MARCH 2024

Features:

TACKLING THE STRATA CHALLENGES

FAST GROWTH CREATES CHALLENGES FOR FINANCIAL LINES

Also inside:

ISSUE 9 – A NIBA BROKERS’ GUIDE REDEFINING SUSTAINABILITY

WE ARE YOUR VOICE

*The Allianz Commercial Paris Olympic Games competition is open to Allianz Australia authorised insurance brokers that are Australian residents and aged over 18. The competition runs from 05/02/2024 to 11:59pm AEDT 29/03/2024. Prize is drawn on 02/04/2024 and published by 09/04/2024 at allianz.com.au/winOlympics. Prize is a 7-night trip for 2 to Olympic Games Paris 2024 including return economy airfares, accommodation, transfers/transportation, tickets to 3 Olympic events and AUD$4,000 spending money, valued up to AUD$44,750 (depending on date/departure). Promoter is Allianz, and full competition terms and conditions are available at allianzengage.com.au/winOlympics. Authorised under: NSW Authority No. TP/00081. ACT Permit No. TP23/02609. SA Permit No. T23/2000 As an Allianz Broker Partner, you could win a trip for 2 to the Olympic Games Paris 2024*. Get ready to cheer on our athletes live with a 7 night trip for 2 to Paris, including return airfares, event tickets to the Olympic Games, accommodation and $4,000 spending money. Visit www.allianzengage.com.au/winOlympics to enter. Entries close 29 March 2024. Ready? On your mark, Get set... Win a trip to Paris 2024

NIBA.COM.AU / 3 CONTENTS March 2024 FEATURES ACN 006 093 849 ABN 94 006 093 849 Insurance Adviser magazine is the monthly magazine of the National Insurance Brokers Association (NIBA). Insurance Adviser magazine is published by NIBA Publisher Philip Kewin, CEO, NIBA T: (02) 9459 4305 E: pkewin@niba.com.au W: niba.com.au NIBA Editor Virat Nehru Editorial enquiries E: editor@niba.com.au National Partnerships Manager Wayne Egelton E: wegelton@niba.com.au Design Citrus Media www.citrusmedia.com.au NIBA gives no warranty and makes no representation that the information contained in this magazine is, and will remain, suitable for any purpose or free from error. To the extent permitted by law, NIBA excludes responsibility and liability in respect of any loss arising in any way (including by way of negligence) from reliance on the information contained in this magazine or otherwise in connection with it. The contents of Insurance Adviser are protected by copyright and NIBA reserves its rights in this regard. 20 NOMINATIONS FOR THE NIBA AWARDS CLOSE SOON This year, you can also self-nominate. Don’t miss out on this life-changing opportunity. 24 A NIBA BROKERS’ GUIDE –ISSUE 9 As the insurance industry strives to build resilient communities, we must approach sustainability from numerous view points. The guide explores sustainability through three crucial angles: data, sustainable communities and supply chains. allianzengage.com.au A NIBA Brokers’ Guide: PART 1, ISSUE 9 - MARCH 2024 Redefining sustainability ALLIANZ COMMERCIAL NIBA004_2024_NIBA A Brokers Guide_Print_v10.indd 1 7/03/2024 3:12:25 PM

CONTENTS March 2024 4 / INSURANCE ADVISER MARCH 2024 FEATURES DISPLAY ADVERTISING INDEX – MARCH 2024 Allianz IFC Vero ...............................................................5 Insurance Advisernet 7 Insure Your Future 9 Ark Mutual 15 Hunter 17 ANZIIF........................................................ 19 Young Broker of the Year Awards 22 CBN 23 CHU 39 CUU 41, 43 Code of Practice ................................... 49 ASR 51 CGU OBC If you’d like to advertise your products and services through NIBA, please contact Wayne Egelton today on 0481 196 820 IN EVERY ISSUE NIBA CEO Welcome 6 Insure Your Future 8 Industry Bulletin 10 Representation ............................................. 16 Member Benefits .......................................... 18 REFERENCE Community Hub 52 Insurer Strength Ratings 58 36 TACKLING THE STRATA CHALLENGES Strata insurance is a burning issue at the moment 44 FAST GROWTH CREATES CHALLENGES FOR FINANCIAL LINES A testing financial climate means it’s an interesting time for brokers

Looking for insights?

You’ll find them here. Scan the QR code to watch the Vero SME Insurance Index webinar on demand or download the report.

In.Sight? 2024 Vero SME Insurance Index

Looking for Business

Insurance issued by AAI Limited ABN 48 005 297 807 trading as Vero Insurance.

BEYOND THE STATUS QUO

There’s a famous quote that “change is scary, but staying the same is scarier” and nothing can be more apt when it comes to this year’s NIBA Convention – ‘Beyond the status quo’. Change is all around us, and unless we continue to evolve and adapt, we will be left behind. At the Gold Coast in 2023, we encouraged brokers to ‘reimagine and think differently’. And what a magnificent celebration it was of everything that is great about our profession. This year, we are asking you to think further and go beyond the norm. Standing still is falling behind.

In October, we are heading to the beautiful city of Adelaide, and our Convention Committee, under the guidance of former NIBA President and Adelaide local Dianne Phelan, are hard at work putting our program together, kicking off with a Sunday afternoon welcome function reminiscent of a Louisiana Mardi Gras Street Fair.

Last year’s NIBA Convention was a tremendous success, bringing together representatives from all broking entities –from international firms to local, small business operators. I encourage you to register, book flights and accommodation early and make your plans for what promises to be a transformative experience. Registrations open on 24 April 2024 and the Convention runs from Sunday 20 October and culminates in the Gala Dinner on Tuesday 22 October, where we will crown the Young Broker and Broker of the Year winners.

In February, the spotlight was on insurers and their response to the 2022 floods in Queensland and Northern NSW through the Standing Committee on Economics. Insurance Council of Australia CEO Andrew Hall apologised on behalf of their members “to those customers whose claims were not handled to the standard our industry strives to achieve”.

What was most telling was the observation from Committee Member and Independent Member for Calare, Andrew Gee, who stated that “people aren’t aware of what they’re covered for and what they’re not covered for, it’s a major problem”. No doubt, most of these people did not have an insurance broker. The insurance industry is under intense scrutiny as premium increases continue to create affordability challenges, and place increasing focus on the policy and the insurer on being able to deliver when it matters most. Hopefully, we can learn and continue to improve to ensure that the community has trust and confidence in the insurance sector.

On a related note, the latest Vero SME Insurance Index delivers interesting insights into the value of a broker to SMEs, which could be a proxy for all insurance policyholders. The survey, which includes over 1,500 SMEs

