Serving

Traverse City Office

236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988

Main Office 5931 Oakland Drive

Portage, MI 49024 269-385-5888 or 888-777-0216

www.zhangfinancial.com

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

Founder and President

*As reported in Barron’s March 11, 2023 and September 17, 2021. Based on assets under management, revenue produced for the firm, regulatory record, quality of practices, and other factors. For fee-only status see NAPFA.org.

**As reported in Forbes April 4, 2023. The Forbes rankings, developed by SHOOK Research, are based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. See zhangfinancial.com/disclosure for full ranking criteria.

Twin Birch Golf Course and Restaurant has opened in Kalkaska. The golf course offers an experience for players of all levels. The restaurant is open for lunch and dinner, and also offers live music. “We are excited to bring Twin Birch to Kalkaska, offering something truly unique for the golf and food enthusiasts,” said owner Kwin Morris. “Our goal is to create a welcoming atmosphere with unforgettable experiences for all who visit us.” Learn more at Twinbirchgolf.com.

Truly Free, a plant-based, refillable cleaning and laundry online subscription service in Traverse City, has opened a retail store at 6261 US-31 in Williamsburg. Truly Free’s new store features all of its online products. Store hours are Monday-Friday, 11 a.m. - 2 p.m. Founded in 2008, Truly Free was one of the first companies to revolutionize the cleaning industry with all-natural products delivered in refillable and sustainable packages.

20Fathoms recently announced a new program for entrepreneurs in the Grand Traverse region. Called The Launch at 20Fathoms, the program is designed to remove barriers and help new businesses grow. “Through The Launch at 20Fathoms, we are expanding our startup incubation services and working hard to help more aspiring entrepreneurs in our region,” said Eric Roberts, 20Fathoms executive director. The Startup + Tech Hub is one new resource available through The Launch. It is an online community providing resources and connection for the region’s entrepreneurs, tech professionals, and partners. Visit 20Fathoms. org/launch.

The Traverse City Violin Company, northern Michigan’s first and only violin shop, has opened at 3003 N. Garfield. The business, owned by Karine Pierson, also has an educational center and provides music lessons. The shop offers new and used violin, viola, cello, and bass sales and repair, as well as luthier service and piano repair service. The shop also has an electric instruments section. MIMusic studio (formerly Vokey Music) provides music lessons and classes on piano, voice, guitar, percussion, and most stringed instruments.

Food Rescue of Northwest Michigan and Traverse Health Clinic and Coalition are the recipients of the first-ever Humanitarian Efforts Awards given by the City of Traverse City Human Rights Commission. The commission established the business/organization humanitarian awards to honor organizations with a sustained commitment to supporting and promoting human rights. Food Rescue, a program of Goodwill Northern Michigan, rescues, harvests, repacks, and delivers more than 2 million pounds of food a year to food pantries and community meal sites. Traverse Health Clinic and Coalition provides people with access to vital health care services regardless of their ability to pay.

The Grand Traverse Resort and Spa is at the finish line of a $10.5 million transformation of the original six-story hotel first opened in 1980. “This is the Resort’s most expansive renovation project to date,” said Matthew Bryant, general manager. The project added two

Crisis Intervention Services

• 24/7 Crisis Line 1-833-295-0616

• 24/7 Crisis Welcoming Center at 105 Hall Street, Traverse City

• Mobile Crisis Teams for Adults and Children

• North Hope Crisis Home – Six new adult crisis residential beds opening in Traverse City in June with support from NLCMHA

Integrated Health Services - Northern Lakes Integrated Health Clinic

• Primary health care clinic for anyone in the community, all ages, all/no insurance. Accepting new patients. Call for appointment: 231-935-3062.

Kandu Island Drop-In Center – a safe place to be, for all, on S. Garfield.

• Psychiatry

• Therapy

• Counseling

• Case Management

• Autism Applied Behavioral Analysis

• Specialized Residential Services

• Long-term Services and Support

• Traverse House & Club Cadillac Clubhouses

• See full list at northernlakescmh.org/services

24/7 Crisis Line: 833-295-0616

Access to Service: 800-492-5742

Customer Service: 800-337-8598

junior suites, and updated four hospitality suites, all guest rooms, corridors, elevators and more. “We brought the beauty of northern Michigan into the rooms while also celebrating our owners, the Grand Traverse Band of Ottawa & Chippewa Indians, with artwork and décor,” added Bryant. The renovation, begun in November, was done entirely by Michigan companies, including Bouma Corporation, D&W Mechanical, Denoyer Brothers Moving, Northern Michigan Glass, Windemuller, and TC Millworks.

of being adaptable in the workplace. Northwest Michigan Works! is offering G.R.O.W. workshops to businesses, organizations, and schools.

The Homebuilders Association of the Grand Traverse Area is hosting the 34th annual Parade of Homes, June 15-18. Top area builders will showcase new and remodeled homes during the four-day event. Parade tickets are $18 in advance (Oleson’s, Bayview Flooring, Northern Building Supply, HBA office) and $20 at the door. More information available at the Parade of Homes app.

New life is coming to the former Silver Swan restaurant at 13692 South West Bay Shore Drive in Greilickville. Glendale Burger Shop, owned by Brittney and Bray McCabe, is taking over the space. The couple previously operated the Glendale Ave. food truck at The Little Fleet for the last few years. The restaurant will seat approximately 30 indoors and will offer both dine-in counter service and takeout orders. The menu features the smash burgers and fries made popular by the truck, plus former rotating specials – such as patty melts and fried chicken sandwiches – along with other sandwiches. There are no immediate plans to have alcohol sales.

Northern Michigan was recently featured in Vogue magazine, in a spread which highlighted many of the region’s shops, restaurants, farms, beverage producers, events, and natural attractions. Businesses receiving a mention included: The Cooks’ House, Farm Club, Boathouse, Modern Bird, Hexenbelle, Crocodile Palace, and The Mill, along with the soon-to-be-opened Mission Proper on Old Mission Peninsula. Farm and purveyor staples Lakeview Hill Farm, Bardenhagen Berries, Buchan’s Blueberry Hill, Idyll Farms, Saltless Sea Creamery, Carlson’s Fish Market, and Bellaire Smokehouse are also featured in the article. Numerous local wineries, including Left Foot Charley, also got a mention, as did downtown TC’s Wilson Antiques and Elk Rapids Antiques.

Inmates at the Benzie County Jail are receiving training that will help them successfully re-enter the workforce when they’re released.

G.R.O.W. (Getting Ready for Opportunities at Work) Workplace

Excellence soft skills training is being offered through a partnership between Northwest Michigan Works! and the Benzie County Sheriff’s Department. These courses coach attendees on what it means to be a dependable employee, how to work with multiple generations respectfully, what clear and positive communication looks like, and the value

A new kind of food cart is now operating in Traverse City. Archie’s Dog Cart provides all-natural dog treats and apparel. The treats are all licensed through the Department of Agriculture. Archie’s Dog Co., founded by Ellie Kebler, started at the Sara Hardy Farmers Market last summer. The cart will be at the downtown TC market again on Saturdays and popping up elsewhere downtown Friday-Sunday. It’s also available for private events and offers delivery on all orders for Traverse City residents. Follow @archiesdogco on Instagram for up-to-date location information.

I got into the taxi tired, but was at least sated by the breakfast bagel and coffee I had picked up after deplaning in Las Vegas.

I bee-lined to the taxi line and was able to hop right into the Ford that immediately pulled up. I hadn’t thought much about the lack of a wait. Everything about my morning – from my 4am wake-up to my now-9am taxi ride – had gone smoothly. It probably had something to do with the fact that it was Tuesday, not a notoriously busy day in Las Vegas.

My taxi driver, Charlie, turned out to be rather talkative, despite the (for Vegas) early hour. In the short drive to the Strip, Charlie spoke about the COVID-19 pandemic through his lens: the devastating change it had wrought on the tourism industry, the impact of which continues to this day.

The market for land, which had been funded by disposable income, and for enclosed spaces like hotel rooms and clubs, was hit by the double-whammy of the pandemic and now-tightening economic conditions. Indeed, I noted to him that my hotel room was only $49 per night. He quickly listed others with prices bottoming out at $10-15 per night.

The lesson from my ride? Never bring a black light to a hotel room.

Well, that ... and the need for diversifying our local economy to shield from the impact of pandemics and economic shifts.

Over the next few days at the Angel Capital Association Summit, I learned that not only are we on the right track, but we’re also ahead of many communities. Communities that have come to the same conclusion, including organizations in Nevada, are now battling to overcome

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020

Traverse City, MI 49685

231-947-8787

ON THE WEB tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

COPY EDITOR

Becky Kalajian

the high stakes of placing their bets on single economic drivers.

