How ACH Payments Fuel Customer Wins and Revenue

Open banking enablement of elegant enrollment

UX fundamentally changed from legacy manual processes

Evolved data set availability to authenticate and mitigate risk

Proven evolved use cases at scale

iGaming

Cryptocurrency exchanges

Pay-by-bank

Real -time Payment

Advancements

Instant disbursements

Introduces an additional “rail” for access to checking/savings account

Request for Payment “RFP” (pay ins/acquiring) enhancements coming soon

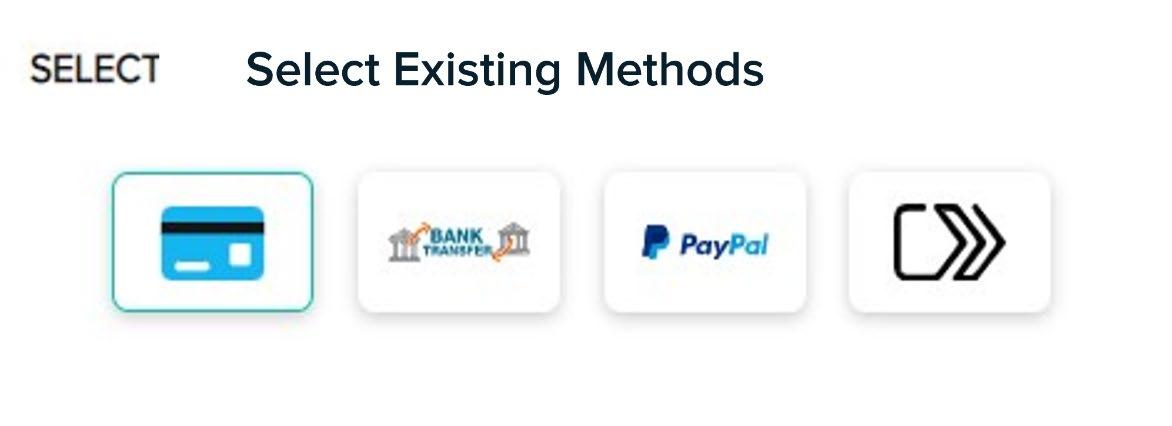

ACH (Automated Clearing House) capabilities, enable us to provide an alternative debit routing solution that is not only cost-effective but a safe and secure way for consumers to pay for their transactions using their checking or savings accounts.

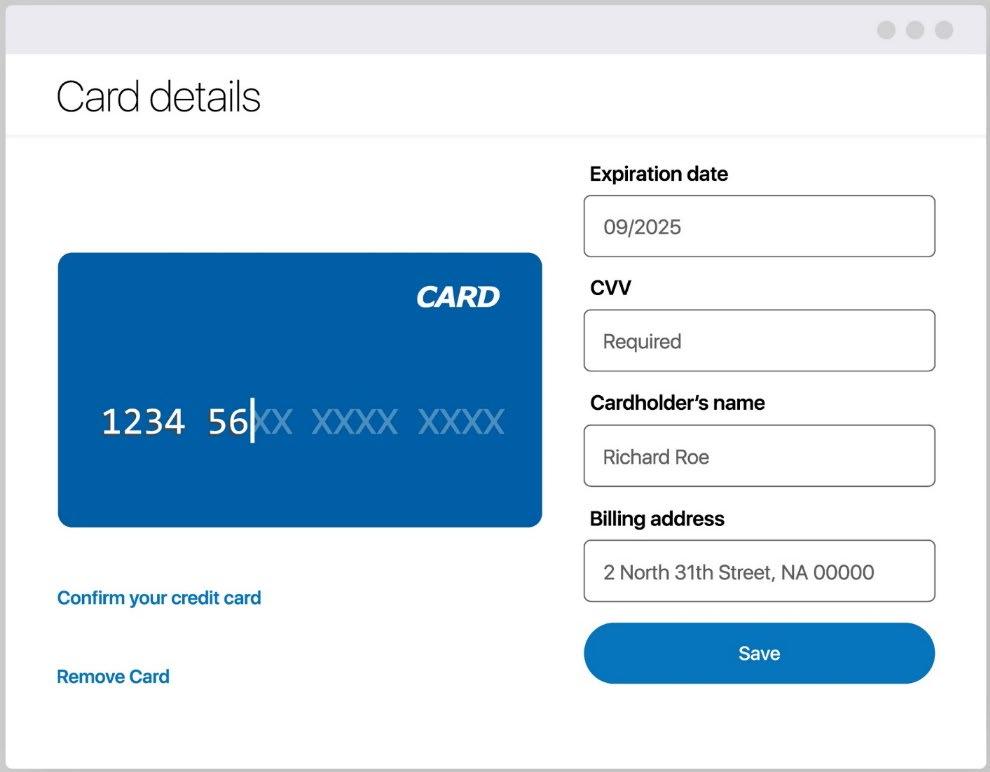

Simple and secure digital enrollment and authentication of bank credentials to facilitate the payment transaction

Access the same bank account endpoint to debit and credit funds without having to pay all the of traditional payment debit networks fees

Leverage token assigned to stored payment credentials on Nuvei platform to enable simple and secure repeat checkouts

Support consumers’ choice to pay with their trusted, secure bank relationship

With access to multiple networks and progressive bank partners, we can support all your ACH transactions.

