Welcome to the 141 st issue of The Aussie Painting Contractor Magazine.

It’s amazing looking back over the years, from when starting APN with a thought after having a workplace accident that sent me spiralling on a pathway to help others in the industry that I love. I was told I would never be able to publish a magazine, now over 140 editions and look at us go!!

With now having been involved in training over 1,000 painters that have come to our industry it gives me a reminder of how small our world is. This weekend, I was at a party and talking with someone there and discovered that I trained her partner. I remember him coming and telling me the day he found out that she was pregnant. It’s the things like this that keep me doing what I do.

APN welcome Miegen to the team, she has years of experience in customer service and career advisor service. Meigen is contacting painters to see how we can assist them in their business needs. If she gives you a call, please welcome her.

It is with great sadness with our team that we are about to say good-bye to Kate at the end of this week. She has been an integral part of our team and helped countless numbers of our members with their needs. We wish her well on her new endeavours. We have a new team member joining us next week to assist you all in your employment needs, we will introduce her next week.

'Til next month, Happy Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Ann Kayis-Kumar

• Caroline Miall

• Helen Kay

• Jim Baker

• Leo Babauta

• Matt Pinnuck

• Michael J. Davern

• Nigel Gorman

• Robert Bauman

• Sandra Price EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you October incur directly or indirectly as a result of

I talk to dozens of people every month — Zen Habits readers, coaching clients and Fearless Living Academy members — who struggle with a feeling of overwhelm from all of the things on their plates.

Overwhelm from tasks, messages, and more is completely normal. It’s based on a fear that we can’t handle everything coming our way. That we’re going to fail at juggling all of these balls, and drop them, and be a failure. It’s a fear of inadequacy, that shows up as anxiety.

So what can we do with that fear? What we can realize is that it’s just an energy, present in our bodies. We have all kinds of energy: joy, love, gratitude, optimism, sadness, hurt, grief, anger, power, and more.

These kinds of energies in our bodies have a few properties we can notice from observing:

• They’re temporary. Energies shift throughout the day, depending on what we’re going on, how much sleep we got, how people are acting towards us, how we’re doing with our actions and intentions, etc.

• We create them. It might seem like the energy of, say, anger, is caused by how someone else acted … but we create the energy of anger as a response to the energy of hurt … which we create because of how we interpret their actions. That doesn’t mean it’s a “bad” interpretation, but the point is that we are the creators of our energy.

• We can shift them. If we’re the creators of the energy, that’s good news, because we can then create whatever we want. Have you ever done gratitude practice? It’s a really simple practice of reminding yourself of what you’re grateful for in your life. Doing this might transform whatever sad or complaining energy you currently have, into gratitude and contentment. That shows that it’s possible to shift things intentionally, with practice.

So if we can shift our energy, how do we deal with the energy of overwhelm? There’s not one way to deal with it, but I’m going to suggest a powerful practice.

1. Get present to the energy of overwhelm, in your body. Notice that you’re feeling overwhelmed. You might notice because you’re either avoiding, or rushing to get everything done. You’re feeling anxious about how many things there are. Just pause, and notice how the energy of overwhelm feels in your body. Where is it located? In your chest? What does it feel like? Get curious.

2. Play with the energy. The energy of overwhelm is just energy — it can feel like fear, anxiety, panic … but we can also feel it as excitement, adventure, creativity. These are all just labels. How can you use the energy to generate courage? To make you get up and dance? To light a fire under yourself? Play with it, as if it were a fire you could use creatively to whatever purpose you’d like.

In this way, the overwhelm doesn’t become a thing that controls us, but rather is something we can feel, love, and use however we like. It becomes the clay for our creative act.

I realize this all might sound a bit weird to some people, but I invite you not to dismiss it, because you’ll be missing out on a powerful and beautiful way to work with something that shows up for you regularly.

You get overwhelmed because you care. May you never stop caring.

