TECHNOLOGY

Technology is revolutioni s ing the financial services industry by enhancing efficiency, security and customer experience, and driving innovative solutions and growth.

Page 9 – 14

DREAD DISEASE

Cover for Dread Disease is crucial as it ensures peace of mind and access to necessary medical treatments in times of need. But do your clients fully understand its importance?

Page 18 – 19

OFFSHORE INVESTING

Offshore investing remains essential for diversifying portfolios and reducing risk. We take a look at what’s happening in this sphere in light of the current trading environment.

Page 22 – 25

The New Paradigm: How AI is redefining financial advising

BY KOBUS BARNARD CEO at Allegiance Consulting

AI has shattered boundaries once thought exclusive to human intellect: passing the Bar and Medical L icencing exams, mastering multiple languages, and revolutionising scientific research with breakthroughs in protein folding and drug development. From defeating world champions in chess to creating stunning art and composing original music, AI’s prowess extends to strategic thinking, creative expression and beyond.

Its transformative impact on financial analysis, market prediction and customer service underscores AI’s role as an unparalleled force of innovation and progress.

It passed the Bar exam, the exam required to practise law in the United States. To pass the exam, the AI had to be able to do complex legal reasoning, consider ethical dilemmas and case law analysis, showcasing its ability to understand and apply intricate legal principles. This was done by a machine that passed in the 90th percentile of all lawyers.

AI systems have participated in live debates with humans, constructing coherent, persuasive arguments and responding to counterarguments in real time. This demonstrates advanced understanding, reasoning, and rhetorical skills.

AI models have excelled in video games such as StarCraft II and Dota 2, where strategic thinking, real-time decision-making and teamwork are crucial. These achievements highlight AI’s ability to handle dynamic environments and long-term planning.

Alice in a financial wonderland

Financial services are not immune to AI. In 2001, an article titled ‘Surviving the Future’ appeared on the cover page of MoneyMarketing, where the writer envisioned a world where artificial intelligence (AI) would revolutionise financial services. At the time, the idea of AI-driven financial advisers seemed like science fiction. Fast forward to today, and that vision is becoming a reality, fundamentally reshaping the financial advisory landscape. This article explores how AI is changing the foundation of financial advising, emphasising that it is not a threat but a business imperative. It also outlines the evolving role of financial advisers and the end of the era of product pushers.

The evolution of financial services

In 2001, AI was in its infancy, and the notion of AIdriven financial services was speculative. Today, AI has permeated every aspect of our lives, including financial services. The ability to perform complex financial calculations, predict market trends and provide personalised advice has become a reality, thanks to advancements in machine learning, natural language processing and data analytics. The shift from an agricultural to a knowledge-based economy has been profound, and we are now witnessing the dawn of a new era in financial services.

www.moneymarketing.co.za @MMMagza @MoneyMarketingSA First for the professional personal financial adviser INSIDE YOUR JUNE ISSUE 30 June 2024

Capital (Pty) Ltd is an authorised financial services provider (FSP 34142).

Laurium

IMAGE S upplied

Continued on next page

Gambling

In times like these, investors are leaning towards safer choices.

Fixed options have surged exponentially, with our very own Fedgroup Secured Investment experiencing a remarkable uptick in the last few years.

Inspired by insights from our broker network, we’ve added two more fixed-rate offerings to our suite of products. The Fedgroup Fixed Endowment is a fixed-rate option tailored to South African investors, bringing stability and diversity to their portfolios, with an added tax benefit to boot!

Our brand-new Flex Income Plan is the ultimate solution for those seeking enhanced income, unparalleled flexibility, and access to a portion of the capital when life happens.

is for the

casino

Why expose your clients to unnecessary risk? Explore Fedgroup’s fixed-rate options today. Email VIP@fedgroup.co.za or call 0860

Fedgroup Financial Holdings (Pty) Ltd is a licensed controlling company and companies within the Group are authorised FSPs.

333 477

Continued from page 1

Shifting business models

Traditionally, financial advisers had to choose between two business models: focusing on fewer clients with deep, personalised service or serving a large volume of clients with more transactional, single-need advice. Disrupting these norms, AI now allows advisers to offer personalised service at scale, enabling them to expand their client base without sacrificing quality. This transformation challenges the conventional wisdom of choosing between depth and breadth, allowing advisers to achieve both.

The role of AI in financial advising

AI can perform millions of financial calculations in seconds, predict future scenarios with high accuracy, and provide tailored advice based on comprehensive data analysis. This empowers advisers to offer more personalised and effective service, enhancing their role rather than replacing it. Trust and relationships remain paramount, and AI supports advisers in building and maintaining these essential connections.

AI’s ability to analyse vast amounts of data and derive actionable insights will transform how financial advisers operate. Traditional methods of financial planning and advising, which rely heavily on manual analysis and human intuition, will give way to data-driven, algorithmic approaches. This shift will enhance the accuracy, efficiency and personalisation of financial advice.

Enhancing adviser roles

Contrary to fears that AI will replace financial advisers, I believe the role of human advisers will become more critical than ever. AI will handle routine tasks, complex calculations and data analysis, freeing advisers to focus on what they do best: building relationships, understanding clients’ unique needs, and providing empathetic, personalised guidance.

The future adviser will be a hybrid professional, combining technical proficiency with emotional intelligence. Advisers will need to understand AI tools, interpret their outputs, and translate these insights into actionable advice that resonates with clients. This requires continuous learning and adaptation, embracing technology as an ally rather than a competitor.

Transforming client relationships

AI will enhance the depth and quality of client relationships. By leveraging AI, advisers can gain a comprehensive understanding of their clients’ financial situations, goals and behaviours. AI can identify patterns and preferences, allowing advisers to offer highly personalised advice and anticipate clients’ needs before they even express them.

This level of personalisation will build trust and loyalty, key ingredients for long-term client relationships. Clients will appreciate the proactive approach, where their adviser seem to know them better than they know themselves. This transformation will redefine the value proposition of financial advisers, positioning them as indispensable partners in their clients’ financial journeys.

Promising research and prototyping

At Allegiance, our research and prototype is yielding promising results. We have successfully fused a financial identity with a multi-modal AI referred to as Ariel, and gave the AI access to our advanced modelling engines. These innovations will enable financial advisers to push boundaries and achieve what was previously impossible, expanding their client base and providing unparalleled service. In simple terms, for the first time it will become possible to scale quality advice, i.e. truly helping advisers to service more clients with less time without compromising quality. The integration of AI into financial

advising represents the pinnacle of this transformation, offering advisers the tools they need to succeed in an ever-changing landscape. By embracing AI, advisers can enhance their practice, build stronger client relationships, and provide unparalleled service.

The integration of AI into financial advising represents the pinnacle of this transformation, offering advisers the tools they need to succeed in an ever-changing landscape. By embracing AI, advisers can enhance their practice, build stronger client relationships and provide excellent service.

The future of financial advising AI is not a threat to financial advisers; it is an enabler. By leveraging AI, advisers can offer more personalised and effective advice, focusing on building longterm relationships with clients. The role of financial advisers is evolving from product pushers to trusted consultants who understand their clients’ unique needs and aspirations.

The rapid pace of technological advancement means that advisers must commit to lifelong learning. Staying ahead in this dynamic landscape requires a proactive approach to education and professional development. Advisers must familiarise themselves with the latest AI tools, understand emerging trends, and continually refine their skills.

The sun is setting on product-focused distribution models

Advisers who focus solely on pushing products without understanding their clients’ foundational needs will soon find themselves disrupted. This disruption is happening slowly-slowly, and then at hyper-speed. The industry is shifting towards a more client-centric approach, where personalised advice and strong relationships are paramount. Advisers who embrace AI will thrive, and they will be able to scale at a pace never seen before.

Expanding client base and access to advice AI will democratise financial advice, making it accessible to a broader audience. Traditional advising models often exclude those with limited assets, as advisers focus on high-net-worth clients. AI-powered platforms can offer affordable, scalable advice to individuals across the wealth spectrum, addressing the underserved segments of the market.

This expansion will open new opportunities for advisers to reach and serve more clients. By utilising AI to handle routine tasks, advisers can offer tiered service models, providing basic automated advice for simpler needs while dedicating their expertise to more complex cases. This approach will maximise their impact and profitability, ensuring no client is left behind.

Ethical considerations and the human touch

While AI offers immense potential, it also raises ethical considerations. Advisers must ensure that AI is used responsibly, maintaining the highest standards of privacy, security and transparency. Clients must be informed about how their data is used and protected, fostering trust in AI-driven solutions.

The human touch remains irreplaceable

Empathy, intuition and ethical judgment are qualities that AI can’t replicate. Advisers must leverage AI to enhance these human attributes, ensuring that technology augments rather than diminishes their role. By blending technological prowess with human empathy, advisers can offer a service that is both cutting-edge and deeply personal.

