAILS HERE

Email: register@media24.com

Web: www.diytradenews.co.za

PUBLISHING TEAM

GENERAL MANAGER Dev Naidoo

GROUP ACCOUNT DIRECTOR B2B: Johann Gerber

PRODUCTION MANAGER Angela Silver

ART DIRECTOR David Kyslinger

DIGITAL MANAGER Varushka Padayachi

MANAGEMENT

CEO NEW MEDIA Aileen Lamb

COMMERCIAL DIRECTOR Maria Tiganis

STRATEGY DIRECTOR

Andrew Nunneley

CHIEF FINANCIAL OFFICER

Venette Malone

CEO: MEDIA24

Ishmet Davidson

Head Office: New Media, a division of Media24 (Pty) Ltd

8th floor, Media24 Centre, 40 Heerengracht Cape Town, 8001

Tel: +27 (0)21 417-1111

Web: www.newmedia.co.za

Johannesburg Office: New Media, a division of Media24 (Pty) Ltd, Ground Floor, 272 Pretoria Avenue, Randburg, 2194

PRINTING

Printed and Bound by CTP PrintersCape Town

Published on behalf of New Media, a division of Media24 (Pty) Ltd

SAPMA Executive Director: Letter from Executive Director

News: Coatings industry and Government at a crossroads

News: Igor Blumenthal explains the diKerent impact bargaining council can make on businesses

News: Synthetic Polymers enjoys bespoke market opportunity

News: Coatings for Africa Preview

One for all, and all for one

'One all, and all for one all’ is the rallying call featured in The Three Musketeers, a French historical adventure novel written in 1844 author Alexandre Dumas. I am sure, many of you enjoyed the musketeers when we were younger – the television programme, movies, and the book. A few weeks ago, I visited Sanjeev Bhatt, SAPMA Chairman, at his premises in Chamdor. At this meeting he shared his real concerns around the Africa Free Trade situation and the potential impact it will have on local manufacturers.

In the conclusion to our interview he said, “Johann, it does not matter if a company is a member of SAPMA or not.

We need everyone to get together and fight for the survival of our industry. Together.” Upon reflection, the gravity of the situation became apparent.

We are past the point of individualism. The livelihoods of many are under threat. Jobs are under threat. Company legacies are under threat. Regardless of

SAPMA affiliation, what's crucial is for all sector stakeholders to engage in urgent dialogue to ensure the government hears their unified voice loud and clear. The Coatings sector is heading for a doomsday disaster if the indicated Chapters are not amended.

Much like the musketeers it is time for the Coating industry to stand together. If you are unsure where to start reach out to SAPMA. sapma.org.za

Unless previously agreed in writing, Coatings SA owns all rights to all contributions, whether image or text. SOURCES Shutterstock, supplied images, editorial staff. While precautions have been taken to ensure the accuracy of its contents and information given to readers, neither the editor, publisher, or its agents can accept responsibility for damages or injury which may arise therefrom. All rights reserved. © DIY Trade News. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, photocopying, electronic, mechanical or otherwise without the prior written permission of the copyright owners.

Johann Gerber

ed’s note

Johann 4 20 6 8 22 ontents Issue 2 | Volume 12 | 2024

Is African Free Trade a threat to South Africa's industries?

The African Continental Free Trade Area (AfCFTA) agreement, signed in 2018, aims to create a single market for goods and services across Africa. While this agreement has the potential to boost economic growth and development, it also poses significant threats to South Africa's:

• Chemical material supplier industry

• Finished goods paint manufacturing sector

• Paint and hardware retail sector.

A major concern amongst the South African Paint Manufacturing Associations (SAPMA) members, is that without any proper consultation, the DTI&C have forged ahead, under the guidance of Minister Ebrahim Patel, with a strategy heading to collapse local sectors in-favour of other African countries. One which will see close to 200 000 jobs sacrificed by, without the approval of its citizens, for African continental harmony.

This strategy could potentially mirror the damage done historically by similar agreements in the textile and clothing sector, which resulted in the closing of large internationally competitive fabric manufacturers and manufacturers of finished clothing products. Businesses now operating without these constraints, from other countries in Africa.

One of the primary concerns of the impact and consequence of the AfCFTA, are the unfair trading conditions between countries in Africa. Countries with less stringent labour laws and which offer extensive government protection for their industries will have a competitive advantage over South Africa, which has stricter labour laws and regulations, and no government protection whatsoever.

The intention by government with the liberalisation of duties under the AfCFTA agreement is to have positive impacts on local suppliers and manufacturers in South Africa. Liberalisation, in simple terms, means removing or reducing South African government controls and restrictions on suppliers and manufacturers from other African countries, who want to play in our markets, namely the supplier,

manufacturing and retail space in our country. It implies opening a market to allow more freedom and competition from outside.

In the context of trade, liberalisation means:

• Reducing or eliminating tariffs (taxes) on imported goods

• Allowing foreign companies to operate freely in South Africa.

In justifying liberalisation, both DIRCO and the DTI&C, aim to promote economic growth, increase consumer welfare, and create a more open and competitive market, for other African Countries to the detriment of South African Sectors. This is how the South African Government justifies liberalisation:

• Increased market access: AfCFTA provides access to a larger market, enabling local suppliers and manufacturers to export their products to other African countries, potentially increasing their sales and revenue. This does not, however, take account for the level of wages and salaries in South Africa compared to those in competing countries in Africa.

• Competition: Liberalisation of duties could lead to increased competition, driving local suppliers and manufacturers to improve product quality, reduce prices, and innovate. You can’t do this when as importers and manufacturers your hands, both of them, have been tied behind your back.

• Economies of scale: With a larger market, local suppliers and manufacturers may achieve economies of scale, reducing production costs and improving efficiency. This would be true if the playing fields were level.

What is not accounted for are the negative impacts of liberalisation under this agreement:

• Unfair competition: Local suppliers and manufacturers may face unfair competition from imported products, potentially leading to a decline in sales and revenue.

• Loss of market share: Liberalisation of duties could result in local suppliers and manufacturers losing market share to imported products, potentially leading to job losses and business closures.

• Dependence on imports: Over-reliance on imported products could undermine local production and manufacturing capabilities.

To mitigate the negative impacts, the South African government could implement measures such as:

• A more acceptable and negotiated gradual liberalisation of duties to allow local industries to adjust

• Implementing safeguards to protect local industries

• Providing support for local suppliers and manufacturers

• Encouraging local procurement and supporting.

• Implementing anti-dumping duties

• Providing support for local industries

• Investing in education and training programmes to upskill workers.

CONCLUSION

The government must address the concerns of the members, of the South African Paint Manufacturing Association (SAPMA) and the Chemical and Paint industries, including the need for genuine and proper consultation. Government must review our labour laws, to be compatible with those of the African Continental Standard and must introduce meaningful protection for local industries. This needs to be accomplished by establishing an 'African Standard' against which all countries falling under the AcFTA must map and follow.

The fate of South Africa's chemical and paint industries hangs in the balance, and it is crucial that the government takes a more nuanced and considered approach to the AfCFTA agreement to ensure the long-term viability of these industries and the jobs they purport to provide. c

Tara Benn Executive Director: SAPMA

From the Executive Director | Coatings SA 4

CHT Group offers high performance silicone and oil-based defoamers for coatings, printing inks, architectural paints and mineral systems. With our SPACTIVE ® product portfolio it is possible to achieve premium quality surfaces and foam free industrial processes. Various delivery options like highly effective concentrates, stable emulsions and free-flowing powders are available worldwide.

