Young talent is something every industry wants to attract. But what about retention? Who are the individuals who’ve chosen our sector, carved a career in it and are current – and likely future – protagonists and even leaders?

OPI set to find out. The ‘results’ were interesting as much as they were encouraging. We have 13 women in our ‘40 under 40’ list, for example, about a third of the total. Secondly, 19 people have spent their entire career so far in the business supplies industry. This bodes well in terms of commitment, acquired knowledge and experience. It also signals a promising future.

FOCUS: JAN/SAN JUGGERNAUT GATHERS PACE

The expected closing of the BradyIFS/ Envoy Solutions deal as announced was a rather vague “in the coming months”. This is probably due to the complicated nature of a transaction involving multiple parties rather than any regulatory concerns – it is highly improbable the merger will be blocked due to competition issues.

As business products resellers from the OP channel delve further into the jan/san sector, it will be interesting to see to what extent they play a part in this consolidation process, either as buyers or sellers. For all the talk of single-source suppliers and the need to diversify, there has been little meaningful cross-fertilisation between the office supplies and jan/san worlds.

16 Focus Mega jan/san merger in the US

18 Special Feature Business leaders of the future: who and where are they?

30 Interview

Pukka Pads’ Alex Bonarius shares his OP journey

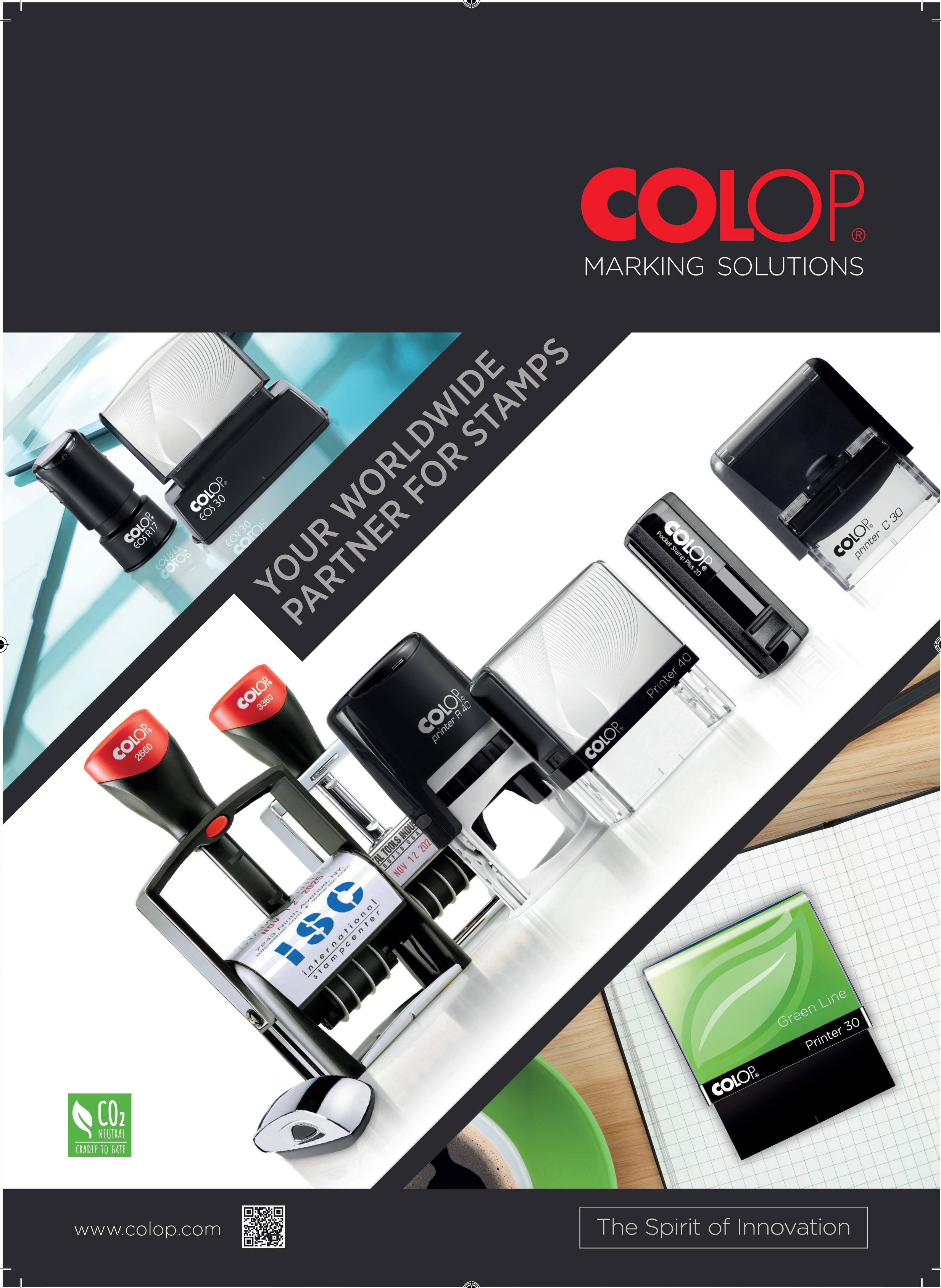

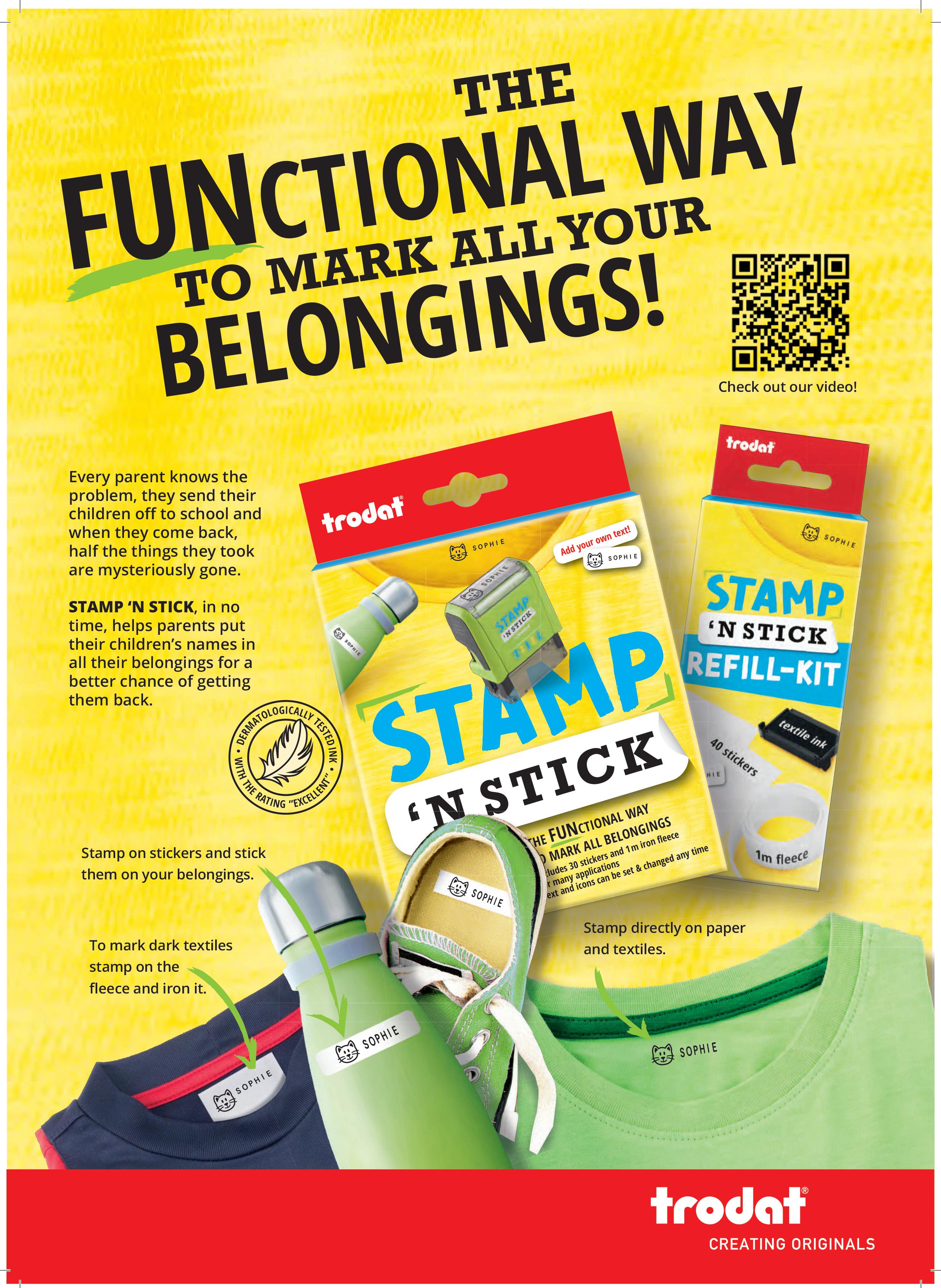

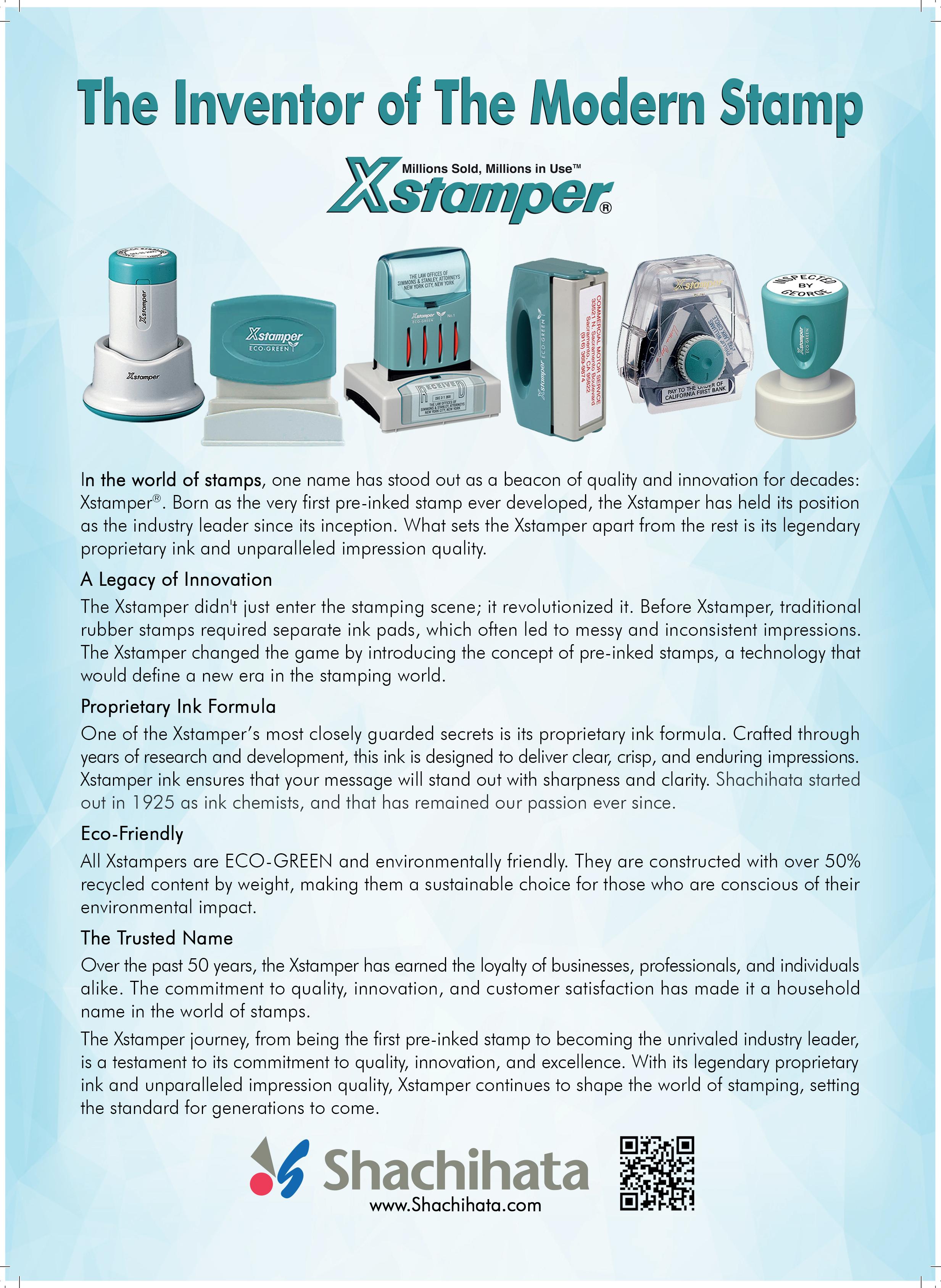

34 Category Update An uncertain future for the stamping sector

