INVESTIGATING THE POTENTIAL OF FIBRE-BASED PACKAGING:

IMPLICATIONS, OPPORTUNITIES AND RESPONSIBILITIES

IMPLICATIONS, OPPORTUNITIES AND RESPONSIBILITIES

THE CONTENT TEAM

Tim Sykes

Victoria Hattersley

Elisabeth Skoda

Libby Munford

Fin Slater

Emma Liggins

Frances Butler

THE PRODUCTION TEAM

Rob Czerwinski

Meg Garratt

Syed Hassan

THE OPERATIONS TEAM

Amber Dawson Operations Director

Kayleigh Harvey Advertising Coordinator

Shona Clacher Customer Success Executive

THE SALES TEAM

Jesse Roberts Sales Director

Dominic Kurkowski Senior Portfolio Sales Manager

Matt Byron Portfolio Sales Manager

Clayton Green Business Development Manager

Part of the Rapid News Communications Group

9 Norwich Business Park, Whiting Road, Norwich, Norfolk, NR4 6DJ, UK

Registered Office: No.3 Office Village, Chester Business Park

Chester, Cheshire, CH4 9QP

Company No: 10531302.

Registered in England. VAT Registration No. GB 265 4148 96

Telephone: +44 (0)1603 885000

Editorial: editor@packagingeurope.com

Studio: production@packagingeurope.com

Advertising: jr@packagingeurope.com

Website: packagingeurope.com

Twitter: twitter.com/PackagingEurope

LinkedIn: uk.linkedin.com/company/packaging-europe

YouTube: youtube.com/PackagingEurope

© Packaging Europe Ltd 2024

No part of this publication may be reproduced in any form for any purpose, other than short sections for the purpose of review, without prior consent of the publisher.

3 Editorial Elisabeth Skoda

Fibre-based packaging Decarbonization and Innovation

Reuse and Refill What are the main barriers? 15 Soft drinks Navigating regulation and consumer demand

E-commerce Ships in product packaging: efficient or irresponsible? 26 FACHPACK news Shining a spotlight at innovations

Cannabis packaging A snapshot of sustainability pursuits in the industry 34 In Conversation With… Why brands should switch to banding and how ATS-Tanner can help

36 In Conversation With… Collaborative lamination with Comexi, Pyroll, and the ML2 machine

38 In Conversation With… An exclusive insight into the next steps for Smurfit Westrock

40 In Conversation With… Aluflexpack at FACHPACK 2024: steps forward for aluminium

42 In Conversation With… How Saica Flex targets a circular future for flexible packaging

45 Sleeves and Labelling Why they are vital for packaging circularity

Welcome to a bumper edition of Packaging Europe magazine!

As summer draws to a close in the Northern Hemisphere, we look forward to a busy autumn of events. Summer is a time of recharging and relaxation for many. Still, as in previous years, the season has given us many reminders of how urgently we have to take action to tackle global heating, with extreme weather resulting in widespread destruction becoming increasingly commonplace.

Collaboration is key to tackling these challenges – and the packaging industry has been taking some important steps towards this. However, more work is needed to find ways to drastically reduce carbon emissions. As in previous years, we hope to be able to play a part in facilitating cross value

chain dialogue and innovation with our Sustainable Packaging Summit and Sustainability Awards. The detailed Summit program is now available, and we are happy to report that it is shaping up to be an even bigger and more impactful event than last year’s.

We have a wide range of topics for you in this magazine. Tim Sykes investigates how MM Board & Paper, a major player in the fibre-based packaging industry, views the opportunities and responsibilities associated with producing renewable packaging in the context of its growing popularity.

Victoria Hattersley surveys the current reuse/refill landscape and tackles some of the main industry-wide challenges that are that are still preventing a wider uptake. Elsewhere, she looks at the important role of labels and sleeves in packaging design and discusses the impact of making the right or wrong choice.

In this edition, we also look at two very different market sectors. Emma Liggins speaks to industry players in the United States to find out about the methods they use to avoid fossil-based polymers in their packaging. Meanwhile, I speak to major beverage brands and get their take on some of the key factors that are shaping the soft drinks markets in 2024. In addition, we discuss the role changing regulations and consumer demands play when it comes to developing packaging.

Furthermore, in the field of e-commerce, Emma Liggins investigates the pros and cons of using 'ship in product' packaging, a practice that sets out to reduce waste, lower costs and streamline the unboxing experience.

Last but not least, we offer a small preview of just some of the innovations you can expect to see at FACHPACK, which takes place in Nuremberg from September 24th to September 26th this year.

We hope you enjoy this edition of Packaging Europe magazine, and look forward to seeing you at the Sustainable Packaging Summit!

Consumers and brand owners have been increasingly enthusiastic about the green credentials of renewable materials. We investigate how a major player in the fibre-based packaging world views the implications, opportunities, and responsibilities associated with this. Tom Kratochwill (CSO for Board & Liner at MM Board & Paper) and Evelyn Hartinger (CSO and Head of Business Unit Paper & Pulp at MM Board & Paper) speak with Packaging Europe’s Tim Sykes.

Q: Tom, as Chief Sales Officer for Board & Liner at MM, what are the key sustainability expectations from your customers in the converting industry, and how is MM positioned to meet them?

Tom Kratochwill: Sustainability is a top priority for both MM and our customers. A global survey including more than 700 brand owners revealed that reducing CO2 emissions, increasing recyclability, and using packaging materials made from renewable resources are the most important targets. Customers are increasingly requiring a sustainable footprint to meet their own targets and to provide CO2 data to demonstrate their progress. As an integrated producer of pulp, paper, cartonboard, and packaging, MM Group can optimize the sustainability performance of the entire value chain, benefiting our customers.

Heading up MM Board & Paper’s Innovation department, all our efforts are directed towards developing packaging solutions from the outset with these goals in mind, considering all environmental impacts.

Q: There’s much debate about the carbon footprint of different packaging materials. How do fibre-based packaging materials compare to plastic in terms of carbon emissions and overall sustainability?

Tom Kratochwill: The carbon footprint of a packaging material cannot be defined solely on a material weight basis. Both virgin and recycled fibre-based materials generally have lower GHG emissions compared to most fossil and bio-based plastics when compared on a weight basis (e.g. 1kg of paper vs 1kg of plastic). However, the amount of material required to fulfil packaging functions, such as protection or providing a barrier, may differ. The high stiffness of fibre-based materials is beneficial in rigid packaging applications, allowing for lower weight usage in paperboard. Yet, replacing rigid paperboard with low-weight flexible plastics might result in lower GHG emissions for the plastic alternatives.

Other environmental indicators, such as recyclability, are crucial in assessing the sustainability of packaging materials. The introduction of

recyclability classes in the PPWR further tips the balance in favour of fibrebased packaging. Fibre-based packaging benefits from a robust European recycling infrastructure, achieving recycling rates of up to 80%, the highest of any packaging material.

Q: Evelyn, could you elaborate on MM’s strategy for reducing its carbon footprint, and what progress has been made so far?

Evelyn Hartinger: MM Group is deeply committed to mitigating climate change by reducing both direct and indirect emissions (Scope 1 and 2) from our operations, as well as emissions across our value chain (Scope 3). Our targets include a 50.4% absolute reduction in Scope 1 and 2 greenhouse gas (GHG) emissions by 2031. As of 2023, we have already achieved a 28.2% reduction compared to our 2019 baseline. For Scope 3, we aim for a 58.1% reduction per euro of value added, equivalent to a 50.4% absolute reduction, within the same timeframe. These ambitious goals, validated by the Science Based Targets initiative (SBTi), align with the Paris Climate Agreement’s objective to limit global warming to below 1.5°C by 2050.

To achieve this, we are investing heavily in enhancing the energy efficiency of our production processes, particularly in our board and paper mills. This includes sourcing green energy and deploying energy-efficient technologies across all operations. By prioritizing these efforts, we aim to significantly reduce our carbon footprint and contribute to a more sustainable future.

Q: What specific investments or product innovations is MM undertaking to support this decarbonization effort?

Evelyn Hartinger: The focus of our activities are energy efficiency projects, where we have made good progress. Also, we have invested in renewable energy and are sourcing renewable energy from the market. These initiatives span all our mills, and we continuously explore new ways to reduce our carbon footprint. We’ve identified over 370 project ideas for further CO2 emission reductions. For instance, our strategic investment in the MM Kwidzyn mill in Poland aims to increase the already high proportion of renewable energy from 65% and reduce fossil fuel use.

From a product perspective, we have ensured that our UFP and softwood pulp are Ecolabel certified, and we are offering eco-grades containing a share of recycled fibres for our saturating kraft paper used in the building and construction industries. Our investments in lightweighting our materials help reduce fibre use, resulting in waste reduction, and lowering logistics costs and emissions.