For further information regarding our SPACTIVE® portfolio visit www.cht.com or contact CHT South Africa

*Visit us at stand B60 at the CFA expo

SPACTIVE ® DEFOAMERS

Coatings sector at critical crossroads

Sanjeev Bhatt, SAPMA chairman, raised three critical warning signs that have flashed to all members and stakeholders in the coatings sector and that the industry is at a delicate juncture. Bhatt believes the coatings sector is now fast approaching a critical crossroads which will set the road forward for the industry.

At the top of the list, is the AFRICAN CONTINENTAL FREE TRADE AGREEMENT (AfCFTA) African Continental Free Trade Agreemen. “This is a great concept that will benefit the greater African Union,” says Bhatt, but he highlights that not enough dialogue was held by the Department of Trade and Industry (DTI) and the coatings sector’s stakeholders or with SAPMA. Bhatt specifically mentions two tariffs that are of gravce concern i.e paints (aqueos & solvent borne) as well as resins.interest, starting withstated in Chapter 32 & 39 respectively. underof the Free Africa Trade Agreement.

Chapter 32, which relates to finished paint, has Tthree categories have been defined under AfCFTA – Category A includes sectors where all tariff duties are being liberalised over a ten year periodfall away across Africa, Category B implements a thirteen ten-year liberalisation waiting period on certain tariff lines, and Category C is the total exclusion of certain industries which are excluded from the Agreement. He warns that under the Agreement both paint and resins that currently have duty protection between 10-15% have been placed in Category B which mean that these duties will be reduced to zero in next decade effective 2021.resin and solvent, which are components of paints and coatings, have such a small protection ranging between 10% and 15%, that for a country such as Egypt it is of no hinderance.

In fact, the Egyptian Government has incentives for its own manufacturers in place for exporting. One such an example is the freight costs being refunded for Egyptian products once the container lands at its destination. Egypt is also an OPEC member giving it access to critical paint & resin raw materials at a fraction of the cost when compared to South African manufacturers.

This creates an uneven playing field. “Opening the floodgates will erode the coatings manufacturing sector in South Africa,” warns Bhatt. “Only the largest Larger companies will adapt & remainstay predominantly engaging in more trading activities, and we will see history repeat itself with a similar scenario as that of the textile industry playing out from 20 years ago.”

SAPMA has raised these issues with the DTI, but they are turning a blind eye. Bhatt continues that there is a real concern for sub-standard coating products to be flooded into the local market, which will lead to roughly 150 of the 250 paint manufacturers locally closing their doors. “We need all companies part of the coatings sector to be classified under Category C,” he says he, “Otherwise we are walkingheading to doomsday! We will see the same situation unfold as when we had no duties on imported solvents, where local companies struggled against claims due to resins not performing as it should.”

Not acting will lead to serious job losses affecting thousands of households and companies closing their doors.

The same can be said about the Chapter 39 situation which considers plastics and covers resins again both acqaueos & solvent borne.

Bhatt is frustrated that the South African Government is not finding better ways to be in touch with the various channels impacting the chapters. He says that the DTI has acknowledged in the past that they do not have the capacity to engage with each & every coating manufacturer and it is here where Bhatt shows that the DTI will benefit by simply engaging with Associations directly. Associations, like SAPMA, represent much majority of the sector in which they operate.

“Government can do better by consulting with the correct consultation methodology and can be in a better position to implement decisions & policies under AfCFTA.

At the end of the day both Chapters 32 and 39 being implemented by the Ggovernment, will spell disaster for the coatings sector.

“This will impact all companies –whether they are members of SAPMA or not,” says Bhatt. It is with this that Bhatt makes an appeal, as the Cchair of SAPMA to all participants in the coatings industry to get together and work together to have all lines moved to Category C. As the alternative is South Africa adopting a similar approach as Dubai – closing its manufacturing operations and simply importing and distributing. c

For more information, visit: https://www.sapma.org.za/

Bhatt makes an appeal, as the chair of SAPMA to all participants in the coatings industry to get together and work together to have all tariff lines pertaining to paints & resins in Chapter 32 & 39 respectively moved to Category C.

News | Coatings SA 6

Sanjeev Bhatt

We are proud to be associated with leading paint manufacturers & have a key focus on EXPORT markets in Africa. We boast a team of highly skilled polymer chemists in the laboratory as well as on the plant to ensure quality control and superior standards of resin. Adding to the mix is our MAINTENANCE team of qualified engineers, fitters, welders & electricians. Our high-quality polymers are the key to vibrant decorative, industrial, automotive, and other coatings. Our state-of-the art laboratory boasts cutting-edge technology and a team of R&D chemists who endeavour to develop products for our customers.

The vision is to RE-DEFINE the COATINGS INDUSTRY with our QCCP (Quality, Consistency & Competitive Prices) THEORY. Are you looking for lightning-fast delivery? Our 20-metric ton bulk delivery vehicle guarantees your order will arrive within 24-72 hours.

• Long, Medium & Short Oil Alkyds

• Urethane Alkyds & Oils

• Hydroxy Functional Acrylics

• Thermoplastic Acrylics

• Speciality Alkyds

• Short & Medium chain stopped Alkyds.

• Styrenated & Acrylated Alkyds

• Amino Resins (Urea & Melamine Formaldehyde)

• Thermoset Acrylics

• Saturated Polyesters

Experience the MAGIC with SYNTHETIC POLYMERS!

010 596 4444 | sgb@syntheticpolymers.co.za | www.syntheticpolymers.co.za

Bargaining council will impact businesses differently

By Dr Ivor Blumenthal, CEO, ArkKonsult

Bargaining council agreements serve as critical frameworks for regulating labour relations and establishing industry standards in South Africa. These agreements, negotiated between employers and trade unions within specific sectors, often address issues such as minimum wages, working conditions, and provide dispute resolution mechanisms meaning that the bargaining council, rather than the CCMA will be licensed to conduct conciliations and arbitrations.

Any extension of bargaining council agreements to cover non-parties, authorised by the minister of employment and labour, presents unique challenges and implications for businesses not directly involved in the negotiation process. This article offers advice on how nonparties can ready themselves and grasp exemptions and appeal options within a bargaining council.

CONSEQUENCES OF EXTENDING, FOR SME NON-PARTIES

Compliance challenges

SMEs often lack the resources and administrative capacity to comply with the regulatory requirements stipulated in extended Bargaining Council Agreements. Minimum wage and working condition requirements can place financial strains and operational limits on SMEs, impacting their competitiveness and market sustainability. It is important to note that those minimum salaries and annual increases are set at a level that medium and large businesses are prepared to apply. There is most often, no engagement with SME’s in setting those standards, which when the agreements are extended, SME’s will have to immediately apply.

Impact on business viability

The extension of bargaining council agreements may disproportionately affect SMEs, as they may struggle to absorb the additional costs associated with regulatory compliance. SMEs

operating on thin profit margins may face heightened risks of financial instability and business closure if unable to adapt to the regulatory requirements imposed by the extended agreements.

Limited bargaining power

SMEs may have limited bargaining power and representation within bargaining council negotiations, making it challenging to advocate for their interests and concerns effectively. The terms of extended agreements may not adequately reflect the diverse needs and circumstances of SMEs, exacerbating disparities and inequalities within the affected sectors.

It is obvious that SME’s to be heard within an established bargaining council, would need to join an active business association, which may already be a party to a bargaining council, or establish from scratch such a business association.

