4 minute read

Industry Update

Capitalizing on "White Space" Opportunities

Mike Jackson

Advertisement

Executive Director, Strategy and Research 248.430.5954 │ mjackson@oesa.org

Automakers and suppliers are constantly evaluating the changing consumer needs to identify the potential for new product opportunities. Any portfolio gaps between existing products are commonly referred to as ‘white space’; representing a blank canvas of opportunity, so long as any new product offerings executed closely represent the genuine needs of consumers.

To explore recent or pending examples, consider the Jeep Gladiator, the Ford Mustang Mach-E, the Kia Telluride, the Chevy Trailblazer, the seven-passenger Jeep Grand Cherokee L, or the Hyundai Santa Cruz compact pickup among many others. What do they all have in common? They represent a variety of all-new light truck entries intended to grow market share and drive profitability by taking up residence in what was previously denoted as white space.

For a variety of reasons, consumers over the past decade have shifted away from passenger cars toward of a growing range of light trucks, including Pickups, Sport Utility Vehicles (SUVs) and Light Commercial Vehicles (LCVs) in the form of various Van offerings. Manufacturers are more than happy to comply with these shifting preferences, as light truck offerings tend to command far greater pricing power than passenger cars on average. Moreover, light truck portfolios benefit from more lenient fuel economy and emissions standards, which do not require as much costly technology investment to meet such targets, which further bolsters profit potential.

For this reason, many manufacturers have pruned their passenger car portfolios, meaning dealers would have fewer nameplates available for sale, unless new light truck entries are evaluated and introduced into the market. This is especially important for unibody light vehicles, where platforms are designed to accommodate a wide range of product types including passenger cars, crossover utility vehicles (CUVs) and others, as a means to reduce costs by achieving strong economies of scale. Recall that Ford’s C1 platform was also the basis for the Transit Connect as well as the now discontinued Focus sedan and C-Max Compact MPV. However, the phasing out of low margin passenger cars or other entries can dramatically reduce total platform volume and sabotage the business case for what had initially been profitable programs.

To counter this effect, Ford is pursuing a proven strategy of differentiation within its compact CUV portfolio. FCA took a similar path to portfolio expansion, as it successfully spawned unique entries on a common platform by pairing a more rounded and organic aesthetic for the Jeep Compass with a rugged two-box design for the Jeep Renegade that appeals to different consumers. Ford has

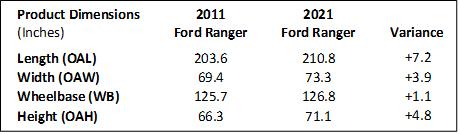

already taken this approach even further by leveraging the Escape’s sleek modern exterior with a refined Lincoln variant in the Corsair CUV. Ford’s expansion introduces a much more capable Bronco Sport along with a more attainable lifestyle-oriented Ford Maverick compact pickup. Some may be skeptical of just how capable the Maverick will be once it arrives later this year, yet bear in mind this entry is not intended to compete with the rugged duty cycle of the larger, more robust full-frame Ranger entry. Maverick will leverage the same reinforced unitized platform as the well-received Bronco Sport, which in principle, served to underpin the Transit Connect a worthy competitor in the Compact Van category. The Ford Maverick is expected to succeed by offering the right blend of size and compact capability. The Ford Ranger and F-150 entries have continued to grow in size over successive model redesigns, offering extraordinary payload and towing capability that far exceed the needs of many consumers. In many markets, the Compact and Subcompact CUV/SUV categories have thrived at the expense of passenger cars as consumers are eager to realize capability and functionality within a more compact dimension and at a more affordable price point.

In this case, Ford also benefits considerably with its Mexican sourcing strategy, as the Bronco Sport and Maverick entries will capitalize on strong export volume. Mexico holds a wide range of free trade agreements that provide favorable terms to nearly 40 countries, making export opportunities especially attractive. Both programs are poised to gain from broad global demand for more capable and attainable compact CUVs as well as strong interest and very limited competition for a compact pickup.

New entries offer the opportunity for volume growth, yet without any sales history, knowing how to account for proposed planning volumes can be tricky. It is important to confirm a competitive vehicle set to the best of your ability. Moreover, it is key to understand markets where the entry will be sold, including export planning volumes over the lifecycle of the vehicle, considering the prospect for sourcing changes.

Contact Mike Jackson to learn more about automotive supplier sentiments. He can also provide information on economic and industry trends, as well as the Chief Financial and Chief Purchasing Officers Councils.