6 / INSURANCE ADVISER MARCH 2024

CEO / Welcome

high quality ADVICE BEGINS WITH A

high quality NETWORK

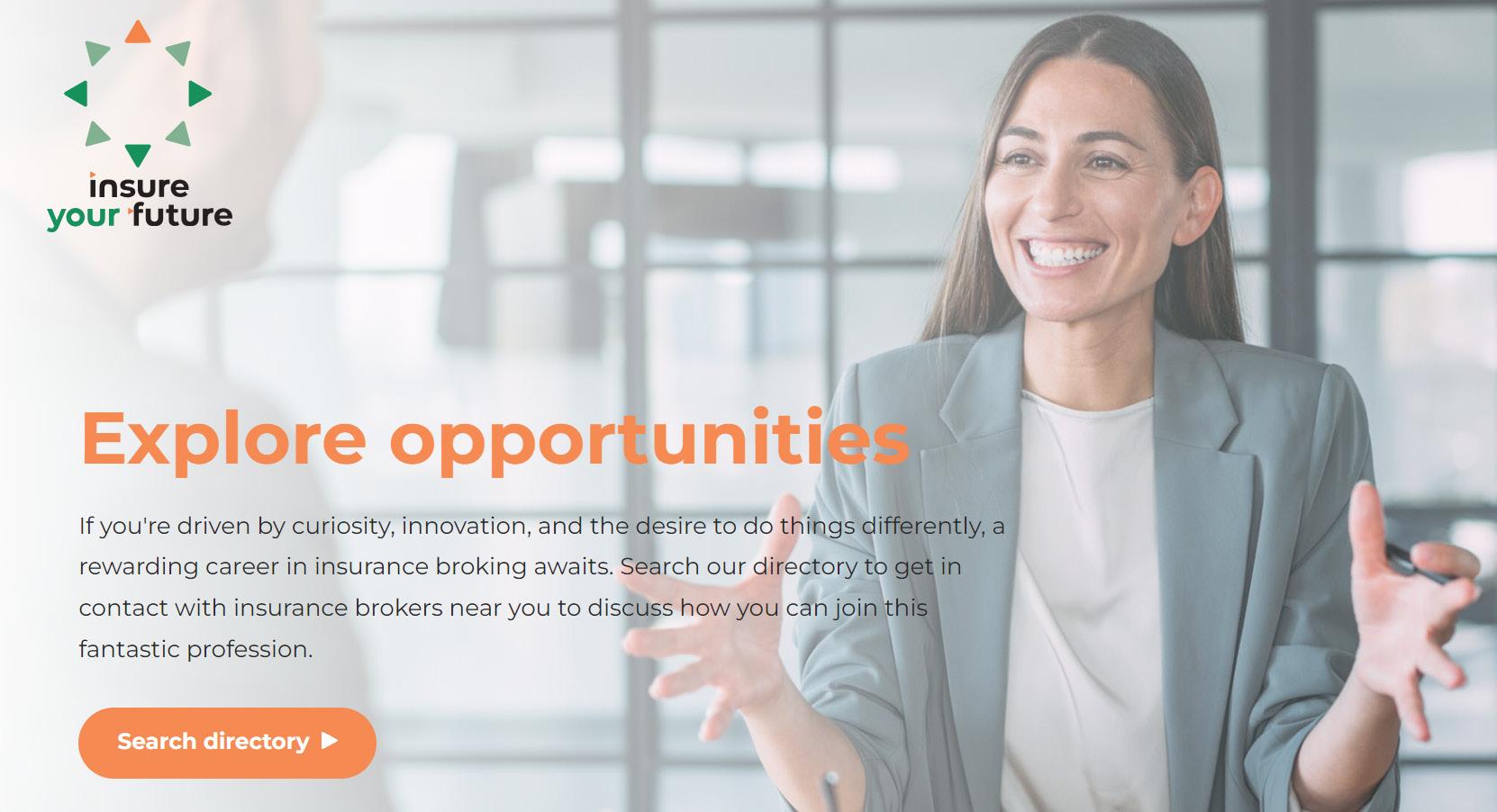

EXPLORE THE NEW ‘INSURE YOUR FUTURE’ WEBSITE

The ‘Insure Your Future’ website is now live! This is a major milestone in our journey, marking the first of many exciting updates on our progress over the coming months.

Previously, the challenge we have faced in communicating the benefits of a career in insurance broking to prospective talent is that, often, people only learn about the possibilities in broking once they have become a broker.

‘Insure Your Future’ aims to change this.

The first step in demystifying the profession and sharing insight into the realities of a career in broking comes with our website. The website hosts a wealth of information for anyone looking into a career in broking: from high-school leavers to graduates and career changers. Our website is more than just a digital space; it’s a launchpad from which visitors can explore the endless possibilities in the world of insurance broking and take the first step towards a rewarding career.

A crucial part of this is the Employer Directory, which enables ‘Insure Your Future’ to connect site visitors directly with NIBA member businesses. The Directory is filterable, meaning individuals can easily find relevant opportunities near them and kickstart their broking career. Visit the Directory page to submit your business for display.

Already like what you see? Make sure to follow ‘Insure Your Future’ on LinkedIn to keep up-to-date with the work being undertaken to further this exciting initiative.

Should you wish to represent IYF at a careers event near you, please email info@insureyourfuture.com.au for assistance.

Visit insureyourfuture.com.au for more information

NIBA is proud to present a first-of-its-kind initiative to promote insurance broking as a career of choice, Insure Your Future.

The aim of the initiative is to promote insurance broking as a career, attract more people into the profession and increase resources and information available about the profession.

Over the coming months, you will receive updates from NIBA’s dedicated Insure Your Future Committee on the project’s progress.

Do you have ideas or thoughts on what we should include? Have you seen something similar being done well elsewhere? Or do you just want to ind out more about the initiative and how you can get involved?

Please email info@insureyourfuture.com.au or contact your state NIBA Committee representative.

insureyourfuture.com.au

ICA ESTIMATES THE COST OF RECENT DISASTER EVENTS TO EXCEED $743 MILLION

The Insurance Council of Australia (ICA) has highlighted that the estimated cost of claims resulting from recent severe weather events such as ex-Tropical Cyclone Jasper in Queensland and the Christmas and New Year storms across the country exceeds $743 million.

The insured losses resulting from Ex-TC Jasper are estimated to be more than $202 million from more than 8000 claims, while Christmas and New Year storms across the country are estimated to cost $541 million from approximately 71,000 claims.

Breaking down claims by state for the Christmas and New Year storms, 74% are from Queensland, 21% are from New South Wales, and 5% are from Victoria.

These estimates by the ICA come off the back of the Insurance Catastrophic Resilience Report 2022-23 released last year, which aimed to contextualise the insured losses of historic catastrophes and made a case for a more considered approach towards risk and disaster mitigation from a policy standpoint.

The report noted that the 2022 SouthEast Queensland and New South Wales Floods cost $6 billion in insured losses, making it the costliest extreme weather event in Australia’s history.

The report highlights that natural disaster claims have been putting pressure on insurers in recent times. Not including Christmas storms or Ex-TC Jasper, since the

2019-20 Black Summer bushfires, insurers have paid out more than $16.8 billion in natural disaster claims from 13 declared catastrophes and 5 significant events.

ICA CEO Andrew Hall noted that there still might be more extreme weather events on the horizon in 2024, with the summer and tropical cyclone season posing a challenge.

“Insurers are closely monitoring the situation in Queensland,” Hall said.

“These two [Christmas and New Year storms and Ex-TC Jasper] severe weather events have had a significant impact on many, and insurers are committed to supporting their customers through this challenging time.”

10 / INSURANCE ADVISER MARCH 2024 PROFESSIONALISM / Industry Bulletin

ICA CALLS ON THE GOVERNMENT FOR A RESILIENCE FUND IN THE FEDERAL BUDGET

The Insurance Council of Australia (ICA) is calling on the government to establish an ongoing resilience fund that would assist Australians to recover from the impact of natural disasters.

The ICA wants the government to commit to a $250 million per year resilience fund as part of the next Federal Budget. This ongoing fund would be used to help buy back and raise homes for those families who have been affected by floods and other natural disasters.

As noted in its ‘Pre-Budget submission’, the ICA wants the amount of $250 million for the ongoing fund to be matched by the states and territories, bringing the total ongoing resilience fund amount to $500 million. It estimates that this amount will be able to help almost 750 families every year to escape their high-risk environments and restart their lives.

The proposed $500 million resilience fund is aimed at supplementing pre-existing arrangements and schemes already in place in states such as NSW and Qld, established in the aftermath of the devastating 2022 floods.

So far, the government has already invested $1.6 billion via joint funding arrangements to help buy back homes that are considered to be at-risk.

The ongoing resilience fund by the ICA would exist over and above the $200 million per year resilience investment provided the government through the Disaster Ready Fund Arrangements (DRFA), an amount which is matched by the respective states and territories.

Other policy suggestions in the ICA’s Pre-Budget submission aimed at driving down cost-of-living and increase in insurance premiums include:

• Incentives provided to state governments to remove insurance

taxes, helping provide immediate costof living relief;

• Extending the current Disaster Ready Fund (DRF) to make it a long-term, 10year rolling program;

• Proposed reforms to land use planning and building codes, protecting Australian homes from long-term risk of extreme weather and;

• Ensuring cheaper vehicle repairs via more training for EV mechanics and lesser barriers for motor trades.

“While there is no one solution that would immediately work to counter these factors, collectively the measures outlined in our Pre-Budget submission work to relieve upward pressure on premiums by reducing risk, which is the ultimate driver of insurance costs, and so support the community’s need for action on cost of living,” said Andrew Hall, CEO of ICA.

NIBA.COM.AU / 11 PROFESSIONALISM / Industry Bulletin

CLIMATE RISK DISCLOSURES BECOMING MORE COMMON, REPORT FINDS

Climate risk disclosures are on the rise, as more companies across the world are disclosing climate-related risks in their financial statements, according to a new joint study published by Chartered Accountants ANZ, University of Melbourne and the University of Queensland.

The new report titled ‘Climate-related financial impacts’, highlights that more than one-third (35%) of entities across the globe are including climate disclosures as part of their financial statements in 2023. This number has dramatically increased from just 18% two years ago.

