October

THE VOICE OF THE HARDWOOD INDUSTRY

HARDWOOD MATTERS

2023

Hardwood Exports Continue to be Battered by Forces Well Beyond our Control

US

VISIT DMSi.COM TO LEARN MORE

TIMBER, LOGGING & LUMBER Handheld & desktop software HARDWOOD END TALLIES Mobile app with A.I. DISTRIBUTION AND RETAIL Inventory and order management

ONE SOFTWARE PARTNER FROM TIMBER TO CONSUMER

EXECUTIVE COMMITTEE

Jon Syre, Chairman Cascade Hardwood, LLC

Bucky Pescaglia, Vice Chairman Missouri-Pacific Lumber Co., Inc.

Jeff Wirkkala, Past Chairman 2020-2022 Hardwood Industries, Inc.

MISSION LEADERS

Sam Glidden, Unique Services GMC Hardwoods, Inc.

Ray White, Rules Harold White Lumber Inc.

Joe Pryor, Industry Advocacy & Promotion Oaks Unlimited

Rich Solano, Structure Pike Lumber Company, Inc.

Stephanie VanDystadt, Membership & Networking DV Hardwoods, Inc.

COMMITTEE CHAIRS

Burt Craig, Membership & Networking Matson Lumber Company

Rob Cabral, Market Impacts Upper Canada Forest Products, Ltd.

Dennis Mann, Convention Baillie Lumber Co.

Tom Oiler, Lumber Services Cole Hardwood, Inc.

Brant Forcey, Inspector Training School Forcey Lumber Company

George Swaner, Education Services Swaner Hardwood Co., Inc.

Sam Glidden, Rules GMC Hardwoods, Inc.

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 1 CONTENTS October 2023 • Issue 249 features 27 US Hardwood Exports Continue to be Battered by Forces Well Beyond our Control by Mike Snow, Executive Director AHEC departments 10 One Common Ground Full-Time For You by Dallin Brooks, Executive Director 12 Inside NHLA 14 Education Spotlight NHLA Celebrates Milestone with Introduction of Spanish-language Hardwood Lumber Grading Course 16 Allied Angle From the Real American Hardwood Board of Directors 18 Membership Matters The Importance of Unity and Collaboration by John Hester, Chief Development Officer 19 Member of the Month 20 Member Spotlight Breeze Dried 22 Legislative Log New Study Questions Wood Product Sustainability by Dana Cole Executive Director Hardwood Federation 36 Rules Corner The Grading Rules Are a Member Benefit by Dana Spessert, NHLA Chief Inspector WHAT'S

Follow us 14 22 27 reader services 6 Chairman’s Message 38 Educational Calendar 40 NHLA Job Board 42 Market Trends

INSIDE

HARDWOOD MATTERS

THE VOICE OF THE HARDWOOD INDUSTRY

National Hardwood Lumber Association PO Box 34518 • Memphis, TN 38184-0518 901-377-1818 • 901-382-6419 (fax) info@nhla.com • www.nhla.com

THE MISSION OF NHLA

To serve NHLA Members engaged in the commerce of North American hardwood lumber by: maintaining order, structure and ethics in the changing global hardwood marketplace; providing unique member services; promoting North American hardwood lumber and advocating the interest of the hardwood community in public/private policy issues; and providing a platform for networking opportunities.

ADVERTISER INDEX

NHLA STAFF

Dallin Brooks, Executive Director dallin@nhla.com

John Hester, Chief Development Officer j.hester@nhla.com

Renee Hornsby, Chief Operating Officer r.hornsby@nhla.com

Dana Spessert, Chief Inspector d.spessert@nhla.com

ACCOUNTING

Desiree Freeman, Controller d.freeman@nhla.com

Jens Lodholm, Data Administration Specialist j.lodholm@nhla.com

Amber Signaigo, Assistant Controller a.signaigo@nhla.com

INDUSTRY SERVICES

Mark Bear, National Inspector m.bear@nhla.com

Tom Byers, National Inspector t.byers@nhla.com

Mark Depp, National Inspector m.depp@nhla.com

Kevin Evilsizer, National Inspector k.evilsizer@nhla.com

Simon Larocque, National Inspector s.larocque@nha.com

Benji Richards, Industry Services Sales Manager b.richards@nhla.com

INSPECTOR TRAINING SCHOOL

Geoff Webb, Dean of the Inspector Training School g.webb@nhla.com

Roman Matyushchenko, Instructor of the Inspector Training School r.matyushchenko@nhla.com

MARKETING/COMMUNICATIONS

Amanda Boutwell, Marketing and Communications Manager a.boutwell@nhla.com

Melissa Ellis Smith, Art Director m.ellis@nhla.com

MEMBERSHIP

Julia Ganey, Member Relations Manager j.ganey@nhla.com

Vicky Quiñones Simms, Membership Development Manager v.simms@nhla.com

2 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

For advertising contact: John Hester j.hester@nhla.com or 901-399-7558 Vicky Simms v.simms@nhla.com or 901-399-7557 29 The AGL Group 39 A.W. Stiles Contractors, Inc. 17 Baillie Lumber Co. 17 BID Group 39 Continental Underwriters, Inc. IFC DMSi/eLimbs/TallyExpress 13 Eagle Machinery & Supply, Inc. 37 Forestry Systems, Inc. 41 Hurst Boiler & Welding Co., Inc. 13 Industrial Vision Systems 23 ISK Biocides 37 JoeScan 7 King City Forwarding USA 23 Kuehne + Nagel, Inc. 24 Lumber Marketplace 11 New Leaf Lumber BC NWH 4 Nyle Dry Kilns 31 Pennsylvania Lumbermens Mutual Insurance Co. IBC Pike Lumber Company, Inc. 3 Rossi Group 41 Showcase Equipment, LLC 15 TMX Shipping, Inc. 31 U•C Coatings 35 USNR 9 UCS Forest Group 19 Wood-Mizer

See the forest through the trees

The RossiGroup has been helping customers navigate the global hardwoods industry for almost a century.

We have raised the bar with our new state-of-the-art Emporium Mill and kiln facilities, our long-term supply agreements, and our uniquely personal brand of customer service.

We deliver a world class selection of hardwoods – including the gold standard in cherry – all sorted, milled and dried to tolerances, consistencies, and yields that were not even possible five years ago. Visit us www.rossilumber.com or call 860-632-3505

WWW.NHLA.COM

INNOVATIVE DRYING SOLUTIONS COME SEE US AT BOOTH 118 www.nyle.com kilnsales@nyle.com (800) 777-NYLE Turn-Key Installations Kiln Optimization Equipment Industry Leading Controls

MY FIRST YEAR AS NHLA PRESIDENT

As year one of my Presidency ends, one of the more eye-opening aspects of the job has been the sheer number of our members involved in the global hardwood markets. Even more interesting are the number of countries our members ship to and the broad array of products they ship. An exciting idea is a brief North-South-East-West look at markets, outreach efforts to promote hardwood in these markets, and what the future might look like, given the economic challenges the world is facing.

Looking North is straightforward. Canadian manufacturers have been members of NHLA since 1906 and are integral to the ongoing success of the National Hardwood Lumber Association. Together, US and Canadian manufacturers have led the world by creating a system for grading hardwood lumber worldwide - the NHLA Hardwood Lumber Grading Rules. Embracing this role and facilitating the use of the NHLA Rules in base grades with temperate and tropical producers worldwide strengthens the NHLA brand and reflects our businesses’ now global nature.

Looking South, Mexico continues to grow in importance as a destination for North American hardwoods. Mexico is thriving as a vibrant, expanding economy with a workforce eager for high-paying manufacturing jobs. There has been a virtual explosion in industrial parks and new businesses opening in Mexico, taking advantage of shorter supply chains and quick market access to consumers across North America. Mexico’s successes prompt the question, “If NHLA is largely a North American-centric organization, shouldn’t there be a focus on bringing Mexican distributors and manufacturers into NHLA since they are our North American neighbors?” Yes, I just put that out there again.

Eastward, Europe is a long-established market for North American hardwoods. Europeans value the sustainability of our resources, and they favor several of our unique species. Europe is the first significant market the American Hardwood Export Council (AHEC) excelled in promoting, and their efforts continue to benefit anyone in the North American hardwood lumber business. Last year, before markets slowed, AHEC’s push for Red Oak in Europe began paying real benefits to all sellers, as it finally showed the results of years of hard work promoting Red Oak as an alternative to White Oak. The European economies have been hit much harder than ours by

increased energy costs alongside higher inflationary pressures. Once the Ukraine-Russia conflict subsides, European exports of North American hardwoods should return to normal levels.

