JIP

Mid October DNV announced that, together with the industry, the independent expert in assurance and risk management has developed a new theoretical framework that enables safe installation of offshore wind turbines in more challenging environments. The work is the result of the first phase of a joint industry project (JIP) on Bottom Impact and Partially Submerged Conditions.

Offshore wind turbine installation is today only done in very benign weather conditions due to the risk of severe impact of the wind turbine installation vessels’ (WTIVs) legs with the sea bed, leading to structural damage to the vessel or cargo.

If the weather deteriorates, vessels have to wait until conditions improve before work can resume. “However, high day rates make delays very costly and there is rising pressure to widen the weather window to undertake projects more efficiently as the industry gradually moves further into new territory with harsher weather and less forgiving seabed (soil) conditions,” says JIP steering committee chairman Andries Hofman of GustoMSC.

In addition, regions exposed to earthquake risk also require new operation philosophies such as operating the crane with the WTIV in a semi-jacked condition. JIP heralds common approach

The absence of class guidelines or good models to fully understand and estimate bottom-impact forces and operations in the semi-jacked condition triggered the formation of the JIP in November 2020.

“The aim was to investigate WTIV operational limits and potential new operational philosophies. Reducing installation costs is key to bringing down the levelized cost of offshore wind energy amid the drive to boost energy security. But in a processdriven industry where time is money, pushing the boundaries founded on proper knowledge is crucial. Doing so based on limited data is very risky,” says Hofman.

With input from all JIP participants, DNV developed a numerical model to accurately predict bottom-impact forces. This allows operators to assess the sea state limit in each situation for safe lowering of the jack-up legs, without the risk of damaging the vessel, the cargo or the environment or endangering crew. It applies to both existing and new WTIVs, ensuring right from the design stage that vessels can operate within a reasonable range of conditions.

“The developed numerical model incorporates vessel heading, weather and soil conditions, as well as the strength of the WTIV, to potentially expand the weather window where the WTIV can be safely installed,” says JIP project manager Antonio

Goncalves, Business Lead, Technical Advisory at DNV. “Harder soil generates more impact than soft soil, while stronger winds and higher waves can exaggerate impact events. Deeper water also causes vessels to behave differently versus shallow water. Geotechnical, hydrodynamic and environmental conditions have to match a given WTIV’s structural capabilities.”

The JIP also considered WTIV loads and motions in a semi-jacked condition, i.e. legs supported on the seabed and the hull in partial submerged condition. This is applicable especially in regions exposed to earthquake risk where contractors prefer the WTIV hull to be as close to the water surface as possible.

“Currently, a number of challenges exist with regard to (soil) liquefaction and acceleration/displacements while lifting the turbine and installing bolts. One needs to consider motions of the tower and turbine as well as the vessel. If we cannot find a balance between motion and foundation investment, semi-jacked operation might come with safety challenges. The problem needs further engineering calculations and we look forward to appropriate guidance from DNV in the future,” says Benjamin Haak, Marine Expert at RWE Renewables.

Predictive simulation is, however, only one dimension of the challenge in achieving a final solution. Another dimension is applying full-scale instrumentation (sensor) measurements to validate model output for real conditions. “The predicted forces have not yet been correlated against actual measured forces from live operations. This is a key area where major strides can be made to improve WTIV operability,” says Goncalves.

The third dimension is documenting the role of safety factors on the probabilities of structural failure. The JIP concluded that the probabilities of structural failure can be relatively high under certain conditions. “We have achieved great insights into simulations and the effect of different parameters, but we still need more insights into the appropriate safety factors needed to ensure safe operations. With more insights from the validation of theoretical models and appropriate safety factors we will get enormous benefits from increased operational efficiency, new operation philosophies, and new designs,” says Goncalves.

DNV is currently preparing a proposal for a second phase of the JIP. The scope provisionally includes calibrating both the bottom-impact and partially submerged models, calibration of safety factors, improving the soil model, further evaluation of crane boom/hook motions in the partially submerged condition, use of motions criteria when going on location and developing related guidelines.

“With such strong team collaboration, I am very confident that the next phase will provide even more value for all parties,” says Goncalves. “Our aim is to outline a complete safety-factor approach using real data to benchmark the model so it can be used as recommended best practice on a level playing field,” says Andries Hofman.

To ensure reliability of the numerical models, data is required from multiple assets working both in fair and rougher weather, from developers/contractors on site soil conditions and potentially even from turbine suppliers. Jan Sand Schanke-Jørgensen of Fred. Olsen Windcarrier says there is high industry interest in getting the full

picture, even as new vessels join the market. “For example, if vessels are shown to be over-dimensioned the inclusion of less steel could reduce building costs while allowing more equipment on deck. Lowering emissions is also a key factor in making the entire installation ecosystem as efficient as possible.”

Although providing data has a clear business case in terms of improved WTIV operability and damage prevention, there is residual concern as to what might happen with proprietary data once shared. Goncalves stresses that all data will be treated as confidential by DNV, and only the developed guidelines will be shared.

There was unanimous appreciation of the JIP process. Positive feedback included the following: “It’s fantastic to sit down and talk over important topics without being commercially driven internally. Focusing on safety-critical issues for our crews, assets and the environment is why this is successful,” said Says Schanke-Jørgensen.

Kevin van de Leur, Lead Engineer at Van Oord Offshore Wind, says: “We have done this kind of site assessment analysis before, but it’s difficult to do properly alone. Working together we can develop a common industry standard that everyone is confident about.”

Eric Romeijn, Manager R&D at Huisman Equipment, adds: “We consider simulations of bottom impact as crucial to further optimize Huisman’s next-generation jacking systems for offshore WTIVs. We expect further benefits of a second JIP phase contributing to safe and reliable jack-up operations.”

Fu Qiang, director of CIMC Raffles’ R&D centre, as well as director of the marketing centre voiced similar sentiments. “We are proud to have participated in this JIP and look forward to continuing the work,” he says.

Eduard Lopkov, WTG Installation Senior Lead Specialist, EPC & Operations, at Ørsted, adds that as a major value-chain stakeholder Ørsted is quite selective about the JIPs its joins. “But this one has the potential to markedly improve operations, having shed light on an area not sufficiently explored previously. We can use our combined knowledge to create solid standards and a reliable predictive model that can make jack-up installations safer while reducing the weather downtime factor.”

“In terms of a level playing field, having uniform guidelines will make the sourcing process easier. This applies both to winter and summer operations and seabed conditions, where we already see projects move from sandbanks to more challenging sites with heavy clay and rocky soils, and deeper water. In terms of data sharing, DNV has an excellent record in managing proprietary data. We look forward to the next stage to develop specific guidance that will benefit everyone.”

The JIP work will be relevant for a long time to come, as bottom-fixed wind farms requiring jack-up installation will remain most costattractive to diversify our energy mix. “The market is developing quicker than the rules and the only way to make significant leaps is through sharing knowledge,” says Goncalves. “Our aim is to formulate solid recommendations that are easily accessible. Through better understanding of what forces are at play for a specific site, and their

'Working together we can develop a common industry standard that everyone is confident about.'

Kevin van de Leur, Lead Engineer Van Oord Offshore Wind

consequences, we can increase performance and safety in worse sea conditions, enabling more efficient and timely turbine installation, which is a great opportunity for the whole industry.”

w partners

Goncalves emphasizes the JIP is open to more partners, be they energy companies, installation contractors, designers and shipyards, crane fabricators or wind turbine manufacturers. General benefits include reducing the risk of project delays, accidents and damage to installed equipment, reducing transaction costs, ensuring specific concerns and objectives are considered in the guidelines, and last but not least the opportunity to network with domain leaders.

Source:

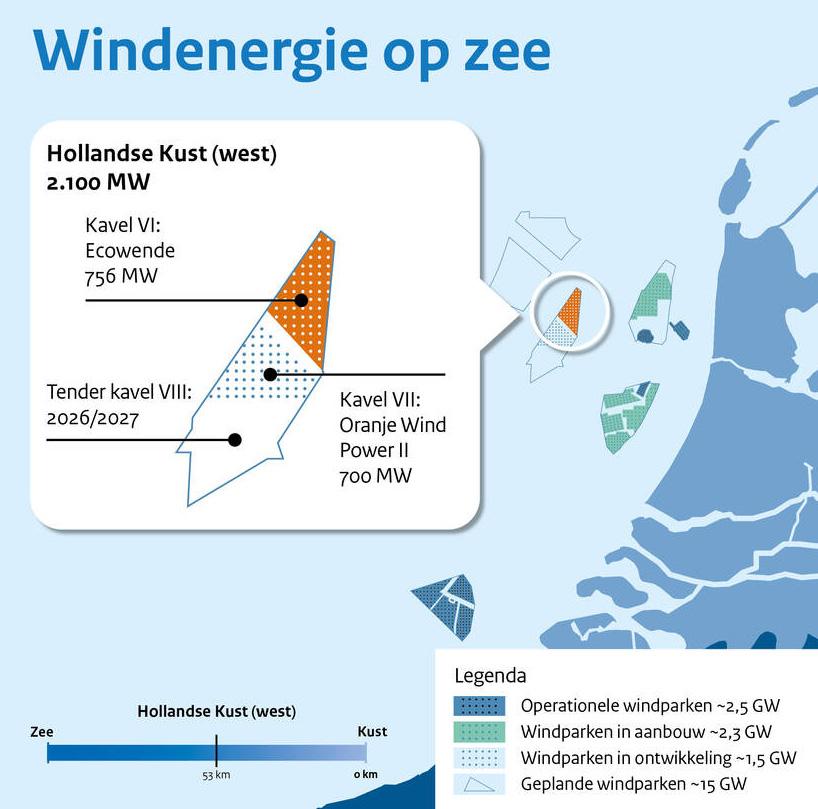

Ecowende will build the wind farm with an eye for nature. This is one of two new wind farms in the Hollandse Kust (west) Wind Farm Zone and is expected to be commissioned in 2026.