“Climate risks are impacting companies’ disclosures concerning asset valuations, impairment testing, financial risks, and provisions,” said Chartered Accountants

ANZ’s Reporting and Assurance Leader, Amir Ghandar.

“As you would expect, emissions intensive industry sectors such as energy and utilities have a larger proportion of companies impacted, but we’re also seeing sectors such as consumer staples and financials calling out climate risks as a key financial consideration,” Mr Ghandar said.

The study looked at the sample size of 356 companies worldwide, with 200 of these companies listed on the Australian Stock Exchange (ASX) that have an up-to-date June 2023 balance sheet.

The study comes on the back of draft legislation released by the Australian Government earlier this year that aims to introduce mandatory reporting for relevant entities in a bid to establish a new climate

disclosure framework. If the proposed reforms become law, relevant entities will be legally required to include an annual sustainability report to go with their annual financial statements.

The Federal Government believes these reforms will help in furthering Australia’s ambitions to achieve net zero emissions.

“These results demonstrate the impacts of climate risk as a financial issue, and investors have increasingly been calling for greater transparency and consistency,” said Mr Ghandar.

“This is no doubt a primary motivation behind the Government’s climate-related financial disclosure draft legislation, and robust assurance will be essential to achieve the level of integrity and investor confidence needed for these new disclosures.”

12 / INSURANCE ADVISER MARCH 2024 PROFESSIONALISM / Industry Bulletin

NEW BOARD DIRECTORS

APPOINTED AS ICARE CONTINUES ITS REFORM JOURNEY

Three board directors have been officially appointed, as NSW’s workers compensation scheme provider continues a journey of reform that began last year.

The three board appointments are as follows:

• Re-appointment of Mr John Walsh AO, a respected actuary, accomplished social policy leader and disability advocate;

• Appointment of Ms Leah Fricke as a nonExecutive Director, a legal professional with extensive executive and board experience, including in the finance industry and on government boards and;

• Appointment of Mr Mark Morey, Secretary of Unions NSW, as the new employee representative on the board.

As noted last year, new legislation passed in 2023 mandating an amendment to icare’s existing governance structure. The

amendment ensured that the Minister for Industrial Relations and Work Health and Safety Sophie Cotsis would have the power to appoint suitable employee and employer body representatives to the icare board.

With the appointment of Mr Morey, the requirement of having an employee representative on the icare board has now been fulfilled. In a media release, the office of Minister Cotsis highlighted the extensive experience of Mr Morey, noting that he had a “deep understanding of the needs of workers accessing the scheme,” and his presence on the board would help bring “a user focus” to those requiring access to the workers compensation scheme.

A suitable employer representative to the icare board shall be appointed by the Minister in due course, once the serving term of an existing director ends later this year, leaving the overall size of the board unchanged.

Minister Cotsis welcomed the appointment of the board of directors.

“These key appointments ensure we have the appropriate skills and experience on the icare board,” Minister Cotsis said.

“Ms Fricke brings deep audit and risk experience which will be instrumental in steering icare through the strategic challenges it faces to achieve financial sustainability.

“Mr Morey has a deep understanding of the needs of injured workers and will focus on ensuring those who experience injuries, accidents or ill-health are at the centre of the system.

“I am also pleased to announce the reappointment of Mr Walsh, an experienced social policy leader who continues to inspire with his dedication to ensuring those with a disability are supported in achieving the best possible quality of life outcomes.”

NIBA.COM.AU / 13 PROFESSIONALISM / Industry Bulletin

SAVE THE DATE!

This year's NIBA Convention will be all about how the broking profession can move beyond the status quo.

Keep an eye out for more exciting details about the upcoming Convention in the next issue.

Land

Early

INDUSTRY SPECIFIC RISK PROTECTION OF BUILDINGS, CONTENTS & BUSINESS INTERRUPTION FOR: Cyclone Insurance. THE MUTUAL FOR ORGANISATIONS AT THE HEART OF LOCAL COMMUNITIES Our Ark Mutual Limited is a discretionary mutual managed by Our Ark Management Pty Ltd ABN 42 619 600 118 an Authorised Representative (AR No: 1302936) of Picnic Licensing Pty Ltd (AFSL No: 532540). Statements in this document include general advice which does not take account of your personal circumstances. Discretionary protection is not the same as insurance. To learn more, contact Our Ark for more information before deciding to become a member including Our Ark’s Constitution, its Product Disclosure Statement and Financial Services Guide. With Cyclone Insurance for Members in Northern Australia. Not for profits, faith-based organisations & charities

& NDIS housing

hotel & accommodation providers

clubs, local clubs & community groups

Community

Regional

Sporting

councils & indigenous businesses

care & education centres And more ... ask us today! Churches, Synagogues, Mosques & other places of worship Fast quotes for: Per location, building + consequential loss up to $5M No limit on number of locations / across a portfolio All Australian states & territories Longer lead time required for locations >$5M Scan the QR code www.ourark.com.au/quote GET A QUOTE

WE ARE YOUR VOICE!

A key part of NIBA’s role is representing the interests of brokers to government and regulators to ensure that all Australians have access to trusted risk advice. NIBA also maintains strong relationships with government, regulators, relevant industry bodies, consumer groups and government agencies.

FIRE AND EMERGENCY SERVICES FUNDING

Last month, the Tasmanian government announced they had “paused” the working group responsible for reforming the current funding model for the state’s Fire and Emergency Services after the group failed to reach a consensus as to how these essential services should be funded.

The proposed reforms have proven almost as controversial as the original funding models, with some groups arguing that the reforms would increase the burden on some households. In contrast, business groups and insurers welcomed the proposed reforms, applauding the Rockcliff government’s commitment to delivering a more transparent, efficient, and equitable fire services funding model.

The Fire Services Levy (FSL) currently increases the cost of commercial insurance policies by up to 28 per cent, contributing to an increase in the rate of under and non-insurance. With premiums increasing as a result of global market conditions and the increasing frequency and severity of natural disasters, the impact of this levy on Tasmanian businesses has become more pronounced, with the revenue collected from insurance customers increasing by 25 per cent in the 2022-23 financial year.

This latest announcement is a disappointing development in what has been a long road to reform. Both the Insurance Council of Australia (ICA) and the National Insurance Brokers Association (NIBA) have expressed their disappointment over the decision, calling on the next Tasmanian government to resume work to transition to a fairer and more sustainable funding model.

The events in Tasmania hint at what may be a difficult journey for the New South Wales government, who last year announced their intention to abolish the Emergency Services Levy (ESL).

This is not the first time that a NSW government has attempted to abolish the ESL, with a then-Liberal government attempting to do so in 2017, before an eleventh-hour backflip saw the levy reinstated just one month before the scheduled change.

The current NSW government appears to be powering ahead with their decision, having already commenced consultations with key stakeholders. While details around

the proposed change are scarce, NSW has a number of local case studies to learn from. Queensland, Western Australia, South Australia and Victoria have all successfully transitioned from an insurance-based levy to a property-based funding model.

With Tasmanians heading to the polls on 23 March, after the government called an early election following a breakdown in negotiations to guarantee confidence and supply, and a consultation paper for the NSW government’s proposed plan to abolish to ESL expected to be released soon, there is certain to be considerable activity around insurance levies over the coming months.

CONTACT NIBA

As always, brokers who have questions about these or any other government or regulatory matters should feel free to contact Head of Policy & Advocacy Allyssa Hextell at ahextell@niba.com.au

16 / INSURANCE ADVISER MARCH 2024 NIBA / Representation

Helping businesses afford the insurance they need Hunter Premium Funding Limited ABN 80 085 628 913. A company of Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708. With 1 in 3 of our customers finding it difficult to make their repayments this year, we’re helping more businesses get back on track. In challenging times, you can count on us to provide tailored support for your clients. Visit HPF.com.au to find out how we can help today.

GET TO KNOW THE NIBA TEAM

NANCY LUI ACCOUNTING AND FINANCE MANAGER

NANCY LUI ACCOUNTING AND FINANCE MANAGER

How long have you worked at NIBA?

I have worked at NIBA since 2010. Thus, I have been fortunate to experience and witness the various phases of NIBA’s positive evolution and development under the outstanding leadership of our past and existing dedicated CEOs and Boards.

What does a typical day in your role look like?