Looking West, there has been a massive change in North American hardwood markets in Asia. The manufacturing base in China is no longer the export-focused market of 10-20 years ago. Chinese consumption is more focused on products remaining in China, which has pushed higher-value species and grades into that market. Vietnam has, in part, replaced China as the furniture manufacturing hub of the world with its growing, export-focused economy supplying furniture and cabinet components to markets across all continents. Many other economies in Asia, Indonesia, Cambodia, and Thailand, are also poised to grow their North American hardwood use when world demand recovers. The key is when and which ones! Please let me know if any of you figure the timing out on that one!

One thing is evident when you examine all of these markets: Promotion gets results. Even those who saw lumber and sell to a local concentration yard or a distributor who deals in a local market ultimately benefit from global markets recognizing the sustainability and value of North American hardwoods. For this reason, I am convinced that the Real American Hardwood Coalition, with its grassroots emphasis on expanding consumer awareness of the benefits hardwood offers, represents the industry’s best effort on promotion in a long time. If you have not seen the new Magnolia campaign, take a look.

Please review your support of the RAHC. Now is the time to transition from a moment to a movement! We are here on the cusp of a spectacular promotional effort, the success of which is in all our hands!

Thank you for taking the time to read my letter—best wishes to you, your families, and your businesses.

Jon Syre NHLA Chairman | Cascade Hardwood

6 | OCTOBER 2023 HARDWOOD MATTERS

CHAIRMAN'S MESSAGE

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 7 MOVING YOUR FREIGHT FORWARD S P E C I A L I Z I N G I N L U M B E R E X P O R T S O U T O F N O R T H A M E R I C A 855-682-1637 kingcitynorthamerica.com Contact Us ESTABLISHED 1977 ESTABLISHED 2013 MONTREAL, QC ALLISTON, ON CHESAPEAKE, VA 3 OFFICES TO SERVE YOU BETTER: S c a n t o R e q u e s t a Q u o t e

Thank you to our 2023 Convention Sponsors

PINNACLE LEVEL

NWH

ALDER LEVEL

Cascade Hardwood, LLC

WALNUT LEVEL

UCS Forest Group of Companies

CHERRY LEVEL

The AGL Group

Baillie Lumber, Co.

BID Group Technologies LTD

Breeze Dried, Inc.

Cole Hardwood, Inc.

Continental Underwriters, Inc.

DMSi Software

Forestry Systems, Inc.

King City Forwarding USA, Inc.

Pennsylvania Lumbermens Mutual Insurance, Co.

SII Dry Kilns

USNR

TMX Shipping Co., Inc.

MAPLE LEVEL

Granite Valley Forest Products - Welter

Hurst Boiler & Welding Co., Inc.

Kuehne + Nagel

Matson Lumber Co.

MO PAC Lumber Co.

Nyle Dry Kilns

PREMIER SPONSOR

BIRCH LEVEL

Ressources Lumber

RED OAK LEVEL

A. W. Stiles Contractors, Inc.

AHC Hardwood Group

Alan McIlvain Co.

American Wood Technology

Cersosimo

Deer Park Lumber, Inc.

Delta ERC

EFM Transportation

Eagle Machinery & Supply, Inc.

East Ohio Hardwood Lumber Co.

Equipment Depot

Falcon Lumber, Ltd.

Frank Miller Lumber Co., Inc.

Froedge Machine & Supply Co., Inc.

Hardwood Industries, Inc.

Hartzell Hardwoods, Inc.

Hermitage Hardwood Lumber Sales

The Horton Group

Industrial Vision Systems

JoeScan

Kittrell Appraisals

Logs2Lumber2You

Legacy Wood Products

McRae Lumber Company

Machinage Piche

Messersmith Manufacturing, Inc.

Penn-Sylvan International, Inc.

Pike Lumber Company, Inc.

Railway Tie Association

Robinson Lumber Company

Swaner Hardwoods Co., Inc.

U•C Coatings

Wood-Mizer

Yoder Lumber

ITSEF GOLF TOURNAMENT SPONSORS

Abenaki Timber Corporation

Alan McIlvain Co.

Allegheny Wood Products

Baillie Lumber, Co.

Brenneman Lumber

Brewco, Inc.

Classic American Hardwoods

Cole Hardwood

Forestry Systems, Inc.

Hardwood Market Report

Hartzell Hardwoods, Inc.

IDI Indiana Dimension

Kittrell Appraisals

Kittrell Sawmill Brokers

McRae Lumber Co.

Messersmith Manufacturing, Inc.

MO PAC Lumber Co.

Penn-Sylvan International, Inc.

Pennsylvania Lumbermens Mutual Insurance, Co.

8 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

to the Winner's Circle. You help make our Annual Convention & Exhibit Showcase a great success! We are grateful for your support and look forward to another great convention next year.

THE DATE, OCTOBER 2-4, 2024 ST. LOUIS, MISSOURI

Welcome

SAVE

The best of nature,

With hardwood lumber, we enhance our customers' business's and the health of the planet. From responsible harvest to fabrication and installation, from use and re-use, hardwood lumber enriches and sustains the places we live, work, and play.

As North America's leading distributor of hardwood lumber, we are committed to quality, accuracy, and unparalleled service.

We are proud to partner with you to bring unique products to the market through the untold possibilities of hardwood lumber.

What you need. When you need it. By people that know and care.

www.ucfp.com www.sierrafp.com stacked with possibility.

FULL-TIME FOR YOU

NHLA members spend a lot of money on full-time staff. For each staff position, you have wages/salary, healthcare benefits, retirement benefits, long-term disability or life insurance, bonuses, and more just to get them to work for you. Then, you also have all the hidden costs like office supplies, office space, travel reimbursement, equipment, training, and other resources for them to do their job; on top of all that, you also have additional government fees and taxes on payroll, workers compensation, unemployment insurance, and much, much more. A lot goes into hiring new full-time staff.

You must plan out the position’s responsibilities and budget ahead of time. That doesn’t even include ensuring you get the right person for the job. You do not decide to hire someone lightly. Having hired, trained, and even fired full-time staff, I know what you go through.

The nice thing about being a member of NHLA is that our staff is here to help you. That is the purpose of associations: to bring the industry together to share costs. But also to save time and money for member companies and to support their full-time staff. No matter how much you pay in dues, it is less than the 19 salaries NHLA pays, so we can assist you.

We cannot eliminate all responsibility; that is not our intent, as we want you to share responsibility with us. We want to save you from having to do as much work on government regulations, legislation, standards, codes, education, marketing, training, grading, and research. NHLA has been contacting members to educate their fulltime staff on what we do. If your staff does not know what we do, we are being underutilized, costing you money.

To help with this and increase communication between NHLA staff and even among members’ employees, NHLA is creating a Community App. Unlike the NHLA Rules App (accessible to everyone), the NHLA Member Community App is for members only. The Member App allows NHLA staff to create a community forum where we can update you on what we are doing and will enable you to provide

feedback. It follows the NHLA Foundation with our six main objectives: Education Services, Convention, Membership & Networking Services, Market Impacts, Lumber Services and Inspector Training School & ITSEF.

Please download our apps from the Android or Apple stores; they are both free. If you or anyone on your staff can’t log in to our member app, or you are not in our Netforum database or have forgotten your login, contact us, and we will set you up. This is an important future step for the NHLA. WE NEED TO STREAMLINE COMMUNICATION BEYOND AN NHLA EMAIL THAT GETS LOST IN YOUR INBOX. Yes, it is that important, and I will shout it out at the NHLA convention and to you here. Having an NHLA Members Only App means you can scroll through it at your leisure; information will be at your fingertips.

If you don’t know what we are doing, how can you be engaged with the process? If you’re not involved in the process, you miss the benefits of being an Association member. Increased communication is vital to showing value to being an NHLA member. If you call, email, text, meet, or use the app to communicate with us, we will find a way to help; all you need to do is ask. We don’t get asked enough. We are here for you full-time. That is one common ground that we share with all your staff.

Dallin Brooks NHLA Executive Director dallin@nhla.com | 360-823-3898

10 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM ONE COMMON GROUND

HENNIK ER FORES T PRODUCT QUALITY KILN DRYING YOU CAN TRUST 1104 Old Concord Road Henniker, NH 03242 meghan@newleaflumber.com P. 603 428 3553

CONGRESSMAN KUSSTOFF'S VISIT: A Boost for Tennessee's Hardwood Industry

Following our visit to Washington, DC, in June for the Hardwood Federation Fly-In, NHLA was pleased to have Congressman David Kustoff (R-TN) and his team reach out, wanting to visit the NHLA Headquarters. On September 1st, he and his congressional aides were treated to an extensive tour of the headquarters and the Inspector Training School. For those of you who have had an opportunity to visit NHLA, you know that it’s quite impressive and very informative. The Congressman was impressed to learn the history of hardwoods in Memphis and Tennessee and to learn even more about the economic impact that our industry has on the State of Tennessee and the U.S.

