People are calling this photo "cool" in other posts. But, this pic can hit you a little differently when you are in the hardwood lumber industry. What's the first thing you thought of?

People are calling this photo "cool" in other posts. But, this pic can hit you a little differently when you are in the hardwood lumber industry. What's the first thing you thought of?

National Hardwood Lumber Association PO Box 34518 • Memphis, TN 38184-0518 901-377-1818 • 901-382-6419 (fax) info@nhla.com • www.nhla.com

To serve NHLA Members engaged in the commerce of North American hardwood lumber by: maintaining order, structure and ethics in the changing global hardwood marketplace; providing unique member services; promoting North American hardwood lumber and advocating the interest of the hardwood community in public/private policy issues; and providing a platform for networking opportunities.

Jon Syre Cascade Hardwood, LLC Chairman

Bucky Pescaglia

Missouri-Pacific Lumber Co., Inc.

Vice Chairman

Jeff Wirkkala

Hardwood Industries, Inc. Past Chairman 2020-2022

NHLA STAFF

Dallin Brooks

Executive Director

Amanda Boutwell

Marketing and Communications Manager

Julia Ganey

Member Relations Manager

John Hester

Director of Membership and Business Development

Renee Hornsby

Director of Marketing & Communications

Jens Lodholm

Data Administration Specialist

Roman Matyushchenko

ITS Instructor and Associate Dean of Education

Carol McElya

Education Services Project Manager

For advertising contact:

John Hester, Director of Membership and Business Development at j.hester@nhla.com or 901-399-7558 or Vicky Simms, Membership Development Manager at v.simms@nhla.com or 901-399-7557

Amber Signaigo

Controller

Vicky Quiñones Simms

Membership Development Manager

Melissa Ellis Smith

Graphic Designer

Dana Spessert

Chief Inspector

MISSION LEADERS

Sam Glidden

GMC Hardwoods, Inc.

Unique Services

Ray White

Harold White Lumber Inc.

Rules

Joe Pryor

Oaks Unlimited Industry Advocacy & Promotion

Rich Solano

Pike Lumber Company, Inc.

Structure

Stephanie VanDystadt

DV Hardwoods, Inc.

Membership & Networking

COMMITTEE CHAIRS

Burt Craig Matson Lumber Company

Membership

Rob Cabral

Upper Canada Forest Products, Ltd.

Promotion & Advocacy

Dennis Mann

Baillie Lumber Co.

Convention

Tom Oiler

Cole Hardwood, Inc.

Inspection Services

Brant Forcey

Forcey Lumber

ITS/Continuing Education

George Swaner

Swaner Hardwood

Communications & Marketing

Joe Snyder

Fitzpatrick & Weller, Inc.

Rules

Cleveland Rocked! By the time you are reading this article, the Cleveland convention will be over. As you all review your experiences from the convention, I assume you will reflect on the new people you met, the old friends you reconnected with, the education you received from the seminars, and the new business you were able to secure. The NHLA Annual Convention is always a highlight of my year, and I hope it was the same for you.

In the Spring of 2020, Brent Stief called me and asked if I would serve as Vice Chairman of the NHLA. Sometimes Canadian humor can be a little different, so I had to clarify that he was serious. After further clarification, I humbly accepted his request to serve as the NHLA Vice Chairman.

I now accept the honor of serving as the Chairman of the NHLA with enthusiasm! I was lucky enough to serve under Jeff Wirkkala for the past two years. I witnessed as he navigated the sometimes-tur bulent waters of Covid, tally discussions, Real American Hardwood Coalition funding, and the need to locate and hire a new NHLA executive director! He led NHLA with passion, class, and efficiency.

Thank you, Jeff, for your service!

Many of you might not know me, so here is a little background. My family homesteaded in the pacific northwest over 100 years ago from Norway. Transitioning through farming, my father invested in timber land and finally found his way into the sawmill business. I worked in the family business beginning in middle school and never left! I started with simple jobs like picking up rocks and sticks in fields. Today, I serve as the President of Cascade Hardwood. My wife, Kerry, and I are raising our two boys, Parker(19) and Ryder(15).

Challenges, hard work, and change are ahead of us all in our specific businesses. In change, there is always opportunity! I am motivated

to embrace the change, adapt to the new environment, and assist Dallin Brooks and NHLA senior staff in enhancing the value of membership for each NHLA member! Both with new ideas and reinventing the old ones!

“To improve is to change; to be perfect is to change often.” — Winston Churchill

The next two years will be exciting and full of change, new ways of supporting the RAHC, investigating ways to adapt our grading school to reach more students, reviewing association consolidation

you to our

Sponsors for making our 125th NHLA Annual Convention & Exhibit Showcase a great success! We are grateful for your support and look forward to another great convention next year in Louisville, Kentucky.

SAVE THE DATE, OCTOBER 4-6, 2023

PINNACLE LEVEL

NWH

ALDER LEVEL

Cascade Hardwood

WALNUT LEVEL

UCS Forest Group

CHERRY LEVEL

Baillie Lumber, Co.

Breeze Dried, Inc.

Cole Hardwood, Inc.

Continental Underwriters, Inc.

DMSi/eLIMBS/TallyExpress

King City Forwarding USA, Inc.

Mayfield Lumber, Co.

Nyle Dry Kilns

Pennsylvania Lumbermens

Mutual Insurance, Co.

