A limited collection of sixty-eight meticulously appointed Gulf-front Estates, Penthouses and Jardin residences.

A limited collection of sixty-eight meticulously appointed Gulf-front Estates, Penthouses and Jardin residences.

The privileges of private estate living with breathtaking views towards the Gulf of Mexico from most residences.

Several new communities planned to rise in eastern Collier County will boost housing inventory by 11,600.

Step back in time as Collier County and the City of Naples honor their centennials in 2023.

The historic storm brought with it several attendant issues.

12

Update on Bayshore Triangle Development and the Downtown Gateway. New REALTORS® guide. Legislative update. Meet the 2023 NABOR® Officers and Board of Directors. Q&A with 2023 President Nick Bobzien. Two apps for planning interiors.

What’s happening in the Naples real estate market? The 50 Percent Rule. The benefits of attending NABOR® events. City and county sign regulations. Proper disclosure after the hurricane. When a buyer’s agent bonus is taken off the table. Learn more about the revised NABOR® contract forms. REALTOR® safety during open house showings.

62 NABORhood

RPAC Committee, social photos, and upcoming events.

73 The Close

Destination: Naples Preserve. Art & Culture: ¡Arte Viva! Festival. Local Scene: The Edge Johnny Nocera Skate Park at Fleischmann Park.

President Nick Bobzien

President Elect

PJ Smith

Vice President/Secretary

Terrilyn VanGorder

Treasurer

Christine Citrano

NABOR® Directors 2023

Paula Angelopoulos Urbinati, Ryan Bleggi (Immediate Past President), Shaun Garry, David Puskaric, Marcie Roggow, Mary Waller, Izabela Wright

NABOR® COMMITTEES 2023

Budget & Finance Chair

Christine Citrano

Commercial Chair

Cristin Madden

Vice Chair

Stuart Tackett

Community Involvement Chair

Nancy Bjork

Vice Chair

Spencer Rigsby

Diversity, Equity, & Inclusion Chair

Paula Angelopoulos Urbinati

Vice Chair

Sandra Schlaupitz

Events for Networking Chair

Ben Boorom

Vice Chair

Shari de Ron

Expo Chair

Julie Blanton

Vice Chair

Dave Antis

Economic Summit Chair

Gwen Davis-Gideon

Facilities Management

Wes Kunkle

Global Business Chair

Brett Brown

Vice Chair

Carol Kairis

Governmental Issues Chair

Tom Regan

Vice Chair

Tina Muracco

Governmental Issues – Water Quality Chairs

Corey McCloskey, Adam Vellano

Grievance Chair

Courtney Smith

Vice Chair

Robert Nardi

Leadership Development Chair

Mariana Beckner

Vice Chair

Vicki Allen

Legal Resources

Chair

Sam Saad

Vice Chair

Nick Bobzien

Media Relations

Chair

Nick Bobzien

Membership Chair

Perry DeSiato

Vice Chair

Nancy Golya

Membership – Broker Involvement Chair

Adam Vellano

NABOR® History Chair

Spencer Haynes

Vice Chair

Heather Haynes NABOR® Magazine Chair

Mary Waller

MLS Chair

BC Cloutier

Vice Chair

Adam Vellano

Professional Development Chair

Rick Baranski

Vice Chair

Tina Falzarano

Professional Development – REALTOR® Safety Chair

Tim Guerrette

Professional Standards Chair

Carrie Lademan

Vice Chair

Will Watson

RPAC Chair

Sara Brand

Vice Chair

Debbie Zalewski

Young Professionals Network Chair

Allisa Pipes

Vice Chair

Kimberly Vargas

Chair

Mary Waller

Director of Marketing

Marcia Albert

Paula Angelopoulos Urbinati

Patricia Asencio

Yvette Benarroch

August Cardona

Shari de Ron

Heather Haynes

Paula King

Liz Koplitz

Julia McCabe

Ruthie Morency

Nicole Porro

Bill Poteet

Dr. Ron Repice, III

NABOR® Staff

Chief Executive Officer

Marty Manion

Chief Financial Officer

Carl Russell

Chief Administrative Officer

Corie Chase

Administrative Assistant

Ann Mazzei

Administrative Assistant to the Executive Committee

Deborah Linville

Assistant to Chief Financial Officer

Deb Joyner

Director of Engagement and Events

Melissa Bognaski

Director of Marketing

Marcia Albert

Director of Membership

Elizabeth Saggio

Director of MLS

Cindy Cornman

Director of Professional Development Services

Michelle McKenna

Education Administrator

Jeanette O’Neill

Membership Administrators

Sherry Olson

Zamira Collado

MLS Compliance and Support Specialist

Cheyenne Chase

MLS Support Specialist

Allisson Gonzalez

Network Technician

Michael Bryant

REALTOR® Store Manager

Taiana Londoño

Receptionist

Joan Welsher

Vice President of Public Policy

Danielle Brazil Hudson

Videographer

Wade Mastro

Publisher Liz Goodman

Editorial Director Daphne Nikolopoulos

Editor Cathy Chestnut

Creative Director Olga M. Gustine

Art Directors Diana Ramírez, Jorge Marquez

CONTRIBUTING WRITERS

Karen Feldman, Artis Henderson, Dick Hogan, Seth So ian, Nanci Theoret

CONTRIBUTING PHOTOGRAPHERS

Shane Antalick, Mariana Birmingham, John Eder, Wade Mastro, David Michael, Andrew Occhipinti

ADVERTISING

Liz Goodman at 239-595-7269

Advertising Services Coordinators Elizabeth Hackney, Pamela Schultz

Marketing Manager Rebecca Desir

PRODUCTION

Production Director Selene M. Ceballo

Production Manager Lourdes Linares

Digital Pre-Press Specialist George Davis

Production Coordinator Ileana Cabán

Digital Marketing Manager Tyler Sansone

Advertising Design Coordinators Anaely J. Perez Vargas, Je rey Rey

OPERATIONS

Chief Operating O icer Todd Schmidt

Accounting Specialist Mary Beth Cook

Accounts Receivable Specialist Ana Coronel

Distribution Manager Judy Heflin

Logistics Manager Omar Morales

Circulation Manager Marjorie Leiva

Circulation Assistant Britney Stinson

Circulation Promotions Manager David Supple

IT Manager Keith Gonzalez

Group Publisher Terry Du y

SUBSCRIPTIONS

800-308-7346

In

(1935-2013)

HOUR

CEO Stefan Wanczyk

President John Balardo

For those who long for a home where captivating modern design and a stunning coastal location are just the beginning, The Ritz-Carlton Residences, Naples redefines elegant Southwest Florida living. Endless Gulf views, white-sand beaches, a marina-front lagoon, more than 50,000 square feet of curated amenities, chef-inspired dining, and legendary Ritz-Carlton service have all come together in one exclusive address limited to just 128 residences.