In a gracious gesture, Congressman Kustoff applauded his visit to NHLA and the fruitful meeting on his Facebook page, saying, “I was happy to meet with Executive Director Dallin Brooks, Chief Development Officer John Hester, and Chief Inspector Dana Spessert with the National Hardwood Lumber Association in Shelby County. Thank you for being a strong voice for the hardwood industry.”

Thank you, Congressman Kustoff, for being a valued partner to the hardwood industry in Washington, D.C.

Correction in August Hardwood Matters

In a recent article, "Saying Yes to Building Success," published in Hardwood Matters Magazine in August 2023, we featured a profile on A.W. Stiles Contractors and the company's remarkable contributions to the hardwood lumber industry. However, we regret to inform our readers of a factual error in the article.

In the article, we mistakenly stated, "A.W.'s youngest son, Tommy Stiles, leads the kiln repair and manufacturing of lumber dry kilns for the company." We deeply apologize for this error, as the late Tommy Stiles tragically passed away in 2017. The correct statement should have been, "A.W.'s youngest son, the late Tommy Stiles, led the kiln repair and manufacturing of lumber dry kilns for the company."

We take full responsibility for this oversight and would like to extend our sincere apologies to the Stiles family and our readership. Our intention is to provide accurate and well-researched information, and we deeply regret any distress or confusion this error may have caused.

Thank you for your continued support and readership.

12 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM INSIDE NHLA

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 13

NHLA Celebrates Milestone

with Introduction of Spanish-language Hardwood Lumber Grading Course

The NHLA Inspector Training School (ITS) celebrated a milestone in its mission to educate and train the hardwood lumber industry. ITS hosted a 2-Week Introduction to Grading Hardwood Lumber course entirely in Spanish for the first time. The members-only class ran from August 7 through August 18, marking a vital step in expanding accessibility within the hardwood lumber community.

Under the instruction of National Hardwood Inspector Mark Bear, the course provided over 60 hours of concentrated education in Spanish as well as hands-on experience in grading hardwood lumber. Mark Bear was assisted by Interpreter Yolanda Hermosillo, whose fluency in English and Spanish was essential in bridging language barriers and ensuring that all participants could fully participate in the learning process.

The 2-week Spanish course welcomed nine students, each bringing unique perspectives and backgrounds to the classroom. Among the participants were:

• Valentin Aleman (Buchanan Hardwoods, Inc.)

• Brett Chappell (Kepley-Frank Hardwood Co. Inc.)

• Jose Colon (Buchanan Hardwoods, Inc.)

• Luis Escribano Tapia (Kendrick Forest Products)

• Joe Flores (Buchanan Hardwoods, Inc.)

• Diego Gaspar (Kepley-Frank Hardwood Co. Inc.)

• Brian Hernandez (B & B Lumber Inc.)

• Eduardo Hernandez Garcia (Kendrick Forest Products)

• Luis Morales (Kendrick Forest Products)

These dedicated individuals contributed to the course’s exciting atmosphere and showcased the growing demand for accessible hardwood lumber education within Spanish-speaking communities.

NHLA firmly believes that diversity and inclusivity are fundamental principles for the future of the hardwood lumber industry. The success of the Spanish-language course is a testament to the commitment of the association’s membership to breaking down language barriers and fostering a more inclusive learning environment.

Our next Spanish-language class will be in Memphis, Tenn., May 6-17, 2024. To enroll or learn more about the program, please visit www.nhla.com/education.

14 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM EDUCATION SPOTLIGHT

FROM THE REAL AMERICAN HARDWOOD BOARD OF DIRECTORS

The RAHC unites the collective efforts and resources of the industry to advance the use of American hardwood. Our partnership with the Magnolia Network and Discovery launched in late July. Early reporting indicates we are on target with our messaging and reaching the consumer audience. The national campaign shows how products created with Real American Hardwood® can fit the style of every individual in a unique, sustainable way. The campaign features five vignettes that capture the spirit of individuality in real-life settings, encouraging consumers to build their world with hardwood.

The six-month campaign is expected to reach 100 million consumers. Ads can be seen on the Magnolia Network channel, as well as on the Magnolia and Discovery+ streaming platforms. Magnolia Network is available through cable and satellite providers; Hulu + Live TV and YouTube TV services; and the Magnolia, HGTV, Discovery+, and Max streaming apps.

This first-of-its-kind industry advertising campaign was made possible by voluntary contributions from all sectors of the industry representing companies from every hardwood-producing state in the country. The RAHC maximizes its impact when every member of the industry participates—from lumber mills to secondary manufacturers, to industrial product producers, to associations.

Contributing to the RAHC is wholly voluntary and needed. Your support will enable the RAHC to maintain a comprehensive promotion campaign. As an RAHC contributor and industry stakeholder, you’re encouraged to use the Real American Hardwood brand logo in your business communications and marketing collateral. Remember, 100 million people will see this logo on TV; you need to show it to them in all your newsletters, emails, magazine ads, articles, publications, websites, facilities, and social media. The logo is available for print or digital use and can be downloaded at RealAmericanHardwood.com/industry/marketing-toolkit

Your continued financial support is critical to continue the momentum. Please consider a tax-deductible contribution or multi-year pledge. You can contribute online at RealAmericanHardwood.com/ industry or talk with your hardwood association executive director.

Help

Visit

Amy Shields, Allegheny Hardwood Utilization Group, Inc.

Tom Inman, Appalachian Hardwood Manufacturers Inc.

Dana Cole, Hardwood Federation

Linda Jovanovich, Hardwood Manufacturers Association

Ray Moistner, Indiana Hardwood Lumbermens Association

Jim Maltese, Lake States Lumber Association

Dallin Brooks, National Hardwood Lumber Association

Michael Martin, National Wood Flooring Association

Jenna Reese, Ohio Forestry Association

Amy Snell, Wood Component Manufacturers Association

16 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM ALLIED ANGLE

us continue to influence consumer choices for hardwood and Build Your World™!

RealAmericanHardwood.com to learn more.

TAKE YOUR PRODUCTION TO A SUPERIOR LEVEL. THE ONLY AI MODELS TRULY DEVELOPED USING HARDWOOD! Call now to find out how you can maximize your production value. 450-435-2121 | info@bidgroup.ca WE’RE CONFIDENT

AI FOR HARDWOOD IS #1 VISIT US AT THE NHLA ANNUAL CONVENTION! October 4-6, Louisville, KY Booth 105 SEE OUR AI-POWERED SCANNERS IN ACTION! BID-20983-5-PUB-Hardwood1-DemiPage-HardwoodMatter-EN.indd 1 2023-07-27 13:43

OUR

THE IMPORTANCE OF UNITY AND COLLABORATION

Some of you may know that I love American History. I wish I had known in high school how interesting it is and not just relied on my buddy Tommy’s notes to scrape by. If you ever want to read about someone fascinating that you think you know, read about Benjamin Franklin. We all know he was a statesman and diplomat and invented the lightning rod and bifocals (some of you have them on while you’re reading this), but he was more than that. Ben Franklin was a writer and publisher, a philosopher and thinker. And he had a great sense of humor. During the Declaration of Independence signing, he is quoted as saying, “We must all hang together, or assuredly we shall all hang separately.” I like to think that’s something I would have said. Dark humor in dark times. I would have had Sam Adams cracking up.

Franklin was making a point of the importance of unity and collaboration among the American colonies. This same concept of unity and collaboration in the hardwood lumber industry and its associations is essential for its growth and success. Here are just a few ways how.

1. Market Presence and Influence: The hardwood lumber industry is diverse and comprises producers, suppliers, manufacturers, and distributors. By coming together through associations, these stakeholders can collectively present a more influential presence in the market. With a unified front, you are better equipped to address industry challenges and advocate for beneficial policies.

2. Research and Innovation: The industry benefits from research and innovation to develop new products and increase overall competitiveness. Associations can pool resources and expertise to fund research initiatives, share knowledge, and drive innovation collectively rather than individually.

3. Education and Training: Associations play a role in providing education and training programs. Sharing knowledge is crucial for the development of a skilled and informed workforce.

4. Market Expansion: In a globalized market, associations can work together to explore and expand into new domestic and international markets. Collaborative efforts, such as those of the RAHC, can help to identify opportunities and navigate the challenges of market diversification.

Like the founding fathers recognized the need for unity to achieve independence, hardwood lumber associations must emphasize unity and collaboration to secure the industry’s prosperity, sustainability, and long-term success. By working together, we can tackle challenges more effectively and ensure a vibrant and thriving hardwood lumber industry.

