Weathering the Ups and Downs of the Real Estate Market

Not long ago, most of the homes that were for sale in Orange County attracted multiple offers and sold quickly, some for far more than the initial asking price. Interest rates were low, and the local housing market was hot. But times have changed. Higher interest rates have cooled the market. How can you protect the money you have? What can you do to make the money you have go further and last longer— perhaps even until rates drop and the market heats up again? And how can you increase your income while you are waiting for the housing market to turn around?

on pages 24–35

CONTENTS

Maximizing Your Money

On February 21, CNN Business reported that “U.S. home sales declined in January for the twelfth consecutive month as mortgage rates remained elevated and stubbornly high prices kept homebuyers out of the market.” That’s bad news for REALTORS®!

Being self-employed creates economic uncertainty. You must earn what you need for today, provide for tomorrow, and save for what you hope will be a comfortable retirement. None of this would be difficult if your income were steady and predictable. But it is not!

Sometimes, your listing sells quickly and for more than you expected. At other times, your listing lingers on the market, attracting little or no interest. And then there are times when there are no listings because few people want to sell.

Although many homeowners have reasons to move to a larger home, a smaller home, or a different neighborhood, they are “hunkering down,” as Steven Thomas observes, “choosing to stay put because their existing fixed-mortgage rate is substantially lower than the 6.27 percent January rate.”

If you can’t change the interest rate to one that is more favorable, what can you do? In this issue, we offer ideas about how to budget, control, invest, and save to maximize the money you have while times are tight and suggest a side hustle or two you might try to supplement your income and maximize your money.

PRESIDENT'S MESSAGE

8

Influence with Intent

Scott White, the 2023 President of OC REALTORS ®, defines leadership as “influence with intent” and encourages Association members to “be an influence with intent.”

COVER STORY: MAXIMIZE YOUR MONEY

24

Is Cryptocurrency Dead?

Josh Cadillac, who teaches real estate professionals how to Close for Life, asserts that, despite recent bad news, cryptocurrency may still mature into a sound investment.

28

App-solutely Take Control of Your Money

After acknowledging that budgeting is a chore, Michelle McCann reviews four apps that are designed to help you accomplish this task.

30

10 Ways Real Estate Pros Can Save When Money Is Tight

Melissa Dittmann Tracey, a contributing editor for REALTOR ® Magazine, offers ten timely tips about taxes, savings accounts, investing, banking on the future, and seeking professional guidance.

34

Sustain the Savings with Free Local Activities!

Sydney Smythe advises readers to forget fancy amusement parks and, instead, experience outdoor movies, classic car displays, local farmers markets, and the Orange County Museum of Art—all for free!

FEATURES

16

Spotlight: Orange County Register Lists Steven Thomas

Among OC’s 125 Most Influential Sherri Butterfield interviews the creator of the bimonthly Orange County Housing Report.

MARCH | APRIL 2023

16 28 20 30 24 34 MARCH | APRIL 2023 OC REALTOR® 4

20

Leadership Academy Alumni

Sabrina Blair asks two Academy graduates why they applied, what they gained, and what advice they would give to others who might be considering enrollment in the Academy.

36

The Orange County Housing Update: Winter Warmth

Steven Thomas says that housing typically heats up during the winter months as demand soars and market times fall.

40

Risk Management: New Laws with Gov Hutchinson

Sherri Butterfield summarizes a mid-January presentation in which Gov Hutchinson described some of the new laws and forms that will affect REALTORS® and the practice of real estate in 2023.

