Connecting the business products world September 2023

INTERVIEW l Amazon dominates GSA platform l ODP’s Varis stuck in neutral l OT Group swoops for Nectere l New CEO at ACCO Brands l AI: friend or foe? l Print under pressure l NAOPA shortlist revealed INSIDE THIS ISSUE TECHNOLOGY SOLUTIONS Special Issue

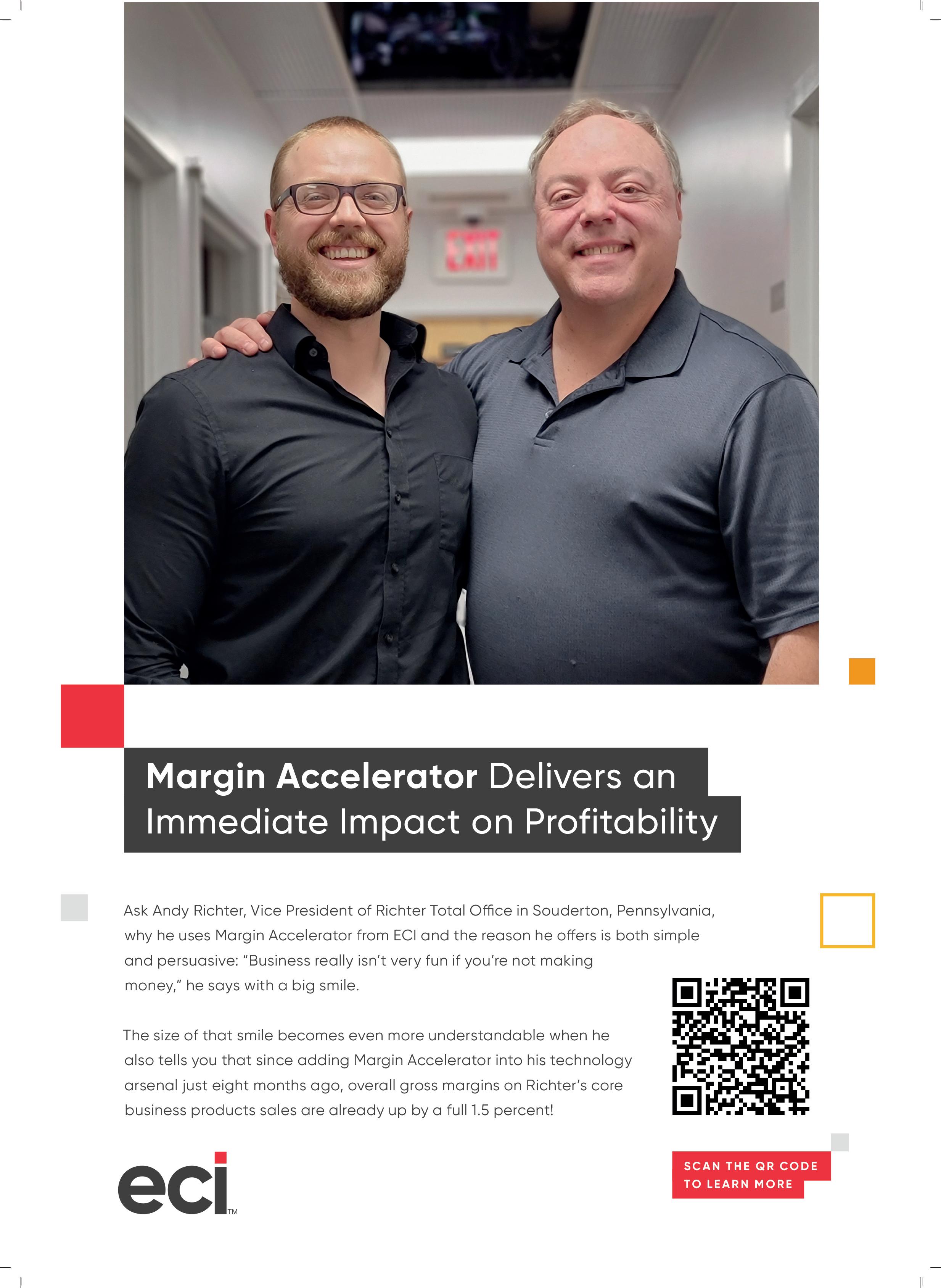

Steve Schultz, RJ Schinner BIG

Big Interview: From the outside looking in

RJ Schinner, predominantly a redistributor of foodservice and jan/san products, has been on the periphery of the business supplies space for many years. Now, under the added guidance of new President Steve Schultz, the family firm aims to become a must-go-to destination for independent dealers. Schultz brings with him plenty of relevant experience. He worked for Essendant – then United Stationers – for 16 years, leading the wholesaler’s Lagasse and ORS Nasco businesses. This was followed by stints at GOJO Industries and S.P. Richards’ legacy jan/san and safety entities.

FEATURE: FULL VISION

Customer experience is the name of the game. If your clients are not having a good experience when shopping with you, they will look elsewhere.

People pay more to shop on big-box sites for a reason. Even a giant like Google factors in customer experience when positioning websites in its rankings.

The refinement and improvement of these optimisations is an enduring task for us, one that requires continuous investment, maintenance and innovation. For example, we have been working with each of our customers to get their sites updated from legacy methodologies to the latest and greatest.

18 Big Interview

Steve Schultz eyes up IDC as new President of RJ Schinner

24 Focus OT Group swoops for distressed Nectere

44 Category Update

Under pressure: imaging supplies, print and MPS

48 Advertorial Lamination in progress at ACCO Brands’ GBC

50 Preview: NAOPA

Shortlist revealed for the 13th North American Office Products Awards

58 Preview: Industry Week ’23 Getting together in the Big Easy

28 Interview

ECI’s Brian Bowerfind on technology in the IDC

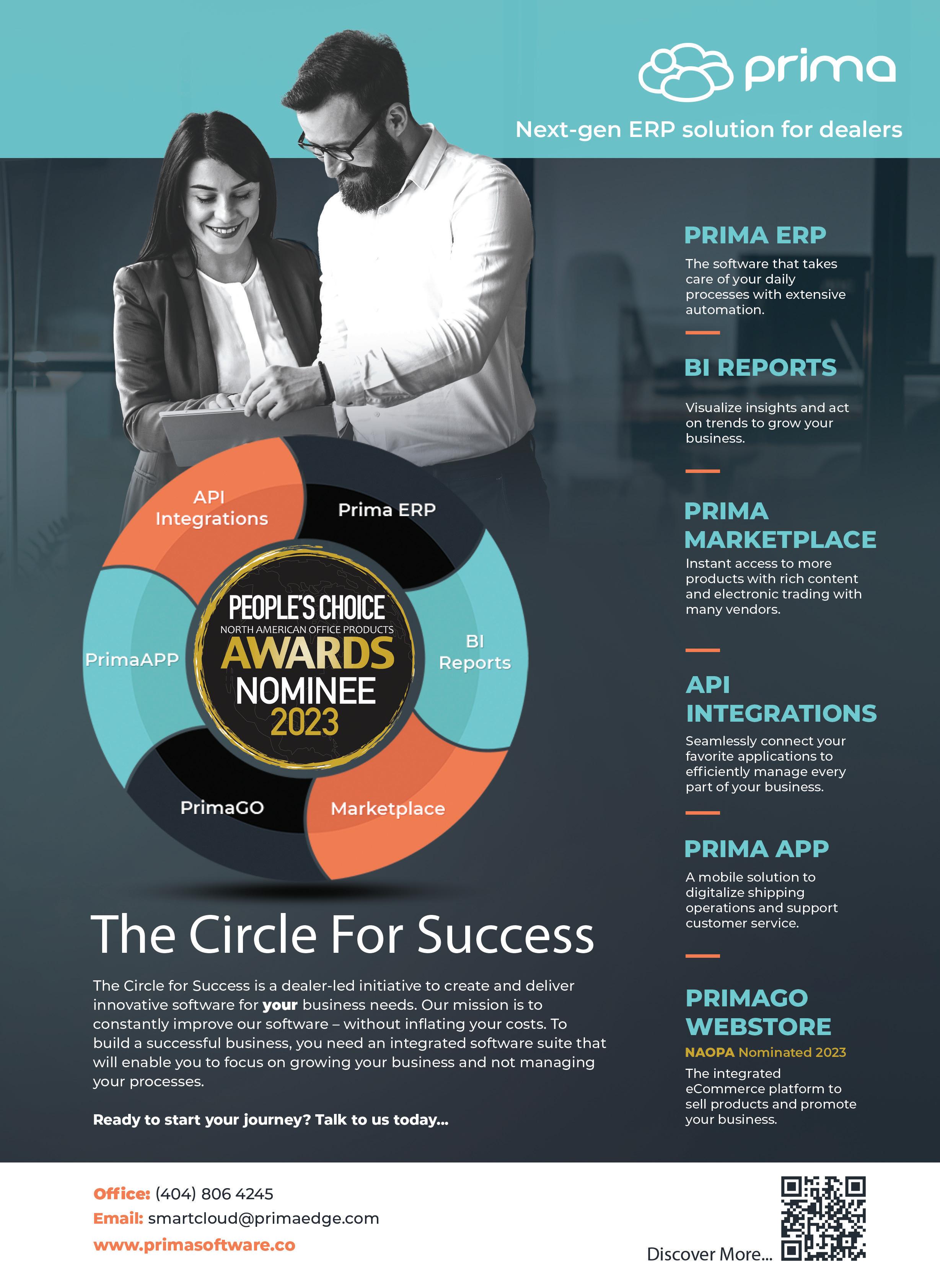

30 Feature Software solutions and how they help dealers

36 Case Study

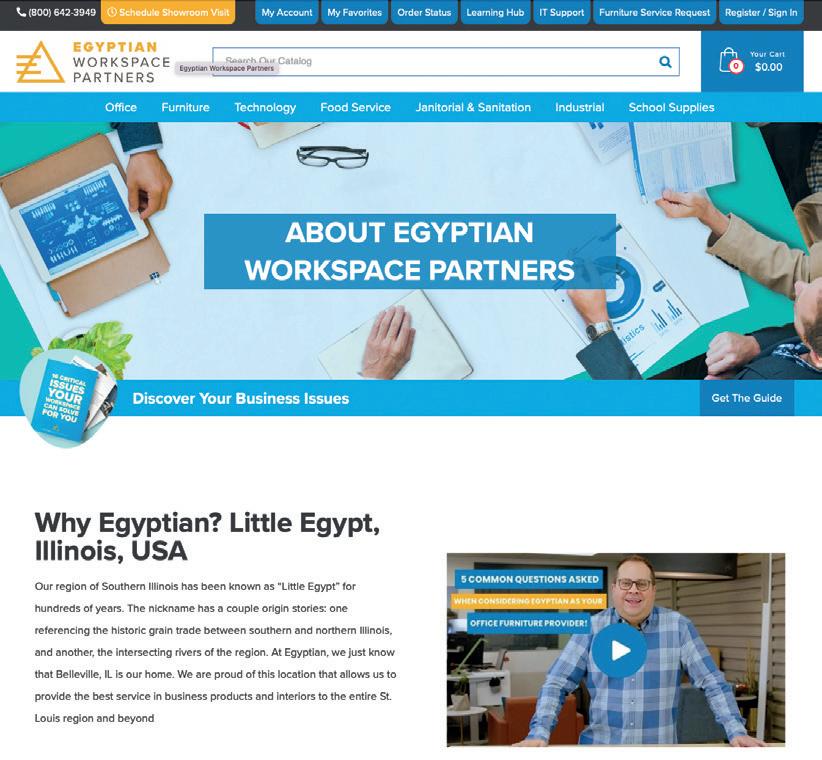

Egyptian Workspace Partners in Illinois, US

40 Spotlight AI: friend or foe?

42 Opinion Work in progress: data and content

REGULARS

September 2023 3

CONTENTS

Green Thinking News

OPI Small Talk

5

with...

