11 minute read

Social distancing should not trans

from Vol 82 - No 6

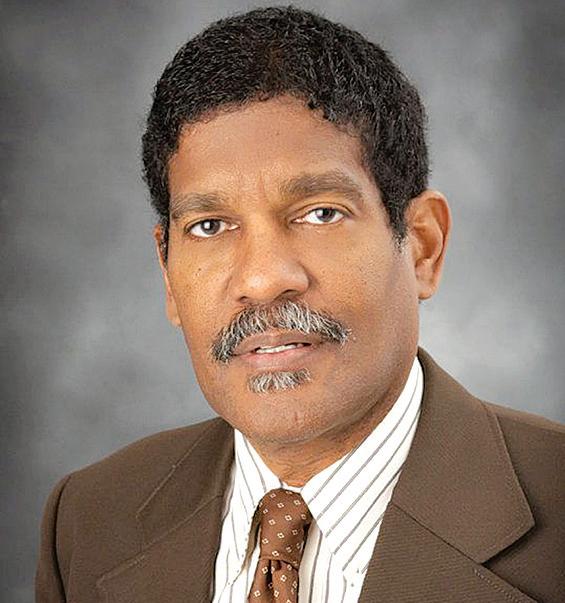

The International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) is one of the largest and most diverse unions in North America, with members in virtually every sector of the economy. Representing nearly 1 million current and retired members of all ethnicities and backgrounds in the United States, Canada, and Mexico, the UAW has never had an African American president. Until now. “I was sitting at home and brainstorming on things that I needed to do, and then the phone started to ring,” stated Rory Gamble, a welder fixture repairman, who joined the UAW in 1974 when he worked at the Ford Motor Co. Dearborn (Mich.) Frame Plant. “The local NAACP chapter president called, and others,” noted Gamble, who in December was named the 13th president of the 85-year-old union. “It hit me then that, ‘Hey, you’re the first African American president,’” Gamble recalled. “It struck me like a rock. It’s a great accomplishment.” Gamble observed a distinct and frequently-used quote that dates back to Winston Churchill: “With great power, comes great responsibility.” “There is a great weight that comes with being the first African American presi