The time has come to make your client’s life legendary.

The Ritz-Carlton Residences, Naples pricing from $2.5 million.

Sales Gallery now open 2355 Vanderbilt Beach Road Suite 106 Naples, Florida 34109 Phone 239-249-6260

RCRNaples.com

THE RITZ-CARLTON RESIDENCES, NAPLES ARE NOT OWNED, SOLD OR DEVELOPED BY THE RITZ-CARLTON HOTEL COMPANY, L.L.C. OR ITS AFFILIATES (“THE RITZ-CARLTON”). STOCK RESIDENCES, USES THE RITZ-CARLTON MARKS UNDER A LICENSE FROM THE RITZ-CARLTON, WHICH HAS NOT CONFIRMED THE ACCURACY OF ANY OF THE STATEMENTS OR REPRESENTATIONS MADE HEREIN. ORAL REPRESENTATION CANNOT BE RELIED

239-316-3006

www.tllfirm.com

It is an incredible honor to serve as your 2023 President. I am fortunate to lead our association with a dedicated group of directors, sta , and volunteer members who are the backbone of NABOR®. As a graduate of the 2014 NABOR® Leadership class, I believe that leadership is about doing the right things, at the right time, for the right reason—and teamwork, collaboration, and inclusion are the keys to success. erefore, I encourage you to join a NABOR® committee. You’ll be empowered to make a di erence and your contributions will be meaningful, e ective, and appreciated. Plus, you’ll forge invaluable relationships, some of which could positively impact your business.

As 2023 unfolds, your board of directors plans to put the following goals into action:

Foster individual resources in order to achieve full potential

2 Continue the spirit of cooperation with the Women’s Council of REALTORS® and National Association of Hispanic Real Estate Professionals® to strengthen our associations

3 Provide cutting-edge technology, tools, and services to give members a competitive edge

4 Expand educational opportunities to provide multiple pathways to members’ success

5 Advocate the ideals of private property rights and the integrity of the real estate industry

6 Strictly adhere to the association’s fiduciary responsibilities with the best interests of members in mind

I am confident we will meet the opportunities and challenges ahead, together, in cooperation and consensus.

“Let’s roll!”

Nick Bobzien NABOR® President

With over 50 years of combined experience, Thompson Lewis has expertise you can trust.

you SAIL THROUGH your real estate closings with ease!

Conroy, Conroy & Durant, P.A. (“CC&D”) is a boutique real estate law firm which has focused on real estate solutions for over 30 years. Founded by attorneys with deep roots in the community, CC&D has grown to help our clients navigate Naples’ increasingly competitive and sophisticated real estate market. Whether seeking representation in the purchase or sale of commercial or residential property, our team of lawyers has experience handling complex real estate transactions with integrity.

Reputable: CC&D has four attorneys who are board certified in real estate law by the Florida Bar. In addition, each partner has achieved an AV-rating by Martindale-Hubbell, demonstrating the highest level of professional excellence and ethics.

Reliable: Over the years we have not only developed procedures for the various types of real estate transactions, but also established relationships with local companies involved in real estate transactions, both of which allows us to provide our clients with reliable and prompt service.

Accessible: Each real estate transaction has a legal team comprised of an attorney, paralegal, and legal assistant, which lends itself to an increased level of communication and availability.

The attorneys and staff at CC&D are proud of our commitment to excellence in real estate.

Metropolitan Naples ‘will undoubtedly redefine’ the eastern gateway into downtown

BY CATHY CHESTNUTAfter decades of dreaming—and hard work by grassroots and governmental groups—the future of the Bayshore community southeast of Naples’ city limits has arrived. A complex of four mid- and high-rises and a public green space with a boardwalk are taking shape while new businesses are opening in the a hip, vibrant, artsy neighborhood.

Twenty years ago, Bayshore was mostly a place where motorists simply passed through while they were headed someplace else. But that’s no longer the case. e Naples Botanical Garden draws visitors from throughout the region and Celebration Park—with food trucks, craft brews, and entertainment— consistently buzzes with regulars and good vibes. In addition to investors and entrepreneurs, the community is attracting young families and a glowing reputation.

e nearly two-mile-long Bayshore Drive corridor recently won the ninth annual “Great Places in Florida” competition sponsored by the American Planning Association Florida Chapter (APA FL). e theme of the contest was “Great Healthy Places” and Bayshore Drive bested three other innovative nalists.

In announcing the 2022 award, APA FL noted: “Bayshore Drive has transformed from an underutilized corridor to a complete street and community asset, setting the standard for other jurisdictions looking to bring health,

well-being and vibrancy to outdated roadways. Bayshore Drive promotes healthy and active lifestyles, advances the community’s quality of life, and fosters social activity, while protecting and enhancing appreciation for the environment.”

Among other features, such as clearly marked bike paths, APA FL cited these projects as contributors to its “Great Healthy Places” status:

∙ A pocket park created on the site of the former Del’s store

∙ New banners greeting visitors

∙ A tra c-calming roundabout at omasson and Bayshore drives

Residents and government o cials recognized the immense potential of the community, so in 2000, Collier County established the Bayshore Gateway Triangle Community Redevelopment Agency (CRA). CRAs work to improve residents’ and business owners’ quality of life in targeted communities through capital improvements and coordination with other public and private agencies.

