Employment

Laminated Law Reference 2nd Edition John Sanchez

Visit to download the full and correct content document: https://textbookfull.com/product/employment-law-a-quickstudy-laminated-law-referenc e-2nd-edition-john-sanchez/

More products digital (pdf, epub, mobi) instant download maybe you interests ...

Legal Research A QuickStudy Laminated Law Reference 2nd Edition Debra Moss Curtis

https://textbookfull.com/product/legal-research-a-quickstudylaminated-law-reference-2nd-edition-debra-moss-curtis/

Federal Income Tax A QuickStudy Laminated Law Reference 3rd Edition Elena Marty Nelson

https://textbookfull.com/product/federal-income-tax-a-quickstudylaminated-law-reference-3rd-edition-elena-marty-nelson/

Quickbooks a QuickStudy Laminated Reference Guide

Quickstudy Reference Guide 2nd Edition Michele Cagan

https://textbookfull.com/product/quickbooks-a-quickstudylaminated-reference-guide-quickstudy-reference-guide-2nd-editionmichele-cagan/

Business Research: A QuickStudy Laminated Reference Guide 2nd Edition Susan Romberg

https://textbookfull.com/product/business-research-a-quickstudylaminated-reference-guide-2nd-edition-susan-romberg/

Chef s Companion A QuickStudy Laminated Reference Guide 2nd Edition Cynthia Parzych

https://textbookfull.com/product/chef-s-companion-a-quickstudylaminated-reference-guide-2nd-edition-cynthia-parzych/

Italian Conversation A QuickStudy Laminated Language Reference Guide 2nd Edition Sally Ann Del Vino

https://textbookfull.com/product/italian-conversation-aquickstudy-laminated-language-reference-guide-2nd-edition-sallyann-del-vino/

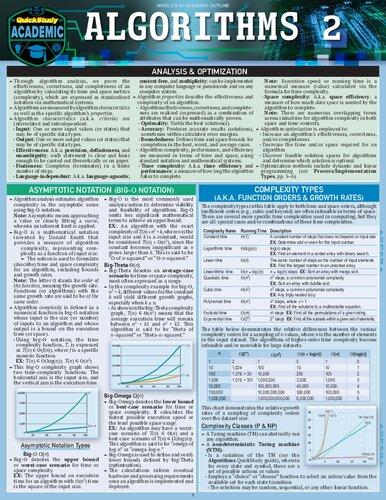

Algorithms 2 A Quickstudy Laminated Reference Guide 1st Edition Babak Ahmadi

https://textbookfull.com/product/algorithms-2-a-quickstudylaminated-reference-guide-1st-edition-babak-ahmadi/

Python Standard Library A Quickstudy Laminated Reference Guide 1st Edition Berajah Jayne

https://textbookfull.com/product/python-standard-library-aquickstudy-laminated-reference-guide-1st-edition-berajah-jayne/

Quickstudy Reference Guides Argumentative Essay 2nd Edition Kathryn Jacobs

https://textbookfull.com/product/quickstudy-reference-guidesargumentative-essay-2nd-edition-kathryn-jacobs/

LABOR ISSUES:

Fair Labor Standards Act (FLSA) [29 U.S.C. §§201–219]

Covers both public and private sectors; weak preemptive effect on state laws

• Coverage

A. All employers engaged in commerce [§203(s); U.S. v. Darby]

B. Factors: Dollar volume of business for some

C. Extension to public sector upheld [Garcia v. San Antonio]

i. All public hospitals, schools, and public agencies are covered

ii. Compensatory time off in lieu of overtime at time-andone-half rate

D. States’ 11th A. immunity from suits for money damages [Alden v. ME]

E. Definition of employee: Any individual employed by an employer [§203(e)(1)]; economic reality test [Rutherford Food Corp. v. McComb]:

i. Employer’s right to control manner in which work is performed ii. Employee’s opportunity for loss or profit

iii. Employee’s investment in equipment

iv. Special skills

v. Permanence of working relationship

vi. Whether work performed is an integral part of employer’s business

F. Workers who are not covered are independent contractors and prisoners (not per se excluded)

• Subjects not covered by FLSA

A. Vacation, holiday, severance, or sick pay

B. Meal or rest breaks and premium pay for weekend or holiday work

C. The number of hours in a day or days in a week an employee may have to work (assuming worker is 16 or older)

• Minimum wage and overtime standards [§§201–219]

A. Identify employees’ workweek and gross amount of pay

B. Calculate number of hours worked during that week

C. Split gross pay into 3 parts: nonwage items (e.g., bonuses) [§7(e) (1)–(3b)]; premium pay [§7(e)(5)–(7)]; and basic straight-time pay

D. For employees paid monthly or semimonthly, multiply monthly pay by 12 (or semimonthly by 24) and divide the result by 52

• Exemptions from overtime pay

A. Seasonal workers, babysitters, and some journalists

B. Five exempt categories, as of 2004 regulations [29 C.F.R. §541]: Executive, administrative (but police, firefighters, and emergency medical technicians continue to get overtime), professional, computer, and outside sales; pharmaceutical sales representatives are FLSA exempt as outside salesmen [Christopher v. SmithKline Beecham Corp.]; service advisors are not covered by exemption overrules [Encino Motorcars, LLC f. Navaro]

C. Three-part test for exempt status: Salary limit test ($23,660 per year are nonexempt; over $100,000 are presumptively exempt), salary basis test, and duties test

• Compensable hours

A. Time spent on key job duties plus incidental duties integral to job; time spent undergoing security screenings is not compensable [Integrity Staffing Solutions v. Busk]

B. Portal-to-Portal Act excludes preliminary and postliminary (waiting to be engaged) activity; 2010 labor regulation states time spent donning and doffing protective equipment compensable

C. Postdonning and predoffing walking time is compensable [IBP, Inc. v. Alvarez]; experts can show hours worked donning and doffing in FLSA class action suits [Tyson Foods, Inc. v. Bouaphakeo]; time spent donning and doffing protective gear is not compensable where collective bargaining agreement so provides [Sandifer v. United States Steel Corp.]

D. Meal times over 2 hours are noncompensable; employers must afford working mothers reasonable break time to express breast milk for 1 year after child’s birth [§4207 of the Patient Protection and Affordable Care Act (PPACA)]

E. Commuting time is noncompensable

• Child labor [§213(c)]

A. Waiver: 10- and 11-year-olds may work as hand harvesters to pick short-season crops (8 weeks per year)

B. Must be 16 years old to work in most nonfarm jobs

C. Must be 18 years old to work in hazardous jobs

D. Exceptions: Children employed by parents in agriculture and as actors and newspaper deliverers

• Enforcement

A. Secretary of labor may bring action for civil liability, money fines for child labor violations, and injunction

B. One or more employees may seek civil damages

C. Department of Justice: Actions for criminal penalties

D. Statute of limitations:

i. Two years for nonwillful violations

ii. Three years for willful violations: Employer knew or showed reckless disregard as to whether act violated FLSA; same definition of “willful” applies to Age Discrimination in Employment Act (ADEA) and Equal Pay Act (EPA) [McLaughlin v. Richland Shoe Co.]

• Retaliation: Oral complaint is protected conduct under antiretaliation provision [Kasten v. Saint-Gobain Performance Plastics Corp.] Employee Polygraph Protection Act (EPPA) [29 U.S.C. §§2001–2009]

• Coverage A. Bars most private employers from using lie detectors either for preemployment screening or during the course of employment [§2001(3)]

B. Covers all employers engaged in commerce [§2002]

• Prohibits employers from [§2002]:

A. Causing any employee or applicant to take a lie detector test

B. Using such test results in any way

C. Discharging, discriminating against, or disciplining any employee or applicant on basis of such test or for refusal to take such test

D. Disciplining any employee for exercising any EPPA rights

• Exemptions [§2006(a)]

A. All public-sector employers are exempt

B. Federal government permitted to test private-sector employees who have access to classified information

C. Federal testing of any contractor of Departments of Defense or Energy allowed

D. Testing of members of intelligence services allowed

E. Federal testing of FBI contractors allowed

F. Private employers conducting ongoing investigation involving economic loss or injury allowed (e.g., theft, embezzlement), but employer cannot randomly test to see if thefts have occurred [29 C.F.R. §801.12]

G. Private employers involved in security services allowed to test applicants [§2006(e)]

H. Testing allowed when drugs are involved [§2006(f)]

• Penalties [§2005(a)(1)]

A. Up to $10,000 for each violation

B. Employee remedies: Legal or equitable relief; being hired, reinstated, or promoted; lost wages and benefits; and costs and attorneys’ fees

• Statute of limitations is 3 years [§2009]

• Preemption: Any state or local law or collective bargaining agreement (CBA) that is more restrictive is not preempted [§2009] National Labor Relations Act (NLRA) [29 U.S.C. §§151–168]

Only governs private-sector collective bargaining [§152(6)]; goal is to eliminate coercion or interference with employee rights to engage in protected concerted acts