ED’S LETTER

When I was growing up, one of my dreams was to see the person I was speaking to on the phone. I never believed it would be possible –cellphones were not even on the radar. How times have changed, and although my dreams came true, today I barely use Facetime. I asked my 21-year-old daughter what technological innovation she could imagine in the future that would improve her life. She couldn’t think of a single thing. Have we reached a place where the technological future is unimaginable? We haven’t, of course, and if our imaginations can’t go there, the microchips will. As we speak, Elon Musk’s AI firm xAI has raised $6bn to compete with rivals such as OpenAI. Musk is promising to build a supercomputer he calls a “gigafactory of computer”.

Meanwhile, Microsoft has also struck a multibillion partnership with OpenAI, which, incidentally, Musk is suing because he believes it has “abandoned its mission to benefit humanity”.

The scary thing about technology is how quickly it changes and how we must adapt to keep up. In this issue, we look at some of the ways technology is influencing the financial services industry. Francois du Toit from PROpulsion says that financial advisers should be approaching technology in a very structured and measured way, to ensure it’s a “benefit and not a burden”. It’s all about ensuring you are up to date with what’s available to ensure your business runs as smoothly as possible, and that your clients’ lives can be managed with ease.

We’re also looking at Fixed Income in this issue, once considered to be the safest bet in terms of investing. Is this still the case? We take a deep dive into this asset class to give you some insight from industry experts.

I’m writing this editorial on the eve of the elections, and I have no doubt that by the time you are reading this, we’ll be looking at a considerably changed political landscape in the country. I can only hope that everything will be free and fair.

Stay financially savvy,

SANDY WELCH Editor, MoneyMarketing

30 June 2024 www.moneymarketing.co.za 3 IMAGES Shutterstock .com and supplied

NEWS & OPINION Scan the QR code to subscribe to the MoneyMarketing newsletter

SUREN MAHARAJ CEO OF SM CONSULTING

In his 29-year career, Suren Maharaj has accumulated extensive experience and expertise, distinguishing himself as an astute chief financial officer (CFO) and leader in both the private and public sectors. He is an active member of several organisations, including SAICA, the Institute of Directors of Southern Africa, CFO South Africa, the Chartered Institute of Government Finance, Audit and Risk Officers, and the South African Institute of Government Auditors. He also plays key roles on various boards and councils at the national, provincial and local government levels.

How did you get involved in the financial world –was it something you always wanted to do?

At high school, mathematics and accounting were my strongest subjects and in matric I achieved the highest marks in both subjects in the country. My first career choice was to become an actuary but at that time only three universities offered the course and they were all out of my reach financially. As a second choice, I became a chartered accountant, which is where I am now, 29 years later.

What was your first investment –and do you still have it?

In 2000 (after the infamous Y2K scare/hoax) I bought shares in Sasfin Holdings, a niche group that focuses on trade finance, with limited exposure to asset management and stockbroking at R10 a share. I sold my portfolio in 2017 at R70 a share, which represents a 600% return on investment!

What is your secret to turning around struggling entities?

Several key steps need to be taken. First, it’s important to diagnose the root causes of the problems, such as financial difficulties, operational inefficiencies and governance challenges. Once the issues have been identified, a comprehensive turnaround strategy should be developed. Strong leadership is crucial in driving the turnaround process, so capable and experienced leaders should be appointed. Engaging stakeholders,

including employees, customers, suppliers and government entities is essential to build trust and gain support. Cost optimisation should be implemented through efficient cost management and restructuring initiatives. Revenue growth can be achieved by identifying new revenue streams, improving sales and marketing efforts, and enhancing customer relationships. Operational efficiency can be improved by streamlining processes, investing in technology, and enhancing productivity. Effective governance, risk management and regulatory compliance should be ensured, and training and development opportunities offered to employees. It’s crucial to continuously monitor progress and adapt to changing circumstances. Foster a culture of innovation and entrepreneurship by encouraging creative solutions and innovative thinking.

You are involved in both the private and public sector. What are the challenges in the public sector?

The public sector is faced with numerous challenges, including economic growth and good stewardship of the country’s resources and economy. This includes ensuring the public sector effectively manages and utilises resources to promote economic growth and development. Another significant challenge is ensuring equal education opportunities for all. The public sector needs to address the issue of access to quality education and bridge the gap between different socioeconomic groups. The public healthcare system also faces significant challenges, which need to be addressed to ensure the provision of quality healthcare services. Investing in and maintaining critical infrastructure is another challenge. This includes roads, transportation systems, water, electricity and sanitation. Delivering social programs effectively, including housing, social welfare services, and community development initiatives, is also a challenge.

Effective financial management is crucial but remains a challenge, with issues such as corruption, unauthorised, irregular, fruitless and wasteful expenditure, and inadequate budgeting processes. Leadership and governance challenges, including corruption, political interference, and inadequate accountability mechanisms also need to be addressed.

Service delivery is a significant challenge, with issues such as inadequate infrastructure, staff shortages, and poor management affecting the quality and efficiency of services.

What are the challenges in the private sector?

The private sector faces numerous challenges for both organic and inorganic growth. Rising costs and interest rates, the tight labour market, longer lead times for inventory and supplies are just some of the factors pressuring cashflows and margins. Private sector leaders need to carefully balance their responses to short-term issues while maintaining a long-term vision for growth. Collaboration is essential. Public-Private Partnerships (PPPs) can provide public services or infrastructure projects. PPPs offer several benefits to the public sector, including improved infrastructure, increased efficiency, reduced costs, enhanced service quality, and job creation.

What have been your best –and worst – financial moments?

My best financial moment was during my tenure as a CFO and Acting CEO of financially turning around Pikitup SOC Limited (a municipal entity within the City of Joburg) by increasing the profits by more than R1bn in five years and rendering the entity solvent for the first time in its history. It was also the first time it achieved a Clean Audit from the Auditor General of South Africa. As a result, I was nominated as a finalist in the Annual CFO Awards in 2016, effectively making me a Top 20 CFO in South Africa.

My worst financial moment was selling my first property, which I bought in 2001 for R235 000. It was a two-bed, two-bath apartment on the beach in Umdloti, KZN. In 2002, I relocated to Joburg and rented it out and two years later after the lease expired, I sold it to the tenant for R500 000, which I thought was an excellent return on investment. However, the market value of the apartment is currently R2.5m.

30 June 2024 NEWS & OPINION 4 www.moneymarketing.co.za IMAGES Shutterstock .com Earn your CPD points The FPI recognises the quality of the content of Money Marketing ’s June 2024 issue and would like to reward its professional members with 2 verifiable CPD points/hours for reading the publication and gaining knowledge on relevant topics. For more information, visit our website at www.moneymarketing.co.za

What are some of the biggest lessons you have learnt about the finance industry?

To achieve long-term success in finance, it’s crucial to understand and mitigate risk through effective risk management. Diversification is key in spreading investments across various asset classes, sectors and geographies to minimise risk. It’s important to prioritise time in the market over timing the market, as longterm investing tends to outperform short-term trading. Harnessing the power of compound interest by starting to save and invest early is a powerful strategy. Being aware of fees associated with investments is essential, as they can eat into returns. Discipline and patience are necessary. Staying aware of changing regulations and their effects on investments is crucial as regulatory environments impact markets. Additionally, financial planning should be holistic, considering your entire financial situation rather than just individual investments. When faced with complex situations, it is recommended to seek professional advice from financial advisers or experts.

What makes a good investment in today’s economic environment?

There are several key strategies to consider. Diversification is important as it minimises risk. Low-volatility investing focuses on stable assets that can weather market fluctuations. Taking a long-term focus means holding onto investments for extended periods rather than seeking quick gains. Sustainability is another factor to consider, with a focus on investing in companies with strong environmental, social and governance credentials. Innovation involves investing in emerging technologies

and industries with growth potential. Dividend yield investing focuses on stocks that pay regular income through dividends. Growth potential investing involves identifying companies with strong growth prospects. Value investing looks for undervalued assets that have the potential for long-term appreciation. One important aspect is maintaining liquidity by keeping a cash reserve available for opportunistic investments. This allows investors to take advantage of favourable market conditions or seize potential investment opportunities that may arise. Work with experienced investment managers or financial advisers who possess the necessary expertise. Additionally, regular portfolio rebalancing is crucial to maintain an optimal asset allocation, which involves reviewing and adjusting investments periodically. Tax efficiency involves evaluating the tax implications of investments and optimising tax strategies. Remember, a good investment strategy is tailored to your individual financial goals, risk tolerance and time horizon.

