5 minute read

Online Solar Marketplace: Opening new possibilities for installers

Online Solar Marketplace

Opening new possibilities for installers

by Mitch Bihuniak

When it comes to renewable energy, everyone talks about solar, but the solar industry is behind the times when it comes to procuring equipment. E-procurement is becoming the norm for B2B purchases. Think of using Amazon for industrial parts. While other vertical industries have B2B trading marketplaces, making it easier to procure materials and cut costs, solar installers and EPC contractors are still working with individual suppliers to source solar panels, inverters, batteries, racking, and other balance of system components. Until now. E-procurement through a central trading hub is emerging as a preferred means of sourcing goods, enabling buyers to bid on components, negotiate terms, and guarantee delivery for both spot and forward purchasing.

The boom in solar installations, combined with supply-chain disruptions, have made it harder to find solar components. Solar installations worldwide increased by 64 percent from 2022 to 2023, with an estimated 413 GW of solar power added in 2023. And inventory is building. Module manufacturing capacity has reached 839 GW for modules, driving prices to an all-time low. At the same time, supplychain challenges, tariffs, and new regulations make it harder to get needed components.

Global procurement problems - how we got here

How did we get here? Supply-chain issues plagued the solar market in 2021, but between 2022 and 2023, solar manufacturing capacity increased from 358 GW to 640 GW. While 80 to 90 percent of photovoltaic manufacturing is still in China, solar manufacturing in India, Europe, and the U.S. is rising. Passage of the Inflation Reduction Act in the U.S. encourages domestic manufacturing of renewable energy products like solar modules, inverters, and batteries. However, breaking the supply chain logjam will take time, especially since the majority of goods come from overseas.

Other factors affecting solar component availability include tariffs on imported crystalline photovoltaic cells (CSPV). Section 201 tariffs passed during the Trump administration have been extended through 2025, making it harder to find cheap imports. The SEIA predicts that the U.S. will continue to import up to 90 percent of solar modules despite higher prices.

The Uyghur Forced Labor Prevention Act, passed in 2021, also extended the prohibition of importing goods made using forced labor. The Act assumes that all goods made in China’s Xinjiang Uyghur Autonomous Region, including solar components, are the product of forced labor, which has directly impacted the supply of solar modules.

Economic and regulatory problems have made it difficult to find a reliable supply of solar modules, aluminum frames, glass, inverters, and other vital solar components. As a result, solar installers are seeing increased costs and delays due to a lack of components, as well as higher labor costs, higher inventory costs, and cash flow issues.

A solar trading exchange can alleviate these issues by consolidating multiple suppliers in one place. Buyers can put out a competitive bid for components, negotiate prices, and coordinate shipping to ensure they have a reliable supply of materials.

Time for a solar component trading platform

B2B marketplaces aren’t new. Just as consumers use online shopping, industrial buyers use online ordering for parts and materials.

McKinsey reports that 65 percent of industrial suppliers offer online purchasing. The pandemic has accelerated the move to online procurement. Personal sales calls are no longer the norm. For the first time, industrial suppliers are more likely to sell goods online instead of taking in-person orders. Following the pandemic, only 20 percent of B2B buyers want to return to in-person selling.

B2B marketplaces simplify procurement and give buyers more options. For example, Zoro is an online source for tools and parts, FashionGo provides wholesale clothing, Bay Supply sells rivets and fasteners ChemNet brokers industrial chemicals. Now, we are seeing trading platforms emerge to provide material for the solar industry.

A solar trading platform gives installers and EPC contractors access to a bigger supplier base and more competitive pricing. It also gives manufacturers and distributors access to a broader, untapped customer base. The SEIA predicts that solar installations will triple by 2028, adding 236 GWdc, so both buyers and sellers need a solar trading exchange now more than ever.

A solar B2B marketplace offers a win-win

A transparent, solar e-procurement exchange provides a competitive platform to source parts and materials, which benefits everyone. Sellers gain direct access to customers on a platform that lets them handle quotes and contracts in one central location. Buyers can find the exact components they need at the best price. And there are other advantages for installers and EPC contractors. A trading platform:

• Provides a single source for all solar parts

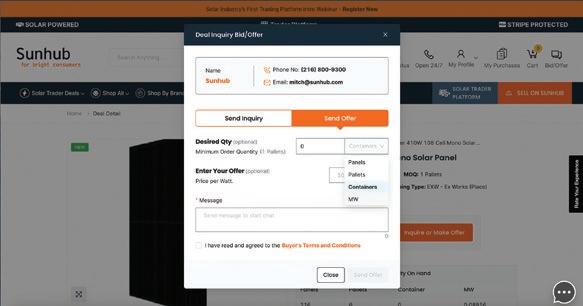

• Supports competitive bidding to get the best price

• Provides access to multiple sources, solving inventory issues

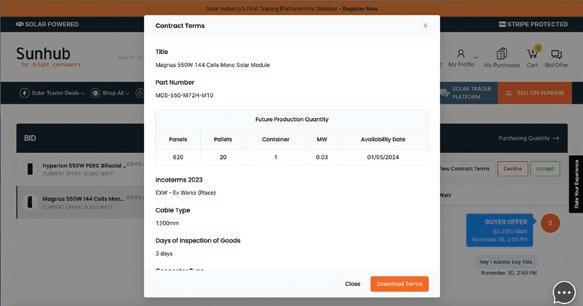

• Makes it easy to negotiate contracts directly with suppliers

• Enables purchase transactions and speeds delivery

• Shows what parts manufacturers have on hand and what’s in production.

• Provides a source for used and new components.

An e-commerce marketplace also makes it easier for solar contractors to bid on bigger contracts and specialty jobs. The platform manages RFQs, including price, quantity, delivery terms, and the final contract. Brand comparison shopping is easy because of transparency. Using the platform for analytics also simplifies planning, budgeting, and inventory management.

The advantages of using a solar trading platform are too great to ignore. Using a centralized e-procurement platform benefits installers, contractors, EPCs, distributors, manufacturers, and electricians. Buyers get 24-hour access to an online warehouse to order what they need. Sellers can communicate directly with customers and introduce their products to new potential customers. Using B2B e-commerce to source solar components will continue to gain momentum, especially through e-procurement trading platforms.

Mitch Bihuniak is a co-founder and CEO of Sunhub, a B2B e-commerce marketplace & distribution platform for solar and renewable energy equipment and components.