Meet MM Board & Paper’s cartonboard characters

MM Board & Paper’s top cartonboard brands include different products to help customers realise their packaging ideas:

Effortlessly cool. Clear and precise like the endless ice of the North. MM’s virgin fibre cartonboard for the highest demands.

Born in the South. Bright and lively for a colourful coastal life. MM’s virgin fibre cartonboard that makes top performance look easy.

Nature at its best. Sustainability and beauty combined in MM’s high-end triplex board for the most fascinating results.

Right at your service. Timeless sophistication that brings an element of style to everyday packaging. MM’s triplex board for smart solutions.

The Gentleman: MCB® The Allrounder: MCM® The Cool: ALASKA®

Your reliable friend. MM´s duplex board for all occasions that knows exactly what you need. MM’s multi-talent for (almost) any application.

ability and credibility in its sustainability initiatives?

Evelyn Hartinger: From the outset, MM recognized the importance of transparency in driving meaningful environmental change. Our ESG strategy prioritizes accountability and continuous improvement through a meticulous, data-driven methodology. Our dedication to sustainability is evident in our 2023 ‘Triple A rating’ from the Carbon Disclosure Project (CDP). We are proud to say that MM Group is one of only 10 companies to achieve a triple ‘A’ out of over 21,000 companies scored in 2023, including listed companies worth two-thirds of global market capitalization, and over 1100 cities, states, and regions. In Europe we are the only packaging company with a Triple A rating from CDP. It confirms that our ambitious science-based goals have put us on the right track.

Q: Tom, back to you: MM’s board portfolio includes both virgin and recycled fibres. What are the environmental impacts of each, and in which applications do they perform better?

Tom Kratochwill: Both virgin and recycled fibres have their unique advantages. Recycled fibres are often preferred for their lower environmental impact, especially a much lower water consumption. In a world of more and more water scarcity this advantage, which is today widely ignored, will gain much more attention. Virgin fibres, on the other hand, offer superior strength and purity, making them ideal for high-quality packaging solutions. We’re constantly innovating to enhance the performance and sustainability of both types of fibres, catering to customer demands that prioritize either strength or environmental impact. Our customers can be sure that both virgin and recycled boards are not only outstanding in qual ity and performance, but also in terms of CO2 footprint.

Q: It’s well known that today’s consumers respond positively to paper as a renewable and widely recycled material. How can MM and the industry capitalize on this for future development and innovation?

Tom Kratochwill: We’re heavily investing in innovation to transition from plastic and non-recyclable solutions to paper and fully recyclable alternatives. We see significant potential in the fresh food, vegetable, and e-commerce markets, to name just a few. There are also opportuni ties where high barrier properties are not as critical. The ‘low-hanging fruit’ in long shelf-life products are mainly in connection with snacks and confectionery, chocolate boxes, or trays for cookies—foods with a lot of

sugar are very easy to preserve. The recent legislation changes, like PPWR, are also supporting this transition and providing clarity and a timeframe.

Q: As the European industry meets at FACHPACK this month, what new ideas or solutions is MM Board & Paper presenting to the market?

We are excited to present several innovative solutions, including our optimized board portfolio. MM has undergone an enormous transformation in recent years, involving a major rethink of our visual identity and product presentation. We have given ourselves a fresh look, harmonized, recognizable brand and product names, and a more personalized offer. Not only do we aim to produce sustainable and innovative cartonboard and liner grades, but we also want to ensure that our customers always know which of our products best suits their needs.

Another innovation worth highlighting is our brand-new Paper Bottle–a bag-in-box concept (cartonboard box with a flexible pouch inside) in the shape of a traditional glass bottle with a super low carbon footprint compared to glass. It’s a real eye-catcher on the shelves. The Paper Bottle is designed for easy separation and recycling, is PPWR-ready, with more than 80% paper content, and can be used for applications like wine, olive oil, spirits, etc. It’s a great showcase whenever you want to reduce carbon footprint and especially reduce weight.

If you are curious for more, please visit us at FACHPACK in Hall 4A, Booth 216.

In this abridged version of an in-depth report published in the new Membership tier of our website, Victoria Hattersley surveys the current reuse/refill landscape, asking: What are some of the main industry-wide challenges preventing wider uptake?

Back in November 2023, when we surveyed our Sustainability Awards jurors about where innovation is most urgently required across the packaging industry, the ‘winner’ was reuse/refill, with 53% naming this as top priority.

This comes as no surprise. It is now recognized that reuse and refill must play a much bigger role in the circular economy moving forward if the industry is to achieve its Net Zero goals, while also tackling the ever-growing issue of plastic pollution. (Not, of course, that reusable and refillable packaging is confined to plastics alone.)

This article sets out some of what we see as the major barriers to scaling reuse and refill (our readers, no doubt, will be able to identify more, in which case we always welcome your input).

There is still, even now, a great deal of confusion around the terms we use when we talk about reuse and refill – and not just among consumers.

At the most fundamental level, says Stephanie Northen, PhD researcher in microplastics and Research Associate for Revolution Plastics and the Global Plastics Policy Centre at the University of Portsmouth, there is still a tendency to use reuse and refill interchangeably, when in fact they require very different approaches.

A project Stephanie was recently involved in with the Global Plastics Policy Centre researched the subject and published a (very comprehensive) analysis of reuse strategies currently available entitled ‘Making Reuse a Reality: A Systems Approach to Tackling Single-use Plastic Pollution’.

Among many other things, says Stephanie, “the definition and understanding of the term 'reuse' ended up becoming a more central focus of our initial research than we originally anticipated. This is because we encountered numerous different definitions when talking to industry representatives and policy negotiators and it revealed a significant overlap in the terminology.”

It may sound needlessly pedantic to fret about terms, but this is not the case: if there isn’t a basic agreement and understanding of the different definitions of reuse then projects, however innovative they are, are far more likely to fail because their essential purpose becomes opaque. As many are aware, there are four basic types of consumer facing model (refill at home, refill on the go, return from home, and return on the go) and all require very different approaches and levels of participation from consumers and the industry.

Addressing the complexity around reuse and refill systems is not just about clarifying separate definitions though – what if, in future, asks circular economy consultant Chris Baker, some of the above-mentioned customer-facing models could be combined to simplify both the reuse cycle and production itself?

“Look at the refill at home model: there’s no reason why that bottle they’re refilling at home couldn’t also be designed so that in the future it could be used in a return for reuse model or it could even be brought back to the store. And then, look at look at a soda can. They’re all basically the same size and shape so there’s no reason if you have a soda can with a cap on top that the same product couldn’t be brought back to a store and refilled in a machine.”

Definitions are not the only area where coherence is lacking. Existing packaging policies and targets across the world are as yet too diverse to facilitate more widespread reuse and refill adoption. In the EU, the revised PPWR is set to include reuse targets for 2030 and 2040 and individual countries (e.g. France, Germany, The Netherlands, Sweden and Poland) are introducing their own legislation. In the US, there is more of a focus on extended producer responsibility (EPR) schemes and deposit return schemes (DPS).

Current competition laws are also hindering collective action. “Mandatory binding targets with clear timings are vital to give businesses the much needed confidence for investment,” explains Tracy Sutton, founder of the packaging circularity agency Root. “Regulation needs to create a level playing field for brands and mature appropriately on anti-competition regulation to create the right environment for competitors to work.”

Anti-competition regulations are also necessary as a way, it is hoped, to foster collaboration by allowing for shared infrastructure, digital platforms and more. There may also be the opportunity in future to share distribution, cleaning and sorting costs in a shared infrastructure. Individual companies or even individual governments cannot effect the necessary change alone.

Greater collaboration is sorely needed across the supply chain so that certain processes can be standardized and entire systems can operate more effi-

Stephanie Northen

The

definition and understanding of the term reuse

ended up becoming a more central focus of our initial research

than we originally anticipated. This is because we encountered numerous different definitions when talking to industry representatives and policy negotiators and it revealed a significant overlap in the terminology.

ciently. Chris Baker highlights a project currently being run by Go Unpackaged, the Refill Coalition, in which members are seeking to co-design a standardized refill solution to get bulk products to the refill machine.

There is also an argument for focusing collaborative efforts further upstream along the supply chain in future, as Stephanie notes.

“Currently we have a very linear packaging and we know that we can’t keep sticking that band-aid on the wound and focus solely on the downstream issue of plastic waste. We need to shift that focus to the upstream and midstream stages to phase out those problematic pieces of packaging; statistics already show how that 80% of a product’s impact is defined at the design phase.”

