2024

l Acquisition for Manutan l Ninestar moves in the US l German stationery show discontinued l Maximising public sector sales l ODP’s strategic decision l Paper sector still challenged l Breakroom benefits l How to leverage influencers l EOPA winners

Connecting the business products world April/May

Kenneth Borup, Lomax BIG INTERVIEW

INSIDE THIS ISSUE

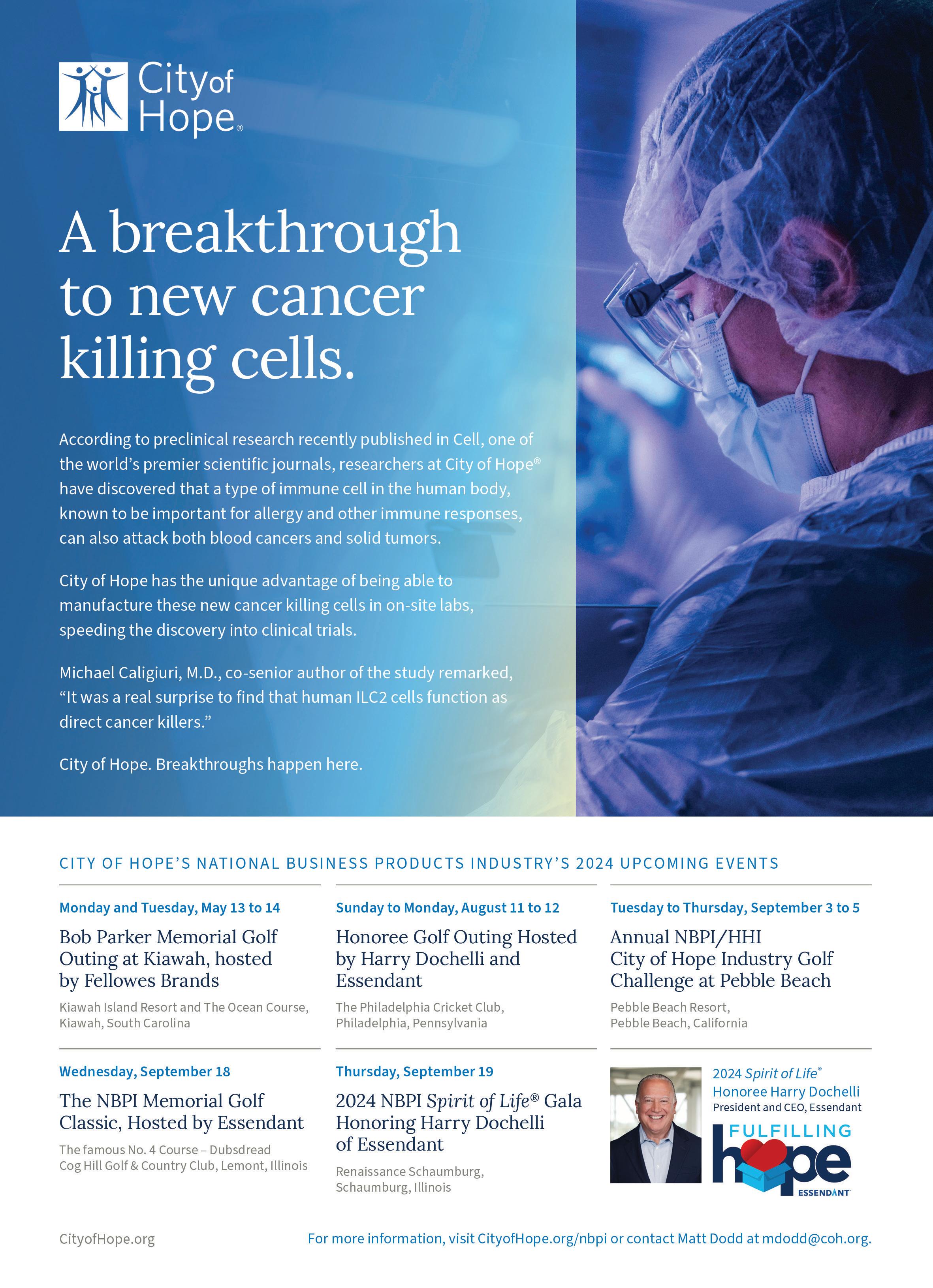

Big Interview: Driving progress

Lomax is now Denmark’s largest specialist online supplier of business products, so it’s no surprise that the reseller’s expertise in e-commerce and digital marketing recently drew attention from Lyreco.

Although the acquisition was ultimately called off late last year, it hasn’t deterred Lomax CEO Kenneth Borup from continuing to hunt for other expansion opportunities. As CEO, he champions Lomax’s dynamic growth while ensuring a positive company culture remains a top priority. Under his tenure, the company has almost doubled its revenue over the past five years, and Borup is keen to maintain this pace.

SPOTLIGHT: IN PURSUIT OF PUBLIC SECTOR SALES

Many dealers are interested in the General Services Administration’s (GSA) Multiple Award Schedule (MAS). 2024 marks the 40th anniversary of this programme. As OPI readers may be aware, the MAS is the federal government’s primary contract vehicle to acquire over 28 million commercial products and services.

There are currently 16,000+ contractors on the MAS. Reported sales for fiscal 2023 were $44 billion, constituting growth of 14% over the previous year. 53% of this volume was sold through a blanket purchase agreement. Approximately 80% of GSA contractors are small businesses.

CONTENTS

18 Big Interview

Lomax CEO Kenneth Borup is gearing up for the next phase of the reseller's expansion

26 Focus

With the ODP Corporation under pressure to be broken up, OPI looks at the possible implications

28 Spotlight

Venturing into US public sector sales can be a challenge, but Steve Noyes knows how to chart a path to success

32 Category Update

Although still facing headwinds, there are pockets of growth in the paper sector

36 Advertorial

Sylvamo maintains a positive outlook

38 Category Update

The breakroom is back and filled with plenty of diverse opportunities

42 How To...

... increase sales and boost brand visibility and credibility through influencer marketing

44 Review: OPI

Partnership 2024

Celebrating its tenth anniversary, Partnership provided the perfect platform for strategic business meetings

46 Review: EOPA

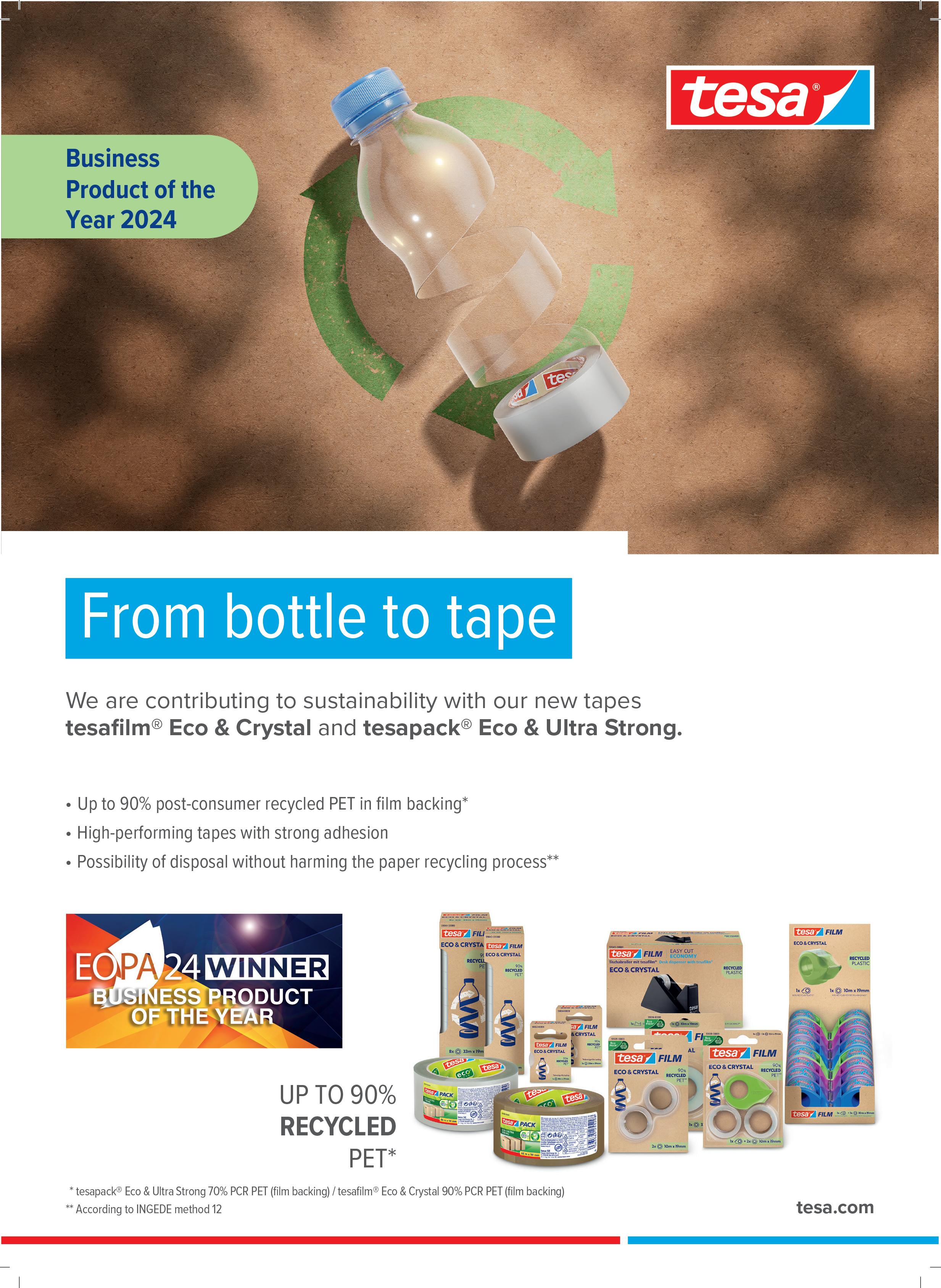

A look at all the winners of the 2024 European Office Products Awards, which was recently hosted in Amsterdam

REGULARS

6

52

April/May 2024 3

Comment

5

News

Green Thinking News 16 OPI Small Talk

14

5 minutes with... Jonathan Weiss

Final Word Jade Wilson

54

Heike Dieckmann

+44 1462 422 143 heike.dieckmann@opi.net

Andy Braithwaite

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman michelle.sturman@workplace360.co.uk

Freelance Contributor

David Holes david.holes@opi.net The

SALES & MARKETING

Chief Commercial Officer

Jade Wilson

+44 7369 232590 jade.wilson@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Commercial Development Manager

Chris Armstrong chris.armstrong@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager

Lisa Haywood events@opi.net

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

PUBLISHERS

CEO

Steve Hilleard

+44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand

+44 20 3290 1511 debbie.garrand@opi.net

Well, at least it is in the Northern Hemisphere, where I write this column for our Editor, Heike, who is recovering from surgery, which should see her bounding about like a newborn lamb in no time. I have a spring in my step too, reflecting on the great job my colleagues did in March (thanks, team!) hosting two enormously successful events in Amsterdam.

