Page

South Africa is sitting on a retirement time bomb, with only 6% of the country’s population on track to retire comfortably. This is according to the sixth edition of the recently released 10X Investments Retirement Reality Report 2023/2024.

The report is based on the findings of the 2023 Brand Atlas Survey. Brand Atlas tracks and measures the lifestyles of the universe of 15,4 million economically active South Africans –defined as those living in households with a monthly income of more than R6 000, aged 16+, with internet access, through online completion surveys.

IMAGES Shutterstock .com

Page

think again. Investors should all be considering making ESG an integral and strategic part of long-term investments.

Pg 2 3

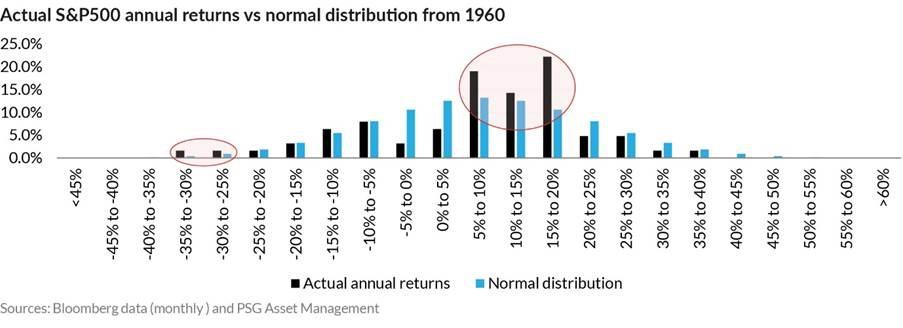

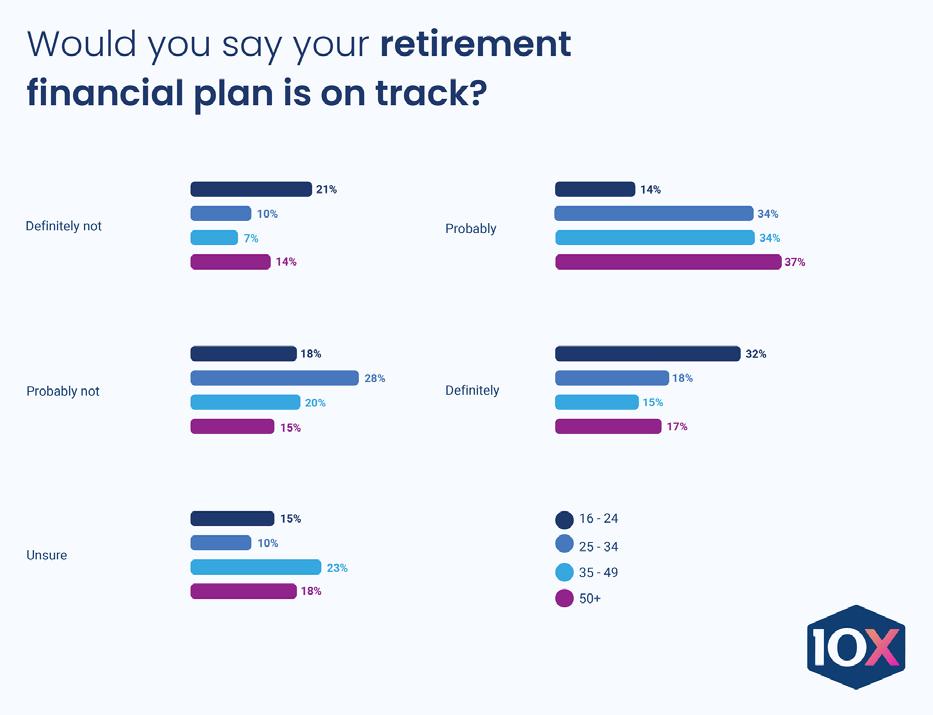

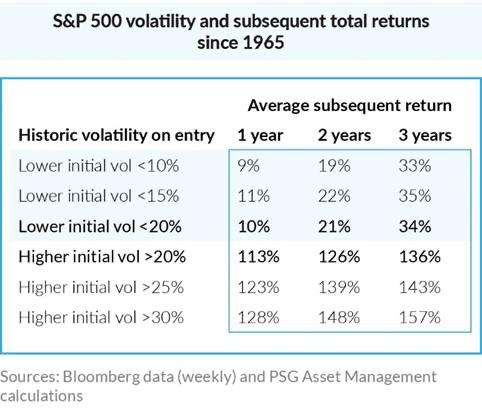

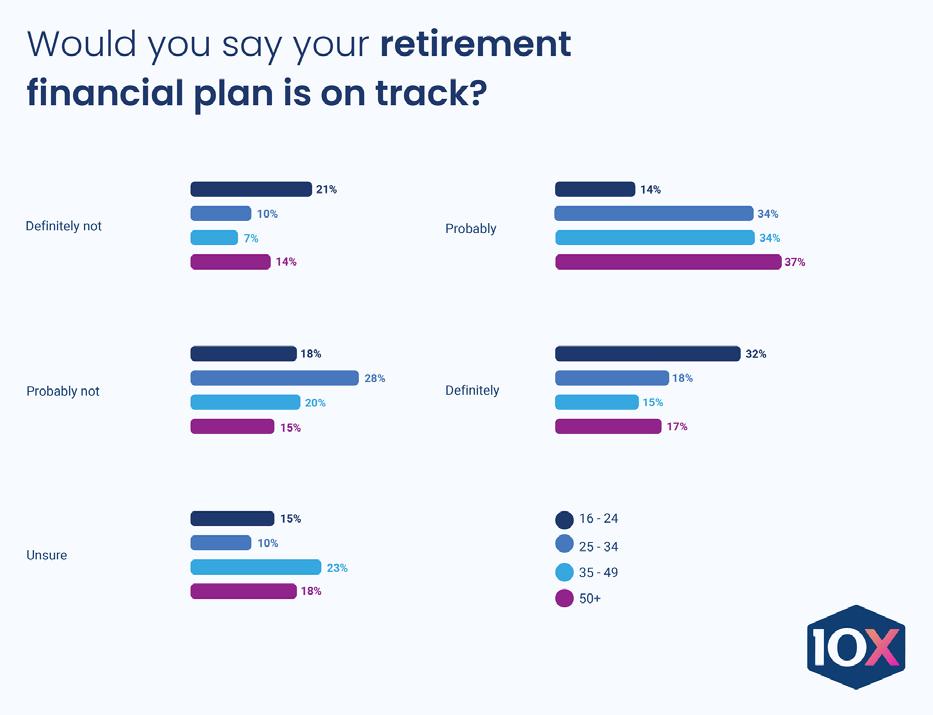

This year’s survey shows that there has been little fundamental change in South Africans’ inclination or ability to plan for retirement in comparison to findings from last year’s report. The 10X Investments Retirement Reality Report 2023/2024 found that the majority of South Africans have not formally planned for retirement, and those who have planned are not confident they are on track to be able to support themselves for the long term, considering inflationary pressures and the economic climate. This comes at a time when half of the South African adult population (49.2%) is living below the poverty line, according to Stats SA.

“29% of people over 50 indicated that their plans were ‘definitely not’ or ‘probably not’ on track”

points, recovered to about -10 points in 2021, but dropped again, hovering around -20 points in 2022 and the first half of 2023.

are key to closing the expectationreality gap – in their long-term interests South Africans need to be better informed on the importance of saving, the power of compound interest, the consequences of not saving, the additional disadvantages that women need to overcome, and the impact of costs,” says Van Heerden.

Planning for retirement

About half of respondents who had a retirement plan indicated that their plans were ‘probably’ or ‘definitely’ on track, with some variation across age groups. Significantly, 29% of people over 50 indicated that their plans were ‘definitely not’ or ‘probably not’ on track. According to 10X, it is extremely difficult to correct any deficit in savings after reaching 50, and requires at least 30%-40% of a monthly salary to be invested into retirement savings in order to comfortably retire.

Consumer confidence, as measured by the FNB/BER Consumer Confidence Index, has been negative since the last quarter of 2019. When Covid-19 hit, it dropped to a record -33

Tobie van Heerden, Chief Executive Officer for 10X Investments, says that in comparison to 2022’s survey, the 2023/24 report found an increase in the number of people recognising the importance of having a retirement plan in place. “The difference between what South Africans expect their retirement to look like and the realities faced by those in retirement and approaching it, cannot be underestimated. Knowledge and information

Almost three quarters of respondents (72%) whose plans were not on track gave ‘I am not able to save enough’ as a reason. This ties in with reasons given for not having a retirement plan in the first place: 70% of respondents without a plan agreed with the sentence: ‘I cannot afford to save, I have nothing left over at the end of the month’.

Continued on next page

www.moneymarketing.co.za @MMMagza @MoneyMarketingSA First for the professional personal financial adviser INSIDE YOUR MARCH ISSUE 31 March 2024 The value of investments may go up as well as down, and past performance is not necessarily a guide to future performance. There are risks involved in buying or selling a financial product.For any additional information such as fund prices, fees, brochures, minimum disclosure documents and application forms please go to www.lauriumcapital.com. Laurium Capital (Pty) Ltd is an authorised financial services provider (FSP 34142). www.lauriumcapital.com Compound your investment tax-free through one of Laurium’s Tax-Free Savings Accounts: • no lockups, • no tax, • no performance fees. Investing for your future C M Y CM MY CY CMY K MoneyMarket_Feb 2024 Tax free.pdf 3 2024/02/21 12:40:29 Majority of cash-strapped South Africans unable to retire comfortably BUDGET SPEECH Despite its reflection of SA’s economic difficulties, the 2024/24 Budget also holds opportunities for FAs.

9

10 LISTED PROPERTY Is now the time to view the listed property sector in a whole new light? We speak to some experts to get the views on the benefits of plunging into this asset class.