On a typical day, I gather information to prepare NIBA’s financial reports to

ABOUT NIBA

OUR MISSION

NIBA is the one voice for insurance brokers in Australia, representing their interests and promoting high standards of professionalism and competence.

OUR OBJECTIVES

Representation

We represent the interests of members and their clients to governments, regulators, industry stakeholders, the media and the community in a manner that is respected and relevant. We have forged strong relationships at a state and national level to ensure that your interests are represented.

ensure its accounting and financial records remain accurate, while meeting various internal and external reporting deadlines. In addition, l also monitor the budget and develop financial forecasts.

What’s something you’ve achieved at NIBA that you’re proud of?

With the transition to two new billing systems within three years, there was complexity around sales data integration. I found a working solution, ensuring that NIBA’s financial reporting could provide a true and fair view of our financial position.

What is your favourite travel destination and why?

Tibet and the Hamalayas. Both are so peaceful with stunning natural scenery and incredible hiking or trekking destinations. Many locations there are still unspoiled. These are regions of incomparable beauty.

As a child, what did you want to be when you grew up and why?

I wanted to be a nurse when I grew up. Unfortunately, I was not qualified to do a major in the sciences required to become a nurse. I could only do commerce. However, I have done some volunteer healthcare work in my free time for a couple of years. I plan to do more in that area when I have more free time.

NIBA SAYS CONGRATULATIONS

NIBA CONGRATULATES THE FOLLOWING MEMBERS FOR RECEIVING THEIR QPIB DESIGNATIONS

Gina De Bonis, Consolidated Insurance Brokers

Amanda Croasdale, ACE Insurance Advisers Pty Ltd

Joe Regan, MGA Insurance Group

Kathleen Barsden, EBM Insurance and Risk

Michaela Bianchini, DeConno & Blanco Insurance Brokers

Chris Jenkins, Guardian Insurance Brokers Pty Ltd

Andrew Miller, Scott & Broad Pty Ltd

Louise Jones, QIB Group t/as T&G Insurance

NIBA CONGRATULATES THE FOLLOWING MEMBER FOR BECOMING AN ASSOCIATE MEMBER

Eseta Toganivalu, Add Insure Pty Ltd

Professionalism

We set and promote high standards of professional practice for insurance brokers for the benefit of their clients and the community through the development of professional standards, QPIB, CPD accreditation and the Insurance Brokers Code of Practice.

Community

We provide members with opportunities to meet, share, grow and prosper, and build professional networks with the wider intermediated insurance community that will last throughout whole careers.

GET IN TOUCH!

Whatever your age, or level of experience, NIBA has brokers’ best interests at the core of everything we do. Find out what we can do to help benefit your business and your team at niba.com.au/membership

18 / INSURANCE ADVISER MARCH 2024 NIBA / Member Benefits

• • • • • • • •

Don’t miss this life-changing opportunity: Nominations for the NIBA Awards close soon

Nominations for the 2024 Young Broker of the Year and the 2024 Broker of the Year Award close soon.Through the awards, NIBA wants to recognise and champion the best broking talent that our profession has to offer. Along with nominations from peers, this year the awards are also open for self-nomination. Submit your application before it’s too late.

Nominations for the 2024 Broker of the Year Awards close soon and this is your last chance to nominate. If you or someone you know has been a senior broker holding themselves to the highest standards of professionalism and always goes above and beyond for their clients, head to the NIBA Broker of the Year Awards page to apply before it’s too late.

NIBA wants to recognise the best broking talent – this means shining a spotlight on those tirelessly hardworking individuals who chase excellence in every facet of their professional lives, be it in their dealings with their clients, professional development or giving back to the community.

The Broker of the Year Award acknowledges the exceptional contributions and accomplishments of senior brokers who demonstrate outstanding commitment, expertise and integrity in their profession. The award serves to inspire and elevate the standards of excellence within the industry, showcasing the pivotal role insurance brokers play in both the insurance industry and the broader community.

The national Broker of the Year winner this year will be the beneficiary of an envious, once-in-a-lifetime opportunity. They can pack their bags for a four-day executive education course at the NYU Stern Business School during the period of April-June 2025.

The prize includes return economy airfares and a seven-night stay in the heart of New York City, near the NYU campus. The 2024 Broker of the Year will get to experience the best of New York before returning and putting their skills and abilities into practice, showcasing themselves as a beacon of leadership to their peers and the wider profession.

NYU Stern is one of the world’s leading business schools. Their short executive courses are specifically designed for ambitious professionals from all across the world who wish to challenge themselves and advance their skills in a competitive and ever-changing environment.

Don’t miss out on this life-changing opportunity. Scan the QR code below to submit your nomination.

20 / INSURANCE ADVISER MARCH 2024 COVER STORY / Nominations for the NIBA Awards Close Soon

Experience a leadership program like no other

It’s not just the national winner of the Broker of the Year Award who will get to participate in a life-changing leadership opportunity. Thanks to award partners CGU, the five state winners for the Broker of the Year Award will also get to experience a transformative leadership program like no other. Applications are closing soon. Make sure you apply, so you don’t miss out.

Time is running out to put your application in for the 2024 NIBA Broker of the Year, proudly supported by award partners CGU. Don’t miss this unique opportunity to be recognised as a senior broker who goes above and beyond for their clients, holding yourself to the highest standards of professionalism.

While the national Broker of the Year will get to participate in a four-day executive education course at the NYU Stern Business School, our five state winners will also be part of a specially curated leadership program like no other.

Exclusively designed for our state winners, our cohort, comprising of the state winners and select CGU leaders, will take part in a transformative program that aims to foster a deep understanding of Ngarrindjeri country and its Indigenous partner organisations through guided regional tours, exclusive insights, and a unique interactive experience with an exceptional Indigenous organisation in the Lower River Murray region of South Australia.

The CGU and JAWUN Ngarrindjeri Country Immersive Experience and Capability Building Workshop will focus on

stretching the cohort’s leadership capability through building a comprehensive understanding of the challenges faced by Indigenous enterprises.

During the program, participants will work together to conduct an interactive insurance workshop that aims to empower Indigenous businesses with comprehensive insurance education and business insights. The primary focus will be on learning how to safeguard their enterprises to effectively adapt as they evolve.

This leadership program will enable our state winners to develop cultural understanding, enhance their leadership capabilities, and contribute to the empowerment of Indigenous businesses through collaborative education and resource development.

JAWUN partners with Indigenous communities in place-based capacity building, to empower Indigenous-led change and foster meaningful connections between Indigenous and non-Indigenous Australians.

The application process is straightforward. This year for the first time, you can also self-nominate. If you’re an aspiring and ambitious senior broker, apply now before it’s too late.

Details about the awards eligibility criteria are available on the NIBA Broker of the Year Awards page.

NIBA.COM.AU / 21 COVER STORY / Experience a Leadership Program Like No Other

2024

Young Broker of the Year Awards

Experience a leadership program like no other

It’s not just the national winner of the Broker of the Year Award who will get to participate in a life-changing leadership opportunity. Thanks to award partners CGU, the five state winners for the Broker of the Year Award will also get to experience a transformative leadership program like no other. Applications are closing soon. Make sure you apply, so you don’t miss out.

Time is running out to put your application in for the 2024 NIBA Broker of the Year, proudly supported by award partners CGU. Don’t miss this unique opportunity to be recognised as a senior broker who goes above and beyond for their clients, holding yourself to the highest standards of professionalism.

The Young Broker of the Year award highlights the achievements and contributions of outstanding young brokers under the age of 35.

While the national Broker of the Year will get to participate in a four-day executive education course at the NYU Stern Business School, our five state winners will also be part of a specially curated leadership program like no other.

State winners receive a four-week professional development program, a full delegate pass to the 2024 NIBA Convention in Adelaide and the opportunity to participate in the Vero Young Brokers Alumni Experience a transformative experience whereby young brokers travel to and support a local community affected by a major weather event.

Exclusively designed for our state winners, our cohort, comprising of the state winners and select CGU leaders, will take part in a transformative program that aims to foster a deep understanding of Ngarrindjeri country and its Indigenous partner organisations through guided regional tours, exclusive insights, and a unique interactive experience with an exceptional Indigenous organisation in the Lower River Murray region of South Australia.

The CGU and JAWUN Ngarrindjeri Country Immersive Experience and Capability Building Workshop will focus on stretching the cohort’s leadership capability through building

The national winner of the Vero-sponsored 2024 Young Broker of the Year Award will receive a tailored learning experience to the value of $10,000

a comprehensive understanding of the challenges faced by Indigenous enterprises.

