35 minute read

FOREST TALK

by nzlogger

Significant drop in log exports predicted

LOG EXPORTS, WILL PEAK AND THEN DROP

by more than a third within a decade, says investment house Forsyth Barr in its latest industry report.

“Export volumes will peak by 2026 then decline as insufficient planting activity after the 1990s boom means total harvest volumes will fall,” says report author and head of research, Andy Bowley. “The use of wood domestically is undergoing a transformation through the use of trees to sequester carbon, power boilers and as a low carbon building material alternative.”

The medium-term outlook is driven by small forestry owners, who will influence export log volumes depending on demand and supply chain constraints, he explains.

Industry dynamics are changing along with the government’s plan to shift the industry towards more domestic processing and higher value processed products. A further shift to net-zero emissions will further impact the industry as moves to biofuels and carbon sequestering may spur more planting and higher prices, but not for the export trade as it currently operates, says Mr Bowley.

“Over the medium term this could be detrimental to export volumes but over the longer term could be very beneficial,” he adds.

Forest Owners Association Chief Executive, Phil Taylor, agrees that small forest owners will remain influential in the near term but that could change depending on market conditions.

“Back in the 1990s, it was the small forest owners who largely developed or established new forests on the back of very strong markets at that time, so they currently represent quite a significant component of the harvest volumes coming out of New Zealand.

“Typically, the small forest owners have one opportunity in say, 28- to 30 years, to optimise the return on their investment so they are very sensitive to what’s happening out in the market, and they have the ability to either harvest or stop harvesting at very short notice.”

He adds that large owners can weather out market downturns but bigger challenges to the sector loom on the horizon with ambitions to encourage more local processing. “We may actually see a high proportion of the logs that are currently exported processed domestically, and then exported as a higher value product.” NZL

Sawn timber key for construction

NEW ZEALAND FACES CHALLENGES IN

meeting demands for key construction materials for infrastructure, with a risk of delays to major projects, says The New Zealand Infrastructure Commission, Te Waihanga,

These findings are among those detailed in Te Waihanga’s Infrastructure Resources Study, which looks at four key materials: timber, aggregates such as gravel and stone, cement/concrete, and steel.

Te Waihanga Chief Executive, Ross Copland, says New Zealand is blessed with an abundance of natural resources but over time various constraints have emerged which are limiting the supply of these resources, creating cost pressures, environmental challenges, and access issues for important infrastructure projects.

“New Zealand has a wealth of physical resources at its fingertips, but this study highlights the need to better manage them to ensure they are available for our critical infrastructure projects. Without ready access when they’re needed, we risk creating an unnecessary handbrake for the construction sector.”

Mr Copland says sustainably produced timber is a material with attributes that mean it will be in high demand for years to come.

“Recent advances in engineering and the need to reduce carbon emissions is leading to a wider range of uses for timber including in multi-storey construction, but there are obvious land-use implications to large-scale production forestry which need to be balanced as well,” he says.

“This study finds that work needs to be done to both improve the domestic supply of sawn timber and look at the opportunities and risks of importing it. Research is also needed on how to best value the carbon benefits of timber as a construction material.

“Based on this study, Te Waihanga has included recommendations for ensuring a secure supply of these materials in our recently released draft New Zealand Infrastructure Strategy, which we are currently working to finalise,” Mr Copland says. NZL

Forestry crews feel the pinch

Story: Murray Robertson

A DRAMATIC DROP IN GLOBAL LOG PRICES HAS IMPACTED ON

operations in the East Coast region and some forestry crews face a lean Christmas until prices lift again and full production hopefully resumes.

Eastland Wood Council (EWC) Chief Executive Philip Hope says global economic factors could have major repercussions for the forestry industry while a prominent contractor says the industry is facing “a very bleak year-end”.

“Right now the forestry industry is dealing with the impacts of a log export crisis that has seen prices plummet,” says Mr Hope.

“The cost of shipping wood to China has almost trebled since January – the result of COVID, increased fuel prices and so on.

“The slowdown in the China economy extends to the construction industry. “As we speak, 10% of the global shipping fleet is sitting in the water off China waiting to discharge and incurring demurrage costs daily,” adds Mr Hope. (Demurrage is a charge payable to the owner of a chartered ship on failure to load or discharge the ship within the time agreed.)

“Many ports have been shut down due to COVID and the holiday season has added further to delays. These factors have resulted in significant increases to inventory costs and a drop in demand for wood.”

Mr Hope says pundits expect the market to recover in the first quarter of 2022. “However, this is little comfort to the forestry industry, which includes everyone in the supply chain. Everyone is facing a very tough time.”