Gerber

Word

5 Comment 6 News 14

16

60

minutes

Gert

62 Final

John Evans

TECHNOLOGY SOLUTIONS Special Issue TECHNOLOGY SOLUTIONS Special Issue Special Issue VENDOR SPECIAL Special Issue VENDOR SPECIA Special Issue VENDOR SPECIAL Special Issue TECHNOLOGY SOLUTIONS

The OPI team

EDITORIAL

Editor

Heike Dieckmann +44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite

+33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman michelle.sturman@opi.net

Freelance Contributor

David Holes david.holes@opi.net

SALES & MARKETING

Chief Commercial Officer

Chris Exner

+44 7973 186801 chris.exner@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Digital Marketing Manager Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager

Lisa Haywood events@opi.net

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

PUBLISHERS

CEO

Steve Hilleard

+44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand

+44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin

Facebook: facebook.com/opimagazine

Podcasts: opi.net/podcast App: opi.net/app

Technology to the rescue

Last time in this column I spoke about growth and how everyone wants more of it. No surprise there. In this issue, we highlight a quite spectacular growth story – that of RJ Schinner, the $700 million US redistributor of foodservice and jan/san products.

A familiar face in our industry, mostly from his days at United Stationers, recently appointed President Steve Schultz talks of 20% CAGR over the past decade in our Big Interview (page 18) . To achieve this, mostly organically, is impressive. To maintain it – as Schultz and the Schinner family clearly intend to – will be even tougher. An operator of this size likely has fairly deep pockets to facilitate the inevitable costs which go hand in hand with scaling up.

Independent dealers – incidentally a channel Schinner is looking at closely – don’t have this luxury. But they still need to provide a top-rated service to their customers.

Technology is the backbone of that service and here is where our industry’s software solutions providers come in. From an engaging and user-friendly – as well as highly ranked – front-end webstore experience to all the back-end functionality which allows them to be comprehensive in their offering and competitive in their pricing, these providers are helping dealers navigate the choppy waters of e-commerce excellence.

A range of features is dedicated to the topic in this issue, including an interview (page 28), a case study (page 36) and several opinion pieces (pages 30, 42 and 62 respectively) – just follow the purple Technology Solutions sticker throughout the magazine.

In the context of technology, there’s no bigger subject right now than artificial intelligence (AI), which we take a good look at in our Spotlight (page 40). Is AI friend or foe; will it pave the way for a workplace revolution that eliminates, well, ‘work’?

I like the concept of what Harry Dochelli referred to at the recent Essendant virtual event (page 8) – cobots. Ignorantly, I had to look this up: a cobot, or collaborative robot, is a robot intended for direct human-robot interaction within a shared space, or where humans and robots are in close proximity. That sounds much better.

due principally to the fact that data cannot always be verified, it is possible that some errors or omissions may occur. Office Products International cannot accept responsibility for such errors or omissions. Office Products International accepts no responsibility for comments made by contributing authors or interviewees that may offend.

September 2023 5

No

COMMENT

The carrier sheet is printed on

Satimat

Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months.

part of this magazine may be reproduced, copied, stored in an electronic retrieval system or transmitted save with written permission or in accordance with provision of the copyright designs and patents act of 1988. Stringent efforts have been made by Office Products International to ensure accuracy. However,

Office Products International Ltd (OPI) Focus7 House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP, UK Tel: +44 20 7841 2950 Connecting the business products world

OPI is printed in the UK by There’s no bigger subject right now than artificial intelligence [...] Is AI friend or foe? www.carbonbalancedpaper.com CBP0009242909111341 HEIKE DIECKMANN, EDITOR

Analysis: Amazon Business dominates GSA marketplace spend

Audit reveals the numbers for the US federal government’s online marketplace project

Amazon Business accounted for 96% of spend on the US General Services Administration’s (GSA) Commercial Platforms initiative in the federal government’s 2021 and 2022 fiscal years.

That was one of the figures revealed in a recently published report from the US Government Accountability Office (GAO), which is mandated by Congress to review the implementation of the programme.

Commercial Platforms has its origins in the 2018 National Defense Authorization Act, which directed the GSA to establish and implement a solution for federal agencies to buy everyday products through commercially available online platforms. In June 2020, three contractors were named for an initial three-year proof-of-concept phase: Amazon Business, Fisher Scientific and Overstock.

GAINING TRACTION

In the first 12 months of the contract to 30 September 2021, just $12.5 million of sales were made by the three suppliers. The latest GAO audit shows the initiative gained traction in the following fiscal year, with total spend increasing by more than 220% to $40.4 million.

Taking the first two years of the pilot phase together – approximately $53 million in sales – Amazon Business clearly dominated the programme, with around $51 million channelled through its marketplace. Over the same timeframe, Fisher picked up about $1.5 million and Overstock just $500,000.

According to GSA officials, Amazon’s high sales volume can be attributed to the familiar

user experience it offers customers and the fact many federal purchasers already had accounts with Amazon prior to the programme starting. The agency is therefore taking steps – informational sessions with buyers, for instance – to encourage increased spend on the other platforms. It has also shared feedback with platform providers to help them add new features that could better serve government customers.

The largest product category – by some margin – over the two years was IT broadcasting and telecommunications (including items such as computer displays, phone headsets and computer docking stations). This was followed by office equipment and supplies, furniture and furnishings, and domestic appliances and consumer electronics.

Federal agency participation grew in 2022, but by just a single-digit number. As of the end of September 2022, 27 agencies were making purchases on the programme, but three of them – the Departments of Agriculture, Veterans Affairs and Justice – accounted for 83% of the dollar volume.

FALLING SHORT

The GSA has established 11 metrics for evaluating the performance of the Commercial Platforms programme. One thorny area where targets are not being met is with the level of AbilityOne spend, despite it being a mandatory requirement.

In 2022, just 0.16% of sales went on AbilityOne products, well below the goal of 2%. This is being worked on currently. Indeed, it was the reason the solicitation for the next round of awards was delayed.

With the pilot phase due to come to an end on 30 September 2023, it was initially expected that contractors would be named well before then. However, with the request for proposals deadline having been pushed back twice, the GSA has extended the proof-of-concept period until the end of this year.

It has been a long and laborious process to get the Commercial Platforms programme to the verge of a full-blown series of awards. Furthermore, the current spending levels are just a drop in the ocean compared to the GSA’s estimated addressable market of $1-$2 billion.

6 www.opi.net NEWS

It has been a long and laborious process to get the Commercial Platforms programme to the verge of a full-blown series of awards

ACCO Brands makes CEO change

ACCO Brands has announced that CEO Boris Elisman is to retire, with COO Tom Tedford taking on the top job from 1 October. At that time, Elisman will continue as Executive Chairman until his retirement in the first half of 2024.

Tedford joined the manufacturer in 2010 as SVP of Corporate Marketing and Product Development. He then served as President of ACCO Brands Americas before becoming President of ACCO Brands North America. In 2021, he was named COO – an appointment that OPI suggested at the time could be part of a CEO transition plan. And so it has turned out to be.

Elisman commented: “During my tenure at ACCO Brands, the company and the industry have undergone significant changes and I am proud of our teams’ accomplishments during this period.”

Looking ahead, Tedford added: “I believe there are immense opportunities to enhance our leadership position in key categories, grow through share gains and new innovative product solutions, optimise our supply chain and improve our margin profile as we remain focused on delivering shareholder value and customer satisfaction.

“Near-term, we are committed to prioritising our free cash flow towards supporting our dividend and debt reduction.”

Varis roll-out stalls

The ODP Corporation’s (ODP) B2B marketplace platform Varis is taking longer to get off the ground than originally planned. ODP has made much of the potential of this new business segment, which is headed by former Amazon Business chief Prentis Wilson and counts several ex-Amazonians in its management team. The indirect procurement space it plays in is estimated at $4 trillion.

It had been hoped that purchases made through Varis would begin to have an impact on the top line in the first half of 2023. However, revenue in the second quarter was revealed as just $2 million – and this was generated by legacy customers using the BuyerQuest purchasing solution acquired in 2021.

ODP CEO Gerry Smith admitted that building Varis’ tech stack was taking longer than expected. He said issues were being resolved and the ramp-up of customers would only be put back by a couple of quarters.

Nevertheless, the delay in the roll-out has meant the reseller has upped its expected FY 2023 operating loss at Varis to a range of $60-$70 million.

Meanwhile, there was better news regarding ODP’s Federation strategy, which has seen it acquire around 15 regional dealers in the past few years. Federation partners now represent more than $500 million in annual revenue and CFO Anthony Scaglione said these businesses had continued to demonstrate “solid growth” in the second quarter.

“This market continues to be highly fragmented and our disciplined approach gives us a tremendous runway to keep growing our platform strategically over time,” he stated.

Responding to an analyst’s question, Scaglione said the Federation had been a “huge success”, with all partners doing “a fantastic job” of achieving cost-of-goods synergies and improving profitability.

ON THE MOVE

New Chair at EVO Group’s Complete EVO Group has named the head of its Premier Vanguard business –Dominic De Luca – as the new Chair of the Complete reseller business. He will also continue to lead Premier Vanguard.

CEO change at Shachihata

USA

Masaaki Okuno

is the new CEO at Shachihata USA. He has been at the vendor for more than 20 years. Most recently, Okuno was an Executive Officer at its Global Business division.