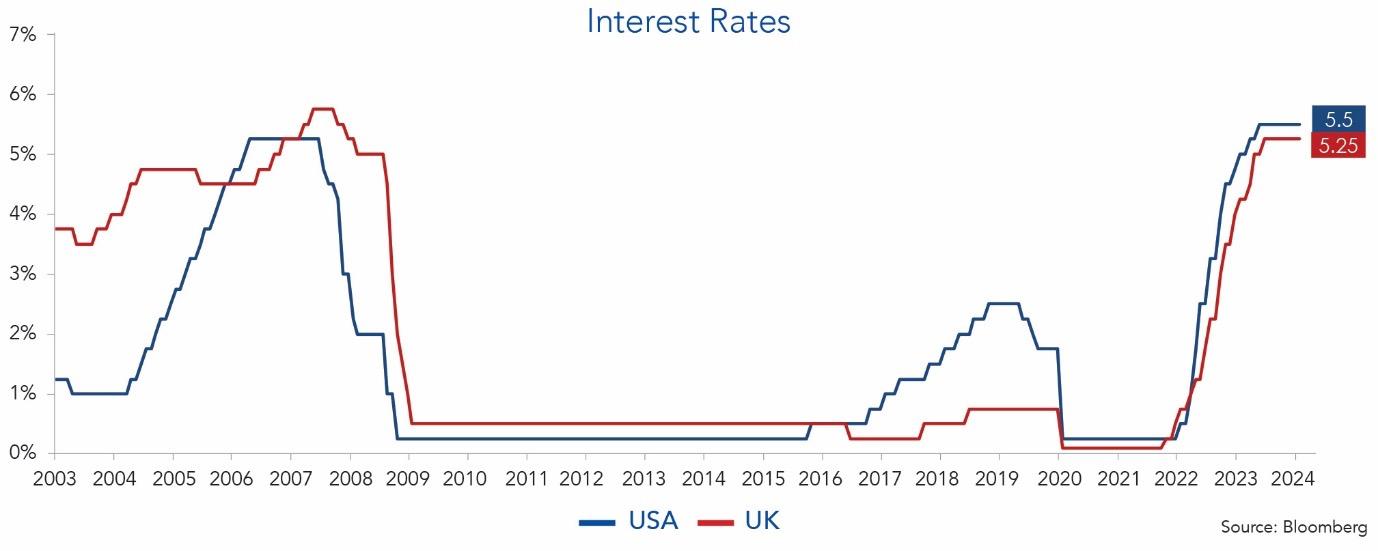

What macroeconomic realities are currently on your watchlist?

Rising inflation is a major concern, driven by supply chain disruptions, energy costs and the ongoing economic recovery. This has led to higher prices for goods and services, putting pressure on consumers and businesses. The Reserve Banks’ decisions on interest rates are also important, as rate hikes and quantitative tightening can impact borrowing costs and economic growth. Geopolitical tensions, such as conflicts, trade wars and political instability, are affecting global trade, investment and economic stability. Additionally, high levels of global debt, including government, corporate and household debt, pose a threat to financial stability and economic

More consumers seek help in a tough environment

BY BENAY SAGER Executive Head of DebtBusters

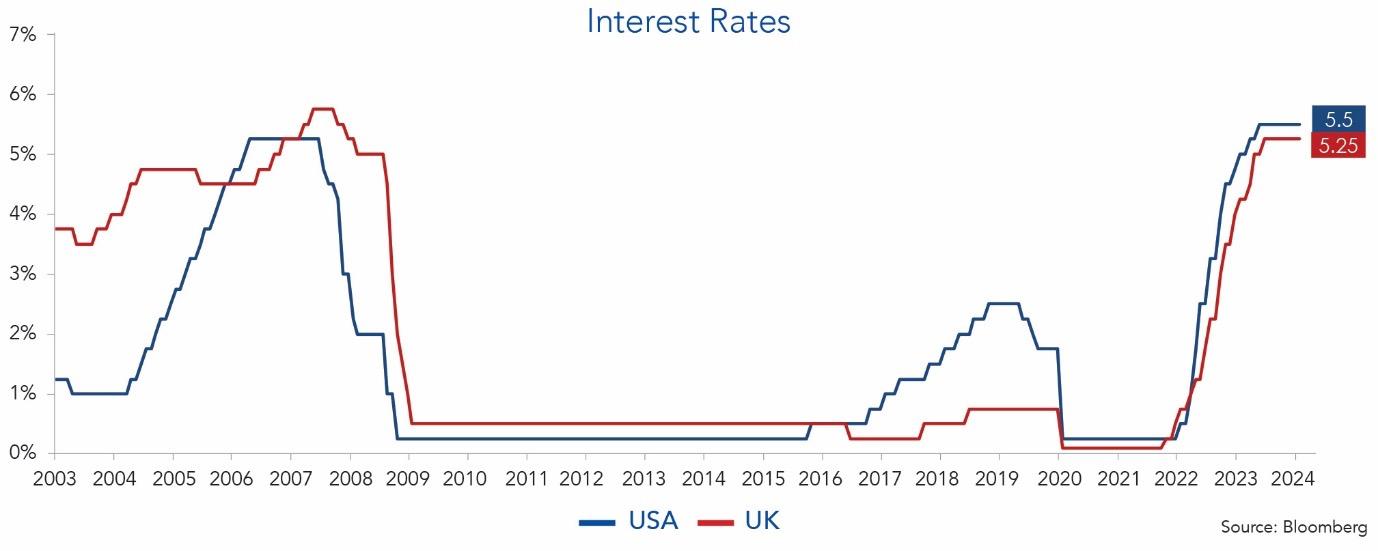

Persistently high interest rates and inflation – especially food inflation – continue to erode consumers’ disposable income, while a lack of any meaningful economic growth is constraining salaries.

Despite this, debt-to-annual-income ratio has remained stable for the past three quarters at 107%. While lower than 2023 levels, this is still high.

These are some of the findings from DebtBusters’ Q1 2024 Debt Index. The quarterly analysis of data from debtcounselling applicants also found that demand for debt management increased, with debt-counselling enquiries rising by 22% and the use of online debt management services up by 30% compared to the same period last year.

Benay Sager, executive head of DebtBusters, says although the improvement in overall debt levels combined with consistent monthly debt repayment trends are positive, the impact of increased interest rates on asset-linked debt is particularly evident in the 40+ age category.

The average interest rate for a bond has increased from 8.3% per annum in Q4 2020 to 12.3% in Q1 2024. For a R1.5m

bond, this adds an extra R4 000 per month to the repayment amount.

“What also continues to be apparent is how higher-income earners are using credit to offset the dual impact of inflation and interest rates – now 475 basis points higher than in 2020. These consumers typically have more short-term loans than those in other income bands and devote a greater proportion of their income to repaying debt.”

“Higher-income earners are using credit to offset the dual impact of inflation and interest rates”

Compared to the same period in 2016, when DebtBusters first began analysing the data, the Q1 2024 Debt Index found: Purchasing power has diminished by 47%. Nominal incomes are 1% lower than in 2016, while the cumulative impact of inflation over the eight years is 48%. While some income groups saw

growth. Currency fluctuations, particularly with the US dollar, are impacting international trade and investment. Fluctuations in commodity prices, such as energy, metals and agricultural products, are influencing inflation, trade and economic growth. Trade policies are undergoing significant shifts, with changes in global trade agreements, tariffs and protectionism impacting international commerce and economic integration. Technological advancements are occurring at an unprecedented rate, leading to significant transformations in industries, employment patterns and economic structures. The transition to sustainable energy sources and environmental concerns are significantly influencing economic growth, investment and global cooperation.

What are some of the best books on property/ finance/investing/leadership that you’ve ever read — and why would you recommend them to others?

I recommend these classic books because they offer valuable insights, practical advice, and timeless wisdom from experienced authors and experts in their fields.

Rich Dad Poor Dad by Robert Kiyosaki – on financial literacy and building wealth through property.

The Intelligent Investor by Benjamin Graham – on value investing and long-term wealth creation.

The Little Book of Common Sense Investing by John C. Bogle – A straightforward guide to index fund investing.

The 7 Habits of Highly Effective People by Stephen Covey – A self-help book for personal and professional growth.

real increase in incomes, on average the trend was slightly downwards. The debt-service burden is high, with the average debt-counselling applicant using 62% of net income to repay debt. The situation is worse among higher income earners. The debt-to-income ratio for people taking home more than R20 000 per month is 127%, while it is 172% for those earning R35 000 or more. These ratios are at or close to the highest ever. Top earners have unsustainably high levels of unsecured debt. While average unsecured debt levels are up 14% compared to 2016, this is lower than recent quarters and is a welcome trend. What is concerning is that for people earning R35 000 and more, unsecured debt levels are 41% higher. This is in line with inflation and indicates that without meaningful salary increases, these consumers are using debt to supplement their income. The average interest rate for unsecured debt is now at an eight-year high of 25.7% per annum.

Sager says that the growth in debt counselling enquiries and use of online debt-management tools is positive as it

indicates more consumers are trying to become financially sustainable.

Last year, the free subscriber base for online debt management tools on www.debtbusters.co.za grew by 82% compared to 2022. These include Debt Radar, which assists subscribers to manage their debt. A new tool, the Debt Sustainability Indicator, shows subscribers the percentage of their income required for debt repayments and how to make the ratio more sustainable.

For those consumers who successfully apply for debt counselling, unsecured interest rates can be reduced by over 90%, from an average of 25.7% to 2.6% per annum. This allows expensive debt to be paid back faster. Vehicle debt and balloon payments can be serviced over a meaningful period, with the average financed vehicle interest rate of 15.4% per annum negotiated down to a more manageable level.

