Connecting the business products world July/August 2023

BIG INTERVIEW l Hamelin buys Pelikan l FTC sues Amazon l Lyreco Interiors launched l Probe into Swiss wholesalers l US bans Ninestar imports l Furniture opportunities l Breakroom changes l NeoCon: evolving workspaces l OPI European Forum review l The new era of AI INSIDE THIS ISSUE

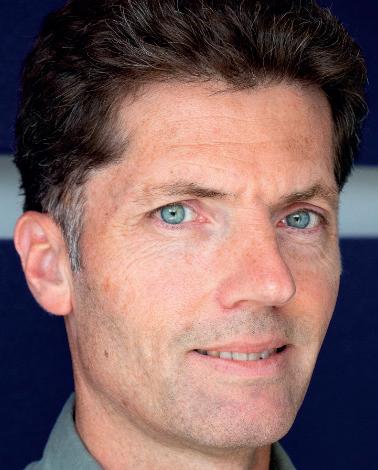

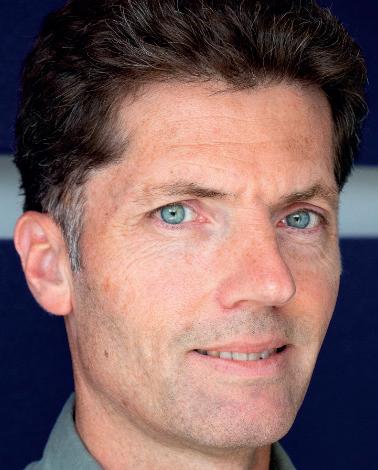

Ingo

Schmidt, Plate

Big Interview: Successful succession

As Managing Director of Plate, one of Germany’s oldest and largest independent dealers, Ingo Schmidt has had his work cut out since taking on the mantle of leadership from his long-reigning, late father Dieter at the beginning of 2021. Throw in a global pandemic and the challenges multiply.

Combining the traditions of a family-run business with a good dollop of much needed technology and modernity, Schmidt is determined to make Plate successful for many years to come. And soon, he can also enjoy the input of his ultimate successor – his daughter who is just about to start her Plate journey.

FOCUS: US HAMMER BLOW FOR NINESTAR

If you are a dealer with a supply chain solely dependent on Ninestar product and you have no backup suppliers, you have a major problem. Some will shift to other China-based manufacturers, but we expect a lot of unease with a sourcing strategy which is 100% reliant on Chinese manufacturing.

[...] There is a potentially catastrophic risk of having one’s brand associated with [forced] labour. Any dealer, seller, retailer or otherwise that is large enough to have a private brand has a supplier code of conduct/ethics which explicitly prohibits this type of human rights violation.

CONTENTS

6 Obituary

Remembering

FusionPlus Data’s Steve Bilton who sadly passed away in June

20 Big Interview

Plate’s Ingo Schmidt is adjusting to a fastchanging German industry landscape –gone are the quiet years

26 Opinion

Customers and culture – the two Cs in Viking’s new strategy

28 Focus Challenges ahead for Ninestar as US bans imports from the Chinese giant

30 Category Update

New ways of working are keeping the furniture sector alive and well

36 Advertorial Pukka Pads celebrates 25 years in business

38 Category Update

Health and sustainability: new breakroom priorities

42 Review: OPI

European Forum

Changing goalposts and continued disruption –it’s do or die for many in our industry

44 Review: NeoCon

Crowds gathered at The Mart for a highly visual and sensory experience

46 Review: Clerkenwell Design Week

Trendspotting in the streets of London

REGULARS

5 Comment

8 News

14 Green Thinking News

18 OPI Small Talk

48 5 minutes with... David Harman

50 Final Word Christian Langvad

July/August 2023 3

The OPI team

EDITORIAL

Editor

Heike Dieckmann +44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite

+33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor Michelle Sturman michelle.sturman@opi.net

Freelance Contributor David Holes david.holes@opi.net

SALES & MARKETING

Chief Commercial Officer

Chris Exner +44 7973 186801 chris.exner@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager

Lisa Haywood events@opi.net

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations Kelly Hilleard kelly.hilleard@opi.net

PUBLISHERS

CEO

Steve Hilleard +44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell +44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand +44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin Facebook: facebook.com/opimagazine

Podcasts: opi.net/podcast App: opi.net/app

There’s growth out there – let’s find it

Just a few days before we went to press with this issue of OPI , news had emerged of Hamelin buying Pelikan Group from its Malaysian owners (page 8) . B ig news and a real statement of intent by Hamelin as to where it’s headed. It’s also positive affirmation that there’s a future in office supplies and several other, quite traditional but not too ‘out there’, categories.

‘Growth’ is the operative word nowadays. How to achieve it comes up in almost every conversation, in every feature in these pages, at every industry event. When I recently talked to Ingo Schmidt at Plate in Germany for our Big Interview (page 20), it was certainly a recurring theme. And it was heartening to hear how much heed Schmidt pays to the importance of ‘people on the street’ – reps talking to customers all the time in order to grow in whichever way possible.

It was also interesting to get his thoughts on consolidation in the vendor community and the challenges this can bring in terms of power shuffles. Hamelin, for one, will feel that little bit stronger once the might of Pelikan and Herlitz is behind it, I would imagine.

What I noticed very acutely during the OPI European Forum in Amsterdam in May is that there is a strong willingness to get through the current period of disruption and grow together (page 42) –competitive rankling aside.

And serious disruption we are facing, no doubt about it. Dare I say articificial intelligence and ChatGPT, ‘everywhere commerce’, inflationary pressures and intelligent pricing? All these topics were discussed at the event – some on stage, others more informally.

One more thing about growth: OPI has expanded! I’m delighted to welcome to the team Kate Davies, who started her role as Assistant Editor in early June. With the addition of a new UK publication at the beginning of the year – Workplace360 – we have been stretched somewhat in our editorial resources, so it’s fantastic to have Kate on board.

With a degree in graphic design and a Masters in journalism, she ’ll be an invaluable asset to the team and many of our readers will hopefully hear from her and see her out and about in the months to come. Right now, she ’s knee-deep immersed in all things business supplies.

July/August 2023 5

No

copyright

International

COMMENT

The

carrier sheet is printed on Satimat Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months.

part of this magazine may be reproduced, copied, stored in an electronic retrieval system or transmitted save with written permission or in accordance with provision of the

designs and patents act of 1988. Stringent efforts have been made by Office Products International to ensure accuracy. However, due principally to the fact that data cannot always be verified, it is possible that some errors or omissions may occur. Office Products

cannot accept responsibility for such errors or omissions. Office Products International accepts no responsibility for comments made by contributing authors or interviewees that may offend.

Office Products International Ltd (OPI) Focus7 House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP, UK Tel: +44 20 7841 2950 Connecting the business products world

OPI is printed in the UK by

www.carbonbalancedpaper.com CBP0009242909111341

There is a strong willingness to get through the current period of disruption and grow together

HEIKE DIECKMANN, EDITOR

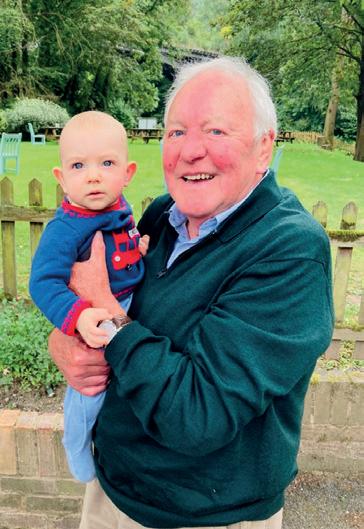

A tragic loss: Steve Bilton

OPI was stunned and deeply saddened to learn of the sudden passing of Steve Bilton, Managing Director of ECI’s FusionPlus Data product content solution.

Steve, or ‘Billo’ as he was affectionately known, was a highly respected and immensely popular figure in the business products industry. He had accumulated 30 years’ experience in the software and data solutions arena, in both the UK and the US, and helped to establish the EvolutionX e-commerce platform.

He was part of the ownership team at FusionPlus’ former parent company, ES Tech Group, which was sold to ECI Software Solutions last year.

Steve’s energy, sharp business mind and infectious enthusiasm will be sorely missed. OPI extends its deepest sympathies to Steve’s family, friends and colleagues.