42

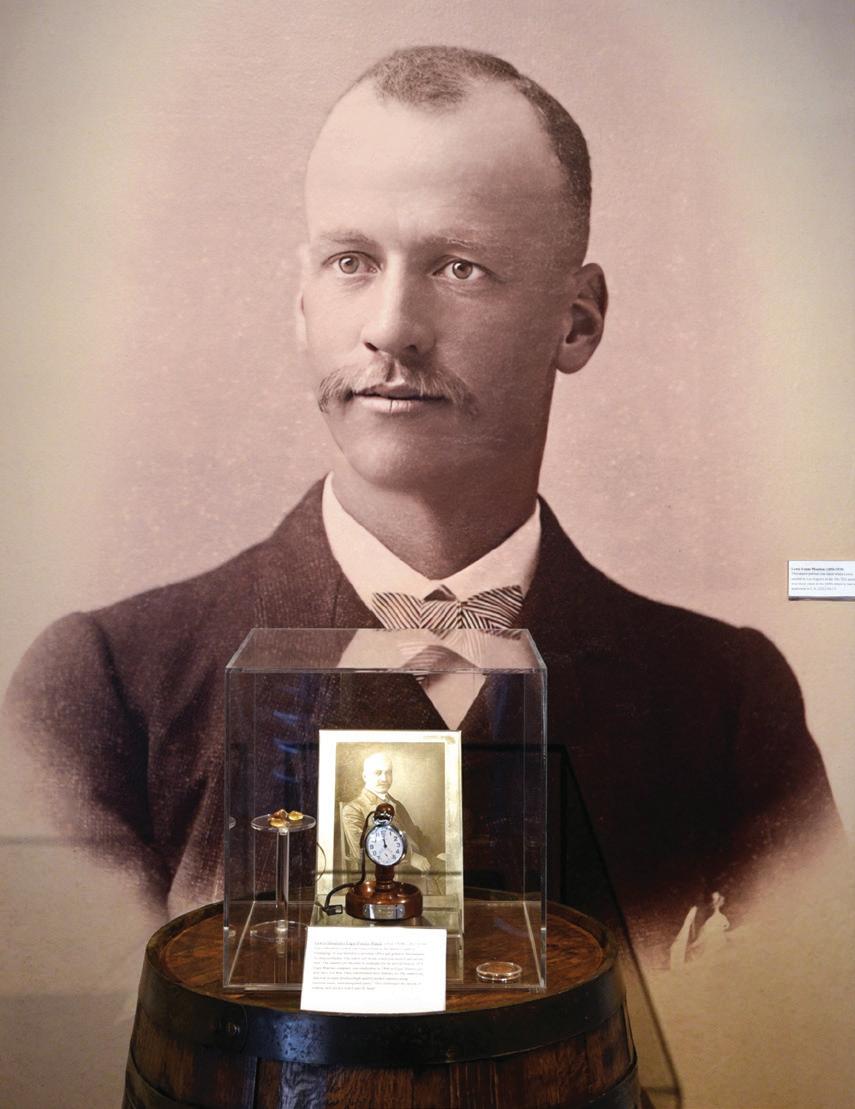

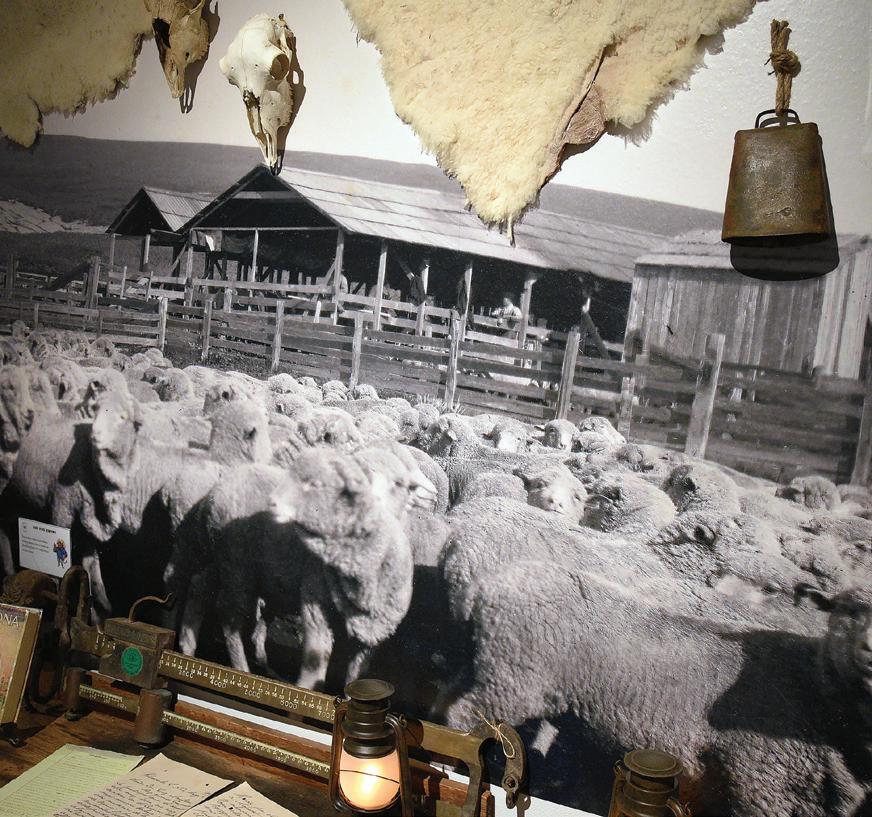

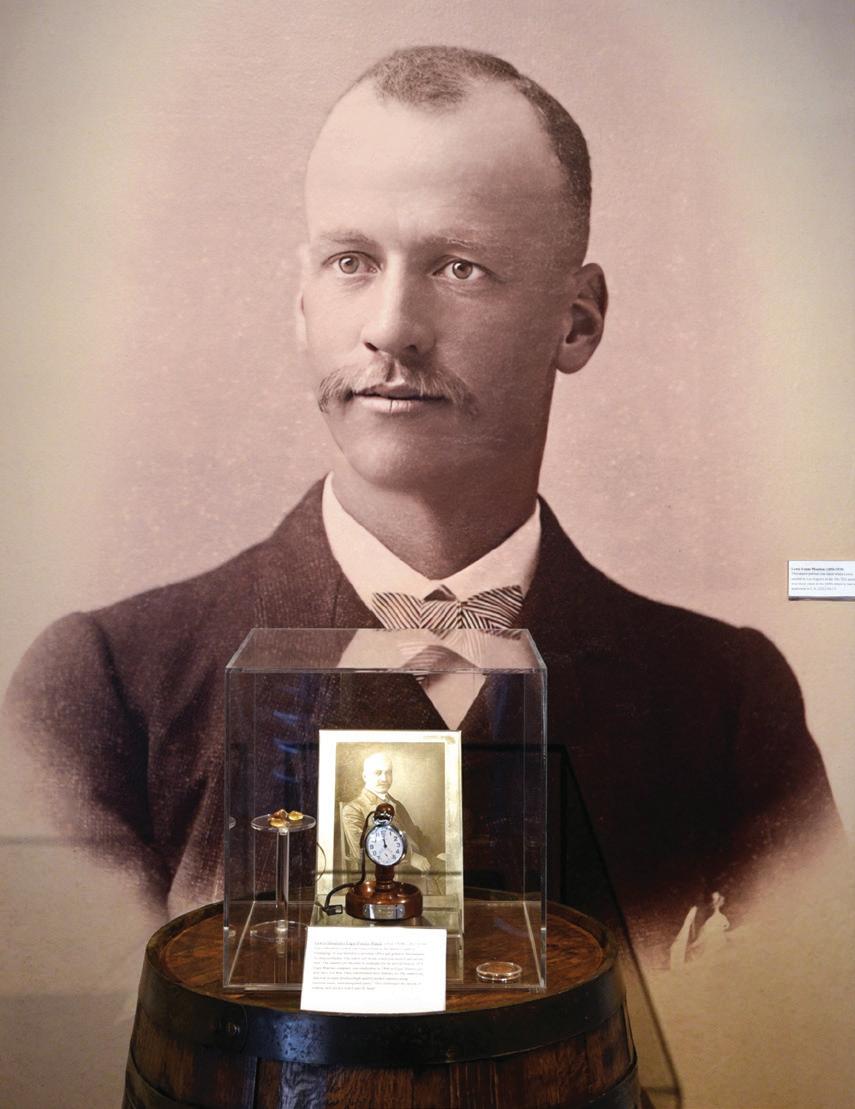

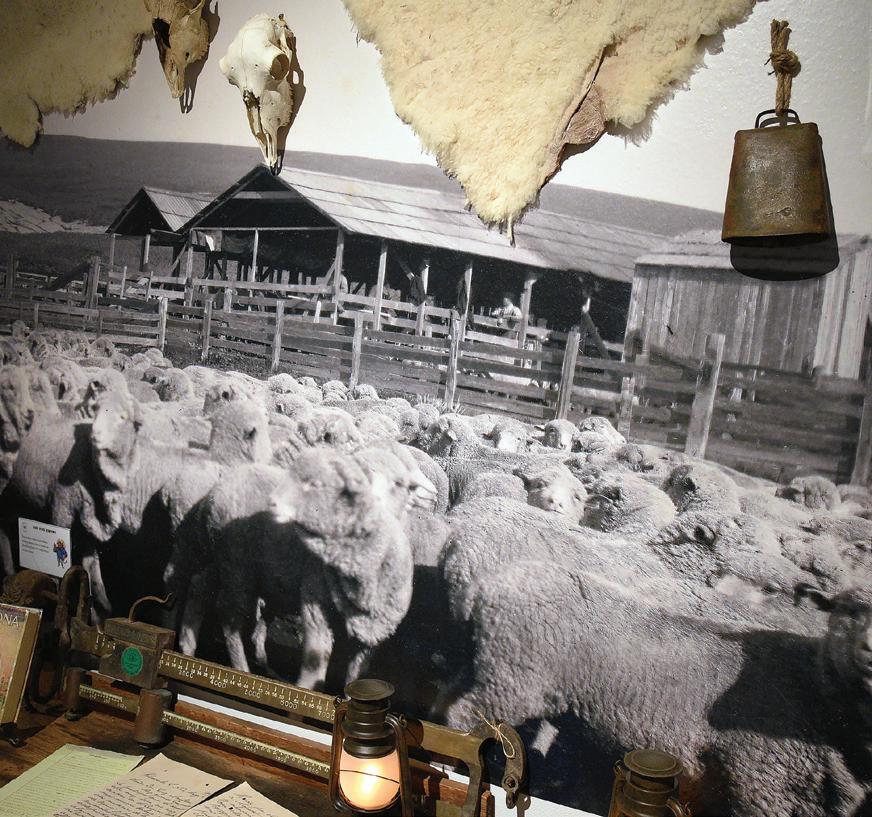

OC Destinations: The Moulton Museum

Sherri Butterfield describes a new museum in Laguna Niguel in which carefully curated objects and pictures nostalgically recreate the look and feel of an old California rancho.

ORANGE COUNTY REALTOR® MAGAZINE

25552 La Paz Road Laguna Hills, CA 92653 949-586-6800

10540 Talbert Avenue, Ste. 225 West Fountain Valley, CA 92708 714-375-9313

2023 OFFICERS

Scott White President

Jeff Jackson President-Elect

Charleen Nagata Newhouse Treasurer

Adam Rodell Immediate Past President

Dave Stefanides Chief Executive Officer

2023 BOARD OF DIRECTORS

Chandy Andre

Erin Barry

Kevin Budde

Danielle Corliss

Matt Cortez

Tony Faulkner

Michele Harrington

Len Herman

Kevin Kaltenbach

Paul LePage

Chip McAllister

DEPARTMENTS

10

Names in the News

22

Education Central: Upcoming Classes by Track

On the Cover: Maximize Your Money

In an original design, Print and Marketing Specialist Ivan Salmeron has artfully combined shades of green with images of currency stuffed in a jar and notes-to-self scrawled in chalk on a board to remind readers that now is the time to take control of your money in ways that will protect and maximize it.

To celebrate our 75th anniversary, we’ve hidden a small diamond icon somewhere in the current print issue. If you locate it and enter our Find the Diamond contest, you will be entered to win (2) two tickets to our 75th Anniversary Gala. To enter, visit www.ocrealtors.org/find-the-diamond

Online Magazine

Love OC REALTOR®? Did you know that you can read it online, anytime? Read past issues at www.ocrealtors.org/magazine

Mission Statement

The mission of Orange County REALTORS® is to promote the REALTOR® Code of Ethics; to provide education, services, and resources to our members; and to advocate the protection of real property rights.

Notice to All Members

Steve Mino

Ed Molina

Eileen Oldroyd

Pam Pedego

Vinil Ramchandran

Mary Rampone

Lacy Robertson

Lisa Schulz

Heidi Stoops

Lynne Suzanski

MAGAZINE STAFF

Sabrina Blair Director of Communications sabrina@ocrealtors.org

Sherri Butterfield Communications Specialist sherri@ocrealtors.org

Breanna Reed Accounting Administrator breanna@ocrealtors.org

Ivan Salmeron Print & Marketing Specialist ivan@ocrealtors.org

It is the long-established policy of this Association, California Association of REALTORS®, and the National Association of REALTORS® to adhere to both the letter and spirit of the federal and state antitrust laws. For their own protection, members should be aware of the antitrust laws as they affect their specific business activities. Any illegal activity under the state and federal antitrust laws is not in compliance with Association policy, nor is it in the interests of the Association or its members. Participation in Association activities must occur only in harmony with these very important laws. Federal law prohibits discrimination based on race, color, sex, religion, or national origin in connection with the sale or rental of residential real estate, in advertising the sale or rental of housing, in the financing of housing, and in the provision of real estate brokerage services. The OC REALTOR® editor reserves the right to review and edit all submissions. Orange County REALTORS® makes no warranties and assumes no responsibility for the accuracy of the information contained herein. The opinions expressed in articles are not necessarily the opinions of Orange County REALTORS®. Orange County REALTORS® does not necessarily endorse the companies, products, or services advertised in this magazine unless specifically stated.

OC REALTOR® (USPS 025-445, ISSN 1945-2179) Volume 14, Issue 2, is published by Orange County REALTORS®, 25552 La Paz Road, Laguna Hills, CA 92653. Periodicals postage paid at Laguna Beach, CA, and additional mailing offices. POSTMASTER: Send address changes to Orange County REALTORS®, 25552 La Paz Road, Laguna Hills, CA 92653-5127. Annual membership dues include $6.09 for a one-year (6 issues) subscription to OC REALTOR® magazine. OC REALTOR® cannot be responsible for unsolicited materials.

Publisher: Orange County REALTORS®

Printer: The Monaco Group

us on social media

Follow

MARCH | APRIL 2023 OC REALTOR® 6

THE RIGHT JUMBO LOAN. RIGHT AT YOUR DOORSTEP.

We know that finding the right home loan to meet your needs is a key part of your financial plan. That’s why Golden 1 Credit Union offers a variety of down payment options with our Jumbo loan.

Well-qualified buyers may borrow:

Enjoy features that could include:

• Fixed Rates

• Adjustable Rates

• Interest-Only Adjustable Rate option

VISIT

OUR HOME LOAN CENTER ON ALICIA PARKWAY IN LAGUNA HILLS!

Make an appointment with one of our Home Loan Advisors to go over your client’s options today.

Dru Bertagni NMLS# 1068471

P 949-922-4099

E dbertagni@golden1.com

Dan Hayes NMLS# 273503

P 949-378-5878

E dhayes@golden1.com

John Durkin NMLS# 380414

P 562-822-4624

E jdurkin@golden1.com

Leioni Clark NMLS# 887896

P 949-665-0002

E leclark@golden1.com

Insured by NCUA

Tom Fashing NMLS# 261832

P 949-291-5443

E tfashing@golden1.com

Mike Steele

NMLS# 1052927

P 949-510-3258

E msteele@golden1.com

Robert Rabano

NMLS# 887896

P 714-906-8824

E rrabano@golden1.com

NMLS

#669333 Equal Housing Opportunity

Loan Amount Down Payment Up to $1,500,000 As low as 10% Up to $2,000,000 As low as 15% Up to $3,000,000 As low as 20% Up to $4,000,000 As low

as 25%

Leadership is influence with intent. Whether it is in daily real estate activities, Association business, community volunteering, or fulfilling civic duties, be an influence with intent.

Photo by Marion Butterfield

By Scott White 2023 PRESIDENT, ORANGE COUNTY REALTORS®

Leadership in business refers to the ability of an individual or group to guide and manage an organization or team toward achieving specific goals and objectives. Normally, effective leadership can help to create a positive and productive work environment, inspire and motivate employees, and drive business success. Different leadership styles—such as autocratic, democratic, and laissez-faire—can be employed, depending on the situation and the specific needs of the business or organization. Most good leaders possess a variety of skills in the areas of communication, decision making, problem solving, and strategic thinking.

Leading our Association of REALTORS® can be a challenging task. It requires a combination of many of the previously listed leadership skills, a good deal of business acumen, and an encyclopedic knowledge of the industry. The role of the leader of the Association is to represent the interests of its members and to promote the profession of real estate.

In addition, Association leaders should have strong communication skills, be able to build relationships, and be able to work effectively with a board of directors and with committees. They should have a deep understanding of the real estate industry, including current trends, regulations, and best practices. They should be able to develop and implement strategic plans, set goals and objectives for the organization, and have a clear vision for the future of the Association and its members. They also should be able to advocate on behalf of the Association and its members at the local, state, and federal level.

PRESIDENT'S MESSAGE

MARCH | APRIL 2023 OC REALTOR® 8

The role of the leader of the Association is to represent the interests of its members and to promote the profession of real estate.

In addition, effective Association leadership includes providing professional development opportunities, educational resources, and networking opportunities to the members of the Association. Furthermore, effective leaders should be able to manage the Association's budget, communicate regularly with members, and work to increase member engagement and retention.

Being a leader of leaders refers to the ability to lead and manage a group of leaders, such as a diverse group of 15,000 independent businesspeople (both REALTORS® and Affiliates), all collaborating and competing with one another. A leader of leaders is responsible for setting direction, providing guidance and support, and creating an environment that empowers the team to lead effectively.

As with the other types of leadership described, to be a successful leader of leaders, one should have strong leadership skills, be able to communicate and delegate tasks, and have a strong understanding of the business and industry. Good leaders also should be able to manage and resolve conflicts within the membership and to inspire and motivate those around them to achieve their full potential.

It is also important for a leader of leaders to be able to coach and mentor team members and colleagues and to provide opportunities for mutual success. This helps to build a strong and capable membership and ensures that the organization has a pipeline of future leaders.

Being a leader of leaders entails having the dual ability to lead, manage, and develop other leaders and to manage a group of leaders toward achieving the goals and objectives of the organization. The most succinct definition of leadership I have heard lately is this: “Leadership is influence with intent.”