Faster Payments Council

Merchant Risk Council

Merchant Advisory Group

Third-Party Payment Processors Association (TPPPA)

Wespay

Nacha Third-Party Validation Service Vendor Service Provider

Nuvei’s Online Bank Transfer is Uniquely Powerful

Take the lead with Nuvei’s ACH Guarentee Funds Program . Our program is designed to enable businesses to keep payment funds while Nuvei handles the collection of returns from customers. You can choose from two return programs - Assured Essential or Assured Complete - to minimize the risk of returns.

Assured Essential - we assume the risk of funding returns.

Assured Complete - we guarantee funds on all returns, including unauthorized returns. Benefits

Get paid faster with next-day funding*

Added flexibility and speed of financial funds knowing they will not be pulled back because of a return

Reduced back-office expense as Nuvei works any returns

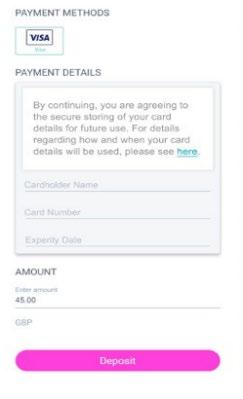

Add a checkout “button” to real estate

A single end-to-end solution for accepting payments

Customizable integration solutions and plugins

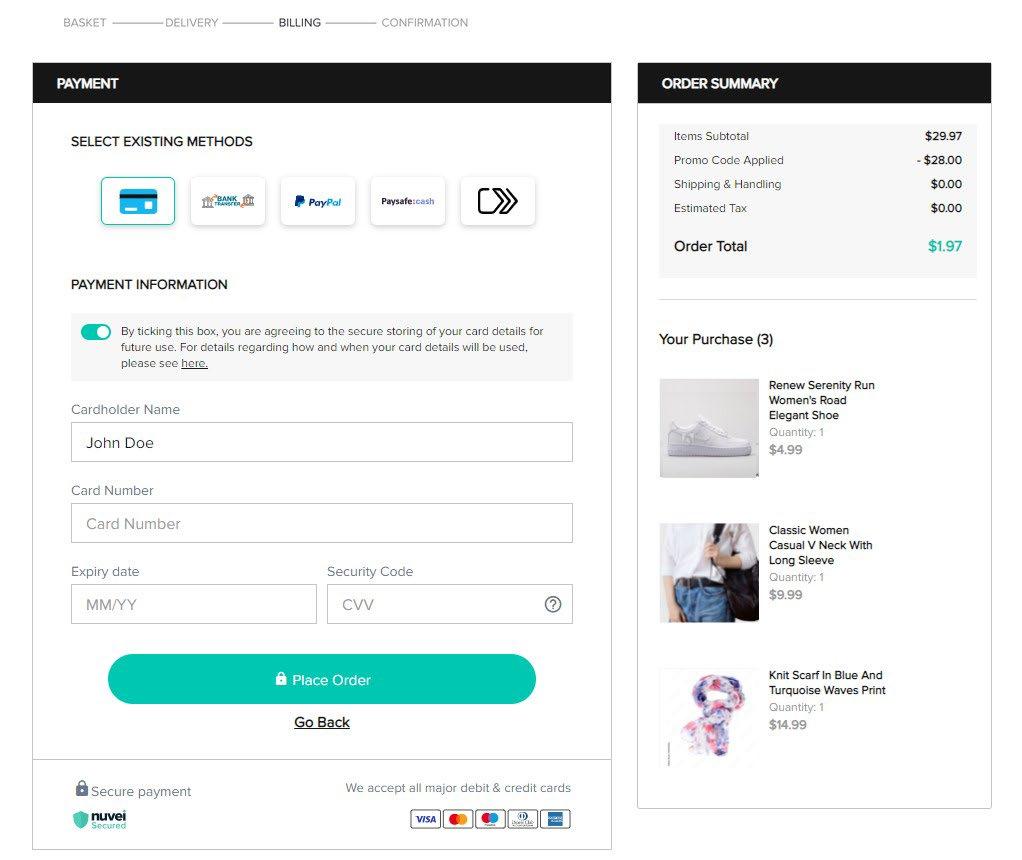

Integrates easily into your payment flow and has its own customizable UI, which embeds seamlessly into your payment page using Nuvei Web SDK.

