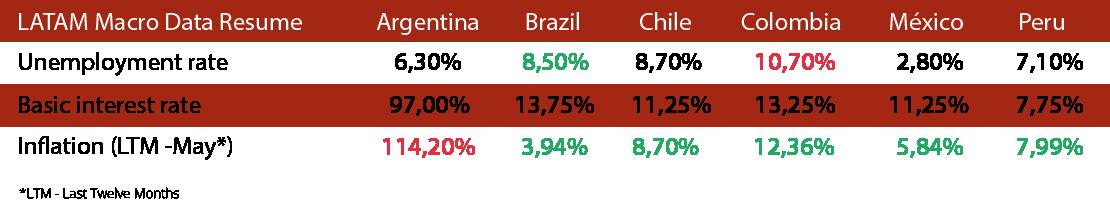

Recent figures for Brazilian’s economy have been positive and above expectations. The first quarter’s GDP was the most important one last disclosed by IBGE, with a growth of 1.9% in comparison with the immediately previous period. This result was essentially pulled by agribusiness, which got an increase of 21.6%. At the same time, on the other hand, investments retracted 3.4% in the face of another 1.3% retraction in the last quarter of last year. It is a critical point of attention; this variable is crucial for solid and long-term economic growth. Nevertheless, the first part of the year was marked by many uncertainties about how would be the new government. Thus, it’s natural to imagine investors’ apprehension. Now, months later, there’s already a more elevated degree of clarity about the economy’s course, which should help the return of substantial financial injection of private resources in the country. Another positive aspect that helps the Brazilian economy is that the American Central Bank kept interests in the range between 5% and 5.25%, ending an expansion cycle. In other words, the monetary tightening won’t be less aggressive than it was thought, and the market reacted well, abroad, and here in Brazil. So much so that the Brazilian Real has advanced in an appreciation tendency, following many currencies across the world, and returning to thresholds near 4.80 reais per dollar.

And a cheaper dollar, although impairs the exportation perspective, especially regarding commodities, contributes – a lot – to the process of controlling inflation. In May, for example, the official price index in Brazil rose

0.23% and accumulated 3.94% in 12 months, according to IBGE’s data. For a statistical matter, inflation should lower slightly more in June and increase once again in the second semester due to last year’s comparison base, when there was a reduction in the tax on fuels that brought along three months of deflation, in the 3rd quarter. With prices being less pressured and the future course of inflation converging towards the goal established by the National Monetary Council, there’s an open road for the Central Bank to start in the short-term, a downturn cycle in the interest rate, currently at 13.75% a year. The attention is being directed towards the Monetary Policy Committee’s meeting in August.

Monetary expansion, or interest reduction, is especially expected by the actual economy that suffers from elevated financial costs. The industry registered a 2.7% retraction in April and accumulated a 1% decrease in a four-month period.

The retailer commerce broadened its volume by 0.5% in the fourth month of the year but still accumulated a 3.1% increase within the year. The negative performance, or low growth, has been pulled by those sectors that depend on credit like the furniture (-7.7%) and house appliances (1.8%) sectors. On the other hand, basic sectors like supermarkets and drugstores continue to expand, at 3.1% and 3%, respectively.

From the service perspective, the sector took off from the economy’s average, even because it was the sector that most suffered during the pandemic, in other words, it is what it’s said: the first one to enter the crisis and the last one to leave. In April, the services’ volume grew by 2.7%. When the segment is analyzed thoroughly, it draws attention

to the 2.9% increase in services provided to families – meaning: tourism. Indeed, Tourism has been an important highlight in the Brazilian economy. According to the monthly survey by FecomercioSP, the activity’s revenue in the entire country was R$ 17.6 billion in April, a 9.8% annual increase, and accumulated a 15.6% gain within the year. It’s worth the reservation that it isn’t about profit, given it is just the revenue and not the financial result. It’s notorious that operational expenses

have pressured business owners’ margins. However, this doesn’t write off the fact that the tourism, leisure, and business sectors are coming back with full power in 2023. Although there are many challenges on the way, which it’s natural in Brazilian economic history, the mid-and long-term scenarios are promising. The reduction in interest will be a great incentive for economic activity in the country, and with milder inflation, it will create space for the expansion of investments and families’ consumption.

In addition to the record grain harvest for this year, the cattle and chicken slaughter also reached the highest level in the first quarter of this year. The higher offer of these products has generated an immediate effect in the reduction of prices for consumers.

According to data from the Ministry of Development, Industry, Trade and Services, e-commerce in Brazil capitalized R$ 187 billion in 2022. The southeast region shares 72% of this total.

The default rate is still high in the country, according to data from the National Confederation of Commerce. In May, 29.1% of families had overdue bills, the same threshold as April and above the 28.7% from the same period in 2022.