Whether it is in daily real estate activities, Association business, community volunteering, or fulfilling civic duties, be an influence with intent.

PRESIDENT'S MESSAGE

by www.istockphoto.com/Overearth

Illustrations

Effective Association leadership includes providing professional development opportunities, educational resources, and networking opportunities to the members of the Association.

OC REALTOR® MARCH | APRIL 2023 9

Being a leader of leaders entails having the dual ability to lead, manage, and develop other leaders and to manage a group of leaders toward achieving the goals and objectives of the organization.

IN THENAMES

On Valentine’s Day, Don Wagner, Chairman of the Orange County Board of Supervisors, presented his State of the County Address at a luncheon hosted by the Orange County Public Affairs Association (OCPAA) at the Pacific Club. “You don’t do this job without a great group of people around you,” said Supervisor Wagner. “What I hope to bring is readiness and willingness to help make Orange County better for all of us who live here.”

Supervisor Wagner listed as Third District Priorities (1) enhancing quality of life, (2) fighting crime, (3) economic recovery, (4) public safety, and (5) constituent outreach.

Regarding public safety, he said that Orange County is doing well. He pointed out that four of the ten safest cities in the state are in Orange County and that three of them are served by the Orange County Sheriff’s Department. He mentioned that safe exchanges have been set up at Sheriff’s Substations to provide places where one parent can deliver a child into the custody of the other parent or where persons who have made purchases online can safely exchange money and goods, thereby creating “one less opportunity for an interaction to go bad.”

As one of his accomplishments, Supervisor Wagner cited the reopening of Irvine Lake. He said that many people had come to him with stories about having enjoyed the lake with their parents when they were young and wanting to offer that same experience to their own children.

NAMES IN THE NEWS

Photos by Marion Butterfield

Supervisor Don Wagner Presents His 2023 State of the County Address

Pictured at the State of the County Address on February 14 are Matt Cortez, Supervisor Don Wagner, Congresswoman Young Kim, Paula Cosenza, Dirissy Doan, Laurie Johnson, Orange County REALTORS® President Scott White, Heidi Twitchell, Ed Molina, Anthony Cosenza, and Ron Pascual

Don Wagner, Chairman of the Orange County Board of Supervisors

MARCH | APRIL 2023 OC REALTOR® 10

C.A.R. Directors Attend Winter Meetings

In early February, Orange County REALTORS® who serve as California Association of REALTORS (C.A.R.) Directors attended winter meetings in Indian Wells. Pictured (from left to right) are Jola Cook, Christina Fu, Ron Pascual, OCR President Scott White, Rita Tayenaka, Lata Jobanputra, Paula Cosenza, Yami Martinez, Rick Cosenza, Charleen Nagata

Orange County REALTORS® Government Affairs

Director Dirissy Doan has been elected secretary of OC Forum and joins President John Christiansen (Cornerstone Communications), Immediate Past President Kate Klimow (University of California, Irvine), President-Elect Emily Grant (SoCal Gas), and Treasurer Henry Mendoza (MM & Company, LLC) on the Executive Committee. OC Forum is a nonprofit, nonpartisan organization that periodically convenes the Orange County community for a discussion of current events in an interactive environment.

Congratulations to Andrew Lin, who has been selected to serve on the California Association of REALTORS® (C.A.R.) Young Professionals Network (YPN) Advisory Board.

Illustration by Pramote Lertnitivanit

NAMES IN THE NEWS

Illustration by Filo

in Indian Wells

Dirissy Doan Elected Secretary of OC Forum

Andrew Lin Selected for YPN Advisory Board

Newhouse, and Suzanne Gignoux.

OC REALTOR® MARCH | APRIL 2023 11

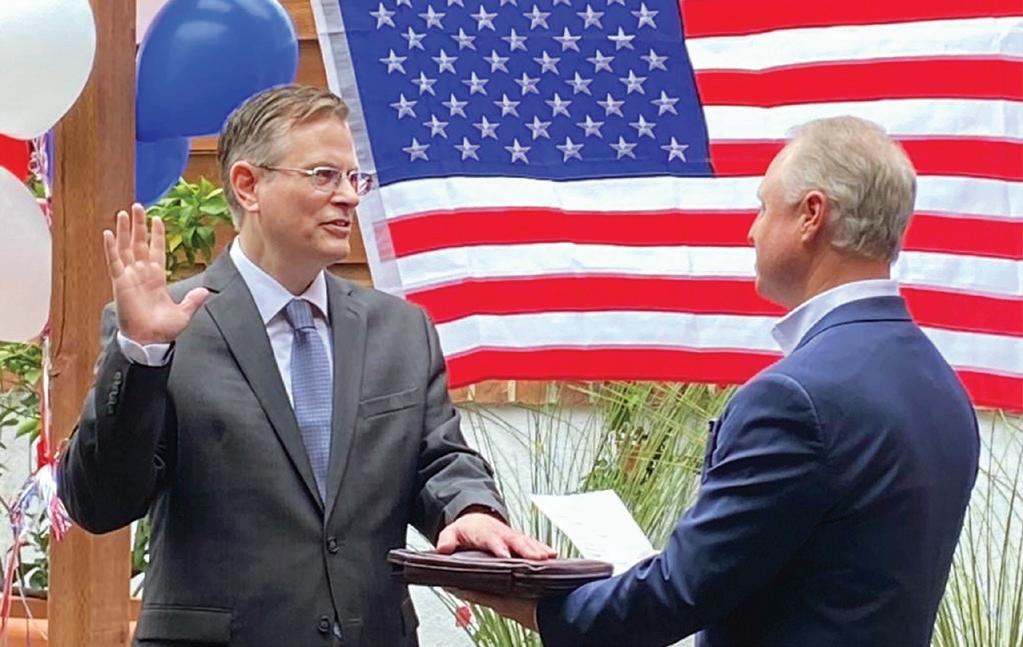

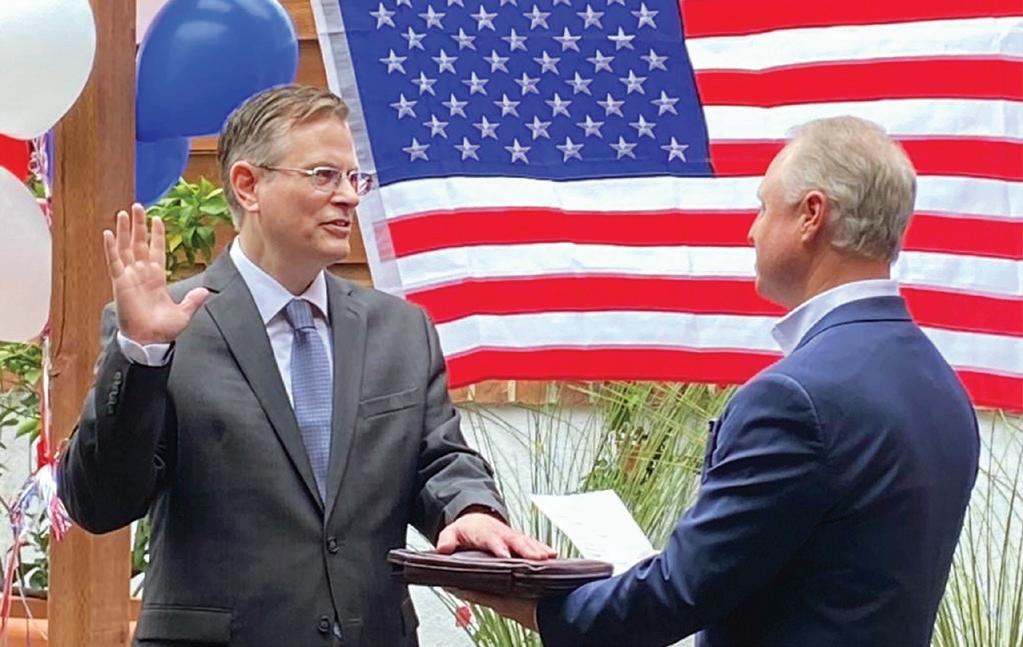

Orange County REALTORS® Immediate Past President Adam Rodell represented OCR at the swearing-in ceremony of Representative Michelle Steele (45th Congressional District) on January 14. Adam serves as Representative Steel’s federal political coordinator.

REALTORS® and Elected Officials Attend Swearing in of Young Kim on January 18

On January 18, Young Kim was sworn in as a congresswoman representing California’s 40th District. Present at the ceremony were (from left to right) Yorba Linda City Council Member Carlos Rodriguez, Lake Forest City Council Member

Scott Voigts, Paula Consenza, Orange County

REALTORS® Government Affairs Director Dirissy

Doan, Rancho Santa Margarita City Council Member Anna Figueroa, Chandy Andre, Orange County

REALTORS® President Scott White, Representative Young Kim, Rick Violett, Joyce Leonard, Rancho

Santa Margarita City Council Member Brad McGirr, Rancho Santa Margarita Mayor Pro Tem Carol Gamble, Moulton Niguel Water District President

Duane Cave, Mike Ameel, and Orange County Board of Education Trustee Mari Barke

Jordan

At noon on January 2, 2023, Andrew N. Hamilton was sworn in as Orange County’s twelfth auditor-controller. Hamilton’s previous experience includes having served as finance director for the City of Yucaipa, having been a member of the Lake Forest City Council, and having served as the chief financial officer at the Mesa Water District. Hamilton, who describes himself as an accountant, said he decided to seek the position after learning that Orange County’s previous auditor-controller, Eric Woolery, had died.

On January 9, Jordan Marks was sworn in as the San Diego County Assessor, Recorder, and County Clerk. Before he sought elective office in San Diego, Jordan served as a government affairs director and worked for Diane Harkey when she was serving on the Board of Equalization. Jordan campaigned on a simple program of making homeownership affordable by limiting tax increases on homes; increasing the renter’s tax credit; protecting working families, veterans, and seniors from overtaxation; and putting the customer first!

NAMES IN THE NEWS

Michelle Steele Sworn in on January 14

Marks Becomes San Diego County Assessor, Recorder, and County Clerk

Andrew N. Hamilton Sworn in As Orange County Auditor-Controller

MARCH | APRIL 2023 OC REALTOR® 12

The Mission Viejo City Council unanimously approved leasing office space on the second floor in City Hall to Congresswoman Young Kim. The lease, which began on February 1, will terminate on January 2, 2025. The office will be staffed by one full-time person and by two others three days a week. Congresswoman Kim will come in on an as-needed basis.

In what is a first, two Orange County politicians have been chosen to co-chair the Congressional Vietnam Caucus. They are Representative Lou Correa (D-Anaheim) and Representative Michelle Steele (R-Seal Beach). The caucus focuses on bilateral U.S.–Vietnam relations and prioritizing issues important to Vietnamese-American communities across the country.

The Association of California Cities–Orange County (ACC-OC) has announced the hiring of Kris Murray as executive director. Kris has more than twenty-five years of experience serving public agencies and private industry across Southern California.

State Senator Janet Nguyen (36th District) was recently selected to chair the Senate Minority Caucus. She is the highest-ranking Vietnamese-American officeholder currently serving in Sacramento. Her job is to work in tandem with Minority Leader Brian Jones of San Diego to lead floor operations, run caucus meetings, and put together the Republican agenda.

