CENTRAL FLORIDA

Spring is Blossoming

CAICF.ORG | 1ST QUARTER 2024

TIMES

CONTACT INFORMATION

P.O. Box 941125

Maitland, FL 32794 www.caicf.org

407-913-3777

Reini Marsh, CED exdir@caicf.org

Membership Manager Tara Ruch membershipmanager@caicf.org

2024 BOARD OF DIRECTORS!

Brian Jones, President

Stefanie Nicholson, CMCA, AMS, Vice President

Tracy Durham, CMCA, AMS, CFCAM, PCAM, PresidentElect

Leslie Ellis, CPA, MSA, CGMA, Treasurer

Jessica Cox, Secretary

Patrick Burton

Stacey Loureiro, CMCA, AMS

Jarad Pizzuti, Past-President

Jackie Swisher

Tom Wheir

Ken Zook, LCAM, CMCA, AMS, PCAM, LSM

A Message from the President

Serving as your Board President is a great honor, and I am proud to serve alongside each of you in this great organization. As a Florida native, I attended Winter Park High School and graduated from the University of Central Florida. For the past 5 years I have served as the Vice President of the Avalon Park Property Owners Association. As a resident and Board Member, I thoroughly enjoy making Avalon Park a better community, in collaboration with other leaders and organizations of East Orlando.

As a community leader, I was introduced to CAI by our Past President – Jarad Pizzuti. I am very thankful to have been introduced to this organization and Board of Directors in March 2022, and the work since that we have accomplished. Recently, our CAI Board of Directors established the “Chuck Strode Memorial Grant” and last month we awarded our first grant recipient for 2023. Also, we enhanced our CARES charity committee by placing our focus on two partnerships with two local non-profit organizations: The Mustard Seed of Central Florida and The Faine House.

The Mustard Seed is the only local Furniture and Clothing Bank and has served our community for the past 35 years. For a decade, The Faine House has operated a 7,000 square foot facility in Orlando. They host ten private bedroom suites for 18–23-year-olds who are in desperate need of access to safety, stability, opportunity, and mentorship. Our Chairperson, John Calpey of One Florida Bank, has taken the lead and this committee has implemented initiatives to ensure we stay on track with our mission to build better communities.

Moving forward, I plan to focus on Member Experience. The members of this organization have built a great foundation of success over the years. To elevate this success, we are reorganizing our committees, ensuring that our chairpersons are aligned, and the hard work pays off with implementation and execution of important initiatives. While we enhance this important part of our organization, we are looking forward to engagement opportunities for all membership types, Board Leaders, Community Management, and Business Partners. Together we will seek to accomplish our goals and elevate CAI Central Florida, in hopes of exceeding expectations.

Thank you for supporting our Central Florida Chapter. As we move forward in 2024, I encourage you to tell a friend or colleague about your experience at CAI and invite them to attend our next luncheon. Additionally, your feedback is valuable, so I invite you to connect with me soon to share your experience and ideas for our future.

Sincerely,

Brian Brian Jones

Vice President, Hotwire Communications 2024 President, Central Florida Chapter CAI

TOPIC

QUARTER

1ST

2024

www.caionline.org #WeAreCAI

If you are interested in getting more involved in the chapter, joining a committee is a great thing to consider. Below are the different committees that we currently have active. Please feel free to contact any of

CA Day/Trade Show Committee

Christy Raymon

Don Asher & Associates christy@donasher.com

Communications Committee

Benjamin Isip Towers Property Management, Inc. ben@towerspropertymgmt.com

Education Committee

Suzan Kearns

Premier Association Management suzan.kearns@premiermgmtcfl.com

Meet the Managers Committee

Angela Timmons

Greystone Management angela@greystone-mgmt.com

Gala Committee

Ken Zook Waterford Lakes ken.zook@mywaterfordlakes.org

Golf Tournament Committee

Seamus Devlin RL James sdevlin@rljames.com

Legislative Committee

Tom Slaten

Larsen and Associates tslaten@larsenandassociates.com

Shayla Mount

Arias Bosinger sjmount@ablawfl.com

Membership & Registration Committee

Mary Ann Sheriff

One Florida Bank msheriff@onelforidabank.com

Social Committee

David Cofressi

Behr Paint dcofressie@behr.com

Cares Committee

John M. Calpey

One Florida Bank

jcalpey@onefloridabank.com

Finance Committee

Leslie Ellis Glickstein Laval Carris LEllis@glccpa.com

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 3 interested in getting more involved? join a caicf committee!

the following committee chairs:

MAY 8–11 | LAS VEGAS

three days of exceptional education , networking,

party, and the infamous Friday night bash! JOIN YOUR COMMUNITY ASSOCIATION COLLEAGUES

For

CAI chapter

Chapter News

BY REINI MARSH, CHAPTER EXECUTIVE DIRECTOR

Happy Spring! While the oaks continue to drop leaves and pollen covers our cars, we are happy to welcome back our warm sunny days. It will be summer before we know it. With this great weather we’re having, we have a wonderful opportunity for our members to help our community. On April 5th, join us for a Volunteer Day from 1:30pm-3:30pm to help hang clothes, straighten the linen, and dish rooms, as well as move furniture at The Mustard Seed. Closed-toed shoes are required.

The Trade Show was a huge success once again and I thank all of you for your participation. I can’t help but admire all the innovative decorations and costumes that the exhibitors came up with. It was a blast to see all those booths celebrating the theme. The interactions between the CAMs and board members at the booths were impressive. Our committee has already started the process for the next Trade Show. The best thing about our show this year was Expo Pass and our on-site badge printing. A lot of time and effort went

into learning the software and going through all the training so that we could make the process seamless for our registered attendees. Success! Thank you to Tara Ruch for all her efforts and thank you to our Trade Show Committee! Check out some photos on pages 24-31 and on the Chapter website you can also view videos of the event at caicf.org/ca-day-trade-show-2024.

As we kick off all the committee meetings, we want to stay strong with participation. You should be receiving an email for a Zoom call to begin our planning. If you were not able to attend the January meeting when we did committee sign-ups, please let me know and I can add you to the list. We’d love to start a Young Professionals Committee; if you are interested in that, please contact me!

We have a lot going on this year with more events in Brevard County and also in Volusia County, which is new this year. Thank you to all my volunteers! Without you, I could not do this job that I love.

4 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024 FROM THE CED

A Proven History of Management Excellence

A Proven History of Management Excellence

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 5

2024 Calendar of Events

More details regarding upcoming events will be posted to caicf.org under the “Events” tab. Check back regularly for the most up-to-date information. CAICF Board Meetings will be held before or after each of the Monthly Meetings. Please be sure to register for all events in advance, as we need an accurate head count for space and food purposes prior to the event. Thank you for your help!

• April 4: Monthly Meeting Luncheon - Orange County Neighborhood Services Division at Azalea Lodge at Mead Gardens. Registration begins at 11:30am and the program begins at 12pm. Manager Members & Homeowner Leaders (HOA Board Members) are FREE and Business Partners cost $37. Click here to register.

• April 5: Volunteer Opportunity at The Mustard Seed of Central Florida from 1:30pm-3:30pm. Please wear closed-toe shoes. Kindly RSVP so we can gather a head count (click here) and fill out the Volunteer Application. Please click here to download the PDF of the Volunteer Application.

• April 18: Brevard Meeting Luncheon - For the Love of Trees presented by Craig Houston of BrightView at Suntree Country

Club in Melbourne. Registration begins at 11:30am and the program begins at 12pm. Manager Members & Homeowner Leaders (HOA Board Members) are FREE and Business Partners cost $37. Click here to register.

• April 25: Happy Hour at Park Avenue Tavern from 4pm-7pm. There is no fee to attend the event, drinks and food are on your own, but kindly RSVP so we can get an accurate head count for the venue. There is a parking lot across street from Park Avenue Tavern and a parking garage around the corner off of W. Lyman Avenue. Click here to register.

