2024 OLIVE OIL PROCESSING WOR K SHOP

18-19 April 2024

LIMITED PLACES BOOK NOW!

2 Day Workshop, Rio Vista Olives, Mypolonga, SA.

Thursday, 18 April

9.30am – 6.00pm: Principles and practices

Evening: Networking dinner

Venue: Rio Vista Olives

Friday, 19 April

8.00am – 1.00pm: Practical processing session and tasting of trial oils 1.00pm – 2.00pm: Lunch

Venue: Rio Vista Olives

Cost: $275 levy payers/AOA members; $375 others

Visit www.olivebiz.com.au/events or contact secretariat@australianolives.com.au, ph: 0478 606 145. Registrations close 11 April 2024. Numbers limited – register now, don’t miss out!

Incorporating Australian Olive Industry Journal

Published by the Australian Olive Association Ltd

Publisher Australian Olive Association Ltd

Executive Editor

Michael Southan ceo@australianolives.com.au

Managing Editor

Gerri Nelligan editor@olivegrower.com.au

Advertising

Gerri Nelligan editor@olivegrower.com.au

Production

Sandra Noke production@olivegrower.com.au

Subscriptions

A one-year subscription (four issues) is: Aust $44 (AOA member discount rate $40), NZ $56 (ONZ member discount rate $52) and international $100. Visit www. olivebiz.com.au to subscribe.

Additional copies $15 each (International + postage). Email editor@olivegrower.com.au to order.

Circulation & Advertising Enquiries editor@olivegrower.com.au

Contributions

Articles and other contributions are welcome and will be published at the discretion of the editor. Photographs are best received as high resolution jpg files via email, and as separate attachments not embedded.

Printing

Lane Print & Post

Cover: The Australian International Olive Awards (AIOA) is becoming one of the most respected competitions on the global olive oil stage, with the stringent practices followed during the judging process just one of the reasons.

Coded samples provide total anonymity of product and entrant, while annual preevent training and careful selection ensure judging teams with a wide breadth of experience across varieties and styles.

Mine inquiry hears of health and EVOO reputational risks

Throughout 2023 we reported on the new heavy metal mine proposed, and subsequently approved, for development at Lue in the Mudgee region of NSW. The mine is a major concern for our industry, as there are 44,400 olive trees planted over 336 hectares within the local government area which are at very real risk of contamination by lead and other toxic substances.

Hope for a possible future revision of the mine approval was raised by an Upper House inquiry into ‘Current and potential impacts of gold, silver, lead and zinc mining on human health, and land, air and water quality in New South Wales’, held from August to October last year.

But when the inquiry’s report was tabled on 15 December, it became clear that the state’s mining activities are not going to be stopped.

Report findings

The inquiry committee made a number of findings, starting with the significant financial and economic benefits the mining industry provides to the state, and the importance of metals and minerals mining.

It stated that “the Environment Protection Authority (EPA) operates under a regulatory framework which generally includes a strong toolkit with which to regulate pollution incidents” and has worked for many years with the Cadia mine site, having issued “maximum infringement notices a number of times as well as court proceedings”. Also that “a range of ongoing issues has been problematic for the environment and community and provide important information which can assist regulation into the future.”

It noted, however, that the maximum penalty of $15,000 “is often inadequate and can fail to act as a deterrent to large or multinational companies”.

Concerning contamination, it found that “water metal level testing conducted by the EPA concludes drinking water near the Cadia mine is within the National Safe Water Guidelines” but that “there may be a concern for the quality of water within tanks throughout the state”, however “recent soil testing conducted by the EPA drew the same results as soil testing conducted prior to Cadia's construction.”

It also believes that the regulatory bodies work across the mining sector “are fundamentally sound”.

Recommendations

The committee also made 11 recommendations, covering:

• strengthening EPA community engagement and communication;

• increasing the maximum penalty for environmental offences; publicly accessible air quality monitoring at all mining operations in NSW;

• wide-scale resident testing and related public health responses; a statewide education campaign on care and maintenance of rainwater tanks, and safe use of water;

• an EPA review of clean air regulations; mandating that environmental impact assessments for proposed mine developments include baseline data of heavy metals in surrounding water tanks, creeks, farm dams and groundwater;

• industry safety and health representatives on metalliferous mine sites;

• NSW Resources Regulator resourcing;

• funding of EPA environmental health experts for community outreach; and

• observation of and rectification of issues around the Broula King Gold Mine site.

Disappointing

It's a little too little for AOA CEO Michael Southan, who had represented local growers and the Australian olive industry during both the Lue mine consultation process and the parliamentary enquiry.

“It is disappointing that the final report recommendations were not tough enough to make the process of new mine approvals far more stringent than is currently the case,” Southan said.

“None of the mining operations have been suspended until serious potential health risks have been addressed or environmental concerns adequately responded to. It’s clear that the whole mining approval process is in need of updating and modernising to address the significant number of public concerns and issues.

“It’s also highly disappointing from an industry point of view, given the evidence that the AOA - and others - submitted on the likelihood of lead contamination in groves.

“We’ll keep in contact with the region’s growers and continue to provide whatever support we can as the Lue mine project progresses.”

More information

The full inquiry report is available to download on the Parliament of NSW website. Go to www.parliament.nsw.gov.au and search for Mining Impacts Inquiry.

The Government Response to the inquiry report is due on 15 March 2024.

There’s also detail on the Lue mine, along with opposition information and a link to all proposal and approval documentation, at www.lueactiongroup.org

Med Diet holds ‘Best Diet’ title for seventh consecutive year

The annual US News Best Diet rating for 2024 was announced in January and we’re all cheering at the results, with the Mediterranean diet taking the top position from a long list of contenders. With olive oil and plant-based eating at its base, the traditional European eating regime once again took the #1 spot in the Best Diets Overall category, making it seven years out of seven as the survey’s outright winner.

The Mediterranean Diet also took the top spot in six of the other nine categories and ranked second in two others, with its final result listing an impressive argument for why it’s undoubtedly the ‘Best’ way to eat:

#1 in Best Diets Overall

#1 in Best Diets for Bone and Joint Health

#1 in Best Family-Friendly Diets

#1 in Best Heart-Healthy Diets

#1 in Best Diabetes Diets

#1 in Best Diets for Healthy Eating

#1 in Easiest Diets to Follow

#2 in Best Plant-Based Diets

#2 in Best Weight-Loss Diets

#18 in Best Fast Weight-Loss Diets (tie)

Diet, not ‘dieting’

As in previous years, the only area in which the Med Diet rated poorly was fast weight loss - not a disappointing result for a ‘lifestyle’ eating regime recognised for its long-term benefits around health and longevity, rather than as a dramatic ‘dieting’ tool.

Pros and cons

The expert review panel credited the Med Diet’s longevity at #1 to that lifestyle approach, describing it as “healthy and delicious, offering variety and flexibility.” In fact they call it “a prime example of the fact that dieting can taste good.”

They listed a bunch of positives around the diet, including that it is: nutritionally sound; includes diverse foods and flavours; involves no counting of carbohydrates, points or calories; is rich in filling, high-fibre foods; no foods or food groups are off-limits (although moderation is, of course, a part of any healthy eating pattern!); and that it has scientifically proven health benefits.

The only negatives raised were ‘tedious portioning, meal planning or preparation’ (compared to the average actual ‘diet’?) and that the diet lacks in-depth nutritional guidance.

Healthy fats the key

Given the importance of olive oil as one of the Med Diet’s key ingredients, it’s not surprising that the other top-ranking diets for 2024 have a lot in common.

Best Diets: Mediterranean Diet Scorecard

Overall 85.1/100

Fast Weight Loss 12/100

Weight Loss 82/100

Easy to Follow 100/100

Healthy 100/100

The

DASH (Dietary Approaches to Stop Hypertension) Diet and the Mind Diet came in #2 and #3 respectively: both place a similar emphasis on ‘healthy eating’, in particular an increase in plantbased foods and the consumption of ‘healthy fats’, along with a decrease in saturated fats.

And the use of olive oil is specified in all.