We also saw from the entries to our Sustainability Awards last year how the use of smart technologies in the design of reuse systems will aid coordination and efficiency across the value chain. One example is Pragmatic Semiconductor with its flexible microchips (FlexICs), which are embedded in NFC (Near Field Communication) or RFID (Radio Frequency Identification) labels, providing reusable packaging with a unique, item-level identifier –and insights into packaging lifespan, washing efficiency and return rates.

Another solution to mention in this context is Vytal – a smart platform which offers an operating system for B2B2C reusable packaging. Starting with delivery food and to-go consumption, according to the company the Vytal app achieves a return rate of 99% and an average return time of less than five days and ‘operates more efficiently than the well-established German beer bottle deposit system’.

The majority of consumers, if asked, would no doubt say they want their packaging to be sustainable: one problem here is that what we say and what we do can be very different (the ‘value-action’ gap). It is not surprising, then, that a recent survey by PA Consulting found that nearly four in five consumers (78%) do not prioritize products with reusable and refillable packaging, even though 80% said they believed in the importance of reducing plastics.

Brands and retailers need to find ways to not just persuade consumers that reusable and refillable packaging are sustainable choices, but to actively incentivize them to make these choices. One way to do this is through loyalty programmes, such as that for Yeo Valley’s reusable lids for yoghurt pots.

Its also vital to understand consumers’ priorities – two of the biggest being simplicity and price point. In terms of simplicity, standardization of refill machines in shops would help consumers get more familiar with these systems and build confidence in using them. Again, smart technologies can also play a role in this regard.

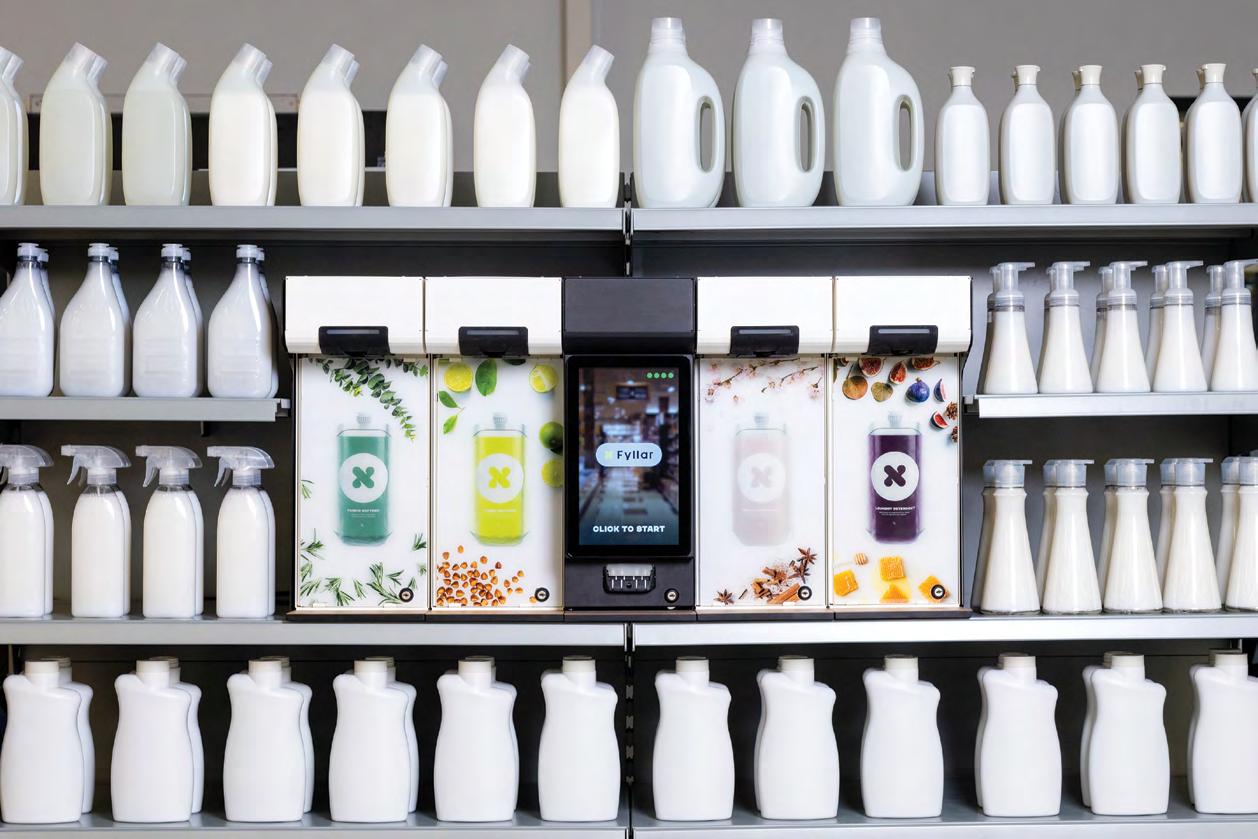

Fyllar, for example – another of the finalists in our 2023 Sustainability Awards – has developed a compact, smart refill system for liquids. According to the company, “Integrated with the smart fill RFID tag, our machines provide a level of intelligence, recognizing different products and ensuring precise, appropriate fills every time. This RFID capability also unlocks endless possibilities; from datadriven reward systems that further incentivize refills, to significant operational advantages that streamline processes and optimize inventory management.”

It is not just consumers that need convincing to embrace reuse and refill models; while a growing number of companies are moving into this sphere, many are still cautious about the perceived risks involved. What might be behind this reluctance?

“Set up costs and first-mover risk, combined with data that suggests consumer engagement is low are key reasons for low confidence,” says Tracy Sutton. “The problem is that the stats are often coming from poorly designed pilots that lacked the right holistic expertise at the concept phase. We mainly have pockets of expertise focusing on their own siloed priorities – we need to address reuse holistically.”

The question of set-up costs can certainly be a big stumbling block. As Chris points out, brands don’t entirely ‘own’ the process from design to packaged product – rather they are tied to lots of infrastructure along the way, the most visible of which is packaging filling lines.

“High-speed filling lines for packaging are set up in a certain way to run a certain type of pack down the line, and changing these to fit a reuse or refill system is going to require companies to make changes. The problem is there is no clear winner yet on the reuse systems and not enough flexibility between systems because they all use different kinds of packaging (single use-type packs for return models, for example, or bulk containers for refill in-store models). Investing heavily in one particular system comes with the risk that a company will have to change it again further down the line.”

With this prospect of locked-in capital, it’s easy to see why brands may be reluctant to be the ones to make that ‘first leap’. Again – at the risk of

12-13 NOV 2024

• Discover the latest innovations in sustainable packaging from more than 50 exhibitors & sponsors

• Hear from the entire FMCG value chain with panels featuring brands, retailers, NGOs, recyclers, and regulators

• Network with 700+ fellow leaders at the ‘Davos’ of sustainable packaging – the largest event of its kind

• Find out which tech our panel of 58 experts judged most impactful at the 2024 Sustainability Awards networking dinner

• Meet & engage with top minds from our partner events SPC engage, FINAT and HolyGrail 2.0

SCAN HERE TO BUY TICKETS

labouring a point – the value chain needs to think collaboratively, systems need to be standardized and the playing field needs to be levelled (the spectre of competition laws rears its head again) in order to hopefully share that risk. Either that, or there have been suggestions that firstmovers could in certain cases be compensated by governments or multistakeholder initiatives so the ‘risk’ element is effectively eliminated.

For the purposes of this article, we are obviously taking it as a given that reuse is a ‘good’ thing. But if we were playing the role of Satan’s advocate for a moment, even here certain environmental concerns have been raised – for instance the water footprint associated with repeated washing of packages; possible increased leaching of microplastics into the environment (unsubstantiated, as yet), and so on. Are these concerns justified?

Tracy Sutton says that, certainly, we have to accept that reuse is not always the best option. “We’ve always believed that single use and reuse need to live in harmony, and be applied strategically – this really is the missing link – we often lack any kind of strategy. Reuse might not be commercially, environmentally and technically feasible; this is why you need to explore your own business case. Microplastics, chemicals, carbon and other impacts will apply to reuse and single use in tandem – there is a lot of poorly designed reusable packaging out there.”

If you want to read the full version of this report (including advice for brands on ‘How to make a start today’), or sign up to our Membership tier to receive regular in-depth reports and industry briefs, visit https://packagingeurope.com/ membership or use the QR code.

Tracy Sutton Regulation needs to create a level playing field for brands and mature appropriately on anti-competition regulation to create the right environment for competitors to work.

INrecent years, evolving packaging legislation has had a notable impact on beverage packaging. Nicholas Hodac, director general of UNESDA, points out the importance of legislation in shaping how beverage packaging is produced, used and disposed of, and underlines the importance of pledges by companies themselves.

“In February 2021, the European soft drinks industry went beyond the requirements of the Single-Use Plastic Directive (SUPD) and pledged to achieve packaging circularity by 2030 by implementing a set of voluntary commitments," he explains.