John Hester NHLA Chief Development Officer j.hester@nhla.com | 901-399-7558

18 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM MEMBERSHIP MATTERS

HULL FOREST PRODUCTS

Member Since 1996

Hull Forest Products was founded in 1965 as a tiny backyard sawmill in Rhode Island. Now in business for over half a century, Hull proudly boasts worldwide distribution of sustainable forest products and is an industry leader in Forest Management and Conservation. Hull Forest Products joined NHLA in 1996 and has been a faithful supporter ever since.

NHLA is proud to recognize Hull Forest Products as our Member of the Month for October! Thank you for your 27 years of membership!

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 19 MEMBER OF THE MONTH

844.339.7815 woodmizer.com © 2023 Wood-Mizer LLC Count on Wood-Mizer’s INDUSTRIAL EQUIPMENT to efficiently process hardwoods into profits. Horizontal & Vertical Sawmills Board Edgers & Gang Saws Resaws Pallet Dismantling Systems Material Handling Blade & Blade Maintenance Custom Saw Lines SEE YOU AT THE NHLA CONVENTION, OCT. 4-6 IN LOUISVILLE AT BOOTH #301 MANY MACHINES AVAILABLE & ON SALE — LIMITED TIME ONLY! —

Revolutionizing Drying Hardwood Lumber and the Solution to Stick Stain

Every year, Canadian Forest Industries (CFI) highlights the “Top 10 Under 40,” which is a list of 10 individuals (under the age of 40) who exemplify the best of Canada’s forest industry. In 2019, the owner and president of Breeze Dried and Townsend Lumber, Mike Penner, was among the honored few.

Since starting in the industry in 2013, Mike has become knowledgeable and passionate about the hardwood lumber industry, and now leads the Breeze Dried team strongly into the future.

When Penner’s father-in-law retired in 2016, Mike and Laura purchased Townsend Lumber and several other related companies, including Breeze Dried, which had already built a name for itself.

The initial development of Breeze Dried sticks happened in the early 1990s when there was great concern about stick stains negatively impact-

ing lumber prices across North America. Breeze Dried tackled the problem with exciting innovations, material research, and pattern experimentation. They discovered the solution in air-drying sticks with a specific pattern. These sticks successfully reduced (and in some cases eliminated) stick stains on lumber. Breeze Dried patented this industry-changing product and officially began selling the Breeze Dried sticks in 1995.

20 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

BREEZE DRIED

MEMBER SPOTLIGHT

Laura Townsend and Mike Penner

After launch, Breeze Dried sticks were well received by the industry. Today, Breeze Dried has produced over 100 million Breeze Dried sticks for mills across North America and Europe. Penner shares the key to Breeze Dried’s success: “Breeze Dried consistently provides a quality product on time, year-round, and of the same quality, volumes, and lead times. Our customers have learned to rely on us because we understand what they need and when they need it.”

When considering the importance of Breeze Dried being an NHLA member, Penner explained, “We have found great value in our membership in NHLA. For Breeze Dried, the NHLA Annual Convention allows us to touch base with customers and find new customers. Attending the Annual Convention is a great way to network with industry people that are facing the same challenges and goals as us. Breeze Dried supports the hardwood industry through our NHLA membership. We also support the industry by advertising on NHLA platforms, exhibiting at the Annual Convention, and sponsoring NHLA events. It’s important to us to support the industry that supports our customers.”

The latest big news at Breeze Dried is their exciting partnership with U-C Coatings LLC, a leading manufacturer and supplier of premium wood protection products. The newly formed partnership makes U-C Coatings the exclusive authorized dealer of Breeze Dried Sticks for “Less-Than-Truckload” (LTL) quantities of Breeze Dried sticks for U.S. customers. Meanwhile, Breeze Dried will continue to fulfill all full truckload sales to customers across North America.

Penner explains the reasoning behind the partnership, asserting, “We have experienced strong demand from smaller operations that only need a single bundle. That’s where U-C Coatings comes in. They can handle the LTL orders much more effectively than we can alone. Teaming up with U-C Coatings allows our staff to stay focused on ensuring quality and timely delivery to our larger-volume customers buying full truckloads while still providing Breeze Dried sticks and customer service to smaller operators.”

The National Sales Director of U-C Coatings is thrilled to be a part of the Breeze Dried team, claiming, “Adding Breeze Dried sticks to

our group of products gives us another great way to help our customers minimize drying defects and protect their lumber.”

Penner agrees, adding, “’A partnership with U-C Coatings just made sense. They sell multiple lumber-drying products, such as waxes and sealants, that assist in kiln-drying and air-drying lumber. Breeze Dried sticks are a major component in both air and kiln drying, so U-C Coatings was a natural fit to work with us. Plus, U-C Coatings has the industry knowledge that our customers expect.”

Penner has a bright outlook for Breeze Dried over the next decade, saying, “The future of Breeze Dried is strong. We will continue providing the best product and supporting our customers season after season and year after year.”

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 21

To contact Breeze Dried, visit them online at www.breezedried.com or call 519-842-6841. Breeze Dried is exhibiting at the 2023 NHLA Annual Convention and Exhibit Showcase October 4-6 in Louisville, KY. Visit Breeze Dried at booth number 417.

New Study Questions Wood Product Sustainability

By DANA COLE, Executive Director of the Hardwood Federation

The hardwood industry, and indeed the entire wood products industry sector, has long fought an uphill battle to better inform the general public, the media, and government policymakers about the sustainability and environmental friendliness of using wood in all its amazing applications. Unfortunately, just when we seem to be making progress, another questionable report comes out that is touted by those who would prefer that our forestlands remain untouched and unmanaged. The World Resource Institute (WRI) is the latest organization to strike.

The WRI recently released a study challenging scientific and public policy claims that the wood products industry is a low or neutral emitter of greenhouse gases (GHG).

Some of the key assertions of the study include:

• Current and future demand for Wood Products undermines efforts to reduce GHG Emissions

• Between 2010 and 2050, annual wood harvests are expected to release three times more carbon dioxide than the global aviation industry.

• Three million square miles of forestland are expected to be “razed” (the size of the continental U.S.).

• There is a massive accounting gap in global greenhouse gas production; netting carbon losses from new harvests with carbon sequestration from the growth of broad forest areas is “inappropriate” and gives a false impression of low, zero or even negative greenhouse gas emissions from wood harvests.

• On one hand, recently harvested trees cannot be included in carbon accounting because you cannot guarantee those forests will continue to grow.

• Yet, on the other hand, they claim current growth can be attributed to past harvest and land clearing.

The Hardwood Federation is in close contact with our industry allies, working to create a strategy to address this claim. As a first step,

our friends at the National Alliance of Forest Owners developed some talking points to use with any members of Congress who may have questions.

Key points include:

• The study ignores a robust, well-established body of science showing the opposite of their claim.

• Intergovernmental Panel on Climate Change (IPCC) has stated, in contradiction to the report’s authors, that “in the long term, a sustainable forest management strategy aimed at maintaining or increasing forest carbon stocks, while producing an annual sustained yield of timber, fiber or energy from the forest, will generate the largest sustained mitigation benefit.”

• Eliminating forest harvest is not the solution to healthy, vibrant forests. Harvesting on National Forests in Washington state was shut down for 30 years in the 1990s. Forests were free of direct human activity and management. What happened? Compared to private lands in Washington state, national forests are growing half as much, and 70% is lost to mortality.

• Cherry-picking science is dangerous. The authors use international forestry data from specific regions to conclude for all forests globally, misrepresented forestry harvest emissions, and underrepresented the sequestration values of replanting and managing forests.

• In the U.S., we don’t cut and move on. We replant, regrow, and regenerate in a never-ending cycle. Private forest owners grow 43% more trees than they harvest each year.

• Felling a tree does not cause an emission. The carbon goes from being in a live, standing tree to a log, then to a product.

While these and other facts can be used in response, it is clear from past debate that direct response from the industry is often viewed as self-serving and does not move the needle in the court of public opinion. Fortunately, some scholars in the forest economics and modeling community have begun to respond to the study. For example, on August 8, Brent Sohngen, an environmental and resource

22 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM LEGISLATIVE LOG

economics professor at Ohio State University, published a blog titled “Why Global Wood Harvests Aren’t Emitting 3.5 to 4.2 Gt CO2 Per Year in Net Emissions.”

Professor Sohngen pushed back on a number of statements made in the WRI study, including the following:

• The authors’ claimed carbon cost of harvesting depends on “a counterfactual that assumes no harvesting at all,” and “their approach and model makes no sense.”