Public Memorial Planned for Rex Hime on March 16 in Sacramento

In February, Rex Stewart Hime passed away at his home in Loomis, California, after a long battle with cancer. Rex was a large man who enjoyed wearing Hawaiian shirts, had a twinkle in his eye, and could light up the room with his infectious smile. He worked easily with anyone to accomplish the goals he believed were important regardless of political affiliation and did so with good humor. To honor his decades of work with the California Building Properties Association, that organization recently bestowed on him the title of CBPA Founding CEO and President Emeritus.

Rex’s family is planning a public memorial for him in Sacramento on March 16 from 4:00 to 6:00 p m at the Hyatt Regency in Downtown Sacramento. Because Rex had a special fondness for the California State Fair, his family requests that, in lieu of flowers, donations be made to the Friends of the California State Fair Scholarship Program, and mailed to Friends of the California State Fair, P.O. Box 15649, Sacramento, California 95851. The tax identification number for this charity is 94-2722656.

NAMES IN THE NEWS

Kris Murray Becomes Executive Director of ACC-OC

Congresswoman Young Kim Opens an Office in Mission Viejo

OC Representatives Co-Chair Congressional Vietnam Caucus

OC Senator Janet Nguyen Chosen to Chair the Senate Minority Caucus

OC REALTOR® MARCH | APRIL 2023 13

A Special Thank You

A special thank you to generous attendees at the Huntington Beach Marketing Meeting and Preview who donated $2,271 to the Huntington Beach Youth Shelter, $2,222 to the Veterans Association of Real Estate Professionals (VAREP), and $550 to our own OCAR Cares during 2022.

Orange County Register Names OC’s 125

Most Influential

At the end of each year, the Orange County Register compiles a list of Orange County’s top influencers for that year. In alphabetical order, some of the names on the list for 2022 are the following:

Valerie Amezcua, who was elected as the first female mayor of Santa Ana in that city’s 153-year history and drew more reader nominations than anyone else on the Register’s 2022 list.

LaVal Brewer, the president and CEO of South County Outreach in Irvine, which assisted 6,180 people during 2022 by providing 731 households with rental or utility assistance and distributing 758,270 pounds of food.

John Burns is the go-to guy for both homebuilders and business writers, and appears regularly in such publications as the New York Times and the Wall Street Journal. John Burns Real Estate Consulting’s network of experts recently tracked more than $50 billion being invested in single-family rental housing.

Katrina Foley beat four opponents last year to win a seat on the Orange County Board of Supervisors, becoming the first Democratic woman to hold that seat.

Bob Page took over in March from highly respected Registrar Neal Kelley and managed a big midterm election without any major mishaps.

Katie Porter won reelection to the House of Representatives in a hotly contested race against Scott Baugh that prompted a campaign visit from President Joe Biden. It will be interesting to see how much influence Porter and her white board retain with Republicans now in control of the House.

Lucy Santana-Ornelas marked twenty years of guiding Girls Inc. OC. The national organization received $10 million from Melinda French Gates, and some of that money will help at-risk young girls here in Orange County.

Gloria Seuss, founder and CEO of Mary’s Kitchen in Orange, went to court to ensure that the city would continue to offer meals and daytime assistance to the area’s hungry and homeless after it ended the Kitchen’s lease on Struck Avenue.

Fred Smoller and Mike Moodian, Chapman University professors who co-founded the Sustainability Decathlon, secured the Orange County Fairgrounds as the home for the 2023 event, which will feature twenty university-led teams.

Nicole Suydam oversees Goodwill’s social enterprise operation that employs 1,400, manages twenty-three local thrift stores and ShopGoodwill.com—the onlinecommerce marketplace for Goodwills across the country—and serves more than 18,999 people annually.

Names in the News is intended to be primarily a place where REALTOR® and Affiliate members of Orange County REALTORS® can share both personal and professional news—about births (of children or grandchildren), graduations, weddings, anniversaries, accomplishments, awards, and other milestones—with one another. If you have news to share, email it to Orange County REALTORS® Writer and Editor Sherri Butterfield at Sherri@ocrealtors.org.

NAMES IN THE NEWS MARCH | APRIL 2023 OC REALTOR® 14

Orange County Register LISTS STEVEN THOMAS AMONG OC’S 125 MOST INFLUENTIAL

Steven’s bimonthly Orange County Housing Report provides data-based market analysis that is easy to understand, available by subscription, and useful in setting the expectations of both buyers and sellers.

By Sherri Butterfield WRITER AND EDITOR

At the end of each year, the Orange County Register identifies and describes 125 people who have been “Orange County’s Most Influential” during that year. The contributions and achievements of these people differ widely and represent fields as disparate as business, nonprofits, politics, real estate, science, sports, and the arts.

Among those listed for 2022 were Ashleigh Aitken, who was the first woman to become mayor of Anaheim; Ryan Getzlaf, whose seventeen-year career with the Ducks included a Stanley Cup championship and eleven seasons as the team’s captain; Phuc (James) Chau Nguyen, a La Quinta High School student who designed a cancer-detecting electric toothbrush after he lost his grandmother to that disease; Shohei Ohtani, the Angels pitcher who became the first player since Babe Ruth to reach double figures in homers and wins as a pitcher; Anton and Jennifer Segerstrom, who were instrumental in finding a permanent home for the $94-million Orange County Museum of Art; and Heidi Zuckerman, who came in as the new director for that museum in 2021 and opened it with a 24-hour party in October 2022.

Also named to the Register’s list for 2022 was Steven Thomas, “whose Reports on Housing goes out to about 2,500 Orange County subscribers every two weeks, breaking down local real estate trends. The reports are widely quoted in real estate agent newsletters and commentaries” (Orange County Register, December 27, 2022, News page A6).

During 2004, Steven developed Reports on Housing and serves as its chief economist. Today, his bimonthly Orange County Housing Report provides data-based housing market analysis that is easy to understand, available by subscription, and useful in setting the expectations of both buyers and sellers. His website is www.ReportsOnHousing.com.

SPOTLIGHT

by www.istockphoto.com/Overearth MARCH | APRIL 2023 OC REALTOR® 16

Illustrations

In late January, I had an opportunity to become better acquainted with Steven during an interview at the Laguna Hills office of Orange County REALTORS® in the Hunt Room.

Tell me about your early years. Where were you born? Where did you grow up?

What was especially interesting or unusual about your childhood?

I was born at a small hospital in Orange but grew up in Mission Viejo, where my family lived in three different houses. I attended Viejo Elementary School and then Barcelona Elementary School, played soccer as part of AYSO Division 84, and attended Capistrano Valley High School, where I ran cross-country and track. I also worked for a time at the Irvine Ranch Farmers Market on the Mission Viejo Lake. I graduated from Capistrano Valley High School in 1987.

After graduating from high school, what did you do?

I went to the University of California, San Diego, where I earned a degree in quantitative economics and decision sciences.

My great-grandfather, whose last name was Thomas, ran successfully for a seat in the Oklahoma Legislature. He was the father of twins named Okla and Homa. My grandparents, Okla and Helen Thomas, had a small real estate brokerage in Manhattan Beach, California. My father, Gary Thomas, became a real estate broker. I am a third-generation broker, and one of my sons is in the title insurance business.

My pathway to real estate was working for my dad, which I began doing in 1991. My first task was making cold calls, which I did not like to do. I did a lot of door-knocking. I put together open houses. I assembled and handed out a bound booklet with plenty of data and articles about real estate. By doing so, I was able to give something of value and slowly build a sphere of influence.

SPOTLIGHT

I discovered that the more information and statistics I provided, the better readers understood what was going on.

OC REALTOR® MARCH | APRIL 2023 17

Photo by Marion Butterfield

In 2004, you developed Reports on Housing to “communicate what buyers, sellers, and real estate professionals were experiencing in the trenches.” To provide this information, you tracked demand, inventory, distressed housing, and market data in individual cities and across Orange County. What was your reason for doing so? What were you hoping to accomplish?

In June 2004, a flood of homes came on the market, and everyone was wondering what was going on, so I started putting data together. Everyone liked the result. I continued to add more data. I discovered that the more information and statistics I provided, the better readers understood what was going on.

The reports looked at escrow activity—supply and demand—at expected market time, and at the speed of the market. In 2006, there were 16,000 homes on the market, and I could see the Great Recession occurring. By March 2007, with 18,000 homes for sale, it was obvious that the Orange County housing market was toast. I started tracking distressed properties. I knew that inventory had been painfully large for far too long.

Once I started preparing these reports, the only time I missed was in 2009, when I had open-heart surgery to correct severe mitral valve prolapse with a titanium valve replacement. I recovered and was able to run the Long Beach Marathon in 2011.

I have been a member of Orange County REALTORS® since 1991. I served on the Member Benefits Committee from 2012 through 2018 and was the chair in 2016. In 2012, the Board of Directors suggested that I write articles for publication in the magazine.

I am spiritual and believe that things happen for a reason. When I founded Reports on Housing and began writing the Orange County Housing Report, there were no smart phones, and things were not as instantaneous as they are today. At some point, Vicki Vargas remarked to me, “You need to monetize this housing report.” And she was right!

In 2011, I left my dad’s company, got into title insurance, and monetized Reports on Housing, which I have been doing solely since 2020. At the time, I had just become a single dad of six children. My first wife had left me with a brand-new baby boy and his five siblings, and I needed to make a steady living but to do it in a way that allowed me the time flexibility I needed to be with my family. And now, Reports on Housing is expanding beyond Orange County. I am adding coverage of the Bay Area, Las Vegas, Phoenix, and the Sacramento Valley.

Photo by Marion Butterfield

SPOTLIGHT MARCH | APRIL 2023 OC REALTOR® 18

What is your approach to real estate market analysis?

One of the things I always bring up is uncertainty. I am an economist. I look at numbers. The thing I love about economics is that it’s not political: it is numbers and data. I need a lot of data to look at over time to know what’s going on. It’s nerdy stuff.

You were a featured speaker at OC Forum’s Annual Signature Housing Event in November 2022. At that time, you reported that home values were declining and that the new trend among would-be buyers was to “hunker down.” What predictions have you for 2023?

As inflation eases, so will mortgage rates. We need for interest rates to drop to about 5 ½ percent. A lot of people have reasons to move, but they have delayed doing so because of the favorable interest rate being charged on their present loan. In California, 40 percent of residents own their own home free and clear. Only 60 percent have a mortgage. Many among that 60 percent have a far more favorable interest rate than what is being offered and advertised today.

Balancing the demands of career and life is challenging for anyone; however, your circumstance is unusual. You and your wife have a blended family that includes nine children. How do you balance the specific demands of your career with the more general—and sometimes less predictable—demands of family and of life?

You handle what is put in front of you. In 2011, I was surviving. In 2014, I met my wife online. At the time, she was a single mom of two children. She took me in even though I had six kids. After I met her in person, I wrote on the back of the receipt from a coffee shop in Orange, “She’s the one.” And she was. We have been married for eight years. The truth is that I married my best friend. For balance, my wife and I carve out time for just the two of us.