For instance, CRAs coordinate sidewalks, parking lots, and tra c improvements and management, and o er grants to incentivize improvements by property owners. In July, a Public Art Pilot Plan was approved by the CRA Executive Board, made up of the Collier County Board of Commissioners, to

encourage the creation of murals.

e award-winning Bayshore Drive is one section of the CRA. at’s where plans for a 17-acre park with restored vegetation and a meandering boardwalk connecting to Sugden Regional Park are underway. e green space includes open lawn and patches of woods and ponds. Collier County CRA Director Debrah Forester says the agency is working with Naples Botanical Garden on site-appropriate plantings and the design is expected to be nalized by the end of May.

e other section is the Gateway Triangle area bounded by U.S. 41 East, Davis Boulevard, and Airport-Pulling Road across the street from Naples Bay Resort & Marina.

In 2009, the CRA purchased land there “as a catalyst site” for redevelopment. e CRA purchased it in 2009 but things moved slowly due to the economic downturn, Forester says, and a request for proposals for mixeduse development “that allows people to live, work, and play in the area and encourage other people to invest in the area” was nally issued in 2015. In November 2020, the CRA sold three parcels totaling 10.4 acres to two entities, which included Metropolitan Naples.

Construction on the first high-rise at Metropolitan Naples started in fall 2022. Metropolitan Naples Realty Director of Sales Ed Gonzalez says construction will begin on the second high-rise, Aura, at the beginning of this year. “The construction timeline for Aura is about 18 months; the expectation is for residents to move in during the third quarter of 2024,” Gonzalez estimates.

Metropolitan Naples has a sales office at Fifth Avenue South.

The Metropolitan Naples complex will include four buildings:

∙ The Ellington, a 10-story luxury hotel with two restaurants

∙ Aura, a 15-story luxury condo residence with 56 residential units and 6,000 square feet of retail space on the ground levels and

a rooftop infinity pool and fitness center overlooking Naples Bay, downtown Naples, and the Gulf of Mexico

∙ A 15-story tower with long-term, luxury condo rentals and 10,000 to 12,000 square feet of retail and office/professional space

∙ A condo development with 70 to 90 residences and 50,000 square feet of restaurant and retail

“I think the impact in the community will be huge,” says Gonzalez. “Metropolitan Naples will undoubtedly redefine the entire area. As a mixeduse community with restaurants, boutiques, and office space and Aura as its signature building with first-class amenities, Metropolitan Naples will become a destination on its own.”

Metropolitan Naples is being developed by two respected, long-time Naples residents and veteran developers, Fred Pezeshkan and Jerry Starkey.

Top: Two renderings of Aura at Metropolitan Naples illustrate how this modern high-rise will reshape the urban landscape.

Above: The popular Celebration Park is a popular gathering spot. Below: A bird’s-eye view of Haldeman Creek in the Bayshore community.

BORGES ARCHITECTS

Top: Two renderings of Aura at Metropolitan Naples illustrate how this modern high-rise will reshape the urban landscape.

Above: The popular Celebration Park is a popular gathering spot. Below: A bird’s-eye view of Haldeman Creek in the Bayshore community.

BORGES ARCHITECTS

Newly licensed REALTORS® and new-to-Naples agents are bound to encounter topics not covered in the classroom or the licensing exam: Selling here is di erent versus “up north.” ere are realities only seasoned local REALTORS® know—and they’re willing to share.

REALTORS® who understand how and why the local real estate landscape is unique will help their customers make informed decisions by knowing the nuances of the Naples market and any potential restrictions, extra costs, and considerations that can a ect their bottom line and peace of mind.

Owning a home in a hurricane-prone area involves risks. REALTORS® should learn how elevation, age, location, roof type, storm protection systems, and other variables factor into a property’s ability to withstand heavy wind and rising water.

“A wind mitigation report by a quali ed inspector documents a home’s features that help withstand high winds in a major storm, including storm shutters, impactrated glass, building materials, and structural reinforcements,” says Corey R. McCloskey, President 2021. “Often, a wind mitigation report sent to an owner’s insurance company will trigger discounts on the premium.”

Agents should also remind buyers that ood insurance is separate from a homeowners policy.

“Only a ood policy will cover damage caused by rising waters,” McCloskey says. “It’s good practice for REALTORS® to maintain a working relationship with a reputable insurance agent and refer buyers to them

before committing to a purchase. In addition to quoting rates, they can con rm whether the home is in a ood zone.”

Florida’s Homestead Exemption reduces a home’s assessed value up to $50,000 before property taxes are calculated. Homeowners must be permanent Florida residents as of January 1 and le the application in person with the Collier County Property Appraiser. Additional exemptions may also apply to qualifying seniors and disabled military and civilians. Check out the exemption tab at collierappraiser.com.

Newcomers soon notice the tell-tale gates of Southwest Florida’s most popular lifestyle: the master-planned community where private amenities deliver a resort experience with supersized pools, grand clubhouses, restaurants, tness centers, spas, pickleball and tennis courts, and championship golf (see No. 4). MPCs are often associated with HOAs and CDDs (see No. 5).

“REALTORS® from other areas are often surprised by the number of Southwest Florida communities with on-site golf clubs, and for some buyers the club is as important as the home,” says McCloskey. “Agents should understand the di erences between equity, nonequity, and bundled memberships, if a club has mandatory fees, and spending minimums.”

Savvy REALTORS® can often arrange a private tour and even a complimentary round for the buyer.

A customer’s big vehicle or big dog may not be welcome in certain neighborhoods or communities. In addition to county and city restrictions, many Southwest Florida homes are also governed by a homeowners or condominium association (HOA or COA) which may govern architectural styles and exterior paint palettes; forbid trucks, motorcycles and RVs; and restrict certain sizes and breeds of dogs. Many communities also establish a community development district (CDD), municipal service taxing unit (MSTU), or other special governmental entities to nance and maintain infrastructure and neighborhood improvements. HOAs, COAs, CDDs and MSTUs add another layer of cost and show up on property taxes.

“When showing property, it’s important to know if the property is subject to any of these entities and what it might mean to the buyer both from a nancial and practical point of view,” says McCloskey. “Make sure your buyers receive a full copy of the current association documents before committing to a purchase and all association and other fees are disclosed to the buyer in writing—on the correct forms,” says McCloskey.

