XXXX Inc. was founded in March 2007 and is headquartered in Richmond, BC, Canada. Known for its reliability and dedication, the company emphasizes professionalism, integrity, and honesty in its relationships with customers, suppliers, and employees. Since its inception, XXXX has significantly contributed to the interior design and construction of many properties for Canada’s largest developers. Specializing in kitchens and bathroom spaces, XXXX Inc. offers a range of services. The company sources high-quality, eco-friendly materials from trusted suppliers ensuring attention to detail and high standards throughout the design and installation process.

XXXX aims to establish its operation in the US market. As a subsidiary of XXXX Inc., we aim to benefit from parent companies' successful global business model and reputation to expand and grow in the US market. Our focus spans from single and multi-residential and commercial spaces.

XXXX will offer a range of high-quality services, including custom kitchen cabinets, built-in furniture, interior doors, and closets, all designed to enhance functionality and style. They also provide comprehensive renovation services and expert millwork for both commercial and residential projects, ensuring meticulous attention to detail and superior craftsmanship.

To address the operational requirements, XXXX is planning to appoint Mr. XXXX as the Chief Marketing and Operating Officer for its US subsidiary. Having been associated with the Company for years, Mr. XXXX’s wealth of experience and deep business understanding will play a crucial role in guiding XXXX to formulate effective strategies and establish operational stability in the US market. With Mr. XXXX at the helm in the US, the company anticipates maintaining significant growth. His unique combination of expertise, extensive experience, and proven operational achievements, along with his pivotal contributions to our company's evolution, positions him perfectly to lead and expand our operations in the US market.

This business plan is multifaceted: it supports Mr. XXXX’s L1 visa application, evaluates XXXX's growth potential, and serves as an operational blueprint to achieve our short-term and long-term goals of the Company.

The U.S. interior design industry's revenue grew at a CAGR of 2.9% from 2019-2024 and looking to maintain the CAGR over the next five years. The U.S. interior design market is growing due to increased consumer spending and a booming construction industry, offering significant opportunities for design firms. Rising per capita income drives demand for high-quality, personalized interior design services. Additionally, the trend towards luxury lifestyles and strategic opportunities like online presence and partnerships present lucrative prospects for the industry. The Global Interior Design market also projected to grow at a CAGR of 5.50% from 2023-2032. Growth is driven by increasing demand for sustainable and wellness-focused designs, along with biophilic and ergonomic solutions.

The establishment of XXXX will create numerous jobs and stimulate local economies, generate significant economic activity through large-scale projects, and introduce state of the art quality and unique solutions that can revamp your kitchen and bathroom spaces to the US market. Our commitment to high-quality service will enhance the lifestyle of the residents. Through the expertise of Mr XXXX and other Senior Management, we aim to enhance the skills of the local workforce.

Financial projections for XXXX indicate a consistent upward trajectory in the company's performance over the next five years. By the end of the third year, we expect to generate a revenue of USD 10.5 million and a net profit of USD 0.8 million. The fifth year is slated to achieve a net profit of USD 1.1 million. The subsequent graph outlines these financial objectives for the company over these five years:

XXXX Financial performance at glance

$16,000,000

$14,000,000

$12,000,000

$10,000,000

$8,000,000

$6,000,000

$4,000,000

$2,000,000

➢ For more detailed assumptions, please view the Financial Plan section of this Presentation.

XXXX Inc. was established in March 2007 by Mr. XXXX. The company is headquartered at XXXX, Canada. XXXX Inc. has over the years built a reputation for being a reliable and dedicated partner in interior design services, emphasizing professionalism, integrity, and honesty in our relationships with customers, suppliers, and employees.

Since its incorporation, XXXX Inc. has played a significant role in the interior design and construction of many properties for Canada's largest property developers. The company has completed nearly 15,000 kitchen and bathroom renovations, installed around 9,000 closets, and fitted 8,000 interior doors. Recently, XXXX has also initiated the renovation of numerous private residences.

The company provides interior design services, specializing in kitchens and bathrooms. This includes offering a wide range of services, including kitchen cabinets, built-in furniture, interior doors, renovations, and millwork for both commercial and residential projects.

Our team consists of highly skilled professionals in design and construction, allowing us to offer clients a complete on-stop solution to their requirements. Over the years, we have built strong, collaborative relationships with our clients, focusing on understanding their unique needs and developing highly customizable solutions.

XXXX Inc. sources materials from trusted suppliers, mainly in Korea, ensuring they are high-quality and ecofriendly. Core to our operations is ensuring attention to detail and maintaining high standards throughout the design and installation process.

Several factors contribute to XXXX Inc.’s success in the interior design industry. The company’s commitment to honesty and reliability has earned a trusted reputation. Our dedication to maintaining long-term relationships with clients and suppliers ensures continuous business growth. XXXX’s focus on high-quality, eco-friendly design and ability to effectively manage and control projects lead to superior results. Our strong team delivers exceptional services, including skilled designers, project managers, and installers.

To maintain the highest levels of professionalism, integrity, and honesty in our relationships with our customers, suppliers, and employees.

To be the most honest and reliable partner of choice.

To be the most trusted partner in the industry.

XXXX Inc. is expanding its operations, by establishing operations in the US market. The company will be incorporated as an LLC. Known for our dedication to quality and innovation, we are excited to establish a strong presence in the US, leveraging our extensive experience and expertise to deliver high-quality kitchen and bathroom spaces. Following the example set by our parent company, our goal is to create elegant, functional, and personalized spaces that enhance our clients' lifestyles.