dent,” Gamble said. “I want to be an example where no one can question my leadership and not use anything against another African American brother or sister to prevent them from being able to ascend to a position like this.” Gamble accepted the job after his predecessor, Gary Jones, resigned amid a corruption scandal. Despite the cloud of suspicion left behind, Gamble observed that the union must continue to move forward. “Being an African American already means you have a great deal of responsibility and so I want to make sure that the way I carry myself will keep the doors open for others to follow,” Gamble expressed during an exclusive interview with NNPA Newswire. “I’ve been blessed. I was able to come up during a time where there was a lot of activism. Unlike today, where a lot of our brothers and sisters get caught up in the digital world, I came up when everything was more hands-on and personal,” Gamble continued. “You couldn’t hide behind a keyboard. You had to get up and see people and look them in the eye. Looking folks in the eye shows that you have a lot more of yourself invested.” That doesn’t mean Gamble is technologically challenged. “I had to get social media because you have to engage and keep up with the times,” he said. “I’m very personal, and I love engaging with the members. I try hard to make sure that our union doesn’t get away from that even though we have this digital and electronic stuff. That’s fine, but the downside is that it can be icy when it comes to human relationships, so I like the eye-to-eye contact.” Gamble, 64, started his UAW career as a welder fixture repairman. Before that, he was a defensive tackle at Northwestern High School in Detroit, where he credited his father, a former elected officer of Local 600, as an early mentor. In 1975, Local 600 members elected Gamble to serve as a plant trustee. From 1976 to 1979, he was the local’s alternate benefit representative and, later, he served as a bargaining committee chair. In 1988 Gamble earned an appointment as staff director and administrative assistant for Local 600’s president, with responsibilities for third-stage grievance agendas for all Ford Rouge plants and as editor of UAW Facts, the local’s newspaper, according to his biography. He was elected delegate to the UAW’s 32nd Constitutional Convention and served on the Constitution Committee. Since 1987 Gamble’s assignments have included local union health and safety coordinator, employee support services program, education director, civil rights coordinator, fitness center coordinator, and family services and learning center coordinator. He has served as director of Local 600 Ford units, including Dearborn Engine and Fuel Tank, Dearborn Truck Plant, Milan, Industrial Athlete, and Dearborn Frame. Other assignments have included retirees’ liaison and coordinator of the Rouge Rehabilitation Center. In 1998 and 2003, Gamble served on the UAW-Ford National Negotiating Team. From 1993 to 2002, he was elected for three terms as the local’s recording secretary. Gamble was elected first vice president of Local 600 in 2002 and re-elected in 2005. In 1999 Gamble received the Spirit of Detroit award; the 2006 Horace L. Sheffield Jr. Humanitarian Award; and the 2008 Minority Women’s Network (Detroit chapter) Man of the Year award. “Labor unions have raised the standards of living, that’s pure and simple,” Gamble observed. “If someone’s family gets into a major health scare, the family could be put into major financial jeopardy. So, the union has provided employees with job security, increased wages and enhanced health care benefits. You can plan for your kids to attend college and other important milestones that you might not otherwise be able to do if you didn’t have that protected status that unions provide.” Gamble continued: “I have never sat across the table from a CEO of any major company who didn’t have a contract with that company that guarantees their wages and benefits and even a golden parachute. That same worker will tell the worker in the plant on the floor that they don’t need a union, but every major CEO has his wages and benefits contracted. That’s a big irony.” Gamble also noted the UAW’s relationship with the Black Press of America had spanned decades because the union and publishers share a common belief in social justice and civil rights. “People need to know how important the Black Press is and how important the union is,” Gamble said. “Both have accomplished so much together. We do this by making sure that we use all of the available resources to educate our people and le t them know how important and relevant the Black Press and the union is especially when they are functioning together. The things we’ve accomplished to uplift society and our people, in general, is something we need to continue to do together.” Gamble The decision to go from renter to homeowner can be exciting. But there’s more to homeownership than your down payment, closing costs, and any other upfront expenses you’ll need to cover – like the cost of moving, and fees to set up or transfer your utilities. To make a financially healthy decision about homeownership, plan ahead for the true cost of ownership before buying your new home. The True Cost of Home Ownership