Sager says the number of people successfully completing debt counselling has increased tenfold since 2016. Those who obtained clearance certificates during the first quarter of 2024 paid back over R600m worth of debt to creditors while they were in debt counselling.

NEWS & OPINION 30 June 2024 www.moneymarketing.co.za 5

SA still receiving a steady stream of foreign direct investment inflows

According to PwC South Africa’s fourth South Africa Economic Outlook report for 2024, it would be a welcome surprise to many South Africans to learn that, despite the country’s many challenges, our economy still attracted almost R100bn in FDI inflows in 2023 – equal to 1.4% of GDP. In fact, while some might expect South Africa’s investment outflows to be larger than inflows, the country has seen a net FDI inflow (inflows minus outflows) in every year since the global financial crisis.

South Africa has many positive attributes for foreign investors, including world-class financial services and communication industries, a deep capital market, quality tertiary institutions producing graduates with internationally comparable qualifications, abundant natural resources (including renewables), a strategic geographical location for entry into the rest of Sub-Saharan Africa, a transparent legal system, and a certain degree of political and policy stability, among many other features.

The perception among non-residents of South Africa’s public governance and business ecosystem are ‘moderately positive’ on average, according to data and classifications from research by nation branding experts Bloom Consulting. PwC’s review of this data shows that international perceptions of South Africa’s public governance and business ecosystem echo the results from other international benchmarking reports: that South Africa’s performance is near the middle of the pack when countries are ranked, and not as dismal as some might think.

For example, when considering the country’s economy and business ecosystem, the average perception score between those familiar and those who are unfamiliar with South Africa indicate a ‘moderately positive’ view on the local business environment. This is in line with, for example, the Venture Capital & Private Equity Country Attractiveness Index 2023 produced by the IESE Business School that ranked South Africa 66th out of 125 countries. This placed South Africa near the middle of the country list – something to be moderately positive about – and in the company of countries like Malta, Croatia and Slovakia.

From an international perspective, Olusegun Zaccheaus, PwC West Africa Strategy& Leader, says: “Despite its challenges, the South African economy is more diversified and stable compared to many other African economies. The country has a very strong financial services and deep capital market, which is more sophisticated than most markets in Africa. South Africa’s banking industry offers clients access to a comprehensive suite of financial instruments and services alongside a robust banking regulatory framework that ensures the safety and soundness of financial institutions and their clients.”

Data from the South African Reserve Bank (SARB) shows that the cumulative value of foreign liabilities (inward investment stock) totalled nearly R3tn in 2022 (the latest available data). The manufacturing industry held the largest share, accounting for 38.5% of liabilities, followed by mining (24.2%) and financial services (20.0%). South Africa’s factory sector is home to production facilities owned by some of the world’s largest producers of vehicles, food products and building materials, among others.

To understand the economic impact of FDI, we modelled the contribution to the economy of a R5bn brownfield capital investment in a local automotive manufacturing facility. This simulates the investment needed to upgrade an existing factory to produce a new model line. Investing this money in the upgrade of an existing plant – with 58% of the money spent locally and 42% on imported equipment – would create R3.5bn in additional national GDP, create and/or sustain 9 000 jobs during the upgrade process, and contribute R673m to the fiscus.

Lullu Krugel, PwC South Africa Chief Economist, says: “South African businesses need to be awakened to the possibilities that foreign investment offers them and the country, as FDI can play a significant role in business and

economic development. It provides local industries and the economy with capital inflows, expansion of business into new markets, cost reduction through economies of scale, and skills enhancement of domestic employees.”

“Our economy still attracted almost R100bn in FDI inflows in 2023 –equal to 1.4% of GDP”

At a company level, the advantages of FDI are easy to comprehend. These include, among many other benefits, the expansion of business into new markets, cost reduction through economies of scale as part of a larger international commercial entity, and skills enhancement of domestic employees through exposure to new technologies.

In PwC’s experience, potential foreign investors are looking for three specific things from prospective investment targets in South Africa:

A demonstrated track record of commercial sustainability across all the systemic crises the country has experienced over the last 30 years. This can be achieved through conducting a financial due diligence (FDD).

Demonstrating that they are well positioned to maintain their performance into the future. That means having relevance in a growth industry underpinned by strong fundamentals. This can be achieved through conducting a commercial due diligence (CDD).

• Demonstrating capabilities that can be exported to solve emerging issues in other territories.

An FDD provides peace of mind to buyers by analysing and validating the financial, commercial, operational and strategic assumptions being made. It uses past trading experience to form a view of the future maintainable earnings, key value drivers, inherent risks in the business and confirms that there are no ‘black holes’. In turn, a CDD assesses the historical and forecast assumptions and performance from the perspective of the markets, customers, competitors and internal capabilities of the organisation. The due diligence provides insight of the growth projections used as a basis for the proposed deal.

For more information on the PWC report, please visit www.pwc.com

30 June 2024 NEWS & OPINION 6 www.moneymarketing.co.za IMAGES Shutterstock .com

Giving your client the (h)edge

BY MIKE TITLEY

Last week while I was driving home, listening to one of my favourite podcasts, an interesting discussion came up on hedge funds. While I enjoyed the coverage of hedge funds, I found the tone of the conversation dressed in fear and wariness. It was acknowledged several times in the interview that hedge funds confuse the average investor. This may be true when compared to an equity fund, which intuitively makes sense to the man on the street; however, try explaining an income fund which uses bonds, FRNs, ILBs, structured notes and other instruments wrapped in colloquial jargon. Investors trust these lower heartbeat income products with their most sensitive short-term investments, often without regret. However, unexpected events can occur, even in income funds, as seen recently when Bridge Taxi Finance defaulted on their loans.

I agree that investors should not go blindly into any investment, and hedge

funds do require a bit more understanding, but over time they have proven their value add to the investment mix.

By their very name, hedge funds, they should instil positive risk management sentiment for investors, ‘hedging your bets’. With a broader toolbox, hedge funds can manage the various possible downside scenarios while not giving up all of the upside. A typical hedge fund may have a starting point of aiming to capture 2/3 of the upside, while mitigating 2/3 of the downside. By missing most of the drawdowns, the funds more than make up for not participating in all of the upside. But given their range of investment opportunities, different hedge funds will seldom behave similarly and may be styled to capture less of the downside or more of the upside. Correlation matrices illustrate how effective hedge funds are at diversifying a portfolio relative to both asset classes and other hedge funds.

The other notable point made during the

discussion was how some hedge funds can blow up in times of extreme stress and black swan events. While this can be proven internationally, within South Africa, our hedge fund industry has proven itself relatively resilient through each of the last few crises. The below chart shows the average Long Short and Market Neutral Fund in last few crises.

The interviewer questioned whether survivorship bias was at play in the hedge fund industry. After a bit of researching with HedgeNews Africa, the attrition rate of hedge funds in SA is between 7% to 8% on average over the past 14 years. This is in line with funds in the unit trust industry where smaller funds fall out or are amalgamated into new strategies.

Many steps have been taken to improve hedge fund access and regulation over the years. Most of the tried and tested Retail Investor Hedge Funds (RIFs) are now listed on major platforms, offering the man on the

street access to some of the best investment minds in the country. These funds are limited to 2x gearing, much less than one would typically take on a house with a bond. An important point to make is that RIFs are traded daily with daily liquidity. They are governed by the same regulations and requirements as unit trusts in South Africa, limiting any fund closures or exit penalties.

With long track records, established processes and philosophies, the experienced portfolio managers usually have their own wealth invested in the funds alongside their investors. At Laurium, we believe that hedge allows us to express our view in the most effective way. Please visit our website to view and invest in our range of hedge funds. www.lauriumcapital.com

A fund for stability and certainty in your portfolio

BY IAN SCOTT Head of Fixed Income at Momentum Investments

Just as individuals rely on the banking market for overdrafts and credit cards, companies and state-owned enterprises (SOEs) turn to capital markets to finance large projects. This is referred to as the fixed interest market. Fixed interest markets, also known as long-term debt markets, involve debt maturing in over a year. Long-term debt, such as bonds, is a liability for issuers like companies or SOEs, while investors treat them as assets. Long-term assets in capital markets have durations of three, five or 10 years, with a set maturity date. Investors receive regular coupons, typically quarterly or semi-annually, representing the bond’s annual interest rate paid from issuance to maturity as a percentage of its face value. In a portfolio, fixed income plays a crucial role, offering stability and certainty, unlike equities. While equity dividends fluctuate daily, fixed income ensures investors know their

invested money’s duration over three, five or 10 years, and that every year they’re going to receive a certain percentage of interest, including on the maturity date. It provides a stable income stream because it is interest-bearing, and gives stability in a portfolio against other potentially more volatile components of the portfolio, like equities.