Leo Babauta ZEN HABITS

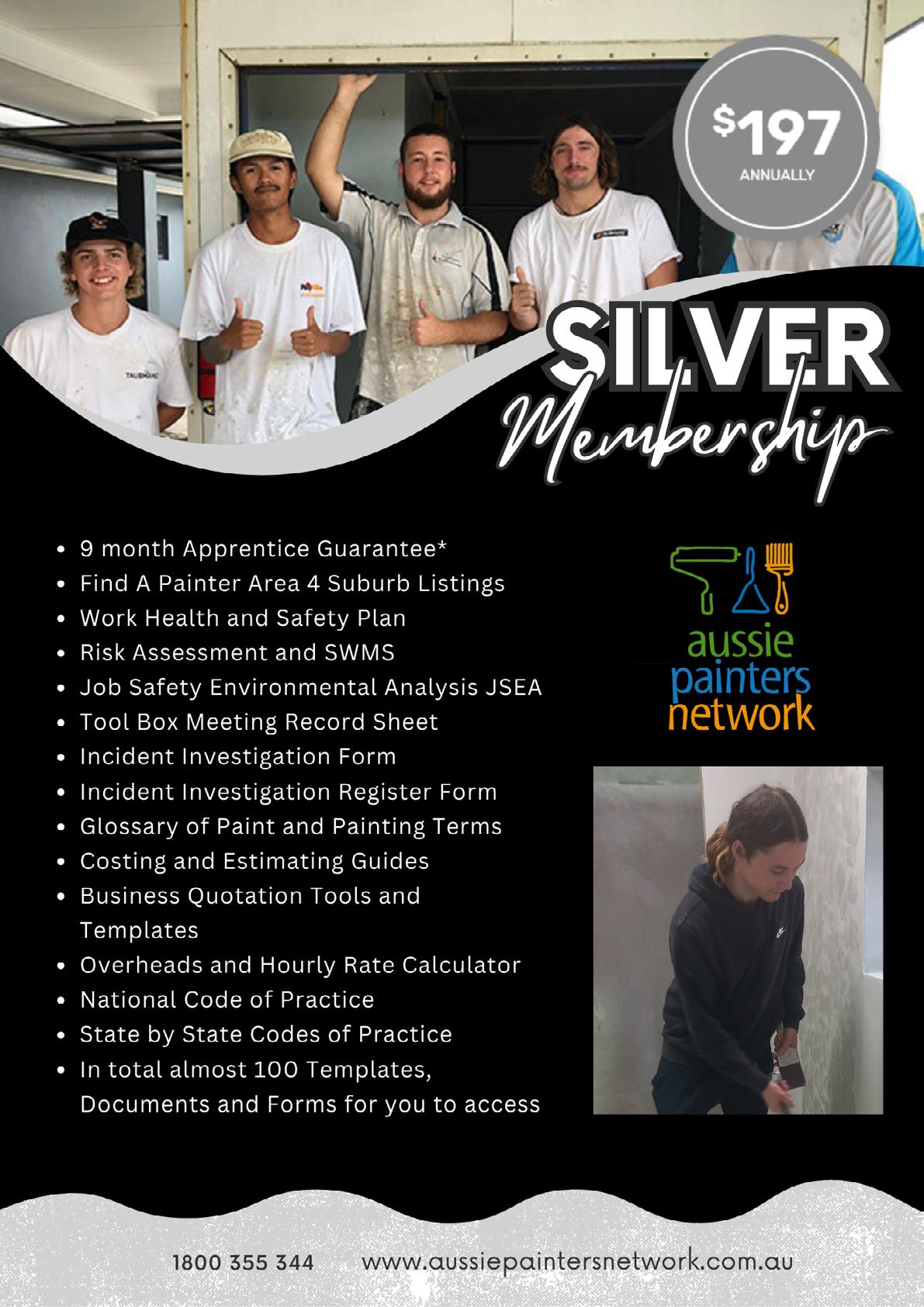

Women make up barely 3% of tradespeople. Aussie Painters Network is proud of the fact that 30% of the apprentices that come though our training facility are female.

At a recent meeting with stakeholders from job-seeking support organisations, two concerns regarding women in skilled trades in Australia were reported as those of most concern to employers. The first was a fear that women might distract male workers, and the second was apprehension about being accused of sexual harassment. These concerns, while significant to employers, are more a reflection of fear and outdated assumptions than actual workplace realities. So, how do we support employers to see beyond these concerns and help women participate safely and effectively in the trades?

The notion that women would distract male workers stems from a long-standing cultural belief that men and women cannot work together without personal dynamics interfering. This perspective is not only outdated but ignores the professionalism that exists in modern workplaces. In environments where respect and collaboration are prioritised, these concerns become irrelevant. Women have long proven their ability to work in highly focused and skilled positions, often in male-dominated sectors, without causing disruption.

Employers need to understand that a respectful and inclusive culture can be cultivated, and that teambased professionalism is the key to a productive workplace. Fears about distraction can be mitigated

through education and training that emphasise collaboration, respect, and the importance of clear communication. In doing so, businesses can ensure that their focus remains on the quality of work and teamwork, rather than baseless concerns about male-female dynamics.

The second issue employers often raise is the fear of being accused of sexual harassment. While this is a serious and real concern in any workplace, the focus should not be on avoiding accusations but on preventing the behaviour that leads to such claims. Creating a respectful work environment is not only a matter of legal compliance but also one of moral responsibility. Sexual harassment should never be tolerated—whether directed at women or men.

Employers can overcome this fear by taking proactive steps to implement clear policies on appropriate behaviour, offering regular training to all employees, and setting firm consequences for misconduct. Providing employees with a solid understanding of what constitutes harassment and creating a safe reporting system for anyone who experiences or witnesses inappropriate behaviour helps build trust and ensures that the workplace remains safe for everyone. These measures not only protect women but create a safer and more productive environment for all workers.

The fears that employers express are largely rooted in a fear of change and a lack of familiarity with managing diverse workforces. However, these concerns are driven more by perception than by reality. Studies consistently show that diverse teams—including gender-diverse teams—are often more productive, creative, and better at problem-solving. Moreover, workplaces that prioritize diversity and inclusion tend to attract and retain top talent, giving them a competitive edge.

Supporting employers in this transition is essential. By offering education and training on diversity, inclusivity, and workplace behaviour, we can help businesses move beyond these fears. This can include:

• Diversity and inclusion training: Employers and employees should understand the value of diversity and how to foster a workplace culture where everyone feels valued and respected.

• Clear policies and enforcement: Companies should implement robust anti-harassment policies, ensure these policies are communicated effectively, and follow through with strong enforcement when necessary. This creates a culture of accountability and safety.

• Mentorship programs: Encouraging mentorship between experienced professionals—both male and female—helps to foster respect and build understanding between different groups in the workplace. Mentorship programs also give women the support they need to succeed and feel confident in their roles.

• Flexible and inclusive work practices: Offering flexible work arrangements, ensuring facilities are inclusive for women, and providing necessary resources (like safe changing spaces) are steps employers can take to make women feel welcome and safe.

The fear that women will disrupt the trades industry or create legal challenges is misguided. The real issue is that workplaces must adapt to support diversity and equality. By addressing these outdated concerns, employers can open the door to a new era where women can participate fully and safely in the trades, benefiting not just themselves but also the industry at large.

Change takes time, but with the right tools, training, and mindset shifts, we can create a workplace where all employees, regardless of gender, can excel. Replacing fear with proactive action is essential to building a trades industry where women can participate fully, confidently, and safely. Women in Painting aims to offer these opportunities, empowering women while helping employers recognize the genuine value they bring—enhancing workplace culture, team dynamics, and the quality of work delivered.

Caroline Miall info@WomenInPainting.com.au

0413 345 595

In our digital age, cybersecurity is a crucial aspect of running any business. Cybersecurity breaches could lead to not only data theft but also reputational and financial loss. Hence, it’s imperative to establish robust cybersecurity measures to protect your business and customers’ sensitive information. Here are some cybersecurity practices that could help safeguard your online presence.

1. Invest in Security Software: One of the fundamental cybersecurity practices for small and medium sized businesses is installing reliable security software that includes antivirus, firewalls, and anti-malware protection. These security solutions can prevent illegitimate access to sensitive information. Keeping the software updated regularly can ensure that you remain protected from the latest threats.

2. Use Strong Passwords: Creating strong passwords is crucial as weak passwords can be easily guessed or hacked. Best practice is to use complex passwords and update them regularly. Using multi-factor authentication (MFA) can also contribute to enhancing password security as can using a third party password vault such as 1Password, Keeper, NordPass or others on the market – search for Password Managers and see what suits your needs.

3. Back-Up Data Regularly: Losing critical data due to cyber threats could have serious consequences. You need to have a backup system in place, either through physical storage or cloud-based back-up. This practice can help your business to recover your data and restore your business operations quickly.

Don’t risk losing critical information when a simple solution already exists.

4. Educate Employees: Human error is one of the leading causes of cybersecurity breaches. Make sure your employees understand and employ cybersecurity best practices. Raise awareness of potential threats such as phishing emails, malware, and social engineering attacks. Conducting regular training sessions can help employees stay vigilant and avoid falling prey to cyber threats.

5. Monitor Network Activity: Monitor your network activity regularly to detect any suspicious activity promptly. Keeping an eye on network traffic and logs can help identify unapproved access or unusual traffic patterns that may indicate a breach.

Every business needs to focus on cybersecurity to protect their reputation and sensitive data from cyber threats. Start by implementing these five cybersecurity practices as a foundation for robust cybersecurity and continue to thrive in the digital age.

Need some help?

Book a strategy session HER E to see how we can improve your bottom line.

Sandra Price

www.tradiebookkeepingsolutions.com.au

What does that mean – and why does it matter?