38 Advertorial S.P. Richards celebrates 20 years of Lorell

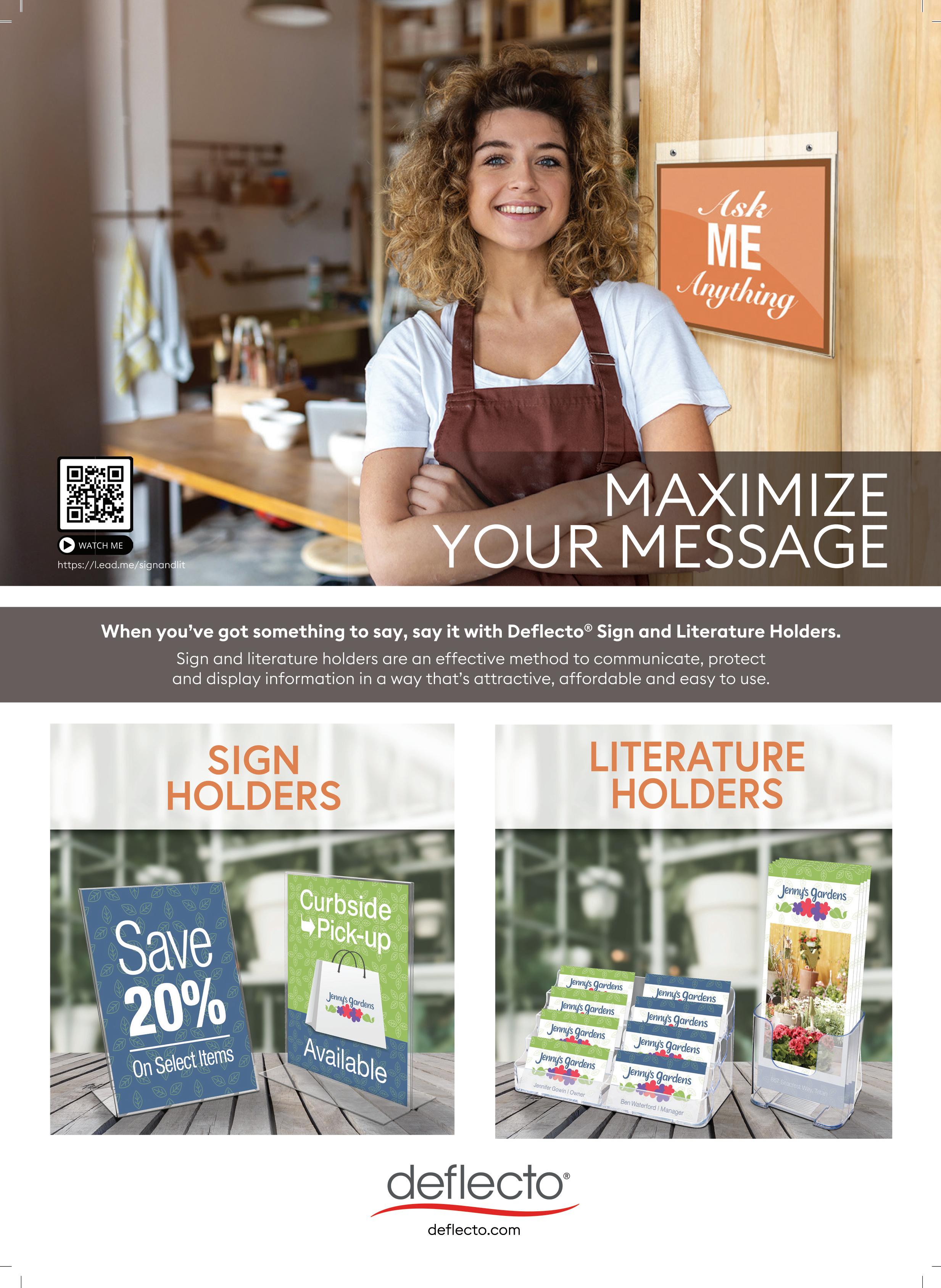

40 Category Update A sector in constant motion: mailroom and packaging supplies

44 Advertorial Sustainable synergies at Global Notes by UPM Raflatac

46 Feature OPI Top 100 list of industry personalities –2023 update

50 Preview: OPI Global Forum Chicagoland plays host to an industry must-attend event

52 Preview: Climb of Life 2023 In support of the Institute of Cancer Research

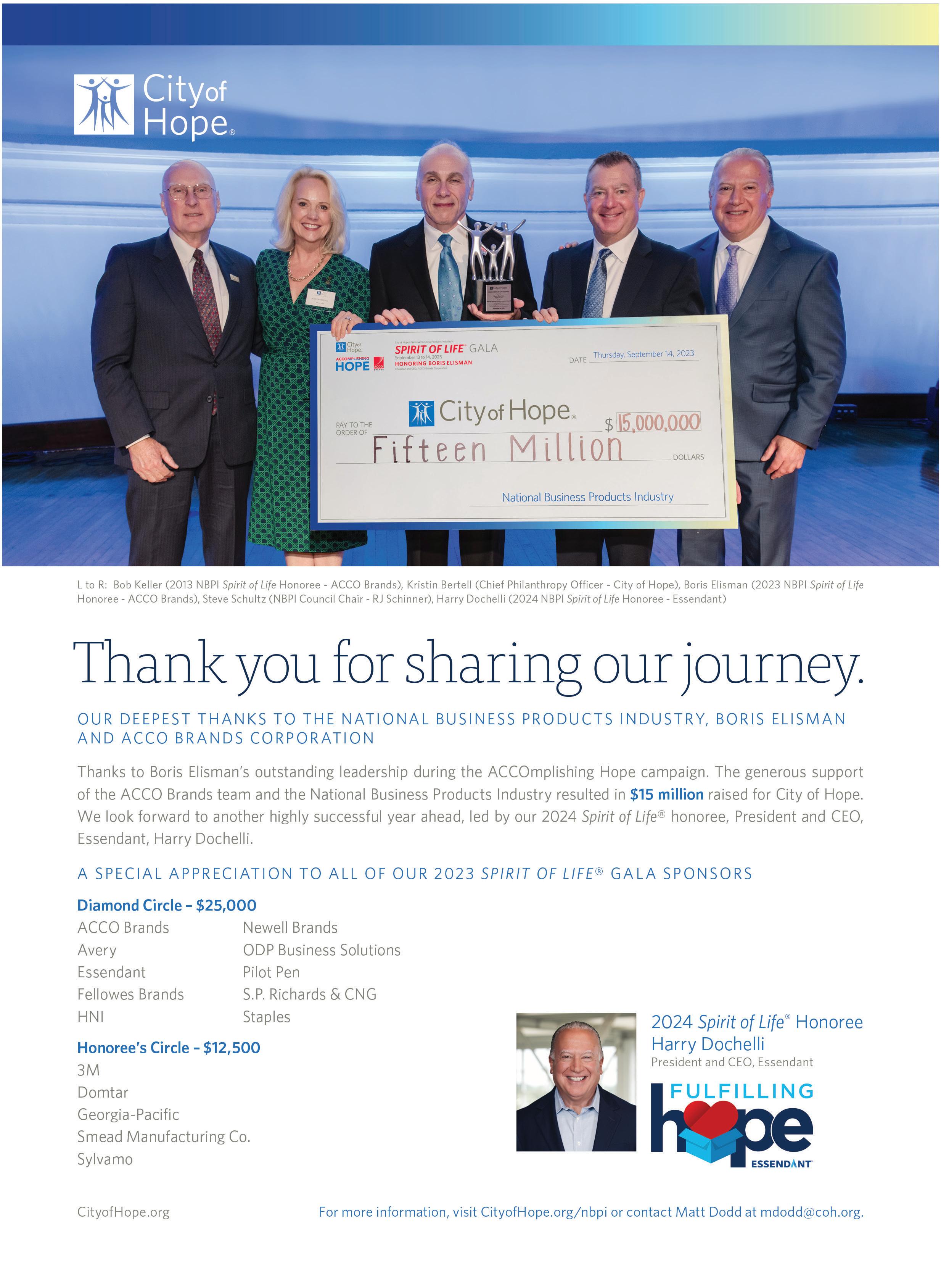

54 Review: City of Hope Gala Dinner Fundraising concludes for the ACCOmplishing Hope campaign

5 Comment

6 News

12 Green Thinking News

14 OPI Small Talk

56 5 minutes with... Lincoln Dix

58 Final Word Brooks Smith

Editor

Heike Dieckmann +44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite +33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman michelle.sturman@opi.net

Freelance Contributor David Holes david.holes@opi.net

Chief Commercial Officer

Chris Exner +44 7973 186801 chris.exner@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

Events Manager

Lisa Haywood events@opi.net

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations Kelly Hilleard kelly.hilleard@opi.net

CEO

Steve Hilleard +44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell +44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand +44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin Facebook: facebook.com/opimagazine Podcasts: opi.net/podcast App: opi.net/app

Earlier in the year, I talked in this column about embracing equity. It was part of our focus on shining the light on an underrepresented – and too invisible – demographic in our industry: women in senior leadership positions.

