DAY ONE.

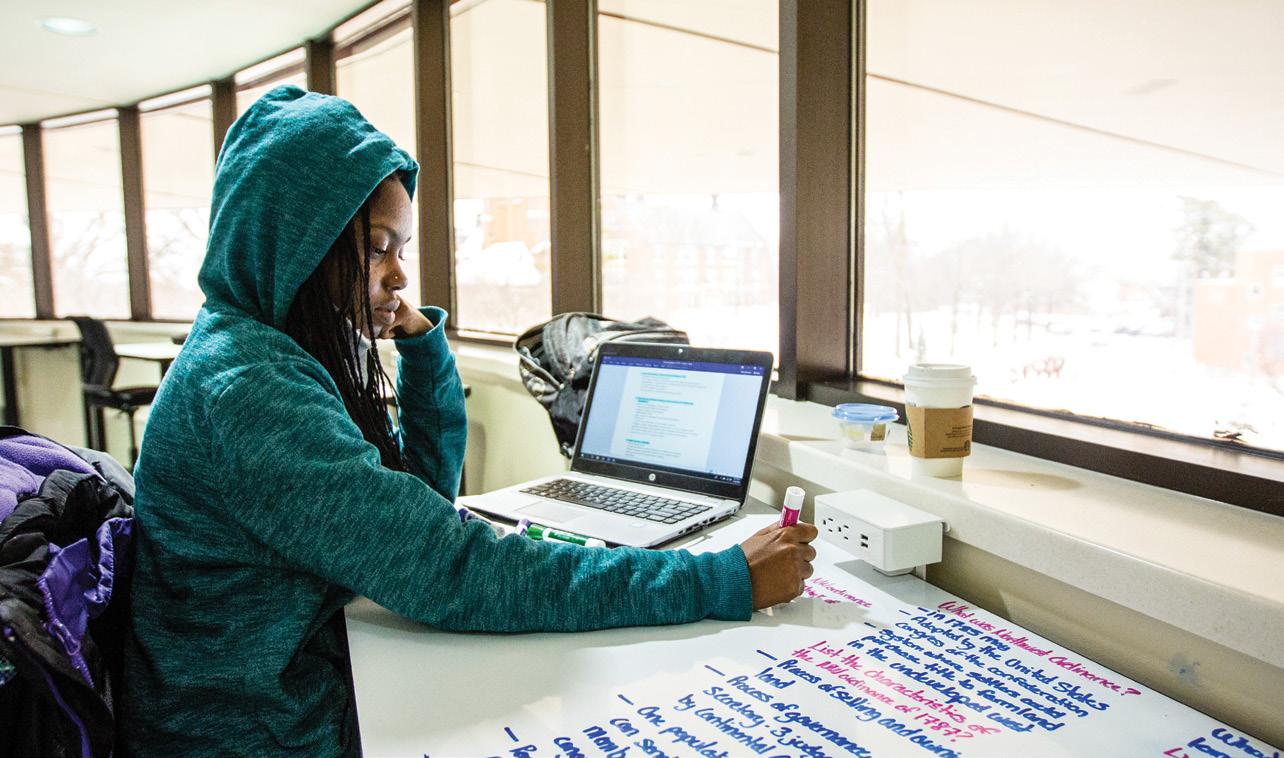

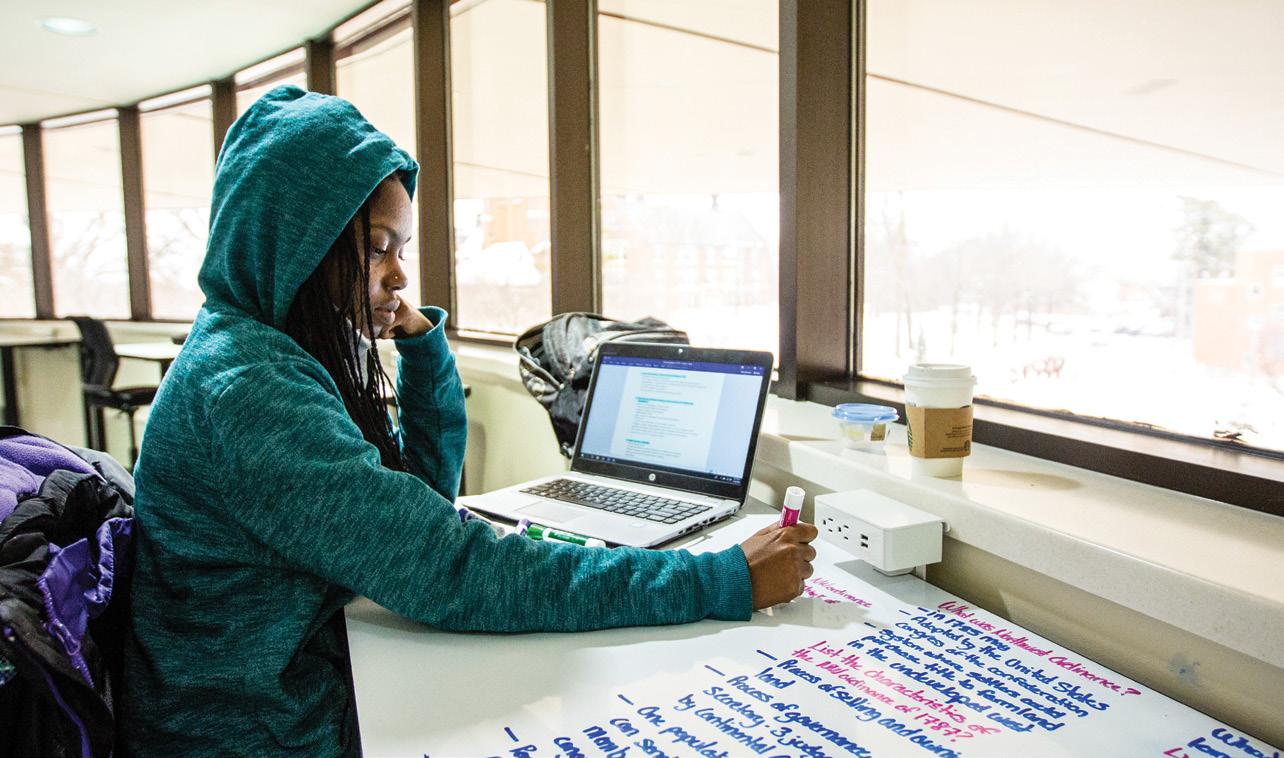

In addition to offering competitive tuition pricing and being a regional leader, Northwest also provides students with an educational experience like no other.

98% of bachelor’s degree earners secure employment or continue their education within six months of graduation.

96% OF FIRST-YEAR STUDENTS RECEIVE AN INSTITUTIONAL SCHOLARSHIP OR GRANT

“The thing that I enjoy most about Northwest is that they care. The professors in my department care about me and what I want to do after college.”

A RETURN ON INVESTMENT.

RATE

98% PLACEMENT

Claire Chesnut HUMANITIES & SOCIAL SCIENCES

A GUIDE TO COST, SCHOLARSHIPS AND FINANCIAL AID. LAPTOP & TEXTBOOKS INCLUDED SAVES

MORE THAN

YEARS* NWMISSOURI.EDU/ADMISSIONS/LAPTOP *FOR MARYVILLE STUDENTS $6,800 IN-STATE STUDENTS

OUT-OF-STATE

AVERAGE UNDERGRADUATE AWARDS

STUDENTS

OVER FOUR

$3,588

STUDENTS $8,904

NORTHWEST IS LISTED AMONG THE TOP 23% MOST AFFORDABLE 4-YEAR UNIVERSITIES IN EACH OF THE LAST FIVE YEARS.

A FINANCIAL FIT

The cost of attendance is an estimate of the educational expenses for the academic year, including tuition and required fees, room and board, books and supplies, and other personal expenses.

WHAT IS NET PRICE?

A net price is an estimate of the actual cost you and your family need to pay in a year to cover education expenses for you to attend a particular college or career school. It is the institution's cost of attendance minus any grants and scholarships for which you may be eligible.

Net price comparison - peer institutions

Average net price by state

AVERAGE MISSOURI RESIDENT billable cost prior to eligible aid $22,306* AVERAGE NON-RESIDENT billable cost prior to eligible aid $29,890*

BILLABLE COST = (TUITION, FEES, ON CAMPUS HOUSING/MEALS)

*Figures above are based on the 2022-2023 academic year. Standard tuition and fees include tuition, designated fees, primary textbook usage fee and technology fee charged per credit hour. Does not include supplemental materials. Based on 15 credit hours per semester for undergraduate students. Financial aid packaging includes an average of housing.

**Other meal plans availablecosts.**Other meal plans available

Our net price is in the lower onethird of our peers, including for families with incomes between $30,000 and $110,000.

Northwest also ranks under the state average in tuition price compared to our top competitors in Missouri, Iowa, Nebraska and Kansas.