Celebrating emerging insurance leaders for more than 30 years

During the program, participants will work together to conduct an interactive insurance workshop that aims to empower Indigenous businesses with comprehensive insurance education and business insights. The primary focus will be on learning how to safeguard their enterprises to effectively adapt as they evolve.

courtesy of Vero. Previous winners have enjoyed enriching experiences such as travelling to London to explore the international broking market and attending a study program at the prestigious Yale School of Management in Connecticut, USA. The national winner will also receive the Warren Tickle Trophy, in honour of the late Warren Tickle.

This leadership program will enable our state winners to develop cultural understanding, enhance their leadership capabilities, and contribute to the empowerment of Indigenous businesses through collaborative education and resource development.

JAWUN partners with Indigenous communities in place-based capacity building, to empower Indigenous-led change and foster meaningful connections between Indigenous and non-Indigenous Australians.

If you know a young broker who displays extraordinary talent, professionalism and commitment to community, nominate them for this incredible opportunity today.

The application process is straightforward. This year for the first time, you can also self-nominate. If you’re an aspiring and ambitious senior broker, apply now before it’s too late.

Details about the awards eligibility criteria are available on the NIBA Broker of the Year Awards page.

Take a few moments to submit your nomination at niba.com.au/awards

22 / INSURANCE ADVISER MARCH 2024 COVER STORY / Experience a Leadership Program Like No Other

Tired of feeling like a lone wolf?

You might have heard that CBN is Australia's largest general insurance authorised broker network ...

For some companies, size slows them down. At CBN, we use our strength to your advantage.

MISSION POSSIBLE

CBN provides Authorised Brokers the support, resources & connections you need, to be your own boss.

Supporting Business Growth

• Work with a dedicated Regional Business Partner for business plans and advice.

• Utilise our Broker Partnering Service during busy periods or for portfolio management.

• Financial support and HR.

Empowering Excellence

• Ensure AFSL compliance with purpose-built compliance management.

• Access professional development through the CBN Academy.

lnsurtech Platforms

• Access all resources, support, and professional development easily through The CBN Hub.

• Harness leading tech platforms like INSIGHT, SCTP, and the CBN Industry Placement Tracker.

• New lead generation website iNeedCover.

Insurance Placement and Claims Support

• Get support for complex placements and access exclusive markets.

• Navigate complex claims with assistance from the team. Be

part of the pack. Autonomous. Connected. Supported. TALK TO US To find out more about joining our network, contact us today: Chris Macperhson Senior Regional Business PartnerEastern Australia • Distribution m 0420 990 720 e chris.macpherson@cbnet.com.au w cbnet.com.au

A NIBA Brokers’ Guide:

Redefining sustainability

allianzengage.com.au

PART 1, ISSUE 9 - MARCH 2024

ALLIANZ COMMERCIAL

Welcome note 26 Data is key to achieving insurance equity 27 Building sustainable cities and homes 30 Technology facilitating sustainably managed supply chains 32 Contents This NIBA Brokers’ Guide is brought to you through a partnership between Allianz Australia Insurance Limited (Allianz) and NIBA. We hope the knowledge of our subject matter experts, coupled with Allianz’s industry expertise, helps you and your clients prepare for the future. We welcome ideas for future subjects – please email your suggestions to editor@niba.com.au. NIBA GUIDES: Part 1, Issue 9 – March 2024 25

Welcome note

PHILIP KEWIN Chief Executive Officer, NIBA

PHILIP KEWIN Chief Executive Officer, NIBA

PHUONG LY Chief General Manager, Allianz Commercial

PHUONG LY Chief General Manager, Allianz Commercial

Understanding sustainability’s extended scope

We’re accustomed to reading and talking about sustainability in the context of our environment – however, the benefits of sustainable practices extend far beyond our climate.

Of course, the environmental impact, and importance of sustainability is significant.

We, as a profession, strive to build resilient communities that are better prepared to withstand and recover from the impacts of natural disasters, we’ve got to approach sustainability from numerous perspectives, including people, technology, buildings, supply chains – as well as the environment.

In this edition of our Broker Guide, created in collaboration with NIBA, we’ve explored sustainability from three angles.

Firstly, and most pressing, is ensuring everyone can access the insurance they need. After every natural disaster, we read stories of underinsurance as well as those situations where people don’t have insurance at all. As a profession, where this is down to cost, or down to a lack of understanding about the value of insurance, we have a responsibility to address this.

Key to establishing more sustainable and equitable insurance is understanding the individual risks customers face in far greater detail. Out of necessity, the industry has long relied on assumptions – a customer’s postcode, for example.

However, today, we increasingly have the tools and data available to us to better understand those individual risks and help ensure affordability.

Another crucial element of creating more sustainable communities in the longer term, of course, is reducing the damage caused by extreme weather events.

While we can’t control the weather, as a society, we have control over how we construct new homes – and how we improve existing buildings.

The more resilient a home is, for example, the less damage weather events can cause. And, while we’re never going to eliminate property damage, we can reduce it by working towards building codes that exceed the minimum expectations.

Creating resilience in our buildings will not only keep people safer but reduce the damage and long-term impact of weather-related damage, too.

That’s damage that can last for a long, long time, and over recent times it’s been exacerbated by significant delays in builders and tradespeople being able to carry out rebuild work.

Ensuring those supply chains are sustainable, so people can quickly get help when they need it, is another hugely important issue.

We’ve got a responsibility to help people back onto their feet as quickly as realistically possible, and ensuring we have those sustainable supply chains to rely on is fundamental to that.

We cover all of these crucial topics in this guide, which is the first of a three-part series exploring how we need to redefine sustainability.

26 NIBA GUIDES: Part 1, Issue 9 – March 2024

Data is key to achieving insurance equity

Knowledge is power, and we’ve never had greater access to information than today. Data and geographical propensity modelling provide consumers with the knowledge they need to make informed insurance decisions –and insurers with the ability to individualise policies.

NIBA GUIDES: Part 1, Issue 9 – March 2024 27

Australia’s changing climate and increased threat of natural hazards is a prominent concern for those underwriting, brokering, and purchasing insurance. Indeed, the threat of natural hazards is a major reason why areas of Northern Queensland, the Northern Territory and Northern New South Wales are cited as the most vulnerable for home insurance affordability pressure.1

That increasing threat is an ongoing concern for the insurance industry, with the cost of extreme weather events expected to hit $35.24 billion annually by 2050. 2

This is why, according to a spokesperson from the Insurance Council of Australia (ICA), insurance affordability is the industry’s number one concern.

“That’s why the ICA and insurers have been advocating so strongly for measures that reduce risk and in doing so, moderate pressures on premiums,” says the spokesperson.

Underinsurance has been a post-disaster headline grabber for a number of years now, and, unsurprisingly, is also on the minds of brokers, says Debbie Pilling, Head of Risk & Analytics, Australasia at Willis Towers Watson.

“Underinsurance reduces the resilience of the country to bounce back from events, with knock-on effects such as reduced employment and lost production – including agriculture – impacting the nation.”

“There is a real possibility that entire towns or suburbs will have to relocate and abandon community resources if insurance becomes prohibitively more expensive or underinsurance becomes more widespread.”

Lack of affordability threatens equitable access

Where affordability is a concern, so too is equitable access – which is a problem, given equitable access to insurance is fundamental to building resilience in communities.

Allianz Australia’s General Manager of Commercial Products & Portfolio, Adam Lloyd, says an equitable insurance solution is finding the right level of customisation.

“‘Equitability is all about really understanding the needs of customers and effectively providing a fair solution,” he says.

“We can learn more about customers, particularly through geographical profiling, so ongoing improvements in modelling tools are essential to understand varying needs. As we know more, a challenge in being equitable is considering individual risk characteristics while maintaining the pooling of risk principle as the heart of insurance.”

Advancements in technology are helping insurers – and brokers – to individualise insurance policies, thus tackling the equity challenge.

Geographical propensity modelling – sometimes known as natural catastrophe (nat cat) modelling – leverages spatial data to make predictions about the likelihood of a weather event in a geographic area. This technique assists both consumers as well as brokers and insurance providers to determine key factors like high-risk fire areas and flood zones.