Not only was that special feature a joy to put together, but it also seriously boosted my book of contacts and knowledge of these amazing leaders I’m slightly ashamed to admit. And it was a big hit with our readership.

As many of you know, typically in this issue of OPI, we profile executives from our long-running Top 100 list – what the top performers have done over the past year, who’s gone, who’s new, etc. We are not doing that this time – the list is still there (page 48), plus a synopsis of how it’s been shaping up this year, but more can be found on opi.net – just look for the Top 100 icon on our home page.

Instead, we’ve ventured down a different avenue which, we firmly believe, is vitally important to the continued success – survival even – of the business supplies sector. We sought to find those young individuals who will – or have already done so – take on the baton of leadership. These are people who have made it through the early stages of their careers, excelled in their roles and moved on to bigger and better things. They chose (so far) to stay in our industry because they’ve found something in it, like so many of us, that really stuck.

After highlighting our ‘40 under 40’ (page 18), we then zoomed in a bit further, asking one of these individuals – Pukka Pads’ Alex Bonarius – what the magic potion for him is in terms of first picking and then sticking with ‘OP’ (page 30)

Why is it so important to acknowledge and develop new talent? Because, as Brooks Smith so eloquently explains in our Final Word (page 58), they are the people who typically have a different perception of our industry and add another dimension.

You only have to read our updates on the stamping as well as mailroom and packaging categories (pages 34 and 40, respectively) to appreciate the challenges operators are facing.

A new dimension might just be what we need to complement – also important –longevity and experience.

A new dimension might just be what we need to complement [...] longevity and experienceHEIKE DIECKMANN, EDITOR

The Danish Competition and Consumer Authority (DCCA) has confirmed it is still investigating Lyreco’s proposed acquisition of online reseller Lomax.

The transaction was initially announced in August 2022, with the hope it would close in the first quarter of this year. In March, Lyreco said it was hoping for a DCCA decision by the end of June. OPI recontacted the France-based group in August, and it was confirmed the process was still ongoing but in the “final stage”.

However, a notice on the DCCA website reveals that, on 13 September, a second questionnaire was sent to the companies’ customers. This, said the DCCA, was because it had “received new information” about the transaction and was therefore opening a new, shorter investigation related to purchases of office supplies and facilities products.

It’s not clear whether this is a positive development for the merging parties, but it seems likely any decision by the DCCA will not be forthcoming until the end of this year at the earliest.

The deal is intended to strengthen Codex’s office furniture arm, which has already grown 225% since 2019, and has seen a 30% increase in sales this year as companies continue to transition to a hybrid working environment. The reseller currently offers office fit-outs, space design, furniture allocation as well as office supplies, with the takeover set to expand its overall range of products and services.

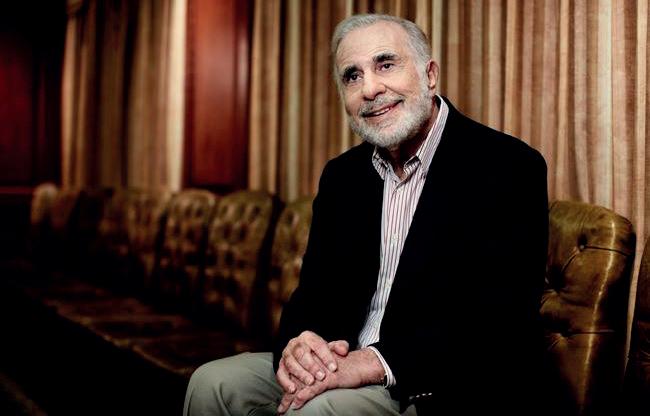

Xerox has said it is buying back all the stock owned by its largest shareholder, activist investor Carl Icahn. In a press release, the print OEM confirmed it would repurchase all common stock owned by Icahn and his affiliates for $15.48 per share, a total dollar amount of $542 million.

Icahn’s involvement in Xerox – which he once told Fortune was “one of the worst-run companies I ever saw” – will likely be remembered for the role he played in spinning off business process outsourcing division Conduent, scuppering the proposed $6.1 billion acquisition of Xerox by Fujifilm, and the failed attempt to acquire HP Inc.

In April 2018, Icahn told Fujifilm that Xerox was worth $45 a share, calling the Japanese firm’s offer of $28.17 an “insult to long-suffering Xerox shareholders”. Prior to COVID, Xerox’s share price had risen to just under $40, but fell off a cliff in March 2020 and has not recovered since then. Year-to-date, the share price has been averaging around $15.

Five years on, the Fujifilm offer does not look so bad, although, Icahn – with a stake in Xerox of approximately 20% – has pocketed close to $200 million in dividends since then.

Icahn is not the only investor cutting his losses in the print segment. Major HP shareholder Warren Buffett has dumped more than $540 million worth of the company’s shares in the past few weeks.

Paper manufacturer Mondi has announced an agreement to sell its Syktyvkar operations in Russia.

Just over three months after a previous RUB95 billion ($980 million) deal fell through, the vendor has confirmed it has reached an agreement to sell the assets to Sezar Invest for RUB80 billion. The acquiror is a subsidiary of Moscow-based property development company Sezar Group.

The transaction is set to close at the end of December 2023 and will mark the exit of Mondi from the Russian market.

Armor Print Solutions – part of the Armor Group – has announced the acquisition of THS Group, a Germany-based specialist in office automation systems that offers solutions in printing consumables, spare parts and MPS software for photocopiers and printers.

Founded in 1995 as Ingolf Hell, THS (Team Hell and Schulte) was established ten years later following the investment in the business of current CEO Christian Schulte. The group – which includes software arm MHS – has a production plant in Hemer (near Dortmund) and a sales and distribution network throughout Europe.

Announcing the deal, Armor said: “From a print consumables market perspective, the two companies operate in different sales channels and are therefore highly complementary. Armor Print Solutions relies on a network of office products resellers, while THS Group works more extensively with specialist resellers. [...] The combination will strengthen the position of both players in Europe, particularly in Germany and the UK.”

Armor Print Solutions CEO Gerwald van der Gijp estimates there is only a 5% product overlap between the two companies. He also believes THS’s ‘made in Germany’ positioning “fits perfectly with [Armor’s] identity as a quality European manufacturer and supplier”.

The businesses will continue to operate as before, with no changes announced in names, brands, teams or general management. Combined, they employ around 700 staff and generate sales of €90 million ($95 million).

Leading Australian office products organisations GNS Wholesale, Office Brands and Office Choice co-hosted their first-ever joint trade show, OPIx 2023, in Melbourne in early September.

OPIx has been running for several years, but this is the first time that both leading dealer groups – Office Brands and Office Choice – have taken part. It also included members of buying group ASA-Australia and leading newsagents. As a result, Office Choice called the development “ground-breaking,” adding: “It was an unprecedented gathering of innovators, trendsetters and decision-makers.”

Long-standing ExaClair Managing Director Mark Daisley has announced his retirement, effective 31 January 2024. Daisley has been with the business (formerly Tollit & Harvey) for over 30 years. He became Managing Director in 2010, two years after it had been acquired by Exacompta Clairefontaine and rebranded to ExaClair. Succeeding him is none other than Chris Exner, currently Chief Commercial Officer at OPI, who will join ExaClair on 1 December. The following two months will then be spent on transitioning the leadership.

Wulff Beltton, the direct business of Wulff in Sweden, has been bought by the person who set up the company 30 years ago.

Veijo Ågerfalk – along with his daughter and son – have acquired the entire share capital of the Wulff Beltton AB entity in Sweden as well as its business in Norway. Ågerfalk already had significant minority stakes in each business: 25% in Sweden and 20% in Norway.

Ågerfalk himself has taken on the CEO role. Daughter Ewelina is in charge of the commercial and purchasing functions, while son Adam oversees new product categories and the online strategy. The transaction closed on 1 September and has resulted in a rebranding of the business to simply Beltton.

It had been on the cards for a while and the US Federal Trade Commission (FTC) finally confirmed it has filed a lawsuit against Amazon.com.

The FTC – along with 17 supporting states – filed a complaint with the District Court Western District of Washington (WA) on 26 September. It alleges that the online retail and technology company is a “monopolist that uses a set of interlocking anticompetitive and unfair strategies to illegally maintain its monopoly power”.

“By stifling competition on price, product selection, quality, and by preventing its current or future rivals from attracting a critical mass of shoppers and sellers, Amazon ensures that no current or future rival can threaten its dominance,” said the FTC in a press release.

It continued: “Amazon’s illegal, exclusionary conduct makes it impossible for competitors to gain a foothold. With its amassed power [...] Amazon extracts enormous monopoly rents from everyone within its reach.”

Specific tactics the FTC accuses Amazon of include:

• Anti-discounting measures that punish sellers and deter other online retailers from offering prices lower than Amazon, keeping prices higher across the internet.

• Conditioning sellers’ ability to obtain Prime eligibility for their products – a virtual necessity for doing business on Amazon – on sellers using Amazon’s costly fulfilment service, which has made it substantially more expensive for sellers to also offer their products on other platforms.

• Degrading the customer experience by replacing relevant, organic search results with paid advertisements – and increasing junk ads that worsen search quality and

frustrate both shoppers seeking products and sellers who are promised a return on their advertising purchase.

• Biasing search results to preference Amazon’s own products over ones Amazon knows are of better quality.

• Charging costly fees to sellers that currently have no choice but to rely on Amazon to stay in business. These fees range from a monthly fee sellers must pay for each item sold, to advertising fees that have become virtually necessary for sellers to do business.