As CEO of the parent company, Mr. XXXX brings extensive experience in interior design and construction management to the US entity. His proven leadership and innovative approach ensure high standards and operational excellence. Additionally, his deep industry knowledge and strategic vision position XXXX for significant growth and success in the US.

XXXX will greatly benefit from the extensive experience and expertise of its parent company. XXXX Inc.'s robust project portfolio and proven success provide a strong foundation for US operations. Alongside Mr. Jingmin Shu's expertise in the field, the parent company will offer full support through knowledge, resources, and best practices, ensuring that US practices align with XXXX's global standards.

• To establish XXXX as a leading provider of premium interior design solutions in the U.S. market.

• To achieve steady year-over-year growth in revenue and market share po th the next five years of operation.

• To develop and maintain long-term client relationships by delivering projects that exceed client expectations regarding quality and innovation.

• To expand and diversify our range of products and services by leveraging emerging design trends and technologies.

• To build a strong brand presence and thought leadership in the U.S. by employing various marketing techniques.

XXXX has secured a significant contract for the Concord Seattle House project with XXX’s partnership. Concord Seattle House project, involving the installation and management of kitchen cabinets, interior doors, and closets for 1131 units. This project is planned to start in mid-June 2024.

Successfully executing this high-profile project will build trust and credibility, establish XXXX's presence in the US market, and pave the way for future opportunities in the competitive interior design industry. This project will highlight XXXX's commitment to excellence and capability in handling large-scale ventures.

XXXX will offer a wide range of services, emphasizing the delivery of high-quality interior design solutions. We are dedicated to delivering personalized designs, high-quality materials, and expert installation services, along with comprehensive post-project support and ongoing assistance for our clients. Through collaboration, our clients benefit from a diversified skill set that is both transparent and adaptable to their needs. Some of our key offerings include the following.

Kitchen Cabinets

Built-in Furniture

Interior Doors

Closets

Millwork for Commercial and Residential

Renovation Services

We provide high-quality, custom kitchen cabinets that combine functionality with modern aesthetics, tailored to meet the unique needs of each client.

Our built-in furniture solutions are designed to maximize space and enhance the overall look and feel of interiors, offering both practicality and style.

We offer a wide selection of interior doors that add character and sophistication to any space, crafted with precision and attention to detail.

Our custom closet designs are both beautiful and efficient, helping clients organize their spaces in a way that reflects their personal style.

We offer expert millwork services for both commercial and residential projects, this includes trimming and molding, cabinetry, staircase, and other craftsmanship services ensuring high quality and attention to detail in every piece.

We will also provide comprehensive renovation services, transforming spaces to meet the highest design and functionality standards.

Delivering high-quality interior design solutions that incorporate the latest trends and technologies. By continuously innovating and maintaining high standards, XXXX ensures client satisfaction and sets itself apart from competitors.

Utilizing the extensive experience and expertise of XXXX Inc., the parent company, which has been a leader in the industry for over a decade. This support provides XXXX US with a solid foundation, access to best practices, and a wealth of knowledge to ensure successful operations.

1 4 3 2

Leveraging the expertise and experience of a skilled team of designers, project managers, and installers. A talented workforce ensures that projects are executed flawlessly, on time, and within budget, enhancing the company's reputation and reliability in the market.

Understanding clients' unique needs and preferences is key to building and maintaining strong, long-term relationships. Providing personalized and tailored design solutions that exceed client expectations fosters loyalty and repeat business.

❖ Finalize and establish operations in the US.

❖ Establish site office and warehouse space.

❖ Acquire all required work permits and licenses for operations.

❖ Purchase necessary tools and equipment for operations.

❖ Establish relationships with clients and gain a network with commercial entities and offices to get orders and execute them. Also, attend trade events to create strong networking among corporate and residential community

❖ Hire local skilled workers in various fields such as design, installation, construction, warehouse, and other operational aspects.

❖ Develop strong relationships with local suppliers, contractors, and clients to create a network for a strong supply chain.

❖ Develop and implement a robust marketing strategy to increase brand awareness and establish XXXX’s presence in the market.

❖ Commence work on the Concord Seattle House project, ensuring smooth execution and meeting the initial project deadlines.

❖ Secure additional contracts building a diverse and impressive portfolio of successful projects.

❖ Continuously adopt new technologies and innovative design solutions while staying updated on market trends and consumer preferences. This will ensure we remain ahead of industry trends and meet our clients' evolving needs.

❖ Achieve steady revenue growth and financial stability, ensuring profitability and reinvestment into the business for future expansion.

❖ Hire additional staff to support the company’s operations.

❖ Streamline operational processes to boost efficiency.

❖ Develop and implement Key Performance Indicators (KPIs) to monitor financial performance and operational success.

❖ Ensure consistent revenue generation and manage expenses effectively to maintain a solid financial position.

❖ Aim to become a top-tier interior designing company in the U.S. with a substantial market share.

❖ Continue to expand our team as per the business growth.

❖ Cultivate a company culture that attracts top talent, emphasizing continuous learning, innovation, and employee well-being.

❖ Expand service offerings per emerging trends and technologies based on market demand analysis.