Calculate your net price at

nwmissouri.edu/finaid/calculator

$0 $5,000 $10,000 $15,000 $20,000 IOWA NEBRASKA KANSAS MISSOURI NORTHWEST $17,779 $15,328 $14,005 $13,762 $13,375

$20,000 $0 $5,000 $10,000 $15,000 Northwest Peer Institution 5 (Mo.) Peer Institution 4 (Kan.) Peer Institution 3 (Kan.) Peer Institution 2 (Mo.) Peer Institution 1 (Mo.) $13,375 $13,394 $14,006 $14,198 $16,804 $16,930 Source: IPEDS Data Center and College Navigator

SOURCE: NATIONAL COLLEGE ATTAINMENT NETWORK (2014-2019 DATA) Tuition and Fees* 1 Semester Fall (15 hrs) 2 Semesters Fall & Spring (30 hrs) In-state students $5,939 $11,878 Out-of-state students $9,731 $19,462 Room Rates (All Double Occupancy) 1 Semester Fall 2 Semesters Fall & Spring Hudson/Perrin $3,365 $6,730 Dieterich and Millikan $2,791 $5,582 South Complex, Roberta and Franken $3,092 $6,184 Tower Suites $3,285 $6,570 Meal Membership Rates 1 Semester Fall 2 Semesters Fall & Spring Silver Meal Membership** (7-days-a-week) $2,136 $4,272 **Meal memberships range from $770 (low-cost housing dining plan) to $2,436 a semester

LET'S RUN SOME FINANCIAL SCENARIOS!

MEAL PLAN TEXTBOOKS LAPTOP WELLNESS SERVICES ATHLETIC EVENTS STUDENT ACTIVITIES AND EVENTS ACADEMIC SUPPORT RESIDENCE HALL INTRAMURALS

DOES YOUR MONEY GO? Items included in the full Northwest experience. FITNESS CENTER CAREER SERVICES Out-of-state student $29,890 = estimated billable expense $5,653 estimated term balance (After student loans/scholarships/grants, before work study and parent loan) Family Size: 4 Students in college: 1 Income: $100K ACT: 29, HS GPA: 3.90 $13,084 SCHOLARSHIPS/GRANTS $5,500 STUDENT LOANS $11,966 PARENT LOAN In-state student $22,306 = estimated billable expense $2,464 estimated term balance (After student loans/scholarships/grants, before work study and parent loan) Family Size: 4 Students in college: 1 Income: $50K ACT: 21, HS GPA: 3.50 $5,500 STUDENT LOANS $5,544 PARENT LOAN $2,400 WORK STUDY Out-of-state student $29,890 = estimated billable expense $8,624 estimated term balance (After student loans/scholarships/grants, before work study and parent loan) Family Size: 5 Students in college: 1 Income: $85K ACT: N/A, HS GPA: 3.50 $7,142 SCHOLARSHIPS/GRANTS $5,500 STUDENT LOANS $17,908 PARENT LOAN $2,400 WORK STUDY

In-state student $22,306 = estimated billable expense $2,998 estimated term balance (After student loans/scholarships/grants, before work study and parent loan) Family Size: 4 Students in college: 2 Income: $72K ACT: 27, HS GPA: 3.90 $10,810 SCHOLARSHIPS/GRANTS $5,500 STUDENT LOANS $6,656 PARENT LOAN $2,400 WORK STUDY $11,878 SCHOLARSHIPS/GRANTS

WHERE

RENEWABLE SCHOLARSHI PS

MERIT-BASED SCHOLARSHIPS

Distinguished, Academic Excellence, Tower, University Scholar and Northwest Merit are mutually exclusive awards.

Out-of-state students can earn IN-STATE rates with the Bearcat Advantage. *Estimate based on 30 credit hours per year. 1(100% waiver of out-of-state fees) 2(50% waiver of out-of-state fees). Stackable with merit-based freshman scholarships.

Eligible U.S. citizens include American Indian or Alaska Native, Asian, Black or African American, Hispanic/Latino, Native Hawaiian or

SCHOLARSHIPS

NORTHWEST A+ SCHOLARSHIP For more information, visit nwmissouri.edu/finaid/Freshman.htm

• $1,500 scholarship (renewable for one additional year)