SII Dry Kilns

U-C Coatings LLC

USNR

WHITE OAK LEVEL

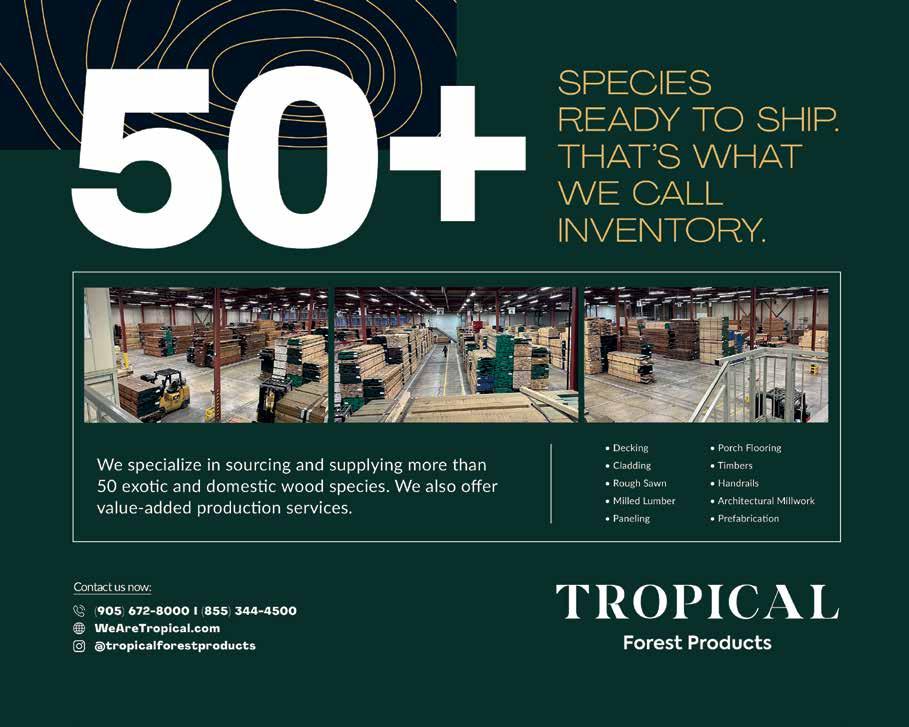

Tropical Forest Products

BIRCH LEVEL

Ressources Lumber, Inc.

MAPLE LEVEL

Abenaki Timber Group

Ally Global Logistics, LLC

BID Group Technologies LTD

BPM Lumber, LLC

Classic American Hardwoods

DV Hardwoods, Inc.

Eagle Machinery & Supply, Inc.

Granite Valley Forest Products

Hardwood Industries Inc.

Hurst Boiler & Welding Co., Inc.

Matson Lumber Co.

MO PAC Lumber Co.

Robinson Lumber Company

TMX Shipping, Co., Inc.

RED OAK LEVEL

A. W. Stiles Contractors, Inc.

Alan McIlvain Co.

Atlanta Hardwood Corp.

Blue Book Services

Carbotech - Autolog

Cersosimo Lumber Co., Inc.

Cooper Machine Co., Inc.

Deer Park Lumber, Inc.

EZLog Company, Inc.

East Ohio Hardwood Lumber Co.

Falcon Lumber, Ltd

Forestry Systems Inc.

Frank Miller Lumber Co., Inc.

HDI

Hartzell Hardwoods, Inc.

Hermitage Hardwood Lumber Sales

Industrial Vision Systems Inc.

Kuehne + Nagel, Inc.

Legacy Wood Products

McClain Forest Products, LLC

Messersmith Manufacturing, Inc.

Oaks Unlimited, Inc.

Pike Lumber Co., Inc.

Quality Hardwoods Ltd.

Swaner Hardwood Co., Inc.

Yoder Lumber Co., Inc.

By DALLIN BROOKS, Executive Director

By DALLIN BROOKS, Executive Director

My mother, God bless her soul, became a substitute teacher when I was a teenager. I had one rule for her. Don’t sub in my class. I thought she would embarrass me. But my friends loved it when she subbed in their classes. Why? Because she was easy. Being a substitute teacher is not easy, no matter how good of a teacher you are. Substitutes are brought in at the last minute without any preparations and are supposed to pick up the curriculum where the teacher left off. Yet they don’t know the teacher’s style, the student’s needs or how they are performing, the buildup the teacher was working towards, or what the teacher will do when they return. So, substitutes just do simple things and keep the class easy, teaching little and holding the class steady until the teacher returns. NHLA is a great lumber mill teacher but is more like a substitute teacher for hardwood users.

If one thing became clear to me at the NHLA meet ings in Cleveland, it was the need for the hardwood industry to come together to teach hardwood users. NHLA is uniquely poised to be the voice and teacher for the hardwood lumber mills and hardwood users across North America because NHLA sets and regulates the hardwood grading Rules (curriculum).

It is great that NHLA hardwood education has focused on lumber mills. The 3-day Intro to Hardwood Lumber Grading course I took last month was beneficial for me in understanding how the Rules affect the value of lumber. The full 8-week hands-on grading course for the Hardwood Lumber Inspection Certification is critical for hardwood mills. So are the kiln drying certifications, yield analysis, and other mill education tools NHLA offers. These need to be taught, and the Inspector Training School is a central focus for the mission of NHLA.

Beyond that, though, NHLA is only a substitute teacher for endusers. We use our grading Rules to step into various classes with-

out preparation, a plan, style, or buildup, nor do we completely understand the student’s needs. We can educate hardwood users by offering learning units for architects and specifiers. We can partner with more universities and allied associations and create content for the rest of the hardwood industry to use and share. But we can’t do it by subbing in and out of all the classrooms; we need to be steady teachers using our curriculum for hardwood users.

The balance between focusing on educating your business staff and your customer’s business is a fine line NHLA needs to walk, but NHLA has offered webinars, seminars, and other training. We have a good curriculum that not only affects the designers, architects, engineers, contractors, and a few consumers, but it can also impact regulators, legislators, and government officials into changing their obscured perception of hardwood.

NHLA staff can create the content, set the plan, and offer a course to hardwood users, one class at a time. Like my friends, we all enjoyed the easy substitute teacher because the expectations were low. Don’t expect NHLA to continue as a substitute; we need to find common ground between our hardwood mill education and hardwood user education so we can be effective teachers for both.