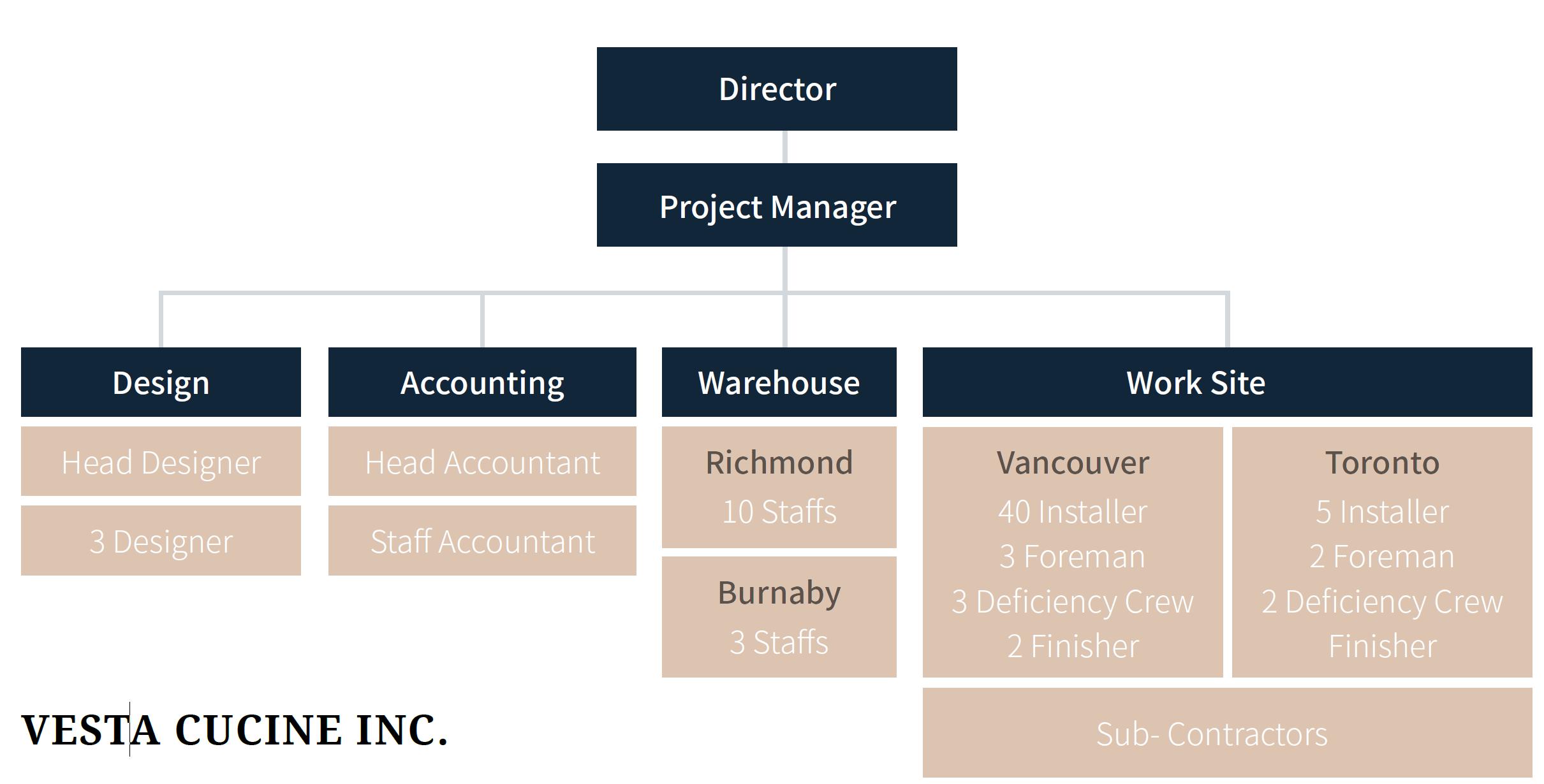

Below is the current organizational chart showcasing the Company's existing structure. Staff recruitment aligns with our comprehensive growth and expansion strategies

MR. XXXX

Chief Marketing and Operating Officer

Mr. XXXX will be the Chief Marketing and Operating Manager of XXXX., in the US bringing extensive experience in both marketing and operations within the interior design industry. Based in he has played a crucial role in driving XXXX Inc.'s marketing strategies and operational efficiency, ensuring the company's success and growth.

Educational Background

Professional Experience

XXXX Chief Executive Officer

Mr. XXXX is the Chief Executive Officer of XXXX Inc., bringing over 18 years of experience in the interior design and construction management industry. He has been instrumental in leading XXXX Inc.’s operations and strategic initiatives, ensuring the delivery of high-quality and innovative interior solutions.

1. ▪ Finalize the US office location in downtown Seattle and begin the process of acquiring necessary work permits for key team members.

2. ▪ Hire and onboard initial staff and establish relationships with local suppliers and contractors.

3.

4.

▪ Develop and finalize the detailed project plan for the Concord Seattle House project with Livart Furniture Canada Co. Ltd.

▪ Begin marketing efforts to build brand awareness in the US market.

▪ Conduct training sessions for new hires, focusing on XXXX’s standards and practices.

▪ Start preliminary design work for the Concord Seattle House project.

5. ▪ Finalize logistics and procurement plans for upcoming installations.

6.

7.

8.

▪ Commence installation and management work at the Concord Seattle House project.

▪ Monitor and ensure the project's progress aligns with the timeline and quality standards.

▪ Evaluate the initial phase of the Concord Seattle House project, addressing any issues or adjustments needed.

▪ Continue building client relationships and pursuing new business opportunities.

▪ Expand the marketing campaign to reach a broader audience in the US.

9. ▪ Conduct a mid-year review of all ongoing projects and operations and implement improvements based on the review findings to enhance efficiency and quality.