Today, real estate information is readily available on the internet, and people can use their cell phones and computers to buy almost anything, from groceries to cars. Under these circumstances, REALTORS® need to make a special effort to explain their value to potential clients and to members of the public. How can your reports help them do so?

There is an intrinsic value in the process of real estate. It is bringing value, knowing the market, and equipping both the buyer and the seller with as much information as possible to make the process understandable and the transition as painless as possible. The more that you can streamline the process, check in on clients, treat them like friends, the better. Buying, selling, and moving is a difficult process. It is not like ordering food on Door Dash. The more we make it smooth, the better.

I love what I do! Sometimes, I ask myself, “How did I end up here?”

SPOTLIGHT OC REALTOR® MARCH | APRIL 2023 19

You handle what is put in front of you.

WHERE ARE THEY NOW?

By Sabrina Blair

DIRECTOR OF COMMUNICATIONS AND PROGRAMS

The Orange County REALTORS® Leadership Academy was launched in 2016 because 2015 President Rita Tayenaka and other Directors saw a need for new blood in leadership roles at the Association level and decided to form an academy to train, grow, and nurture leaders. We recently completed our fifth class, and the Leadership Academy now has ninety-three graduates. To give readers a better idea about what the Academy can do for members, we are featuring graduates in OC REALTOR ®. To learn more about the Leadership Academy or to apply for the next class, visit www.ocrealtors.org/la

Have you always been a natural leader or interested in leadership roles?

I have always gravitated toward leadership roles. Growing up, I was captain of sports teams, even when I wasn’t the best player on the team. At my first job out of college, I was made the youngest Sales Manager in company history. I’ve always been intrigued by different leaders and their ability to make everyone around them better.

What was the biggest thing you gained from participating in the Academy?

There was a great class on the different ways people are motivated and how to figure out what motivates each person on a team, as well as strategies to use to keep an entire team motivated.

Where has your leadership journey taken you since graduation? What leadership roles have you obtained?

I am currently serving as Affiliate North Co-Chair for Orange County REALTORS®. I have also served in two different roles, including president for my Business Networking International (BNI) group.

What advice or words of encouragement would you give to someone considering applying for the Academy? The Academy offers a well-balanced experience between tactical and abstract knowledge of business and leadership. The networking aspect is powerful both during the program and after graduation because it places you in a select group of leaders. We still regularly communicate through social media and in-person events.

Leadership Academy Alumni

Leadership Academy Alumni

LEADERSHIP ACADEMY MARCH | APRIL 2023 OC REALTOR® 20

What spurred you to apply for the Leadership Academy?

There were several factors that spurred my interest in OCR's Leadership Academy and my quick decision to apply. I saw value in the opportunity and in the program (as it was described). This inaugural program promised to increase a participant.’s awareness of and involvement in Orange County REALTORS®, the California Association of REALTORS®, and the National Association of REALTORS®. We would meet once a month for eight months and then end our program with a trip to the State Capitol for Legislative Day. Creators of the program shared that these servant leader participants would be developed personally and professionally and would build useful skills and networks in OCR and in the community at large. All of this was very intriguing to me and answered a desire I had for mentorship. Years before becoming a REALTOR®, I earned a Bachelor of Science degree in Organizational Leadership at Biola University. I chose that major because I was (and still am) a servant leader. I desired to develop a better understanding of leadership, decision-making, policy and procedure, and human relations in organizations. That education and exposure gave me the confidence and ability to enter the real estate industry as a broker, with no prior experience. I knew the Leadership Academy at OCR would build on that foundation and make me a better organizational leader, colleague, business owner, and community volunteer.

Where has your leadership journey taken you since graduation? What leadership roles have you obtained?

Since graduating, I have learned how to run for an elected office. I was honored to have the trust of my fellow OC REALTORS® as they elected me to serve on the Board of Directors, and as I was selected to serve on the C.A.R. Board of Directors. Over the past nine years, including my service in the Women’s Council of REALTORS® and OCR Leadership Academy, I have served (and continue to serve) on numerous committees at the local and state level. These include, but are not limited to, Grievance, CRMLS, Bylaws, Leadership and Professional Development, Global Business Alliance, Professional Standards, Credentials, Land Use and Environmental, Investment Housing, Fair Housing Policy, Expert Witness, 2020 Vice-Chair and 2021 Chair of C.A.R.'s Commercial Investment Forum, and the 2021 President-Elect of Women's Council of REALTORS®–Southwest Riverside County Chapter. In addition, I have served and/or currently serve on the Board of Directors for the California Association of Black Real Estate Professionals (CABREP), REALTORS® Commercial Alliance of Orange County (RCAOC), National Association of Real Estate Brokers (NAREB) OC Chapter–Beach City REALTIST®. Presently, I am pursuing my life-long dream of becoming an attorney. I recently took the Law School Admissions Test and am in the process of applying.

What advice or words of encouragement would you give to someone considering applying for the Academy? Do it! You’re already a servant leader or desiring to serve. You’re working hard every day to help others achieve their dream of homeownership or investing in real estate to build generational wealth for their families. What do you have to lose? The benefits of being an OCR Leadership Academy graduate far outweigh any time or energy investment you'll make for those few months. You owe this to yourself. The industry knowledge, organizational insight, public policy exposure, and all the relationships you will gain from this commitment to yourself and to your business are worth the investment. You got this! I'm looking forward to seeing you here!

WHAT GRADUATES SAY ABOUT THE LEADERSHIP ACADEMY

“The networking aspect is powerful both during the program and after graduation because it places you in a select group of leaders.”

—Mike Grambow

“The industry knowledge, organizational insight, public policy exposure, and all the relationships you will gain from this commitment to yourself and to your business are worth the investment.”

—Dorinda François

LEADERSHIP ACADEMY

OC REALTOR® MARCH | APRIL 2023 21

OC REALTOR® MARCH | APRIL 2023 23

Does FTX’s

belly up

owner’s

crypto?

By Josh Cadillac

Josh Cadillac is a top-selling agent, real estate coach, national speaker, investor, developer, and author who teaches real estate professionals how to Close for Life by building lasting success through extensive knowledge. He gives agents the education they need not only to close the deal and survive in this industry but also to create loyal customers who would never do business with anyone else.

With so much of the crypto news being focused on one crisis or collapse after another, the talk on the street seems to have transitioned from “you are crazy if you are not buying crypto” to “this whole crypto thing was a scam.” The most noteworthy of these collapses must be FTX. Does the failure of this company spell the end for crypto? To answer that question, we first need to figure out what crypto is and if the idea has merit. This was my approach to entering the crypto scene. I was a lifelong investor but a late comer to crypto. My investment of choice has always been real estate (which happens to be the industry I work in and teach about all over the country). You can’t find an investment that is much more different from cryptocurrency than real estate!

As an investor, though, I have learned to analyze things based on their properties. If there is a need something fills or a long-standing problem it solves, then it is probably a worthwhile thing to consider investing in. That may sound like a line from a show like Shark Tank, but it is definitely the way to examine the durability of cryptocurrency. Don’t forget that the internet was also a “fad,” and all those people at Amazon know how to do is lose money! How did that turn out? Many people got that wrong, and we don’t want to be foolish and repeat their mistake and, at the same time, don’t want to buy into the next iteration of the Betamax either.

First, we need to distinguish between crypto and exchanges. A cryptocurrency is a type of digital money that is usually trying to solve some of the problems that exist with the money we have. What problems, you may ask. Here are just a few: Have you ever heard of a little thing called inflation? Have you ever had a hard time getting your money out of a bank? Have any of your accounts ever been hacked? Have you ever needed to exchange money when visiting a foreign country? These are all issues that cryptocurrency seeks to fix and, in many ways, has done so.

COVER STORY

going

and its

probably going to prison spell the end of

Or are failures of coins and exchanges a normal stop on the road to maturity as a sound investment?

Photo by www.istockphoto.com/ Eoneren

MARCH | APRIL 2023 OC REALTOR® 24

Let’s look at one problem in particular: Have you ever not wanted to depend on the government to have control over your money? In the developing world that has been deprived of stable money, the answer to that last question is a resounding yes. That brings us to an important idea which is that cryptocurrencies are a global currency to which everyone shares access. In the case of Bitcoin for instance, there is a limited supply of only 21,000,000 Bitcoin that will ever exist for the entire world to use. This is very different from other countries’ currencies that are routinely added to by governments, which devalues the savings of the people holding them. This alone means that folks in the developing world will have access to a means of building wealth and investing in their families, businesses, and economies in an unprecedented way. Stable money is the key to any country’s citizens’ ability to accumulate wealth, and cryptocurrencies like Bitcoin can potentially solve this problem.

The obvious counter to this argument is that the volatility of cryptocurrencies makes them a terrible store of wealth because you never know what they will be worth. This is a fair criticism based on the current state of how the crypto market works. If you look back once again to the internet stocks though, you saw very similar volatility. When the idea is new, there is tremendous speculation, and that speculation leads to the volatility. It does not, however, mean that the underlying idea is bad. With time and broader dissemination of cryptocurrencies, the volatility will decline and a more stable value should emerge, as was the case with the internet stocks today.

How does that differ from an exchange? An exchange is a place where you can buy and sell cryptocurrency. You can trade your fiat money (like dollars) to purchase crypto much like the New York Stock Exchange is a place where you can trade dollars for stocks. You can also borrow and buy on margin from many crypto exchanges as well, and they often have a way to “stake” your crypto to earn interest to fund the lending for margin buyers. Crypto exchanges resemble an online brokerage account like an E-trade account. You connect them with your bank, and you buy and sell things you hope will make money.

COVER STORY

If there is a need something fills or a long-standing problem it solves, then it is probably a worthwhile thing to consider investing in .

OC REALTOR® MARCH | APRIL 2023 25

A cryptocurrency is a type of digital money that is usually trying to solve some of the problems that exist with the money we have.

That is what FTX was, and that is who most of the people getting busted out of the crypto space are. There are many of the smaller cryptocurrency coins that also won’t be around in the future as the market has decided the problem they are trying to solve isn’t worth the money. When the money tightens up, the marginal players are eliminated. That is nothing new and once again parallels the early days of the internet. There was a time that if you bought any internet stock, you looked like a genius. People didn’t do their research and just bought, and many got wiped out. If you were paying attention and bought the right companies that are still around today, you made a fortune because the idea itself was a great one.

So, does FTX’s going belly up and its owner’s probably going to prison spell the end of crypto? That would be like asking if E-trade went bankrupt if that makes General Electric a bad company because you could buy that stock on their exchange. If the company is different from the exchange on which you buy stock in it, then it must be for crypto as well. Failures of coins and exchanges do not spell an end to cryptocurrency but are a normal stop on the road to maturity as an investment. Want to learn more about crypto? Sign up for one of Josh Cadillac’s upcoming classes.

COVER STORY

The ACE Negotiator: The No-Nonsense Negotiating Course May 19, 9:00 a.m. – 1:00 p.m., Webinar ACE Crypto 1 (Intro): How to Understand and Meet Customers’ Needs in a Blockchain World June 9, 9:00 a.m. – 1:00 p.m., Webinar ACE Investment 1: Real Estate Investment Essentials—How Making Money in Real Estate Works July 7, 9:00 a.m. – 1:00 p.m., Webinar

Failures of coins and exchanges do not spell an end to cryptocurrency but are a normal stop on the road to maturity as an investment.

