Record keeping for Tradie Businesses

It shows that you treat your business, customers, and subcontractors responsibly.

The Moment that Ruins

Our Focus

Just try to catch the moment when it’s happening.

5 Financial Review Tips for your 30s and beyond

Your 30s are also a great time to take control of your finances.

Protect Your Cash Flow and Limit Legal Liability

Professionally Drafted Terms and Conditions

www.aussiepaintersnetwork.com.au

From the Editor

Hey Everyone,

Welcome to the 137th issue of The Aussie Painting Contractor Magazine.

What an amazing month we have had here at APN. We have attended Trade Shows, Career Expo’s, run Try a Trade Days at our training facility, had a Lady Training Day where we had NAWIC, Busy Sisters and Simone for Cabots attend and share their stories about the industry. In total with these we have placed people into employment and apprenticeships, we have also engaged with 1000’s of people telling them about our industry.

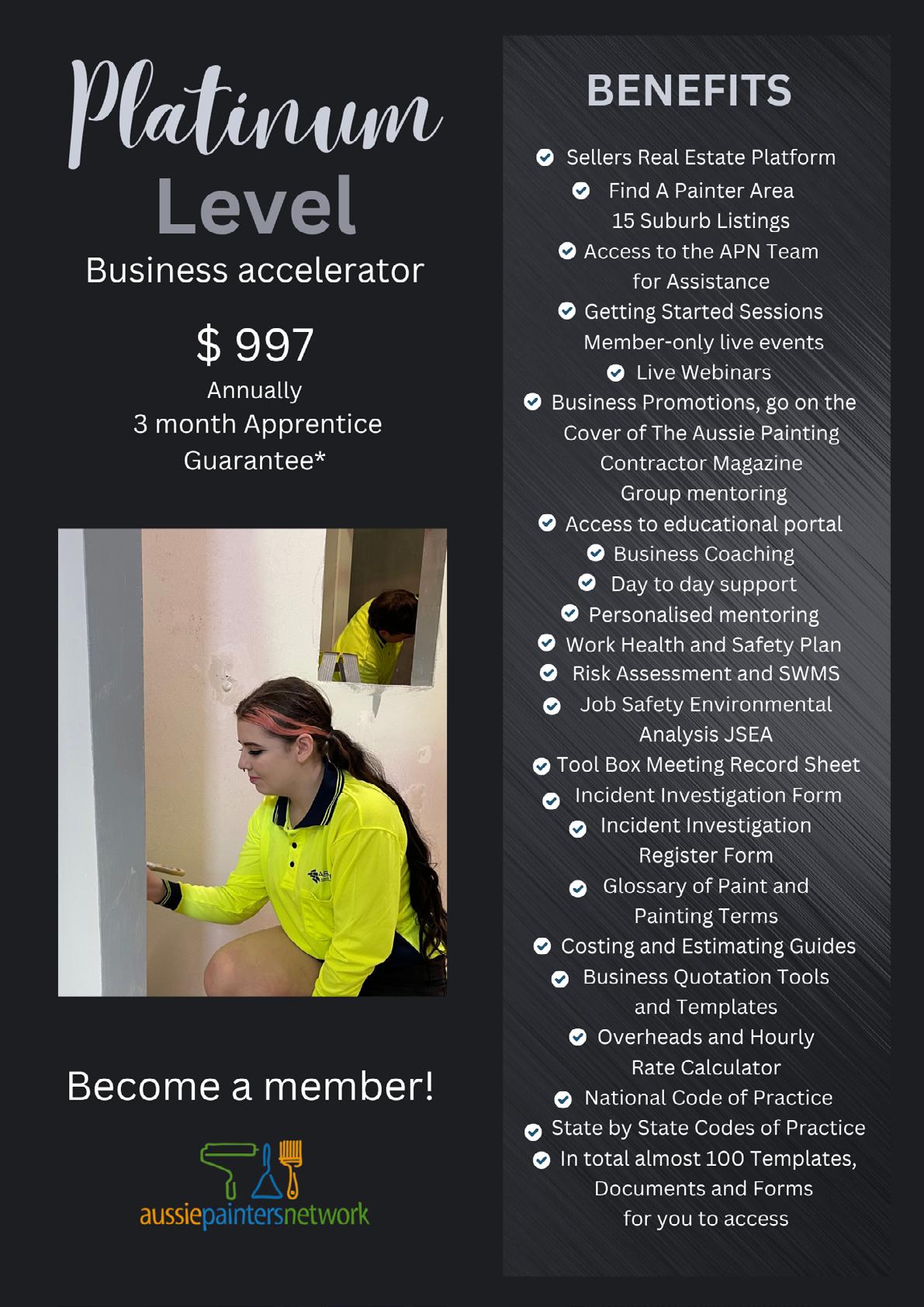

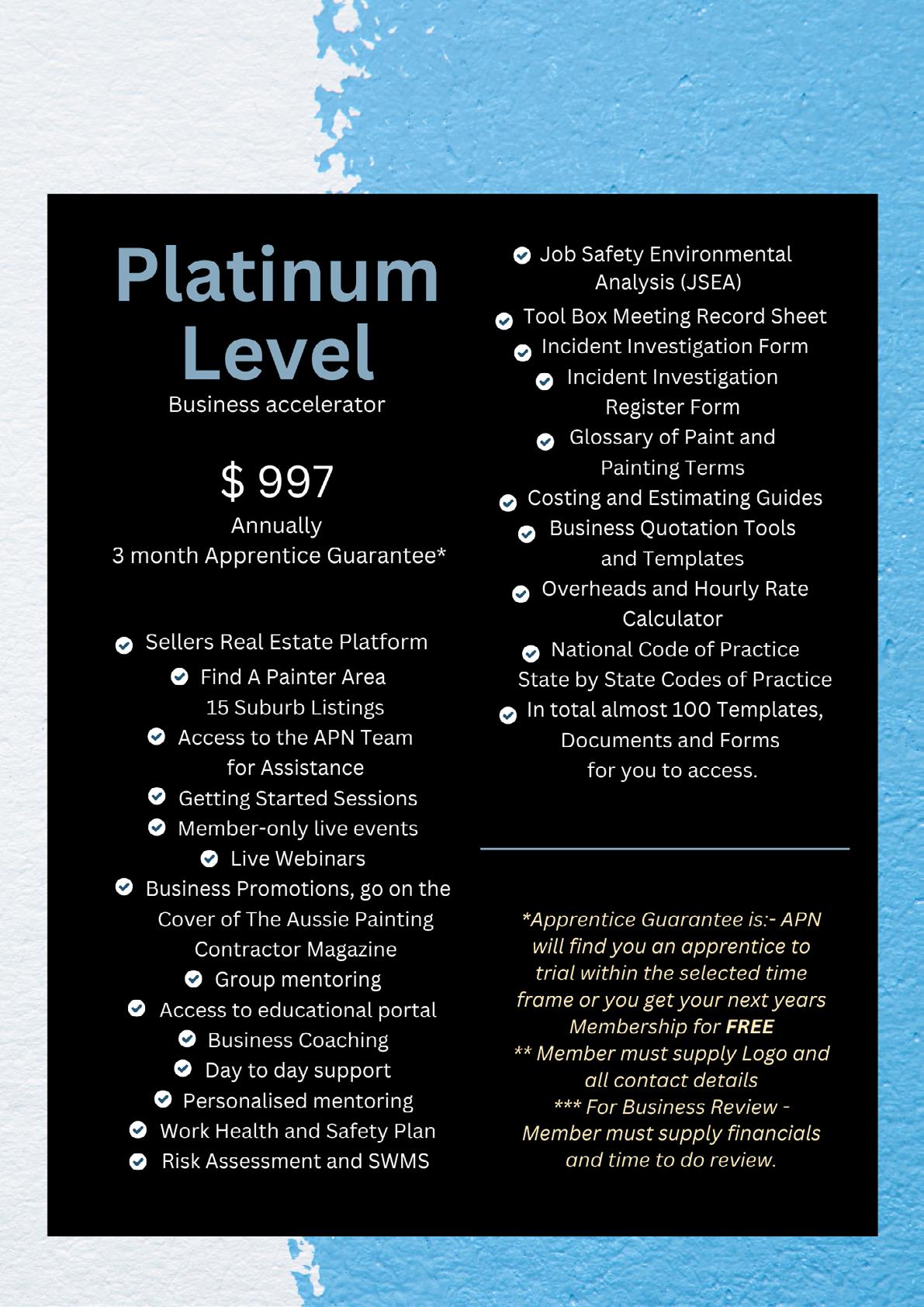

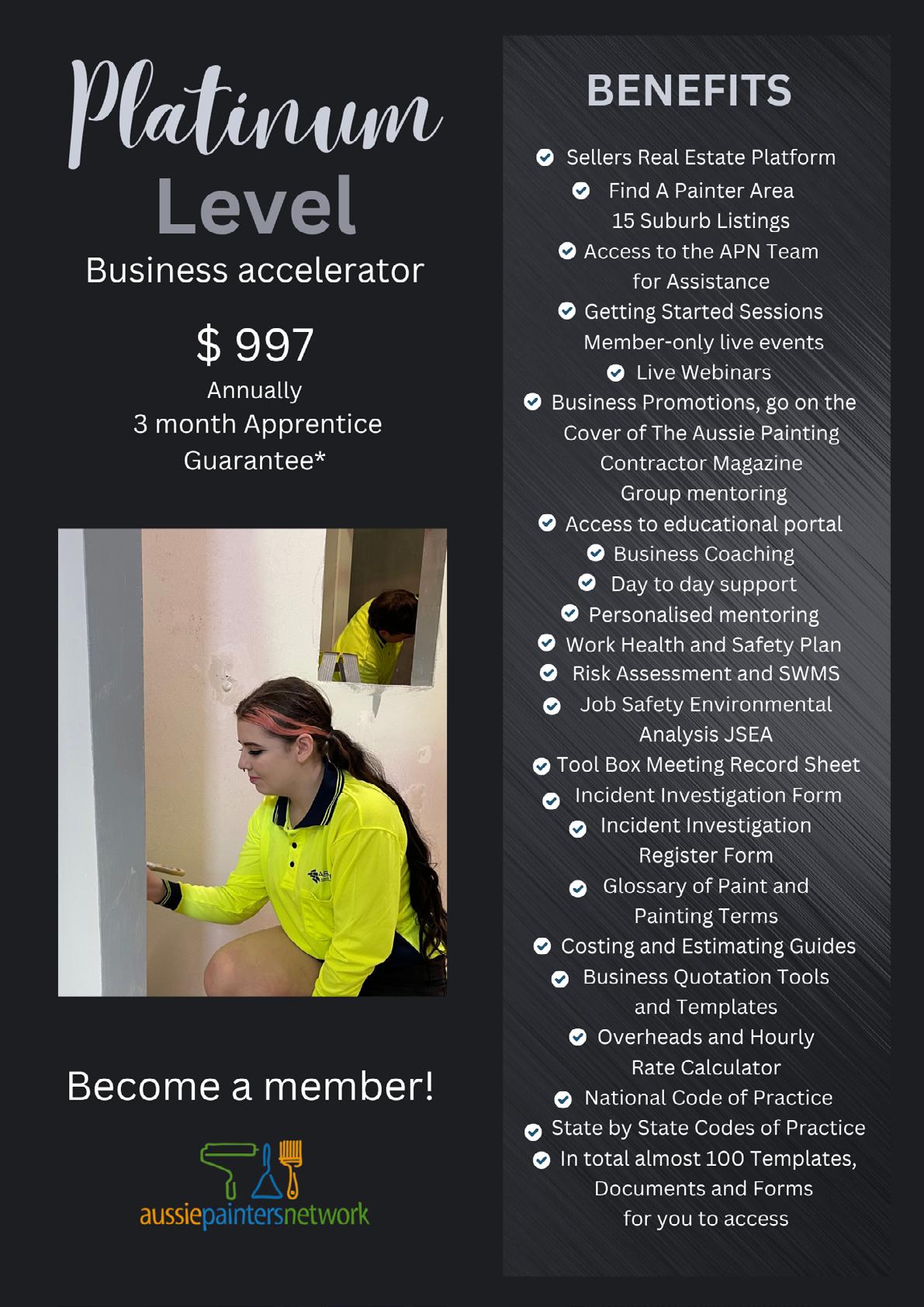

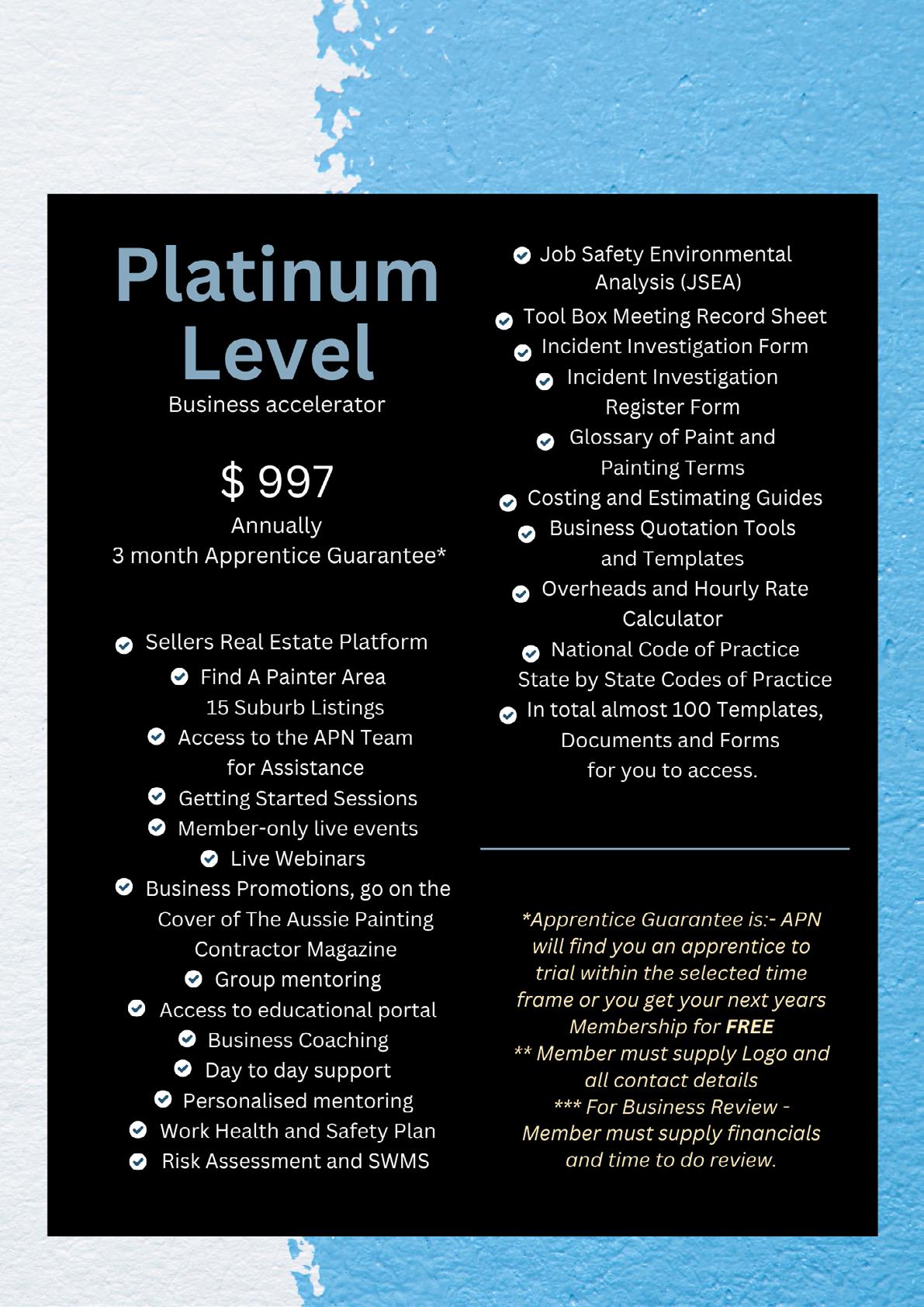

And that’s just the beginning. I’m excited to announce the Game Changer for Platinum Members, exclusive to only APN. It’s the Sellers Real-estate Agents Portal. This is where the agents become your BDM’s and send you quotes on behalf of the homeowners. Keep an eye out for all the details hitting your inbox and on Facebook. Contact us if you are wanting more information.

As always, if you are looking for apprentices anywhere in the country we can help you. We look after all our Members needs with marketing and sourcing the best candidate for you.

'Til next month, Happy Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Helen Kay

• Jim Baker

• Leo Babauta

• Nigel Gorman

• Pi-Shen Seet

• Robert Bauman

• Sandra Price

• Timothy Colin Bednall

• Wee-Liang Tan

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Advertise with us... 1800 355 344 07 3555 8010 info@aussiepaintersnetwork.com.au www.aussiepaintingcontractor.com

Record keeping for Tradie Businesses

Comparing Public Liability Policies

The Moment that Ruins OUR FOCUS

Use Technology Wisely Don’t let it be your ball and chain!

Will checking character references really help you find the best candidate for a job?