The Hollandse Kust (west) Wind Farm ZoneHKWWFZ - is located more than 50 km off the Dutch coast near IJmuiden. The wind farm has a capacity of 756 MW and consists of 54 wind turbines.

These will produce enough electricity each year to meet approximately 3% of the Dutch electricity demand – approximately equal to the consumption of one million households. The wind farm will be realised without subsidy. New to the tenders for the HKWWFZ is that the parties were asked to make a financial offer. Together with the costs for the environmental impact assessments and location studies that are being paid by Ecowende, this yields about €63.5 million. That amount is used to ensure wind farms are designed with due care to the environment and other activities in the North Sea.

n

order to test the effectiveness of this in the interim, an expert advisory group will be consulted and knowledge actively shared so it can be used for future wind farms.

New research suggests a dimming of upstream activity in the North Sea, as adverse regulatory and tax measures erode appetite for new E&P. Taking the utilization of North Sea semisubmersibles (semis) as a measure of contract award activity, the 2023 demand outlook is uninspiring and could result in more units leaving the region next year, said Westwood Insight, a consultancy.

Recent years have been challenging for the region. According to its data, North Sea semi supply shrunk by 36% or by 17 units between January 2015 and November 2022, following a prolonged lack of demand for these units, especially in the more mature UK sector.

While Westwood sees many other regions in the world now recording consistent committed rig utilization highs in the 90% arena, Northwest Europe in comparison is lagging. This has led to more units leaving or being bid outside the region for new contracts with longer terms and higher dayrate potential. The same can be said for the North Sea jackup segment too.

The outlook for next year looks tough. Westwood currently records just under 2,000 days of demand outstanding for work likely to be awarded in 2023, consisting of pre-tenders, tenders, and direct negotiations. Additionally, there is prospective demand for approximately 2,300 further days of work yet to be tendered.

The dead hand of regulation may be a factor here. The additional windfall tax on UK oil and gas profits, as well as the Norwegian government’s plans to phase out its tax relief package introduced during the Covid-19 crisis in 2020, may be having an impact.

Industry lobbyists have been calling for a rethink about government policy on the UK windfall tax, citing its pernicious impact on North Sea activity.

Deirdre Michie, chief executive of Offshore Energies UK (OEUK) has warned that the UK’s oil and gas production will drop in the coming years unless it supports energy companies in further North Sea exploration. She said the UK Continental Shelf (UKCS) must invest in new oil and gas wells across the North Sea, to replace the 2,100 destined for decommissioning.

And as older wells become depleted and are shut down new ones must be opened - or the UK will become increasingly dependent on imports.

The OEUK was reacting to the 17 November UK Treasury Autumn Statement in which Chancellor Jeremy Hunt raised overall taxes on UK oil and gas production by 10 percentage points to 75%, under the Energy Profits Levy (EPL) that critics deem a windfall tax. The extended oil and gas levy comes on top of the 40% headline tax already paid on profits. Not only did the Sunak government raise taxes, it extended the windfall tax’s life from end-2025 to March 2028.

In OEUK’s view, the tax changes would impact not just North Sea operators but the hundreds of other companies in their supply chains, operating in towns and cities across the UK. It says UK production will fall by up to 15% a year unless there is rapid investment in new infrastructure.

There is ample evidence to back up Michie’s claims. The fact that four exploration wells have been drilled in 2022 compared to 16 in 2019, the most recent pre-pandemic comparison year, is a sign of how subdued E&P activity is in the UKCS.

North Sea semi supply shrunk by 36% or by 17 units between January 2015 and November 2022, following a prolonged lack of demand for these units, especially in the more mature UK sector.

Despite the relative lack of activity, there are plentiful resources in the region. According to OEUK and Westwood consultants estimates, there are over 6.1 billion barrels of oil equivalent (boe) remaining to be discovered within 30km of existing infrastructure, with a further 7.5 billion boe located beyond that distance.

Meanwhile over in Norway, the government announced on 29th November that it would not issue licenses for energy companies to explore for oil and gas in frontier areas during the life of the current parliament, which ends in 2025. The decision to postpone the 26th licensing round was the result of the minority government's budget deal with the opposition Socialist Left Party, which wants Norway to stop exploring for new petroleum resources.

North Sea operators note the windfall tax’s impact. Pete Jones, CEO of Neptune Energy, said while the company had been maturing new development opportunities across its global portfolio, some of these opportunities are at risk from potentially poorly targeted windfall taxes, particularly in the UK, Germany and the Netherlands. “Neptune is supportive of a fair level of taxation, but mechanisms must not discourage investment in incremental production to support energy security priorities, as well as carbon reduction initiatives,” he said

Linda Cook, the CEO of another UKCS-focused independent, Harbour Energy, which is the UK’s largest oil and gas producer, said the recently announced EPL and speculation about further fiscal changes have created uncertainty for independent oil and gas companies like Harbour. As a result, evaluating expected returns from long term investments has become more difficult and investors are advocating for geographic diversification.

“At a time when oil and gas producers are being asked to invest more to help ensure the UK’s energy security and are considering longer term, material investments in CCS, additional taxes would run the risk of undermining our ability to do either,” she said.

Yet not all oil companies are singing from the same songsheet, BP’s UK chief Louise Kingham told the Reuters Energy Transition Europe 2022 event on November 16 that “taxation is not for companies to determine. When companies make more profits, they expect to pay more taxes, and that's exactly what we are doing," she said.

Some operators acknowledge that the EPL includes an investment allowance that lets firms claw back just over 90% in tax relief on money invested in UK oil and gas. For every £100 invested in decarbonizing upstream production, companies will be able to claim back £109.25 when calculating their profits

Subsidization of platform electrification – a key component of North Sea decarbonization efforts – will allow companies to reach a target of a 50% cut in emissions by 2030.

The next year will go a long way to testing out how far the tax sweeteners sugar the bitter pill of prime minister Sunak’s oil profits levy, and whether the gloomier views of UKCS operators about the impact on long-term E&P activity in the North Sea will be borne out.

Energy transition is high on every country’s agenda. Many have committed to strict targets to lower greenhouse gas emissions as a measure to limit global warming. The switch from fossil fuels to renewable and sustainable energy sources is challenging, while the clock is ticking.

At the moment, the most implemented alternatives for hydrocarbons are solar and wind. Within the wind energy space, offshore energy generation is an obvious solution, because of the ample global availability of wind and space, without too many disrupting NIMBY effects. The interest in offshore wind is also reflected in the recent installation numbers, showing a slowdown of onshore activity, and ramping up of offshore projects.

From a mere cost perspective, offshore wind energy is still relatively expensive. Especially once the ‘easy’ shallow-water acreage has been covered, it will become inevitable to focus on locations that are in deeper waters and further offshore. This will most likely result in a higher cost price per energy unit, indicated in Levelized Cost of Energy (LCoE).

In this article Hans Simons - HoTai Energy Consult, addresses one of the main challenges that the wind industry encounters on its steep path of expansion: increasing the supply chain efficiency. More specifically, the potential of feeder solutions for transportation of components for offshore construction will be explored.

Key variables for wind farm development are operational efficiency and cost levels, clearly two sides of the same coin. Greenhouse gas emissions are another important aspect to bear in mind. This variable may even tip the balance when opting for alternative supply chain solutions.

USA

During the interviews that serve as a basis for this analysis, industrial conservatism was often part of the conversation, said Simons.

‘If it ain’t broke, don’t mend it’, so let’s continue to use wind turbine installation vessels also for transportation of the turbine components from port into the wind farm. But wind farm developments in the US offer a great – yet not entirely voluntary - opportunity to test alternatives. There are just not enough US-flag installation vessels available for the foreseeable future to execute the ambitious offshore wind plansso how can this supply shortage issue be solved?

Simons: “The analysis will be on two levels. On an execution level, we will take a closer look at transportation alternatives for offshore wind farm installation - and see whether gains can be made on the path to an optimised supply chain. But beyond the single project approach, there is another industry-wide problem looming. Many project investment cases are fragile, and today’s economic developments (inflation, interest rates, commodity prices - and supply chain issues) do not bode well for future return rates. Can feeder alternatives contribute to the offshore business case - and continue to attract investors that can enable the implementation of the offshore wind pipeline for the upcoming decades?”

The pipeline for new offshore wind projects is impressive - and very ambitious. But is it also realistic? End of Q3 2022, the global commissioned offshore wind capacity was a little over 50GW. Based on country pipelines, this number will is planned to rise to more than 270GW by 2030. In the United States for example, the Biden administration has planned for 30GW by 2030. To put this target into perspective - that is more than the year-end 2021 capacity of 28 GW that had been installed in Europe since the start of offshore wind energy in the early nineties. Now, instead of over a period of 30 years, this new US capacity will have to be installed and commissioned within 8 years - with virtually no local track record in offshore wind development.