• §7 employee right to:

A. Self-organization

B. Engage in protected concerted acts (e.g., strikes)

i. Protected activity relates to terms and conditions of employment

ii. Unprotected activity (e.g., violence, strikes in breach of contract)

iii. Concerted: Requires more than 1 in nonunion setting

iv. Constructive concerted: Only need 1 employee invoking CBA in union setting

C. Bargain collectively through agents of own choosing

D. Not join a union in right-to-work states (in 2018, there were 28 right-to-work states)

• §8 unfair labor practices

A. §8(a)

i. §8(a)(1): Bars employers from interfering with, restraining, or coercing employees in exercising NLRA rights [§158(a)(1)]

ii. §8(a)(2): Employer cannot dominate, support, or interfere with union formation or administration [§158(a)(2)]

iii. §8(a)(3): Employer cannot discriminate in hiring, tenure, or any term or condition of employment that either encourages or discourages participation in union [§158(a)(3)]

iv. §8(a)(4): Antiretaliation provision [§158(a)(4)]

v. §8(a)(5): Employer cannot refuse to bargain collectively with union over mandatory subjects of bargaining [§158(a)(5)]

B. §8(b): Bans analogous unions, unfair labor practices, and secondary boycotts [§158(b)]

C. §8(c): Right of employer, employee, and union to speak freely absent threat of reprisal or force or promise of benefit [§158(c)]

• Jurisdiction of National Labor Relations Board (NLRB)

A. Representation cases: Procedures for conducting a union election

i. Determines appropriate bargaining unit

ii. Determines whether employees want an election [§159]

iii. Certifies elected union or decertifies unions

B. Unfair labor practices (ULPs) cases

i. Charges filed with NLRB

ii. NLRB’s General Counsel has unreviewable discretion as to whether a charge should be dismissed or a complaint be issued

iii. ULPs cases heard by administrative law judge, and NLRB panel issues opinion

iv. Appeal to Federal Circuit Court of Appeals where NLRB panel sits [§160(e)–(f)]

C. Three members of the NLRB constitute quorum necessary to conduct business [New Process Steel v. NLRB]

• Preemption

A. Garmon preemption [359 U.S. 236 (1959)]

i. State courts lack jurisdiction over conduct arguably subject to §§7 and 8 of the NLRA

ii. Exceptions: Matters of peripheral concern to federal labor law and interests deeply rooted in local feeling

B. Field preemption (machinist) [427 U.S. 132 (1976)]: Congress intended some acts unregulated by federal or state law

C. §301 preemption test

i. Whether state court must interpret CBA to decide state claims [Lingle v. Norge Div. of Magic Chef, Inc.]

ii. Court, not arbitrator, decides CBA’s ratification date [Granite Rock Co. v. Int’l Bhd. of Teamsters]

iii. §301(a) supports a federal cause of action only for breach of contract claims, not claims of tortious interference of contract [Granite Rock Co.]

Occupational Safety & Health Act (OSHA) [29 U.S.C. §§651–678]

• Employer duties [§654(a)]

A. Maintain workplace free from recognized hazards

B. Obey OSHA standards

• Employee rights and duties

A. Question unsafe conditions and require inspection [§657(f)]

B. Assist OSHA inspectors [§657(e)]

C. Aid in judging whether imminent danger exists

D. Bring action to force secretary of labor to seek injunctive relief [§662]

E. Refuse to perform hazardous work [29 C.F.R. §1977.12] if there is reasonable fear of death or injury and no other way to cure danger [§660]

F. Employees face no sanctions for violating OSHA standards by OSHA, but employer may discipline employee

G. Protection against retaliation [§660]

H. Right to access exposure records

I. Right to access own medical files

• Inspections

A. In response to employee complaints

B. After injuries or deaths

C. Imminent dangers

D. Regional programmed inspections

E. If denied access, OSHA must obtain a warrant [Marshall v. Barlow’s, Inc.]

F. Government must show either probable cause or believe OSHA violations exist upon showing of administrative probable cause

• Promulgation of standards: Adopt existing standards, new standards, and emergency standards

• Violations

A. Of general duty clause, secretary must prove employer failed to maintain a workplace free of a hazard that was recognized and caused death or serious physical harm

B. Types of violations: De minimis, nonserious, serious, and willful or repeated

C. Negligence per se

i. About 25% of the states have ruled that a breach of a duty imposed by a statute (like OSHA) or regulation is negligence per se if the party injured is a member of the class of persons the statute was intended to protect [Teal v. E.I. DuPont de Nemours & Co.]

ii. Majority rule: OSHA standards are only some evidence of the standard of care

• Contesting citations

A. Employer has 15 days to contest citation [§659]

B. OSHA commission may accept, reject, or modify citation or remedy

C. At administrative hearing, secretary must prove relevance of standard, noncompliance, employee exposure, or access and that employer knew or should have known of violation

D. Employer defenses

i. Procedural defects: Invalid warrant, denial of walkaround rights, vague citation, and use of incorrect standard

ii. Substantive defenses: Compliance posed greater hazard, compliance not technically feasible, employee refused to comply, and noncontrolling employer was ignorant of hazard

iii. Compliance with OSHA standards is no defense to state tort or criminal liability

• Enforcement

A. Secretary of labor may seek injunction to abate violation [§662]

B. Employee may ask secretary to seek injunctive relief

• Remedies

A. Injunctions to abate violation

B. Civil penalties

C. Criminal penalties [§666] for a willful violation causing death, giving advance notice of inspection, and knowingly making false statements in OSHA report

• Preemption

A. OSHA preempts all state health and safety legislation

B. Exceptions: OSHA-approved state plans [§18], state and local fire regulations, zoning ordinances, criminal laws, and state tort claims

Labor Issues: Fair Practices & Employee Safety & Protection

C. Federal Employers’ Liability Act: Trial courts must give jury instruction that one’s fear of cancer claim from workplace exposure to asbestos must be “genuine and serious” [CSX Transp., Inc. v. Hensley]

Federal Unemployment Compensation Act

[42 U.S.C. §§501–504, 1101–1105]

• Goals

A. Matching up jobless with job openings

B. Creating disincentives for employers to lay off employees by experience rating (lower rates for fewer claims)

C. Paying benefits to jobless

• Joint federal-state system

A. Federal tax on payrolls (6.2%)

B. Federal tax sharply reduced if state law for compensating jobless meets federal standards

• Benefits eligibility

A. Claimant must have earned set amount of wages in a covered job

B. Claimant is presently jobless

C. Claimant is able to and available for work

D. Claimant has registered at unemployment office

E. Benefits are paid out of employer’s individual reserve account

F. Maximum number of weeks is usually 26, but more during economic recessions

• Disqualification

A. Varies from temporary postponement of eligibility to 1-year ineligibility

B. Voluntarily quit

i. Some states: Leaving job without good cause

ii. Other states: Leaving job without good cause connected with or attributable to work

C. Quitting over religious objections usually will not disqualify claimant [Thomas v. Review Bd.]

D. Misconduct

i. Disobeying reasonable order amounts to willful misconduct

ii. Incompetence, inexperience, and poor performance may amount to good cause to fire but not misconduct sufficient to disqualify for benefits

iii. Disqualifying for off-duty misconduct is rare

E. Factors of refusing suitable job: Age, education, and experience; degree of risk; employee’s past earnings; length of commute; and duration of unemployment

F. Labor disputes: Lockout is not disqualifying, but strike disqualifies

G. Setoffs: Workers’ compensation, severance pay, and pension

• Procedure

A. Administration: Employer contests claim

i. Hearing officer’s decision is appealable to administrative board

ii. Appeal to state court

B. Hearing is informal and brief

• State and local laws barring discrimination on grounds of unemployed status

Worker Adjustment & Retraining Notification Act (WARN) [29 U.S.C. §§2101–2109]

• Coverage

A. Private employers with over 100 employees

B. If 50 or more employees are laid off [§2102(a)(2)]

C. An employment loss during any 30-day period at a single site of either 33% of the employees (if they number 50 or more) or 500 or more employees [§2101(a)(3)]

D. Part-time employees working fewer than 20 hours per week or employed fewer than 6 of the 12 months preceding date of required notice are not included

• Definition of employment loss

A. An employment termination other than a discharge for cause, voluntary departure, or retirement

B. A layoff exceeding 6 months

C. A reduction in hours of work over 50% during each month of any 6-month period

• Notification

A. Sixty calendar days advance written notice before plant closings or mass layoffs [§2102(a)]

B. Notice to individual employees must mention bumping rights

C. Notice to union must identify affected job classifications, names of affected employees, and probable date of termination or layoff (14-day window)

D. When less than 60-day notice is required:

i. If employer who is seeking capital or new business in order to stay profitable has good-faith belief that giving notice would jeopardize odds of landing needed capital or business [§2104(a)(4)]

ii. If closing or layoff is the result of business circumstances that were not reasonably foreseeable

iii. If closing or layoff stems from natural disaster

iv. In each case, employer must give as much notice as is practical [§2102(b)]