While our reputation as a tourist haven is well-deserved, it is not in our long-term best interests. Our economy extends beyond the allure of golden beaches and wineries. Traverse City is also a growing hub of entrepreneurship. As CFO of a venture firm and executive director of an angel investor group in our beautiful town, I have witnessed the evolving business landscape, revealing a promising trend that underlies the importance of a diverse and dynamic economy.

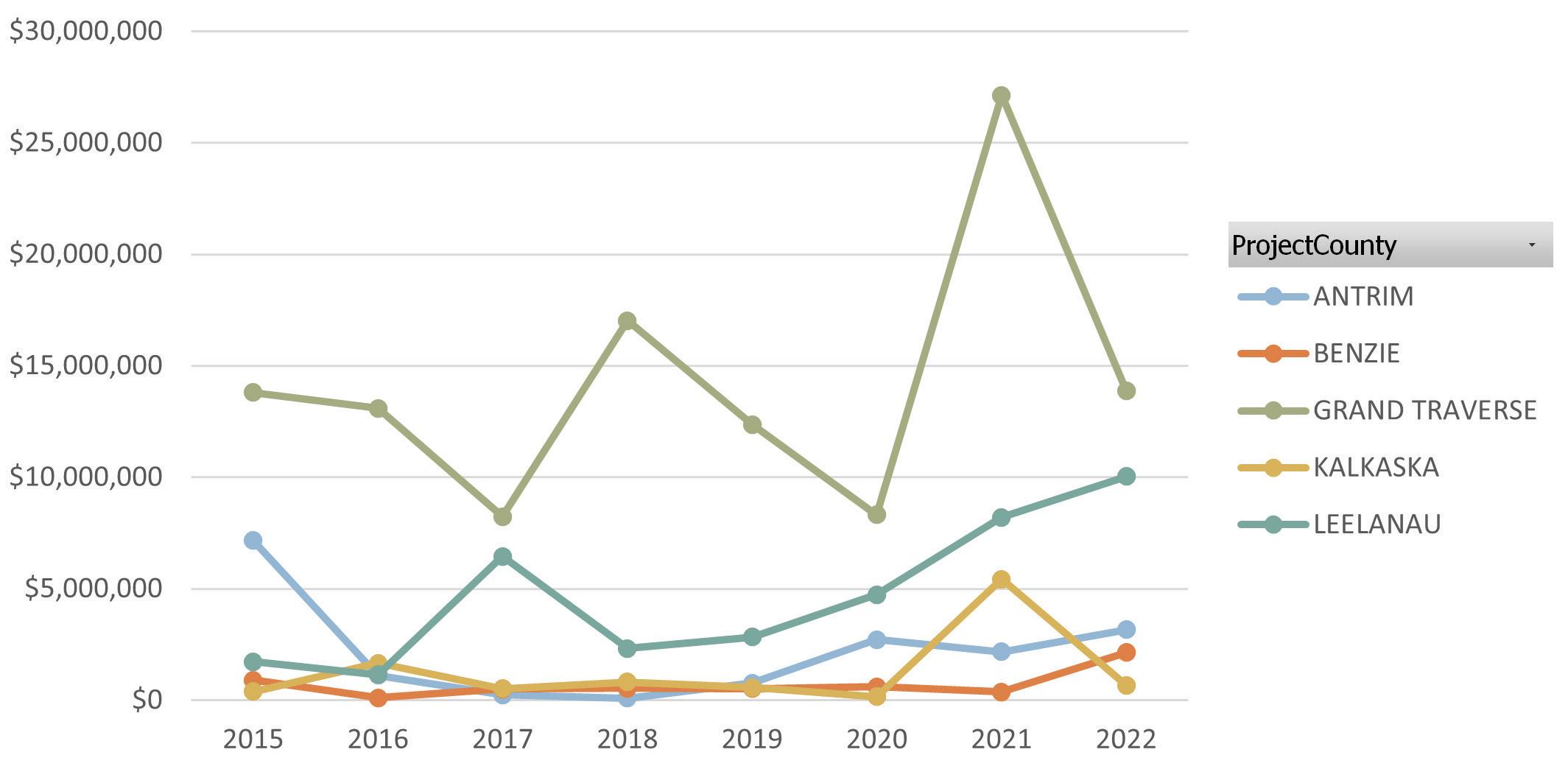

Boomerang Catapult (early-stage venture fund) and Northern Michigan Angels (local angel investors) are committed to nurturing this startup culture. Together, over the past five years, the two organizations have invested $18 million in 20 local startups, contributing to job creation and local economic development.

The 10-to-1 magnifier on attracting capital typical of venture funds applies here as well. These investments have attracted over $180 million in additional investments and created connections to a robust and active network across the Midwest.

If one were to follow a ‘startup ecosystem playbook’ providing a strategic roadmap to economic growth, we’re off to a good start. We must continue to:

1. Foster collaboration, encouraging partnerships between startups, educational institutions, and established businesses to stimulate innovation and skill-building.

2. Provide networking opportunities and mentorship, facilitating connections between experienced business leaders and entrepreneurs.

3. Increase access to capital, promoting local investment, be it through angel in-

CREATIVE DIRECTOR

Kyra Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Clark Miller

Rick Haglund

Megan Kelto

WEB PRODUCTION

Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Gary Twardowski

SERVING: Grand Traverse, Kalkaska, Leelanau and Benzie counties

vestors, venture capital, or favorable loan options from local banks.

Entrepreneurial businesses are more than just a source of local employment –they are the key to building resilience in our community. Studies have shown that communities with a diverse economic base, especially those oriented toward high-value creation, are more likely to weather economic storms.

As the world faced unprecedented challenges due to the COVID-19 pandemic, our local economy demonstrated remarkable resilience buoyed by the force of this growing ecosystem.

However, the continued growth and diversity of our economy are not guaranteed. They require strategic investment and unwavering support from government, financial institutions and our community. The reality of growing communities like ours involves inevitable strains, such as high demand for affordable housing and the need for childcare services.

To build a robust support infrastructure, we need public policies that foster a conducive environment for startups and small businesses. This includes offering tax incentives for startups, supporting zoning laws that are friendly to businesses, and promoting grant programs that encourage entrepreneurship and collaboration to bring more founders the resources they need to scale and thrive.

Banks and financial organizations play a significant role in nurturing this ecosystem. According to a report by the Federal Reserve, approximately 40% of small businesses in rural communities depend on local banks for their financing needs. In Traverse City, our local banks have been instrumental in supporting established

AD SALES

Caroline Bloemer cbloemer@tcbusinessnews.com

Lisa Gillespie lisa@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

businesses’ growth. However, it’s the early-stage capital provided by angel investors and venture funds that have spurred new startups to form or relocate here.

This investment signals faith in our entrepreneurs and fosters economic diversity, empowering sectors beyond our dominant tourism industry. The same attributes attractive to tourists are also attracting entrepreneurs, innovators, and professionals to relocate here. The growth of our small business sector feeds into our tourism economy, enhancing the experience of those who visit while ensuring the wealth stays in our community.

As we look toward the future, fostering a supportive startup economy is crucial. Innovative young companies bring fresh ideas, create jobs and can have a significant positive impact on local economies.

As community members, we can each contribute to our collective economic future. By supporting local businesses –whether that’s shopping at local stores, using local services, investing in local startups or advocating for policies that support small businesses – we help ensure the continued vibrancy and diversity of our local economy.

Unlike Las Vegas, with its gamble on tourism, Traverse City has made a bet on its ability to diversify – creating a dynamic environment in which we can do more than just welcome tourists to play. We can go to work … with a view.

Jody (Lundquist) Trietch is chief financial officer of Boomerang Catapult LLC. She is also owner of Taste the Local Difference and executive director of Northern Michigan Angels, an angel investment organization.

The Traverse City Business News

Published monthly by Eyes Only Media, LLC

P.O. Box 4020 Traverse City, MI 49685

231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2022 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

One hundred and eighty miles stretch between downtown Traverse City and the main campus of Michigan State University (MSU) in East Lansing. Increasingly, MSU’s presence and investment in northern Michigan is shrinking that distance for students, alumni and community members alike.

Today, MSU has numerous ties to Traverse City, ranging from the wellknown MSU Extension program to an increasingly robust bridge between northern Michigan and the MSU medical school.

The MSU Extension dates back more than 100 years. It was 1907 when MSU – then Michigan State College – hired its first livestock field agent. That staff member was technically the first Extension employee, even though the program wasn’t formally organized until the following decade.