While there’s always the potential for mold given Florida’s humid climate, out-

of-state buyers and REALTORS® are often surprised to learn that radon is also a concern. A professional mold and radon inspection prior to closing can prevent unforeseen issues.

7 Closing Costs

Both buyers and sellers typically pay closing costs in Florida, which often catches out-of-state buyers and REALTORS® o guard, says McCloskey. “ e NABOR® sales contract clearly outlines who’s responsible for certain portions of the closing costs so there are no surprises at the closing table,” she says. “Agents should talk to their buyers and sellers about their responsibilities

or obtain an estimated closing statement from a local attorney. Some law rms have closing cost calculators on their websites.”

8

Know the Market Knowledge is power. Agents should school themselves in key market indicators and advanced features on the Southwest Florida MLS to create customized reports for their customers.

professional network and get acquainted with allied and a liate members who o er local services agents and their customers need, from builders, legal rms, banks, and mortgage, insurance and title companies to home inspectors, interior designers, landscapers and accounting rms specializing in real estate.

10

NABOR® Membership has its Privileges NABOR®’s events, mixers, and activities help REALTORS® expand their

9

From Abaco Bay to Wyndemere, NABOR® provides a comprehensive A-to-nearly-Z rundown of Collier and Lee County developments at naplesarea.com/ nd-community.

REALTORS® and homeowners can breathe a little easier thanks to a comprehensive property insurance reform bill—Senate Bill 2D—passed during a special legislative session in May convened specifically to address the state’s property insurance issues. Here are highlights of the new laws, which were supported by Florida Realtors®:

Protecting Policyholders from Nonrenewal: Insurers may not refuse to write or renew policies on homes with roofs that are less than 15 years old solely because of the roof’s age.

Roof Solicitations: Requires roofing solicitations to contain consumer-awareness language that the homeowner is responsible for the deductible under the insurance policy. It is insurance fraud for the contractor to reduce or waive the deductible or file a claim with false or misleading information.

Roof Deductible: Allows insurance companies to offer a policy at a reduced rate to consumers that includes a roof deductible of up to 2 percent, with certain circumstances like a total covered loss waiving the deductible.

Improving Affordability for Policyholders:

Authorizes $2 billion for a new Reinsurance to Assist Policyholders (RAP) program for insurers. This reinsurance is provided at no cost to the insurer. Participating insurers had to reduce their premiums by June 30, 2022, to reflect savings from the program. Insurers that deferred using RAP until 2023 must reduce policyholder rates by May 1 this year.

Assignment of Benefits Reform: Bans the transfer of the one-way attorney fee provision through an assignment to third parties and

closes a loophole that some unscrupulous vendors used to circumvent the law.

Contingency Fee Multiplier: Overturns bad case law by returning the use of a contingency fee multiplier to “rare and exceptional” circumstances, reducing the chance of extraordinarily inflated attorney fee awards in run-of-the-mill cases.

Notice of Intent to Litigate: Enforces the required notice of intent to litigate contained within 2021’s Senate Bill 76 by allowing the insurer to collect attorney fees if the case is dismissed because a notice was not properly filed.

Civil Remedy Notice: Reins in “gotcha” bad faith lawsuits by requiring an actual breach of contract for extra-contractual damages to be awarded.

Home Hardening Grants: Appropriates $150 million to provide hurricane mitigation inspections and matching grants to help Floridians afford home hardening improvements to their homestead singlefamily residences valued at $500,000 or less. The program provides $2 in grant funds for every $1 provided by the homeowner. Applicants may receive up to $10,000 in program money.

“Private property rights are vital to homeownership so, through our Governmental A airs Committee and REALTORS® Political Action Committee advocacy e orts, we are going to stay at the forefront of these issues and be the voice for all.” —Nick

Bobzien, President 2023

Bobzien, President 2023

“My top five goals are: Help grow members’ businesses to be resilient and thriving; be a strong advocate for private property rights and homeownership; provide training and mentorships for chairs and vice chairs to be more e ective leaders; foster a culture of inclusion on committees, events, forums, and communications; and be a voice of conservative fiscal management of our members’ finances.” —PJ

Smith, President-Elect

“I hope to make valuable contributions such as helping in the planning of events, working to improve e ciencies relative to scheduling meetings and events, developing and facilitating communication with our members, and making certain that allied and a liate members are fully aware of the benefits of their NABOR® membership.”

—Terrilyn VanGorder, Vice President/Secretary“The successful management of our finances allows us the opportunity to provide our members with the tools and education they need to run their businesses, and the networking events that we o er a ord our members the chance to interact with each other in a fun way and to form alliances that will further foster the success of their businesses.”

—Christine Citrano, Treasurer

“My goals are to create an environment in which REALTORS® feel motivated to further their education and advance their careers, to give energy and traction to new ideas, to support members who wish to have a voice, and to help members feel that their participation, input, and feedback are highly valued.” —Paula

Angelopoulos Urbinati“My goal is to empower the next generation of NABOR® leadership by supporting new ideas and sharing a historical perspective. I also will continue my focus on new MLS products and services to keep NABOR® at the forefront of innovations in real estate.” —Ryan

Bleggi, Immediate Past President

Bleggi, Immediate Past President

“My focus will be on providing the best possible tools and education to our members to be successful. I am also focused on looking forward to the future of NABOR®. As a real estate attorney and a REALTOR®, I look forward to providing my unique perspective to the board. I am honored as a native of Naples to be a part of this wonderful community.” —Shaun

“My goal is to continue to do my part to advance a shared vision that puts a spotlight on education, professionalism, and inclusion while implementing lasting, innovative changes for the benefit of our members and their businesses.” —David Puskaric

M. Garry, JD

M. Garry, JD

“In my 49 years as a REALTOR®, my three key focus points have been on education, governmental issues that affect private property rights, and professional standards/ethics. There is much work to be done in all three of these categories. One goal is to bring in more national trainers to NABOR® to share their wisdom. And the Naples City Council and Collier County Board of Commissioners are going to keep us busy with proposed changes. The NABOR® Strategic Plan calls for a specific focus on these three topics.” —Marcie

Roggow“My focus will be on providing quality resources to help build members’ business, always at their service, always with a smile.” —Mary Waller

“I will promote diversity and inclusion at NABOR® and encourage members to make a difference at the local, state, and national levels. The real estate industry is rapidly changing, and the leadership has an obligation to adapt so we can better serve our members and the community at large. Raising awareness among members on the impact and opportunity of international real estate is another important goal of mine.” —Izabela

Wright

Wright

Ten years ago, Nick Bobzien got involved with the Naples Area Board of REALTORS® (NABOR®) when he joined the Young Professionals Network. With a decade of service and leadership in the association, he’s assuming the year-long term as 2023 President with passion and vision.