The EWC has been in regular contact with member forestry companies and reached out to many contractors and industry stakeholders across Tairāwhiti to help them understand the challenges they face so the EWC can help with solutions.

“While member forestry companies are doing all they can to retain contractors, at the present time it is uneconomic to harvest, especially the smaller woodlots.

“We are aware some contractors have received notice to finish harvesting operations, others have been placed on reduced harvest volumes and others have been given notice of an extended break over Christmas.”

In one example, a forestry contracting company with six crews in Tairāwhiti faces a long shutdown.

“Two crews will stop on December 3, two others have been given notice to stop on December 3, but potentially could go until December 17, and two crews remain, but on 80% of their usual production — a month’s shutdown for them from December 17 until January 17.”

The business manager for one of the region’s biggest forestry contractors told Mr Hope they were facing port storage issues even before the price drop.

“We were still facing issues at Eastland Port with a lack of storage again,” the manager says. “You’ll find lot of crews have huge amounts of stock sitting on skids, and this is money sitting there that the contractor needs.

“After the August lockdown the port cleared the storage and we had a clear run for a few weeks. Then the log grade restrictions started again and lack of shipping hasn’t helped either.

“Now, combined with the price drop, we are facing a very bleak yearend. We are worried for our staff.”

Mr Hope says EWC members, forestry contractors and industry stakeholders have faced many challenges, especially over the past six months.

“The resilience of the forestry industry in Tairawhiti relies on the supply chain continuing to move.”

The contracting manager says they are trying everything possible to keep every single person employed and to ride out this slump.

“But we need help from Eastland Wood Council, local and national government and industry leaders to help ease financial pressure. Ultimately, forestry contractors don’t want to lose staff so if we could have financial help to pay wages while on standdown for instance, then that would be a huge help.”

Mr Hope says the current pressure points for many in the industry include freeing up cashflow to be able to continue paying wages, meeting creditor payments and retaining those key relationships; having to explain to bankers and finance companies the situation; seeking support with fill-gap measures; and the uncertainty the workforce of more than 1000 face to provide for their whānau.

“The safety and wellbeing of our workforce and their families is our priority. For this reason, EWC has made an approach to MP Kiri Allan and Tairāwhiti’s regional leaders to inform them of this crisis and the need for a support package.”

He says a rough estimate of the number of contractors being impacted on to varying degrees could be around 70 across Tairāwhiti.

“Those contractors employ a large number of workers and have machinery, too, whether it be haulers, diggers, trucks and so on. If we can get a support package for our industry, it would certainly help prevent people from going to the wall,” he says.

“Collaboration across the supply chain, together with regional leadership, will help us rebuild resilience and enable the industry collective to respond.”

Forestry Industry Contractors Association Chief Executive, Prue Younger says the trends of export log prices have always been cyclical “but this next hump is one out of the norm”.

“We have never been here before where the China market, sea freight and international pressures of COVID are coming to roost.”

First published in The Gisborne Herald. NZL

Export Barometer: Kiwi businesses adapting

TIMES MAY BE TOUGH BUT THE 2021

ExportNZ DHL Export Barometer has found that as New Zealand continues to move through the pandemic, Kiwi exporters remain confident and optimistic. However, the impact of COVID-19 has changed the course of the industry’s future and created an unsettling year.

Catherine Beard, Executive Director of ExportNZ, says, “Kiwi exporters are working hard to maintain their indispensable relationship to the global exporting industry. Businesses are increasingly concerned that while the rest of the world is getting back to business, New Zealand exporters risk losing business to competitors and/ or gaining a reputation of being unreliable, expensive and potentially slow to deliver. While it is positive to see ingenuity from Kiwi exporters and the increasing value of greater investment in Research & Development – it may still take time for these changes to pay off.”

According to the 319 New Zealand exporters surveyed, COVID-19 has brought new barriers to the forefront. 78% of Kiwi exporters cite the increased costs and unpredictable transport options as the number one barrier to exporting. This is followed by 51% who stressed the inability to travel due to border/MIQ restrictions.

With the congestion at Ports, lack of space on underbellies due to the reduced passenger flights by commercial airlines and a border system that has been dubbed “broken”, the ability for New Zealand businesses to operate is heavily impacted.

Furthermore, concerns were raised around the increasingly high cost of doing business in New Zealand and the cost of labour, which are both reflected by the increased minimum wage, the low unemployment rate and the lack of ability to get talents domestically and into New Zealand due to an immigration reset.

The effects that the global freight congestion is having on Kiwi businesses is staggering. 88% of Kiwi exporters experienced an increase in logistics costs, 86% experienced delayed transport times and 57% are unable to even get shipping space, prompting the need for the government to monitor the situation closely.