10. ▪ Attend industry events and networking opportunities to establish XXXX US as a thought leader.

11.

▪ Finalize plans for year-end project completions and client handovers.

▪ Prepare a comprehensive report on the first year's performance and lessons learned. 12.

▪ Complete the first year’s projects and milestones and monitor its progress.

▪ Set strategic goals and plans for the next year, focusing on further expansion and innovation.

Position Key Responsibility

Strategic Oversight:

▪ Ensure that XXXX aligns with the parent company’s strategic goals and objectives.

▪ Provide guidance and support to the US management team in implementing the company’s long-term vision and strategy.

Leadership and Governance:

▪ Serve as the primary liaison between the parent company and the US operations, facilitating effective communication and governance.

▪ Ensure that the US entity adheres to the company’s core values, policies, and standards.

Performance Monitoring:

▪ Regularly review and assess the performance of XXXX in the US, including financial performance, operational efficiency, and market growth.

▪ Set key performance indicators (KPIs) and ensure that the US operations meet or exceed these benchmarks.

Financial Oversight:

Chief Executive Officer

▪ Oversee the financial health of XXXX, including budget approvals, financial reporting, and cost management.

▪ Ensure that the US operations are financially sustainable and contribute positively to the overall profitability of XXXX Inc.

Resource Allocation:

▪ Approve and allocate resources necessary for the successful operation of XXXX, including capital investments, staffing, and technology.

▪ Ensure that the US entity has the support and resources needed to achieve its objectives.

Stakeholder Management:

▪ Maintain strong relationships with key stakeholders, including clients, suppliers, and partners, to support the growth and success of XXXX in the US.

▪ Represent the parent company in high-level meetings and negotiations to secure new opportunities and partnerships.

Mentorship and Development:

▪ Provide mentorship and professional development opportunities to the US management team to enhance their leadership capabilities.

▪ Foster a culture of continuous improvement and excellence within the US operations.

▪ Reporting to the CEO of the Parent Company: Regularly update the CEO of XXXX Inc. on the progress, challenges, and strategic plans of XXXX’s operations in the US to ensure alignment with overall company goals.

▪ Operational Strategy Development: Formulate and implement operational strategies to improve the efficiency, productivity, and profitability of XXXX’s US operations.

▪ Day-to-day Operations Management: Oversee the daily operations of the company, ensuring smooth execution of projects and adherence to quality standards.

▪ Staff Management: Lead and manage the operational team, including hiring, training, and performance evaluation, to ensure a motivated and skilled workforce.

▪ Budget and Financial Oversight: Monitor and manage budgets for various operational activities, ensuring cost control and financial efficiency.

▪ Project Management: Oversee project management activities, ensuring timely delivery, budget adherence, and high-quality outcomes for all projects.

▪ Supply Chain and Inventory Management: Manage supply chain operations, including procurement, logistics, and inventory management, to ensure the timely availability of materials and resources.

▪ Quality Control and Compliance: Implement and monitor quality control processes to ensure all projects meet XXXX’s standards and comply with relevant regulations.

▪ Process Improvement: Identify and implement process improvements to enhance operational efficiency and productivity, leveraging technology and best practices.

▪ Strategic Marketing Planning: Develop and implement comprehensive marketing strategies to enhance XXXX’s brand presence and market share in the US.

▪ Market Research and Analysis: Conduct thorough market research to identify trends, opportunities, and competitive landscape. Analyze market data to inform strategic decisions and improve marketing effectiveness.

▪ Campaign Management: Oversee the creation, execution, and performance of marketing campaigns across various channels, ensuring alignment with business objectives and target audience.

▪ Brand Management: Maintain and enhance the XXXX brand image by ensuring consistency in messaging, design, and overall brand experience.

▪ Digital Marketing: Lead digital marketing efforts, including SEO, PPC, social media, and content marketing, to drive online visibility and engagement.

▪ Public Relations and Communications: Manage public relations activities, including press releases, media relations, and event coordination, to boost brand awareness and reputation.

We intend to operate with the right team members based on their competency, creativity, qualifications, and experience in the interior design industry. We already have the expertise to train our staff and develop a team to meet the quality standard we aim to provide our clients.

Position Key Responsibility

Lead Designer

▪ Design Leadership: Lead the design team in creating innovative and functional interior design solutions. Ensure all designs meet client specifications and company standards.

▪ Project Collaboration: Work closely with project managers and clients to understand project requirements. Develop design concepts and plans accordingly.

▪ Quality Control: Review and approve all design work before it is presented to clients or implemented on-site. Ensure all designs are of the highest quality.

▪ Trend Analysis: Stay updated on industry trends and emerging technologies. Incorporate new ideas and techniques into design work.

▪ Client Presentation: Present design concepts and plans to clients. Explain design choices and modifications clearly and professionally.

▪ Team Development: Mentor and develop junior designers. Foster a collaborative and creative team environment.

▪ Inventory Management: Oversee the receipt, storage, and distribution of materials and products. Maintain accurate inventory records.

▪ Logistics Coordination: Coordinate with suppliers, transport companies, and project managers to ensure timely delivery of materials and products to project sites.

Warehouse Manager

▪ Warehouse Operations: Ensure the warehouse operates efficiently and safely. Implement processes and procedures to optimize material storage and handling.

▪ Quality Control: Inspect incoming materials and products for quality and accuracy. Address any discrepancies or defects promptly.

▪ Team Supervision: Lead and manage warehouse staff. Ensure all team members are trained and adhere to safety and operational standards.

