9 minute read

Industry Update

Beware of Divergent SUV Growth Rates

Mike Jackson

Advertisement

Executive Director, Strategy and Research 248.430.5954 │ mjackson@oesa.org

U.S. auto sales in the first quarter of 2021 surged 12% from depressed levels in 1Q 2020. Strong demand accounted for an increase of 430,000 units, reaching 3.97 million units, up sharply from a year ago when the onset of the pandemic triggered lockdowns in March 2020.

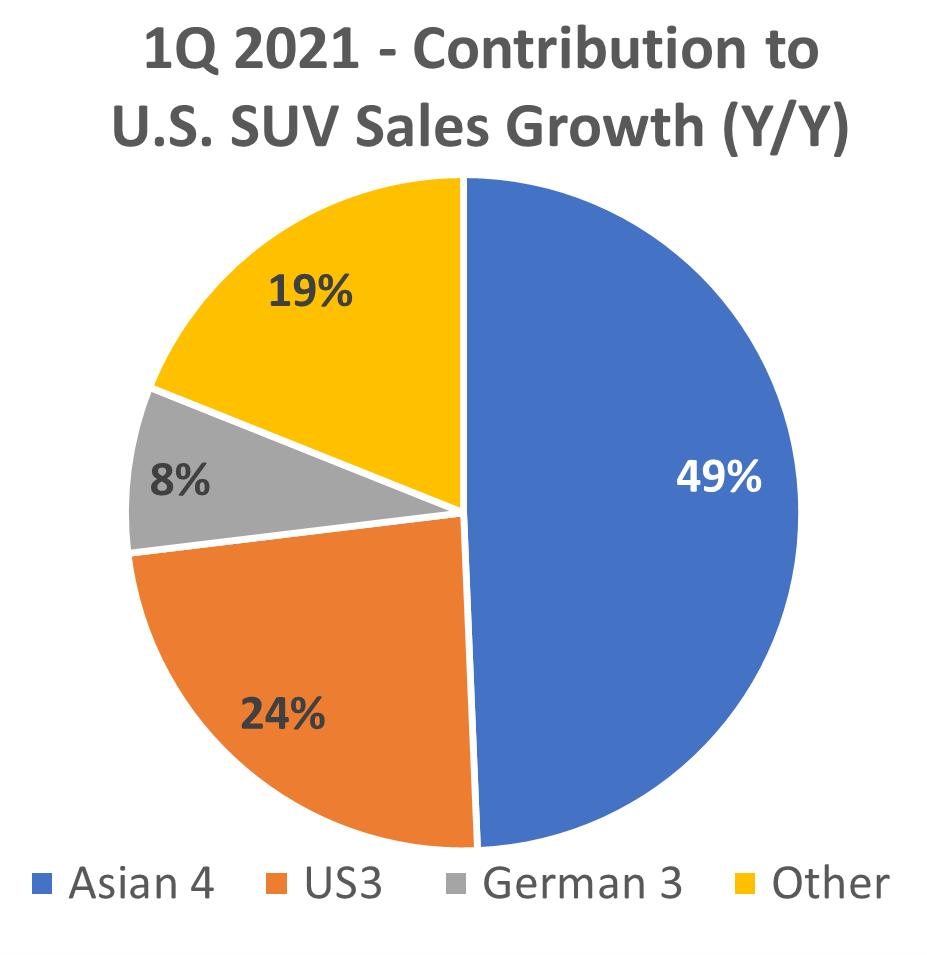

Most manufacturers posted net sales gains, favoring auto makers with growing light truck portfolios. Passenger car sales fell 2.3% to just under 910,000 units in 1Q 2021, in sharp contrast to the 17.3% surge in light truck demand, accounting for 3.06 million units of pickups, SUVs and vans. Remarkably, the SUV category accounted for 82% of volume growth in 1Q 2021, or just under 370,000 units.

Decades ago, GM, Ford and Stellantis (formerly FCA) fueled the emergence and growth of the SUV category, which still accounts for strong market share today. The industry eventually adopted the unibody architecture helping to drive strong economies of scale. As a tremendous influx of competition arrives in more mature categories, core entries that previously have been cash cows will face a tougher sales environment. It is critical for the US3 to continue exploring new product opportunities with variants across the sport utility and light truck categories. A few recent examples include the Chevy Trailblazer (subcompact SUV), the Ford Bronco Sport (compact SUV) and the Jeep Grand Wagoneer (full-size SUV).