Fixed income is not just about one asset class – bonds – which is one pillar of it. This includes Government Bonds, SOEs and Government Guaranteed Bonds. The second pillar of an overall portfolio is a cash component, which is essential in volatile markets. The third pillar is exposure to credit to optimise risk-return trade-offs. The fourth pillar we would include is Inflation-Linked Bonds because that is one of the two ways to protect your savings against inflation. The fifth pillar would be the market that is opening up and exciting us – private debt markets – where an investor can get exposure to the institutional unlisted market. In the past, private debt markets were perceived as unlisted, unrated and high-risk. We believe the contrary: We are finding great quality companies that may not be creditrated or listed but we know the balance sheets are strong. Public-private partnerships are the new way in which South Africa expects to finance infrastructure with partnerships

between government and private sector institutions. Those entities will come to the private debt markets to finance large capital projects, not necessarily on the JSE-listed market. The Momentum Income Plus Fund is the vehicle for investors to get exposure to private markets.

The Momentum Income Plus Fund aims to maximise income derived from credit instruments primarily domiciled in South African debt capital markets. It is suitable for investors with a low-to-moderate-risk profile who are looking for the highest possible income yield and stability on capital invested. In an investment portfolio, the Momentum Income Plus Fund is a good diversification away from more risky investments like equities , with an investment term of three or more years. Its low correlation to other fixed interest funds and asset classes makes it a valuable building block for portfolios.

Through a monthly debit order of around R500, an individual can get access to the private institutional debt market and have access to big infrastructure spending that we are going to see in South Africa, and the financing thereof. It is an exciting opportunity for individual investors to access this market.

For more information on the Momentum Income Plus Fund, please visit momentum.co.za.

NEWS & OPINION 30 June 2024 www.moneymarketing.co.za 7

Business Development and Marketing at Laurium Capital -13.2% -16.7% -7.5% -2.4% -9.1% -3.2% 0.4% -2.6% 0.3% -20% -15% -10% -5% 0% 5% GFC Sept 2008 Pandemic 2020 Inflation Crisis 2022 SA Equity SA Long Short HF Ave SA Market Neutral HF Ave 5 4 3 2 1 Hedge Funds 1.00 Laurium Aggr HF 1 1.00 0.82 Laurium MN HF 2 1.00 0.19 0.18 Hedge Fund 1 3 1.00 0.22 0.38 0.45 Hedge Fund 2 4 1.00 0.39 0.82 0.26 0.46 Hedge Fund 3 5 5 4 3 2 1 Market Indices 1.00 Laurium MN HF 1 1.00 0.82 Laurium Aggr HF 2 1.00 -0.33 -0.29 SA Cash (STeFi) 3 1.00 0.03 0.19 -0.01 SA Bonds (ALBI) 4 1.00 0.46 -0.15 0.70 0.34 SA Equity (SWIX) 5

Source: Morningstar, HedgeNews Africa

Source: Morningstar. Correlation ranges between -1 and 1. The lower the value, the lower the correlation between the comparison. Underlying data run from 1 March 2013 to 29 Feb 2024

Figure 1: Correlation Matrices versus other hedge funds & against SA indices

Figure 2: Largest monthly drawdowns in recent crises, compared to hedge funds

Momentum Collective Investments (RF) (Pty) Ltd (the “Manager”), registration number 1987/004287/07, is authorised in terms of the Collective Investment Schemes Control Act, No 45 of 2002 to administer Collective Investment Schemes (CIS) in Securities. The Manager is the manager of the Momentum Collective Investments Scheme. Standard Bank of South Africa Limited, registration number 1962/000738/06, is the trustee of the scheme. CIS’s are generally medium to long-term investments. The value of participatory interests may go down as well as up and past performance is not necessarily a guide to the future. The terms and conditions, a schedule of fees, charges and maximum commissions, and additional risks are available on the minimum disclosure document (MDD) and quarterly investor report (QIR) for each portfolio which is available on momentum.co.za All performance figures are net of fees and represents the A class in each portfolio.

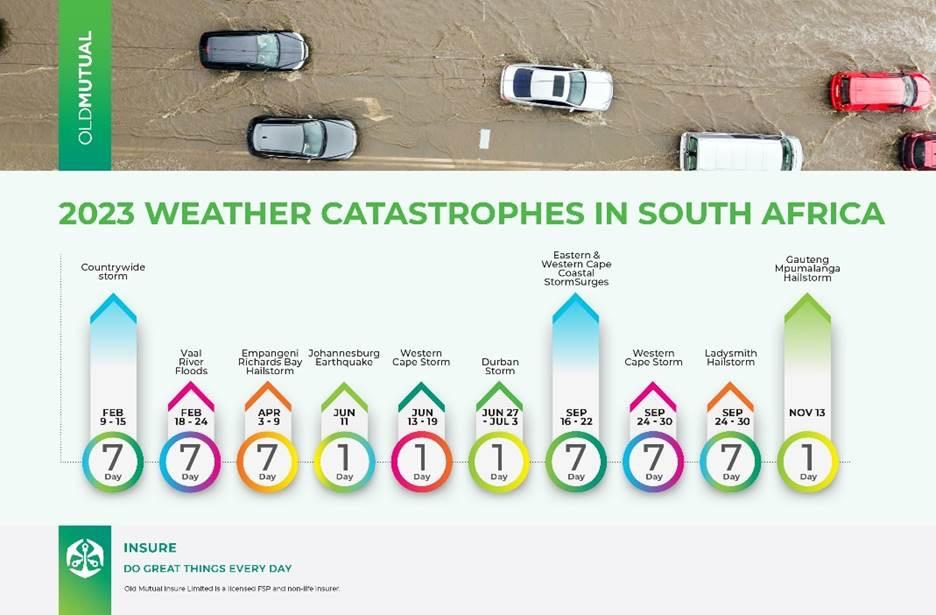

Who let the CATs out?

BY RONALD RICHMAN Chief Actuary at Old Mutual Insure

The sheer number of weather-related catastrophes over the past few years, and last year in particular, has shaken the foundation of the insurance market, signalling a looming crisis. Can insurance still be counted on to pick up the pieces when things fall apart?

The ominous rumblings of climate change have reached the insurance industry’s doorstep, and the forecast is troubling. This is the view of Ronald Richman, Chief Actuary at Old Mutual Insure, who says that globally, weatherrelated events are threatening to cause an insurance crisis. In South Africa, insurers are bracing for its impact.

“While the country used to be a Catastrophic Event (CAT) free zone, the scale and magnitude at which disasters have taken place recently means we are now experiencing a dramatic shift in the CAT landscape,” says Richman.

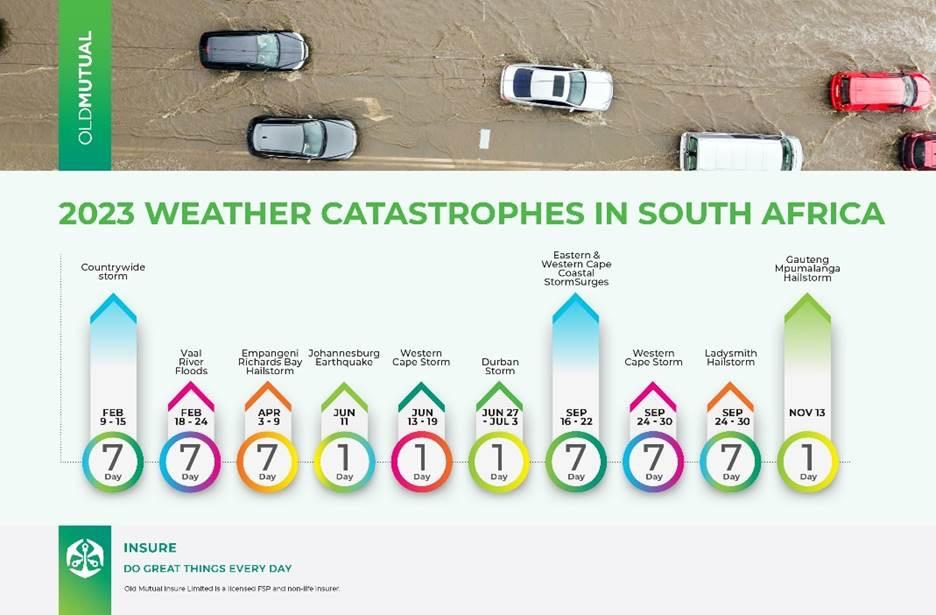

In 2023, Old Mutual Insure recorded 10 weather-related claims events, of which three were significant, running into millions of rands. These were the Western Cape storms in June and then again on Heritage Day weekend in September, as well as the Gauteng and Mpumalanga hailstorm in November 2023.

This is not a phenomenon unique to South Africa: globally, severe weather is impacting the sustainability of the insurance industry in new and unexpected ways. Across the world, Richman says data shows that severe convective storms were predominantly responsible for CAT losses, accounting for 68% of global insured natural catastrophe losses in the first half of 2023. Severe thunderstorms in the US led to $34bn in insured losses, some 70% of total insured CAT losses, during the same period – an unprecedented level

of financial damage in such a short time, according to Swiss Re Group’s Sigma publications. Whereas large single events, such as hurricanes or earthquakes, have often been the driver of record CAT losses in previous years, data from 2023 suggests that smaller events were the main issue during 2023. This was likewise the case in the South African environment.