▪ Reporting: Provide regular reports on inventory levels, order status, and warehouse performance to senior management.

▪ Site Management: Oversee daily operations at project sites and ensure all activities are carried out according to project plans and timelines.

▪ Team Coordination: Manage on-site teams, including installers and subcontractors. Ensure all team members understand their tasks and responsibilities.

▪ Safety Compliance: Ensure all on-site activities comply with safety regulations and protocols. Conduct regular safety inspections and training sessions.

▪ Issue Resolution: Identify and address any issues or challenges that arise on-site. Implement solutions to keep the project on track.

▪ Client Communication: Act as the on-site point of contact for clients. Provide updates on project progress and address any client concerns promptly.

The establishment of XXXX in the US will have multifaceted benefits for the U.S. economy:

• Job Creation

By establishing XXXX’s operations in the US, we will be able to create numerous job opportunities, ranging from administrative roles to specialized positions in design, installation, and project management. This will help improve employment opportunities and stimulate local economies.

• Economic Growth

The successful execution of large-scale projects, such as Concord Seattle Housing, will generate significant economic activity. This includes direct spending on materials and labor and indirect benefits to local businesses such as suppliers and service providers.

• Industry Expertise and Innovation

The management’s global experience in interior design and construction management will bring advanced practices and innovative solutions to the US market. This can improve industry standards and inspire local firms to enhance their operations, fostering a more competitive and dynamic industry landscape.

• Investment in Sustainable Practices

By emphasizing sustainable and eco-friendly design solutions, the company will contribute to the growing demand for green practices in the US. This aligns with broader environmental goals and can help reduce the carbon footprint of construction projects.

• Community Development

XXXX's high-quality, functional, and aesthetically pleasing spaces will improve living and working environments. This can enhance residents' quality of life and contribute to community development and satisfaction.

• Knowledge Transfer and Training

Our commitment to training and development will equip the US workforce with valuable skills and knowledge. This will not only benefit XXXX but also enhance the overall skill level of the local labor market, making workers more competitive and versatile.

The U.S. interior design market is experiencing significant growth, with a steady upward trajectory expected. This growth is driven by increased consumer spending on home improvements and enhanced living spaces, presenting lucrative opportunities for interior design companies to expand and capture market share.

The boom in the U.S. construction industry, encompassing residential, commercial, and infrastructure projects, is driving demand for interior design services. This surge provides a robust pipeline of opportunities for interior design firms to contribute to creating functional and aesthetically pleasing spaces.

The rise in per capita income in the U.S. is not just a statistic but a powerful driver of change in the interior design market. It's leading to a significant increase in consumer spending on quality interior design services, with consumers now more willing to invest in premium materials, unique design concepts, and personalized services. This shift in consumer behavior is creating a demand for diverse and high-quality design solutions.

A growing trend towards luxurious lifestyles is evident, with wealthy individuals and high-net-worth households seeking unique, high-end interior design solutions. This trend extends to commercial properties, where businesses aim to create sophisticated environments, presenting opportunities for firms offering luxury and innovation.

Strategic growth opportunities include developing an online presence and e-design services, forming partnerships with real estate developers and retailers, and specializing in niche markets like luxury or sustainable design. By focusing on these areas, interior design firms can achieve sustainable growth and capitalize on the dynamic market opportunities in the U.S.

XXXX Inc. is looking to attract commercial and residential clients who are willing to revamp their kitchen and bathroom space. We recognize that clients are emotionally attached to their homes and strive to deliver services that not only meet but exceed their expectations. We take immense pride in completing large-scale projects with top-notch customer satisfaction and long-term affiliations. Our target market includes:

XXXX specializes in high-end residential projects, providing premium kitchen cabinets, built-in furniture, closets, and interior doors. Our services will cater to homeowners seeking customized, eco-friendly design solutions that enhance their living spaces with both functionality and aesthetics. Additionally, we will target the luxury market, offering top-quality, custom-made design solutions that reflect clients' status and tastes, while also appealing to environmentally conscious homeowners with a focus on sustainable designs.

or commercial clients, XXXX will offer comprehensive millwork and renovation services tailored for office spaces, retail stores, and other commercial properties. Our extensive portfolio with multi-residential developers will showcase our strong presence in largescale projects. The company will collaborate with property developers, business owners, and prominent urban developers, focusing on creating functional and visually appealing environments for commercial use, reinforcing our reputation in the commercial sector.

The Interior Design market was valued at USD 130.5 billion in 2022 and is projected to grow to USD 211.29 billion by 2032, with a compound annual growth rate (CAGR) of 5.50% from 2023 to 2032. Key growth factors include the increasing need for sustainable and wellness-focused designs driven by a greater consciousness of climate change and a desire to reduce the environmental footprint of interior spaces. This trend is coupled with a growing demand for designs integrating health and wellness elements, such as biophilic design and ergonomic solutions, promoting physical and mental well-being.

Segments Insight

By End-Use: Residential and Commercial segments.

By Decoration Type: New and Renovation Project

By Regional: North America, Europe, Asia Pacific, and the Rest of the World Market Segmentation

Market Size ($ Billion)

By End-Use: The Interior Design market is divided into residential and commercial segments. The residential sector is the largest, driven by urbanization, middle-class growth, and a focus on home aesthetics and convenience. Online platforms showcasing design inspiration have made interior design services more accessible and desirable, boosting investment in personalized and beautifully designed homes.