The FTC and its state partners are seeking a permanent injunction in federal court that would “prohibit Amazon from engaging in its unlawful conduct and pry loose Amazon’s monopolistic control to restore competition”.

Amazon was quick to hit back at the lawsuit. In a response posted online, its General Counsel David Zapolsky accused the FTC of a “fundamental misunderstanding of retail”. He further stated that the e-tailer’s “innovations and customer-centric focus have benefited American consumers through low prices and increased competition”.

Ninestar has filed a lawsuit with a US federal court in an attempt to overturn a ban on importing products into the country.

In June, the Department of Homeland Security (DHS) added Ninestar and several of its Zhuhai-based subsidiaries to the Uyghur Forced Labor Prevention Act (UFLPA) entity list. This made it illegal to import goods into the US made by or sourced from these companies.

After saying it would assess the potential impact of the ban, Ninestar has now confirmed it is taking legal action. Referring to the “irreparable harm” caused by the ban, it is suing the DHS and other related parties before the US Court of International Trade, claiming their actions are unlawful. Importantly, Ninestar has also filed a motion with the same court requesting a preliminary injunction on the company’s inclusion on the UFLPA list.

In a Chinese stock market filing, Ninestar said the DHS ban was not only harming its business and reputation in the US, but also on a global basis.

Acme United has made an opportunistic acquisition in its hugely successful first aid category. The vendor has paid around $1 million for “selected assets” of Canadian company Hawktree Solutions, a supplier of first aid and survival kits, medical supplies and training that was placed into receivership in July.

One of the main assets Acme has purchased is an exclusive licence for first aid, safety and survival products with the Canadian Red Cross. The acquired business will be operated from Acme’s facilities in Laval, Canada.

US dealer group Independent Suppliers Group (ISG) has announced its new President and CEO, who will take over from the retiring Mike Gentile.

James Rodgers joined ISG at the beginning of October. He spent the past four years ascending from Director of Sales and Operations to VP of Supplier Development at Network Distribution, one of the jan/san industry’s largest buying groups.

Jan/san, incidentally, is the fastest-growing adjacent market for ISG members. No stranger to the OP channel either, Rodgers previously held various marketing, sales and sales leadership positions during his ten-year tenure with Essendant.

Shortly after the CEO announcement, ISG promoted EVP Charles Forman to the position of COO, also effective from October. In his expanded responsibilities, Forman will oversee the EPIC Business Essentials programme and its cooperative contracts.

Over the next few months, Gentile will be working closely with both Rodgers and Forman to help facilitate a smooth leadership transition.

The BOSS Federation has elected its first-ever female Chair to succeed the outgoing Simon Drakeford. YPO Finance Director – and former Office Friendly Managing Director – Julie Hawley will take over from Drakeford following the organisation’s AGM in mid-October.

Hawley, who joined YPO in 2021, has more than 30 years of experience in the business products industry.

Former ACCO World – now ACCO Brands – Vice Chairman Desmond ‘Dez’ LaPlace passed away on 23 September at the age of 91, OPI has learned.

Dez was a driving force behind the international expansion of ACCO from the 1970s to the 1990s, working alongside the likes of Doug Chapman. He retired in 1996.

OPI extends its heartfelt condolences to Dez’s family and friends.

HP Inc’s Stephanie Dismore has moved to the UK to take on the role of Managing Director, Northwest Europe, at the tech giant. She held the same title in the North American market for the previous four years. Dismore will be replaced in the US by Anneliese Olson.

Stora Enso has appointed Hans Sohlström as CEO, succeeding Annica Bresky. Sohlström previously spent 20 years in leadership positions at UPM.

Mondi has promoted Bernhard Cantzler to Sales and Marketing Director of its Uncoated Fine Paper (UFP) division. Cantzler has been with the group for 18 years, most recently as Head of Marketing and Innovation at UFP.

OptiGroup has named Henrik Hjalmarsson as its new CEO, succeeding Sören Gaardboe. Until Hjalmarsson assumes office in March 2024, CFO Thomas Eriksson will be interim CEO.

Avitor UK names CEO

Avitor Distribution has appointed Suzanne Tiernan as CEO of its UK subsidiary. Tiernan joins from tech accessories supplier Neomounts.

Durable has reorganised the management team at its France subsidiary. Former Key Account Manager Delphine Cléron is now Commercial Director, reporting directly to CEO Rolf Schifferens. Vincent Blanchard, Operations Director of Durable France since 2022, has left the company.

Workspace furniture vendor

Royal Ahrend has promoted Rolf Vurspuij to the CEO role, effective 1 December 2023. Currently CFO/COO, Vurspuij will succeed Eugène Sterken.

187,000 SKUs stocked by Japanese reseller Askul

Staples Inc CEO John Lederer has been awarded the Order of Canada. He was recognised for his leadership in business, and for his philanthropy in support of the community and health sectors.

On average, German employees spend 17% of their working hours at home, according to Munich-based research firm IFO. In the IT and advertising sectors, it’s almost 66%, while the average for white-collar workers in service industries is around 25%.

German online retailer Böttcher has donated €5,000 ($5,326) to the palliative care ward at University Hospital Jena. CEO Udo Böttcher and his team have been active supporters of the Living Also Means Dying charitable association at the hospital for the past ten years.

£276 million

The amount the UK government collected during the first year of the plastic packaging tax

40% Firms using the metaverse and augmented reality by 2027

PICTURE OF THE MONTH

On 19 September, Australian reseller COS brought staff together to celebrate the country’s annual Family Business Day. In a coup for the company, Forbes Australia chose co-CEOs Amie and Belinda Lyone for its 2023 Family Business Day feature.

86%of US workers say that air purification systems are a officemust-have amenity

German working trends revealed

The ability of [AI] to create outcomes in your environment will be determined not by the power of generative AI, but in the data and the predictive AI models behind it

Clover Imaging Group has announced its commitment to convert all its printer cartridge exterior packaging to sustainable material –coated recycled paperboard (CRB) – by the end of 2023.

CRB is fully recyclable and made using 100% post-consumer recycled content. Clover claims the switch will conserve almost 600,000 lbs (272,155 kg) of cardboard annually.

A report by the Port of London Authority, Cross River Partnership and Transport for London (TfL) has detailed the best approach to marine and landside infrastructure in London, UK, to transport more parcels by river and reduce carbon emissions.

The organisations released the report to meet growing demand to reduce the transportation of small goods by road. The aim is to moderate traffic in central London while still providing a sustainable and financially viable delivery solution. Suggestions include utilising existing pier infrastructure and increasing e-cargo bikes on and near Thames-side piers.

The guidance focuses on the general technical and spatial requirements for a light freight service to operate from a typical pier, including recommended access spacings, gradient considerations and water edge safety implications. In addition, it provides advice on the operations side of such a service, including rider training and etiquette.

Lyreco is one of the operators in the business supplies industry that has taken steps to improve river transport. The reseller was involved in the London Light Freight River Trial, which began in February, first to deliver to the Thames bankside area, then around the capital. By taking part in the trial, Lyreco has taken one delivery vehicle off the road.

Adhesive products supplier tesa has begun construction of a photovoltaic system at its Offenburg plant in Germany. The initiative is expected to cover around 25% of the site’s energy requirements by the end of 2024.

Solar panels will be installed at three locations on the factory site, producing a total output of 5,600 kWp (six million kWh/year).

Tesa aims for climate-neutral production by 2030 (Scope 1 and Scope 2). Since 2020, all office and production sites have purchased electricity exclusively from renewable sources.

ODP Business Solutions has published its Diverse Supplier catalogue for 2023, which includes 1,800 products sourced from certified minority-, women-, disabled-, LGBTQ+-, veteran-owned and small businesses.

Additionally, it features around 800 products which also contain eco-attributes or ecolabels. New to the 2023 catalogue is chair mat manufacturer ES Robbins, a certified women-owned business.

Packaging and paper manufacturer Metsä Group has announced plans to boost biodiversity in its mill areas across Europe –starting with a pilot project in Kemi, Finland.

The Kemi location includes a bioproduct mill, currently under construction, and a paperboard mill. The company said the goal is to modify land use on the site and improve the state of nature in industrial environments. Plans include adding around 12 hectares (120,000 sq m) of land to the area while utilising local vegetation to establish open habitats for endangered species to thrive.

The manufacturer said that various measures will be carried out at other locations over the next few years, using the operating models developed in Kemi.

The UK government has outlined bans and restrictions on a range of polluting single-use plastic products which came into force on 1 October. As of that date, no business – including retailers, takeaway outlets, food vendors or parts of the hospitality industry – will be able to sell single-use plastic cutlery, balloon sticks, polystyrene cups or food containers in England.

The ban will not apply to single-use plastic plates, trays and bowls used as packaging in shelf-ready, pre-packaged food. However, these will be included in future plans for an extended producer responsibility scheme which aims to incentivise manufacturers to use less packaging and meet higher recycling targets.

The new regulations were first announced in January and form part of the UK’s intention to eliminate all avoidable plastic waste by 2042. Responses from the public demonstrated support for the ban, with 95% in favour of all prohibitions.

In April 2022, the government introduced a packaging tax, which charges more than £200 ($245) per tonne for plastic packaging manufactured in or imported into the UK that does not contain at least 30% recycled plastic.

The Waste and Resources Action Programme (WRAP), meanwhile, has been working with businesses across the UK since 2018 to eliminate unnecessary and unrecyclable plastic packaging. Since then, 620 million single-use plastic items have been removed from shops.

Head of Material Systems at WRAP, Helen Bird, said of the latest restrictions: “Single-use plastics dominate our world and have even become embedded into the planet itself. This ban is an important moment in tackling the scourge of plastic pollution.”

Further guidance on the ban for businesses can be found at https://www.gov.uk/guidance/single-use-plastics-ban-plates-bowlstrays-containers-cutlery-and-balloon-sticks

The American Forest & Paper Association has reported that 2022 paper recycling rates in the US reached 67.9% – essentially flat versus 2021’s figure of 68%.

It noted that paper and cardboard were some of the most highly recycled materials. In addition, cardboard boxes – or old corrugated containers – were the most recycled packaging material at 93%, a slight increase over the previous year’s rate (91.4%).

The report also said that nearly 50 million tons of used paper had been recycled into sustainable paper products.

Leading Australian independent dealer COS has urged staff to be more engaged with their employers’ philanthropic activities. The call came after a survey revealed 54% of respondents said their companies donate to charity, but almost half (42%) don’t know which causes the monies support.