In addition, 2023 was the hottest year on record, with scorching temperatures driven by climate change and further amplified by El Niño – a naturally occurring climate phenomenon that takes place every two to seven years –and other cyclical weather phenomena. In 2023, some experts said that the US economy is overexposed to climate risk in the same way that it was overexposed to mortgage risk in 2008, a major cause of the catastrophic financial crisis at the time.

“Given this picture, it is not farfetched to believe that climate change has the potential to destabilise the global insurance industry, with ripple effects for SA,” says Richman. Signs of stress are already emerging in several parts of the United States, with companies withdrawing coverage from California and Florida.

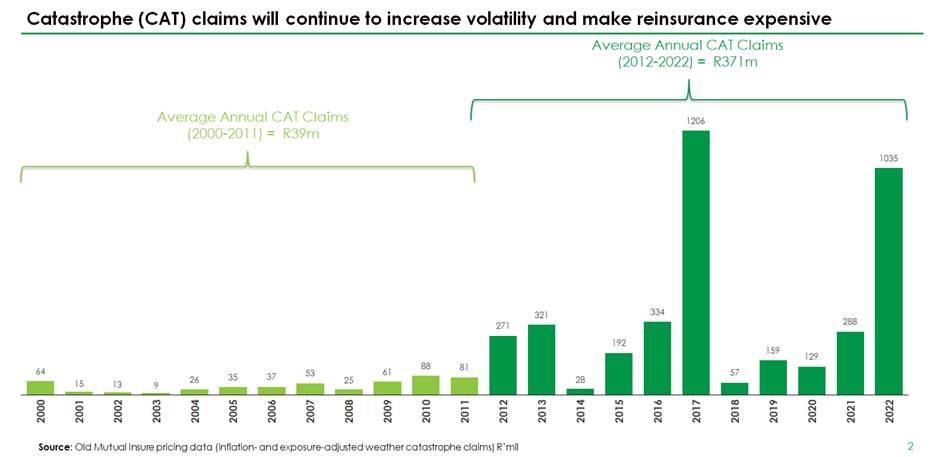

He says that structural changes in the reinsurance market have compounded the challenges.

“While many of the recent events have not been unprecedented, insurers have experienced them as particularly acute losses hitting their bottom lines and capital reserves. This is due to reinsurers taking significantly less risk from these types of events, leaving insurers unable to smooth out the losses over time,” says Richman.

In 2023, according to research undertaken by PwC, reinsurers again ranked climate change as the most

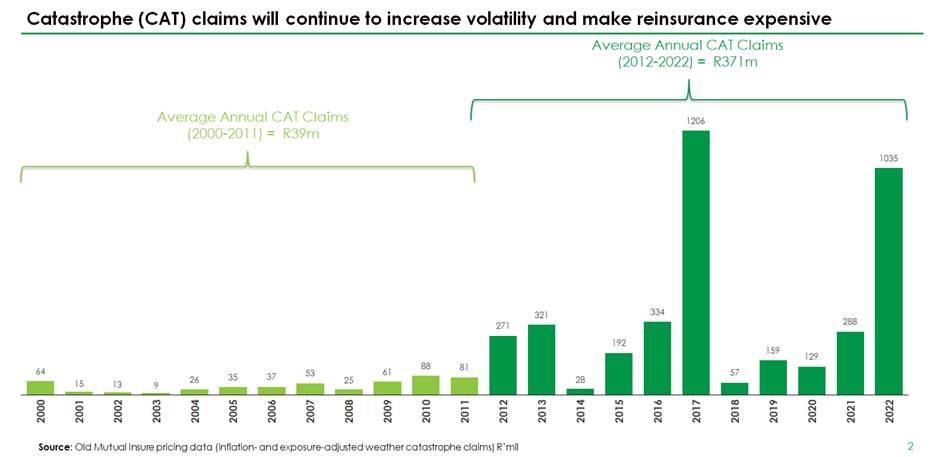

GRAPH 2: CAT claims will continue to increase volatility and make reinsurance expensive, according to

significant risk facing the sector. According to Moody’s, reinsurers are feeling the pinch as they accumulate losses from customerfacing insurance companies. To counter this, many are raising prices, limiting coverage, and even exiting some markets to improve returns.

“This structural shift in the reinsurance market has far-reaching implications, demanding a fundamental re-evaluation of how the market approaches risk and pricing,” says Richman, emphasising that contrary to popular belief, profit margins in the traditional lines of business in the non-life insurance industry are slim. “This, together with the convergence of inflationary pressures and losses from CAT events, means that we are in a pressure pot, ready to bubble over.”

He says that for insurance to be sustainable, the right price must be charged for cover that reflects the true cost of risk in the current volatile climate.

“Otherwise, you jeopardise the trust placed in the insurance system to be there when things fall apart,” says Richman. “To fund the level of coverage policyholders have previously enjoyed, price increases will be necessary over time to account for these losses and needs to be done in a manner that reflects the true risk posed by each policy.”

He adds that it is not all bad news, as sophisticated modelling techniques and innovative solutions are being explored to better quantify the rising climate risks. These should help in navigating these turbulent waters.

Earlier in 2024, Old Mutual Insure announced an innovative new approach to capturing climate change data and aligning this with the insurance policy experience to help close the gap between

“Globally, severe weather is impacting the sustainability of the insurance industry in new and unexpected ways”

the prediction and pricing of weatherrelated risks. It is the first project of its kind in SA to overlay climate-data with claims-data.

But collective action is imperative.

“Mitigation efforts are essential. Education is key, as consumers must understand the importance of risk management and asset protection against climate change,” says Richman. “In addition, public-private partnerships can help address underinsurance in the SA market and spread risk more equitably. Currently, there isn’t a structure for this type of solution, unlike in other parts of the world where it has been introduced successfully.”

He points to Flood Re, which is a flood reinsurance scheme in the UK – a joint initiative between government and insurers to make flood cover more affordable.

“In South Africa, where structural deficiencies exacerbate the disparity between the insured and the uninsured, a similar approach is warranted. The insurance industry in South Africa has the breadth and depth of knowledge and skill, coupled with a desire to help and be a solution to the problem. Ultimately, this would ease the burden of these events on all stakeholders in SA,” concludes Richman.

30 June 2024 NEWS & OPINION 8 www.moneymarketing.co.za IMAGES S upplied

GRAPH 1: Old Mutual Insure claim events in 2023

data from Old Mutual Insure

Using AI & Advanced Analytics to beat insurance fraud in South Africa

BY STEPAN VANIN Regional Leader of Insurance Business Advisory, META & APAC at SAS

Despite higher inflation, interest rates and cost of living, the South African insurances market experienced a revival during the last two years, with the gross written premium across the local insurances market expected to show an annual growth rate of 5.14% from 2024 to 2028 (CAGR 2024-2028), achieving a market volume of US$100.30bn by 2028. While cloud and advanced data analytics adoption remain catalysts to driving innovation and faster, more accurate intelligent decisioning, and thereby growth for modern insurers, the rise and increased sophistication of insurance fraud remains a top tier threat.

Significant steps have been taken to address fraud in the local insurances markets. In fact, reporting on 2022 data, the Association for Savings and Investment South Africa (ASISA) recorded that overall the local insurance industry saw a R77m loss due to fraud and dishonesty; however, losses amounting to R1.1bn had been prevented.

Despite this, with the advent and accessibility of artificial intelligence (AI) in recent years, SAS believes that the world is entering a Dark Age of Fraud. Fraudsters are already leveraging sophisticated toolsets based on AI and machine learning to propagate financial crimes. For instance, AI and deepfake technology are helping fraudsters hone their multitrillion-dollar craft. Phishing messages are more polished. Imitation websites look stunningly legitimate. A crook can clone a voice with a few seconds of audio using simple online tools.

Given the size of the insurances market in South Africa, insurers are being spurred into action.

“Based on worldwide benchmarks, fraudulent claims comprise 3-7% in total claims number and up to 20-30% in claims amount paid. That’s why Motor, Health and Life

Insurers must constantly modernise their fraud detection systems to address the increased sophistication of financial crimes also fuelled by growing poverty. Fortunately, both regulation, competition and growing fraud complexity pushes insurers to rethink how they can leverage technologies like graph analysis, statistical anomaly detection, computer vision and text analytics to protect their business operations while also maintaining top level service to the decent customers,” says Stepan Vanin, Regional Leader of Insurance Business Advisory, META & APAC at SAS.

This is where the adoption of AIenabled solutions that integrate AI and machine learning capabilities becomes essential. For example, SAS solutions enable insurers to detect suspicious activities through the lifecycle of a claim using a whole spectrum of technologies.

