4 minute read

Staying on Target to Pass the CPA Exam

By KIM CONDURSO, NJCPA MEMBERSHIP DEVELOPMENT SPECIALIST

Just as the business world continues to evolve, so does the CPA Exam. From minor updates to significant overhauls, the goal is to ensure that future CPAs are equipped with the skillsets necessary for an adapting profession.

Advertisement

Every six months or so, the Uniform CPA Examination undergoes revisions that help to maintain the relevancy of the CPA Exam content. In most cases, these changes are minimal, like the addition of a new topic resulting from recent legislation or removal of subject matter that has become obsolete. Other times, the changes are more substantial and affect multiple sections, such as the inclusion of more tech-focused concepts across all sections to address analytical and critical thinking. These more significant revisions could even have an impact on education and eligibility requirements to sit for the CPA Exam.

RECENT CPA EXAM CHANGES

While 2020 was a challenging year in many respects, updates to the CPA Exam were relatively modest. Adoption of a continuous testing model resulting in the elimination of testing windows garnered the most attention when it was implemented in July. Continuous testing was a positive and welcome change, especially after pandemic-related testing center closures last spring. The continuous testing model not only allows for year-round testing with very limited restrictions; it also resulted in the elimination of testing windows in addition to the two-week blackout window at the end of each quarter where testing was previously prohibited. Before this rule was implemented, candidates who failed a section of the Exam would be required to wait until the next testing window to retake the section and could not sit for the same section twice in one testing window. Now that these testing windows have been removed, candidates can apply for a new Notice to Schedule (NTS) and, in most cases, retake an Exam section immediately after scores are released. The removal of the testing windows is permanent and was not a direct result of the pandemic.

The good news for candidates sitting for the Exam during the first part of 2021 is that the more comprehensive changes that were originally set to go into effect in the first half of 2021 have been pushed back because of the pandemic.

Future CPAs sitting for the CPA Exam in 2021 should be aware of the following updates:

* As of Oct. 1, 2020, the Coronavirus, Aid, Relief, and Economic Security (CARES) Act has become a testable topic, mainly in Regulation (REG) and Financial Accounting & Reporting (FAR).

* There is more focus on technology, particularly in Auditing & Attestation (AUD) and Business Environment & Concepts (BEC), in the areas of data analytics and SOC reports.

* IFRS versus GAAP has been removed from FAR.

* Estate taxation has been removed from REG.

There are a handful of other minor changes that can be learned about at aicpa.org/becomeacpa/cpaexam/ cpa-exam-announcements.html.

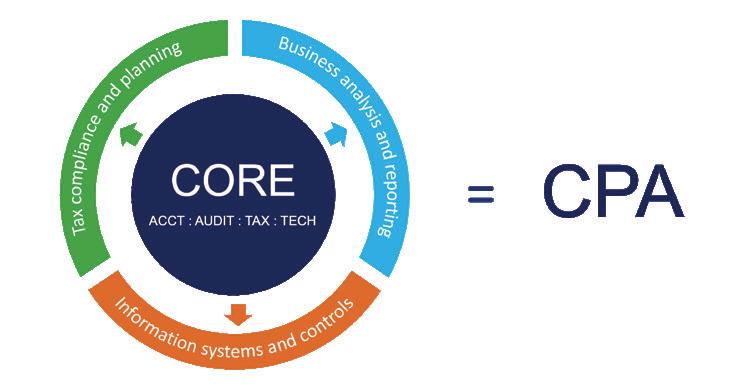

CPA EVOLUTION

The most significant modification coming to the CPA Exam since 2017 will be the implementation of CPA Evolution, an entirely new licensure model, with proposed changes going into effect in 2024. The goals of this initiative, spearheaded by the National Association of State Boards of Accountancy (NASBA) and the American Institute of CPAs (AICPA), are to “enhance public protection” by producing candidates with deep knowledge and to redesign the model to be “adaptive and flexible, helping to future-proof the CPA” as a foundation for the changing profession. This new model will allow all Exam candidates to demonstrate knowledge in four core areas: accounting, auditing, tax and technology. In addition, candidates must elect to specialize in one of three disciplines: tax compliance and planning; business analysis and reporting; or information systems and controls. All candidates will earn the same license, regardless of the chosen specialization. Despite selecting one of the three disciplines, future CPAs will not be required to practice in their specialized area so long as they have the education, skills and capabilities to practice in the area(s) of their choice.

ASSISTANCE FOR NJCPA MEMBERS

From education to the CPA Exam, the cost of becoming a CPA can be significant. According to a 2020 article by ROI-NJ, New Jerseyans have the twelfth-highest student loan debt balance as compared to all U.S. states, with an average of $35,000 per borrower.

To help address this issue among NJCPA members, the Student Loan Debt Task Force, chaired by Melissa Dardani, CPA, and Zachary Cohen, CPA, submitted a proposal to the NJCPA Scholarship Fund to request that the Fund set money aside to help NJCPA members reduce their student loan debt. The Fund agreed to allocate funds to establish the NJCPA Student Loan Debt Lottery, with the first lottery drawing occurring in November 2020. The lottery was open to NJCPA Fellow and Associate members who had at least $1,200 of student loan debt.

A total of 172 members, with cumulative debt exceeding $5.8 million, submitted an entry. Ten winners were randomly selected to each receive $1,200 paid directly to his or her student loan provider. These winners alone had combined student loan debt of over $425,000.

For more than 60 years, the NJCPA Scholarship Fund has awarded dozens of scholarships annually to high school seniors planning to major or concentrate in accounting and college juniors and seniors majoring in accounting. Two years ago, the Fund began offering a CPA Exam Fee Lottery that annually awards 10 NJCPA Student and CPA Candidate members with $750 vouchers to help cover registration and other fees associated with sitting for the CPA Exam.

Kim Condurso is a membership development specialist at the NJCPA. She can be reached at kcondurso@njcpa.org.

READ MORE:

CPA EXAM INFORMATION AND RESOURCES njcpa.org/cpaexam

CPA EVOLUTION evolutionofcpa.org

CPA EXAM BLUEPRINTS aicpa.org/becomeacpa/cpaexam /examinationcontent.html

NJCPA SCHOLARSHIP FUND njcpa.org/scholarship