The reseller also found that two-thirds of staff would like to be included in the decision on where the funds go. Other key findings include:

• Of the surveyed employees whose companies donate to charity, 46% said they believe all organisations should give back.

• 35% added that they like working for a company which supports the community.

• Nearly two-thirds of respondents from firms that are not engaged in charity giving said they wished their organisation was.

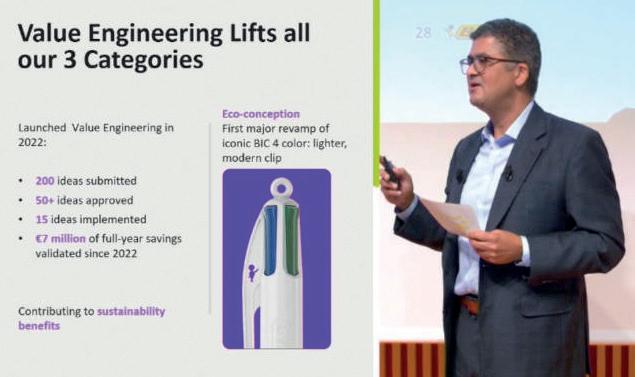

Sustainability is not just about using more recycled materials, it’s about reducing excess in non-essential areas, BIC demonstrated at a recent investor conference.

During the Paris event on 11 September, CFO Chad Spooner (pictured) talked about ‘value engineering’ – meaning focusing on what is important for the customer – in the design of BIC’s products. For example, engineers have redesigned the clip of the BIC 4-Colour retractable pen so it requires 10% less plastic in the mould. This equates to reducing plastic consumption by 24 tonnes a year.

Out of the 200 value engineering ideas the BIC teams have presented in the past year, 15 have been approved. These will lead to savings of €7 million ($7.5 million) a year.

Boris Elisman: I’ve been lucky and privileged to determine my own timing; that’s not always the case with CEOs. We began planning and preparing for this with the board a few years ago to make sure there’s a smooth succession and transition.

Why now? As OPI readers can imagine, being a CEO – while it’s a great job – involves a lot of stress, responsibility and travel, and your time is not really your own. I’m now of an age – not too old or young – when I want to spend more time with my wife and family.

The past few years have not been easy with COVID-19 and its after-effects. Clearly, that would not have been a good time for a CEO change. Today, the situation is a bit more stable and I believe the company is in good shape. We certainly have a great person to take over in Tom Tedford so, all things considered, it seemed a perfect time.

The external environment has been very difficult. As an industry, we have gone through a lot of consolidation, particularly in the past ten years; as a supplier, you are always facing pressures because of this. When customers consolidate, they buy less and you have to race to refill that bucket.

I believe this has been much more challenging than in other sectors. There are a lot of firms either no longer in existence or a shadow of their former selves.

Firstly, our product portfolio is very different now compared to when I joined the 14 www.opi.net

I would split what happened during my tenure into ‘hard’ and ‘soft’ changes.

organisation in 2004. Back then, we were predominantly an office products company; you could even say a ‘back office’ products company. By that, I mean a supplier of brands which weren’t particularly well known; they were purchased by buyers as opposed to being demanded by end users.

We went through a fairly radical transition to reposition ourselves towards consumer-centric brands required and bought by customers and supplied by our channel partners. We’re not done with that, but I’m pleased with what we have been able to accomplish. The portfolio is also much more balanced in terms of geography and faster-growing categories.

Financially, we are much stronger and more profitable than we used to be, and we have solid free cash flow generation ability. Even though we are more highly levered today than I would like – based on the PowerA acquisition we made in 2020 – we are definitely on track to get ourselves to the right leverage situation.

On the soft side, I feel our culture has evolved for the better. It’s really based on meritocracy. People enjoy working at ACCO Brands; they have the freedom to do what they want in an environment that is both accountable and respectful.

Nothing is ever perfect. I wish our stock price was ten times higher, but – overall – I’m proud of my time at ACCO Brands.

We went through a fairly radical transition to reposition ourselves towards consumer-centric brands required and bought by customers and supplied by our channel partners

Consolidation in the US janitorial space is accelerating with the tie-up between BradyIFS and Envoy Solutions – by Andy Braithwaite

Many long-standing business products execs will recall the heady days of the 1990s and early 2000s when consolidation in the then-fragmented reseller channel was in full swing. The likes of USOP, Staples, Office Depot, Boise Cascade and Buhrmann were snapping up businesses left, right and centre. While M&A still takes place, the feeding frenzy that shaped our world at the time is long gone. The same cannot be said of the North American jan/san distribution channel, which has increasingly attracted the interest of private equity investors in the past few years.

Leading the charge in terms of the sheer number of deals is Imperial Dade which, as of early October, had made 74 acquisitions since father and son team Bob and Jason Tillis took charge in 2007. More than 60 of those have happened since the combination of Imperial Bag & Paper and Dade Paper in 2017. The vision to create a national supplier was backed by Audax Private Equity and then Bain Capital, with Advent International joining in 2022. But Imperial Dade is far from the only 800-lb gorilla in the room. Two of its rivals, BradyIFS and Envoy Solutions have also been buying up independent resellers at regular intervals. Both BradyIFS and Envoy Solutions are relatively new entities.

In 2019, Kelso & Company acquired Individual FoodService, buying Brady Industries a year later to create BradyIFS. Meanwhile, Envoy Solutions was formed in 2020 when FEMSA (a Mexico-based conglomerate mainly known for its soft drinks bottling operations) purchased regional distributors WAXIE and North American Paper. Now, in a major development, BradyIFS and Envoy Solutions are set to merge to create a $5 billion distribution giant.

Going back to February 2023, FEMSA announced it was exploring ‘strategic alternatives’ for its US-based distribution platform. It said these could include a sale of the company or the “potential addition of new strategic partners”.

At the time, OPI speculated whether a tie-up with Imperial Dade or BradyIFS might be on the cards or if Envoy could be a private equity play in its own right. In fact, it is a combination of these two scenarios that has come to pass.

At the end of August, FEMSA confirmed it had entered into a definitive agreement with

If you look at what it brings to each party, this merger really does make sense

Kelso to combine Envoy and BradyIFS. FEMSA will receive approximately $1.7 billion in cash and retain an ownership stake of 37% in the new entity. The remaining 63% will be owned by Kelso, Brady IFS management, private equity giant Warburg Pincus and the current minority shareholders of Envoy Solutions –although the specific shareholdings of each have not been disclosed.

One person who has a good perspective on this transaction is Mike Rowsey, business products industry veteran and CEO of manufacturer rep group Harbinger International. He suggests the BradyIFS/ Envoy Solutions combination is a logical strategic fit on many levels. “If you look at what it brings to each party, this merger really does make sense,” he notes.

platform model, akin to the Federation strategy at ODP Business Solutions, where local companies have kept their original identities.

This, notes Rowsey, raises questions as to the future of some of the individual brands. WAXIE, for example, is a well-known and respected name on the US West Coast.

An aspect of the transaction Rowsey finds potentially surprising is the continued ownership stake of FEMSA post-closing. One way of looking at it is that FEMSA is more than happy to maintain a shareholding because of the positive returns it has seen since 2020 and the belief there is more value to be unlocked.

That said, the FEMSA Forward strategic plan announced earlier this year underlined a desire to focus on the core businesses of retail, Coca-Cola and digital, not industrial distribution. Perhaps the Mexican group’s asking price was too high and it was obliged to keep a slice of the business?

One area is the complementary product offering. Just as ‘office products’ no longer refer simply to stationery, so the jan/san channel comprises many different categories. In addition to cleaning and hygiene, they now include foodservice disposables, safety, PPE, MRO and packaging – and OP.

Packaging in particular, where we only have to look at the spectacular success of Uline, is a fast-growing adjacency more resellers are looking to enhance. Here, the strong presence of Envoy Solutions will dovetail with BradyIFS’s range in verticals such as foodservice.

Rowsey also points to the ability the enlarged business will have to develop its own brands, source globally and negotiate better pricing with vendors. Then there is the expanded geographic presence across the US, with an estimated 175 combined locations.

Despite some overlap between the firms, he believes there will initially be enough “low-hanging fruit” for the owners to take cost out without disrupting customer relationships. Non-consumer-facing synergies could include a more centralised approach to purchasing and consolidation of some corporate roles.

Tied in with the customer relationship aspects of the merger is the question of branding. Over the past three years, BradyIFS and Envoy Solutions have adopted different approaches to integrating acquisitions. The former has morphed firms into the BradyIFS name while Envoy Solutions has developed more of a

Regardless, FEMSA has confirmed it does not expect to contribute incremental capital to the combined entity going forward. This could be where new investor Warburg Pincus comes in. With more than $83 billion in assets under management, it is a real financial powerhouse which will give the new business the clout to pursue its growth strategy.

Rowsey does not doubt that further acquisitions will follow, but sees a window of opportunity for Imperial Dade, both before the transaction is finalised and for a period post-closing. “There could be some things on the back burner until people understand how this merger will pan out,” he says.

“If I was Imperial Dade, I would be going out there after everyone I can with the pitch: ‘You know who we are, what we do and how we do it. But you have no idea what this transaction is going to look like in the end’.”

How long Imperial’s window will last is not clear. The expected closing of the BradyIFS/ Envoy Solutions deal as announced was a rather vague “in the coming months”. This is probably due to the complicated nature of a transaction involving multiple parties rather than any regulatory concerns – it is highly improbable the merger will be blocked due to competition issues.

As business products resellers from the OP channel delve further into the jan/san sector, it will be interesting to see to what extent they play a part in this consolidation process, either as buyers or sellers. For all the talk of single-source suppliers and the need to diversify, there has been little meaningful cross-fertilisation between the office supplies and jan/san worlds.

If I was Imperial Dade, I would be going out there after everyone I canMike

Rowsey

Young talent is something every industry wants to attract and I don’t think we’re doing too badly in that regard. But what about retention?

A couple of years ago, on the occasion of OPI’s 30th anniversary, we profiled ‘30 under 30’. Some of these individuals are making a reappearance here, which is fantastic, but I also know that quite a few have moved on. Business supplies for them was a stepping stone, not a career.

So who are the people who’ve chosen our industry, carved a career in it and are current –and future – protagonists and even leaders?

Have they stumbled into our space almost by accident – through a university placement or fresh-out-of-school apprenticeship? Or been involved in the family business all their lives? Maybe they’ve moved through the ranks in various channels and companies in our sector; or entered completely from the outside.