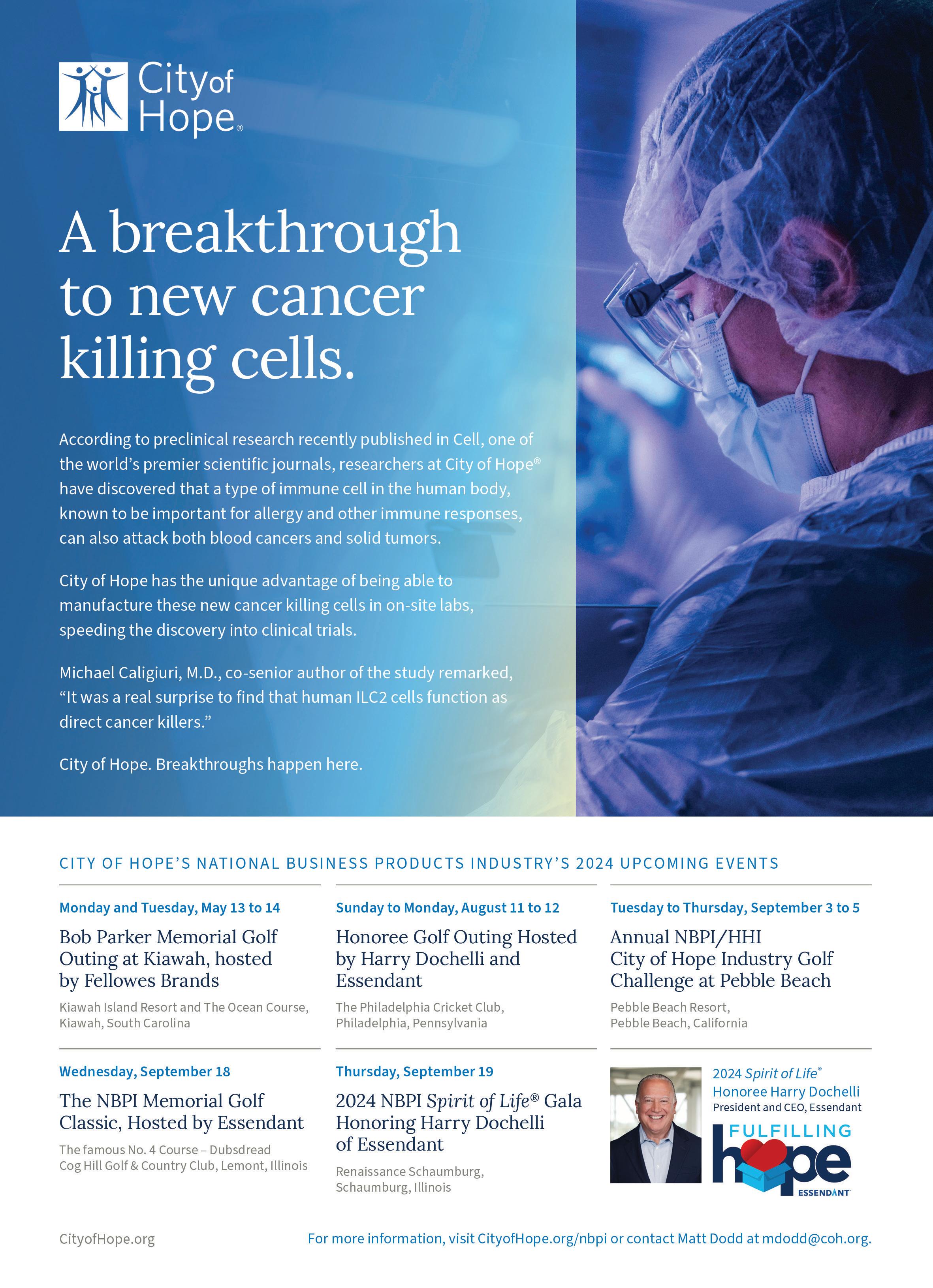

The tenth annual OPI Partnership event (see page 44) and the co-hosted European Office Products Awards (see page 46) brought together most of the continent’s leading resellers, brands and suppliers for a couple of very productive days that saw many of the senior executives in attendance head back to the office with renewed optimism for the future.

With hugely impressive younger individuals [...] following in the footsteps of iconic leaders [...] there is good cause for optimism

Despite all the numerous and well-documented challenges that the office and workplace supplies industry continues to grapple with, it was evident that there is plenty of stomach to address those issues, particularly from an emerging group of leaders – individuals and companies – bringing fresh ideas and energy to our space.

I met dozens of new – and often younger – faces this year and all remarked on what a close and resilient community we have. Indeed, there was a palpable energy at the EOPA as the 12 trophies were handed over, and a sense that this is an industry well versed in adapting and evolving and will fight hard to remain relevant.

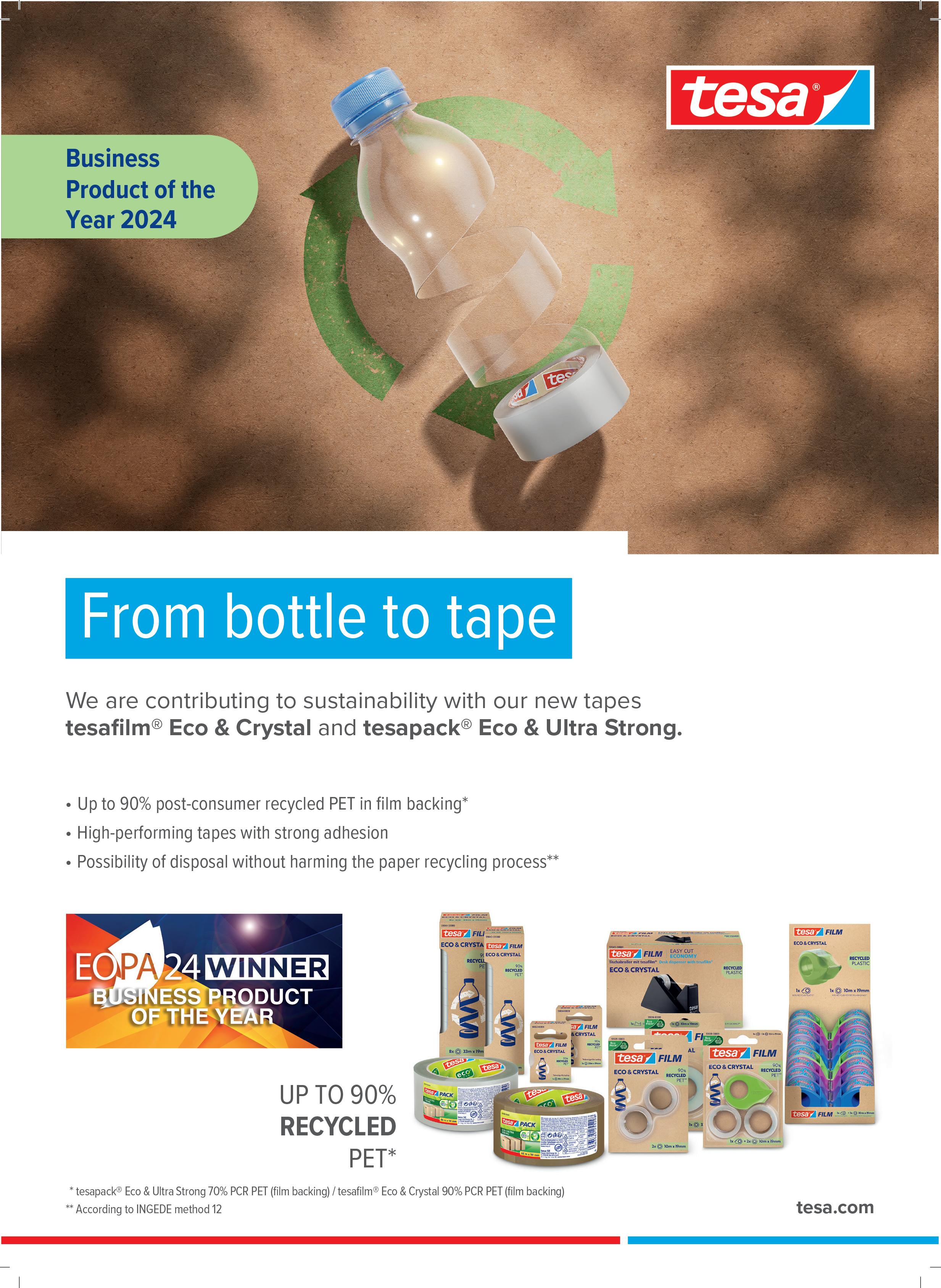

Having been privileged to chair the EOPA judging meeting again this year, I was fortunate to read all the entries submitted. I remain convinced that our community is in good hands with world-class companies such as Lyreco, Fellowes Brands and tesa, to name a few, continuing to demonstrate leadership in key areas including sustainability, diversification and business transformation.

With hugely impressive younger individuals like Leanne Gregg, Rasmus Olsen and Jonathan Weiss following in the footsteps of iconic leaders such as Alain Josse and Nicolas Potier, there is good cause for optimism.

Finally, I will take this opportunity to thank my colleague Michelle Sturman for stepping up and acting as Editor for this issue.