Sophisticated machine learning algorithms combined with a library of 200+ industry-validated business scenarios allow detection of strange claim circumstances and suspicious behavioural patterns. Automatic mathematical graph analysis adds more here by identifying typical collusion schemas between claim participants. Finally, computer vision helps to detect reused or corrected photos submitted in other claims months ago. The technology can also be used to stop potential fraudsters from taking out new policies at the point of policy inception. It empowers insurers to collect, manage and analyse intelligence from any source to improve

operational efficiency and effectiveness in the ongoing war against fraud.

AI provides insurers with access to tools that can take and digest data and create relationships between variables that they might never have thought about. AI also assists insurers to price and manage risk much better than before.

“Fraudsters are already leveraging sophisticated toolsets based on AI and machine learning to propagate financial crimes”

“An AI-enabled solution can help increase the accuracy and speed of agent fraud detection by using an analytical approach, anomaly detection techniques, and machine learning. Using such an integrated platform can also centralise and automate fraud detection logic in a single decisioning point while reducing investigation time and increasing the efficiency of investigations,” says Itumeleng Nomlomo, Senior Business Solutions Manager at SAS in South Africa. Currently, many insurers rely on basic approaches to detect agent fraud – at the application and claims settlement stages. Very few fraud cases are detected due to a lack of an integrated process between automatic detection and case investigation. SAS assisted one of its global insurance customers in increasing the accuracy and speed of agent fraud detection by using an analytical approach. This centralised and automated fraud detection logic in a single decisioning point. The result was an up to 40% increase in detected and confirmed agent fraud cases. It has saved the business millions of dollars in just one year in prevented losses and has reduced investigation time from several weeks to a few hours.

“With SAS, companies can use AI and machine learning techniques to identify which types of insurance transactions are likely to be fraudulent. AI techniques, including adaptive machine learning and unsupervised intelligent agents, can predict fraudulent transactions in real-time based on changes and inconsistencies in customer behaviour patterns,” adds Vanin.

Finding insurance fraud faster will enable organisations to stop it sooner. More importantly, by reducing false positives they can improve the efficiency of investigations.

“Going with a hybrid analytics approach that uses multilayered detection methods to find fraud at the individual claim or new business transaction phases, will contribute significantly to reducing the financial impact of fraud. By reducing false positives with AI and machine learning, insurers can use analytics to ensure that the alerts highlighted for triage are significantly more likely to be provable fraud,” says Nomlomo.

Itumeleng Nomlomo,

TECHNOLOGY FEATURE 30 June 2024 www.moneymarketing.co.za 9 IMAGES Shutterstock .com

SAS and all other SAS Institute Inc. product or service names are registered trademarks or trademarks of SAS Institute Inc. in the USA and other countries. ® indicates USA registration. brand and product names are trademarks of their respective companies. Copyright © 2022 SAS Institute Inc. All rights reserved.

Senior Business Solutions Manager at SA S

The love-hate relationship between financial planning and technology

BY FRANCOIS DU TOIT CFP® PROpulsion

The financial planning profession and advice industry are changing fast because of technology. Financial planners, advisers, wealth managers and advisory firm owners must adapt to this changing environment. This article will discuss important aspects of using technology in financial planning without losing the vital human connection.

The need for a unified system

Many financial advisers wish they had one system that could do everything for them. However, this is not realistic. Advisers often end up with systems that are based on what others use or what is cheap, which leads to dissatisfaction and wasted potential. Some try to build their own software, but this usually fails because they lack the skills. The answer is to create a technology stack – a mix of top-quality software that suits specific needs. But be careful not to make such a technology stack too complex or sophisticated. The right technology depends on the practice’s needs and how the technology can improve

rather than interfere with operations. Technology should be a benefit, not a burden. It should allow for deeper, more advanced analysis rather than just making things faster.

Start with the business, not the technology

The main thing is to understand that technology is just a tool, because that helps you see the bigger picture. No tool is useful unless you know what the goal is that you are trying to achieve. Yet, this is what most people do. We get the tool before we know what we want to accomplish.

Everyday AI and game-changing AI

AI is changing financial services and our lives in a way never seen before. AI tools such as voice assistants and chatbots are examples of everyday AI, which enhance human abilities and simplify tasks. Game-changing AI, meanwhile, adds new value, produces insights, and tackles complex challenges. In the future, financial professionals need to make use of both kinds of AI.

“The main thing is to understand that technology is just a tool, because that helps you see the bigger picture”

Everyday AI can streamline repetitive tasks, increase productivity and improve customer satisfaction. Game-changing AI can help identify new possibilities, develop new offerings and stand out from rivals. Learning about the possibilities of AI and building skills in prompt engineering – crafting questions and commands to get the best outcomes from AI systems – is essential.

Everyday AI is essential for anyone who wants to stay competitive and relevant, as those who don’t use it will fall behind. However, game-changing AI will be limited and inaccessible to many, but it will offer a huge advantage to those who can afford and apply it; at least for now.

Where to tech and when to human

Financial advice can benefit greatly from technology. It can collect and process data, design personalised financial plans, track clients’ progress, and enable communication. However, technology cannot substitute human interaction, which is crucial for establishing trust and identifying clients’ needs.

Financial advisers should leverage technology for data gathering, processing, and reporting. Human interaction should be dedicated to understanding clients’ personal and emotional needs, educating and empowering them, and offering support during difficult times. It’s all about finding the right balance.

Improving customer experience with technology

The way customers interact with financial planners has changed from in-person visits and paper documents to online channels. Some of the technologies that improve customer experience are financial planning software, client portals, AI and chatbots, and VR and AR.

Financial planning software shows current financial outcomes and potential scenarios. Client portals allow safe access to financial information, increasing engagement, and satisfaction. AI tools deal with common questions and offer initial guidance, while VR and AR provide realistic experiences, making financial planning more interesting.

Before riding the AI wave

Financial professionals need to adopt AI to keep up. They should know how to use AI tools, manage and improve data, and work with tech experts. For instance, Microsoft’s Copilot can simplify tasks and make experiences tailored to each user.

AI readiness rests on three pillars: principles (set up clear rules for AI use), data (prioritise relevant data) and security (enforce strong security standards). It is also important to teach staff and clients how to use AI tools and maintain secure communication.

Technology can be a valuable asset that can improve the financial planning process. However, it should supplement, not supplant, human communication. By finding the right mix of technology and human touch, financial professionals can offer effective and customised advice. Keeping an open mind and constantly learning about new technologies will help financial planners, advisers, and wealth managers keep up in this fast-changing industry.

Stay curious!

Francois Du Toit founded PROpulsion, a thriving community for financial planners and advisers focused on helping them belong, grow and thrive. He hosts the PROpulsion LIVE show (every Friday at 8am live on YouTube) with more than 250 episodes and counting, sharing his two and a half decades of experience and engaging with local and international guests to inspire and inform. Committed to learning and using new technology, he is on a mission to change lives at scale. Visit www.propulsion.co.za for more information.

30 June 2024 TECHNOLOGY FEATURE 10 www.moneymarketing.co.za IMAGES Shutterstock .com

The role of technology in assisting FSPs to meet their FICA obligations

BY DOCFOX FICA COMPLIANCE EXPERTS

In recent months, the Financial Sector Conduct Authority (FSCA) has issued several fines to Financial Service Providers (FSPs) for failing to comply with Anti-Money Laundering (AML) regulations. As the FSCA intensifies and continues its enforcement efforts, FSPs are urged to ensure their AML regulatory processes are not only created but actively used and implemented.

Technology has become a critical tool in the fight against financial crimes. From simplifying how businesses onboard their customers, automatically performing ongoing monitoring and risk management , to automating mundane tasks, it has become an essential component of any business.

There is no doubt that software and digital solutions have forever changed how businesses manage their regulatory compliance. But what is it that businesses are finding so useful and why have so many turned to software to assist with their Financial Intelligence Centre Act (FICA) compliance needs?

• Enhanced productivity

The benefit of using an automated solution means that repetitive tasks get completed automatically and mundane tasks (like collecting and filing mountains of paperwork) are removed. In terms of FICA compliance, an example of this is no longer having to manually request nor send countless emails to collect and follow up on customers’ documentation for FICA purposes. Automated software enables you to load a customer with a specific entity type, and it takes care of emailing the customer to ask for the relevant forms and will send a followup email when the incorrect or invalid documentation has been sent.

• Ensure consistent policies and procedures

As a business grows, the task of ensuring everyone is consistently carrying out the correct procedure becomes more complex. According to the FIC Amendment Act, risk-rating your customers, to ultimately determine the amount of due diligence to be done, is

vital and should be consistently carried out whenever you onboard a customer.

Having a configured system that is set up according to your business rules means that when onboarding a client , you can enforce that each client is risk-rated and onboarded consistently across your business, according to your rules.

• Enhance accuracy and streamline client screening processes

Compliance is often an onerous task, and due to its monotonous nature, there is possibility for human error. Automation largely takes away the monotonous work and enables staff to instead focus on decision making. Using a software solution to automate your sanction, Domestic Politically Exposed Person (DPEP) and Foreign Politically Exposed Person (FPEP) screening means that staff no longer have to spend hours searching sanctions lists. As a bonus, software solutions can largely reduce risk more as they have the ability to enable algorithms that skilfully handle

variations in names and spelling, ensuring that nothing slips through the cracks. For example, a solution like DocFox has a watchlist service that provides ongoing, reliable and efficient screening of your customer against a range of international sanctions and watchlists that could indicate potential higher risks to you and your business.