By Type of Decoration: The market is also segmented by decoration type, including renovation and new projects. The renovation segment is the largest, as there is a growing need to rejuvenate aging urban spaces. Renovations are seen as a cost-effective way to update interiors, driven by evolving demands, technological advancements, and design preferences.

Regional Insights: The Asia-Pacific Interior Design market is expected to lead, fueled by rapid urbanization, a growing middle class, higher

incomes, and modernization efforts. China holds the largest market share, with India being the fastest-growing market. North America has the second-largest share, supported by a strong economy and interest in sustainable and wellness-oriented designs. Europe is expanding the fastest due to construction growth, urbanization, tourism, and demand for luxurious interiors.

The current performance of the interior design industry in the U.S. has been driven by economic performance and construction activity, with residential and commercial markets being vital. Positive consumer spending trends and a robust housing market have offset weaker activity in the nonresidential sector, benefiting independent designers as homeowners invest more in interior design. Industry revenue has grown at a compound annual growth rate (CAGR) of 2.9%, reaching $25.9 billion. Despite pandemic disruptions, residential designers thrived due to increased housing starts and homeownership, while commercial designers faced challenges from economic uncertainty and reduced corporate investments.

The projected performance of the U.S. interior design industry will continue to be influenced by economic factors and construction activity. Stabilizing inflation and anticipated growth in consumer confidence will benefit designers, but high interest rates will pose challenges by cooling the housing market and stunting commercial construction. With more time spent away from home, consumer interest in revamping living spaces will be muted, and uncertainty about in-person office work will deter corporate office design investments. Despite these hurdles, the industry is expected to grow at a modest CAGR of 2.9%, reaching $29.8 billion over the next five years, driven by positive consumer trends and solid microeconomic indicators.

Key Market Statistics:

Employees:

The industry employs 177,000 people, with a 3.2% CAGR from 2019 to 2024. Employment is projected to grow slightly faster at 3.3% CAGR from 2024 to 2029, a response to the increasing demand for skilled designers. This optimistic projection reflects the industry's readiness to adapt and grow.

Businesses:

There are currently 160,000 businesses in the industry, which grew at a 6.1% CAGR from 2019 to 2024. The number of companies is expected to grow at a 4.9% CAGR from 2024 to 2029, indicating a competitive and attractive market. This exciting market landscape presents numerous business opportunities for potential investors and leaders.

Profit:

The industry profits are currently $2.7 billion, with a 4.7% CAGR from 2019 to 2024. This strong profit growth highlights effective cost management and high demand, ensuring continued profitability.

Profit Margin:

The profit margin is 10.6%, increasing by 0.9 points from 2019 to 2024. Maintaining and potentially increasing this margin will be crucial for sustained profitability amid economic uncertainties.

Wages:

Industry wages total $4.8 billion, with a modest 0.9% CAGR from 2019 to 2024. Wage growth is expected to accelerate to 3.2% CAGR from 2024 to 2029, reflecting increased investment in skilled labor to meet growing service demand.

The demand for custom software development in the U.S. is influenced by several key determinants. We have identified a few critical drivers as follows:

Economic Conditions: The overall state of the economy plays a significant role in driving demand. During periods of economic growth, higher disposable incomes and increased consumer confidence lead to more spending on interior design services. Conversely, during economic downturns, discretionary spending decreases, reducing demand.

Housing Market Activity: The health of the housing market directly impacts the demand for interior design services. Increased home construction, sales, and renovations boost demand for interior design services. Conversely, a slowdown in the housing market can decrease the need for these services.

Consumer Preferences and Lifestyle Trends: Shifts in consumer preferences and lifestyle trends significantly influence demand. Trends such as the desire for sustainable and wellness-focused designs and personalized and customized interiors drive higher demand for innovative interior design solutions.

Technological Advancements: Integrating new technologies in homes and workplaces increases demand for interior design services that incorporate smart home systems, energy-efficient solutions, and advanced digital design tools. Consumers are attracted to designs that offer both aesthetic appeal and functional technological benefits.

Urbanization and Demographic Changes: Urbanization and demographic changes, such as an increasing number of young professionals and retirees, affect demand. Urban areas often demand more interior design services as more people move into cities and seek to personalize smaller living spaces. Additionally, aging populations may require design modifications for accessibility and convenience.

Government regulations and building codes impact the interior design industry. Compliance with safety, environmental, and accessibility standards is mandatory. Changes in regulations can lead to increased costs and necessitate operational adjustments for interior design firms.

The level of per capita income significantly affects the interior design industry. Higher per capita income increases discretionary spending, enabling more consumers to afford interior design services. Conversely, lower per capita income can restrict consumer spending on non-essential services like interior design.

Fiscal policies, interest rates, and financial regulations affect the industry by influencing consumer spending and investment in construction and renovation projects. High interest rates can dampen housing market activity and reduce demand for interior design services, while favorable financial policies can stimulate growth.

Growing environmental awareness and the demand for sustainable practices impact the interior design industry. Clients increasingly seek eco-friendly materials and energyefficient designs. External pressures from environmental advocacy groups and regulations drive designers to adopt sustainable practices, affecting material choices and design approaches.

▪ High-Quality Standards: XXXX is renowned for delivering high-quality, innovative design solutions, setting them apart from competitors.

▪ Strong Parent Company Support: Leveraging the experience and resources of XXXX Inc. provides a solid foundation for success and growth in the US market.

▪ Established Client Relationships: Existing partnerships and a proven track record with large-scale projects enhance credibility and client trust.