Risk Frontiers has been assisting the insurance industry since 1994 with a suite of nat cat loss models. Managing Director Ryan Crompton says the modelling has a range of insurer uses, including to help determine aggregate exposure management, purchasing or repurchasing of policies and pricing.

“For quite some time now, there’s been a push towards risk-based pricing, which is particularly important for flood and bushfire where you can differentiate risk at the address level,” he says.

“The tools exist to be able to then assess risk at a fine level, particularly for things like bushfire and flood, where you can differentiate the risk.”

Using data to better understand the risks we face

The use of data and modelling is helping insurers better understand customers and the risks they face at a granular level.

“As an insurer, we have to make assumptions about customers. We use intermediaries like brokers to inform us more intelligently, or more holistically, of what that customer profile looks like to return a more equitable type of insurance solution for that type of customer,” says Lloyd.

Pilling notes the use of data is helping brokers optimise insurance agreements through renewal negotiations.

“Brokers can also collaborate closely with insurers to suggest risk mitigation strategies based on nat cat modelling insights. These could include structural improvements, disaster preparedness plans, or relocation suggestions.”

The ICA spokesperson says such technological advancements in modelling will also play a critical role in the future of the insurance industry, helping to reduce administrative costs, provide customers with clear information about their coverage, and empower them to make informed decisions about the risks they face.

28 NIBA GUIDES: Part 1, Issue 9 – March 2024

Greater data means greater capability

As insurers begin to work with more third-party management consultants and technology, insurers are reaping the benefits of greater access to data.

“That is where we are seeing the evolution, as opposed to just an insurance company solely relying on the information that they’ve gathered in the past,” says Lloyd.

“I think we’re certainly seeing a richer pool of information and insights coming into the decisions that insurers are making when it comes to catastrophe modelling.”

There are also risk management benefits for brokers using modelling, says Crompton.

“If a client has a number of assets, which assets are the ones that are driving the insurance premium? The type of work that we do can help identify the risk profile of a broker client’s individual,” he says.

“Another area of focus is future climate scenarios. That’s another evolution from our point of view, where the cat loss models are used to look at future loss scenarios, using the modelling framework to look at the correlation between the perils.”

Tips for brokers

1. Geographical or nat cat modelling can help brokers understand a client’s potential risk and help them make informed decisions about their insurance.

2.Modelling can provide insights to help clients explore reducing their total cost of risk through resilience measures.

3.Look for parametric solutions that make payments on a specific weather event, instead of damage sustained.

4.Parametric solutions can provide liquidity and certainty for defined risks.

Climate change requires investment

Risk Frontiers provided data to the ICA’s Insurance Catastrophe Resilience Report 22-23, showing more than $16.8 billion was paid by insurers in natural disaster claims since the 2019-20 Black Summer bushfires.

An ICA spokesperson says that to stabilise insurance premiums in the long term, there needs to be greater investment by governments in resilience measures that increase the protection of homes and communities from the impacts of extreme weather events. This is an addition to changing planning regulations to stop further development in flood-prone locations.

Brokers need to play a critical role in preparing clients for future climate-related events, and the impact on their future insurability.

Pilling says, “We also need to be mindful that climate change uncertainty will make standard insurance products harder to obtain in areas prone to weather events. Clients need to build their resilience now to a changing insurance market so that they can take control and be disaster-ready, if not disaster-proof.”

“Brokers should be working with their clients to understand their future exposure to the changing climate and consider this as part of the longer-term strategy.”

1 https://insurancecouncil.com.au/wp-content/uploads/2022/11/ICA-Climate-ChangeRoadmap_NOV-1-FINAL.pdf

2. https://insurancecouncil.com.au/wp-content/uploads/2022/09/20683_ICA_Final_ WebOptimised.pdf

NIBA GUIDES: Part 1, Issue 9 – March 2024 29 29 NIBA GUIDES: Part 1, Issue 9 – March 2024

Building sustainable cities and homes

Insurance is a key piece in the puzzle of future sustainable communities. The risk of natural hazards has never been higher, and sustainable buildings need to be resilient enough to withstand such weather events.

The concept of sustainability has moved beyond the scope of helping the environment to a comprehensive approach of improving the world we live in, including the urban development of our future cities.

As Australia continues to weather the effects of a changing climate, the need for a societal shift towards constructing sustainable homes and buildings has never been greater. This provides both opportunities and challenges for the insurance industry.

A spokesperson for the Insurance Council of Australia (ICA) says the role of the industry is vital in making a change.

“Insurance plays a vital role in building future sustainable communities, and by providing financial resilience, promoting risk mitigation and supporting sustainable infrastructure, insurance can help create a more sustainable society.”

The ICA is advocating for strengthening the National Construction Code (NCC) to legislate the need for more resilient new homes. This move is thought to have a flowon savings of close to $4 billion annually for homeowners.³

As major weather events are becoming more frequent and more expensive to recover from, addressing sustainability becomes central to the debate.

“Addressing sustainability in our properties and communities is a very important and pressing issue, and one which takes the combined efforts of the insurance industry, government and the community together,” says General Manager of Sustainability at Allianz Australia, Sema Whittle.

“As an insurer, Allianz plays a dual role – firstly, we continue to put in place measures to support our own resilience as an organisation, and secondly, to support our customers and the community.”

More than the minimum required

Resilient and sustainable communities are far better equipped against the increasing threat of natural hazards. While the NCC in Australia establishes baseline standards for the construction of buildings to minimise risk, it may not comprehensively address all the unique challenges created by a catastrophic weather event.

Dr David Henderson is the Chief Engineer of the Cyclone Testing Station based out of the James Cook University Campus in Townsville. Although the NCC sets a minimum standard for natural hazard-resistant criteria like wind loading, experts like Dr Henderson warn the minimum is just that.

30 NIBA GUIDES: Part 1, Issue 9 – March 2024

“Pretty much everybody focuses on the minimum criteria and thinks: that’s great. Well, it’s just a minimum. A fairly crude analogy is your car – it’s got crumple zones and 27 airbags and all these things, it’s just not a latched seatbelt anymore. And that may well have been the minimum criteria,” he says.

“We should be really pushing to go beyond the minimum and the benefits that’s giving us in terms of thinking about better window seals, fixing our flashings to our building, fixing our solar panels more correctly and all those other things to improve the resilience and functionality of our building.”

Dr Henderson also said there are differences across the codes at state and territory levels, such as the key difference in wind load design in Western Australia.

The geographic area of a building must be considered beyond the basic NCC requirements. The ICA has previously called for all states and territories to reform planning rules to prevent new homes from being built in high-risk areas of the floodplain.

It’s also worth noting that the NCC primarily applies to the design and construction of new buildings and, in some cases, the structures associated with buildings. It also applies to the plumbing and drainage systems in new and existing buildings.

In October 2023, NSW became the first state to implement enhanced sustainable building standards for new homes and commercial buildings.⁴ These new changes align with the NCC 2022, which, although all states and territories have agreed to, has a varying timeline for commencing changes.

The strive to meet the challenge

A spokesperson for the ICA says the insurance industry has a responsibility to lead the way in addressing climate change.

“By working to reduce greenhouse gas emissions and promote a more resilient economy, the insurance industry can contribute to a more sustainable future for all,” the spokesperson said.

Allianz is one insurer working to reduce emissions. Some examples of their initiatives include using more digital assessments, electronic documents and looking for opportunities to repair over replace in its motor portfolio.

Using Green Specs to make changes

“The Green Building Council of Australia has partnered with Allianz to encourage their customers to make small changes to contribute to a more sustainable future,” says Whittle.

“Green Specs offers homeowners practical ideas to boost the energy efficiently and resilience of people’s homes.

“There are a number of barriers that people face when it comes to sustainable improvements, including the associated high costs and complexity,” she says.

“What entails sustainable renovations is still unclear, with almost half of Australian homeowners saying there isn’t enough information available on how to make their home more sustainable and they don’t know where to start.”

Davina Rooney, CEO of the Green Building Council of Australia, says the insurance industry has an enormous opportunity to drive the sustainable building conversation forward in Australia.

“In many aspects, insurers are the first to be aware of the full scale of damage and so there’s an enormous opportunity to take that key insight that they have and use that to drive strategic change across all of the industry,” says Rooney.

“The thing that we all want to see is a better-built form, which is more responsive to shocks and stresses in the built environment. There are real challenges otherwise – there is an enormous impact on everyone involved, and sadly, the most vulnerable suffer.”