Dallin Brooks NHLA Executive Director | dallin@nhla.com

Shattering the conventional wisdom that the interests of industry and the environment are perpetually divergent, the forest products industry demonstrates that working forests are an environmental and economic “win-win.” While members of the forest products community understand and take pride in this, we must ask, “How can we succeed in earning the trust of the general public who subscribe to conventional wisdom or who believe the myth that cutting trees is bad for our environment?”

I am pleased to report that conservation organizations are stepping forward and providing a great answer to this question. Several conservation organizations actively recognize commercial timber harvesters as invaluable partners in the pursuit of improved habitat and forest health. As they do so, they provide an exceptional testimonial to the environmental benefits of forest management.

In partnership with several conservation groups, including the National Fish and Wildlife Federation and the Ruffed Grouse Society, the Pennsylvania Department of Conservation and Natural Resources (DCNR) Bureau of State Parks announced it is incorporating “Dynamic Forest Restoration Blocks” into its management of state park lands; a way of introducing variation into the landscape to improve habitat and diversity in the forest. Resembling a checkerboard, these non-contiguous harvests will improve forest health and wildlife habitat.

While state forest lands have always been managed as working forests and an indispensable part of their mission, it is difficult to overstate the significance of this shift in policy at the Bureau of State Parks. Previously, state park lands had not been actively managed. The result has been a decline in forest health and habitat and a loss of diversity among plants and animals – especially birds. The driving factor that led the Bureau to shift its policy? Campers at state park campgrounds have complained about the lack of birds near their campsites. The conservation organizations looking to loggers as the solution to bring birds back to our parks is a monumental endorsement of the importance of the forest products industry to improving and maintaining forest health!

This recognition that working forests optimize recreation, wildlife, habitat, and environmental sustainability is important because it

provides independent confirmation that the benefits of the forest products industry extend well beyond the family-sustaining jobs and high-demand commodities our supply chain produces every day. While we love to share the good news about the forest products industry’s positive contributions to habitat and forest health, we are thrilled when credible conservation partners such as the Ruffed Grouse Society are willing to confirm what we are saying, and we are eager to share this example as evidence that our industry’s presence is vital to improving the landscape.

Of course, the positive environmental impact of the forest products industry extends well past the end of the logging job. The products our industry creates are not only of the highest quality that consumers demand; they are also among the greenest building materials on earth and the only materials that can credibly claim to be carbon negative.

As the association conducting statewide advocacy and government affairs on behalf of Pennsylvania’s entire forest products supply chain, the Pennsylvania Forest Products Association (PFPA) works daily to share this information with policymakers in state and local governments to help inform their decisions.

Of course, we must also get these facts in front of consumers –which is why we are so enthusiastic about supporting the Real American Hardwood Coalition. Several years in the making, 2022 brings the unveiling of the campaign’s consumer-oriented website, www.RealAmericanHardwood.com. As a state-level partner with allied organizations across the country, such as NHLA and the Hardwood Federation, we are proud to work as ambassadors on behalf of everyone who depends on healthy, well-managed forests and the high-quality, environmentally friendly products our forests make possible.

Matt Gabler is the executive director of the Pennsylvania Forest Products Association; a membership association focused on state-level advocacy and regulatory affairs for Pennsylvania’s Forest Products Industry. He can be reached at matt@paforestproducts.org

The RossiGroup has been helping customers navigate the global hardwoods industry for almost a century.

We have raised the bar with our new state-of-the-art Emporium Mill and kiln facilities, our long-term supply agreements, and our uniquely personal brand of customer service.

We deliver a world class selection of hardwoods – including the gold standard in cherry – all sorted, milled and dried to tolerances, consistencies, and yields that were not even possible five years ago. Visit us www.rossilumber.com or call 860-632-3505

By DANA COLE, Executive Director of the Hardwood Federation

By DANA COLE, Executive Director of the Hardwood Federation

Every five years the Hardwood Federation focuses its attention on legislative negotiations around legislation commonly known as the Farm Bill, a massive bill that contains much more than just farm related provisions. The current Farm Bill is up for reauthorization in 2023 and, as with any major legislative effort, preparations must begin far in advance. Over the last couple of Farm Bill cycles in 2013 and 2018, the Hardwood Federation team has been an active participant in the Forests in the Farm Bill (FIFB) coalition. This group is comprised of representatives from every facet of the forestry and forest products value chain, including forest landowners, saw mills and the pulp and paper industry. A number of conservation groups are also part of this coalition, which has a proven track record of notching considerable policy victories over the last two cycles.

This year we are once again actively involved in the FIFB, which has just begun to meet and break into subgroups in an effort to refine the policy platform that the coalition will ultimately be taking to

the Hill in the coming months. The HF team is participating in the Markets and Research Workgroup, which will be discussing and fashioning proposals—existing and new—to be considered by the overall group. An ideal outcome for this workgroup would be to identify additional policies in the context of the next Farm Bill that promote demand for U.S. produced hardwood and softwood products. Data have shown for generations now that strong demand for the forest resource is critical for maintaining thriving, healthy forestlands. We intend to push this message as part of our FIFB participation and to support our overall Farm Bill advocacy efforts. Working in parallel to this process, the Hardwood Federation’s Policy Committee met September to discuss proposals that our sector can support for inclusion in this next reauthorization process. Federation staff has also been collecting ideas during various industry meetings and conversations with hardwood leaders. We hope to forge consensus on at least a few items that we can work either as part of the FIFB platform or on our own.

As you know, the Farm Bill reaches well beyond traditional row crop agriculture support systems and federal nutrition programs. This comprehensive measure includes a robust forestry title as well as an energy title that seeks to promote biomass energy we use in our mills. We anticipate a strong push next year to build on provisions in the recently enacted Inflation Reduction Act to promote wood building materials due to their known carbon sequestering capability, forestry as a natural climate solution and biomass energy as an alternative to fossil fuels.