Leadership addition for Static Control exec Static Control has appointed Juan Carlos Bonell as its new CEO, effective immediately. He will also continue to serve as the Managing Director of the firm’s European operations.

New Office Power Commercial Director E-commerce and digital market specialist Helen Batstone has joined EO Group’s dealer technology and service platform Office Power as its Commercial Director.

IAI names VP

US manufacturer rep group Institutional Associates (IAI) has promoted Kevin Longshore to VP. In the role, he will provide a more hands-on service and explore opportunities in IAI’s traditional as well as emerging markets.

NEWS September 2023 7

Tom Tedford

Boris Elisman

Prentis Wilson

Analysis: Virtual reality

OPI reports on Essendant’s recent virtual conference and supplier event

million packages it delivers every day. It would have been impossible to absorb the remaining 80% across other carriers. Essendant’s recommendation to customers had been to order items early – hopefully dealers are not now sitting on too much stock.

Network optimisation was another area Engstrom spoke about. Recent investments have been made in the product information and transport management systems, while a pilot is being conducted on the use of cobots – collaborative robots for direct human-robot interaction – in one of the wholesaler’s facilities.

In July, US wholesaler Essendant held an online conference and trade show that was attended by hundreds of delegates and around 60 suppliers. Run on the vFairs platform, the event included – among other things – a Q&A session and town hall with three members of the senior leadership team: President/CEO Harry Dochelli; SVP of Sales and Merchandising Renee Starr; and SVP of Supply Chain Tim Engstrom.

It was the company’s first large-scale gathering since the ransomware attack which crippled operations for a period in March. This was a topic Elizabeth Castro, Essendant’s Director of Corporate Communications Strategy, quizzed Dochelli on during the Q&A.

“We are all vulnerable,” said the CEO, revealing the company was in “scramble mode” for 24-48 hours. He also reiterated that the wholesaler had done its due diligence prior to the incident, including holding several dry runs.

During the town hall, Dochelli said his team was “as confident as it could be” in its preparedness for another attack. While there are no assurances Essendant will not be targeted again, it would be unusual for cybercriminals to go after the wholesaler a second time, especially as no ransom was paid. Dochelli also believes the company’s data is “not that attractive” to bad actors.

UPS CONCERNS

Another topic high on the agenda was the threat of strike action by UPS workers – which was a real possibility in mid-July. Thankfully, as OPI went to press, it appeared the delivery giant and the Teamsters union had reached an agreement and industrial action could be avoided. Essendant is one of UPS’s largest customers, so there would clearly have been disruption in its supply chain.

As Engstrom noted, UPS would only have been able to handle around 20% of the 18

A major project has been the introduction of a third-party logistics (3PL) offering, which is something The ODP Corporation is also looking to develop with its Veyer subsidiary. As Dochelli noted: “As we look to diversify and strengthen our business, in order to support our customers long-term, we’ve got to find new ways to generate revenue and profitability. 3PL is a great spot for us and I’m excited about where this is going to take us in the next two to three years.”

EXPANDED ASSORTMENTS

Linked to supply chain capability is Essendant’s ability to expand its product assortments, a subject Starr spoke about.

“We’re really focused on gaining share and expanding into new customer channels for our key categories such as office products and technology, but we’re also looking at how to grow and expand our offering in jan/san, foodservice, safety and furniture,” she said.

According to Starr, Essendant is “uniquely positioned” to sell a broad range of items in all the above categories. This is thanks to several new vendor partnerships that have given access to, for example, 400 foodservice products and 2,200 new safety SKUs.

A new furniture programme called Alera Access Plus which uses distribution hubs in California and New Jersey has made a good start. Approximately 500 customers have already signed up, and Starr said the initiative was “generating a lot of orders”.

All in all, it was a well-attended and organised event – and unlikely to be the last such conference Essendant holds online. While some regional gatherings are still held in person, the wholesaler has fully embraced the shift to virtual. As Dochelli highlighted, it’s all about providing value and ROI.

NEWS 8 www.opi.net

Pictured, from left: Elizabeth Castro, Tim Engstrom, Renee Starr and Harry Dochelli

3PL is a great spot for us and I’m excited about where this is going to take us

Veritiv agrees takeover bid

US facilities and packaging distributor Veritiv has agreed to be taken private in a $2.3 billion deal. The company has entered into a definitive agreement to be acquired by an affiliate of investment firm Clayton, Dubilier & Rice for $170 a share, a premium of almost 20% over its closing price at the beginning of August.

The transaction has been approved by Veritiv’s board but still requires the green light from its shareholders.

ADVEO completes Top Office deal

ADVEO France has confirmed the acquisition of office superstore retailer Top Office. The transaction was finalised in July, with ADVEO acquiring the brands Top Office and Top Office Business as well as the reseller’s websites.

ADVEO did not provide any further details, such as who now owns the 33 Top Office stores, of which just 11 were previously run under a franchise model. Top Office joins ADVEO’s three other go-to-market brands: Plein Ciel, Calipage and Buro+. It is a move which gives the multichannel operator both greater scale and more opportunity to develop in the retail space –a segment that has been faring relatively well in France.

Pilot creates subsidiary in India

Promotions at SPR

S.P. Richards (SPR) has announced two senior promotions to its team. Charles McLaughlin has moved from his Marketing Communications Manager role to that of Senior Marketing Communications Manager. Meanwhile, Brian Moore has been promoted to Senior Category Marketing Manager. He will be responsible for developing innovative marketing approaches to all of SPR’s product categories.

Writing instruments leader Pilot is setting up its own manufacturing and distribution footprint in India. Pilot Pen India formally began operations as a single entity on 1 July 2023, effectively ending a distribution partnership the Japanese firm established with local vendor Luxor almost 40 years ago. Speaking to the Indian press, Pilot Corporation President Shu Itoh said having 100% control would allow the company to develop the brand more comprehensively. As well as setting up a local production unit, Pilot is looking to rapidly expand its distribution network over the next 18 months. Currently, Pilot’s annual sales in India are approximately $120 million. The goal is to triple this by 2028.

Eakes back on the acquisition trail

US dealer Eakes Office Solutions has made an acquisition in its home state of Nebraska.

The latest deal for Eakes involves Scottsbluff-based Western Plains Business Solutions, an established local source for custom printing, forms, signs and banners, and business paper products to customers in western Nebraska. Following the transaction, Eugene Batt, the owner of Western Plains for

the past 34 years and a 45-year print industry veteran, will retire.

NEWS 10 www.opi.net

Charles McLaughlin

Brian Moore

Below, from left: Kevin Hafer, Mark Miller, Eugene Batt, Paul McKinney & Cameron Peister

Office Choice gives staffing update Essity continues restructuring in the US

Brad O’Brien, CEO of Office Choice, has provided OPI with an update on the organisation’s recent management and support team changes. Following the corporate restructuring of the Australian dealer group last November, O’Brien oversaw two key appointments in the first quarter of 2023. Brian Clutterbuck was brought in as CFO while Teresa Thompson was named Chief Marketing & Merchandise Officer.

In addition, O’Brien said there had been an opportunity to reshape the marketing and merchandising functions following the departure of National Marketing Manager Cameron Osborne in June. This has led to the appointments of Jasmine Maniquis, National Marketing & E-commerce Manager; Aaron Bassett, Pricing & Product Data Administrator; and Josh Turville, Digital Marketing Coordinator

An as-yet-unnamed Contractor –Special Projects has also been hired, with extensive experience in the technology category and in private label programmes.

Marcia Allan, named General Manager of Marketing last year, has left the group, OPI has learned.

Tork brand owner Essity is to close two Professional Hygiene facilities in the US as it looks to focus on higher-margin business. The cleaning and hygiene vendor confirmed it is “planning to implement restructuring measures in Professional Hygiene in the US that include the closure of two production plants in New York state”.

The restructuring is expected to have a low single-digit negative impact on volume in the second half of 2023 and for the full year 2024. It is a similar rate to that seen in Europe in Q2 following Essity’s restructuring initiative there.

NEWS September 2023 11

Teresa Thompson

Brian Clutterbuck

BACK TO SCHOOL SPECIAL

Average cost of sending a child back to school in France

ODP makes big BTS donation

As part of its Start Proud! community investment programme, The ODP Corporation has donated 18,000 backpacks filled with $2 million worth of school supplies. In September, the reseller is running teacher ‘shopping sprees’ valued at $20,000 per school, supporting vendors including Boise Paper, Domtar and Crayola.

24% Secondary school parents in Ireland taking out a loan or borrowing from friends to meet BTS costs

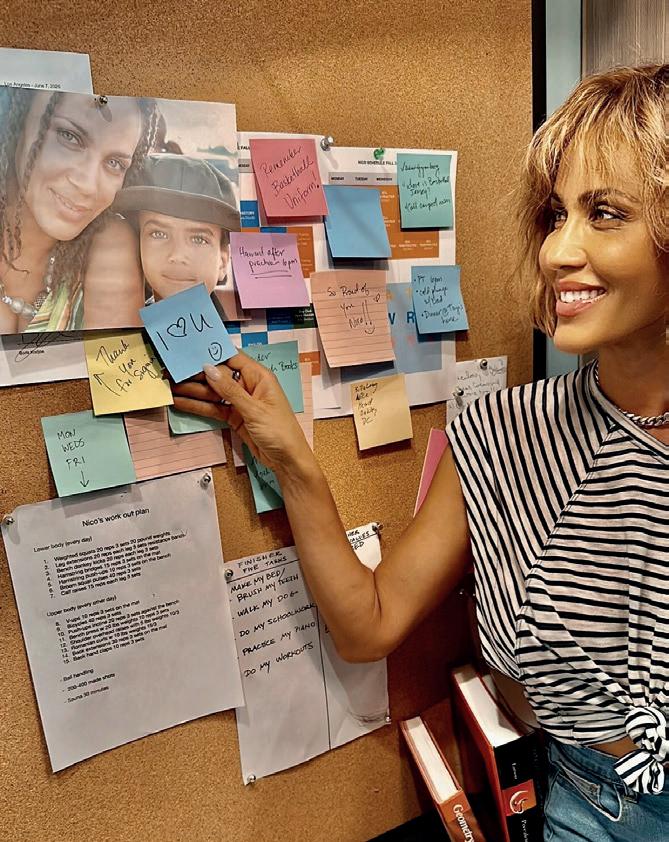

Social media platforms key for BTS market

A growing trend for the global BTS segment is social media and influencer marketing. Skyquest Technology Group notes social media is being used to share product recommendations, reviews and for price comparisons. Meanwhile, brands are partnering with influencers to promote products on social media.