“The goal for 2030 is to achieve a >90% collection of all our beverage packaging, make all PET bottles from 100% recycled and/or renewable material if technically and economically feasible, and increase the use of reusable beverage systems.”

Mr Hodac points out that these commitments came ahead of the proposal for a Packaging and Packaging Waste Regulation (PPWR).

“We believe that self-regulatory initiatives can drive even greater impact, demonstrating industry leadership and responsibility in doing its part to create a more sustainable Europe.”

The PPWR, in turn, created key enablers for the sector to meet its collection and recycled content targets, he says.

“The mandatory 90% collection target for beverage PET bottles and aluminium cans and the obligation for Member States to set up well-designed Deposit and Return Systems (DRS) are essential measures to boost packaging collection and reduce packaging waste. The PPWR also enables Member States to set up a mechanism of priority access to specific recycled materials, therefore enabling high-quality recycling when it makes sense. This measure will help us improve recycling of beverage packaging.”

Michelle Norman, Director of Sustainability and External Affairs Suntory Beverage & Food Europe explains that it is a company’s role to adapt to

meet regulatory requirements and consumer expectations. Each aspect of new legislation will be carefully considered, how to make it work and how it can shape strategy.

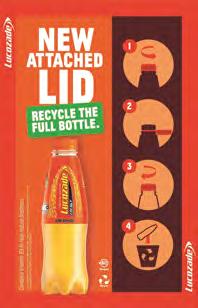

“Tethered caps, for example, are designed to prevent littering of caps, and improve the overall recyclability of packaging, yet they were not driven by consumer demand. Consequently, we have had consumer feedback from across the EU about the challenge of drinking from a bottle with the cap attached. Our technologists work to understand how this impacts product consumption, and we factor that into our design briefs. For tethered caps, we used the opportunity of the closure change to also alter the neck size to 26mm in products sold in France and Spain, which led to a reduction in plastic without impacting the consumer experience.”

Like many brand owners, PepsiCo tries to anticipate regulatory changes and updates. For example, in Europe, the company pledged to use rPET in its bottles back in 2018. Furthermore, a global ambition was added in 2023 to deliver 20% of all beverage sales volume through reusable models by 2030.

“Appropriate regulatory targets can be supportive of our packaging sustainability journey, for example, recycled content targets are a strong demand lever that can incentivize collection and recycling of packaging, and we know that some countries with aggressive recycling targets are more performant in terms of recycling,” says Lauren Cotter, PepsiCo Europe Head of Packaging.

“For beverage containers, Deposit Return Schemes (DRS) have proven to deliver high collection rates and improved quality of secondary raw materials thanks to their segregating nature, as opposed to curbside collection where different packaging types are mixed.”

Many FMCG companies set themselves ambitious goals around reusability and recyclability. But, as we approach 2025, realism has set in, and many companies were forced to push back their sustainability goals to 2030.

Ambitious goals resonate well with consumers and brand perception, but as John Blake, a senior director analyst at Gartner, who predicted this trend back in 2021, explained to Packaging Europe, goals are sometimes adopted before being fully vetted by R&D, supply chain, procurement and manufacturing.

“The level of engineering and science that is inherent in common packaging formats is often misunderstood. Plastics for example have been highly engineered over several decades to provide the benefits of offering lightweight, safe, economical and convenient product protection. But they were not developed for easy or eco nomical reuse or recycling. The industry has found that to unwind this innovation in a short timeframe isn’t yet technically or economically feasible,” he explained.

Michelle Norman

can pose a challenge to reach ambitious goals, as Ms Cotter points out.

“In many markets around the world collection and recycling of packaging is difficult or the supply of high-quality recycled materials is limited, making it harder to meet the demand for recycled packaging. Therefore, collective work is needed to create industry-wide schemes and collaboration across businesses, as well as governments, to improve circularity.”

PepsiCo takes a collaborative approach to tackle this challenge.

“As we strive to make progress on our own PepsiCo Positive (pep+) goals, we’re involving others in our value chain, such as our bottlers and co-manufacturing partners, to also take specific actions and contribute to progress towards our targets.”

Ms Norman points out the challenge of delivering quality and product protection, while further improving sustainability.

“Across SBFE we sell a wide range of drinks packaged in a variety of container formats. Our goal is to deliver the best-tasting drinks in packaging that suits all drinking occasions. The challenge we face is how to continue to deliver on that promise while improving packaging sustainability, while at the same time ensuring it protects the product to maintain its quality and safety, that it looks great to attract attention and stands out on the shelf, and retains all of the design attributes that create a bond with the consumer.”

Ms Cotter observes that consumers are calling for more sustainable packaging choices, and the company strives to design our packaging to balance several critical criteria, including compliance with food safety regulations, maintaining the quality of the product, environmental sustainability, affordability, and consumer preferences, including convenience.

Ms Norman says that the soft drinks market is vibrant and one of the most innovative categories in food & beverage, with big growth in lower-calorie drinks, energy drinks and ready-to-drink teas and coffees.

“Convenience continues to be a key driver of purchase for the consumer as evidenced by the growth in ready-to-drink formats, and the small but growing segment of refillable drinks. Our packaging developments have been focused on making our products more sustainable while still meeting the consumer expectation of convenience.”

She explains that SBFE’s sustainability packaging goal is to have 100% sustainable packaging by 2030, with plans to use recyclable packaging that is designed for circularity, and for plastics to ensure that we only use recycled or bio-based content.

“We also want to reduce our emissions coming from packaging, as well as reduce all associated environmental impacts such as water use,” she adds.

“Across our portfolio, we use an average of 44% recycled PET in our primary packaging. Our drinks portfolio is 75% recyclable in the current infrastructure. Already some of our best-selling brands such as Schweppes in Spain and Oasis in France are sold in bottles that are made from 100% recycled plastic. We will continue to increase the recycled content of our packaging and transition the remainder of our drinks portfolio to be fully recyclable, for example removing the full plastic sleeve used on Lucozade Energy in the UK and Ireland to only a half sleeve. This will reduce both the plastic used and emissions and make the bottles fully circular to encourage more bottle-to-bottle recycling.”

able in 100% rPET packaging, and our 100% rPET Pepsi bottles (excluding cap and label) made it to consumer shelves across ten EU markets by the end of last year. Looking ahead, we have targets to cut virgin plastic per serving by 50% across our global food and beverage portfolio (against a 2020 baseline) by 2030 and to scale new business models that avoid or minimize single-use packaging materials,” she says.

Predicting the future is notoriously difficult, but what do our experts expect to see in the coming years?

Ms Cotter anticipates that there will be adoption of technology across the sector to help better processes and drive innovation forward.

“We’re already using automation and AI throughout our supply chain. AI and machine learning are increasingly being used for product innovation to help consumers make better choices. For example, PepsiCo is amongst the brands backing the Perfect Sorting Consortium to improve packaging waste sorting through AI to create a circular economy for flexible packaging.”

Similarly, Suntory will continue to focus on looking at design initiatives to reduce unnecessary packaging and move to more sustainable and less carbon-intensive materials.

“For example, we are part of a consortium with green technologists Carbios, working to accelerate bio-recycling which has the potential to further reduce plastic PET waste with their infinite recycling technology,” explains Ms Norman.

Products are increasingly arriving on our doorsteps in their own packaging. Usually, this is an effort to reduce waste, lower costs, and streamline the unboxing experience. But how does it work, what does it achieve, and could it have some drawbacks? Emma Liggins investigates.

Founded in 2008, e-commerce giant Amazon’s Frustration-Free Packaging Initiative is a three-tier certification programme. The second tier, Ships in Product Packaging (SIPP; formerly known as Ships in Own Container), sees the retailer lab-test its products to gauge the viability of shipping them to consumers in their original packaging.

Where it is safe to do so, the company aims to deliver goods without additional Amazon-branded boxes, envelopes, or bags via its Ships in Product Packaging Programme. Plastic clamshells and wire ties are specifically ruled out – a move thought to ensure the packaging is easy to open, and therefore ‘frustration-free’.

Consumers in Europe, Canada, and the United States are informed at checkout that their product will be shipped in its original packaging. Should they want to keep the product hidden for any reason, they can opt back

into Amazon packaging at no extra cost. In theory, though, the programme strips a delivery down to its essential packaging components and reduces the amount of packaging arriving on a shopper’s doorstep.

A LinkedIn post published by My Amazon Guy, an expert Amazon agency, provides a general guideline for shipping products in their original packaging – although it emphasizes that every individual pack requires International Safe Transit Association (ISTA) 6 approval to certify minimal rates of damage or defects.