Trade is also an important plank in our Farm Bill advocacy and we will once again be lobbying for full funding for the Market Access (MAP) and Foreign Market Development (FMD) Programs. These two initiatives have long been supported by the Hardwood Federation due to their excellent track record of opening up markets overseas for domestically produced hardwood forest products. In 2018, MAP and FMD were brought together under a new Agriculture Trade Promotion and Facilitation Program with an accompanying new Priority Trade Fund (PTF)—seeded with a $255 million mandatory permanent budgetary baseline annually for all the programs

throughout the life of the current Farm Bill. This consolidation was designed to protect these programs from threats that would arise annually as part of the each year’s appropriations process. The Federation will be working closely with our industry allies that also benefit from these promotion programs to ensure that we secure at least the same level of mandatory funding that they currently enjoy, with the goal of increasing monetary support for these two critical programs.

We will keep you regularly apprised of our progress on hardwood priorities as the 2023 Farm Bill process kicks into full gear. In the meantime, if you have any thoughts on policies that we should be pursuing in the context of this process, please reach out to us. We—your Hardwood Federation team—likes to believe that we know the legislative process and pressure points to touch to get things done in Congress, but you are the experts on your operations and the market challenges you are facing. If there is an idea on your mind that would be helpful to our overall Farm Bill goal of growing demand for domestic hardwood forest products, we would love to hear from you. www.hardwoodfederation.com

"We anticipate a strong push next year to build on provisions in the recently enacted Inflation Reduction Act to promote wood building materials due to their known carbon sequestering capability, forestry as a natural climate solution and biomass energy as an alternative to fossil fuels."

Like any successful family business, Ally Global Logistics has deep roots. In 1984, Cindra and Stephen J. Zambo started a logistics company and became the first freight forwarder specializing in forest products. As a result, their son, Stephen A. Zambo (aka Steve), spent his childhood growing up around forest products and logistics. With that background, it is no surprise that in 2011 Steve and his dad decided to start a new company, taking the good things they had learned in the past and building upon them to make a better company with a fresh approach. They called the company Ally Global Logistics because it is an ally for their customers. Operationally, the company started in 2013, focusing solely on providing export services to the Forest Products Industry. In 2020 they added a domestic line to their existing export business, transporting about 30,000 containers annually.

The company’s president, Steve Zambo, is proud of Ally Global’s deep roots, saying, “We are excited to hit a major milestone in 2023. Next September, we will have been in business for ten years. A decade! It is very exciting. Most businesses don’t make it past a year. Even fewer make it past five years. So, we are looking forward to celebrating our tenth anniversary! We would not be able to get to

this point without our clients or our team. They are what makes the company truly special.”

Before Ally Global reaches that milestone, they have a lot of big moves coming up. Ally Global will open a reload transport facility in Pennsylvania by the end of the year. Steve said, “The Pennsylvania

facility is 50,000 square feet and will help lumber companies move their product more effectively. This is a different approach compared to what most of our competitors are doing. We are in the process of building proprietary software with real-time data allowing our customers to see where their shipment is at any given time versus having to ask for a status update, ETA, or wondering how their documents are progressing. It will be totally different from a transparency and visibility standpoint compared to what most of the industry has been accustomed to utilizing. We aim to become an extension of our clients business, so they can focus on what matters, selling lumber.”

Ally Global doesn’t solely focus on new technology and company growth. They also bring their staff together with a charity program they call Ally Cares. Steve said, “Ally Cares is an important program to us. With Ally Cares, we aren’t just moving freight. We are giving back by setting $1 aside for every load we move. It adds up quickly. Each year, our staff as a whole submits what charities they believe should receive the donation. And then, as a company, we all put in blind votes, and the money raised is donated to the charity that wins the popular vote. Our initial goal was to raise $100,000 in five years. And as it stands today, we are on pace to raise $100,000 within just three years. In 2022, we’ve donated to Wounded Warriors, Boston Children’s Hospital, and Doctors Without Borders.”

The list of services Ally Global supplies is long. They offer domestic, export and import shipping as well as drayage, banking, insurance, and warehousing. They can do ocean shipping, fumigation and offer a suite of documentation services. The list

“Our membership with NHLA is important to us because we are invested in the lumber industry, and we are invested in the success of the companies within the industry. Our NHLA membership isn’t just something nice to be a part of; it is crucial to our success. Our customers are NHLA members, and we support them by supporting NHLA. ”

goes on, but the key takeaway is that if you need it, Ally Global can provide it. “We’ve positioned ourselves as a full end to end service provider for the forest products market. We view lumber and logs as a vital industry to our nation and the world. Aligning ourselves with the industry helps to ensure future success.”

Steve is an advocate for the hardwood lumber industry, saying, “Our membership with NHLA is important to us because we are invested in the lumber industry, and we are invested in the success of the companies within the industry. Our NHLA membership isn’t just something nice to be a part of; it is crucial to our success. Our customers are NHLA members, and we support them by supporting NHLA. Plus, NHLA Conventions are an absolutely awesome place to meet many of our clients that we might not be able to see throughout the year. We sponsor and exhibit every year because it provides great exposure and supports our customers. We would never stop sponsoring or exhibiting.”

Looking toward the future, Steve is enthusiastic, “We’re going to be offering a software platform that, quite frankly, no one else has because it is custom made. This platform is going to help a lot of organizations to better manage the way that they handle their freight regardless of market conditions. More importantly it is going to help manage the flow of information compared to today’s standards.”

You can reach out to Ally Global Logistics online at www.allygloballogistics.com, via email at sales@allygloballogistics.com, or by phone at (781) 544-3970.