MARCH | APRIL 2023 OC REALTOR® 26

Illustrations by www.istockphoto.com/ NatalyaBurova

CONTROL OF YOUR MONEY App-solutely Take

By Michelle McCann

MARKETING AND PROGRAMS MANAGER

Let’s be real—budgeting is a chore! But in a commission-driven profession, budgeting and financial planning can help you weather lean times and ensure that you are going in the right direction. Instead of spreadsheets, math (so much math!), and penny pinching, try a budgeting app! A budgeting app can help you pinpoint areas where you can save money and adjust your budget accordingly.

The apps mentioned below either are free, offer a free version, or have a free trial period so users can get acquainted with them before signing up.

Mint

Mint had more reviews on App Store and Google Play than any other app reviewed here. It is free and syncs checking and savings accounts, credit cards, loans, investments, and bills. This app tracks expenses and places them in budget categories that users can personalize and set limits on. Mint will notify users if they approach their limits. “Mintsights” allows users to track goals and pay down debts.

Standout Features

» Free credit checks

» The ability to pay bills automatically

» The ability to set, track, and celebrate short- and longterm personal and professional goals

» Payment due date and suspicious charges alerts

» A personalized financial plan based on spending habits

» Instant access to view an estimate of your net worth

Cost: Free Apple store rating: 4.8

Google Play rating: 4.3

Goodbudget

Goodbudget is based on an envelope budgeting system in which a portion of income is applied to specific spending categories like mortgage, groceries, business expenses, or debt payoff, which are also called “envelopes.” This app does not connect to bank accounts, and balances must be added manually.

Standout Features

» Notifications if you go beyond your budget

» Custom features such as saving for an emergency or for a vacation

» Real-time updates of how your transactions impact your budget

» Offers educational resources such as a blog, a podcast, and online courses

Cost: Get 20 envelopes for free. The charge for Goodbudget Plus is $8 a month or $70 per year.

Apple store rating: 4.7

Google Play rating: 4.3

Budgeting is a chore; but in a commission-driven profession, it is absolutely a necessity. The good news is that there’s an app for that!

COVER STORY

MARCH | APRIL 2023 OC REALTOR® 28

Illustrations by www.istockphoto.com/ThinkNeo

You Need a Budget (YNAB)

You Need a Budget (YNAB) plans financial decisions ahead of time rather than tracking past transactions. As soon as users get paid, they tell YNAB how much income should go toward various categories, including expenses, goals, and savings. This app helps users be intentional with their money and adjust their spending habits accordingly.

Standout Features

» Allocates every dollar you earn to something in a zero-based budgeting system. Every dollar has a specific job.

» Designed to help you get out of debt

» Syncs to your bank accounts and credit cards

» You can set goals and customize the spending categories

» Offers educational resources, such as budgeting advice, and more than one hundred free workshops every week

Cost: 34-day free trial and then $99 per year or $14.99 per month

Apple store rating: 4.8

Google Play rating: 4.6

BONUS MONEY SAVING APP

Hurdlr

PocketGuard

This app is simple! Users can connect bank accounts, credit cards, loans, and investments and track bills, but there is a manual option as well. After setting aside money for necessities, PocketGuard shows users how much they have left to spend.

Standout Features

» Takes into account users' estimated income and upcoming expenses

» "In My Pocket” shows how much users have available for everyday spending

» Allows users to set up reminders and shows areas where they can negotiate better rates

Cost: Basic PocketGuard is free. PocketGuard Plus costs $7.99 per month, $34.99 per year, or $79.99 for a lifetime purchase.

Apple store rating: 4.7

Google Play rating: 4.4

Hurdlr is an app that helps real estate professionals automatically track business mileage, expenses, income, and self-employment taxes. Hurdlr also allows users to track finances for each listing and buyer.

Standout Features

» 100 percent automatic mileage tracking with auto start and stop

» Built-in AI technology that learns your tagging habits, helps you tag expenses and mileage automatically, and serves this information up to you for quick reference

» Detailed tax calculations with your potential tax deductions

» Instant links to your other financial accounts

» Includes holistic financials, tying in listings, commissions, expenses, and deductions

Cost: Free for C.A.R. Members

Apple store rating: 4.7

Google Play rating: 4.5

COVER STORY OC REALTOR® MARCH | APRIL 2023 29

You may be watching your cash flow during the market slowdown. Use these smart tips to protect your nest egg.

By Melissa Dittmann Tracey

By Melissa Dittmann Tracey

News about economic tumult may be making you feel jittery about your finances. A “housing recession,” as National Association of REALTORS® Chief Economist Lawrence Yun characterizes the current market slowdown, may be daunting for real estate pros whose commission checks can vary greatly with the ebbs and flows of the real estate cycle.

After all, 37 percent of agents last November said they were struggling to pay rent for their offices, according to a poll by Alignable, an online network for small business owners. Real estate professionals, along with other American workers, may not be feeling particularly rich: About six in ten consumers say they are living paycheck to paycheck—about 45 percent of whom earn more than $100,000 per year—according to a late November poll from PYMNTS and LendingClub. Further, consider that the median gross income of REALTORS® was $54,330 in 2021, and incomes tend to grow with more years of experience, according to NAR data.

To weather potential business hiccups, financial experts offer 10 money-saving tips:

1. Beef up your reserves. A reserve account consists of savings to cover any unforeseen expenses, which can be crucial during tough financial periods. For the selfemployed, a good rule of thumb is to put enough savings to cover six months of expenses into a cash or stable value-type account, advises Brian Wiley, founder of Tree City Advisors in Boise, Idaho, and host of “The Real Money Pros” radio show.

COVER STORY

MARCH | APRIL 2023 OC REALTOR® 30

Photo by www.istockphoto.com/ AaronAmat

2. Revisit your spending habits. Scrutinize your expenses to find ways to reduce or eliminate excess. “This is a good practice in any economy, but it’s even more important when cashflow is limited,” Wiley says. “You might be surprised how much you can save by eliminating extra television services, daily lattes and memberships.” Pay special attention to items like your car or homeowner’s insurance: Drivers who comparison shop on auto insurance, for example, can save an average of $1,127 a year, according to a study from CarInsurance.com. Michael Soon Lee, CRS, GRI, associate broker at Realty ONE Group Future in Dublin, California, advised in a Center for REALTOR® Financial Wellness webinar to cut at least $1,000 a month in personal expenses, particularly if you lack three or six months’ worth of savings. Cut back on noncritical spending, such as dining out, gym memberships, coffee shop visits and cable TV, and find more ways to save at sites like AmericaSaves.org, he suggests.

3. Re-evaluate where you’re investing money. Assess the value of all your accounts like checking, savings, investments, retirement, etc. “Each of these may become critical resources and should be prepared ahead of a need,” Wiley says. “The best practice is to have any money, which might be needed in the next three years, set aside as a ‘cash-like’ investment, such as a CD, money market or shortterm government bond.” On the other hand, stocks are often volatile in an economic slowdown and often require a more long-term growth strategy. So, if you have an important savings goal to fund within a year, choose a more stable investment, like CDs or bonds. “Be sure risk investments are purposeful and are given the amount of time needed to recover before the value is needed,” Wiley notes.

4. Get smarter about taxes. Work with a qualified tax adviser to ensure you’ve taken advantage of every tax-reducing method available to you and that your business is structured appropriately, Wiley suggests. For example, how much of your income should be designated as W-2 pay (self-employment income)? In some cases, the answer may be all of it, Wiley says. “But in many other cases, the answer is some of it, which leaves the balance to be distributed as a dividend if you are filing as an S-Corporation,” he adds. “This type of strategy could save you lots of tax dollars.” Wiley says the top financial mistake real estate professionals make is not saving enough for taxes and missing out on savings. “If you do not have a good tax plan, then you are likely paying much more in taxes than necessary,” he says. “I have seen many cases where independent contractors pay 50 percent more in taxes than they should.”

5. Create a budget. You’ve heard it before, but now is a good time to have a budget. Too often, “many people discount the concept of making a budget until they find themselves living in lean times,” Wiley says. “It is always better to be prepared—and trained—before you need to adhere to a tight budget.” Have a personal and business budget that estimates your earnings and expenses and breaks down a full list, item by item, of regular expenses. Track how you do and modify when needed. Need help creating one? The Center for REALTOR® Financial Wellness includes budgeting tips and spreadsheets to help. Sites like Mint.com or your bank, credit union or credit card company likely offer budgeting tools as well, Wiley says.

COVER STORY

Illustrations

by www.istockphoto.com/ Irina_Strenikova

OC REALTOR® MARCH | APRIL 2023 31

Photo by www.istockphoto.com/ gazanfer

6. Open specialized savings accounts. To help stay on budget, financial experts recommend opening multiple, individual savings accounts. For example, pool funds into multiple accounts labeled for emergency/reserves, taxes, retirement and business expenses. Ryan Serhant, CEO of Serhant and equity holder in RLTY Capital, offers tips to independent contractors on financial health. Since the beginning of his real estate career, he has allocated commission checks to separate banking accounts, particularly for taxes, to avoid spending commission money he doesn’t really have. His general rule of thumb: Save one-third of each paycheck for taxes and one-third for living expenses; the rest can go to savings.

7. Keep on investing. No matter the market, it’s always smart to continue investing, Wiley says. He recommends a dollar-cost averaging strategy—the practice of investing a fixed dollar amount on a regular basis. In a sluggish market, the lower prices on investments can serve as an advantage in that they likely will increase over time. Also, investing even a little amount could make a significant difference over the long haul. For example, the Acorns app automatically rounds up the price on everyday purchases to the nearest dollar and then places the excess into an investment portfolio. So, if you buy a donut for $2.30, Acorns rounds that to $3 and invests the 70-cent difference on your behalf. Daily spare change like that could amount to $900 per year in investments.

9. Bank on the future. Retirement savings are often one of the first expenses people nix when finances get lean. Wiley, who hosted a webinar for the Center for REALTOR® Financial Wellness in January called “How Inflation and Market Volatility May Impact Your Plans for Retirement,” says there are many strategies for independent contractors to save for their post-career future. He suggests setting aside at least 10 percent of gross income for retirement. If you haven’t been doing that, you can still catch up. Most real estate professionals have their biggest earning years in the latter third of their career, he says. This still “presents a great opportunity to save more of their income for retirement and to use the many tax advantages offered to ‘late savers,’ such as catch-up contribution limits in 401(k)s, IRAs and ROTH IRAs,” he adds. “Saving more in these types of retirement plans will not only help the professional have a larger nest egg but will likely also reduce taxes along the way. Consider it more of a ‘snowball’ effect.” Wiley also says ROTH conversions during lower income years could serve as another retirement savings tool.

10. Find extra guidance. Financial advisers and tax planners can help you identify ways to meet your savings goals and expand your financial safety nets. Also, sites like financialwellness.realtor, an educational resource for real estate professionals provided by NAR, offers personalized financial planning goals, budgeting tips, tax and retirement planning, and ongoing webinars on various topics. “Get help from an investment professional if you need guidance, and always be sure to only hire an adviser who will work in your best fiduciary interests,” Wiley says.

8.