• Exemptions: WARN does not apply:

A. To plant closing or layoff at a temporary facility or as result of completing a special project, so long as employees know work was temporary

B. In case of strike or lockout, unless aimed at evading WARN requirements

• Liability

A. Civil penalty of up to $500 per day for each day of violation to local government that was not notified

B. Back pay to each aggrieved employee for each day of violation

C. Costs and attorneys’ fees are at the court’s discretion

D. Lost benefits

E. Defined benefit pension liability may be met by crediting each affected employee with the appropriate additional amount of service [§2104]

Workers’ Compensation

• Each state has its own statute

A. Repeated-trauma injuries: Employment-based impairments and normal wear and tear of ordinary living; normal wear and tear not compensable

B. Soft-tissue injuries: Causation problems; injury is compensable even if existing impairment is aggravated by employment

C. Mental injuries: Causation problems; compensable if associated with physical trauma; many states require proof of extraordinary stress

D. Impairment versus disability

i. Medical impairment: An alteration of health status assessed by medical means

ii. Disability: An alteration of the patient’s capacity to meet personal, social, or occupational demands assessed by nonmedical means

• Occupational diseases: 3 types of statutes:

A. Scheduled diseases associated with specific occupation

B. Compensates for diseases arising naturally from type of job (excludes ordinary diseases of life)

C. Limits coverage to diseases peculiar to the type of job

• Arising out of and in the course of employment

A. “Arising out of” refers to cause or origin

B. “In the course of” refers to time, place, and circumstances [Guess v. Sharp Mfg. of Am.]

C. Going-and-coming rule excludes coverage for injuries during commute; exceptions:

i. Employer provides means of transport

ii. Being on road is a normal part of work

iii. After-hours injuries compensable if employee is on on-call status

iv. Employee, while on employer errand, is injured during commute

D. Injuries sustained during employer-sponsored recreation activity are compensable

E. Injuries caused by natural forces (e.g., lightning) are compensable according to positional risk doctrine

• Ways around workers’ compensation: Sometimes injured employees prefer to sue employer in tort in lieu of workers’ compensation

A. Injuries resulting from either employer’s or coworker’s intentional tort; minority rule: willful, wanton, reckless misconduct will allow employee to sue in tort

B. Dual-capacity rule (minority):

i. If employee was injured while tortfeasor was serving its role as employer, then employee’s injury is covered by workers’ compensation

ii. But employee may recover in tort for negligent aggravation of a work-related injury against an employer who assumes the capacity of medical care provider by treating employee’s injury itself [Weinstein v. St. Mary’s Med. Ctr.]

• Actions against third parties

A. Actions against an affiliated company

B. Actions against general contractors by employees of subcontractors

C. Employees of general contractor or subcontractor suing other subcontractors

D. Action against architect, engineer, or safety and health consultant

E. Action against a property owner

F. Action against a coworker (minority view): Occupational Safety and Health Law [§21:7 (2007)]

G. Actions against insurance companies, labor unions, and government agencies: Occupational Safety and Health Law [§21:10–12 (2007)]

H. Liability actions against manufacturers of defective products causing injury or illness [York v. Union Carbide Corp.]

• Benefits

A. Medical benefits

i. What constitutes proper care? (e.g., home nursing service)

ii. Has injured employee achieved maximum recovery?

iii. Who selects treating physician?

iv. Did employee refuse to undergo treatment?

B. Disability benefits

i. Amount of each weekly payment is typically about half of employee’s average weekly earnings

ii. Types of disability: Temporary total, temporary partial, permanent total, and permanent partial

C. Death benefits typically go to deceased employee’s spouse and minor children

D. Rehabilitation benefits

• Administration and procedure

A. Notice by employee that injury or illness has occurred

B. Employer must notify state agency

C. Disputes are investigated by agency and hearing is conducted

i. Statute of limitations commences when reasonable person would be aware of injury

ii. Reopening cases stemming from change of circumstances

D. Insurance premiums paid by employer based on experience rating (as more employees make workers’ compensation claims, employer’s insurance rates go up)

Social Security Disability [42 U.S.C. §423 et seq.]

• Coverage

A. Federal compensation for non-job-related disability that precludes an individual from working

B. Claimants must have worked a certain number of quarters to be eligible

• Definition of disability

A. Eligible only if physical or mental impairments are so severe that one is unable to do previous job, and, considering age, educa-

tion, and work experience, cannot engage in any other kind of substantial, gainful work nationwide

B. Five-step sequential evaluation process; claimant must show:

i. He/She is not working at a substantial, gainful activity

ii. He/She has a severe impairment

iii. Whether claimed impairment is on list of acknowledged severe impairments; if on list, claimant qualifies

iv. If not on list, ask whether claimant can do his/her previous job

v. Consideration of vocational factors (age, education, and work record) in assessing whether claimant can perform other jobs existing in significant numbers in the national economy [Barnhart v. Thomas]

Whistleblower Statutes

• Federal

A. Whistleblower Protection Act of 1989 [5 U.S.C. §2301(b)(9)]

i. Protects federal employees who expose violations of law, mismanagement, waste of funds, abuse of authority, or dangers to public health or safety

ii. Employee seeks corrective action from Merit Systems Protection Board

iii. Remedies: Back pay, benefits, medical costs, and attorneys’ fees and costs

B. False Claims Act bars qui tam suits based on information already disclosed in a state or local administrative hearing or report [Graham Cnty. Soil & Water Conservation Dist. v. U.S. ex rel. Wilson]

C. PPACA bars bias and retaliation against whistleblowing employees involving violations of Title I of the PPACA

D. Sarbanes-Oxley Act: Protects whistleblowers who are employees of private contractors [Lawson v. FMR LLC]

• State

A. Scope of protection varies from state to state

B. Prima facie case; employee must show that:

i. He/She engaged in activity protected by the act

ii. He/She was subject of adverse employment action

iii. Causal link exists between protected activity and the adverse employment action

C. Some state courts refuse to recognize whistleblowing claims absent a statute [Hostettler v. Pioneer Hi-Bred Int’l, Inc.]

D. Some courts rule that statutory whistleblower remedies preclude common law claims, such as wrongful discharge in violation of public policy [Dudewicz v. Norris-Schmid, Inc.]

E. American Recovery and Reinvestment Act of 2009

i. Protects state and local public employees and contractors who whistleblow [§1553]

ii. Protects whistleblowers alleging waste of stimulus funds

iii. Covers disclosure of information reasonably believed to be evidence of gross mismanagement, gross waste, or abuse of authority

Termination of Employment

• At-will employment

A. Common law rule: Either employer or employee can end employment relationship at any time for any or no reason, with or without notice

i. The at-will doctrine promotes laissez-faire and freedom of contract

ii. Application of at-will doctrine is simple and consistent

B. Exceptions: Unionized employees (need cause to fire), employees hired for definite term, most civil servants with job tenure, and tenured academics are not at-will

• Common law erosion of at-will employment

A. Wrongful discharge in violation of public policy

i. Sounds in tort; therefore, punitives possible

ii. When employee refuses to commit illegal act

iii. When employee performs statutory duty (e.g., attending jury duty)

iv. When employee exercises legal right (e.g., filing workers’ compensation claim)

v. When employee reports employer misconduct (whistleblowing)

B. Sources of public policy: Constitutions, statutes, judicial opinions, administrative regulations, and codes of professional conduct

C. Breach of implied-in-fact contract

i. Based on conduct of the parties

ii. Promises made in manuals and handbooks may create binding employer commitments or create unilateral contract that employer may unilaterally alter or withdraw; disclaimer must be clear

iii. Oral promises of job security

iv. Employer’s practices and practices in the industry

v. Job security based on acceptable or satisfactory job performance does not alter at-will status

vi. Implied-in-fact remedies available against public employers as well [Cooper v. Mayor of Haddon Heights]

D. Implied covenant of good faith and fair dealing

i. Neither party will interfere with the other party’s ability to receive benefits under the contract [Restatement (2d) Contracts §205]

ii. Sounds in contract, not in tort [Foley v. Interactive Data Corp.]

iii. Factors: Longevity of service

E. Remedies: Damages offset by duty to mitigate (possibly punitives for wrongful discharge tort); no reinstatement

• Wrongful termination statutes

A. No general federal law

B. Only MT enacted a wrongful termination statute (MT Code Ann.) [§§39-2-902–914]; discharge based on mistaken facts actionable [Marcy v. Delta Airlines]

• Just-cause discharge: Theft, dishonesty, fighting at workplace, possession or use of alcohol or drugs on duty, insubordination, sleeping at work, excessive absenteeism, and disloyalty

• Breach of employment

A. Contracts for

B. Remedies

i. Damages, measured by cost to replace employee

ii. Specific performance violates 13th A. prohibition against involuntary servitude

iii. Negative injunctions bar breaching employee from working for former employer’s rivals for duration of contract term