There are clear obstacles and hurdles to a smooth realisation of the

offshore wind ambitions. First of all, policies and regulations can hamper energy transition ambitions. Final approval is often subject to lengthy tender and decision processes including consultation of stakeholders on local, regional and national levels. Delays as a result of necessary, yet time-consuming procedures have a grave impact on the energy transition progress for offshore wind.

Then there is the uncertainty caused by a fickle political environment. Change of government or intermediate elections may result in changes to already agreed targets and policies. The situation in the United States and South Korea are examples of the potential impact of shifting political winds.

Strict local content requirements affect wind farm development from both a cost and a timing perspective. European field developers will, for instance, have the option to look at different vessel classes for transportation and installation of the wind turbine components - even though most contractors will use the wind turbine installation vessel also for transportation of components in the base case.

If however stimulation policies apply for national industries, then a shortage of qualifying local equipment and personnel may force the wind farm developers to find alternatives for all or part of the wind farm installation stages. The Jones Act in the United States is a well-known example of so-called cabotage regulation and a case in point. It enhances local content successfully by reserving coastwise trade and activities to qualified US-flag vessels. Unfortunately this set of federal laws may also increase the LCoE of wind energy and thus potentially even hamper a swift roll-out of renewable energy plans in the US.

But even with these hurdles, the underlying trend is of course very positive news for energy transition. Massive development of offshore wind energy generation is an essential component on the pathway to curb global warming. Ambitions, as the milestones set for 2030, are an excellent driver for governments and energy companies to put their money where their mouth is. Subsidies, tax shelters and grants are often being used as stimulation, to get off the mark. In the end however, the offshore wind industry has to make a standalone, viable business case - and should be able to compete without government support with existing energy generation from fossil fuels. To achieve that objective, it is important that every aspect of wind farm development will be as efficient and economic as possible.

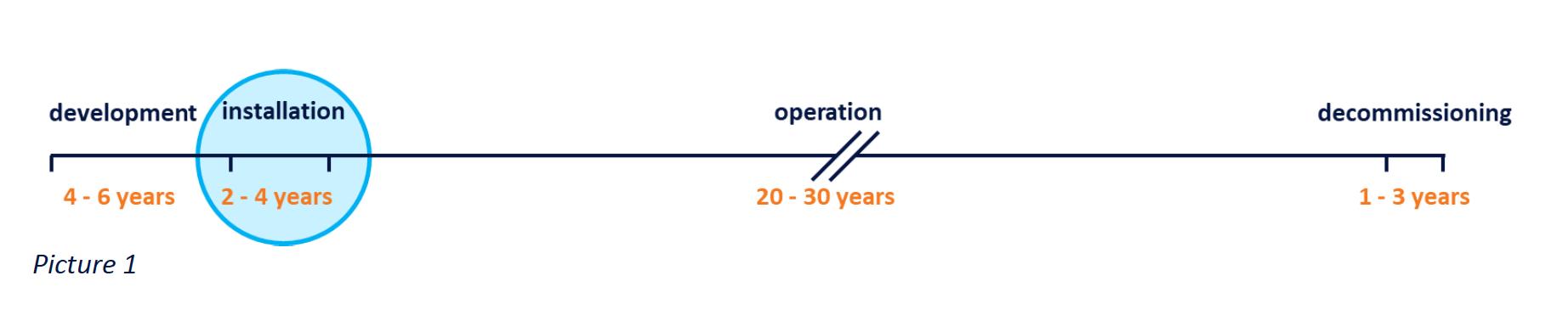

The wind farm life span in fact already starts before the final investment decision (FID) has been taken. This stage comprises activities such as permitting, surveys and large scopes of engineering & design, as well as the early stage project management. The early development planning stage takes about 4 to 6 years until FID. Emphasis will be on the wind turbine installation stage of the wind farm life cycle. During the 2 to 4 years of procurement and installation activities, most of the capital for a project is being spent - typically some 50 to 70%. Cost control during construction is essential for the profitability of the wind farm during the next 20 to 30 years of operation.

The actual investment per turbine - or better - per MW, may differ quite a bit. Physical circumstances, (water depth, seabed conditions, prevailing sea state, distance to shore) but also technical specifications of subsea infrastructure and wind turbines, as well as the local policy framework (subsidies, power pricing agreements, labour union, local content requirements) will impact the total amount of capital that has to be invested.

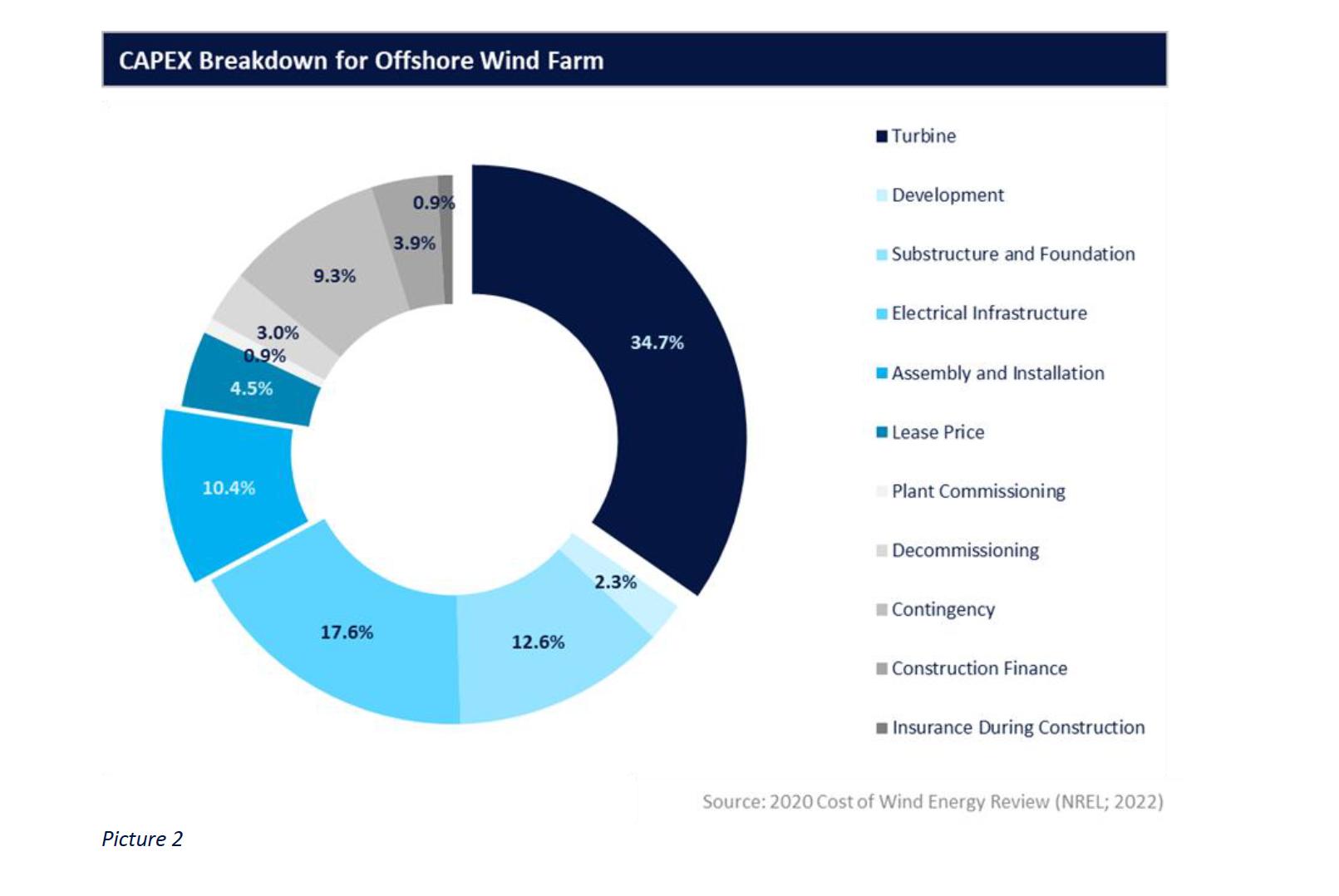

A frequently used capital expenditures (CAPEX) breakdown is the one from the National Renewable Energy Laboratory (NREL). The expenditures are comprising not only the hardware investments in the initial

infrastructure (turbines and the balance of system), but also include some 18% of ‘soft costs’ - as NREL calls them - such as construction finance, contingency and decommissioning.

If it is assumed that the costs for the wind turbine (35%), substructure & foundation (13%) and electrical infrastructure (18%) leave relatively limited room for improvement by the project management, then the next substantial cost category is assembly & installation. This amount that comprises some 10% of the total CAPEX - can be reduced by optimising the supply chain performance.

In fact any risk-reducing improvements during transportation and installation will also have a positive impact on use of the project contingency amount. A more efficient and predictable performance of the logistics will limit use of this financial headroom for overruns. For now, these derived advantages are not being taken into account when comparing transportation alternatives. The impact of a more efficient supply chain on the contingency amount will however be of interest for developers in the investment decision process, and for contractors in tender procedures; if supply chain expenses can be better controlled, the contingency for these activities may accordingly be reduced.