• May 2: Monthly Meeting Luncheon at Azalea Lodge

• June 6: Monthly Meeting Luncheon at Azalea Lodge

• July 11: Meet the Managers

• August 1: Monthly Meeting Luncheon at Azalea Lodge

• September 5: Monthly Meeting Luncheon at Azalea Lodge

• October 3: Monthly Meeting Luncheon at Azalea Lodge

• October TBD: Annual Golf Tournament

• November 7: Monthly Meeting Luncheon at Azalea Lodge

• December 5: Holiday Gala & Annual Meeting

SPONSOR AN UPCOMING CHAPTER MEETING!

Each sponsor for the Chapter Meetings receive face time in front of the membership with the microphone to talk about your company. You will also be able to put give-away items and collateral on all the tables. Space is also provided for our sponsors to display their marketing materials. Every sponsor is important to our chapter and your generous donation goes directly to off set the costs of the program. Only three sponsors are permitted per program. Please consider sponsoring today!

CONTACT REINI MARSH AT EXDIR@CAICF.ORG OR 407-913-7777

LOOKING FOR A SERVICE PROVIDER?

CAI Central Florida has a list of great service providers in most every industry a Community Association could need! The best part is, they are members! Check it out at: caicf.org/directory.

6 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024 CHAPTER UPDATE

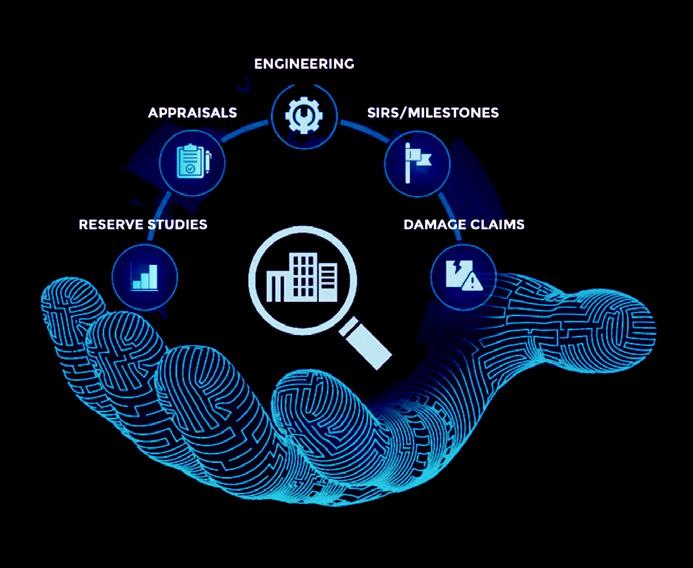

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 7 Assessing community priorities is complicated. NO NEED TO GO IT ALONE Our easy to understand reserve studies help your board make smarter, more confident decisions that support your community’s financial health. NOW OFFERING STRUCTURAL INTEGRITY RESERVE STUDIES For your reserve study proposal, contact us at (800) 980-9881 or visit reserveadvisors.com. 407.396.0529 yellowstonelandscape.com

Upcoming Workshops & Manager Education Classes

COMMUNITY CONNECTIONS WORKSHOP SERIES

This series is hosted in partnership by Orange County Neighborhood Services Division and the City of Orlando Office of Communications & Neighborhood Relations. The workshops are free to all and offered monthly. Please note, there are no workshops in December.

How to Organize/Reorganize Neighborhood Association

Saturday, April 13 from 9am - 11am

Internal Operations Center 1: 450 E. South Street, Orlando

Every neighborhood is vital to the overall health of our community. City and county neighborhoods teams want to assist residents with “getting organized” to make their community the best possible place to live. In this workshop you will learn about resources needed to create, maintain and reorganize a self-sufficient voluntary neighborhood organization in an effort to address challenges confronting neighborhoods. Click here to register on Eventbrite.

How to Avoid Leadership Burnout

Saturday, May 11 from 9am - 11am

Internal Operations Center 1: 450 E. South Street, Orlando

Too often, neighborhood leaders burn out because they allow their leadership responsibilities to be all consuming. In this workshop, you will learn strategies to rejuvenate yourself so that you can lead your neighborhood more effectively. Click here to register on Eventbrite.

Just Elected, Now What?

Saturday, June 8 from 9am - 11am

Internal Operations Center 1: 450 E. South Street, Orlando

Have you just been elected to the Board of Directors for your neighborhood organization? There are many questions that new board members have about their roles and responsibilities. This workshop will give you a better understanding of what to expect.

You will also have an opportunity to learn some tips from more seasoned board members. Click here to register on Eventbrite.

HOA & Condo Board of Directors Certification Training

Saturday, July 13 from 9am - 12pm

Internal Operations Center 1: 450 E. South Street, Orlando

Serving on a HOA or condominium association board requires Florida’s certification compliance within 90 days of being elected. This workshop will provide an overview of the many responsibilities and areas of oversight required by condominium and homeowners’ association board of directors. You will learn about condominium and HOA operations, records maintenance and owner access to records, dispute resolution options, budgets and reserves, election requirements and financial reporting. Click here to register on Eventbrite.

EDUCATION FOR MANAGERS

CAI offers many online learning opportunities (click on the dates below to register or obtain more information on these Live Virtual Courses) that lead to professional credentials. View the 2024 Education Catalog for additional resources.

» April 11-12: M-320 - High Rise Maintenance and Management

» April 18-19: M-100 - The Essentials of Community Association Management

» May 23-24: M-206 - Financial Management

» May 30-31: M-203 - Community Leadership

» June 6-7: M-100 - The Essentials of Community Association Management

» June 13-14: M-370 - Managing Developing Communities

» June 27-28: M-202 - Association Communications

» July 11-12: M-201 - Facilities Management

» July 25-26: M-350 - Manager and the Law

8 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

EDUCATION

9 Free Defect Inspection and Consultation Cost Estimation for Mediation Interim Repairs Waterproofing Sufficiency Of Settlement Analysis Destructive Testing Post Litigation Repairs Call For Your Free Inspection Today! info@empireworks.com 888.278.8200 www.empireworks.com Construction Management and Consulting Stucco Application Carpentry Deck Coatings Reconstruction Scope of Work Creation Construction Planning

NEW CHAPTER MEMBERS

BUSINESS PARTNER MEMBERS

Affordable Quality Roofing

Michael Dooley

Cloud 9 Service

Rick Fender

Concrete Textures

Allen Kreuscher

ET&T Distributors Inc

Erin Toung

Farha Roofing

Rich Wagner

Hogan Landscapes, Inc.

Brett Hogan

ICA Insurance Claims Advocates, LLC

Ricardo Barnes

Insurance General Contractors

Jeffrey M Ziemer, Jr.

Kasco

Marti Veatch

PowerPump

Pascale Van Cleemput

Radkin LLC

Lauronzo Garmon

RestoPros of Greater Orlando

Terri Lerner

Roof-A-Cide

Chad Gillyard

ServisFirst Bank

Jon Kolb

Smart Scoops

Lindsay Hinesley

Space Coast Pool School, LLC

Lauren Broom

Strive Engineering Group, Inc.

Fereidoon Angoory

BUSINESS PARTNERS CONTINUED

TEM Systems, Inc.

Ryan Mcintosh

The JD Law Firm

D. Jefferson Davis

White Oaks Landscape LLC

Chris Rogers

Willis & Oden PL

Patrick H. Willis, Esq.

NATIONAL BUSINESS PARTNERS

Pinnacle Financial Partners

Michael Coleman

The McGowan Companies

Joel W. Meskin, Esq., CIRMS

MANAGEMENT COMPANY MEMBERS

Bridlewood Real Estate Compay

Amber Clark

Solaris Management Inc

Kurt Von der osten

MANAGER MEMBERS

Jessica Finn Shearer

Edison Association Management

Seth Joseph Emmons, CMCA

Hunter’s Creek Community Association

Amanda Smith

Leland Management, Inc.

Tammy Collins

RealManage

Margaret Thiem Bodenrader

Ciara Alexis Ortiz

PUBLIC INTEREST PARTNER

City of Orlando

Cindy Light

VOLUNTEER HOMEOWNER LEADER MEMBERS

Cori Napolitan

Falcon Trace Property Owner’s Association, Inc

Marti Schmidt

Lake Ashton Homeowners Association

David Darling

Live Oak Reserve Homeowners Association, Inc.

Barbara Gross

Live Oak Reserve Homeowners Association, Inc.