-

12

15 ESG INVESTING

you thought it was just a fad, it’s time to

-

If

1 CONTINUOUS PROFESSIONAL DEVELOPMENT

Westbrooke Yield Plus Plc is an open-ended Jersey Expert Fund which provides investors with a high-yielding, fixed income alternative investment, through a diversified portfolio of approximately 50 secured UK loans. With a track record of over 5 years of performance, the Fund provides a unique investment advantage driven by an asymmetric risk / return profile. Invest with the Westbrooke Advantage. westbrooke.com pr ivate debt hybr id capital real estate pr ivate equity Westbrooke is a registered financial services provider. T’s & C’s apply * Based on current run-rate returns, which are not guaranteed Invest in UK Private Debt with Westbrooke before 27 March 2024 Alternative Asset Management twice your cash yield with a downside shield Earn 9.5%+* p.a. in £ through a diversified portfolio of 50+ secured UK loans Scan to learn more

Continued from page 1

According to Van Heerden, the survey responses underline the harsh economic realities for most South African consumers. “Year after year, we are seeing a large proportion of respondents that have been partially or strongly of the view that they will need to continue earning a living after their formal retirement date.” Of the respondents who do have a retirement plan, only 37% could give a definitive answer on the costs, as an annual percentage of assets, of their retirement investments. Another 37% had no idea what the costs on their investments were; 13% believed that the fee depended on performance; while 13% believed they were not being charged at all.

contributions of up to 27.5% of your annual remuneration.

The retirement industry and National Treasury have long been concerned about the high proportion of working people who cash in their retirement savings when they change jobs. This is reflected in the survey: 10% of respondents say they cashed in, whereas a lower number (8%) preserved their savings. To put it another way, 56% of respondents leaving a retirement fund did not preserve their savings. In the 2021 survey, this percentage was 56%, and in 2022 it was 59%, suggesting that efforts by the retirement industry and the government to encourage employees to preserve their savings are not having the desired outcomes.

When will you retire?

Younger people believe they will retire younger, whereas those aged 55 all agree they will need to retire later – big disconnect. It may be natural for active, younger people to visualise themselves never stopping working (20% of people between 16 and 24 years old); 17% of respondents older than 50 indicated they did not plan on retiring, pointing to a lack of planning and the necessity to continue working for a living.

Although the percentages are low, more respondents below 35 than those of 35 or older indicated they plan to retire before turning 60. This may be attributed to the idealism of youth and a lack of awareness among younger people on what it takes in the way of planning and savings to retire comfortably.

Occupational retirement plans

Many people in formal employment belong to an occupational retirement fund, and for a large proportion of them this is the only form of retirement savings they have. This system has the advantage that you are forced to save, because contributions are deducted from your salary automatically. Another advantage is that your contributions are tax deductible: you pay no tax on

Women’s financial health

Over the years, women have consistently been rated lower than men in most metrics concerning financial wellbeing and retirement planning. Half (49%) of all female respondents to the survey indicated they do not have a retirement plan, compared with 43% of men. More than double (11% versus 5%) the number of men said they were diligently following a well-conceived retirement plan.

Women tend to save more than men (30% of women versus 26% of men), while men tend to invest more (24% of men versus 14% of women). According to the report, although a prudent, cautious approach to investing is admirable, it may ultimately be to women’s detriment, as only higher-risk investments, such as listed equities, can deliver inflation-beating growth over the long term.

Stagnant GDP, large-scale retrenchments, and the impact of COVID-19 have resulted in people increasingly changing their jobs. According to the Retirement Reality Report 2023/2024, 56% of working people changing jobs admitted to cashing in their retirement savings.

Retiring on own terms

Fewer people can retire on their own terms. In the 2021 report, this figure was 70%; this year it had dropped to 60%, one of the most significant statistics to come out of the survey. Van Heerden says, “This trend reflects the challenging economic times we are living in, indicating a rise in employers compelling their older workers to take early-retirement packages.”

Only just over a third (35%) of the retirees who had saved for retirement indicated they were ‘fairly’ or ‘very confident’ that their savings would last. Notably, two percent of retirees indicated they had already run out of savings, meaning they were relying either on family or state support.

WEDITOR’S NOTE

e’ve all known for some time that South Africans are not adequately prepared for retirement. The latest edition of the 10X Investments Retirement Reality Report confirms this. It’s a dire state of events, with an ageing population that hasn’t planned properly for a future beyond their working years. It comes down once again to reinforcing the education of the younger generations on the importance of saving for their future – but in an economic climate where people are struggling to put food on the table, there’s not much left to put away. In addition, getting young people to think about a world so many years away, instead of focusing on instant gratification, can be almost impossible. Then there’s the impending Two Pot System, which Minster Enoch Godongwana has said will be implemented in September. While it may be beneficial for tax collection, we can only speculate at this stage how this will impact the long-term retirement situation.

One of our main features this month looks at SA Listed Property, which was the top-performing asset class on the JSE last year. Property has always been a tricky investment, with some potential investors showing reluctance, but could this perhaps be the year to take the plunge and reap the benefits of an asset class that seems set to perform even better this year? We take a deeper dive into listed property and get some industry expert opinions on the trends to look out for.

As promised, we’re continuing to look at the impending NHI and its potential impact on the health industry. I had an interesting interview with Devan Moodley, Regional Manager Healthcare at NMG Benefits, where he suggested that it was perhaps time to reframe the discussions around the NHI. He has some fascinating insights. Read all about it on the inside back page of the magazine.

We’ve also got some reflections on this year’s budget, with a few industry players looking at the key take-outs and how these can affect FAs – as well as what opportunities can be seized upon.

Happy reading,

SANDY WELCH Acting Editor, MoneyMarketing

P a g e 3 NEWS & OPINION 31 March 2024 www.moneymarketing.co.za 3

10X Investments (Pty) Ltd is a licensed Financial Services Provider #28250 and S13B Pension Funds Administrator #24/444. CallingFinancial Advisors CallingFinancialAdvisors AProfileData/FEfundinfojointventure ForfurtherinformationpleasecontactTraceyWiseon079-522-8953oremail:tracey@profile.co.za www.profile.co.za/analytics.htm BrandedreportingandPortfoliomodellingatyourfingertips FundResearchComparison&AnalysisPortfolioModellingPresentations&Reports

SANAN PILLAY PORTFOLIO MANAGER AT SANLAM INVESTMENTS MULTI-MANAGER

How did you get involved in financial services –was it something you always wanted to do?

I’ve always wanted to work in financial services, but it did take me some time to find the niche that was best for me. I had been on the accounting path at university, but after doing a vacation programme at Sanlam Investments, I realised that I was attracted to the dynamism and shifting challenges of the investments space. I joined the Sanlam Investments Multi-Manager graduate programme, first as an analyst on certain business projects before transitioning into the investment team. I find the investment profession very rewarding, as I am constantly learning and problem-solving to the benefit of our clients.

What was your first investment –and do you still have it?

My first investment was an investment in PSG shares, which I made while I was in high school. With professional hindsight, this was a risky move, as I had not done the type of thorough analysis that good equity investing requires; I had invested simply because I liked Jannie Mouton’s investment philosophy and the story behind his business. I was fortunate that this investment would increase in value substantially in the subsequent years. I eventually sold the investment to fund my further education.

What have been your best –and worst – financial moments?

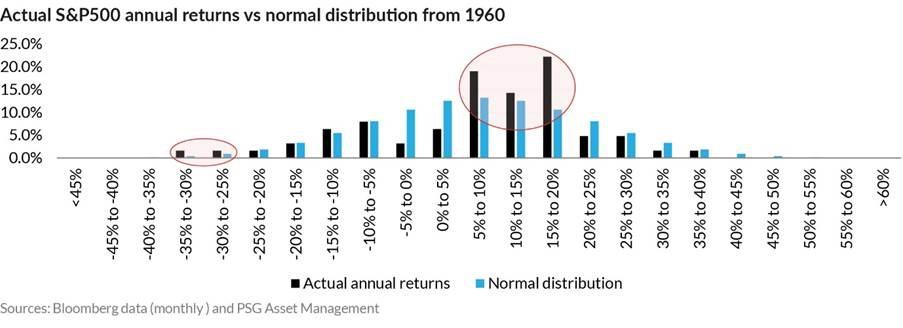

My best financial moment has been my decision to maximise my retirement contributions at the beginning of my career. I credit my first boss for this advice, as he told me that I might feel a ‘pinch’ in the beginning as I save more and spend less, but that it would be the best thing for me in the long term. My retirement savings are now the largest component of my overall savings, and I get a tax refund every year due to the tax deductibility of retirement fund contributions. My worst financial

moment would be not fully taking advantage of the sharp market drawdown that occurred in early 2020. I had some capital to invest at the time, and traditional investing wisdom is to be greedy when others are fearful. However, I chose to invest my money conservatively, despite recognising that the degree to which local assets were being sold off meant that some mean reversion was quite likely. I ended up missing out on a large part of the subsequent recovery that occurred. It was a valuable lesson in trusting one’s own knowledge and insight.

What are some of the biggest lessons you’ve learnt in and about the finance industry?

To be successful in this industry one needs to regularly ‘look up’ from one’s work to read and learn about the broader world. Many of the major events that have impacted markets in recent years, such as pandemics and geopolitical conflicts, originated from outside the financial space. I believe people with a natural curiosity about the world are often better positioned to react to risks that come from outside their domain of expertise. Another key lesson is that this industry has no shortage of very smart people, so being smart is not a competitive advantage. One needs to work consistently and always pursue self-improvement to separate oneself from the pack and succeed in the long term.

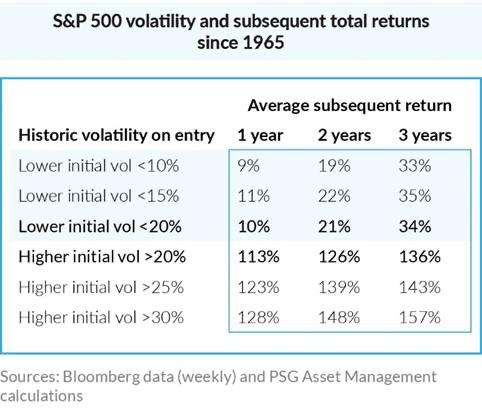

What makes a good investment in today’s economic environment?