THE PAST FEW YEARS HAVE BROUGHT

UNPRECEDENTED CHANGE TO THE U.S. HARDWOOD INDUSTRY. A trade war with our largest market, COVID shutdowns, supply chain disruptions, an unexpected boom in construction and home renovation markets, spiking energy costs, global inflation, and now a land war in Europe engulfing two major hardwood-producing nations have all conspired to create new challenges as well as opportunities for U.S. exporters. Indeed, despite significant headwinds in the global economy, the first half of 2022 saw U.S. hardwood lumber exports grow by 12% in volume and 13% in value over the same period in 2021, nearly returning to the pre-trade war levels of 2018. U.S. hardwood logs and veneer were also up by 13% and 8% by value. (Graph #1) Whether that momentum can be carried into the second half of the year remains to be seen, but early indications point to many bumps in the road.

China remains the largest single market for U.S. hardwood exporters. Through June, lumber exports grew 7% by volume and 20% by value over the same period in 2021 despite a significant slow-down in GDP growth, a collapsing housing market, and repeated lockdowns stemming from the country’s “Zero COVID” policy. (Graph #2) Nevertheless, even with the increase, the total volume for the half year was just over 602,000 cubic meters, approximately half of the pre-trade-war level of 2018. Moving forward, we have likely seen the end of China’s rapid growth, and the next few years are expected to prove challenging for the Chinese economy; as the housing market—one of the primary drivers of growth over the past two decades—softens significantly and a growing debt crisis threatens future infrastructure investment.

E.U.

After decades of declining or stagnant shipments to the E.U., we have seen consistent and significant growth in U.S. hardwood lumber exports to Europe for the past two years. In fact, through the first six months of the year, shipments to the E.U. 27 plus the U.K. increased by over 47% to nearly 270,000 cubic meters.

(Graph #3) All four main markets saw substantial increases, particularly Italy, which saw an 81% jump from the same period in 2021. Historically, Italy has strong links to hardwood supplies from Eastern Europe and Russia, so the current upheaval in supply is driving manufacturers to seek alternative suppliers, and six-month totals for 2022 already exceed the full year 2021 exports for both red and white oak. Nevertheless, the continuing war in the Ukraine and the prospect of skyrocketing energy prices across Europe will likely put a damper on demand for the second half of the year as European consumers cut back on spending.

Perhaps no country stands to gain more from the trade tensions between the U.S. and China than Mexico. Supply chain woes and the growth of “nearshoring” make the country, with its unfettered access to the U.S. market, an attractive magnet for manufacturers seeking to remain close to the U.S. market. After growing by more

than 40% in 2021, U.S. hardwood lumber exports to Mexico increased an additional 27% for the first six months of 2022. (Graph #4) A recent visit by AHEC to the TecnoMueble furniture show in Guadalajara provided strong evidence of this renewed global interest in Mexico as Chinese and Taiwanese companies were in attendance, and the Malaysian Timber Council had a booth at the show for the first time in memory.

Despite a solid start to the year, the six-month export statistics to Southeast Asia are a mixed bag. As a region, January to June 2022 were the strongest on record despite a severe slow-down in exports to Vietnam, the largest market in the region, beginning in the summer. This decline is largely a result of declining demand for furniture in the U.S. and Europe, as well as supply chain issues and labor market disruptions resulting from the pandemic. For the first six months of the year, exports to Vietnam were down by 10% by value but actually increased 9% by volume. (Graph #5) This was not only the result of a higher overall lumber process relative to 2021 but also reflects a change in Vietnam’s species mix with higher volumes of red and white oak, alder, and walnut, complementing the traditional yellow poplar business. Much of the decline in volume to Vietnam was offset by gains in other Southeast Asian

markets as Thailand saw a 54% increase, the Philippines 39%, Malaysia 16%, and Indonesia 9%.

Buoyed by a robust first quarter, Japan’s imports of American hardwood lumber grew substantially in the first half of the year, with shipments up 32% by volume and 42% by value over the same period in 2021. The ban on Russian log exports at the beginning of the year and the embargo following that country’s invasion of Ukraine have created uncertainty in the Japanese market as manufacturers scramble to find alternative supplies. The relatively high process of quarter-sawn white oak—a staple in the Japanese market—also has traders looking to expand the species mix, and walnut, red oak, and hickory have all seen substantial increases. A slowing housing market in the second half of the year is likely to dampen Japanese demand, but the long-term outlook remains positive.

The total volume of U.S. hardwood lumber shipped to India during the first six months of the year increased by 15% to 3,791 m3, while the value rose by 36% to USD 2.7 million. (Graph #6) Shipments of hickory, white oak, and red oak were all up significantly com-

pared to the same period in 2021. Albeit very low for a country the size of India, the volume of U.S. hardwoods shipped to the market has seen sustained growth for the past three years, and all signs point to a continuation of this trend. India is set to remain the fastest-growing major economy this year, with GDP growth forecast at somewhere between 7.2 and 7.5%. While much of the rest of the world is suffering from the dual impacts of pandemicinduced economic turmoil and energy price hikes due to the Russian invasion of Ukraine, India remains set on a course of economic buoyancy.

It is becoming increasingly common to see wood furniture and handicrafts on sale around the world with a ‘Made in India’ label. Over the past two years or so, growth in the Indian furniture and handicrafts sector has been exponential, with exports seeing a year-on-year increase for the past decade. Consequently, the level of interest in American hardwoods from Indian manufacturers has risen very steeply in recent years, especially in the past two years or so. This trend has continued through the first half of 2022, and AHEC is now receiving weekly inquiries from Indian furniture, handicraft, and door manufacturers about sourcing American hardwoods. While the country’s wood furniture industry is thriving and expanding, with production increasing for both export and the

SAW U.S. HARDWOOD LUMBER EXPORTS GROW BY 12% IN VOLUME AND 13% IN VALUE OVER THE SAME PERIOD IN 2021, NEARLY RETURNING TO THE PRE-TRADE WAR LEVELS OF 2018.

domestic market, the availability of locally-sourced hardwoods is in terminal decline. At the same time, the taste for Western designs and surfaces is growing.