Annmarie Hunker-huie

Live Oak Reserve Homeowners Association, Inc.

William Brooks

Redfish Key Villas Condominium Association

Geoff Alpert

The Plantation at Leesburg Homeowners Association

Jerry Tucker

The Plantation at Leesburg Homeowners Association

Suzanne Blandi

WANT TO JOIN THE CENTRAL FLORIDA CHAPTER?

Homeowners, Managers, and Business Partners can become members. If you provide products or services to community associations, CAI can give you direct access to thousands of potential customers and provide unique opportunities through networking luncheons, socials, and other great events. Visit caicf.org/resources/ membership to learn more!

10 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 11 STRATUS ROOFING “I absolutely would recommend Stratus Roofing to anyone looking to hire a solid, professional roofing company. They are exceptional at producing quality work, consistently meeting or exceeding deadlines, provide hands-on supervision on-site and are a company of absolute integrity.” — Property Manager, Mosaic at Millenia www.STRATUSROOFING.com (407) 625-5866 SHINGLES METAL TILE MODIFIED PVC EPDM TPO What our customers are saying… Our Customers… SPECIALIZING IN APARTMENTS & CONDOMINIUM COMMUNITIES Licensed & Insured CCC1326094 | CRC026344 A Community Management Company Built for Communities Scan, Click or Call 407-770-1748

SPECIAL ASSESSMENTS

Manageable Alternative to Costly, Immediate & Painful Special Assessments

BY SACHIN MEHROTRA, ASSOCIATION LENDING SERVICES

Q: Why do associations need special assessments?

A: To pay for an immediate expense for common area repairs and replacement projects stemming from causes such as age of the building, 40- or 50-year certifications and milestone inspection reports. The association also may be unable to pay for this large expense from its assets on the balance sheet.

Q: What is an attractive alternative to large special assessments?

A: Obtaining an association loan that is provided to the association under its corporate name (not to the individual unit owners) to pay for common area repairs and replacement projects, with no personal guarantees from any owner and no lien on any unit owner’s property. It helps stretch the payments and makes the total monthly assessments more manageable.

Q: How does an association loan impact those owners who do not want to participate?

A: An association loan offers a volunteer option for those with available cash and not wanting to participate and to pay their proportionate share upfront; hence, saving interest cost and related fees. The remainder of the unit owners that want a longer-term installment payment option now have a viable choice to meet their respective proportionate expense obligation for the common area repairs and replacement projects.

Q: How does an association loan give more financial control to the association’s board and property management in managing cost and cash flow?

A: By obtaining an association loan the Board and property management will not need to wait for each individual unit owner to arrange for their own financing to meet their respective portion of the common area projects and can focus on locking in the best possible price with several vendors quickly and potentially insulating the association from unnecessary delays and future price hikes. This can also prevent the need to piece meal projects and prevent patch work that may result in cumulative operating losses.

Q: What are the general terms, structure, minimum and maximum loan amount, and availability for association loans?

A: Loans are structured as interest only during the first few years of a construction/renovation phase, followed by monthly principal and interest payments, generally fully amortized over 5-10 years. Longer amortization periods (10-20 years) are made available subject to project size and financial strength of an association. Rates

are generally fixed for 5-10 years between 275 to 350 basis points above the current 5- or 10-years treasuries. There is no personal guarantee and/or real estate lien from any unit owner. Assignment of general and special assessments is the collateral. Typical loans are anywhere between $1-5 million, but some large projects can go well north of $10,000,000. Association loans can accommodate any amount as long as an association can financially afford it. These types of commercial loans are non-real estate secured and hence only the niche lenders play in this space, therefore it is best to work with a dedicated lending professional with significant experience to ensure that the single largest and most impactful relationship to the association’s balance sheet is handled right the first time.

Q: What are the pros and cons of an association loan and why is it likely the win-win for all?

A: Any loan requires an interest payment to have the ability to use other people’s money. So, the total cost on a stand-alone basis is higher but it is a reasonable and viable alternative to putting many owners at risk who have a fixed income and expense budget for their monthly needs. Those with the pocketbook to withstand a large onetime special assessment will not bear the burden of monthly interest payments. It can help preserve and grow everyone’s equity by not pressing several owners to put their properties untimely for sale.

Recognized for his extensive market experience and exceptional execution record, Sachin Mehrotra shines as a highly regarded professional in the Condominium Association and Investment CRE financing worlds. With an unwavering commitment to his clients, Sachin consistently delivers outstanding results, earning him a trusted industry reputation. His area of expertise is, effectively, structuring complex association and investment CRE financing transactions, in such diverse areas as Acquisition and Construction Financing, Capex Management, Ground-Up Development and Strategic Value Enhancement. With an impressive 20-year career in the industry, Sachin brings a wealth of experience to every client engagement, thus ensuring the opportunity to collaborate with a seasoned professional. For more information, contact Sachin at smehra@assoicationfinancing.org or visit associationlendingservices.com.

12 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

Pain�ng and Waterproofing

Commercial, High Rise & Condominium Buildings

Concrete Repair Specialists

Pre-Stressed, Poured in Place, Post Tension Systems

Urethane Deck Systems

Private Balconies, Walkways, Parking Garages & All Types of Elevated Concrete Surfaces

Addi�onal Services

Post Hurricane Reconstruc�on, Distributor, and Installer of PGT Hurricane Rated Windows & Pa�o Doors

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 13

(800) 755 - 3348 www.rljames.com

“

How to Protect Association Finances During Hurricane Season

BY TAMMY ZUKNICK, VICE PRESIDENT, ASSOCIATION BANKING, AMERICAN MOMENTUM BANK

Most Florida homeowners know what they need to do to prepare their property for an impending storm and the potential devastation that can follow. However, Florida’s storm season not only poses a threat to homes - it can also present risks to the financial health and safety of community associations.

These threats can range from insufficient funds to cover immediate necessary repairs to becoming a victim of theft.

With hurricane season approaching, read on for tips to help safeguard associations’ finances before and after a storm.

PREPARING BEFORE A STORM

It’s important that association managers and boards prepare for potential damage to their communities in advance of hurricane season.

For example, if a community association has not prepared accordingly and the power goes out or infrastructure is demolished, it’s difficult – if not impossible – to quickly access the information and resources they will need during the storm and afterward to begin repairs.

Prior to storm season, ensure your community has the following available:

Cash Reserves & Blank Checks

Communities that do not have cash reserves available could be waiting months – if not years – for their insurance claims to come through to fund clean-up and repairs.

Ideally, communities should aim to have enough readily available liquid cash to cover the expenses of disaster clean-up and/or to fund insurance deductibles immediately after a storm.

Also, make sure to keep a few blank checks on hand. That way, the community can hire and pay vendors, even if the banks or management company has lost power.

Updated Financials

Prior to a storm, make sure your community’s financials are up-todate and readily accessible. If you need to try to open a line of credit

Continued on page 16

14 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024 ASSOCIATION FINANCES

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 15 Engage.Envision.Engineer. KIPCON provides our clients with the most CUTTING EDGE DRONE TECHNOLOGY in the industry. Drone technology is now fully-integrated into all of our services, and increases quality and efficiency in a timely and cost-effective manner. THE FUTURE IS HERE. KIPCON provides our clients with the best Reserve Study Report for their community. The Kipcon Reserve Study +™ provides ongoing planing tools, including access to our online password-protected portal which allows the client to interactively adjust their Reserve Study. Engineering Consultants Reserve Studies, Transition Studies, Inspections and more Designs and Specs, Building/Site Kipcon Florida 8297 Champions Gate Blvd. #270, Champions Gate, FL 33896 Phone (407)782-5214 • jshannon@kipcon.com • Kipcon.com PAINTING & RESTORATION

ASSOCIATION OPERATIONS

or increase an existing line after a storm, you’ll have the required paperwork on hand.

Print hard copies and keep them safe so you can still access your financials if the power goes out.

A Trusted, Association-Friendly Banking Partner

Ideally, you’ll work with an “association-friendly” bank that understands communities’ unique needs after a storm.

For example, if your community needs a loan for repairs, the Assignment of Assessment Rights is the only form of collateral your bank should require. If the bank wants to mortgage your clubhouse, which creates significant closing-cost expenses, you may want to look for a bank specializing in association banking.