The ranking process

THE

STARK L — 37mm cutting capacity, powerful 21.6v Lithium Ion Cordless plug in battery power, Pole mountable, available with 2 or 3 batteries as required. Ideal for Olive and fruit orchards.

T-Fox —

Now in its 14th year, the annual US News Best Diets listing ranks current popular diets across 11 categories, rating their effects on aspects including heart health, short- and long-term weight loss, ease of following, safety and nutrition.

For the 2024 listing, 43 popular diets were reviewed by the US News team, with 30 chosen to be evaluated for the ranking. In-depth profiles for each were prepared, outlining how the diet works, whether its claims are realistic, associated possible health risks and the practicalities of living on the diet. The profiles also included scientific studies supporting any health benefits.

The 30 diets were then thoroughly evaluated by a panel of 43 health experts, including medical doctors, registered dietitian nutritionists, nutritional epidemiologists and weight loss researchers, and ranked them across the 11 categories.

‘Overall’ panel considerations

When considering the Best Diets Overall category, the panelists considered:

• nutritional completeness,

• health risks and benefits, long-term sustainability, and

• evidence-based effectiveness.

We reckon that makes it a ‘no-brainer’ as to why the olive-oil rich Med Diet keeps coming up #1.

Source: www.usnews.com

STARK L — Telescopic Extension Pole - 1.5mtr to 2.3mtr, Carbon Fibre material, easily gives you the option to transform your STARK L into a tool that will prune high up into the canopy of your trees.

ALICE 58 Premium –Market leading harvester with improved speed options through 58v Brushless Motor, lighter and longer lasting parts, lighter Carbon Fibre Poles as well as optional Aluminium Pole alternative. Can be run off 12v Battery or new 58v Backpack alternative.

For more information and the nearest stockist in your area, contact us on P: 08 8351 8611

1 Marlow Road, Keswick 5035 South Australia

E: info@eclipseenterprises.com.au W: www.eclipseenterprises.com.au

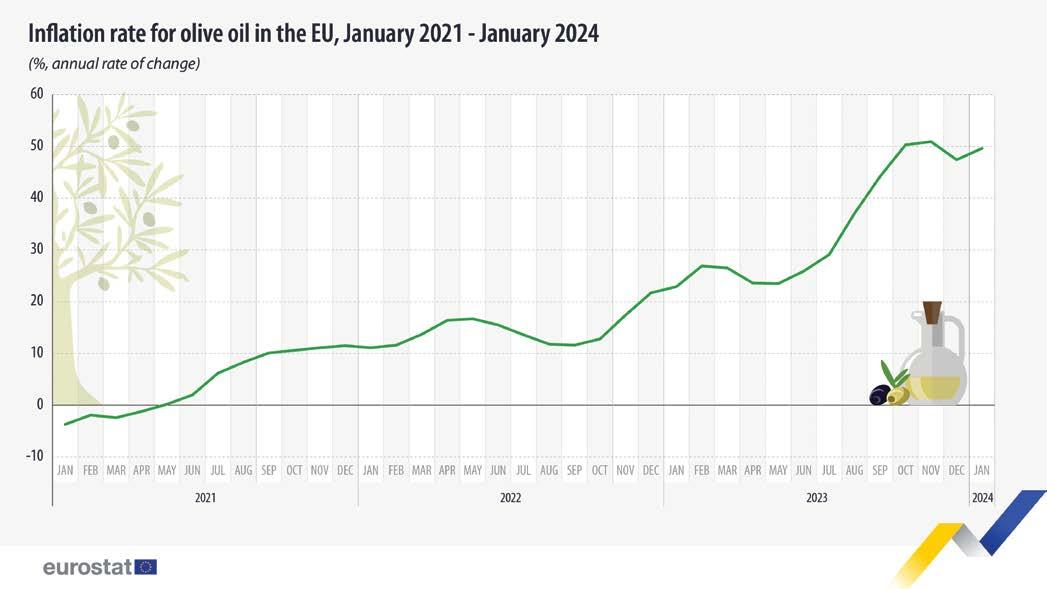

EU olive oil price up 50% in one year

We’ve all heard the reports of rapidly increasing prices for olive oil in Europe and now it’s official: the EU’s statistical office, Eurostat, has published figures showing that in January 2024, the price of olive oil in the EU was 50% higher than in January 2023.

The price of olive oil skyrocketed in the second half of 2023 with a 37% increase in August (compared with August 2022). This trend accelerated in September (+44%) and October (+50%).

The peak in the annual rate of change occurred in November 2023 (+51% compared with November 2022). In December, there was a small slowdown, as the prices were 47% higher (compared with December 2022).

Wide variance between countries

In January 2024, all the EU countries reported an increase in the annual inflation for olive oil.

The highest increase was recorded in Portugal (+69% compared with January 2023), followed by Greece (+67%) and Spain (+63%).

In contrast, the smallest price increases were recorded in Romania (+13%), Ireland (+16%) and the Netherlands (+18%).

Source: Eurostat, the statistical office of the European Union - www.ec.europa.eu/eurostat.

Lisa leaves legacy of action on AOA Board

After 20 years on the steering team of the industry’s representative body, Lisa Rowntree has vacated her seat on the Australian Olive Association (AOA) Board.

Lisa was one of the most influential members of the national organisation during the industry’s formative years, and leaves behind a legacy of action which has seen the Australian olive industry grow and thrive. In particular, Lisa led a number of milestone proactive initiatives around both structural progression and marketing, including the instigation of the industry R&D levy and the resoundingly successful Fresher Tastes Better and Everyday promotional campaigns.

Early industry involvement

Lisa has been part of the industry since 1998, when she and her husband Jim established their Longridge Olives grove at Coonalpyn in South Australia’s Murray-Mallee region. The super-high density grove now has more than 87,000 trees, producing award-winning EVOO and Agrumato flavoured olive oils.

The Rowntrees were among the first phase of the modern industry’s entrants, at a time when olives were being heavily promoted as a new crop for Australian horticulture. Active from the outset, they joined the state industry organisation, Olives South Australia (OSA), and Lisa became a member of its board and President for 10 years. She represented OSA on the AOA Board for a number of years, then in 2003 became the AOA Board’s South Australian Director.

Board and CEO positions

Lisa remained on the AOA Board following the state/national organisational restructure and in 2011 became CEO, a position she held for six years. Handing over the reins in 2017, Lisa stayed on

Paul Miller, AOA Director and International AdvisorFocus, belief and a long-term view

“Lisa’s list of achievements is impressive and I have been lucky enough to work with her on most of these. Lisa’s focus on the industry and belief that for any of us to succeed the industry must succeed has driven a remarkable amount of time and effort spent on OSA and AOA.

“And all this while raising four children with Jim, also these days several grandchildren, and with Jim establishing Longridge at Coonalpyn, while establishing and managing several other olive oil farms along the way.

“Olive trees are long lived. As we know from experience the olive business requires a long-term view and Lisa has that and more. She helped to save the AOA when the industry was struggling, inspiring others to continue their involvement and support.

“She endured the difficult times and celebrated the successes, none better than the 2002 Adelaide AOA conference that Lisa and OSA organised, which kind of put Australia on the international olive map.

“Lisa’s strong views and skilled leadership also aided the transition of the AOA from (naturally) a kind of club in the early days to what these days is a professional industry body.

“The Rowntrees are a remarkable family. I hope that they can see the impact they have had in the industry and that all that time Lisa spent at her desk - with a myriad of other things happening around her in their always welcoming and often chaotic home - has been worthwhile.

“Lisa, I salute you.”

Michael Southan - AOA CEO and OliveCare® Administrator

“Lisa has been the foundation for what the AOA and Australian olive industry is today. Many of the programs which underpin Australia’s rapid evolution as a high-quality producer of extra virgin olive oil have occurred under Lisa’s realm at the AOA.

“It was clear to me very early on when I started in the role that Lisa had been instrumental in developing the industry, through establishing the Australian Standard for Olive Oil and Olive Pomace Oil, establishing a best practice code which is now OliveCare®, and taking the health benefits of fresh Australian EVOO to consumers. This impacted firstly to encourage more Australians to consume EVOO as opposed to other seed and vegetable oils, and secondly to encourage Australians to buy local fresh EVOO in preference to imported product.

