NIPSANEWS

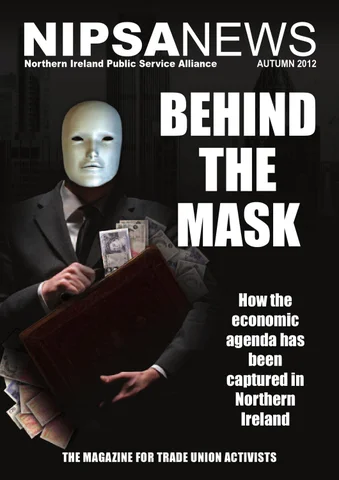

BEHIND THE MASK

Northern Ireland Public Service Alliance

AUTUMN 2012

How the economic agenda has been captured in Northern Ireland THE MAGAZINE FOR TRADE UNION ACTIVISTS

NIPSANEWS

BEHIND THE MASK

Northern Ireland Public Service Alliance

AUTUMN 2012

How the economic agenda has been captured in Northern Ireland THE MAGAZINE FOR TRADE UNION ACTIVISTS