Number 49 - october /2024

Number 49 - october /2024

Brazil continues to experience an internal disconnect between the present and the future. In the current situation, the economy continues to expand well, at 3.1% in August year-on-year, according to the Economic Activity Index (IBC-BR) from the Central Bank, which is a kind of preview of the GDP. With the low percentage of investments in relation to the gross domestic product, less than 17%, there is an imminent risk of this heated demand reverting to stronger pressure on inflation by 2025. It is because of this observation that the Monetary Policy Council, COPOM, decided to increase the basic interest rate to 10.75%, which could rise by 1 percentage point in the next two meetings, with an estimate of reaching 11.75% when the last meeting of the year takes place, in the second week of December. Interestingly, the FED in the United States reduced the interest rate band there to 4.75% and 5%, after a period of more than a year in which it remained in the range between 5.25% and 5.50%. Projections point to a new reduction of the year to 4.50%, continuing this trend throughout 2025. In theory, reducing US interest rates and, at the same time, increasing the SELIC rate in Brazil could make the real more attractive, increasing the currency’s value. However, what we saw was an opposite movement, with the Brazilian currency devaluing, previously fluctuating around R$5.50 and now, in mid-October, being quoted close to R$5.70. The conflicts in the Middle East contributed to the appreciation of the US currency, but they do not diminish the importance of domestic challenges. Brazil continues to face significant risks for 2025, and the main one is the fiscal issue, of how the government will balance its accounts and respect the fiscal framework. The current projection is that

there will be a deficit of R$28 billion this year, which is at the maximum limit of the government’s new fiscal rule. Despite the very intense economic activity and strong growth in revenue, the government closed the month of August, for example, in the red by R$22.4 billion, indicating a scenario of excessive spending.

In addition, in October, Gabriel Galípolo was approved to succeed Roberto Campos Neto as president of the Central Bank starting in January. Despite the institution’s independence and the fact that he supported the majority vote of COPOM, which unanimously voted to raise interest rates at the last meeting, there is a fear of government interference in monetary policy and pressure to reduce interest rates. Therefore, the near future is full of doubts in the fiscal and monetary spheres, which inhibit investment and increased confidence in the country. However, when we look at the current situation, it is far from looking like there could be some kind of crisis. Retail sales showed growth of 3.1% in August in the annual comparison, with practically all segments showing positive variations. It is worth highlighting the automotive sector, which saw an 8.3% increase in sales in the month and accumulated 12.7% in the year, which ends up being unexpected given the high interest rates. Even with an average interest rate of 25.7% per year for vehicle purchases, credit taken out by families grows by more than 20% in real terms in one year. The increase in consumption and credit uptake has been made possible by the strong labor market, with the lowest unemployment rate in the historical series for the quarter ending in August, at 6.6%. With inflation remaining at a level between 4% and 4.5%, it has allowed a significant real gain in labor income, also helping to reduce default rates in the country, from 30.2% to 29%, between the months of

September 2023 and 2024, according to research by the National Confederation of Commerce, CNC. Tourism is also becoming an objective for directing these resources from families and contributing to the growth of the sector in the year. According to a survey by FecomercioSP, revenue from the main Tourism services in Brazil was R$16.6 billion in August, an annual increase of 5.2% and a cumulative increase of 2.6% for the year. As average prices for hotel rates, car rentals and airline tickets are still under pressure, part of this increase in revenue is due to the higher financial volume. However, this does not reduce the heated demand, both for leisure and corporate purposes, which, according to ALAGEV, companies’ spending on travel services has been at a record high in recent months. Industry recorded growth of 2.2% in August

1

After a period of excess supply of cattle at the beginning of the year, the scenario is beginning to change, especially in the off-season, putting pressure on the price of cattle, with an increase of around 30%, reaching close to R$ 300. The consequences are reaching the consumer, with an average increase in the market, in September alone, of almost 3%.

SEPTEMBER/2024

and a cumulative increase of 3% for the year. Services in general increased by 2.7% in August and 1.9% for the year. And the agricultural sector continues to be expected to experience a decline in the grain harvest and low commodity prices, partly due to a weaker global dynamic. Therefore, it is a fact that Brazil is in a positive phase of its economy, but the foundations are fragile. Low level of investments, high interest rates and a valueadded tax that should be 28%, according to the tax reform being discussed in Congress. In addition to these points, there is low productivity and a shortage of labor in the country. Thus, in theory, there is no way to maintain this current pace for a very long time without negative corrections. This is the great dilemma that the country currently faces, from the encouraging present to the unpredictable future.