“Lisa also worked with exporters in opening new markets for Australian products, and did all this while raising a family and working in the family business.

“Many thanks, Lisa, for your dedicated commitment to the industry and growers. Without your efforts the AOA would not be what it is today!”

for a year to support new incumbent Greg Seymour as the AOA secretariat. She then returned to the AOA Board as one of its Large Enterprise Group (LEG) Directors, providing input via that role from January 2018 until her resignation late last year.

Always willing to play her part in the industry, Lisa has now rejoined the board of Olives SA.

Successful marketing activities

Throughout that time Lisa has been part of and/or driven many of the AOA’s major initiatives, while also involved in the ground-floor running of the organisation.

While all have had positive impact, Lisa said the work she holds highest are the marketing activities undertaken by the AOA on behalf of the industry.

“The Fresher Tastes Better campaign went straight out to the consumer with information about how crucial freshness is to both the flavour and health benefits of olive oil,” Lisa said.

“It was a great success. Over 80,000 taste tests were completed, which helped consumers realise that freshness is important and that buying locally-produced EVOO is the way to ensure you are getting fresh EVOO. I helped instigate the campaign and it is one of the things I’m most proud of.

“Also the Everyday campaign, which saw marketing of Australian EVOO directly to consumers across Australia via social media.

“Before that there’d been no cohesive industry marketing of Australian EVOO products, and we recognised that we needed to help connect people to certified EVOO growers and their products, whilst at the same time really pushing the “fresher is better” and “buy local” messages.

“The messaging reached a lot of consumers, and continues to do so via the Everyday website and FaceBook page.”

Supermarket testing

The testing of supermarket oils - and the impact of the results - is another initiative Lisa is proud of.

“Run by then Code of Practice Administrator Peter McFarlane, the program involved independent testing of a range of supermarket oils - both imported and Australian - purporting to be olive oil or EVOO,” Lisa said.

“It was done annually and the results were significant, driving home

that at that time you couldn’t trust the imported oils to be what was on the label. Many were saying ‘extra virgin olive oil’ when they were anything but, which meant consumers were paying top dollar and getting ripped off.

“It was exposed by Choice and on A Current Affair, and the clear message was that you can get fresh EVOO produced here in Australia which will be better for your health and taste buds.

“Then roll in what Boundary Bend were doing with communicating the health benefits, the public education by Dr Joanna McMillan and

the Fresher Tastes Better campaign, and consumers really got that message.

“We realised that to change attitudes around imported vs local EVOO, there had to be industry-led, consumer-faced messages going out. So that’s what we did.”

Code of Practice and Australian Standard

The Australian Olive Industry Code of Practice (now OliveCare®) is yet another ‘big project’ on Lisa’s achievement list. While originally started many years ago by others, it was finalised and activated by Lisa and then AOA President Paul Miller. The current program is the result of revisions by Lisa and Peter McFarlane, and led to the creation of the AOA’s labelling guide and other quality management and compliance documents.

“The Code of Practice also demonstrated to government that olive growers themselves were prepared to abide by standards, which allowed us to continue fighting for a national Australian Standard that we hoped would become law.

“As CEO I was behind Leandro (Ravetti) and Paul as they fought long and hard to make this a reality, doing the background work as they handled the technical side.”

National olive industry levy

The instigation of the national olive levy is up there on the list too, Lisa said.

“The impetus for the levy was that we had to move from RIRDC (Rural Industries Research and Development Corporation), which had been doing the olive R&D, as we were no longer a new and emerging industry.

“I had introduced a voluntary levy in South Australia, which laid the groundwork and showed that we could do it nationally. That compulsory national levy gave us money for industry R&D that we didn’t have before and enabled us to get so much important work done – like the supermarket testing program, the national field day programs and all of the IPDM resources.

“It made sense that there was a national levy which was going to benefit everyone who was selling olive oil and, while there were some

who initially didn’t want to pay the levy, they’ve now benefited from the work that was done.

“When I became CEO that was one of the things I wanted to do, and it’s been very satisfying to see what we’ve been able to achieve from the levy.”

… and much more

“I was also proud that we got all the state bodies to join the AOA as branches. All were struggling to fill roles and we were doubling up on things unnecessarily. It’s also made us more harmonious as an industry.

“Then there were the conferences that I organised, and so many small things that you do when you’re running a not-for-profit industry organisation - basic things, like creating artwork because there was no money for graphic designers. I pretty much used every skill I could muster.

“But my biggest skills set was setting direction and charting a course for the industry, then finding the right people and hitting some of those goals that we set out to achieve.”

Positive industry position

And achieving those goals has put the industry in a far more positive position, Lisa said.

“We’ve been through some really tough times over the years but I think the industry is in a very comfortable place now,” she said.

“There is a group of committed growers in the industry that have a lot of skin in the game, the price for oil is good, and most people can sell what they’ve got. We’ve also managed to successfully knock back issues like the use of the word ‘Agrumato’ for our co-processed flavoured oils.

“That’s why it’s important to support industry bodies: the moment something negative happens - like the Agrumato trademark attempt - we have to be ready with an industry voice. And governments listen to an industry representative body more than they’re going to listen to individuals.

“The fees to join the AOA aren’t high and the benefits of being part of it far outweigh the cost.”

AIOA judging unpacked

The Australian International Olive Awards (AIOA) is becoming one of the most respected competitions on the global olive oil stage, increasingly attracting both international entries and attention. Its high product quality standards are one reason, as are the stringent practices followed during the judging process, and the calibre and dedication of the judges themselves. We spoke with AIOA organiser and Chief Steward Trudie Michels about the judging team, how they’re chosen and how the judging process is organised.

OG&P: How do you find and choose the AIOA judges?

TM: Our international panels are sourced through existing industry relationships and networks created over many years. They are all well-credentialled olive experts with experience in olive oil quality and organoleptic assessment, who share the AIOA’s commitment to a thoughtful, nonbiased judging process based purely on merit.

And the feedback we get from them is that they consider it an honour to be

Standardised judging criteria

invited to judge in such a highly respected competition.

For the Australian panels, one major source is the state competitions. They have a pool of local judges and then, for the calibre of our competition, we pick from judges or associate judges who have already done at least two or three state-based competitions - the WA Olive Competition, the Sydney Royal or the Royal Adelaide. They also come via recommendations from the head judge and other senior judges, who have worked with them at other competitions.

Individual and comprehensive sets of ‘Judging Criteria’ and ‘Sensory Assessment’ forms have been created for use in the extra virgin olive oil competition, flavoured oils competition and table olive competition respectively. This makes the judging process as streamlined and methodical as possible across all three competitions.

For accuracy and consistency, all entries need to be judged across the globe using a standard approach. This limits personal bias and provides score and tasting comments that are clear, fair, and comprehensive.

It is important for the reputation of the Australian International Olive Awards that each entry is evaluated on its merit (not compared) and that all judges assess each oil or table olive systematically, so all attributes are recorded thoroughly and professionally.

The use of the AIOA’s custom forms across all judging panels and competitions promotes this process and detail.

A lot of the judges are producers - or were and have now retired - and many of them are on the NSW DPI or Modern Olives sensory panel, or trained with them. A good percentage of them have been judging olive oil for a long time, so they bring years of experience into the room.

Between them, our judges bring a breadth of experience across varieties and styles. The international judges are more familiar with styles from their regions and countries, and have a keen interest in exploring the different flavour profiles and characteristics

of Australian olive oils.

And while we’re a ‘new world’ country on the global olive oil stage, that brings its own benefits. Each European country has its own common varieties but here we have a good selection of those, so our judges regularly get to taste a wide range of varieties. That means Australian judges have a really good level of experience across the varietal spectrum.

OG&P: How are they trained?

TM: I work with the chief judge and get an idea of where each judge is at. Depending on their level of experience and knowledge, they will be assigned either an associate judge or full judge role. Then all, no matter what their level of experience, have to do the annual judges training.