As a whole, exports of U.S. hardwoods to the MENA region (including Pakistan) grew by 9% to 46,721 m3, during the first half of this year, compared to the same period in 2021. This growth was almost entirely driven by a rise in exports to just two markets – Turkey and the United Arab Emirates. In the UAE, the rise in demand was almost entirely due to the big importers restocking after a long and very cautious previous year. Economic uncertainty in the UAE has waned this year, with fuel price increases actually benefitting the oil and gas-rich Gulf nations. At the same time, the UAE’s strong

ties with Russia have led to an influx of Russians and Russian money in recent months, further helping to fuel the economy.

The significant rise (65% year-on-year to 11,084 m3) in the volume of exports of American hardwoods to Turkey during the January to June period seems to be at odds with the country’s economic crisis, which is only getting worse. However, demand for U.S. hardwoods (notably ash, tulipwood, and red oak) is primarily driven by a handful of TMT producers, while demand for white oak is driven by just a few solid wood furniture manufacturers. At the same time, there has been a shift of some furniture manufacturing to Turkey from China as a direct result of the COVID pandemic and associated supply issues.

Kendrick Forest Products is a member of the National Hardwood Lumber Association’s (NHLA) Facility Grade Certification Program. This is a voluntary quality assurance program where our lumber is re-inspected by the NHLA National Inspector 2-3 times per year to ensure we are representing the lumber properly. It is with a great deal of pride that I can inform you Cory Christen passed his test with flying colors. He was well within what the NHLA allows. Great job, Cory! This certification gives us a competitive advantage when selling in the marketplace as new customers know that we honor the NHLA grades and system. Most mills are not certified. In fact, Kendrick is the only mill in Iowa with this designation and one of only two in the American Walnut Manufacturers Association.

Kevin and the NHLA have been a great resource for continuing to build into our team. We look forward to Kevin coming back in the summer.”

— Greg Blomberg, General Manager at Kendrick Forest Products

The National Hardwood Lumber Association was established in 1898 to create a uniform way to inspect hardwood lumber, ease trade, and lessen confusion. The Hardwood Grading Rules that were created then were much different than they are today.

regular basis. In most cases, the answer is typically found in historical documents, such as the former NHLA Rules Books. Based on my research of the former NHLA Rules Books, I can only assume that the “Defect Limitations” were derived from what was formerly not considered a defect when defect grading.

An example of Firsts and Seconds from the 1931 Rules Book, page 17:

“38. Heart center, where the extent or damage does not exceed the equivalent if standard defects allowed, will be admitted.

39. Six inches of straight split in one end, or its equivalent in both ends, will not be considered a defect.

40. Splits in excess of the equivalent of two standard defects will not be admitted.

The original NHLA Rules Book was adopted on May 6, 1898. The Rules were based on the amount and size of defects for all Standard Grades and all species.

By 1932, the NHLA Rules Book dramatically differed from the proceeding Rules Books. The “Clear Cutting Method” had been incorporated into the Standard Grades, including Walnut. The Walnut 6’ and 7’ defect grading was not included in the Rules Book until 1954, and then it was flagged as “When Specified.”

Anyone familiar with Walnut 6’ and 7’ FAS knows about defect grading. The defects are limited in quantity and size, with some being considered as ‘not defects’ when they are smaller and fall within the parameters. There is no yield requirement when grading on a defect basis, which can pose issues with predicting yield in manufacturing products.

The purpose of the beforementioned Rules transformations is that our students and others in our industry question the “Defect Limitations” for FAS, F1F, Selects and 1 Common on a somewhat

42. Wane along the edges not exceeding in the aggregate one-sixth the length if the piece, or its equivalent at one end or both ends, not exceeding in thickness one-half the thickness of the piece, and not exceeding in width as shown in the following table shall not be considered a defect.”

As you can see from the above, the “Defect Limitations” had their roots in the original inspection rules. I believe they are there to allow defects on the boards yet keep them in check so as not to allow defects to dominate the higher grades of lumber. For example, without defect limitations, a 6” wide by 12’ long board could have 1’ of wane across the face on both ends, and you would still have an FAS board!

Do you have questions about the Rules? Chief Inspector Dana Spessert can be reached by email at d.spessert@nhla.com or by phone at 901-399-7551.

Crossville Hardwoods in TN is seeking a Lumber Procurement Manager. The Lumber Procurement Manager will develop, implement, and maintain the strategy and results of lumber procurement. Will understand and align business operations and lumber procurement as he/she executes their role to help meet financial and operational objectives.

Skills & Experience Required

• Proven leadership skills and lumber industry experience

• Excellent communication and interpersonal skills

• Proficient with Microsoft business applications software (Excel, Word, PowerPoint)

• Possess a solid understanding of wood procurement

• Possess strong analytical capabilities

• Self-Starter

• High sense of urgency

• Continuous improvement mindset

• Bachelor's degree, ideally in business, supply chain, or related areas (Lumber)

• 5+ years of experience in the Lumber Industry / mill-oriented atmosphere

• NHLA Lumber Grader certified

• Experienced in negotiating prices, developing sources, and purchasing material

• Demonstrated knowledge of lumber practices

Salary & Benefits

• Pay: Negotiable - DOE

• 401(k)

• Dental Insurance

• Health insurance

• Vision insurance

• Paid Time Off

How to Apply

Send your resume to: sindic@somersetwood.com

Crossville Hardwoods, Inc.

656 Interstate Dr. | Crossville, Tennessee 38555 931-456-1802

Northcentral Technical College (NTC) is seeking a knowledgeable, energetic, professional full-time faculty member to teach in its Associate Degree Wood Science Program. This unique two-year program is taught out of NTC’s beautiful, one-of-a-kind 27,000-square-foot Wood Technology Center of Excellence. This bright and modern facility houses state-of-the-art equipment used for both the Associate Degree program as well as several certificates and Continuing Education classes. Due to the unique learning environment, businesses send students from around the country to NTC for this exceptional training. Located in Antigo, Wisconsin, the area offers many lakes and expansive forested areas featuring numerous outdoor activities including hunting, fishing, hiking, golfing, camping, skiing, snowshoeing, and biking. With a population of around 7,700, the city of Antigo has a small town feel, yet is large enough to meet your daily needs with multiple dining and retail businesses, and it is only 40 minutes from Wausau.