“I’m looking forward to a positive and successful year, along with the 2023 board of directors,” he says. “We are here to serve members’ best interests at the local, state, and national level.”

Bobzien, a broker associate at DowningFrye Realty, moved to Naples in 2003 after earning his bachelor’s degree in business administration with a concentration in sports management from Florida Southern College in Lakeland. In April 2005, he joined Downing-Frye Realty as a sales agent and has been with the rm ever since.

During his free time, the father of three–a daughter at Florida Atlantic University and a daughter and son at St. John Neumann High School–enjoys boating and relaxing at the beach. A former golf professional, Bobzien sneaks in rounds when he can. “I don’t have as much time to play as I’d like,” he says, “But I still love to play the game.”

You have many family members who were in real estate—it’s literally in your blood. Tell us about that. My great-grandmother was the rst female real estate broker in the state of Kentucky. One of my uncles owned and operated one of the rst real estate colleges in the state of Florida. At one time, my parents

both had their Florida appraiser licenses. My dad held a real estate sales license in Hawaii and a real estate broker license in Florida and Colorado before he retired last year.

What are some of the most important NABOR® benefits? e extensive education classes o ered (in-person and on Zoom)— many of which are free—are designed to help members become more successful. We have more than 20 committees that members can join. ese committees help support and grow NABOR® and provide valuable networking opportunities for our members. Personally, I can attest that I’ve had many real estate transactions that grew out of relationships fostered through networking and volunteer opportunities at NABOR®.

What are some of the biggest statewide and/or nationwide issues in this industry? Protecting homeowners’ private property rights is paramount. Homeowners should have the ability to rent their property or build on their land without having to worry about government overreach.

Other issues we’re facing in Florida are homeowners insurance, the attainable housing shortage, and comprehensive planning and zoning policies, especially at the local level. Nationwide, high interest rates will certainly play a huge role in our industry in 2023, and likely longer. In January 2022, the 30-year, xed conventional rate was just over 3 percent and by November 2022, it was in the 7 percent range.

COURTESY: NICK BOBZIENAnother major nationwide issue is potential fundamental changes to the MLS currently under review by the U.S. Department of Justice. The National Association of REALTORS® is also facing lawsuits targeting the MLS. Our members should be aware of, and stay updated, on both issues.

What are some goals you want to achieve as the new president? One of my goals is to continue to offer our members plenty of

educational classes, most of which will be for free. The more educated our members are, the more professionalism we provide for customers.

Private property rights are vital to homeownership so, through our Governmental Affairs Committee and REALTORS® Political Action Committee (RPAC) advocacy efforts, we are going to stay at the forefront of these issues and be the voice for all. Also, I would be thrilled to see more engagement and participation from NABOR® members. We have a myriad of

talent within our membership, and utilizing these talents is an asset for our association.

As a professional in this market, what makes buying and selling property unique in the Naples area? Buyers from all over the world specifically search for Naples real estate. It’s a well-known destination where people want to live. We have properties for sale in Naples from $200,000 to more than $60 million. We have something for everyone— other than mountain views, I often joke.

There’s so much to love here. New homes from four premier builders. A vibrant town center with shopping, dining, and fun events. Parks, trails, open space, and recreational activities galore. You’ll find yourself saying, what’s not to love?

This welcome bin is great for open houses—especially when you may not be able to greet everybody that comes in—because it shows potential buyers you care about the oors in what may be their new home. e foldable shoe cover holder is made of heavy-duty canvas and is available in black and blue.

Member Price: $9 + tax

Size: 8 in. x 8 in. x 10 in. (open)

1 in. x 11 in. x 12 in. (folded)

Shoe covers sold separately. A package of ve pairs: $1.95 + tax

Here are two cool apps that can help you answer two frequent questions that often arise in the eld (professionally and in your own home): magicplan

With magicplan, use your phone or iPad to scan a room and ascertain its size and dimensions, including ceiling heights. If you’re feeling ambitious, build complete oor plans and save the dimensions as a PDF. is app—designed for contractors but handy for anyone programming or planning an interior space—provides a quick, accurate, and professional way to measure a room in 2D or 3D and even store and share it through the cloud.

How to get it: Google Play, Apple App Store, or magicplan.app

Price: Free for the first two projects; $9.99/ month for unlimited projects in the basic Sketch application

Need to touch up sco marks? ColorSnap allows you to use your phone’s camera to get a color match for wall paint. You also can scan a room with the camera’s lens and “paint” the room with your desired colors to envision how they would look. Share it with sellers who want to touch-up wall surfaces and with buyers so they can visualize the color potential of speci c rooms. is color-selection app was created by Sherwin-Williams to work in tandem with its product lines.

How to get it: Google Play, Apple App Store

Price: Free

Your golfing friends at Eagle Creek invite you to

NEW COMMUNITIES PLANNED TO RISE ON THE LAST REMAINING LARGE SWATHS OF LAND IN EASTERN COLLIER COUNTY ARE EXPECTED TO EXPAND HOUSING INVENTORY BY 11,650 UNITS

BY SETH SOFFIANCollier County’s housing supply will be getting a shot in the arm in the indefinite future as developers push east into some of the county’s last large swaths of available land. Spearheaded primarily by county namesake Collier Enterprises, at least five large-scale communities have moved through various stages of planning and approvals on former farmland. Most of the development will unfold along Oil Well Road east of Golden Gate Estates.

Three of those communities—the villages of Rivergrass, Bellmar, and Longwater—are part of Collier Enterprises’ proposed Town of Big Cypress, approved in 2020 and 2021 by the Board of Collier County Commissioners for up to 7,850 homes. Each village encompasses about 1,000 acres.