It’s very comprehensive and takes quite a bit of time: two separate packs of oils and olives are sent out, a month or so apart, and the judges need to taste and create comprehensive evaluation notes for each sample using the official AIOA assessment criteria and forms. Not just give it a score but a proper full judges’ description, covering all the elements from aromas and flavours to harmony and complexity.

So the training is in both organoleptic assessment and also in creating really good notes of that assessment - one part is tasting, the other is communicatingbecause the judges’ feedback is such an important part of the AIOA competition. And even the most senior judges do that training each year.

The results are evaluated and feedback

Australian International Olive Awards Judging Principles

1. Confidentiality

The ONLY individuals that know the identity of entries (until the release of results) are the chief steward and stewarding team. All stewards complete a signed confidentiality agreement beforethey can officiate in the competition. Judges, who may also be entrants, are NEVER able to judge their own entry, nor influence another judge who has been given the task of doing so. All judges and stewards must also complete and sign a conflict-of-interest and full disclosure document before they can be involved in the competition.

2. Fairness

A formal standardised judging kit is express couriered to each of the international panel leaders. This provides the panels with everything they require for systematic and ordered judging.

Oils are packed in dark glass and labelled with a single code. This ensures the identity of every entry is not known.

3. Independence

The chief steward will always be independent of the competition and its entries. Stewarding is conducted under the auspices of an independent head judge/chairperson who is not an entrant.

4. Accountability

is provided, and from that we make our decisions about which judges to invite that year, and the structure of the various panels.

OG&P: How do you choose the panels?

TM: First of all, we look at who can do what. It’s an expensive exercise flying people in, providing accommodation, hiring the venue, etc, so ideally we want judges who have the skills and knowledge to judge all competitions - EVOOs, flavoured oils and table olives.

Then we look at personality, making sure that there’s a strong senior judge, and where possible an associate, in each one, and that we know the teams will work well together. It’s particularly important that there’s a very strong senior person in each panel, as we need to have a panel leader who can

Judges are briefed by the head judge before the commencement of judging and reminded of their responsibilities. A panel leader with international experience is appointed for each panel, which will consist of at least three experienced and fully trained judges.

Any judge found not adhering to these requirements will be relieved of their judging duties immediately.

5. Teamwork

Initially each judge independently assesses the entries. The judges then discuss the entry and their score. In consultation with the panel leader, an agreed final score and comment is reached.

If agreement cannot be reached, the panel leader will seek the opinion of the head judge, who, following tasting and consultation with the panel leader and chief steward, will allocate a final score.

manage both the process and the group. They also need to be confident enough to make the final call at those times when there are differing opinions, and that might be to call the head judge over to assist.

The chief steward and chief judge then monitor the judging process and how it’s going throughout each day.

We also mix up the panels up each day so judges get experience working with more of the group. That really helps with that ongoing learning process, and also allows us to have the best panels for the various competitions - e.g. table olives, EVOO, etc.

OG&P: What about allocating entries to the judging panels - is that done randomly, for fairness?

TM: No, just the opposite: I sit down and allocate who is judging what oils or olives. The most important element there is ensuring that no judge EVER judges their own products.

I go through every oil and every panel and cross reference them. It’s all done by hand, and takes a long time. I allocate oils to each panel and then cross-check the panel members with the entries: if there are any conflict issues, I swap out oils to other panels.

OG&P: So does a judge ever judge their own products?

TM: No judge ever judges their own oil or olives. We make absolutely sure of that.

We do have producers judging in the competition, and that’s an incredible resource. They add an extra element of experience and knowledge to their judging panels because they are producers: they make olive products and they know what’s caused some of the characteristics - both good and problematic. Their input adds more to the tapestry of the overall judging panel.

With the AIOA, there are multiple checks in place to make sure they never judge their own, ensuring there’s absolutely no producer bias in any of the process:

1. All judges (and stewards) must declare any conflicts of interest prior to the selection process.

2. All entries are blind-tasted: coded, prepoured - no product packaging is in sight at all for identification - and codes are changed for Best in Class and Best in Show judging for extra anonymity.

3. Exhibits are allocated manually to panels, ensuring no judge assesses own products.

4. Judges have no access to the stewarding room, even visual. If their own products (judged by others earlier) are in Best in Class and/or Best in Show line-upsusually assessed by all judges - producer judges must leave the room before the samples are even brought in.

5. No results are divulged until individual results are sent out in early October and judges are like any other entrant: they only find out their results when everyone else does. Even the chief judge doesn’t know until the presentation dinner.

OG&P: How are the entries prepared for judging?

TM: As soon as they enter the competition system they are assigned a code. This code is used for the entire competition and only when all judging is completed and results are collated does that code revert back to the entry name.

So even Kent (Hallett, senior steward) doesn’t know whose is whose; and the head judge definitely doesn’t know. When the panels get their oils or olives to taste, each sample has just one code. Then when the Best in Class and Best in Show entries are judged,

each is assigned another code.

So there’s a total clean slate identificationwise for Best in Class, and then another new code for Best in Show, ensuring total anonymity throughout the judging process. That extra step guarantees there’s no pre-judged biased - for example, if they remembered they really liked a particular coded oil.

So when the judges go home, they have no idea about the identity of any oil they’ve assessed. Even if they were to write the codes down and then reference the results book, the entries have reverted back to the brand names for the results listings, so there’s no way to identify them.

Total team transparency

It sounds a bit 007 but Michels said it’s all part of ensuring transparency and respect for the judging process.

“We also have everyone involved in the judging process sign a non-disclosure statement, and also complete and sign a conflict-of-interest declaration,” she said.

“Everyone has to do that - judges, stewards, the people inputting the results data - and not just about what they produce but any affiliations with brands - e.g. they might do marketing, or consulting via blending or processing. That information all has to be formally declared during the team selection process.

“It’s an important element of the work which goes into making sure the judges are the right people for the job and that the exhibits are treated with complete fairness and full attention to detail.

“We put a huge amount of work into that, and it’s the foundation of the AIOA’s highly respected judging process.”

More information:

www.internationaloliveawardsaustralia.com.au

Judges’ perspectives

We were also keen to hear about the process from the judges’ perspective, so we asked several of them why they do it and what they get out of being an AIOA judge.

Jill Clemenson, Victoria:

“Why? I love the industry, especially the sharing aspect. It doesn’t have the competitive element of most other industries. And the AIOA is about learning and sharing, spreading the knowledge around so others benefit from it.

“I’m very appreciative of the learning journey that I’ve been able to be on and part of that is tasting – the more I taste, the more I learn. Every judging day is a school day: different flavours, different textures, different varieties, different uses. I get a lot from that and I love it.

“The AIOA is an international platform which is available to us. The opportunity to judge lots of oils from different places is a rare thing, and trying new varieties I haven’t tasted before is a joy. They’re all blind tasted but you get something on the palate that you know is different, and that’s really exciting.

“So it’s also partly selfish - I benefit from it and learn from it.

“It’s an honour to be asked to judge. And there are lots of people who would love to take that seat and be selected, so it’s an honour I don’t take lightly.

“Every competition is important to get right but this is an international competition and you’re very much accountable for its credibility. That’s

important, and everyone there understands the gravity of what they’re doing.

“I put a lot into it and I like to think I’ve done the very best job I can.”

Ali Tanner, New South Wales:

“It’s a follow-on from being on the Australian Olive Oil Sensory Panel in Wagga. I’ve been a member of that for a decade, training monthly and assessing olive oil, and judging turned that into a community service.

“I started at the Golden Olive Awards, then the Sydney Fine Food Awards and when an invitation to judge at the AIOA came I saw that as a real honour. The competition can’t happen without solid judges and I think it’s important that people get the opportunity to have their oils assessed and get recognition for their efforts.

“We know how much effort and investment goes into producing quality olive oil and when people come away with a really positive result, that’s really important to the growers – and to the

Australian industry. We help open people’s eyes to locally-produced EVOO, as customers see that medal and it makes the product special.

“Judging at the AIOA is also an opportunity to extend my skills. We put a lot of time and energy into ensuring the training opportunities are addressed with dedication, and there’s a lot of effort that goes into preparing the in-depth descriptors for each entry. That’s not always easy, especially with very complex or closed oils, but at each competition you learn more about oils and varieties and the way to describe things; and you gain insight from other judges through both their skills and experiences.