Rigid packaging should constitute a sealed, six-sided box of an appropriate size. This means any packaging with cut-outs exposing the product, including handholds, should be redesigned. Fragile or liquid items, or prod-

Generally, loose or protruding components like handles, tuck flaps or tabs, or auto-lock bottom boxes can be tucked in and taped down, the agency says. Otherwise, they can be removed entirely. It is advised that thicker cardboard or a higher board grade should replace any packaging that would otherwise deform in transit; and any packaging that would be damaged and expose the product should not be shipped in its own packaging.

Flexible packaging must offer a minimum thickness of 2 mils and a tear strength of at least 130 grams in line with ASTM D1922. No holes exceeding 0.25” or 6.4mm are permitted on the pack, although smaller holes are permitted for ventilation if required to prevent swelling or damage. Spherical or cylindrical items must be delivered with a rigid inner pack, while liquids, food for human consumption, sharp, pointed or magnetic items, and granular or loose items under 1” in diameter cannot be shipped in their own flexible packs.

These requirements overlap with the expectations for Frustration-Free Packaging, which also mandate minimum dimensions of 6” x 4” by 0.375”, a maximum weight of 23kg, and an acceptable product-to-packaging ratio (calculated by dividing the volume of the product by the total volume of the packaging). It must be ‘easy to open’ – i.e., it should not be overly reliant on scissors to access the product, which should be removable in under 120 seconds – and should be 100% recyclable at kerbside.

My Amazon Guy adds that products of a sensitive nature can be shipped in their own packaging if it is opaque and discreet. The post cites examples of personal hygiene products like diapers and bed-wetting materials geared towards adults, but generally applies to items that may be considered embarrassing by the consumer and/or inappropriate for children.

Since 2015, the SIPP initiative is said to have reduced packaging per shipment by 41%, equating to over 2 million tons. Nearly 12 million products were qualified to be shipped in their original product packaging in 2023, it

Singapore, and 3% in Japan.

An initiative has been launched to extend the SIPP programme to Fulfillment by Amazon (FBA) sellers – sellers that outsource their order fulfilment, including customer service and returns, to Amazon – in a bid to reduce expenses and improve customer experience. Eligible products on the American, Canadian, British, French, German, Italian, and Spanish markets can now be submitted, tested for qualification, and delivered to consumers without unnecessary packaging.

“Where it is safe to do so, the company aims to deliver goods without additional Amazon-branded boxes, envelopes, or bags via its Ships in Product Packaging Programme. Plastic clamshells and wire ties are specifically ruled out.”

The company adds that it helps suppliers with unsuitable packaging designs to make changes and qualify for the programme.

Amazon cites international sports equipment seller B2Fitness as a successful participant. Over 30 of its fitness products – boxing gloves, weight lifting belts, weight lifting wrist wraps, and more – have been tested and certified to be shippable in their own packaging, Amazon reports. Since the existing cardboard designs were already considered recyclable and suitable for e-commerce applications, they were only said to require the ‘minimal’ adaptation of applying standard tape to keep the box sealed in transit.

On the other hand, the Samsung 49” Series 5 TV saw substantial changes in its packaging. Apparently, the SIPP Programme is responsible for the removal of nine extra packaging components, equating to a 39% decrease, and a 69% reduction in packaging volume, streamlining it from

fitting into one delivery van; this means fewer journeys are needed to distrib ute more orders.

Not only is this logistically efficient, but it is also expected to offer the environmental benefit of delivery vehicles emitting less CO2 in transit. Indeed, Amazon aims to reach net-zero carbon emissions by 2040; and to deploy more electric delivery vehicles onto the world’s roads, targeting 10,000 in India by 2025 (claiming to have reached 7,200 in 2023) and at least 100,000 globally by 2030 (reporting over 19,000 on the roads last year).

Although SIPP has been generally well-received, not everyone is on board with the concept. Collectors, for example, have expressed concerns that sticking a shipping label directly onto a valuable box could affect its worth; or that the packaging will be damaged in transit, with non-collectors showing little consideration for its sentimental or financial value.

Furthermore, Jeff Haden, contributing editor at Inc Magazine, wrote an article last year questioning the suitability of a product’s own container if a consumer decides to return their order. Even if a pack is not opened, he said, wear and tear in transit could still require the product to be repackaged before redistribution.

However, most of the conversation stems from the clash between branding and discretion. In a recent conversation with Packaging Europe, SIPP Programme global lead Kayla Fenton raised the point that the nature of online shopping itself has raised new opportunities for brands to reach their consumers.

“Retail packaging can be oversized and glossy to capture customer attention,” she explained. “Because customers can see multiple product images online, e-commerce allows for simpler – and often lower-cost – packaging.

“The SIPP programme has the benefit of helping sellers connect with customers, who immediately see their branding upon delivery.”

Plenty of industry players are accepting of outward branding; in ‘E-commerce Order Tetris: 7 Tips for Better Product Packaging’, PackHelp argues

choose a font and print that leads consumers to associate the pack with the brand – but cautions that designers should avoid over-cluttering their design.

A common counterargument is the threat of porch piracy. Thieves are inclined to target packages that visibly contain valuable items, says Golden West Packaging Group in ‘The Dos and Don’ts of Packaging for an E-Commerce Business’. Discretion may be key to avoiding porch piracy, but it doesn’t necessarily rule out shipping products in their own packaging; rather, it may simply encourage redesigning packaging for this purpose. Indeed, Golden West believes that a plain exterior and an eye-catching interior can enhance the unboxing experience for consumers, while the PRINTING United Alliance noted the prevalence of interior print as a packaging trend in 2019.

Swiftpak adds that simplified packaging is cheaper for customers since it takes less time to pack and sort, and even encourages companies to perfect their packaging designs before turning their attention to improving the delivery process.

Shipping in product packaging is still a relatively new concept, practiced mostly by Amazon and independent sellers on marketplaces like Vinted. Experience will undoubtedly teach us more about its workings and allow its proponents to refine the process, but with minimal complaints about the process so far, it seems to be one of many viable alternatives to overpacked

What’s on show at FACHPACK? Find out about some of the innovations at the event in this round-up.

ATFACHPACK 2024, LEIBINGER will showcase the world of the LEIBINGER IQJET. Visitors will experience how state-of-the-art technology can evolve into an art form at booth 7-550 in Hall 7. In May, IQJET was awarded the coveted ‘German Innovation Award’ and LEIBINGER was named ‘Innovator of the Year’.

With its IQJET, LEIBINGER is showcasing a solution that the company says defines all-new standards in industrial coding & marking. When it comes to controlling, this translates into substantial cost-savings across the entire product life cycle (TCO), as demonstrated by the IQJET operating cost calculator on LEIBINGER’s homepage. With an intermittent pump, the IQJET runs for five years without requiring any maintenance. Even after five years, the IQJET continues to operate reliably until a scheduled maintenance window presents itself, when only replacement of the affected wear parts is required.

This eliminates the need for expensive disposable modules, frequent maintenance intervals and inflexible maintenance times.

The IQJET’s features include power consumption of 36 watts and economical use of solvent. LEIBINGER manufactures its own ink and has equipped the IQJET with an advanced ink management system. This combination perfects the CIJ (Continuous Inkjet) process. In LEIBINGER printers, the ink doesn’t dry out during production breaks and doesn’t clog the lines. This is ensured by the fully automatic nozzle sealing technology. The IQJET’s smart ink management system also guarantees optimum viscosity and a constant ink temperature at all times, regardless of ambient temperatures. The outcome is flawless printing.

With its Plug & Print maxim, LEIBINGER delivers what other providers can only promise: Switch on, press Print and let it get to work. With its numerous interfaces, including the standardized OPC UA for automation technology and PLC for industry, the IQJET integrates seamlessly into existing system controls.

Visit LEIBINGER at FACHPACK 2024 and experience hourly live demonstrations, presentations and more. The company will be showcasing the entire LEIBINGER range of printing systems from simple to complex, as well as our software solutions and in-house inks for a variety of industrial sectors such as food, beverage bottling and convenience. On the LEIBINGER website, you can already schedule appointments with experts and obtain free admission codes. https://leibinger-group.com/ FACHPACK-2024

Find LEIBINGER on booth 7-550 in hall 7 at FACHPACK in Nuremberg from September 24 to 26. www.leibinger-group.com

Ever-changing consumer needs and new regulatory requirements are constantly presenting the packaging industry with new challenges. From September 24 to 26, Henkel Adhesive Technologies will make a contribution to the key topic of “Transition in Packaging” with its innovative adhesive solutions in Hall 1, Stand 153.

The Packaging and Packaging Waste Regulation (PPWR) will soon bring new requirements to the packaging industry, setting stricter rules for the recyclability of packaging and the use of recyclates, including a 100% reuse requirement for certain industrial and commercial packaging. As Henkel’s sustainability strategy is based on the corporate philosophy “Pioneers at heart for the good of generations”, the global provider of adhesives, sealants and functional coatings is already offering solutions that comply with the planned regulations.