Steve Hilleard, CEO, OPI

April/May 2024 5

The carrier sheet is printed on Satimat Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months. No part of this magazine may be reproduced, copied, stored in an electronic retrieval system or transmitted save with written permission or in accordance with provision of the copyright designs and patents act of 1988. Stringent efforts have been made by Office Products International to ensure accuracy. However, due principally to the fact that data cannot always be verified, it is possible that some errors or omissions may occur. Office Products International cannot accept responsibility for such errors or omissions. Office Products International accepts no responsibility for comments made by contributing authors or interviewees that may offend. COMMENT Spring is in the air

Office Products International Ltd (OPI) Focus House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP, UK Tel: +44 20 7841 2950

Editor

EDITORIAL

Editor

News

+33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

OPI team

Follow us online Twitter: @opinews Linkedin: opi.net/linkedin Facebook: facebook.com/opimagazine Podcasts: opi.net/podcast App: opi.net/app OPI is printed in the UK by

www.carbonbalancedpaper.com CBP0009242909111341 THIS YEAR'S OPI TEAM AT EOPA

Manutan acquires UK educational supplier

France-based B2B distributor Manutan has bought leading UK educational supplies company Findel for an undisclosed sum. Headquartered near Manchester, Findel can trace its roots back to 1817. In 2021, private equity firm Endless – the owner of multichannel operator evo – backed a management buyout in a £30 million ($38 million) deal after regulators blocked Findel’s acquisition by purchasing organisation YPO.

“At Endless, we are only ever a temporary custodian of a business, but I’m incredibly proud of what our teams have achieved over the past three years and look forward to seeing what they can do as part of the Manutan Group in the future,” commented Endless Investment Partner Andy Ross.

Findel CEO Chris Mahady added: “It’s been a remarkable three years with the Endless team, where we have transformed the business from an unloved and non-core division of a PLC to the digital leader in our sector, with ESG at the heart of our operations and culture.”

In the 12 months to 31 March 2023, Findel generated revenue of £116 million and achieved adjusted EBITDA of £10.4 million. Although it describes itself as an international company, more than 90% of its sales are derived from the UK. Its second-largest market last year was Asia, with around £2.4 million in sales.

The company will fit nicely into Manutan’s Local Authorities division which, until now, has operated almost exclusively in France via the Manutan Collectivités, Papeteries Pichon and Casal Sport reseller brands. With Findel, the division will account for around 30% of Manutan’s total group sales, offer some 440,000 products and employ approximately 750 staff.

The acquisition will also give Manutan – which has annual revenue of around €950 million ($1.03 billion) – a better geographical balance, with more than half of its sales set to come from outside of its home market.

End of the road for Insights-X

The organiser of German stationery trade show Insights-X has pulled the plug on the event. Nuremberg’s Spielwarenmesse said it was with a “heavy heart” that it had decided to discontinue Insights-X after almost ten years.

Although “many key brands” had already registered for this year’s event originally scheduled for October, it confirmed the show had not been performing from a commercial perspective.

Spielwarenmesse will focus on its core toy categories but said there were still opportunities for stationery vendors to participate in its iconic Toy Fair taking place at the end of January 2025.

Insights-X was established in 2015 at the behest of three of the biggest writing instruments manufacturers based in the Nuremberg region: Faber-Castell, Stabilo and Staedtler.

AllOffice expands in cleaning category

Leading Nordics business products reseller AllOffice has bought regional wholesaler and supplier Zerva from local investment firm Tången. A Sweden-based distributor of janitorial products, Zerva was founded in 2010. It operates a store in Skövde, 150 km (90 miles) northeast of Gothenburg. Employing 12 staff, Zerva generated revenue of SEK50 million ($5 million) in 2023.

AllOffice said the move was “completely in line with its strategy to grow in cleaning and hygiene with strong local players”.

6 www.opi.net NEWS

FILA to close European factories

Stationery and school supplies vendor FILA has said it will close four European production facilities in an effort to boost profitability. Speaking on the company’s FY23 conference call in March, CEO Massimo Candela confirmed that four Europe-based plants would go as part of an “organisational efficiency project” that will be implemented over the next 24-30 months, beginning this June.

At the same time, FILA will tap into its production assets in India, with more products made in India set to be sold in the European market and elsewhere. Candela said the actions would have a positive impact on cash resources and reduce FILA’s breakeven threshold in Europe.

He called the company’s operations in India a “significant competitive advantage”, in terms of both cost and supply chain security. “We have a lot of competitors that are extremely exposed to China,” he noted, calling this an “unbelievable risk”. He also underlined the “comparable quality” in products from the DOMS business in India which went public in an IPO at the end of last year – although FILA is still its largest shareholder. FILA’s sales in Europe fell by 8% in 2023, a decline largely blamed on inventory destocking.

Brother makes move for Roland DG

Japan-based Brother Industries has launched a surprise takeover bid for industrial print specialist Roland DG. Brother is making a tender offer for the common stock of Roland DG at ¥5,200 per share in a deal worth ¥64 billion ($430 million). The Brother offer is ¥165 a share higher than a private equity-backed MBO that Roland’s board has already approved.

In a statement, Roland said it had not received any prior communication from Brother ahead of its announcement. Roland’s board will now analyse the bid before advising its shareholders on a course of action. Brother said the acquisition of the fellow Japan-based firm formed part of its business portfolio transformation strategy, which aims to reduce its exposure to the consumer and workplace printing segments.

It highlighted several areas of synergy between itself and Roland in fields such as visual communications, digital production and dental solutions. In addition, it pointed to reducing manufacturing costs through joint purchasing and leveraging the companies’ complementary sales channels.

Lexmark assets sold

Ninestar has announced that more than $200 million in cash will be generated following the sale of key Lexmark assets, including a major chunk of its iconic campus in the US.

According to a Ninestar regulatory filing, properties totalling 1.45 million sq ft (145,000 sq m) and 135 acres (55 hectares) of land in Lexington, Kentucky, are being sold to an entity owned by real estate asset management giant Sculptor for approximately $127 million. Lexmark will then lease the locations back, paying rent of around $1.1 million a month.

In a separate transaction, Lexmark has sold around 43,000 sq m of space at its Cebu facility in the Philippines for an amount that is not expected to exceed $80 million. Ninestar said the proceeds would be used to expand further financing channels and meet the capital needs of its Lexmark International subsidiaries.

IKEA launches largestever office line-up

Buoyed by its growing importance as a hybrid workplace furniture and accessories destination, IKEA has unveiled its largest office system to date. The Mittzon range comprises 85 items that have been developed with aspects such as ergonomics, acoustics and well-being in mind.

They include acoustic screens, the first high-level acoustic solutions that IKEA has developed. While some of the products would be suited to a home office, IKEA is clearly also going after other workspaces and the B2B channel with its Mittzon launch.

“The rise of hybrid work has shifted the role of the physical office from a static space, where everyone has a permanent desk, to one where every day is different, and flexibility is key to meeting changing needs,” the Swedish retailer stated.

The Mittzon family will be available from April 2024, although it won’t be launched in North America until July. More products are set to be added to the offering in 2025.

NEWS April/May 2024 7

ISG makes EPIC appointment

US dealer group Independent Suppliers Group (ISG) has hired Dante Ercoli as the new Managing Director of its EPIC Business Essentials national accounts initiative. Ercoli has spent over 20 years in the business products industry with vendors such as ACCO Brands, Elmers and Velcro.

Steelcase appoints EMEA President

Workplace furniture giant Steelcase has named Alessandro Centrone as its first-ever EMEA President. Centrone has been with Steelcase since 2012 and was most recently VP of Marketing for EMEA. His appointment was described as a “significant shift” in Steelcase’s operating structure and is set to give increased autonomy to the region.

Viking departures

Simon Allan-Brooks, Managing Director of Viking UK & Ireland, left the company at the end of March. He joined the business in 2020 as Logistics Director and was named Managing Director in September 2022 by new owner RAJA Group.

Meanwhile, Viking Europe Director of Merchandising and Product Marketing Andrea Kenna has left the company after more than 20 years.

MD change at ADVEO Benelux

Erwin Snoeker (left) has taken over as Managing Director of wholesaler and dealer network organisation ADVEO Benelux. He succeeds Roland Laschet, who retired at the end of March.

Snoeker, previously the company’s Sales and IT Director, will be supported by Miguel Haelvoet (CFO) and Robbie Vermeulen (Purchasing and Merchandising Director); while Laschet will remain available in an advisory capacity.

New CCO at Staples Canada

Staples Canada has appointed Priscilla Luna as its new Chief Commercial Officer. She joins the reseller after more than 22 years of retail operations, strategy and services experience in the pharmacy sector, mostly with Canadian group Loblaw Companies Limited.

At Staples, she will be accountable for all aspects of its merchandising business and strategy, as well as its end-to-end services business across B2B and B2C.

OPIx, the Australian office products event co-hosted by dealer groups Office Brands and Office Choice, and wholesaler GNS, has been earmarked for the first half of 2025.

Following last year’s OPIx, there was an expectation it would take place again in the second half of this year. However, in a statement, the co-organisers have confirmed they have agreed to stage the next OPIx in H1 2025, with an exact date yet to be determined.

It appears some extra time is needed to get all industry stakeholders on board following what were described as “delivery challenges” in 2023, particularly in relation to staging the trade show part of the event.

That said, there is support for OPIx to be continued, with a number of improvements set to be implemented. An advisory committee is also being formed that will include some “key partners”.

OPI announces AI Online Summit

OPI has announced that its inaugural AI Online Summit for business supplies executives to harness the potential of the latest AI technologies will be hosted virtually on 23 May 2024. The OPI team stresses the summit will not look at AI in the abstract but will instead provide takeaways businesses can act on immediately.

The three-hour summit includes inspiring talks and discussions led by experts in AI, followed by presentations, interviews and panels led by industry leaders, providing advice and case studies.

OPI has confirmed West McDonald, GoWest.ai founder and the driving force behind the AI Explorers Group, will host a practical session on the potential of AI in the business supplies channel. Among other topics explored, the presentation will highlight the importance of AI business readiness assessment and showcase real-world applications of the technology.