Key concerns in today’s economic environment include high levels of pessimism regarding local assets, and an uncertain economic outlook wherein the precise path of inflation and interest rates is difficult to forecast. A good investment would be an investment with a fund manager that has a good track record of adapting their positioning to their environment, and who looks beyond the day-today news flow to select good opportunities based on the fundamentals and a longer-term view.

What finance/investment trends and macroeconomic realities are currently on your watchlist?

An investment industry trend that I’m keeping an eye on is the gradual ‘retailisation’ of alternative assets.

A broader range of investors are now able to access alternative asset classes that were previously only accessible to large institutions and high-net-worth individuals. The unique characteristics of alternatives, along with their increased accessibility, mean that investment professionals now have a broader range of potential solutions they can build to assist their clients in reaching their financial goals.

A macroeconomic trend that I’m watching is the performance of emerging market assets. Emerging market equities have underperformed developed market equities for an extended period, and relative performance tends to work in cycles.

What are some of the best books on finance/ investing that you’ve ever read, and why would you recommend them?

Niall Ferguson’s The Ascent of Money explains the origin of our global financial system and its various components, such as the equity and bond markets. Understanding history helps us to understand how things came to be the way they are in the present, and having a deeper understanding of the present helps us to make better decisions about the future. Antifragile by Nassim Taleb is an excellent book for those looking to better understand risk and the role that it plays in our lives. The identification of opportunities is the more interesting part of investing, but the best long-term investors are often those who understand the importance of managing their risk effectively. Taleb’s book broadened my understanding of what risk looks like and how to manage it.

NEWS & OPINION 4 www.moneymarketing.co.za IMAGES Shutterstock .com Earn your CPD points The FPI recognises the quality of the content of Money Marketing ’s March 2024 issue and would like to reward its professional members with 1 verifiable CPD points/hours for reading the publication and gaining knowledge on relevant topics. For more information, visit our website at www.moneymarketing.co.za

1 CONTINUOUS PROFESSIONAL DEVELOPMENT Sanlam Multi Manager International (Pty) Ltd is approved as a Discretionary Financial Service Provider in terms of the Financial Advisory and Intermediary Services Act, 2002. Sanlam Investments consists of the following authorised Financial Services Providers: Sanlam Investment Management (Pty) Ltd (“SIM”), Sanlam Multi Manager International (Pty) Ltd (“SMMI”), Satrix Managers (RF) (Pty) Ltd, Graviton Wealth Management (Pty) Ltd (“GWM”), Graviton Financial Partners (Pty) Ltd (“GFP”), Satrix Investments (Pty) Ltd, Amplify Investment Partners (Pty) Ltd (“Amplify”), Sanlam Africa Real Estate Advisor Pty Ltd (“SAREA”), Simeka Wealth (Pty) Ltd and Absa Alternative Asset Management (Pty) Ltd (“AAM”); and has the following approved Management Companies under the Collective Investment Schemes Control Act: Sanlam Collective Investments (RF) (Pty) Ltd (“SCI”), Satrix Managers (RF) (Pty) Ltd (“Satrix”) and Absa Fund Managers (RF) (Pty) Ltd. Sanlam is a full member of ASISA. Please note that past performances are not necessarily an accurate determination of future performances, and that the value of investments/collective investment units/ unit trusts may go down as well as up. The information in this article does not constitute financial advice. While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSPs, their shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaim all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.

Private markets outlook –it’s time for optimism

BY DR NILS RODE Chief Investment Officer, Private Assets, at Schroders

Following a phase of very strong fundraising during the pandemic, 2023 marked a period of slower capital raising for many private asset classes. We now see private markets having largely reverted to pre-pandemic levels in terms of fundraising, investment activity, and valuations. However, noteworthy exceptions include large buyouts in private equity, where fundraising has remained vigorous – a concern as it results in higher dry powder and entry valuations. Moreover, fundraising for infrastructure and venture capital has seen a significant downturn, and real estate valuations have undergone strong corrections in some regions and market segments.

It is time for optimism

Developed markets have made remarkable strides in bringing inflation closer to policy goals, with a considerably lesser impact on growth, notably in the US, than markets had anticipated. While potential uncertainties arise from geopolitical risks and muted growth expectations for 2024, we believe it’s time to

be optimistic about the potential for private market investments, given that private market conditions have largely normalised (with a few exceptions).

Private markets offer the advantage of diversification across risk premia, access to investments with defensive characteristics, and exposure to 3D Reset themes: deglobalisation, demographics and decarbonisation, as well as the AI revolution. Many of these trends will favour specific investment categories, including sustainability and impactaligned investments, renewable energy, generative AI, and investments in India.

Simultaneously, some of these themes are inflationary, contributing to higher

“We’re also drawn to strategies with higher capital needs due to the retreat of traditional capital providers, such as real estate debt”

interest rates. Coupled with funding gaps created by regulatory capital limitations on banks, we anticipate this will generate appealing lending opportunities.

Capital flows: A contrarian indicator

Many private market strategies operate as closed systems where fundraising determines the amount of available dry powder, which subsequently influences entry valuations and ultimately investment returns. Therefore, we favour strategies with stable fundraising dynamics, such as small/mid buyouts, and see potential in strategies where fundraising has significantly deviated below its long-term trend, like infrastructure equity and venture capital. We’re also drawn to strategies with higher capital needs due to the retreat of traditional capital providers, such as real estate debt, insurancelinked securities, specialty finance, microfinance, and private credit.

Selectivity remains key

Many current private investments involve ‘re-ups’, or reinvestments with

existing partners. The pandemic has amplified this trend as due diligence on new strategies and meeting new managers posed a challenge.

Considering the new market dynamics driven by the 3D Reset and the AI revolution, we believe it’s crucial to question whether past successes can be replicated. Are existing partners and strategies well-positioned for today’s trends (decarbonisation, deglobalisation, demographics, and the AI revolution)? Are the fundraising and dry powder dynamics within the sub-sector healthy? Given the changes in market dynamics, it’s likely that opportunity sets should also evolve.

Now, more than ever, it’s vital to expand investments into opportunities that benefit from these transformative trends and policy changes, diversify a private allocation as it matures, and concentrate on areas with healthy fundraising dynamics that provide access to less efficient markets and opportunities.

NEWS & OPINION 31 March 2024 www.moneymarketing.co.za 5 IMAGES Shutterstock .com Business to the power of people Spreadsheets don’t secure investments. People do. Unlock business success by hiring the right people. Access SA’s largest jobseeker database with over 6 million candidates, ensuring effortless recruitment. Visit pnet.co.za to learn more. PNET_Print_220mm x 80mm.indd 1 2024/02/12 09:32

South Africans are living hand-to-mouth

BY BRINA BIGGS Senior Manager at 1Life Insurance

Due to the drastic changes in the economy over the past two years, South African consumers’ financial realities and concerns have also changed. For many, getting by has become a priority, while investments and building wealth have taken a back seat.

In late 2023, 1Life undertook its third annual 1Life Generational Wealth Survey, and the most notable stat is that over 57% of respondents feel that they are just surviving, with continuous anxiety over meeting their monthly expenses, which is testament to the increased cost of living that is burdening South Africans.

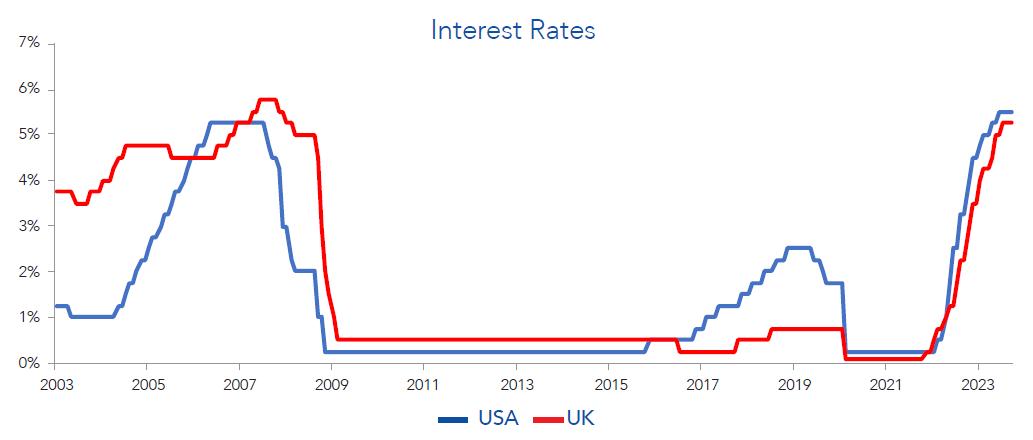

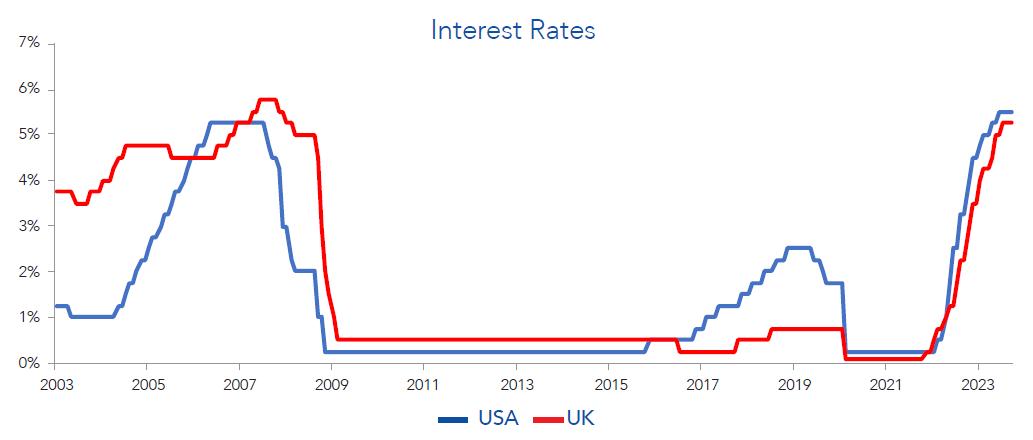

Top of the list is household expenses – with over 51% of respondents having to worry about how they will meet their monthly household expenses such as rent, home loans, rates, and utilities, followed by whether they will be able to adequately support their families, the survey reveals. This comes as no surprise , given that the Monetary Policy Committee has increased the interest rate eleven times since November 2021, and the repo rate reaching a 14-year high of 8.25%. The survey further uncovers that

31% of respondents have started a side hustle or second job to make ends meet; however, 73% of them still have to use their savings and investments to get by.