As an example, in the paint and coatings sector, the South African Paint Manufacturers Association, which is not a party to the NBCCI, and represents the majority of small businesses in the sector, would need to become a party to the bargaining council to be able to properly express the views of the SME contingent of the sector.

CONSEQUENCES FOR MEDIUMTO-LARGE ENTERPRISES NONPARTIES

Compliance Burdens

Imagine if you were Facebook and were not a bargaining council party. Suddenly a bargaining council in which

Elon Musk and 'X' have taken the lead as an employer and a party to the council, manages to get the Minister to extend the councils agreements to cover nonparties such as Facebook. Suddenly a free-market in-terms of employment which Facebook has always ascribed to, now suddenly has to operate interms of standards established by 'X' in that council.

Medium-to-large enterprises not involved in a council encounter comparable compliance hurdles as SMEs, yet they might possess more resources to handle regulatory duties.

Legal and reputational risks

Medium-to-large enterprises as nonparties, risk facing legal penalties, fines, and reputational damage if found to be in violation of the terms of extended bargaining council agreements. Noncompliance with prescribed minimum wages and working conditions can lead to enforcement actions and negative publicity, tarnishing the corporate image and brand reputation of medium-tolarge enterprises.

PREPARING FOR COMPLIANCE

Conduct a comprehensive review

Non-parties should conduct a thorough review of the terms and conditions of extended bargaining council agreements to understand their obligations fully. This includes examining provisions related to minimum wages, Conditions of employment such as working hours, leave entitlements, and the provisions made within

Feature | Coatings SA 8

a council for dispute resolution mechanisms to ensure compliance with regulatory requirements.

Assess financial implications

Non-parties must assess the financial implications of regulatory compliance on their business operations and profitability. Conducting a cost-benefit analysis can help identify cost-saving measures, operational efficiencies, and strategic investments to mitigate the impact of increased regulatory burdens.

Invest in capacity building

Driven by a collective response to the possibility of an extension, business associations need to facilitate SME’s and medium-to-large enterprises investing in building internal capacity and capabilities to manage regulatory compliance effectively. This may involve providing training and resources to HR personnel, implementing robust recordkeeping systems, and seeking external support from legal and compliance experts as needed.

C008-8.pdf 1 2024/05/07 14:15

UNDERSTANDING EXEMPTIONS AND APPEAL OPPORTUNITIES

Exemptions process

Bargaining councils must have provisions for granting exemptions to non-parties based on certain criteria, such as financial hardship or operational constraints. Nonparties seeking exemptions from specific provisions of extended agreements must submit applications to the bargaining council, providing relevant evidence and justification for their request.

Appeal mechanisms

Non-parties dissatisfied with decisions regarding exemptions or other matters related to extended bargaining council agreements have the right to appeal to higher authorities or judicial bodies. Bargaining councils must establish internal appeal processes to adjudicate disputes and grievances promptly, ensuring transparency and fairness in decision-making.

CONCLUSION

The extension of bargaining council agreements to non-parties presents multifaceted challenges and implications for businesses operating within affected sectors, particularly SMEs and medium-to-large enterprises. Non-parties must prepare themselves beforehand by understanding their obligations, assessing the financial implications of suddenly being faced with increased minimum wages and annual increases, and investing in capacity building to manage regulatory compliance effectively.

Additionally, non-parties should familiarise themselves with the exemptions process and appeal mechanisms available within bargaining councils to navigate compliance requirements and address grievances efficiently. By taking proactive measures and seeking collaborative solutions, non-parties can mitigate risks and uphold their interests in the context of extended bargaining council agreements. c

| Coatings SA 9 Feature

C M Y CM MY CY CMY K

Fast-curing UV-resistant curing agent

Evonik has launched a new fast-curing and UV- resistant epoxy curing agent, Ancamine® 2880, that offers excellent mechanical properties, abrasion resistance, and colour stability throughout its service life.

With its low colour and high gloss, Ancamine 2880 is ideal for flooring applications that require excellent surface appearance. In addition, Evonik’s new globally available low viscosity curing agent offers ambient and low temperature curing for easy application, and its rapid hardness development enables early walk-on floors.

"Our customers need solutions that provide performance advantages and meet the latest labelling requirements, so we are excited to introduce our new high-performance curing agent in the Ancamine® series to the market,” said Christian Schmidt, head of the Crosslinkers business line. “Ancamine 2880 addresses the performance gaps

found with existing available curing agents and its excellent EH&S profile make it a game-changer for the coatings market."

Ancamine 2880 offers outstanding abrasion and carbamation resistance for excellent aesthetics even under adverse conditions. Its strong resistance to different classes of chemicals and UV stability makes Ancamine 2880 a preferred choice not only for industrial and decorative floor coatings, but also for general high solids coatings.

Ancamine 2880 offers an enhanced EH&S profile and underscores Evonik’s commitment to meeting the evolving needs of the global coatings industry by providing innovative solutions that satisfy the highest performance and environmental standards. c

For more technical and performance information about Ancamine 2880, please visit https://crosslinkers. evonik.com/en/products/ancamine/ ancamine-2880

About Evonik Crosslinkers

The Specialty Additives division combines the businesses of versatile additives and high performance crosslinkers. They make end products more valuable, more durable, save more energy and are simply better. As formulation experts in fast growing markets such as coatings, mobility, infrastructure and consumer goods, Specialty Additives combines a small amount with a big effect. With its 3 500 employees the division generated sales of €3.52 billion in 2023.

| Coatings SA 10 News

Delta Colours reports on their experience at this year’s Paint India Conference

Nirvashni Mahara and Petrus Scheepers from Delta Colours share some of their personal feedback from their attendance of Paint India in 2024.

Q. You recently attended Paint India, how was the show?

A. The show was a hive of excitement and activity. It was very well attended by local manufacturers and multinational suppliers. There were more than 500 exhibitors from various sectors including paints and coatings, inks, construction chemicals and adhesive/sealants.

Q. Any specific highlights or trends that you can share with us?

A. The architectural segment remains the primary growth driver due to robust construction activity and urbanisation. Government initiatives such as "'Housing for All"' are bolstering demand for decorative paints. The industrial coatings segment is expanding rapidly, particularly in automotive, oil and gas, and general industrial sectors.

The automotive industry, which has seen India become the thirdlargest vehicle market globally, is a major contributor to this growth. Companies like Asian Paints PPG and Berger Paints are increasing their production capacities to meet the rising demand for protective and performance coatings.

Q. What can the local industry learn from our friends in India?

A. There is a significant shift towards water-borne and highperformance coatings due to their environmental benefits. Innovations in coating technologies are focusing on improving durability, reducing environmental impact, and enhancing protective qualities, especially against corrosion. This focus on sustainability

and innovation will likely shape the future landscape of the industry.

Q. Coatings for Africa is happening again in June, what are the major differences between Paint India and CfA?

A. The Paint India Show is well represented and attended by the local manufacturers of pigments and associated chemicals. This is very appealing to paint producers outside of India and therefore they had a huge Multinational attendance. CFA has a larger number of distributors.

Q. In your opinion what should CfA improve to move to a better show for the African continent?

A. Perhaps leverage social media to create a pre-event buzz. Share behind-the-scenes content, highlight key exhibitors, and use targeted ads to reach a broader international audience. Encourage attendees to share their experiences using a branded hashtag to amplify the event's reach.

Q. Anything special that Delta Colours will be sharing at the CfA?

A. Yes, together with one of our key suppliers, we will be launching the coatings industry’s first and only volumetrically dosed tinting system of solid colourants designed for use in water-borne architectural and industrial applications is reshaping the future of tinting systems.