On behalf of the ECI family, Business Unit Leader Paddy Donnelly has issued the following tribute:

IN LOVING MEMORY OF BILLO

A beacon of light extinguished all too soon, Billo was more than a friend; he was a brother, a business partner, and a soul woven into the fabric of our lives for the past 13 years.

He was an unfailing source of support and encouragement, professionally and personally, and he constantly saw the beauty in life and the people around him.

His passing is a painful reminder of the battles one can wage. Despite his silent internal struggles, Billo never ceased to offer us his warm smile, comforting words and a shoulder to lean on. His ability to spread love while quietly enduring pain speaks to his tremendous strength and compassion.

We are left now with the echo of his laughter, the memory of his warm embrace and the legacy of his kindness. We mourn his loss and honour his memory, knowing that even though he isn’t with us physically, he remains in our hearts forever.

In the face of this unspeakable tragedy, let us remember Billo, not for how he left us, but for how he lived among us – a genuinely wonderful and gentle man who brought joy to all who had the pleasure to know him.

INDUSTRY TRIBUTES

Many more tributes were paid on LinkedIn (slightly edited). Below is a small representation.

Ian Buckley, Managing Director, Prima Software

Shocked to the core by this sad news, you leave behind many friends and a lasting legacy. It’s times like this when you realise what an impact people have on your career.

I’ll forever be grateful for the guidance and knowledge that Billo was so generous with –not to mention the many great nights out and events over the years.

Dave Bent, SVP Operations – Distribution Division, ECI Software Solutions

A wonderful person who cared deeply about others. Always fun to be with and he had a huge impact on our business and customers in both the UK and the US.

Craig Noyle, Director, Inovocom

A legend in the UK, but also around the world.

Vanessa Warne, Category Director Furniture, VOW Wholesale

Funny, unique and definitely one of a kind!

Mark Wilkinson, Regional VP, UK & Ireland, ACCO Brands EMEA

You will be missed Billo.

6 www.opi.net

OBITUARY

YOU ARE INVITED TO ENTER THE EUROPEAN OFFICE PRODUCTS AWARDS 2024

CALL FOR ENTRIES

ENTRIES ARE NOW BEING ACCEPTED IN THE FOLLOWING CATEGORIES:

l Business Product of the Year

l Sustainability Excellence

– Vendor and Reseller

l Marketing Campaign of the Year

l Initiative of the Year

l Marketplace/Platform of the Year

l Vendor of the Year

l Reseller of the Year

l Wholesaler of the Year

l Young Executive of the Year

l Executive of the Year

l Industry Achievement

FOR THE FULL CRITERIA, PLEASE VISIT WWW.OPI.NET/EOPA2024

HOW TO ENTER

Winning an award can make a real difference to your business, so be sure to get involved. Simply complete an entry form online at www.opi.net/EOPA2024 or email your nominations to awards@opi.net

The closing date for entries is 13 November 2023

AWARDS PRESENTATION – MARK YOUR DIARY!

WINNERS WILL BE ANNOUNCED AT THE ANNUAL EOPA DINNER

12 MARCH 2024, HOTEL OKURA, AMSTERDAM

BY

ORGANISED

Hamelin acquires Pelikan

There has been a major transaction in the global stationery market as France-based Hamelin has been revealed as the buyer of Pelikan Group from Pelikan International Corporation Berhad (PICB).

In May of this year, PICB – which is listed on the Malaysian stock exchange – confirmed it was in talks to offload most of its operations to a “strategic buyer”, ie an existing market player.

Hamelin has agreed to a share purchase of three PICB entities – essentially the Pelikan and Herlitz school and office products businesses. These include four production sites in Germany, Poland, Mexico and Colombia.

Hamelin will pay PICB €136 million ($148 million) in cash for Pelikan. In addition, it will assume responsibility for debts totalling around €32 million. PICB said the deal represented an implied enterprise value for Pelikan of €189 million and a selling price of around 9.6 times its 2022 adjusted EBITDA of €19.6 million. Hamelin confirmed to OPI that it will fund the acquisition through loans and existing cash on hand.

The transaction is still subject to a number of closing conditions. These include regulatory approvals in Germany, the green light from PICB’s shareholders, and the successful carve-out of a number of PICB assets that are not included in the acquisition. Closing is expected to take place before the end of October this year.

Senior appointments at EVO

There has been a raft of staff changes at EVO as the UK multichannel operator announced its Complete management team which includes John Barker as Managing Director and Elaine Collett as Head of Sales. Collett is supported by two new Regional Sales Managers for the North and South, Karen Blatherwick and Carl Rundle. Other appointments are:

• Pamela Wakefield, Head of Facilities

• Lee Jarvis, Head of Workwear Operations

• Phil Sibson, Head of Interiors

• Jonathan Thiem, Managing Director of Technology

• Nigel Hindmarch, Head of Purchasing

• Ian Robins, National Service Director

• Alex Gerrard, Interim Financial Director

• Rebecca Bower, Senior Commercial Financial Manager

At Banner meanwhile, Karen Child has been promoted to Head of Marketing while VOW Wholesale made Phillippa Bourne Head of Marketing. Also on a VOW note, Managing Director Adrian Butler has joined the BOSS Federation board, effective immediately.

Colton joins PPS

Helen Colton has joined Product Promotion Services as Head of Marketing and Supplier Relations. She’s also been named Head of Business Development at InControl Marketing.

Tatham

back at Westcoast

Alex Tatham rejoined Westcoast at the beginning of June. He had spent 14 years at the distributor before leaving in 2022 for a brief spell at services and consulting firm NSC Global.

New AFFLINK CEO named

AFFLINK chose an internal candidate, Performance Food Group’s Michael Wilson, to succeed outgoing CEO Dennis Riffer. It has also named Chip Shields as CFO/COO.

UFIPA appoints new President

UFIPA has elected Stéphanie Verrier, Managing Director of Trodat France, as President of the French association. Bruneau CEO Nicolas Potier was named Treasurer.

CEO leaves Logitech

Logitech CEO Bracken Darrell has stepped down after over ten years in the job. Director Guy Gecht has been named interim CEO.

8 www.opi.net NEWS

ON THE MOVE

Stéphanie Verrier

Helen Colton

Alex Tatham

Michael Wilson

Bracken Darrell

PICB – which acquired the stationery business in 2005 – stated that the industry has “evolved significantly” since then, notably in terms of distribution channels, production technology and secular declines. It said it did not have the financial resources to tackle any of these three areas and the proposed sale to Hamelin was in the best interests of PICB shareholders.

In a press release, Hamelin CEO Eric Joan said: “Pelikan’s brands, product range and global distribution network fit perfectly with Hamelin’s industrial plan to become a global player in the school and office supplies markets.

“The synergies are considerable, and the growth potential is very significant for the Oxford and Pelikan brands worldwide,” he added.

Pelikan – headquartered in Berlin – generated revenue of about €206 million in 2022. 53%

of that came from Germany, so Hamelin will clearly strengthen its position in this key European market. Most of the remaining 47% of Pelikan’s sales are split evenly between the rest of Europe and the Americas region, specifically Mexico, Argentina and Colombia.

The deal will also reinforce Hamelin’s presence in the school sector. About 44% of Pelikan’s sales last year came from this segment, with the next largest being office, at 36%. Other categories are fine writing (7%) and hobby, arts & crafts (5%).

The combined Hamelin/ Pelikan businesses will have annual revenue in excess of €600 million and – at current levels – employ more than 4,000 staff worldwide.

By comparison, competitor FILA – which OPI had tipped as a potential acquiror of Pelikan – has annual sales of approximately €760 million and about 11,500 employees.

FriendsOffice promotion

FriendsOffice has promoted Director of Sales Kim Belknap to VP of Sales and Marketing. Belknap joined the US dealer in 2021.

New recruit at Beaverswood

Beaverswood in the UK has named Kirsty Rogers as Sales Manager. She previously worked for firms such as Manutan and Safe Industrial.

Antalis appoints UK MD

Nick Thompson has been announced as the new Managing Director of Antalis in the UK & Ireland, succeeding the retiring David Hunter.

EO Group moves

EO Group has appointed Michael Baker-Mosley as its Group Marketing Director. He joins from leading sports betting platform provider Kambi. Danny Berendsen, meanwhile, has returned to EO Group as Managing Director of online reseller Euroffice. He was with the company for six years before joining Bi-silque in 2017.