Furthermore, 44% of Kiwi exporters want to see government assistance in a border system that prioritises exporters for vaccinations and safe travel, with no MIQ being necessary. Kiwi exporters have stressed that the closed borders are heavily impacting their business; forcing them to make staff cuts, shut down or relocate offshore until the border closure rules offer a solution.

Nonetheless, as experienced exporters looked beyond previous assumptions that supported years of stable, predictable growth, they instead searched for opportunities and developed new products and services to increase export sales. Because of this, just over half of Kiwi exporters (51%) saw an increase in their sales and 62% have indicated the potential for a strong year ahead in 2022. 66% of Kiwi exporters have had to change the way they work due to COVID-19. The pandemic has fundamentally shifted the way Kiwi businesses work, with many forced to plan for the long term until they see some stability. With the lack of trust in supply chains among Kiwi exporters, they now hold surplus stock onsite, and have increased product costs or re-looked at their export markets due to the increased logistic costs.

Selina Deadman, Vice President, Commercial, DHL Express New Zealand, says, “While this year’s ExportNZ DHL Export Barometer results highlighted another tough year for our Kiwi exporters, it is pleasing to see that 51% experienced an increase in their international export orders; a statistic that is reflected in the strong export shipment growth that we have seen through our network. The pandemic has once again put the spotlight on Kiwi exporters investing in innovation, new product development and sustainable initiatives to reach international audiences.”

This year’s ExportNZ DHL Export Barometer results highlight that there have been some substantial changes in the way that New Zealand businesses work, with NZ exporters thinking hard about their supply chain reliability and the markets they operate in. One of the biggest challenges Kiwi exporters will be facing from now and into the future is how they manage the supply chain disruption and how they transform their traditional supply chain models, she says.

Throughout 2021, we have seen a greater reliance on the digital world to keep businesses running and New Zealand has adapted. 44% of Kiwi exporters implemented online initiatives such as zoom calls, delivering online sales and automation, but the majority of our manufacturing exporters are still reluctant to invest in online channels to generate sales. Ms Deadman adds, “We expect the boom in e-commerce to continue to grow and adapt with the market, as more and more of our customers tap into online sales and benefits for their business”. *The results of the 2021 ExportNZ DHL Export Barometer were compiled before the current Delta outbreak in New Zealand. NZL

Mobile harbour cranes for Eastland Port

TWO MOBILE HARBOUR CRANES WILL PROVIDE FOR SAFER AND

more efficient handling of cargo at Mount Maunganui-headquartered port logistics company, ISO’s operation at Eastland Port.

CEO of ISO, Paul Cameron, says, ”The new technology will remove our people from high-risk areas on the wharf and enable cargo to flow more efficiently through the increasingly pressured supply chain. With the implementation of the cranes we are upskilling and training staff we move out of high-risk areas into other machinery-based roles within the business.”

ISO commissioned the German-manufactured Liebherr mobile harbour cranes to suit its operating environment, with advanced technology and safety specifications designed by its technology team.

Eastland Port is the second port to benefit from introducing ISO’s mobile harbour cranes, following the introduction of four cranes in Mount Maunganui in August 2020.

Andrew Davies, COO of ISO says, “We’ve seen significant improvements in safety and productivity in Mount Maunganui with the introduction of mobile harbour cranes, including a 75% reduction in incidents. The cranes provide a safer, more efficient and reliable method of loading logs directly from trailers into the vessels’ holds with mobile cranes instead of ships’ cranes. We expect to see similar results in Te Tairāwhiti. The mobile cranes allow us to handle all types of cargo for a wider range of vessels, which increases handling cycles, lift capacity and vessel turnarounds – which means a better result for our customers, our business, and the port.”

Eastland Port Infrastructure Manager, Marty Bayley adds, “We have the largest infrastructure developments in a century happening at Eastland Port over the next few years — including stage one of the Twin Berth project beginning in a few months. ISO is the sole stevedore operator at the port, and their new mobile cranes will help keep exports moving as volumes grow in Te Tairāwhiti. It’s fantastic to see ISO’s commitment to investing in world-leading technology to help improve safety and cargo flow throughout the entire forestry supply chain, providing an improved service for our customers.”

ISO will ship one of its Mount Maunganui-based mobile cranes to Te Tairāwhiti, so three cranes are available at each port. A world-first in terms of size and capacity, each fully mobile crane weighs 465 tonnes, has a 51-metre maximum lifting height, a 54-metre maximum outreach, and can lift a maximum load of 124 tonnes.

ISO, which handles more than half of New Zealand’s log exports, is applying robotics, automation and IT across its operations nationwide to minimise exposure to hazards and move its people into more skilled roles.