• “They acknowledge economics is hard, so they ignore it and instead deploy a set of arbitrary rules to consume wood, harvest trees, and regenerate trees.”

• Thus, “their key result that there are 3.5 to 4.2 Gt CO2 in net emissions from wood harvesting is ridiculous.”

• More specifically, Professor Sohngen states that the authors get to their key result through multiple technical errors, including:

• “First, they ignore economics and construct a purely biophysical model. This will result in overestimating harvests and underestimating regrowth …”

• “Second, the WRI study is just an implementation of the incorrect argument by Searchinger et al. (2009) that emissions from timber harvesting and burning should be double counted. . . . Searchinger’s argument is wrong. Double counting emissions, in contradiction to the correct approach by the IPCC, leads to less, not more, forests.”

• “Third, WRI is making a normative judgment . . . to ignore tree growth before harvesting. This convention is different from every other forest sector model.” (And this greatly overstates the carbon impacts of harvesting.)

• “Fourth, their approach to discounting is just strange . . . [and] amplifies their results and ignores how markets respond . . .”

• “Fifth, their counterfactual is unrealistic, and not just because it assumes no harvesting of wood.” The problem also is that they run “a scenario of no harvesting of wood without considering the market response.”

You may read more from the WRI report here: www.wri.org/insights/wood-harvests-overlooked-carbon-costs

You may read Professor Sohngen’s full post

Of course, more scholars, scientists, and environmentalists need to come out and push back on this flawed reasoning, and we are hopeful more such work is in the pipeline. We will continue to work closely with our allies and double our efforts to share the facts about the wood products industry with policy leaders in D.C. Hopefully, the talking points will allow you to push back on your local level as well.

WWW.NHLA.COM

US Hardwood Exports Continue to be Battered by Forces Well Beyond our Control

By MIKE SNOW, Executive Director of AHEC

The unprecedented dislocations and market shifts that our industry—and indeed the global economy as a whole—have experienced over the past five years continue to wreak havoc on our export markets. Trade wars, COVID shutdowns followed by pent-up demand and supply chain disruptions, a land war on the European continent, rapidly increasing interest rates, skyrocketing energy prices, inflation, and a severe housing and construction meltdown in our largest external market all conspired to produce one of the most challenging business environments in decades. At the same time, new environmental regulations in Europe have the potential to spill over into other markets and add to the uncertainty.

As a result, it is no surprise that our exports of hardwood lumber had a rough start to 2023. (Graph #1) This graph illustrates the change in board footage of lumber exports from the first half of 2023 compared to the same period last year. The five largest growing markets are in green, and the five that dropped the most are in red. The growth markets are led by India, which is up by 1.21 million board feet since last year and is on another record pace for trade in US hardwoods. The US currently has less than 3% of Indian hardwood lumber imports (a $300 million total market in 2022). Through continued network outreach and education, we are convinced there is a serious upside to this market.

Many of the markets that have struggled so far this year are coming off record years in 2022. The UK, Mexico, and Canada all benefitted from retail and construction booms at a time when reduced Chinese demand left a significant amount of lumber on the market. Many of these developed markets, like the US domestic market, saw two years’ worth of demand get pushed into one during the extreme post-COVID demand in the construction and remodeling sector. It

is not surprising, therefore, that current conditions are challenging, to say the least. In fact, if the trends from the first half of the year continue, then 2023 will likely be the lowest year for US hardwood lumber exports since 2010. (Graph #2). Not surprisingly, the slowing export markets, along with headwinds at home, have left their mark on hardwood production in the US as well. According to the Hardwood Market Report estimates, production was down more than 1.73 BBF (23%) for the first half of the year relative to 2022, one of the slowest 6-month totals on record.

Following is a brief synopsis of current conditions in a few key export markets:

CHINA:

While China continues to be our largest export market for hardwood lumber and logs, volumes are down considerably from the peak year of 2018 (Graph #3). While it is easy to trace the beginnings of the decline of our business to China with the tariffs and trade war that began in the second half of that year, the truth is the

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 27

Jan-June YOY Volume Change in 2023

US Lumber Exports (Board Feet)

Malaysia

Korea,

Indonesia

Thailand

Japan Mid.

Other

European

Mexico

Vietnam

Canada

China

28 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM 1.21 1.09 0.88 0.76 0.65 (15.51) (16.17) (19.00) (28.42) (47.92) (50) (45) (40) (35) (30) (25) (20) (15) (10) (5)5 Millions of Board Feet

GATS 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2018 2019 2020 2021 2022 2023* Millions (board feet)

UK. Mexico Vietnam China Canada India Morocco UAE Guatemala SaudiArabia Source: USDA

OTHER Australia

South

East & N. Africa

Europe

Union-27

& HK

USDA GATS, 2023 number annualized based on May data

Source:

(Graph #1) (Graph #2)

M

A K I N G L I V E S E A S I E R .

Domestic & Drayage Trucking

S h i p p i n g F o r e s t r y

Domestic Intermodal

Export & Import Logistics

Customs Brokerage

A c c e s s t o o u r p r e m i e r n e t w o r k

o f f l a t b e d / c o n e s t o g a p a r t n e r s

T i e r 1 O c e a n E x p o r t R a t e s

L o n g - s t a n d i n g , t r u s t e d

o v e r s e a s p a r t n e r s t h a t h a v e

g r o w n w i t h o u r b u s i n e s s

781.544.3970

SALES@THEAGLGROUP.COM

WWW.THEAGLGROUP.COM

WEYMOUTH, MA

JACKSONVILLE, FL

US Hardwood Lumber to China (m3)

Volume Down 1.3 million m3 from 2017 (over 560 million board feet)

current low levels of exports to China are primarily the result of issues with the Chinese economy itself—and this can be made abundantly clear by the fact that China’s hardwood exports from ALL sources, not just the United States, has been on the decline (Graph #4) Despite much cause for optimism at the beginning of 2023 when China finally dropped its draconian “zero-COVID” policy, the much-anticipated boom in Chinese demand and consumer spending has yet to materialize. In fact, at the time of this writing, manufacturing in China contracted for the 4th straight month; Chinese exports were down 14% from the same period in 2022, and imports were down an additional 12%, all indicators of slowing demand. At the same time, the housing and construction industries are in a free fall, with the home process continuing to drop and new home sales down 33%. Adding fuel to the fire are defaults and bankruptcy declarations by two of the country’s largest property developers. This represents double bad news for our industry as not only is most of the country’s personal wealth tied up in real estate, but most US hardwood exports to China over the past decade have been absorbed by the nation’s property market. The story is unlikely to improve in the near future; recently, Oxford Economics estimated that by the end of 2022, Chinese housing demand averaged 8 million units a year over the previous decade but would drop to only 4.6 million units annually between 2023 and 2030.

Value Down $671 million

SOUTHEAST ASIA

Similarly, the Southeast Asia markets are showing signs of being dragged down by the economic woes of their large neighbor as well as decreased industrial demand from the US and Europe. The results can be seen quite clearly in the hardwood export numbers, as US hardwood lumber exports to the region were down 36% in the first half of 2023 and totaled just over $143 million. Log exports decreased another 14% to just over $35 million, and veneer exports followed suit with a 17% decrease. It is important to note that Vietnam alone represents more than 80% of the region’s hardwood imports, and “friendshoring” away from China by many industries is putting increased stress on the Vietnamese labor markets, with many furniture factories reporting difficulties in attracting enough staff.

THE EUROPEAN UNION AND THE UK

While high energy prices, food inflation, and slowing demand are battering the European markets (not to mention a land war on its territory), much of the discussion in Europe relating to the wood industry revolves around the upcoming EU Deforestation Regulation (EUDR) which appears poised to create uncertainty and doubt in a market already battered by economic headwinds. While much has been written about the regulation and how it differs from the EU Timber Regulation (EUTR), the fact remains that a solution for

30 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 2017 2018 2019 2020 2021 2022

Other Temperate Hickory Maple

Western Red Alder Yellow Poplar Ash Walnut Cherry White Oak Red Oak

Source: USDA GATS

(Graph #3)

At Pennsylvania Lumbermens Mutual Insurance Company (PLM), we think beyond insurance coverages to help you find solutions to keep your operations safer. We continuously look for new technologies and research different companies to partner with to provide risk management tools to our customers at discounted pricing.

Whether it be industrial fans to prevent combustible dust build-up in wood manufacturing operations or telematic devices and safety cameras to reduce the risk and cost of accidents in your fleet, PLM is dedicated to helping you find the right solutions to improve the overall safety of your lumber business.

Learn more about PLM’s safety partners at www.plmins.com/loss-control.

