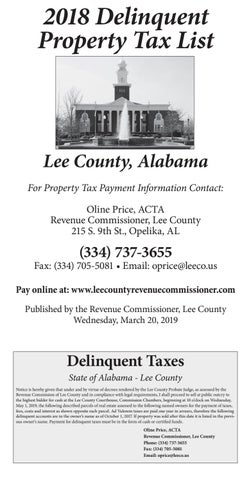

2018 Delinquent Property Tax List

Lee County, Alabama For Property Tax Payment Information Contact: Oline Price, ACTA Revenue Commissioner, Lee County 215 S. 9th St., Opelika, AL

(334) 737-3655

Fax: (334) 705-5081 • Email: oprice@leeco.us Pay online at: www.leecountyrevenuecommissioner.com Published by the Revenue Commissioner, Lee County Wednesday, March 20, 2019

Delinquent Taxes State of Alabama - Lee County

Notice is hereby given that under and by virtue of decrees rendered by the Lee County Probate Judge, as assessed by the Revenue Commission of Lee County and in compliance with legal requirements, I shall proceed to sell at public outcry to the highest bidder for cash at the Lee County Courthouse, Commission Chambers, beginning at 10 o’clock on Wednesday, May 1, 2019, the following described parcels of real estate assessed to the following named owners for the payment of taxes, fees, costs and interest as shown opposite each parcel. Ad Valorem taxes are paid one year in arrears, therefore the following delinquent accounts are in the owner’s name as of October 1, 2017. If property was sold after this date it is listed in the previous owner’s name. Payment for delinquent taxes must be in the form of cash or certified funds.

Oline Price, ACTA Revenue Commissioner, Lee County Phone: (334) 737-3655 Fax: (334) 705-5081 Email: oprice@leeco.us