CAPEX that relate most to the actual installation of the wind farm are the purchase cost of all wind turbine components, transportation from port to site, and the subsequent offshore assembly. In the picture below, the proportion of these expenses is shown in the two outer segments of the doughnut.

Efficiency gains can have a direct impact on project CAPEX when installation costs become lower than projected. When the project developer however decides to contract the installation works on a risk limiting lump-sum basis, any efficiency upside will stay with the subcontractor under that agreement. In that case, there will be no direct positive impact on the project CAPEX. However in the longer run, cost savings from optimised installation processes will be reflected in lower lump sum contracts in a competitive tendering environment.

The pivotal piece of equipment during the wind turbine installation process is the wind turbine installation vessel (WTIV). After the foundations have been installed, the WTIV is the most expensive tool at the installation site, and therefore the supply chain for the turbine assembly will have to be structured around this unit.

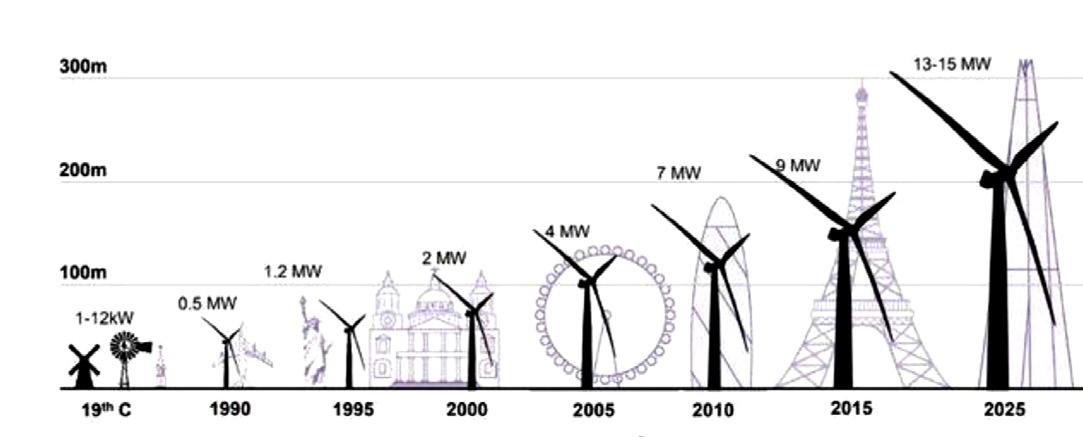

In many segments of the world fleet, the balance between supply and demand is determined by newbuilding orderbook and average age of the fleet. In a perfectly balanced situation, the vessels under construction or on order will cover the increase in demand as well as the replacement of retiring ships.

In the case of wind farm installation vessels, there is an additional factor that plays an important role. Technological developments always have an impact on changes in ship design, but in this case the effect is quite exceptional. The offshore wind industry is in a sizing-up mode, ever since the first wind farm in the early 90s. For many years, several vessels from the oil & gas industry could fairly easily be deployed for the latest generation of wind turbines. Foundations were already within the capabilities of the existing heavy lift vessels, and turbines can often be handled as well after some modifications or upgrade.

The first generation of purpose-built wind farm installation vessels could do the full range of lifting work, from foundation and transition piece to tower segments, nacelle and blades. With the sizing-up of the wind turbine design - especially in recent years - a split in the fleet has started. Next to the multipurpose vessels, contractors have been

Then there is the uncertainty caused by a fickle political environment. Change of government or intermediate elections may result in changes to already agreed targets and policies. The situation in the United States and South Korea are examples of the potential impact of shifting political winds.Hans

Simons, HoTai Energy Consult.

ordering more specialised units, with a prime focus on either foundation or turbine installation. This specialisation will continue, driven by the projected increase in foundation weight and turbine height. One of the consequences of this development is that many of the existing WTIVs will become obsolete much earlier than expected, as they cannot meet the lift requirements for the next generations of turbines. Upgrading of crane capacity is an option for younger vessels, thus buying a life extension - at a substantial cost. Many jack-up vessels - especially the older ones - are being side-tracked, and condemned to less rewarding repair & maintenance work in the existing wind farms with smaller turbines.

While the earlier-generation WTIVs are cascading down in the installation hierarchy, expensive high-end crane vessels from the oil & gas industry are being chartered in by developers to do ‘light’ turbine installation work to fill the supply gap. This is a sub-optimal alternative that comes at dear cost. The day rates reflect the substantially higher operational expenses for these behemoths, as well as the prevailing mismatch between demand and supply. Competition for these crane vessels will further increase with the recovery of the offshore oil & gas market, and even higher rates lie ahead.

Not only sizing-up (larger, higher-capacity turbines) but also scaling-up (more turbines per wind farm) has a profound impact on the logistics for offshore wind. Here again, LCoE is the main driver. If offshore wind wants to be a sustainable and affordable alternative, average investment per MW must come down. This can be achieved by economies of scale throughout the life cycle of the wind farm. A way to accomplish this, is through larger wind farms with more turbines. Average operational expenses per turbine will come down because of the higher utilisation of the offshore support assets, like SOVs and installation vessels. Response time in case of a turbine’s downtime can be shorter, as it makes economic sense to have dedicated repair vessels readily available when a large population of turbines has to be taken care of.

The offshore wind industry is growing exponentially, and the supply chain can hardly keep up with this growth. Transportation, assembly and repair functions for wind farms will become more concentrated in one place. But also equipment - whether fixed, floating or travelling - is following the growth trend of the turbines. Moving them around and have them available when needed, will have to be managed meticulously to avoid hitches and delays as a result of congestion. The accumulation of activities in one spot, and demand for qualified human resources will rise exponentially. Especially during the installation stage of large offshore projects, there may be a mismatch in resources, resulting in upward pressure on rates and wages in port - which will impact the total installation cost.

In the specific case of US east coast, access to marshalling ports can also be limited because of the existing infrastructure. The air gap of bridges limits the leg length of jack-up vessels that can sail into port. Another restriction is the water depth of the access channels of many ports along the coast line.

The simplest way to bring the larger components of a turbine to the wind farm, is by using the installation vessel also for transportation purposes. There will be only one interface moment, in port, when components are lifted from the quayside onto the WTIV’s deck. Because of the onboard crane, the installation vessel can be independent of any quayside equipment - though she will have to jack up first. A large open deck space of the WTIV makes it possible to take on multiple turbine sets in one run, limiting the number of round trips for the installation ship. In a perfect world, where weather is mild and predictable, where installation vessel supply is abundant and where day rates are low, there is no reason to change this ‘commute’ model. Reality is however unruly, and multiple factors disturb the logistics.

To optimise the installation stage of the supply chain, one expects the WTIV to be deployed where it is needed most, and no cheaper alternatives are available. Ideally the vessel leaves the installation site only once - when the last turbine of the campaign has been completed. So - what are decisive building blocks of the logistical equation for wind turbine transportation?

At the shore end of the wind farm supply chain, scale and size already have a massive impact on port infrastructure. To install and maintain a wind farm, large plots of land are required. Because of the size of the turbines, hinterland transportation is becoming more difficult. Components will have to be manufactured as close as possible to the wind farm’s marshalling port, or be shipped in from elsewhere. The size of the marshalling areas will become more important - not only for the increasing dimensions of the turbine components - but also because the number of offshore installations per wind farm is growing. Just-in-time project execution is difficult to achieve, as an offshore installation operation is more prone to weather impact.

• Cost. A good alternative to the WTIV should in any case be cheaper. If the alternative’s cost (charter rate plus additional logistical expenses) is lower than the WTIV’s charter rate, it makes sense to keep the latter in the wind farm to let it do what it has been built for in the first place: assembling wind turbines on site, as many and as fast as possible;

• Timeliness. To optimise the utilisation of an installation vessel, a new set of turbine parts should be on site as soon as the WITV has jacked up at the next foundation and is positioned to receive the components. Any idle time must be avoided;

• Flexibility and redundancy. During the installation stage of the wind farm, everything is about the speed of assembly of the turbines. Flexibility can enhance the utilisation of installation vessels. If the costly installation vessel has the opportunity to start assembly of the next turbine ahead of schedule, instead of being idle at the site, average cost per turbine can be improved, and so will the LCoE. Redundancy in the feeder chain is therefore another way of optimisation;

• Deck Capacity. The number of turbine sets that can be taken on board is an important variable. Installation vessels can take multiple

sets on deck. For feeders that may be a challenge – and under the US Jones Act there are further restrictions, as will be discussed below; • Emission savings. Though not directly affecting the installation process, this parameter is becoming ever more important. Carbon emission considerations may push the field development towards more sustainable solutions with lighter equipment and eco-friendly modes of transportation.

But alternative transportation modes also introduce new aspects to the supply chain. By keeping the installation vessel in the wind farm, larger components of the wind turbine will have to be transferred twice instead of only once.

The first interface, the transfer of components at the shore end of the chain, will not change in its essence, although in practice there may be some changes. This will depend on the alternative that has been chosen. A WTIV will jack up and handle the components autonomously. Alternative transportation solutions typically lack crane capacity to lift tower pieces, nacelle or blades on board when coming along quayside. The transport ship or barge will have to rely on a shore crane. Alternatively, heavier components can also be rolled on board, depending on the design of the feeder. In both cases, port infrastructure may require certain additional investments.