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 31 Risk Management Get more from your insurance policy with a partner committed to finding you the right services to reduce your risk. Request a quote at www.plmins.com/quote It’s more than an insurance policy.

(Graph #4)

(Graph #5)

China

Lumber Imports from All Countries (Jan-June each year)

Imports down 36% ($1.2 billion)

Lumber to India (Board Feet)

USA less than 3% Market

Share in India

Vietnam

Indonesia

Laos

Cameroon

Romania

Myanmar

Gabon

Russia

United States

Thailand

Yellow

Western

Walnut

Red

Hickory

White

32 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM $$500 $1,000 $1,500 $2,000 $2,500 $3,000 01/201706/2017 01/201806/2018 01/201906/2019 01/202006/2020 01/202106/2021 01/202206/2022 01/202306/2023 Millions ($USD)

OTHER

Source: Global Trade Atlas

500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 2017 2018 2019 2020 2021 2022 Jan - May 2022 Jan - May 2023

-

Tropical Birch

Poplar

Cherry

Red Alder

Ash

Other Temperate Maple

Oak

Oak

Source: USDA GATS

EUDR Timeline

Red

(Board Feet)

Turkey

Germany

Spain United

Italy

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 33

Source: ATIBT

<250 EMPLOYEES

0 5 10 15 20 25 30 35 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023* Millions (Board Feet)

(Graph #6)

Oak Lumber to Europe

OTHER Sweden Greece Ireland Portugal France

Kingdom

June

Source: USDA GATS, 2023* Annualized

from

Data

Red Oak Exports up 692% by volume

$7 million $18 million $53 million $36 million*

(Graph #7)

JAN-JUN 2023 U.S. HARDWOOD LUMBER EXPORTS (m3) – Middle East

JAN-JUN 2023 U.S. HARDWOOD LUMBER EXPORTS (m3) – INDIA

Walnut

34 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

AMERICAN HARDWOOD EXPORT COUNCIL

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 60,000 65,000 70,000 75,000 80,000 85,000 90,000 95,000 100,000 105,000 2017 2018 2019 2020 2021 2022 Jan-Jun 2022 Jan-Jun 2023 Others Bahrain Algeria Qatar Jordan Lebanon Morocco Israel Egypt Saudi Arabia Turkey Pakistan UAE

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 2017 2018 2019 2020 2021 2022 Jan-Jun 2022 Jan-Jun 2023 Birch

Source: USDA Foreign Agricultural Service

m3 (Graph

#8)

Tulipwood Cherry Maple Western red alder

Other Temperate Red oak Tropical Ash White oak Hickory

AMERICAN HARDWOOD EXPORT COUNCIL

m3

Source: USDA Foreign Agricultural Service

(Graph

#9)

our industry must be found. (Graph #5). 2022 was a record year for US hardwood exports to Europe, and the region was crucial for making up some of the lost ground on red oak exports to China (Graph #6)

MEXICO

Mexico remains the third largest market for US hardwood exports and has been the subject of much discussion on “nearshoring” and “friendshoring” resulting from the US-China trade tensions. Indeed, 2022 was a record year for US hardwood lumber exports, and plenty of anecdotal evidence pointed to the real potential of a significant portion of the Asian furniture industry relocating here to take advantage of unfettered access to the US market. The first six months of 2022 saw a record $206 million in hardwood lumber alone exported to Mexico, but that number has fallen by more than 18% this year as a housing and renovation slowdown in the US brought about by climbing interest rates and fears of inflation put the brakes on some of the investment. Nevertheless, the long-term prospects remain positive, and Mexico will likely be a market to watch for years to come.

EMERGING MARKETS: MIDDLE EAST AND INDIA

There was a 1% year-on-year increase in the volume of US hardwood lumber exports to the Middle East through the first six months of 2023, but that was offset by a 4% decline in value over the same period. (Graph #8) Much of this was the result of declines in the region’s second-largest market, Pakistan, which saw a 29% drop in volume and a 24% drop in value due to the ongoing liquidity crisis in the market. Shipments to the United Arab Emirates, Saudi Arabia, and Morocco were all up during the period, while exports to Turkey, Egypt, and Israel were all down due to economic uncertainty and, in the case of Egypt, another liquidity crisis.

On the other hand, India was the best-performing market for the first half of the year, at least in terms of volume change, with exports of US lumber growing by 76%. (Graph #9) This was tempered by two major caveats, however: the value of US lumber exports declined by 47% over the same period, and the Indian market remains extremely underserved by the US industry as total exports for the first half of the year were less than $4 million, representing an anemic US market share of under 3%. Hardwood log exports to India were down 37% in value and 25% in volume over the same six-month period.

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 35

À travers la scierie. À travers le monde.

The Grading Rules Are A Member Benefit

By DANA SPESSERT, Chief Inspector

We are celebrating our 125th anniversary as a trade association with the original goal of creating a standard for trading hardwood lumber. The first grading rules were published the same year that NHLA was born.

I find myself sitting in a hotel in China (As I have done many times over the past 13 years). The American Hardwood Export Council (AHEC) once again held its Annual Southeast Asia & Greater China Convention, their 26th edition. AHEC invited me to speak to the audience on the NHLA Hardwood Lumber Grading Rules.

As I prepare for the presentation, I am in awe of the efforts made by the staff and leadership of AHEC for their many years of marketing hardwoods in this region and around the globe. China and other areas of the world welcome hardwoods from North America due mainly to the grading system that our forefathers saw fit to create and polish for the past 125 years.

I have also considered how the industry got to this point with the Hardwood Rules. The Rules are designed to be editable to stay current in today’s markets.

I want to point out some areas of the Rules that could be developed to help the industry move forward.

1. The standardization of frame stock lumber. I have personally inspected and shipped many loads of frame stock. Frame stock is primarily used to construct furniture covered in fabric, such as recliners and couches.

2. The standardization of pallet stock is an area that needs to be addressed - soon. The pallet industry is moving away from using hardwoods in favor of a more consistent and easier-to-use product. With modern edgers and carriages, making lumber to a stock width is relatively simple and accurate and will ease the downstream manufacturing process.

3. The standardization of rustic or antique wood. The Rustic grade was established under the Colonial Poplar and Rustic Oak Rules. Unfortunately, these Rules have not been utilized, as they do not fit the needs of the consumers. I would suggest a minimum amount of character to be included in this type of grade.

One of the many benefits of being an NHLA member is the right to vote on the Rules changes. The impact you can have on the future of the hardwood industry is unmeasurable. I am sure that when the fine gentlemen gathered to start the NHLA, they never imagined their lumber would be sold globally someday!

Other areas of the NHLA that our industry should consider utilizing more are our highly trained and skilled National Inspectors - education for your staff, Facility Grade Certification program, and Quality Control and Yield Analysis programs, which are all conducted by the team of National Inspectors.

I would like to ask the industry to ponder where we would be without the NHLA and the standardization of the grades. I would bet a government agency would control us, and everyone would be required to be audited monthly. Avoiding government interference is another overlooked benefit of being an NHLA member.

With all the benefits of being a member of the NHLA, I, for one, cannot understand why a company in the hardwood industry would choose not to join!

Reach out to me to schedule a National Inspector visit or see us in person at the NHLA Convention.

As always, please send your hardwood lumber grading questions to Dana Spessert at d.spessert@nhla.com or call 901-399-7551.

36 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM RULES CORNER

FOR THE MEASUREMENT & INSPECTION OF HARDWOOD & CYPRESS Plus NHLA Sales Code & Inspection Regulations Effective January 1, 2023

RULES

LUMBER INDUSTRY FOR 37 YEARS.

SIMPLY BETTER

JS-50 X6B NEW

CARRIAGES & SHORT-INFEED EDGERS

SAWMILL SCANNING

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 37

NHLA PROVIDES EDUCATION AND TRAINING TO IMPROVE YOUR BOTTOM LINE

OCT

Oct. 23-27

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Wood-Mizer, LLC

Location: Indianapolis, IN

Instructor: Kevin Evilsizer, National Inspector

Oct. 24-27

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Glenville State University

Location: Glenville, WV

Instructor: Mark Depp, National Inspector

NOV

Nov. 27-Dec. 8

Inspector Training School Online Training Program MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, ITS Instructor

DEC

Dec. 11-14

Hardwood Processing 101

A 3-day workshop to broaden the knowledge of hardwood processing for those who support sawmills and mill operations. We will explore the process path from tree to kiln and includes tours of local sawmills and a concentration yard. Housing and meals are included.

Venue: NHLA Headquarters Location: Memphis, TN

JAN

Jan. 8-March 1 2024

Inspector Training School 205th Class

Traditional 8-week hands-on training to achieve the certificate of completion in Hardwood Lumber Inspection.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

MAR

March 20-22

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Roman Matyushchenko, ITS Instructor

38 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM Register for classes at www.nhla.com/Education.