• Must have a minimum of two years (4,000 hours) full-time (or equivalent) demonstrated relevant wood industry occupational experience, one of which must be within the last five years.

• Bachelor’s degree in Wood Science and Technology or related field, or an Associate’s degree with the agreement to obtain a Bachelor’s degree upon hire.

• Willing/able to meet Wisconsin Technical College System (WTCS) and Higher Learning Commission (HLC) requirements, accreditation standards, and/or licensing standards where applicable.

• Experience in teaching and working with diverse populations preferred.

Salary & Benefits

• Health, Dental, and Vision Insurance

• Life and Long-Term Disability Insurance

• Short Term Disability

• Wisconsin Retirement System

• 403(b) Pre-Tax Retirement Savings

• 457 Deferred Compensation Plan (Pre-tax & Roth Option)

• 529 Plan

• The Standard -Accident, Critical Illness (voluntary)

• Paid Holidays & Sick Leave

• Professional Development

How to Apply

Send your resume to: katrina@ajdforestproducts.com

Northcentral Technical College

1000 W Campus Dr. | Wausau, WI 54401 715-803-1483

Oct. 17-21

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Wood-Mizer, LLC

Location: Indianapolis, IN

Instructor: Kevin Evilsizer, National Inspector

Nov. 15-17

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Cumberland Mountain State Park

Location: Crossville, TN

Instructor: Benji Richards, ITS Instructor

Nov. 28-Dec. 9

Inspector Training School

Online Training Program MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, ITS Instructor

Dec. 5-7

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Cherokee Wood Products, Inc. Location: Upland, CA

Instructor: Dana Spessert, NHLA Chief Inspector

Jan. 9-Mar. 3

Inspector Training School 201st Class

Traditional 8-week hands-on training to achieve the certificate of completion in Hardwood Lumber Inspection.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

March 20-31

Inspector Training School

Online Training Program MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, ITS Instructor

“I enjoyed and was extremely impressed with our 3-day Intro to Grading Hardwood Lumber class. The class was very informative and truly gave me a different perspective on what’s involved in the hardwood lumber grading process. Roman did an awesome job as our instructor. Everyone at NHLA welcomed us and treated us as a part of their family. I applaud everybody involved for a job well done.”

Frank Hooks

April 24-26

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

Aug. 21- Sept. 1

Inspector Training School

Online Training Program MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, ITS Instructor

Sept. 6-8

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

Sept. 25- Nov. 17

Inspector Training School

203rd Class

Traditional 8-week hands-on training to achieve the certificate of completion in Hardwood Lumber Inspection.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

Nov. 27-Dec. 8

Inspector Training School

Online Training Program MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study

Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, ITS Instructor

Hardwood Markets Matter and it is important for NHLA to share market details of the entire Hardwood Industry. We appreciate the support of allied associations and publishers in gathering and sharing this important market information that can help you understand the complete hardwood industry picture.

Since peaking in mid-June, the Hardwood Review KD price index has fallen 8%, and prevailing prices for a number of items have fallen 20% or more. In recent weeks, the downturn has started to impact Ash, leaving Yellow Birch as the only species relatively unimpacted by the market shift. Despite the sharp declines, the index currently sits 17% higher than the previous market peak in July 2018, at the start of the U.S.-China trade war, and even the items that have fallen the furthest remain well above historic norms. The prevailing price for Appalachian KD 4/4 FAS/1F White Oak has come down 18% since February, for example, but is still two-thirds higher than the average price during the three years prior to the current runup. Similarly, even after a year of declines, Appalachian KD 4/4 FAS/1F Poplar is still priced 31% higher than its maximum price in the three years prior to the runup. North Central KD 4/4 Sel/Btr #1&2 White Hard Maple never exceeded $1,900/MBF gross tally from October 2017 through October 2020, but has now been above $3,200 every week for 13 months, and was still rising as recently as late-May. All in all, this market runup was the largest and quickest ever recorded, and lasted at peak levels for many months longer than any other previous upcycle

More gradual, sustained increases in hardwood lumber prices are typically driven by rising demand, such as in the early 2000s when China needed substantially more lumber to supply its expanding manufacturing sector, and again during the three-year expansion in Chinese demand ahead of the 2018 trade war. The steep price spikes that started in October 2020, however, were almost exclusively the result of supply shortages. Low log decks, labor issues and shipping disruptions limited hardwood supplies. Accordingly, the recent return of abundant lumber supplies—coupled with a rather sudden downturn in demand associated with inflation and slower housing markets—is responsible for the current price declines.

www.ahec.org

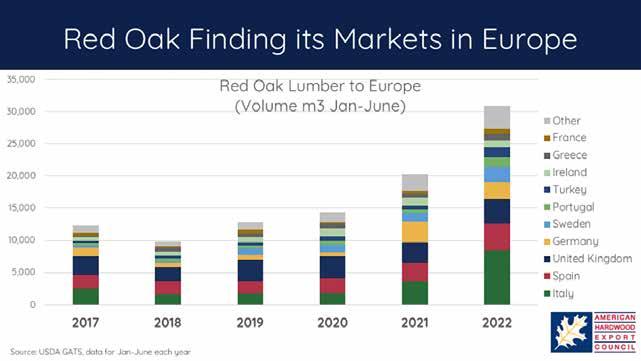

By volume, exports of American red oak lumber to Europe increased by more than 50% through the first half of 2022 compared to last year. This represents an increase of 215% since 2018, and a value of over $27 million for the first half of this year alone. Italy has quickly become the largest market for red oak in Europe, importing 132% more of the species in 2022 for a volume of 8,750m3 in the first half of the year (value of $7.3 million). In just six months, Italy has purchased as much red oak as they did for all of 2021. Encouragingly, this growth isn’t coming at the expense of our white oak exports, which have also increased by over 50% to Europe through the first half of 2022. Increased awareness and understanding of American red oak, an abundant species in our industry, combined

with limited supply of competing timber have created market conditions that can further boost adoption of this species in Europe.