Post-it to win big 3M’s Post-it brand teamed up with actress, producer, entrepreneur and philanthropist Nicole Ari Parker, for its Think Loud sweepstakes campaign, giving parents the chance to win a $5,000 BTS shopping spree for their children – and another $5,000 for themselves.

$94 billion

Predicted US back-to-college spending, about $20 billion more than last year

School supply drive for Staples CA

Staples Canada has launched its 18th annual school supply drive which has raised $16 million to date. From 7 August, in-store customers can add a donation to their purchase, which is allocated to one of Staples’ charitable partners. This year’s partners include Kiwanis Foundation of Canada and United Way Centraide.

NEWS 12 www.opi.net IN BRIEF

Philip Rist, EVP of Strategy, Prosper Insights & Analytics

PICTURE OF THE MONTH

Even though consumers plan to spend more on school- and college-related items this year, [...] they are stretching their dollars by comparing prices, considering offbrand or store-brand items, and are more likely to shop at discount stores

€262

EU adopts more reporting standards for companies

The European Commission has adopted the European Sustainability Reporting Standards (ESRS) for use by all companies, subject to the Corporate Sustainability Reporting Directive (CSRD).

The CSRD will take effect in the 2024 financial year. It requires all large companies in the EU – including subsidiaries of non-EU firms – and listed SMBs to publish regular updates on their environmental and social performance according to a common set of standards. In all, it is expected that around 50,000 organisations throughout the bloc will be affected.

Reporting requirements are governed by 12 ESRS that were proposed by the European Financial Reporting Advisory Group (EFRAG). The group’s final draft of November last year was subject to a number of modifications by the EU Commission before being adopted at the end of July 2023.

The changes include an extended phasing-in period for businesses with fewer than 750 employees, more flexibility for companies to decide which of the ESRS are material to them, and a reduction in the number of mandatory requirements.

Some environmental groups accused the EC of watering down EFRAG’s proposals, with WWF saying it had “caved in to pressure from conservative industry groups”.

T3L ups recycled content

European manufacturer T3L is using more recycled materials in the products of its Djois brand. Over the next few months, the company’s Smartfolder range is transitioning from virgin to 100% recycled cardboard which is FSC and Blue Angel certified.

At the same time, the Color Collection document protection and presentation line will begin using post-consumer recycled polypropylene (rPP). The new products are REACH compliant, made with at least 80% rPP, and are 100% recyclable.

Soennecken releases sustainability report

Soennecken has published its 2022 Sustainability Report, providing detailed insights into its comprehensive CSR projects. The German dealer group said it had been “committed to environmental protection, fair working conditions and the future viability of the cooperative and its members”. Highlights in the report include:

• the expansion of its own brand Oeco which currently comprises around 150 items;

• Soennecken joining Germany’s B.A.U.M., the now Europe-wide network for sustainable management practices;

• 40,272 parcels delivered in the city of Cologne by cargo bike, saving 5.5 tonnes of cardboard and 18.5 tonnes of CO2;

• 433 trees planted in partnership with PLANT-MY-TREE by the end of 2022 –another 1,350 will be added this year.

product sales grow at Grainger

Grainger’s High-Touch unit sold more than $1 billion worth of environmentally preferred products in 2022. In the company’s Q2 earnings call in July, CEO D.G. MacPherson said revenue from these types of items has increased over the past few years as customer conversations around their environmental footprint have become more commonplace. Grainger has also been working to lower its CO2 emissions. Since 2018, it has cut global absolute Scope 1 and Scope 2 emissions by 26%. These results mean it’s nearing its 2030 goal of a 30% reduction.

14 www.opi.net GREEN THINKING

‘Green’

OfficeMax NZ introduces expansive CSR initiatives

More sustainability support needed from print vendors

Print research organisation Quocirca says vendors need to provide better support to enable channel partners to fully capitalise on sustainability-led sales opportunities.

In its 2023 Channel Sustainability Study, Quocirca estimates that an average of 12% of channel revenue is derived from sustainability-led sales, but this is expected to rise to 22% by 2025.

OfficeMax New Zealand has launched a Responsible Supplier Code and Sustainable Packaging Guidelines for approximately 500 domestic and international suppliers.

They are designed to support OfficeMax’s 2020-2025 Sustainability Strategy and improve the social and environmental footprint of its supply chain. The launch follows a trial and feedback period with suppliers.

The Responsible Supplier Code will focus on enhancing ethical business activities. Vendors will need to self-assess their organisations against Standard, Standard PLUS or Advanced criteria in the coming year. The Standard level is the minimum required to continue doing business with OfficeMax. Suppliers have to understand what they have to do prior to the commencement of an audit programme which will launch in July 2024.

The Sustainable Packaging Guidelines were developed to align with the Plastic and Related Products Regulations 2022. They will see all suppliers within OfficeMax’s supply chain support a circular waste process by maximising the ongoing sustainable value of packaging materials. This, in turn, will support OfficeMax in reaching its goal of achieving 100% reusable, recyclable or compostable packaging by 2025.

Pukka Pads adds solar energy

Pukka Pads has finished the installation of its first solar panels at its distribution centre in Lutterworth, UK.

Described as a “huge milestone”, the vendor said its solar energy initiatives are part of an effort to become carbon neutral and reduce dependency on the national grid. The new panels – which Pukka Pads claims will reduce CO2 emissions by around eight tons a year – will be used to power its fleet of forklift trucks at the site as well as an electric car charging station.

Around four in ten companies say sustainability criteria feature in some or all of the RFPs they respond to, with 92% stating customers are prepared to pay more for solutions with a stronger sustainability focus, at least some of the time.

The key areas of interest are energy-efficient hardware (65% of respondents), followed by long-life consumables and toner (35%) and minimum end-of-life waste (30%). These priorities are reflected in the topics channel partners most want more support on, namely:

• clear and detailed metrics on product life cycle impact (38%);

• help in identifying ways to advise customers on saving energy across a print fleet (36%);

• carbon footprint assessment tools (35%).

Only 20% of respondents say they are fully satisfied with the support they are receiving from vendors on sustainability. “Businesses are looking to acquire print technology that is efficient, secure and sustainable throughout its entire life cycle,” said Quocirca Director Louella Fernandes.

Brother awarded ecolabel

Brother UK has received the Blue Angel certification for its recycled toner cartridge, the TN-3512 RE, produced at Brother’s facility in Slovakia. The vendor received its first Blue Angel in 2001 for a laser printer and has been working to acquire the certification for more products ever since.

As part of its environmental efforts, the OEM also collects used cartridges from laser printers and all-in-ones, recycles them into toner cartridges, and redistributes them.

As of March 2023, around 37 million cartridges had been recycled across the group, says Brother.

GREEN THINKING NEWS September 2023 15

The heat IS ON

As the US state of Arizona sweltered in temperatures exceeding 110°F (43°C), OPI Talk spoke to Ian Wist, General Manager of Wist Business Products and Equipment, headquartered near Phoenix

The July heatwave

Ian Wist: We are used to days when it gets up to 46°C, but what’s unusual this year is that we had almost 30 straight days of it. However, it has had less impact on business than you may think. If there’s a city that’s adjusted and ready for extreme temperatures, it’s Phoenix.

At Wist, we have taken a closer look at our drivers and their well-being to make sure they’re not overheated and are drinking enough fluids. For example, we have added extra fans to their trucks so they have more air circulating through the cab. For us, it’s about the health and welfare of our people who are outside, because it’s tough for them.

On the product side, we have been shifting a lot of water. We are selling the equivalent of a 40-ft shipping container every other day –tens of thousands of cases. If you had told me last summer we’d be doing this in 12 months’ time, I would have said “probably not”.

To me, it just demonstrates that, to remain successful, you have to pivot every day to provide what customers want. We’re moving into so many different adjacencies, but it is a natural evolution and we have to embrace it.

Buying local

We are an active member of Local First Arizona, which is celebrating its 20th anniversary in 2023. We have a partnership agreement whereby the agency facilitates introductions for us to organisations and businesses in the state. Local First gets a small percentage of profit on those sales, which helps in keeping its lights on. It benefits both of us by making sure businesses here remain healthy.

The buy local trend is gaining a little more traction every year. What COVID did was increase customers’ awareness of all the categories a business products dealer can

Ian Wist

bring to the workplace. It started with PPE –masks and gloves, etc – and local companies now see us as a partner for many more products. The water I’ve just referred to earlier is an example of this.

Greater emphasis on sustainable products

Large organisations have had ‘green’ committees for some time, but we are finding they’re finally beginning to have an impact on purchasing decisions. In the past, they would make recommendations, but the products would either be too expensive or the procurement department would prefer a different item.

Now, we’re seeing these committees gain more influence. Some spending is being diverted to higher-priced, sustainable products because there is a belief this will make a difference [to the planet].

From our point of view, we do whatever we can to keep our carbon footprint as small as possible. This includes regulating office temperatures during the day and night, and being very methodical with truck routing so we are not wasting fuel.

Independent Suppliers Group update Mike Gentile is retiring and a very important decision has to be made about the new leadership. There are four people on the committee leading the search process and working hard to get to the right individuals. When a candidate has been selected, he or she then has to be approved by the board. It does take time, but we are hopeful we can get it done in time for Industry Week in October.

16 www.opi.net SMALL TALK

The buy local trend is gaining a little more traction every year

LOOKING IN the outsideFROM

RJ Schinner has been on the periphery of the business supplies space for many years. Now, under the added guidance of industry veteran Steve Schultz, its aim is to become a must-go-to destination

The name Steve Schultz is perhaps more familiar to many readers of OPI than the company he now works for: RJ Schinner.

After flying under the radar somewhat over the past few years, Schultz made headlines in recent months, first with his appointment in April to the role of President of Schinner and then, in June, when he was named Chair of City of Hope’s National Business Products Industry (NBPI) Council.

Highly respected, pragmatic and extremely knowledgeable in his field, he talks to OPI’s Steve Hilleard about what RJ Schinner, chiefly a redistributor of foodservice and jan/san products, brings to the business products industry – and the independent dealer channel (IDC) within it.

OPI: Let’s start with a run-through of your career to explain your background.

Steve Schultz: Sure. I’ve worked in a variety of redistribution and manufacturing organisations over the past 30 years. The most formative have been my 16 years at United Stationers – now Essendant – where I worked on growing the wholesaler’s Lagasse and ORS Nasco businesses.

I left in 2012 and joined GOJO Industries, which was a fantastic experience in a family, privately-owned organisation. After approximately six years there, I joined the other large wholesaler in the business supplies space – S.P. Richards (SPR).