C. Agreements not to compete

i. Some states, like CA, refuse to enforce such agreements [CA Bus. & Prof. Code §16600]

ii. Most states enforce such agreements provided they are reasonable in time and scope [Restatement of Contracts 2d §188 (1981)]; courts can rewrite such agreements to make them reasonable

iii. Remedies: Damages (measured by lost business profits) and injunctions (employee’s services must be unique or extraordinary)

D. Trade secrets

HEALTH ISSUES: BENEFITS & RIGHTS

Comprehensive Omnibus Budget Reconciliation Act (COBRA) [29 U.S.C. §§1161–1168]

• Coverage: Both private and public employers with more than 19 employees [§1161(b)]

• Notification

A. Plan administrator must notify any qualified beneficiary of right to continue health insurance coverage for up to 18 months after a qualifying event [§1166(a) (4)]

i. Notice must be sufficient to allow qualified beneficiary to make an informed decision whether to elect coverage at a cost of no more than 102% of the premium

ii. Beneficiary must elect coverage within 60 days after qualifying event but may not be required to make the first premium payment before 45 days after election [§§1162, 1165]

iii. Each qualified beneficiary may choose own type of coverage [§1165(2)]

iv. Burden of proving proper notice is on plan administrator

B. Qualified beneficiary includes spouse of covered employee [§1167(3)(b)]

C. Qualifying events:

i. When covered employee is terminated [§1163(2)]

ii. When employee dies or becomes covered by Medicare

iii. When covered spouse is divorced or legally separated

iv. When dependent child ceases to be dependent child

v. When employer files for bankruptcy

D. Disqualification if terminated for gross misconduct [§1163(2)] or reduction in hours [§1167(3)(B)]

E. American Recovery and Reinvestment Act of 2009: Eligible unemployed entitled to have up to 65% of COBRA insurance premiums paid for by their former employers

Health Insurance Portability & Accountability Act (HIPAA) [42 U.S.C. §300gg et seq.]

• Coverage: Employer-based group health plans and commercially issued, employer-based group health insurance

• Key provisions

A. Curtails use of exclusions for preexisting conditions

B. Employers and insurers may adopt a maximum, 1-time, 12-month exclusion of illness that was diagnosed or treated within 6 months prior to enrollment, but individuals must be given credit for time covered under another plan

C. No exclusions for pregnancy, newborns, or adopted children

D. Group health plans may not discriminate based on eligibility

E. Medical privacy rules allow tougher state laws governing disclosure of patient medical information

F. Prevents employer from singling out 1 illness for reduced benefits

Mental Health Parity & Addiction Equity Act of 2008

• Covers group health plans with 50 or more employees

• Bars imposing any caps or limitations on mental health or substance abuse disorder benefits that are not applied to medical or surgical benefits

Presidential Memorandum 2009 [74 FR 29,393]

• Extends some benefits to same-sex partners of federal employees (e.g., taking leave to care for sick partners, long-term care insurance available for same-sex partners)

i. Information developed by employer over the years at great expense and kept under tight security (e.g., customer lists)

ii. Not protected when not treated as confidential and secret by employer, when generally available to other employees and known by persons in the trade, or when easily duplicated

iii. Uniform Trade Secrets Act of 1979 adopted by half the states

iv. Remedies: Injunction (must be reasonable in time and scope); some states treat misappropriation of trade secrets as a crime (e.g., MA Gen. Laws ch. 266 §30(4))

E. Agreements to assign invention rights to employer; unenforceable if:

i. Employee did not use employer’s equipment or information;

ii. Employee developed invention on his/her own time; and

iii. Invention does not relate to employer’s business [CA Lab. Code §2870]

Patient Protection & Affordable Care Act of 2010 (PPACA)

• Supreme Court upheld constitutionality of individual mandate under Congress’s taxing power [Nat’l Fed’n of Indep. Bus. v. Sebelius]

• ACA regulations imposing contraceptive mandate on closely held corporations violates Religious Freedom Reformation Act [Burwell v. Hobby Lobby Stores]

Family Medical Leave Act (FMLA)

[29 U.S.C. §§2601–2659]

• Coverage A. Employers of 50 or more employees

B. Both private and public sectors

C. 11th A. immunity: No 11th A. immunity from FMLA claims [NV Dep’t of Human Res. v. Hibbs], but FMLA self-care leave provision is not enforceable against states [Coleman v. MD Court of Appeals]

• Eligibility

A. Must work 1 year (at least 1,250 hours during preceding 12 months)

B. Leave must be for birth of a child; for adoption or foster care of a child; to care for a spouse, child, or parent with serious health condition; or to care for employee’s own serious health condition [§2612(a)(2)]

C. 2008 additions: Family leave in connection with Injured Members of the Armed Forces Act

i. Active duty family leave: Relatives of military personnel get additional FMLA leave

ii. Injured service member leave: Employee entitled up to 26 weeks of leave if family member is injured in the line of duty

D. Secretary of labor’s 2008 FMLA regulations [29 C.F.R. Part 825]:

i. Specifically designated parties may call employee’s health care provider to clarify and authenticate employee’s leave request

ii. Employees required to use employer’s customary call-in procedures, absent emergency

iii. Time spent by employee performing light-duty work does not count against employee’s FMLA leave entitlement

• Terms of leave

A. For up to 12 weeks of unpaid leave during a 12-month period

B. Employer’s duties are to continue to provide health benefits and to reinstate employee to former position [§2614(c)(1)]

i. May be denied if employee ranks in top 10% salary range if necessary to prevent economic injury [§2614(b)]

ii. Employer must notify employee of intent to deny reinstatement

C. Employee’s duties are to provide 30-day notice for foreseeable leave [§2612(e)], and if leave unforeseeable, as much notice as possible

• Enforcement

A. Civil actions by employees (including class actions) or by secretary of labor [§2617]

B. If secretary sues, employee cannot

C. Remedies

i. Damages: Lost wages and benefits

ii. Liquidated damages equal to actual damages recoverable, unless employer acted in good faith

iii. Equitable relief (e.g., reinstatement, back pay)

iv. Attorneys’ fees and costs recoverable only by prevailing employee

D. Statute of limitations: 2 years for nonwillful violations and 3 years for willful violations (employer knew or acted with reckless disregard)

• State Laws: Several statewide paid sick leave measures were enacted

TREATMENT & PROTECTED CLASSES

Discrimination

• Title VII of the Civil Rights Act of 1964 [42 U.S.C. §2000 et seq.]

A. Coverage

i. Both private and public sectors

ii. Private employers with 15 or more employees

iii. All state and local public employers

iv. States enjoy no 11th A. immunity [Fitzpatrick v. Bitzer]

B. Bans race, color, religion, sex, and national origin discrimination in employment

C. Legal frameworks for bringing Title VII claims:

i. Disparate treatment: Intentional discrimination

(a) McDonnell Douglas framework [McDonnell Douglas v. Green]

(1) Plaintiff proves prima facie case

(2) Employer articulates legitimate, nondiscriminatory reason

(3) Plaintiff proves employer’s reason is pretextual

(b) Mixed motive [Price Waterhouse v. Hopkins]

(1) Employer’s defense: Would have taken same action absent discriminatory reason

(2) Plaintiff still entitled to declaratory relief and attorneys’ fees [§2000e-5(g)(2)(B)]

(3) Plaintiff may rely on direct or circumstantial evidence to prevail in a mixedmotive case [Desert Palace, Inc. v. Costa]

(c) Facial discrimination: Employer admits it discriminates

(1) Employer’s defense: Bona fide occupational qualification (BFOQ)

(2) An affirmative action plan

ii. Disparate impact: Unintentional discrimination [Griggs v. Duke Power Co.]

(a) Plaintiff identifies a neutral employment practice that injures a protected class

(b) Employer’s defense: Business necessity

D. Race discrimination

i. BFOQ defense unavailable

ii. Any race may bring suit, even against member of same race

iii. Harassment: Hostile work environment

iv. Affirmative action

(a) Court-ordered [§2000e-5(g)]: Need finding of prior discrimination by employer

(b) Voluntary: Easier at hiring stage; rejected at layoff stage

(c) Before employer can engage in intentional discrimination in order to remedy an unintentional disparate impact, employer must have a strong basis in evidence to believe it will be subject to disparate impact liability if it fails to take the raceconscious discriminatory action [Ricci v. DeStefano]

E. Sex and pregnancy discrimination

i. Sex stereotyping

ii. Pregnancy Discrimination Act (PDA) bars bias based on pregnancy or abortion; employer duty is to treat pregnant employees same as nonpregnant employees; PDA does not apply retroactively [AT&T Corp. v. Hulteen]

iii. Pregnant worker proves disparate treatment under McDonnell-Douglas by showing that she is pregnant, she sought an accommodation, the employer did not accommodate, and the employer accommodated others similarly situated [Young v. UPS]

iv. Sexual harassment

(a) Quid pro quo

(b) Hostile work environment [Meritor Sav. Bank v. Vinson]; need not prove psychological injury [Harris v. Forklift Sys., Inc.]