At FACHPACK, Henkel will focus on two products. One of the main topics is palletizing with hotmelt adhesives. Instead of using large amounts of plastic film, hot melt adhesives from the Technomelt Supra PS range stabilize stacked goods during transport on pallets. The adhesive is applied to the packaged goods and prevents them from tipping thanks to its anti-slip effect. This ensures safe transportation, allows higher stacking – depending on the content - and reduces the use of stretch film by up to 90%. It also eliminates the need for intermediate layers, reducing overall material costs by up to 80%. With this palletizing solution, Henkel fulfils two pillars of the PPWR: the avoidance of packaging waste and the recyclability of packaging. Visitors to FACHPACK will be able to see for themselves the adhesive strength of the palletizing solution in an exhibit.

Henkel is also presenting another product highlight exclusively at the fair, an addition to the hot melt portfolio for end-of-line packaging. The product is particularly suitable for sustainabilityconscious companies as it can reduce CO2 emissions, improve process efficiency and is fully compatible with the paper recycling process. www.henkel.com

HERMA’s new label applicator that the company says is designed for a diverse range of standard applications will make its world debut at FACHPACK in Hall 3C, Stand 322. It reportedly combines cost-effectiveness and high quality with a level of engineering and manufacturing quality.

Costing the same as the predecessor model HERMA basic, the HERMA eco boasts a multitude of new features. Integration of the new HERMA eco into a packaging system and therefore into a higherlevel control system (PLC) boosts conveience. This is made possible by, among other things, a series of additional I/O signals. In conjunction with the system control unit, these signals enable, for example, the automatic power on/power off function, separate

starting of the labeling process as well as manual label dispensing, which is an advantage especially when setting up an applicator.

Thanks to these signals, end-of-reel checking is now also possible. Furthermore, the printer and the peel system will in future each have their own connections that can be monitored separately. As a result, it will be possible to use, for example, a printer in combination with a pneumatic transfer unit. The HERMA eco is therefore well prepared even for simple pharmaceutical or healthcare systems, not least because it has a master encoder function. This function enables continuous and automatic synchronization with the speed of the conveyor belt. It ensures precision, even at the maximum speed of up to 30 metres per minute

for labels with a width of up to 160 millimetres. The newly designed winders and unwinders also contribute to accuracy, thanks to the reduced inert mass that has to be moved.

In the HERMA online configurator, the HERMA eco can be adapted even more easily to specific requirements, particularly by mechanical engineers.

FACHPACK visitors will have an opportunity to find out about the full range of sustainable, cost-effective solutions that packaging manufacturer Schubert has developed for consumer goods manufacturers at Stand 1-244 in Hall 1. As an example for the new ‘Power Compact’ machine concept – high output in the smallest space with lean yet high-quality technology – a bar packer with a single-lane erector and feeding via the Comfort Feeder will be in operation at the stand. The Schubert experts will also be demonstrating how further sustainability potential through the interaction between packaging and machine technology can be harnessed.

ATOne of the company’s key objectives is to support consumer goods manufacturers on their journey towards a sustainable future. It is therefore constantly evolving its modular machine technology to improve energy efficiency in machine operation, and to maximise the efficient use of all technical components in line design and achieve optimum performance from the leanest possible solution.

Lean machine concept saves resources and costs

This can be experienced live on the ‘Power Compact’ line showcased at the Schubert stand. The bar packer with a single-lane erector and blank infeed

FACHPACK in Hall 4A, stand 306, paper and board manufacturer Sappi will be showcasing its portfolio of new products from the flexible packaging, wet glue label, paperboard and containerboard segments under the motto 'Futureproof'.

Sappi is expanding its portfolio of functional papers with the new Guard ICC, Guard OHS and Guard Twist Gloss papers, which will be introduced at FACHPACK. Guard ICC is a packaging paper with a barrier coating on both sides. It was developed for flexible packaging applications where dimensional stability and protection on both sides are required. Available in a grammage of 110 g/m², Guard ICC is used in the food sector, especially for packaging ice-cream cones. Guard OHS is a paper with a vapour and oxygen barrier tailored to the needs of confectionary packaging with integrated heat-sealing, therefore meeting both heat and cold seal requirements and is suitable for flexible packaging applications such as flow wraps, sachets and pouches for the food and non-food sectors. The third paper in the line-up of new products is Guard Twist Gloss: The

directly from the pallet via a Comfort Feeder offers manufacturers a lean machine concept: a compact and space-saving line, erecting, filling and closing at 60 cycles per minute.

The manufacturer’s flexible, modular and easily convertible packaging machines process both conventional and fully recyclable packaging. Visitors to the stand will experience how Schubert is using its decades of experience with cardboard and the creation of innovative technologies, such as Dotlock, a new technology for joining packaging made of solid or corrugated cardboard entirely without glue –but with the same strength as glued packaging. www.schubert.group.

one-side coated paper with a barrier coating on the reverse side was developed primarily for twist wrap applications in the confectionery industry, such as sticky sweets or chocolate.

Sappi will also have its portfolio of uncoated and coated products on display. At FACHPACK, the company will be introducing the new Algro Finess C paper suited for wrapper applications in the coffee and food sector, such as snacks and confectionery. The wet-glue label paper Parade Label WS is a wet-strength and alkali-resistant paper that guarantees with a high-quality surface. The glossy paper is available in grammages ranging from 65 to 80 g/m2. Sappi is also presenting a linen-embossed version for the first time at FACHPACK.

The premium boards from the Algro Design product family are suited to packaging applications in the luxury fragrance, cosmetic and confectionery sectors. The latest addition to the portfolio on show at FACHPACK is Algro Volume, a premium paperboard with full coated top side. www.sappi.com

The Packaging Europe team is based in the UK, where cannabis is illegal – but with Smithers projecting a value of $1.6 billion for the cannabis packaging market in 2024, it is an ever-expanding market with an increasing interest in environmentalism. We spoke to two industry players in the United States to hear about their methods of avoiding fossil-based polymers in their packaging.

WEstarted with Bryan Gregori, managing director at Tree Hugger Containers, which seeks to eliminate single-use plastics and reduce cannabis-related waste with a range of alternative formats.

What led you to choose recycled glass for your cannabis packaging? Where do you source the glass recyclate?

BG: Our commitment to helping support a circular life cycle with our packaging offerings led us to choose recycled glass (also known as cullet) for our jars. We strive to develop packaging that, at a minimum, improves the sustainability of that product when you compare it to standard packaging that does not take the environment into consideration.

By choosing recycled glass, we’re reusing materials that have already been in circulation, which limits the amount of raw materials needed to make our glass packaging. Our recycled glass jars can be recycled at the end of their life and turned into another glass product.

We source our recycled glass from both Germany and Taiwan. Both countries have exceptional recycling rates.

Similarly, where do you source the ocean-bound plastic for your lids and vape tubes? How do you colour them without impacting their recyclability?

BG: The ocean-bound plastic we use in our packaging is sourced from Oceanworks via our close packaging partner, Sana Packaging.

The ocean-bound plastic products are coloured during the manufacturing process, typically in either white or black. When recycled at the end of its lifecycle, the plastic is sorted by resin type and then by colour using optical sensors. This allows the plastics to be recycled with similar colours and turned into new plastic products.

You also offer post-consumer recycled mylar bags printed with carbon-neutral printers and polymerbased, air pollutant-free inks. Could you tell us more about this production process?

BG: Our post-consumer recycled mylar bags are printed using carbon-neutral HP digital printers. Currently, our PCR bags are made with 43% postconsumer recycled materials and we’re working to increase the amount

Bryan Gregori

The government has made it very difficult for cannabis companies to make a profit, so offering sustainable packaging at a great price is of the utmost importance.

of PCR in these bags to provide even more environmental benefits. These bags are lightweight and save considerable fuel/energy during transporta tion. With more than a dozen manufacturing sites in the United States and globally, we have our bags made at the nearest manufacturing site to each customer to cut down on transportation costs and our carbon footprint.

Could you go into detail about the child-resistant properties of your packaging?

BG: All our packaging comes standard with certified, child-resistant features to comply with state and federal laws for cannabis packaging. Our recycled glass jars are designed to fit our ocean-bound plastic, childresistant lids using a push-down-and-turn feature, giving it the certified child resistance needed.

Our pre-roll and vape tubes typically use a 'pop-top' style child-resistant feature where the tubes must be squeezed in the right place to pop open the lid. Our PCR mylar bags use a child-resistant zipper, so anyone opening them cannot simply pull them open. You have to dig your fingernail into the zipper to pull it apart.