About 20 months later, I had a front-row seat at the table when Mike Maggio and Yancey Jones Sr bought the OP wholesale side of

SPR – that was in 2020, in the early days of the pandemic. At the time, there was also a portfolio of jan/san and safety companies that SPR had bought over the years as part of its diversification strategy – Garland C Norris, The Safety Zone and Impact Products, for instance. When Genuine Parts decided to divest these businesses, we packaged them up and formed a company called Supply Source with private equity backing. I ran that new standalone organisation for two and a half years. Then it was time to move on – to RJ Schinner as it happened, where I’ve been since April.

OPI: What’s the story behind this new job?

SS: I didn’t necessarily target RJ Schinner, but I’ve known the family for about 25 years. When they reached out to check what my aspirations were post Supply Source, we spent a lot of time talking about my experiences and my ability to bring an outside, professional point of view to their rapidly growing business. It was a great opportunity for mutual value creation – that’s how I would describe it.

Wholesale redistribution is in my blood apparently – I don’t seem to be able to get away from it.

18 www.opi.net BIG INTERVIEW

OPI: Quite often in family-held businesses, there’s a hesitancy to hire someone from the ‘outside’. But this has clearly happened here. Is this a succession issue, a change in strategy or just coincidence? I guess you’re almost part of the family if you’ve known them that long.

SS: Well, I haven’t been invited to join in family holiday traditions, but our shared history certainly helped. My track record both as a supplier and competitor to Schinner created some unique circumstances of familiarity. But I would actually say that Schinner has been bucking the typical trend you’re referring to – it has routinely reached out in the past and brought in outside expertise.

Ken Schinner, our CEO, is the third generation of family leadership. I suspect in the next three to five years we’ll see the fourth

generation coming in. I felt very comfortable joining the organisation. I’ve worked for public companies, private family-owned firms and private equity-backed entities. I’m not saying one ownership model is better than the other, but having been given the chance to take a leadership position again, in a family-owned business, it was something I jumped at.

OPI: What’s your remit?

SS: It’s threefold: my job is to help develop growth strategies for the company; to reinforce foundational operating practices that you naturally have to scale to support growth; and, finally, to retain and strengthen the family and growth-orientated company culture Jim and Ken Schinner have worked so hard to build.

In short, I would say that I add experience and bandwidth to RJ Schinner’s already strong leadership team.

OPI: Can you give a brief overview and highlight some company milestones?

SS: Of course. RJ Schinner has been in business for 65 years. It was founded and is still headquartered in Wisconsin and is one of the largest privately-held redistribution

BIG INTERVIEW Steve Schultz September 2023 19

I add experience and bandwidth to RJ Schinner’s already strong leadership team

companies in the US with annual revenue eclipsing $700 million this year. What is really exciting is the growth we’ve experienced pre-pandemic but also during COVID-19.

Schinner has enjoyed a ten-year CAGR north of 20%, essentially doubling the business every four to five years. I would call that an excellent run.

Geographic expansion has been a huge part of this growth – the company has evolved from a regional player to a true national redistributor over the past decade. We have just opened our 20th facility in Southern California, broken ground on a new facility in Minnesota and are actively moving or expanding four of our distribution centres across the country. Reinvestment is a big part of the family business model and strategy.

In terms of staff, we employ over 600 people. About 35% of those employees are customer facing – they are working in sales, marketing, customer service, logistics, etc. It’s a real differentiator.

We have 150 tractors and trailers with our own driver employees and deliver more than 90% of our revenue nationally with our fleet. It means we have the ability to completely control the service model which is a crucial part of Schinner’s go-to-market strategy. It’s a bit different to some of the other wholesale operators in the US and our comprehensive

national reach with our fleet of trucks is definitely another big tick.

Something else to mention is our product scope and its evolution. RJ Schinner has its roots in foodservice disposables, but today the business is 50% foodservice and 50% janitorial and paper. This change is noteworthy as regards the ability to leverage our mix to really unlock additional growth in the years ahead.

OPI: To what extent has the considerable M&A-driven growth of companies such as Bunzl helped determine your strategy?

SS: Schinner has done a few small tuck-in acquisitions of some single location independent redistributors in the US over the past decade – nothing on a broad scale. This is why we’re one of the industry’s darling growth stories from an organic growth perspective. When I worked at other wholesalers, the use of M&A was a real driver to differentiate and diversify away from core OP. Schinner hasn’t had to acquire to spread its reach.

That’s not to say we’re not in a position or don’t have the ability to use strategic acquisitions as a growth driver. But we still have a full plate, if you will, for unlocking amazing organic opportunities.

OPI: You use the term ‘redistribution’ which is not that widely known to my knowledge.

BIG INTERVIEW Steve Schultz 20 www.opi.net

Can you define it? What, for example, is the difference – if any – between redistribution and wholesale distribution?

SS: I think it’s a purist definition. Pure wholesale means you do not serve the end consumer and are 100% dedicated to selling to distributors, resellers, dealer communities, etc, in the various channels. But sometimes we conflate wholesale with redistribution, with redistribution having a bifurcated strategy whereby redistributors also serve certain channels directly.

RJ Schinner is pure wholesale but, to confuse things even further, we actually do call ourselves a redistributor. However, we do not sell to the end consumer and are focused on the reseller communities. Make sense?

OPI: (laughs) Clear as mud. Let’s talk about the team at Schinner. You mentioned Ken as the CEO and you’re the President.

SS: Yes. It starts with Jim Schinner, Chairman and our patriarch. Jim is second generation and, as I previously mentioned, Ken the third. Deservedly, Ken moved to the CEO role to vacate the role of President which he occupied for many years before my arrival.

The senior leadership team of Jim, Ken and I is paired with a seasoned selection of individuals in their various functions. Some have been with the company for a long time; this is blended with new recruits who bring considerable outside experience to the table.

The third leg of the stool is imported items which, I think, are vital for bringing the appropriate wholesale value proposition to multiple channels of distribution. The pandemic really accelerated the role of imports when it was a case of where could you find product – in our case predominantly Southeast Asia.

For Schinner – and again, I credit Jim and Ken – importing has been an essential ingredient in our growth. Five years ago, so pre-pandemic, Schinner established a WFOE – our wholly foreign-owned enterprise in Shanghai. Six company employees now manage a rapidly growing import business which adds quite a bit of depth and dimension to our overall product and service offering.

OPI: What impact did the pandemic have on the company; have there been any transformative effects?

SS: I was with another wholesaler when it all started, so any comments about how RJ Schinner has fared are post-pandemic learnings. I think of COVID-19, from a business perspective, as comprising three phases, nuanced by business type and product mix.

Generally, most of us experienced extreme growth and a colossal surge in demand in the early months – March 2020 through to September/October in the US, I would say.

This was followed by phase two – rapid decline. It was the effect of consumers being sheltered at home and wildly shifting demand patterns. Production caught up with demand and ultimately overstuffed the pipeline. This period lasted another six months to a year, depending on your positioning in the industry.

I give Jim and Ken a lot of credit for breaking the mould, so to speak, from the provincial-type thinking we so often see in family-owned organisations to really opening that aperture and thinking more broadly about the future growth and needs of the company.

OPI: Let’s talk about product. I guess a lot of Schinner’s sales come from brands and products our audience will be familiar with.

SS: For sure. The national brands make up the broad offering of foodservice, paper and janitorial products you would expect to see in any wholesaler and definitely at Schinner.

Equally as important are own brands. Our private label offering is very robust across the foodservice and paper categories in particular, but there are also some janitorial products.

The third phase is the most important: the aftershocks. As a global health issue, the pandemic has been declared over, but the aftershocks are still with us: shifting demand and consumption patterns; the market’s – and end users’ – acceptance of item substitution; dealing with excess inventory.

I think great companies – and I put RJ Schinner in this category given what I’m able to see now – were positioned well going into this hugely disruptive period and came out stronger on the other end.

I would argue the business navigated all the ups and downs very well and is now positioned to continue with its track record of growth.

OPI: 20% CAGR is certainly not easy to maintain. Did that faze you when you were considering taking on this role?

SS: I recall joking with Jim and Ken that my arrival would likely coincide with our CAGR going down. When you get to a certain level, the law of big numbers starts to kick in.

BIG INTERVIEW Steve Schultz September 2023 21

Great companies [...] were positioned well going into this hugely disruptive period and came out stronger on the other end

Everyone at Schinner should be very proud of the milestone of achieving a decade of 20% CAGR, and the company remains in the mindset of continuing to create double-digit growth and to stay on pace. Breaking the $1 billion barrier would be a fantastic achievement for a start.

There’s no question in my mind that market opportunities exist to continue growth at accelerated levels. Externally, we will always encounter macroeconomic difficulties and competitive challenges. Internally, meanwhile, rapid acceleration puts extreme pressure on all functions of a business.

Growth can cover a multitude of sins. But at the same time, organisations with these phenomenal trajectories need to look at the supporting cast – the infrastructure required to sustain and continue to build out support for those numbers. This is where businesses sometimes fall down.

Part of my responsibility is to do exactly that – make sure we’re looking at the overall scale of the company and have the competencies and capabilities to continue to be able to support the capture of the opportunities which appear available.

OPI: Can you give a flavour of your customer base in terms of the different segments and the relative importance of independents versus other clients?

SS: The core of the current RJ Schinner business is in the foodservice, paper, packaging and janitorial distribution community. We have a growing industrial and healthcare distribution base as well as a meaningful foundational position in the office products IDC.

We have very little exposure to the big box players in the US. It’s not an overt strategy to stay away, but more a reflection of where we believe the overall value proposition of Schinner is most effectively deployed. And it’s in the IDC where we see the biggest potential.

OPI: You have a relationship with Independent Suppliers Group, is that right?

SS: Correct. We have established and growing relationships with most, if not all, of the buying groups and marketing organisations OPI readers would be most familiar with.

OPI: You use the phrase ‘foundational position’ in the IDC. What are your goals?

SS: Yes, it’s definitely still foundational and predominantly through working with some of

BIG INTERVIEW Steve Schultz 22 www.opi.net

There is always a time when an industry is ripe for consolidation

For more from the interview, including topics such as channel blurring, data content and e-commerce capabilities, and the impact of hybrid working on the jan/san space, see our Xtra content in the September issue on opi.net

the group affiliations just mentioned. There’s an important distinction between Schinner and some of the other wholesale alternatives.

We don’t aspire to have ‘wrap and label’ or small parcel national drop-ship capabilities, for instance, so servicing a stockless e-commerce dealer set-up is not part of our strategy. That’s by design. It isn’t that we can’t or wouldn’t, but it’s not the sweet spot.