Other prominent speakers at the summit include Henry Coutinho-Mason, author of The Future Normal and Trend-Driven Innovation. Coutinho-Mason’s session will emphasise optimistic visions about how AI and robots can improve the world of work.

Meanwhile, Infosys Consulting’s Chief Decision Scientist Serge Plata and Associate Partner Jim Wheeler will explore problems and questions relating to technology, data and modern science in an eye-opening Q&A session. To book a place, visit www.opi.net/ai2024.

NEWS 8 www.opi.net

ON THE MOVE Aussie show OPIx pencilled in for H1 2025

Office Choice makes strategic acquisition

Australian dealer group Office Choice has made an acquisition it describes as “the beginning of a new chapter”. The organisation has bought Rosebud Office Choice, a dealer member based just south of Melbourne. It said the move was a “major step” in the execution of its ‘2023 and Beyond’ strategic vision agreed by the board at the end of 2022 and underscored its “commitment to expansion”.

“Rosebud Office Choice will be seamlessly integrated under the Office Choice Limited umbrella, heralding a new era of innovation, operational excellence and competitive robustness,” the group said.

“This acquisition signifies a stepping stone towards continuous growth and value enhancement for our shareholders, members and the broader Office Choice community,” it continued. “This is a clear signal of our intent to not only participate in the market but to lead and redefine it.”

In a statement to OPI, Office Choice added: “The existing [Rosebud] team are happily remaining in place, excited for this new chapter supported by our National Support Office team.”

US court denies Ninestar injunction

The United States Court of International Trade has denied Ninestar’s motion for an immediate lifting of its import ban into the country.

In a filing published on 29 February, Judge Gary Katzmann ruled that Ninestar’s motion was unlikely to succeed, the company had failed to establish “irreparable harm” to its business and a preliminary injunction was not in the public interest.

“The embargo is still in force, meaning that Ninestar’s merchandise continues to be prohibited from entering the United States,” ruled Judge Katzmann.

It appears Ninestar will now have to prove to the US government – in line with Department of Homeland Security procedures – that it is not working with the Chinese government to “recruit, transport, transfer, harbour or receive forced labour or persecuted ethnic minorities out of the Xinjiang Uyghur Autonomous Region”.

Speaking to OPI, Ninestar said it was committed to moving forward in its legal battle with the US government.

NEWS April/May 2024 9

All change at BBSC

OPI’s Kelly Hilleard has been named Chair of the UK’s BOSS Business Supplies Charity. She succeeds Martin Wilde, who stepped down at the end of March. Trustee Philip Wesolowski will take over from Hilleard as Vice Chair.

Logicblock names director

US solutions provider Logicblock has hired e-commerce entrepreneur John Jordan as Director of Customer Growth and Experience. Jordan’s experience includes developing two online business supplies operations, iBuyOfficeSupply. com and Zerbee Business Products.

Sass switches to EON

Former Source Office & Technology

President David Sass has joined fellow Colorado reseller EON Office. Sass spent more than seven years at Source – which was acquired by The Supply Room in 2022 – before leaving at the end of last year.

At EON, he has taken on the role of President of Technology, overseeing a new copier sales and service division.

Highlands makes US appointments

Highlands has promoted Monique Sluzynski (top) to Director, Strategic Accounts. In her new role, she will manage growth for Highlands’ clients at wholesale distributor Essendant.

The sales and marketing agency has also promoted Alex Gordon to Senior Director, Wholesale – a role in which he will oversee the channel’s Business Development Managers.

Meanwhile, Susan Fisher has joined Highlands as its new Director of Strategic Accounts for the office channel in the US. Her primary focus will be on the Staples and Quill accounts.

Execs join Supply Chimp

US dealer Supply Chimp has appointed Jeff Burwell (top) as VP of Operations and Pat Voller as VP of Business Development.

Burwell will lead the company’s operations team, overseeing functions such as vendor partnerships, customer service and order management.

Voller is in charge of pursuing new business opportunities within the government sector.

Mitsubishi buys Lamy

Uni brand owner Mitsubishi Pencil has acquired high-end German manufacturer C. Josef Lamy for an undisclosed sum. The agreement – which followed a “complex process” – will see all shares in Lamy transferred to Mitsubishi Pencil along with the promise to maintain the company’s headquarters and production facility in Heidelberg.

The Japanese company also intends to invest in the further development of the LAMY brand, which could include areas such as digital writing and greater penetration in e-commerce channels.

Lamy was founded in 1930 and today employs around 340 people. Its brand is present in more than 80 countries and over 15,600 points of sale. These include approximately 200 LAMY-branded outlets located throughout the world.

Part of Mitsubishi Pencil’s medium-term strategy is to develop in global markets. Currently, around half of its sales are generated in its home market of Japan.

Strategic developments at In Ufficio

Leading Italian office products dealer group In Ufficio has significantly bolstered its membership ahead of a change in its senior management. The organisation announced that as of 1 March, 14 members of the CIAC dealer group had joined, taking its total membership to 34 – with end-user sales of €220 million ($240 million).

The dealer switch comes after the closure of CIAC, which was Italy’s oldest independent reseller group, having been founded in 1975. Earlier this year, Luigi Vallero joined In Ufficio as General Manager. Vallero spent more than 16 years at CIAC as General Coordinator, and he is largely responsible for the 14 former CIAC members (out of 15) making the move over to In Ufficio. In addition, In Ufficio has acquired some CIAC assets, including its private label brands.

Vallero’s appointment has allowed longstanding In Ufficio CEO Adriano Alessio to move ahead with his retirement plans. He is now set to step down following the In Ufficio Day event taking place in Milan on 31 May. Vallero will then take on overall responsibility – although OPI understands Alessio will still have an advisory role.

The event will also be an opportunity for stakeholders and partners to learn more about the expanded In Ufficio’s plans to achieve synergies from its new members, which are largely retail-focused, as opposed to the group’s historically B2B-oriented resellers.

NEWS 10 www.opi.net

ON THE MOVE

Adriano Alessio (l) and Luigi Vallero

11-13 NOVEMBER

RADISSON BLU EDWARDIAN BLOOMSBURY STREET HOTEL, LONDON

EUROPEAN Forum 2024

JOIN US FOR AN OUTSTANDING EVENT PROGRAMME TO STIMULATE THOUGHT AND DEBATE WHILE EXPLORING THE FUTURE OF THE EUROPEAN BUSINESS SUPPLIES SECTOR

n Bringing senior executives together from all sectors to better understand the continued changes to our industry.

n Practical takeaways that will enable informed strategic decisions on the direction of your business.

n Learn how peers and industry experts are coping with the challenges and opportunities ahead.

KEYNOTE SPEAKER: Henry Coutinho-Mason

DESIGNING A PEOPLE-FIRST AI STRATEGY

Book now and take advantage of the early rate: opi.net/ef2024

Special rates for OPI members

Marketplace is an

engine

for our business. It is also the fastest-growing aspect of e-commerce for us outside the US

Amazon Business expands

Amazon

Xerox sells

the US.

€100

million

Amount Kellanova has invested in new technology to develop and produce a recyclable Pringles tube

As part of its geographical rationalisation strategy, Xerox has sold its operations in Argentina and Chile to local partner Datco.

19 Acquisitions agreed by Bunzl in 2023, with a committed spend of £468 million ($592 million)

35.9% Office occupancy rates in the UK at the beginning of March 2024 – the highest level since the pandemic

Joann in Chapter 11

62,400

Second-hand furniture items Lyreco will

after this year’s Olympic and Paralympic Games in Paris, France

NEWS 12 www.opi.net

IN BRIEF

US arts and crafts retailer Joann filed for Chapter 11 bankruptcy in March this year. However, its 800 stores remain open and the company is expected to go private in the coming weeks.

ACCO Brands Australia Managing Director Adam Colman (centre) saying a few words after the company was named Connect Gold Partner of the Year by leading Australian reseller Winc.

sell

Business recently launched in Mexico, its ninth market outside of

Doug McMillon, CEO, Walmart

PICTURE OF THE MONTH

GREEN THINKING

3M announces mailer innovation

3M says it has introduced the first known padded, paper-based kerbside recyclable mailer material that businesses can also use to automate their packaging process.

According to the vendor, the new material, called PACR (Padded Automatable Curbside Recyclable), is capable of producing packages up to three times faster than manual packing when paired with qualified automated packaging machines. PACR is not industry specific and is compatible with a range of printing technologies. It also comes in a wide array of sizes to meet the packaging requirements for all kinds of goods.

The new mailer is made with a single layer of kraft paper that is lightweight and durable, and resists moisture penetration. The proprietary padding technology helps protect against drops, bursts, vibrations and other potential risks incurred during shipping.

Pilot launches impact calculator

Pilot Pen Australia has teamed up with sustainability consulting firm Lifecycles to launch an online calculator that can demonstrate the cost and carbon footprint savings of using pen refills.

According to the manufacturer, refilling just one pen can reduce carbon emissions by 40% and plastic use by 31%. However, a survey of office workers showed that, while the vast majority (80%) are aware that pens and markers can be refilled, more than two-thirds don’t currently refill them – mostly due to forgetting or losing the refills.

“With the average office worker using 15 pens and markers per year, in a company of 100 employees, that works out to be approximately 1,500 [items] that are going straight into landfill.

“That is clearly not desirable – not to mention the additional cost to replace pens,” said Jarrad Murray, Head of Marketing at Pilot Pen Australia.

ACCO improves EcoVadis performance

Manutan targets Scope 3 reductions

European reseller Manutan is aiming to reduce its Scope 3 transport emissions by 7% in 2024. To help it achieve this goal, the company has entrusted nearly 25% of the pallet shipments from its Gonesse site near Paris to third-party carrier Mazet.

Family-owned transport firm Mazet has a fleet that runs on 50% rapeseed biofuel, with the product sourced locally from French growers. Its partnership with Manutan covers 11 departments across France.

CEP supports local farmers

CEP has partnered with Oklima – a subsidiary of power giant EDF – to support two low-carbon agricultural products near the office products vendor’s French production facility.

By providing financial support to two local farmers in its decarbonisation efforts, CEP will be able to offset its residual emissions.