▪ Niche Market Operation: Operating in a niche segment by focusing on interior design for kitchens and bathrooms, increasing specialization and expertise.

▪ Expertise of Mr. Shu: His extensive knowledge and experience in the industry add significant value and strength to the company's operations.

▪ Current Project Handling: The ongoing Concord Seattle House project not only provides a base foundation for operations but also ensures strong cash flow and operational stability for the US company.

▪ Global Market Presence: Already established in the global market, their support in operations will be a strength for XXXX in establishing US operations.

▪ Growing Demand for Interior Design: Increasing trends in home renovation and commercial space optimization present significant market opportunities.

▪ Sustainability Trends: Rising demand for eco-friendly and sustainable design solutions can open new market segments.

▪ Technological Integration: Leveraging advanced design technologies like VR and AR can enhance client experiences and streamline operations.

▪ Urban Development: Ongoing urbanization and new construction projects in major US cities offer numerous opportunities.

▪ Market Entry Challenges: Despite already being involved in a new project establishing the operations would be a major challenge. It will be critical that we identify customer tastes and trends in the US market for our services through appropriate research and development.

▪ Brand Recognition: Building brand recognition in the US market will take time and significant marketing efforts.

▪ Resource Allocation: Initial stages may strain resources, both financial and human, as the company sets up its operations and workforce.

▪ Economic Uncertainty: Economic fluctuations can impact client spending on interior design services.

▪ High Competition: The interior design market in the US is highly competitive, with numerous established firms.

▪ Regulatory Changes: Potential changes in regulations and building codes can affect operations and increase compliance costs.

▪ Supply Chain Disruptions: Dependence on international suppliers for materials can lead to delays and increased costs due to supply chain disruptions.

The U.S. interior design industry is highly competitive, influenced by a variety of players and factors. This market is characterized by the presence of both established firms with extensive design expertise and innovative newcomers bringing fresh approaches to interior solutions. Companies that stand out in this field successfully blend trustworthiness, in-depth industry knowledge, outstanding client support, and competitive pricing strategies.

For XXXX, the competition arises from other firms specializing in high-end interior design. Many of these competitors have established their market positions through their proven expertise, creative acumen, and reliable reputations. Despite the competitive environment, the growing demand for personalized and innovative interior solutions invites new entrants to the market. Therefore, it is essential for XXXX to continually sharpen its specialized skills, unique service propositions, authenticity, and client-focused approach to sustain and enhance its market presence in this dynamic industry.

XXXX’s direct competitors will be other interior designing companies in the Settle US.

NB Design Group has been creating refined, meaningful interior design for our discerning clientele for nearly 30 years. As a premier Seattle interior design firm, we embrace a process that incorporates multitude of elements essential to experiencing a building or space as a complete environment.

We specialize in full-service interior design, including custom furniture, lighting and art procurement/installation. Our project resumé ́ includes both new home construction and renovations of residential interiors of all sizes, small to large. NB Design Group also has design experience in boutique hotels, luxury yachts, private aircraft, and small commercial offices.

Responsive to our clients’ vision, we are committed to design that expresses the interrelationships between architecture and place, space and form, color and materials, economy and integrity.

At Board & Vellum, we talk a lot about being your advocate. But what does that even mean? It means we aren’t in this business to feed our egos — giant egos are definitely not our thing. We are in this for you. We’re here to collaborate on something awesome, a space that you our clients and community — will love and consider as part of the fabric of your life and neighborhood.

XXXX is strategically positioned to address the evolving needs of the interior designing industry. Our competitive advantage is built on a robust foundation of expertise, innovation, and high-quality products and services. Here is how we will establish itself as a competitive force in the market: Our management team will leverage the global experience gained from our parent company, providing a significant advantage in establishing our market presence. Mr. XXXX as CEO and Mr. XXXX, COO bring years of industry experience and a proven track record. Their expertise in project management and client negotiation ensures effective management of large-scale projects.

Already established a strong supply chain globally enabling us access to some of the finest materials and supplies. This will be a massive competitive advantage.

The Concord Seattle House project is a significant milestone, showcasing XXXX's ability to secure and manage largescale ventures. This high-profile project with over 1131 units enhances the company’s credibility in the US market. It underscores XXXX's reliability and capability.

XXXX emphasizes comprehensive training programs to ensure its staff meets industry standards. This commitment to professional development results in a highly skilled workforce. It enhances overall service quality and client satisfaction.

Innovation and technological advancement are central to XXXX’s strategy. The company leverages the latest design technologies, such as VR and AR, to enhance client experiences. This focus on cutting-edge solutions ensures modern, functional, and aesthetically pleasing design services.

The marketing objectives of XXXX are integral to the company's overarching goals, focusing on operational excellence, customer engagement, brand development, credibility, and growth in the interior designing industry. Our marketing strategy is crafted to attract a diverse range of clients, with principal targets including:

Increase Brand Awareness: Establish XXXX as a high-end interior design firm in the US by implementing targeted marketing campaigns, leveraging media exposure, and participating in industry events to enhance visibility and recognition.

Expand Market Share: Capture a market share of the high-end residential and commercial interior design markets by offering unique, high-quality, and customized design solutions that cater to diverse client needs.

Generate Qualified Leads: Develop and execute effective lead generation strategies to attract potential clients, focusing on personalized marketing approaches and leveraging digital channels to reach a broader audience.

Build Long-Term Client Relationships: Foster strong, lasting relationships with clients by consistently delivering exceptional service and maintaining high standards of quality and innovation, encouraging repeat business and referrals.