’Tis the season! But not the one that involves giving gifts and carol singing. It’s corporate Australia’s earnings season, where accountants get to take the centre stage.

In February and August each year, most companies listed on the Australian Securities Exchange (ASX) have to report their half-yearly performance in detail.

This might seem like quite a dull affair, but for the world of finance, it’s a blockbuster event. Investors watch on with bated breath, and company share prices can move dramatically with the announcements.

And it has big implications for the rest of us, too. Here’s why earnings season is so important, and how to make sense of all the noise.

Read more: Earnings announcements at an AGM can reflect a corporate power play, not necessarily a company's true value

Earnings season is also called “profit season” or “reporting season”.

It falls at the same time each year because ASX-listed companies are all required to report their earnings

within two months of the end of their half-yearly reporting periods – typically January to June, and July to December.

An earnings report is like a school report card for a company and its management. It provides key financial information about half-yearly performance, such as revenue, profit, earnings per share, and a range of other metrics.

Together, these provide important insights into a company’s performance and financial health.

Let’s look at three of the metrics investors and analysts pay the most attention to in a company report. They can help assess whether a company is growing, stagnating, or declining.

Net profit after tax – “NPAT”

This figure is a company’s “bottom line” – income minus expenses. It adds up all the different sources of revenue for a company, and deducts all the different expenses incurred, including taxes and interest.

Earnings before interest and taxes – “EBIT”

EBIT is still a measure of profit, but in contrast to NPAT, it excludes interest and tax payments from a firm’s calculated expenses.

Why leave these things out? Put simply, EBIT can give a sense of whether a firm is making good business investment decisions, regardless of how it is taxed or how it is financing capital.

Earnings per share – “EPS”

EPS is calculated by dividing a company’s NPAT by the number of common shares on issue. This indicates how much of a company’s profit can be attributed to each share.

Earnings season is an important opportunity for the market to assess whether companies are meeting or beating its expectations – or else failing to deliver.

Like a school report card, there are consequences for these “grades”, particularly if they turn out to be different to what the market expects. They can lead to significant activity and short-term volatility in the share market, with consequences for individual companies’ share prices. Let’s look at some examples from this month.

On August 14, the Australian medical imaging company Pro Medicus reported a higher-than-expected full year net profit of A$82.8 million, up 36.5% on the year before. Its share price closed the day 7.2% higher.

The next day, Cochlear, a well-known hearing implant company, also reported an increase in net profit, up 19%. But its share price fell by 7% after the announcement.

Why would a company’s share price fall when its earnings go up? The key here is expectations.

A company’s current share price factors in all the publicly available information about that company and its expected ongoing performance.

If an increase in earnings is still less than what the market expected, as we saw with Cochlear, its share price may go down.

Conversely, if an earnings decrease is less than expected, or forecast losses are not as bad as anticipated, a company’s share price may go up.

These daily share price movements when earnings are announced can be extremely large, but not unusual. In comparison, benchmark average annual share returns are typically around 10%.

It might still seem like high finance, but the consequences of these earnings announcements go well beyond the specific companies involved and interested investors.

Australia has a relatively small share market, dominated by some major players. The performance of these major companies during earnings season can often tell us something about broader economic trends, just as we use changes in gross domestic product (GDP) and inflation as economic indicators.

Strong earnings performance across key industries could suggest a healthy economy, while poor earnings could indicate economic trouble.

Last week, for example, electronics retailer JB Hi-Fi announced stronger-than-expected sales, which was interpreted by the market as a suggestion weak consumer demand may be coming to an end more broadly.

nearly all of us have a further vested interest in the performance of these companies.

Whether we follow the market or not, our growing superannuation “nest eggs” are tethered to its performance. For those of us still in our working years, longterm performance matters more, but nobody wants to see a market downturn as they enter retirement.

Whether you follow the share market on a secondby-second basis or not, what happens in earnings season will affect you.

Earnings reporting season can also provide some insights into industry specific trends.

For example, if multiple tech companies all reported strong earnings in the same period, market participants would quickly try to work out potential causes of overall industry growth – in this case, perhaps increased uptake of artificial intelligence and related technologies. It matters to the rest of us, too

Beyond any immediate concerns for the economy,

This article is part of The Conversation’s “Business Basics” series where we ask experts to discuss key concepts in business, economics and finance.

Michael J. Davern Professor of Accounting & Business Information Systems, The University of Melbourne

In the complex world of business, contracts are the backbone that hold relationships together. One such crucial contract is the Master Service Agreement (MSA). If you’re running a business, understanding MSAs is vital to ensure smooth, long-term collaborations. This blog will delve into the essentials of an MSA, how it differs from other agreements like Service Level Agreements (SLAs), standard contracts, and Statements of Work (SOWs).

A Master Service Agreement, or MSA, is a contract between two or more parties that establishes the terms and conditions that will govern future transactions or agreements. The MSA serves as a framework for future agreements and can cover a range of services, from IT support to consulting services.

By having an MSA in place, businesses can streamline their processes and avoid the need to renegotiate terms every time a new project or service is initiated. This saves time and reduces the risk of disputes, as all parties have already agreed on the foundational terms.

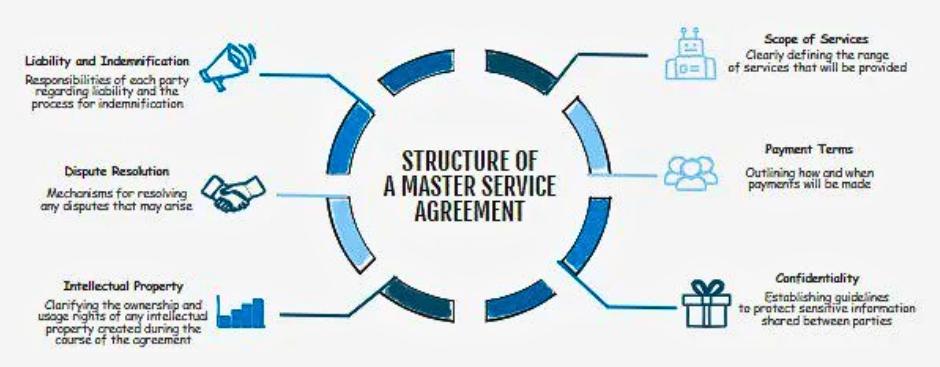

An MSA is meticulously crafted to encompass all critical aspects of the business relationship, ensuring

that all potential scenarios and obligations are addressed upfront. Key components often include:

1: Scope of Services: Clearly defining the range of services that will be provided.

2: Payment Terms: Outlining how and when payments will be made, including invoicing schedules and payment methods.

3: Confidentiality: Establishing guidelines to protect sensitive information shared between parties.

4: Intellectual Property: Clarifying the ownership and usage rights of any intellectual property created during the course of the agreement.