Swiss wholesalers investigated

Two Swiss business products wholesalers are under investigation by the local competition authority following suspicions of price fixing.

At the beginning of June, the Competition Commission (COMCO) confirmed it was looking into the online trading of print consumables and office supplies. It suspects two wholesalers – Office World Group’s Oridis and Ecomedia – and resellers of colluding on end-user pricing.

In a statement to OPI, Office World confirmed the headquarters of its two subsidiaries had been searched by COMCO representatives and the companies were fully cooperating with the authorities.

SSI names President System Solutions (SSI) has named VP John Evans as new company President. Evans succeeds Charles Russell who will remain in a senior management role.

Lexmark senior appointments

Lexmark has named Tonya Jackson as Chief People Officer, succeeding Sharon Votaw. Taking on Jackson’s Chief Product Delivery Officer position is Billy Spears, previously VP of Global Service Delivery and Supply Chain Operations.

Viking management changes

Viking has confirmed two senior appointments in the UK & Ireland. Experienced exec Peter d’Amery was named Sales Director, tasked with growing the key accounts customer profile.

Julia Martin, meanwhile, has been appointed Senior Manager Customer Service.

NEWS July/August 2023 9

Michael Baker-Mosley

Kim Belknap

Kirsty Rogers

Nick Thompson

Danny Berendsen

John Evans

Tonya Jackson

Bill Spears

Julia Martin

Peter d’Amery

FTC sues Amazon

Clover buys reman firm

Clover Environmental Solutions has acquired a remanufacturing company as part of its diversification strategy. The company – which recently rebranded from Clover Imaging Group to Clover Environmental Solutions – has purchased all the operating assets of America’s Remanufacturing Company (ARC), a returns management and remanufacturing solutions business servicing OEMs, distributors and retailers.

The US Federal Trade Commission (FTC) has filed a complaint against Amazon over the way the e-tailer enrols customers onto its Prime programme.

The FTC alleges that Amazon “knowingly duped” millions of customers into subscribing to Amazon Prime by using “manipulative, coercive, or deceptive user-interface designs known as ‘dark patterns’ to trick consumers into enrolling in automatically renewing Prime subscriptions”.

The complaint – filed in the US District Court for the Western District of Washington – also charges Amazon with complicating the process for Prime subscribers to end their membership. It alleges that the “primary purpose of its Prime cancellation process was not to enable subscribers to cancel, but to stop them”.

“Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money,” said FTC Chair Lina Khan. “These manipulative tactics harm consumers and law-abiding businesses alike.”

The FTC is also reportedly preparing to file an antitrust lawsuit that will target Amazon’s core online business. It is expected to claim the company has improperly used its power to reward online merchants which use its logistics services while penalising those that do not.

Lyreco Interiors initiative launched

Lyreco in the UK and Ireland has launched Lyreco Interiors, providing a broad range of services beyond the reseller’s traditional workplace furniture offering. The portfolio entails space audits and planning, interior design, furniture fit-outs, audiovisual installations, display screen equipment assessments, sustainability advice, delivery and installation.

For its Interiors team, Lyreco has created what it calls ‘category champions’ from 16 members of its existing sales force. They are overseen by Steve Weston – who heads the Core Office unit at Lyreco – and Senior Product Manager Chloe Lovatt. The company is working with several supplier partners on the initiative. These include Bisley, Dams, Ocee & Four Design and Broadbase.

Headquartered in Augusta, Georgia, ARC operates in several product categories such as small home appliances and consumer electronics, floor care, home comfort, powered hand tools and outdoor power equipment. Financial details were not disclosed.

Omnia Partners secures Premier assets

US group purchasing organisation (GPO) Omnia Partners has agreed to buy the non-healthcare operations of Premier for $800 million.

Premier is a key player in the healthcare purchasing market, but has also expanded its membership beyond this vertical to include educational, hospitality and recreation organisations – numbering around 175,000 as of mid-2020. Essentially, this made it a competitor of Omnia and other providers of cooperative contracts.

Following the closing of the transaction – which is expected by early August – Omnia will become the primary GPO for these non-healthcare customers. Business products organisations that hold Premier GPO contracts include AOPD, Essendant (in partnership with Independent Suppliers Group), Staples and ODP Business Solutions.

In June, Lyreco held an event in London’s Clerkenwell district to mark the opening of the Interiors offering. It is also creating a new showroom at its Telford headquarters to exhibit its latest innovations in workplace design.

NEWS 10 www.opi.net

Fellowes opens new Chicago centre

Fellowes has debuted its new Design and Experience Center during the first annual Fulton Market Design Days in Chicago, Illinois, coinciding with NeoCon (see Event, page 44)

Located on the 9th floor of 800 W Fulton Market in a 12,000 sq ft (1,200 sq m) facility, the centre showcases the vendor’s full range of WorkLife products. In addition, it serves “as an educational and interactive creative space for designers, architects, dealers and end users to collaborate and inspire workplace solutions”.

The products on display include modular walls, furniture, air quality

management and workplace products, and business machines.

“Each area of the centre has been developed for a distinct and specific purpose, setting out to imaginatively serve our customers, the industry and the market better,” said CEO John Fellowes.

Meanwhile, Fellowes has expanded its European contract furniture offering with the acquisition of Dutch vendor Filex Workspace Solutions. Filex is a provider of monitor arms and electrification products, mainly to specialist resellers in the Benelux market.

New NBPI Chair announced

RJ Schinner President Steve Schultz

has been confirmed as the new Chair of the National Business Products Industry (NBPI) Council and Committee at the City of Hope.

Steve Schultz

Schultz takes over from Scott Light, who is retiring from Georgia-Pacific after 25 years.

Schultz is a familiar face in the US business products world, having had senior roles at firms such as United Stationers/Essendant, GOJO, S.P. Richards and Supply Source Enterprises. He joined RJ Schinner earlier this year.

For more on RJ Schinner and Schultz, look out for our Big Interview in the next issue of OPI

NEWS July/August 2023 11

Stephen Almond, Executive Director, Regulatory Risk

Essendant earns VETS award Russian market changes

Essity has agreed to sell its Russian business to local management. The sale is expected to be finalised shortly.

Mondi, meanwhile, withdrew from an agreement to divest its Russia-based Syktyvkar operations due to a “lack of progress” from potential buyer Augment Investments.

Many company leaders today are preoccupied with the ongoing debate about days in the office rather than the capabilities and strategies being deployed to create a sustainable, responsive and magnetic workplace experience

McKinsey Survey, June 2023

£17,000

Total amount raised at the BOSS Business Supplies Charity Day at Belton Woods resort, Grantham, UK

Industry legend publishes book

Former Spicers CEO Bill Armstrong has published the story of his life and career. A Life In Perspective begins with Armstrong’s formative years before delving into his 34-year career at Spicers.

US wholesaler Essendant has earned the designation of Recognized Employer in the 2023 VETS Indexes Employer Awards.

The programme acknowledges organisations committed to recruiting, hiring, retaining, developing and supporting veterans and the military-connected community.

¥5 billion

Extraordinary loss to earnings expected by Nippon Paper after closure of M5 paper machine at its Maryvale mill in Australia

Industry leaders cycle for cancer charity

OPI’s Steve Hilleard was among 18 participants who cycled the third annual Ride of Life in May to raise £12,149 ($15,535) for the Institute of Cancer Research.

The challenge involved either a 50 km (31 miles) or 100 km journey through country lanes in the UK. Most opted for the longer route, which climbed over 1,200 metres in height.

EU ends pulp cartel case

The European Commission has closed its antitrust investigation into the wood pulp sector. In 2021, it inspected several companies for possible violations of EU antitrust rules. Now, it has concluded, there are “insufficient grounds” to continue.

NEWS 12 www.opi.net

IN BRIEF

97% Percentage of business owners who believe ChatGPT will benefit their companies

Businesses are right to see the opportunity that generative AI offers, whether to create better services for customers or to cut the costs of their services. But they must not be blind to the privacy risks

PICTURE OF THE MONTH

Officeworks opens green energy store

In June, Australian office products reseller Officeworks celebrated the launch of its lowest emission store. The outlet in Warana, Queensland, is the first of its kind to be powered by a 100 kWh lithium battery and also includes 100 kW of solar panels. Together, these will provide enough energy to power around 70% of the store’s electricity needs. Other improvements that have previously been carried out at the location include LED light fixtures, a building energy management system, thermal coating and double insulation in the roof.

