10 minute read

Ontario Beef Market Development Program

BY JIM CLARK | CEO, Ontario Beef Market Development Program

As with most organizations, 2020 began with a heightened sense of optimism within the Joint Marketing Committee. The new Ontario Beef Market Development Program was developed and approved, and our first year of implementation began in January 2020. The new program provides Ontario beef farmers with a clear path forward with a defined market development strategy featuring clearly defined objectives and comprehensive market indicators and performance measures to demonstrate return on check-off investment.

I want to thank the committee members, Rob Lipsett, Jason Reid, Craig McLaughlin, Jack Chaffe, Dale Pallister and Mike Conlin, for their willingness to provide strong leadership and direction to the strategy.

The strategy was developed to support growth for branded Ontario beef by supporting established brands in the local market, supporting the development of new Ontario beef brands, and expanding our marketing efforts into key international markets to continue to drive demand for Ontario cattle. By specifying Ontario cattle in these brands, the market essentially eliminates a portion of imported beef as a supply option since it is not open for substitution. Increased demand for local cattle benefits all sectors of the cattle supply chain.

We have seen the impact of the increased share of our domestic market. After several years of steady decline, we have seen Ontario fed slaughter volumes and inventory numbers of slaughter cattle stabilized since 2012. Since that time, we have also seen a steady decline in imports, while Ontario production’s share of consumption has concurrently increased. This all provides a strong rationale for the increased marketing efforts we have undertaken.

Ontario beef featured in key trade events in domestic and international markets

In January, we partnered with Canada Beef to host several Ontario beef-branded programs at the Restaurant Canada show. This event provides Ontario-branded beef suppliers with access to national foodservice customers and suppliers and the opportunity to showcase their products in a high-priority industry event that attracts over 20,000 industry delegates. Having Ontario beef brands represented in our national pavilion provides a high level of profile and credibility.

Ontario beef was also represented at the Japan Supermarket Trade Show in Japan in February in collaboration with Canada Beef. Ontario Corn Fed Beef has been the market-leading brand of Canadian beef in Japan since its entrance to that market in 2015, and it continues to see tremendous growth. This year’s event was also the initial launch of a second brand of Ontario beef in Japan: Ontario Heritage Angus Beef. This event attracts over 60,000 influential Japanese retail industry delegates annually and is the priority retail trade event in Japan.

Many other high-profile events in key export markets that we had planned for in 2020 were cancelled due to the pandemic. Markets affected include Vietnam, Taiwan, Philippines and Singapore. As these markets reopen, we will be in a strong position to re-engage with the established relationships developed in each market.

Promotional events in key export markets

Many of our high-value export markets continue to be severely affected by the pandemic. The United Arab Emirates and the Kingdom of Saudi Arabia are both priority markets that have been severely affected by losses in the tourism and hospitality industries. With committed partners in these markets, there is good opportunity for us to gain back share once the situation is resolved.

With a very strong distribution partner and retail customer base, we continue to prioritize the Japanese market by providing promotional support for existing Ontario beef brands. Japan has also been significantly affected by the pandemic, but retail demand has been very high as more consumers are cooking meals at home. Currently, there are 21 retail partners promoting Ontario beef in 567 outlets across Japan. Ontario Corn Fed Beef is the most widely recognized brand of Canadian beef in Japan. Ontario beef export volumes and values are outpacing Canadian beef exports to Japan from 2016 to 2020.

Loss of incoming trade missions

Incoming trade missions are an important strategy in developing relationships with targeted customers in export markets. This year, we had planned on hosting customers from Japan, Vietnam and Taiwan here in Ontario, which unfortunately had to be cancelled due to the pandemic. These missions provide valuable opportunities for foreign buyers and targeted customers to understand cattle and beef production in Ontario and experience the vast natural resources of Ontario. Valued relationships with many key export customers from Japan, China, Indonesia, United Arab Emirates, Saudi Arabia and the United States have been developed through incoming trade missions.

Coronavirus pandemic affects program implementation

By end of February last year, implementation of the strategy was being significantly affected by the coronavirus. It quickly became clear that the focus of the strategy in 2020 needed to primarily focus on supporting our existing brand partners in key markets around the world.

The pandemic has had a significant impact on the ability to develop new branding initiatives in Ontario, as packers and retailers focus on operations and safety of their employees.

The foodservice sector, which represents a significant percentage of beef sales in the province, has seen sales drop by as much as 40 per cent, as reported by market analysts. At the end of June, many dining establishments were limited to take out or patio dining with limited menu options. As the year came to an end with a provincewide lockdown of restaurants, the impact once again was significant. We also saw a massive drop in customer capacity in the catering sector, which typically drives high volume during the summer months.

With the significant challenges facing the industry, focus has shifted to supporting existing brand partners.

Promotional activities to support Ontario beef

Promotional initiatives were supported with distributor partners, retail chains, and independent butcher shops and restaurants across the province. Many of the activities reinforced the commitments of our brand partners and enhanced awareness in the market.

Enhancing value of Ontario beef through quality assurance

The Ontario Beef Market Development strategy also prioritizes creating value for producers in Ontario-specific quality assurance programming, which enhances our ability to differentiate Ontario beef and enables Ontario producers to capture market opportunities from on-farm quality assurance programs.

A significant outcome of this objective resulted in the Ontario Corn Fed Beef Quality Assurance Program becoming an approved certifying body for the Canadian Roundtable for Sustainable Beef (CRSB). To obtain approval, the Ontario Corn Fed Beef Quality Assurance Program was thoroughly reviewed and assessed by the CRSB and the oversight body, NSF International.