“And honestly, I do it because I enjoy it. I’m not a producer, so the chance to network and learn more about the industry and production is great, as is meeting fellow judges from all over the world. I’ve found myself mixing with a different crowd, and learning from each other is fabulous.”

Toshiya Tada, Japan:

“It is a great pleasure to judge in olive oil competitions, especially the Australian contests, which are very interesting.

“Australian oils have developed into much more diverse products and the judges are very open to new styles and learning. They get excited when they taste something they haven’t tasted before: they share it among the panels, bring it to the attention of the head judge, so everyone can have a look at it as a learning exercise.

“The judges are all eager to learn and they want to judge. They volunteer their time – some even take annual leave so they can be there. That shows their dedication.

“And they complement each other’s skills.”

2023 Australian International Olive Awards winners

2023

Adrian and Jo Doyle, Arthur's Grove - Bowelling, WA

• Best WA EVOO - Arthur’s Grove Manzanillo Reserve Champion Robust EVOO - Arthur’s Grove Manzanillo

• Gold - Arthur’s Grove Manzanillo

2023

• Gold - Wilson Family Olives Olive D’Or EVOO Picual Hojiblanca Gold - Wilson Family Olives Olive D’Or EVOO Picual Coratina

• Silver - Wilson Family Olives Olive D’Or Extra Picual

Silver –

2023 2023

2023 2023

• Champion Spanish Varietal - Grassy Spur Olives

• Reserve Champion Italian Varietal – Grassy

• Gold - Grassy Spur Olives Picual

• Gold - Grassy Spur Olives Coratina Gold - Grassy Spur Olives Frantoio

• Gold - Grassy Spur Olives Premium Blend

• Gold - Grassy Spur Olives Lemon Agrumato 2023

Nick and Carla Aoun, Snowy Mountain Estate - Numeralla, NSW • Snowy Mountain Estate EVOO2023 Australian International Olive Awards winners

®

Emilia and Robert Armstrong, ALTO Olives – Crookwell, NSW

• Best Table Olive of Show, Commercial Volume – ALTO Olives Misto

• Best Table Olive of Show, Southern Hemisphere - ALTO Olives Misto

• Best Australian Table Olive - ALTO Olives Misto

Champion Medley of Olives - ALTO Olives Misto

• Gold - ALTO Olives Vividus

• Silver – ALTO Olives Robusts 2023

• Highest Phenolic

•

Daniela de Moraes Aviani, Attache (Agriculture) Brazil, for Estância Das Oliveiras – Viamão, Brazil

Champion Robust EVOO - Estância Das Oliveiras Blend

Los Dos

• Gold - Estância Das Oliveiras Blend Los Dos

• Silver - Estância Das Oliveiras Frantoio

• Bronze – Macaw Creek Signore 2023

Marvick Native Farms tops AIOA field with natural flavoured ‘medicine’

The belief in “food as medicine” sits well alongside olive production, as does an appreciation for natural flavours. And when Marvick Native Farms owners Mark Andrew and Vickie Shina combined those elements as part of their business model, they laid a path to one of the Australian olive industry’s highest accolades.

The WA native fruit producers wowed the judges at the 2023 Australian International Olive Awards with their Marvick Native Farms Kaffir Lime flavoured olive oil, awarded a soaring score of 94/100. The Gold medal-winning oil was named Champion Agrumato Olive Oil, before also taking the major trophy for Best Flavoured Oil of Show, Boutique Volume.

“Processing small amounts enabled us to work out the best combinations - olive variety, and citrus-to-olive ratio - for each individual native citrus variety.”

The Gold was just one of five medals awarded to Marvick Native Farms’ Agrumato-style flavoured oils in the 2023 competition, along with a Silver for its Red Centre Lime and Bronze medals for its Pearl Finger Lime, Sunrise Lime and Jade Finger Lime olive oils.

Background

The Marvick Native Farms story started in 1999, when Mark and Vickie bought a 45-hectare property at Regans Ford, 100kms north of Perth in the WA wheatbelt. It was the first step in a venture

which combined their respective careers as a chef and a registered nurse with a dream to produce delicious food with health benefits.

Mark had spent 25 years in restaurant kitchens, starting as one of the first apprentice chefs at the Melbourne Hilton and going on to hold a number of head chef positions. Trained in French cuisine, he transitioned into the use of Australian native ingredients as they became more readily available in the early 1990s.

Vickie had completed her nursing training and travelled for many years, working as a registered nurse until moving into medical sales. In 1996 a work transfer saw them move from Melbourne to Perth, opening the door to their subsequent ‘tree change’ and the establishment of Marvick Native Farms.

Complimentary interests

Vickie had grown up in rural NSW with her family growing their own fruit and vegetables, and had a strong belief in the medicinal value of food, while Mark’s interest in Australian native fruit flavours had increased even further. They delved into the data on the health benefits of native fruits and it stacked up, so they developed the Regans Ford property and became part of the establishing Australian native food industry.

Scientific planning

They planned well, ensuring that the property they purchased had a water licence and looking carefully into crop options before they planted.

“We originally looked at the quandong industry but then took the opportunity to be part of the first growers of the newly-released CSIRO finger lime hybrids, which are immune to the scorching summers and chilly winters in our region,” Vickie said.

“We were keen to really explore them, so our first planting was 300 Red Centre Limes, 300 Outback Desert Limes, 300 Sunrise Limes and 100 Rainforest Pearl Finger Limes.

“As one of only five commercial Australian bush lime growers in Australia, we now tend to around 4,000 trees producing five different varieties of bush lime: ruby limes, golden limes, finger limes, and two types of desert lime.”

Value-adding

Like many small food production businesses, it was a slow slog to make an impact with their products.

“It was hard selling these strange fruit that have actually been here for a millennium: there was a lot of footwork and only small orders in the early days. It’s lucky we didn’t give up our day jobs,” Vickie said.

Marvick Native Farms’ 2023 AIOA results

Marvick Native Farms Kaffir LimeGold, 94/100

• Best Flavoured Oil of Show, Boutique Volume

• Champion Agrumato Olive Oil

Marvick Native Farms Red Centre LimeSilver, 80/100

Marvick Native Farms Pearl Finger Lime - Bronze, 71/100

Marvick Native Farms Sunrise LimeBronze, 70/100

Marvick Native Farms Jade Finger LimeBronze, 68/100

“So we started to value-add with jams and relishes, which we’d sell at farmer markets, and it was at this time Mark started looking at the olive oil Agrumato process. The native citrus marmalades produced completely different flavoured products than traditional citrus, so we thought we could also use the native citrus to produce different flavoured citrus olive oils.”

“There was a lot of footwork and only small orders in the early days. It’s lucky we didn’t give up our day jobs.”

Perfect match

And luckily, they met the right people at the right time to make it happen.

“In 2010 we were introduced to the Gantz family, who ran Jumanga Olives just north of Perth. They had a small grove with a variety of olives and a processing unit that did small volumes,” Vickie said.

“This was a relationship made in heaven: Tom (Gantz) was doing a PhD in olive oil production, Mark and Tom had a variety of olives and fruit to play with, and we could process small amounts. It enabled us to work out the best combinations - olive variety, and citrus-to-olive ratio - for each individual native citrus variety. And luckily our Kaffir Lime, Sunrise, Red Centre and Finger lime varieties all ripen during the olive harvesting season, so production timing worked.

“Demand for the products grew slowly. Customers were not aware that Australia has native citrus and were unfamiliar with the flavour, plus we were only producing small quantities for farmer markets. But eventually sales began to increase, with product uptake in restaurants, tourism outlets and specialty gourmet shops.”

Growing partners

More than a dozen years later Marvick Native Farms still doesn’t grow olives, remaining focussed on the native citrus fruits which go into the co-processed blends.

The olive side of their flavoured oil production now comes from Regans Ridge, an organic olive grove seven kilometres from Mark and Vickie’s farm. Their 18,000 trees are all oil varieties, and provide

a ‘fruit salad’ of geographical origins and flavour profiles - Frantoio, Leccino, Koroneiki, Barnea and Picual – ideal for matching and blending with the various native fruits. Given Marvick’s success with Agrumato olive oil production, it’s obviously another match made in heaven.