5 Financial Review Tips for your 30s and beyond

Xero Revamps Software Plans For Smoother Operations and Enhanced Functionality

Protect Your Cash Flow and Limit Legal Liability with Professionally Drafted Terms and Conditions

Life’s big moments can impact an entrepreneur’s success –but not always in the way you’d expect

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you September incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

Contents

SGRAFFITO

The Possibility of SLOWING DOWN

Industry Idiots Important Contacts 06 08 14 17 20 24 33 34 42 46 30 47 26

Record kee p in g for Tradie Businesses

If you’re a tradie, it can be challenging to manage your schedule and complex projects, all while ensuring your paperwork, documents, and contracts are in order. It’s important to keep a paper trail of your work and practice due diligence. Keeping all your working documents in order shows that you treat your business, customers, and subcontractors responsibly. This is not only a mark of professionalism but can also help you if you have an insurance or legal claim to deal with.

Contractor paperwork documentation and procedures

If you haven’t already, you should develop documentation and record keeping procedures that are appropriate for your contracting operation or service. Once procedures are in place, it’s equally important to ensure that everyone understands and follows

the procedures. It’s good practice to hold a toolbox on documentation procedures with your employees and have them sign off that they understand and have copies of the procedures.

For construction jobs, some of the documents that may be obtained and maintained as part of your documentation procedure include:

• Project tenders/estimates

• Contracts or work orders

• Service M8 Software

• Service M8 – job management software

• Duty to perform documents

• Site inspection forms

• Tests on work completed

• Documentation for materials delivered to the site

• Documentation of your risk services assessment

• Certificates of insurance from your subcontractors

6 | Aussie Painting Contractor

Using Digital Tools and Software

Implementing project management and documentation software can significantly reduce the time spent on paperwork. These tools can help in tracking project progress, managing invoices, and storing important documents securely in the cloud for easy access from any location.

There are many options on the market and it’s unlikely that a single piece of software will meet all of your project management needs. Companies usually combine a few applications to create a custom solution.

This is why we recommend choosing project management tools that integrate nicely with the parts of your setup that don’t need changing.

What to look for :

Real-time reporting capability

Effective construction project management requires up-to-date information. Without this, you won’t be able to make important decisions unless you rely on guesswork, which isn’t a good way to do things.

The best project management tools for the construction industry offer instant reporting.

Accessibility

Your data must be as accessible as possible. The best construction project management tools are cloud/web-based, which makes them accessible from virtually anywhere in the world.

Good Support

You’ll inevitably encounter hiccups when incorporating even the best construction project management

tools. That’s why you should look for programs from companies with reliable customer support.

Security

Your data is very valuable and sensitive. Construction project management tools and techniques should reflect this. Before you incorporate any software into your workflow, research the company behind it, their terms of use, and what security measures they implement to keep your company’s data private.

Construction project management tool checklist

Here are questions to ask yourself once you’ve narrowed your options using the above criteria.

→ Does the software come with enough licences for my company?

→ Can I use the tool on multiple devices?

→ Does the software have several positive reviews?

→ Will the company demo its software for my company?

→ Can my current data be easily transferred to this new software?

→ Do partner companies use the same software or a program that integrates well with this one?

The right construction project management tools can make a big difference to your company and its productivity.

We hope this helps identify the best picks and what you must consider when evaluating them.

Get in touch with us if you have any questions.

Sandra Price

Sandra Price

www.tradiebookkeepingsolutions.com.au

2024 June Issue | 7

Comparing Public Liability Policies

What makes one tradies public liability policy different to another?

We speak with a lot of trade business owners every week, and sometimes we’re asked why there is a difference in cost between two policies which seem the same.

The thinking is, if one public liability policy covers a carpenter for $5 million, it’s no different to another policy which covers the same trade for the same amount.

And with that being the case, why would one policy be more expensive than the other? Presumably the more expensive one is just a rip-off, right?

Wrong!

Two policies which seem the same on the surface can actually be massively different, and can have huge consequences at claim time.

Let’s take a look at some of the differences…

Excess

This is a fairly basic difference that most people will understand. Just like your home or car insurance has an excess, so does public liability insurance.

Some policies have an excess as low as $250 per claim, whilst others can be $2,500 or more.

The higher excess could be a result of your higherrisk trade, your claims history or perhaps an insurer which just has a higher excess for their own reasons.

Either way, the difference at claim time is important. You might choose a policy which is $50 a year cheaper but has a $500 excess. If you don’t make a claim, you’ve done well. But if you do make a claim, you would have been better off with the slightly more expensive policy that had a lower excess.

When comparing the premiums on two different public liability insurance policies, make sure you look at the excess and not just the initial cost.

Domestic V Commercial Work

All policies don’t necessarily cover all types of work.

Taking an electrician as an example, some insurer’s standard public liability policies only cover domestic, some cover domestic and light commercial, whilst others cover anything other than industrial.

But that might not be completely obvious when looking at the quote. Instead you need to dig into the Product Disclosure Statement (PDS), policy wording or policy schedule.

As an electrician you might get one public liability quote for $500 and another for $700. You might think the $700 policy is too expensive, without realising that the cheaper one won’t actually cover the industrial work you’re doing.

If you then need to make a claim for the industrial work you were doing, you could find your claim declined and yourself out of pocket by thousands of dollars (or much more) just because you tried to save a couple of hundred on the premium.

8 | Aussie Painting Contractor

Most standard policies will exclude work on airports and oil rigs for example. If you’re comparing a couple of common policies, you won’t notice much difference in that area.

But there can be other differences in exclusions between policies, and sometimes in areas that you wouldn’t expect.

For example one well-known insurer recently limited cover for plumbers working on buildings greater than three storeys.

If you have a policy with that particular insurer, the difference between a three-storey building and a four-storey building could be a declined claim leaving you in major financial trouble.

So before you decide one policy is more expensive than the other and therefore a rip-off, check the exclusions to see if there is a good reason for the difference in price.

Customer

Service

It’s one thing for the policy to be up to scratch, but what about the service behind the product?

This is another area where you need to consider the differences between what’s on offer.

One policy for example could be offered by an online-only provider who doesn’t offer phone support. Their public liability quote might be super cheap, but so is their service.

Or perhaps they do offer phone support, but you’re dealing with a call centre filled with staff who only meet the minimum training and experience requirements, and may only deal with a tradie once or twice a week.

Compare that to Trade Risk, where every client has their own account manager who is a qualified and experienced insurance broker. You have their direct mobile number to call them anytime, and you know that you’re dealing with someone who specialises in the trades.

That might not mean much when purchasing the policy, but it could mean an awful lot when things go pear-shaped and you need an expert on your side to guide you through the claim process.

The cost of an insurance policy is generally going to take into account the cost of the people standing

behind it. If you want the best service, you’re probably not going to get it from the cheapest policy.

Putting it into context

We completely understand that business insurance can become quite complex, which is why we recommend using a specialist trade insurance broker such as us.

But to put the above into context, here’s an example to think about.

Let’s say we’re comparing two cordless drills. I found this Ozito drill at Bunnings for $49, and this Festool drill at Total Tools for $824.

One is almost 20 times more expensive than the other! But they’re both just cordless drills right? You stick a drill bit in the end and makes holes in things…

As a tradie, you’d laugh at us for even mentioning those two items in the same paragraph! But the same is true of public liability, and any other form of insurance for that matter.

You might think that two policies are both the same, but to us we might immediately know they are completely different and not comparable at all.

Just like the Festool drill isn’t a rip-off just because it’s more expensive than the Ozito, one public liability policy isn’t a rip-off just because it’s more expensive than another.

Getting advice

Ultimately it pays to get the right advice. If you can’t tell the difference between two policies, or more likely don’t have the time to conduct a thorough comparison yourself, trust a professional to do it for you.

You’re the expert at your trade and know which tools you need, whilst we’re the experts in trade insurance and know which policies you need.

If you’d like to speak with a trade insurance specialist about you needs, click here to contact us online or call our friendly team on 1800 808 800.

2024 June Issue | 11

12 | Aussie Painting Contractor

The Moment that Ruins OUR FOCUS

I challenge you to do a test before you read the rest of this post (well OK, read the next two paragraphs then go do the challenge) …

Open an email that’s been sitting in your inbox but that you’ve been avoiding responding to or acting on. Pick the hardest one. Try to sit there, read the email, and then act on it and/or respond to it.

Then notice if there’s a moment when you want to just get away from that email. What does that moment feel like?

This moment of overwhelm and anxiety is usually invisible to most of us. It happens multiple times throughout the day (possibly dozens), and determines the actions we take or don’t take. But we rarely notice it — we just try to get away from it.

This is the moment that ruins our focus. It’s the moment that causes our procrastination and avoidance. It’s the moment that ruins our best habits and our best intentions.