(1) Harassment by supervisors; discussing scope of supervisor liability rule under Title VII [Vance v. Ball State Univ.]; employer is per se liable for sexual harassment by supervisor when employee suffers tangible employment action [Faragher v. City of Boca Raton]; when employee suffers no tangible employment action, employer defense: [a] That it exercised reasonable care to prevent and correct harassment promptly [b] Employee unreasonably failed to avail self of corrective option [Burlington Indus., Inc. v. Ellerth]

(2) Constructive discharge due to a hostile work environment attributable to a supervisor states a claim under Title VII [PA State Police v. Suders]

(c) Same-sex sexual harassment [Oncale v. Sundowner Offshore Servs., Inc.] versus sexual-orientation harassment

(d) Consent is no defense: Sexual overture must be unwelcome

v. Sex BFOQ; women prison guards posed safety hazard [Dothard v. Rawlinson]

vi. Sex discrimination in pension plans [Los Angeles Dep’t of Water & Power v. Manhart]

vii. Lilly Ledbetter Fair Pay Act of 2009: A biased wage decision occurs each time compensation is paid pursuant to the discriminatory compensation decision

F. National origin

i. Speaking English fluently [Fragante v. City & Cnty. of Honolulu]

ii. English-only laws

iii. Hostile work environment

iv. Height and weight rules assessed under disparate impact analysis

G. Religion [§2000e-(j)]

i. Employee’s prima facie case: Employer cannot make applicant’s religious practice a factor in employment decisions [EEOC v. Abercrombie & Fitch Stores Inc.]; prove practice is religious, prove religious belief is sincerely held, inform employer of conflict, and suffer discriminatory treatment

ii. Most common conflicts: Being required to work on employee’s Sabbath, grooming, and wearing religious garb at work

iii. Employer’s duty of reasonable accommodation

iv. Employer’s defense: Undue burden

(a) Need only prove de minimis burden [Trans World Airlines, Inc. v. Hardison]

(b) Employer must offer reasonable accommodation but need not show that each of employee’s alternatives is undue hardship [Ansonia Bd. of Educ. v. Philbrook]

(c) Ministerial exception bars minister’s termination suit against church [HosannaTabor Evang. Lutheran Church & Sch. v. Equal Emp’t Opportunity Comm’n]

H. Other Title VII defenses

i. Bona fide seniority system [§2000e-2(h)]

ii. Bennett Amendment bars sex-based wage bias claims where gap is authorized under 1 of the 4 defenses of EPA [§2000e-2(h)]

I. Retaliation claims [§704(a)]

i. Adverse employment actions are not confined to those that are job related or occur at the workplace; any employer action that would dissuade a reasonable worker from filing a Title VII claim suffices [Burlington N. & Santa Fe Ry. Co. v. White]; Title VII retaliation claims must be proved by “but-for” causation [University of Texas v. Nassar]

ii. §704(a) bars retaliation against both current and former employees [Robinson v. Shell Oil Co.]

iii. Title VII’s antiretaliation provision covers employee who speaks out about bias not on own initiative but in answering questions [Crawford v. Metro. Gov’t of Nashville]

iv. Title VII recognizes third-party retaliation for persons who did not themselves engage in protected activity [Thompson v. N. Am. Stainless, LP]

v. Constructive discharge claim accrues when employee gives a notice of resignation [Green v. Brennan]

J. Title VII procedure [§706]

i. File charge with EEOC or state agency; candidates denied jobs filed a timely EEOC charge because new violation occurred each time city hired from its eligibility list having disparate impact on African Americans [Lewis v. Chicago]; courts can review if EEOC has fulfilled its Title VII duty to conciliate [Mach Mining, LLC. V. EEOC]

ii. EEOC may sue employer; whether to enforce or quash EEOC subpoena is reviewed for abuse of discretion [McLane Co. Inc. v. EEOC]

iii. Attorney general may sue state [§§2000e-5(f), -6]

iv. All district court proceedings under Title VII are de novo

v. Complaint need not contain specific facts establishing a prima facie case of discrimination; must contain only a short and plain statement of the claim showing that the pleader is entitled to relief [Swierkiewicz v. Sorema N.A.]

K. Title VII remedies

i. Injunctions, reinstatement, and retroactive seniority

ii. Back pay is limited to 2 years before the filing of the charge with the EEOC

iii. Compensatory damages: Front pay is not an element of compensatory damages [Pollard v. E.I. DuPont de Nemours & Co.]

iv. Punitive damages

v. Attorneys’ fees to prevailing parties; attorneys’ fees should rarely include an enhancement for extraordinary performance [Perdue v. Kenny A.]; attorneys’ fees awarded under the Equal Access to Justice Act are payable to litigants, not their attorneys [Astrue v. Ratliff ]; a favorable ruling on merits is not needed for defendant to be a prevailing party when plaintiff’s claim is frivolous [CRST Van Epedited, Inc. v. EEOC]

vi. 1.5 million member class cannot be certified [Wal-Mart Stores v. Dukes]

L. Arbitration in lieu of litigation

i. A provision in a CBA that clearly and unmistakably requires union members to arbitrate ADEA claims is enforceable [14 Penn Plaza LLC v. Pyett]

ii. A general arbitration clause in a CBA does not bar suit under the Americans with Disabilities Act (ADA) unless waiver is clear and unmistakable [Wright v. Universal Mar. Serv. Corp.]

iii. Federal Arbitration Act (FAA) only exempts employment contracts covering transportation workers [Circuit City Stores, Inc. v. Adams]

iv. Under FAA, arbitrator, not court, decides whether arbitration agreement is unconscionable [Rent-A-Center W. v. Jackson]; Stolt-Nielsen S.A. v. Animal Feeds Int’l Corp. opens the door to express waivers of class arbitration under the FAA; arbitrator can order class arbitration [Oxford Health Plans v. Sutter]

v. FAA does not bar EEOC from suing employer for ADA violation, even though employee is bound by arbitration agreement [EEOC v. Waffle House, Inc.]

vi. FAA preempts state law rendering class action waiver unconscionable [AT&T Mobility v. Concepcion]

vii. When waiver of statutory rights is clear in individual contract of employment, employee’s exclusive forum is arbitration [Gilmer v. Interstate/Johnson Lane Corp.]

M. Genetic Information Nondiscrimination Act of 2008 bars employers from requiring or requesting that one undergo a genetic test as a condition of employment; bars bias on basis of “genetic information”; same coverage and remedies as Title VII, but no disparate impact claims allowed

• State antidiscrimination statutes

A. Most modeled on Title VII

B. Expanding grounds beyond Title VII: Antinepotism laws, ban on sexual orientation bias, ban on marital status discrimination, and ban on bias based on weight or appearance

• EPA [29 U.S.C. §216(d)]

A. Coverage: Both private and public employers

i. Shares same basic coverage as FLSA

ii. White-collar exemption under FLSA does not govern EPA [29 C.F.R. §1620.1(a)(1)]

B. Key provisions

i. Employers must pay men and women equal pay for equal work

ii. Plaintiff’s prima facie case: Need not prove intent

(a) Equal work: Employee bears burden of proving that 2 jobs are substantially equal (need not be identical)

[Corning Glass Works v. Brennan]

(b) Four factors: Equal skill (e.g., experience, training, education), equal effort (amount of physical or mental energy), equal responsibility (level of accountability), and similar working conditions (surroundings [e.g., toxic chemicals] and hazards [i.e., risk of injury versus risk of crime])

iii. Antiretaliation provision: Some courts apply Title VII’s McDonnell Douglas burden-shifting framework

C. Employer defenses [§206(d)(1)] when unequal pay is the result of bona fide merit system (skill, speed, accuracy, experience), piece-rate system, seniority system, or differential based on any other factor other than sex

D. Enforcement and remedies

i. Enforcement procedures follow FLSA

(a) Employer liability is similar to FLSA [29 C.F.R. §1620.33]

(b) Except enforcement of EPA was transferred from the Department of Labor to EEOC

(c) Lilly Ledbetter Fair Pay Act of 2009 [Public Law No: 111-2] reset the 180-day statute of limitations for equal pay lawsuits under EPA

ii. Either EEOC, employee, or class may sue for back pay, liquidated damages, and attorneys’ fees (mandatory)

(a) EEOC may seek injunction

(b) Two-year statute of limitations if violation nonwillful; 3 years if violation is willful [29 C.F.R. §1620.33(b)]

iii. Criminal sanctions

(a) $10,000 fine for first offense

(b) Prison for second conviction [29 C.F.R. §1620.338]

iv. Supervisors may be individually liable

v. Employer’s good faith is no defense but renders violation nonwillful

• Comparable worth (a.k.a. pay equity)

A. Definition: Compares wage rates for jobs held mostly by women with jobs held mostly by men that provide equal value to employers