Over the past three years, 13 Robotic Scaling Machines (RSM’s) for scaling logs have been installed across ISO’s North and South Island operations to automate the accurate volumetric measurement (scaling) of export logs on trucks and trailers. The world-first robotic technology was developed by Tauranga-based Robotics Plus in collaboration with ISO.

Earlier this year, ISO started the rollout of its Automatic Tally Stations, developed by its technology team, to replace manual scanning of tickets on packets of logs at the wharf following scaling through the RSM offsite. When the truck drives through the new stations, tickets attached to the logs are scanned automatically while drivers safely stay in the truck. In addition, mobile harbour cranes allow logs to be loaded directly from trucks onto vessels. NZL

Port results buoyed by record log exports

New Zealand’s ports have reported varied results for their financial year ends with performance impacted by the global supply chain and shipping challenges. Strong log exports helped to buoy results, with more positive than negative indications.

CentrePort

CentrePort has recorded a positive financial result despite ongoing COVID-19 related impacts with the 1.8m JAS of logs exported being the highest in CentrePort’s history and a 21% increase on the previous year. The 194,000 JAS exported in June was the largest volume for a single month.

CentrePort recorded an underlying net profit after tax (NPAT) of $7.2m (this is before Kaikoura earthquake-related items, Changes in Fair Value, Abnormal Items and the tax impact of these items) compared to $14.7 million in FY20.

Operating revenue of $80.2m compared with $84.9 million the previous year reflected the absence of cruises due to the ongoing COVIDrelated ban on international cruise ship visits. These visits are not anticipated to resume in the coming year.

Effective cost-management saw significant reductions in operating expenses. CentrePort received the final earthquake related insurance settlement in FY20, however quake-related costs continued during the year such as roadbridging until March, and machine hire and generator costs.

Dividends of $5m were paid to the shareholders – Greater Wellington Regional Council and Horizons Regional Council - (FY20 $5m) as well as a special dividend of $15m.

CEO, Derek Nind says all trade volumes were up, with log exports particularly strong. Vehicles were another area of strong growth, up 21% on FY20, with more than 24,000 units processed through the port.

Mr Nind says despite the global logistics supply chain disruptions CentrePort maintained container volume levels.

Good progress was made on the $38.6 million Thorndon Container Wharf reinstatement project, which will increase the operational length of the gantry cranes from 126 metres to 261 metres. The project is due for completion in early 2022.

Ground-resilience improvements throughout the port continued while damaged and redundant structures were removed, creating thousands of square metres of additional operational space.

Mr Nind says implementation of the port’s carbon emissions reduction strategy finalised in August 2020 is well underway.

“We are focused on meeting our targets of reducing emissions by 30% by 2030 and the port being a net zero emitter by 2040,” he says.

Napier port

Napier Port’s revenue for the year to 30 September 2021 rose 9% to a record $109.5 million from $100.4 million in the same period a year ago, driven by increases in bulk cargo volumes and record log exports in particular.

Napier Port, which operates the leading freight gateway for the central and lower North Island, achieved the record despite the challenges from global container shipping disruptions and the absence of cruise ship visits to the region.

The Port has invested to improve services to customers including work to deploy an on-port log debarker, which will allow the company to cease on-port log fumigation.

“Our base-case volume forecast for log exports in FY2022 is in-line with FY2021. We have been a beneficiary of buoyant log export markets for the past year, but we are not complacent about the potential for a cooling in these favourable conditions to impact volumes through Napier Port,” says Chief Executive, Todd Dawson.

Bulk cargo revenue rose 32.7% to $41.5 million from $31.3 million principally due to higher log volumes, which increased 27.6% to a record 3.02 million tonnes. Average revenue per tonne improved due to tariff increases, one-off cost recoveries, and an improved cargo mix.

Container services revenue increased by 4.8% to $65.3 million from $62.3 million, thanks to a 2.9% increase in container volumes to 276k TEU and improved average revenue per TEU.

Napier Port’s result from operating activities rose 6.4% to $43.8 million from $41.2 million, with the unwinding of the protective cost saving measures introduced at the start of the pandemic in 2020 and ongoing investment in capability to drive growth, together with costs associated with increased activity, partially offsetting the impact of revenue growth.

Underlying net profit after tax, after adjusting for non-recurring reported net gains, increased by 7% to $22.0 million from $20.5 million, while reported net profit after tax increased 5.2% from $22.0 million to $23.2 million.

Chair Alasdair MacLeod says: “In the face of a global pandemic, lockdowns, global shipping congestion, disrupted shipping schedules and supply chains, we have kept the cargo flowing and have moved record volumes, the majority of which was the food and fibre exports that underpin the prosperity of our region. Meanwhile, we have continued to invest in infrastructure to support our region and our customers for the long term. “Our new 350m-long 6 Wharf is the centrepiece of this investment. We expect it to be operational next year.