By 2025, the aim is for all Officeworks Queensland stores to operate using 100% renewable energy as the retailer works towards its target of net zero emissions by 2030.

More substances added to TCO list

IT products certification organisation TCO Certified has added six more chemicals to its accepted substance list. TCO said: “Dioxins, halogens and other toxic substances end up in the natural environment because of improper use in manufacturing and when products are not recycled responsibly in a controlled environment.”

As part of its efforts to enable safer choices and provide more transparency, TCO has developed its accepted substance list as a reference tool for IT manufacturers.

In 2021, the system was expanded from substances used in products to also cover cleaner and degreaser substances used in manufacturing processes. The new items (all process chemicals) on the list are:

• n-Butanol (71-36-3)

• Butanone (78-93-3)

• Ammonium hydroxide (1336-21-6)

• CYBERSOLV (C8882 and C8622)

• Vital (GW9066)

ODP releases sustainability report

The ODP Corporation has published the 2023 Sustainability Report, providing information on its environmental, social and governance practices and goals.

The publication covers ODP’s accomplishments, impact and continued focus on meeting its sustainability goals while helping customers achieve their own commitments and supplier diversity targets. Highlights in the report include:

• Committed to setting near-term, company-wide emission reductions in line with climate science with the Science Based Targets Initiative.

• Reduced Scope 1 and Scope 2 greenhouse gas emissions by 29% (since 2019).

• Collected $2.15 million to benefit 68 Title I schools and donated 18,000 fully stocked backpacks.

• Achieved 69% waste diversion with more than 64 million lbs (30 million kg) of waste diverted from landfills.

• Logged 4,500 total volunteer hours from 970 associates in 15 communities during the Season of Service and Depot Day of Service initiatives.

• Increased spending with diverse and small businesses by 26%.

• Supported 10,000+ minority entrepreneurs through its Elevate Together project.

14 www.opi.net GREEN THINKING

European aftermarket supplies vendor KMP is showing customers how much CO2 they save when purchasing remanufactured cartridges. The company said it has developed a methodology with an independent testing institute in accordance with the DIN EN ISO/IEC 17020 standard.

This allows KMP to monitor and analyse the remanufacturing process of its cartridges in terms of CO2 emissions. From now on, KMP will include the CO2 emissions of its products on customer invoices and tell them how much they have saved compared to buying a new cartridge – although it did not specify exactly how it makes this calculation. The vendor claims its products saved almost 54 tonnes of CO2 in 2022.

Platinum medal for sustainability at Essity

Health and hygiene vendor Essity has been awarded its third Platinum medal by sustainability ratings provider EcoVadis. The manufacturer received 78 out of a possible 100 points, which has placed it in the top 1% of all companies assessed by EcoVadis for their sustainability performance.

The assessment considers four areas of impact when rating a company: environmental, labour and human rights, ethics and sustainable sourcing.

Meanwhile, Essity’s B2B brand Tork added to its owner’s sustainability successes. In June, Tork announced it offers carbon neutral certification on 27 of its existing soap, toilet paper and hand towel dispensers. The products – currently available in Europe – are made with renewable electricity and the remaining emissions are compensated for by investments in certified climate projects.

GREEN THINKING NEWS July/August 2023 15

KMP highlights CO2 savings

Paper Excellence looks ahead

Pulp and paper giant Paper Excellence Canada has published its Forward Focused: 2022 Sustainability Report. The third of its kind, it looks at the group’s achievements and the opportunities to do better.

The report includes the company’s environmental and economic impacts across Canada and on a mill-by-mill basis. Paper Excellence said 82% of its total energy use in 2022 was renewable, while it continues to reduce its greenhouse gas emissions – now down by 67% since 1990.

“To supplement the hard data in the report, we’ve also produced eight Practices and Perspectives stories that are linked to our website via QR codes,” said Graham Kissack, VP of Environment, Health & Safety and Corporate Communications.

Envoy Solutions joins SmartWay collaboration

Jan/san and facilities supplies distributor Envoy Solutions has recently joined the SmartWay Transport Partnership. Launched in 2004, SmartWay is a collaboration between the US Environmental Protection Agency and industry that provides a framework to assess the environmental and energy efficiency of supply chains.

The initiative relies on SmartWay tools and approaches to track and reduce emissions and fuel use from goods movement. It currently has over 3,000 partners including shippers, logistics companies, and truck, rail, barge and multimodal carriers.

Exacompta in licensing partnership

Paper and stationery manufacturer Exacompta has announced a licensing partnership with global financial technology company SumUp for a co-branded environmentally responsible thermal reel.

The reel – produced in France – has no core or plastic packaging and is plastic- and phenol-free. This, said Exacompta, “reinforces the sustainable development commitments of both companies”. In addition, the product is FSC-certified and complies with all relevant European regulations.

The reel, which is compatible with the SumUp printer and card reader bundles, is available in retail and distribution channels across Europe from July 2023.

Epson tackles plastic pollution with 5 Gyres

Print OEM Epson has partnered with non-profit organisation, the 5 Gyres Institute, to raise awareness of plastic pollution and identify solutions for customers to reduce plastics in their work and at home.

5 Gyres is a leader in the global movement against plastic pollution with nearly 15 years of expertise in scientific research and engagement on this issue. The team leads research to drive upstream solutions, vet innovation, and support good policy measures that address the many sources of this type of pollution.

Through the partnership, Epson will support 5 Gyres’ solutions-focused research in 2023 by investigating the environmental fate and toxicity of bioplastics, determining the release of nano- and microplastics from everyday items, and assessing novel materials in waste management streams, including compost.

Denmaur signs up to SBTi

Denmaur Independent Papers has said it is the first national paper and board merchant in the UK to have a science-based target validated by the Science Based Targets Initiative (SBTi). The target is in line with the 1.5°C pathway set out in the 2015 Paris Agreement.

Denmaur now appears on the SBTi website with a 2030 near-term declaration to reduce its Scope 1 and 2 emissions (emissions from fuels, vehicles and purchased electricity). The company is also required to update and publish its progress towards this goal each year.

Denmaur’s near-term reduction target of 46% by 2030 is based on its 2019 footprint and also includes the 2019 carbon footprint of its Bescot operation, which was acquired from Middleton Paper in 2022.

Denmaur worked with carbon specialists Nero Carbon to measure its emissions in line with the Greenhouse Gas Protocol and ISO14064-1 standards. It will continue to work with Nero on submitting its long-term net zero target with the SBTi by September of this year.

GREEN THINKING NEWS 16 www.opi.net

Matters of IMPORTANCE

The heads of two very different alliances were recent guests on OPI Talk – Interaction’s Jan Van Belleghem and Sam Moncada from COPA. Their priorities are different, but their focus is similarly sharp

The evolution of Q-Connect…

Jan Van Belleghem: After 25 years, we felt the need to clarify the brand values of Q-Connect. We embarked on a brand identity exercise and it became clear that sustainability was one of the elements needing more focus. It was also very much on the agenda of our board.

Some of our members – such as EVO, Wulff and PBS Holding – had acquired businesses from Staples Solutions which served large customers with sustainability written into their general purchasing policies. Therefore, it was important to position Q-Connect as an environmentally sound brand.

However, all members are aware that this is a train everybody needs to catch – you don’t want to be left on the platform – and there’s broad support for sustainable initiatives.

Q-Conscious explained…

Q-Conscious is our journey towards sustainability. It means being conscious of the people who make our products and the planet

Return-to-the-office in Canada…

Sam Moncada: It has been a challenge for employers to get their staff back to work. There is one company that comes to mind which mandated everyone to return to the office full time, with no flexibility. This was not well received, resulting in people leaving and even in legal issues.

My perception is that, in the next 12 months, you will see most organisations offering employees a hybrid environment. They will have no choice.

we live on – social and environmental aspects as well as the products themselves are the three pillars at the core of our CSR Charter. Using a team of experts from within our member organisations, we have defined several criteria. These include having a recognised environmental label, using recycled or biodegradable materials, and eliminating plastic packaging. For a product to be part of the Q-Conscious family, it must meet at least one of these criteria.