It’s a moment that has a feeling we don’t want to feel. In fact, we’ll often spend a lot of our time trying to avoid that feeling. It feels too hard to feel.

We might have even set up a large part of our lives so that we don’t have to feel it — our lives are designed around that kind of feeling, to avoid it. For example, if you feel that feeling when you talk in front of a group, you might have set up your life so you never have to talk in front of a group. If socializing with strangers gives you that feeling, you might have a life where you don’t have to do that. If you get the feeling when

you share your creative work with others, then you might have a life where you never have to do that. You get the picture.

That’s all fine — you don’t have to change your life. But if you’d like to not have to avoid the feeling, and you’d like to create amazing focus and the ability not to avoid your most meaningful work … read on.

The main thing is to let yourself feel the feeling, whenever you notice it. If you can do that repeatedly, as a training, you’ll get much better at it, and the feeling becomes much less of a big deal.

So first, notice when the moment comes — when you’re feeling the thing that is overwhelming and that you want to get away from. It might be because of a difficult or scary task, an upcoming event or meeting or trip, a difficult conversation or a frustrating person, an email or message you don’t want to read. Just try to catch the moment when it’s happening.

When you notice it, pause. Just sit for a few seconds, and breathe deeper and more slowly. Let yourself calm down for a minute, and just be with the feeling. That means to give it your attention and not to turn away from it, just for a few seconds. If it’s too intense, get up and walk around. Shake it off. Distract yourself. Then you might try again, just for a few seconds. Maybe do that 2-3 times if you feel up to it. No need to push yourself too far.

If you practice this several times a day, you’ll get better at it. If you do it 10 times a day, you’ll get better even faster. Soon, you’ll be able to stay with it for 15 seconds, 30 seconds, a minute. Then longer. You’ll grow your capacity to be with this moment.

Then everything becomes possible.

Leo Babauta ZEN HABITS

14 | Aussie Painting Contractor

Use Technology Wisely

Don’t let it be your ball and chain!

What would we do without current technologies? They make everything so much easier, communication so simple and save us so much time… or do they? Information and communication technologies are so very efficient and prevalent in our work and personal lives now that it’s almost out of our control! Whilst making things simpler, they may also have increased our workload to a point where finding a balance with our personal, off-line, lives is nearly impossible. Is your email in box so full of stuff you plan on getting to later, that you never get through it? Do you get distracted from the important stuff by texts, emails, facebook, or are you twittering your life away? The fact is there are just so many technological mediums out there that, if used wisely, can undoubtedly help you in your work, and free up your time for the things you love, but if not employed professionally and kept in check, may well complicate life and waste precious spare time.

A lot of us couldn’t imagine life without our smart phones, wireless internet and laptops or I pads. It’s undeniable that these can be powerful professional tools and, indeed, if you’re not using some of them, you probably should be! But the down side is that they are all loaded up with gizmos, games and functions that have no place in your work day, or when you could otherwise be spending time with family! To turn this around, find out the bits and pieces in your favourite gadget which will help you save time and investigate those thoroughly. There are fantastic ‘apps’ and programs available that can help you plan, budget, communicate, schedule, navigate etc., so search some app reviews and take advantage of them. (Apps are generally dirt cheap too, so you can try a few out without losing $$)

As a small, or large business, or even an independent contractor, an online presence is so important now, because that is where people are seeking their services; and utilising social media like facebook and Linkedin is also an astute way to be seen. But it can get complicated and overwhelming if you don’t approach it carefully, and they too can chew through your time.

Consider using social media sites as part of your advertising plan, but look into getting guidance on how to build up your “likers” and what ways to use the medium to your best advantage. There are plenty of professional services that do this now. And keep your professional profile separate to your personal one.

So, its not the technology, but the way in which we use it which can become the problem. Here are a few tips to ensuring that you keep your use of technology effective on a professional level:

Turn off, or silence the devices when you are with people-- give people a higher priority than technology – Especially when you are quoting!

Don’t be tempted to multi task with your phone or lap top when you’re on a phone call, or worse, face to face with someone. Even if the other person will never know you’re checking your email whilst on the phone; it’s a respect issue, and you may miss important details.

Try to avoid wearing a Bluetooth earpiece around. Apart from looking a bit self-important, the nonverbal message you’re sending to everyone around you is, “You can talk to me but at any moment someone more important than you may call me and I’ll need to answer it.”

Don’t email, sms etc., anything that should really be spoken in person. It’s difficult to convey tone and emotion in text and if you have something with any detail that need to be explained it can really create problems.

Technology is great for business, and can make our personal lives simpler and save precious time, if it is used properly. The key is to use technology to serve you, not the other way around. This requires you to make deliberate choices of when to engage with technology so that it aids in your accomplishment of what is most important in your business and your life. Just be careful to be the master not the slave!