PROTECTING THE ASSOCIATION’S FINANCES AFTER A STORM

After Hurricanes Ian and Nicole struck Florida in 2022, we saw an increase in fraudulent activity and theft that attempted to take advantage of communities still in recovery.

Sadly, criminals prey on people and businesses that are upended by disasters, seeing them as overextended, less vigilant, and, therefore, less likely to notice their crimes. However, the good news is, the more communities are aware of these crimes, the better the chances of preventing them.

Here are the top two ways we’ve seen criminals trying to take advantage of disaster-struck communities and tips for protecting against these attempts.

Stolen Checks

In early 2023, we saw a significant increase in stolen check fraud cases involving clients in an area severely impacted by Hurricane Ian. It appeared there was a ring of criminals stealing mail in this area. Checks were stolen from the locked mailboxes of vendors, as well as from individual mailboxes within communities.

Several owners paying large special assessments for storm repairs had their checks stolen and fraudulently cashed. In one case, the criminal “washed” (erased) the payee’s name on the check, then wrote in another name so they could deposit the check into their account.

In other cases, stolen checks – unaltered – were deposited into criminals’ fraudulent accounts.

To protect against check fraud, management companies and selfmanaged associations should:

» Pay bills electronically, when possible.

» For checks being delivered via snail mail, have your mail carrier come into the office to collect the mail so checks aren’t sitting in a mailbox.

» If a check mailed to a vendor gets stolen, you should require that the vendor be on ACH moving forward. Often, check fraud can be an inside job committed by an employee.

Wire/ACH Fraud

“Spear-phishing” is a form of business email compromise where criminals send company employees fraudulent emails that appear to be from a trusted sender to induce them to reveal confidential information or perform an action that seems legitimate. Criminals use this prime tactic to attempt wire or ACH fraud targeting disasterstruck communities.

As one example following Hurricane Ida in 2021, a New Orleans condo association that was severely damaged fell victim to wire fraud. The association thought they were paying a contractor for repairs, but in reality, the $400,000 ended up in a criminal’s bank account.

These types of fraud can go on for years after a storm. Hurricane Ian hit in September 2022, and we caught a wire fraud attempt targeting a community impacted by that storm as recently as February 2024.

To protect against cybercrimes that could result in ACH or wire fraud, management companies and self-managed associations should be hyper-vigilant:

» When asked to send money electronically, speak to the vendor directly rather than relying on email communication alone.

» Train employees on how to detect fraudulent emails by noticing potential red flags.

» Verbally verify any electronic payment instructions directly with the vendor.

Hurricane season poses a number of threats to homeowners and communities, including to the association’s finances. However, association managers and boards that prepare in advance and know the risks following a storm – and how to defend against them – will be in the best position to protect their associations and homeowners.

Tammy Zuknick is Vice President of Association Banking at American Momentum Bank. For more information, Tammy can be reached at tzuknick@ americanmomentum.bank and 941-713-8523.

16 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 17 One Partner for All Your Landscape Needs Design • Develop • Maintain • Enhance Contact Us David George 407 341 1729 david.george@brightview.com www.brightview.com A Resident Expert in your Landscape Creating a place that feels like home starts from the ground up. Enlist a skilled team with deep expertise in creating outdoor spaces that increase property value and ensure your community is a coveted place to live. With thoughtful planning and an unwavering attention to detail, we ensure your community’s goals are met and resident satisfaction is high. allianceassociationbank.com Top 10 - Forbes Best Banks *All offers of credit are subject to credit approval. Alliance Association Bank, a division of Western Alliance Bank, Member FDIC. Western Alliance ranks top ten on Forbes’ Best Banks in America list, four years in a row. Managing and innovating association banking solutions is our business, so you can focus on growing yours. No-Fee Checking Accounts Online Banking Loans & Credit Solutions* ConnectLiveTM Software Integrations In-State No-Fee Lockbox Services ACH & Online Payment Services Specializing in: Meet Your Association Banking Experts: Paul Knuth, LCAM Senior Vice President (407) 865-4800 pknuth@allianceassociationbank.com Tyler Morton Sales Support Officer (772) 696-1566 tmorton@allianceassociationbank.com

RECENT LUNCHEON MEETINGS

18 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 19 A TRUSTED PARTNER FOR COMMUNITY ASSOCIATIONS

Metro District

Schmidt Community Association Specialist The Sherwin-Williams Company (352) 504-9079

understands the needs of HOAs and has the products and services to ensure long-lasting curb appeal

From premium paints that provide performance

protection to color design services, on-site assistance, maintenance

and more — we’re here to help throughout the state of Florida. © 2020 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. VLY0971 EXPERIENCE THE HOME OF HOA BANKING It’s time you had one place to go to meet all your HOA banking needs. Simplify your HOA banking experience today. Shelby Benson | VP | Business Banking HOA | COA Solutions Group 321.332.3186 or sbenson@valley.com

Orlando

Amber

Sherwin-Williams

and easy maintenance.

and

manuals

Toxic Water? When Community Ponds Can Become Deadly

ARTICLE & PHOTOS BY SOLITUDE LAKE MANAGEMENT

Most community waterbodies are man-made to prevent flooding and capture pollutants by collecting and filtering stormwater runoff. They can also offer aesthetic allure and recreational advantages, which may contribute to increased property values and community desirability. Despite these benefits, they can present substantial risks if not properly managed. Eroded shorelines may collapse, posing dangers to residents and landscapers. Nuisance weeds contribute to physical hazards in the water, while muck and debris can obstruct stormwater equipment, elevating the risk of flooding and damage to community infrastructure. However, one of the most significant threats often goes overlooked – algae.

Algae found in freshwater generally fall into two categories: filamentous algae form dense, slimy patches and planktonic algae have a dye-like appearance. Some species of planktonic algae, like cyanobacteria, can form harmful algal blooms (HABs).

WHAT ARE HABS?

Also referred to as blue-green algae, cyanobacteria are capable of producing toxins that can be harmful (and in some cases deadly) to fish, birds, livestock, and other mammals. Sadly, reports come out each year of dogs dying after exposure to cyanotoxins through swimming in or ingesting contaminated water. Toxins

can also become airborne, exposing both humans and animals to contaminated air droplets. This airborne exposure can lead to irritation of the eyes, nose, throat, and lungs.

While there is currently no evidence indicating HABs are lifethreatening to humans, their harmful effects cannot be understated. Exposure to cyanotoxins may result in a range of adverse effects, including vomiting, headaches, stomach aches, diarrhea, muscle weakness, dizziness, slurred speech, and liver damage. According to the Centers for Disease Control (CDC) and Prevention, there may be a link between prolonged toxin exposure and the development of neurological diseases, such as Alzheimer’s, Parkinson’s, and Amyotrophic Lateral Sclerosis (ALS).

The CDC reports that there is no specific diagnostic test, antidote, or treatment for cyanotoxin exposure, beyond management of the symptoms.

HOW DO HABS DEVELOP?

Like any form of algae, HABs typically develop in waterbodies that contain elevated nutrient levels. The combination of abundant sunlight and high temperatures facilitates photosynthesis,

20 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

LAKES & PONDS

Continued on page 22

Cyanobacteria toxic algae at a country club.

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 21 · Painting · Repairs · Interiors/Exteriors · Pressure Washing · Industrial Coatings · Pool Deck Restoration Leave it to Stephens Commercial & Residential • Licensed & Insured 407.676.1470 w w w. A l l S t e p h e n s . c o m Governance Meetings Made Simple Achieve quorum, pass bylaws, and reduce cost with the all-in-one virtual meeting and electronic voting solution that makes Annual and Governance Meetings a breeze. www.getquorum.com 1-877-353-9450 contact@getquorum.com

making mid to late summer the prime time for HAB occurrences. Cyanobacteria consume substantial amounts of dissolved oxygen (DO). In the event of a large bloom, rapid depletion of DO exacerbates the stress on fish and other aquatic organisms.

Evidence suggests that HABs are occurring more frequently. In recent time, there has been a notable upward trend in average summer temperatures, especially in Northern states. Runoff from roadways, urban developments and agricultural land, lawn fertilizers, sewage, and other pollutants introduces abnormally elevated levels of nutrients into our waterbodies, amplifying the conditions that fuel HABs.