Port Nelson

The 2021 financial year saw Port Nelson’s performance impacted by the global supply chain and shipping challenges. The Port had previously set its lowest profit budget in five years for 2021, due to concerns over how trade would respond in a COVID environment. This budget was exceeded despite lower cargo volumes due to strong cost control and increases in property valuations.

Port Nelson reported a Net Profit After Tax (NPAT), excluding one-off property revaluations, of $9.1m, up $1.7m (23%) on budget, and up 12% on the previous year. Strong commercial property revaluations contributed to an equity increase of $3.9m, impacting positively on the year’s profitability. The final NPAT was $13.0m. The Port declared a fullyear dividend of $4.0 million.

The Port’s cargo volumes for 2020/21 were 3.25 million tonnes, down 3% on budget, and 1% on the previous year. This result masks some key variances in major cargo groups. Log exports were up 8% on budget, reflecting strong demand and prices in China. Container throughput was 102,995 TwentyFoot Equivalent Units (TEU), down 13% on budget and 11% on last year.

As a consequence of lower cargo and container volumes, non-property-related revenue was well down on budget.

Chief Executive, Hugh Morrison, says the Port focused on several cost-saving and cost deferment initiatives to mitigate the lower revenue: “The most significant was a deferral in wharf maintenance costs and a slowdown in capital investments. These costs will now be spread over future years. Savings were also made through a review of administration costs. A number of one-off savings also worked in our favour, in particular foreign exchange transactions”.

The lack of containers, difficulty in finding and retaining vessel booking slots, omitted or delayed vessel calls, and significant cost increases have been ongoing obstacles for all parties to overcome. These challenges come on top of the impact of the Boxing Day hailstorm and other climatic events.

During the year, the Port finalised its greenhouse gas emissions reduction targets. These targets have been set at levels that allow the Port to play its part to meet New Zealand’s Paris Agreement obligations.

Funding has been approved for the development of a modernised marine maintenance facility for vessels up to 400 tonnes. The Main Wharf North upgrade was completed in July 2021. The Port also purchased a new Liebherr Crane, an investment of nearly $9 million, and the Port’s first Reach Stacker. The new equipment provides safer, more efficient and environmentally-friendly container operations. NZL

Name change for Hancock Forest Management NZ

Southern Kinleith Forest.

HANCOCK FOREST MANAGEMENT NZ HAS CHANGED ITS NAME TO

Manulife Investment Management Forest Management NZ (MFM NZ), or Manulife.

The change represents a visual transition to align with the parent company, Manulife Investment Management (MFM).

There are no changes to how the business will operate in New Zealand with the wider business strategy and investment decision-making processes remaining the same. The change also has no impact on jobs within the company.

Managing Director Australasian Timberland Operations, Robert Green, says the rebranding signals an ongoing commitment to the company’s future in New Zealand: “It is an important moment for us. We’re confident that clients will benefit from the strength and resources of Manulife Investment Management while continuing to tap into our deep, strategic timber and agriculture expertise.”

The change has been taking place behind the scenes for 24- to 36- months, with consideration to how this could be rolled out across the global business. “By aligning our capabilities, MFM NZ provides the company with a base to keep building upon moving forward,” says Mr Green.

The global business is headed by Christoph Schumacher, who recently joined Manulife Investment Management as Global Head of Real Assets, Private Markets. The role unites the firm’s real asset capabilities across real estate, infrastructure, timberland, and agriculture, all of which have been key drivers of diversification, offering sustainable and nature-based solutions and have a long history of helping to generate differentiated returns for clients, Mr Green adds.

In New Zealand, Robert Green will remain in his role as Managing Director Australasian Timberland Operations, in addition to General Manager Kerry Ellem and the existing team. NZL

ArborGen sells to Hugh Fletcher

TREE SEEDLING COMPANY ARBORGEN HAS SOLD ITS NEW ZEALAND

and Australian assets to a consortium led by Hugh Fletcher for $22.25 million.

ArborGen is one of the last remnants of the former Fletcher Forests, and has a range of nurseries producing seedlings for the timber and agriculture industries. The company disclosed in June that it was undertaking a strategic review on its future options after receiving a bid.

The company produces some 30 million tree stocks a year in New Zealand and 5.5 million in Australia and would require “significant” additional capital to expand capacity, said ArborGen Chairman David Knott in a statement: “The board believes the money would be better spent in its higher growth markets in the United States and Brazil. It will also use the funds to explore new growth opportunities and repay debt.”