The pages that follow show it’s all of the above. A couple of stats piqued my interest and came as a bit of a surprise: we have 13 women in our list, a healthy third of the total. Granted, it could and should be more equal, but it’s certainly a notch up from the 12% in our Top 100 list (page 46)

Second stat: 19 out of these 40 individuals have spent their entire career in the business

supplies industry. It may not necessarily be completely obvious from the entries – there literally wasn’t enough space to highlight everyone in minute detail – but our research and background information suggests this is definitely the case.

Putting this list together has been no mean feat and it wouldn’t be wrong to say it’s been a monumental effort. To start with, not every company wants to put their shining stars into the spotlight, so that was a hurdle to overcome.

Secondly, ‘ageism’ is a real thing and we had to ask some awkward – and not always welcome – questions. We were also quizzed about why the ‘cut off’ at 39 when there are so many amazing people in their forties, serving their companies and doing great things. Well, we don’t call it the Fortune 502 either, if that illustrates the point.

What’s really important to note is that the people highlighted in our list provide just a snapshot of this particular age demographic – they are brilliant at what they do and have the potential to do even more.

There is no doubt this inaugural list is incomplete in many ways and that there are hundreds of others – certainly more than 40 – who deserve a mention. But, I believe, it’s an excellent start and it’s been great getting to know these individuals throughout the process.

In this special feature, OPI gives a snapshot of 40 personalities who are impressing their companies – and our industry – with their work ethic and achievements. It bodes well for the future – by Heike Dieckmann

Cameron Ables is one of three sons of second-generation Ables-Land owner and CEO Gary Ables. He helps run the dealership in Texas, US, with his twin brothers Chris and Cody (who, for ‘age reasons’, aren’t featured more prominently in these pages).

Ables has been working full-time in the company – realistically you always start much earlier in a family business, he admits – for over a decade, straight after full-time education. He is currently in charge of sales in the Office Products division, a role he loves due to the close customer involvement it brings. OP is one of three core competencies at Ables-Land.

While Ables is quick to point out that all-round knowledge of and expertise in all aspects of running the organisation is essential, especially with succession in mind, he adds that a diversified and ‘parallel’ job share with his brothers has been working well so far.

After joining Pilot France’s marketing department as an intern in September 2008, Julien Barabant’s career went on a journey that took him from a number of local and national roles to fully-fledged European responsibilities.

For the first ten years, he worked for the company’s French subsidiary, serving as the Marketing Manager for customers in stationery stores as well as the office equipment, e-commerce and fine-writing channels.

In October 2020, he became Digital & Brand Manager of Pilot Corporation of Europe. His responsibilities include digitising the company’s operations by implementing a range of core solutions – a product information management system, for instance, and B2B ordering platforms. His role also includes harmonising Pilot’s overall brand image.

Before taking over as President in 2019, Daniel Benjamin learned the ropes of the US family business in a number of roles, first as Director of Business Development and then as VP. Over the past nine years at Benjamin Office Supply, he has worked to create a new go-to-market strategy, open new company headquarters and passionately serve customers.

As Benjamin’s second President, his vision for his leadership is to maintain a highly customer-centric dealership – it’s more than just selling pens and paper – fuelled by a strong employee culture. Creating a warm and respectful culture is something Benjamin feels strongly about: “I believe the people who work for Benjamin make it the company it is today and will be tomorrow. My greatest joy is being part of each employee’s journey to see them realising their full potential.”

Alex Bonarius, Global Sales Director, Pukka Pads

Rooted firmly in the business supplies manufacturing community where he’s been for the past eight years, Alex Bonarius has embraced all aspects of our sector wholeheartedly. Sales is his passion, from the first meeting to signing on the dotted line, followed perhaps by a round of golf where he enthusiastically networks with his peers – with sales still in mind!

As highlighted in our interview which immediately follows this list of budding industry leaders (page 30), Bonarius started his OP career at UK vendor Rapesco where his previously learned skills of speaking fluent German stood him in excellent stead to develop the brand in key European markets – Germany being one of them – and beyond.

In his current role as Global Sales Director of fellow British vendor Pukka Pads, he is responsible for all sales channels and markets across the business and its multiple brands.

Gemma Bush, Account Manager, GNS Wholesale Stationers

A 15-year sales expert, Gemma Bush has vast experience across the wholesale, retail and convenience sectors, currently as Account Manager of GNS Wholesale Stationers in Australia. Having joined the organisation in 2014 as a Business Development Representative servicing newsagents, her sales knowledge and training skills helped her territory’s revenue grow consistently across all major seasonal retail promotions.

Five years ago, Bush took on a wider sales remit to also include GNS’ commercial reseller customers. According to company Managing Director Paul Yardley, she has brilliantly adapted to and excelled at everything thrown at her, always going “above and beyond”.

Bush’s latest challenge happened in 2022 when she successfully took on managing GNS’s national multisite retail chain customer Spotlight.

Scott Castle, Head of Campaign Marketing, EVO Group

Scott Castle joined the business supplies space in 2013 as Marketing Manager of VOW Retail. Over the past decade, he’s enjoyed a variety of positions within EVO Group, excelling in all of them. As Product Marketing Manager for VOW Wholesale, for instance, he won the Young Executive of the Year at the 2019 European Office Products Awards (EOPA) while in the same year also scooping the BOSS Emerging Professional of the Year award.

Just over a year ago, Castle was promoted to Head of Campaign Marketing for EVO Group, responsible for managing the product marketing team, building relationships with suppliers, and planning and activating all product marketing activities across EVO’s businesses.

Castle has also displayed a wide-ranging commitment to the industry as a whole. He chaired the BOSS Leaders of the Future Committee between 2020 and 2022, for instance.

Tyler Condry, President, Sundance Office

Tyler Condry grew up with and in Sundance Office and, following graduation, joined the family business as Marketing Director. He has been President since 2021.

Condry has explored a variety of different avenues at Sundance. In 2012, for instance, he launched UrbanGirl – an internet start-up that was focused on the sale of fashionable office products. After struggling to scale the business, he changed tack, using the talent on the team to instead create – very successfully – a custom print and promotional products division, known as Sundance Promos.

In addition to constantly seeking to make the dealership bigger and better, Condry is also deeply involved in community projects. He’s been instrumental in developing Sundance Cares, for example, a programme which gives back to Oklahoma communities.

Kristian Danielson is a Key Account Manager at BIC World. Having started his career working for McCain Foods, he quickly realised account management was the career path for him. He subsequently moved to Henkel and then Comvita in similar account management positions, experiences that allowed him to learn new methods and approaches to succeed.

The opportunity to work at BIC in the UK arose in 2019. As Key Account Manager, he works closely with all the main wholesalers and dealer groups. No two days are the same, Danielson enthuses, saying he might find himself negotiating pricing, delivering sales training, evaluating promotional effectiveness or meeting end users at trade shows. Working collaboratively with a variety of stakeholders is another aspect of the job he enjoys plus – and he’s not the first one to say this – the friendliness of the people in the industry.

James

Among incredibly tough competition, James Day was this year’s EOPA winner in the Young Executive of the Year category. Day joined Durable UK in 2018 and has impressed ever since with his outstanding work ethic and talent for building trust with channel partners.

He began his career at the vendor as Senior National Account Manager, progressed to Head of Commercial and, most recently, Sales & Marketing Director. In his current role, Day has more opportunities to guide the strategic direction of the business as he oversees Durable UK’s complete sales and marketing functions.

He has a clear vision of how Durable can grow with its resellers and has made a real impact at the vendor. He is also a keen advocate of bringing young talent into our sector and has served on the BOSS Leaders of the Future Committee since 2021.

The only ‘joint’ team in our list, husband and wife team Marc Deu Grota and Camila Riveros Jaramillo are Co-owners and CEOs of Spanish reseller Office24. With Deu Grota having grown up in the office supplies industry through family connections, he carried on the tradition when he joined Office24 in 2009; his wife joined him four years later.

Both individuals ascended through the organisation, reaching management level, with Deu Grota being COO and Riveros Jaramillo CMO. In 2021, when the company was close to shutting its doors as a result of the COVID-19 challenges, they had the opportunity to buy Office24 and its partner wholesale company, Distribution of Supplies for Offices (DSO).

The couple worked hard to introduce a wide range of new business ideas, entering the office and school supplies market, and launching various e-commerce projects.

Scott Ellis has been in the business supplies industry for over 15 years. He’s worked at Banner, now part of EVO Group, for all this time, being a core contributor to its success. He was recently asked to join the senior leadership team as Head of Corporate Accounts.

Ellis began his career in 2008 as a Customer Service Advisor in Banner’s government team. Two years later, during the acquisition of Accord, he was instrumental in transitioning accounts between the two organisations. Moving further up the ranks in various roles, he became Sales Manager in 2022.

Ellis credits his success to Banner’s unwavering support – in terms of both personal and professional development. This, coupled with plenty of ambition and an ability to adapt, has served him well so far and, no doubt, will continue to do so in the future.

For almost ten years, Kelly Ennis has been the force behind growing JAM Paper & Envelope’s – now JAM BNC – product sales. She joined the e-commerce focused operator – a subsidiary of Hudson Envelope Corporation – straight out of college in 2013.

In 2021, JAM Paper merged with BIGNAME Commerce, with all of the latter’s office supply channel relationships falling under her remit. She currently manages a team of more than two dozen people as Chief Revenue Officer and is responsible for e-commerce sales.

Ennis has led the development of numerous custom business intelligence reports and interactive dashboards that now drive informed decision-making at all levels of the organisation. These have included the design of a proprietary forecasting algorithm that has proven to be a game changer for efficient inventory management.

Adam Fox, VP of Marketing, S.P. Richards

Currently VP of Marketing at S.P. Richards (SPR), Adam Fox came to the wholesaler with an already distinguished career in marketing through various positions in the foodservice and jan/san industries. When he joined SPR in 2019 as Channel Marketing Manager, he rapidly developed his knowledge of the OP side of the business and was soon identified as a high-potential candidate who could overhaul the company’s marketing activities.

Named Director of Marketing in 2020, he built a creative team that has enabled SPR’s customers to expand into the digital marketing and social media spaces, allowing them to better compete in today’s online world. He was promoted to his current role earlier this year.

Away from SPR, Fox is working alongside industry colleagues on the Emerging Leaders Council at City of Hope.