In 1914, the United States Congress passed the Smith-Lever Act, which officially created the Cooperative Extension System. That act obligated federal land grant colleges to oversee the new system by providing education and outreach services to outlying areas of their states. Since Michigan State College was one such land grant institution,

it had a duty to undertake statewide Extension work.

(Note: Land grant colleges are higher education institutions borne out of the first Morrill Act, signed by Abraham Lincoln in 1892. That act granted feder-

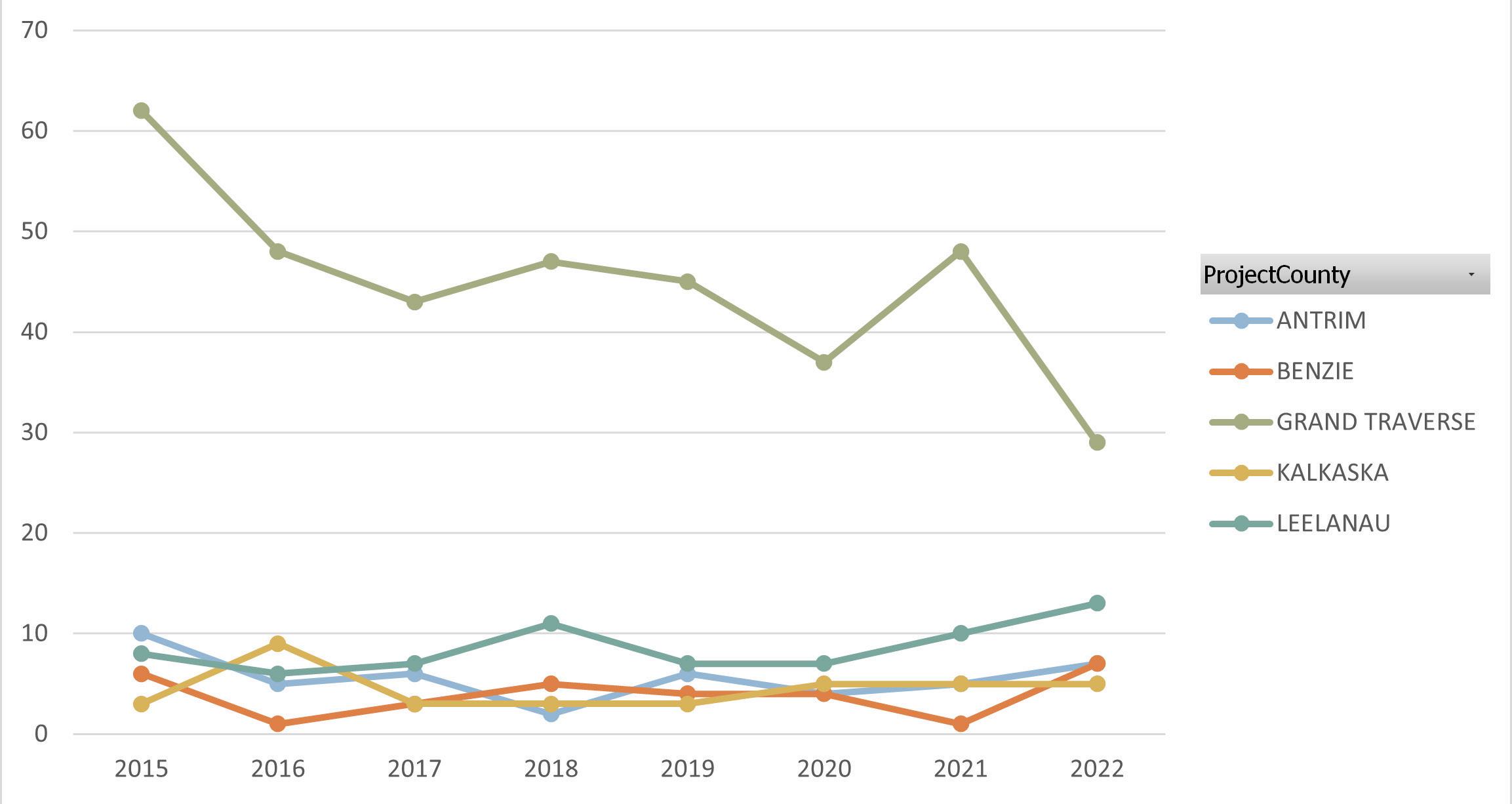

The Grand Traverse County office (or District 3 office) of the MSU Extension services six counties in the region – Grand Traverse, Leelanau, Benzie, Antrim, Kalkaska and Manistee – and is based in downtown Traverse City.

ing educational outreach, research and other resources to help farmers improve their chances at success.

One major MSU Extension program in the region is the Northwest Michigan Horticulture Research Center, a 137acre agricultural facility that MSU touts as a premier research site for integrated pest management, horticultural production and handling, value-added processing, marketing, and farm financial management practices.

ally controlled land to states – including Michigan – and allowed them to use that land for multiple purposes, including to endow land-grant colleges. MSU is one of four land-grant colleges in Michigan, along with Saginaw Chippewa Tribal College, Bay Mills Community College, and Keweenaw Bay Ojibwa Community College.)

MSU describes its Extension program as a mechanism that “helps people improve their lives by bringing the vast knowledge resources of MSU directly to individuals, communities, and businesses.”

According to District 3 Director Jennifer Berkey, the ultimate goal of the MSU Extension is to meet community needs, which means each district has different priorities based on the unique flavor of the region it serves.

In northwest Michigan, Berkey pointed to the diversity of our agriculture as what defines the flavor of the region – at least in terms of Extension services and priorities. In particular, the District 3 office works closely with local tart cherry growers, apple growers, wine grape growers, and hops growers, provid -

“We do research on the critical issues facing our area’s different commodities, and then we bring that knowledge back to the growers through updates, farm visits, outreach events and more,” Berkey explained. “We’re trying to answer those cutting-edge types of questions that our farmers are having specifically around their crop production.”

Other ag-based programs abound. Youth 4-H programs teach kids and teens about livestock, animal care, business skills and more. The MSU Extension Product Center, meanwhile, works with food-based or bio-based businesses and entrepreneurs throughout the state, helping them develop and nurture their ideas, work through regulatory hurdles, and get their products or business concepts to market.

“Thanks to the Extension, every community has access to our whole statewide network.”

– Jennifer Berkey, District 3 director, MSU Extension

According to Berkey, a long list of local agricultural businesses has thrived with help from the product center. This spring, for instance, the Northport-based Hallstedt-Homestead Cherries won the product center’s “Barrier Buster” award, which recognizes a Product Center client that reduces or eliminates barriers to entrepreneurial success at the local, regional, or state level.

The Extension is also adding new programming to its slate each year. Last summer, the Extension teamed up with local restaurateur and sommelier Amanda Danielson (owner of Trattoria Stella) to launch the “Dirt to Glass” conference.

“That program asked, ‘What can we do from a soil perspective to be able to improve the quality of the wine that’s being produced here in northern Michigan?’” Berkey explained. “Leading speakers from across the nation were brought in, either via Zoom or in person, to provide this cutting-edge information to our local growers.”

By popular demand, Dirt to Glass will be back for a second year this August.

Overall, Berkey thinks that the value of Extension programming is how it can provide a quick link between the pain points, concerns, and needs of regions like northern Michigan and the hub of knowledge and expertise that MSU has on its campus in East Lansing.

“So, let’s say Kingsley had a particular issue that they needed to solve around water safety, or water ecology, or something with regard to septic,” she said. “We would likely be able to tap in folks from down at MSU proper to come up and speak to that particular issue that might be facing that community. Thanks to the Extension, every community has access to our whole statewide network.”

While every community in the state has access to Extension services, not every community has all the other MSU-affiliated programs that Traverse City does. Take the MSU Federal Credit Union, founded in the 1930s in East Lansing, but operating two branches in Traverse City since 2019. Or take the region’s extremely active MSU alumni association, the Grand Traverse Area Spartans, which counts more than 7,600 Spartans among its local contingent.

The group hosts regular events in the region, including networking engagements, get-togethers at 7 Monks to watch MSU basketball and football games, volunteer opportunities, and the annual Scholarship Golf Outing & Luncheon at Grand Traverse Resort and Spa, scheduled for June 30 this year.

Perhaps most unique of all is the growing link between Traverse City and the MSU College of Human Medicine. That college is a community-based medical school, which means that rather than having one central campus or hospital where all students learn and do their hospital rotations, enrollees are scattered across the state at eight campuses, 57 community hospitals, and over 90 clinics.

One of those campuses is here in Traverse City, where students hone their medical skills not just at Munson Medical Center, but also at the other seven Munson Healthcare hospitals as well as additional participating hospitals like MidMichigan Health Center in Alpena and Spectrum Health Ludington Hospital.