Tips for brokers 1.Ask for a Climate Resilience Assessment to assess current and future risks. 2.Protect your clients against future risk by regularly reviewing coverage against potential financial losses. 3.Use your curiosity to uncover your client’s risk management. 4.Check the Australian Building Codes Board (ABCB) resource library for in-depth understanding of NCC-related materials. 3. https://insurancecouncil.com.au/wp-content/uploads/2023/10/231023-CIE-Final-ReportICA-Summary-Report_Format_Master.pdf 4. https://www.planning.nsw.gov.au/policy-and-legislation/buildings/sustainable-buildingssepp NIBA GUIDES: Part 1, Issue 9 – March 2024 31

Technology facilitating sustainably managed supply chains

A customer’s perceived value of insurance is often impacted by the claims resolution process. As Australia faces more natural hazards than ever before, advancements in technology and AI are helping the industry to meet increasing demand.

32 NIBA GUIDES: Part 1, Issue 9 – March 2024

In the wake of a natural disaster, timely and fair claims handling is crucial. As of February 2023, the Australian Financial Complaints Authority (AFCA) found delays to be the leading cause for complaints in the 2022 floods in New South Wales and South East Queensland.

“In the past, the summer was our CAT season – however, today, the CAT season is essentially 12 months a year,” says Danny Adams, General Manager, General Insurance Claims at Allianz.

“As an industry, we’re now specialising in disaster response. We let the government and the emergency services play their roles at the beginning, and then it’s over to insurers to continue the recovery.”

Scott Cooper, National Manager, Disaster & Recovery at Allianz, agrees the frequency of natural disaster claims is increasing.

“As an insurer, we’re starting to see event frequency and therefore claims volume for CAT claims rival our BAU books. There are times where I think the two books are almost neck and neck,” he says.

How insurers can help improve outcomes

Considered to be the risk managers of society, insurers have a key role in establishing sustainable and purpose-driven solutions for the many facets of the claims process. When insurers and underwriters work closely with brokers, better customer outcomes are reached.

“In the first instance, I think that there’s a much better customer outcome where broker, insurer, builder-repairer all work together for the common good,” says Cooper.

Allianz use a rigorous Request for Proposal (RFP) process that includes regularly reviewing panels every three years to both minimise the environmental impact and ensure it partners with expert professionals with the ability to scale their efforts after a disaster.

This includes forming relationships with large, multifaceted trade professionals that can act as a ‘one-stop shop’ to help improve timelines from assessment to reconstruction and claims resolution.

“Understanding what supply chains we use on these types of claims ensures the right capabilities put on those claims from the beginning – not at week one, week two, week three,” says Adams. “We can fast track the assessment phase especially, but also ensure that our customers are looked after from A to B.”

Working in partnership with communities

Post-catastrophe, Allianz is working in communities with targeted efforts focused on streamlining partners to work efficiently in the same community.

“It gives us the ability to also drive and direct builder A for street number one, builder B for street number two and so on, so that we just haven’t got builders and or loss adjusters crisscrossing all over the place,” says Cooper.

NIBA GUIDES: Part 1, Issue 9 – March 2024 33

“Ultimately, the goal is for Allianz customers to have the same builder, the same assessor, the same person that they know and who can work within our business through the whole claims process”.

The use of technology and data is also helping insurers learn about a customer’s loss, potentially even before the customer themselves know.

“The technology also provides value-adds that we’re trying to give to our brokers as well,” explains Adams. “Giving them the information to know that our joint customer essentially has suffered a loss. Brokers can also play a key role around communication.”

Aside from ensuring the claims resolution process is as smooth as possible, insurers – and brokers – must be part of rebuilding communities so that they’re more prepared and more resilient against future catastrophic events.

“I think that the re is a key role that insurer plays in the aftermath of a catastrophic loss in talking about what ‘building back better’ looks like,” says Cooper.

Against a backdrop of inflation and the rising cost of living, Cooper says a prudent and hard discussion between brokers and customers must be had around the true understanding of sums insured, and the realistic cost of repairing a home to a standard that can withstand a similar event.

“It’s a conversation that needs to be led by the insurance profession to help people understand what it’s going to be like to rebuild. It’s going to take a particularly delicate and targeted approach to work with customers around this area, and that’s the role an insurance professional like a broker will play.”

Why consistency is key

Data from ICA and finalisation rates are useful measures when insurance benchmarking. For Cooper, his main criteria are more subjective, particularly for regional areas.

“I think it’s how the customers are experiencing these things. If you’re a regional broker, for example, you’re living and working in that community,” he says.

“You’re going to see which insurers are active in your community because you’ve been through the event at the same time and you’re also going to have some corporate memory of the last event that took place in your community and who did well and who didn’t.”

Adams advises brokers to request a portfolio view of natural disasters from an insurer, to gauge the finalisation rates and speed they move at compared to ICA data.

How AI is changing the claims resolution process

The use of data and mapping gives insurers an insight into potentially impacted customers, who can then be contacted through outbound calls for welfare checks.

By partnering with data providers, insurers can use satellite images to see things like the depth of water in a flood zone every 12 hours, which can, in turn, help predict damage.

“We can identify and sometimes know of an impacted home before a customer themselves knows, particularly if they’ve been taken to an evacuation centre,” says Cooper.

“From our perspective, information is absolutely missioncritical to what we do, and it helps our partners. Being able to turn the data we get early into insights for our broking partners as well is so useful. We can get to the point where we can place an outbound call to a broker saying we think this is coming, you should contact our customer.”

Sustainability a key concern for insurers

Beyond the notion of efficiency, insurers in 2024 are looking for ways to minimise the impact on the environment.

“It’s a huge agenda for Allianz globally,” says Adams. “It underpins everything, every aspect of our business –from claims management to underwriting to supply chain, it goes right across our business and customers as well.”

“Really measuring their portfolio performance versus the rest of the industry will gain the broker some really key insights on insurance performance,” he says.

Research from ASIC shows the highest consumer satisfaction is from open communication and presentation of a map of the claims process, and it’s a sentiment that is backed by Cooper’s own experience in the sector.

“Natural hazard events are now so commonplace that it’s a real differentiator for insurers in terms of how we respond,” says Cooper.

“There will be differentiators around levels of cover, but there will also be differentiators around an insurer’s physical response to the event and how they are treating mutual customers. I think that’s been a real shift in the marketplace in the time that I’ve been doing this work and I genuinely believe its been for the better.”

34 NIBA GUIDES: Part 1, Issue 9 – March 2024

The New Business Resilience – Part One

NIBA Guides

Member Helpline: Tel: 02 9459 4300 / niba@niba.com.au / www.niba.com.au

National Insurance Brokers Association Suite 4.01B, Level 4, 31 Market Street / Sydney NSW 2000

Allianz Australia Insurance Limited Level 16, 10 Carrington Street / Sydney NSW 2000

For the latest product news and information from Allianz, visit www.allianzengage.com.au and connect with us on www.Linkedin.com/showcase/AllianzBrokerandAgencyAU

CPD Entitlement

NIBA Members can gain ½ a point per hour engaged in reading the substantive content of an issue of A NIBA Brokers’ Guide. For more information and to download a CPD reading record sheet, visit www.niba.com.au/unstructured-cpd. Members can claim a maximum of 7.5 points annually for unstructured training (professional reading and individual research activities).

Allianz and NIBA gives no warranty and makes no representation that the information contained in this publication dated March 2024 is, and will remain, suitable for any purpose or free from error. To the extent permitted by law, Allianz and NIBA excludes responsibility and liability in respect of any loss arising in any way (including by way of negligence) from reliance on the general information contained in this publication or otherwise in connection with it. The contents of this guide are protected by copyright. © Allianz Australia Insurance Limited (ABN 15 000 122 850) and National Insurance Brokers Association 2024.

TACKLING THE STRATA CHALLENGES

If you’re searching for talking points within the housing, strata and landlord sector, you don’t need to look too far.

By MARTIN WANLESS

The 2022 floods in South East Queensland and Northern NSW –which resulted in more than 242,000 claims and a loss of more than $6bn –are still fresh in the minds of most. Last year’s Insurance Catastrophic Resilience Report 2022-23 from the Insurance Council of Australia recommended a range of actions, including increased investment in resilience and risk mitigation, as well as the reform of ‘unfair’ state taxes that increase the cost of insurance.