A key reason for the persistent decline of the passenger car category stems from what was a swift erosion in residual values. Some automakers became overly dependent on low-margin fleet sales to rental car companies. These sales helped maintain strong utilization rates at passenger car plants, yet eventually flooded the used car market, leaving consumers to carry the financial hit. The US3 auto makers shifted away from passenger cars in varying degrees and OEMs are wise to prioritize investments toward products that yield the highest returns. In contrast, passenger car portfolios at Toyota and Honda have been reduced, yet remain key contributors to profitability, augmenting their SUV product lines.

Although VW and others were slow to expand their SUV portfolios, many have since redoubled efforts, allocating massive investments to meet growing consumer demand within regional and global markets. To this point, U.S. demand across the SUV category, fueled sales growth of 20.3% or 369,000 units in 1Q 2021, to reach 2.19 million units. This is certainly a rising tide that can lift nearly all boats, yet not all to the same height. For more mature categories, competition offers the potential to drive tremendous margin pressure despite growing market volume.

As U.S. sales of SUVs grew 20.3% in 1Q 2021, the Asian 4 producers (Toyota, Honda, Nissan, Hyundai/Kia) outpaced the market with 26% growth in the same period. The German 3 automakers posted strong gains of 16.6%, helped by nameplate growth at VW and Mercedes. The US3 reflected meaningful sales gains of 11.9%, off of a materially stronger base volume. Finally, the strongest growth rate in the SUV category comes from ‘other’ as Subaru, Tesla, Mazda and Volvo drive robust gains, despite steep sales declines for Jaguar/Land Rover.

Despite strong category growth, suppliers must be mindful of growing profit pressures that accompany an increasingly competitive environment due to a sharply higher number of SUV nameplates.

To learn more about automotive supplier sentiments, as well as economic and industry trends, contact Mike Jackson. He can also share information on economic and industry trends, as well as the Chief Financial and Chief Purchasing Officers Councils.

Assembling a car with Argus metals prices - Technology focus

Illuminating the electric vehicle transition.

Spurred by governments and car buyers, vehicles have increasingly electrified not only their engines and components but also their interface with passengers. But, transitioning towards an electric vehicle (EV) future has brought the automotive market up against a number of hurdles.

Suppliers of battery materials are having to adjust their material offerings to meet greater battery production rates. This has noticeably intersected supply-chains in already large markets like nickel and cobalt.

Growing demand has also contributed to higher lithium prices in Asia, with Argus’ Chinese lithium carbonate assessments at almost 3yr highs, meanwhile nickel prices hit 7yr highs in February riding a wave of EV battery sentiment.

The US is on track to add 127GWh of lithium-ion battery capacity by 2025 with Biden’s infrastructure bill expanding charging infrastructure by 500,000 stations, while Argus coverage has highlighted the potential future of recycling batteries from EVs.

In already challenging environment, semiconductor shortages have plagued automotive supply chains with some warning that nearly 1.3mn vehicles may not be produced in 2021 as a result.

The EV transition is raising the need both to track and to understand materials like lithium, cobalt and rare earths that traditionally had little to no impact on the automotive world.

illuminating the markets

Technology Metals

Application: Used in semiconductors, instrumentation, speakers, touch screens, wiring, and other electronics. Copper, battery materials, rare earths, silicon, nickel, gallium, tellurium, and more

Argus product offerings:

Argus Metals International Argus Battery Materials Analytics Argus Rare Earths Analytics

Rare Earths

Application: Used glass, mirrors, speakers, EV drivetrains

Argus product offerings:

Argus Metals International Argus Rare Earths Analytics Battery Materials

Application: Used in batteries for EV’s as well as the wiring and related electronics. Copper, Lithium, Cobalt hydroxide, nickel, LME+premiums on base metals, rare earths and graphite

Argus product offerings:

Argus Metals International Argus Battery Materials Analytics Argus Metals Prices

Metals Coverage (# of prices)

Global exchange prices, real-time or delayed Base metals 255 Rare earths 64

Ferro-alloys 83 Stainless

57 Ferrous scrap 285 Steel 94 Nonferrous scrap and secondary 244 Steel raw materials 153 Minor and specialty 188 Precious 83

To learn more about Argus’ services for the automotive sector, please visit www.argusmedia.com or email metals-m@argusmedia.com

Mexico: The Answer to America's Labor Shortage in Manufacturing

It’s no secret: The US auto sector has a labor crunch. Mexico o ers a strong solution to close that talent gap, but only if workers are able to keep skills current. That’s why the new Entrada Learning Center came to life.