According to Norman Beauchamp, who serves as MSU’s executive vice president for health sciences, the College of Human Medicine places 12 students per year in northern Michigan, where they do their third and fourth-year medical

Beyond training the healthcare professionals of tomorrow inside the communities that they will hopefully choose to call home, Beauchamp noted that MSU’s on-the-ground presence in areas like northern Michigan allows the College of Human Medicine to tackle research projects that relate to specific regional health problems, such as breast cancer.

“One of the things we identified is that Grand Traverse County has the highest rate of breast cancer in the state,” Beauchamp noted. “It’s about 20% higher than the average for the state, according to the National Cancer Institute, and we don’t know why.”

Beauchamp says that having a researcher in Grand Traverse County to focus on this question can help ascertain if there are modifiable lifestyle risk factors.

“...(T)hings such as nutrition and obesity, that could be used as mechanisms to lower cancer,” he said.

The MSU College of Human Medicine is also a partner in the growing push to build a health-tech hub in Traverse City. TCBN has previously reported on numerous innovative biotech companies that have decided to relocate their operations to northern Michi -

Boomerang Catapult, and other players to establish a kind of health innovation district in Traverse City.

A rubric for that kind of health innovation cluster already exists in the MSU repertoire: The university’s Grand Rapids Doug Meijer Medical Innovation Building is a public-private collaboration that seeks to be a health innovation hub for biomedical research, bioengineering, and health technology.

“In an innovation district, it’s bringing together institutions, local government, federal government, public, private, you name it,” Beauchamp explained. “It gives you the capacity to bring discoveries more quickly to people to disseminate them, but it also allows you to train students in an innovative environment, and it brings businesses into the community.”

Putting that kind of district in a rural healthcare landscape like northern Michigan, Beauchamp continued, could be a genuine game-changer.

“When I came back (to Michigan) to improve health, one of my priorities was to address the social determinants of health: stuff like access to food, healthy places to live, jobs,” Beauchamp continued. “That’s why we want to build this.”

Berkey BeauchampThe MSU College of Human Medicine is also a partner in the growing push to build a health-tech hub in Traverse City.

school rotations at local hospitals and clinics. Since the Traverse City campus opened in 2009, MSU has trained 136 future medical professionals in northern Michigan.

“And what’s nice is about 30% of those students stay,” Beauchamp said, which in turn helps address gaps in rural healthcare.

Beyond training the healthcare professionals of tomorrow inside the communities that they will hopefully choose to call home, Beauchamp noted that MSU’s on-the-ground presence in areas like northern Michigan allows the College of Human Medicine to tackle research projects that relate to specific regional health problems, such as breast cancer.

“One of the things we identified is that Grand Traverse County has the highest rate of breast cancer in the state,” Beauchamp noted. “It’s about 20% higher than the average for the state, according to the National Cancer Institute, and we don’t know why.”

Beauchamp says that having a researcher in Grand Traverse County to focus on this question can help ascertain if there are modifiable lifestyle risk factors.

“...(T)hings such as nutrition and obesity, that could be used as mechanisms to lower cancer,” he said.

The MSU College of Human Medicine is also a partner in the growing push to build a health-tech hub in Traverse City. TCBN has previously reported on numerous innovative biotech companies that have decided to relocate their operations to northern Michi -

gan – from IncellDx, which is working to develop a solution for long-haul COVID-19, to Atterx, which is developing therapeutics to combat the rising problem of drug-resistant bacteria.

Beauchamp says he is well aware of those newcomers, and is working side-by-side with Munson, local tech incubator 20Fathoms, Casey Cowell of Boomerang Catapult, and other players to establish a kind of health innovation district in Traverse City.

A rubric for that kind of health innovation cluster already exists in the MSU repertoire: The university’s Grand Rapids Doug Meijer Medical Innovation Building is a public-private collaboration that seeks to be a health innovation hub for biomedical research, bioengineering, and health technology.

“In an innovation district, it’s bringing together institutions, local government, federal government, public, private, you name it,” Beauchamp explained. “It gives you the capacity to bring discoveries more quickly to people to disseminate them, but it also allows you to train students in an innovative environment, and it brings businesses into the community.”

Putting that kind of district in a rural healthcare landscape like northern Michigan, Beauchamp continued, could be a genuine game-changer.

“When I came back (to Michigan) to improve health, one of my priorities was to address the social determinants of health: stuff like access to food, healthy places to live, jobs,” Beauchamp continued. “That’s why we want to build this.”

Like it or not, tourism is still the top driver of economic activity in northern Michigan. At the outset of yet another busy summer vacation season, how is our local hospitality industry coping with labor shortages, massive inflation, and the rise of short-term rentals? What’s summer 2023 to look like? We convened a panel of local tourism and hospitality leaders for a roundtable discussion to find out.

Our panel includes:

• Trevor Tkach, president and CEO, Traverse City Tourism

• Matthew Bryant, general manager, Grand Traverse Resort and Spa

• Amy Parker, general manager, Park Place Hotel & Conference Center

• John Melcher, CEO, Crystal Mountain

• Teresa Woods, owner, Visit Up North Vacation Rentals

What’s your read on the state of the local tourism industry? Are we back to preCOVID levels, or are we still recovering?

Bryant: Largely, the concerns from COVID are gone. But I think the business has changed again, because now you have inflation that’s impacting us. So business

has kind of spun the other way [than it did during the pandemic]. FIT (free independent traveler) business is trending down, but group business continues to grow. Group business is so strong they’re adding the staycation on top of it, but the economy is definitely impacting the FIT. So, while we’re out of COVID, we’re in something totally different now.

that we had with labor, but also the capacity restrictions.

I think we’re still seeing a continued demand for outdoor activities, including people that came up north for the first time and really got to enjoy it. And hopefully, we can turn them into lifelong guests that we welcome back every year. But I would say, overall, I think we’re in a good space.

mand – specifically, the corporate groups – is very high. I think a lot of that has to do with the fact that a lot of businesses were remote, or are still remote, and they have that desire to have in-person interaction with their off-site meetings.

Parker: And I think what Traverse City Tourism (TCT) is doing regarding the FIT market – Trevor, correct me if I’m mistaken – but it’s so important for us to massage that FIT market because it’s nearly non-existent. The transient is not as strong, so we need to replace it with something.

Melcher: Our industry saw such an extreme impact with the pandemic. We closed our doors thinking it was just going to be two weeks, and then we had to figure how we were going to open up safely and provide a good experience to guests. We got on our feet pretty quickly after things started opening up, but then all of us dealt with the surge of interest from people wanting to get outdoors, specifically in northern Michigan. So then, the challenge was huge demand coming our way, and trying to figure out how to service that demand with then constraints

Parker: I agree with what Matthew said about FIT. Transient, for us, is not as strong, especially moving into the summer. I do anticipate that we’ll book transient closer to their anticipated arrival date. Group is very strong. The association market just seemed to have exploded, which is good for us, because it creates a really nice base.

Melcher: We’re seeing the same thing. With the leisure traveler, the booking window has gotten much shorter than it was the last couple years. And the group de-

Bryant: I think one thing we cannot forget is a short-term rental (STR) piece and how that is impacting FIT. The biggest way we see that [at The Resort] is that our rooms are down, but our golf continues to grow. As we survey the golfers, that’s the first thing we ask: ‘You’re not a Resort member or a Resort guest. Where are you staying?’ And they tell us, ‘Oh, we’re renting this house here, or this condo there.’ So the FIT is a morphing type of customer. They’re looking for different experiences, and a traditional hotel isn’t [what they want], but they do want to experiences what we have at The Resort.

Something interesting is that, with COVID, golf has just skyrocketed. Even already, starting this season out, we’re ahead

“Currently, I have no dishwashers in the entire Resort. I have salaried managers taking turns doing that right now.”

–Matthew Bryant, general manager, Grand Traverse Resort and Spa

leaders weigh in on

of last year, which was ahead of the year before, which was ahead of the year before. So that just goes to show you that FIT is a morphing customer. The age demographics are changing, and they’re going more to that STR. So, we as The Resort, we have to really look at and change our marketing

of membership. Grand Traverse County has more than 4,000 total hotel rooms that we represent. Add Benzie County on top of that and you’ve got another 800. Some of them are STRs. Only some of them are full-service properties, so our analytics may show something a little bit

tion, more than a dozen years. So that’s exciting. And I’m getting a lot of calls in my office of people seeing the ads from outside-of-market. That’s a good sign. The campaign is being seen and recognized, so now it’s just about conversion.

Where does that lead? Hopefully,

shortage? What is your organization doing to address it?