The reality is that while the situation may already be at its worst for many consumers, the economic situation may not improve anytime soon. With job cuts and the increase in inflation in the past two years, many families are living hand-to-mouth, with no means to save for emergencies, let alone build generational wealth for their families.

As the economic situation worsens, so does the pressure to be financially secure. In fact, 87% of the survey respondents are expected to create generational wealth to secure their families’ financial future. Similarly, 84% see the significance of leaving generational wealth for their loved ones.

Unfortunately, though, less than 50% have been able to keep all their policies in the past year. This means that should the breadwinner pass, families are left financially vulnerable. For many families, insurance is there to break the cycle of poverty and move a family into a cycle of

generational wealth and, therefore, having those important conversations with your insurer or broker to find the best way to keep your cover in place is key.

While many may feel that the lack of financial insurance is justifiable under these circumstances, the reality is that this is one of the building blocks to creating financial security and future wealth for your family. It should, therefore, be a key priority in one’s monthly expenses, but understandably, putting food on the table will always take top priority.

Talking about putting food on the table – the research shows that 51% of respondents have had to take out a microloan or an advance on their salary (monthly) to do just this, as well as cover transport costs, and other living expenses.

The reality is that while taking out a loan may offer short-term relief from financial stress, the act itself has a snowball effect on earnings – making one poorer, as they often cannot recoup the money each month that they took from the month before. At this point, the solution is to start planning on

how this cycle can be stopped before one finds themselves in debt review, or worse, bankruptcy.

When looking at the respondents’ perception of wealth-building methods, the survey revealed that most respondents (22%) associate wealth with assets like property inherited from relatives/parents. While this is correct, there are various other methods available to build wealth, and it is encouraging to note that 89% of respondents think Life Cover is one of them. This outcome indicates significant improvement in the understanding of what wealth generation means and how it can be achieved.

We cannot deny that the current economic reality has been harsh on the pocket, but now is not the time for consumers to let their guard down. In fact, they should be seeking financial education and speaking to their financial advisor or insurer to determine the best way to financially navigate these difficult times.

“87% of the survey respondents are expected to create generational wealth to secure their families’ financial future”

31 March 2024 6 www.moneymarketing.co.za IMAGES Shutterstock .com

NEWS & OPINION

Change your TFSA investment cycle to March

BY MIKE TITLEY Business Development and Marketing at Laurium Capital

There are two certainties in life: death and taxes. The South African government has given you a pass on one of these, and it is not death. History shows, by proactively investing in a Tax-Free Savings Account on 1 March each year, instead of waiting for the tax year end, one could be R108 000 (21%)* better off.

On 1 March 2015, the South African government introduced a new savings vehicle that aimed to incentivise saving outside of the regular retirement savings route. The Tax-Free Savings Account (TFSA) allows investors to maximise tax relief on their investments. All proceeds from the investments in a TFSA, including interest income, capital gains and dividends, are exempt from tax. In 2015, the annual contribution limit was set at R30 000 while the lifetime contribution was limited to R500 000. This was then adjusted to R33 000 in March 2017 and then to R36 000 in March 2020, with no change to the R500 000 lifetime limit. At the current parameters, one could maximise the contribution rate for a period of just over 15 years before reaching the lifetime limit. For individuals proactive and fortunate enough to have begun investing in 2015 in a TFSA, they could have contributed R309 000 by 29 February 2024. To use an example of a family of four, this equates to R1 236 000 of after-tax contributions from 2015 to the end of February 2024 that are compounding tax free.

“For younger investors, a TFSA allows one to invest tax effectively in a liquid investment vehicle towards a future event”

When considering the various savings avenues, some serious considerations are returns, costs, tax and liquidity. A TFSA investment option ticks all these boxes and makes sense as a first port of call for individuals trying to save for their future.

An individual can access a wide variety of asset classes and investment strategies via TFSA unit trusts provided by the asset management industry.

The gains, interest and dividends generated by the investments are not subject to tax.

An individual may withdraw from the tax-free investment at any time, up to any amount.

• TFSA investments may not levy performance fees and, therefore, any outperformance by the investment is retained (untaxed), excluding the flat management fee.

There are some caveats to TFSA accounts , however. These have been put in place to try to encourage individuals to stay invested and to invest as soon as possible:

• There is no carry over of your annual allowance into the following year. By way of example, if one did not make any TFSA investment in the tax year ending 28 February 2024, they could not carry the R36 000 allowance into the 2025 tax year. You remain limited to the R36 000 per annum until reaching the lifetime limit of R500 000.

• Any withdrawals made from a TFSA cannot be replenished. If you have contributed the R309 000 to date and choose to withdraw R100 000, your overall lifetime limit will then drop from R500 000 to R400 000. Contributing more than the annual R36 000 and lifetime limit of R500 000 will result in tax penalties. TFSA is targeted at the average South African saver, trying to encourage saving beyond their bank accounts and under their mattresses.

There are several incentives to use a Tax-Free Savings Account:

• For younger investors, a TFSA allows one to invest tax- effectively in a liquid investment vehicle towards a future event. This may include buying a house or affording a wedding.

• Unlike retirement savings, TFSA is not subject to Regulation 28, allowing one to invest more aggressively in equities (above the 75% limit) or at higher offshore exposures than the 45% offshore.

Should one’s investment strategy or objective change, switches between TFSA unit trusts may be made without triggering a CGT event (introduced on 1 March 2018). There is no limit on the number of tax-free accounts one can have.

• Down the line, in retirement, drawing down on one’s TFSA account can be

used to offset the withdrawals needed from a living annuity. This will result in an overall tax saving until such time as the TFSA is depleted.

So, for those who have just topped up their TFSA accounts at the end of February 2024, why delay to the end of February 2025 for the next allocation? Switching ones investing behaviour to proactively investing on 1 March each year as opposed to by 28 February can accelerate your growth potential by a year.

Chart 1 illustrates three TFSA investment scenarios utilising the 15-year performance history of the South African FTSE JSE ALSI (TR) equity index. It compares the scenario of investing at the earliest possible date each year (1 March) versus investing at year end (28 February), and lastly, utilising a monthly debit order. Each scenario has an equal total value invested of R500 000, just at different timings.

In the above table , simply by investing early, one could have been ahead by 21% or R108 000, tax free! At Laurium, we offer all our long only funds on a TFSA basis, at a flat fee. Please see the Laurium Funds listed as follows:

• Laurium Flexible Prescient Fund

Laurium BCI Strategic Income Fund

Laurium Africa Bond USD Prescient Fund

Laurium Stable Prescient Fund

• Amplify SCI Balanced Fund (Managed by Laurium)

Nedgroup Investments SA Equity Fund (Managed by Laurium).

These can be accessed directly via our website (www.lauriumcapital.com). Good growth return prospects with no lockups, no tax, no performance fees. Invest today! The 8th wonder of the world, compounding, is on offer, tax-free, in one of our TFSA unit trusts.

NEWS & OPINION 31 March 2024 IMAGES Shutterstock .com

Start date Frequency Contribution Total Invested Value at 29 February 2024* 1 March 2009 1 March, lump sum R36 000 R500 000 R 1 260 000 28 February 2010 28 Feb, lump sum R36 000 R500 000 R 1 165 000 1 March 2009 Monthly payments R3 000 pm R500 000 R 1 152 000 *Performance for the month of February 2024 is estimated at 1.0%. -100000 100000 300000 500000 700000 900000 1100000 1300000 1500000 Mar-09 Aug-09 Jan-10 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Jul-12 Dec-12 May-13 Oct-13 Mar-14 Aug-14 Jan-15 Jun-15 Nov-15 Apr-16 Sep-16 Feb-17 Jul-17 Dec-17 May-18 Oct-18 Mar-19 Aug-19 Jan-20 Jun-20 Nov-20 Apr-21 Sep-21 Feb-22 Jul-22 Dec-22 May-23 Oct-23 Tax Free Savings Account - Scenario Analysis Full Allocation P.A, 1 March, Early 1/12, Monthly debit Full Allocation 28 Feb, Year End CHART