The purchasers are a consortium of New Zealand investors including charitable trusts and private families, led by Hugh Fletcher who was a director of ArborGen predecessor Rubicon until September 2019. An independent assessment of the deal by corporate advisory firm Grant Samuel found the offer was “fair”.

ArborGen, which is now based in South Carolina in the US, owns one of the world’s largest and most diverse genetic libraries for commercial tree germplasm, and is one of the world’s largest providers of advanced genetic seedlings.

In New Zealand and Australia, where it has seven nurseries and two orchards, its key seedling species are radiata pine, eucalyptus and other native horticultural species. The operations generated US$9.9m (NZ$14m) of revenue last year, making up 19% of the group’s US$52.7m revenue. NZL

Forest sales for Ernslaw One

ERNSLAW ONE HAS COMPLETED AN AGREEMENT TO SELL THE

Whangapoua and Ruatoria forests with a combined area of 15,100 productive hectares to Summit Forests New Zealand.

Yong Tiong, Executive Director of the Oregon Group, the parent company of Ernslaw One, says this is a significant step forward in executing Ernslaw One’s strategy in New Zealand.

“This reflects a continued focus on positioning our estate to meet our strategic goals of creating high value downstream products,” says Mr Tiong.

Part of the proceeds from this transaction will facilitate further investments in the Group’s timber and pulp processing facilities located in the North Island.

Takashi Sasaoka, Managing Director of Summit Forests New Zealand, says this is an important day for Summit Forests as it continues to establish a long-term business in New Zealand.

“This acquisition of highly productive forests will complement the other assets acquired over the last decade in New Zealand. We look forward to continuing to manage these forests in line with Summit’s commitment to best practice and the highest environmental standards,” says Mr Sasaoka.

Ernslaw One’s advisor Cranleigh Partners’ Managing Partner Stephen Cozens says the sale and purchase are in-line with both companies’ strategy: “This largely reflects the ongoing international interest to acquire high quality, sustainable Pinus radiata New Zealand Forest estates, given both the current and forecast international fibre supply concerns being faced.” NZL

EXCLUSIVE EXCLUSIVE NEW ZEALAND NEW ZEALAND DISTRIBUTOR OF DISTRIBUTOR GB FORESTRY PRODUCTS GB FORESTRY PRODUCTS

EXCLUSIVE NEW ZEALAND DISTRIBUTOR OF EXCLUSIVE NEW ZEALAND GB FORESTRY PRODUCTS DISTRIBUTOR OF GB FORESTRY PRODUCTS

EXCLUSIVE NEW ZEALAND DISTRIBUTOR OF EXCLUSIVE NEW ZEALAND GB FORESTRY EQUIPMENT DISTRIBUTOR OF GB FORESTRY EQUIPMENT

PITCHGAUGE

EXCLUSIVE NEW ZEALAND " " DISTRIBUTOR GB FORESTRY PRODUCTSPITCHGAUGE " "3/4

PITCHGAUGE

EXCLUSIVE

PITCHGAUGE " "3/4 NEW ZEALAND DISTRIBUTOR OF

EXCLUSIVE GB FORESTRY NEW ZEALAND DISTRIBUTOR OF PRODUCTS

GB FORESTRY

PRODUCTS EXCLUSIVE EXCLUSIVE NEW ZEALAND NEW ZEALAND DISTRIBUTOR OF GB FORESTRY DISTRIBUTOR OF GB FORESTRY PRODUCTS PRODUCTS

How ‘good’ is

your ‘good’? Story: Fiona Ewing, FISC National Safety Director

RECENTLY I CAME ACROSS A FOREST MANAGER THAT HAS ADOPTED

a great way of collaborating with their harvesting contractors. They’ve come up with an ‘integrated’ model – which means that in addition to using their machinery to mechanically harvest, their contractors also harvest the road-line corridors, they build the roads, and they clear-fell the ground-base and the hauler terrain.

For the contractors, the benefit of this approach is that they can maximise use of their expensive machinery, making it easier for them to cover the costs of mechanisation. For the forest manager, having better equipped contractors is delivering productivity gains and cost reductions. For workers, it’s delivering a safer work environment and more job security.

This is a great example of a forest manager creating what I call ‘good work’. The term ‘good work’ sums up three key concepts that in health and safety ‘geek-speak’ are known as: ‘safety in design’, ‘higher order controls’ and ‘upstream duties’.

Traditionally in forestry much of the responsibility for creating safe, healthy worksites has been shouldered by the crews contracted in to do the planting, tree maintenance and harvesting. However, decisions made by forest owners and managers also have an enormous impact on contractors’ ability to work in a safe, healthy way. This includes decisions about where trees are planted, and how they will be maintained and harvested. Forest owners and managers have an opportunity to build in health and safety when they make these decisions. This process is known as ‘safety in design’.