5: Dispute Resolution: Setting forth the mechanisms for resolving any disputes that may arise, such as mediation or arbitration.

6: Liability and Indemnification: Detailing the responsibilities of each party regarding liability and the process for indemnification.

While both SLAs and MSAs are crucial in managing business relationships, they serve different purposes and address distinct aspects of the contractual framework.

An SLA, or Service Level Agreement, is a detailed document that outlines the specific services to be provided, the expected standards of service, and the metrics by which service performance will be measured. Essentially, an SLA focuses on the quality and performance of the services being provided. It includes:

• Service Specifications: Detailed descriptions of the services offered, ensuring both parties have a clear understanding of what is being delivered.

• Performance Metrics: Specific criteria and benchmarks for measuring the service performance, such as uptime percentages, response times, and resolution times.

• Accountability and Reporting: Guidelines on how performance will be monitored, reported, and what penalties or remedies will be in place if service levels are not met.

• Customer Responsibilities: Outline of the customer’s obligations to ensure smooth service delivery, such as providing necessary access or resources.

• SLAs are essential for managing expectations and ensuring that the service provider meets the agreed-upon standards, thus maintaining a high level of service quality and customer satisfaction.

Think of the MSA as the umbrella agreement under which SLAs can be tailored to specific projects or services. The MSA establishes the foundational terms that apply to the entire relationship, providing a consistent and comprehensive framework. Within this framework, SLAs can be created to address the specific details and performance criteria for individual services or projects.

Consider a scenario where a business outsources its IT services to a provider. The MSA would cover the overall relationship, setting the stage for confidentiality, intellectual property rights, and dispute

resolution. Within this MSA, separate SLAs would be established for different aspects of the IT services, such as network management, helpdesk support, and cybersecurity. Each SLA would detail the specific service levels expected for those particular services, including response times, resolution times, and performance metrics.

In summary, while SLAs and MSAs both play crucial roles in managing business relationships, they serve different purposes. An SLA focuses on the quality and performance of specific services, ensuring that the service provider meets the agreed-upon standards. An MSA, on the other hand, establishes the broad terms and conditions for the overall relationship, providing a consistent and comprehensive framework under which multiple SLAs can be tailored to specific projects or services.

At first glance, a Master Service Agreement (MSA) might seem just like any other contract. However, there are key differences that distinguish MSAs from standard contracts. Understanding these differences is essential for businesses to manage their relationships and projects effectively.

A standard contract is typically designed to be projectspecific, detailing the terms and conditions for a single transaction or project. This type of contract includes specifics such as the scope of work, deadlines, deliverables, payment terms, and other details pertinent to that particular project. Once the project is completed, the obligations under the contract are fulfilled, and the contract ends. If another project arises, a new contract would need to be negotiated and signed, which can be time-consuming and repetitive.

By establishing these broad terms upfront, an MSA makes it easier and faster to negotiate the specifics of new projects or transactions. Instead of drafting and agreeing on a completely new contract each time, the parties can simply create a Statement of Work (SOW) or similar document that outlines the details specific to the new project, while the general terms are already set in the MSA.

• Efficiency and Speed: With an MSA in place, businesses can quickly move forward with new projects without the need to negotiate basic terms repeatedly. This efficiency can lead to faster project initiation and completion.

• Consistency and Clarity: An MSA ensures that the fundamental terms of the relationship are consistent across all projects. This consistency reduces the risk of misunderstandings or disputes and provides clarity for all parties involved.

• Flexibility: An MSA allows for greater flexibility in managing multiple projects. Since the foundational terms are already agreed upon, the parties can easily adapt to changing circumstances or new opportunities by simply modifying or adding new SOWs.

• Stronger Relationships: By setting the terms for a long-term relationship, an MSA can foster stronger partnerships between businesses. This long-term commitment can lead to better collaboration, trust, and mutual benefits over time.

MSAs are commonly used in industries where businesses have ongoing relationships and multiple projects with the same partners. For example, in the IT and technology sectors, companies often enter into MSAs with service providers for ongoing support, maintenance, and development services. Similarly, in consulting and professional services, MSAs are used to manage long-term relationships with clients who require periodic or continuous services.

What’s the Difference Between an MSA and a Statement of Work (SOW)?

A Statement of Work (SOW) is another important document in the world of business agreements. The SOW is project-specific and outlines the detailed work to be done, including deliverables, timelines, and costs. It’s a crucial document for ensuring all parties are clear on the specifics of what is being delivered and when.

The MSA, in contrast, sets the overall terms and conditions under which these specific projects will be executed. In essence, the SOW operates within the framework provided by the MSA. The MSA handles the “how” of the relationship (e.g., payment terms, liability), while the SOW deals with the “what” and “when” of the specific project.

To illustrate, imagine your business signs an MSA with a consulting firm. The MSA covers overarching terms like confidentiality, dispute resolution, and intellectual property rights. When a new project arises, a specific SOW is created detailing the project’s objectives, deliverables, timelines, and costs. The SOW functions under the MSA’s framework, ensuring that both parties understand the scope and specifics of the project while adhering to the agreed-upon terms in the MSA. This layered approach provides both flexibility and clarity, making it easier to manage multiple projects within the same business relationship.

Master Service Agreements (MSAs) are more than just legal documents; they are strategic tools that can significantly enhance the efficiency, consistency, and flexibility of business operations. Here’s an in-depth look at why MSAs are beneficial for businesses:

Consistency in business operations is crucial for maintaining strong relationships and ensuring smooth execution of projects. With an MSA, businesses can ensure consistent terms across multiple projects, reducing the risk of discrepancies and misunderstandings.

• Standardized Terms: An MSA sets out standard terms and conditions that apply to all projects under its scope, ensuring that everyone is on the same page from the outset. This uniformity helps avoid confusion and ensures that all parties have a clear understanding of their obligations.

• Predictable Expectations: Clients and service providers know what to expect in terms of service delivery, payment terms, and other critical aspects. This predictability fosters trust and reliability, essential components for long-term business relationships.

Time is a valuable resource in any business. Negotiating a new contract for every project can be time-consuming and labor-intensive. An MSA provides a foundation that speeds up this process.

• Streamlined Negotiations: With the core terms already established in the MSA, businesses can focus on the specific details of each new project or service without renegotiating the entire contract. This streamlined approach reduces administrative burden and accelerates project kick-offs.

• Reduced Legal Costs: Repeatedly drafting and reviewing new contracts can be costly. An MSA minimizes these costs by serving as a comprehensive reference point, reducing the need for extensive legal oversight with each new engagement.

Effective risk management is essential for the sustainability and growth of any business. By having a clear, overarching agreement, businesses can better manage risks and handle disputes more effectively.

• Clear Dispute Resolution: MSAs typically include well-defined dispute resolution mechanisms. This clarity helps resolve conflicts efficiently and reduces the likelihood of lengthy and costly legal battles.