This approval is an important milestone for our industry because the market demand for beef raised according to sustainability standards, as set by CRSB, continues to increase. At this time, demand exceeds the available supply. And with the recent certification of the Cargill Guelph facility to process cattle originating from CRSBcertified farms and ranches, the Ontario beef industry is well positioned to meet this increasing market demand. Our retail and foodservice partners have also been very clear in their desire to source certified and sustainable beef in Ontario.

CRSB certification is an excellent way for Ontario farmers to share their sustainability story. Consumers are increasingly interested in how their food is produced, and they are seeking more information than ever before about the practices used to raise beef in Canada. From land and water stewardship to supporting local communities, and from animal care to innovations that improve efficiency and productivity, certification provides producers with recognition for the sustainable practices they already employ.

As a result of the approval of Ontario Corn Fed Beef Quality Assurance Program as a CRSB certifying body, Ontario’s feedlot sector and the bulk of finished animals in the province will be well positioned to take advantage of sustainable beef programming.

It is anticipated that the market will see an increase in demand from the feedlot sector for VBP+-certified calves in the cow-calf sector, especially from those who are interested in participating in Cargill’s Certified Sustainable Program.

“We are pleased with Ontario Corn Feed Beef’s commitment to supporting their producers in demonstrating sustainable practices in Ontario feedlot operations by offering this element within their already successful quality assurance program,” said Anne Wasko, Chair of CRSB. “Incorporating the option of CRSB certification is a win-win for Ontario’s beef industry with a single streamlined audit process, which will help meet consumer demand for sustainably raised beef.”

“Local beef raised under a quality assurance program was identified through our public research as an important purchasing driver for consumers, so having a made-in-Ontario program that is also recognized nationally will serve our members and consumers well,” shared Richard Horne, BFO’s Executive Director.

MARKET INDICATORS

Market indicators are data points or tangible outcomes that indicate progress towards the overall performance measures. They are reported annually.

Ontario Federal & Provincial Cattle Processing

2020 slaughter volumes were affected by coronavirus interruptions, and also by the closure of a federal plant in 2019 (Ryding Regency). Ontario slaughter volumes were showing strong growth from 2016 to 2019. An effective Ontario Beef Market Development Program will contribute to increasing slaughter volumes and more demand for Ontario fed cattle.

Federal/Provincial Share of Total Slaughter

Share of federally and provincially inspected slaughter has remained consistent prior to 2020. Provincial share increased in 2020, with significant impacts to federal slaughter related to coronavirus and loss of a federal plant in 2019.

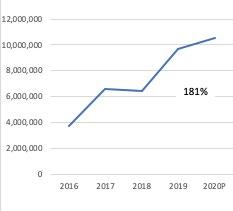

Ontario Beef Exports to Japan

Due to market closures in several high-priority export markets related to coronavirus, Ontario beef export initiatives in 2020 were focused on Japan.

It’s important to note that the value of export markets is that they provide significant opportunities to increase the overall value of Ontario beef carcasses. Canfax Research Services estimates that over $600 or 38 per cent of a fed carcass value is driven by export markets.

Export volume of Ontario beef to Japan has increased to a projected 10,500,000 kg in 2020 from 3,739,313 kg in 2016. This is an increase of 181 per cent.

At the same time, increased to a projected $77,000,000 in 2020 from $24,006,036, which is an increase of 221 per cent.

Ontario beef marketing efforts in Japan began in 2015 with Ontario Corn Fed Beef.

Kg Volume Ontario Beef Exports to Japan

$ Value Ontario Beef Exports to Japan

Source: AAFC

Industry Perceptions Surveys

Surveys of industry partners provide perspective on the value of support programs provided. Surveys are an industry standard of measurement to provide insight into return on producer investment and assess perceived value of project-related services among industry partners, including packers, exporters, retailers and distributors.

ONTARIO BEEF MARKET DEVELOPMENT SUPPORT HAS INCREASED OUR ABILITY TO GROW SALES IN ONTARIO

86% Completely Agree

14% Somewhat Agree

10 respondents

ONTARIO BEEF MARKET DEVELOPMENT SUPPORT HAS INCREASED OUR ABILITY TO GROW SALES IN EXPORT MARKETS

100% Completely Agree

5 respondents

ONTARIO BEEF MARKET DEVELOPMENT SUPPORT HAS INCREASED OUR ABILITY TO GROW SALES IN JAPAN

100% Completely Agree

12 respondents

PROJECT EXPENSES

Revenue amount of $1,100,000 for the 2020 strategy was based on BFO checkoff projections. The Ontario Beef Market Development Program is funded by $1.25 of producer check-off investment in Ontario.

Actual expenses for 2020 totaled $678,203.45.

Expenses include marketing and promotions, program implementation, project management/contracted services, market intelligence/data services, and administration.

The Ontario Beef Market Development strategy will be evaluated annually for return on check-off investment, including project deliverables, expenses and market indicators. There will be a comprehensive review of all performance measures at the end of 2023.

Performance measures listed below are designed to measure key factors that affect the competitiveness and long-term viability of the Ontario cattle industry. As per the agreement between BFO and OCFA, a comprehensive thirdparty assessment of results generated against the performance measures will be provided to determine return on investment of the $1.25 per head of Ontario check-off funding allocated to the program.

After the analysis of the performance measures at the end of 2023, a decision will be made to continue with the strategy, make revisions to the strategy, or cancel the strategy and reallocate the funding to other marketing initiatives.