B. Not cognizable under EPA: Jobs are not substantially equal work [Cnty. of Washington v. Gunther]

C. Not cognizable under Title VII: Market force defense [AFSCME v. WA]

D. States: Massachusetts limits inquiries about applicants’ prior salaries; twenty states recognize comparable worth theory for public employment; MN is key state recognizing comparable worth [MN Stat. §§471.991–999]

E. Collective bargaining (unions negotiating over comparable worth)

• ADEA [29 U.S.C. §§621–634]

A. Coverage: Protects employees age 40 and older; bans mandatory retirement

i. Covers both private and public employment

(a) 11th A. immunity: State employees cannot sue state employer in federal court for money damages [Kimel v. FL Bd. of Regents]

(b) Exceptions: Suits by federal government, suits against state agents in their individual capacities, suits for injunctive relief, and suits against cities and counties that are not subdivisions of state; state may waive 11th A. immunity

(c) ADEA allows mandatory retirement of police officers and firefighters

ii. Private-sector employment

(a) Employers with 20 or more employees [§630(b)]

(b) Permits dismissals based on age of highly paid executives [§631(c)]

(c) Permits mandatory retirement of airline pilots at age 60 [W. Airlines v. Criswell]

B. Disparate treatment

i. Disparate treatment claims under ADEA largely modeled on McDonnell Douglas framework under Title VII; plaintiff must prove he/she:

(a) Is at least 40 years old

(b) Is a competent employee

(c) Suffered adverse employment action

(d) Was replaced by younger employee; need not be replaced by someone under 40 years old; even 68-yearold replaced by 65-year-old states claim [O’Connor v. Consol. Coin Caterers Corp.]

(e) “Me, too” evidence testimony by coworkers that they were also discriminated against on basis of age by other supervisors is not subject to a per se rule of admissibility under the ADEA [Sprint/United Mgmt. Co. v. Mendelsohn]

ii. Mixed-motive disparate treatment framework not available under ADEA [Gross v. FBL Fin. Servs., Inc.]

C. Disparate impact: Cognizable under ADEA [Smith v. City of Jackson, MS]

D. Harassment, retaliation, and constructive discharge claims all cognizable under ADEA; absence of explicit antiretaliation provision in federal-sector part of ADEA does not preclude retaliation claims [Gomez-Perez v. Potter]

E. Voluntary affirmative action for older employees permissible; employers may favor older employees over younger ones, even younger ones older than 40 [General Dynamics Land Sys., Inc. v. Cline]

F. Employer defenses

i. BFOQ, business necessity, and bona fide seniority system

ii. Business necessity defense is inapplicable under ADEA [Meacham v. Knolls Atomic Power Labs.]

iii. Reasonable factors other than age (RFOA) [§623(f)(1)]

(a) Most common employer defense under ADEA

(b) Decisions based on years of service: Not per se age based [Hazen Paper Co. v. Biggins]

(c) Employer bears burden of production and persuasion in making RFOA defense [Meacham]

G. Enforcement

i. Enforcement procedures mostly follow FLSA pattern

ii. Employee must give EEOC chance to settle case [§626(b), (c), (d)]

iii. Agreements to arbitrate rather than litigate age bias claims are enforceable [Gilmer v. Interstate-Johnson Lane Corp.]

H. Remedies

i. Back pay, liquidated damages if employer’s act is willful, reinstatement or front pay in lieu of reinstatement, retroactive seniority, attorneys’ fees and costs [§626(b)]

ii. Willful: Employer knows or acts with reckless disregard; no compensatory or punitive damages

• Older Workers’ Benefit Protection Act (OWBPA) [29 U.S.C.

§623(f)(2)(B)(ii)]

A. Benefits: Older employees’ benefits may be less than those for younger employees if cost is the same for both classes [§623(f)(2)(B)(i)]

B. Regulates early retirement programs

C. Regulates when waivers of ADEA rights are enforceable:

i. Waivers must be voluntary and knowing [§623(f)]

ii. Employees who sign releases and receive money do not waive ADEA claims unless waiver satisfies OWBPA requirements [Oubre v. Entergy Operations, Inc.]

D. Differential treatment based on pension status does not per se constitute discrimination “because of” age [KY Ret. Sys. v. EEOC]

• ADA [42 U.S.C. §§12101–12213 (1990)]

A. Coverage: Both private and public employment sectors

i. 11th A. immunity: State employees cannot sue state employers for damages under ADA [Bd. of Trustees of the Univ. of AL v. Garrett]

ii. Same coverage as Title VII

B. Definition of disability

i. A physical or mental impairment that substantially limits 1 or more major life activities [§12102(2)]

(a) “Transitory impairments” not covered by ADA and for which no reasonable accommodation is required, defined as lasting 6 months or less (2008 ADA A.) (b) “Episodic conditions” and conditions in remission are covered if they substantially limit a major life activity (2008 ADA A.)

(c) Impairments are evaluated in their unmitigated state except for eyeglasses and contact lenses (2008 ADA A.) (d) Symptomatic HIV+ employees are disabled per se [Bragdon v. Abbott]

ii. A record of such impairment

iii. Being regarded as having an impairment

iv. Bans bias against employee who associates with disabled people [§12112(b)(4)]

C. Definition of qualified individual

i. Does not include current drug users [§12210(a)]

ii. Employer may screen applicants with history of drug use [29 C.F.R. §1630.3]

iii. Social Security Disability claimant does not per se disqualify employee from ADA protection [Cleveland v. Policy Mgmt. Sys. Corp.]

D. Plaintiff’s prima facie case: ADA explicitly adopts McDonnell Douglas framework [§12112(b)(6)]

E. Preemployment medical exams and inquiries [§12112(d)]

i. Excludes physical agility tests [29 C.F.R. §1630.14(a)]

ii. Permits questions on whether applicant can perform the job

iii. After offer of employment, employer may conduct medical exam of all new employees [§12112(d)(3)]

iv. Voluntary medical exams permitted [§12112(d)(4)]

F. Employer’s duty of reasonable accommodation (making workplace accessible and usable) [§12112(b)(5)(A)]: Job reassignment, modified work schedule; no duty to accommodate nondisabled employee owing to employee’s ties to disabled family member, and employers need not accommodate medical marijuana users in the workplace

G. Employer’s defense is undue hardship [§12112(b)(5)]; factors are cost, employer’s onsite resources, employer’s overall resources, and nature of operation

H. ADA recognizes hostile work environment claims (e.g., Cannice v. Norwest Bank IA N.A.)

I. Antiretaliation provision [§12203]

i. Remedies include compensatory and punitive damages

ii. No right to jury trial [Kramer v. Banc of America Securities, LLC]

J. ADA procedures, enforcement, and remedies are identical to those under Title VII

• Reconstruction Civil Rights Acts

A. §1981

i. Bans only race discrimination in private employment

ii. Discrimination based on ancestry or ethnicity covered as well [Saint Francis Coll. v. Al-Khazraji]

iii. Covers discrimination against whites as well [McDonald v. Santa Fe Trail Transp. Co.]

iv. Plaintiff must prove intent but need not prove racial animus [Ferrill v. Parker Group, Inc.]

v. Retaliation claims: Complaining to employer about dismissal of another is protected activity [CBOCS W. v. Humphries]

vi. Remedies: Uncapped compensatory and punitive damage awards

B. §1983

i. Must establish state action

ii. Plaintiff must prove intent [Washington v. Davis]

iii. Legal vehicle for suing state for constitutional or federal law violations (e.g., 1st A. protects public employees engaging in protected political activity [Heffernan v. City of Paterson, NJ]); public employees cannot be forced by a union they do not wish to join or support to subsidize speech on matters of public concern [Harris v. Quinn]; agency fees violate freedom of association [Janus v. AFSCME]; public employee’s sworn testimony is speech on a matter of public concern [Lane v. Franks]

iv. Both state and federal courts may hear [§1983 claims] v. Government employees may be sued individually and in official capacity for damages [KY v. Graham]

Fair Treatment & Protected Classes (continued )

vi. Remedies: Damages and possibly punitives (but municipalities are immune from punitive), back pay, injury to reputation, and mental distress

C. §1985 supports a claim for 3 types of conspiracies:

i. To block a federal officer from performance of duties

ii. To obstruct justice by intimidation or interference with a party, witness, or juror

iii. To deprive a person (or class) of Equal Protection or rights and privileges Immigration Reform & Control Act [8 U.S.C. §1324b]

• Prohibitions for employers

A. Hiring undocumented aliens

B. Discriminating against any individual based on his/her national origin or citizenship status [§1324(b)(a)(1)(A), (B)]

C. State statute criminalizing undocumented aliens whose work is preempted [AZ v. U.S.]

D. State statute penalizing employers who hire undocumented aliens is not preempted [Chamber of Commerce of the U.S. v. Whiting]

• Employer’s duties

A. Verifying U.S. citizenship [§1324(b)(3)]: U.S. passport, a

certificate of U.S. citizenship, or a certificate of naturalization or a resident alien card