Also in 2020, Sarasota-based Neal Communities was approved to build up to 1,800 homes as part of 642-acre Hyde Park Village on Oil Well Road east of Everglades Boulevard. And in October, the Collier County Planning Commission voted unanimously in favor of a new Barron Collier Companies community called Brightshore. The 681-acre development still needs final approval for what

will be 2,000 homes north of the intersection of Immokalee Road and Everglades Boulevard, six miles north of Oil Well Road.

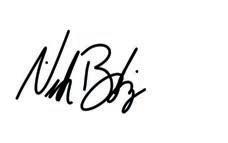

All five communities sit within the county’s Rural Lands Stewardship Area (RLSA). Encompassing 185,000 acres around Immokalee, the RSLA allows for development on land with low conservation value, such as farmland, in exchange for preservation of more environmentally sensitive areas.

The RLSA program—enacted by Collier County in 2002 in response to state orders to direct development away from wetlands and wildlife habitat and avoid urban sprawl—began in earnest in 2005 with the establishment of the bedroom community of Ave Maria, also on Oil Well Road.

While the new developments have faced challenges over concerns about environmental impacts, increased traffic, and required costneutrality to the county, they ultimately would bring 11,650 new housing units to eastern Collier on more than 4,300 acres.

Positioned between Golden Gate Estates and Ave Maria, the new communities would collectively add a town approximately half the size of Ave Maria.

An aerial of the town of Ave Maria, developed by Barron Collier Companies. Since the opening of the community in 2007, more than 3,900 new homes have been sold in the town, which has a planned build-out of approximately 11,000 residents with housing options that include single-family, condo, and villa homes.

An aerial of the town of Ave Maria, developed by Barron Collier Companies. Since the opening of the community in 2007, more than 3,900 new homes have been sold in the town, which has a planned build-out of approximately 11,000 residents with housing options that include single-family, condo, and villa homes.

Collier Enterprises has “a demonstrated track record of success in planning awardwinning, sought-after projects in Southwest Florida … all with a consistent focus on responsible stewardship for the unique environment of the place the company has called home for more than a century,” according to the development’s website.

As stipulated for projects in the RLSA, developers must set aside land elsewhere to be preserved.

In Big Cypress, for instance, Collier Enterprises says 12,300 acres will be preserved in exchange for the three 1,000-acre villages,

as well as a 515-acre town center that will link all three villages on both sides of Oil Well Road and along the eastern side of the proposed Big Cypress Parkway.

Rivergrass, approved by a 3-2 vote of county commissioners in January 2020 ahead of their 4-1 approvals for Longwater and Bellmar roughly 18 months later, has seen progress

slowed by an unsuccessful lawsuit from the Conservancy of Southwest Florida that has been appealed.

But commissioners ultimately have decided the proposed communities meet the rules outlined by the RLSA, which itself is open to a public review period typically every five years.

Along with varying housing mixtures—including 880 attainable housing units—all five community plans include varying amounts of commercial development, town space, parks and other amenities, such as a golf course in Rivergrass and school in Big Cypress.

“These are the lands that are set aside for this kind of development,” planning commissioner Robert Klucik said during a public meeting in October in support of Brightshore. While Klucik, who lives in Ave Maria, recused himself from the vote due to a conflict, he and other planning commissioners described Brightshore as an exemplary model of development within the RLSA in part because of its location on the least sensitive land in that area. The RLSA sits between the Florida Panther National Wildlife Refuge to the south and the Okaloacoochee Slough State Forest to the north.

Brightshore “looks ideal,” planning commissioner Paul Shea said of the environmental intent of programs in the RLSA, calling it “one of the best projects we’ve seen.”

“We would love to put the whole thing in preserves, but we can’t,” planning commissioner Joe Schmitt said at the meeting. “People own this property. They have the right to develop it.”

Above: There are more than 40 businesses in the Ave Maria Town Center. The town includes other amenities, including a water park, soccer and baseball fields, amphitheater, dog park, trails, playground, bocce and tennis courts, and private schools. It is located at the intersection of Oil Well and Camp Keais roads in the Rural Lands Stewardship Area (RLSA), where future communities, such as the Town of Big Cypress, will be taking shape. Left: Collier County Planning and Zoning Division map of the RLSA.Targeted sales prices and affordable housing have been important discussion points with all the pending communities.

After voting against approval of Rivergrass in January 2020, County Commissioner Burt Saunders voted in favor of sister communities Longwater and Bellmar 18 months later, in part because Collier Enterprises committed to devoting 15 percent of their 5,350 units to affordable housing.

Hyde Park was approved in June 2020 with the developer at the time targeting price ranges from $168,000 for multi-family to $373,000 for single-family homes. County housing staff recommended the developer commit to setting aside 215 of Hyde Park’s 1,800 units for low- or moderate-income housing because of changing market conditions. No requirements were established.

Now, as Brightshore joins the mix of pending projects, it does so under revised RLSA requiring developers to set aside affordable housing units, although they need not be on site. The requirement is part of revisions approved by the county in July 2021 after a years-long delay caused by a host of factors, including the Great Recession.

Brightshore’s proposal includes providing 170 low- or moderately priced units. If those are built off-site rather than among Brightshore’s 2,000 homes, the county could purchase the land for it using money already allocated for that use. That would enable the county to maintain the affordable price and control the targeted income levels for those homes as long as it chooses, according to county planning Director Mike Bosi. “We would have control of that in perpetuity,” Bosi told the planning commission.

The perceived potential impacts on wildlife also vary with each project. Hyde Park, for instance, faced less pushback from environmental groups over its potential impact on the Florida panther despite sitting almost immediately west of more-controversial Rivergrass – both on the northern side of Oil Well Road.

Longwater and Bellmar, meanwhile, are positioned on the southern side of Oil Well Road, extending south of Golden Gate Boulevard’s termination into the future Big Cypress Parkway. That puts them closer to the Florida Panther National Wildlife Refuge.

But these communities and newly proposed Brightshore have support in environmental corners for the land that is being preserved in exchange for development rights—as the RLSA program intends—as well as for elements meant to minimize human and wildlife interactions.