2024 June Issue | 17

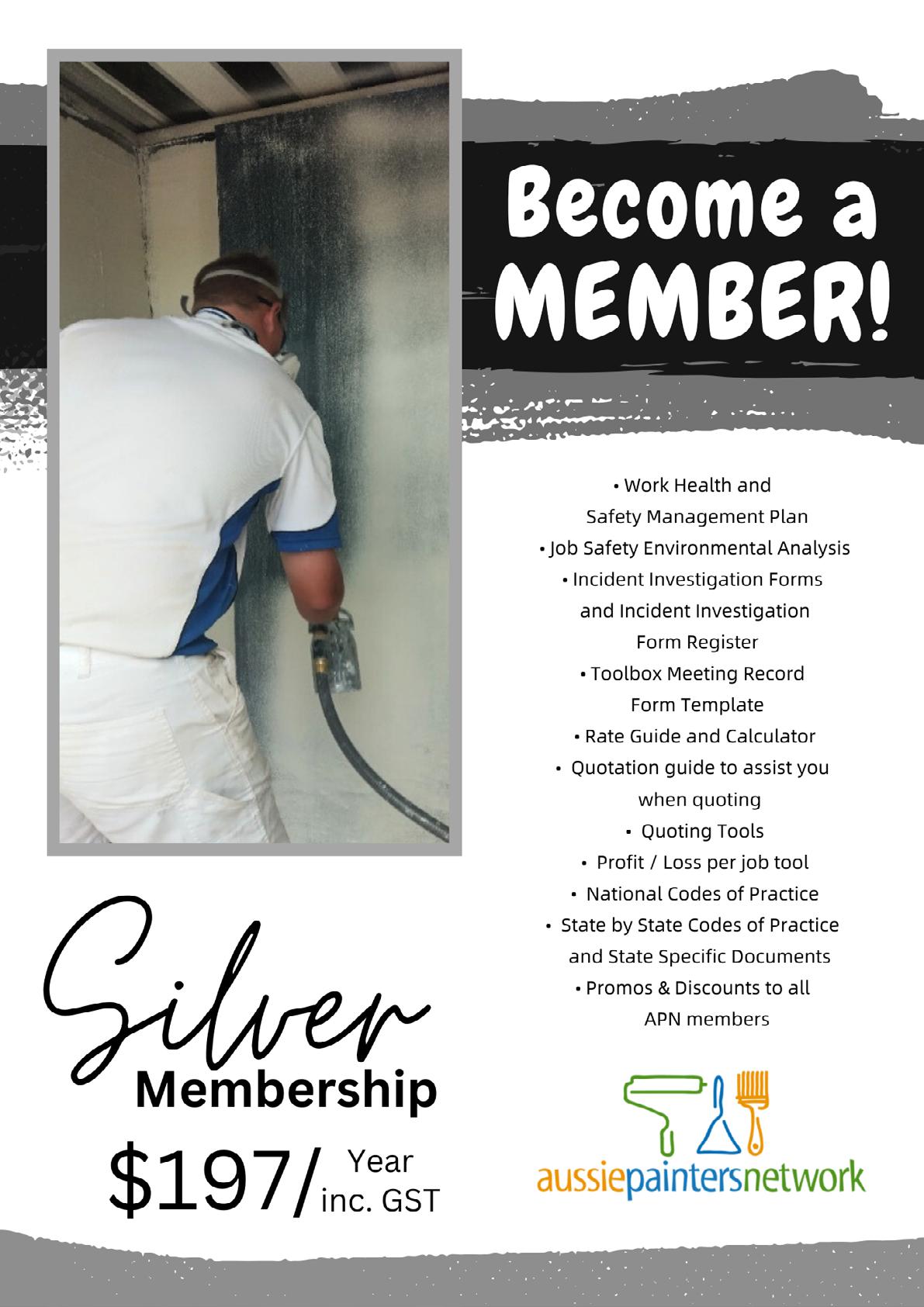

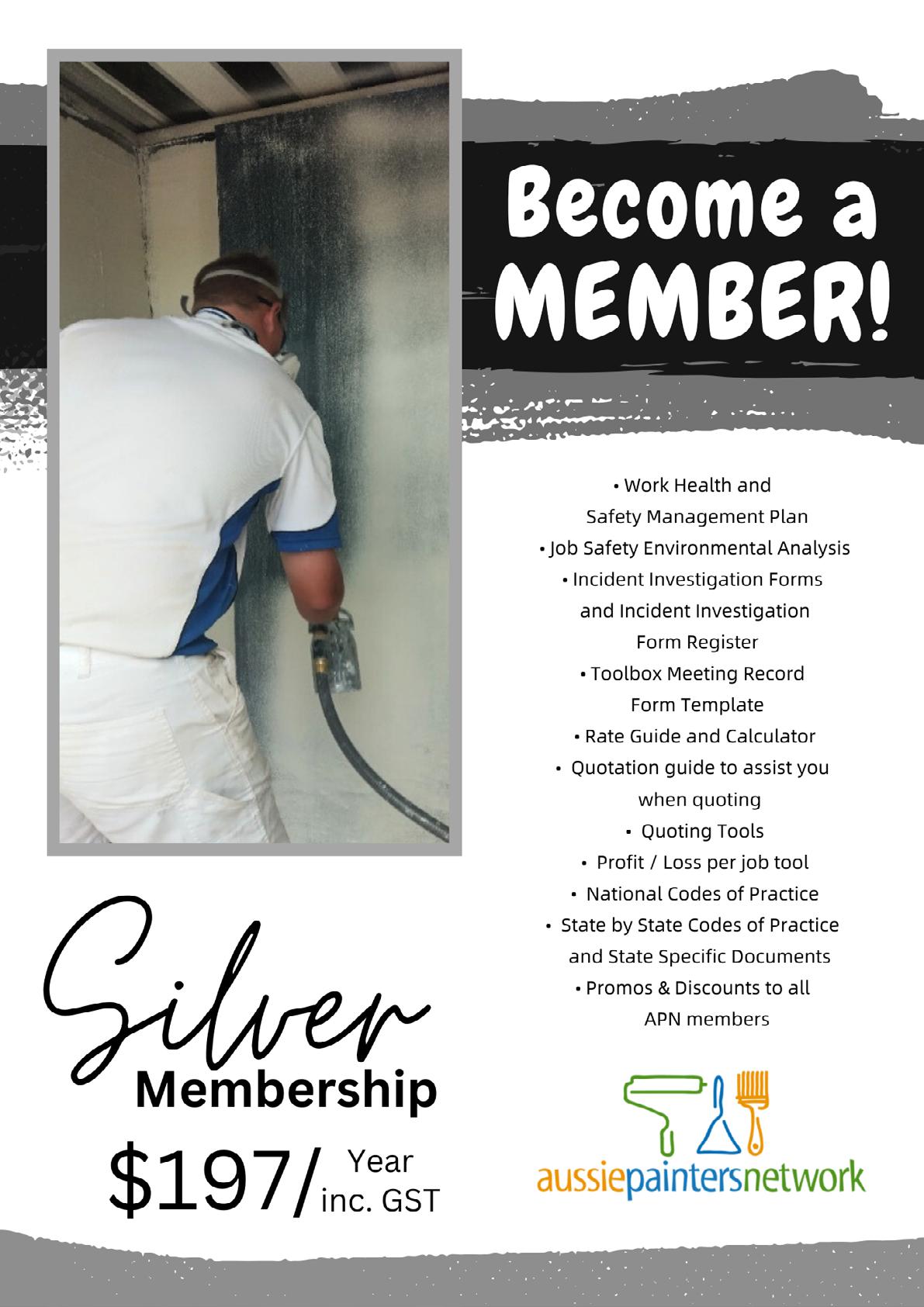

Membership

Packages

Will checking character references really help you find the best candidate for a job?

Finding the best person to fill a position can be tough, from drafting a job ad to producing a shortlist of top interview candidates.

Employers typically consider information from several sources, including the applicant’s work history, social media presence, responses to interview questions and sometimes, psychometric testing results.

It’s also common for hiring managers to check an applicant’s references by chatting to the candidate’s nominated referees or reading over their letters of recommendations.

Reference checks tend to be the final hurdle; a sort of background check for the candidate’s job history and credentials.

Nearly every employer does reference checks, but research suggests there are important limitations worth keeping in mind.

INCONSISTENCY CAN BE A PROBLEM

A reliable selection method produces a consistent measure of candidate suitability. In other words, reliability enables an apples-to-apples comparison of each candidate. But early research into reference checks found referees tend to give substantially different ratings to the same candidates.

This inconsistency is problematic because it is unclear if a favourable report reflects genuine suitability or the candidate was fortunate enough to nominate a lenient referee.

Part of the problem is employers often do not take a structured approach to obtaining information from referees.

For instance, if asked overly general or vague questions about the candidate, each referee may focus on different aspects of past job performance or omit negative information.

20 | Aussie Painting Contractor

Often referees for the same person give inconsistent assessments. Ground Picture/Shutterstock

Research suggests using a standardised set of questions can produce more reliable outcomes. This provides a stronger basis for making a meaningful comparison between candidates. Unfortunately, even using a standardised assessment, referees still tend to disagree on their ratings.

This disagreement may still be worthwhile, as it can reveal important contextual differences in the candidate’s performance. For instance, one referee may have observed a candidate leading a team, while another may have only seen their project work.

However, employers still need to make sense of these different perspectives.

A REFERENCE IS A POOR INDICATOR OF FUTURE PERFORMANCE

A valid selection method is job-specific and provides useful information about how a candidate will actually perform in the role.

Reference checks are a relatively easy hurdle for candidates to overcome because referees are typically self-selected, and most job seekers can find at least one colleague who is willing to speak positively about them.

Read more: Employers should use skill-based hiring to find hidden talent and address labour challenges

As well, a candidate’s performance in a previous position may not always be relevant for the job they are applying for.

For these reasons, reference checks show only a small correlation with employee performance in their new job.

But because of their limited ability to predict performance, employers should not rely solely on reference checks.

A MIX OF CHECKS THE BEST APPROACH

A recent systematic review of employee selection methods suggests structured interviews, work samples, and pre-employment assessments can provide useful insights into how employees will perform.

Pre-hiring assessments can reveal information about a person’s job knowledge, cognitive ability, integrity, personality, and emotional intelligence where appropriate. They are especially useful for screening numerous applicants, such as for graduate recruitment programs.

Ultimately, the job selection process should be tailored to the role requirements. For instance, if a role requires strong writing skills, this could be assessed through work samples or pre-hiring assessments.

SOME CANDIDATES COULD BE DISADVANTAGED

A fair selection method is one that is unbiased and avoids giving weight to irrelevant information. It does not disadvantage people because of characteristics such as gender identity, age, or cultural background.

From this perspective, reference checks have several potential problems.

One is that candidates may not have access to referees of similar credibility.

For instance, a person from a high socioeconomic background is more likely to have access to senior leaders or experienced professionals in relevant fields who are willing to provide positive reports.

REFERENCE CHECKS MAY PERPETUATE EXISTING INEQUALITIES.

In most cases, referees will want to provide positive reports. If the referee is a close colleague of the job applicant, they may be concerned that negative reports will be traced back to them and affect their ongoing relationship.

And employers may be motivated to offer under performers a glowing review to get rid of them.

2024 June Issue | 21

Most references are difficult to verify, so referees are unlikely to suffer damage to their reputation if they talk up an average candidate, especially if the referee is outside the employer’s professional network.

In most cases a referee will want to provide a positive report. AlexSkopje/Shutterstock

Research suggests letters of recommendation can actually disadvantage female candidates by planting doubts about their suitability.

For instance, letters about female candidates more frequently contain negativity (such as, “does not have much teaching experience”), faint praise (“needs minimal supervision”) and hedging (“has the potential to become a strong performer”).

These types of statements can lead employers to evaluate female candidates more harshly.

However, when a structured questionnaire is used, this bias does not emerge.

A FLAWED BUT WORTHWHILE TOOL

While reference checks remain common, their limitations are clear. They can be unreliable, offer only moderate validity in predicting performance at best and raise fairness concerns.

However, reference checks shouldn’t be discarded. By implementing structured questioning and adopting other well-established employee selection methods, references can still be included as a final step in a robust hiring process.

Timothy Colin Bednall Associate Professor in Management, Swinburne University of Technology

A D V A N T A 6 [ Eliminate the B.S. in your business and your mates will be asking... "how do you have time to go fishing on the weekend?" Tradies Advantage offers you the COMPLETE FINANCIAL SOLUTION under one roofbookkeeping and accounting at a monthly FIXED price.