ITS CALENDAR

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 39 Get the insurance coverage you need and the service you deserve. If you’re in the Forest Products Industry, get to know us. WE PROVIDE INSURANCE TO PROTECT THE WAY YOU DO BUSINESS. To learn how, call 804.643.7800 TheNationalSolution to YourLocalRisk™ contund.com THROUGH THE YEARS A.W. STILES CONTRACTORS HAS DONE EVERYTHING IMAGINABLE TO LUMBER DRY KILNS. FROM COMPLETE NEW GREEN FIELD FABRICATION AND INSTALLATION PROJECTS TO MINOR REPAIRS.

KILN REPAIRS WE DO ROUTINELY:

COMPLETE ENERGY EFFICIENT REBUILDS

ROOF REPLACEMENTS

DOOR REPLACEMENTS, EXISTING DOOR REPAIR

ELECTRICAL CONTROLS & UPGRADES

NEW COIL/ STEAM PIPE REPLACEMENTS

MATTER THE SIZE OF YOUR KILN PROJECT, WE WILL BE HAPPY TO TAKE A LOOK AT IT

YOU.

ffice: 931-668-8768

lee@awscontractorsinc.com or casey@awscontractorsinc.com

DRY

•

•

•

•

•

NO

WITH

O

Email:

NHLA JOB BOARD

Here you will find our current job listings.

To see more details of the job or to post a job, visit www.nhla.com/resources/careers-center

HARDWOOD LUMBER GRADER HILLSGROVE, PA

Dwight Lewis Lumber Co. is looking for an experienced green and kiln-dried lumber grader for initial inspection in the mill process and also for kiln-dried lumber going into final packaging. The selected candidate will have the ability to work in both areas.

HOW TO APPLY

Send your resume to: matt@dlewislumber.com

Dwight Lewis Lumber Co.

1895 Route 87 | Hillsgrove, PA 18619 570-924-3507

DIRECTOR OF WORKFORCE AND PROFESSIONAL DEVELOPMENT HYBRID WITHIN OHIO

The Ohio Forestry Association is seeking a Director of Workforce and Professional Development. Responsibilities will include:

• Managing the Lumber Grading Short Course

• Managing the Kiln Drying Short Course

• Working with OFA Workforce and Professional Development Committee to create a suite of relevant training and workshops (e.g., technical, business, and general) for OFA members on an annual basis.

• Scheduling and coordinating CSAW training statewide

• Developing strong working relationships with Ohio FFA, Envirothon, Scouting, etc.

• Working with the Ohio Department of Education to maintain CSAW accreditation.

• Managing CSAW training for career technical/high school students and coordinating with the Ohio Master Logger Program Manager

• Collaborating with secondary and post-secondary educators to expose students to in-field work experience and Camp Canopy

• Assisting members with the State of Ohio’s TechCred and IMAP programs

• Working with OFA Workforce and Professional Development Committee on workforce initiatives

• Creating and maintaining job board for industry postings

• OFA Annual Meeting programming

• OFA Liaison to Project Learning Tree, Youth Pathways in Forestry Committee (ODNR), Ohio Woodland Stewards, A DAY in the WOODS, etc.

• All other duties as assigned.

HOW TO APPLY

Send your resume to: Jenna@ohioforest.org

Ohio Forestry Association

507 Main St suite 200 | Zanesville, OH 43701 888-388-7337

OHIO MASTER LOGGER PROGRAM MANAGER HYBRID WITHIN OHIO

The Ohio Forestry Association is seeking a Master Logger Program Manager. The main duties of this position include:

• Training as a CSAW instructor, providing that training for career centers, and maintaining a pool of qualified CSAW trainers.

• Promoting the Ohio Master Logger Program around the state

• Educating landowners to use Ohio Master Loggers

• Teaching BMPs

• Working with the Logging Standards Council (LSC) to monitor inconsistent practices

• Coordinating relevant training for Ohio’s Master Loggers

• Sending postcards prior to the meetings

• Logging credits to master loggers as they complete

• Monthly notices to loggers regarding credit expiration

• Communication with chapters regarding training, bank accounts

• Gathering all the monthly chapter bank statements needed for filing taxes

• Sending communications regarding actions decided at LSC meetings

• Attending LSC meetings and some Logger Chapter meetings

• Setting up products, sending invoices and certificates through YourMembership database

• All other duties as assigned

HOW TO APPLY

Send your resume to: Jenna@ohioforest.org

Ohio Forestry Association

507 Main St suite 200 | Zanesville, OH 43701 888-388-7337

40 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 41 We are a Forestry Related company! We have years of experience under the belts of our staff! •We can help with complete layout/blueprints for your setup •We can rebuild existing equipment to like new specs •(Coming soon) Brand New Equipment ~log decks ~green chains ~rollcases ~lumber carts We also have a monthly catalog advertising our equipment and we will list your equipment to sell in our catalog and also on our website! We have room to advertise your business in our monthly catalog. Call Gaylord to get a free quote! Need your equipment shipped or delivered? We can help find a truck for you! Call Benny for a free quote! Ph: 260.633.4047 ~Wayne or Jerry (sales): ext 1 or 2 ~Gaylord (advertising): ext 3 ~Benny (trucking): ext 4 206 E Vine St Wolcottville, IN 46795 In Stock: •mills •debarkers •chippers •resaws •edgers (and much more) NHLA EDUCATIONAL WEBINARS Visit www.NHLA.com to find our online learning portal. In this area, you will find and access live online courses and webinar replays. Webinar replays are FREE to NHLA Members. Non-members can view for a fee.

HARDWOOD MARKETS MATTER

Hardwood Markets Matter, and it is important for NHLA to share market details of the entire Hardwood Industry. We appreciate the support of allied associations and publishers in gathering and sharing this important market information that can help you understand the complete hardwood industry picture.

It looks like Hard Maple markets are finally reaching stability after 18 months of steep declines. Across regions, average prevailing KD 4/4 #1/Btr prices dropped to or below their pre-COVID levels by August 2023. Those low prices further depressed Hard Maple production this summer—beyond the normal seasonal drop—pushing mills to take extended downtime, slow production, or shift to other species. An industry veteran recently noted that if Hard Maple prices did not go up, he could not maintain production.

Chinese buyers took advantage of low Hard Maple prices this spring to stock up. U.S. Hard Maple exports to China were 68% (+3.6 million board feet) higher in the first half of 2023 than in the first half of 2022, with March, April and May the three strongest shipping months in five years. Although Chinese purchasing backed off in June, the buying spree helped draw down kiln-dried Hard Maple inventories and stabilize prices. By August, price declines were smaller and isolated in specific items. As September rolled around, a number of contacts said their KD Hard Maple inventories were limited and reports of green availability issues started to surface.

Despite hints of improvement, however, Hard Maple has a long way to recover. At a prevailing price of $1,585/MBF gross tally at the start of September, KD North Central 4/4 Sel/Btr #1&2 White Hard Maple was at its lowest price since 2011, near the end of the housing and financial crisis. On the whole, 4/4 Hard Maple prices need to increase 10-15% just to get back to pre-COVID levels, and that doesn’t even account for inflation or the rise in production costs over the past few years. However, we don’t expect a quick turnaround like we’ve seen in White Oak, as Hard Maple production will increase with cooler weather and demand isn’t showing any signs of rapid expansion.

42 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM MARKET TRENDS

$500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500

Avg. KD 4/4 White & Sap/Btr Hard Maple Prices

$/MBF

Upper-grade #1 Common

www.hardwoodreview.com

www.hmr.com

The HMR Demand Index (HDI) is a feature in HMR Executive® that illustrates monthly trends in reported demand from 10 major domestic markets for hardwood lumber. Components of the index are color coded with various shades of blue when demand is slow, they transition to gray when demand is fair, and then to light red and deep red when demand moves from good to strong.

Index for August which is published the first week of September.

Cabinets

Residential Flrg.

Truck Trailer Flrg.

Upholst. Furniture

Wood Furniture

Moulding/Millwork

Wood Components

Board Road

Pallets

Railroad

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 43

Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23

Quite Slow Slow Fair/Steady Good Quite Good

Ties

WOOD TIE GRADING MINISERIES: KNOTS AND HOLES

By Nate Irby, Railway Tie Association (RTA)

Wood ties and timbers used on our nation’s railroad infrastructure support freight and passenger trains and help us continue to thrive as a country. There are over 136,000 miles of track in North America to maintain. The tracks require immense effort, and wood-tie and timber producers bring 18-20 million ties to the marketplace annually. These ties and timbers are not simply “industrial” products but integral pieces of architecture, with strength and structural integrity at the forefront of the procurement process.