HOW CAN HABS BE IDENTIFIED?

Cyanobacteria blooms often appear as blue, blue-green, or “pea soup” green scum that resembles oil or spilled paint on the water’s surface. In some cases, they can also appear red, brown, white, or gold. They may accumulate in specific areas of a waterbody due to wind or water currents, and multiple toxic blooms may occur simultaneously. Likewise, smaller or shallower ponds have the potential to form concentrated toxic zones.

A cyanobacteria bloom and the presence of toxins must be confirmed through professional water quality testing. Not all cyanobacteria blooms release toxins, but recognizing the signs is pivotal to protecting residents, employees, pets, and wildlife from potential harm.

HOW ARE HABS MANAGED?

If urgent management is necessary, professionals may apply an EPA-registered algaecide in an attempt to rapidly eliminate the bloom. However, toxins can be released during die-off. Even when cyanobacteria are no longer visible, there is no reliable way to remove toxins from the water. Managing HABs when toxins are present is challenging and may not always yield the ideal results. The most responsible way to keep humans and animals safe from cyanotoxins is through prevention.

An ongoing lake management program equips community leaders with proactive solutions to keep a close eye on the environmental conditions and detect imbalances that signal a bloom may be imminent. Water quality testing, nutrient management, fountains and aeration, and shoreline vegetation maintenance are central to a proactive water quality management program. And if serious water quality or shoreline issues do arise, aquatic experts can implement more impactful solutions like shoreline restoration and depth restoration to help improve water health and community safety.

Homeowners and staff also play an important role in preventing water quality imbalances. Remind residents to properly dispose of pet waste and trash. Ask landscapers to bag grass clippings and lawn debris, and limit the use of fertilizers. These small efforts can prevent excess nutrients and bacteria from entering nearby waterbodies.

While pond aesthetics are important, the well-being of residents should always take precedence. Property managers hold the keys to both. Through proactive strategies, collaboration with experts, and a steadfast commitment to ecological balance, stakeholders can work together to cultivate clean, beautiful waterbodies that enhance quality of life and elevate the desirability of their communities for years to come.

Everyone wants a beautiful lake but it’s not always easy, which is why SOLitude uses science-backed solutions to take care of algae, weeds, and other lake issues so you can avoid the frustrations and enjoy clean water. SOLitude’s team of aquatic scientists specialize in providing customized lake, stormwater pond, wetland and fisheries management programs. Services include water quality testing and restoration, algae and aquatic weed control, installation and maintenance of fountains and aeration systems, shoreline erosion control, muck and sediment removal and invasive species management. Contact SOLitude at 855-534-3545 or visit solitudelakemanagement.com.

22 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

POND

LAKE &

Cyanobacteria toxic algae closeup.

Cyanobacteria Toxic Algae

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 23 What’s Lurking Beneath the Surface in Your Community BOUTIQUE SERVICE | TOWERING CAPABILITIES Construction Legal Services | www.balljanik.com We handle claims on a contingent fee basis, advancing all fees and costs We have attorneys Board Certified in Construction Law by The Florida Bar We will partner with your current attorney for your association and solely handle the construction defect claim Do not let your claims expire! Call us at 407.455.5664 for a free inspection and report of any findings of construction defects

24 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 25

26 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 27

28 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 29

30 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 31

The Future of HOA Management: Why You Need to Modernize Now

BY MIGUEL GUINARD, CEO, EMPOWER HOA

As we transition into a more digitally connected world, HOA management isn’t just about maintaining physical spaces—it’s also about adopting technologies that facilitate easier living and better communication among residents. This article aims to underline the importance of modernizing your HOA management practices meeting current demands and futureproof your community.

THE RISE OF TECH-SAVVY RESIDENTS

Understanding the New Age Resident

The younger generations moving into homes today are already tech-savvy. They’ve grown up with smartphones, apps, and instant messaging. They’re used to having everything at their fingertips— literally. Even older demographics are increasingly comfortable using technology for a variety of tasks, from online banking to telehealth appointments.

Meeting Resident Expectations

Residents now expect this level of convenience from their HOAs. They don’t want to have to visit an office or make a phone call every time they need to resolve an issue or get information. They want to access services and information when it’s convenient for them, which is why digital solutions are no longer an optional luxury; they’re a necessity.

THE NEED FOR TRANSPARENCY

Building Trust Through Transparency

Residents have a right to know how their HOA fees are being utilized, what the community bylaws are, and how decisions are made. Transparency is a key component in building trust with your community members.

32 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

TECHNOLOGY Continued

on page 34

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 33 Serve up savings for your community A better internet experience for where you live starts here. Scan, click or call today! BLUESTREAMFIBER.COM/BULK CALL 888-960-BULK Save up to 50% on internet services "Devoted to the Personalized Representation of Community Associations" 111 N. Orange Ave., Ste. 725, Orlando, FL 32801 6767 N. Wickham Rd., Suite 400-H, Melbourne, FL 32940 www.ruggierilawfirm.com

TECHNOLOGY

Benefits of Digital Platforms

By adopting digital platforms, you make this information readily accessible. Online portals where residents can view budgets, meeting minutes, and upcoming projects not only boost transparency, but also reduce the administrative burden on your team.

IMPROVED COMMUNICATION

Bridging Communication Gaps

Communication is often cited as one of the most significant pain points in HOAs. Misunderstandings or lack of communication can lead to unnecessary conflicts.

Multi-Channel Communication

Through modern software solutions, you can streamline your community communications to provide real-time updates via app notifications, SMS, and emails. These multi-channel communication avenues ensure that every resident receives the information they need, in the format that works best for them.

EFFICIENCY & COST-EFFECTIVENESS

Streamlining Operations

Time is money, and in the context of HOA management, both are

often in short supply. The manual labor of tracking payments, scheduling amenities, and organizing board meetings can add up.

The Role of Automation

Automation takes these tasks off your hands, ensuring that processes run smoothly with minimal input. When you automate routine tasks, you’re not just saving time—you’re also making your HOA more efficient, which can result in financial savings that can be redirected towards community improvements.

LEGAL COMPLIANCE & SECURITY

Keeping Up with Regulations

Local, state, and federal laws regarding HOA management are in constant flux. Non-compliance can result in fines and legal headaches that no one wants to deal with.

Built-in Compliance Measures

Modern HOA management software can be updated in real-time to comply with new laws and regulations. This automatic updating can save you a lot of time and worry, giving you peace of mind about your community’s legal standing.

RESIDENT ENGAGEMENT

The Importance of an Engaged Community

An engaged community is a happy community. Engaged residents are more likely to comply with rules, pay their fees on time, and contribute to a harmonious living environment.

Tools for Effective Engagement

Features like online voting, discussion boards, and instant surveys on a digital platform can drive up resident engagement significantly. They provide avenues for residents to voice their opinions, get involved in community decisions, and feel like a part of the larger community fabric.

The shift towards digital isn’t just a trend—it’s the new standard for HOA management. If you’re not modernizing your approach, you risk falling behind and becoming obsolete in the eyes of your residents.

Miguel Guinard is the CEO of EmpowerHOA that offers websites and software, providing better value and support for your community, as well as seamless integration with your existing systems. For more information, call 407-901-4145 email Miguel at miguel@empowerhoa.com, or visit empowerhoa.com.