The goal is to remove more than 350 tonnes of carbon dioxide from the agricultural production chain over the next five years.

ACCO Brands EMEA has achieved an improved score this year from sustainability ratings organisation EcoVadis. The vendor has been awarded the EcoVadis bronze medal for 2024. The award places ACCO Brands EMEA in the top 24% of companies rated by EcoVadis in the ‘manufacture of other articles of paper and paperboard’ category.

This compares favourably to its previous assessment, when ACCO came in the top 50%. The company scored particularly well on environmental topics, placing in the top 9%, and on sustainable procurement, ranking in the top 8%.

Jacqueline Wellhaeusser, Sustainability Director at ACCO Brands EMEA, commented: “This considerable improvement in our second review shows our focus and commitment to our sustainability programme, which we have had in place for more than 14 years. [It also demonstrates] that our strategy and plan are the right ones to help us continually improve working sustainably and protecting the environment.”

14 www.opi.net

SMALL TALK

A VIEW FROM THE TOP

Tom Tedford took over as CEO of ACCO Brands last October. Shortly after the publication of the company’s annual results, he was the guest on the OPI Talk podcast and spoke about some of the recent developments at the leading business products vendor

The handover with

Boris Elisman

The backdrop in which we’ve done the transition continues to be challenging. Certainly, the environment that we operate in hasn’t improved or changed.

It’s been tremendously helpful having Boris around; he is a very tenured CEO and understands the nuances of our business like few others do. He’s a great mentor and has been invaluable to lean on as we’ve transitioned. His time on the board is wrapping up and we’ll miss him dearly.

From three reporting divisions to two There was a combination of factors in play as we considered various structural options. It was really a decision to help move key leaders like Cezary Monko (now VP, International) and Pat Buchenroth (now VP, Americas) into roles where they can make the maximum impact. It moves them closer to our customers and commercial activities and also enables them to become more engaged in activities such as product development.

In addition, it was an opportunity for us to delay and simplify the organisational structure – which gives us a chance to make decisions more quickly. Ultimately, we settled on two segments and a global supply chain, which we think best sets us up for future success.

We have a terrific team in Australia and New Zealand led by a great leader, Adam Colman. I feel we are in a really good position in these countries. The intention is that Cezary will spend a little more time there, perhaps bring 16 www.opi.net

Tom Tedford

in some new product ideas or look at potential acquisition opportunities.

On the ground, I’m not sure the local team will feel much change on a day-to-day basis; but hopefully, they’ll see more possibilities for introducing new products into the market and other actions that will drive long-term profitable growth for ANZ and the rest of the company.

2023 recap

At the beginning of the year, our number one priority was to restore the company’s gross margins. 2022 was a year in which we navigated unprecedented inflation and supply chain disruptions, and these negatively impacted our gross margins and cash flow.

It was really a decision to help move key leaders like Cezary Monko [...] and Pat Buchenroth [...] into roles where they can make the maximum impact

I’m very proud of our team and the work they did to restore margins. We are now back near to where we think we need to be, at pre-pandemic gross margin rates. We finished 2023 at 32.6%, which we believe is a fair return to the value that we add in the process of bringing product to market.

Overall, I would describe the year as ‘mixed’. Revenue was a bit weaker than we had anticipated, for reasons that are

well documented in the industry and across our categories. However, we managed the things we can control quite well; and now we’re starting to look ahead and really making some investments in product development, innovation, our team and our infrastructure to ensure we’re in a great position moving forward.

Category exits

Each year, our teams do a nice job of looking at our portfolio and making sure the products we have serve a purpose within our category strategies. Most of the business exits I referenced on the earnings call were concentrated in the US and related to private label listings.

With the inflation we’ve incurred, particularly in some raw materials that were used to make those products, we just felt they no longer serve a strategic purpose. Our decision will have an impact on our top line, but in the long term, it was the right move.

In addition, we are exiting certain product categories within the wellness space. Pre-COVID, we decided to enter the air purification market; however, following the pandemic, there was a proliferation of products that really drove down the price points. Therefore, we made the difficult decision to exit air purifiers but will continue to support wellness in other areas.

R&D focus

I’m really energised by the team and the work they’re doing. We’ve got a number of exciting developments, although it’s probably a little early to talk about them; I don’t want to get ahead of our commercial teams.

In the recent past, we have had a strong emphasis on gaming and technology products. Going forward, we’re going to be a little more balanced in our approach; we have a big core

business that we’re very proud of, and we’ve got to lean in there a little more aggressively.

Hugh Darcy, who is based in the UK, will be working across our business driving many of our core categories. That said, we’ll keep local product development as well where that makes sense. We’re excited about the future of the product roadmap and the launches we’ll be bringing to market over the next couple of years.

Regarding some of the current supply chain challenges, we will look at things on a case-by-case basis

The supply chain

Greg McCormack is now leading our global supply chain. He’s taking a holistic look at everything we do so we can share best practices throughout our operations. Ultimately, the objective is that one leader will focus on driving improved inventory turns, freeing up cash for us to reinvest in our business while providing best-in-class customer service in our categories.

Regarding some of the current supply chain challenges, we will look at things on a case-by-case basis. We have a diversified and robust supply chain; some product we make locally, some we source and we have multiple countries of origin.

Naturally, we pay attention to geopolitical issues. We may have to lean in with some additional safety stocks in certain categories that we’re sourcing from the Far East. However, we have a good balance to our supply chain, so while there are probably some headwinds at the moment, we also have some tailwinds in other areas that should enable us to offset these.

TruSens: ACCO Brands is exiting the air purification category

April/May 2024 17 SMALL TALK

Tom Tedford

DRIVING progress

Rising from the ashes to dominate the business supplies e-commerce space, the journey of Denmark-based Lomax is one of resilience, versatility and strategic foresight

Kenneth Borup has dedicated his career to the business supplies sector, with the majority spent at Lomax, Denmark’s largest specialist online office supplier. Lomax’s expertise in e-commerce and digital marketing recently drew attention from Lyreco, Europe’s leading business supplies reseller. However, the potential acquisition was ultimately abandoned by both parties in Q4 last year.

As CEO, Borup champions Lomax’s dynamic growth and expansion while ensuring a positive company culture remains a top priority. So, it is no surprise that his industry-wide respect was cemented when he won the Business Leader of the Year award at the 2023 European Office Products Awards OPI’s Steve Hilleard spoke with Borup to uncover the strategies behind Lomax’s achievements.

OPI: Could you start by sharing a bit about your background and your career journey?

Kenneth Borup: After a basic business school education and serving in the military, I became a trainee at office supplier Barfod from 1997-1999. Interestingly, during my tenure as a trainee, Barfod was acquired by Lyreco – so it was a case of déjà vu when Lyreco expressed interest in acquiring Lomax in 2022!

After my training at Barfod/Lyreco, I transitioned to Lomax in August 1999 as a product manager for office supplies and eventually took on additional responsibilities for the technology and office furniture categories. By 2002, I’d advanced to the role of Marketing Manager and later became Marketing Director, overseeing all marketing initiatives, product assortments and procurement. Importantly, I

also laid the groundwork for our e-commerce presence – we didn’t even have a website when I started in 1999.

I spent many years as the Marketing Director at Lomax and was promoted to COO in 2015. By 2017, I ascended to the CEO position following the retirement of our then-director, Michael Lerche, who nominated me as his successor. This August marks my 25th anniversary with Lomax, totalling 27 years in the industry. It’s been an incredible journey.

OPI: Alongside your career at Lomax, did you pursue any further education?

KB: I joined the company at a relatively young age, so to catch up academically, I spent my evenings and weekends studying, earning a Graduate Diploma in Business Administration and Law. I also have an MBA.

I don’t subscribe to the notion that the grass is always greener on the other side, which is why I’ve dedicated so many years to Lomax. Also, I really think the business supplies industry is amazing and very innovative in terms of product development, marketing initiatives and e-commerce.

18 www.opi.net BIG INTERVIEW

I don’t subscribe to the notion that the grass is always greener on the other side

OPI: I believe Lomax started in 1962?

KB: Yes. Lomax has a long history; but in December 1971, following a Christmas party, the company unfortunately burned down.

OPI: That must have been some party!

KB: (laughs) I’m sure it must have been, although the exact cause of the fire has never been made clear.

OPI: So Lomax started as a manufacturer?

KB: Correct. Until then, we had been manufacturing plastic products such as binders and covers. Following the fire, then-owner Niels Aage Risgaard decided not to reinvest in new machinery and shift from production to becoming a mail order company catering to Danish businesses.

It marked the beginning of our journey as office suppliers. Another major shift came in 2003 when our new, visionary CEO made a strategic pivot towards making Lomax an e-commerce-centric business.

I was responsible for making it happen – from assembling the right team to selecting and implementing the necessary systems to make it a reality. It was great to have support from the CEO at that point, as we were investing a lot of money in systems and hiring people. Incidentally, many of those skilled employees we hired at that time are still with us today.

OPI: Who owns the company?

KB: Lomax is primarily owned by two individuals with backgrounds in private equity, alongside a family-owned business which acquired a minority stake in 2019.

OPI: You’re the public face, but what does the rest of the management team look like?

KB: Besides me, the management team consists of six highly skilled members, many of whom have been with the company for a considerable time. Each person brings their

BIG INTERVIEW Kenneth Borup April/May 2024 19

own expertise and is responsible for different areas within the management structure.

OPI: How many employees do you have?

KB: We currently have around 220 employees.

OPI: Is that just in one location?

KB: Our head office is in Frederikssund, with facilities in Odense and Jutland. Lomax has also expanded into Sweden, where we also have an office.

OPI: As an e-commerce player, what’s the structure for managing the flow of products from manufacturers to customers?

KB: Our logistics are diversified across three main methods. Our primary warehouse is located alongside our headquarters in Frederikssund. As our business experienced significant growth, this facility began to reach capacity with a number of products.

Instead of investing in a new warehouse, we partnered with a third-party logistics (3PL) provider in Denmark for our larger items, such as furniture. The bulk of our product lines are still managed through our primary warehouse.

The 3PL partnership was a good decision because if we had bought a new warehouse, there is a chance it would again be too small for us today. Instead, we have flexibility and scale with the current set-up.