AHEC is actively developing new markets for American hardwoods, including promoting red oak to European designers, furniture makers, and specifiers. Our latest project, Perpetuum Mobile, is an exhibition with Italian Designer Benedetta Tagliabue at Milan Design Week that recreates the imaginative designs of her late husband and partner, acclaimed Spanish architect Enric Miralles. Projects like this keep red oak front of mind for the design community who has the ability to specify the material in future project lines.

Peak sawmill output (especially wood crosstie production) usually hits stride in the three month period in August to October. Even in “wet” years, the seasonality of spring/early summer rains fade as we approach late summer and the mills crank out high wood volume due to high log availability. Mills can get long-term debt paid off during this period and are also equipped to buy winter logs at appreciable quantities to keep running during the winter rains. However, railroads need ties year-round, and the days of the feast or famine in terms of purchase order issue and withdraw are categorically behind us. Does that appeal enough to sawmills to re-think their output slate to produce ties year-round regardless of other hardwood product/commodity pressures?

To qualify, we need to consider the railroad purchasing methodology of today versus the railroads we used to know that would stop an open order overnight. One disclaimer, the seasonality of the railroad is typically isolated to working conditions in the mountain regions, so most of that track maintenance there gets done in the summer; however, not all railroads bear that mountain winter burden, and ALL railroads have track they can maintain year-round. Railroads will buy ties year-round to help flatten the peak/valley paradigm to avoid shortfalls, and steady demand will theoretically prevail, if mills can allot a certain amount of production to ties year-round for sake of known business and strategic partnership formation.

As accounting and finance majors climb the corporate ladders, due process will follow, but some education/insight (for those corporate personnel) into the forest products world can assist proper production/ demand alignment that can be mutually beneficial. Railroad purchasers are increasingly being scrutinized on every dollar that is spent, how many people they can staff, and what to keep “in-house” and what to “outsource”. Providing railroad personnel with knowledge of seasonal tie production awareness and portraying a “steady as she goes” M.O. can help empower them plus build railroad/mill loyalty at the same time. This coalescence is a real possibility and should be consider on both sides –sawmills and railroads. The Railway Tie Association provides a platform for all entities in the wood tie industry and helps educate all along the way – with your help, we look forward to keeping everyone on track for many years to come.

REGARDING YOUR ABOVE ANSWER, PLEASE PROVIDE CONTEXT FOR MARKET, WEATHER OR OTHER CONDITIONS.

Minnesota, Iowa, Wisconsin, Michigan, N Indiana, N Illinois: High grade lumber markets are going lower in price and demand. Pallet cants remain strong. Weather has been mild and good for logging.

North & South Carolina: Most lumber markets have collapsed.

West Virginia: Lumber markets have softened up, price decreases and less volume. Pallet mills are close to target inventory. Some areas got hit hard with substantial rain and it affected their log decks, but most had enough logs that didn't effect production.

Virginia: Flooring Oak, pallets, and poplar are slowing down. Ties are starting to be looked at again.

Pennsylvania: Flooring and grade lumber prices are going lower. Timber mats for gas market is getting better in price and demand.

New England 1: Fuel prices and labor shortages have loggers struggling to stay in business. Weather conditions have been good for logging. Tie production seems to be improving. Sawmills are trying to keep log inventories in check due to not knowing what the lumber markets are going to do next. Pallet prices are holding for now, but demand seems to be dropping.

MIDSOUTH

SE Missouri, N Arkansas: About the same as last month and got some rain in august so badly needed. But logs are moving very well and cutting all that they can right now.

E Texas, NW Louisiana: August was wetter than normal and this has slowed logs down a little but they are still moving so we will keep our fingers crossed.

Central & S Arkansas, NW Louisiana: Mills are having problems moving hardwood lumber so some mills are cutting more pine.

www.hmr.com

The HMR Demand Index (HDI) is a feature in HMR Executive® that illustrates monthly trends in reported demand from 10 major domestic markets for hardwood lumber. Components of the index are color coded with various shades of blue when demand is slow, they transition to gray when demand is fair, and then to light red and deep red when demand moves from good to strong.

Cabinets

Residential Flrg

Truck Trailer Flrg

Upholst. Furniture

Wood Furniture

Moulding/Millwork

Wood Components

Board Road

Pallets

Railroad Ties

It’s no secret, the hardwood industry has been losing market share to products that look like wood, but have none of the natural benefits or authentic attributes of Real American Hardwood™ products. In order to recapture market share and improve industry stability, hardwood organizations united to form the Real American Hardwood Coalition.

The goal is to develop a national consumer promotion campaign on a scale that’s never been seen before. And a lot has been accomplished in a short period of time—including the completion of an extensive consumer research initiative, establishing brand guidelines, registering trademarks, and launching social media profiles.

The next steps will have the largest impact on the industry and require buy-in from all industry stakeholders. The Coalition is preparing to launch a comprehensive promotion campaign—including a consumer-oriented website, in-store promotion at top big box stores, a broad media relations campaign, social media influencer partnerships, print and web advertising, and much more.

Moving the campaign forward and expanding its reach will take the support of the entire industry—for the benefit of the entire industry.

■ Make a voluntary contribution to help fund the consumer promotion campaign.

■ Use the Real American Hardwood logo on your sales and marketing communications, facilities and vehicles, products, and website.

■ Follow @RealAmericanHardwood on Instagram and Facebook, and tag #RealAmericanHardwood in your social media posts.