Bryant: Negative 10? We just opened our housing unit this past weekend. So, that’s [space for] 48 new international H-2B and J-1 [visa] workers, and it takes us to housing for 124 international

Utilize design/build to construct a new, larger medical office that enhances patient experience, improves efficiency and meets HIPAA regulations.

Burdco didn’t cut corners.They always did quality work and actually went above and beyond. That gave me a lot of peace. I think Burdco, especially since Mike Brown is at the helm of this, really exudes character and quality in the facilities they build and stand by.

can’t keep up with inflation. We’d close our doors. And I don’t know how you recruit any more entry-level hospitality people that love to wash dishes, or to clean rooms.

To work the beverage carts [on the golf course] this summer, I had 800 girls apply. I only need 40. To all of those people, we said. ‘Well, we’ve got server jobs in Aerie!’ Nope, they want bev cart jobs, because they know that those girls make incredible tips. So, it’s all specific to a certain genre [of jobs]. Golf? Every golf job is full. Applicants want to be outside; they want to get the free golf; they know the benefits of [those jobs]. But you go inside – front desk agents, third shift, retail, bartenders, servers, cooks – and we’re just dying. Currently, I have no dishwashers in the entire Resort. I have salaried managers taking turns doing that right now. We just had a banquets conference in where we had 600 people for breakfast, lunch and dinner yesterday. We were all down there doing dishes. I don’t know how you recruit people for those jobs anymore.

Parker: We had a 450-person event last night, with 13 employees. I was there. I worked the event. My managers worked the event. We just don’t have enough people. I had a line cook who makes $20-something-per-hour washing dishes last night. That’s an expensive dishwasher.

Melcher: The international staffing, we know, is going to be a key component of

our future. Certainly, if you look at the demographic trends of the country, this is not a problem that’s going to go away. It’s just going to get worse. So, we’ve been investing in housing for our international staff, too. We went from being able to house 16 folks a couple years ago and will be up to 58 this year, and we’ll continue to look at that because that is an integral part of our strategy going forward.

We’ve also just signed a collaborative partnership with the Ferris State University that will place interns on the ground for real work experience in our facilities, but which also allows our employees to get continuing education and certifications in a whole range of different disciplines and topics. That will hopefully improve their job satisfaction and act as a retention strategy for us.

Bryant: Internships are great, because that’s your bench. This year, we have 31 interns. We could have more, but we have no place to house them. But we have been very successful at capturing those interns for our full-time jobs. Central Michigan has a great 30-week program, and I think we’ve hired 4-5 [CMU grads] in the last three years that did their 30week internship with us, graduated, and then we hired them. That’s probably our best way to find people. And those people still struggle with finding housing; they end up living in Cadillac and Mancelona

and commuting, because there’s nothing affordable for them [in Traverse City].

Melcher: Definitely. A huge part of the struggle here is affordable workforce housing. We’re starting to get some traction –certainly in our neighborhood, with some of the projects that the Homestretch is doing. Hopefully, we’ll have one down the street from us. But I think the one down the street is only going to be 32 units, and the last study was that we’re about 620 units short in our area. I’m sure it’s worse as you get closer to Traverse City. I think,

as a region, we’re going have to figure out how we get more of these affordable housing projects up and running to keep the workforce close to our businesses.

Matthew talked a bit about inflation and its impact on wages. Beyond salary, how is inflation impacting your organizations, and local tourism?

Bryant: It’s affecting everything. All of our food costs, our cost of goods, our retail. We have to watch this stuff every single day. Before, at our restaurants, we

could let our prices run a whole year. Now, we’re looking at them almost every other week, because different items spike and you can’t lose that percentage [profit margin] because food and beverage is so tight anyway. So, that’s a tough thing. Either we’re taking menu items off, or we’re taking prices up. I’ve never done that much pricing with food and beverage in 30 years of being in hospitality.

Parker: I locked in our natural gas price three years old, so it’s decent cost of gas. Water is astronomical. Water and sewage is very high. But to what Matthew said about food costs, it’s very high. Our chef has to be very creative in portion sizing and substitutions. It really pushes the F&B team to do things differently.

Bryant: And if you think about groups, they’ve made their budget out a year in advance. It used to be we could do 60 days out with banquet menus. Now, we’re pushing two weeks out on the orders, and cutting and reducing the quality of a product to make their budget. That makes it very, very challenging. Some of them are willing to pay more, but most of their budgets are fixed because they’ve already sold registrations. They can’t increase their prices [to attendees].

Melcher: It’s really true that inflation is touching every area of our operations.

We are doing some road repair work [at Crystal Mountain], and it’s amazing how much asphalt has gone up in the last 30 days. As Matthew said, we’ve got to really keep our focus on what the costs are to make sure that we’re not destroying the thin margins that we do enjoy.

There’s a lot of debate about how to integrate short-term vacation rentals into the local tourism space. What’s the right balance?

are the worst vacation rentals that you could possibly build. And all these new little companies are coming in going, ‘Hey, I can rent your one bedrooms!’ So, the market is so saturated with all this crap right now, and I’m sure the hotels hate them too. But then we get blamed for the housing market, and it’s so frustrating.

I was at the East Bay Township meeting last night until 10:30pm, hearing about how vacation rentals are ruining the hous-

market, our kids don’t have all these bells and whistles in the schools that they have.

Bryant: I think The Resort is a prime example of good balance. It’s a PUD with STR condos there, a hotel, and long-term housing. That’s how you really protect the core entity of the destinies of Traverse City. If government has to be involved, then we need to find the proper zoning to put STRs in the right location and in the right box, so that it doesn’t impact your house, your kids, this neighbor, that neighbor…

Woods: We [Visit Up North Vacation Rentals] have been in business since the ‘70s and doing vacation rentals forever. It has always been a really wonderful thing for people to be able to keep their homes in their family. It’s been a great thing for people who are buying a second home and want to come up here and retire at some point, or that want to just use it for their family part of the time.

But with the new boom of Airbnb stuff, you have all these buildings going up with a million one-bedroom units, which

ing market, and how [the township] is going to put a moratorium on them because of the fact that there’s no houses for locals to live in. And I’m sitting there thinking, ‘Okay, what about the 4,000-square-foot home that I manage on Spider Lake? Or the family cottage that will never be a long-term rental?’ What about these things that have been rentals forever? It’s just a really tough time, because we used to be seen as this blessing, because these townships rely on the second home market. If they do not have that second home

Crystal Mountain is another prime example of that. It’s designed as a destination with multi-use elements. To me, that’s the best way to go. I have no preference of how many STRs you have. But think of the core of why people come here. Think of the community they experience downtown: the shops, the restaurants; they want to experience that stuff. But you can still put them in a nice location and make sure they’re there. I think that’s a good way to go.

And then you have the lakes, the beaches; that’s a different type of destination. And a lot of [homes in those areas] are already second homes, so they’re ideal for short term rental. They’re already set up for it, and people have been doing it for decades: having places on beaches where they only spend part time, and [renting those out short term] is not

“I think a lot of times, sadly, tourism has been a four-letter word. It’s easy to vilify tourism. But the reality is it’s a big part of the economy.”

–Trevor Tkach, president and CEO, Traverse City Tourism

really going to impact you as a resident. Because how many year-round residents live at those lakes and those beaches? Not as many as in the city core, in apartments and subdivisions, or up in Holiday Hills. That’s where your yearround residents are.

Woods: When we were the only show in town [for vacation rentals], I’d have people calling me from Holiday Hills, or down on Avenue E, and we’d say, ‘No, those homes are not appropriate for vacation rentals.’ Those are residential neighborhoods. And the problem with what the townships are doing now is they have to throw the baby out with the bathwater. If STRs are good for this part, and it’s zoned the same as this other part, then it’s either all in or it’s all out.

Trying to get a handle on that is very difficult. Because as soon as you start to say, ‘Ok, well you can’t do these smaller houses [as STRs],’ or ‘You can’t do an Airbnb where you live there and also rent,’ then the people start saying, ‘Listen, I’m not a wealthy person; these wealthy people with big cottages are allowed to do this, why can’t I do this and pay part of my mortgage so I can afford to live here? Which is a thing now! People are having a hard time just living here, so they pull out of here a couple months per year and they rent their place. So, it’s a really hard dance.

Right now, these little houses or one-bedroom places are saturating the [vacation rental] market and nobody’s going to rent them. If people wanted to rent one-bedrooms, they’d go to a hotel. And so, eventually, these small places will sell and become long-term housing again. It’s just going to be cyclical.