The disadvantage of operating more than one warehouse is the potential for splitting orders, which can sometimes lead to higher

costs due to handling expenses at both our primary and 3PL warehouses. However, the clever part is that orders are often consolidated at the same terminal, allowing for a single delivery to the customer.

In addition to our warehouse operations, we use drop shipments for our extensive product range. Our assortment totals 35,000 on our Danish website, with the potential to increase even more.

OPI: The fact that you would have outgrown the warehouse you didn’t build suggests that you’re expanding quite rapidly. Could you please provide some insight into your financial performance?

KB: In 2023, sales reached €130 million ($141 million), and we are pleased with the profit margin. From 2019-2023, we achieved 85% growth, nearly doubling our revenue. This translates to a CAGR of 16%, which is due to a great effort from the whole Lomax team.

Over those five years, while the surge in demand for COVID-related products certainly contributed to our growth, our core business also expanded significantly.

We acquired many new customers during this period and I’m proud that we have successfully retained those we gained during the pandemic. Last year, we continued to see strong growth from our core business.

OPI: I know from speaking to other players that operate e-commerce-driven businesses

BIG INTERVIEW Kenneth Borup 20 www.opi.net

that the cost of customer acquisition can be high. From what you’re telling me, you seem to be managing that process quite well.

KB: We position Lomax as a one-stop shop for business supplies, differentiating ourselves through a broad assortment of 35,000 items. While our range is expansive, we focus on a wide rather than deep selection of products. We employ two main strategies to engage and retain customers: our gift and bonus concepts. Our gift concept is straightforward: buy certain items and receive a gift. It has been a successful strategy, with multiple gift promotions running each week.

The bonus concept, however, plays a crucial role in customer retention. Instead of offering discounted prices to large customers, we reward them with higher bonus percentages, removing the need for individual pricing adjustments. For example, a customer can earn a 5% bonus over a quarter, which can be used in the following quarter to purchase products; although unused bonuses expire. Besides these tools, customer satisfaction is our main priority. Behind me is a screen where I can see how customers rate us and their feedback. Sometimes, there are important insights gained from this.

OPI: It sounds like quite a labour-intensive task for an e-commerce business. Do you have a lot of salespeople handling this?

KB: Actually, the bonus concept operates automatically, streamlining the process significantly for us. As a primarily e-commerce business, we don’t rely on a traditional salesforce on the road.

We position Lomax as a one-stop shop for business supplies

However, we do have a sales department that handles inbound calls and conducts outbound calls. The account management group is responsible for some of the bigger clients and prepares custom offers, such as quotes for bulk orders of office chairs, for example. We also have specialised teams for office furniture and Christmas gifts.

OPI: Is there a sweet-spot client?

KB: Our core focus is serving small and medium-sized businesses, which constitute about 80% of our clientele. While we engage with larger corporations, they are not our primary target. They often deal with the big contract players and turn to us for the items they can’t source from their primary supplier.

Government business is another area we engage in, albeit to a lesser extent, as it requires participation in specific purchasing agreements, which we have opted not to pursue. We also cater to individual consumers, representing about 5% of our sales. While we obviously don’t say no to business from private customers, it’s not a demographic we specifically target.

OPI: But your website is open to anyone?

KB: It’s completely open, which means we benefit from traffic-generating activities such as Google Ads, organic search etc, and we have a team responsible for that. While 90% of our revenue is online, it’s vital we remain very focused on traditional customer service.

For instance, we have a rule in the sales department whereby incoming calls must be answered within seven seconds or else a screen will go red. It’s very important that customers can easily contact us, which is often not the case for many e-commerce companies.

OPI: With the growing interest in AI, how do you see it playing a role in your operations?

KB: We recognise the immense potential of AI and are actively incorporating it into Lomax’s workflow. We’ve established an AI support team, with designated AI ambassadors including technical experts and department representatives, to identify areas where it can streamline manual processes.

The goal is to minimise time spent on manual tasks, redirecting efforts towards more strategic and rewarding activities. It’s quite a big focus area for us and we’re striving to take full advantage of it across our business and incorporate it for different purposes.

OPI: What does the Danish business supplies market look like in terms of the competitive landscape and where does Lomax rank in the top five?

KB: Denmark’s business supplies market is vibrant and healthy, albeit with noticeable consolidation trends. Lomax is the leading e-commerce entity in this space, having captured a significant market share. Other players engage mainly on the contract side; and the market also features niche operators specialising in specific segments such as technology, furniture or warehouse equipment.

OPI: What about the dealer community – are they a strong force in your market?

KB: Independent dealers are also pursuing the SMB market, so they are competitors; as are the niche e-commerce players because they have a strong focus within their product category and are often quite aggressive online.

BIG INTERVIEW Kenneth Borup April/May 2024 21

OPI: Let’s discuss Amazon. It doesn’t have a presence in Denmark yet, correct?

KB: That is right. Amazon is not present in Denmark. However, it operates in Sweden and Germany, which Danish businesses can purchase from. In reality, I don’t believe this happens frequently. So at the moment, we have not really experienced the big pull from Amazon in our segment. And from what I understand, its performance in Sweden hasn’t been particularly good.

OPI: Why do you think that is?

KB: I believe it largely comes down to the maturity of the e-commerce landscape. When Amazon expanded into the US, Germany and the UK, the e-commerce sectors were not as mature as they are today. However, in places like Sweden, there were already some very good online players when it entered the market. So I think Amazon has a harder time now than in the early days of e-commerce.

This is also evident in the Netherlands, where Amazon has struggled against established e-commerce player Bol. Although there have been rumours for years that Amazon will enter Denmark, we’ve yet to see it happen.

Even if they do enter this market, the business model of purchasing from a supplier that is not a well-known local Danish one might be a barrier for business customers.

OPI: Moving on to the Lyreco situation, remind us why you and the board of Lyreco thought it was a great fit.

KB: Well, Lyreco wanted to buy Lomax and it was a strategic fit because we operate in distinct but complementary market segments. Lyreco focuses on contract business, catering primarily to larger clients and the public sector; while Lomax serves small and medium-sized enterprises with an e-commerce model.

Lyreco’s interest in acquiring Lomax meant it could enhance its capabilities in e-commerce, leveraging our expertise in this area. From our side, we could obviously have benefitted from this major player in many ways, including possibilities outside of Denmark.

OPI: You came under pretty intense scrutiny from the Danish Competition and Consumer Authority (DCCA). What are your thoughts on the decision that it came to?

KB: It was a long journey – 18 months – and the process focused heavily on how the market is defined and the consequent implications for market share. Let’s just say we didn’t hold the same view on how the market should be defined or the assumptions the DCCA made –this eventually led to a negative outcome.

I have only positive things to say about Lyreco – a professional approach throughout the process and a great impression of those I had contact with. A lot of energy went into this, so of course both parties were disappointed.

OPI: What was the impact on the business?

KB: My job, and also that of the management team, was to run the business as usual during this period. Our employees also needed careful management during this time, so it was very important to me to be as transparent as possible and ensure they were informed and felt secure.

OPI: When the deal was called off, I think you said you’d look at exploring some growth opportunities. What exactly does that mean?

KB: First of all, there’s plenty of room to grow in the Danish market – not only in terms of taking market share but also diversifying our product offering. Second, there is the Swedish and broader Nordics market, where we have only really just got started but are witnessing record progress already. We can come on to that later. And, finally, we are exploring avenues for growth through potential new ownership structures.

We have a holistic approach [...] as regards e-commerce. It’s not just about having an online department

OPI: Essentially, you’re suggesting that, given the right circumstances and a suitable buyer, there’s a possibility for the business to be sold?

KB: I would say most businesses are open to being sold and Lomax has now been under its current private equity owners for a decade.

OPI: What would you be looking for if a new business were to come along and talk to your current owners?

KB: There’s actually quite a lot. I would say an ideal match would be if a company is seeking to establish or expand its market presence in Denmark, or maybe has ambitions in the rest of Scandinavia. Additionally, if it offers products not currently in Lomax’s portfolio, integrating these could leverage our extensive customer base. Equally, it could be a partner that could benefit from our expertise in e-commerce and, generally, from any synergies that could be achieved by sharing best practices.

OPI: The interest from Lyreco was partly due to your e-commerce expertise. What

BIG INTERVIEW Kenneth Borup 22 www.opi.net

makes Lomax stand out in terms of e-commerce and what have you developed that has resulted in this impressive growth?

KB: We have a holistic approach at Lomax as regards e-commerce. It’s not just about having an online department; every part of our organisation plays a role in making e-commerce a success. From the outset, I prioritised building our in-house expertise, opting to use consultants only for very specialised needs.

For me, a key lesson has been the importance of having the right team to fully exploit any system we invest in. You might buy one with the capabilities of a Porsche, but without the right people to ‘drive’ it, you’re never going to realise its full potential.

I have been working with e-commerce for years now and I would say the team has a deep understanding of what it takes to attract customers to the web shop and also what it takes to convert these customers.

OPI: Are there any e-commerce players that provide inspiration for you?

KB: Truthfully, when I need inspiration, I mostly turn to the major players in the US to see what they’re doing. Amazon is, of course, one – but you need to be careful. It may have a feature you like but it would probably cost a fortune to emulate. You have to be realistic and really prioritise your time and effort.

OPI: With 35,000 items available in your range, how do you view your assortment compared to others in the industry that might have over one million products?

KB: Naturally, we would like to have more items; but equally, it’s important to curate the range for customers – there is such a thing as too much. It can sometimes be easier for them if they only have a choice of 100 pens compared to 1,000.

Our assignment is to choose the right products for customers and not necessarily to have the deepest assortment within each category. However, in some areas, it would be great to have more items – particularly technology, where I believe we could easily double our range.

OPI: The dynamic nature of technology, with its rapid lifecycle changes and obsolescence, might mean changing your model a bit.

KB: Of course – you need to be very good at getting the new products in your system and making sure the process is smooth and easy if you want to have 100,000 technology items available. Plus, you need to focus on site search and filters.

OPI: Let’s get back to discussing Sweden. What’s happening with your current business there and the potential you see in similar markets?