• Attend an A+ eligible Missouri high school and complete the A+ requirements

• Indicate A+ on your application for admission

• Minimum of

cumulative high school grade-point average

SAT score ACT score HIGH SCHOOL GPA 3.95+ 3.85-3.94 3.75-3.84 3.50-3.74 3.25-3.49 3.00-3.24 2.75-2.99 1280-1600 27-36 $4,000 $4,000 $4,000 $3,000 $3,000 $2,000 $1,500 1200-1270 25-26 $3,000 $3,000 $3,000 $3,000 $2,000 $1,500 $1,000 1130-1190 23-24 $3,000 $3,000 $3,000 $2,000 $2,000 $1,500 $1,000 1060-1120 21-22 $2,000 $2,000 $2,000 $1,500 $1,500 $1,500 $1,000 980-1050 19-20 $2,000 $1,500 $1,500 $1,000 $1,000 $1,000 $1,000 Less than 980 or no SAT test score Less than 19 or no ACT test score $2,000 $1,500 $1,000 $1,000 $1,000 N/A N/A

OUT-OF-STATE STUDENT SCHOLARSHIPS

SAT score ACT score HIGH SCHOOL GPA 3.95+ 3.85-3.94 3.75-3.84 3.50-3.74 3.25-3.49 3.00-3.24 2.75-2.99 1280-1600 27-36 $7,584 $7,584 $7,584 $7,584 $7,584 $7,584 $3,792 1200-1270 25-26 $7,584 $7,584 $7,584 $7,584 $7,584 $3,792 $3,792 1130-1190 23-24 $7,584 $7,584 $7,584 $7,584 $7,584 $3,792 $3,792 1060-1120 21-22 $7,584 $7,584 $7,584 $3,792 $3,792 $3,792 $3,792 980-1050 19-20 $7,584 $7,584 $7,584 $3,792 $3,792 $3,792 $3,792 Less than 980 or no SAT test score Less than 19 or no ACT test score $7,584 $7,584 $7,584 $3,792 $3,792 N/A N/A MULTICULTURAL

other Pacific Islander, or a graduate from eligible high schools. For more information, visit nwmissouri.edu/finaid/Freshman.htm SAT score ACT score HIGH SCHOOL GPA 3.95+ 3.85-3.94 3.75-3.84 3.50-3.74 3.25-3.49 3.00-3.24 2.75-2.99 1280-1600 27-36 $1,500 $1,500 $1,500 $1,200 $1,200 $1,200 $1,000 1200-1270 25-26 $1,200 $1,200 $1,200 $1,200 $1,200 $1,000 $1,000 1130-1190 23-24 $1,200 $1,200 $1,200 $1,200 $1,200 $1,000 $1,000 1060-1120 21-22 $1,200 $1,200 $1,200 $1,000 $1,000 $1,000 $1,000 980-1050 19-20 $1,200 $1,200 $1,200 $1,000 $1,000 $1,000 $1,000 Less than 980 or no SAT test score Less than 19 or no ACT test score $1,200 $1,200 $1,200 $1,000 $1,000 N/A N/A $4,000 Distinguished Scholar $3,000 Academic Excellence $2,000 Tower Scholar $1,500 University Scholar $1,000 Northwest Merit

3.25

$3,792 Green & White Advantage*2 $7,584 Bearcat Advantage*1

View a full list of scholarships at nwmissouri.edu/finaid/scholarships NORTHWEST IS A SUPERSCORE University NORTHWEST PROMISE PROGRAM Attend Northwest without paying tuition and standard fees. Find out more by going to www.nwmissouri.edu/finaid/aid/grants.htm Do you qualify? Fill out FAFSA by Feb. 1 A family income of $65,000 or less -ORPell grant-eligible MISSOURI RESIDENT • High School GPA 2.50+ and ACT 18-36 -OR• 2.75+ high school GPA with less than 18 ACT or no ACT test score NON-MISSOURI RESIDENT must be eligible for Bearcat Advantage NEW!

How to apply for FINANCIAL AID

1

Beginning Oct. 1, submit a 2023-24 FAFSA at studentaid.gov/fafsa or by mailing a paper FAFSA directly to the central processor.

2

List Northwest’s school code (002496) on the FAFSA so that we may receive your results.

3

It is strongly recommended that the IRS Data Retrieval Tool is used to transfer 2021 IRS income tax information on the FAFSA.

4

FYI

Keep your address current with the University.

All financial aid materials and requests will be mailed to your permanent address. If you have questions about financial aid, contact the Office of Scholarships and Financial Assistance at 660.562.1363 or finaid@nwmissouri.edu.

THE FINANCIAL AID PROCESS

can seem overwhelming when trying to focus on your academic goals. Our financial aid sta are here to help, as you finance your education.

PREPARATION FAFSA

TYPES OF STUDENT AID

$ $ GRANT

SCHOLARSHIP

START

SAVINGS: Begin saving early.

SCHOLARSHIPS: Search for local, regional, and national scholarships.