‘Safety in design’ is the idea that work should be designed in a way that is safe – rather than safety being a ‘clip-on’ added later. A good example of ‘safety in design’ is not planting trees on slopes that are too steep to harvest mechanically. Another example is the one above – a forest manager designing the harvest so contractors can maximise use of their machinery, making it easier for them to invest in mechanisation.

Mechanisation itself is an excellent example of using ‘higher order controls’ – which are the most effective means of protecting workers from risks. Mechanisation removes workers from doing the two most dangerous tasks in forestry – manual tree falling and manual breaking-out. It is far more effective in protecting people than ‘lower order controls’ like hard hats and paperwork.

While mechanisation brings its own challenges – for example, sitting in a cab all day can have a negative impact on worker health – to date no worker has died in New Zealand while felling or breakingout trees mechanically. The anecdote above is also a great example of a forest manager using their commercial influence to support contractors to adopt the ‘higher order control’.

So why should forest owners and managers care about ‘safety in design’ and ‘higher order controls’? Well, in addition to the obvious argument about the need to stop fatalities (33 forestry workers have died on the job in New Zealand since 2015) these concepts also help forest owners and managers meet their ‘upstream duties’.

‘Upstream duties’ refers to the legal responsibilities forest owners and managers have for the health and safety of their contractors and contractors’ workers. The revamped 2015 Health and Safety at Work Act emphasised the importance of these upstream duties, and recently WorkSafe put them to use when it prosecuted a forest manager, along with the contractor, over a worker’s death. One of the best ways forest owners and managers can fulfil these duties is by using ‘safety in design’ principles and ‘higher order controls’ that will prevent fatalities and serious injuries occurring.

Encouragingly, there are already good examples of forest owners and managers recognising their role in creating ‘good work’ – like the one described. Their challenge now is to make sure their ‘good’ continues to improve and that they challenge themselves about what they could do better. This challenge is relevant to all forestry companies because serious harm and fatalities occur right across the industry, irrespective of the size of the forest.

This approach to health and safety – that it’s about designing ‘good work’, not just compliance and assurance – is one that needs to grow in forestry. That is why Safetree has made creating ‘good work’ one of three pillars in its new strategy – along with promoting an improved certification scheme and encouraging greater worker involvement in health and safety.

Safetree will be encouraging and supporting forest owners and managers to use ‘safety in design’ and ‘higher order controls’ to help create ‘good work’. We’ll also be sharing stories of how people have done this and the commercial and wellbeing benefits that have resulted.

How ‘good’ is your ‘good’? Tell us about it so we can share it with the sector.

Fiona Ewing runs Safetree, operated by the Forest Industry Safety Council. The Council’s members include representatives from the industry, workers, the Council of Trade Unions, WorkSafe, ACC and Māori. NZL FISC National Safety Director,Fiona Ewing.

Engineered for Extreme.

The smart choice for Skidders. Nokian Tyres, rugged but very clever!

Call AB Equipment today. Proud to now supply Nokian Tyres nationwide.

Contact your local AB Equipment branch on 0800 30 30 90 abequipment.co.nz

Home-grown meth detection

THE FORESTRY INDUSTRY HAS NOT ESCAPED THE IMPACT OF

drugs in the workplace. Whether planting or harvesting, it is essential that workers are not impaired by drugs or alcohol, especially when operating heavy machinery or driving log trucks. Even strict policies on drug-taking and random testing can miss, especially with forest owners often employing contractors to do the work.

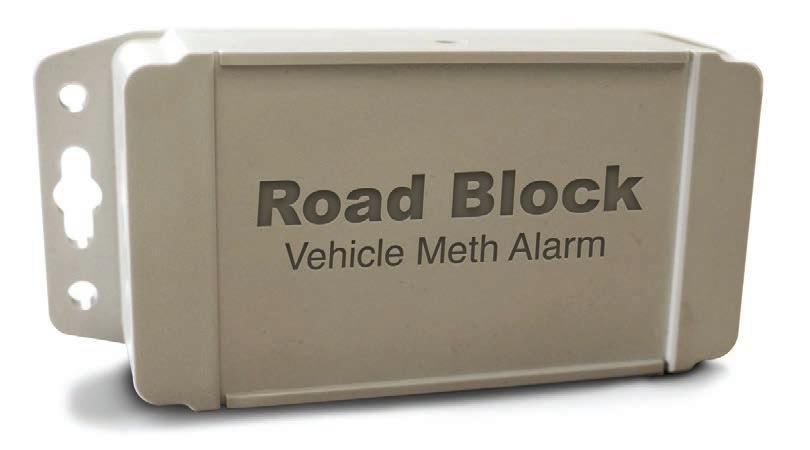

Now a New Zealand-developed methamphetamine detector and alarm system is being fitted in trucks.