B. Complete verification within 3 business days of hire

C. Preserve verification form for 3 years [§1324(b)(3)]

D. Examine documents to see if reasonably genuine [§1324(b) (1)(A)]

• Penalties: Civil and criminal

• Remedies: Injunctions and back pay; NLRB cannot award back pay to illegal alien unlawfully fired for engaging in union activity [Hoffman Plastic Compounds, Inc. v. NLRB]

Veterans’ Preference Laws

• Federal laws

A. Vietnam-Era Veterans’ Readjustment Act of 1972 [38 U.S.C. §2012]: Government contractors must grant disabled Vietnam-era veterans preference in hiring over other disabled veterans if qualified [§4103A(a)(1)]

B. Vietnam-Era Veterans’ Readjustment Assistance Act: Military reservists attending reserve training over 3 months must be reemployed to former job [Carlson v. NH Dep’t of Safety]

C. Veterans’ Reemployment Rights Act [38 U.S.C. §2021]: Public employers cannot deny reemployment to employees serving reserve duty [§2021(b)(3)]

PUBLIC SECTOR: SPECIFIC RULES & REGULATIONS

• Collective bargaining

A. Influence of NLRA, which excludes public sector [24 U.S.C. §152(2)]

B. Many state statutes governing public-sector collective bargaining are modeled on NLRA (e.g., AK Stat. §23.40.110)

i. Exclusivity of union representation (e.g., MI Stat. §179.67(1))

ii. Defining ULPs (e.g., VT Stat. Ann. tit. 3, §§961, 962)

C. Meet and confer statutes: Employer only owes a duty to listen to union proposals

D. Constitutional protection for public-sector collective bargaining

i. 1st A. and Equal Protection claims usually fail

ii. Freedom of association: Right of public employees to form and join a union [AFSCME v. Woodward]

E. State labor boards conduct union election/adjudicate ULPs

F. Duty to bargain in good faith modeled on NLRA

G. Meet and confer states: No duty to bargain to impasse

• Civil service

A. Classified versus unclassified employees

B. Aim: To substitute a merit system in place of spoils system

C. Protect public employees from politics [Rutan v. Republican Party]

D. Public officers are excluded from civil service protection [15A Am. Jur. 2d, Civil Service §15]

E. Civil service commissions’ functions:

i. Executive or administrative

ii. Promulgate rules and regulations

• Political activity

A. Federal Hatch Act [5 U.S.C. §§1501–1508]

i. To ensure political neutrality in federal employment

ii. Bans partisan political acts

iii. Permits nonpartisan political acts

iv. Penalties range from 30 days unpaid suspension to removal from office

B. State little Hatch Acts

i. All states also limit political acts of state employees

ii. Most modeled on federal Hatch Act

iii. Distinguishes between partisan and nonpartisan elections

• Public pensions

A. Not governed by Employee Retirement Income Security Act

B. Originally treated as gratuities; now, as deferred compensation (e.g., MA G. L. c. 32, §25(5))

C. Right to pension benefits vest upon acceptance of employment

D. Most public pension programs are defined benefit plans (e.g., FL Stat. §121.091)

E. U.S. Constitution Contracts Clause protects public pensions from unilateral alteration or termination

RETIREMENT ISSUES

F. Sex discrimination in public pensions: Equal Protection violation [City of Los Angeles v. Manhart]

• §1983 claims: Saucier v. Katz and Pearson v. Callahan set out 2-step analysis for public officials’ qualified immunity under §1983; defendant is the state or a subdivision of the state; qualified immunity for government contractors [Filarsky v. Delia]

A. Violations of federal laws

B. Constitutional violations i. 1st A.

(a) Free speech: Pickering-Connick-Garcetti test

(1) Is speech of private or public concern [Connick v Myers]? Look at content, form, and context of speech; was speech pursuant to employee’s job duties? If so, employee loses [Garcetti v. Ceballos]

(2) Only if speech touches on matter of public concern, balance employee’s right to speak out on matters of public concern [Pickering v. Bd. of Educ.] with employer’s right to run efficient workplace; don’t need actual disruption; potential disruption sufficient

(b) Freedom of association: Right to join a labor union; laws against police associating with felons; midyear union dues increase requires Hudson notice and nonmembers must affirmatively consent [Knox v. Serv. Emps. Int’l Union]

(c) Free exercise of religion: Religious tests for public office, religious objections to workplace policies, and wearing religious garb at work; Petition Clause: 1st A. retaliation liability under the Petition Clause is limited to matters of public concern [Borough of Duryea v. Guarnieri]

ii. 4th A. protects against unreasonable searches and seizures

(a) Searches of public employee workplace subject to 4th A. [O’Connor v. Ortega]; public employer may search employee’s text messages on city-issued pager if employer has “a legitimate work-related purpose” for inspecting the communications [City of Ontario v. Quon]

(b) Employee’s expectation of privacy determined on caseby-case basis (strip searches versus surveillance of work area); NASA’s background check did not violate federal contract employees’ 4th A. right to informational privacy [NASA v. Nelson]

(c) Balance employee’s privacy interest against public employer’s need for efficient workplace

(d) Drug testing

(1) Preemployment

(2) Routine periodic testing; urinalysis upheld as compelling governmental interest for gun-toting customs employees [Nat’l Treasury Emps. Union v. Von Raab]

Employee Retirement Income Security Act (ERISA)

[29 U.S.C. §§1011–1145]

• Covers only private-sector employers engaged in commerce [29 U.S.C. §1003(a)(1)]

• Excludes public employers, religious entities, plans governing workers’ compensation, unemployment compensation, and disability benefits

• Welfare plans are exempt from participation, vesting, funding, and plan termination rules

• Title I [§§1011–1145] rules governing:

A. Participation

i. ERISA does not require any employee benefits

ii. Employees allowed to participate in pension plan after 1 year of service [§1052]

iii. Types of pensions

(a) Defined benefit: A fixed monthly amount for life based on salary and years of service; may be lost if employer goes bankrupt

(b) Defined contribution: Based on employee and employer contributions; unaffected by employer’s bankruptcy (e.g., 401(k))

(c) Cash balance: Hybrid between defined benefit and defined contribution (under ERISA, treated as defined benefit); based on yearly credits of cash and interest credits; validated by Pension Protection Act of 2006; typically used by employers to switch from defined benefit plans

D. Uniformed Services Employment & Reemployment Rights Act of 1994 [38 U.S.C. §4323(c)(2)]

i. Bans employment discrimination against employees serving in military

ii. Service members returning from military service must notify employer of intent to return [§4312(e)(1)(a)(I)]

iii. Entitled to unbroken pension participation, vesting, and benefits; same seniority, status, and pay as if never left

iv. Employers owe a duty to reasonably accommodate a disability

v. Employer liability under “cat’s paw” theory [Staub v. Proctor Hosp.]

• State veterans’ preference laws

A. Grant veterans hiring preference in public employment by adding points on civil service exams (e.g., CA Gov’t Code §48973)

B. Some states grant vets preference in promotions, seniority, and in avoiding layoffs (e.g., FL Stat. §295.08)

C. Even absolute vet preference does not amount to sex discrimination under Equal Protection despite its disparate impact on women [Feeney v. MA]

(3) Random testing usually upheld where public safety is at stake

(4) Postaccident testing; special needs exception to warrant requirement [Skinner v. Railway Labor Executives Association]

(e) Polygraph and psychological testing

(f) Seven state constitutions (AZ, CA, HI, IL, LA, MO, WA) expressly recognize a constitutional right of privacy in private employment

iii. 5th A. right against self-incrimination

(a) Privilege violated if employee fired for refusing to waive right

(b) Polygraph testing permissible unless results used in criminal proceeding or employee threatened with discipline for refusing to waive privilege

iv. 14th A. Due Process

(a) Procedural

(1) Property interest in job: Can only fire for cause; state law determines if public employee has property interest in job [Perry v. Sindermann]; entitled to notice; hearing is usually pretermination; at-will employees have no property interest in job

(2) Liberty interest: All public employees, even at-will, enjoy liberty interest; injury to reputation not enough: slur must alter employee’s economic status and be stigmatizing [Paul v. Davis]; requires public disclosure; name-clearing hearing is posttermination and no damages or reinstatement

(b) Substantive: When fundamental rights are infringed (e.g., rule against hiring married applicants) and when revoking professional licenses

v. 14th A. Equal Protection: Plaintiff must prove intent

(a) Race discrimination: Strict scrutiny

(b) Affirmative action: Strict scrutiny

(c) Sex discrimination: Intermediate scrutiny

(d) Sexual orientation, age, and disability discrimination: Rational basis analysis [New York City Auth. v. Beazer]

(e) Right to travel: Residency rules [Wardwell v. BOE]; strict scrutiny for interstate, rational basis for intrastate

(f) Equal Protection does not provide a cause of action to a public employee claiming her dismissal was for arbitrary, vindictive, or malicious reasons; “class of one” claims [Engquist v. OR Dep’t of Agric.]