Beth Freeman, EVP, FSIoffice

EVP of FSIoffice, Beth Freeman is the daughter of company CEO Kim Leazer, following in the giant footsteps of her mother, grandmother and aunt as an emerging female leader in our industry. She has already had a broad impact on the dealership through her efforts in sales, marketing and procurement, while also being the driving force behind comprehensively modernising the family business.

After graduating in 2006, Freeman joined FSI full-time as Corporate Administration and Pricing Specialist, before being promoted to Assistant VP of Sales and then becoming EVP in 2018. Her passion for advancing her own company and the industry she works in – she is also President of the board of directors at AOPD – was recognised when she won the Young Executive of the Year at the North American Office Products Awards (NAOPA) 2019.

John Friedrich, Senior Account Manager, Fellowes Brands

John Friedrich’s journey in the OP industry has been shaped, he says, by the guidance of many remarkable leaders and mentors, who helped make him the manager he is today.

Prior to joining Fellowes Brands in 2020, he honed his skills as a National Account Manager at The HON Company. Using his customer service experience, he helped train team members, while managing a dedicated market and fulfilment channel, solidifying his reputation as a trusted professional within the industry.

Friedrich currently serves as a Senior Account Manager at Fellowes Brands. In this role, he oversees the independent dealer, wholesale and IT channels, as well as key accounts. An active member of industry organisations, he contributes to the BSA Executive Board, the AOPD Business Partner Advisory Board, and the City of Hope Emerging Leaders Council.

Lindsay Gibbons, VP of Supply Chain, S.P. Richards

Lindsay Gibbons joined S.P. Richards (SPR) as Customer Supply Chain Director in 2018. A year on, she became Senior Director, with a further promotion in 2020 to VP of Supply Chain.

Gibbons brings to the SPR table not only an Ivy League undergraduate degree, but also two Masters’ degrees. She balances that impressive educational background with a personal, caring touch that allows her to build a strong team.

With an immaculate record of driving operational excellence and achieving substantial cost savings for the wholesaler, Gibbons’ strong focus on inventory management, demand planning and supplier relationships has meant her team consistently exceeds SPR’s expectations. Her colleagues also specifically highlight her outstanding leadership and resourcefulness – in supply chain terms – during the intensely difficult COVID-19 period.

Christopher Götz, Director of Marketing & E-Commerce, Avery Zweckform

Christopher Götz was appointed Director of Marketing & E-Commerce at Avery Zweckform in Germany earlier this year, another step up the ladder in his 14-year career at the manufacturer which he began as an industrial placement during his university studies.

Götz’s knowledge and expertise is comprehensive and has been accumulated during years of learning his craft, from product management and trade marketing to business development and digital know-how. Most recently, his remit has been to set up and expand Avery’s presence in the e-commerce channel.

A thorough appreciation of where customers are and how they want to buy has been key to Götz’s success. Indeed, technologically savvy and forward-thinking is how he is described by his peers – both in his own market of Germany, but also by his colleagues globally.

Elizabeth Hawver, VP Wholesale & Office Distribution, Essity

As VP of Essity’s Wholesale and Office Distribution team, Elizabeth Hawver is in charge of the strategy and execution of the company’s growth plans in this channel.

She leads a seasoned team of over 30 sales and marketing professionals and is responsible for some of the company’s key strategic distribution partners, while focused on driving sales for the Tork brand of professional hygiene products.

Hawver began her career at Essity in 2009 as a Strategic Analyst. Her talent was quickly recognised and resulted in rapid career progression, culminating in her becoming the youngest director in the company. Since then, she has demonstrated continued success with roles across finance, global strategic planning, competitive intelligence and commercial sales leadership.

Emily Hiner, Shopper Marketing Leader Office Channel, 3M

Emily Hiner is currently 3M’s Shopper Marketing Leader responsible for account-specific activations within the office, grocery and craft channels. She began her consumer career in 2011 where she gained valuable knowledge in sales, analytics and shopper marketing. Although she has worked in multiple channels over the years, Hiner argues that the office channel has been the most remarkable experience for her due to the people and also the important work the industry does in the community.

Hiner is a proud member of the Emerging Leaders Council for City of Hope, again an opportunity that wouldn’t have been possible outside the office channel. In terms of her priorities, Hiner wants to continue to stay close to the customer and loves building 3M solutions for the end user based on insights.

Jean-Francois Houle, National Customer Service Director, Novexco

Jean-Francois Houle was appointed National Customer Service Director for Novexco’s three sales channels – wholesale, Hamster commercial customers and Hamster dealers – in 2019. He has worked in a variety of roles at the Canadian operator for the past 11 years.

Houle’s current position involves working with a team of 40 customer service representatives, meeting the needs of Novexco’s 65,000 customers. He implemented ‘The One Call Resolution’ that allowed his team to resolve all types of customer requests on the first call. Another example of Houle’s commitment to building positive relationships is his presence on the Novexco Customer Experience Committee which focuses on “delighting” more people every time they contact the operator. Novexco CEO Denis Mathieu credits Houle with being a key player in the organisation, regularly maintaining above 95% in customer retention figures.

Jordan Hoxie, Commercial Account Manager, Beatties (Staples Professional Canada)

Some people are born into this industry and Jordan Hoxie is an excellent example of this. Hoxie is part of family business Beatties which dates back to 1860 (but, incidentally, was bought by Staples Professional Canada in August in another big-box dealer buyout).

Over the past 16 years, he’s been on a steady progression course, dipping his toes into many parts of the business, including warehousing and logistics, purchasing and retail. Commercial Account Manager for the past ten years, he oversees Beatties’ sales in south-western Ontario. In this role – and still operating in a separate entity from Staples –Hoxie assists clients in managing and optimising their procurement spend.

On a wider industry scale, Hoxie has been serving on the board of the Canadian Office Products Association for the past two years.

Hunter Jordan, Director of Sales, Herald Office Solutions

This and the next entry are further proof of just how important family-run dealerships are in our industry, especially in North America. Hunter Jordan, a Young Executive of the Year NAOPA winner in 2021, needs little introduction. Son of company owner and President Thomas Jordan and brother of Myers (below), his skill set firmly lies in sales.

Starting straight after college in the furniture segment of the company where he worked on government contracts, Jordan quickly progressed to run the whole Interiors division, posting record revenue increases. This has since been further extended to include the Business Products and Office Equipment verticals. Since 2020, he’s held the title of Director of Sales. Jordan previously served on the Furniture Purchasing Committee for Independent Suppliers Group and is currently Chairman of its NEXT Committee.

Like his brother, Myers Jordan took a deep dive into the business supplies space from an early age, working at Herald Office Solutions after completing his first degree – and then during his Master’s in Business Administration studies which he completed at the University of South Carolina in 2016.

A can-do attitude, bags of enthusiasm and a willingness to learn have sent Jordan up the company ladder in a relatively short time. His specific product knowledge revolves around the breakroom and jan/san categories which he’s been hugely successful in moving forward for Herald.

He has combined his dealer-specific knowledge with a keen interest in getting immersed in the broader industry, serving on a wide range of committees and forums.

Falko Köhler won the Young Executive of the Year accolade at the 2022 EOPA and it’s easy to see why. His current position is Director of Business Innovation & Development (and Marketing & E-Commerce) at Lyreco Germany. This is another step up from his previous position of Director Customer Experience which changed in 2021 when Lyreco acquired parts of Staples Solutions’ European businesses.

Köhler, who joined the reseller in 2016, has steadily moved up through the ranks and brings with him an infectious and determined enthusiasm to, quite simply, enhance the customer experience. His job, he says, gives him the opportunity to add sustainable value to the entire business, while moving Lyreco from its transactional product and service offerings to becoming a true partner. There’s no doubt that his last promotion wasn’t the final one.

Alicia Kolbus,

Alicia Kolbus is an almost rare example of a young successful professional in the US side of our industry who is not related to the owners of her business. She initially worked in San Francisco pursuing a career in art institutions but, deciding to move to be closer to her family, found a position at Stinson’s through a job fair ten years ago.

Starting in sales, she quickly developed interests in analytics and marketing – areas where a full-time position didn’t really exist at the time. However, as Kolbus explains: “It was Stinson’s willingness and encouragement to let me pursue my interests and acquire new skills that really enticed me to stay. Together, we created a department focused on data analytics.”

In her current role as Analytics Specialist, she develops new marketing initiatives, while managing contracts and pricing programmes to support the sales and purchasing teams.

Margaux Lefaucheux has been a part of the AF International team for over a decade. Her journey started as Major Account Coordinator before being promoted to Key Account Manager. In 2021, she was named European Account Manager, followed by AF Brand Manager in 2022.

In this latest role, Lefaucheux embodies the image of AF International, presenting it enthusiastically in everything she does – within the company and in all external interactions, both in the OP industry and the wider B2C market.

After ten years, Lefaucheux eagerly anticipates further opportunities to contribute to AF International’s growth. Her dedication to the vendor, she explains, is rooted in its “dedication to excellence” which she shares a passion for.

With a background in retail, Rachael Lewis hasn’t been in our industry for that long, but she’s excelled in everything she’s done so far and is certainly one to watch in the future.

Lewis started as Head of Commercial Finance and Pricing for Spicers in 2019, before becoming the Head of Pricing and Margin for OT Group. After 18 months in this position, she was promoted to Sales Operations Director at the beginning of last year, where she now works closely with the group’s experienced sales team to drive growth and margin optimisation.

A crucial part of her role is to work alongside other departments on business-critical projects, all to ensure the group maximises the customer experience.

With her natural leadership ability, Lewis is also keen to develop young talent in our sector. She became Co-Chair of the BOSS Leaders of the Future Committee in 2022.

HB Macey, President, Perry Office Plus

HB Macey is another ‘40 under 40’ candidate who has learned the trade from the ground up. He started his career at Perry Office Plus in 2011 as a delivery driver and warehouse worker before becoming a sales rep. Here, he earned the respect of his peers due to his hard work, plus his dedication to the company and the wider industry. He became Sales Manager in 2014; since then sales have grown over 100%, with significant expansion particularly in the dealer’s jan/san category.

Macey was named President in 2021, adding a laundry/warewash and floor equipment division during the same year. In 2022, together with his wife Lynnsay, he purchased the family business from his retiring parents. He is part of the Independent Suppliers Group NEXT Committee and won last year’s NAOPA Young Executive of the Year accolade.

Jake Mages, VP of Sales, Guernsey

Jake Mages turned 16 the day his father – who recently retired from the US dealership after 26 years – called to offer him a job working in the warehouse. During these high school years, holidays were spent at the main distribution centre serving as receiving clerk, picking and packing orders, and occasionally filling in as a route driver.