Those include more wildlife crossings, dark sky lighting, bear-proof trash cans for residential and commercial properties, and homeowners guides for “living in bear country.”

In gaining approval for Longwater and Bellmar, Collier Enterprises agreed to use more than the minimum required credits it earned in exchange for setting aside 12,300 acres for preservation for the Town of Big Cypress. That leaves fewer credits for future developments.

Brightshore, if approved, would bring the total land preserved through the RLSA program to just under 50,000 acres, Bosi told the planning commission. “That’s an economic benefit to the county,” Bosi said, “at no cost to the taxpayer.”

*BELLMAR

Developer: Collier Enterprises

Acreage: 1,000

Location: South of Oil Well Road, east of Everglades Boulevard

Homes: Up to 2,750 singleand multi-family

Timeline: Approved 4-1 by the Board of Collier County Commissioners in June 2021

Commercial space: At least 45,000 sq. ft.

Timeline: Approved 4-1 by the Board of Collier County Commissioners in June 2020

*LONGWATER

Developer: Collier Enterprises

Acreage: 1,000

Location: South of Oil Well Road, east of Everglades Boulevard

Homes: Up to 2,600 singleand multi-family

Timeline: Approved 4-1 by the Board of Collier County Commissioners in June 2021

BRIGHTSHORE

Developer: Barron Collier Companies

Acreage: 681

Location: North of Immokalee Road at intersection with Everglades Boulevard

Homes: Up to 2,000 singleand multi-family

Commercial space: Up to 120,000 sq. ft.

Timeline: Approval unanimously recommended by Collier County Planning Commission in October 2022

HYDE PARK VILLAGE

Developer: Neal Communities

Acreage: 642

Location: North of Oil Well Road, east of Everglades Boulevard

Homes: Up 1,800, including 300-1,000 multi-family residences

*RIVERGRASS

Developer: Collier Enterprises

Acreage: 1,000

Location: North of Oil Well Road, east of Everglades Boulevard

Homes: Up to 2,500 singleand multi-family

Timeline: Approved 3-2 by the Board of Collier County Commissioners in January 2020

* Bellmar, Longwater, and Rivergrass are connected by the proposed Town of Big Cypress. Note: The total commercial space for the Town of Big Cypress and Rivergrass, Bellmar, and Longwater villages is 1.575 million square feet, according to the developer.