“We’ve been working with Regans Ridge since 2018,” Vickie said.

“We were able to buy their olives and utilise their new processing facility, which had been rebuilt after a devastating tornado storm

in 2014. This provided easy transport of fresh fruit to the processing plant and a wide varietal olive blend selection, and allowed us to increase our production volume.”

… and growing the market

Their creative approach has also seen Marvick Farms increase their product range in recent years, and the quality of their productionalong with the uniqueness of their products - has enabled them to greatly expand their market.

“While Indigenous Australians have used bush medicine for thousands of years, scientists are just realizing the incredible power and potency of bushfood, which offers many of the healing properties of pharmaceuticals without the side effects,” Vickie said.

“We are proud to be a part of an industry that’s promoting healing through food, and excited to be playing a part in taking native superfoods to the world.

“Desert limes have a very short harvesting season, so we collect over six tonnes of fruit over the course of 10 days. As they also have a short shelf life, the harvest is frozen before being shipped throughout Australia and across the globe for use by distilleries, cosmetics companies and the pharmaceutical industry.

“And on the culinary side, proponents of ‘bush tucker’ love to use Australian native citrus to add flavour to fish, elevate gin and tonics, and bake into desserts. As more people discover them, they’re increasingly realising how versatile they are.

“We’ve also created a range of value-adding products in addition to the flavoured olive oils, including our own relishes and marmalades. They taste great on toast, added to marinades or shaken into a cocktail.

“And to make the most of the short shelf life, we also produce freeze-dried fruit powders and chips. They allow us to make the most of the crop and mean people can access the unique flavours of Australian native fruits all year round.”

Unique blends

Mark and Vickie believe there are a number of elements responsible for the success of their flavoured olive oils, with uniqueness and freshness at the top of the list.

“We are the only producers in the world using Australian Native Citrus varieties. That provides a great interest factor, which is then

backed up by the unique flavours of our oils,” Vickie said.

“The freshness of the fruit at production time is also important: being able to utilise fresh fruit picked at the same time as the olives means the citrus flavours are really intense and clean. The range of fruit varieties we grow, and the ability to match them with the various olive fruit flavours, is another major factor.

“And by selecting Australian plant varieties that don’t require chemical sprays, we are committed to producing ‘clean crops’ – a factor which we believe is reflected in the high quality of our products.”

Acknowledgement and promotion

Like all boutique grower-producers, Mark and Vickie have put years of time, money and effort into creating Marvick Native Farms and its range of products. So it’s great to hear that winning Best of Show at the 2023 Australian International Olive Awards has provided some payback for those efforts, both personally and for their brand and business.

“Getting major awards in a competition like the AIOA is acknowledgement of all the hard work that’s gone into Marvick, and particularly into the flavour development,” Vickie said.

“And it’s been really positive for the business. We were just starting to gain some considerable momentum when Covid arrived, and it’s been like restarting the business from the beginning. These awards have put a spotlight on our business, and highlighted the unusual flavours of native citrus, and both Marvick and our distributors have been able to use our success for promotional and social media activity.”

Embracing and showcasing quality

Which is one reason they feel that quality competitions like the AIOA are so important to both producers and the industry.

“Competitions like the AIOA give growers the opportunity to develop and improve the standard and quality of their products,” they said.

“It embraces all businesses - small, large and those ‘left of field’ - who contribute to the olive industry, and allows them to showcase their products to the world.”

More information: www.marvicknativefarms.com.au

2024

Entries open

1 June - 23 August

Don’t miss out

• Global EVOO appraisal by expert judges:

» International judging panels in 5 countries

» Australian judging collaboratively in Adelaide

• All EVOO, Flavoured Oils and Table Olive entries compete for Best of Show Awards

• Every entry assessed and awarded on merit

• Comprehensive judging feedback for all entries

• Successful judging provides eligibility for OliveCare® certification

2024 Australian International Olive Awards Schedule

Entries open: 1 June

Entries close: 23 August at 5pm CST

Post deadline (Australian entries): 16 August

Medals announced (by email): 7 October

Awards Dinner/Trophy presentation: 25 October

Full details & entry forms: www.internationaloliveawards.com.au

THE LATEST UPDATES ON R&D WITHIN THE OLIVE INDUSTRY

R&D Insights contains the latest levy-funded R&D project updates, research findings and related industry resources, which all happen under the Hort Innovation Olive Fund.

Hort Innovation partners with leading service providers to complete a range of R&D projects to ensure the long-term sustainability and profitability of the olive industry.

Maximise quality and output at 2024 AOA Processing Workshop

Want to improve your processing skills? Keen to learn the secrets of getting the most from your fruit, in terms of both oil quality and output? Or brand-new to the EVOO game? Then mark your calendar off for 18-19 April and book a trip to South Australia for the AOA’s annual Processing Workshop.

Run as part of the ongoing olive

levy project Australian olive industry communications and extension program (OL22000), the Processing Workshop is one of the most indemand events on the industry. This year’s workshop is once again being held at Mypolonga, in South Australia’s Murraylands region, hosted by awardwinning EVOO and flavoured oil producers Rio Vista Olives.

Stage by stage focus

Making great EVOO is all about ensuring quality at every stage of the process, so the comprehensive twoday course covers it all - from grove management for optimal fruit quality to best-practice processing and storage. Along the way attendees learn a lot about olive oil chemistry, and get the answers to many of those frustrating

“why did/does that happen to my oil?” questions, as the focus moves firmly onto the practical aspects of oil extraction.

Expert presenters, straightforward information Guiding participants through all this information is international olive oil consultant, processing expert and EVOO judge Pablo Canamasas, and Rio Vista Olives’ master miller Jared Bettio.

“It demonstrated that it’s not just a case of getting your olives in the machine and turning it on: you really have to investigate your fruit and then work with what you’ve got.”

When:

18-19 April 2024

Where:

Rio Vista Olives, 262 Carawatha Drive, Mypolonga, SA

Presenters:

International Olive Oil

Consultant Pablo CanamasasQuality, Chemistry, Processing

Rio Vista Olives Master Miller Jared Bettio - Processing

Cost:

$275 - AOA members/levy payers

$375- non-member/processor/ other industry

More information:

www.olivebiz.com.au

Their combined wealth of knowledge and practical experience is impressive but they’re both pretty down-to-earth guys, ensuring that any complex information is presented in a user-friendly format. They’re also happy to answer questions along the way, making the workshop ideal for growers and producers at every stage and production size.

Packed program

This year the entire program happens at Rio Vista Olives’ Mypolonga grove and mill, where Canamasas and Bettio will work through the practices and processes from grove to finished product.

It all starts with Pre-season arrangements, looking at aspects related to the operations set up and organisation ahead of harvest time, along with oil chemistry

basics and storage considerations. Agronomical aspects impacting on oil quality are covered next, including irrigation, pests and diseases, and determining optimal harvesting times, before a deep dive into Crushing and malaxing, looking at types of equipment, timing and impacts on quality. Use of processing aids is another major topic, covering the product and methodology options and their impact on paste extractability and oil quality.

The course then moves on to Centrifugation, looking at the differences between 2 and 3 phase processes, horizontal vs vertical, operational parameters and impacts, before Day 1 finishes with Oil storage and filtration

The Day 2 program moves on to hands-on demonstrations of the processing methods and practices discussed the previous day. Fruit will be processed using different paste preparation approaches to evaluate oil

“The results of the trial show that a few minor adjustments make a huge difference in terms of your output.”

extraction efficiency and quality, and the session will finish with a tasting of the oils obtained during the trials and discussion around the results.

A networking dinner on Day 1 is also included, along with lunches and morning/afternoon teas.

Register early

Places for the Processing Workshop are limited and sell out quickly each year, so if you’re keen to learn the science and best practice of producing high-quality EVOO, jump online and book your spot NOW!

Register via ‘Events’ on the OliveBiz website - www.olivebiz.com.au.