Get your invoices out on time

Stop ch asing debtor s and get paid quicker

Better manage rece ipts and paperwork

Lodge your BAS on time - don't cop a fine

Stop mi ssing deductions

Plan ahead and measure how you're going CONTACT US 07 3333 2415 info@tradiesadvantage.com.au 191 Wynnum Road, Norman Park QLD 4170

•

•

•

•

•

•

SGRAFFITO

For the past few weeks, my wife and I have been travelling in the Czech Republic, Germany and Austria, with the next four weeks being in Italy, Switzerland and the Greek Islands. We love coming over to this part of the world for it’s history, scenery, food, ‘wine’ and the culture. We’ve stayed in many different accomodation properties so far, some that are over 600 years old. It’s truly amazing how they have stood the ‘test of time’ and are in such amazing condition.

The of old buildings in Europe all have their different characters to them, being either plane, elaborately painted, or like the photos above, have very intricate facades. This really fascinated me as I didn’t know how the effect was achieved or how far it dated back, so by doing a simple ‘Google’ search, I found my answer.

The technique is called ‘Sgraffito’. It dates back to the 6th century with examples adorning walls, ceramics and paintings in grand houses and palaces around the world. In the photos above though, it came more into use on exterior buildings around the 15th and 16th centuries. In these cases, It is a technique of wall decor, produced by applying layers of plaster tinted in contrasting colours to a moistened surface and then ‘scratching’ the superficial layer off in such a way that the pattern or shape that emerges is of the lower colour.

When you take into consideration the age of our Australian buildings since European settlement, you just wonder if they will still be around in another 350 years time. I’m quite sure my house won’t be.

Jim Baker www.mytools4business.com

2024 June Issue | 25

The Possibility of SLOWING DOWN

Our days are a busy rush, often from the moment we wake up. Even in our moments of rest, we are often on our phones or using technology to distract ourselves. The result is a life of stress, overwhelm, and habitual patterns.

What would it be like to slow down? To find stillness in your day, moments of rest and quietude?

The possibility of slowing down goes much deeper than just having a bit less busyness in your day …

Slowing down, if we go deeper, allows us to:

• Notice what’s coming up for us, and to attend to our emotions. This is much, much more important than people realize — most of our problems come from an inability to regulate our emotions or even recognize that they’re there.

• Make decisions from a place of choosing from the heart. If we have a decision to make, instead of overthinking it, we can slow down and sit in stillness for a few moments, and notice what our heart chooses. This makes decision-making much more effortless, once you learn to trust this.

• Make time for creating, instead of just busywork. We rush to do busywork because of fear, and because it’s easier than setting aside time to create. By slowing down, we can make the time to create, and slow down with our fears that are keeping us from doing this.

• Focus on what’s really important. What’s most important to you in your life? Spending time on loved ones, on your health, on your most important work? Whatever is most important to you, by slowing down, you can become more intentional and purposeful, and fully be with whatever you choose to do.

• Start to break up our habitual patterns. We live our lives mostly on autopilot, driven by old habitual patterns. This isn’t bad, but it means we struggle to do things the way we’d really like. We can begin break up those old patterns by slowing down, and noticing that we’re caught up in them.

• Start to get some rest and self-care into our lives. When we are rushed and busy and distracted all day long, it leads to feeling depleted and exhausted. This is a huge problem for many of us. Slowing down can create a bit of spaciousness to choose into rest and taking care of ourselves.

• Start to truly appreciate life. Rushing through our day, we barely notice the world in front of us. What if we could start to slow down and find wonder in the everyday moments?

These are just a handful of the possibilities of slowing down. It’s a deep, sacred, beautiful practice that can transform our lives, if we really engage with it regularly.

If you’d like to practice with me, I invite you to join me in my Deepening Into Slowing Down Retreat

26 | Aussie Painting Contractor

The Deepening Into Slowing Down Retreat

I’m holding an online retreat, Deepening Into Slowing Down , from June 21-23, 2024, and you’re invited.

In this retreat, we’ll meditate together, I’ll teach about the depths possible in slowing down, we’ll look at our old habitual patterns, and do some work on this together. It’s a 3-day retreat designed to have you leave a changed person.

Join mindfulness teacher Leo Babauta, creator of Zen Habits, in a retreat designed to have you practice slowing down with the fullness of your life.

Leo Babauta ZEN HABITS

Leo Babauta ZEN HABITS

5 Financial Review Tips for your 30s and beyond

Your 30s are an exciting time. You’re typically making more money than you were in your 20s and you’re looking to the future to determine the type of life you want to live. Your 30s are also a great time to take control of your finances, so you have more security and flexibility in the coming years.

Here are 5 financial tips to follow in your 30s, to help you get ahead.

1. Create and stick to a budget

Budgets are a great way to set your financial goals and create a strategy for achieving those goals. Too often, we go from month to month without any overall plan, which usually results in not getting ahead— and sometimes we wind up in even more debt.

Determine your short- and long-term goals and figure out what you need to do financially to reach those goals. Do you want to buy a house? Go on a big vacation? Retire early? Do you need to spend less? Sell some items? Put more money in savings?

Without a budget, years can go by and you’ll realise you’re in exactly the same place financially that you were 5 years ago. Instead, create a budget, set out how much you’ll spend—and on what—how much you’ll save and what you’ll do with the rest of your money. Then, stick to your budget.

2. Diversify your income

Multiple income streams not only allow you to increase your earnings, they protect you in case of an emergency. Income from your job provides stability, but what happens if you’re suddenly unable to work? Having multiple sources of income protects you in such situations so you don’t find yourself in a financial crisis.

You can invest in property or stocks, for example. Or you can create passive income by writing and selling books in areas you’re an expert in. You could have a side job that allows you to earn extra money so you can pay down your debt faster.

30 | Aussie Painting Contractor

3. Pay off your debt

It may be impossible to live completely debt free in your 30s, but getting rid of some debt such as credit cards and lines of credit can free up your income to allow you to save more for the future.

Pay off your credit card bills, your lines of credit and anything that has a high interest rate first, then move to other debts with lower interest rates.

4. Stop overspending

It’s tempting to overspend because we want to keep up with the people around us. Typically, when we hit our 30s we’re making more money, have greater disposable income and are surrounded by people who are also spending their money. It’s natural to want to keep up.

The problem is that spending too much in your 30s can affect your finances for the next few decades. Instead of buying a big house that impresses people but eats up your salary, consider something smaller that’s more affordable. Rather than buying a highpower new car, consider a less expensive model.

There are times when it’s worth it for you to spend big on items, but don’t do it just so you can keep up with other people—and definitely don’t do it if you can’t afford it.

5. Have an emergency fund

An emergency fund is essential to help you get through any extreme financial circumstances. Even if you’ve diversified your income, you need to have funds that you can access quickly in case of unexpected expenses, such as home and car repairs or medical bills.

An emergency fund is there to carry you through unforeseen circumstances, but having one also means you don’t have the stress of worrying about what will

happen to you if something should go wrong. You have the peace of mind of knowing that you’ll have the financial means to react and adjust.

The amount recommended for an emergency fund varies depending on your lifestyle, finances available to you and job, but consider having around 6 months of expenses in a special account. Then promise yourself you won’t touch that money, except in a real emergency.

Final thoughts

By following these simple tips, you can take important steps in your 30s to set yourself up well financially for the future.

Feel free to arrange a FREE No-Obligation Meeting with me to help you review your business or personal health situation. Call my office on 07 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Copyright © 2024 Robert Bauman.

2024 June Issue | 31

Xero Revamps Software Plans For Smoother Operations and Enhanced Functionality

Starting July 1, 2024, Xero is unveiling three new business plans tailored to suit your needs: Xero Ignite, Xero Grow, and Xero Comprehensive. These upgraded plans are meticulously crafted to grant you easier access to essential tools, empowering you to efficiently manage your business. With an array of key features now seamlessly integrated into each plan, navigating through fewer options and add-ons has never been simpler.

To streamline our offerings, Xero will be retiring the Payroll Only, Starter, Standard, and Premium plans as of July 1, 2024. Furthermore, existing add-ons will no longer be available for individual purchase from this date onwards. As part of this transition, all Premium 10-100 plans will be automatically converted to corresponding Ultimate plans effective July 1, 2024.

For our valued Australian subscribers, please note that there will be adjustments to pricing effective July 1, 2024. Here’s a breakdown of the changes:

● Payroll Only plan increasing to $20 per month

● Starter plan increasing to $35 per month

● Standard plan increasing to $70 per month

● Premium 5 plan increasing to $90 per month

● Premium 10-100 plans will convert to the equivalent tier Ultimate plan at the new Ultimate pricing

● Ultimate 10 plan will remain at $115 per month

● Ultimate 20 plan increasing to $145 per month

● Ultimate 50 plan increasing to $200 per month

● Ultimate 100 plan increasing to $245 per month

All prices are in AUD and inclusive of GST. For more details, please refer to Xero’s pricing page.