• Defined Liabilities: An MSA delineates the responsibilities and liabilities of each party, helping to mitigate risks associated with service delivery, intellectual property, and confidentiality. This clarity protects businesses from potential legal exposure and financial loss.

• Continuity Assurance: In the event of changes in project scope or unforeseen circumstances, an MSA provides a structured approach to adapt and continue operations without significant disruption.

In the dynamic business environment, flexibility is key to adapting to new opportunities and challenges. MSAs are designed to adapt to new projects and services, providing a flexible framework that can evolve with the business relationship.

• Adaptable Framework: An MSA establishes a flexible yet robust framework that can accommodate various projects and services over time. This adaptability allows businesses to scale operations, introduce new services, and respond to market changes without renegotiating terms.

• Incremental Adjustments: Businesses can easily make incremental adjustments to the MSA to

reflect changes in regulatory requirements, market conditions, or internal policies, ensuring continued relevance and compliance.

• Long-term Relationships: MSAs foster long-term relationships by providing a stable foundation that can accommodate evolving needs. This stability encourages collaboration and innovation, driving mutual growth and success.

For businesses looking to implement an MSA, it’s crucial to ensure the agreement is comprehensive and clear. Engaging with legal professionals who specialize in commercial law can be invaluable. They can help draft an MSA that covers all necessary aspects, from confidentiality clauses to dispute resolution mechanisms, ensuring your business is well-protected and positioned for successful partnerships.

At Rise Legal, we specialise in drafting robust Master Service Agreements tailored to your business needs. Our expertise ensures that your agreements are not only legally sound but also strategically aligned with your business objectives. Contact us today to learn more about how we can help you establish strong, clear, and effective MSAs.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Traditionally, employers have relied on giving employees raises as a way to retain their staff and reward them for being hard working and loyal. Raises can get expensive, and there is often an upper limit for what you can offer when it comes to increasing salaries and wages.

Keeping your employees happy makes business sense. You want to keep your good employees, and it costs money to find, hire and train new staff. Beyond that, employees that are satisfied and feel valued are more motivated and productive.

Here are some ways to keep your employees happy that don’t rely on higher salaries.

Not everyone wants, or is able, to work a regular Monday to Friday from 9 to 5. Some people have family priorities or other commitments that keep them busy during regular business hours. If it makes sense for your business, consider flexible work arrangements, such as compressed work weeks (longer days in exchange for more days off), varied start and end times, or job sharing arrangements. Remote work is another option that employees may want to take advantage of.

Not only will your employees appreciate flexible work arrangements, your customers and clients may also benefit from your business having increased availability.

Good employees want to improve their skills and grow professionally. Often, other priorities get in the way of upgrading skills. Paying for professional development, for example by having a fund people can access or by bringing in experts to run workshops, shows your staff you care enough to invest in them. Meanwhile, your business benefits by having staff trained on the newest procedures and technologies.

Employees want a life that’s fulfilling, but it’s difficult to find a balance between work life and home life. Having an employer that encourages a work-life balance makes it easier. Avoid messaging (texting, phoning or emailing) employees after work hours and make it clear that people should enjoy their personal time. Encourage employees to take their sick leave and use their vacation days. Be a role model by striving for work-life balance yourself

Being open and honest with your workers fosters a sense of trust and belonging among your staff. Have regular meetings where you discuss your organization’s goals, strengths and challenges and receive input and feedback from your team. This encourages engagement and shows your workers their perspective is valuable.

Having a set of values that applies to your staff

Sometimes organizations create noble values that they apply to their customers, but they don’t apply them to their workers. Employees see clients and customers being treated well but then wonder why those same values aren’t applicable to them. Create a set of values that applies to your staff. Set out how you want your staff to feel. Do you want them to feel valued? Supported? What does that look like in your organization?

Ask your staff what they need

It’s difficult to come up with solutions that everyone will find meaningful. Ask your staff what would be valuable to them–and what would make them happy enough to stay. They may be happy with additional vacation days or more banked sick time, for example.

Listen to their suggestions and consider whether any of the options they mention could work for your organization.

While increasing salary is one thing you can do to keep your employees happy, there are other things they may value that you can offer.

If you have any questions on this topic, feel free to arrange a FREE No-Obligation Meeting with me. Call my office on 07 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Copyright © 2024 Robert Bauman.

Networking is not for everyone but is a necessary skill for all small business owners. You are probably thinking that this is a silly question to be asking. If you understand the importance of using your innate skills wisely, it is a question that needs to be asked.

Networking for people who do it innately just do it without thinking. They are extraverts, love people and enjoy being where the action is and it is done with ease. They are happy to small talk and have the ability to get information out of people without even realising that they are doing it.

On the other hand, networking can be a very difficult thing for a lot of people. For most introverts, it is a painful experience but there are some extroverts that find it hard as well. These people just do not like people all that much and are not comfortable in this type of environment. They find chit-chat and gossip unimportant and extremely boring. They are more comfortable in their own skin when they are alone.

If you are a solo entrepreneur who is an introvert or not comfortable networking, you need to be smart. By learning the necessary skills to become more relaxed in a networking situation, you will find that relationship building will become easier. Networking is vital for a business to grow today so the learning of correct skills for each personality type can make a big difference.

It is easiest for an introvert to be the first to arrive at a function so that they can set the space for themselves when other people enter the room. I often suggest to people who are uncomfortable in this situation to look for others who are just as uncomfortable. They will be happy to talk and be relieved to have someone else to support them. So, become the supporter for them and help yourself at the same time.

It is important for all business people to become aware that networking is an investment, not a nuisance, for your business growth.

If you have lots of contacts and you know lots of people, it will then be easier to find who and what you need. Without contacts, you will find it time wasting looking for the relevant information or people to give you what you want. Putting in the time to create your network, which does not have to be large, will pay off in the long run.

Be aware that if networking is a struggle in the beginning you may need to meet a lot of people … and maybe kiss a lot of frogs on the way! Once you find your correct niche market it will become easier and you will eventually find the people you like and want to have around you.

If meeting people is difficult for you it is important that you do not spend too much time going to networking events as the following up is the most important part when you are starting out. Go to one or two events a month and build on that until you become more comfortable. Over a year you will have built yourself a database of people who you will be able to support you to gain what needs you have in the marketplace.

Sometimes for people who do not like networking it is good to meet one or two people for lunch or drinks rather than at an event with lots of attendees. This gives you the opportunity to get to know people

better in a more comfortable setting. Discuss things that you like eg hobbies, golf or fishing, what they do for fun etc. Ask them these questions to find out if you have any synergy away from the business environment.

If you do not like networking more than likely you are intuitive and analytical. So, analyse your results. What is working, what is not and where do you get the best results from the money you are spending.