I also don’t think it’s going to be forever that somebody is going to have an Airbnb out on, say, River Road that’s not on the river. I used to live on the Boardman River, and I’d pass this house that is not on the river, and it’s just a dumpy little house, but it’s a vacation rental now. Who wants to stay there? What experience are you going to get there? At some point, if we have more opportunities with the resorts doing more in the vacation rental realm, then STR business will probably just go more toward that, and then also to the bigger homes like I’ve always done. Because those are the types of vacation rentals people want.

Tkach: What’s often misrepresented, as Teresa is pointing out, is there’s not a one-to-one correlation between an STR and a lack of affordable housing. The lack of affordable housing is literally the pandemic of our day right now. It is the challenge internationally. There’s not enough houses for people; that’s just reality. So, to correlate it back to STRs is probably an unfair statement in general, considering you’ve got a housing issue in Grand Rapids and other places, and they don’t have the STRs we do.

Once you look at how many STRs are in Grand Traverse County, it’s probably 3-5% of our total housing stock, and a lot of those aren’t the affordable homes or the houses people are going to use for long-term rentals. It’s the $3 million houses, right Teresa? I think the problem is that long-housing that would maybe more accessible and affordable for a typical worker hasn’t been incentivized in our market by any municipalities. We’ve let developers develop a condo that immediately turns into STRs.

Since 1973, we at Long Lake Marina have been earning the trust of northwest Michigan and beyond.

Bryant: Well, what’s a builder going to make his money off? It all goes back to that.

Tkach: Exactly. If I’m a builder, why would I build affordable housing when I can make twice building the same thing for a different market of buyer?

Woods: Well, and they can sell those one-bedrooms faster and easier. They slap them up and say, ‘Woah, Airbnb! VRBO! Whatever!’ And people are like, ‘Oh, I can afford that!’ And so then they buy it – but trying to afford to keep it is going to be a toughie.

Tkach: At certain times of year, we have far more supply than demand –in hotel rooms, in STRs, all of it. We know there’s demand in the summertime. People show up in July and August; it’s a foregone conclusion. But what happens the other 10 months out of the year? Everyone’s already talking about slim margins. Now, looking at the pie, the pieces are getting smaller. There’s more inventory, but demand isn’t necessarily growing.

Bryant: That’s what I’ve wondered. There are 800 new hotel rooms coming to town right now. Sorry, but Trevor, what data are they getting that can warrant them to build these mega-hotels and support the business year-round? What data do they have that

says, ‘I’m going to build a $20 million hotel, and I’m going to make money off of that?’ Do they not look at the labor supply? Are they not looking at the marketing and the demographics of how occupancy works in this area – about how they’re likely to get 52% occupancy? Is that enough to cover their debt? Is that a good investment?

Parker: I think we’re getting close to killing the goose that lays the golden egg.

have an attraction. They don’t have golf. They don’t have skiing. They don’t have a beach; they’re on the other side of the street, and there’s no catwalk unless they go all the way down the State Park.

Tkach: We have pushed our shoulder seasons, and we know that does help hotels keep people more fully employed, or at least help some businesses break even or not go into an operational deficit as early as they used to. I think we’ve done

“With the leisure traveler, the booking window has gotten much shorter than it was the last couple years. And the group demand – specifically, the corporate groups – is very high.”

One of the questions I had actually was ‘Are we getting oversaturated in terms of hotels?’ And it sounds like the answer in the room is yes.

Bryant: We’re pushing that level. I think that oftentimes, those developers aren’t looking at the STRs that are part of the occupancy. When you look at that, and the total number rooms that are available out there, it’s going to be challenging. I feel for them. I really do. Because [these hotels that are under construction] don’t

a good job, collectively, of telling a yearround story. And I think having partners like Crystal Mountain, where we can tell the ski story, or being able to talk about wineries and all these other great things that are happening in four seasons, has helped. You can see it: It’s visibly changed the demand patterns [for local tourism]. But there’s a good chance, because there is a labor shortage, and because maybe there isn’t enough demand to keep everyone solvent, that the strong will survive. And it’ll be a situation where the

new properties being built won’t necessarily be the ones that go out of business. Instead, they may force others into a more difficult position. I think that’s what you’ll start to see. We’ve already seen one hotel within the past three years flip half of its units into being apartments. You may see more of that happening. You may see more conversion of hotels into what would be, I guess, our new workforce housing option, or senior living.

If you had to predict what summer 2023 will look like in one word or phrase, what would it be? What are you predicting for the upcoming busy season?

Melcher: Optimistic.

Bryant: One word? I think that the word would be ‘normal.’

Tkach: I’m at a loss. One word…well, as I’ve pointed out, from our perspective, there’s more inventory, so I think the word is ‘best.’ We’re going to have the best year ever. I mean, we just are. It might not mean everyone in the room is going to have the best year ever, but TCT collectively will.

Woods: We’re a little down. Which is the first time in I-can’t-rememberhow-long – probably since the last time everybody was screaming ‘recession.’ Or maybe September 11. We’re usually

r tful preparation, warm hospitality and a unique setting make Red Spire Brunch House a destination that is one-of-a-kind. American classics prepared and served with elegant simplicity.

Enjoy a classic brunch cocktail, bubbly, wine or beer.

Located in the Mercato in The Village at Grand Traverse Commons

Mon - Fri 8AM - 3PM

Closed Tuesdays February – April

(Closed Tues.)

Weekdays 7 am - 4 pm

Sat - Sun 9AM - 3PM

Saturday - Sunday 9 am - 3 pm

Outdoor patio available (weather permitting)

231.252 4648

RedSpireBrunchHouse com

–John Melcher, CEO, Crystal Mountain

booked so far out in advance that I can say, ‘Hey, guess we’re going to have a banner year.’ We’re not like crazy down, but we are more on cue with 2021 than we were with 2022, which was just rockin’. It’ll still be a good year if we turn out like 2021. But I’d sure like to have 2022 again.

Parker: Well, we are preparing now for a busy summer. We have amazing group business on the books, and our weekends take care of themselves. So, it’s really about preparing the staff. Preparing the staff to pivot; inspiring them, training them, coaching them; everything we can do to prepare them. Because we need them.

If you had to make one big prediction about how local tourism and hospitality will evolve in the next five years, what would it be?

Bryant: Growth.

Melcher: Same thing, continued growth. I think the pandemic brought a lot of people to Northern Michigan, including those that hadn’t visited us before or had not visited us in a long time. And I think that interest in being up north is going to continue to be strong.

Tkach: I’d say it’s collaboration. I think TCT has always extended the olive branch.

We want to be partners with the community. We want to be partners with all sectors. I think a lot of times, sadly, tourism has been a four-letter word. It’s easy to vilify tourism. But the reality is it’s a big part of the economy. And it’s also the calling card for all the other great things that are going to happen in this area. A lot of the investments in natural resources and other amenities that locals take advantage of, that was brought about because of a strong tourism economy. So, we need to protect the tourism economy and help it along. And it only works if other industries collaborate with us. We work really closely with the airport. That’s an obvious correlation, but it’s such a huge benefit to the locals to have that here. I don’t know if people always recognize how important it is that they get to fly other places in the world because we’re such a popular destination to fly to. And there’s other things. Healthcare: We’re talking with Munson about how we can be partners with them in helping them keep their staffing high, and keep those high-skilled workers here to make sure that we all have that service. And education: How are we going to keep these schools strong and make sure we have educators for the workforce that we’re bringing to town?

Ultimately, all of us are in this together, so my vision is collaboration. That’s the only way this is really going to work for all of us in five years.

Making it in retail is tough. Surviving and thriving for decades is a testament to persistence and changing with the times.

Long-time store owners and managers share their history, their challenges, what the future may hold and why they do what they do. Whether purveyors of clothing, appliances, sporting goods or a little bit of everything, they are all looking forward, while taking a fond backward glance.

Owens purchased the store from his father in 2001, marking the third generation at Max’s.

The tires were discarded in the ‘80s to make way for television sets and other electronics. Those too eventually left the building.

“They didn’t fit our niche,” Owens said. Today the store’s niche includes a number of familiar brands, such as

GE, Frigidaire, Wolf and Weber, for kitchen and home. Owens said the grills, washers, dryers, ranges, refrigerators, freezers and hoods have changed, some more slowly than others. For years, even with their improvements, washing machines “looked like your grandma had in the basement. Now they’re front loading and more efficient.”

Another change he’s noticed is the quality of appliances has changed.

“Appliances are not designed to last

as long. Motors are smaller and there’s more plastic,” he said. “They’re not designed to be repaired, but replaced.”

The pandemic increased demand as people eschewed dining out for staying home and sales were brisk. Add to that the burgeoning choices, in terms of style, size and color, and Owens had to get another warehouse.