Consider a side hustle. If you’re especially tight on money, consider a side hustle to supplement your income and leverage your skillsets in other ways. Lee suggests generating extra funds by serving as a notary (which could offer $75 to $200 per appointment), home stager, appraiser or property manager. However, understand that you also likely will need to get extra training or licenses to do many of these jobs. To find opportunities, Lee cites websites like SideHustleNation.com or Upwork.com, which connect professionals to businesses who are seeking specialized services.

Melissa Dittmann Tracey is a contributing editor for REALTOR® Magazine, editor of the Styled, Staged & Sold blog, and produces a segment called "Hot or Not?" in home design that airs on NAR’s Real Estate Today radio show. Follow Melissa on Instagram and Twitter at @housingmuse.

Reprinted from REALTOR® Magazine by permission of the National Association of REALTORS®

Copyright 2023. All rights reserved.

COVER STORY

MARCH | APRIL 2023 OC REALTOR® 32

Sustain the $avings with Free Local Activities!

Forget expensive amusement parks and venture out to experience Orange County’s many hidden gems of entertainment—all at no cost!

By Sydney Smythe MARKETING & COMMUNICATIONS ASSISTANT

With tax season and spring cleaning in full swing, a priority for many is getting their life in order— financials included. Luckily, having some fun does not have to cost you money. So put your wallet back in your pocket, take the hammer away from the piggy bank, and enjoy some of the free amusements that Orange County has to offer!

Outdoor Movies in the Park

Skip the kids arcade. Instead, see one of Orange County’s outdoor movies in the park! Not only are there different movies playing throughout the year, but also there are various locations! Keep in mind that the showings are popular, so come early. Bring a blanket and some snacks, and you’re all set! Most locations have snack booths or food trucks if you’re willing to splurge. View the 2023 movie schedule at www.enjoyorangecounty.com/ outdoor-movies-in-the-park

Crystal Cove

Tired of crowded gyms or just need some fresh air? Take a hike at Crystal Cove and enjoy the breathtaking scenery. Nestled between Corona Del Mar and Laguna Beach, Crystal Cove has 18 miles of hiking trails spanning 3.2 miles of the Pacific coastline! Surrounded by bluffs and accompanied by the sound of crashing waves, your hike will be one for the books! Learn more at www.crystalcovestatepark.org

South OC Cars and Coffee

No matter what your favorite car may be, South OC Cars and Coffee is the place for car junkies. Taking place every Saturday from 9:00 a m. to 11:00 a m. at the Outlets at San Clemente, it is the world’s largest weekly car meet! Because more than one hundred cars show up each week, you never know what you will see. You may even find yourself next to a rally Porsche or a ’65 Chevy Chevelle! Learn more at www.southoccarsandcoffee.com

COVER STORY

MARCH | APRIL 2023 OC REALTOR® 34

Illustrations by www.istockphoto.com/ Vadym llchenko

Orange County Museum of Art

Located at the beautiful Segerstrom Center for the Arts Campus in Costa Mesa, the Orange County Museum of Art showcases modern and contemporary art pieces from the twentieth and twenty-first centuries. The museum makes a point of discovering living artists at critical moments in their careers and featuring their works. Because no ticket or advanced registration is required, art lovers can pop in on a whim! But do check to be certain that the museum is open. It is closed occasionally for exhibition changeovers. See a list of current exhibits at www.ocma.art/exhibitions

Dana Point Certified Farmers Market

The Dana Point Certified Farmers Market is only one of the many farmers markets available throughout Orange County. This market is open on Saturdays from 9:00 a m to 1:00 p m in La Plaza Park off the Pacific Coast Highway and Golden Lantern. Although the goods in the booths are for sale, there is no charge for entering, walking around, and exploring. Every second Saturday of the month, arts and crafts vendors join the market for double the fun! To find a farmers market in your area, visit www.orangecounty.net/html/ farmersmarkets.html

Fullerton Arboretum

Great Park Balloon

If you’re an adrenaline junkie on a budget, the Great Park Balloon ride in Irvine is just the thrill for you! As one of the largest tethered helium balloons, this orange giant offers visitors a free trip 400 feet up in the air. On a clear day, you can see 40 miles! It is important to note that this is a popular activity, and the flight list fills up fast. Visit www.cityofirvine.org/great-park/greatpark-balloon-carousel for hours and details.

Are you into wildlife and nature? Then the Fullerton Arboretum is the place for you! As a botanical garden, it houses rare, threatened, and endangered plants. It features Woodlands, Desert, and Mediterranean collections along a wide variety of nature paths to explore and enjoy. There is no entry fee, although a $5 donation is suggested. To learn more, visit www.fullertonarboretum.org.

COVER STORY

Illustrations by www.istockphoto.com/ linaflerova

Illustrations by www.istockphoto.com/ klyaksun OC REALTOR® MARCH | APRIL 2023 35

Illustrations by www.istockphoto.com/ seamartini

By Steven Thomas REPORTSONHOUSING.COM

Steven Thomas has a degree in quantitative economics and decision sciences from the University of California, San Diego, and more than twenty years of experience in real estate. His bimonthly Orange County Housing Report is available by subscription and provides housing market analysis that is easy to understand and useful in setting the expectations of both buyers and sellers. His website is www.ReportsOnHousing.com

Climbing into a car during the dead of winter can be brutal. The seats are cold. The steering wheel is cold. Most important, the air temperature feels as if it is below zero, even in sunny Southern California. When the heater is first turned on, frigid air blows through the vents. After the car is driven a short distance, the air warms, ending the harsh reality of winter’s chill. Similarly, after hitting its slowest time of the year during the Holiday Market, housing quickly heats up and transitions to the Winter Market, where demand surges higher, the inventory slowly grows, and market times drop.

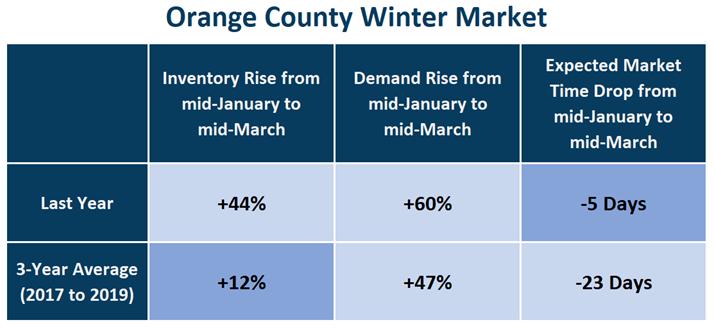

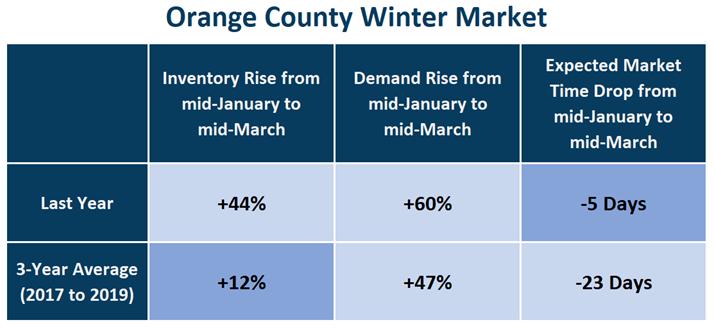

Regardless of the economic situation, without fail, housing revs its enormous economic engine, and the market heats up during the Winter Market, from mid-January to mid-March. Last year the inventory of available homes hit a record low; by mid-January, there were only 1,080 homes on the market. By mid-March, the start of the Spring Market, the inventory had grown to 1,556, a small addition of 476 homes, yet a 44 percent rise from January. Demand, a snapshot of the number of new escrows over the prior month, rocketed higher and increased from 1,426 pending sales at the start of the Winter Market to 2,284 in March, up 60 percent, or an additional 860. The Expected Market Time—the time between coming on the market and opening escrow—decreased from an insanely hot 23 days in January to an even hotter 20 days by spring (see Figure 1).

THE ORANGE COUNTY HOUSING UPDATE

During the Winter Market, housing heats up as demand soars and market times fall.

MARCH | APRIL 2023 OC REALTOR® 36

Expected Market Time decreased from 23 days in January to 20 days by spring.

Yet, it is hard to compare the Winter Market of 2023 to last year’s unbelievably hot, unprecedented housing market, where there was nearly nothing available; 25, 50, or more offers were the norm; homes were selling instantly; buyers were paying tens of thousands of dollars above the asking price; and home values were climbing at an unhealthy pace. Even though the market followed the normal Winter Market pattern, the threeyear average before COVID (2017 to 2019) is a much better comparison. The three-year average inventory grew from 4,739 to 5,286 homes, up 12 percent, or 547 additional homes. Demand shot up from 1,710 to 2,517 pending sales, up a substantial 47 percent, or 808 additional pending sales. The three-year average Expected Market Time dropped from 86 to 63 days, shedding 23 days during the Winter Market.

In looking at the number of sellers entering the market before the pandemic in Orange County, December is the month with the fewest new sellers. In January, the number of homes coming on the market more than doubled from December’s low. More homes come on the market each month until it peaks in May. This year, February started with only 2,384 available homes in the county, the second lowest February level since tracking began 19 years ago. Only last year was lower. After starting 2023 with 2,431 homes, the inventory surprisingly declined in January, dropping by 2 percent.

THE ORANGE COUNTY HOUSING UPDATE

P hoto by www.istockphoto.com/ Shutthiphong Chandaeng

OC REALTOR® MARCH | APRIL 2023 37

Figure 1. Orange County Winter Market. Typically, Orange County housing heats up during the Winter Market, from mid-January to mid-March. Last year, the inventory of available homes hit a record low; by mid-January, there were only 1,080 homes on the market. By mid-March, the start of the Spring Market, the inventory had risen 44 percent. Demand increased 60 percent. And the

Even with the lower demand levels which resulted from the higher interest rate environment, the inventory will not change much during the Winter Market and may even decline slightly. Countering the reduced demand is the fact that homeowners are “hunkering down.” Many who would like to move for various reasons are choosing to stay put because their existing fixed-mortgage rate is substantially lower than the 6.27 percent January rate. There were 45 percent fewer new sellers in January compared to the three-year pre-pandemic average.