KB: The decision to expand into Sweden was driven by the opportunity to capitalise on our existing logistics framework and e-commerce expertise for a smooth transition. The Danish and Swedish markets are quite similar in terms of culture and customer behaviour, including a high e-commerce penetration.

The Swedish market is characterised by one big operator – Lyreco – as well as smaller online players that purchase their products from distributors. This makes it quite easy to establish an e-commerce business but can make it harder to make a profit since you are paying more for the items compared with dealing with a supplier directly.

During the start-up phase, our focus wasn’t fully on Sweden due to the substantial demands from our expanding customer base in Denmark. We’ve now shifted our attention towards an ambitious growth plan for the country, constantly and meticulously reviewing our performance there.

Comparatively, year over year, we’ve seen growth rates of 190% – albeit from a relatively low base. The priority is to ensure we’re in the black in Sweden before even considering entering new geographic markets.

I really have a newfound respect for those businesses entering a new country where your brand is unknown and there are skilled players in the field already – it takes a lot of effort.

BIG INTERVIEW Kenneth Borup April/May 2024 23

My primary concern revolves around the timing and selection of new products to compensate for the decline in traditional office supplies

OPI: How long do you think that will be?

KB: There is a plan in place, but I don’t want to comment on it. I will say, however, that it won’t be too long.

OPI: It would be wrong to have an interview that didn’t mention sustainability. What role does it play in terms of the business?

KB: We aim to simplify the process for customers to make environmentally friendly purchases, creating a mutually beneficial scenario where they adopt greener practices and we meet our CO2 reduction targets.

But it’s not a one-man show; it requires a collaborative effort with suppliers to innovate and offer eco-friendly products. Patience is also key, as introducing green alternatives doesn’t instantly shift purchasing habits.

However, by creating an environment where customers can easily find green products, we make it as straightforward as possible for them to opt for sustainable choices.

However, it’s frustrating that the EU continues to impose environmental taxes, especially with the work it takes to obtain valid data.

OPI: Are these products growing in importance in your assortment in terms of sales and SKUs?

KB: Sustainable products have become a vital part of our range at Lomax. We’ve also been particularly successful in capturing market share for products that support environmental initiatives, such as waste-sorting solutions.

OPI: Beyond sustainable products, are there other categories experiencing growth?

KB: We’ve identified categories experiencing significant growth, but where our market share remains modest. Our strategy focuses on leveraging these areas of high growth potential where we have room to increase our market share, rather than constantly seeking to introduce new items.

This approach allows us to fully capitalise on the potential of existing categories before venturing into new ones. Currently, we’re witnessing growth in the catering and janitorial categories and are continuing to expand our PPE range. After a difficult year due to high interest rates, the office furniture category is showing signs of recovery and growth.

OPI: How would you define your leadership style? You’ve obviously had many influences, but you’ve only really been in one company for most of your career.

KB: Leadership, in my view, revolves around trust and delegation. I believe in assigning responsibilities to empower team members, making them feel valued and productive. My approach is to ensure discussions are constructive and I’m prepared to make swift decisions when necessary.

There are a lot of good ideas within Lomax. I think it’s a CEO’s responsibility to be highly involved in prioritising the best ones, but more importantly, to say no to those you don’t believe in and that will spread the company too thinly.

Having spent 25 years with Lomax, my deep understanding of the business allows me to delve into details and resolve issues effectively. It is great in some situations but can be time-consuming if you get bogged down by the minute details and lose focus on the bigger picture. I think one of my main roles is to be the guy who clears the obstacles – the ‘fallen trees on the road’, if you like. I do my best to remove the trees so the team can move on.

OPI: So what keeps you awake at night and what gives you hope for the future?

KB: My hope for the future is to achieve success beyond Danish borders while continuing to grow within Denmark. I am positive we will succeed on both these fronts.

My primary concern revolves around the timing and selection of new products to compensate for the decline in traditional office supplies. It’s a delicate balance and we need to be on top of this.

OPI: I think everyone reading this article is likely facing the same challenge as you.

Thanks, Kenneth.

BIG INTERVIEW Kenneth Borup 24 www.opi.net

Let’s STAY TOGETHER

The ODP Corporation will not be broken up… for now – by Andy Braithwaite

As OPI readers may recall, at the end of last year, investment firm AREX Capital Management issued an open letter to the board of The ODP Corporation (ODP). That document called for two strategic changes to be made: spin-off the Office Depot retail division and divest at least a majority stake in B2B procurement platform Varis.

Apart from a brief response thanking AREX for its input, there was a period of radio silence from ODP – until, that is, the publication of its 2023 earnings at the end of February. Clearly, ODP’s board had been busy behind the scenes working on the points AREX had raised.

As CEO Gerry Smith confirmed on the earnings conference call: “We re-evaluated the merits of fully separating our B2C business as a way to increase shareholder value. As part of this process, we retained a top three strategic consulting firm as well as the support of an investment bank to review the merits of a separation.”

THE RESULT?

“While we believe there is a significant value creation in our unique routes to market, at the present time, we do not see a full separation of our B2C business as a material avenue for

additional shareholder value creation, given certain dis-synergies and costs associated with the separation,” Smith stated.

Expanding on this topic during the Q&A session, the CEO confirmed ODP had used the same team that had worked on the company’s previous separation project in 2021-2022, with the conclusion that breaking up the company “doesn’t make sense […] at this time”.

He further commented: “The answer as of today is: keep it together, drive the four business unit (4BU) strategy, continue the low-cost model, buy back shares and drive cash flow and EBITDA.”

We do not see a full separation of our B2C business as a material avenue for additional shareholder value creation

2023 was ODP’s first full year operating under the 4BU model. This gives each unit –ODP Business Solutions, Office Depot, Varis and Veyer – responsibility for its own P&L. The thinking is that this will provide investors with more visibility into the company and stop them from valuing the business from a purely retail perspective. How long the 4BU structure stays in place remains to be seen.

26 www.opi.net

FOCUS

WHAT NEXT FOR VARIS?

Although the company has ruled out a near-term break-up of its B2B and B2C reselling arms, the future of Varis is less certain. A new, enterprise-wide initiative called Project Core (see below) includes a strategic review of the procurement platform, where the roll-out continues to be delayed.

The technology issues hampering Varis were still evident in the fourth quarter of 2023.

Its Q4 sales stalled at $2 million – which relates to legacy subscriptions from the February 2021 BuyerQuest acquisition – while it posted an operating loss of $15 million.

For the full year, revenue at Varis was just $8 million and it reported an operating loss of $63 million – although this was slightly lower than the $66 million operating loss in 2022.

In addition, a $68 million non-cash impairment charge related to goodwill at Varis led to ODP reporting an operating loss of $31 million for the final quarter of 2023. In all, the investment in Varis over the past three years is estimated at around $300 million.

[Varis] could also be on the chopping block, with the prospect of further steep losses being incurred

Is time running out for Varis? According to ODP’s revenue outlook for this year, it is forecasting “consistent trends” at the unit, which hardly seems encouraging. Furthermore, Smith confirmed that the review – which began at the end of last year – was not merely looking at cost optimisation, but “all alternatives” for this business. All should be revealed when ODP reports its first quarter earnings on 8 May.

ECHOES OF THE PAST

Back in 2017, ODP forked out $1 billion for IT services company CompuCom. The deal was heralded as the beginning of the transformation of the reseller “from a traditional provider of primarily office products into a broader product and business services platform”.

As we know, that move didn’t work out as planned. ODP cut its losses at the end of

2021 when it sold CompuCom – recognising a capital loss of $841 million.

Similarly, when ODP purchased BuyerQuest – the precursor to Varis – the message was that this move would “transform how businesses buy and sell”. Yet three years later, this venture could also be on the chopping block, with the prospect of further steep losses being incurred.

STICK TO THE CORE

The above certainly highlights the challenges with moving away from one’s central competencies; although it can be argued that CompuCom and Varis were/are by no means that far removed from delivering business products and services.

While there may have been execution problems, ODP is by no means alone. Other examples of projects that have failed to deliver include the Catch marketplace acquisition by Officeworks’ parent company Wesfarmers. This division posted a loss of A$163 million (US$107 million) in its most recent financial year.

Staying in that part of the world, New Zealand’s The Warehouse Group – which operates the Warehouse Stationery retail network – has just announced it is axing its own TheMarket online initiative after it racked up repeated losses over a four-year period.

A clue to ODP’s future direction could simply be in the name of its latest strategic plan – Project Core. This promises to “enhance the focus on the core business to support future profitable growth”.

While it is not clear what this means exactly, Smith and his team have done a good job of both reducing costs and restoring margins. Strong cash flow generation has also enabled robust share buyback programmes, which go down well with shareholders.

The $64,000 question now is probably whether ODP’s primary focus is being done with a view to making the business more ‘sellable’, or whether the reseller could actually play a more active M&A role over and above its successful Federation dealer acquisition strategy. Given current market dynamics, there would appear to be ample opportunities for further consolidation.

PROJECT CORE AT A GLANCE

• The third restructuring plan since Gerry Smith became CEO in 2017.

• Targeting annualised cost savings of between $50-$60 million.

• Involves “cost efficiency measures” across the whole enterprise, including Varis.

• Includes an expanded three-year $1 billion share repurchase programme.

• Will cost an estimated $20-$30 million to implement, with most of the expenses incurred this year.

April/May 2024 27 FOCUS The ODP Corporation

In PURSUIT of PUBLIC SECTOR SALES SPOTLIGHT

Venturing into the US public sector can be complicated. However, dealers that have a network of trusted partners, a strategy to build relationships and a comfort level with research can chart a path for success, says Steve Noyes

Amajor challenge post-COVID has been the struggle to accommodate the hybrid work environment.

The debate to return to the office, work from home or both continues to rage. But this is not the case at the Pentagon or military bases. As such, the opportunities here shouldn’t be underestimated.

The US federal government is the largest consumer in the world. Reports suggest that spending on products and services was approximately $700 billion in the most recent fiscal year. Meanwhile, the public sector as a whole – including federal, state and local governments plus the education vertical (aka the Fed-SLED) – has been growing over the past three years due to increased annual budgets and an expanded workforce.