34 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 35 © 2024 Banc of California. All rights reserved. Member FDIC. YOUR VISION. OUR TAILORED SOLUTION. WE ARE THE BANC FOR COMMUNITY ASSOCIATIONS SmartStreet, powered by Banc of California, is a banking partner of choice in the community association management industry nationwide. Our extensive experience, industry-specific API integrated platform and in-depth understanding of your unique banking requirements allow us to deliver financial solutions to meet your needs today and into the future. Contact us today. bancofcal.com TOGETHER WE WIN® Michael McCaffrey VP, Regional Account Executive Michael.McCaffrey@bancofcal.com 813-753-4555 Elisa Paz VP, Regional Account Executive Elisa.Paz@bancofcal.com 305-582-1403 CB26AD0324

Tax 101 for HOAs: What You Need to Know

BY JEREMY NEWMAN, CPA, NEWMAN CERTIFIED PUBLIC ACCOUNTANT, PC

Community associations usually have a December 31 tax year-end, but it’s never too early to start thinking about filing taxes. Whether you’re a board member or a community manager, it’s important to understand the federal tax filing requirements of community associations, including homeowners’ associations (HOAs). Here’s an overview:

FORM 1120-H OR FORM 1120

All residential real estate management associations, condominium management associations, and timeshare associations must file federal tax returns using one of two forms:

• Form 1120-H: U.S. Income Tax Return for Homeowners Associations

• Form 1120: U.S. Corporation Income Tax Return

Form 1120-H is simpler and shorter than Form 1120, but an association must meet a few requirements to be eligible to file it:

• At least 60% of the association’s gross income for the tax year must consist of exempt function income (membership fees, dues or assessments of homeowners).

• At least 90% of the association’s expenses for the tax year must consist of expenses to acquire, build, manage, maintain, or care for its property. (For timeshare associations, at least

90% of expenses must be for activities provided to members of the timeshare association.)

• At least 85% of the units, lots or buildings must be used by individuals for residences.

• No private shareholder or individual can profit from the association’s net earnings except by acquiring, building, managing, maintaining, or caring for association property or by a rebate of excess membership dues, fees, or assessments.

Form 1120 is the alternative for associations that do not meet the above qualifications. So, if more than 40% of an association’s income is non-exempt income (i.e., payment from nonmembers or members for rental of the clubhouse or payment from nonmembers for use of the community’s pools), or an association has more than 10% of its expenses attributable to something other than managing/ maintaining the property, it would file Form 1120.

FORM 1120’S PRIMARY ADVANTAGE

Generally, Form 1120-H is best for most associations. So, why might an association choose to file taxes using Form 1120 vs. Form 1120-H? The short answer: to reduce their taxes owed.

Continued on page 38

36 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

TAXES

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 37 4450 W Eau Gallie Blvd. Suite 120, Melbourne FL 32934 OFFICE 4350 W Cypress St. Suite 102, Tampa FL 33607 SEBRING OFFICE 1245 US 27 S., Sebring, FL 33870 ORLANDO OFFICE 333 S Garland Ave. 13th Floor, Orlando, FL 32801 FORT MYERS OFFICE 11390 Palm Beach Blvd. Suite 301, Fort Myers, FL 33905 321.323.3118 813.694.7727 863.774.7076 407.675.6767 239.744.2193 Are Your Repairs Covered By Insurance? Call 877.275.0275 or Visit www.AskAnAdjuster.com FREE INSPECTION FREE POLICY REVIEW

TAXES

An association’s net income from exempt activities is not subject to federal tax, but net income from non-exempt activities is taxable at a flat rate of 30% on Form 1120-H. On Form 1120, the tax rate is 21%. If your association generates a high amount of taxable income and doesn’t have sufficient related expenses to deduct from that income, using Form 1120 could save you on that tax bill. There are two disadvantages worth mentioning: 1) the 1120 is much more complex than the 1120-H; 2) income that is otherwise considered exempt income under Form 1120-H could be taxable income under Form 1120; and 3) Form 1120 has a higher chance of being audited.

FILING DEADLINES

Generally, both Form 1120-H and Form 1120 are due by the 15th day of the fourth month after the close of an association’s tax year-end. So, if your association has a December 31 calendar year-end, your tax return is due by April 15th of the following year. Associations with a fiscal year-end in June must file by the 15th day of the third month after the end of its tax year (September 15th).

As a calendar year-end association, you can file an extension that would give you until October 15th to file your return—but you’ll still need to make an extension payment that estimates your total tax liability (due April 15th as a December 31 tax year-end association).

FORM 990: A RARE OUTLIER

You might have heard that HOAs can obtain tax-exempt status, which allows them to file Form 990: Return of Organizations

Exempt from Tax. This is rare. An association would have to prove itself a “social welfare organization” that is operated for the benefit of all residents in a community (not just members of the association/ people who live in the neighborhood).

HOA TAX EXPERTS CAN HELP

This is a high-level summary of your annual federal tax filing requirements as an HOA or other community association, but there are lots of rules about what income is taxable and consequences to keep in mind. Talk with a CPA firm that specializes in audit and tax services for community associations/common interest realty associations and knows the ins and outs of all federal regulations.

A final word of advice: plan ahead. Tax time is busy for accounting firms, and the sooner you provide all required documentation and information, the more likely a firm will be able to complete your return by the filing deadline.

Learn about Newman CPA’s tax services for residential and commercial associations at hoacpa.com/tax.

38 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 39 Creating complete customized insurance programs for community associations. www.assuredpartners.com NEGAR SHARIFI Senior Vice President P: (407) 440-0928 negar.sharifi@assuredpartners.com PHIL MASI Senior Vice President P: (407) 278-1627 phil.masi@assuredpartners.com

Managers Under Fire

BY DENNIS MASCH, LCAM

The need for licensed managers in our industry will only continue to grow as almost all residential development today includes some form of homeowner, condominium, or townhome association. As many of the experienced managers retire, or move out of the industry all together, newer managers cannot simply replace them on a one-for-one basis.

There is also significant movement of managers from one management company to another. That change brings with it a different company culture and potentially different accounting and management software. The popular accounting software packages for associations, even if the same, doesn’t mean they are setup the same company to company. A fair percentage (no known survey has even been taken) of managers moving is as much for the dissatisfaction with the workload, how they’re treated vs. just a better financial opportunity.

The manager’s duty is to advise and carry out the (legal) decisions of the association’s board of directors. You cannot find many managers who have served the industry that haven’t run into the situation

where you need to inform the board of what they cannot do, need to do, or take an action they do not want to take. “Shoot the messenger” is as brief an explanation of the reaction there is. The worse the problem or problems are, the more likely the board’s dissatisfaction, which may result in a call to the management company and request a new manager. The board may just decide to hire a new management company. Appreciation of the manager informing a board of a critical situation is not as common as it should be. Defending their manager is not always the norm of the management company.

Our industry, especially in Florida, only requires sixteen (16) to eighteen (18) hours of education before you can sit for the State license test to become a CAM. The focus is the Statutes. However, managers don’t provide legal advice. There is no education or required experience in accounting, management, facilities/ construction, insurance or people skills. Managers need all of these and are expected to provide them to the association. The best some managers can hope for is monthly “lunch and learn” seminars from

Continued on page 42

40 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

MANAGERS

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 41 COMMUNITY ASSOCIATION PROGRAM The CommuniTy Banking SoluTion for CommuniTy aSSoCiaTionS John Calpey SVP/Business Development 407-693-0527 (o) 407-920-1789 (m) ONEFLORIDABANK.COM Mary Ann Sheriff SVP/Market Executive 407-693-0606 (o) 407-247-4887 (m) associationservices@onefloridabank.com Experience the Difference of Working with a Florida Based Bank

COMMUNITY MANAGERS

various vendors or approved providers for continuing education and training. How often are the managers allowed or given the time to attend? It should be mandatory. Yet we turn managers loose where they are expected to deal with problems and conditions they most likely have never experienced before.

What workload can an individual manager (portfolio) handle? It usually comes down to the total “number of doors” needed to generate the revenue from the door fees to properly pay the manager. Lose a property, your income drops even if the loss of an association has nothing to do with the work and effort you put forth. How many portfolio managers are given less than ten associations? How far apart are the locations? A forty-hour work week during normal business hours would be a welcome exception to hours that spread into the evenings for meetings and expectation to be on call twenty-four, seven for any emergency. The strain on personal and family life takes a toll. An emergency on a property can cause chaos to your schedule.

Don’t forget about the members themselves. Their expectations can present you “opportunities” you never dreamed you would ever encounter. “I don’t think I should have to pay my monthly assessment for the months I am not here.” Or, “somebody told me, that ....” I cannot recall a property I ever managed that didn’t have “somebody” as a resident expert. “I’m sorry you feel that way.” My feelings seldom influence what I am telling you.

The latest good idea, from an article published by the Community Association Institute, Washington D.C. headquarters was managers need to be able to recognize members that may be under stress or require other assistance and be able to refer them to resources, including medical, available in their area. Excuse me. Psychology and medical assessment are now an additional skill set managers need? Manager’s burnout is one of the leading causes for managers who leave the industry.