Scholarships and grants can help cover the cost of college, but you may find yourself in need of additional assistance.

FAFSA is the Free Application for Federal Student Aid and is the only way to apply for federal student aid. Listing Northwest on your FAFSA will allow us to evaluate your financial need and determine how much aid you are eligible to receive.

Northwest’s FAFSA school code is 002496

WORK-STUDY LOAN

A job that gives you the opportunity to earn money to help pay your educational expenses.

$ TAXES SAVINGS $ SAVINGS & 529 PLANS

OCT SCHOLARSHIPS

$ STATE AID STATE AID

STATE AID: Missouri residents may benefit from several state aid programs, based on academic achievement or financial need.

IT’S TIME TO APPLY FOR FINANCIAL AID

FAFSA

OCTOBER: Each October, the FAFSA is available for the next school year. It is best to fill it out by February 1 since some aid is first-come, first-served.

FAFSA.COM STUDENTAID .GOV/FAFSA

SAR SSA

FAFSA TAXES: When you complete the FAFSA, you’ll need to provide personal and tax information. You may be able to automatically retrieve your tax information from the IRS.

STUDENTAID.GOV/ FAFSA: Complete and submit online. Be sure to submit the FAFSA for each year you will attend.

Free money that does not have to be repaid. Student loans need to be repaid with interest, similar to a car or home loan.

STANDARD SCHOLARSHIP

APPLICATION:

Opens Sept. 1, closes Feb. 1 and used to apply for all departmental and foundation scholarships.

Your FAFSA helps us determine the types of federal student you are eligible to receive.

EARLY

APPLY

How to apply for HOUSING

1 Beginning Nov. 1, Log in to CatPAWS

2 Select 'Housing' tab

3 Navigate into the Housing System

4 Click 'New Residents'

5 Click '2023-2024'

6 Start your application by selecting one of the following options:

Option 1) Start LLC Application Option 2) Apply to Honor's LLC (first year students only) Option 3) Start Housing Application

7 Complete your application

8 Submit pre-payment to secure your place

Bearcat Checklist

Apply for admission.

Submit transcript(s) and test scores, if available, to be used in the admission decision.

Complete your Free Application for Federal Student Aid (FAFSA) beginning Oct. 1 at studentaid.gov/fafsa (Northwest school code is 002496) .

Apply for housing beginning Nov. 1.

Respond to any request to verify information submitted on the FAFSA.

Select your resident hall and room.

Complete the Northwest Standard Scholarship Application by Feb. 1.

Register to attend Summer Orientation Advisement and Registration (SOAR).

SOAR registration includes the advisement intake form. This information is used to create your initial class schedule.

Review and accept financial aid offer. Merit scholarships are awarded to admitted students. Apply for admission by May 1 to guarantee scholarship awards.

Request final high school and dual credit transcripts be sent to Northwest by recommended date of Aug. 15.

SUCCESS AID OFFER AIDOFFER AID OFFER $ $ $ AIDOFFER AID OFFER AIDOFFER AIDOFFER FINANCIAL AID OFFER COLLEGE BEYOND EDUCATION Your aid o er explains the combination of scholarship, grants, work-study, and loans we can o er you. The o er may contain federal, state and/or institutional aid. Compare aid o ers from multiple schools to find the best financial fit. Every year, thousands of students join the Bearcat family. Our financial aid o ce is here to help guide you along the way. REPAYMENT: Once you leave school, you will need to repay your student loans. Contact your loan servicer to discuss your repayment options. WORKFORCE: Graduation and success in the workforce is the ultimate end-goal and Northwest takes pride in ensuring students are career ready, day one. determine

EARLY Northwest Missouri State University O ce of Scholarships and Financial Assistance Administration Building, Room 273 800 University Drive Maryville, MO 64468 660.562.1363 (phone) 660.562.1674 (fax) finaid@nwmissouri.edu

student aid receive.

DAY ONE.

We're here to help. CALL US WITH YOUR QUESTIONS Student Account Services and Cashiering Offices Billing and refunds...........................660.562.1578 Payment arrangement....................660.562.1583 Scholarships and Financial Assistance Scholarships, grants, federal work study, loans..............660.562.1363 Student Success Center Orientation, academic advising and degree planning, academic support ..........................660.562.1726 Accessibility and Accommodations 660.562.1873 Admissions 660.562.1148 Athletics..............................................660.562.1977 Diversity and Inclusion 660.562.1517 General Information 660.562.1212 or 800.633.1175 For additional student and consumer information, visit nwmissouri.edu/facts/consumerinfo.htm.