Apply now for a Churchill Fellowship and learn globally, inspire locally

Applications are now open for the 2024 round of Churchill Fellowships, offering the opportunity to travel overseas and investigate a topic or issue you are passionate about.

Churchill Fellowships are a nonacademic award available to Australians from all walks of life, with no formal qualifications required to meet the criteria. Recipients receive fully-funded travel for four to eight weeks, and support from the Winston Churchill Trust, so they can spend time with international leaders in their field of interest, visiting and gleaning insights from abroad, and then bring their newfound knowledge and ideas home to share with and benefit their industry or community.

Horticulture Fellowships

Hort Innovation has joined forces with the Churchill Trust to offer three Fellowships annually, each valued at around $26,000, to drive innovation and transformation within Australia’s horticulture industry.

The Horticulture Fellowships are run under the ongoing project Churchill Fellowships (LP16002), funded by Hort Frontiers Leadership Fund as part of its strategic co-investment initiative.

To meet the criteria for selection, applicants must propose topics that will provide clear benefit to the Australian horticulture sector and, ultimately, to the wider community; and be transformational in nature for the horticulture industry in general. While the topic of focus is completely up to the applicant, it is expected that they have worked through the issue thoroughly in Australia, exhausting locally available knowledge.

Importantly, the applicant must also be able to demonstrate the potential benefits to their sector and the community, and be willing and able to share the findings on their return.

Note: for projects that are specific to a particular horticultural industry, the applicant must be from a registered levy-paying Australian horticulture business in that industry.

Details

The 2024 application round closes on 1 May and successful applicants will be announced in September. The process also involves selection interviews.

Recipients design their own itinerary and travel at time of their choosing within the 12 months from 1 November 2024.

For more information and to apply, go to www.churchilltrust.com.auBecome a Fellow.

Churchill Fellowships are funded by the Hort Frontiers Leadership Fund, with coinvestment from the Winston Churchill Memorial Foundation and contributions from the Australian Government. The Hort Frontiers Leadership Fund involves a number of strategic long-term research and development programs that use a combination of government funding and partner investments, and endeavour to address major challenges in key areas identified as crucial to securing the future of Australian horticulture industries.

More growers thinking about business co-operation

The AOA’s most recent webinar miniseries showed that olive producers are keen to contemplate multigrower co-operatives as a business model.

There was a great turn-out for both webinars, which explored the opportunities provided by cooperatives, structure options and the practical realities.

Structures and practices

Co-ops 101 for Olive Growers was presented by Claire Fountain from Co-operative Bonds and the Business Council of Co-operatives and Mutuals (BCCM). The session covered the foundations of the co-operative business model (‘what is a co-op’), looking at various structure options and case studies.

Matakana Olive Co-operative then took the topic a step further, diving into the practical realities of cooperatives. New Zealand producer David Sullivan of Mahurangi Olives shared his experiences as a longtime member of the Matakana Olive Cooperative, a regional collective with a strong focus on volume cost-savings and marketing.

The co-op recently recalibrated due to a change in circumstances for some members but over its lifetime provided a shared-cost, viable production and distribution model for boutique olive oil producers.

Information and tools

AOA CEO Michael Southan said the webinars were run in response to increased interest among industry members, and did a great job in providing insight for those wanting to look further into the ‘strength in numbers’ concept.

“From the numbers we’ve seen attend

both webinars, there’s definitely strong interest in the co-op model among the smaller growers in Australia,” he said.

“And the webinars have given those people the information and tools to know how to start looking at putting a co-op business model togetherwhich was our aim.

Groundwork

“Clare provided fantastic background on co-op structures, and good examples of co-op models already in business in Australia. They ranged from very big down to quite small, including some everyday names that people wouldn’t realise were co-ops or mutuals.

“She covered the different types of structures within co-op models which could be adopted, and some of the legalities. She has also offered herself as a resource for olive producers wanting further information, via support from the BCCM.

“So that was a really good groundwork set-up.

Real-life experience

“David’s presentation then provided an overview of a real-life olive growers co-operative with growers of different sizes. He shared his experiences of 10 years in a co-operative, including great insight into what works and what doesn’t.

“He was very honest and relayed the information very clearly, so people could really understand what the Matakana experience was.

“There were several important points he raised in particular: the need to have the arrangement in writing; that co-operatives need good governance and process, like any other business

model; and the benefits of economies of scale in terms of things like procuring consumables.”

Food for thought

“All up the webinars provided really good food for thought for anyone thinking about joining forces with other olive producers to increase their viability.

“And while it’s clear that it’s not always easy to set up and run a co-operative business model, the key thing is that people go in with eyes wide open, fully aware of their responsibilities and the expectations of all members.”

“The AOA thanks both presenters, and all who attended. The webinars were a great start to 2024 extension activities and we’re looking forward to covering more topical issues as they arise.”

Miss the webinars?

The AOA team are aware that not everyone can make it to the webinars when scheduled, so they record the sessions to share with those who missed out.

The recordings of the two webinars are now available on the OliveBiz website, so if you weren’t able to attend - or did and want to refresh on what was discussed - you can watch the sessions whenever you’re ready. Go to www.olivebiz.com.au – Projects – 2024 Webinars and you’ll find the links to the recordings in the overview for each webinar.

This webinar series is part of the Olive levy project Australian olive industry communications and extension program (OL22000), funded by Hort Innovation, using the Hort Innovation olive research and development levy, co-investment from the Australian Olive Association and contributions from the Australian Government.

High pest load? There’s help at hand from IPDM resources

Unpredictable weather continues to present challenges for growers in many regions, with grove and property damage reported from floods, frosts, unseasonal hot winds and storms.

Less dramatic but just as problematic is the ongoing increased rainfall experienced in many regions. Much of Australia’s east coast, and therefore many of the country’s growing regions, are now experiencing wet conditions regularly and unseasonably and the greater level of moisture in groves is causing an increased issue with black scale on olives.

Perfect storm’ for black scale infestation

Olive industry pest and disease expert Dr Robert Spooner-Hart discussed the issue at the AOA’s Olive Lace Bug Webinar late last year, and said it’s important that growers are aware of the correlation between unseasonal weather and an increased pest load in groves.

“The recent La Nina-type patterns are directly associated with an increase in olive lace bug and black scale,” he said.

“Their crawler stage is most susceptible to hot, dry weather: along with targeted spot spraying, that will keep them under control and generally at a manageable level. In contrast, when the heat and dry conditions don’t happen, they thrive.

“Furthermore, increased moisture sees the trees grow more foliage, and it’s also more difficult to get into groves to prune or spray. All up, it’s a bit like a “perfect storm” in terms of issues like black scale.”

Online and on-call

For those impacted by black scale, there’s help at hand in the industry IPDM (integrated pest and disease management) resources available on the OliveBiz website - www.olivebiz. com.au

Created as part of the olive levy R&D project An Integrated Pest and

BLACK SCALE, Saissetia oleae

Adult Size: 3-5mm

Biology and damage

This species is widely distributed in Australia. First generation crawlers normally emerge in late spring-early summer, earliest in the north. Two or three generations occur per year, with more in northern parts. Hot, dry weather reduces the survival of crawlers.

Scales attack leaves and twigs, resulting in leaf drop, reduced tree vigour and twig dieback in heavy infestations. Ants and sooty mould are commonly associated with the production of honeydew by adults and nymphs of black scale. The movement of ants up a trunk is indicative of active black scale in the tree, even if the scales are not obvious.

Major natural enemies

Black scale has many natural enemies that can play an important role in its management in olive groves. These include small parasitic wasps such as Metaphycus spp. and Scutellista caerulea; ladybirds, lacewing larvae and the scale-eating caterpillar. Parasitised scales may show exit holes once the wasps have emerged.

Management

If required, black scale can be targeted by judicious use of spray oils or insect growth regulators. Sprays need to be targeted at crawlers and young nymphal stages, so timing is critical for effective management. This makes monitoring for crawler development important. Opening up tree canopies exposes crawlers to greater likelihood of dehydration, and also to access by sprays targeted against them. Management of black scale will reduce ant problems, and vice-versa.