Add into the mix the forecast El Niño which, at the time of writing at least, hasn’t eventuated as feared, the Parliamentary inquiry into the industry’s response to the 2022 floods, increased frequency and cost of claims, rising premiums, availability of cover, building defects and the Reinsurance Pool, and it’s clear to see it’s a sector that’s comprising a few moving parts at present.

“Insurance companies are continuously having to adapt to this evolving landscape of risk, and in my opinion, it’s not always necessarily for the better,” says Kass Carroll, Strata Team – Broking Manager, Aviso Broking.

“Some are becoming a little more sophisticated in their risk assessment techniques – certainly with the advent of new technologies, including flood and bushfire mapping and the use of drones – and most also have access to massive amounts of data analytics and predictive modelling to allow them to better understand the potential for claims on certain properties in specific regions or locations, which informs premiums, deductibles and risk appetite.

“In areas or regions where the risk is deemed too high or on properties that have had a significant volume of claims over a short period of time, the insurers will deem continuation of cover far too unprofitable or ‘too high in risk’ and may refuse to offer renewal altogether or cease offering insurance in certain regions. This, in turn, leads to reduced competition and availability of insurance for properties in some areas.”

Luke Scott, General Manager of Longitude Insurance, says placing strata buildings in high-risk locations is becoming challenging.

“Insurers are monitoring their exposure to natural catastrophes closely and are placing more emphasis on being selective

36 / INSURANCE ADVISER MARCH 2024 FEATURE / Strata Insurance

NIBA.COM.AU / 37 FEATURE / Strata Insurance

“INSURANCE COMPANIES ARE CONTINUOUSLY HAVING TO ADAPT TO THIS EVOLVING LANDSCAPE OF RISK, AND IN MY OPINION, IT’S NOT ALWAYS NECESSARILY FOR THE BETTER.”

– KASS CARROLL, STRATA TEAM – BROKING MANAGER AT AVISO BROKING

when accepting strata buildings in highrisk peril areas. For example, we are seeing insurers re-evaluate their appetite when it comes to insuring strata risks close to the coast due to the exposure to storm and rainwater runoff.”

Peter Gibb, Senior Underwriter at Wellington Underwriting Agencies, shares a similar sentiment.

“It continues to be challenging for our insureds to source well-priced cover in flood and cyclone-affected areas of Australia.

“The local insurance market has been unable to provide coverage that gives insured certainty and delivers a reasonable profit to underwriters. We have been able to work with our local and overseas markets to deliver more cost-effective solutions, more efficient program design, and work closely with our broker partners about messaging and risk mitigation.”

This isn’t just an insurance issue, and solving it needs a multifaceted approach.

Kimberley Jonsson, CEO of CHU Underwriting Agencies, says, ‘We are working closely with industry bodies, government and regulators on the issues of preparedness and affordability.

“Government, industry bodies and businesses are all coming together to put policies and procedures in place to be better prepared when these catastrophic events occur.

“We have begun implementing technology enhancements to facilitate real-time access to claims information and improve communication with brokers and policyholders, while in terms of affordability, we’re already seeing some positive impacts for customers in the premium cycle from being part of the ARPC Cyclone Pool, especially for those in cyclone-prone areas.”

TACKLING BUILDING DEFECTS

Of course, away from the weather, building defects is the cause of another major – and ongoing – headache.

“Building defects are a common issue across Australia for apartment owners and strata managers,” says Jonsson.

“Some level of building defects are considered inevitable, however, the rising number of defects has led to significant distress in affected residents and owners. It

38 / INSURANCE ADVISER MARCH 2024 FEATURE / Strata Insurance

Lithium-ion battery fires on the rise

Lithium-ion batteries are present in many devices, gadgets and appliances we use every day. However, they bring with them a serious fire risk, which insurers are paying close attention to.

CHU’s Jonsson says, “Fires started by lithium batteries are the next claims on our radar. They are low in number at present but increasing in frequency. But when they do occur, they are intense. These events receive a lot of media attention both here in Australia and overseas, like the unit fire at North Bondi on 19 January 2024, sparked by a faulty lithium-ion battery, and a resident in North Carolina starting a house fire while attempting to replace a battery themselves.”

The ACCC received 231 product safety reports related to lithium-ion batteries between April 2017 and March 2023, recorded 23 product recalls in the five years to December 2022, and saw a 92% increase in reports of lithium-ion battery incidents from 2020 to 2022.

Lithium-ion battery fires can be hugely destructive and often need to burn out due to the thermal runaway. The advice is to use batteries that are approved for use in Australia, and product-specific, approved chargers, as well as only charging in accordance with manufacturer guidelines.

is important to note that, while defects may be excluded from the property section of the policy, the exclusion may not carry over to the liability section of the policy. In the event of a building disaster that injures or causes death, the bulk of the claim may likely come from the liability section of the strata insurance policy.”

Andrew Robson, General Manager of SUU, says, “Some strata buildings continue to be impacted by the discovery of defective building works. This often results in either an increase in insurance costs or the inability to find coverage.

“Clients need to be proactive once they first discover the defective works and manage the identification, mediation, and rectification as closely as possible to ensure the best outcome for all owners. Not only will this lead to a faster rectification solution, it will most likely assist with the placement of coverage.

“Most strata specialist underwriters will look to work with existing Owners Corporation clients as they work through their defective works – as long as there is

clear and active communication, active participation in rectification, and a workable timeline to manage their risk exposure.”

Scott says a proactive approach to risk management and defect rectification programs on the part of the Owners Corporation and their representatives is key here.

“Most insurers will work with existing clients who are working to address their increased exposures in a timely manner,” he says. “However, clients who are not being proactive in rectifying these issues are finding it the most difficult to insure their buildings, with some having to engage nontraditional markets to source cover.”

Time, says Gibb, is a commodity sometimes not afforded, however.

“The new unwillingness of major strata players to give unit owners time to get building defects attended to has seen several large properties having to look at alternative solutions, which all include an element of self-insurance, either through high deductibles or exclusions.”

40 / INSURANCE ADVISER MARCH 2024 FEATURE / Strata Insurance

FIRE RISK

Of course, it would be naive to suggest challenges in strata insurance are confined to the headlines. For example, says Robson, fire has been a rising source of strata claims over recent years.

“Fires are not only extremely costly and dangerous, they also result in many people being displaced, generally forcing owners and tenants into the rental market which is already experiencing a shortage.

“Specifically, there has been a rise in cooking accidents within strata properties, with more than one in five fire claims originating from these incidents. Additionally, fires caused by arson, electrical faults in appliances and battery fires [see breakout] create exposure challenges.

“Owners and tenants can take preventative actions to reduce the possibility of fires, including taking care when cooking with fire ignition sources or fuel as well as appropriately maintaining electrical equipment – like white goods and air

conditioning units – in accordance with manufacturers’ recommendations, including storage. Appropriate fire control systems, including simple items like functioning smoke detectors and fire extinguishers, will all assist in reducing the impact of fires in strata.”

Likewise, water and other infrastructure faults are common issues for insurance to deal with, and ongoing maintenance plans are essential to minimise claims.

“Strata buildings are complex structures with key components like water pipes, electrical wiring, air conditioning systems throughout the buildings, so when something goes wrong with these components, the disruption and damage can be significant,” says Carroll.

“Water damage is one of the most common causes of strata insurance claims. Significant claims will have an impact on insurance premiums on renewal. The key is to minimise claims with a good maintenance/prevention regime in place, both at the building and lot-owner level.”

“WE ARE WORKING CLOSELY WITH INDUSTRY BODIES, GOVERNMENT AND REGULATORS ON THE ISSUES OF PREPAREDNESS AND AFFORDABILITY.”

– KIMBERLEY JONSSON, CEO AT CHU UNDERWRITING AGENCIES

of mind for the strata community

FEATURE / Strata Insurance

www.suu.com.au

peace

VALUATIONS KEY IN AN INFLATIONARY ENVIRONMENT

For brokers working with strata clients, building valuations should be front of mind, says Robson.

“With significant increases in building costs, brokers should encourage and highlight the need to ensure that properties are insured for their full replacement value. While generally, strata legislation requires properties to be insured for their full replacement value, different states carry different valuation requirements and brokers need to work with their clients to ensure coverage is continually reviewed for adequacy and amended accordingly.”

Scott agrees, adding, “With rising claims and cost inflation, it is more important now than ever to obtain regular valuations and index the building sum insured each year.”

Carroll says her role as a broker is part broker, part educator.

“It’s incumbent on us, as professional advisers, to discuss all relevant risk