It begs the question of where we can add value. For the best part of the last decade, dealers have migrated away from facility maintenance and breakroom as merely a convenience category and begun to position themselves as real destinations for full-line foodservice and janitorial products. This is where we are strong.

As I mentioned, we control the service proposition with our fleet. So, as the IDC continues to evolve and become more committed in these categories – and the leading players are already a destination for these products for their customers – we become a viable option and alternative, supplementing, filling gaps, providing depth and breadth, and offering advantaged services and pricing. It’s ultimately how we see our dealer strategy evolving.

OPI: Consolidation and M&A remains a hot topic – we spoke about it briefly already. You’ve seen plenty of it in the early part of your OP career, but now there’s a lot of it coming from your space too. I’m talking about companies like Imperial Dade, BradyIFS, etc. What’s your view?

SS: It’s fascinating. Earlier in my career, as you say, we were the acquirer, completing four acquisitions while I was at United. There were so many roll-ups in the OP world and then the buying into all the adjacencies in the jan/san and industrial space.

Now we’re seeing similar consolidation patterns in the jan/san world led by Imperial Dade, Brady as well as Envoy Solutions with FEMSA. There’s always a time when an industry is ripe for consolidation – it was true for OP in the early 2000s and now is that time for the jan/san sector.

Does it have an impact? Of course, and you always need to consider your own position strategically and transactionally with those consolidators. However, even with consolidation, about 50% of the US marketplace is still in the hands of independent, single entity resellers. And these operators are growing and taking share by offering a differentiated service, white glove treatment, specific local product knowledge and an awful lot of know-how.

OPI: It sounds as if you’re positive about the future. What bold predictions would you make as to how the industry might look over the course of the next few years?

SS: I don’t know about bold, but I see consolidation continuing over the next three to five years. The pace may slow, but I’m convinced it will remain a market driver.

From a Schinner point of view, we have the luxury of operating in two areas of opportunity. Wonderful macro changes are happening in the foodservice space with the influence of sustainability, global manufacturing and the higher propensity for takeaway and carry-outs. Some of it is mainly shifting products, but there are also new trends that will shape the foodservice disposables side of the equation.

Janitorial and paper, meanwhile, typically runs around US GDP over time. And while the outlook for the next couple of years may be low single digits as we continue to deal with post-pandemic return-to-work issues, many of our suppliers and customers are positioned to outgrow the overall market through a myriad of different growth drivers.

These are the partners we want to align with and continue to invest in – and the ones we’ll grow with. So yes, I am positive about the overall outlook for our industry.

OPI: One final question and this one is completely unrelated to what we’ve talked about so far. You’ve fairly recently taken over chairing the NBPI Council at the City of Hope. What should we expect from your chairmanship tenure?

SS: First of all, I want to say what an absolute honour it is to be involved with City of Hope at any level. I thought the pinnacle of my connection was serving as the Spirit of Life honouree in 2017.

So, when I was approached with the opportunity to throw my name in the hat for Chair, I was humbled to even be considered. Filling the big shoes that Scott Light leaves is going to be a tall order. Scott became Chair after a long legacy of seven others who were icons in the OP industry. He, as somewhat of an outsider to the traditional OP space, was the Chair who epitomised the shift from the National Office Products Industry to the National Business Products Industry Council.

From this standpoint, I look at my tenure as a continuation of the evolution of our industry’s support for City of Hope: the janitorial, industrial and certainly the OP communities coming together, outside of day-to-day business, in pursuit of being able to meaningfully contribute to the great work that City of Hope does. That’s something I know we can all get behind.

BIG INTERVIEW Steve Schultz September 2023 23

OT GROUP steps in

Just a few months after its Spicers wholesaling business reported a “five-year multimillion pound” agreement with Nectere, OT Group made a “strategic investment” in the UK dealer services organisation.

Several weeks after the announcement and at the time of OPI going to press, OT Group still hadn’t disclosed the exact nature or the amount of the investment, but the deal apparently is not being viewed as an acquisition per se.

Nevertheless, with a press release referring to the “inclusion of Nectere into the OT Group” and Nectere pointing to “a significant cash injection and the successful securing of funds”, it can probably be assumed that OT exercises a strong degree of control.

Both parties are also keeping quiet about the exact reasons for OT Group’s intervention and what the consequences would have been had it not done so. There is, perhaps, a clue in a letter Nectere sent to its stakeholders.

“We recognise that market conditions have affected most, if not all, companies in our sector and [we haven’t] been immune to this,” it wrote, adding: “The past few months have without doubt been impacted by [the] credit squeeze and confidence in our company.”

BUSINESS IN MOTION

It has been an ‘interesting’ few months for Nectere, to say the least. In February, founder Paul Musgrove and his wife Serena – joint owners – sold the firm in an MBO led by Mike O’Reilly and Heema Naik. At the time, it was said the transaction had been “carefully structured to secure the future of the business”.

Shortly afterwards, a long-standing wholesaling agreement with EVO Group’s

VOW suddenly came to an end and Nectere moved over to Spicers. Whether that was related to the leadership change at EVO last December, the fall-out of the failure of leading independent reseller Complete and its acquisition by EVO in January or other factors is not clear. Nectere’s Head of Commercial Steve Harrop underlined the better commercial terms achieved with Spicers following a period of “skyrocketing” costs.

Then, just weeks into the Nectere/ Spicers relationship, came news of OT Group’s investment to shore up the dealer organisation’s finances. It appears that OT Group’s hand was forced into injecting capital into Nectere – a move that is possibly not dissimilar to the situation which resulted in its main direct competitor acquiring Complete at the start of the year.

HISTORY LESSON

Martin Eames, the recently retired former owner of Product Promotion Services, adds a historical perspective. “I understand Spicers has been struggling to make significant headway in the dealer channel due to a range of issues, particularly with a problematic systems investment,” he notes.

“Therefore, it is worth remembering the early days of Spicers in France [in the 1990s]. The business initially failed to make much impact until it invested in two dealer groups, first creating Calipage, then acquiring Plein Ciel.

24 www.opi.net

FOCUS

There has been further market consolidation in the UK as OT Group takes a stake in Nectere

–

by Andy Braithwaite

The past few months have without doubt been impacted by [the] credit squeeze and confidence in our company

“These transformed Spicers France’s performance, so perhaps the Nectere investment is a similar move.”

An industry source who wishes to remain anonymous says tying in Nectere’s wholesaling spend to Spicers – which OPI estimates at approximately £10 million ($12.7 million) – is a “logical” step.

“It’s no secret that Paragon [OT Group’s owner, which recently rebranded to Grenadier Holdings] wants to double revenue over three years. It has to get that from somewhere and, as the number of dealers in the market continues to decline, competitors are fighting over a smaller pie.”

Nectere has been diversifying out of core stationery and office supplies, today accounting for just over 35% of revenue. This ties in with OT Group’s goal of offering a million products by the end of 2023 and three million two years later via its SmartPad platform. Nectere partners will also have access to a growing range of services which can be repackaged for them.

“An exciting aspect of the Nectere model is that all partners are on the same platform,” adds Harrop. “It means you can really push out the marketing collateral and content, particularly working with suppliers and the wholesale channel. I believe, with the stable support of OT Group, the potential is huge.”

He adds: “I view this as a land grab for dealers. It doesn’t necessarily mean OT Group will go out and buy other dealer groups, but I can see it building out as many services as it can within Nectere and then using this to recruit other dealers.”

OT Group’s growth ambitions probably suffered a blow when Complete ended up in the EVO camp. That would have added more than £100 million to its top line. Now, with Nectere aligned, it has about 130 reseller partners that give Spicers a strong footing at the smaller end of the market.

LOOKING AHEAD

Industry veteran Harrop has been acting as the public face of Nectere over the past few months and is keen to look forward.

“It’s very clear we have a unique entrepreneurial model, and the way we go to market will be protected by being with OT Group,” he says, pointing to the opportunity for both financial and operational synergies between the companies.

The platform part is critical for Nectere. It is currently running on a legacy system which is coming to the end of its life. While OT Group has had some teething troubles getting up to full speed after its own ERP implementation towards the end of last year, its scale and up-to-date e-commerce architecture is another obvious area where it can come to Nectere’s rescue.

Says Harrop: “From our perspective, we need the service provider to give us a platform and let the dealers go out and sell. There is still room in the market for smaller independent resellers, but unless we are careful, our industry is going to end up with a handful of large players.

“Our partners have a massive instinct to survive, but they have to have the support behind them, and this is where we sit – now with the backing of OT.”

He concludes: “The industry wants an exciting alternative, and suppliers want to see their customers succeed. That’s the message I’m getting. Of course, we now have to go out and deliver.”

TOO MUCH PRESSURE

Nectere has typically been viewed as something of a success story over the past 15 years, starting from scratch and developing into a £37 million business by 2018. Since then, however, its top line has been eroded by almost £10 million, according to its most recently available public accounts.

Despite a focus on reducing costs and taking steps to safeguard cash flow, it appears the inflationary environment and sluggish economy coming out of COVID was too much of a burden for the new management structure.

OT Group has had its own issues recently as well, but has an ambitious owner with deep pockets. It may have missed out on Complete, but Nectere might give Spicers just the sort of impetus it needs.

FOCUS OT Group/Nectere 26 www.opi.net

I can see [OT Group] building out as many services as it can within Nectere and then using this to recruit other dealers

Steve Harrop

GETTING YOUR ducks in a row

a closed loop process around utilising CRM, email marketing and social media tools to maximise their results.

VENDOR SPECIAL Special Issue

There are certain technology components independent dealers in the business supplies industry need to get right to succeed in today’s online world. But many are doing exactly that, Brian Bowerfind, President of Office Products and Contract Furniture at ECI Software Solutions, tells OPI’s Heike Dieckmann.

OPI: What’s your perception of the state of your dealer customers right now, given the many obstacles over the past few years?

Brian Bowerfind: I’ve said it many times before and I’ll say it again: the independent dealer channel continues to show significant entrepreneurial spirit in good as well as bad times. There will always be challenges, but excellent leaders understand how to think strategically and execute on plans which are typically fluid in nature.

I believe the pandemic helped our industry in a roundabout way. Anyone who led an organisation through that period had to demonstrate the ability to figure out what was working and expand it, what was not working and stop it, and what needed extra care to move in the right direction. Those who understood this flourished and came out the other end with a stronger entity. The ones that didn’t react and continued with business as usual are probably no longer operating today or are in a seriously weakened position.