2

According to data from CAGED, the Ministry of Labor, between January and August of this year there was a positive balance of 1.7 million jobs in the country, with the main influence being the Services sector with just over 900 thousand. These numbers are important for analyzing the injection of the 13th salary at the end of this year, important resources for Black Friday and Christmas sales.

3

* The risk rating agency Moddy’s changed – positively – Brazil’s rating from Ba2 to Ba1, putting it one level away from obtaining investment grade again. Despite the good news, the process of resuming the GI will still be long and the large investment funds demand that the country at least have the investment grade granted by two risk agencies.

The Consumer Confidence Index (ICC) registered a 3.2% drop in September compared to August, returning to 123.2 points, the lowest level since May of last year (122.2 points). Although current consumer conditions are positive, with record employment and low inflation, there is skepticism about the country in the long term, with increasingly less optimistic views, which could affect employment and pocketbooks. The Business Confidence Index (ICEC) recorded a slight increase of 0.6%, going from 108.5 points in August to 109.1 points in September. However, in the annual comparison, there is a slight decrease of 1%. In the same way as consumers, although sales figures in the retail sector are very favorable, there is caution regarding what may happen to the country’s economy in 2025, especially with the return of interest rate hikes and possible price increases.

Note: The ICC and ICEC range from 0 to 200. From 100 to 200 points is considered an optimistic level, and below 100 points pessimistic. Although the indicators are from the city of São Paulo, they follow the trend of what is happening in the rest of the country since the city, the largest in Brazil, represents 11% of the national GDP.