1 TABLE 1

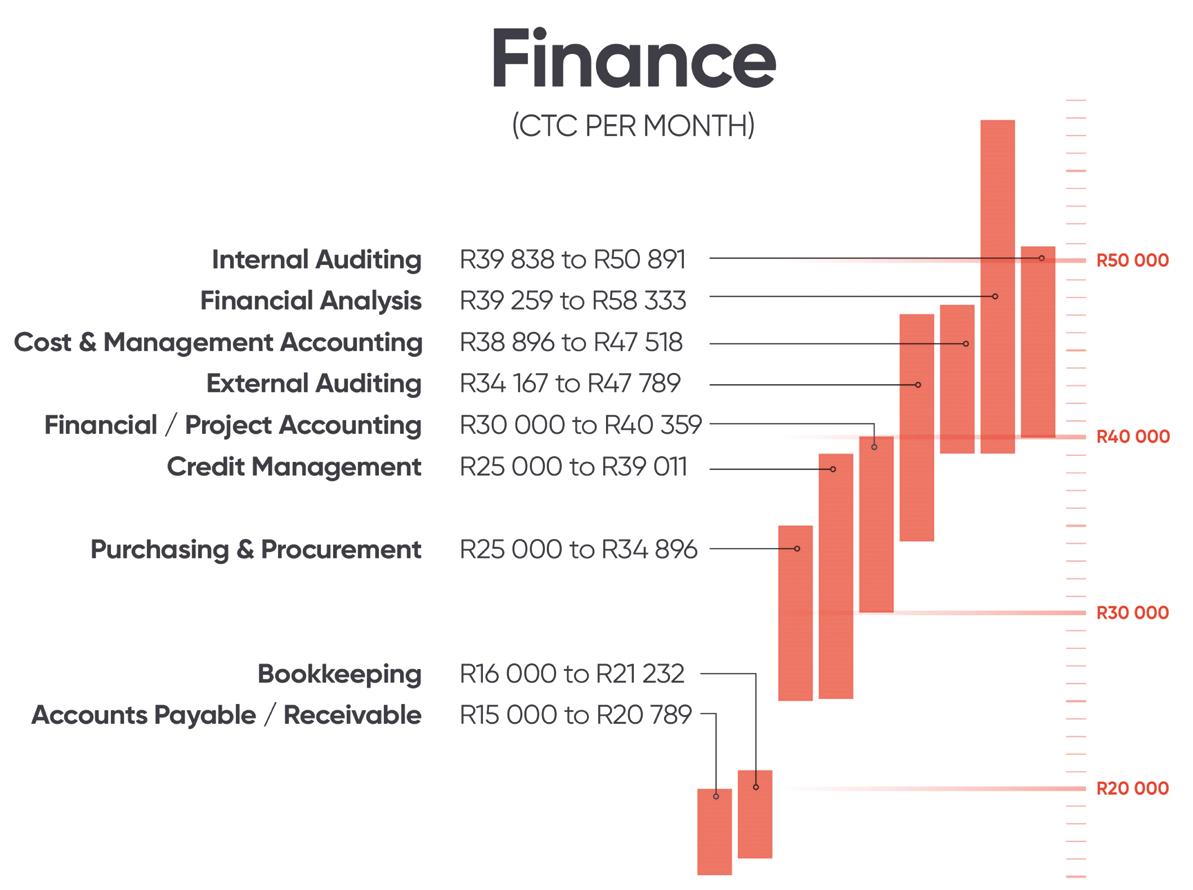

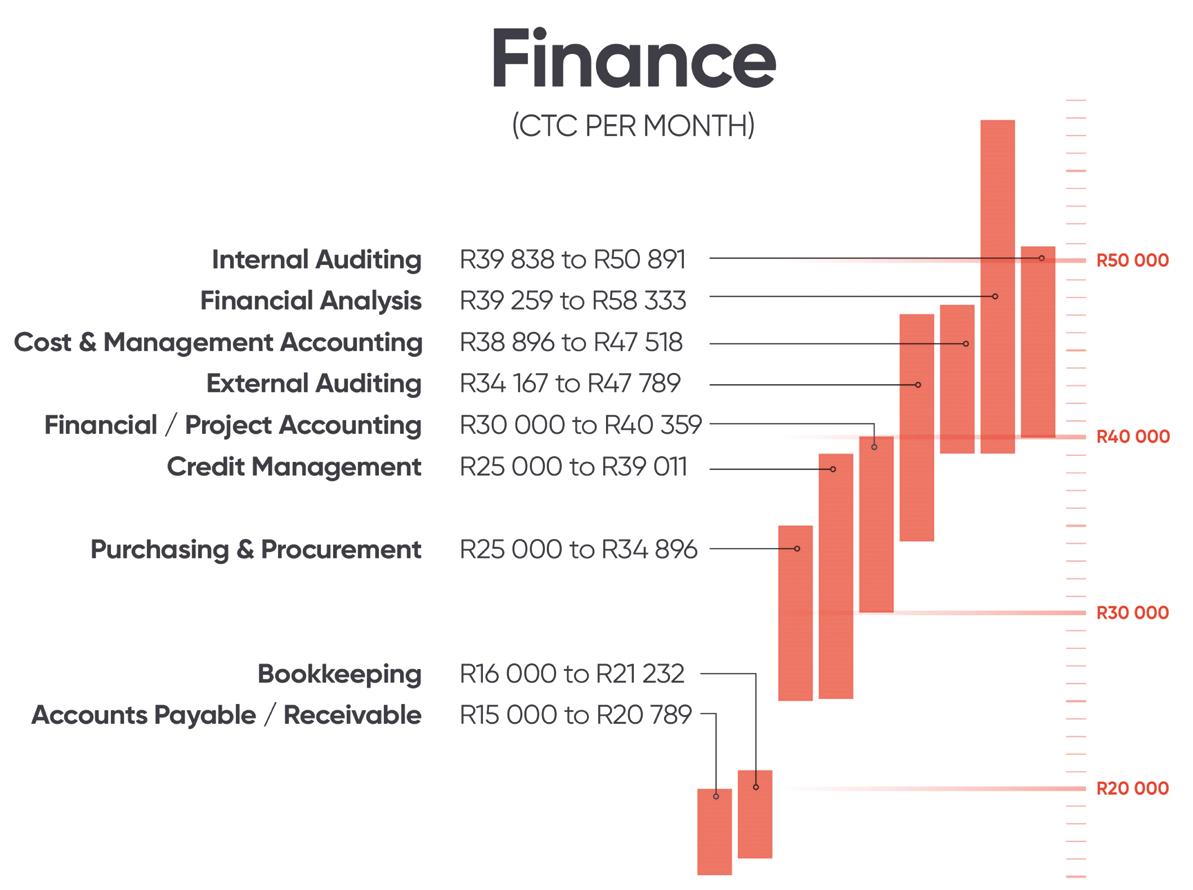

2024 Salary Guide for the Finance sector

Pnet’s Job Market Trends Report provides data-driven insights into recruitment and employment trends in the local market. Developed to give local businesses a comprehensive summary of the trends shaping the local recruitment market, the report also unpacks specific sector insights – from both an employer and candidate perspective.

In the latest report (Q4:2023), Pnet provides insights into the market-related monthly salaries that the job market is offering for specific job roles and professionals. Earning a salary is the number one reason why people look for a job, take up a job or find a new job. However, talking about salaries is still a taboo topic and most people simply speculate about what others earn.

According to Statistics South Africa, the average monthly salary in South Africa is R26 086. In the interest of job seekers, employers and recruitment specialists, Pnet has taken a deep dive into market-related salaries, providing insights into what the job market is offering for specific job roles and professionals in the Finance sector: Year-on-year increases in salary offerings were evident for Bookkeeping (7%), Credit Management (between 20% and 25%), and Internal Auditing (between 10% and 14%).

On the other hand, External Auditing

experienced a year-on-year decrease in salary offerings (between -2% and -6%). Top earners in Finance are Financial Analysts, Internal Auditors, External Auditors and Cost & Management Accountants.

How Pnet solves recruitment challenges for SMEs

Pnet is the leading online recruitment platform in South Africa, offering a range of benefits to help SMEs hire the right people:

• Time and cost efficiency: Pnet streamlines the hiring process so that SMEs can quickly and directly reach more jobseekers. Pnet’s smart-matching technology makes it easy to filter and shortlist potential candidates. This reduces the administrative tasks associated with hiring activity, resulting in significant time and cost savings for SMEs. In addition, Pnet’s Response Handling Team can free up time for SME employees to focus on their core activities by managing the entire recruitment process on their behalf, with pricing to suit SMEs of all sizes.

• Access to a larger talent pool: With a database of six million jobseekers, Pnet provides access to a diverse pool of quality candidates, including both active and passive jobseekers. SMEs can connect with candidates from various locations and backgrounds, increasing

the likelihood of finding the right fit for their roles. What’s more, job ads get extra exposure through Pnet’s extensive investment in marketing and promotion of job listings on the platform, and get further reach from the 100 million Job Alerts that Pnet sends directly to jobseekers’ inboxes every month.

• Brand visibility: Even smaller companies can gain visibility and credibility through Pnet, thanks to its Company Hub solution, which enables SMEs to enhance their

Five essential discussions every FA should have with clients in 2024

BY HENRI LE GRANGE Old Mutual Personal Finance Certified Financial Planner®

In the dynamic landscape of 2024, financial advisers in South Africa are redefining their roles – they are not only keeping an eye on wealth but also helping customers navigate their journey to sustainable financial wellness. This year marks a transformative chapter for financial advice, where the blend of nuanced communication and forwardthinking strategy will lay the groundwork for lasting financial wellbeing. It’s a time of great potential and pivotal change for financial advisers.

As we navigate through shifting market trends, technological changes, and the introduction of the innovative Two-Pot Retirement System currently scheduled for 1 September 2024, it becomes increasingly important for financial advisers to engage in strategic conversations with their customers.

The Two-Pot Retirement System offers a balanced and structured practice for retirement planning. By categorising savings into two separate pots, this system provides customers short-term relief during financial emergencies. This system promotes present-day financial safety and ensures customers think more carefully about their retirement years.

The following five essential conversations allow advisers to guide their customers towards making informed financial decisions, ultimately leading them into a better financial position.

Conversation 1. Goalsetting

Effective goalsetting involves aligning customers’ short-term and long-term financial aspirations with realistic investment and risk-management strategies. Advisers should facilitate this process by helping customers define clear, measurable goals and designing a tailored investment approach to achieve these objectives. This method provides a roadmap for financial success that is both ambitious and attainable. Tailoring each individual’s unique financial scenario is essential. This personalisation involves considering factors like risk tolerance, timing, and specific financial goals.

Conversation 2. Behavioural finance and its implications

Behavioural finance shows that our biases and emotions greatly influence investment choices. Advisers must talk to their customers about common biases, like being too confident or following the crowd. This helps people notice and reduce these tendencies. By doing this, advisers can encourage a more logical and less emotion-driven way of making investment decisions.