The manager in the field should be able to depend upon support

from the company they work for. It appears there is less of that than there used to be. Management company merger mania has been underway for a number of years. Management Company A merges, buys, takes a majority stake in Management Company B. Company B will either disappear within two years or be part of Company A’s brand or family. It is akin to changing employers without changing jobs. Growth and profit margins have increasingly become the focus. That along with “lifestyle.” The bigger the organization, the less flexible it becomes to address issues, communities, or managers.

The Senior or Divisional CAM oversees multiple managers in the field. They should be the most experienced, know their people and what they need. Many times, they don’t and have their own associations to serve along with their other duties. Keeping the account, making the client happy takes priority over support, continuing education and training the manager’s need. How can the manager do their job if they first need to worry that they won’t get the support from their employer?

Then there is the State of Florida annually changing the statutes they enacted that don’t work in the real world we operate in. It has become an annual process with its own name – glitch bills to fix their prior legislation. Managers get a preview of these, attend an annual legal update seminar (time permitting) and many times need to bring that information back to the associations they serve. This year, associations contributing a portion of their assessments to outside charities and no longer allowed to charge for an estoppel are under consideration. Why?

Board members, volunteers to their community, are held to a low level of accountability for any Florida not-for-profit corporation, as it should be. Once elected, all you need to do is attend a two-hour board member certification course within ninety days, or sign an affidavit. Can we at least start by eliminating the affidavit option? Maybe that certification course should be a requirement to be completed before you can become a candidate. Maybe a continuing education course annually, for board members should also be required in order for a board to hear from someone other than the manager or disgruntled members. Getting outside the community boundary, possible interactions with other board members in other communities could benefit everyone. Yes, you are all just volunteers, but you volunteered and there are responsibilities.

An expression of appreciation for the manager can go a long way. Over the years, I needed to inform Boards on several matters I was sure they didn’t want to hear. The manager cannot be afraid to do their job. There is no place for the personal attacks when they do. A BOD President once asked me, “Don’t you ever have any good news?” My reply, “Stop asking questions.” We both laughed. We have moved on since then but it is still a story we enjoy telling. It was a rare level of support and trust that we can all use more of.

42 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

nviro Tree Service is a full-service provider of commercial and residential tree care as well as preconstruction activities such as land clearing, tree protection, arborist consulting and biological assessments.

We are a privately-owned, certi ed Majority Woman-Owned Business and have been serving central Florida for over 9 years. Enviro Tree Service has over 100 combined years of professional tree care

experience between our 6 ISA Certi ed Arborists on sta . Our biologist has 13 years of agency experience and spent over two years providing commercial environmental consulting services. We currently employ over 60 tree care professionals, heavy equipment operators as well as our biologist and Commercial Applicator.

Our scope of work includes tree removals, tree pruning, root pruning & control, palm pruning and planting, cabling and bracing, storm and emergency work, tree surveys, environmental consulting, tree health care services and site clearing and mowing.

Enviro Tree Service prides itself in having the most specialized equipment and certi cations to complete your job in a safe and e cient manner. Our land clear-

ing division is equipped with a horizontal grinder, excavator and

loader. We also have three grapple trucks to assist in debris removal.

Managers on sta are all ISA Certi ed Arborists. Other certi cations include TCIA Certi ed Tree Care Safety Professional, Advanced Mitigation of Tra c (MOT), Aerial Rescue, First Aid and CPR, Gopher Tortoise Agent, OSHA 30, and Florida Commercial Applicator for aquatic environments, roadways and natural areas.

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 43

C M Y CM MY CY CMY K Enviro Ad-half page.pdf 1 3/12/2020 12:22:01 PM

What’s a Midge Fly – and How Can You Control Them?

PHOTOS BY CLARKE & ARTICLE BY CHERRIEF JACKSON, CONTROL CONSULTANT – CENTRAL FLORIDA, CLARKE

You’ve probably experienced swatting at a swarm of flies while trying to enjoy time outside, and you’re not alone. Unfortunately, each summer – or even year-round in warmer climates – midge flies can become a significant nuisance wreaking havoc on property and driving residents away from outdoor resources. But what even is a midge fly? And how can you reduce them on your property?

WHAT’S A MIDGE FLY OR ‘BLIND MOSQUITO’?

Midges refer to several species of small, non-mosquito flies that come from the family Chironomidae (referring to midges) in the order Diptera (referring to flies overall). There are two main species – Chironomidae and Chaoboridae

In more practical terms, midges are small, dainty flies with one pair of long, narrow wings and long, skinny legs. Males tend to have feathery antennae used to hear the high-pitched sounds emitted by the female’s wings.

While midges are usually found near naturally occurring lakes and

ponds in small, non-nuisance levels, the abundance of nutrients within stormwater systems acts as a beacon to breeding midges, and they can reproduce in vast quantities. That’s when they become an issue in communities.

WHAT’S THE DIFFERENCE BETWEEN MIDGES AND MOSQUITOES?

Midges and mosquitoes are often mistaken for each other, which makes sense given that both belong to the order Diptera. The largest difference between the two is that mosquitoes have a proboscis, a mouthpart used to bite and suck blood. Midges do not. Otherwise, most of the visible differences are in the fine details.

Midges have the following characteristics:

» When landed, fold their first leg pair in a ‘prayer’ position (which can be mistaken for antennae)

» Have long tarsi of foot portions of the forelegs

» Lack scales on their wings, making them smooth

44 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024 INSECT CONTROL

Continued

46

on page

INSECT CONTROL

Mosquitoes have the following characteristics:

» When landed, hold their second/back leg pair in the air

» Have scaly wings with a light fringe on their tips

» Typically don’t form swarms

WHERE ARE MIDGE FLIES FOUND?

Midge flies can be found almost anywhere. But in certain southern states, such as Florida or Texas, their warm climates allow populations to thrive year-round.

Midges deposit their eggs near still waterbodies, often boggy marshes or stormwater ponds. Because of this, their adult counterparts are generally also found in these same areas.

It’s common to see midges in swarms or ‘clouds’ around dusk, which can be when community residents become irritated or frustrated by their presence.

DO MIDGE FLIES BITE?

Thankfully, most species of midge flies don’t bite humans – in fact, they only live for a few weeks at most and thus rarely eat anything in their adult stage beyond nectar, fruit juices or sugar water. However, they can land and crawl around the skin, which many find irritating and unwanted.

WHY DO MIDGES KEEP POPPING UP?

Part of what makes midges so difficult to control is their ongoing lifecycle that starts in ponds, lakes and stormwater systems and ends on land. Midges have a four-stage lifecycle, starting as eggs laid on a waterbody’s surface before sinking into the muck. Depending on the species, these eggs hatch into larvae that either borrow further into the sediment or swim freely through the water. Finally, the larvae develop into pupae before emerging as fully formed, flying adults. This ongoing process can take as little as two to three weeks.

That means that if you’re trying to control midges by just combating the adult ones flying around, you still have plenty of them in eggs, larvae and pupae stages, ready to continue the cycle.

HOW DO YOU CONTROL MIDGE FLIES?

Communities should take an integrated approach that combines chemical, biological, and preventative methods to keep midges away while also working to control the population.

1. Surveillance – Take samples of midges to identify which are present and estimate their population levels (as well as to figure out where they are coming from).

2. Chemical Control – Done mainly to reduce annoyance; these may include larvicides applied to waterbodies, ULV adulticide, barrier treatments applied to siding and foliage, or more.

There are other strategies you can implement - such as improving the quality of your waters or introducing biological controls like specific species and amounts of fish - to help bolster these approaches.

MIDGE FLIES: THE BOTTOM LINE

When controlling midge fly populations, it’s essential to take an integrated approach. This calls for control measures at each stage of the lifecycle to more effectively mitigate their final adult form through a combination of surveillance, larvicide and adulticide control measures.

Clarke is a third-generation, family-owned mosquito control products and services company that has been helping support livable, safe and comfortable communities around the world for over 75 years. Visit www.clarke.com for more information.

