Rental Market Update

To create a place where we can facilitate our people’s growth.

Family.

Our colleagues are our broader family, assist when needed and when in need.

Mutuality.

Respect our colleagues and our clients as you would like to be respected.

Realising potential. Unlock your full potential, encourage and support your colleagues.

Strive for excellence; be open minded and willing to embrace change.

Health and energy.

Work towards being well balanced within yourself.

Hi Guys, it’s Dean OBrien from OBrien Real Estate with the tenth edition of the monthly property news for 2022 where real estate information is on the house.

Things are getting better for us, that is the truth even though it doesn’t always seem that way or as the media likes to portray it. We live better than ever. The world’s population today is 7.98 billion and 169,000 people are coming out of extreme poverty every single day and it’s been like that for the last 20 years. Wealth per capita in Australia is currently $553,954 according to Australia Bureau of Statistics and household deposits grew by 0.5 percent, households have now accumulated just shy of $312 billion in deposits since the pandemic.

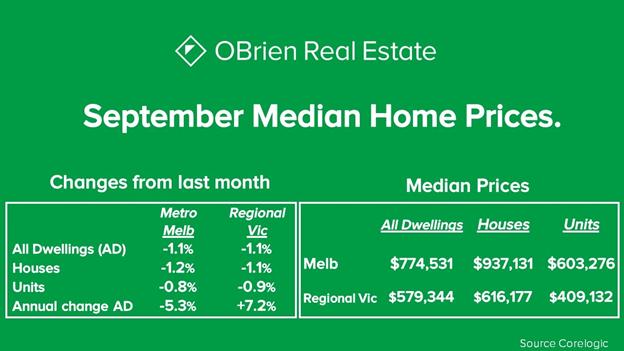

For Melbourne Metro declines in the Home Value Index over September eased slightly in comparison to August, this is the second month in a row that we have seen declines ease, although the declines are continuing to trend. Corelogic reported that combined dwellings of houses and units fell 1.1 percent, prices in Melbourne and is now down 5.3 percent year to date. Regional Victoria on the other hand is still in positive home price territory with 7.2 percent growth for the year so far, although September had a 1.1 percent decline like Melbourne Metro.

Looking at the rental market, rents in Metro Melbourne during September has had its slowest growth since December 2021 which is a little surprising considering the low vacancy rates and the increase in migration. However gross yields for investors in units and apartments are now realising a 4.0 percent gross yield which is further evidence of a shift of rental demand back towards higher density living and is a preference we are seeing strongly post covid-19 lockdowns.

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.

“Is our market just more normal now?”

A snapshot of last months leases.

Address Suburb

Berwick Berwick Berwick Berwick Berwick Berwick

30CarcoolaRise

1/9CherryplumCourt

BotanicRidge BotanicRidge ClydeNorth Cranbourne Cranbourne Cranbourne CranbourneEast CranbourneNorth CranbourneNorth CranbourneNorth Doveton Highett Keysborough NarreWarren NarreWarren NarreWarren Pakenham Pakenham

Rowville Seaford Tooradin Tooradin

5 2

2 2

2 2

2 2

1 0

3 2

2 2

2 2

2 2

1 2

1 2

2 2

2 2

2 2

2 1

2 2

1 1

1 2

1 2

2 2

per week

1

2 2

2 2

2

0

3

4

2

2 2

$800 $470 $550 $590 $470 $750 $500 $500 $460 $450 $450 $480 $430 $440 $380 $400 $350 $390 $335 $550 $355 $450 $375 $360 $345 $430 $580 $500 $500

Reason #1

Access to more renters.

Inter-office promotion and selling increasing your property’s exposure. Latest prospective renter database.

Reason #2

Experience, integrity and knowledge.

Local area specialists, highly skilled and trained property managers across all offices.

Our low days on market can translate into marketing savings. Less time on market ensures you receive the best possible price.

Reason #4

Constant improvement.

All property managers receive specialist industry training and have regular meetings.

Reason #5

Specialised marketing.

Professional photography and lease boards, utilising Australia’s premier real estate websites.