Networking is not something people should do for the sake of doing it, if they are smart. It is important you have a goal for every event you go to. It is not all about just meeting new people, it is about finding the people who are the best fit for you and your business. It is also important that you can support them too as you may have resources or contacts that are important to them.

A big milestone for any business owner is when you purchase your own property to operate from.

For many tradies, your first business premises is essentially your ute or your van, and maybe your garage or shed for storage.

Making the step up to a property owner, with a workshop, warehouse or office space means taking a step up in your business insurance as well.

Here at Trade Risk we help plenty of trade and building business owners with their building insurance needs.

Whether you have a small storage unit, or a portfolio of multi-million dollar buildings across the country, we can help.

In this guide we’ll run through the basics of commercial property owner’s insurance.

If you prefer to speak to someone, please call our team on 1800 808 800.

Select a topic below to just straight to the section:

• What is commercial property owner’s insurance?

• What does property owner’s insurance cover?

• What else should I be covering?

• Do I need this form of insurance?

• What if I rent my property to someone else?

• Do I need separate public liability insurance?

• What information is needed for a quote?

• Will I need a property survey?

What is commercial property owner’s insurance?

Most tradies and builders will be familiar with general property insurance, which is more about your tools and equipment.

Often this is referred to simply as tool insurance.

Property owner’s insurance is all about the building, and more specifically, a building that you own.

An easy way to understand is to compare it with home insurance.

Commercial property owner’s insurance = building insurance.

General property insurance = contents insurance.

As is the case with a home your live in, if you own the building you need to insure both the building and your contents, but if you’re renting you only need to insure the contents.

The same is essentially true with commercial property.

What does property owner’s insurance cover?

Property owner’s insurance covers commercial and industrial buildings of most types.

For a trade or building business it’s most likely to be a warehouse or workshop space, possibly with some office space included.

There may also be retail space if you’re selling products to the general public.

The types of perils covered by property owner’s insurance are similar to what you’d expect from a typical home insurance policy:

• Fire damage

• Storm damage

• Malicious damage

• Flood (optional)

What else should I be covering?

Taking out a commercial property owner’s policy doesn’t provide blanket cover for everything that might go wrong at your property.

Other options and coverages to consider include:

• Machinery breakdown insurance

• Business interruption insurance

• Glass coverage

• Contents & stock insurance

• Theft

Your insurance broker can run through all of these options with you in more detail.

Do I need this form of insurance?

Broadly speaking, if you own commercial property, you’ll need commercial property insurance.

If you have financed the building, the bank or finance provider will require a copy of your insurance certificate, just like when you purchase a home with a mortgage.

There are some cases where you won’t need to insure the building, with the most common one being that your premises are part of a strata plan.

In this case, even though you own your particular unit in the building, the entire building is covered under a single policy through the strata plan.

We strongly recommend speaking with your Trade Risk insurance broker to determine whether or not you need to insure your part of the building separately.

What if I rent my property to someone else?

You might outgrow your business premises, but instead of selling, you hang onto it and rent to someone else.

Or you might simply have purchased it as an investment property from the start.

Either way, you’ll still need much the same form of property owner’s insurance regardless of whether you’re operating a business from there yourself or renting it to someone else.

One option you may wish to add is loss of rent insurance, or rent default insurance.

Your Trade Risk insurance broker can discuss these options with you, and we can certainly help with your insurance regardless of whether you’re an investor or owner occupier.

We’ll take a look at two separate examples.

Example one:

You operate your electrical contracting business from a mixed use commercial unit which includes warehouse space downstairs and some office space upstairs.

A supplier is visiting your business to talk about a new product, but as they walk back down the stairs they trip on a piece of carpet that has come loose, and suffer a nasty fall.

Although the incident happened whilst the person was there to visit your electrical business, the responsibility for the loose carpet on the stairs may sit with the property owner rather than the electrical business.

Do I need separate public liability insurance?

This will depend on how the property is owned.

If the property is owned by the same entity that operates the business, a single public liability policy will generally cover your business operations including what happens on premises.

But many business owners will own the premises outside of their operating entity. Our clients sometimes own property through their self-managed super fund or a separate family trust.

In this case the super fund or the family trust (or whatever the entity happens to be) will need to hold it’s own public liability insurance as the property owner.

The reason for this comes down to which entity is found to be responsible for an incident.

Even though both the business and the property are ultimately controlled by you, the individual entity is very important when it comes to legal liability.

In this case it might be found that both the property owner and the business operation have shared responsibility, and both policies will be claimed on.

Example two:

In this example we’ll look at a claim that is likely to be more clear on which entity is responsible.

A friend who also runs an electrical company is visiting your premises to borrow a tool for a job they’re on.

They walk through your workshop and slash their leg on a sharp piece of sheet metal that has been left protruding into the walkway.

In this case it’s more clear that the claim isn’t related to the maintenance of the building, and is more about the business operating with the premises.

Either way, it’s important to have public liability insurance for each entity which owns and / or operates the premises.

What information is needed for a quote?

Much of the information needed for a quote on commercial property owner’s insurance will be similar to what you’d be asked for a home insurance policy.

Common questions will include:

• Age of the building

• Building materials used

• Replacement cost

• Building location

• Security

• Building use

The insurers may also ask about certain other types of business which are located in the same building or complex. If they are considered high risk, they could impact upon your own premiums.

Will I need a property survey?

For properties over a certain value, the insurance company may request a survey.

This is to establish exactly how much the property would cost to rebuild, and therefore how much it should be insured for.

This is generally for properties valued in the millions.

More information

Although Trade Risk is often associated with smaller trade and building operations, we do help numerous clients with multi-million dollar commercial properties.

If you’re an existing Trade Risk client you should contact your broker directly. If you’re not a current client, or don’t have contact details for your broker, simply call the office on 1800 808 800. www.traderisk.com.au

A painting apprenticeship not just gives you a job, it gives you a career. You can go anywhere once you complete your apprenticeship.

You can work for others or you can go into business for yourself.

Its an extremely rewarding job. Where else do you get to create something new for people to enjoy for as long as they choose?

Why become a painter?

I continually get asked why you would want to become a painter.

Well, here’s a few of what my thoughts of the answers are. The job satisfaction that you get from looking at a completed job after all the other trades have been in and you’re the one that finishes everyone’s work that the look that the client has in the smile on their face when they see your finished product.

Painting is an industry is completely different to most other construction trades.

I’ll use a couple of examples:-

A Concreter comes in and does the formwork and pours the slab, once they’ve completed that there’s nothing further for them to do on that job.

A bricklayer comes in puts up the walls and lays the bricks to the building or structure that’s being built, once they’ve completed that there’s nothing more for them to do. This continues through all of the trades as you go from the carpenter to the electrician to the plumber to the plasterer and all the other trades on a project, once they’ve completed their job, the work is over and they need to find a new project to work on.