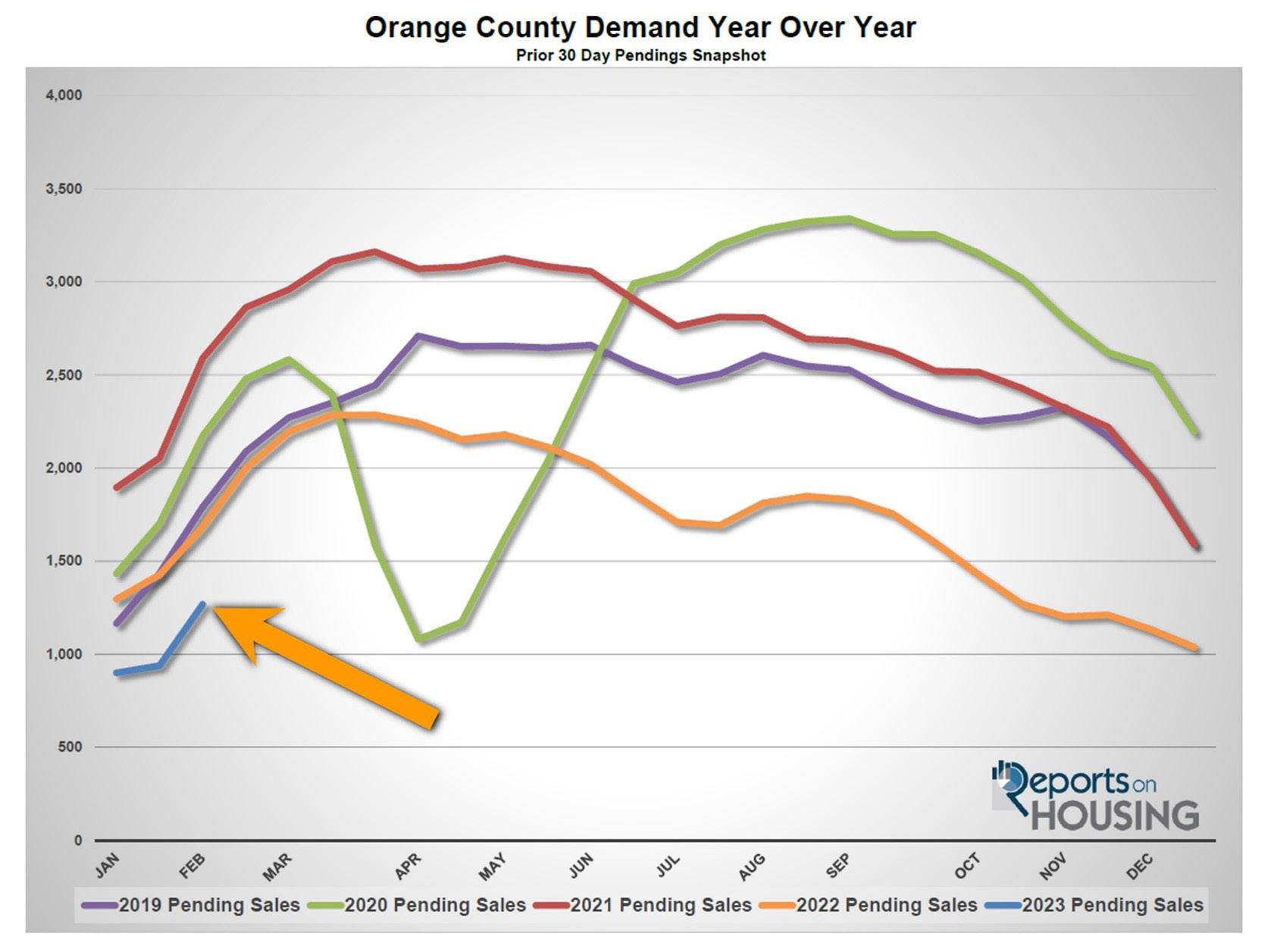

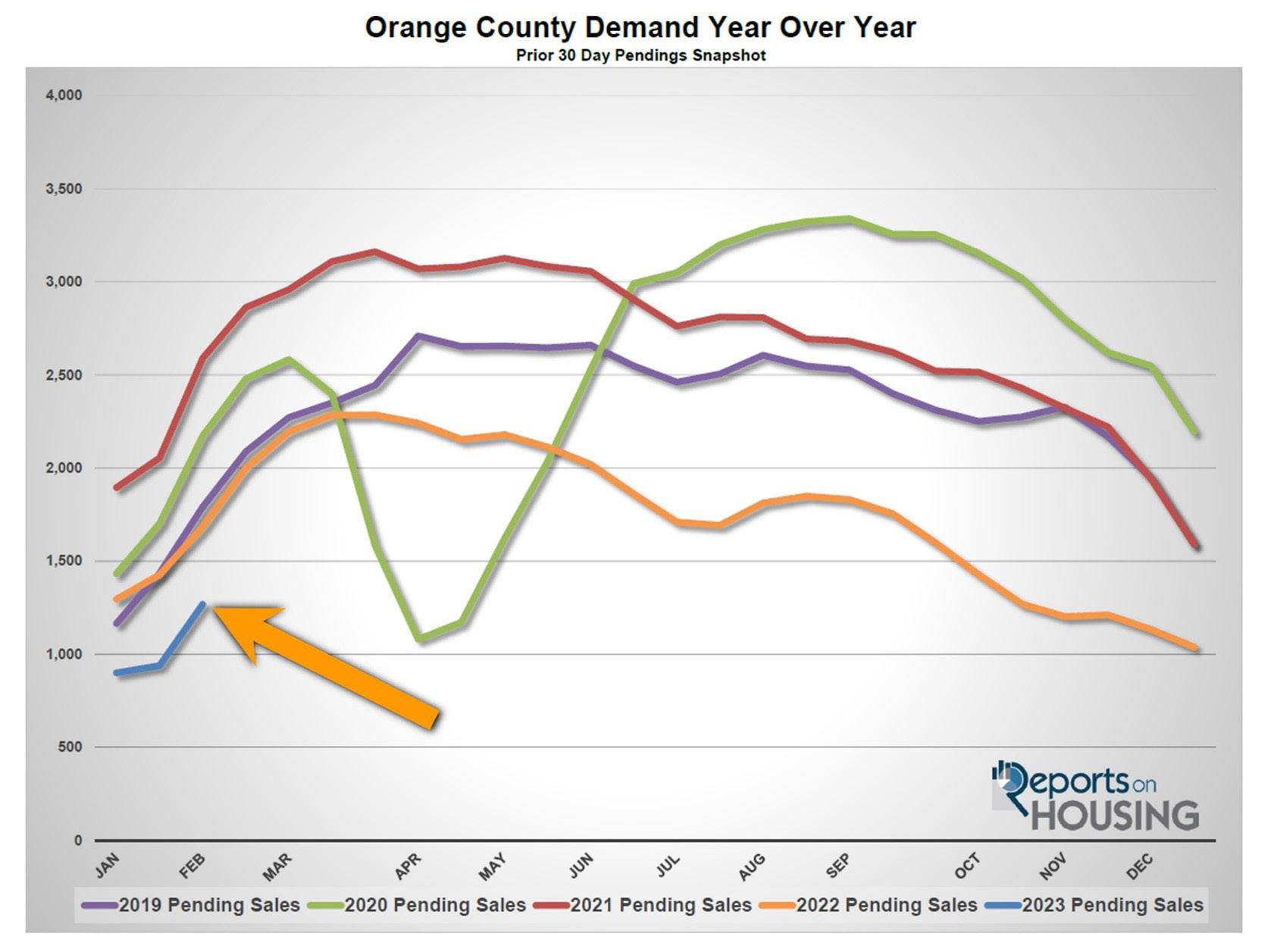

Demand will increase substantially from mid-January through mid-March. In fact, from January 19 through February 2, demand screamed higher, rising from 939 to 1,304 pending sales, up 39 percent, or an additional 365. This demand reading may be similar to levels reached during the initial pandemic lockdown in April 2020, yet it will nonetheless explode higher through the Winter Market. There will be more activity. More buyers will pull the trigger and purchase, especially if rates continue to fall. The lower rates fall, the more demand will climb. Many buyers who stopped looking for a home during the holidays will resume their search

With inventory not increasing much, or even dropping, and demand surging, the Expected Market Time—the time between coming on the market and opening escrow—will fall, and housing will feel hotter. It dropped from 81 days in mid-January to 56 at the start of February. The conditions are often the best for sellers from the Super Bowl through the end of March. There is limited inventory along with rapidly increasing demand and falling market times. These conditions are turning up the heat for Orange County housing.

(see Figure 2).

(see Figure 2).

THE ORANGE COUNTY HOUSING UPDATE

Figure 2. Orange County Demand Year Over Year. From January 19 through February 2, demand screamed higher, rising from 939 to 1,304 pending sales, up 39 percent, or an additional 365 homes. The lower rates fall, the more demand will climb.

MARCH | APRIL 2023 OC REALTOR® 38

The conditions are often the best for sellers from the Super Bowl through the end of March.

with Gov Hutchinson

New Laws That Affect REALTORS® Directly

By Sherri Butterfield WRITER AND EDITOR

By Sherri Butterfield WRITER AND EDITOR

On January 19, Bryan Zuetel, chair of the Risk Management Committee, welcomed Gov Hutchinson, vice president and assistant general counsel of the California Association of REALTORS® (C.A.R.), who described some of the laws that took effect in 2023 and the ways in which these laws are likely to affect REALTORS® and the practice of real estate. Below is a condensed version of Gov’s presentation.

Governor Newsom signed 997 bills into law this year. What I am going to do is give you the big picture. In discussions of this type, I always take a conservative approach. The advice I will give here is general. If you have questions about a specific situation, I recommend that you either call the C.A.R. Member Legal Hotline (213-739-8282) or consult a real estate attorney whose specialty applies in the instance or to the case involved.

The Eviction Moratorium is over unless you are in Los Angeles County. But California is currently under a declared State of Emergency because of the recent storms and flooding. Don’t increase your tenants’ rent by more than 10 percent. In instances like these, you should not be the expert. If you have questions, call the Legal Hotline.

The Two-Year Prerequisite. This year, there’s only one new law that affects REALTORS® directly, and that is the two-year prerequisite. This law provides that a real estate agent must have been an active agent in at least two of the last five years before becoming a broker. (Assembly Bill 2745)

Domestic Violence in Rental Housing. Landlords cannot evict because of domestic violence, but tenants can use domestic violence as a reason to require that the perpetrator be evicted. As evidence, they must produce either a police report or a temporary restraining order. Landlords who violate this law can be fined $5,000.

HOAs. Homeowners’ Associations must allow 2.5 percent of the units in the Association to be rented out, but they can prohibit short-term rentals and the operation of bed-and-breakfast establishments. Homeowners who want to reconfigure the inside of a house in a HOA can do so in any way they wish so long as they comply with the applicable building codes.

Accessory Dwelling Units (ADUs). There is still an approval process for constructing ADUs. Cities, counties, and homeowners’ associations can still restrict this usage but far less than they could under the previous law.

REOs (that is, properties owned by a lender—typically a bank, government agency, or government loan insurer—after an unsuccessful sale at a foreclosure auction). For the first thirty days, the bank can sell the property only to people who want to live in it. After thirty days, the bank can sell the property to anyone. If the property includes multiple dwellings, these must be sold individually, not in groups or batches.

RISK MANAGEMENT

The C.A.R. vice president and assistant general counsel describes some of the laws that will affect REALTORS® and the practice of real estate in 2023.

Gov Hutchinson, C.A.R. vice president and assistant general counsel

MARCH | APRIL 2023 OC REALTOR® 40

Photos by Marion Butterfield

Parking. One of the things that has discouraged builders from constructing housing has been the requirement that they provide adequate space for owners and renters to park their vehicles. Now, builders are no longer required to provide parking spaces for the homes that they construct within half a mile of a major transit stop.

Mobil Home Park Managers must take regular training.

Local Water Districts must ensure that households in their districts do not use more than 47 gallons of water a day. (Previously, the law had established a limit of 55 gallons until January 2023; however, this latter figure now has been reduced from 55 gallons to 47 gallons.)

Fair Housing. Every landlord is now a Section 8 landlord. Landlords cannot arbitrarily say that they do not accept applicants who are Section 8.