Andrew Bliss

Along these lines, we want to offer even greater carbon- and plastic-reducing solutions. We are currently working on a new material made of our Ecoshell plus ocean-bound plastic.

Moving forward, we’re researching and working to develop packaging using compostable materials, such as PHA, that will improve every stage of the packaging’s life cycle – from where and how the material is sourced, to how it’s manufactured and transported, to how it’s discarded, recycled, or composted. Each step of the process is highly important to improving the environment and moving to a circular economic model.

We’re starting to work with several partners to continue innovation and development while also trying to keep costs affordable for our customers. The government has made it very difficult for cannabis companies to make a profit, so offering sustainable packaging at a great price is of the utmost importance.

We also asked Andrew Bliss, founder and CEO of Ecoshell, about its patented bio-calcium made from eggshells – a solution claimed to cut plastic by 50% and carbon by 70%.

For those who don’t know, can you explain how Ecoshell is made?

AB: Ecoshell is born from a seven-step, patented process from cleaning the eggshells through to crushing, grinding, heating them to an extreme degree, then pelletizing. Our patented process gives our bio-calcium carbonate its special properties which separate it from traditional limestone CaCO

For example, Ecoshell’s particles are much more porous, giving them more surface area and space for better bonds with plastic polymers. This makes a better end product, and also means we can safely replace much more plastic.

The bio-calcium used to make Ecoshell is sourced from agricultural waste. Could you tell us more about where you get this waste from?

AB: We work with egg and food production companies across Asia, where they use the proteins and we collect the waste shells. Likewise, we partner with agricultural sources where eggshells in a large amount can be harmful to the environment.

AB: At the current state of regulation and with the drug class that cannabis is in, the profit margin for cannabis companies is razor thin. Switching over to sustainable packaging, though, is generally an expensive undertaking. It usually requires material testing and sampling, trialling the new designs, and even upgrading machines and shipping containers for the final output.

On top of this, a lot of eco-materials can be up to twice as expensive as virgin plastics. So, even though their consumers demand it, and now even with governments requiring plastic reduction (SB 54 in California), making that switch is often not an economic possibility.

With Ecoshell, however, brands can simply use 25–30% of our resin in their current compounds used to make their packaging to satisfy all reduction requirements at little or no increase in cost. There is also zero need for packaging redesign, machinery upgrades, or any change of shipping container for their products.

Our resin is also easily incorporated, so there is minimal downtime. If brands want an even more eco-friendly product, we can provide resins for use with PCR or PIR plastics, as well as complete compounds with zero virgin plastic and 30% reduction off the top.

AB: We are focused on real and true carbon reduction, looking at the creation of the product through to its end of life. We like to position ourselves as anti-greenwashing, calling out solutions that claim to be sustainable but, in reality, offer no real carbon reduction.

We adhere to the three Rs and are proud that we take up to 50% of plastic out of the economy (reduce); that our material can make products of exceptional quality for frequent use (reuse); and that we have certification for being fully recyclable (recycle).

Along these lines, we want to offer even greater carbon- and plasticreducing solutions. We are currently working on a new material made of our Ecoshell plus ocean-bound plastic, which would provide the greatest carbon reduction on the market.

In addition, while we currently provide materials and engineering support to our clients’ factories or provide OEM services through our network of factories in Taiwan and Asia, we are working to set up our own production here in North America, from the pelletizing of our powder to the production of Ecoshellbranded eco-friendly products and manufacturing services. We will start with film blowing for bags and bubble wrap, and move on from there. All materials will be made with Ecoshell, of course, and paired with PCR or ocean-bound plastic.

Banding has become an increasingly popular packaging solution, from Mondi and ATS-Tanner’s previous work to wrap drinks, fruits, vegetables, and e-commerce deliveries in a single material strip; to Aldi’s trial of a paper band for its bananas. But why should manufacturers choose this solution, and how does it benefit consumers?

Urs Fischer, head of Business Unit Sales International at ATS-Tanner, tells us what we might gain by banding – and why we should do it using the company’s machinery.

Let’s start with the basics. What materials are typically used in banding applications?

The range is very wide and varies depending on the product, application, and requirements.

We have paper and monofilm bands from 15 to 100 mm in width in various strengths. The bands have different characteristics in terms of tear resistance, moisture resistance, printability, transparency, and stretchability, for example. We have numerous different qualities for both paper and film – made from virgin raw material or post-consumer recycled material, depending on your wishes and requirements.

We have noticed that our customers are increasingly looking for solutions using paper and want to avoid plastic where it makes sense and is possible. Our in-house development 'TruePaper' – a paper band that can be sealed using ultrasonic welding technology but does not contain a plastic coating – is currently very popular.

As we all know, the upcoming Packaging and Packaging Waste Regulation is an important consideration in packaging design. How does banding align with sustainability regulation?

The upcoming Packaging and Packaging Waste Regulation has three main targets: reduction of packaging waste, promotion of reuse and recycling,

and the use of sustainable materials. Banding fulfills these goals – and goes one step further.

• Banding reduces packaging to the absolute minimum.

• We offer bands made from post-consumer recycled material. Both those made of paper and those made of film. We are constantly expanding our range in this direction.

• Banding makes recycling easy: our bands are made of mono-material and can be opened and separated from the packaged product very easily. Adhesives are not used.

• In addition, the bands can be printed just in time with instructions and labels on how they can be recycled. These instructions increase recycling rates and are already mandatory in some countries.

Could you tell us about the functional benefits of banding solutions, and what they offer to packaging manufacturers?

Banding is extremely versatile and can take on different packaging functions. Here is a selection:

• Branding with banding: embellish products

Bands can be printed on both sides with up to 12 colours and offer plenty of space for information – from recipe ideas and ingredient lists to variable information, such as best-before dates or 1D or 2D codes.

• Adhesive-free labelling

Banding machines with integrated printers band and label in a single step, eliminating the need for additional labelling.

• Closing and sealing of packaging

Whether it is heavy shipping cartons, shoe boxes, meal trays for takeout meals, or cardboard trays for fruits and vegetables, paper or film banding closes packaging securely, gently, and in a customer-friendly manner.

• Bundling with a minimum of packaging

Banding combines smaller consignments or items into larger units to optimize transport and storage processes. Optional just-in-time codes printed on the bands enable goods to be recorded and tracked quickly.

• Multipacks and promotional packaging

A band is frustration-free packaging. The infinitely variable sealing force of ATS ultrasonic sealing technology ensures the right mix of security and ease of opening. Consumers benefit from the simplest possible product handling: there is no need to laboriously cut open films, simply tear them open.

How about consumers? How will their experience with a banded product differ from other kinds of packaging?

As mentioned above, bands are extremely customer-friendly and frustrationfree packaging: they are very easy to open by hand (paper bands at any point, film bands when sealing), produce extremely little waste, and can be disposed of correctly and returned to the recycling system with ease.