Showcase Project Successes: Highlight successful projects, such as the Concord Seattle House, through detailed case studies, client testimonials, and visually appealing portfolio showcases to demonstrate expertise and reliability.

Promote Innovative Design Solutions: Emphasize XXXX’s commitment to innovation by incorporating cutting-edge technologies, sustainable practices, and the latest design trends in marketing materials to attract clients seeking modern and eco-friendly solutions.

Drive Customer Engagement: Increase customer engagement through interactive and personalized marketing initiatives, such as virtual design consultations, immersive VR experiences, and tailored content that resonates with the target audience.

XXXX’s marketing strategy focuses on building a strong brand presence and generating awareness through a multi-channel approach, including digital marketing, social media, and traditional advertising. We will leverage SEO, PPC, content marketing, and social media platforms to drive traffic and engage with potential clients. Traditional advertising and public relations efforts will enhance our visibility, targeting high-net-worth individuals and businesses. High-quality content and email marketing campaigns will demonstrate our expertise and nurture leads. By creating a cohesive and integrated strategy, XXXX aims to establish itself as a top choice for interior design services in the US.

XXXX’s sales strategy centers on building strong client relationships and converting leads through a consultative approach. Our sales team will use CRM software to manage leads and interactions, ensuring a seamless process. Strategic partnerships with real estate developers, architects, and contractors will secure referrals and collaborative projects. Virtual design consultations and advanced technologies will enhance the client experience. By providing excellent post-project support and prioritizing relationship-building, XXXX aims to achieve consistent sales growth and expand its market presence.

Key Highlights of our advertisement channels include the following

Channel Strategy

▪ Search Engine Marketing (SEM): Utilize Google Ads to target keywords related to high-end interior design, custom kitchen cabinets, and residential and commercial renovations. This will help capture potential clients actively searching for these services.

Digital Advertising

Content Marketing

▪ Social Media Advertising: Leverage platforms like Instagram, Facebook, and LinkedIn to run targeted ads showcasing XXXX’s portfolio, client testimonials, and design projects. Use visually appealing content to attract high-net-worth individuals and businesses.

▪ Display Ads and Retargeting: Implement display advertising on design and architecture websites and use retargeting ads to re-engage users who have visited the XXXX website but haven’t converted.

▪ Blog Posts and Articles: Publish informative blog posts and articles on XXXX’s website covering design trends, project showcases, and industry insights. Promote these through social media and email newsletters.

▪ Video Content: Create and promote video content, including project walkthroughs, client testimonials, and behind-the-scenes footage of the design process. Share these videos on YouTube, social media, and the company website.

▪ Press Releases: Distribute press releases announcing new projects, company milestones, and significant partnerships to industry publications and local media.

Public Relations

Event Sponsorship and Participation

Direct Mail

Influencer Partnerships

▪ Media Features: Secure features and interviews in design magazines, newspapers, and on relevant blogs to highlight XXXX’s expertise and successful projects.

▪ Industry Events: Sponsor and participate in design expos, trade shows, and architecture conferences to network with potential clients and industry professionals.

▪ Workshops and Webinars: Host workshops and webinars on interior design trends and tips, positioning XXXX as a thought leader and attracting potential clients.

▪ Brochures and Catalogs: Send high-quality brochures and catalogs showcasing XXXX’s services and past projects to targeted residential and commercial prospects.

▪ Collaborate with Influencers: Partner with influencers in the home decor and real estate niches to promote XXXX’s services through their platforms, reaching a broader audience.

The parent company will invest USD 0.5 million through to establish its operation in the US, these funds will be utilized mainly for initial inventory and working capital to support initial company’s operations.

Revenue growth displays a positive trend, starting with a 19% increase in Year 2 and peaking at a 69% CAGR by Year 4, demonstrating significant business expansion and market penetration.

The net profit margin shows stability around 8-9% for most years, although there is a slight dip to 7% in Year 5, indicating a need for careful cost management and operational efficiency.

Cash flow growth is exceptionally strong, particularly in Year 2 with a 113% increase, ensuring substantial liquidity to support ongoing operations and investments, although the growth rate moderates to 35% by Year 5.

Under the leadership of Mr XXXX, XXXX aims to recruit the following roles, which will be integral to the company’s success.

$16,000,000

$14,000,000

$12,000,000

$10,000,000

$8,000,000

$6,000,000

$4,000,000

$2,000,000

$-

$35,000,000

$30,000,000

$25,000,000

$20,000,000

$15,000,000

$10,000,000

$5,000,000

$33,247,716 $-

$5,001,670

$24,694,165

$16,785,751

$10,640,630

01 Market Research

02 Market Research

04 Competitor

https://www.marketresearchfuture.com/reports/interior-design-market-11246

https://www.ibisworld.com/industry-statistics/market-size/interior-designers-united-states/

https://www.nbdesigngroup.net/company-profile

05 Competitor https://www.boardandvellum.com/about/

06 Warehouse Rent

07 Office Rent

08 Tax

https://www.loopnet.com/search/listings/warehouses/seattle-wa/for-lease/

https://www.commercialcafe.com/office/us/wa/seattle/#:~:text=Find%20your%20best%20Seattle%2C%20WA,of%20%2443.13%20per%20squar e%20foot.

https://www.investopedia.com/terms/c/corporatetax.asp#:~:text=In%20the%20U.S.%2C%20the%20federal,%2C%20subsidies%2C%20and%20o ther%20practices.

09 Images https://www.freepik.com/