Today, while demand has leveled off, it’s still busy, and the supply chain problems continue to make some appliances difficult to get, especially

those on the higher end.

He sees demand for both sales and service remaining strong in the years to come. Owens is confident that as long as Max’s continues to deliver the customer service that’s been its strength, it will continue to be successful. He’s just hopeful he will continue to have enough employees to meet demand.

“We’re always looking for good help,” Owens said about sales, repair and especially delivery.

Old store, new(ish) owners: Hunter and Maggie Gardner purchased the cycle shop, which first opened in 1955, in April of 2021.

“I’m still pretty green,” said Hunter, an avid bicycler who was exposed to bike shops as an undergrad at the University of Colorado in Boulder.

Now, after moving to Traverse City (where he was born, though he grew up in Indiana) and working at TentCraft and as an environmental consultant, he’s back into bikes. He works in both sales and service, while Maggie keeps a close eye on customer service while working part-time as an RN.

While City Bike Shop’s history dates back nearly 70 years, it’s been joined by many others over the years. It’s also moved locations, most recently from Union Street to its present site on Eighth Street – right across the street from Brick Wheels and McClain Cycle and Fitness (which also have welcomed new owners in the past two years). Gardner said the working relationship with his neighbors is great, and the situation benefits customers.

“It’s the only place in the country with three bike shops within 50 yards,” he said. “It’s great for consumers.”

He added that bicyclists tend to have strong brand loyalties, both with bike manufacturers and with their retailers.

“It’s tough to earn business from someone who identifies with another brand,” he said. “Everyone finds their own niche.”

He jumped back into the bike business while supply lines were still being impacted, but at the same time outdoor activities were energized.

“I knew I was entering the industry at a tumultuous time,” he said.

One of his first tasks, beyond dealing with supply and demand, was to modernize aspects of the business, improving internal and external communications via texting and investing in more tech tools for inventory management.

He takes issue with those who think all retail is going to be relegated to online sales.

“Certain things are safe from being fully cannibalized,” he said, pointing to service as a key to survival. That loyalty he mentioned comes into play too, as does being able to select a bike and ride out with it.

“A bike is not just a commodity,” he said. “Bike people are passionate. They want to touch and feel the product.”

He knows customers appreciate help finding the right bike for their needs, fitting it to them and providing necessary service. So despite all the challenges, he’s confident that dedicated bike retailers, including City Bike Shop, will continue to thrive.

Owning a store for 24 years is an accomplishment, but for Jim and Marcy Richards, that only represents 13% of the lifetime of their Old Mission General Store. The store dates back to 1839, only four years after Michigan had become a state. Jim is proud to carry on the legacy of those who came before him.

“It was the first post office between Muskegon and Mackinac Island,” said Jim, admittedly a huge history buff.

The Richards are distantly related to the Lardie family and took the store over from them in 1998, carrying on the legacy and mix of products in the store.

He and Marcy met in Hollywood, where he was active in theater, radio, television and movies. His performing background comes through in person and on the phone, as he loves to regale customers with tales and trivia about the store’s history.

“It’s decked out like the 1800s,” he said. “We represent all the periods of the store.” Richards noted the store was also open during the Spanish Flu pandemic of 1918, and the yellow fever one before that. When the pandemic hit, it was regarded as an essential business and was able to stay open.

“Essential for pickles, pasties and pizza,” he said proudly.

As to the future, he said he has no expectations.

“I take it one day at a time,” he said. “We love the store, spend a lot of time here.” One hope is for some additional help to run it, especially as he is recovering from heart surgery.

“Business is good. We hope for more (employees) this summer,” he said. “Like everybody else we feel it – there’s not enough help.”

them and providing necessary service. So despite all the challenges, he’s confident that dedicated bike retailers, including City Bike Shop, will continue to thrive.

Owning a store for 24 years is an accomplishment, but for Jim and Marcy Richards, that only represents 13% of the lifetime of their Old Mission General Store. The store dates back to 1839, only four years after Michigan had become a state. Jim is proud to carry on the legacy of those who came before him.

“It was the first post office between Muskegon and Mackinac Island,” said Jim, admittedly a huge history buff.

The Richards are distantly related to the Lardie family and took the store over from them in 1998, carrying on the legacy and mix of products in the store.

He and Marcy met in Hollywood, where he was active in theater, radio, television and movies. His performing background comes through in person and on the phone, as he loves to regale customers with tales and trivia about the store’s history.

“It’s decked out like the 1800s,” he said. “We represent all the periods of the store.” Richards noted the store was also open during the Spanish Flu pandemic of 1918, and the yellow fever one before that. When the pandemic hit, it was regarded as an essential business and was able to stay open.

“Essential for pickles, pasties and pizza,” he said proudly.

As to the future, he said he has no expectations.

“I take it one day at a time,” he said. “We love the store, spend a lot of time here.”

One hope is for some additional help to run it, especially as he is recovering from heart surgery.

“Business is good. We hope for more (employees) this summer,” he said. “Like everybody else we feel it – there’s not enough help.”

Mercantile

mercbank.com/business

Kennedy MacGirr is proud to carry on a family tradition. She took over the operation of Hull’s of Frankfort in 2019, making her the fourth generation at the women’s clothing store.

Originally opened as a laundromat and dry cleaners by her great-grandparents Roland and Harriet Hull in 1956, it soon began to sell women’s clothing. Over the years, as the cleaning business dissipated, the clothing lines expanded, and the shop’s reputation grew. Roland and Harriet’s daughter-in-law Maren Hull – Mac Girr’s maternal grandmother – took over the business in the late 1980s, and her daughter Mariah purchased and ran the store in the 2000s.

MacGirr, Mariah’s daughter, worked at the store growing up, and took over when her mother passed away in late 2019. So she was dealing with the aftermath of her mom’s death and running a business when the pandemic hit.

“It actually gave me time to get myself started,” she said of shuttering the store, then reopening to conform with the need for masking and sterilizing most everything, even trying to determine whether it was safe to operate the fitting rooms.

“It was quite a time to take over,” she said. “It was an adjust ment for everyone.”

Since then both she and the business have settled into a more regular routine. She relies on her familiarity with the store and the shoppers, as the clientele and her offerings have changed over the years. Things have become more casual, and she’s also expanded the size range of the clothing, from size 0 to 20 and extra-small to 3X.

“Clothing got more comfy,” she said. “We try to find more everyday (clothing), carry a wider variety than ever before.”

She says shopping in a store still offers advantages over doing so online. “There’s instant gratification, (purchasing) on the spot.”

With its antique displays, wood floors and other reminders of days past, Bahle’s of Suttons Bay looks just like it did all those years ago.

Except not really: While the store has been in existence for nearly 150 years, in truth, the store never resembled this iteration until a renovation.

The setting and decor that suggest the past were the brainchild of manager Stacy Sheren. The furnishings and artifacts, such as orchard ladders used as displays and the original post office fixtures in the back of the store, are props meant to recall the days when Lars “L.E.” Bahle opened the store in 1876 as the prototypical general store. Back then, it sold most everything, from clothing and dry goods to hardware and other staples of pre-20th century life.

Fast forward 100-plus years and four generations, and the store now stocks men’s and women’s clothing by Barbour, Patagonia, Harley of Scotland and other upscale brands. Sheren said that as the town morphed to a tourist destination, so too did its clientele change, leading to the emphasis on a mix of classic clothing and sportswear.

The store is still owned by the Bahle family, with Chris Bahle handling the finance end of things. His siblings Rich, Lois, Karl and Bob work “behind the scenes” as Sheren put it, including various philanthropic endeavors. The fifth generation is represented by Rich’s son Erik, who is active in the property management side of the family’s business.

Sheren said like many other retail operations that survived the pandemic, the rebound brought an influx of business.

“People wanted to get out,” she said.

Now the store has largely made it through the supply chain issues, and Sheren said its reputation for customer service positions it well for the future.

“We try to remember people’s names, provide a pleasant shopping experience and go the extra mile,” she said. “It’s the old-school tradition, being more personal.”

One thing she’s excited about is the use of technology to further that service approach.

“There’s really cool new tech for dress shirts. An iPad measures 200 points in about 30 seconds. Then customers can pick their collar, buttons, cuffs, and get it in about two weeks,” she said about the technology, which costs only about $30 more than an off-the-shelf shirt.

Kennedy MacGirr is proud to carry on a family tradition. She took over the operation of Hull’s of Frankfort in 2019, making her the fourth generation at the women’s clothing store.