• Keep up to date with the latest regulatory requirements

Software solutions are often built around the latest requirements, with the best providers having an in-house compliance team that ensures the software is up to date with compliance regulations, meaning your business can rely on your software provider to keep you up to date with the latest regulatory requirements.

Implementing a streamlined system to guarantee consistent adherence to FICA across your business with clear central oversight, even with teams working remotely, can give a level of comfort that, should the regulator come knocking, you can rest assured all requirements are met.

TECHNOLOGY FEATURE 30 June 2024 www.moneymarketing.co.za 11

AHuman connection, financial guidance

BY ANGELIQUE BARNARD Coordinator of Daily Adventures, Allegiance Consulting

n adviser can be an Einsteinian equation maestro, and view financial plans in 4D, but their success hinges not only on their financial acumen, but equally on the strength of their relationship with clients. Good client relationships are the foundation of a successful advisory practice.

Building trust and confidence

Trust is the heartbeat of the client-adviser relationship. Clients come to advisers with their dreams, fears and hopes for the future. They seek not just expertise, but a partner in their journey. When an adviser earns a client’s trust, the partnership expands exponentially, each move building on the last, creating a harmonious flow that leads to confident decisions towards a remarkable life.

Enhanced communication

Open and honest communication is vital. A good client relationship ensures that communication channels are always open, enabling advisers to understand their clients’ goals, fears and expectations. This ongoing dialogue helps in tailoring advice that is not just accurate, but deeply personal.

Personalised service

Every client is different, with distinct goals and circumstances. Recognising this, a good adviser offers personalised service, crafting bespoke financial strategies that align with each client’s individual goals. A plan where the client feels valued and understood is a true work of art.

Increased client retention

Retaining clients is as vital as acquiring new ones. A strong client relationship, built on trust and tailored advice, naturally leads to higher retention rates. Satisfied clients are not just loyal; they become advocates, bringing in new clients through the power of word of mouth. This creates a virtuous cycle of growth and stability for the adviser’s practice.

Adaptability and support

The financial landscape is dynamic, with constant changes and uncertainties. A strong relationship ensures that clients feel supported during volatile times. Advisers with solid client relationships can better guide them through market downturns and financial crises.

The heartbeat of technology

Imagine a world where every interaction, every conversation, and every detail about your client’s needs is seamlessly captured and easily accessible. This vision inspired the creation of Allegiance Consulting’s new CRM platform, a tool designed to enhance the human connection at the heart of financial advising. This CRM is more than a software solution; it is the embodiment of the company’s commitment to excellence in client service. It enables advisers to manage tasks, set reminders, track leads and opportunities, and oversee business cases with precision. The platform also facilitates collaboration with your network partners to ensure comprehensive and coordinated client care.

The relationship between financial adviser and client is a beautiful interplay of trust and collaboration. It’s about more than just managing money; it’s about building relationships that endure through the highs and lows of financial markets. It’s about transitioning into a holistic life coach, and being there for your client through the financial and emotional ups and downs. As technology continues to evolve, the Allegiance Consulting CRM platform stands as a testament to its dedication to this collaboration, enhancing the human connection that is so essential to successful financial advising. Invest in these relationships, and watch your practice thrive as you guide your clients through the intricate steps of their remarkable journey.

The Holly Experience: Underwriting simplified with the help of technology

BY AMANDA VAN HEERDEN

Underwriting Consultant at Hollard Life Solutions

In the rapidly evolving insurance landscape, digital transformation is reshaping the way intermediaries interact with clients and process claims.

Just over a year and a half ago, Hollard Life Solutions launched a first for South Africa: a digital tool to streamline the underwriting process and improve the overall customer experience. Known as the Holly Digital Solution, or simply Holly, the programme was designed to assist brokers in streamlining and simplifying their interactions with clients and improving the overall insurance experience for both advisers and clients.

Amanda van Heerden, Underwriting Consultant at Hollard Life Solutions, says, “Hollard recognises the crucial role played by insurance in providing a safety net for consumers in some of life’s unpredictable circumstances. At the same time, we acknowledge that the complexity of the process can sometimes discourage consumers from purchasing certain insurance products.”

Some consumers struggle to understand the processes, while others become impatient with them. Technology can simplify these processes, Van Heerden explains. “Holly was introduced to address some of the challenges faced by intermediaries in completing applications and meeting underwriting requirements. Holly eliminates the back-andforth associated with incomplete information in manual applications by introducing a simplified underwriting

process that enables quicker onboarding and smoother claims processing,” she says.

The Holly Digital Solution tailors the questions it asks to the client’s declaration, and there are fewer medical questions for standard life policies.

Holly is the first fully underwritten digital offering that makes an immediate decision for standard, or mildly impaired applicants when it comes to underwriting. If a client does not accept terms offered by Holly, or if the nature of impairment or sum assured doesn’t qualify for an immediate decision, they can ask for full underwriting, combining the immediacy of digital processing with the precision of manual underwriting.

The uptake of the Holly solution by intermediaries has been mixed. Van Heerden says, “We’ve had an interesting mix in terms of the response from advisers. There is currently a 1:3 ratio of completed Holly applications to manual applications.

“Some intermediaries are adopting it for its operational efficiencies and productivity gains, while others have been slow to take it on because of misconceptions that Holly is a non-underwritten product. However, for those who have embraced Holly, the benefits are clear.”

One of the key benefits of Holly is its impact on the speed of the overall underwriting process. It has eased the demands of SLAs and eliminated the effects of incomplete

information on decision-making, leading to faster processing times and improved service delivery to clients. Holly’s unique features, such as its suitability for all personal applications, regardless of health status and/or the sum assured, make it a valuable tool for intermediaries looking to enhance the quality of services provided to their clients. The option of combining the digital process with full underwriting provides clients with an immediate decision for single impairments or a more precise manual underwriting process with medical and or financial information.

As with all digital solutions, Holly is always evolving, and Hollard Life Solutions continually evaluates its effectiveness as it becomes a familiar feature of the brokers’ customercentric tools. Among its benefits is that it’s the only fully underwritten digital process in the market that offers an immediate decision on standard, or single impairment lives, with or without HIV. The immediate response to clients is a major benefit. It makes it suitable for all personal applications and as there are no returns on incomplete information, it has reduced the time spent on applications. Plans to further enhance Holly in the future include using of third-party data to increase approval rates and lessen the need for medical examinations. There is also the possibility of integrating business insurance into the system, should the adoption rate increase.

TECHNOLOGY FEATURE 30 June 2024 www.moneymarketing.co.za 13 IMAGES S upplied

The impact of tech on forex trading

BY ISAAC MAMOROBELA Managing Director, Flexi Forex Trading College

In the fast-paced world of forex trading, automation is offering traders a new way to engage with the markets. Here's some indepth information about automated forex trading, from its inception to its advantages, drawbacks, and future trends.

What is automation in forex trading?

The foreign exchange market, known for its liquidity and accessibility, operates globally, allowing participants to trade currencies around the clock. Traditionally dominated by large institutions, the market became accessible to individual investors with the rise of online platforms and digital brokers. Automated trading systems, also called algorithmic trading, further democratised forex trading, enabling traders to execute trades based on pre-set rules and criteria.

Automated trading utilises algorithms to analyse market conditions, identify trading opportunities, and execute trades efficiently. Expert advisers (EAs) or forex robots are key components of these systems, autonomously executing trades on popular platforms like MetaTrader. While automation offers benefits such as increased efficiency and reduced emotional bias, it also poses risks, including technical failures and overreliance on algorithms.

Despite these challenges, many traders are drawn to automated trading for its potential to streamline processes and enhance profitability. However, success ultimately depends on a trader’s understanding of both technical and fundamental aspects of trading, as well as their ability to manage risk and adhere to a trading strategy. As technology continues to evolve, the future of automated forex trading holds promise, with advancements in artificial intelligence and machine learning shaping the landscape of algorithmic trading.

Benefits of automated trading

There are numerous problems associated with the human element in trades, which make a compelling argument for automated trading:

• One major reason why traders utilise automated trading is that it removes emotion from the trading experience. This objectivity often leads to greater adherence to the trading plan.

Automated trading allows comprehensive back-testing before live implementation. This rigorous evaluation enables traders to refine their trading idea and ascertain the system’s expectancy, which is the average profit or loss per risk unit.

• Automated trades often execute faster than conventional trades. Even a few seconds’ difference in entering or exiting a trade can greatly impact the trade’s

“Automated trading utilises algorithms to analyse market conditions, identify trading opportunities, and execute trades efficiently”

result. As computers instantaneously react to market fluctuations, according to pre-set parameters, automated systems can issue orders as soon as the trading criteria are met.