Rest assured, the pricing of any optional add-ons included in your current subscription remains unchanged. Additionally, any existing Xero promo codes will continue to be honored until their expiration date.

For comprehensive information about these updates, please visit the dedicated web page HERE. Should you have any inquiries, feel free to reach out. We’re here to assist you every step of the way.

2024 June Issue | 33

Protect Your Cash Flow and Limit Legal Liability

with Professionally Drafted Terms and Conditions

How many businesses are operating without sufficient legal safeguards in place? Have you thought about this? Safeguarding your business operations with legally binding Terms and Conditions is not just recommended; it’s essential. Well-drafted Terms and Conditions serve as the backbone of your business transactions, ensuring clarity and compliance with applicable laws. That’s where we come in. Our fixedfee terms and conditions packages are not only clear but are customised to meet the unique requirements of your business, ensuring that you are fully protected against unforeseen legal challenges.

1. Clarify Legal Boundaries and Business Expectations Effective Terms and Conditions

Clearly outline what each party is agreeing to, significantly reducing the potential for misunderstandings and disputes. By clearly outlining what each party is agreeing to, these documents significantly reduce the potential for misunderstandings and disputes, which are common in business transactions. This clarity is essential not only for smooth operations but also for maintaining long-term relationships with clients and suppliers.

Here’s why every business owner should consider this crucial step:

34 | Aussie Painting Contractor

Specifying the Scope of Services: Detailing the scope of services within your Terms and Conditions is crucial. It precisely defines what your business will deliver, helping to set clear expectations for your clients. For example, if you are a service provider, your Terms should include the nature of the services, project timelines, and the expected outcomes. This specification helps in preventing scope creep and ensures both parties are aligned, which enhances customer satisfaction and reduces the likelihood of contractual disputes.

Establishing Payment Terms: Clearly articulated payment terms ensure there is no ambiguity about financial obligations. These should detail the payment amounts, due dates, acceptable payment methods, and penalties for late payments. By establishing these terms upfront, businesses can improve cash flow management—a critical component of financial stability—and minimise the risk of payment delinquencies.

Defining Client Responsibilities: Defining client responsibilities in your Terms and Conditions protects your business by ensuring that clients and users are aware of their obligations. This could include aspects such as compliance with regulations, standards for conduct in using a service or product, and restrictions on misuse of the provided services. This transparency is pivotal in creating a professional environment where all parties understand and respect their boundaries and commitments.

Creating a Transparent and Trustworthy Environment: Incorporating these elements into your Terms and Conditions contributes to a transparent and trustworthy environment. Transparency in business

practices fosters trust, a vital component of professional relationships. It encourages ongoing business interactions and partnerships, enhancing your reputation and reliability in the market.

2. Enhance Consumer Protection

Provide your customers with peace of mind by clearly stating their rights under your Terms and Conditions. This includes refund policies, product warranties, and cancellation procedures, which not only comply with consumer protection laws but also enhance customer satisfaction and loyalty.

Detailed Refund Policies:

Specify your refund policies to offer clear guidance on how returns are handled. Include conditions under which refunds are applicable, the timeline for processing refunds, and any necessary steps customers must take to initiate a refund. Having a clear refund policy not only complies with consumer protection laws but also builds trust.

Comprehensive Product Warranties:

Clearly articulate the warranties (and warranty claims process) provided with your products. Detail what is covered, the duration of the warranty, and the process for claiming a warranty. This reassurance can be a significant decision-making factor for potential buyers.

Transparent

Cancellation

Procedures:

Outline straightforward procedures for cancelling services or orders. This should include any deadlines, possible penalties, or steps to follow for a cancellation. Transparency in these procedures can decrease customer frustrations and prevent disputes.

Compliance with Consumer Protection Laws:

Ensure that your Terms and Conditions reflect compliance with local and international consumer protection laws. This not only legalises customer interactions but also demonstrates your commitment to ethical business practices.

Enhancing Customer Satisfaction and Loyalty:

Emphasise how these policies are designed to enhance customer satisfaction and promote loyalty. Highlight stories or testimonials where your effective policies have positively impacted customers.

2024 June Issue | 35

3. Strengthen Enforcement and Dispute Resolution

Incorporate provisions that dictate how disputes will be handled. This ensures that any disagreements arising from your business dealings are resolved efficiently, saving you time and legal expenses.

Clear Dispute Resolution Provisions: It’s crucial to include specific provisions in your Terms and Conditions that outline how disputes will be managed. This includes detailing the choice of law, which establishes the legal jurisdiction that will govern the terms and the resolution of disputes.

Arbitration Procedures: Arbitration can be a more efficient alternative to court litigation. Specify the arbitration process, including how arbitrators will be selected, the location of arbitration, and the expected timelines for resolution. This not only expedites dispute resolution but also reduces legal costs, providing a quick path to resolving conflicts.

Benefits of Streamlined Dispute Resolutions: Emphasise the advantages of having these provisions, such as quicker resolutions, cost savings, and less stress. Explain how these benefits support not just the business but also the customer by providing predictability and security in business transactions.

Compliance with Australian Laws: Ensure that all dispute resolution procedures comply with Australian law, reinforcing the legality and enforceability of your terms. This builds trust and credibility with your customers, knowing that they are entering into agreements that are legally sound and fair.

4. Protect Intellectual Property

Your Terms and Conditions can serve as a tool to protect your intellectual property by restricting how your website, products, and services are used. By ex-

plicitly defining how your intellectual assets can be used and any limitations, you safeguard your business against intellectual property theft.

Define Intellectual Property Rights: Clearly articulate what constitutes your intellectual property within the Terms and Conditions. This can include logos, original content, unique product designs, proprietary software, trademarks, or patents. By defining these elements, you prevent any ambiguity about what is protected under your IP rights.

Restrict Usage of Your IP: Specify the permissible uses of your website, products, and services. This includes limitations on copying, modifying, redistributing, or selling your intellectual assets. Establishing these boundaries is essential for preventing misuse and ensuring that your IP rights are respected.

Outline Consequences for Infringement: It is crucial to detail the consequences if your intellectual property rights are violated. IP infringement consequences might include legal actions, fines, or termination of service, providing a deterrent against potential infringement.

Regular Updates Reflecting Current Laws: Keep your Terms and Conditions updated with the current IP laws and regulations in Australia. This not only ensures compliance but also fortifies the legal enforceability of your IP rights.

Educate Your Users: Use your Terms and Conditions to educate users about the importance of IP and their role in respecting these rights. An informed user base is less likely to inadvertently infringe on your IP rights and more likely to report potential abuses they encounter. Incorporating IP education and awareness of IP rights is crucial for everyone’s success.

2024 June Issue | 37

Limitation clauses within your Terms and Conditions can protect your business from potential legal claims by setting out the extent of your liabilities and the circumstances under which you are liable. This is crucial for mitigating risks associated with your products or services.

Defining the Scope of Liability: Limitation clauses in your Terms and Conditions should clearly define the extent of your business’s liabilities. This involves outlining specific scenarios under which your company can be held accountable for issues such as product failures, service disruptions, or other operational mishaps. By clearly defining these terms, you help prevent misunderstandings and ensure that clients and customers have realistic expectations.

Circumstances Under Which You Are Liable: It is crucial to specify the circumstances under which your business accepts liability. This might include, for example, liability for breaches of contract, negligence directly linked to your products or services, or compliance with statutory warranties. Explicitly stating these circumstances helps limit claims by clarifying when your business is and isn’t responsible for damages or losses.

Caps on Liability: One effective way to manage risk is to include clauses that cap the amount of liability your business could face. This could be a fixed monetary limit or a cap based on a percentage of the value of the products or services provided. Such caps ensure that potential damages do not exceed a predictable and insurable amount, thereby protecting your business’s financial stability.

Exclusions from Liability: Your Terms and Conditions should also clearly state any exclusions from liability. Common exclusions might include indirect or consequential losses (such as lost profits or third-party claims) or damages arising from improper use of a product or service. Articulating these exclusions helps further shield your business from unforeseen financial impacts.

Time Limits for Claims: Implementing time limits for filing claims against your company is another critical element. This not only encourages prompt resolution of issues but also helps prevent the uncertainty and potential disruption of long-dormant claims surfacing years after a transaction.

Legal Compliance and Best Practices: Ensure that all limitation clauses comply with applicable laws

and reflect best practices within your industry. Some jurisdictions place restrictions on certain types of liability limitations—particularly those affecting consumer rights—so it’s important to tailor these clauses to be both effective and legally enforceable.