Q-Conscious is our journey towards sustainability

Progress so far…

Last year, around 600 of more than 3,500 Q-Connect products fell into the Q-Conscious portfolio. This will rise to 700-800 by the end of 2023. We realise not every SKU can be turned into a Q-Conscious item, so our ambition is to reach 80% of the range by 2027.

Beyond ‘office products’…

A few years ago, the Canadian Office Products Association (COPA) began managing the Canadian Hardware and Housewares Manufacturers Association due to its synergies with OP – think vendors such as 3M or Newell Rubbermaid. We’ve since transitioned to the Canadian Home Products Trade Association, partly to appeal to a wider membership.

COPA is on the verge [of something similar]. Our new learning platform – the Home and Office Products campus – gives a clue as to where we’re headed.

Sam Moncada

18 www.opi.net SMALL TALK

Jan Van Belleghem

OPI GLOBAL FORUM - BOOK NOW!

Early bird rates are available – book by 31 July, with free cancellation until 5 October 2023. We also have special, discounted deals for OPI members and independent dealers.

“Two days of excellent, thought-provoking conversations, presentations and discussions. A great opportunity to step back from day-to-day operations, learn from others and take home new ideas.”

This is a unique event where senior executives take time out of their business in order to work on their business. Don’t miss this opportunity to join them

The OPI Global Forum was a great opportunity to have all levels of the IDC together in one room sharing our successes, concerns and visions for the future. I am thankful I attended.”

“

BOOK NOW WWW.OPI.NET/GF2023

CHARLIE KENNEDY KENNEDY OFFICE

DAVE BENT

ECI SOFTWARE SOLUTIONS

Successful SUCCESSION

Germany’s Plate survived the coronavirus crises pretty well. But the disruption caused now requires permanent change, says Managing Director Ingo

Succession can be a difficult endeavour in any family-run business. And while deep roots and long-standing traditions often make for a loyal customer base, bringing in new ideas and affecting change is tough. Throw in a pandemic and the challenges multiply.

Ingo Schmidt knows plenty about all of the above. As Managing Director of Plate, one of Germany’s oldest and biggest independent dealers, he’s had his work cut out since taking on the mantle of leadership from his long-reigning, late father Dieter at the beginning of 2021.

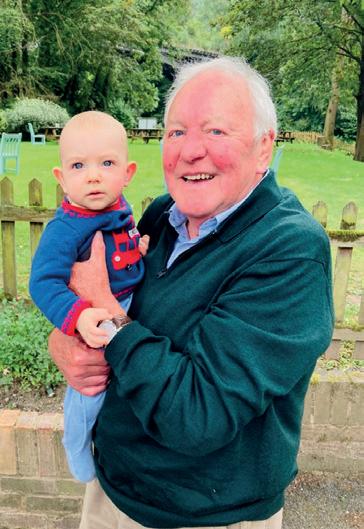

More than 12 years after OPI’s first-ever interview with the company’s old guard, Heike Dieckmann once again visited her home turf of Bremen in the north of the country to chat to the new leading man. Schmidt, interestingly, brought along his designated ultimate successor – his daughter Merle who is about to start her career at the dealership, learning from the ground up and bringing with her youth, enthusiasm and a fresh pair of eyes and ears.

Candidly open and honest, he talked about mistakes made – and not to be repeated –current challenges and how he hopes tradition combined with a much-needed dollop of technology will make Plate successful for many years to come.

OPI: You’ve been immersed in the family business all your life. What are your earliest memories of ‘life at Plate’?

Ingo Schmidt: When I was a little boy, eight or nine perhaps, my father – he was already Managing Director at the time – took me to the

Schmidt

warehouse to show me around. I remember it well – I saw a pallet truck which takes goods to the entrance, ready for loading into vehicles.

When no one was watching, I very naughtily got in the truck and drove it around the warehouse – it was like a toy car to me. I got caught by the manager and told off severely. So much for making a first impression.

Throughout my childhood and definitely during my final years at school, I spent a lot of time in the firm, mostly in the warehouse, to help out and learn as much as possible. It was interesting because I became really good friends with some of the staff during that time, but these friendships became something quite different when, years later, I began working at Plate properly.

As the son of the owner with a stake in the business, people all of a sudden started treating me differently. It was a real lesson to me and not a particularly nice one.

OPI: So you didn’t spend your entire professional career at Plate?

IS: No, I didn’t. I completed an apprenticeship in wholesale and B2B trading at a dealership in southern Germany for two and a half years.

20 www.opi.net BIG INTERVIEW

Following that, I joined German manufacturer Herma for a few months.

I began working at Plate as a field sales rep in 1993. I actually started studying at the same time, in evening classes, but ultimately couldn’t make it work as my rep job took me to some remote corners of northern Germany while the classes were in a different place completely. It was stressful and incredibly time-consuming –I gave up after a relatively short period.

I was fairly familiar with the internal workings of the firm from my youth, but I had never done anything customer-facing. I loved the rep job I did for the first five years – meeting customers, hitting sales targets and being my own boss in many ways. Then, in 1998, I started in-house in the purchasing department, working with my dad – he taught me everything about the business.

OPI: You mentioned the challenges of relationships with employees and the ‘us’ and ‘them’ barrier. Did you overcome this?

IS: It’s just a reality in my opinion. I found that good leadership is a very difficult thing to master, particularly on the HR side. You can never please everyone and are almost by default the bad guy.

There are always difficult decisions to be made – firing someone or making them redundant is the hardest, but many other things will keep you awake at night. This notion that, if you run your own business, you are your own boss, decide how to spend your time, etc – it’s nonsense. Being an entrepreneur is a 24/7 job, at the expense of almost everything else. I found it tough, I freely admit.

About two years ago, I came up with a rule: after 12.30 pm on a Friday, I do not want to hear any bad news. Simply because we won’t be able to deal with it that day, so inevitably you carry the worry into the weekend. Either the supplier you’re dealing with is not around, or the member of staff in charge of sorting the specific issue is gone for the day. The concept has worked very well so far. I sleep much better now.

BIG INTERVIEW Ingo Schmidt July/August 2023 21

I found that good leadership is a very difficult thing to master, particularly on the HR side

OPI: Is your mother still involved in the firm?

IS: Yes, she is. She’s supporting me in everything I do.

OPI: I talked to your father in 2011 – how would you summarise the past 12 years?

IS: Between 2011 and 2019, Plate went through what I would describe as a quiet period. The competition was the same – we battled with Lyreco and Staples Advantage at the top end and with other independent dealers of varying sizes at the other end of the spectrum. Nobody went bankrupt and there was steady if not spectacular growth in the market.

Yes, paper consumption went down a bit, as did sales of filing products, but nothing was happening fast and no one was disrupting the status quo. Most operators didn’t see the need to alter anything dramatically – Plate included.

Digitisation was gaining momentum during those years, but that too seemed evolutionary rather than revolutionary.

OPI: And then came COVID I guess.

IS: Indeed, it did. The landscape changed radically and it was all about Zoom, Teams, Skype and ‘home office’. Much of the customer base we served was sent home to work and people didn’t need office supplies, paper, ink, toner and water canisters anymore.

At least not from us. When they did require something, they got given Amazon vouchers by their employers and could spend them as they saw fit. As long as purchases weren’t overly extravagant, nobody cared – it was the easiest way for companies to deal with a new and difficult situation. That was what they believed anyhow.

OPI: Even some of the bigger customers you deal with?

IS: Absolutely. We have a customer in Bremen which did exactly that. As did another, a big accountancy firm with 300 employees. I cannot imagine what the costs were for these companies which completely abandoned their normal purchasing protocols.

OPI: Was it mainly Amazon that benefitted?

IS: Böttcher did very well too. I don’t know about OTTO Office, as it’s always more expensive. I don’t really understand the overall Printus strategy with all the different shops it has. The running costs must be horrendous.

OPI: What did Plate do during this period?

IS: We sold enormous amounts of masks, hygiene products and COVID testing kits. And we did that really well, partly through our EOSA links and excellent sourcing partners in China.

Nothing else was important – the fact no one wanted ring binders, for example. Our customer base got quite distorted at this time too. We were a major supplier of masks to hospitals in the Hamburg area, for instance.