Q. What is your outlook for the local coatings market over the next 2-3 years?

A. The increased spending on

public infrastructure and housing development is expected to boost demand for architectural and protective coatings. Investments in the automotive industry, including the expansion of manufacturing plants by companies like Ford, are likely to spur demand for automotive coatings. Despite these positive drivers, our industry faces challenges such as fluctuating raw material prices and economic instability, which could impact growth. Load shedding and other economic disruptions are also notable concerns. While the South African coatings industry is poised for, we will need to navigate economic and regulatory challenges to sustain this growth over the next two years.

Q. Will we see any specific trends?

A. One major trend is the increasing adoption of sustainable and ecofriendly practices. Manufacturers are focusing on reducing energy consumption, driven by both regulatory pressures and consumer demand. This includes the use of energy-saving technologies and a shift towards renewable energy sources in production processes. There is also a huge drive to eradicate heavy metals, lead, and so a lot of work is being done on high performance pigments that are ecofriendlier and more durable. c

Innovations in coating technologies are focusing on improving durability, reducing environmental impact, and enhancing protective qualities

Feature | Coatings SA 12

Blue Sheep • Bright Ideas

• Anti-corrosive pigments

• Aluminium and Pearlescent pigments

• Functional fillers

• Cellulosic thickener

• High performance inorganic and organic pigments

• Titanium Dioxide and Buff TiO2

• Opaque polymer emulsions

• Carbon black

• UV additives

• Photo Initiators

• Pigment preparations and colour solutions

partner

solutions

Your

in colour

Phone: +27 21 876 4167 | Email: orders@deltacolours.com 71 Village Artisan, Cabriére Street, Franschhoek 7690 Western Cape, South Africa www.deltacolours.com Coatings,

If you need help with any of the above, CALL US TODAY!

Construction and Inks:

When Paint Or Coatings Require Extra-special Characteristics!