Communicating Liability Terms Clearly: Finally, the effectiveness of limitation clauses relies heavily on clear communication. Your Terms and Conditions should be written in plain language that your clients can easily understand, minimising the risk of disputes over interpretation. Consider highlighting or otherwise emphasising key limitation clauses to ensure they are noticed by your customers.

6. Ensure Compliance with Industry Standards

Tailoring your Terms and Conditions to reflect the specifics of your industry and jurisdiction ensures compliance with regional and international regulations, helping you avoid costly legal violations.

Adaptation to Regional Regulations: Businesses operate in a dynamic regulatory environment where laws can vary significantly from one region to another. Customised Terms and Conditions that consider these geographical nuances ensure that your business practices align with local legal requirements. For example, data protection laws such as GDPR in Europe and the CCPA in California have specific stipulations that must be addressed directly in your Terms and Conditions to ensure compliance.

Alignment with

Industry-Specific Legislation:

Each industry has its unique set of regulations and standards. For instance, the healthcare sector is bound by HIPAA regulations in the U.S., which dictate how patient information is handled. Similarly, financial services are subject to stringent compliance measures under laws like the Dodd-Frank Act. By tailoring your Terms and Conditions to include specific clauses that address these regulations, your business can avoid breaches that lead to severe penalties.

5. Limit

Liability

38 | Aussie Painting Contractor

Mitigation of Legal Risks: Customised Terms and Conditions are a proactive measure in legal risk management. By clearly stating the legal obligations of all parties involved and ensuring that these obligations are in line with current laws, your business minimises the risk of non-compliance. This not only prevents legal disputes but also establishes a framework for swiftly resolving potential issues that could arise.

Regular Updates and Reviews: Laws and regulations are continually evolving, and so should your Terms and Conditions. Regular reviews and updates are essential to keep pace with changes in the law. This ongoing process ensures that your business remains compliant over time, even as new regulations are created or existing ones are amended. Establishing a routine review process, perhaps annually or bi-annually, will help maintain the relevancy and effectiveness of your contractual agreements.

Building Trust with Stakeholders: Compliance with industry standards through well-crafted Terms and Conditions not only protects the business legally but also boosts your credibility and reputation among stakeholders. Customers, partners, and regulatory bodies are more likely to trust and engage with a company that demonstrates commitment to legal and ethical standards. This trust is invaluable, particularly in industries where consumer confidence directly affects business success.

Enhancing International Operations: For businesses operating across international borders, compliance with global standards and laws is particularly challenging yet critical. Tailored Terms and Conditions that cater to international laws and cultural nuances can facilitate smoother operations and partnerships. This global perspective in drafting your terms can open doors to international markets and opportunities, further driving growth and innovation.

Crafting Comprehensive Terms and Conditions with Rise Legal

We specialise in customising Terms and Conditions that are not only legally sound but also tailored to the unique needs of your business. Whether you operate an e-commerce store, a SaaS provider, or a service-based business, our legal experts are here to ensure that your business is protected on all fronts.

Why Choose Us?

Expertise in Business Law: Our legal team has extensive experience drafting Terms and Conditions across various sectors.

Custom Solutions: We understand that one size doesn’t fit all. Our services are tailored to meet the specific needs and challenges of your business.

Fixed Fees: We operate on a fixed fee basis where we quote you for what you want and you know from the outset what the bill is at the end of the matter. No nasty end of month surprises like traditional law firms. Clear Communication: We prioritise clarity and simplicity, ensuring that legal jargon doesn’t stand in the way of understanding your rights and responsibilities.

Ready to Protect Your Business? Contact us today for a free consultation and let us help you draft Terms and Conditions that will protect your business interests and support your company’s growth. Let Rise Legal be your partner in navigating the complexities of business law.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Disclaimer: This blog post is intended for informational purposes only and should not be considered legal advice. Consult with a qualified commercial lawyer for personalised advice related to your specific circumstances.

2024 June Issue | 39

Life’s big moments can impact an entrepreneur’s success –but not always in the way you’d expect

Entrepreneurs are the lifeblood of any innovative economy.

New business creation has been shown to have a significant and positive impact on economic growth, innovation and job creation. But it isn’t easy, and most new businesses fail.

Starting a new venture is often a family affair. ergonofis/Unsplash

When someone starts a business, they usually aren’t doing it alone – their whole family forms part of the journey. All of them can experience the emotional rollercoaster of entrepreneurship.

This obviously flows in the other direction as well –founders’ personal lives have their own big ups and downs.

Big positive changes in a family – including job promotions, weddings and new babies – and negative changes – such as when someone sadly passes away – can really shake things up for someone trying to start a business.

Yet only minimal research has looked into the extent of these effects on new venture creation.

In a recently published study, we looked at how big family events affect the success of new ventures.

Surprisingly, our findings reveal that by making entrepreneurs overconfident, certain kinds of positive family events can have a bigger detrimental effect on new venture survival than negative ones.

42 | Aussie Painting Contractor

Emotions have complicated effects

We used data from the Australian Household, Income and Labour Dynamics (HILDA) survey to analyse the emotions caused by major family events that entrepreneurs experience.

Our study found that many of these family events had the influence you’d expect based on both intuition and past research – positive events typically helped and negative events typically harmed new venture survival.

Major positive family events can simpact an entrepreneur’s emotional state. PeopleImages.com - Yuri A/Shutterstock

But existing research may oversimplify this connection. The structure of a family – their relationships, emotions and goals – can affect an entrepreneur’s mental state and decision-making in complicated ways.

The effect on founders’ confidence levels is particularly important. Confidence is necessary to start a business, but can become a problem in excess when entrepreneurs overestimate their own abilities.

Notably, some positive events can lead to overconfidence, which could take the form of being overly optimistic about the extent of one’s abilities, or overestimating the accuracy of one’s own beliefs.

And perhaps counter-intuitively, we found that overconfidence resulting from positive family events had a negative impact on new venture survival. This impact was bigger than the impact of explicitly negative events.

Why might this be happening?

Two key theories from psychology may help explain why overconfidence ends up being harmful.

First “affect-as-information theory” suggests that our emotions serve as a kind of compass, guiding us to understand whether a situation is beneficial or harmful.

When entrepreneurs feel good due to a positive family event, like marriage to a childhood sweetheart, they may lean on their existing knowledge and heuristics.

Second, entrepreneurs may succumb to “affect priming”, which suggests that emotions influence decision-making by automatically bringing up related ideas and memories.

Such priming may not just influence what they think, but also how they think. For example, if entrepreneurs are in a good mood, their mind will offer up memories linked to positive emotion – whether relevant or not – to help them make decisions.

These theories suggest that major family events can influence an entrepreneur’s confidence by subtly and automatically adjusting how they evaluate opportunities and risks in decision-making.

2024 June Issue | 43

Emotions play a significant role in our decision-making.

Priscilla Du Preez/Unsplash

On the one hand, positive family events may lead to a more holistic thinking style and rapid decisionmaking. This can be beneficial for entrepreneurs who need to make quick and efficient decisions under time and resource constraints.

However, if entrepreneurs are too confident, believing that their abilities alone can make up for any lack of information, positive family events may just reinforce this overconfidence.

Like other people, when entrepreneurs think they’re better at things than they actually are, they may begin to believe tasks are easier than they really are.

This can lead to errors in judgement that seriously harm new ventures.

Overconfidence can make us more prone to make mistakes. Perfect Wave/Shutterstock

How does the research help entrepreneurs? Our study highlights the embeddedness of family in the entrepreneurial process.

Entrepreneurs need to be aware of the need to carefully manage their own emotional state, particularly their confidence levels.

Entrepreneurship training and support programs often focus solely on business strategies to make new ventures succeed. This research suggests it is also important to incorporate elements like maintaining emotional health, managing major family events and accessing support.

Read more: Entrepreneurs are facing a mental health crisis — here's how to help them

.

Pi-Shen Seet

Professor of Entrepreneurship and Innovation, Edith Cowan University

Wee-Liang Tan

Adjunct Associate Professor of Strategic Management, Singapore Management University

2024 June Issue | 45

46 | Aussie Painting Contractor

IMPORTANT Contacts

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Workplace Health and Safety Contacts

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA NT WorkSafe

WorkSafe Tasmania

Cancer Council Australia

Ph. 0430 399 800

Ph. 1300 319 790

Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au cancersa.org.au cancervic.org.au

cancerwa.asn.au

(02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333

2024 June Issue | 47

1300 366 979 02 6207 3000 1300 362 128 1800 136 089 13 10 50 1300 365 255 1300 307 877 1800 019 115 1300 366 322 ACT NSW NT QLD SA

VIC WA

Sandra Price

Sandra Price

Leo Babauta ZEN HABITS

Leo Babauta ZEN HABITS