Timely availability of land-based equipment can be impacted by congestion on the quayside. Supply of floating cranes, like sheerlegs, may take away this bottleneck but adds to the all-in cost of transportation - and might create congestion on the water as well. When using quayside equipment, vessel movements may need to be motion compensated. Given the fact that ports are usually in sheltered waters, this compensation requirement will be limited and can be handled by heave compensation in the crane. In the case of a dedicated feeder solution, a second interface will be added to the supply chain. This one is more challenging as the transfer of components will have to be executed offshore on open water, exposed to wind and sea conditions. Several aspects need careful consideration, including mooring and manoeuvrability, motion compensation and weather windows.

Let’s look at some transportation concepts to get a better understanding of where the transportation practice is heading. Quite a few of the feeder solutions are still in design stages, or at best under construction. Primary reason is that only under pressure of the Jones Act, the industry is for the first time incentivised to come up with alternatives to WTIV transportation. To enable the offshore wind industry in the US to reach its goals, several alternatives are being developed.

The fastest way to take components from port to wind farm, will be with a shipshape purpose-built feeder vessel. Crucial feature is the motion compensating capability of the ship. To have maximum manoeuvrability, the vessel will be outfitted with dynamic positioning (DP) capabilities. These feeder ships can be basic or built with all the bells and whistlesin both cases the required investment remains substantial. The offshore wind market has shown that day rates, especially for long periods (for instance for SOVs), are relatively low. For installation work, charter contracts are shorter (linked to a specific project or campaign), and thus ship owners will need higher day rates to secure decent bank financing.

The key challenge will be the initial investment amount. When specifically looking at Jones Act-compliant ships, newbuilding prices will be two to three times higher than for comparable vessels built outside the US – and even that rule of thumb might be too optimistic.

A couple of Jones Act-compliant rock installation vessels that are under construction at an American shipyard, have been ordered in 2021 for close to USD 200 mln each. These ships will of course differ in onboard equipment, but the overall dimensions are fairly comparable. That records are there to be broken was proven in late October. Two container vessels have been ordered at the same American yard at a price that was almost eight times higher than a newbuilding from an international yard. Shipping, offshore oil & gas and offshore wind are all competing for limited US yard capacity, and the newbuilding prices for Jones Act-compliant vessels reflect this situation.

Design of an offshore wind feeder vessel.

An alternative to a newbuilding can be a converted self-propelled flattop heavy cargo vessel. This ship type is often used for long-haul project cargoes for oil & gas and civil engineering projects. Some of these ships are semisubmersible, making them very suitable for roll-on operations in port. Also for discharging offshore, in the wind farm, partly ballasting can increase stability during lifting operations.

Such vessels have to be upgraded with motion compensating equipment, either permanently or temporarily, in order to qualify for safe feeder operations. Depending on the expected employment, the operator may choose for a permanent upgrade (against a substantial investment) or opt for a more flexible solution with rental equipment. In any caseconversion candidates are few, and all of them built outside the US.

Upgrading existing seagoing barges with motion compensating equipment seems to be the most cost efficient way to transport turbine components to the wind farm. The necessary equipment can be rented, limiting the investment amount even further. The layout of the motion compensating on-deck spread has a high degree of flexibility, and will operate in concert with a heave-compensated hook in the crane.6

The CAPEX component can be kept low, but this feeder alternative comes with relatively high additional operational expenses (OPEX). As the barge is non-propelled, the concept also requires at least one tug to tow the barge from port to WTIV, and back. To bring the barge alongside the installation vessel, a second tug will be required. Alternatively, manoeuvrability of the barge can be enhanced by adding (rental) DP systems - but DP systems add to the total spread cost as well.

There are quite some parallels between the offshore wind and offshore oil & gas industries. One of these aspects is the tendency to come up with innovative, and sometimes even eccentric concepts. Development and construction cost are often high, and create economic vulnerability when day rates come down. But as long as the supply of installation vessels is lagging demand, and the concepts deal with the challenges, there may be room for these solutions.

A few interesting feeder concepts that have come to the market to cope with the US Jones Act limitations are the Maersk Supply Service concept, the Feederdock concept, the Havfram concept and the BargeRack concept.

Design company Friede & Goldman, with a long track record in developing drilling rig designs, has surprised the offshore wind market with another barge lift solution. The WTIV will lift the feeder barge with its cargo out of the water by using a gigantic forklift, thus eliminating the vessel motions of the feeder, and creating a fixed-to-fixed situationsimilar to the aforementioned cases of Maersk, Feederdock and Havfram.10

Currently, prototype turbines with a rated capacity of 14MW and 15MW are being tested by Vestas, Siemens Gamesa and GE, while Chinese turbine manufacturers are following suit and eying foreign markets as well.

Turbine development is not going to stop at this size, and 20MW machines will be installed in the not- too-distant future. The continuous changes of the wind generators - in scale, size and design - make adaptation within the supply chain a great challenge. Several parameters have to be taken into account, to come to an alternative

transportation solution and relieve the shortage of installation vessels, aggravated by local content regulation in countries like the US. So what are the key features for a good alternative to an installation vessel’s solo performance?

One of the first things that contractors will look for, are the potential cost advantages. If the difference is slim, the likelihood that they will change to a new mode of transport is small. Any deviation from the conventional method is considered a potential risk.

The day rate of any alternative is a function of the newbuilding cost. Dedicated jack-up installation vessels will have all-in project cost of at least USD 250 mln, but more likely beyond USD 300 mln. 11 Ships built for the protected American market will have a CAPEX north of USD 450 mln. From this perspective, even the more exotic foreign design concepts will probably have lower day rates than any locally built WTIV.

But in the offshore wind industry with its ongoing tendency towards sizing-up and scaling-up, service equipment owners are under a constant pressure to meet the latest operational requirements. Installation vessels have to be able to lift ever heavier foundations, and reach ever higher hubs of the next generation turbines. For the supporting transportation assets, this means they have to follow the latest developments as well, or end up in a second-tier market segment after 10 to 15 years. The minimum day rate that ship owners need for their vessels is usually based on the expected economic life of an asset. The latter is now threatened by the sizing-up of components. This tendency decreases the available time for an asset owner to recoup the invested capital, and also brings uncertainty into the financeability of newbuilding projects by banks and debt funds.

'The offshore wind industry is still young - only dating back to the early nineties of the previous century. At the first site - the 5MW Vindeby wind farm in Denmark - the installed turbine capacity was a mere 450KW. 'Hans Simons, HoTai Energy Consult

Day rates are of course an important factor, but there are more features that must be taken into account when looking for alternatives. The WITV remains the linchpin in the installation process, and must be the driver of the organisation, planning and timing of the supply chain. Therefore it is essential that the feeder solution has maximum flexibility, to accommodate an optimised use of the WTIV. A new set of wind turbine components always has to be ready for offloading when the installation vessel is in jacked-up position next to the foundation. The components can then be lifted off, and assembled right away, without loss of time for the WTIV.

This demand for timely availability offshore creates a new problem. After delivery of the turbine components, the feeder vessel may not have sufficient time for a round trip to bring a new set. To keep the process going – especially when the distance to shore increases - the supply chain will require sufficient operational redundancy, by way of a second feeder ship or tug-barge combination. The two service vessels can now provide an alternate service. Moreover, the available redundancy makes it also possible to cope with potential congestion in port, especially when it gets busy at the quayside. While one barge is on its way to the wind farm, the other barge can be loaded and prepared for the next delivery whenever there is an opportunity to load. This illustrates another advantage of feedering. If the WTIV is also doing transportation services, the logistics planning in port must be flawless because any waiting time will be added to the total installation time. Late arrival of the WTIV due to weather issues can impact a smooth loading process in port even more, and delays will cascade through the chain.

For the delivery of the turbine components to the installation vessel, two other features are important, one of which is manoeuvrability. Assuming that the self-elevating installation vessel is already in jacked-up position at the foundation site when the feeder arrives, the feeder will have to come alongside, and stay in that position during the transfer of the turbine components to the WTIV. There are several ways to achieve this, from physically being moored against the installation ship, to hovering on dynamic positioning systems without making any direct contact with the installation platform. In the past, existing smaller jack-up vessels and lift boats have been used on occasions, but with the turbine scaling-up these vessels lack the required deck space and carrying/jacking capacity.

The other feature for the actual delivery of the components, is adequate compensation of the movements of the cargo during lift-off. The transfer will take place on open sea, and thus be exposed to waves and wind. Only when the feeder is self-elevating or lifted out of the water, transfer of the components can be performed fixed-to-fixed - without motion compensation. A few of these solutions are mentioned in this white paper. In many cases, at least one of the two vessels will be floating when the components are being lifted off.

The offshore oil & gas industry has ample experience with ship-toplatform transfers. This is mostly done with relatively light weights or via motion compensating gangways. Offshore wind turbine installation is of a different character. The components are heavier than the usual transfers, odd-sized and often more vulnerable.