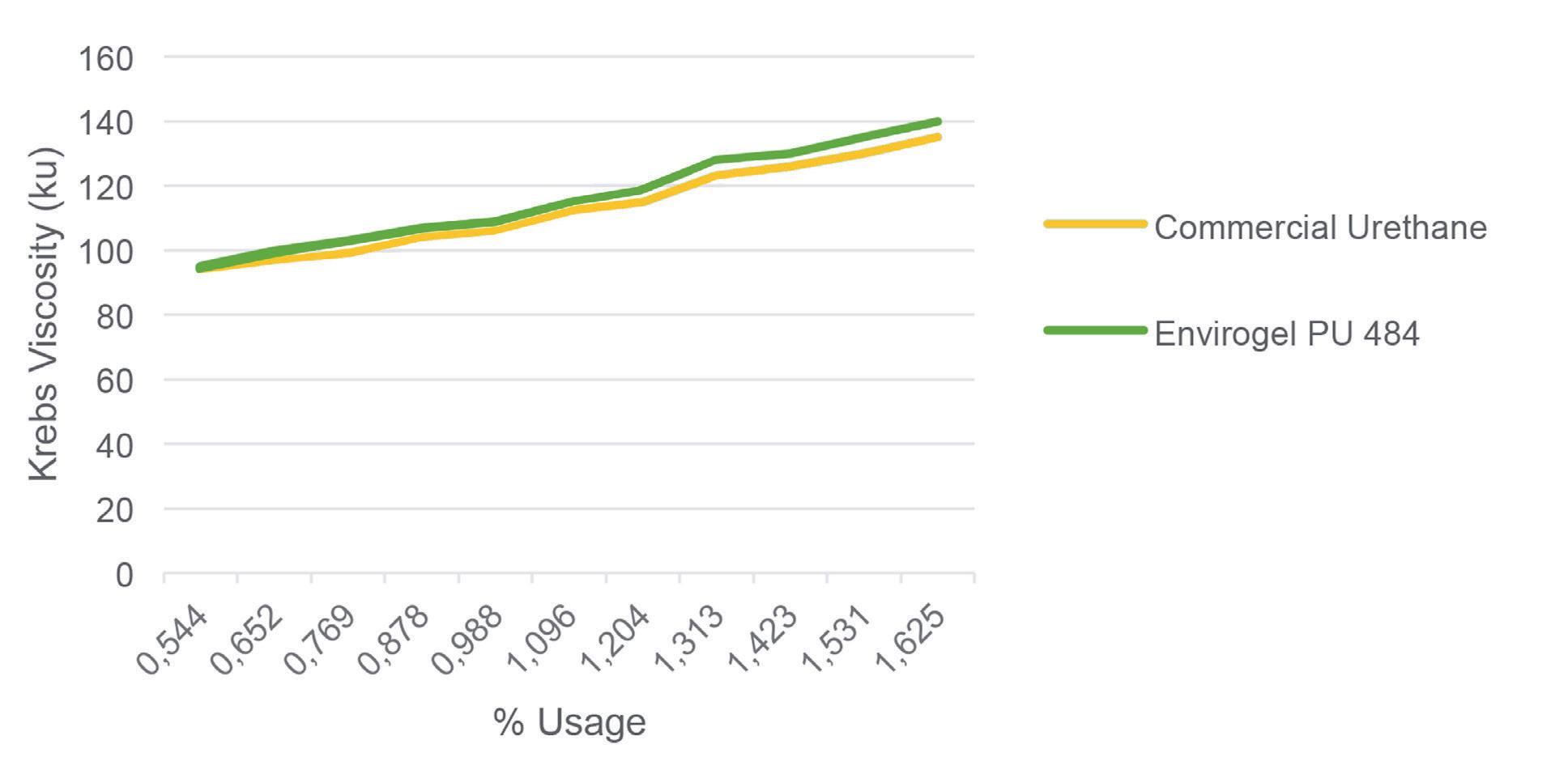

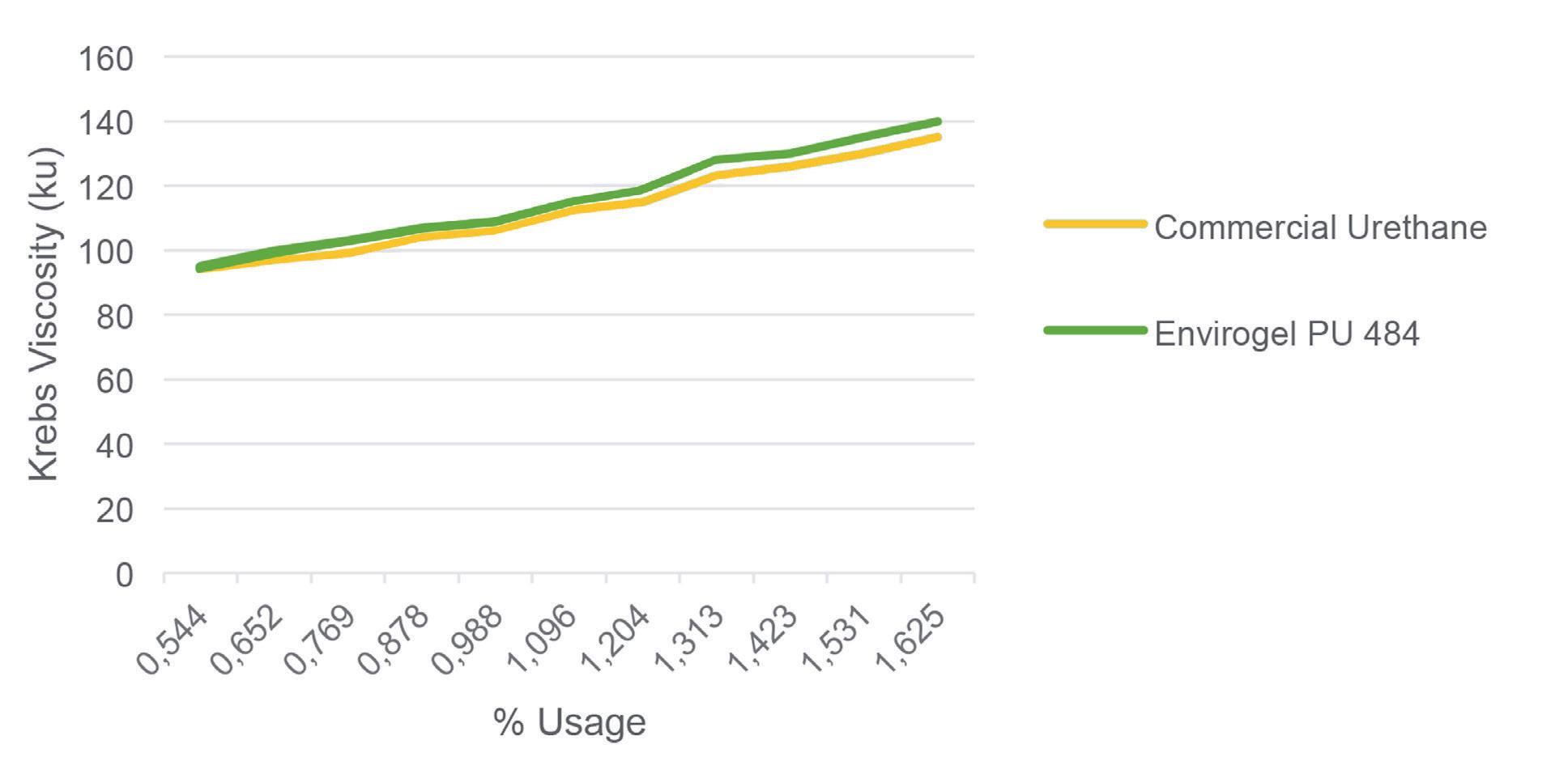

Envirogel PU 484 is another superbly formulated product from Sancryl Chemicals, renown for the practical and commercial value their products add to other manufacturers.

Envirogel PU 484 is a low-odour, water-based, non-ionic associative urethane rheology modifier with a Newtonian flow behaviour that provides excellent flow and levelling, uniform film formation as well as gloss display performance.

Being a hydrophobically modified urethane rheology modifier, Envirogel PU 484 is an easy-to-use product that removes fear of flocculation and localised particle formation.

Envirogel PU 484 is designed for use in the manufacturing of all types of paints and coatings, including coatings where a Zero to Low VOC is required.

Envirogel PU 484 has the ability to perform at high and low shear viscosity with a high thickening efficiency that impart excellent dispersion performance and in-can storage stability.

Due to its high-performance efficiency at low volume usage, Envirogel PU 484 has

a reduced impact on the water resistance and scrubs resistance of coatings.

Features and Benefits:

• Ability to perform in various applications and compatible with a wide range and types of coatings

• High thickening efficiency with minimal additions, at good cost benefit

• Excellent film build, Imparts low viscosity with high shear force, allowing thicker film applications with no sag

• Excellent splatter resistance, fluidity, and levelling

• Independent of pH

• Functions in cationic solutions

• Improved shelf-life stability, resistant to microbial attack.

Dispersion Curve Of A Commercially Available Urethane Thickener Versus Envirogel PU 484

• Formulated for paint manufacturers

• Perfect for producing low odour coatings

• Excellent flow and levelling properties

• Uniform film formation

• Gloss display performance.

SANCRYL • www.sancryl.co.za • +27 (0)31 902 1422 ENVIROGEL PU 484 8026 Sancryl Chemicals Coatings SA JUNE’24 DPS in order for YOU to improve YOUR Coatings Products! ENVIRO

PU 484 is a water-based non-ionic associative urethane rheology modifier that is easy to use

zero to Low VOC is required. It also stabilizes in-can storage

GEL

- even where

substantially!

Axalta scoops prestigious awards

Axalta Coating Systems, a leading global coatings company, announced today that it has won three 2024 Edison Awards™.

Axalta Irus Mix won silver in the Environmental and Industrial Solutions category. Axalta’s Voltatex® 7345 A ECO Wire enamel and its low carbon footprint sustainable coating system with Hyperdur® Primer and Chromadyne® Colorcoat won silver and bronze, respectively, in the coatings and manufacturing category. This is the sixth consecutive year that Axalta has won prestigious Edison Awards™.

“We are honoured again to be an Edison Awards recipient, as it reflects our company’s focus on innovation,” said Dr Robert Roop, Axalta's chief technology officer.

“These three remarkable solutions further showcase what our innovations can do for our customers. I want to recognise the entire Axalta team for their commitment to innovate smarter surface solutions for better living and a sustainable future."

Edison Awards winners were recently announced at the 37th annual Edison Awards event in Fort Myers, Florida. They were chosen as the 'best of the best' within their respective categories by some of the world’s top senior business executives, designers, academics, and innovation leaders.

SILVER WINNER – IRUS MIX

Axalta Irus Mix is the first fully automated, completely hands-free paint mixing machine that delivers highly accurate colour, maximising efficiency in a body shop. Axalta Irus Mix uses innovative packaging

made from 50% recycled plastic with precise dosing lids that dispenses paint without waste, boosting profitability and providing sustainable benefits to Refinish customers.

SILVER WINNER – VOLTATEX

Axalta’s Voltatex® 7345 A ECO Wire Enamel is a cresol-free, low hazard insulating varnish for magnet wires in motors, transformers, generators, and other electrical devices that drive electrification in many areas of daily life. This highperformance material is easy to process,

reduces risk to workers and contributes to an improved carbon footprint.

BRONZE WINNER – LOW CARBON FOOTPRINT SUSTAINABLE COATINGS SYSTEM

Axalta’s innovative Low Carbon Footprint Sustainable Coating System with Hyperdur® Primer and Chromadyne® Colorcoat reduces energy consumption by up to 21% and decreases CO2 emissions by up to 5% or 17kg per unit produced.

This novel, sustainable coating system provides manufacturing flexibility while maintaining superior appearance.

Named after Thomas Edison, the Edison Awards have recognised and honoured some of the most innovative new products, services, and business leaders in the world since 1987. c

About Axalta

Axalta is a global leader in the coatings industry, providing customers with innovative, colourful, beautiful, and sustainable coatings solutions. From light vehicles, commercial vehicles and refinish applications to electric motors, building facades and other industrial applications, our coatings are designed to prevent corrosion, increase productivity, and enhance durability. With more than 150 years of experience in the coatings industry, the global team at Axalta continues to find ways to serve our more than 100 000 customers in over 140 countries better every day with the finest coatings, application systems and technology.

| Coatings SA 16 News

Shutterstock.com

Photo credit:

For more information, visit axalta.com.

RHINE RUHR PROCESS EQUIPMENT (PTY) LTD www.rhineruhr.com HAVE A QUESTION? VISIT US AT COATINGS FOR AFRICA 2024 STAND C70-D71 19-21 JUNE 2024 SANDTON CONVENTION CENTRE OR CONTACT US DIRECTLY AT: sales@rhineruhr.com | +27(0)11-609-0411 REPRESENTING THE BEST IN EVERY FIELD! POWDER CONVEYING AND DOSING SYSTEMS | HIGH SPEED DISPERSERS | BEAD MILLS | AGITATORS | FILLING MACHINES | LABELLING MACHINES | POT WASHERS | GRINDING MEDIA

AkzoNobel continues innovation with impact

AkzoNobel’s investment in Dutch research labs will enable further pioneering product development.