Financially speaking – and despite the many challenges surrounding imports, certifications, etc – we had the best years ever during the pandemic with revenues well over €100 million ($109 million). I’d say about 20% of sales came from COVID products.

OPI: What about now – how well-placed did you emerge from it?

IS: The artificial high is gone and we always knew it would be temporary. Until the end of last year, COVID products were still holding up

FAST FACTS

Founded: 1871 by Diedrich Plate Headquarters: Lilienthal (Bremen), Germany

Leadership: Ingo Schmidt, Managing Director Staff: 320

Geographical coverage: Germany (with eight facilities)

Revenues: €100 million ($109 million)

SKU count: 50,000

BIG INTERVIEW Ingo Schmidt 22 www.opi.net

pretty well, we didn’t see an impact on sales. Other categories did well too. The beginning of the year was slower, but the real dip began in March and this has carried on ever since.

I think many other operators are seeing this too.

I don’t know why March was so bad when pandemic products had already stopped being big sellers months before. Perhaps it’s the fact that prices were not as ridiculously high anymore plus a fear of a looming recession. Revenues are down and substantially so, that’s certainly a fact.

Take furniture. We performed well here at the tail end of the pandemic thanks to refits, home offices, etc. But large furniture projects are an investment and nobody invests when heading into a recession. Few new office blocks are going up and no one is really relocating.

OPI: What are you doing about it?

IS: We’re constantly debating what we could add to our portfolio, within the widest scope of workplace products. We’re trying to stick to our ‘office’ audience – this is where our sales force is very accomplished. If we veered too far away from that, we’d have to position ourselves quite differently.

Even going to other departments, at an existing customer but outside the typical purchasing role, is hard work. IT is a prime example. IT people are poles apart from OP buyers. We haven’t got a choice, however, as it’s a category where we’re really strong –keyboards, mice, webcams, monitors, etc. But the sales process is so different. And try and sell videoconferencing equipment to IT people as a traditional reseller... that’s another story. Hygiene and cleaning products are big for us and an area where we see huge potential still. You have to be quite careful not to break any rules as regards stocking flammable products, anything that needs to be temperature controlled, etc.

Breakroom is another opportunity – cutlery, crockery, dishwasher tablets, you name it. In this category, you can also sell artificial plants, small furniture, acoustic dividers and so on. The list of adjacencies is endless and some of them are a bit hit-and-miss. We tried pet food – it didn’t work.

OPI: Product aside, what else has become a priority during your tenure?

IS: We had already realised pre-pandemic that we needed to overhaul our systems and we’re currently going through this process. We integrated a new PIM system back in 2019, the idea being that, if we ever wanted to properly go to market with a web shop, we needed to facilitate the movement of data.

We are working on a new ERP system now. Ultimately, all our systems will be completely integrated and can work together – it’s essential to have complete visibility across the organisation in terms of data.

We are also completely relaunching our online presence, with our existing shop plus a more market-facing one scheduled to be ready next year with full ERP system integration.

OPI: What’s your typical customer?

IS: Any company with between 50 and 200 employees – that’s always been our core base and will continue to be so. We compete with the online players for the smaller accounts and with Lyreco, Lyreco Advantage and Viking for the key accounts, so we have customers at both ends of the spectrum. But at the heart of Plate is the mid-sized customer.

OPI: What is your main USP?

IS: We look after our clients in a very personalised way and that is partially due

BIG INTERVIEW Ingo Schmidt July/August 2023 23

It’s essential to have complete visibility across the organisation in terms of data

to our dedicated ‘people on the street’, our external sales force. We rarely lose clients, but we have to work hard for new ones – with this sales force, not by customers stumbling across our web shop and ordering from it.

For us as a dealership, it doesn’t make sense to plough ridiculous amounts of money into Google marketing – we simply haven’t got the resources to do that and also – if I’m being really honest – we are not technically savvy enough to maximise the opportunities and get the most out of our investment. We’re doing our best, but we will never be a Böttcher, Printus or Amazon.

With the sales reps comes a challenge, however: they are very difficult to find. We would love to have more, up from our current tally of 35, but recruitment is really tough.

OPI: 35 seems quite a lot.

IS: Maybe, but it isn’t actually enough. We’re spending an incredible amount of time and money on this and are taking a slightly different approach in that we got rid of performance figures and required sales quota – nobody benefits from those.

People on the street have become quite rare in our space, but when you find good ones, they’re worth their weight in gold.

OPI: Has COVID changed the way of doing business somewhat? Zoom, Teams, etc?

IS: No. This customer demographic doesn’t negotiate on Teams. If you want to discuss pricing, you go and see them. I can’t think of a single customer where this would not be true. Perhaps it’s different for a Lyreco because the buyers in the big corporates typically don’t want to see reps anymore.

OPI: What’s the situation in Germany now as regards office-based, hybrid and homeworking? And how affected are you?

IS: It’s a mix. Three days in the office, two at home is the norm now. This just about works for us, because consumption during the three days is relatively high and staff may also take items home which were bought from the company account.

There’s no doubt independents have suffered as a result of both the work-from-home trend and the fact that there’s no compensation from COVID-related items anymore.

OPI: Let’s talk about the competition some more – who do you rub shoulders or butt heads with?

IS: Well, going back to Lyreco and Lyreco Advantage with the former Staples business thrown in, this is a player we’ve competed with

for a long time and it used to be much fiercer competition. We don’t come across Lyreco too much now as it deals more with the top end.

But it appears to be doing well, as we don’t even see tenders from organisations like VW or Daimler anymore. You don’t keep an account like this for many years and not make money on it – or lose it.

As we’ve already alluded to, you then have the online players. They exist and we have to live with them. Printus, OTTO Office, Böttcher and several more of that ilk are much more accomplished in the online game – it’s where they excel. We’re playing in this sandpit too, but not in any dominant fashion.

Of course, over the past few years, those operators have had a real advantage as online trade exploded when the global workforce was sent home. They completely grazed the fields because they could and they did it well.

But the tide has begun to turn again, as Amazon’s results in Q1 this year have shown.

OPI: Talking of Amazon, you are on that platform, aren’t you?

IS: We are, but not meaningfully so. The costs to serve in every conceivable way are just so high. Same with Unite – we used to be quite prolific on this platform and it’s done very cleverly but ultimately, the return on investment wasn’t there for us. Sales is one thing, profit quite another.

OPI: What about Kaut-Bullinger? It used to be the largest independent in the country, but plenty has changed in recent times. IS: That’s correct, we were serious competitors years ago, but it’s more amicable today as we’re both sticking to our own backyard a bit more, despite being nationwide operators. Plate, broadly speaking and with some overlap, covers the top half of the country while Kaut-Bullinger does the bottom half. In terms of size, we are about equal now.

Kaut–Bullinger’s Robert Brech has had a very difficult few years and the company did everything it could to bring that organisation back from the brink.

And who knows, maybe we’ll move closer together again one day through the dealer groups – it makes no sense to take chunks out of each other.

BIG INTERVIEW Ingo Schmidt 24 www.opi.net

We’re spending an incredible amount of time and money on [our external sales force]

For more from the interview, including topics such as Plate’s membership of InterES/Büroring, its involvement with EOSA and the reseller’s logistics set-up, see our Xtra content in the July/ August issue on opi.net

OPI: One more question about the competition: who’s taken the market share that the previous 50+ Staples stores left which are now gone?

IS: Good question. I don’t know. We haven’t. Viking could have been a beneficiary.

OPI: What else keeps you awake at night?

IS: (laughs) Several things. Digitisation is something that affects every single reseller in our industry and many manufacturers too. Volumes of traditional office supplies are seriously down – Leitz will be able to confirm this as regards its lever arch file business. It’s obviously part of the very diversified ACCO Brands group, so a small fish in a big pool.

But there are many other vendors where I cannot see how they can absorb the losses –I’m sure there’ll be further consolidation. This will have a knock-on effect on the reseller and the independent dealer channel in particular. Too much consolidation in the vendor community isn’t good because we are at the mercy of their terms more and more as there are so few of them.

OPI: Can you be specific?

IS: Price increases are a good example. The grocery industry in Germany has started to address this. Companies like Aldi, Edeka and Rewe got together to say to manufacturers that they don’t accept any more price increases because they can’t pass them on. And they’re willing to drop suppliers which continue to impose them. Strength in numbers.