COVID-19 certainly placed a significant focus on getting just about any operator online. I would argue that the business supplies space has been well ahead of other industries from an e-commerce perspective over the past decade as regards the online customer experience, rich A+ content and robust SEO capabilities. Most dealers I speak with ensure they have

We recently conducted a study among dealers using our EvolutionX e-commerce platform – The Secret Recipe to B2B Ecommerce Success – with the aim to identify trends from those generating the highest revenue through their online store. We compared the top 20% of online revenue earners to the rest. For marketing tools specifically, the results were clear: dealers investing time in leveraging the capabilities are seeing a better return.

The top 20% have nearly three times the number of active promotions, for instance, including discounts and special offers. They also have five times the amount of quicklists/ favourites set up to help their customers purchase frequently bought items faster. In the past 12 months, EvolutionX dealers have recovered nearly £5 million ($6.5 million) in revenue from re-engaging abandoned carts.

OPI: What have been the most fundamental changes in terms of what your dealers require? How do you address those needs?

BB: The biggest change I’ve seen over the past few years is that dealers are selling or wanting to sell a much larger assortment of categories. Some of this was a response to the changing buying habits of their customers and some of it was just good old diversification of their business model.

They are asking their clients: “What are you buying that I’m not selling you?” Dealers’ ability to react profitably to this question can play a significant role in their future success.

As a technology provider, it’s important our solutions support their model as it expands. One way we’re doing this is to ensure dealers’ e-commerce set-up can support any category they wish to move into. We achieve this by offering a highly scalable platform which allows them to consume as many manufacturers or wholesaler catalogues as they wish.

28 www.opi.net

Despite many challenges, progressive dealers are jumping on the technology bandwagon and, with the solutions on offer, are maximising the opportunities

INTERVIEW

Special Issue

TECHNOLOGY SOLUTIONS

Our dealers are now able to sell hundreds of thousands of non-wholesaler supported SKUs with ease. The term ‘endless aisle’ has been thrown around for years, but it’s finally becoming a reality.

Back to the study I’ve just mentioned, we found the most successful dealers have nearly double the number of total SKUs on their websites compared to those that are not doing so well. The wider your breadth of product offering, the more you’re likely to sell.

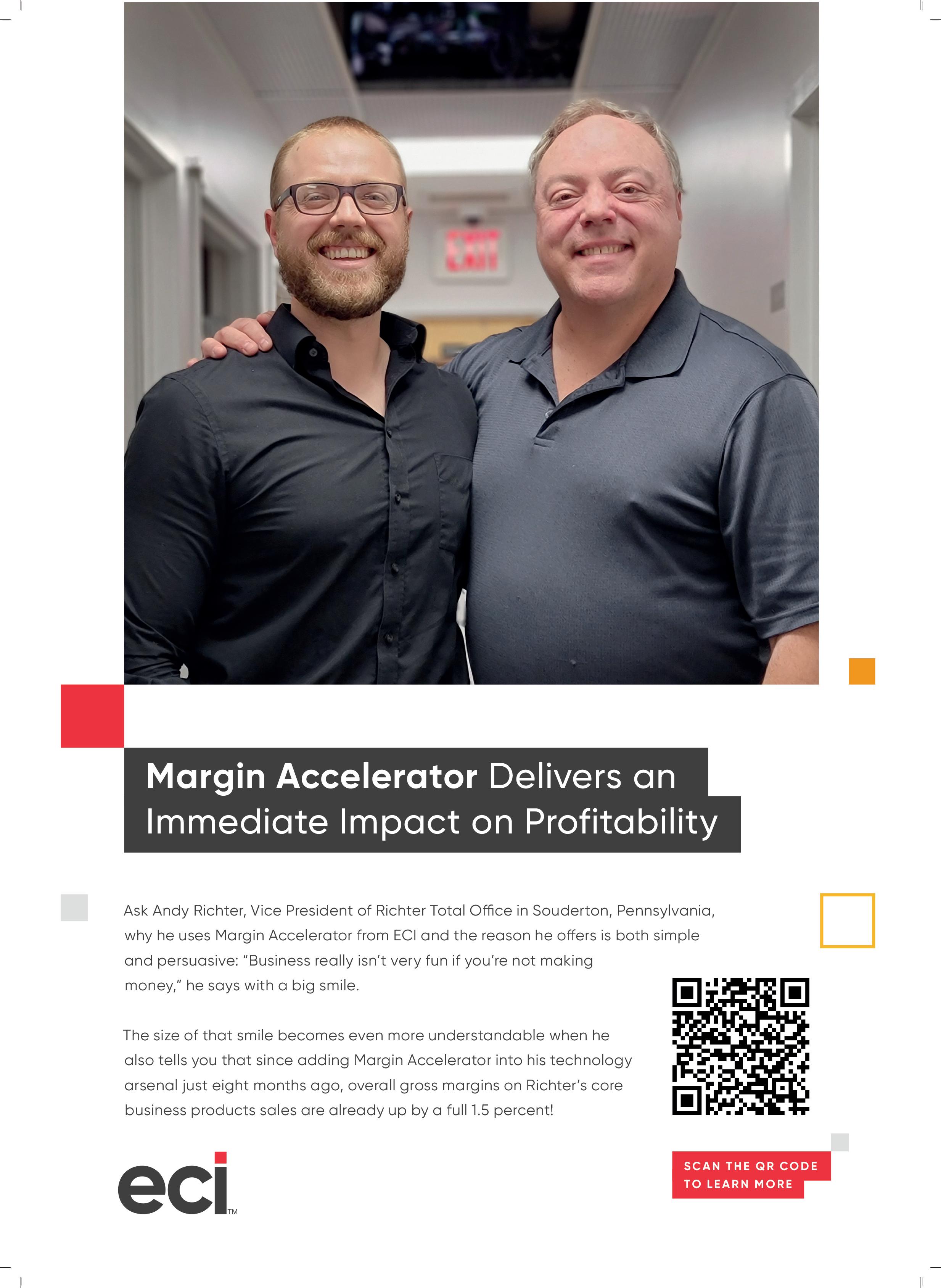

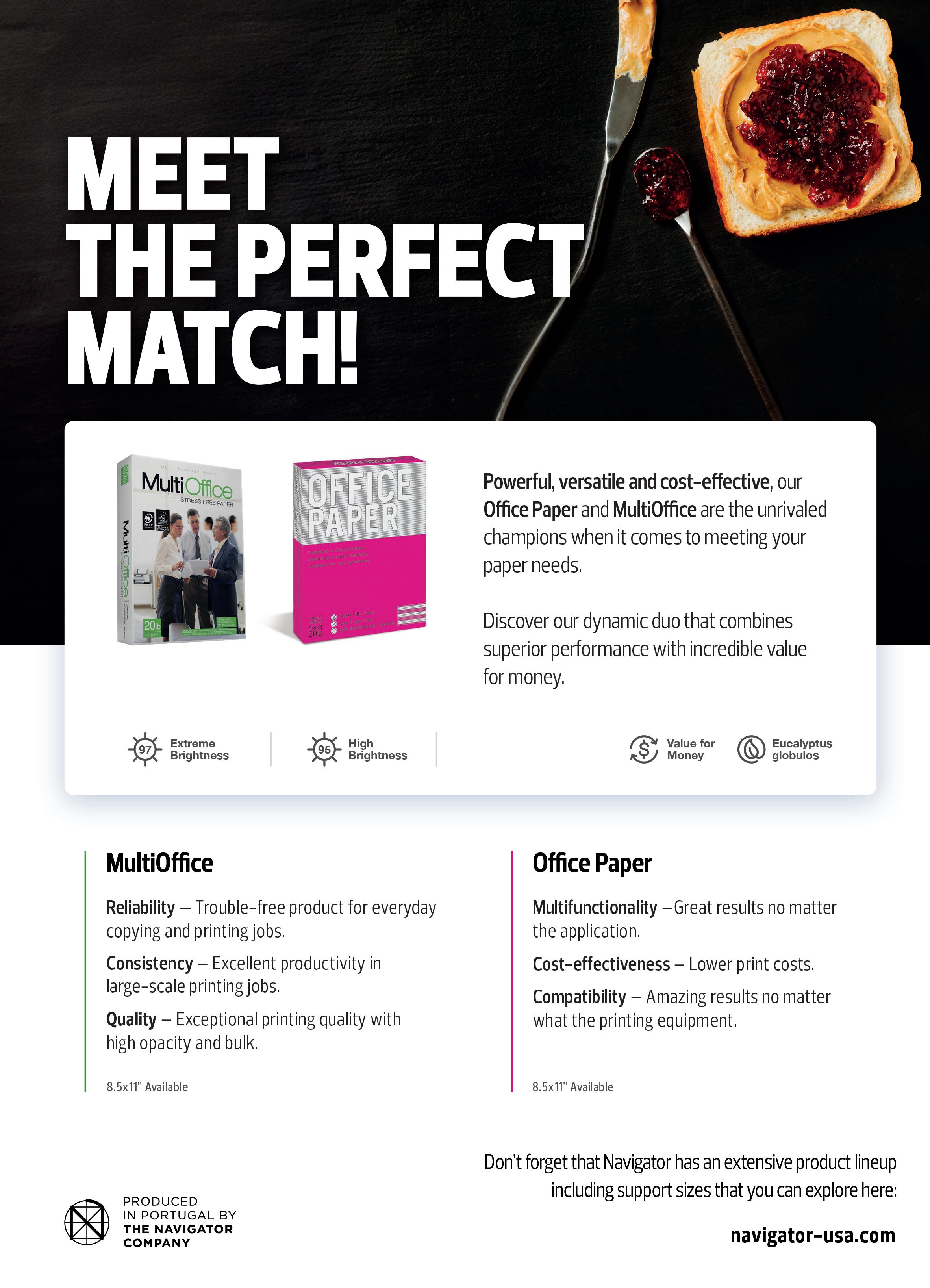

OPI: In addition to product scope and revenue, let’s talk about margins and profit. I believe ECI’s Margin Accelerator is the tool which generates results here.

BB: It does. Margin Accelerator has brought an amazing amount of profit to dealers. We partnered with The InterBiz Group a few years ago to customise pricing plans for dealers so that they are simultaneously market competitive and much more profitable than they were before they engaged with us.

Each dealer is provided with a set of up to five matrices so they can quickly move margins up or down depending on the sensitivity of the customer. We also include profitability coaching at no extra charge, so dealers can quickly respond to issues arising within their businesses.

OPI: How savvy are dealers with dynamic pricing these days?