Why Watts Electric? Watts Electric Company is an electrical contractor doing business in 6 states. We specialize in Distribution, Transmission, Overhead, Underground, and Substation Construction. Whatever the project requires, Watts Electric has the expertise and equipment to build it. We realize our employees are our greatest asset. We aim to attract, develop, and retain the best talent. We foster a merit-based environment, where employees can determine their own success. Let us train you! Watts Electric is seeking Powerline Apprentice. Weeknight travel is typical. Hours range from 50 - 60 hours per week. During outages and due to deadline constraints, weekend work would be required. Minimum qualifi cations include: • Associates Degree in Powerline • No felony convictions and able to clear a high security background check • Class A Commercial Driver’s License with no loss of license in 2 years and no more than 2 citations in the past 2 years. • Able to pass a pre-employment physical, obtain a medical card, and pass a drug screen • Able to lift / push / pull 100 pounds • Stand / kneel / bend on uneven surfaces for 13 hours per day • Able to climb structures up to 120 feet with lineman belt and hooks • Must be able to see close vision, distant vision, color vision, peripheral vision, depth perception and adjust focus • Must be able to use hand and reach with hands and arms • Able to work in confi ned spaces • Work 100% outdoors • Available for overnight travel • Available for weekend work Benefi t Package Includes: • Per Diem • Health Insurance • Dental Insurance • Vision Insurance • Company Paid Life Insurance • Company Paid Short Term Disability Insurance • Flexible Spending Account • Critical Illness Insurance • Paid Time Off • Holiday Pay • Matching 401K • Tool Purchase Loan Program • Reimbursable Apprenticeship Programs Watts Electric is a Smoke-Free, Drug Free Employer. Watts Electric is an Equal Employment Opportunity. Minorities and Females are strongly encouraged to apply. Reasonable Accommodations will be made to a person with disabilities. Let us train you! Watts Electric Company is an electrical contractor doing business in Nebraska and the surrounding states for more than 35 years. We tackle a diversifi ed electrical scope of work including airports, roadway lighting, signing, and underground utility construction. We understand that our employees are the greatest asset in the company. We aim to attract, develop, and retain the best talent. We foster a merit based environment where employees are able to determine their own success. Position Description: This is a great opportunity to build a career and learn a trade! We welcome applicants both with and without experience. 4 day work-weeks are available part of the year. Weeknight travel is typical. Hours range from 50 – 60 hours per week. During outages or due to deadline constraints, weekend work would be required. Minimum Qualifi cations: • High School Equivalency • No felony convictions and able to clear a high security background check • Able to clear drug screen • Valid operator’s license with no loss of license in 2 years • Higher wages for Class A CDL license • Able to lift / push / pull 100 pounds (physical required) • Stand / kneel / bend on uneven surfaces for 13 hours per day (physical required) • Able to work in confi ned spaces • Able to work at heights up to 60 feet • Work 100% outdoors • Available for overnight travel • Available for weekend work • Must be 18 years of age or older Benefi t Package Includes: • Wage is determined by experience. Minimum starting wage is $16.00 per hour. • Per Diem for overnight stay • Health insurance • Dental insurance • Vision Insurance • Company paid life insurance • Company paid short term disability insurance • Paid time off • Holiday pay • Matching 401K • Reimbursable apprenticeship programs Watts Electric is a Smoke-Free, Drug Free Employer. Watts Electric is an Equal Employment Opportunity. Minorities and Females are strongly encouraged to apply. NTT Security (US), Inc. is hiring an Alliance Engagement Director (AED) in Omaha, NE. Employee may work from home. Apply at https://careers. nttsecurity.com/search/ Alliance Engagement Director (AED) Know the regular fixed expenses After purchasing the home, there are ongoing fixed costs, such as: • Mortgage payment (principal and interest) • Private mortgage insurance (if applicable) • Property taxes • Utilities • Homeowners insurance • Homeowners association and other community fees (if applicable) Though the payments for these items may come at different times (e.g., monthly, quarterly or annually), you should add up the monthly cost of each to understand how they’ll affect you on a dayto-day basis. Make sure to factor these costs – including the monthly amounts you’ll have to save for your annual payments – into your monthly spending plan. Doing this will help you avoid buying a house that you can’t afford, which can happen even if you’ve been approved for the mortgage. You’ll also be able to fully grasp how much you’ll have left over for flexible and discretionary expenses. The Hands on Banking® website has more resources on making a spending plan. Plan for ongoing maintenance and repairs Owning a home also means planning for ongoing maintenance and repairs. Homeowners may need to budget 1% to 2% of the purchase price of their home on maintenance each year, though that may vary based on the condition o f the home. Remodeling rooms or the entire home would cost considerably more. It’s always a good idea to put money aside in an emergency fund to protect against surprise situations. But some home maintenance and repairs aren’t really emergencies, because you can count on features eventually reaching the end of their useful life – things like the roof or appliance replacement. Instead of dipping into your emergency fund for these costs, it’s best to set aside a certain amount of money every month specifically for them. You can use a savings account to save for home-related costs, like repaving your driveway or renovating parts of your house. That way, you can reserve your emergency fund for truly urgent situations, such as medical needs or sudden unemployment. Buying a home can be both rewarding and challenging. Doing your homework will ensure that homeownership is as stress-free as possible, both during and after the purchase. More information is available on Hands on Banking, a great place to start educating yourself about these costs. (© 2019 Wells Fargo Bank, N.A All rights reserved)