This would be impossible in our industry. As an independent dealer in Germany, you cannot say to an ACCO Brands, edding, Avery or Durable: “If we don’t come to a sensible compromise, we’re going to drop you.”

These are very difficult conversations, for a number of reasons – we need them, they need us, certainly the traditional suppliers. Nobody is growing in office supplies – not a Böttcher, not a Lyreco, not a Plate – so we have to stick together to do the best we can.

With digitisation and product diversification in mind, getting closer to the customer is another big focus for us. As I mentioned, we have a very accomplished field sales force. But we don’t do enough follow-up through our in-house customer service team and are not proactive. Clients typically come to us when they need something. That’s not the future – it’s definitely our job to tell them what they might need and asking them – constantly and knowledgeably – how we can help.

For this again, you need data. We’re in the process of soft-launching Power BI, a customer management system that will allow our team to see the bigger picture – what clients have bought, the feedback they gave, when they last saw a sales rep, order history, etc.

Power BI will be fully rolled out by the end of the year and we’ve got an amazing member of staff who’s been driving and implementing this. It’s a module-based system so we can add to it. I’m very excited to see it work properly.

OPI: Plenty to do, it seems. 12 years ago I asked your father whether he had any expansion plans for Plate beyond Germany. He said ‘no’, but that the next generation may feel differently. Do you?

IS: As regards expansion, definitely, and we’ve already made a local acquisition a few years ago. And we’ll likely do more to become bigger and better in Germany. But not abroad – it makes no sense to me.

All the projects we have going on right now will take us 3-5 years to complete. Once they successfully come to fruition, I’m confident we will continue to grow nicely. If, at the same time and beyond, my daughter is learning all there’s to know about our industry – and enjoying the experience – I’ll be very happy.

BIG INTERVIEW Ingo Schmidt July/August 2023 25

The acquisition of Viking by RAJA Group represents a great opportunity – maybe the last – for Viking to be really successful again. The culture and values of RAJA are actually very similar to the ones of Viking in the past. We identified very quickly what we needed to fix and started on that change immediately. Our industry is in a period of great disruption, so it’s imperative any turnaround at Viking happens quickly.

CUSTOMER SERVICE & CULTURE

The most important aspects of the journey relate to two core themes. The first is our customers – customer service is at the centre of all our activities. Secondly, our culture. This is vital, all the way from the top down. Under these broad umbrella points, we’ve done a number of things:

Employee accountability and happiness

We demonstrated to our staff that top management is working with all the teams. RAJA’s Executive Committee and Viking management are not just here to be reported to and say “yes” to presentations.

We are deeply involved and contribute to the development of the business. We want all employees to be invested in what they’re doing and in the future of the company. Accountability is important.

Evolving team

We appointed a Managing Director for the UK/Ireland – Simon Allan-Brooks – and created a new Viking group management team. Some people were promoted but there were also some new recruits.

In-sourcing

We brought back the customer service function to our UK market from previously outsourced South African and Indian locations. We want to speak to our customers in their language and be part of their culture.

In addition, our sales and customer service teams that were previously in Ashton-under-Lyne were relocated to Oldham, just a few miles away.

Shift of emphasis

Over the past few years, under private equity ownership, the entrepreneurial spirit of the company suffered. There was too much ‘analysing’ and not enough ‘acting’. We’re pushing for the reverse.

Viking events

The first Viking Convention happened in March 2022 and we’ve had two this year – one for our UK/Ireland staff in Leicester and one in Venlo, the Netherlands, for our continental European employees.

At these events, RAJA Group CEO Danièle Kapel-Marcovici presented to all employees the achievements of the previous year as well as the goals and projects for the future. As Managing Director of Viking, meanwhile, I talked in greater detail about the specifics for this part of the organisation.

I believe events like these are hugely important, especially in tough times. We need to be in touch with our people and give them transparency as well as recognition. We do this, firstly, in a business-type environment but also, more informally, as part of a variety of social functions.

Apart from monthly online town hall meetings with all employees where we talk about current results and projects, we are passionate about hosting more in-person events. Summer barbecues, Christmas parties, adult and children sports activities, etc, are vital for a good company culture.

We are also participating in various ventures in aid of the Danièle Kapel-Marcovici Foundation which supports initiatives that allow women to stand up against violence.

PERSONAL TOUCH

Going back to customer service, what I personally love to do is directly call customers that are unhappy with any aspect of service they’ve received. I talk to our teams about these issues and then put the customer at the very heart of our activities. This is what Viking has historically been all about and what we absolutely can achieve again.

26 www.opi.net

OPINION

We need to be in touch with our people and give them transparency as well as recognition

Christa Furter, Managing Director, Viking Group

Products from Ninestar have been banned by law from entering the US, a decision likely to have serious consequences for the hardware and supplies sectors

US hammer blow FOR NINESTAR

The imaging channel was rocked in mid-June by the news that the US Department of Homeland Security (DHS) had added Ninestar and eight of its Zhuhai-based subsidiaries to the entity list of the Uyghur Forced Labor Prevention Act (UFLPA).

UFLPA – signed into law at the end of 2021 – prohibits goods made by companies on the entity list from being imported into the US, unless the importer can prove “by clear and convincing evidence” the items were not produced with forced labour. Virtually overnight, therefore, it became illegal to bring products from Ninestar into the country.

The China-based group has evolved over the past 23 years into a true giant in both the OEM and aftermarket printer hardware, supplies and component channels. With annual sales of around $3.8 billion, its sprawling empire includes Lexmark, Static Control Components, Pantum, Seine, G&G, Apex and Geehy.

In a statement to OPI, a Ninestar spokesperson said the company was “surprised” to learn about its inclusion on the UFLPA list, adding: “Ninestar and our subsidiaries value and respect human rights and have always been committed to upholding the high standards of labour practices in our business and our supply chains. We strongly condemn and oppose any and all forms of forced labour.

“We endeavour to comply with applicable laws and regulations in the jurisdictions where we operate and sell our products. We have always respected and protected the rights and interests of our employees and suppliers.”

ALL EYES ON LEXMARK

In the US, there have naturally been question marks about the position of Lexmark, which is majority-owned by Ninestar and is a major supplier to the US government. Since the ban was announced, the Kentucky-based OEM has issued two statements, one a letter to customers and the other a post on its website. In each instance, the manufacturer distanced

UFLPA UPDATE

In the first 12 months of enforcement, US Customs and Border Protection (CBP) checked almost 4,300 shipments into the US, representing goods worth around $1.4 billion. Just 16% of these were denied entry (with a value of $40.5 million), although a further 1,985 shipments are still pending. More resources have been allocated to the CBP, with it looking to appoint another 300 officials.

In a recent interview to mark the first anniversary of UFLPA enforcement, CBP official Eric Choy explained how the agency maps out global supply chains to identify countries or shipments that could raise red flags. One method is by identifying affiliates and subsidiaries of companies included on the entity list, even if they are located outside Xinjiang (and China).

Choy also revealed how the CBP is becoming savvier to evasion tactics as some businesses try to circumvent the new law. These, he said, include changing company identities or locations, port ‘hopping’ and falsifying documentation.

He advised those who rely on imports to conduct thorough due diligence on their supply chains, not just looking at finished goods, but also the components and raw materials they contain. The message was that UFLPA is “not going away” – indeed there is hope of broader international cooperation with the likes of the UK, the EU, Japan and Malaysia.

28 www.opi.net

FOCUS

Eric Choy

itself from its main shareholder. In fact, it did not even mention the relationship, instead referring to the Chinese group as a “supplier”.

“Lexmark has stopped shipments from Ninestar and its affected subsidiaries to the US and will replace Ninestar as a supplier globally,” it stated.

“As a global manufacturer that utilises a multisource strategy and regional manufacturing facilities, only a small portion of Lexmark manufacturing comes from Ninestar and its affected subsidiaries. We do not anticipate significant business disruption from this order,” it added.

Lexmark’s claim that a “small portion” of its manufacturing is sourced from Ninestar has raised eyebrows. The ProductFrom.com website lists China as by far the largest country of origin for Lexmark’s printers and toners.

In Ninestar’s 2022 sustainability report, a group subsidiary called Ninestar Corporation Zhuhai Branch is known in its shortened form as the Lexmark Business Consumables Business Unit.