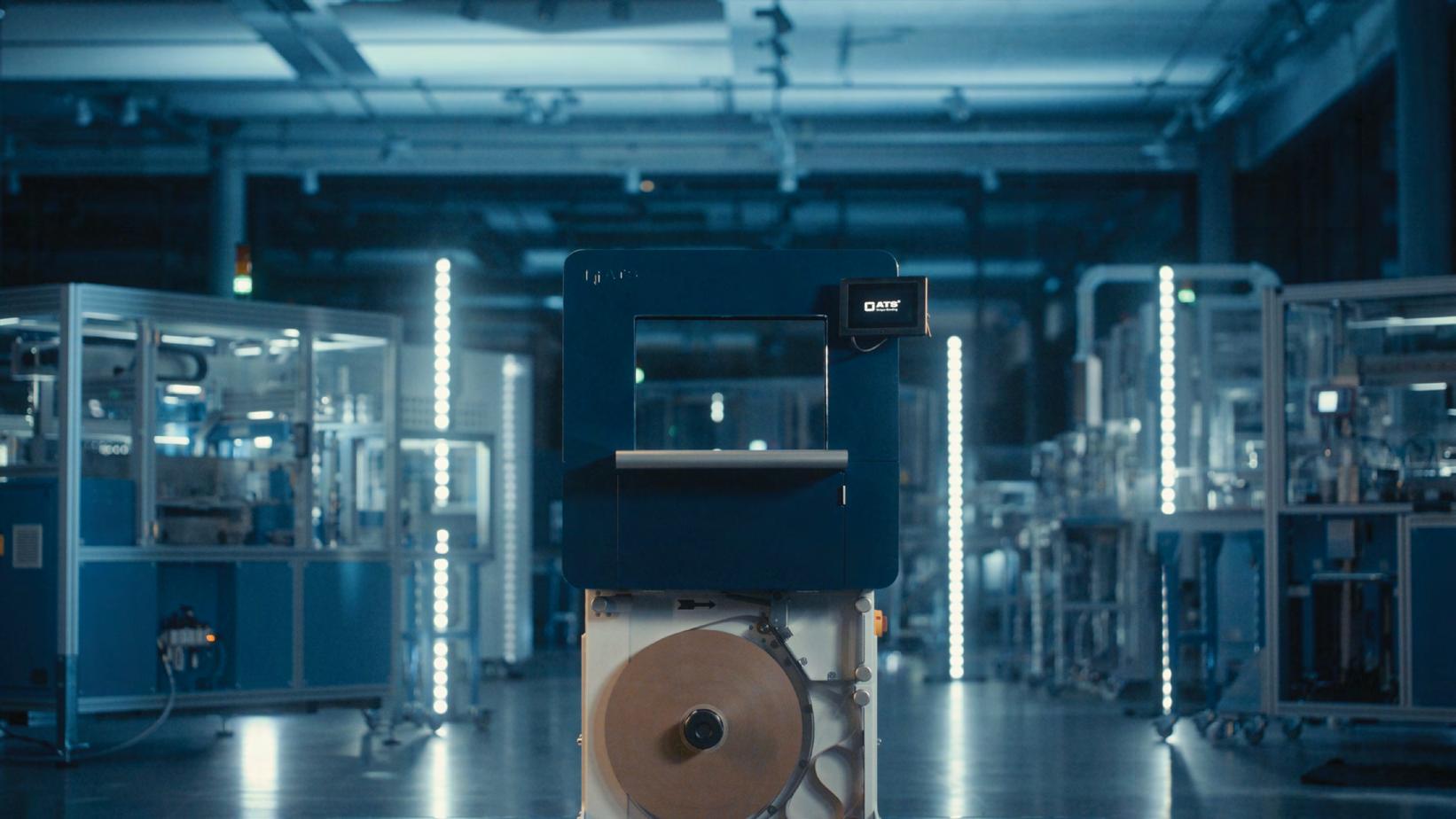

Tell us more about ATS-Tanner’s US-3000 banding machine. How does it compare to other solutions on the market?

The US-3000 is the successor to the world’s best-selling banding machine and combines the best of more than 30 years of mechanical engineering experience with state-of-the-art technology. We are proud to say that the US-3000 is the most reliable, user-friendly, and sophisticated standalone banding machine we have ever built.

The banding machine with ultrasonic welding technology is the perfect combination of design and function: it is made exclusively of high-quality materials and components. The functionally well-thought-out and timeless design ensures that it is a pleasure to operate and makes it a powerful, sophisticated, and elegant machine with a high recognition value.

A positive user experience increases productivity by avoiding operator errors, reduces training costs, and ensures motivated employees. That’s

why we’ve invested heavily in design, from the self-explanatory user interface to the height-adjustable table and effortless band change.

Also important: service and maintenance have never been more efficient. All components are conveniently accessible. The clear separation of mechanics and electronics ensures ideal order, structure, and overview. Error diagnoses and information for rectification are provided via the HMI.

The best thing to do is to visit us at FACHPACK in Nuremberg, see the machine and try it out. You must experience it.

The second-best thing is to look at the numerous benefits and impressive videos on our website at ATS US-3000 Banding Machine - Enhance Your Packaging Efficiency (ats-tanner.com).

Here are seven main reasons why a prospective customer should pick ATS-Tanner as their partner:

1. ATS banding machines achieve the highest cycle rates on the market. A critical factor for high productivity and efficient operations.

2. The powerful ATS banding machines achieve the highest band tension on the market. A critical advantage when banding heavy products.

3. Our patented ultrasonic sealing technology: Banding machines with ultrasonic sealing technology are the most powerful, reliable, and energyefficient packaging machines on the market.

4. We have a wide range of innovative, eco-friendly banding materials. It is as diverse as the applications for which banding is used. We know the characteristics of each of our products down to the last detail.

5. We are there for our customers around the world in the event of a malfunction, with a service or maintenance contract tailored to your individual needs.

6. We are passionate mechanical engineers and software developers. We have a lot of experience in solving challenges, automation, and seamless integration into processes.

7. Designed and built in Switzerland: Our banding machines are built to high quality and safety standards. They are subjected to rigorous endurance testing before delivery.

We and our brand-new US-3000 are at FACHPACK – Hall 7A, Booth 414. To learn more about banding and what ATS-Tanner can offer visit: www.ats-tanner.com/en/banding Energy-efficient

Our US-3000 is the new standard banding machine for industrial environments; see www.ats-tanner.com/en/lp/the-new-ats-banding-machine.

Comexi’s ML2 machine aspires for modularity and flexibility throughout the trolley system, with its capabilities ranging from plastic and paper laminates or coatings to packaging windows. In this edition of ‘In Conversation With…’, we spoke to Anthony Plasse, area manager for Comexi, as well as Pyroll’s chief sales and marketing officer, Ari-Pekka Pietilä, and plant manager Pekka Vähävihu to learn more about their collaboration, its claims to sustainability, and the broader applications for the ML2.

Broadly speaking, how does Comexi’s ML2 machine work? What benefits do you think it brings to customers in general?

AP: Our ML2 is a Swiss knife, capable of solving all the challenges of laminating and coating. Indeed, the core of the machine is the trolley feature. We created five different trolleys: solventless, gravure, flexo, semiflexo, and reverse doctor blade chamber. Given the specifics of each client, we can recommend the best trolleys. They are totally interchangeable and can be changed at any moment in function of the production’s needs. This is a great solution for the clients as it allows them to be future proof. We are seeing a trend to move away from the traditional structure PET/PE, laminated in solventless. The solution is to go towards coating either on paper or on mono-material plastics.

PV: The starting point for this project was to improve production efficiency to be able to offer cost-competitive solutions to customers. It was also to increase flexibility and versatility to meet customer needs efficiently.

The new ML2 line replaces the old self-made lamination line. This old line was originally designed to meet customers’ unique needs for paper laminates, and particularly window laminates.

Few selected laminate-line manufacturers were contacted. It was Comexi´s willingness and ability to take the risk to design and tailor their standard ML2 line to meet our individual needs and of course the final offer.

What kinds of products would the packaging produced on an ML2 be applied to?

Last but not least, in an age where skilled labour is scarce, this machine also comes fully equipped to make it autonomous. You can now control the adhesive/coating weight in line, without stopping the production.

AP: This machine is so versatile in terms of materials. Broadly speaking it can work on all the applications of packaging: food, pet food, pharmaceutical, cosmetics, etc... It can work on any plastic film, paper from 40 to 100gsm, and aluminium foil.

In your view, what does this machine offer from a sustainability perspective?

AP: From a sustainability perspective, this machine is capable of working with all kinds of adhesives (solventless, solvent-based, water-based) and also all the coatings. The same is true for the materials.

From a brand owner’s perspective, this is great because they can work with their existing structures and launch instantly after validating new sustainable structures.

What would you say to a company that might be considering ML2 for its own packaging operations?

AP: This machine represents the solution to any packaging challenge you may have.

Traditionally the market was looking at two kinds of machines: solventless or multi-lamination machines (ML2). The multi-lamination machine was exclusive to only a few specific sectors: pharma and retort applications.

With the sustainability challenges our industry is facing, this dichotomy stands no more. The future is going more and more towards coating, paper applications and the lamination and/or coating of mono-materials.

The machine is available at our demo centre in Girona. Come and see for yourself, we are looking forward to welcoming you.

What kinds of products would the packaging produced on the ML2 be applied to?

A-PP: Pyroll is developing new innovative fibre-based solutions, combined with functional layers such as plastics to offer new characteristics for different materials.

Mainly, the new products are for food packaging, but options to produce other categories are possible and under development. A good example of such a product is to combine different board materials with specific adhesives to offer unique properties such as light barriers or ovenability.

Generally speaking, our development work is in the beginning, so all the properties are not fully in use yet. Many new things can be developed and brought to market.

In your view, what does this machine offer from a sustainability perspective?

A-PP: The new machine offers a wide variety of options to meet changing sustainability laws and targets. We are not tied to certain solutions, but we offer different solutions to meet different sides of the requirements; for example, minimized CO2 emissions or recyclability. We can offer a much better variety of options to our customers where they can choose the best solution for their requirements.

Smurfit Kappa and WestRock’s combination to form Smurfit Westrock has been the talk of the packaging industry since it was announced last September – but what can we expect from its future? Saverio Mayer, CEO of Smurfit Westrock Europe MEA and APAC, walks us through his vision of the new company’s industrial, financial, and efficiency benefits, and how this all reflects on its pursuit of sustainable packaging, in this ‘In Conversation With…’ feature.

For any readers who may be unfamiliar, could you outline the details of the combination and what it means for the companies involved?