Railway Tie Association is the membership group that represents those tie-producing entities and end-users that run railroads on them. It also helps to keep wood tie markets strong and sustainable - and has been doing so since 1919. One of our annual tenants is to provide education at our premiere event, the “Tie Grading Seminar.” This article is a representative snapshot highlighting that prestigious educational offering, focusing on knots and holes in wood ties and timbers.

Today, mainline railroad crossties are generally 7”x9”x8’6” grade 5, predominately oak and hickory, “sleepers” or pieces of wood utilized to hold up rail, anchor in ballast, and have locomotives and railcars roll over the top of them. When it comes to wood tie grading, knots and holes are important for tie integrity. Such defects can limit the ability of a tie to hold dimensional form, allow for hardware to attach correctly, and provide an entry pathway for water to penetrate interior untreated portions of the tie and cause premature decay and failure.

Knots, as defined by wood scientists, are a portion of the tree branch that has become embedded in the wood and can be a stress concentration point if the wood product is placed under a load (i.e., trains rolling over ties with knots in or near the rail-bearing area.) Many cite knots by common names: tight, loose, edge, or firm, in accordance with their visual characteristics. However, with ties and timber, many use the terms knots and holes as words of specification allowance synonymously.

Holes can be knots, decay pockets, stump pulls, or stems from other biological or mechanical root causes. For holes and knots, many railroads offer a diameter and depth specified limitation per tie grade (Mainline Grade, Industrial Grade, or Reject/Cull). With the addition of southern yellow pine as an acceptable species for some tie and timber applications, knot/hole “clusters” are also specified as to tie grade and application. In both cases, knots and holes are potential defects and can alter the service life of tie and timber, so they should be scrutinized in the inspection/grading process accordingly.

Limitations for crosstie defects are delineated in the AREMA 30 standards and covered extensively at the RTA annual Tie Grading Seminar. Please visit rta.org for more information on wood ties and timbers, the Tie Grading Seminar and other offerings RTA provides to our industry.

SOURCES:

Railway Supply Institute: https://www.rsiweb.org/data-technical-resources/rail-supply-economic-impact-study/) Railway Tie Association: https:// www.rta.org/why-rta

McConnell and Irby, 2013: https://senr.osu.edu/sites/senr/files/imce/ files/McConnell_forestry/F_85_13.pdf

American Railway and Engineering Maintenance-of-way Association: https://www.arema.org/AREMA_MBRR/Committees/30.aspx

44 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM www.rta.org

Example of knots/holes in and near the rail-bearing area (RBA) of wood crossties.

REGARDING YOUR ABOVE ANSWER, PLEASE PROVIDE CONTEXT FOR MARKET, WEATHER OR OTHER CONDITIONS.

EASTERN US

LAKE STATES

Minnesota, Iowa, Wisconsin, Michigan, N Indiana, N Illinois: Hot & Dry - log crews aren't able to take advantage of the good logging weather because nobody wants logs - no where to sell and wood products. Many mills only sawing 3 days per week. Log inventories are sitting around 2 weeks with no immediate plans to buy more. Timber is still available but costs outweigh income potential.

ATLANTIC

West Virginia: A Lot of rain in sections of Appalachia. Log inventories are down. Mills don't seem to care if they run out of logs because of the markets.

Virginia: Ties are almost the only product that is able to make the mills money at this time. Flooring, pallet, and poplar markets have all slowed down. Weather is still good for logging.

NEW ENGLAND

New England 1: Logs are too high for mills to pay, and loggers can't drop prices. Tie production is trending down due to lack of log availability. Slower logging season coming up and most mills are very concerned about having enough logs to make it through the winter. Some of the larger mills are shutting down temporarily due to lack of log inventories.

Pennsylvania: Wet August and not so good for logging. Tie competition remains very strong.

MIDSOUTH

Arkansas, Louisiana, Mississippi, W Tennessee: The increase to log inventories and log availability is only very slight. Far below what is should be for this time of year.

E Texas, NW Louisiana: Pallet is still struggling and pulp-wood is a problem getting rid of, chips is also but weather is dry so if mills want logs they can get them

SE Missiouri, N Arkansas: Weather is good and production is along SOUTHEAST

Kentucky, Tennessee: Labor issues, Low log prices, uncertainty in the markets. high fuel prices and the low demand for pulp wood has causes many loggers to choose to sit and wait for better time.

Alabama, Florida, Georgia: Log inventories have improved over last month as pulpwood restraints have eased. Pallet demand is soft.

Mississippi: Log inventory is low. Production has slowed due to soft markets and quotas on lumber.

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 45

WHAT IS YOUR VIEW OF CROSSTIE COMPETITIVE POSITION RELATIVE TO OTHER HARDWOOD PRODUCTS?

www.nwfa.org

Long-term threat to real wood products:

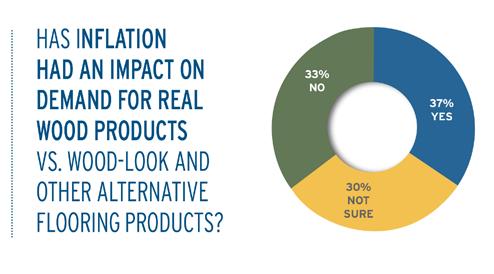

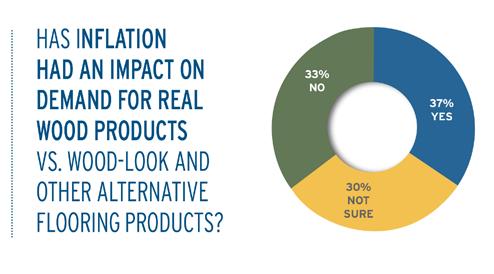

According to the NWFA/Hardwood Floors magazine’s 2023 Industry Outlook, concerns about real-wood product sales continue this year, with about 51 percent of members reporting negative impacts from wood-look products such as LVT, WPC, and laminate. Of those respondents concerned about the impacts wood-look products will have on their business, 53 percent believe the impact will stay the same.

Inflation: Respondents to NWFA/Hardwood Floors magazine’s 2023 Industry Outlook remained split when asked if inflation impacted demand for real wood products versus wood-look or alternatives. Nearly 37 percent think the price gap has closed and believe customers are considering real wood over wood-look products more frequently, with another 33 percent seeing no real change due to inflation.

46 | OCTOBER 2023 HARDWOOD MATTERS WWW.NHLA.COM

www.ahec.org

CHINA’S LUMBER IMPORTS DOWN ACROSS THE BOARD

By Tripp Pryor, AHEC

Manager

China Lumber Imports from All Countries (Jan-June each year)

The Chinese demand for lumber is 36% lower in 2023 than in 2018, a loss of $1.2 billion in imports through just the first half of the year. This significant drop in imports is tied to reduced demand in China for furniture, flooring, and panels made with solid wood, and sustained concerns about the future of the housing market. Chinese furniture companies are watching their warehouses fill up with unsold furniture and are hesitant to buy materials to produce more. Manufacturing output has dropped for most of the year, and exports are down 14% from 2022. Housing prices in China continue to fall and new home sales have declined by 33%. Many people were unable to work during the strict lockdowns, which required them to dip into their savings. However, now that

the lockdowns have been lifted and people are returning to work, there is hope that the Chinese consumers will be able to build back their savings and return to a strong consumer market soon.

The market share for US hardwood lumber in China dropped as low as 20% in 2020 but has returned to over 25% in 2023. AHEC has been able to schedule and host more in-person events in China this year in our efforts to connect with our largest export market and drive growth. The AHEC China Convention in Chengdu and booth at FMC Premium in Shanghai supported direct networking opportunities for more than 20 US hardwood exporters, and we look forward to a strong schedule of events in 2023.

WWW.NHLA.COM OCTOBER 2023 HARDWOOD MATTERS | 47

30.41% 30.41% 22.50% 20.60% 24.47% 26.05% 25.60% $$500 $1,000 $1,500 $2,000 $2,500 $3,000 01/201706/2017 01/201806/2018 01/201906/2019 01/202006/2020 01/202106/2021 01/202206/2022 01/202306/2023 Millions ($USD)

International Program

OTHER Vietnam Indonesia Laos Cameroon Romania Myanmar Gabon Russia United States Thailand

Source: Global Trade Atlas

Imports down 36% ($1.2 billion)

Our industry has stories to tell.

We’re telling them.

Contribute Now to Build Your World

The Real American Hardwood Coalition has launched its Build Your World™ campaign in partnership with Magnolia Network. The ads are inspiring a national audience by educating them on the benefits of Real American Hardwood® products.