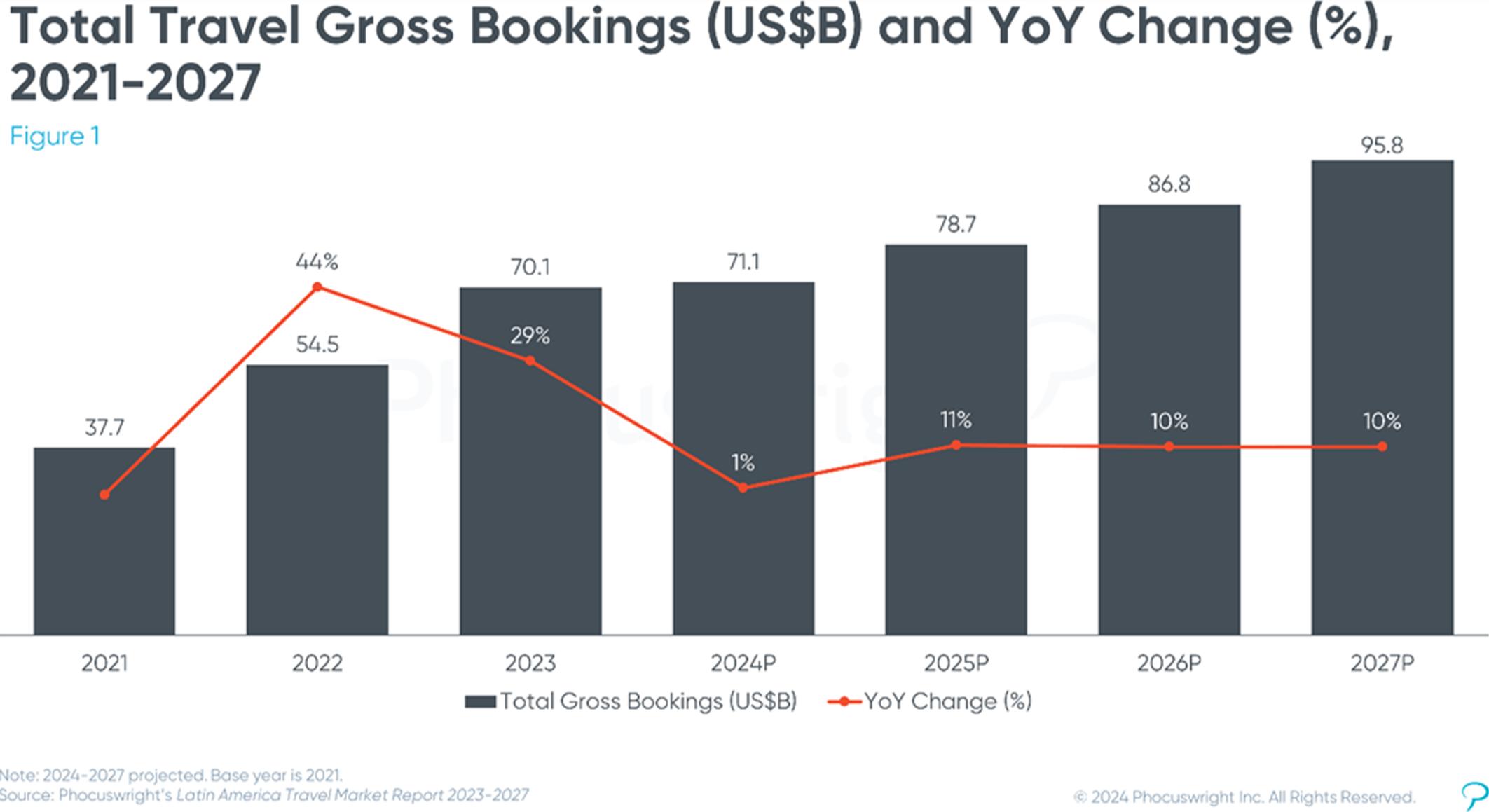

u The new edition of the Phocuswright Latin America Travel Market Report – 20232027 study points out that, despite the political volatility in Latin America, there are good reasons to invest in the Travel and Tourism sector in the region, as its GDP grew by 2.2% in 2023, led by Mexico’s 3.2%. Unemployment fell to 6.5%, the lowest level in ten years, and the hotel industry has hundreds of new hotels being built or already announced in Brazil, Mexico and Colombia.

u The Travel and Tourism market in Latin America grew for the third consecutive year, with sales increasing by 29% over 2022, reaching US$70.1 billion last year.

u Mexico is the largest market in Latin America, accounting for 45% of travel sales. Brazil has a 31% share in the region and comes in second place. Together, the two countries account for more

than 75% of the Latin American market.

u Sales through offline channels accounted for more than half of the total, but Phocuswright predicts that this share will fall to 46% in 2027. OTAs would reach 27%, the same share predicted for direct sales from suppliers. In any case, indirect sales (traditional channels plus OTAs) will continue to dominate the landscape, with 73% of total travel sales.

u The largest sales by segment come from the hotel industry and not from the airline industry, as many people think. The hotel industry accounts for 47% of sales in Latin America, reaching US$32.7 billion.

u Airlines come in second, with 34% of the total, or US$28.1 billion. In Brazil, the airline industry is larger than the hotel industry, with 21 million international passengers in 2023 and 51% of sales. The great distances that need to be covered

in the country justify this leadership.

u Brazil had the highest growth of all Latin American markets: a 37% increase and a total of US$21.8 billion in travel sales in 2023.

u By 2024, Brazil is expected to grow 7% and reach US$23.4 billion. Online revenue represents 49% of all sales in Brazil.

u The airline industry in the region is expected to shrink by 3% in 2024, despite the good results of most companies. In addition to the currency devaluation crisis in Mexico and Argentina, some companies succumbed to the economic crisis and are recovering, such as the Brazilian airline Gol (under Chapter 11).

u The complete study by Phocuswright provides detailed information on the distribution of each segment (Aviation, Hotel, Rental and Tour Operators) and an analysis of each of them in the countries, including Brazil.

u Learn more at www.phocuswright.com

The company is represented in Brazil by Mapie, which can be contacted via the email of partner Carolina Sass de Haro : carolina@mapie.com.br.

u The Brazilian summer (winter in the Northern Hemisphere) is strong for seasonal flights serving tourists on vacation. American Airlines and Delta Air Lines will launch flights from Rio to the United States, and Lufthansa will begin a connection from São Paulo to Munich.

u Tourism also celebrates the reopening of Salgado Filho Airport, in Porto Alegre, good news both for incoming, especially in Serra Gaucha destinations, and for corporate and international travel. International flights will return on December 16th (Copa Airlines) and in January (Latam and Aerolíneas Argentinas). Tap will return the Porto Alegre-Lisbon flight in April 2025.

u Expectations are high for the opening of the BTG Pactual Terminal, at Guarulhos Airport. It will be a terminal focused on the luxury traveler, with exclusive services and handling a maximum of 100 passengers per day (US$ 590 is the initial rate per person). It’s further proof that the luxury travel segment continues to grow and attract a lot of investment in Brazil. The investment in the new terminal was R$80 million and the promise is of service without queues and with access to the aircraft door via express lanes.

This report is produced by PANROTAS and FECOMERCIOSP to support your business decisions. The contents are valuable assets to Destinations and Travel Organizations, both domestic as well as international. For further information please contact ri@fecomercio.com.br redacao@panrotas.com.br