Originally opened as a laundromat and dry cleaners by her great-grandparents Roland and Harriet Hull in 1956, it soon began to sell women’s clothing. Over the years, as the cleaning business dissipated, the clothing lines expanded, and the shop’s reputation grew. Roland and Harriet’s daughter-in-law Maren Hull – MacGirr’s maternal grandmother – took over the business in the late 1980s, and her daughter Mariah purchased and ran the store in the 2000s.

MacGirr, Mariah’s daughter, worked at the store growing up, and took over when her mother passed away in late 2019. So she was dealing with the aftermath of her mom’s death and running a business when the pandemic hit.

“It actually gave me time to get myself started,” she said of shuttering the store, then reopening to conform with the need for masking and sterilizing most everything, even trying to determine whether it was safe to operate the fitting rooms.

“It was quite a time to take over,” she said. “It was an adjustment for everyone.”

Since then both she and the business have settled into a more regular routine. She relies on her familiarity with the store and the shoppers, as the clientele and her offerings have changed over the years. Things have become more casual, and she’s also expanded the size range of the clothing, from size 0 to 20 and extra-small to 3X.

“Clothing got more comfy,” she said. “We try to find more everyday (clothing), carry a wider variety than ever before.”

She says shopping in a store still offers advantages over doing so online. “There’s instant gratification, (purchasing) on the spot.”

get it in about two weeks,” she said about the technology, which costs only about $30 more than an off-the-shelf shirt.

In 1954, Don Orr Ski Shop debuted in Traverse City. After a couple moves early on it’s still here, having landed across from East Bay and Traverse City State Park Beach in 1960. That’s where you’ll find owner Jeff Swanson and his crew, and it remains one of the area’s most popular destinations for ski equipment and service.

The industry has changed over the years as new materials and methodologies have been introduced, from clothing to bindings to skis and helmets. Swanson said he and the staff have always been dedicated to growing with the times and providing customers with what they needed.

“Skiers are a unique group of people,” he said, noting their loyalty to those who take care of them and their equipment.

He said that is the edge that has kept the company in business all these years.

“One of the foundations is service. That’s why we’re still here, service and customer service,” he said.

Swanson began working there in 1982, and three decades on he bought the business from Bonnie Orr. Its central focus has always been and will always be taking care of those hitting the slopes, but the store added beachwear and summer necessities for its off season. In the summer, that keeps him and three others busy, while the winter staff triples in size.

“I’ve been blessed with very little turnover,” he said.

Despite moving to Traverse City in fifth grade and then reveling in being able to go downtown by herself as she grew up, Amanda Walton wasn’t a customer at Toy Harbor until she had kids. Now she has a vested interest in the store, having purchased it from her mother-in-law.

Nancy Walton opened the store in 1984. Back then a woman typically couldn’t get a loan by herself.

“It was difficult as a female business owner,” Amanda said. Attitudes and subsequent business practices have changed in the nearly four decades since, as has the downtown. Yet the store has remained an iconic presence.

“The sign is a staple,” said Walton, who took over after serving as manager for 10 years.

She said the store’s mix includes creative and classic toys, while she’s also tried to keep up with trends. That diversity has helped it survive potential downturns posed by the presence of malls and Amazon.

“It was a challenge when the mall opened and downtown was empty,” she said. Another came with the onset of COVID-19. With the store and schools closed, Walton adapted, creating Home Quarantine Kits to keep kids occupied and engaged, with puzzles, art supplies, jump-ropes and other items that were educational and fun.

“It was tough for parents,” she said.

To help those families looking to limit exposure, she even began delivering the kits.

With the pandemic mostly in the rear-view mirror, Walton remains cognizant of change and how it impacts her business. One she’s noticed over the years is that the seasonal nature of business has lessened.

“Now January and February are kind of quiet, but we have visitors yearround,” she said.

She is also developing a website to allow for online shopping for those who love the store but aren’t able to visit in-person.

She said the store just underwent a facelift, necessitated by a leak, providing a refreshed experience for customers.

“We still want people to come downtown,” she said.

While the vast majority of his business is done during the ski season, Swanson said the rush of business following the pandemic nearly emptied the store of its summer inventory – and the same was true for the following winter.

“In June it was like the floodgates had opened,” he said. “We never saw that amount of business in the summer...ever.”

Then it got even busier for the ski season. Everybody started enjoying the outdoors, and in ‘20, ‘21 and ‘22 Swanson reports he had the “best” three years.

Part of the reason for the success those three years was that most of his manufacturers are in Europe, not Asia, so there wasn’t as much of a bottleneck in the supply chain. But there are challenges there as well.

“Cross country took a bit of a hit because … two of the largest factories in the world (for that equipment) are in Ukraine,” Swanson said.

He admitted he is worried about another challenge facing the entire industry: the specter of climate change.

“The last three years we have had horrible seasons in terms of snow,” he said.

Even when it’s been cold enough for the resorts and ski hills to make snow, it sometimes hasn’t lasted.

“We had three storms this year with more than a foot of snow, and a week later it was 50 degrees,” Swanson said.

In 1954, Don Orr Ski Shop debuted in Traverse City. After a couple moves early on it’s still here, having landed across from East Bay and Traverse City State Park Beach in 1960.

That’s where you’ll find owner Jeff Swanson and his crew, and it remains one of the area’s most popular destinations for ski equipment and service.

The industry has changed over the years as new materials and methodologies have been introduced, from clothing to bindings to skis and helmets. Swanson said he and the staff have always been dedicated to growing with the times and providing customers with what they needed.

“Skiers are a unique group of people,” he said, noting their loyalty to those who take care of them and their equipment.

He said that is the edge that has kept the company in business all these years.

“One of the foundations is service. That’s why we’re still here, service and customer service,” he said.

Swanson began working there in 1982, and three decades on he bought the business from Bonnie Orr. Its central focus has always been and will always be taking care of those hitting the slopes, but the store added beachwear and summer necessities for its off season. In the summer, that keeps him and three others busy, while the winter staff triples in size.

“I’ve been blessed with very little turnover,” he said.

While the vast majority of his business is done during the ski season, Swanson said the rush of business following the pandemic nearly emptied the store of its summer inventory – and the same was true for the following winter.

“In June it was like the floodgates had opened,” he said. “We never saw that amount of business in the summer...ever.”

Then it got even busier for the ski season. Everybody started enjoying the outdoors, and in ‘20, ‘21 and ‘22 Swanson reports he had the “best” three years.

Part of the reason for the success those three years was that most of his manufacturers are in Europe, not Asia, so there wasn’t as much of a bottleneck in the supply chain. But there are challenges there as well.

“Cross country took a bit of a hit because … two of the largest factories in the world (for that equipment) are in Ukraine,” Swanson said.

He admitted he is worried about another challenge facing the entire industry: the specter of climate change.

“The last three years we have had horrible seasons in terms of snow,” he said.

Even when it’s been cold enough for the resorts and ski hills to make snow, it sometimes hasn’t lasted.

“We had three storms this year with more than a foot of snow, and a week later it was 50 degrees,” Swanson said.

What do flooring, metalsmithing/design and pet food have in common?

If you answered Kathy and Tim Hyland, you’re right. They are the owners and moving forces behind Bayview Flooring, Bayview Displays and Pets Naturally.

It all started 40 years ago when a young Tim Hyland got his start in the flooring business. Ever the entrepreneur, he struck out on his own just two years later, at age 26.

“I found a building and went to lease the space, but I had no money,” Hyland said.

Knowing the building had been vacant for three years, he made a deal with the owner: He’d lease the space for 90 days rent-free, but would cover the utilities. So Cash and Carry Flooring was born.

Still, with two kids and one on the way, he said the choice to jump in was a leap of faith ... sort of.

“I had a following from the other store,” Hyland recalled.

He was able to secure his first big job at the Reef Petroleum building on West Grand Traverse Bay, today known as Centerpointe. That enabled Cash and Carry Flooring to expand, eventually with locations in Elk Rapids, Bay Harbor, Gaylord and Traverse City.

He sold the Gaylord location to the store manager and the others when they received what he called “an offer they couldn’t re-

fuse.” That was in 2004, including signing a seven-year non-compete clause.

The Hylands moved to Florida, where they flipped some houses and Tim worked as a handyman on a barrier island.

But after the seven years had passed, they jumped back in, with a new name: Bay View Flooring. The 18,000 squarefoot showroom on Division next to Culver’s, backed by a 25,000 square-foot warehouse, has been a huge success. Tim

led to numerous five-star reviews online, which they emphasized in their marketing. According to the industry journal Floor Focus, the store is in the top 70 dealers nationwide, and Bay View Flooring has also been named a Top Ten Small Business by the Traverse City Area Chamber of Commerce and one of 50 Companies to Watch by Michigan Celebrates Small Business.

As Bay View Flooring was experienc-