The compensation can be done at two levels; on the feeder deck, with motion compensating platforms that predominantly cope with the pitch and roll movements of the vessel, or high up in the hook of the crane of the installation vessel, by way of a heave compensating device. It is not expected that the feeder vessel will need motion compensating capabilities for all dimensions. The heave-compensation from the turbine installation vessels is becoming more and more advanced. Initially, compensation was done through active heave compensation (AHC) of the ship’s main crane. Adding specialised heave-compensating tools to the hook of the crane is gradually replaced the crane’s AHC. This is considered to be safer during floating-to-fixed lifting operations.

The step to heave-compensating features is relatively small, and will decrease the required specifications for a feeder vessel’s deck equipment. On board of the feeder vessel, the essence is in mitigating the movements in the X and Y-dimensions - the pitch and roll of a vessel (the horizontal space). On the WTIV, the tool in the crane hook compensates for the Z-dimension movements – the vessel’s heave (the vertical space). With the increasing capabilities of heave compensating crane tools, motion compensation on board of the feeder can be limited to transfer of tall and heavy components like the tower pieces. From a CAPEX perspective, this technical improvement to the WTIV crane may make expensive, high-end feeder alternatives less relevant, and reduce the overall cost of transporting components to the wind farm site even more. Heave compensation in the crane hook will however add an additional tool to the WTIV box. It will require additional planning & flexibility on board of the installation vessel.

Moreover, a heave-compensating tool means yet another piece of equipment with the possibility of downtime risk, according to some of the people that have been interviewed. Project managers will therefor follow the operational performance during the first feeder cases closely, to assess any potential future risk.

There is of course the potential loss of time during this second, offshore interface. Motion compensation by way of hook and on-deck devices has its limits. Above certain weather (wind speed) and sea (wave height and period) conditions, component transfers are no longer considered safe, or allowed under existing insurance policies. The lift-off time at the wind farm site thus adds additional exposure for the activities offshore, compared to a WTIV that has brought out the components from port. This may require longer weather windows per turbine installation as result of time lost because of waiting on weather.

But maybe even more important is the fact that the WTIV needs sufficient time to jack up and jack down, as well as a good weather window, when moving around within the wind farm. To limit the installation work’s exposure to weather and sea state as much as possible, it is important to keep the vessel at the wind farm site, and not waste any time with return trips to the marshalling port. Feeders can do that low-profile work, whilst the installation vessel has maximum flexibility for installation of turbines and moving to the next foundation site. The feeders – with their redundancy embedded in the alternate transport service – will limit any time lost in the field, because once the installation vessel is positioned, there will be a new set of components available. This time redundancy can prove to be very

valuable for efficient project development, especially when the installation works are also going to be performed during the winter season.

Short-lived assets like motion compensating platforms and crane hooks, are comparatively expensive because of their limited economic life. Standardisation is an effective way to curb CAPEX and rental cost. First, because this creates manufacturing benefits from economies of scale and repeat processes. Second, and equally important, standardisation makes it easier to deploy equipment on multiple types of vessels. The offshore oil & gas services industry can be considered a predecessor of the offshore wind installation business. As an example, after initial experiments with specialised and one-off offshore gangway designs, the industry now has a few generally accepted types of motion compensating gangways that can be installed on a wide scope of service vessels. For offshore wind it seems like a small step to use the oil & gas experience, and avoid going through the same learning curve. Unfortunately, there is virtually no comparable track record for motion compensating platforms in oil & gas. It’s therefore important that offshore wind learns from its predecessors, and manages to compress the development process for motion compensating tools to assist turbine installation. The sooner standard systems are agreed and accepted, the better.

Closely related to standardisation is mobilisation. Although offshore wind developments are meticulously planned, not everything can be projected and controlled. Mishaps during the earlier stages of the wind farm happen, for instance during foundation installation, and they can push out subsequent activities in the supply chain.

The same goes for delays that can spill over - from one offshore wind project to the next project because the booked assets are still tied up, or the installation vessel has to be released, while the project is not yet finished. Exceptional weather situations may also result in an unplanned extensions of the construction period.

In case of rescheduling and adjustment of the project planning, flexible supply chain management of equipment and vessel availability can save time, and consequently rental and charter expenses. The WTIV is the least flexible and most expensive link in the chain. Therefore flexibility should be sought in the marine spread of support services and transportation means.

The ease of mobilising supporting assets for the installation vessel can substantially add to the solution of these planning and execution

problems. A good example is the use of a tug-barge combination with on-board motion compensating platforms. When the WTIV is idle or not yet available, the feeder barges and tugs can be put to work for alternative jobs. It will be relatively easy to deploy the plug & play tools when they are easy to mobilise. Temporary storage in standard container boxes creates flexibility as well. The motion compensating equipment can be brought on board on a just-in-time schedule, and prepared to be ready to feed the WTIV when the installation work is starting.

Wind farm installation is not only about expenses and LCoE. Even in case of equal cost for transportation alternatives, carbon emissions can vary widely. Supply chain emissions may be calculated for the potential scenarios at hand. Fuel type and daily consumption data are available to the developers and their project managers, and the alternatives can be compared. In case of two feeders performing the transportation duties, the project manager can opt for slow steaming for the return leg of the trip, and reduce carbon emission of the tug considerably.

But not only the actual carbon emission during the installation stage matters. If the WTIV can maximise its productivity with as little downtime as possible, the turbines will become operational earlier, and thus replacement of fossil fuels by wind-generated energy is brought forward in time – thus reducing greenhouse gas emissions. This added value is an essential part of the decision process, to make offshore wind a sustainable industry

Attention for feeder solutions is predominantly driven by the requirements under the Jones Act for offshore wind project in the US. In April 2022 a ruling confirmed that a foreign WTIV can install foundations and tower components in US waters, provided it has not transported such items from a US point. So foreign vessels are not allowed to pick up components in a US port and transport them to the site, as this would in violation of the coastal trade regulations. Moreover, because any offshore wind turbine foundations is considered a US point, a foreign-flag WTIV is not allowed to take an additional set of components from one foundation to the next. Therefor a feeder vessel can only deliver one turbine set at a time.

There are however no Jones Act-compliant installation vessels available yet. The Charybdis is under construction - with expected delivery by the end of 2023 - but apart from that unit, the order book is empty. To realise the ‘30 by 30’ target, the industry has no choice but to use some kind of feeder solutions for the upcoming installation contracts.

The offshore oil & gas services industry can be considered a predecessor of the offshore wind installation business.

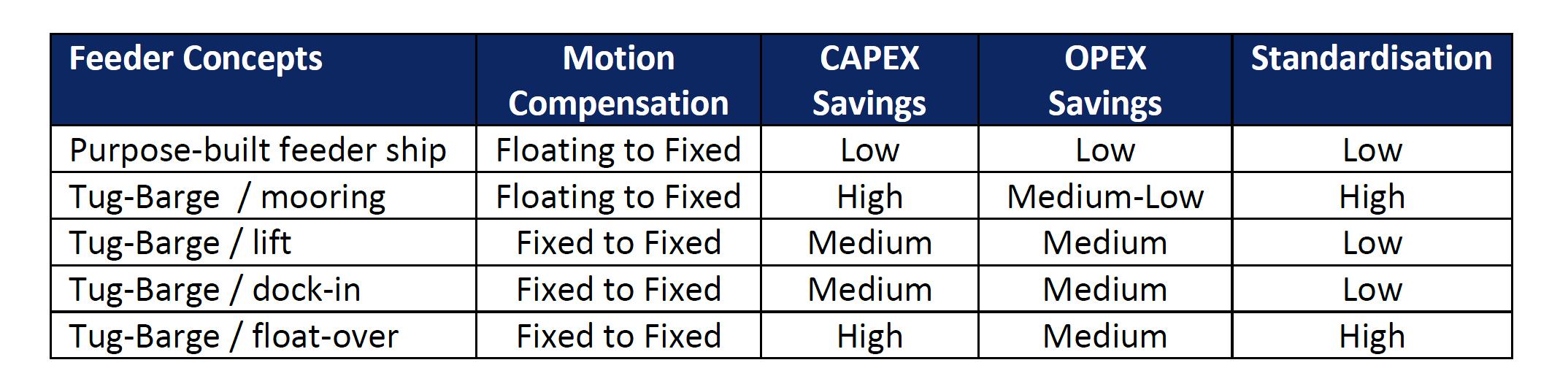

There are two kinds of offshore transfer methods. Floating-to-fixed, when the components will be lifted from the feeder vessel with assistance of motion compensating equipment. In table X, the purpose-built feeder ship and the moored tug-barge combination use this technique. In the case of fixed-to-fixed, the barge will first be secured in or on the WTIV. However, before the barge is fixed, there will be the lift, float-over or dock-in moment – also creating a floating-tofixed situation. In this case the components and transportation barge are together brought into a secured state before the actual lifting of the components takes place. Nevertheless, in any feeder alternative the additional offshore interface in the supply chain forces the project managers to cope with the movements on the sea.

Building at US shipyards is expensive. The higher the specifications of a feeder vessel, the higher the investment will have to be. For a purpose-built feeder ship, CAPEX savings will most likely be limited. Especially when the supply chain requires a pair of feeder ships with dynamic positioning (DP). In such a case it might even be worth it to just build an American WTIV.

For the barge solutions, much depends on the design of the barges. More specialised implies higher investments. In case of mooring or float-over, standard barges can probably be used – comparatively the cheapest alternative, also because there already is a fleet of these assets available that can be chartered or rented.