Two new research labs are being built by AkzoNobel at its Sassenheim site in the Netherlands to further propel the company’s pioneering product development. Work is about to start on building a technology centre for Powder Coatings, while a new polymer lab has just opened which will develop innovative resin technologies for all the company’s businesses.

The total investment in the Sassenheim site – AkzoNobel’s largest global R&D centre – amounts to around €8 million. The facility already houses the biggest R&D teams in

Europe for the company’s Decorative Paint and Automotive and Specialty Coatings businesses. The addition of the two new labs will help the company further build on its global reputation for pioneering product development focused on providing creative solutions for customers.

“Creating the new Powder Coatings lab will enable us to carry out the fundamental research needed to continue to innovate with impact and bring more sustainable products to the market,” explains Roger Jakeman, AkzoNobel’s chief technology officer. “By developing new technologies for

the future, we’ll unlock more customer and application opportunities while supporting multiple options, including low bake cure. This will further enhance our ability to cut carbon emissions across the value chain.”

The recently opened polymer lab – part of the company’s Research organisation – will accommodate 15 scientists. It will mainly focus on the development of more sustainable polymer technologies and new coatings to support AkzoNobel’s ambition to halve carbon emissions across the value chain by 2030. “The performance of a paint or coating is largely defined by the design of the resins used,” continues Jakeman. “They’re a vital ingredient in the manufacturing process. The new lab will therefore play an important role in boosting our capabilities and strengthen our industry-leading expertise.”

Adds Carla Breuer, Mayor of Teylingen, the municipality where Sassenheim is located: “AkzoNobel's investment in these two new research laboratories underlines the company's commitment to sustainable product development in our region and in the Netherlands.

We’re proud that this initiative is taking shape in our municipality.”

AkzoNobel employs around 3 000 R&D professionals worldwide in 70 laboratories, with more than €1.25 billion having been spent on research and development over the last five years. c

| Coatings SA 18 News

credit: Shutterstock.com

Photo

Mayor of Teylingen, Carla Breuer, is pictured with a symbolic powder-coated tulip during a ceremony held inside the building that will become the new powder technology centre. Also pictured, left to right: Alderman Heleen Hooij; Roger Jakeman, AkzoNobel’s chief technology officer; David Williams, AkzoNobel’s chief innovation officer; and Kees-Jan Starrenburg, AkzoNobel’s country director for the Netherlands.

SLOW AND STEADY...

We are proud to be associated with leading paint manufacturers & have a key focus on EXPORT markets in Africa. We boast a team of highly skilled polymer chemists in the laboratory as well as on the plant to ensure quality control and superior standards of resin. Adding to the mix is our MAINTENANCE team of qualified engineers, fitters, welders & electricians. Our high-quality polymers are the key to vibrant decorative, industrial, automotive, and other coatings. Our state-of-the art laboratory boasts cutting-edge technology and a team of R&D chemists who endeavour to develop products for our customers.

The vision is to RE-DEFINE the COATINGS INDUSTRY with our QCCP (Quality, Consistency & Competitive Prices) THEORY.

Are you looking for lightning-fast delivery? Our 20-metric ton bulk delivery vehicle guarantees your order will arrive within 24-72 hours.

• Long, Medium & Short Oil Alkyds

• Urethane Alkyds & Oils

• Hydroxy Functional Acrylics

• Thermoplastic Acrylics

• Speciality Alkyds

• Short & Medium chain stopped Alkyds.

• Styrenated & Acrylated Alkyds

• Amino Resins (Urea & Melamine Formaldehyde)

• Thermoset Acrylics

• Saturated Polyesters

Experience the MAGIC with SYNTHETIC POLYMERS!

010 596 4444 | sgb@syntheticpolymers.co.za | www.syntheticpolymers.co.za

The right niche to flourish

Synthetic Polymers have managed to grow year on year despite a tough economic terriain in its nine-year history and has managed to create niche markets for itself, while continuing to be an important supplier to the coatings manufacturing industry.

One such niche market is the refinish automotive market. The refinish market requires a high solid, low viscosity premium product. “Our products have been extremely well accepted,” says Sanjeev Bhatt, managing director from Synthetic Polymers. “We thank the entire market and the manufacturers for accepting us, without them we would not have survived.” There is also development into heavy duty coatings for metal and marine applications.

Bhatt is optimistic about the future with further research and development work currently taking place. It further developed direct to metal for harsh

save time and money, categorised under medium to heavy industrial. “Our products are specifically formulated for high chemical environments and harsh weather climates where the high salt content in the air necessitates for a product like ours,” he explained. “This is not the run of the mill quick drying enamels; these products are aimed for severe chemical environments.”

These types of products have extremely low manufacturing volumes in South Africa due to their limited industry need and Bhatt is proud that the products from Synthetic Polymers are developed and manufactured locally.

“We are exploring further expansion of our ranges over the next two years, as we are assessing the market’s needs and

we invite clients to watch this space.”

SUPPORTING ITS COMMUNITY

Synthetic Polymers actively engage in multiple corporate social responsibility initiatives. A local healthcare professional visits the site weekly to ensure necessary health checks are done regularly and is geared towards preserving the country's natural beauty.

It has installed a heating system ensuring all heating is done through biofuels and is exploring an opportunity to making it the first complete alternative energy chemical plants in South Africa. c

For more information, call 010-596-4444

| Coatings SA 20 Feature

South Africa Kenya Australia East Africa Ireland United Kingdom CARST.COM Products & Services Across The Spectrum Adhesives & Coatings “ ” Reliably supplying high quality globally sourced raw materials to the South African Coatings Industry for 90 years! lick here

What’s happening at Coatings for Africa 2024

Here are some of the exciting highlights you can expect at this year’s Coatings for Africa show.

AECI SPECIALITY CHEMICALS

AECI Specialty Chemicals is a highly diversified industry-focused business serving a broad spectrum of customers across sectors that include, coatings, construction, plastic masterbatch and adhesives. In both its manufactured and traded businesses, it adds value through strategic relationships and services that include skilled and dedicated sales and service representatives, well-equipped and staffed technical development laboratories, a country-wide and African distribution footprint and a network of global technology partners who are leaders in their fields. Contact: 011-806-8700.

Shutterstock.com

for Africa

Photo

credit:

Coatings

| Coatings SA 22

Coatings for Africa

BAMR

BAMR supplies, repair, service and calibrate instruments, especially in the coatings, corrosion, physical paint testing and allied industries since 1946. BAMR is a tightly knit third generation family business that sees the value in building long and lasting relationships with suppliers, distributors and customers. It has been the suppliers and distributors of Elcometer instruments and equipment since 1947 in South Africa and Africa. It is a leading supplier of quality control instrumentation and equipment in the coating and corrosion industries, by staying abreast of the latest technology and research as part of educating the market. The business strives to combine quality products at competitive prices, with personalised service. Our partners are at the forefront of research and innovation. BAMR looks forward to seeing you at our stand (A01) at Coatings for Africa where our popular instruments and equipment will be on display. Contact: 021-683-2100.