Conversation 3. Balancing immediate and long-term financial needs

A critical skill is navigating the tightrope between immediate financial needs and long-term aspirations. Advisers play a crucial role in helping customers understand the importance of maintaining an emergency fund while simultaneously investing in long-term growth opportunities. This balanced strategy ensures financial resilience in the face of unforeseen

employer brand and attract top talent without going to the expense of investing in their own website.

The role of data in recruitment has emerged as a crucial factor in staying competitive and relevant. By understanding the challenges unique to the Finance sector, businesses can leverage data-driven recruitment to ensure a steady pipeline of qualified candidates and reinforce their position in a competitive market.

circumstances and steady progress towards future financial goals. Long-term financial stability is a cornerstone of an effective financial plan. Advisers should encourage customers to contribute to their funds and maintain a diversified portfolio consistently. This disciplined approach and the system’s structure help build a robust financial foundation.

Conversation 4. The evolving role of financial advisers in customer relationships

The role of financial advisers is becoming more dynamic. Advisers should focus more on understanding their customers’ evolving life stages, financial situations and emotional needs. By aligning financial strategies with these changing dynamics, advisers can provide more personalised and effective financial guidance, leading to stronger customer relationships and better economic outcomes. A financial plan’s strength lies in its ability to be diversified. Advisers should highlight how the plan allows new options based on changing life circumstances or financial goals. Additionally, it should focus on diversifying assets across different classes and timelines.

Conversation 5. The rise of digital financial tools

The rise of digital financial tools has revolutionised how customers interact with their investments. Advisers should emphasise the convenience, accessibility, and real-time analytics these tools provide, which empower customers to make more informed decisions. Furthermore, integrating these digital solutions can create additional options tailored to customers’ needs.

31 March 2024 NEWS & OPINION 8 www.moneymarketing.co.za IMAGES Shutterstock .com

The Budget for 2024/25 was a sobering reflection of the economic challenges facing South Africa. It aimed to balance fiscal consolidation, debt reduction, revenue mobilisation and social spending, while also addressing some of the long-standing structural issues in the financial sector.

Budget overview

There’s no broad relief for taxpayers this year, as the government seeks to raise an additional R15bn in tax revenue, mostly through direct taxes. The personal income tax brackets were not adjusted for inflation, resulting in fiscal drag and higher effective tax rates for most taxpayers. There were also no changes to the fuel levy, dividends withholding tax, estate duty, donations tax, medical tax credits, foreign employment exemption or the tax-free savings annual contribution limit. Furthermore, the solar incentive was not extended.

Retirement reform

The budget confirmed the new two-pot system for retirement fund withdrawals, starting from 1 September 2024. This system lets you access part of your retirement fund savings before you retire, within certain limits and tax consequences. The system affects funds saved from 1 September 2024 onwards, and only the ‘savings component’ of the fund. The withdrawals that are allowed are taxed at marginal tax rates. Seed capital of R30 000 (or 10% of the fund value, whichever is less) will be provided for the savings component. This will be transferred from the existing fund value on 1 September 2024. The remaining part of the fund, called the retirement component, is kept until retirement. Government is forecasting that it will collect R5bn in taxes from withdrawals made from the savings component in 2024/25 tax year.

Budget 2024: Opportunities for financial planning and advice

BY FRANCOIS DU TOIT, CFP® PROpulsion

Reform of the Gold and Foreign Exchange Contingency Reserve Account (GFECRA)

The budget announced a plan to use some of the money the Reserve Bank has made from foreign exchange transactions. This money is kept in a special account called the GFECRA. The last time the government and the Reserve Bank shared this money was almost 20 years ago. Now they have agreed to split R150bn over three years, starting from 2024/25. This money will help the government borrow less and pay less interest on its debt.

Crypto-assets policy

The government plans to regulate the crypto-assets market. A position paper on crypto assets was published in June 2021, proposing a regulatory framework and timelines. In November 2023, the FSCA declared crypto assets to be a financial product, requiring FSPs to be licensed by them in this regard. It also said that stablecoins, crypto assets linked to other currencies or assets, will be regulated by 2024. The IFWG will suggest policies based on international standards. The government may also require reporting of crypto-asset transactions above R49 999.

Tokenisation

The IFWG is studying the implications of tokenisation, which involves the conversion of assets, such as securities and payments, into digital tokens on a blockchain and plans to publish two papers on the topic by December 2024. The papers will provide guidance on the rules and policies.

Digital payments

The National Treasury and the Reserve Bank have partnered with Switzerland and FinMark Trust to launch an inclusive

payments digitalisation programme to run from 2024 to 2027. It’ll involve four digital payments pilot projects with different financial service providers.

Unclaimed assets

The FSCA is working on a framework to deal with unclaimed financial assets, which are assets that belong to owners who cannot be found or contacted. The framework will be based on the feedback from a discussion paper that the FSCA published in 2022, and will include guidelines for identifying, monitoring, managing and reporting unclaimed assets, as well as finding the rightful owners.

“The fiscal drag and the higher tax burden on taxpayers create a need for tax-efficient planning, especially for highincome earners”

Opportunities

Despite the challenges and constraints, there are always opportunities for financial planning and advice. Some areas to explore with your clients are:

Tax-efficient planning: The fiscal drag and the higher tax burden on taxpayers create a need for tax-efficient planning, especially for high-income earners. Help your clients to optimise their tax deductions, such as retirement fund contributions, medical expenses and donations, and to utilise their tax exemptions, such as interest income, capital gains and foreign dividends. Also advise clients on the tax implications of different investment vehicles, such as unit

trusts, exchange-traded funds, endowments and trusts, and help them to choose the most suitable ones.

Analyse IT34 assessments for opportunities: Analyse your clients’ IT34 assessments for opportunities to improve their tax position, such as claiming additional deductions, correcting errors or objecting to incorrect assessments. The IT34 assessments can also identify sources of income, expenses and assets, enabling you to provide holistic financial advice based on their financial situation.

More flexibility for retirement planning: The new two-pot system for retirement fund withdrawals offers more flexibility for retirement planning. You can help clients understand the benefits and risks of the new system. You can also assist clients with the tax planning and the investment strategy for their retirement fund savings.

Review trusts and structures: The antiavoidance rules for low-interest or interestfree loans to trusts have been tweaked, effective 1 January 2024. The changes affect the calculation of the deemed interest and the donations tax on such loans, especially when they are denominated in foreign currency. Review your clients’ trusts and structures, and advise them on the impact of the changes on their tax liability and estate planning. Assist clients to restructure their trusts and structures.

Be careful not to make saving or not paying tax the primary goal of any planning. Rather focus on the required outcomes the client is looking for and then plan as tax efficiently as possible.

About Francois du Toit: Du Toit founded PROpulsion, a thriving community for financial planners and advisers focused on helping them belong, grow and thrive. He hosts the PROpulsion LIVE podcast (every Friday at 8am live on YouTube), sharing his two and a half decades of experience and engaging with guests to inspire and inform. Visit www.propulsion.co.za for more information.

NEWS & OPINION 31 March 2024

The 2024 Budget and what it means for our economy

BY ANGELIQUE STRONKHORST Consultant, AJM

On 21 February 2024, Finance

Minister Enoch Godongwana took the stage to give the last budget of the sixth democratic administration.

BOBBY WESSELS Manager: Corporate and International Tax, AJM

BOBBY WESSELS Manager: Corporate and International Tax, AJM

With a need to control government debt, curb expenditure, and enhance measures to grow our economy, the Minister tabled the 2024 Budget under what can only be described as extremely challenging economic conditions. The Minister himself recognises that our so-called ‘economic pie’ is not growing fast enough to meet our development needs and generate sufficient income to allocate towards our key focus areas.

In the weeks leading up to his address, the media was buzzing with speculation about tax increases to (among others) fund the budget deficit and curb debt. For every R1 of government revenue, 20c is spent on servicing debt, whereas a further 60c is allocated to the social wage bill. The simple maths shows that only 20c of the R1 remains available for all other expenditures. However, in stark contrast to the

speculation, there were no material tax changes to either income tax, corporate tax, or indirect tax. Unfortunately, for the average consumer this is not necessarily good news. From a personal income tax perspective, there were no adjustments to the tax brackets, rebates, or medical tax credits. There were also no adjustments to the limits on tax-free savings accounts and contributions to pension funds.

Freezing the tax thresholds and the lack of adjustments to the rebates will likely lead to fiscal drag as more taxpayers are ‘dragged’ into higher tax brackets, especially, for example, where those taxpayers receive inflationary-adjusted salary increases. Accordingly, despite not increasing tax rates, these measures will lead to increased revenue collection, amounting to an additional R15bn in revenue. Although these measures place pressure on the average consumer, with roughly 40% of revenue collected being raised from personal income tax, it is no surprise that the government has turned

to these measures to raise additional revenue. Taxpayers were provided with some solace as there were no changes to the general fuel levy, resulting in tax relief of roughly R4bn.

The only increases in tax rates came about on a sin tax level. There will be an increase in excise duty for alcohol products, ranging from 6.7 to 7.2 per cent, which surpasses inflation rates. Excise duties for tobacco products are proposed to increase between 4.7 and 8.2 percent, depending on the tobacco product. In addition, government is proposing an increase in the excise duty on electronic nicotine and non-nicotine delivery systems, commonly referred to as vapes, which is estimated to amount to R3.04 per millilitre after the said adjustments.

On the expenditure side (aside from usual government expenditure) R1.4bn has been allocated to the national health insurance over the next three years for preparatory work. Besides the allocation, the Budget did not devolve any further

“Freezing the tax thresholds and the lack of adjustments to the rebates will likely lead to fiscal drag as more taxpayers are ‘dragged’ into higher tax brackets”

information about the government’s plans for national health insurance. Being an election year, the government has allocated an additional R2.3bn to the Independent Electoral Commission.