Comparison of the operational expenses is predominantly driven by the number of barges, tugs and equipment operators that are required for the different alternatives. In case of mooring barges, more tugs will be required for save manoeuvring. Alternatively the barge may be equipped with DP, saving on tugs but adding equipment & operators. The purpose-built DP feeders ships will in any case be expensive to operate, as they will have a full American crew that exceeds the manning of the barge and tug. In case of a pair of these vessels, total OPEX will be quite high.

Standardisation is assessed based on potential uses for the vessels, outside the US offshore wind industry. In case of mooring or float-over, a standard 400ft barge will most probably be used for wind farm feedering. This barge class can be deployed in many other markets like civil works, coastal transportation and oil & gas. For the other two alternatives (lift & dock-in), the barges will be designed and built as

part of a specific concept - and be limited for work in other segments, and probably also more expensive than competing assets in those markets.

The ship shape feeders will be high-end assets, specifically built for offshore wind with bespoke equipment and deck layout - ruling them out as a competitive alternative in standard offshore work. In particular outside the US.

It may be clear by now that there are many solutions, bringing a variety of parameters to the equation. They will all have an impact on changing the offshore wind supply chain. Still, it is worthwhile to have a stab at potential efficiency gains from a cost and time perspective - to try to quantify the consequences of the main alternatives.

Based on the input from interviews with industry professionals, a model has been used to explore the impact of three scenarios, using different modes of transportation

• The conventional approach, using a Jones Act-compliant wind turbine installation vessel for transportation of the wind turbine components from marshalling port to offshore site as well;

• Tug-barge combination, serving as a feeder for the intra-field foreignflag installation vessel. In this scenario, the feeder vessel will be moored alongside the WTIV;

• Purpose-built feeder ship with dynamic positioning, serving as a feeder for the intra-field foreign-flag installation vessel.

For comparison purposes we are assuming that all assets - vessels and equipment – will be on a charter or rental basis that reflects CAPEX and OPEX.

A first comparison shows the time it takes in each scenario, to pick up, transport, deliver and assemble a wind turbine generator, as well as the return trip to port - a full cycle. One set comprises two or three tower pieces, a nacelle and three blades. In case of the US-flag WTIV, it has been assumed that she takes on 4 full sets every trip. The case at hand is for a wind farm of 70 turbines, with an average distance of 60 km from marshalling port to site.

For the US-flag WTIV, there will only be one interface - when the components are taken on board in port. With a feeder solution, there will be the additional interface to lift off the components at the wind farm. In the graphs, time spent is broken down in four categories. ‘OWF / Lifting’ includes positioning at site and - in case of a feeder - the time to lift-off all components, onto the installation vessel.

Comparing a US WTIV (taking 4 sets per trip) with a foreign-flag ship using some type of feeder transport (restricted to one set per trip under the Jones Act) this testcase shows a slight advantage for the conventional approach. As long as the lift-off time of the feeder takes longer than the time that the US WTIV is occupied for transportation purposes (spread over 4 sets), the latter will be faster.

Distance to port and speed of the transportation vessels are decisive parameters - and changes can tip the balance. The relative difference between the fastest and slowest mode is rapidly decreasing with longer distances, and installation times converge.

Comparing installation cost per turbine gives an entirely different outcome, as can be seen from the graphs below. Again the activities have been broken down in 4 categories.

Because the day rate for an American WTIV is much higher than the rate for the foreign competitor in case of a feeder solution, there are substantial savings in installation cost. As input a day rate of USD 450,000 has been applied for the former, and USD 225,000 for the latter. A tug-barge combination is the cheapest solution, but even a US-built DP feeder vessel is worthwhile deploying as an alternative for an American WTIV.

Looking at time and cost for just a single turbine only tells part of the story. To better understand the impact of feeder solutions for an entire project, we should also look at the bigger picture - and analyse the supply chain.

For this purpose, instead of a single tug-barge feeder combination, two units have been assigned to the project. Even though an additional feeder increases the charter & rental cost for transportation purposes, it saves almost a month in total installation time, resulting in, for instance, less charter days for the WTIV. This has to do with the turnaround time of a single tug-barge combination - to go back to port and bring a new set to the WTIV. In the testcase, the turnaround time of the barge-tug combination exceeds the time required by the WTIV for installation of one turbine and subsequent move to the next location.

In such suboptimal scenario, the installation vessel will be idle for almost 12 hours, waiting for the feeder to return. By using two tugbarge combinations, there will always be a next turbine available for installation, after completion of the previous one. The same approach applies for the feeder ship case, though idle time would be only 2 hours and 20 minutes per turbine because of the higher speed of a purpose-built ship compared to a barge on tow, and swifter positioning next to the WTIV using DP.

To calculate the total cost of transportation and installation for the project, it is assumed that equipment and vessels are full-time on hirefrom picking up the first set of components for the project until the final turbine has been installed. When using the barge-tug feeder solution, savings are about USD 13 million - over 25% less than when an American WTIV would do the transportation as well. For the purposebuilt and more expensive US-flag feeder ship, savings are considerably less, but still getting close to USD 5 million, or 10%.

Over time, the distance to shore as well as the size of the wind farms has gradually been increasing, and there are no signs that this trend will change in the upcoming years. A sensitivity analysis for both feeder alternatives shows the cost savings for larger projects that are further from port (see tables).

So far, perfect circumstances have been assumed in all above calculations, meaning that poor weather conditions are not taken into account. Wind and sea state may have a serious impact on the installation activities for a wind turbine. In all three scenarios, the WTIV as a self-elevating platform has to jack up next to the foundation, and jack down again after completion of the job. Any delay will cost additional charter hire for the ship. Bad weather will be especially costly in case of the US-flag WTIV. First of course because of the difference in day rate with the foreign-flag vessel. Secondly, there is no redundancy for the transportation stages of the installation cycle. Loss of valuable time may get bigger when the installation vessel has to commute to the marshalling port in challenging seas as well. Applying a pair of feeders can limit the additional expenses in such cases. Consequences of congestion are another aspect that has not yet been taken into account. This will depend on local circumstances. If a single marshalling port has to service multiple wind farms, delays as result of complications in logistics are very likely.

For the calculation, an installation time per turbine of 36 to 38 hours is applied, which includes all stages from port to offshore site. This estimate is based on the assumption of highest efficiency and flawless execution. In reality, the average installation time has been 3.1 days per turbine over the past 5 years.

The aforementioned potential cost savings during project development can drive a turnaround from a project financing perspective. The current investment cases for offshore wind farms are often quite vulnerable. Main focus is too much on installation and commissioning, with still rather theoretical and rough assumptions towards the future operations and associated expenses. The offshore wind industry has a limited operational track record, with very few wind farms having gone through the full wind farm life cycle. Although experience with long-term management of big-size turbines will increase over time, it is understandable that accurate OPEX projections are still difficult to make.

A comparison with onshore wind farms shows parallels, but there are also crucial differences. Recent experiences with smaller-size offshore turbines have shown that wear and tear at sea is more severe than on land, and replacement and repairs have to be done sooner after commissioning, and more often as well. For next-generation turbines, there is no operational track record yet, but it is fair to assume that

experiences will be the same given size and scale of this unknown territory. In addition, offshore repair jobs require more extensive planning and execution, and have an entirely different cost dimension. Underestimation of operational expenses will result in overly optimistic project return assumptions, like the internal rate of return (IRR). A worrying thing about the OPEX modelling is the assumption of uniformity. It is not a uniform annual amount, but starts relatively low and increases as the wind farm matures – unknown territory as there is no experience with large-size offshore wind turbines. If we combine this observation with earlier-than-expected repair and replacement works, then the outlook is quite gloomy.

At the moment there is an abundance of earmarked private and public green funds and oil & gas companies that are looking to step up their investments in renewable energy. This overwhelming demand for new sustainable investment opportunities pushes the IRRs further down in highly competitive tender and bidding processes. So instead of a necessary upward correction of the IRRs for future projects, returns are squeezed to the max.

The Dogger Bank wind farm may serve as an example for what seems to be the case with many offshore wind farms. It is the largest wind farm under construction, with a total capacity of 3.6 GW. One would expect positive effect of economies of scale, improving the IRR. In reality, the returns are meagre. Norwegian research from 2021 has indicated that the rate of return does not exceed investor Equinor's rate of return requirement, and that the project in fact is unprofitable if compared with alternative investment opportunities that the energy company hasaccording to University of Stavanger researchers. This may be a bold statement, but it shows that the financial headroom is limited, even for such a large-scale wind farm.

Since the publication of this Norwegian research, the investing environment for offshore wind farms has changed - for the worse. Recently project developer Avangrid announced that under the current power purchase agreements (PPA) at least one of its US windfarms is no longer viable and it will not be able to move forward if no amendments are going to be made. Key reasons are price increases for global commodities, sharp and sudden increases in interest rates, prolonged supply chain constraints, and persistent inflation, according to the company.16

As revenues are often locked in for many years through offtake agreements like PPAs and contracts-for-difference, there is hardly any upside. As a result of disappointing OPEX levels there can however be

a serious downside to the projected IRRs. Whether the prevailing IRR levels accurately reflect the risk/return profile, remains yet to be seen. Upside from higher revenues, like with commodity prices in the offshore oil & gas industry, is virtually non-existent for offshore wind. It is therefore important for the offshore wind industry to minimise expenses during the investment stage - as this is the phase when costs can best be managed and controlled.