CARST & WALKER

Carst & Walker South Africa, a member of the Hobart Enterprises group, Adhesives and Coatings Division has product offerings covering amongst others: resins and polymers, titanium dioxide, hydrocarbon resins, rheological additives, PU dispersions and emulsions, hyperdispersants, surface modifiers, fillers and extenders, fluorescent and security pigments, cellulose fibres, cellulose ethers, gum rosin, photo initiators and light stabilisers. Carst & Walker is looking forward to seeing visitors at stand E21. Contact: 011-489-3600.

CHEMIPOL SOLUTIONS

Chemipol Solutions sees the exhibition as a fantastic opportunity to reintroduce its business, presenting both new innovations and longstanding principles. Joining the company is its partners Cinic and Mazda. Leaders in the global high-performance pigment and phthalocyanine pigments markets, respectively. Contact: 011-372-4647.

CHT

CHT will be showcasing at Stand B60 at Coatings Expo 2024. The company invites visitors to join its technical team who can help in finding a solution to your company’s unique challenges. Its range includes defoamers, rheology modifiers, surface modifiers and more. CHT is looking forward to seeing you. Contact: 031-700-8436.

DELTA COLOURS

Visitors to this year's Coatings for Africa exhibition can expect an exciting showcase from Delta Colours. The company will feature its extensive range of organic and inorganic pigments. Attendees will have the opportunity to explore the latest advancements in Specialised pigments for automotive application, high performance pigments for lead replacement and pigment solutions for road marking paint amongst other products.

Delta Colours has partnered with one of its key suppliers, Vibrantz Technologies whose Color Solutions Team will showcase its expanded portfolio of products for paints and coatings, as well as unveil the latest innovations including Pearls technology and Pigment dispersions. Visit Delta Colours’ booth for a Pearls demonstration and learn about how the coatings industry’s first and only volumetrically dosed tinting system of solid colorants designed for use in water-borne architectural and industrial applications is reshaping the future of tinting systems. Contact: 021-876-4167

IMCD SOUTH AFRICA

IMCD South Africa Coatings & Construction team offers specialty raw materials that drive performance, innovation, and sustainability of formulations. Offering formulation advice, performance optimisation, and troubleshooting support, the company is committed to customer success. Visitors can join IMCD South Africa at stand B58 to learn more about the leading formulation trends for the City of Tomorrow and the latest product innovations its principal partners can offer. Contact: 011-570-4260.

LEJN

Lejn will again be supporting the Coatings Exhibition this year. Visitors can come and chat to its expert team about tinting and paint testing requirements. The company will have representatives from Fast & Fluid Management, Largo Innova and TQC-Sheen on the stand to assist with any queries. Contact: 011-452-0223 visit Lejn at stand C14.

POLYOAK

Polyoak Packaging (Stand A80) manufactures recyclable plastic buckets and drums with a range of functional closures for paint, coatings and industrial applications, in sizes ranging from 1L to 210L, available with high quality decoration and containing recycled plastic for enhanced sustainability and carbon footprint reduction. Contact: 011-247-6297.

| Coatings SA 24

credit: Shutterstock.com

Photo

C M Y CM MY CY CMY K

Transparent

Organic

Inorganic Pigments

Carbon

Aluminium Pastes

Hyperdispersants & Additives

Titanium Dioxides

Iron oxide Pigments

Lead Chromates

Anti-corrosive pigments

High Performance Pigments

NC Chip colourants

WHY CHOOSE US? Industry Focus: Distribution of chemical raw materials Target Industries: Coatings, plastics, and ink industries in Southern Africa

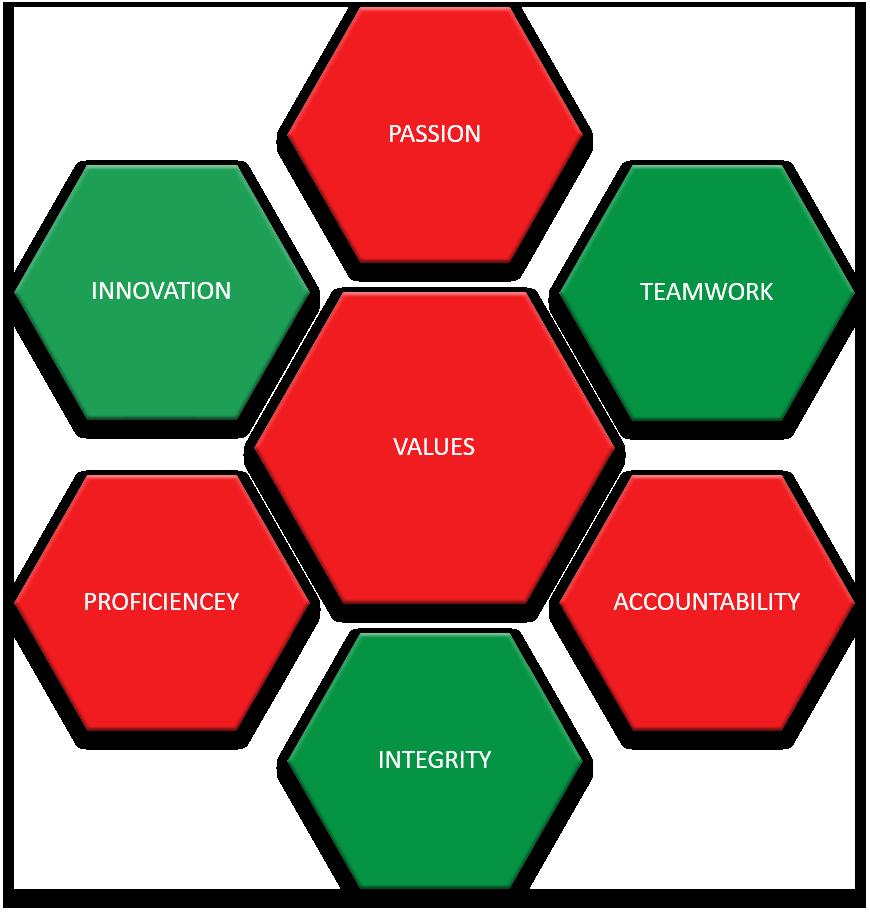

1999 Partnership: Viewing customers and suppliers as partners for long-term and sustainable growth. Collaboration: Working closely with customers and suppliers to foster mutual success. 18 Friesland Drive, Longmeadow Business Estate, Gauteng www.chemipol.co.za +27 (0)11 372 4676/57 info@chemipol.co.za PRODUCTS SUPPLIED PASSION TEAMWORK INTEGRITY PROFICIENCY INNOVATION ACCOUNTABILITY VALUES

Established:

Iron Oxides

Pigments

Black

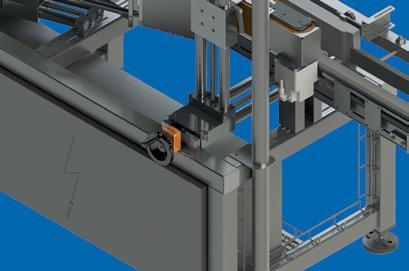

Witness the next step in the wet grinding processes: The Cenomic Optima 3 at Stand C10-D11 at the Coatings for Africa Exhibition. Don't miss Rhine Ruhr Process Equipment / Buhler AG at Stand C10-D11! The companies are showcasing the revolutionary Cenomic Optima 3 Horizontal Bead Mill, the future of wet grinding technology. Get ready to experience unparalleled performance and efficiency. Contact: 011-609-0411

SYNTHETIC POLYMERS

Synthetic Polymers will once again be exhibiting at this year’s Coatings for Africa show to connect with its customers. The team will be using the opportunity to continue discussions about its research and development as well as the varied applications that its products are created for. Visitors to the stand can expect a personal experience with its new technologies based mainly in the automative refinish market as well as medium to heavy industrial chemicals. Contact: 010-596-4444

Interactive Product Demonstrations:

As champions of sustainability, SAPMA's stand will emphasise the eco-friendly aspects of coatings, including low VOC formulations, recycled content, and energy-efficient production processes. Visitors will learn about SAPMA's commitent to environmental stewardship and how coatings contribute to green building initiatives and sustainable development.