Disease Management Extension program for the Olive Industry, assistance with black scale is provided across a range of resources, including a Fact Sheet, Online Tutorial (#4), the IPDM Revised Field Guide (page 24 for black scale), the Best Practice IPDM Manual and several of the IPDM Videos and Presentations.

The information on the fact sheet provides great introductory information on identification and management:

Olive industry IPDM resources

IPDM Flyers

Concise 1-2 page summaries of information on specific topics. There are nine flyers: Black scale, Olive lace bug, Weevils, Anthracnose, Peacock spot, Cercospora leaf mould, Olive wood rots and dieback, Exotic pests and diseases, and Current chemical options for key pests and diseases.

IPDM Online Tutorials

These nine tutorials provide up to date information on IPDM, Monitoring and Biosecurity, as well as key pests and diseases: Black scale, Olive lace bug, Apple weevil, Anthracnose, Peacock spot and Cercospora leaf spot. Each tutorial includes a brief knowledge self-assessment, as well as questions to prompt changes to and improve practices on completion. Tutorials comprise 12-20 slides, and completion

time is expected to be 10-15 minutes each.

IPDM – Revised Field Guide

The revised Field Guide to Olive Pests, Diseases and Disorders provides updated Australian information as well as inclusion of new exotic pests and diseases (such as Xylella and Verticillium wilt (Defoliating strain)). It is primarily to assist in identification of possible pests, diseases and disorders, as well as important beneficial natural enemies.

Best Practice IPDM Manual

The Manual is a supplementary extension tool to the web-based tutorials, flyers and field guide. It contains explanatory information on a range of IPDM strategies, enabling more informed decision making.

It includes a section on pesticide selection and application.

IPDM Videos & Presentations

There’s also great information and experiential learning available in the outputs from the 2018 Integrated Pest & Disease Management workshops. The field days were organized by AOA in conjunction with Western Sydney University to explore appropriate IPDM extension services focused particularly on black scale, olive lace bug and anthracnose.

Where to find them

All of these – and many more industry information resources and learning tools – are available on the AOA’s OliveBiz website –www.olivebiz.com.au

MyPestGuide® Trees identification field guide

Another new tool in the biosecurity kit is the MyPestGuide® Trees ap, created to aid industry, government and citizen scientists in mitigating the impact of invasive pests and diseases on our forests and tree crops.

The MyPestGuide® Trees app is designed to promote, encourage and simplify the reporting of new pest sightings, maximizing opportunities for the early detection of exotic pest incursions.

Researchers from Plant Health Australia (PHA), the WA Department of Primary Industries and Regional

Development (DPIRD), the Department of Agriculture, Fisheries and Forestry (DAFF) and other stakeholder groups were involved in developing the ap, which is both a pest identification field guide and a pest reporting tool.

The app allows users to filter pests using various criteria to identify causal organisms and, if required, submit images of pests to their state or territory agriculture department for identification. The pest information database includes details about both established and exotic pests, their impacts (to support identification) and the suggested action required.

The MyPestGuide® Trees app is now available for free download via the Apple App Store® or Google Play™ . A web-based version is also available at https://mypestguide.agric.wa.gov. au/guides/trees.

2022/23 horticulture statistics published

The latest edition of the Australian Horticulture Statistics Handbook was released in February, providing data across the Australian horticulture industry for the year ending June 2023. The new data shows mixed fortunes for the sector, brought about by challenge on both local and global fronts, however an increased production value made for an overall positive outcome.

Overall horticulture figures 2022-2023

The horticulture sector overall achieved $16,253.8M in production value in 2022-2023, an increase of $434.3M (2.8%) from $15,622.4M in 2021-2022. As usual, there was mixed performance across the various commodity groups, with the major contributors of growth being significant value increases in the fruit and vegetable categories - which increased 12.6% and 5.4% respectively.

Key movements

Fruit value was particularly strong, increasing by $708.1M to $6,320.3M, while overall vegetable production values increased by $500M to a high of $5,830M. While value increased, however, 2022/23 saw a 3.2% decrease in vegetable production volume, continuing the previous year’s decline and making 2022/23 the lowest year for vegetable production volume in six years.

The nut sector saw an even more dramatic result in 2022/23, with production value decreasing by $527M to $721.1 million, a 42% decline, while production volume decreased by 24%. Nut export value saw a 15%

decrease. Figures covering the past five financial years show the 2022/23 average nut price dropped to $5.50/ kg, compared with the high of $9.8/kg in 2019/20.

Export value for the nursery sector increased dramatically in 2022/23, up 63%, and both the nursery and potato sectors reached their highest recorded export values.

Total production

Total production across all horticultural products in 2022/23 was 6,453,481T (6,545,575T year ending June 2022).

Fruit accounted for well over a third of that figure at 2,652,061 (2,551,741T), with olives at 100,536T (77,000T).

Total value

Total value of all horticultural products in 2022/23 was $16,253.8M ($15,622.4M), with fruit also accounting for more than a third of that amount at $6,320.3M ($5,521.9M).

The production value of olives was

$124.7M ($95.5M), ranking the industry at 12th (18th) in the fruit category.

Total exports

For the year ending June 2023, Australia exported $2.79B worth of horticultural products ($2.75B), with fresh fruit once again the largest value export grouping at $1,370.9M ($1,224.8M). Within that, table grapes and avocados saw the highest yearon-year growth in export values, increasing 28% and 13% respectively on 2021/22 levels.

Processed fruit accounted for $135.7M of the total ($149.8M), including olives and olive oil at $8.9M ($23.1M).

Total imports

For the year ending June 2023, Australia imported $3.14B ($2.84B) worth of horticultural products.

Processed fruit was again the largest value import grouping at $1,117M ($1,081M), including olives and olive oil valued at $150.5M ($175.7M).

Olives Overview

The handbook covers four industry category sections - Vegetables, Fruit, Nuts, and Other horticulture. The Fruit section includes the Olives Overview, providing a snapshot of the Australian olive industry for the 2022/23 year.

Key statistics include:

state-by-state production was unchanged from the previous year, and has remained stable over recent years, with percentages remaining at: Victoria 69%, South Australia and WA 11% each, New South Wales 9%, and Queensland and Tasmania both <1%;

the production area recorded has increased dramatically, from 21,250 ha in the 2020/21 year to 33,595ha in 2022/23 (*no figure is provided for the 2021/22 year);

annual production increased by 31% from the previous year, from 77,000T to 100,536T. This is, however, a substantial decrease from the 2020/21 ‘on-year’ harvest figure of 130,000T;

production value saw a parallel increase of 31%, from $95.5M in 2021/22 to $124.7M ($161.2M in 2020/21, $62M in 2019/20);

just over 97% of fruit produced was extracted for oil (98% in 2021/22), producing 17,509T of olive oil, a substantial increase from the 12,049T of oil produced in 2021/22 (20,678T in 2020/21, 8,662T in 2019/20;

the remaining 3% of fruit was used for table olive production, almost all for the domestic market; less than 1% (264T) of table olives were exported, with a value of $1.5M (142T, $0.7M in 2021/22);

the wholesale value of oil produced was $232.2M, up 15% from $201.5M in 2021/22 ($320.6M in 2020/21, $224M 2019/20);

consumption of olive oil per capita (Australia), based on volume supplied, was 1.1kg, substantially lower than the 1.25kg in 2021/22 and also that of the previous three years.

Note: no other value figures or information are provided for table olives.

Olive oil international trade

The international trade figures for 2022/23 saw differing outcomes for olive oil exports from and imports to Australia:

1,090T of olive oil was exported, down 38% on the 2021/22 figure of 1,758T (continuing the decreases of 15% and 23% in the previous two years);

the value of olive oil exports also decreased, down by 43% to $7.4M; this follows a 10% decrease in 2021/22 ($12.8M, down from $14.2M in 2020/2021) and is a significant reduction from the 2019/2020 value figure of $18.8M;

olive oil imports were also dramatically lower, the 12,524T representing a 43% decrease from the 2021/22 figure of 22,165Twhich was in turn a 40% reduction on the 37,201T in 2020/21.

the value of olive oil imports therefore decreased by 30%, the $85.5M equating to just under half of the 2020/21 value of $175.8M;