By: JP McDaris

Business Development Director

Entrada Group

+1 (512) 300 - 8383 jpmcdaris@entradagroup.com

We are now more than a year into the pandemic and its detrimental e ects are still being felt. To me, this quote from OESA’s Automotive Supplier Barometer report summarizes the paradoxical issue facing a lot of suppliers to the industry:

“Even with the highest unemployment rate since the Great Recession, the lack of quali ed candidates remains the top hiring constraint. Competition for other industries and wage demands remains

prevalent.” — Q3 2020 OESA Automotive Supplier Barometer report.

It seems counterintuitive, but the labor crunch facing the auto sector remains challenging for many companies.

One common theme I notice, when talking to owners and CEOs of manufacturing companies, is a high percentage of plants operating at less than full capacity. It’s hard to meet quarterly targets if you are running fewer shifts and operating with one hand behind your back.

As the absentee rate remains higher than normal in the manufacturing workforce — whether as workers opt to stay home to help with childcare or to prevent contracting COVID — the longer-term structural workforce issues facing the industry have only gotten worse in the past year due to the pandemic.

Many wonder if plants will ever bounce back to pre-COVID levels when “normalcy” returns. Fortunately, Mexico o ers a nearby, proven, abundant and a ordable labor alternative to US operations, as many automakers and the producers up and down the supply chain demonstrate. Without ongoing professional development, however, Mexico’s workforce will fall behind and its advantages will erode. Recognizing this, we recently launched the Entrada Group Learning Center, to ensure our clients can maintain an ongoing commitment to training and professional development, stay competitive and ensure compliance with changing industry requirements.

The Learning Center enables Entrada’s clients to o er a range of professional certi cations and training programs, facilitating a culture of continuous improvement. We launched the Learning Center late in 2020; IPC 610 and IPC 620 certi cations were the rst courses o ered. Entrada will add the IPC J-STD-001 certi cation by mid-2021.

Mexico: A Convenient Solution

About Entrada Group

Entrada Group guides international auto sector manufacturers in establishing and running their own cost-competitive Mexico operations. Our plug-and-play manufacturing support platform enables our clients to shortcut to the bene ts of Mexico without their own legal entity there. Recently, we launched the new Entrada Learning Center, an exclusive training center for our clients in Mexico. You can learn more about the Learning Center in the recent OESA Podcast or on our website.

Visit us: www.entradagroup.com

Onsite Training Increases Convenience

One unique advantage of the Entrada Learning Center, which is the only of its kind in the state of Zacatecas, is that it is co-located at our manufacturing campus. This is a huge bene t for Entrada clients, as they no longer need to send workers to faraway cities for training, nor experience lengthy production downtimes.

By making professional development convenient and accessible, our clients can commit to dedicated continuous improvement programs that have been shown to improve production e ciency, increase employee satisfaction and aid retention. It also reinforces one of Mexico’s greatest strengths as a cost-competitive production location: its abundant and a ordable workforce.

“[Mexico] labor rates are very economical certainly compared to the rest of North America and even a slight advantage to what you see in the Far East,”

Michael Upchurch, chief financial officer of railroad Kansas City Southern, said at a Goldman Sachs conference in late 2020. Entrada's clients are already leveraging our new Learning Center as part of their commitment to Continuous Improvement

The manufacturing labor force in the US will have 2.4 million jobs to ll by 2028, according to The Manufacturing Institute.

Entrada's Learning Center o ers clients convenient, onsite training

What Kind of Training is Important?

To keep skill sets current and promote the continuous improvement of our clients, Entrada’s Learning Center will o er programs in three major areas: universal, industry-wide certi cations (such as IPC); hands-on training in a range of disciplines to promote standardization and uniformity; and management and professional courses for indirects. (For a full list of the courses we offer, drop me an email).

Entrada is already planning to roll out additional electronics assembly and manufacturing certi cations in mid-2021.

This reinforces our commitment to professional development and continuous improvement, which we feel will give our clients a competitive advantage in the marketplace.