Meanwhile, in a November 2019 article, trade publication The Recycler wrote: “Lexmark consumables production has been transferred to [Ninestar’s] Zhuhai production in the first half of 2019. In terms of printer hardware, the Lexmark printer production line has been established in Zhuhai.”

OEM models; engines used in several A4 printers depend on components sourced from Lexmark/Ninestar; and Ninestar has taken a significant share of the private label market in retail and online channels, including a strong presence on e-commerce marketplaces.

According to Tricia Judge, Executive Director of the International Imaging Technology Council, shipments are already being detained, but the impact on the aftermarket channel won’t be felt until existing stocks have been depleted.

“If you are a dealer with a supply chain solely dependent on Ninestar product and you have no backup suppliers, you have a major problem,” she warns. “Some will shift to other China-based manufacturers, but we expect a lot of unease with a sourcing strategy which is 100% reliant on Chinese manufacturing.”

Judge also points to the “huge risk” importers would be taking if they were to continue to source Ninestar products affected by the ban as well as the “predicament” some retailers now find themselves in regarding their private label ranges.

“There is a potentially catastrophic risk of having one’s brand associated with [forced] labour,” she states. “Any dealer, seller, retailer or otherwise that is large enough to have a private brand has a supplier code of conduct/ ethics which explicitly prohibits this type of human rights violation.”

FIGHTING BACK

Lexmark does have facilities in countries such as Mexico, but it is not clear if these use components shipped from Zhuhai. This would be important for two reasons. Firstly, as part of the United States-Mexico-Canada Agreement signed in 2020, Mexico adopted a resolution to ban the import of products associated with forced labour.

Secondly, US Customs and Border Protection, the agency responsible for enforcing UFLPA, is developing strategies to more effectively trace goods emanating from the Xinjiang region of China (see ‘UFLPA update’, left)

A MAJOR PROBLEM

Time will tell if the Ninestar ban is an issue for Lexmark, but there are other areas where the DHS ruling will have an impact. Apex has a dominant position in the global market for chips, including those used in some popular

Of course, there is an argument that Ninestar has been caught up in the geopolitical row between the US and China. It has categorically denied any connection to discrimination against the Uyghur population – and this may well be true.

Unfortunately for the group and its subsidiaries, this is a moot point. The fact is it’s now on the DHS entity list and the ban is part of US law. While its legal team will no doubt be pulling out all the stops to have it lifted, it will be a long process, even in a best-case scenario; since the first entity list was published in June 2022, no company has succeeded in getting itself removed.

THE BANNED NINESTAR ENTITIES

• Ninestar Corporation

• Zhuhai Ninestar Information Technology

• Zhuhai Pantum Electronics

• Zhuhai Apex Microelectronics

• Geehy Semiconductor

• Zhuhai Pu-Tech Industrial

• Zhuhai G&G Digital Technology

• Zhuhai Seine Printing Technology

• Zhuhai Ninestar Management

July/August 2023 29 FOCUS Ninestar

If you are a dealer with a supply chain solely dependent on Ninestar product and you have no backup suppliers, you have a major problem

Tricia Judge

TURNING the tables

When COVID-19 reared its ugly head and workplaces across the world closed virtually overnight, suppliers of furniture were hit hard as demand fell through the floor.

“The past few years have been extraordinarily challenging for the furniture sector,” says Neil Verlander, Director of Sales at UK manufacturer and wholesaler Dynamic Office Solutions.

“Uncertainty created a reluctance to commit to stock, while social distancing resulted in a significant drop in demand for items like visitor chairs. Also, abnormal demand created elongated manufacturing lead times for certain SKUs, causing challenges with order forecasting, with knock-on effects on storage, space and funding.

“Additionally, pricing stability was affected by the costs of raw materials, utilities and labour. As most manufacturers source components from overseas, the office furniture industry is particularly prone to changes in shipping costs. Record highs saw them forced to react. However, dealers were unable to cope with the constant price increases, so had to rethink their entire supply chain strategy or risk losing customers.”

If there was a silver lining, it was that sales of furniture for hastily arranged home offices

increased significantly. Veijo Ågerfalk, CEO of Sweden’s Wulff Beltton, which is 75% owned by Finnish reseller Wulff Group, explains: “There was an emergence of completely new furniture specifically for domestic working environments. Customers sought well-designed, ergonomic items that would fit seamlessly into their houses.

“Examples included desks just 60-80 cm wide, cabinets designed to conceal homeworking set-ups when not in use, and electrically-adjustable tables with memory settings for multiple users. For us, demand surpassed the ability to supply.”

ONGOING HEADWINDS

Fast forward to the present day and the supply chain appears mostly stable, although it is still not fully back to its pre-pandemic norm. “Some challenges remain,” says Ågerfalk. “To cope, companies are diversifying their sources, increasing inventory levels and investing in digital supply chain management tools.”

There have been other fundamental changes that look certain to stay. According to Verlander, furlough meant many firms temporarily cut back on non-essential employees. The subsequent realisation they could continue to operate with lower

30 www.opi.net

CATEGORY UPDATE

The office furniture sector has taken a battering in recent years, but those operators that embraced the new ways of working are now reaping the rewards – by David Holes

Workspace by Alera

overheads resulted in these staffing reductions becoming permanent, creating less need for workplace furniture.

Further post-COVID effects include a dramatic fall-back in online sales, says Gavin Bradley, founder & Chief Wellness Officer at Yo-Yo OFFICE: “This has been caused by Chinese factory brands flooding the market. They offer no customer service, but are selling at 50% below UK prices and heavily targeting the direct-to-consumer and work-from-home (WFH) verticals.”

HIGH EXPECTATIONS

All this being said, the future for the sector is looking bright. Alex Schmirl, Director of Merchandising at Essendant in the US, says: “We continue to invest in the category with new products as well as programmes that bring them to market in different, more efficient ways. Because of this, we have high expectations for the next 12 months. Also, all market data shows that the furniture category is expected to grow over the next eight to ten years – we want to get more than our fair share of that increase.”

According to Ågerfalk, Wulff Beltton expects a rise of over 15% in office furniture sales in 2023 while Andy Shears, Furniture

in a record-breaking year for OTG Furniture. We’re also forecasting further increases as we move into 2024.”

THE HOME REVOLUTION

As mentioned, one of the biggest changes in the furniture market has been the shift to WFH or hybrid domestic/office-based arrangements. Schmirl says this is forcing suppliers to think about the category in an entirely different manner. “Consumers are looking for products with alternative colours and aesthetics compared to commercial customers.

“Additionally, they are increasingly reliant on e-tailers, which means we need products that drop-ship damage-free, using small parcel carriers such as UPS and FedEx. At the same time, we have to provide a high standard of digital content so customers are confident in what they are buying.

“An example is the launch of our new sub-brand Workspace by Alera which has been designed with the home office in mind. It is a broad range with designs comprising farmhouse styles as well as modern writing desks, with splashes of colour added throughout the seating assortment. We package these products in a way which minimises the higher damage rates you typically see with small parcel carriers.

Sales Director at OT Group in the UK, paints a similarly positive picture: “This category continues to defy the doom and gloom we hear in the news. Sales have continued to grow in the past 12 months which will result

“We’ve furthermore kept weight and dimensions below key thresholds to avoid extra freight charges which would eventually creep into the market price of the product. On top of this, Essendant has invested in high-end content to ensure the best shopping experience – including 360º views, infographics, hot spots and close-up photography to highlight important details.”

Shears admits that while a cutback in workplace-based staff has reduced the long-term need for furniture, it has also meant many businesses have transformed their premises: “The reduction in the number of desks required has allowed more space for collaboration and flexible areas. This has led to us being involved in several office reconfigurations which would not have gone ahead without the advent of hybrid working.”

In Australia, Officeworks has introduced an entirely new service known as Flexiworks to support novel ways of working. It enables businesses to select a range of fit-for-purpose office supplies, furniture or technology for their workforce. All employees are then given an allowance which enables them to access and order what they need to work effectively from home or elsewhere, at any time.

Interestingly, the reseller’s Flexiworks Snapshot survey revealed that 94% of

CATEGORY UPDATE Furniture July/August 2023 31

This category continues to defy the doom and gloom we hear in the news

Flexible Yo-Yo PODs