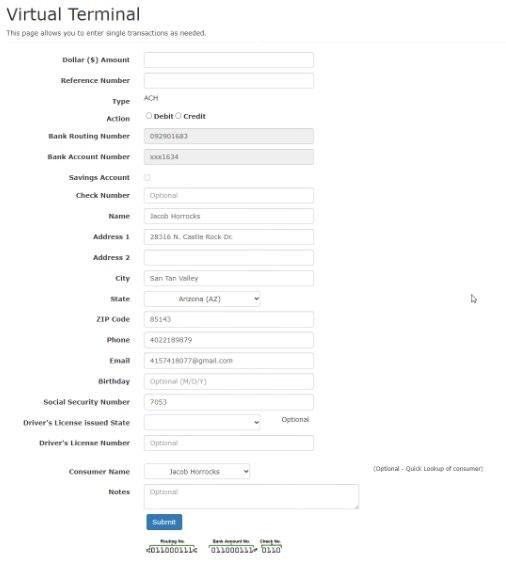

Provides an effortless transaction experience for you and your customers, including the ability to execute manual payment card transactions offline.

You don’t need to change your existing setup. Nuvei’s Virtual Terminal integrates with any existing system or customized setup so you can easily import/export your existing customer database files.

Follow your business performance anytime, from anywhere. Export business reports in your preferred file formats (XML, Excel, PDF and more).

Avoid errors by letting the gateway manage recurring payments. Plus, process transactions from repeat customers, without re-entering customer information.

Easily accept payments from customers via an online payment page accessed through a link, text message, or QR code.

Key benefits include:

Increase revenue: Recover declined or abandoned transactions with a follow-up link.

Convenient: Flexibility to personalize your payment page without any development work.

Mobile friendly: SMS message delivered directly to a mobile device with a QR code or URL to create a quick and seamless payment experience.

Fast: Enables your customers to pay immediately and can be embedded in invoices for fast payment.

Immediate notification: You are notified in real-time about your customer’s payment completion.

Discover new opportunities

Shield against attrition by strengthening merchant relationships and customer retention with ACH.

Expand into new merchant segments including subscriptions, non-profits, education and B2B.

Spice up your pitch

Expand into new merchant segments including subscriptions, non-profits, education and B2B.

Forge strong

Merchant bonds

Enhance customer relationships using ACH and foster merchant loyalty to effectively reduce attrition

46 %

of respondents have used Online Bank Transfer payments.

40 %

26 %

of respondents have heard of Online Bank Transfer payments but have never used them.

38 %

20 %

of respondents estimated to be 64 million Americans are interested in using Online Bank Transfer payments in 2023.

of consumers are interested in Online Bank Transfer payments due to checkout speed and 34% due to easier payment tracking

say transfer speed is the most important reason for being interested.

Support consumer desire for frictionless digital payments

Reduce the total cost of processing

Incentivize consumer use

Store tokenized credentials for one-click payments

Continue to support NFC transactions at POS terminals whereby credentials are stored within device digital wallet or merchant app

Price online direct A2A debit payments the same as you price networkbased debit

• Your margin will be increased by elimination of network expense

Offer discounted direct debit processing to win a net new merchant client.

Offer discounted direct A2A debit pricing for priority placement of the payment option (checkout real estate and operator assisted narrative)

Introduce direct A2A as an alternative to surcharging for debit/credit.

Introduce direct A2A as a new tender for ISV embedded payment offering to get foot in door – champion/challenger play to existing debit/credit relationships.

• Pay-by-Bank Rewards Programs Can Build Stronger Consumer-Merchant Bonds (pymnts.com)

• Account-to-Account Payments Have a Branding Problem (pymnts.com)

• Over 41% of Consumers Interested In Pay By Bank Despite Security Fears (pymnts.com)

• https://www.pymnts.com/partnerships/2023/stripeenables-airbnb-customers-pay-by-bank-transfer/

• Uber and Stripe Expand Partnership to Enable Pay by Bank (pymnts.com)

• 75% of Consumers Who Use Online Bank Transfers Worry About Fraud (pymnts.com)

• Consumers Who Try Online Bank Transfers for Recurring Bill Pay Like It (pymnts.com)

We offer the widest choice of pay-in and payout methods to support your expansion into new markets.

Convert more sales and boost your P&L with our proprietary, in-house, best-in-class optimization suite.

However, wherever you do business, get a complete payment experience online, in-store, or in-platform.

A technology platform that gives you the peace of mind your business will be always on and scale seamlessly.

No matter your organization’s size, development capability, or need for personalization, we have the solution.

Customer-specific features rolled out seamlessly, instantly, globally. Includes regulatory and countryspecific customizations.

Manage complexity with data, insights, and a smooth payment orchestration platform.

Sophisticated merchants need dedicated human experts, not chatbots. We’ve got your back, always.