BB: To answer this question I think we need to look at the past. When ECI first created DDMS, it offered a very robust customer-specific pricing module. Each client could have multiple items held at a specific price for an extended period if necessary. In my experience, customers do not compare each price when placing an order; they are primarily concerned with certain benchmark items like copy paper.

That being said, over the years price scraping and focused marketing campaigns have led many dealers to minimise the number and size of customer-specific contracts because they consider them hard to manage. But in some cases, moving away from ‘custom contracts’ has hurt their competitiveness as well as their ability to please individual clients.

This challenge can only be solved by looking at all the options available to meet the needs of individual customers – while keeping margins. We help with this and very little work is required from dealers, so I think the time is right for them to become reacquainted with this sort of dynamic pricing if they’re not already.

OPI: You mention price scraping. How important is it?

BB: That’s an interesting one. Let’s start with Amazon. It changes prices multiple times daily,

so anyone who ‘scrapes’ the site would need to do it constantly. Independents don’t have the time to change their prices that often and, in my opinion, they don’t need to. The best operators are growing and one of the primary reasons is the amazing service they provide.

A customer recently said to me: “It’s not just about the last mile of delivery, everyone has that figured out. It’s about the last foot of delivery and 3PLs just can’t compete with what we can provide.”

As for scraping other competitors, there could be value, but they also change their prices quite often. Within the past few months, several dealers have called about Margin Accelerator, because big competitors have cut services, reps and prices. Some dealers have experienced margin degradation of over 30% because their price matching software has forced their pricing down with no sense of where the marketplace truly is.

Many dealers have figured out that they don’t have to provide the exact same price to their customers as their competitors do. It’s more about ensuring your end-user pricing is competitive where it needs to be while understanding what margin you require to maintain a healthy business.

September 2023 29 INTERVIEW Brian Bowerfind

Customers do not compare each price when placing an order; they are primarily concerned with certain benchmark items

Brian Bowerfind

FULL VISION

All resellers in our industry need a fully-fledged technology set-up with comprehensive support – it’s become a no-brainer. The issues dealers have to address under that broad umbrella are manifold, however.

What, for example, do they need to do about SEO ranking and overall digital marketing?

How can they remain competitive, ahead of the curve even, from a pricing perspective? What do end users demand from a customer experience perspective?

OPI’s Heike Dieckmann spoke to a range of software providers to get their take on where progress has been made, what’s important and which issues still need addressing.

TECHNOLOGY SUPPORT – WHEREVER YOU WORK

ANDY BALLARD, DIRECTOR OF SALES, GOPD

When the COVID-19 pandemic hit and everyone was sent home, dealers found that the transition to remote or hybrid work was seamless with GOPD. All of our tools were online already, so as long as they had access to the internet, they could continue to do their job from home.

Customer service and purchasing were online and worked the same wherever the location. Dealers that needed multiple people working on their QuickBooks systems could move, if they didn’t use it already, to a GOPD-hosted server and access it from anywhere. Salespeople often worked from home anyhow and, with proper e-commerce sites in place, orders just flowed from the customer to the dealer to the wholesaler.

We developed several new tools for our clients, making it even easier to work remotely or on a hybrid schedule. The first one was a new e-commerce capability for sales staff. In addition to all the usual – product searches, specifications, customer history, favourites, etc – we added the capability to modify pricing, create quotes, save to the customer’s shopping cart, or release as an order.

We next added other service features: being able to change orders created by customers

VENDOR SPECIAL Special Issue

and salespeople; managing purchasing down to the item level including working with multiple sources; setting up customers; dealing with marketing such as coupons, and seeing orders based on status.

A Sales Manager Dashboard now gives owners, managers and reps the ability to see their analytics, comprising sales by customer, client-specific and overall numbers, category revenue and comparisons to previous years.

In addition to independent dealers being truly able to work from anywhere, they have the flexibility to hire the best candidates regardless of their location. And, of course, they have the option to save overheads by reducing office space.

COVID did not cause dealers to miss a beat in my opinion, and now they can enjoy the technology flexibility and advances providers such as GOPD have facilitated. Find out more: www.gopd.com

30 www.opi.net FEATURE

Special Issue

TECHNOLOGY SOLUTIONS

Software solutions providers are the helping hand – and often the voice of experience – that guide independent dealers through the maze of technology options

COVID did not not cause dealers to miss a beat in my opinion, and now they can enjoy the technology flexibility and advances

FULL MARKETING STEAM AHEAD

JENNIFER RAE STINE, PRESIDENT, FORTUNE WEB MARKETING

Dealers that previously sat on the fence about starting new marketing tactics or strategies have finally realised the urgency. They’ve learned that you never know what lies ahead in business – and the world in general – so they need to make sure their marketing is not only agile and flexible, but they actually have strategies in place to build upon and evolve with. Starting from scratch is not an option.

What I find really refreshing is that dealers which have been continuously innovating their marketing programmes are now looking to take it a step further – better e-commerce sites, integrations and new tools such as HubSpot. The push into new verticals and products/services, such as micro markets, is also a positive, as is the growing foray into the architecture and design market for furniture, breakroom and promo.

SEO and ranking is a perennial topic for anyone with an online presence. Everybody by now should have migrated to GA4, the new Google Analytics platform, following the retired previous version. Dealers always

want to start with SEO, but most of them in this industry lack the budget and the patience it takes to rank highly. SEO is not a quick money-in-the-pocket tactic – you have to be in it for the long haul, with a consistent strategy.

Social media and email are still on the rise – often underrated in the business supplies space in my view – but a very important component of marketing. It’s particularly important given that buyer personas are shifting to a younger demographic. Find out more: www.fortunewebmarketing.com

September 2023 31 FEATURE Technology Solutions

PRICE MONITORING AND MARGIN MANAGEMENT

LAUREL LOEHLIN, PRESIDENT, BUSINESS MANAGEMENT INTERNATIONAL

Dynamic pricing is finally gaining traction. In the past, dealers’ entire mindset revolved around net pricing. Suggested net pricing is provided by the wholesalers, with dealers then oftentimes setting their own – for specific customers or groups of clients.

But it was all done manually. When costs changed, it was again a manual process to determine what to do and how often to do it. Profits were being left on the table because independents were not quick enough to react.

In order to plug this gap, Business Management International (BMI) created a tool called Margin Management. The functionality allows dealers to set criteria

ALL ABOUT THE CUSTOMER

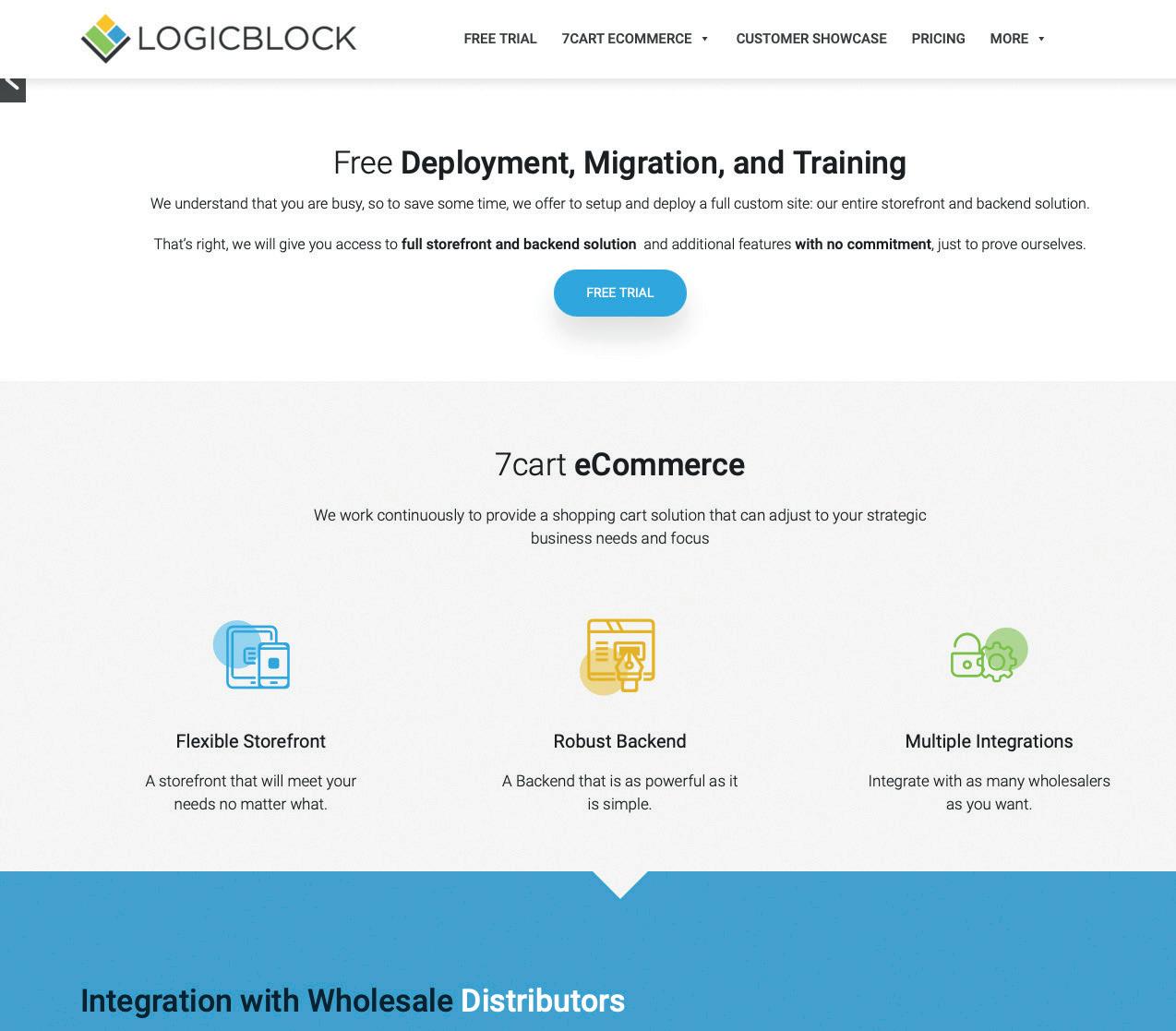

ALEXANDER NICOLAIDES, PRESIDENT, LOGICBLOCK

EXPERIENCE

Customer experience is the name of the game. If your clients are not having a good experience when shopping with you, they will look elsewhere.

People pay more to shop big-box sites for a reason. Even a giant like Google factors in customer experience when positioning websites in its rankings. The refinement and improvement of these optimisations is an enduring task for us, one that requires continuous investment, maintenance and innovation. For example, we have been working with each of our customers to get their sites updated from legacy methodologies to the latest and greatest.