After graduating, Mages took a job in outside sales, apprenticing in Guernsey’s largest contract account. He’s since held positions in category and mid-level sales management, before achieving his current position of VP of Sales.

He says: “No two days are the same and I love that. One day I may be working on a project for a school, the next I could be in an office demonstrating a high-end bean-to-cup coffee machine. I love problem-solving and coming up with creative solutions.”

Andrew McKenna, Marketing Director, ACCO Brands Australia & New Zealand

Andrew Kenna has been with ACCO Brands Australia for about 13 years, in roles of ever-increasing responsibility – from Junior Product Manager over Senior Brand Manager to his current position of Marketing Director.

McKenna, according to his peers, has the skill to combine creative thinking with the commercial discipline required in his present role which he’s held for the past two years. An outstanding work ethic, great management style and an ability to generate a positive culture are other character traits associated with him.

Working for an organisation like ACCO, which has seen so many changes, has been, in McKenna’s words “fantastic”. “From innovation across multiple product portfolios to the way we communicate with our consumers, it’s great to work in an industry so adaptive to change.”

Jiří Novotný joined Czech Republic-based OFFICEO in 2014 – then still under Office Depot Europe ownership – quickly climbing the career ladder to his current position as Head of Contract Sales which he assumed in 2021. He is well known in his organisation and beyond for his hard work, dedication and eagerness to succeed.

Parent company PBS Holding, which bought the Czech and Slovakian subsidiaries of Office Depot Europe in 2019, recognised Novotný’s potential early on, placing him on its high potential training programme which is designed to prepare those with key skills and talent for future leadership roles.

Novotný was also instrumental in the company‘s rebranding process – from Office Depot to OFFICEO – and the merger with PBS Holding’s Büroprofi.

Rasmus Olsen has spent the majority of his career at Danish reseller Lomax – 15 years so far. He began working in the technology products department while still being a student. After completion of his formal education, he began working as a Product Manager, in charge of office supplies, packaging and creative products – a portfolio of more than 10,000 SKUs.

In addition to this role, Olsen is also the Team Lead of Lomax’s online product specialists, which create all the content visible on the e-commerce websites in Denmark and Sweden.

He has long been involved in industry organisation KONPA and earlier this year was elected as a board member. He clearly loves what he does: “I’m constantly challenged in my job, but feel that the decisions I make and the development I help create directly contribute to driving the company forward. That’s a good place to be.”

When Jérôme Perhaut joined Fellowes Brands in 2015, he was an intern with a Master’s degree from the EM Normandy International Business School. He had previously worked at Henkel, Staedtler and Deflecto and, in fact, had been “raised” in the business supplies industry as his father had managed Staedtler France. It was certainly enough to make him want to stay in our space and give it a go. And this he did very successfully.

During his internship, Perhaut’s first responsibility was to participate in the commercial development of its air purification range in 2015. By 2017, he was an Account Manager and three years later he was promoted to Key Account Manager. He’s now responsible for the Amazon and Bureau Vallée accounts while also coordinating sales rep activities for the vendor’s expansive product portfolio in the OP, office furniture and IT categories.

Having grown up in the family business, Andy Richter began his career at a young age working in the warehouse. In his high school days, he moved on to deliveries, before then taking on a sales role during college summer holidays. Following graduation, he was initially employed as an admissions counsellor at his alma mater, before taking the decision to move back to Pennsylvania and work for Richter Total Office full-time.

His initial role was Sales Manager before being promoted to VP in 2017 and subsequently President in 2022. His current job is hugely diverse: he oversees the sales team and customer service department; handles equipment sales; monitors vendor relationships and manages key accounts. Despite these all-encompassing tasks, Richter wouldn’t have it any other way and is grateful for the opportunity to be part of the family business.

Claudia Roberti, Trade Marketing & Supply Chain Control Specialist, Avery

With a degree in management engineering, Italian Claudia Roberti began her professional career as an intern at Avery. In that role, she had the opportunity to learn and gain experience in different departments at the manufacturer – customer service, marketing and supply chain perspectives, for instance.

Roberti is currently Trade Marketing & Supply Chain Control Specialist for Avery in Italy from where she liaises with customers in both Italy and Spain, and links sales needs to marketing objectives. She is regarded as a highly intelligent multi-tasker who, coupled with her excellent communication skills, is widely billed as a business leader of the future.

And she relishes the challenge: “My job gives me the chance to combine processes and data analysis with creative and strategic solutions. And who doesn’t love stationery?”

Oliver Rowles, Customer Services Manager, Prima Software UK & Ireland

Software companies don’t often get a shout-out for individual achievement and excellence.

Oliver Rowles at Prima Software very much deserves one, however. He joined the firm in 2014 as an 18-year-old apprentice. Since then, he has worked his way up to become UK & Ireland Customer Services Manager, reporting directly to the board.

Over the past nine years and embracing ongoing training and professional development, Rowles has developed a rich understanding of the logistics and strategies of commercial stationers and the office products supply chain in general.

Rowles is responsible for eight agents as part of the customer services team. His department not only troubleshoots users’ software issues, but also seeks to enhance their system usage through coaching and consultation.

Having worked in the education and defence sectors prior to joining the office products industry six years ago, Sam Rylands is currently Head of Marketing at Durable UK – a position she has held since 2022.

As an experienced marketing leader, change manager and team builder, her primary role is to bring Durable’s wide range of workplace solutions to the UK market. In addition, she is a key contributor to leading change within both the business and the wider industry. This, she finds, is one of the most challenging and rewarding parts of her job.

Rylands admits that prior to joining Durable, she didn’t know much about our sector, but quickly realised it was undergoing rapid transformation to meet new customer demands. Plenty of opportunity to implement ideas – exactly what she intends to do.

As the Director of Sales & Marketing at Innovative Office Solutions, Bridget Smith has become a charismatic influencer who thrives on connecting people, ideas and resources to create maximum productivity.

Smith – married to Max Smith (profiled below), son of company CEO Brooks Smith and the late Jennifer Smith – brings contagious energy to any dynamic environment and leads teams with a forward-thinking approach. Her passion extends beyond the business realm and into philanthropic endeavours, among them the InSports Foundation which encourages and helps children to participate in sports. She has also been involved with Essendant’s Young Professionals Group for several years.

Smith is currently on maternity leave, having had her third child recently.

Max Smith, Account Executive, Innovative Office Solutions

Max Smith grew up in our industry and is part of the third generation of the Innovative Office Solutions family business.

Starting with an internship back in 2010, Smith has over the past 13 years become one of Innovative’s top account executives. He thrives in a sales environment where he can use his in-depth knowledge of cross-category solutions to uncover client pain points and ultimately make them more successful.

Smith, along with his wife Bridget, has also long been involved in philanthropic community efforts. Indeed, in 2013, while at Concordia College, he founded the InSports Foundation, a non-profit organisation that has since impacted many thousands of underprivileged children throughout the Midwest by providing free camps and financial assistance.

Alex Stone has shot through the ranks at Office Friendly over the past decade, from a junior marketeer to his current role as Sales Director. He first experienced the UK dealer group during his industrial placement as part of his degree before joining full-time in 2013.

Over the next few years, he took every opportunity he could to learn and enhance his skills, transitioning into a business development role for the north-east of England. He steadily took on more responsibilities, with his remit always expanding to cover wider regional areas, plus several key accounts. He was promoted to Head of Sales before starting his current directorship role this year.

And now he can’t imagine not being in our industry. “I’ve naturally gravitated to a position where I can collaborate and work with fantastic individuals and create real value,” he says.

Cameron Ables, Sales Manager Office Products, Ables-Land

Julien Barabant, Digital & Brand Manager, Pilot Corporation of Europe

Daniel Benjamin, President, Benjamin Office Supply

Alex Bonarius, Global Sales Director, Pukka Pads

Gemma Bush, Account Manager, GNS Wholesale Stationers

Scott Castle, Head of Campaign Marketing, EVO Group

Tyler Condry, President, Sundance Office

Kristian Danielson, Key Account Manager, BIC World

James Day, Sales & Marketing Director, Durable UK

Marc Deu Grota & Camila Riveros Jaramillo, Co-owners & CEOs, Office24

Scott Ellis, Head of Corporate Accounts, Banner (EVO Group)

Kelly Ennis, Chief Revenue Officer, JAM BNC

Adam Fox, VP of Marketing, S.P. Richards

Beth Freeman, EVP, FSIoffice

John Friedrich, Senior Account Manager, Fellowes Brands

Lindsay Gibbons, VP of Supply Chain, S.P. Richards

Christopher Götz, Director of Marketing & E-commerce, Avery Zweckform

Elizabeth Hawver, VP Wholesale & Office Distribution, Essity

Emily Hiner, Shopper Marketing Leader Office Channel, 3M

Jean-Francois Houle, National Customer Service Director, Novexco

Jordan Hoxie, Commercial Account Manager, Beatties (Staples Professional Canada)

Hunter Jordan, Director of Sales, Herald Office Solutions

Myers Jordan, Team Member, Herald Office Solutions

Falko Köhler, Director of Business Innovation & Development, Lyreco Germany

Alicia Kolbus, Analytics Specialist, Stinson’s

Margaux Lefaucheux, European Brand Manager, AF International

Rachael Lewis, Sales Operations Director, OT Group

HB Macey, President, Perry Office Plus

Jake Mages, VP of Sales, Guernsey

Andrew McKenna, Marketing Director, ACCO Brands Australia & New Zealand

Jiří Novotný, Head of Contract Sales, OFFICEO

Rasmus Olsen, Product Manager & Team Lead, Lomax

Jérôme Perhaut, Key Account Manager, Fellowes Brands

Andy Richter, President, Richter Total Office

Claudia Roberti, Trade Marketing & Supply Chain Control Specialist, Avery

Oliver Rowles, Customer Services Manager, Prima Software UK & Ireland

Sam Rylands, Head of Marketing, Durable UK

Bridget Smith, Director of Sales & Marketing, Innovative Office Solutions

Max Smith, Account Executive, Innovative Office Solutions

Alex Stone, Sales Director, Office Friendly

Alex Bonarius came onto the business supplies scene almost a decade ago. As one of OPI’s ‘40 under 40’ (page 18), he shares his insight of a young person’s journey through the industry

When Brit Alex Bonarius moved to Germany in 2010, he began learning skills that would help him a few years later when joining the business supplies industry.