Supply chain issues are not only a great concern for developers, but for the turbine manufacturers as well. GE Renewable Energy, Siemens Gamesa and Vestas all face more or less the same problems.

Even in such a rapidly growing market with a positive demand outlook for decades to come, the manufacturing companies have shown low, even negative EBIT and profit margins. One of the manufacturers for instance reports the Lost Production Factor (LPF), a measurement of potential energy production that is not captured by installed wind turbines. From 2010 to 2015 the percentage for extraordinary repair and upgrades dropped, from almost 5% to below 2%. After some 4 years of stable LPF the curve has started to increase gradually after 2017, back to currently over 3%. Main reason is the extraordinary repair and upgrade level. This is a noteworthy development.

One might expect that industry manufacturing leaders would manage to bring down the LPF when the technology matures and life cycle experience is increasing, but apparently the opposite is happening. Given the performance of the leading manufacturers from turbine sales (including warranties), no substantial price reductions or discounts are to be expected for wind farm developers any time soon.

So in order to curb the impact of disappointments in the future, developers have to find cost-effective solutions in other stages of the

wind farm investment. One place to look is among the generally accepted, and often costly industry practices - and thus create more headroom for future operational adversities. Improvements can be achieved during the installation and construction activities - and specifically in the port-to-site supply chain services.

Our high-level attempt to assess potential savings in this part of the supply chain for a US offshore project is quite promising. The numbers may not seem high compared to the total investment for a wind farm, but with IRRs hovering around 5% - before any unanticipated project cost overruns or disappointing wind farm OPEX levels - it is an important opportunity to consider.

What are the takeaways of this supply chain analysis? The focus has been on efficiency in the supply chain – from a cost and from a time perspective.

In order to achieve the ambitious global targets, the offshore wind industry will need a modern fleet of vessels that can handle the next generation of wind turbines. Shipowners face the challenge that turbine manufacturers keep raising the bar by increasing turbine size continually.

The shortage of tier-1 ships will translate into higher day rates. The lack of long-term charter contracts for newbuildings also keeps an upward pressure on day rates, as financing of the ships will be expensive.

To cope with the higher installation costs - now and in the near futurethe supply chain has to be optimised. Installation of wind turbines does offer opportunity for improvement.

How can time efficiencies be achieved?

• The crane vessel is key in the installation process. Keep it at the wind farm site - to avoid any cascading loss of time as result of transportation, port congestion and waiting on weather;

• Keeping her in the field means that the WTIV must be fed by transportation vessels like tug-barge combinations or purpose-built feeder ships;

• Distance is a factor, but the loading and offloading time of the transportation vessel is at least as important. If that is not done efficiently, the added value of the feeders suffers;

• There must be redundancy in port-to-wind farm transportation. By using a pair of feeder vessels per WTIV, flexibility is introducedand the total process optimised. This will result in better control of the installation time of the project and reduce execution risks.

Where in the installation supply chain can cost be cut?

• Transportation of the components into the wind farm is fairly straightforward work that can be done by vessels that are much cheaper than a wind turbine installation vessel;

• Planning can be vastly improved by using multiple feeders, but this comes at a price;

• State-of-the-art motion compensating equipment is indispensable for safe offshore transfer of the turbine components;

• The actual feeder vessel has to be the main cost saver. Using standard barges and tugs will have more impact than purpose-built feeders;

• US offshore wind will make a compelling case for the feeder model in protected markets. Initial calculations show ample room to save installation cost. Foreign-flag WTIVs and their US-flag feeder vessels should be an attractive and competitive alternative to US-flag WTIV's - allowing the ambitious installation targets to be met.

What impact can a feeder model have from a carbon emission perspective?

• Emission savings during installation. Relieving an installation vessel from its transportation duties by using tugs may save fuel consumption. Moreover, when using a pair of feeders, emissions can be cut more by applying slow steaming;

• Emission savings because of earlier fossil fuel replacement. An efficient feeder concept will result in earlier completion of the wind farm, and subsequent replacement of fossil fuels by wind energy.

• The supply chain needs more coordination and discipline. To make a viable business case, it will be all about total project cost - and the resulting LCoE. Sizing-up of turbines should not be a unilateral decision, but be done in concert with the installation contractors and shipowners - to avoid mismatches in demand and supply of tier-1 installation ships;

• Newbuilding projects should be backed by long term employment contracts to bring down finance costs, but this seldom happens. For new entrants to the market it is hard to raise the required financing if they are not backed by a strong balance sheet or support of shareholders;

• The prevailing industry preference for time charter contracts to cover project installation work slows down innovation and cost cutting efforts. The owners of installation ships are not really incentivised or rewarded to deliver earlier, and have every reason to stick with the conventional way of wind turbine installation practice;

• More transparency and standardisation will enhance the efficiency of the installation process. Currently, many developers and contractors are treating the supply chain as a black box, informing subcontractors on a need-to-know basis only. This is counterproductive, hampers innovation and increases installation cost.

Thanks to Hans Simons – HoTai Energy Consult.

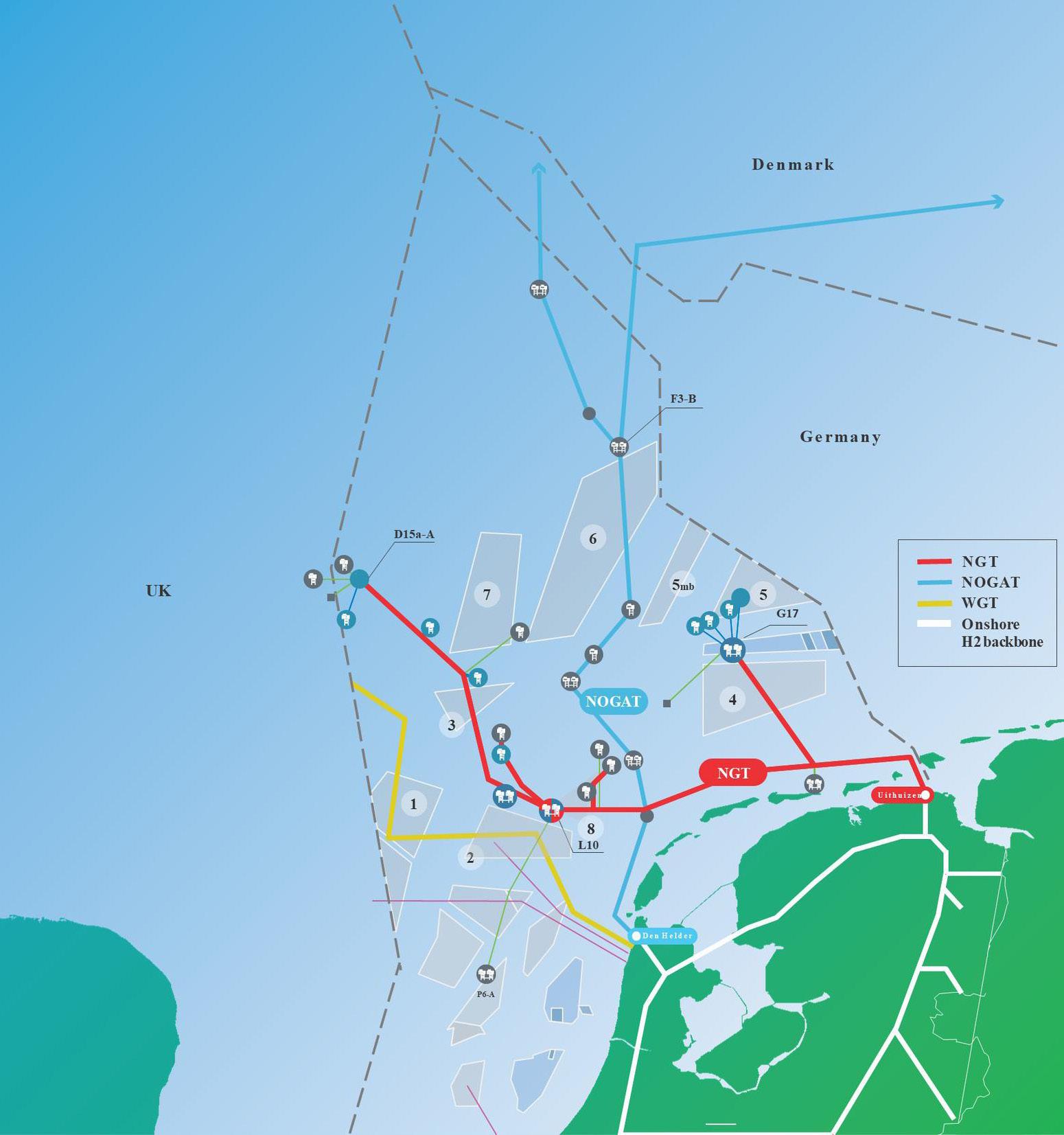

The ambitions for wind energy from the North Sea, and for hydrogen production, have recently been raised. By 2050, the goal is to have 70 GW of wind power generated in the Dutch sector of the North Sea.

Besides electricity, offshore green hydrogen production will play an important role for locations further from the coast, as indicated in the Parliamentary Letter Offshore Wind Energy 2030-2050 dated September 16th, 2022.