Unfortunately, the budget shortfall is estimated to worsen from 4.0 to 4.9 per cent of GDP, which has forced the government to turn inward to manage this shortfall by withdrawing (a once-off) 30% of the R500bn strategic Gold and Foreign Exchange Contingency Reserve held by the Reserve Bank.

While the budget may not appear to have made significant adjustments at first glance, it is evident that the 2024 Budget, consistent with the budgets presented since 1994, aims to advance our economy while tackling the persistent inequalities and hardships that afflict our society. The key focus for the government would be centered around curbing unnecessary government expenditure as furtherance of this cause.

It is evident that the government’s goal throughout the last three decades has been to revive fairness in both social and economic realms within our nation, aiming to tackle the entrenched inequality stemming from systemic discrimination and dispossession.

In summary, echoing the sentiments of Nelson Mandela, our esteemed first democratic President, and underscored by Finance Minister Enoch Godongwana, it’s imperative to recognise that achieving socioeconomic justice and shared prosperity is an ongoing journey rather than a final destination.

31 March 2024 NEWS & OPINION 10 www.moneymarketing.co.za IMAGES Shutterstock .com

The fundamental duty of the fiduciary practitioner

BY DR EBEN NEL

National Chairperson, The Fiduciary Institute of Southern Africa

Not all advisory relationships require the same level of trust. Although many service providers, including financial advisors, are expected by their clients to fulfil their duties with honesty, diligence and fairness, the benchmark set for the fiduciary practitioner is higher than just that. The reason being that the fiduciary practitioner’s position establishes a relationship with a third party who is often in a vulnerable position. The fiduciary concept is derived from the Latin term fides, referring to trust, loyalty, and good faith. The fiduciary practitioner, particularly in the role of trustee or executor, is expected to conform to the highest level of integrity. The practitioner has a fiduciary

duty towards the third party who must be able to trust him or her.

The trustee is directed by legislation to perform his or her duties and exercise their powers with the care, diligence and skill that can reasonably be expected of a person who manages the affairs of another. A trustee is prohibited from being exempted or indemnified against liability for breach of trust where he or she fails to show the required degree of care, diligence and skill. Whereby a person manages the affairs of another to whom he or she owns a fiduciary duty, the law requires such a person to act with more care and diligence than when dealing with his or her own matters. This concept,

“To act with integrity includes honesty, fairness, objectivity and independence of thought and behaviour”

which is contradictory to the selfishness of humans in general, has been referred to as an ‘other-regarding duty’. It is not the trustee’s duty to fulfil the expectations or to grant the wishes of a particular person, but to objectively act in the best interest of all the parties that he or she has a fiduciary duty towards.

A well-known law professor liked to equate the duty to act with the necessary care and diligence when dealing with another’s affairs as that of a person wearing a belt and braces at the same time. It is generally accepted that besides the duty to act with the necessary care, diligence and skill, the trustee’s fiduciary duty also includes the duties of impartiality, accountability and independence. An executor of a deceased estate is potentially placed in several complex relationships with parties who may have an interest in the deceased estate. These may include spouses,

The imperative of fiduciary duty in South African financial services

BY JAMES GEORGE Compliance Manager, Compli-Serve SA

In the realm of South African financial services, the concept of fiduciary duty stands as a cornerstone, dictating the ethical and legal obligations that financial service providers (FSPs) owe to their clients. This duty, enshrined in various legislative frameworks, including the Financial Advisory and Intermediary Services Act (FAIS Act), the Companies Act, and grounded in common law principles, is pivotal in ensuring the integrity, trust and professionalism of the financial industry.

At its core, fiduciary duty necessitates that FSPs, encompassing financial advisors and planners, act in the best interests of their clients. This extends beyond mere advice and into the realm of market conduct. It requires prioritising client needs, objectives and circumstances above all else. The essence of this duty is not only to provide appropriate advice but also to offer services that align closely with individual client profiles.

Transparency and disclosure form another critical aspect of fiduciary duty. FSPs are mandated to clearly reveal any potential conflicts of interest and to furnish clients with all pertinent information concerning financial products and services. This includes a comprehensive breakdown of risks, costs and benefits, ensuring that clients make informed decisions.

Moreover, the fiduciary duty encompasses due diligence and care in professional activities. FSPs are expected

to conduct thorough analyses, base their advice on accurate and complete information, and exercise a high degree of professionalism. Alongside this, maintaining the confidentiality of client information is non-negotiable, upholding the sanctity of the client-provider relationship.

The oversight of these duties falls largely to the Financial Sector Conduct Authority (FSCA) in South Africa, tasked with ensuring that FSPs adhere to legal standards, embodying principles of fairness, transparency and accountability. The FSCA has the power to impose disciplinary measures on FSPs who fail in their fiduciary duties, ensuring that the industry maintains its integrity.

The impact of fiduciary duty on the financial services sector cannot be overstated. It is instrumental in fostering

“FSPs are mandated to clearly reveal any potential conflicts of interest and to furnish clients with all pertinent information concerning financial products and services”

legatees, heirs, business partners, and creditors of the deceased. Many, but not necessarily all, of these relationships may be of a fiduciary character. Even if not, everyone will have the right to expect from the executor to at least act lawfully and in good faith.

A fiduciary practitioner who is a member of the Fiduciary Institute of Southern Africa (FISA ) is bound by the association’s code of ethics, focused on two broad principles, namely integrity and diligence. To act with integrity includes honesty, fairness, objectivity and independence of thought and behaviour. The fiduciary is also expected to take all reasonable steps to avoid conflicts of interest. To pass the test of diligence, a high level of knowledge and competence is required. The fiduciary must further treat relevant information with confidentiality and do everything necessary to ensure their personal financial stability.

trust between clients and their financial service providers. This trust is crucial, especially in an industry that deals with the sensitive matter of personal and corporate finance.

However, the landscape is not without its challenges. There have been instances where the fiduciary duty has been seen wanting, leading to significant consequences. Real-world examples in South Africa, such as the collapse of African Bank in 2014 and, more recently, the controversy surrounding Steinhoff International, highlight the repercussions of neglecting fiduciary responsibilities. In these cases, poor governance and a lack of adherence to fiduciary duties not only led to financial losses but also eroded public trust in the financial sector.

For FSPs who breach their fiduciary obligations, the consequences are severe. They face not just legal and regulatory repercussions, including fines and potential revocation of licenses, but also the loss of client trust, which can be devastating for any financial institution. Clients affected by such breaches have the right to seek legal redress, which often includes compensation for damages.

As the financial landscape evolves, the continuous upholding of fair and ethical treatment remains essential for protecting consumers and maintaining confidence in the financial system.

CONSUMER RIGHTS 31 March 2024 www.moneymarketing.co.za 11

Listed property builds on 2023’s market-leading performance

BY SIOBHAN CASSIDY MoneyMarketing

Investors can no longer afford to ignore SA Listed Property, the top-performing asset class on the JSE in 2023, but there is still resistance to the sector with which South African investors have long had a love-hate relationship. The FTSE/JSE All Property Index (ALPI) delivered a total return of 10.70% in 2023, outperforming bonds (FTSE/JSE All Bond Index) at 9.70%, equities (FTSE/JSE All Share Index or ALSI) at 9.25%, and cash (Alexander Forbes Short Term Fixed Interest Index or STEFI Index) at 8.06%. Shane Packman, associate investment analyst at Morningstar South Africa, notes that the sector has continued to perform well into 2024. He pointed to data for the three months to the end of January, during which time JSE-listed property was up 24.8%, compared to the ALSI’s comparatively modest increase of 7.5%.

However, Mvula Seroto, SA Portfolio Manager at Catalyst Fund Managers, says, “A lot of our asset allocators are still hesitant. They are sitting on the fence. They don’t want to be the first movers.” Investing in property has long been considered a cornerstone of wealth creation, but to own property directly is often complicated and expensive. Hence the allure of investing in listed property is strong. For most investors, it’s the simplest and most transparent route to gaining exposure to commercial real estate in South Africa.

While the asset class has recovered somewhat from pandemic lows, investors remain uncertain as to whether the sector can weather the headwinds that continue to buffer SA. The million-dollar question is: Can the sector provide opportunity during these uncertain times?

Listed property explained

Listed property comprises shares or holdings in companies that own, develop and/or manage real estate and trade on an exchange. Investing in the sector gives access to ownership of real estate but, unlike traditional property ownership, investing in listed properties provides investors with daily liquidity. “When investing in listed property, you have the ability to consider the current and changing market conditions and valuations,” says Packman. “In addition, you gain exposure to the underlying performance of the listed company, as well as the underlying performance of that portfolio of properties.”

The flipside of the liquidity, adds Packman, is mark-tomarket risk, since “it is on an exchange, it is traded daily”. Naeem Tilly, Portfolio Manager & Head of Research at Sesfikile Capital, explains: “Compared to direct property, listed property offers investors a liquidity benefit, professional management and diversification. But, on the other hand, you have a tradable market that values your asset differently from its book value. It could trade at a premium, but at the current time it’s trading below the fair value.”

Packman adds, “When you are buying and selling, you could experience a loss in the underlying, and there’s also a risk that it underperforms. If there’s a sentiment shock towards SA equities, for example, values can take a knock.” However, in addition to the expectation that the share price will increase over time, investors receive income in the form of regular shareholder distributions of rental income. Rental income is usually reasonably reliable since it is generally based on contracts, the value of which tend to rise over time and in step with inflation.

This means that listed property has characteristics of both equities and of bonds, making it a good diversifier of investment returns.

Regulatory controls

Another benefit of investing in listed property is regulatory oversight. Many listed property companies have adopted the framework that governs Real Estate Investment Trusts (REITs). A REIT is a listed property company that is governed by strict regulations in terms of structure and operations. South Africa’s regulation of REITs is very similar to that in other countries, which helps to underpin investor confidence. REITs are required to pay out at least 75% of their earnings to investors as dividends, which makes earnings reliable and predictable.