SAPMA Business Directory

Coatings SA has introduced the SAPMA Business Directory where all advertisers automatically qualify for a free insert. Non-advertisers can pay a small fee for inclusion in this feature — please contact Natalie Sanders at nsdiytrade@gmail.com or 082 4502317 for assistance.

Networking Lounge: The Networking Lounge will provide a relaxed environment for industry professionals to connect, collaborate, and exchange ideas. Visitors can enjoy refreshments while networking with fellow attendees, discussing industry trends, and forging valuable partnerships. Contact: 076-792-0048. 021 683 2100 www.bamr.co.za

| Coatings SA 26 Coatings for Africa/ Business Directory Uplifting the Industry 010 009 6823 www. sapma. co.za We speak Packaging www.polyoakpackaging.co.za www.cht.com Specialty Raw Materials & Ingredients www.carst.com National Supplier & Manufacturer of Polymers, Specialty Industrial Chemicals & Coatings 031 902 1422 www. sancryl.co.za

RHINE RUHR PROCESS EQUIPMENT

Photo credit: Shutterstock.com

SAPMA

Business Directory | Coatings SA 27 “Disperse, Mill, Mix, Package”. www.rhineruhr.com. Creating a World of Opportunity Tel No: 086 136 6019 Email: info@imcdsa.co.za Web: www.imcdgroup.com Paint Testing requirements 011 452 0223 www.lejn.co.za Expertise, Innovation, Drive www.orchem.co.za 010 5964444 www.syntheticpolymers.co.za South Africa’s leading supplier of organic, inorganic pigments & specialty chemicals for plastics, coatings, inks, construction and cosmetics www.deltacolours.com www.heubach.com For advertising enquiries, contact Natalie Sanders 082 450 2317 www.promacpaints.co.za 011 801 3500 www.buhlergroup.com +27 (0)11 372 4676/57 www.chemipol.co.za Advertise in Coatings SA by contacting Natalie Sanders on 082 450 2317 2023 SAPMA Golf Incentive driven holiday! Africa returns! IMCD announces ssue 2 Volume 12 2024 SAPMA Chair calls all industry stakeholders to stand together Coatings for Africa Preview Bargain Council to make impact B G UR HA D E U N 22 086 112 7425 www.ashak.co.za 011 474 1900 www.excelsiorpaints.co.za 011 389 4600 www.prominentpaints.co.za

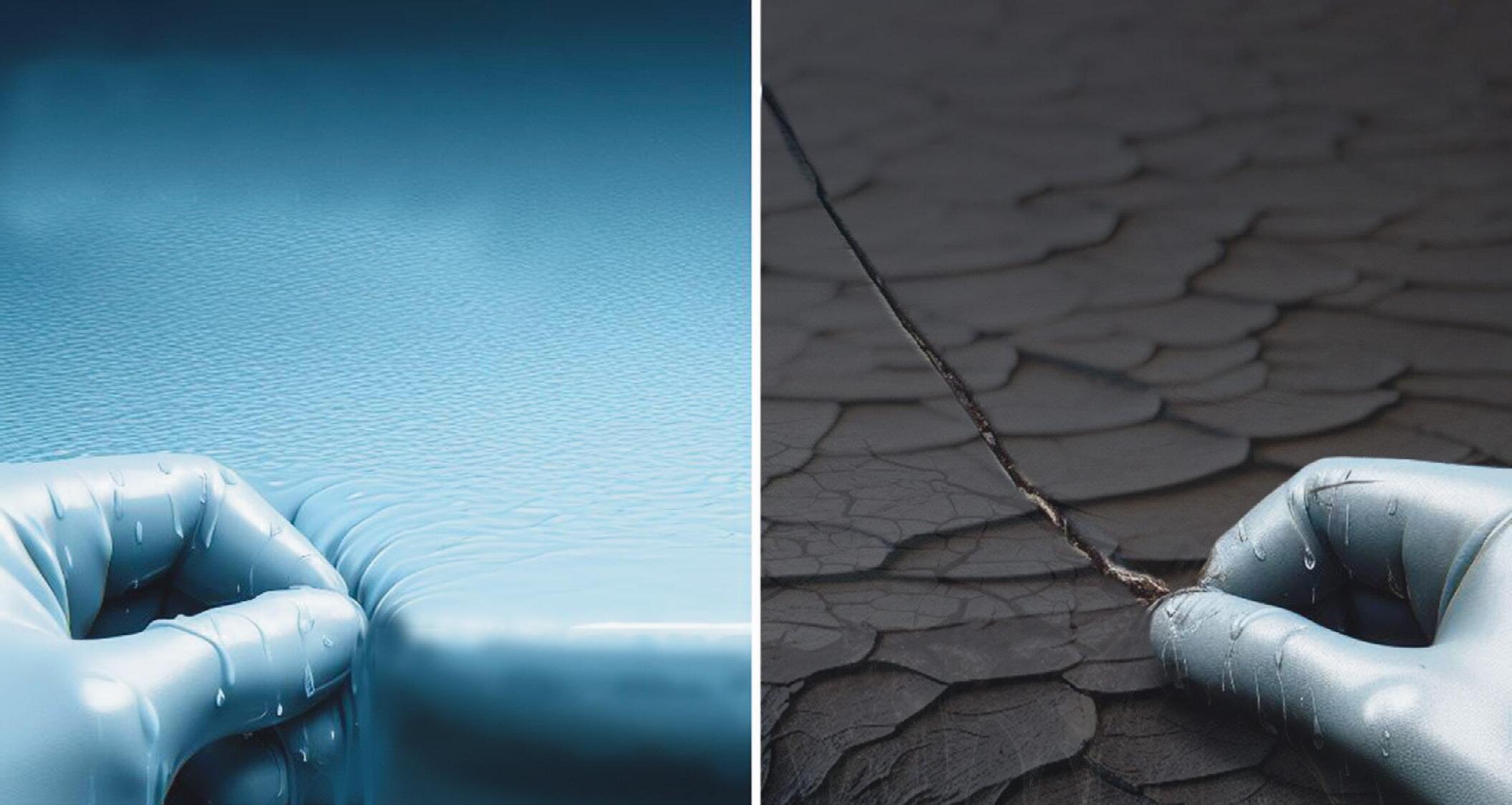

Waterproof Reliably With

POLYMER VS RUBBER

= no contest!

Polymer Remains Elastic AND is UV Resistant!

Our modern Polymer-based Waterproofing technology has improved multi-directional elasticity, adheres better to surfaces and is also UV resistant - important for Africa’s harsh conditions!

Rubber Perishes, Cracks and Loses Elasticity!

FEATURES AND ADVANTAGES

• Good adhesion to substrates

• Dries quickly: ±1 hour

• Non-toxic - contains no plasticizers or solvents

• Tough durable and highly flexible

• Non-staining and stain blocking

• Resistant to acids and alkalis

8028 ASHAK FP AD JUNE’24 COATINGS SA

AQUALOC