As an example, federal agencies added 11,000 jobs in January 2024 – a 20-year high. These employees all need office products, imaging supplies, furniture, breakroom replenishment and jan/san items.

MAS APPEAL

Many dealers are interested in the General Services Administration’s (GSA) Multiple Award Schedule (MAS). 2024 marks the 40th anniversary of this programme. As OPI readers may be aware, the MAS is the federal government’s primary contract vehicle to acquire over 28 million commercial products and services.

There are currently 16,000+ contractors on the MAS. Reported sales for fiscal 2023 were $44 billion, constituting growth of 14% over the previous year. 53% of this volume was sold through a blanket purchase agreement. Approximately 80% of GSA contractors

are small businesses. The Small Business Administration policy allows agencies credit through MAS procurement to satisfy small business purchasing objectives. Meanwhile, certain buyers can establish set-asides to direct a percentage of spending volume to these companies.

GSA considers the small business community a very important constituency. Around 40% of the membership of the Workplace Solutions Association (WSA) holds a GSA schedule. The WSA is grateful to Erv Koehler, Assistant Commissioner, General Supplies and Services at the GSA Federal Acquisition Service, for serving as a featured speaker at the annual WSA Legislative Advocacy Summit in Washington (DC) in April.

For those who invest the time in cultivating strategic relationships, the opportunity is significant

Within the MAS, most office and imaging supplies are sold through two Special Item Numbers (SINs). Revenues for these two SINs in 2023 were $66 million generated by the Office Supplies 339940 contract via 259 contractors and $47 million by the FSSI Office Supplies contract through 60 contractors.

The probability that business supplies dealers will maximise sales in this vertical increases proportionately to their understanding of the unique selection and purchasing processes involved. For those who invest the time in cultivating strategic relationships, the opportunity is significant. Conversely, those who apply for a GSA schedule and ‘post and

28 www.opi.net

pray’ that federal consumers may find them will likely fail to meet the sales requirement to retain their schedule. After December 2024, the revised clause I-FSS-639 sets a 60-month timeline to sell $100,000.

LEVELLING THE PLAYING FIELD

Industry has welcomed an array of enhancements to the MAS. The dedicated and talented team at GSA continues to drive innovation and improvements to level the playing field for reputable dealers and create a trusted marketplace for all stakeholders.

For example, the Federal Catalog Platform (FCP) is a web-based platform designed to give federal contractors quick and easy access to update their product offering on the MAS. The FCP improves data integrity by integrating with GSA contract writing systems.

Meanwhile, Category Management is a strategic approach employed by GSA to buy common goods and services organised under ten categories. Category managers and a team of experts within their respective market areas drive improvements, analyse spend data and measure efficiencies by using quantitative metrics, or KPIs, to track agency and government-wide category success.

Another feature is Demand Data, which enables dealers to make data-driven decisions regarding the selection and price of the products on their schedule. As Koehler reports: “Over half of the $1.5 billion in annual general supplies and services is represented by 5,000 items.” Koehler and his team have posted a Demand Data file every other month since March 2023.

OTHER CONSIDERATIONS

Among the purchasing objectives considered by the federal government is support of the AbilityOne programme. This is one of the largest providers of employment in the US for people who are blind or have significant disabilities. In 2023, this initiative employed over 40,000 people and generated sales of more than $4 billion.

Almost 300 authorised AbilityOne distributors have access to sell products from this dynamic portfolio. Policies and regulations prevent ‘essentially the same’ (ETS) SKUs from being featured on the MAS. If a SKU has the same form, fit or function as an AbilityOne product, then it is identified as ETS and must be removed from the MAS.

For the past few years, OPI has been following GSA’s Commercial Platforms Initiative (CPI), an online marketplace aimed at providing more visibility on ad hoc spend on everyday items by Federal Purchase

Card holders. As it currently stands, the CPI includes Amazon, Overstock and Fischer Scientific, with Phase 3 expected to be launched later this year. Aspirations include a greater opportunity for independent business supplies resellers to participate outside of a third-party marketplace model.

OVERCOMING CHALLENGES

Steve Noyes represents TRI Industries and Clover Imaging Group. His practice assists companies in maximising their sales to the federal government and the public sector. Previously SVP of Global Accounts and Public Sector Sales at Clover Imaging Group, he founded Noyes Associates in May 2023

The requirements imposed on dealers involved in the MAS have certainly enhanced the shopping experience. However, liabilities have driven certain businesses away. For example, misrepresentation on the MAS can be considered a felony offence and may be prosecuted under the False Claims Act. Consequences may include penalties of up to three times the selling price (factored from the date of the first sale), legal fees, court costs, loss of schedule, debarment, criminal prosecution and even incarceration. There is no doubt that buying for, and selling to, the federal government can be a challenge. Some have compared it to solving a puzzle. Here are some best practice recommendations for dealers to consider:

• Prospect early and before the release of a bid or request for quotation.

• Build relationships with decision-makers and shape the bid before it is released.

• Research the quantity purchased and qualify why certain brands and SKUs have been selected.

• Sell what sells, but steer what your customers buy.

• Audit, update and challenge their previous purchases.

• Make recommendations about how you can help satisfy purchasing objectives.

All of the above can establish your company as a ‘go-to’ trusted resource rather than just another vendor.

SPOTLIGHT P ublic S ector S ales 30 www.opi.net

CATEGORY UPDATE

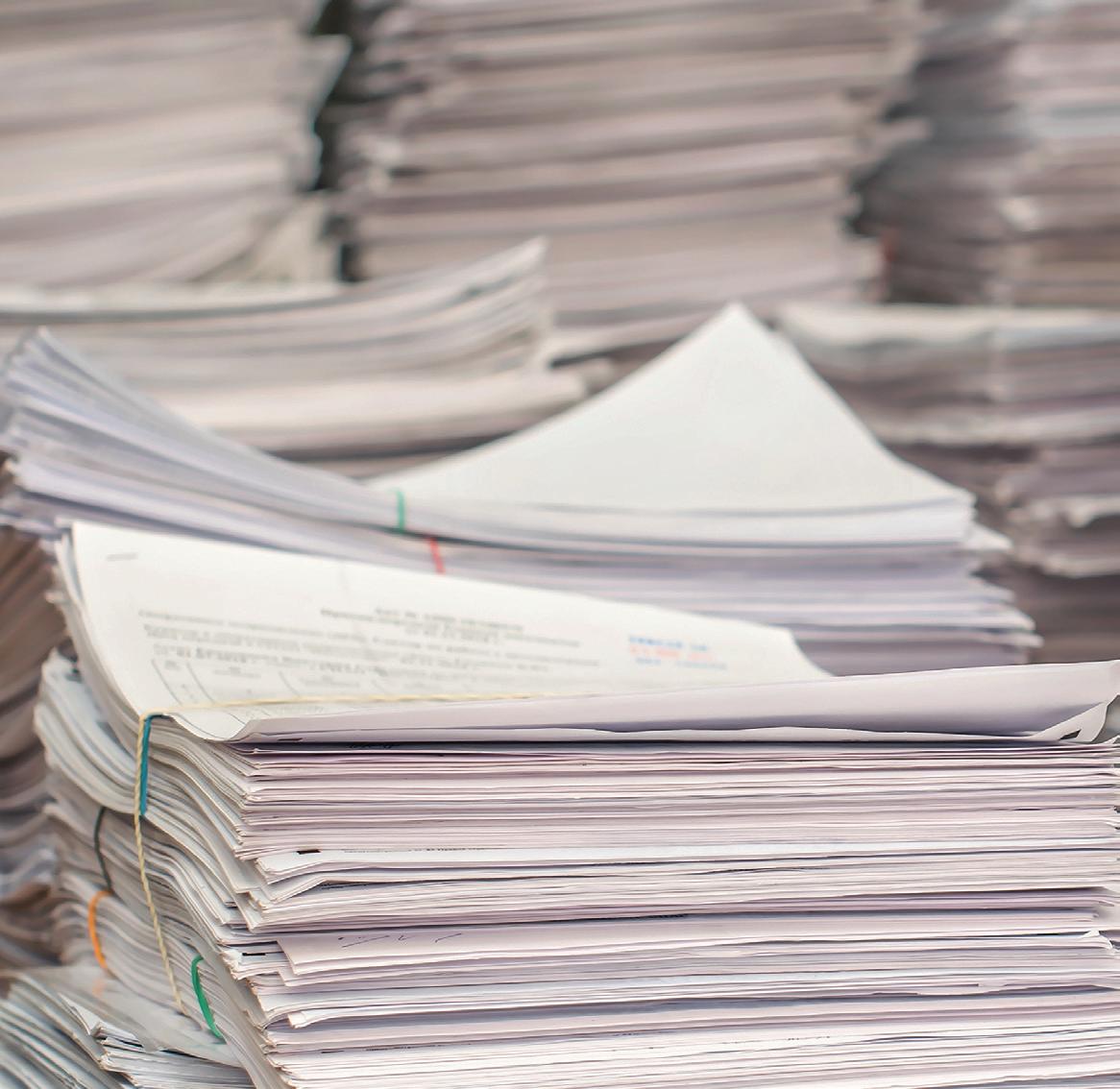

PAPER trail

The office paper industry, influenced by global events and economic uncertainties, faces a future that is challenging to forecast – by David Holes

The office paper industry is navigating through turbulent times, with a convergence of factors posing difficult challenges. In an increasingly unstable global landscape, currency fluctuations, geopolitical unrest, raw material inflation, capacity reductions and mill closures are creating a perfect storm that is proving tricky to weather.

The ongoing crisis in the Panama Canal, coupled with current tensions in the Middle East and the ensuing turmoil in the Red Sea have added more fuel to the fire. These events have led to a decrease in shipping volumes and increased prices for imports from Asia.

DAMPENING DEMAND

Eric Kriegsman, Senior Manager Purchasing & Assortment at RAJA Group-owned Viking, observes that these circumstances are prompting European producers to ramp up their production capacity.

He adds: “Despite experiencing price decreases in 2023, the industry has seen a reversal this year, with manufacturers announcing their intent to further increase prices to regain profitability. However, end consumer use is still declining and we feel that the industry is killing itself by dampening down demand for its products.