The Consumer Confidence Index (ICC) retracted by 2.3% in May and returned to 122.2 points. This is the third consecutive drop; however, the current threshold is the highest one for the month since 2013. In comparison to April 2022, there was a 15.4% rise. There’s a more favorable scenario in relation to employment and income in the capital of the state of São Paulo, which allows the discharge of overdue debts and a little extra amount left in the budget. The Trade Entrepreneur Confidence Index (ICEC) pointed out 107.7 points in May, a decrease of 1.5% in the monthly counterbalance and of -8.3% in the annual comparison. Since the end of last year, the index has been following a descending course. And this is much more linked to the country’s situation than related to the business itself. The economy is still growing slowly, and the high interest has brought a lot of concern to commerce, with a limited capacity for consumers to get credit.

Note: The ICC and ICEC vary from 0 to 200. From 100 to 200 points, it is considered an optimistic threshold, and below 100 points, a pessimistic one.

Although the indexes are from the city of São Paulo, they follow a tendency of what is happening in the rest of the country since the city, the largest in Brazil, represents 11% of the National GDP.

The second half of the year is starting with optimism. The post-pandemic frenzy doesn’t exist anymore, with a travel boom that caught suppliers still in a moment of restructuring, however, trips within Brazil are still increasing. Yet, this increase is happening with planning (even because of high costs, still existant), with more offers, and within normality that comes with new habits, new demands, and more flexibility, especially regarding leisure trips.

The second semester starts with more international flights, like:

Belo Horizonte-Curaçao;

Belo Horizonte-Fort Lauderdale;

Belo Horizonte-Orlando;

Recife-Orlando – all offered by Azul. And still:

São Paulo-Cairo, offered by Egypt Air

São Paulo-Los Angeles, by Latam (in partnership with Delta Air Lines)

Besides the flights that returned or were launched in the first semester, like São PauloWashington, by United Airlines, and São PauloParis, operated by Azul.

Latam, the company with the most international flights departing from Brazil, has announced more unprecedented connections for the upcoming months, aside from São Paulo-Los Angeles: Foz do Iguaçu-Lima;

Belo Horizonte-Santiago;

Santiago-Melbourne; Lima-Aruba;

Medellin-Miami; and Lima-Atlanta.

In parallel, Azul has announced full focus on two fronts: equate the flights departing from Brazil to Europe with the number of flights from Brazil to the United States and increase the number of flights in partnership with JetBlue and United departing from Orlando and Fort Lauderdale, and therefore reach more American destinations. In relation to Europe, this same partnership exists with Tap Air Portugal, which has its flights for sale on Azul’s website. Azul, which is already the national Airline with the most destinations in its air network within Brazil, is willing to establish a more solid international air network.

Nonetheless, the international flight offers in Brazil haven’t reached the 2019’s indexes yet, which explains in part the increase in fares. The indicators for international demand and offer of Brazilian companies didn’t surpass, in May, the indexes from May 2019, varying negatively at 12.1% and 9.5%, respectively.

The number of passengers transported abroad by Brazilian Airlines was 1.6 million, which represents 86.1% of the transactions from May 2019.

In the market, the expectation for the beginning of the paid online and mandatory visa to Europe is high (Great Britain should be the first country to adopt the new practice); and for the reduction of lines and the waiting period in the American consulate – a new visa is still taking a year to be booked. The American consulates in Brazil started operating

on Saturdays and hired more employees to solve the issue.

The largest travel operator in Brazil, CVC Corp has a new structure, but counting on old acquaintances. The company is going through a restructuring of its executives and shareholders, and it’s bringing back experienced professionals with whom they have already worked and know the operator, like the CEO Fábio Godinho, the franchising director, Emerson Belan, the IT director, Paulo Palaia, among several other managers and coordinators. We can expect a more aggressive, more active CVC and a company that is closer to the partners in the second semester.

At the same time, the competitor Azul Viagens, which already has 50 stores in the country (compared to 1.2 thousand of CVC), has already announced their plan to double this number by the end of the year, reaching 103 physical stores.

In the IPW 2023, the Brazilian operators Agaxtur, Abreutur, CVC Corp, Diversa, and

Orinter were awarded. They were the companies that most sold “the United States” last year and that have projects for the promotion of this destination in the second semester. Orinter, for example, will have the “United States Connection” (Conexão Estados Unidos) in August, in Rio de Janeiro. Diversa will hold a FAM tour to the USA with an awarded itinerary in September. Both events count on Brand USA’s support.

The event “Visit USA 2023” will take place on August 7th in São Paulo, and on the 9th in Campinas. The event is held by the US Commercial Service in Brazil.

PANROTAS Next Goiânia – August 1st

PANROTAS Next Ribeirão Preto – August 3rd

Avirrp – Ribeirão Preto – August 4th and 5th

Visit USA São Paulo – August 7th

PANROTAS Next Porto Alegre – August 8th

Visit USA Campinas – August 9th

PANROTAS Next Curitiba – August 10th

Abav Expo 2023 – Rio de Janeiro – September 27th to 29th

BTM – Fortaleza – October 19th and 20th

100X Brazil – São Paulo – October

Festuris – Gramado – November 9th to 12th

This report is produced by PANROTAS and FECOMERCIOSP to support your business decisions. The contents are valuable assets to Destinations and Travel Organizations, both domestic as well as international. For further information please contact ri@fecomercio.com.br redacao@panrotas.com.br