46 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 47

How To Stay On Your Toes When You’re Deposed

BY DAVE MILTON, ATTORNEY, BECKER

You’re a board member or a community association manager, and, after months or even years of effort, your association is running smoothly; your meetings are efficient, and your vendors are reasonably priced and performing well. And then, out of nowhere and to everyone’s dismay, your association ends up involved in a lawsuit.

You don’t want to sit for a deposition, but despite your association’s attorney’s best efforts, your deposition has been scheduled and you’ve received a formal notice of deposition. Sitting for a deposition can be intimidating; at the very least, it’s anxiety-producing. These few tips can help you alleviate some of that anxiety.

First, speak with your association’s attorney to discuss the issues that are likely to come up in your deposition, and then review any relevant documents. Preparation is essential.

In addition to preparation, here are three general principles that can help your deposition to be as painless as possible.

1. TELL THE TRUTH

This is the first and most important pointer. The truth can be hard

because it might seem like the truth will hurt the association, but the truth will keep you out of trouble, and good attorneys can (like Tom Cruise in A Few Good Men) handle the truth.

There are a few statements that, at first blush, might not look like the truth but that, in fact, be true truth: a) I don’t know, and b) I can’t remember. If either of those statements is true, don’t be afraid to make them – and stick to them, especially when the attorney asking the questions tries to make you feel dumb or ill-informed for not knowing or not remembering.

2. DON’T TRY TO BE AN EXPERT

One of the ways some lawyers try to trick witnesses is to ask questions that require expertise to answer. For example, they’ll ask detailed questions about construction defects. Although you could say you saw stucco cracks or heard other people mention cracks, you don’t have the evidence or expertise to explain why the stucco cracks exist or what damage (existing and future) the stucco cracks are causing. Let the experts offer their expert opinions; you can do this by saying you’re deferring to the association’s expert(s).

48 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

LEGAL

Continued

on page 49

Another trick some lawyers will employ is to ask – in a roundabout way – for an interpretation of a legal document like a contract or an association’s governing documents. While you might recognize a contract or the association’s governing documents (facts you can acknowledge, if true), it may constitute the unlicensed practice of law to interpret those documents. If a question feels like it would require a legal interpretation, you can respond by saying that you can’t provide a legal interpretation and will defer to the association’s attorney for any interpretations.

3. DO YOUR BEST

Nobody – not even experts who are involved in lawsuits regularly – gets everything right all the time. Some attorneys will try to intimidate you into speculating or changing your answer but don’t get rattled. If you do give an answer that requires clarification, your association’s attorney will have the chance to ask questions to get that clarification. Just do your best.

Serving on an association’s board or as its manager is a hard, and often thankless job, but your association will be better off because of your effort.

If you’ve been designated as a corporate representative, you’ll need to do some additional homework to get prepared. I’ll write another article on that for another issue.

David Milton is an attorney in Becker’s Construction Law and Litigation Practice. He represents community associations in multi-party construction defect litigation, frequently meeting with association board members and managers to evaluate potential construction defect claims and discuss legal options and strategy. Mr. Milton guides clients through the Chapter 558 claims process as well as conducts board meetings, and special member meetings under Chapter 720, to provide information to and resolve concerns of board members and homeowners. For more information, visit beckerlawyers.com.

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 49 LEGAL

C. Howell | Scott Kiernan | David M. Milton | Claramargaret H. Groover | Aaron K. Crews | Kaylin Martinelli | Jake Herrel 18 Board Certified Construction Litigators Throughout Florida Offering Any Fee Structure to Fit Your Needs Florida | New York | New Jersey | Washington, D.C. (407) 875-0955 beckerlawyers.com

Patrick

MANAGER DEVELOPMENT

Rule of Law

BY BETSY BARBIEUX, CAM, CFCAM, CMCA, FLORIDA CAM SCHOOLS

Turn on the television and you’ll likely see a national news program. If you listen long enough, you may hear the phrase “rule of law,” followed by “we are a constitutional republic” and our constitution is the law of the land.

But what does “rule of law” mean. Is it the opposite of “rule of man”? Why or how does any of this relate to community associations?

Go back to King John of England and the Magna Carta (1215), Article 39, though short lived, said King John of England could not arbitrarily take away the life, liberty, or property of his subjects. The fate of a person should not be in the hands of one person (the rule of man), but in accordance with natural laws that even the king was not above.

On November 11, 1620, the Mayflower Compact was drafted by the Pilgrims before they disembarked from the ship. They realized the need to agree on a form of self-governance which for them was based on the people being moral people (don’t lie, don’t cheat, don’t steal, don’t swear), with the added statement “unto which we promise all due submission and obedience.”

Then on July 4, 1776, the Continental Congress announced its separation of the 13 colonies from Great Britian and documented its intent in the Declaration of Independence, which says: “Governments are instituted among men, deriving their just powers from the consent of the governed.” Like the Mayflower Compact, the Declaration of Independence was based on people being moral people.

On September 17, 1787, the Constitution was signed and by July 1789, had been ratified by all 13 states. The U.S. Constitution became the law of the land with its senators and representatives to serve at the pleasure of the people.

Contained within the Oath of Allegiance to the United States are these phrases: “That I will support and defend the Constitution and laws of the United States of America” and “that I take this obligation freely without any mental reservation or purpose of evasion.”

So, woven throughout our national history is the “rule of law” as opposed to the “rule of man” such as a king or dictator. This “rule of

Continued on page 52

50 CENTRAL FLORIDA TIMES | 1ST QUARTER 2024

1ST QUARTER 2024 | CENTRAL FLORIDA TIMES 51 floridapaints.com We Make Paint for the Sunshine State We've Got You Covered Florida's weather is hard on paint Trust our team of experts to recommend the right paint system for your next project Florida Tested Florida Proven We formulate every can of Florida Paints to resist the unique challenges Florida weather brings Protect and Beautify Our TropiCrete flooring solutions deliver unrivaled protection and beauty for your concrete surfaces Your Paint Partner

MANAGER DEVELOPMENT

law” has made its way into our community associations. Here’s how.

Each community has a set of documents (declaration, proprietary lease, articles of incorporation, and bylaws) that is the law of the land. Board members are elected by the people to serve at the pleasure of the people. The exception is that in community associations, the board members do not serve a constituency, but serve the governing documents and statutes.

By signing closing documents for the purchase of a condominium, or cooperative, or homeowners’ association home, every owner has “promised all due submission and obedience” and they will “support and defend” the restrictive covenants spelled out in the governing documents. And they have entered this “obligation freely.” These restrictive covenants give the owners certain rights and place some restrictions on the use of their property. Some owners understand that commitment to the restrictive covenants; others don’t.

Ask a manager and he’ll tell you about willful owners and residents who defy the restrictive covenants on a regular basis despite their commitment to comply. Since boards and managers can’t send anyone to jail or put them in stocks, they are left to spend a lot of time and money forcing voluntary compliance.

What about board members? Does the “rule of law” apply to them? Of course, it does, but in a different way. The documents and statutes presume board members have a fiduciary relationship to the owners and give board members the responsibility of maintaining the common areas, buildings and grounds, and tangible personal property. By accepting the role as a board member, each has agreed to this fiduciary duty.

However, recent history has revealed board members who failed to perform scheduled maintenance or take care of emergency

maintenance or just kicked the can down the road to let somebody else handle it. Sometimes, it’s not for a lack of funds, they just don’t want to do the hard work and make difficult decisions.

It is very hard for some board members to resist the urge to make popular decisions instead of the right decision. It is hard to increase the reserve funding or monthly assessment when board members know it will significantly impact their fixed-income neighbors. But with the new condominium and cooperative laws in place for buildings three-stories and higher, board members will no longer be able to kick the can down the road. The buck will stop with them.

Thinking into the future, what about “all due submission and obedience” when Gen X, Millennials, Y, Z move into community associations. We already know their attitude toward authority is different so what will be their attitude toward “rule of law” in a community association.

Few of them have grown up in the same societal or educational environment as the Traditionalist/Builders and Baby Boomers. They have different morals, loyalties, priorities, and attitudes toward authority and rules.

Some generation experts say that Gen X wants rules changed and think that change is better. Wait until they realize how difficult it is to change the restrictions in the governing documents.