However, the painter comes in at the end of the project and paints it. The project then requires repainting in another 8 to 10 years, this is the cycle. You will find unless there is more work to be done, (example would be an extension) there is not any work for any other of the previous trades except for the painter. The construction painting industry can be broken into a couple of areas. New and repaint.

The new work market, the opportunity that everything gets built will need to be painted. Let’s use a new house as an example:- The house will take anything between 3 to 6 months to get built, now the painters at the end of that that building cycle so what happens from that point is the painter comes in at the end of the job being months after the concreter has poured the slab. If there is a construction industry downturn the concreters are the first to be affected, the painter is the last.

All the other trades start looking for work and as soon as there is work available again all the other trades start working longer days and weekends to catch up on lost income when things were quiet. The painter though just moves to the repaint market until the new work market has started again. The flow of work does not tend to runout for painters in the same way as other trades.

Most construction industry trades are affected by the elements. If worked correctly by the painter, they should have a consistent flow of work. If it’s raining, they should have inside or undercover work.

How much money does a painter earn?

Well, the sky is the limit. If you are working for wages, you could be earning between $28-$45 per hour depending on your experience and entitlements etc. If you are working for yourself you could be earning $100 plus per hour depending on the sort of work you do.

There are just too many variables when it comes to running your own business and I recommend you talk to professionals and get business training to ensure your profitability.

But as a quick example using rough figures.

You can run your own business and have 10 staff, each of which you could be making $20 per hour out of when you take out all your running costs, you could be making $200 per hour.

It all comes down to how you run your business and understanding your companies figures. For more information Contact Me.

Nigel Gorman nigel@aussiepaintersnetwork.com.au

07 3555 8010

The goal when creating a customer is to give them an unexpected positive experience that keeps you and your business at the top of their mind.

Your goal is to have a frequent interaction, so when the time arrives for another paint job, they will think about you and your business first.

By doing this you start to add value that your competitors aren't doing. This value is often the point of difference that sets you apart and stops your competitors moving in on your key customers.

Remember, it is always easier for your competitors to steal your market share rather than trying to find a new customer.

By using some of the following ideas, you not only give your customers a reason to return to your business, but also you build a brick wall around your customers against the influence of your competitors.

Using the following techniques will make it easy to create a unique point of difference for yourself.

Send a ‘Thankyou’ note: One of the most powerful ways to create a point of difference is by saying, ‘Thank you for your business’ or ‘I appreciate the opportunity to quote your project'.

What to do if you don't get the acceptance: Just as you say thank you for the business, you need to say thank you if you don't win the quote.

‘Why?’

1. Because you were given an opportunity to be considered in the first place as some people are not even asked.

2. You get the last say.

If the successful business doesn’t produce the right results, then you are at the top of the list for next time. You may even get re-considered because you went the extra mile. Not all are totally satisfied after they make their decision. Usually 60% of people give up after the first rejection and 95% have given up after the sixth, so perseverance is a positive, proactive approach.

Follow up phone calls: Everything you do needs to be followed up with a phone call or an e-mail. Never assume that they received the information and totally understood the quote.

Keep a database of all customers; accepted or not: You have spent a lot of effort, money and time to create a new customer. Once the job is completed, give them a call after 6-12 months to make sure they don’t have any concerns with the work. If you did any clear coating on an exterior, let them know you will give them a ‘Free Inspection’ to see if it is holding up to the weather and advise them if it requires a freshen up coat for that extra protection.

Keeping in contact with them after, 2, 5 or 10 years is also an excellent way of letting them know you happy to give them a quote on any more work. You can also ask for a referral to their friends and family.

Although you may have missed out on some customers, give them a notification after a few years to see if you could be considered on any future work. You never know, they could have been very disappointed on the previous painter’s work.

Jim Baker www.mytools4business.com

Most entrepreneurs find a time in their business when they need to access financing. It may be in the early stages of their business, when start-up costs for offices, equipment and employees must be covered. Or it may be later on, when they have to relocate, purchase more inventory or equipment, or market their business more aggressively.

Financing a business can be scary, but there are many options for entrepreneurs to consider. They each have different advantages and disadvantages, but chances are there’s a financing option that will work well.

Here are three options for financing your small business.

Business owners typically only think of small business loans that are offered by banks, and financial institutions do offer such loans. Banks may be more conservative with their small business loan offers, however. It can be difficult to secure a bank loan if you have no credit history or collateral to back the loan.

There are other ways to obtain small business loans. Many governments offer small business financing programs, which can be used for a variety of entrepreneurial expenses. Look into your government’s financing programs to determine if you can obtain money for the expenses you face. Look closely though, not all expenses are necessarily included.

Less traditional small business loan providers can also be found. Thanks to the Internet, there are even ways to obtain small business loans online, through lending companies. It may be easier to obtain a small business loan through such companies, but they may come with an important disadvantage: high interest rates. Before you agree to any loan, no matter who offers it, make sure you understand all the terms and conditions.

Angel investors are people who invest their own money into start-up businesses with the expectation that they receive a return if the business succeeds. They are often already successful at investing and could inject experience and wisdom into your business. They also won’t require a loan payment, which can affect your cash flow.

They may take part ownership of your company and tend to invest in businesses where they can receive a high return. This means that you should be thinking about your business becoming massive venture in the future, not staying small. You should also be okay with accepting input about your business from someone else.

If you have the money saved or the motivation to work extra hard to make the money you need, and the above options don’t appeal to you, you can always finance your business yourself. The advantage is that you won’t be paying interest rates, you won’t lose ownership of

your business and you won’t owe any money. You also won’t feel that you have to give anyone else a say in how you run your company.

The disadvantage is that you may not be able to grow as quickly as you want, you’ll be dipping into your savings, and you may wind up working very long hours to make up the money.

Most small business require an influx of cash in the early stages so the owner can cover the start up costs and pay bills until regular revenue rolls in. The type of funding you access can depend heavily on your financial situation, your business goals, and your willingness to give up a portion of your company’s ownership.

If you are unsure if this is relevant for your situation or would like to have a 15 min consultation with Sandra, book HERE

One of the biggest obstacles standing in the way of our personal progress is discouragement. Whether you’re trying to form a new habit (reading, meditation, exercise, waking early) or taking on a meaningful project, or just getting your life in order … discouragement is one of the biggest reasons you’ll get stopped.

Here’s the “bad” news: discouragement is unavoidable. You will encounter it on your path, if you’re taking on anything challenging or meaningful. It’s a part of the meaningful path. I actually don’t think it’s really bad news, it’s just how the path looks.

And here’s the good news: discouragement isn’t a problem. It’s a property of learning, of growth, of trying. Just like heat is a property of the sun or fire.

Discouragement is a property of caring and having hope.

So with that in mind, how do we deal with it when we encounter discouragement on our path?