Catalyst Fund Managers’ Seroto says, “The main reason why the REIT structure is so compelling is that you access the opportunity to invest in an asset that you would never be able to afford as an individual. The REIT structure allows you relatively easy and cheap access to some of the best assets in the country, and in the world.”

REITs are not the only game in town. Other companies in the sector are structured as Property Unit Trusts and must adhere to the regulations governing the unit trust industry.

What’s the downside?

Detractors will tell you that, benefits aside, listed property is volatile and too risky. Says Packman, “A large portion of the assets of REITs are very exposed to the local economy, meaning they will be impacted by any headwinds the SA economy faces.” There is also quite a lot of concentration in the listed property space. “If you look at the top three holdings, it makes up almost 40%. So, if we do see some movement within any of these underlyings, it would shift the market quite a bit. That’s different from the all-share, which has over 100 listed securities in it.”

The offshore influence

As at the end of January 2024, approximately 48% of the revenue of the FTSE/JSE SA Listed Property Index was generated outside South Africa, meaning the sector’s dividend yield and return are derived from both local and offshore revenue streams.

The largest constituent in the index, Nepi Rockcastle, which accounts for more than 25% of the index, generates 100% of its revenue from central and eastern Europe. While global property has faced its challenges in recent years, Nepi Rockcastle has reported strong distributable earnings, reflecting resilience in the region. The shift in revenue exposure to global markets provides access to

LISTED PROPERTY 12 www.moneymarketing.co.za

a diversified revenue stream, reducing reliance solely on the local economy. Sesfikile Capital’s Tilly says, “If, say, you decide to build your wealth using buy-to-rent properties, depending on your wealth, you could build a small portfolio of properties. If you buy into just one of the bigger South African listed companies, you’ve got access to several hundred properties in South Africa, assets potentially in Eastern Europe or the UK.”

Highest performers

The sector also benefits from internal diversification The largest segment of the asset class is retail, which makes up more than 60% of the index by market capitalisation. Overall, national retail vacancies have shown resilience coming in at 5.1% at the end of the third quarter of 2023, which is below the peak of 7% recorded in 2021. Retailers’ cost of occupancy, at its lowest level in 10 years, further improved in the third quarter of 2023 as sales growth continued to outpace the growth in gross rental.

The second-largest segment is industrial, at just under 20% of the index. It has continued to be the outperformer among the three major sectors in South Africa, with the lowest vacancy rates and the highest base rental growth. Of the various sub-sectors within industrial, manufacturing faces headwinds, but logistics and storage are seeing good demand.

The third big sub-sector, office, makes up less than 15% of the index. Work-from-home pressure and weak business confidence continue to put pressure on office vacancy levels, with national vacancies of 15.2% at the end December 2023, down from a high of 16.7% in 2022.

The last few years in perspective

Before 2017, it was common for multi-asset funds to have healthy allocations to the SA listed opportunity set, mostly due to the appeal of property companies offering relatively stable dividends. The SA property market demonstrated strong performance between 2013 and 2017, attracting significant investment flows into the sector. These were bullish times in Listed Property and the REIT space, with some companies paying out between 90% and 100% of their earnings. The Alexander Forbes Large Manager Watch Survey indicates that locally listed property allocations in balanced and multi-asset funds fell below 3% on average in 2023, contrasting with a peak of over 6% in 2017.

Sentiment began to weaken in early 2018 on concerns around the overuse of debt and possible financial engineering between these companies. In the context of corporate governance concerns and a deteriorating local economy, valuations started to look quite expensive, and questions were raised about the sustainability of earnings.

And then Covid arrived. The FTSE/JSE SA Listed Property Index lost 62.6% of its value between 1 January 2018 and 31 October 2020, with most of the drawdown occurring when the pandemic hit.

In some important ways the listed property sector emerged from the pandemic in better shape than it was before. Yes, shopping centres were deserted, and offices emptied as staff worked from home. Tenants were unable to pay rent and contracts were not renewed. But many in the sector used the opportunity to hit the pause button, hold back on their payouts, and reduce their holdings in non-core assets.

The result was that many cleaned up their balance sheets and emerged from Covid looking better than they had when they entered. Importantly, companies were no longer paying out 90% to 100% of their earnings

“Investors have generally been underweight in the sector for some time, but we believe average allocations will increase this year as the recovery in fundamentals continues”

Trends going foward

Towards the end of last year, we saw a bit of a rerating of listed REITs, says Packman, which had been trading at a large discount to NAV basis. “When expectations shifted from ‘interest rates being higher for longer’ to ‘potentially being cut’ (both globally and in South Africa), the asset class did quite well. This shift really bolstered sentiment towards REITs and has subsequently assisted the performance that was seen over the past three months.”

Tilly agrees. He says property fundamentals showed signs of recovery throughout 2023, but a material rebound in share prices was seen when rate expectations started to turn in the fourth quarter. He expects the growth will “really start to come in the next year to 18 months”. He adds, “While there has certainly been increased interest in the sector, some investors remain hesitant, as the recent run may have closed the upside potential the sector was offering.

“Investors have generally been underweight in the sector for some time, but we believe average allocations will increase this year as the recovery in fundamentals continues and rates start to decline, improving confidence in the outlook through increased visibility in earnings growth. We continue to see 10-15% total return potential for the sector.”

Seroto agrees that the mood is changing. “I see all the negative headlines, about too much risk in property. If I didn’t know much about it, I might also think it was too risky. And, yes, there are pockets, like office, which are still a threat. But that is 15% of the listed property universe in SA (globally, it’s even lower). They don’t talk about industrial, a net beneficiary of Covid, and the retail recovery.”

He adds that there was “a theme last year”, where everyone was underweight property, and the hedge funds were shorting property. “Now we look back and in 2023 property was the best-performing asset class in South Africa, and that momentum has continued into 2024.”

31 March 2024 www.moneymarketing.co.za 13 IMAGES Shutterstock .com

Retail real estate investment trust shows growth

BY LAURENCE RAPP CEO of Vukile Property Fund

Vukile’s South African and Spanish retail property portfolios delivered impressive increases in performance in November and December 2023, signalling a successful Black Friday and holiday trading period.

Vukile is a consumer-focused specialist retail real estate investment trust (REIT) that holds a defensive portfolio of retail property assets valued at around R40bn, 40% of which is in South Africa and 60% in Spain. The Spanish assets are held in the Madrid-listed subsidiary Castellana Properties Socimi (“Castellana”), in which Vukile has a 99.5% holding.

The South Africa position

All key operating metrics for November and December 2023 were positive and in line with expectations, with a particularly strong festive trading performance. During December 2023, shopper footfall in the portfolio increased by 2.0%, demonstrating strong and steady support. A quarter of shoppers who visited Vukile’s malls on Black Friday also returned during December. Township and rural malls enjoyed higher rates of repeat visitors, emphasising the central role they play in their communities.

The portfolio’s sales grew by 2.6% for the 2023 calendar year, with festive trading figures being notably higher than those in 2022.

The portfolio delivered strong December 2023 figures, with trading

densities growing by 7.6% compared to December 2022. Township shopping centres led this performance with 13.2% growth, followed by rural shopping centres (+7.2%) and the urban shopping centres (+4.5%).

During the combined November and December period, the portfolio’s trading density increased by 4.3% compared to the same months in 2022. The township portfolio enjoyed an increase of 9.7%, the rural assets rose by 3.3% and the urban properties showed growth of 1.3%.

These numbers are more impressive when considered against the backdrop of figures reported by Statistics South Africa, indicating a decline in retail sales for November.

The Vukile portfolio experienced a seasonal uptick in the fashion trade. Women’s wear sales surged 14.5% in December, marking an overall 10.4% increase for the final two months of the year. Meanwhile, men’s wear saw a healthy 8.1% growth in sales during November and December 2023. Sales in the grocery/supermarket category rose by 2.4%, while the fast foods segment saw a 5.4% rise, indicating steady demand for essentials.

The Spanish position Spain demonstrated excellent performance, leading Europe with a 5.3% growth in footfall in the last quarter of 2023, per the Shopper Track report. The report indicates a strong positive trend

in the Spanish retail market, especially the shopping centre segment. For the 2023 festive season, Spain ranked top with a 5.7% increase in visits. Castellana outperformed this benchmark, growing its portfolio footfall by 6.1%.

Castellana closed the 2023 calendar year with a new record footfall of more than 44.8 million visits for the 12 months, up 6.4% from 2022. El Faro and Bahía Sur shopping centres attracted over 8 million visits in the 2023 calendar year –a new record for both. Similarly, Puerta Europa achieved its highest annual visitor numbers since opening, with almost 5 million visits or a 6.2% increase from 2022. Los Arcos and Habaneras also exceeded 2022 levels by an impressive 9.7% and 11.1%, respectively. Vallsur Shopping Centre broke its footfall record by 4.1% in 2023, with the opening of La Chismería last December – its new leisure and dining zone – exceeding retailers’ expectations.

In terms of sales, 2023 numbers improved by 7.9% over 2022, even though 2022 was one of the strongest years for Castellana’s tenants to date. The shopping centre portfolio demonstrated sales growth of 9.6% in 2023 versus 2022, outperforming retail parks at 3.7%.

Black Friday and festive season trading was extremely positive, with increases in sales of 7.0% in November and 6.1% in December – representing real growth in the portfolio.

All retail categories exceeded 2022 performance. The three categories achieving the highest increases in sales were media and technology (19.5%), health and beauty (14.2%) and food and beverage (12.3%). The leisure category, which demonstrated sales growth of 11.4% in 2023 vs 2022, finally surpassed 2019 levels by 3.7% after several tough trading years.

Outlook going forward

Based on a continuously strong trading performance and having completed nine months of its current financial year, Vukile is pleased to report that it expects to outperform the upper end of its upgraded guidance for both FFO per share (4-6% growth) and dividend per share (8-10% growth) for the year ending 31 March 2024.