• Bivens actions: Bivens v. Six Unknown Named Agents

A. Suits against federal government

B. For violations of the U.S. Constitution and federal law

C. Federal Public Health Service employees enjoy absolute immunity from constitutional tort claims arising out of the scope of their employment

B. Vesting

i. Benefits must vest (i.e., become nonforfeitable) within set time, usually 5 years, and 100% vesting at 7 years [§1053]

ii. Pensions may not be assigned or alienated (spendthrift provision) [§1056(d)]; exception: qualified domestic relations order (e.g., alimony, child support)

iii. Vested pension benefits are nonforfeitable (contrast with public pensions, which may be forfeited after criminal conviction, such as bribery)

iv. Participants must begin drawing down pension at age 70

v. Retirement Equity Act of 1984 [29 U.S.C. §1052(b)(5)(A)] authorizes up to 5 years of parental leave without losing pension rights

C. Fund management: Plan designates fiduciary and trustee to administer plan [§1102(a)]

D. Fiduciary duties [§1104]: Fiduciaries must act for exclusive purpose of:

i. Providing benefits to participants and beneficiaries

ii. Defraying administrative expenses of plan; fiduciaries cannot attach participant’s assets since remedy is not equitable [Montanile v. Bd. of Trustees of the Nat’l Elevator Indus. Health Benefit Plan]

iii. No conflict of interests [§1104]: Exclusive benefit rule

(a) Duty of loyalty [§1104(1)(A)] (b) Duty of prudence [§1104(1)(B)] (c) Duty of diversification [§1104(1)(C)]

iv. Investment in employer’s stock capped at 10%; exceptions: defined contribution plans [§§1104(a)(2), 1107(b)(1)] and employee stock ownership plans [§1104(a)(2)]

v. Fiduciary liability to restore lost profits, removal [§1109], and penalty of 20% recovered [§1132(1)]

vi. Fiduciary exercises discretionary authority in managing plan assets, renders investment advice for a fee, and enjoys discretionary administrative authority [§1002(21)(A)]; generally, employer is not a fiduciary but acts more like a settlor of a trust [Lockheed v. Spink]

E. Reporting and disclosure

i. Duty to furnish participants with summary plan descriptions [§1022]

ii. Plan must file annual financial reports (identify workers whose benefits have vested and amount of benefits) [§§1023, 1024]

F. Administration and enforcement

i. Federal enforcement

(a) Department of Justice prosecutes criminal violations

(b) Treasury Department regulates plan qualification and deductions

(c) Department of Labor regulates fiduciary conduct, receives reports, and prosecutes civil violations

ii. Plan participants and beneficiaries may bring civil actions for any breaches of Title I [§1132(a)]; suit must be brought within 6 years of fiduciary breach [Tibble v. Edison International]

iii. ERISA claimant entitled to attorneys’ fee if there is “some degree of success on the merits” [Hardt v. Reliance Standard Life Ins. Co.]

(a) Only equitable relief (no damages recoverable); ERISA relief is recoverable even absent detrimental reliance [CIGNA Corp. v. Amara; 131 S.Ct. 1866]

(b) Judicial review of denial of benefits:

(1) Abuse of discretion (used when plan grants fiduciary discretion in allowing benefits)

(2) De novo review (used when plan is silent) [Firestone Tire & Rubber Co. v. Bruch]

(3) ERISA plan administrator’s interpretation is entitled to deference even after reversal for violating ERISA [Conkright v. Frommert]

• Negligence

Employment-Related Torts

A. Negligent hiring

i. Employer vicariously liable for intentional injuries inflicted by employees on customers and clients, as well as other third parties, even when injuries occur outside scope of employment so long as they are foreseeable [Anderson Trucking Serv., Inc. v. Gibson]

ii. Suits by employee for negligent hiring of coworker often barred by workers’ compensation

B. Negligent retention: After hiring employee, employer learns of employee’s violent tendencies and fails to protect public [Doe v. XYC Corp.]

C. Negligent training that results in foreseeable third-party injuries [Madden v. Aldrich]

• Defamation

A. Prima facie case

i. Defamatory statement must be communicated to third party (a) Compelled self-publication: When discharged employee communicates defamatory statement to third party [Lewis v. Equitable Life Assurance Soc’y]; minority view ii. Must be false and must harm employee’s reputation

B. Employer defenses: Qualified privilege (which may be lost if abused) and truth

• Invasion of privacy

A. Intrusion into seclusion: Must be unreasonable or offensive (e.g., urinalysis, polygraph testing); Biometric Privacy Act [740 ILCS 14/1] regulates collection, use, and storage of biometric data for employment purposes

B. Public disclosure of private facts (e.g., disclosure of disciplinary, medical, or personnel records)

C. False light [Harris v. Dist. Bd. of Trustees of Polk Cmty. Coll.]

D. Misappropriation of name or likeness

• Intentional infliction of emotional distress or outrageous conduct

A. Employer conduct so extreme and outrageous that it exceeds all bounds of decency [Rest. 2d Torts §46 (1986)]

B. Outrageous conduct: May be based on recklessness if special relationship exists [Bodewig v. Kmart, Inc.]

• Intentional interference with contractual relations

A. Must involve third party (other than employer and employee; e.g., rival lures away highly skilled employee from current job [Beverly Glen Music, Inc. v. Warner Commc’ns, Inc]

iv. Ban on discrimination or retaliation against employee for exercising ERISA rights (must prove intent) [§1140]

• Title II: Tax laws governing both welfare and pension benefit plans

A. Qualified pension and welfare benefit plans: Contributions are tax-deductible

B. Employees need not report any contributions as income until they receive pension benefits

C. §§1201–1242: Jurisdiction, administration, and enforcement

• Title IV: Pension Benefit Guaranty Corp. (PBGC), plan termination insurance, and multiemployer plans

• Preemption

A. ERISA preempts state laws that relate to any employee benefit plan [§1144(a)]; 2 tests: connection with test and refer to test; state statute requiring health insurers to report payments for database preempted [Gobeille v. Liberty Mutual Insurance]

B. Exceptions

i. Savings Clause: State laws regulating insurance, banking, or securities [§1144(b)(2)(A)]

ii. Qualified domestic relations orders

iii. Criminal laws

C. Deemer Clause: Self-insured plans do not constitute insurance [FMC Corp. v. Holliday]

Old-Age Social Security Pension Benefits

• Credit system A. Need 40 credits (10 years)

B. Employee gains 1 credit for each $970 earnings in a quarter

C. Maximum credits: 4 per year

• Calculating benefits: Based on wages for best-paid 35 years of work

• Benefits based on age

A. Age 62: 25% reduction in benefits

B. Full benefits: Either age 66 or 67, depending on year of birth

C. Benefits increase for each month claimant waits to retire after full retirement age, up to age 70

D. Age 70: Can start receiving benefits without having to retire

• Financing

A. Tax on wages

i. Employee pays 6.2% of first $90,000; employer pays 6.2% ii. Self-employed pays entire 12.4%

B. Remedies: Injunction (only if legal remedy is inadequate) and damages

• Misrepresentation

A. Intentional (i.e., fraud); prima facie case

i. Scienter: Affirmative lie, active concealment, and silence when there is a duty to speak

ii. Material misrepresentation of material fact

iii. Reasonable reliance

iv. Injury

v. Remedies: Damages, rescission, and constructive trust

B. Negligent misrepresentation

C. Innocent misrepresentation: Fraud minus scienter (no consequential damages) Bankruptcy

• Procedures for a company seeking relief from its collective bargaining obligations [11 U.S.C. §1113]

A. After filing for bankruptcy, debtor in possession or trustee must: i. Offer proposal to union, listing modifications of the CBA necessary to permit reorganization

ii. Provide union with all relevant information necessary to assess proposal

iii. During this period, trustee must meet with union and confer in good faith over proposed contract modifications

B. A court may approve rejection of the CBA only if the court finds that:

i. Trustee has satisfied the 3 duties mentioned previously

ii. Union refuses proposal without good cause

iii. Balance of the equities favors rejection of the contract

• Priorities in bankruptcy

A. First priority:

i. Wages earned up to $10,000 but uncollected before bankruptcy (up to 180 days) [§507(a)(4)(A)]

ii. Prepetition claims for back-pay awards by a judicial or NLRB proceeding [§503(b)(1)(A)(ii)]

B. Second priority: Postfiling administrative expenses

i. Wage claims for postbankruptcy work (payable before most other creditors) [§503(b)(1)(A)]

ii. Welfare and pension benefits earned postbankruptcy

C. Third priority:

i. Prepetition vacation pay earned within 90 days before filing up to $2,000 per employee [§507(a)(4)(A)]

ii. Prepetition pension claims incurred within 180 days of filing up to $2,000 per employee

B. Social Security surplus (until 2017) invested in long-term, low-risk U.S. government bonds

• Constitutional issues