Road Block can be installed in either concealed or visible locations – sending an instant alert to an operator’s mobile phone if traces of meth are detected in a vehicle… or even on the clothing, hair or shoes of its occupants.

The device, which is battery-powered and measures 150mm x 70mm (slightly smaller than A6-size paper), is an evolution of Te Awamutu-based P Alert Industries’ meth detection and alarm device installed by landlords and commercial property owners.

The company says it has found a demand in the trucking industry for the Road Block meth detector and alarm system – along with interest from forestry and earthmoving operators and companies with large fleets of cars.

P Alert co-owner Jamie Hansen, a Te Awamutu mechanical engineer who developed the system, says road transport customers are already discovering how sensitive the Road Block device is.

“The P Alert and Road Block are very sensitive, detecting down to one part per million. And it’s very accurate.

“We had one unit go off and the vehicle owner realised their truck was still in the yard. It wasn’t the driver but one of the mechanics who was smoking in the workshop. The unit in the truck was sensitive enough to pick it up,” says Mr Hansen.

“And there has been a case where the alarm went off at the same time each night. It turned out a driver who was starting his shift had been smoking earlier in the evening and the Road Block picked it up.”

He says that the methamphetamine alarm has deterrent and detection benefits as well as obvious road safety benefits: “It’s a massive safety issue. I think everyone on the road would be happy to know that the vehicle coming the other way, or right behind them, isn’t being driven by someone under the influence.”

The Road Block unit operates on a 4G network – using AA lithium batteries with a 12-month lifespan. It reports via a SIM card to a nominated mobile phone – usually the vehicle owner or fleet manager.

The device tests the air every 30 minutes and can detect both smoking and manufacture of methamphetamine. In addition to the silent real-time alerts sent immediately any trace of methamphetamine is detected, it will also send a weekly report to a nominated mobile phone.

Road Block is programmed to individual vehicles and registration plates, so it can’t be moved between vehicles. It also has a tamper alarm. Mr Hansen says it’s extremely rugged and can be used in harsh environments.

P Alert Industries, owned by Hansen and Te Awamutu accountant Allan Spice, began research and development work on the system 10 years ago and has been marketing it since 2017.

“The product was developed here in Te Awamutu and is manufactured in East Auckland to Telarc ISO9001 certification. We hold a worldwide patent and have been exporting to Australia and America,” Mr Hansen says.

The device has regulatory approvals in the US and Canada, but P Alert has only recently set up a network of distributors nationally.

Nevertheless, he says, the number of units already in use in New Zealand and Australia “is now in the thousands”.

“We were at Fieldays earlier this year and there was a lot of interest and feedback.”

He says campervan hire companies, taxi and Uber operators, along with the mining and excavation industries, were among those interested. NZL

Mobile hose service for Rotorua

TERRA CAT HAS INTRODUCED A MOBILE HOSE SOLUTION TO ROTORUA

and surrounding regions, with a focus on hose and coupling solutions for logging businesses.

Fully trained and experienced Mobile Hydraulic Hose Technician, Kim Harland, services the greater Rotorua region. Why Rotorua? With logging being a key driver of New Zealand industry in the region, what better location to service customers?

Caterpillar has designed and manufactured hydraulic hoses since the 1960s, refining and testing products, not just to meet the international standard but to exceed the standards. “These hoses suit any machine, no matter the make or model. Caterpillar’s safety mindset and quality support delivers value for your fleet, in turn driving better value for your bottom line,” says Product Manager for Hydraulics, Paul Verwey.

He adds: “As New Zealand’s dealer for the industry’s leading brand, we know the hoses and coupling on your machines best. We will always make sure the parts we use to build your hose assembly are what’s required for the application. There’s no guessing and no changing out fittings and adaptors to make the product fit.

“We have user-friendly technology that saves you time. Each hose assembly comes from the factory with a hose part no tag that has all the information we need to build the hose assembly the way the original manufacturer intended. If your hose is without its tag, we are good with that and we can build it too.

“Our new mobile capabilities mean we can build hoses to the Hydraulic Information System (HIS) specification or custom-make them. Our aim is to get you your hoses faster and make sure your machines are working reliably for longer, this means helping to minimise downtime.

“Caterpillar hose and couplings are made to an extremely high-quality standard compared with those on the general market. You’ll experience a lower failure rate when using Caterpillar hose and couplings, giving you more machine uptime,” he says. NZL

Kim Harland – Mobile Hydraulic Hose Sales and Hose Technician.