Some people will just crush hope, and try not to care or get optimistic. If we don’t hope, we can’t get let down right? But that just means our hearts are shut down. Similarly, they might not even try … because if you try, you might fail, right? But that just means we can’t create any new possibilities that we care about.

The way to deal with discouragement isn’t to shut down our hearts to trying or caring or hoping … it’s to take it as part of the package. Just like a hurt heart is a part of loving, or soreness is a part of exercising. When we care, and hope, and try … we will get discouragement.

Then when it comes, just let yourself feel it. Take care of it — do you need a hot cup of tea, a talk with a friend or a therapist, some love? Let discouragement be an opportunity to practice loving yourself and taking care of yourself.

Then care and try again. Get your heart back to hope & possibility. Take the next small step. Create something new, one tiny motion at a time.

Discouragement isn’t the end of the journey — it’s a place to stop and lick your wounds, tend to your heart, catch your breath, and then start again.

You’ve got this.

Leo Babauta ZEN HABITS

For many people a tax refund is a much-anticipated lump sum of money.

So, it is understandable Australians will be looking for ways to maximise their returns – particularly we are in a cost-of-living crisis.

But, whether you do your own return or use a tax agent, taking risks is not advised.

Be wary of tax hacks

But be wary of “tax hacks” you might hear about from online sources (I’m looking at you, TikTok). Two truisms spring to mind:

Many tax hacks suggest you spend considerable money on purchases up front to claim tax deductions. But a tax deduction isn’t actually worth the value amount of your spend.

For example: let’s say you’re on a taxable income of A$60,000 per year, which puts you roughly in the 50th percentile of income earners and means your marginal tax rate is 32.5 cents.

You might spend $1,000 on a purchase in the hope of getting a sweet $1,000 tax deduction. However, you’re going to be $675 out of pocket. This is because that $1,000 deduction is only worth $325 (be-

cause tax is calculated on your taxable income, which is assessable income less allowable deductions).

It will be worth even less next year because of the introduction of the revised Stage 3 tax cuts and that’s a good thing because you’ll be paying less tax overall.

Even if you use a registered tax agent (and it’s important to check they are registered by checking the Tax Practitioners’ Board), it’s a common pitfall to think any aggressive deductions they might suggest are their responsibility if the Australian Taxation Office (ATO) comes knocking. That’s not the case.

Taxpayers are responsible for errors in returns made by their tax agents, so the ATO will hold you responsible.

Indeed, the ATO has announced it will be taking a close look at three common errors being made by taxpayers:

• incorrectly claiming work-related expenses

• inflating claims for rental properties

• failing to include all income when lodging.

It might be tempting to think you’ve got away with over claiming deductions or under reporting income but the ATO has sophisticated systems to analyse your data) and track your claims.

You’ll need to substantiate your claims, so keep records. If the tax office finds mistakes, you could face financial penalties, even jail time.

Two months ago, a woman was sentenced to two years and six months jail and ordered to repay $39,600 after she lodged three fraudulent Business Activity Statements and received a GST refund to which she wasn’t entitled. While under investigation, she then sent eight false statements to the ATO and tried to claim more money.

This is one on many individuals named on the ATO’s website highlighting the results of regular crackdowns.

There are nearly 20.5 million active tax file numbers registered to individuals in Australia and last tax year the ATO received 13.7 million individual tax return lodgements. This was a 3% increase on the previous year. Of these lodgements more than 5.6 million were lodged by self-preparers and more than 8 million were lodged by tax agents.

Most Australians use a tax agent because it saves time and is less stressful. insta_photos/Shutterstock

It makes sense most Australians use agents to prepare and lodge their tax returns. It’s easier, less stressful, gives you confidence the job is being done right and saves time.

Having said that, it does come at a price (see above on the value of deductions), and previous research

which finds that every extra dollar spent on a tax agent only yields an estimated tax savings of 20 cents), and if you have simple tax affairs then it’s relatively easy and quick to do it yourself.

Generally, everyone should be lodging an income tax return each year (or, if you don’t need to lodge a tax return, lodging a non-lodgement advice). The ATO has a “Do I need to lodge a tax return?” tool if you’re unsure.

It also has a useful two minute video which steps you through the process for lodging with their online system myTax.

For those of us with simple tax affairs, you just need to follow these steps:

• gather and prepare all your information regarding income from work, interest, dividends and any other income such as capital gains from crypto assets or sale of shares

• then gather and prepare all your information on deductions and work expenses to be claimed making sure you have the evidence to back up your claims. This can be in the form receipts, invoices, log books and diary entries

• if you are a self-preparer you can log onto your myGov or the ATO’s app to prepare and lodge your return. If you wait until late-July you’ll have the benefit of the ATO’s pre-filled data, too. This gives you plenty of time to make the October 31 deadline.

There’s also the option to use the ATO’s free, volunteer-run TaxHelp program (provided you meet the eligibility criteria), your local Tax Clinic (details here), or by seeking help from a registered tax agent. Just make sure you engage them before the October 31 deadline.

But for others, for example if you have an ABN, it gets a bit more complicated. If you operate your business as a sole trader, you must lodge a tax return, even if your income is below the tax-free threshold.

And if you have registered for GST – which you must do when your business or enterprise has a GST turnover of $75,000 or more, or if you are a taxi driver or Uber driver – then you will also need to submit quarterly BAS.

It gets even more complicated for partnerships, trusts and companies, so it is best to seek the guidance and professional expertise of a registered tax agent, if you aren’t already.

This year, many Australians are doing it tough. Indeed, research by the ASIC’s Moneysmart program estimates more than five million Australians are in financial strife.

Many people will find it hard to prioritise paying a registered tax agent when they cannot afford basic necessities like food.

If you’re in this situation, you might find it useful to get in touch with a free financial counsellor via the National Debt Helpline or the Small Business Debt Helpline.

Don’t put off doing your tax. If you’re behind, it might seem daunting to get back on track, especially if you think you’ll have to pay extra tax this year instead of getting a refund. But not lodging your returns will backfire. Like avoiding a trip to the doctor to get a skin check, the longer you wait, the more the problem will grow.

Reaching out to the ATO is the key because they have tools to support you, including payment plans. It also shows the ATO that you are willing to comply. Ultimately, being up to date will save you fines, interest and penalties.

If you are one of the 80,000 Australians in serious hardship who need but can’t afford professional help to complete and lodge overdue returns, the government-funded National Tax Clinics Program can help with free tax advice.

Ann Kayis-Kumar

Associate Professor Ann Kayis-Kumar is the Founding Director of UNSW Tax and Business Advisory Clinic, UNSW Sydney

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA NT WorkSafe

WorkSafe Tasmania

Cancer Council Australia

Ph. 0430 399 800

Ph. 1300 319 790

Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au cancersa.org.au cancervic.org.au

cancerwa.asn.au

(02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333