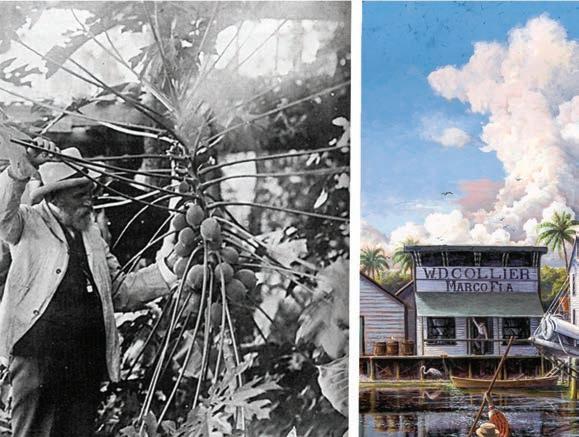

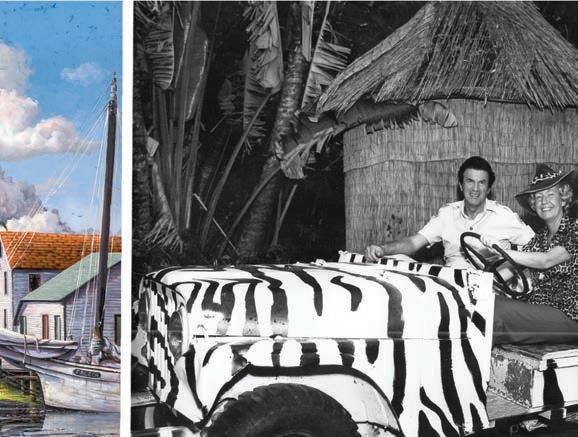

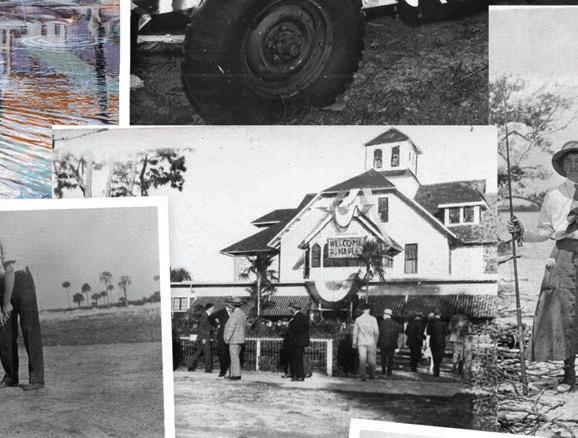

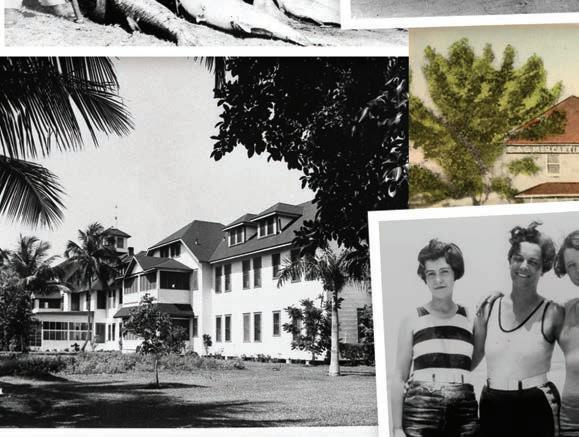

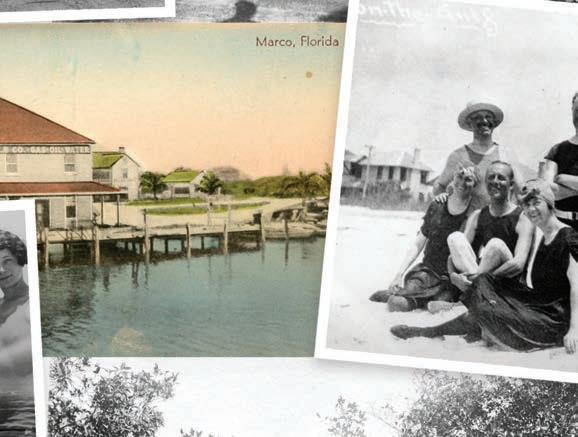

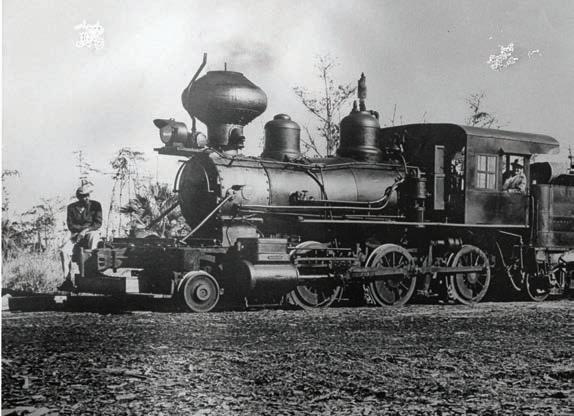

From swampland to prime property, Collier County and the City of Naples are honoring their centennials this year

BY NANCI THEORETIn 1923, Time published its debut issue, Babe Ruth hit a homer during the first-ever game played in Yankee Stadium, and a sign advertising a new real estate development in the hills above Los Angeles was hoisted, spelling out its name in block letters: Hollywoodland. Meanwhile, in the remote reaches of Florida’s most southwestern coast, a county and two cities were newly minted by state legislators.

2023 rings in year-long celebrations commemorating the triple centennials of Collier County and its county seats—first Everglades City, then Naples. During the past century, the untamed wilds of this Florida backcountry transformed into a coveted cosmopolitan destination of resorts, high-end retailers and restaurants, and rich cultural landscape, and a robust real estate market punctuated by record-breaking prices, including last summer’s $62 million titleholder.

Collier County and its cities tend to woo almost anyone who steps foot here. Long before airports, interstates and electricity, the area was accessible only by boat, then by seaplane.

There were no roads plunging into the tangle of wilderness and swampland, and travel by land was time-consuming and arduous. Those arriving by sea in the late 1800s were welcomed by a postcard setting—sweeping stretches of white-sand beaches along the gently sloping Gulf of Mexico, a bay just beyond with meandering tributaries, and mangrove islands teeming with fish.

The area’s history is intrinsically tied to the railroad, the road and real estate. It’s a past forever intertwined with the unique visions of two men who made their fortunes in publishing and advertising. Walter H. Haldeman and U.S. Senator John Stuart Williams, Naples’ founding fathers, recognized Naples’ potential in the 1880s, imagining the country’s newest wintertime paradise.

Barron Gift Collier, Sr., however, was the harbinger of future growth and tourism, providing the missing link by forging across the inhospitable Everglades terrain to connect the state's west and east coasts with the completion of a Tampa-toMiami thoroughfare—which came to be called the Tamiami Trail—across Florida’s “Last Frontier.” A self-made millionaire, Collier bankrolled both projects and in return, state legislators thanked him with a county named in his honor.

Haldeman, the publisher of the Louisville Courier, joined Williams, who had served as a Confederate general, during U.S. surveys of Southwest Florida in 1885. With dreams of establishing a new city, they sailed south, combing the shoreline for potential sites. They were smitten by Naples’ location and regaled folks back home with tales of balmy beaches and beautiful blue water.

The Naples Town Improvement Company was established in 1886 as the city’s first developer with the goal of attracting tourists to the peninsula formed by the Gulf and Naples Bay, a location promoted as reminiscent of the Italian city. The company paid $11,136 for 3,712 acres, sold lots for $10, and went belly-up in a year.

Williams, Haldeman, and their Kentucky cronies assumed ownership in 1887 and within two years built the 16-room Naples Hotel on the fringes of the present-day Third Street South district, the 600-foot predecessor of the Naples Pier, a general store, and post office. Rose Cleveland, the sister of President Grover Cleveland, was the hotel’s first official guest in 1889. Despite exciting progress, the

newest iteration of the Naples Town Company failed, and its assets were sold in 1890 at a public auction in the hotel. Haldeman was the sole bidder, paying $50,000 for 8,600 acres, the hotel, pier, and the steamship Fearless, which ferried visitors to Naples.

Today, Haldeman’s two-story, 3,500-square-foot, tabby-and-mortar home built in 1895 is the headquarters of the Naples Historical Society. Called Historic Palm Cottage, it’s Naples’ oldest home. When Haldeman died in 1902, St. Pete developer Ed Crayton stepped in, building upon Haldeman’s modest success for three decades and ushering in the era of Barron Collier, rail service, electricity, and the Tamiami Trail.

A visit to the historic Ted Smallwood Store on Chokoloskee Bay provides a freeze-frame of life in nearby Everglades City at the turn of the century—a stark contrast to Naples

1886 The Naples Town Improvement Company is founded to promote the city as a winter vacation retreat

1889 The company completes the 16-room Naples Hotel and 600-foot Naples Pier

1890 Kentucky publisher Walter Haldeman buys the Naples Town Improvement Company’s entire holdings,

40 miles away. Perched on stilts and filled with curiosities, the store was a trading post for the Seminoles in a wilderness becoming legendary for its prime hunting and tales of 300-pound Goliath grouper and game fish larger than a human.

Collier, who made his millions in streetcar advertising, bought Everglade City’s Rod & Gun Club and much of Southwest Florida in 1922. At the club, he entertained international dignitaries and U.S. presidents, and in 1923 agreed to finance the beleaguered Tampa-to-Miami road—an $8 million project the state couldn’t afford. Construction crews were based out of Everglades City, which the state recognized in 1923 as the county seat of the new county carved out of adjoining Lee County.

By its first U.S. Census count in 1930— two years after the Tamiami Trail’s official grand opening —Collier County was home to a population of 2,833. Upon his

encompassing 8,600 acres, the hotel, pier, and the steamship Fearless for $50,000

1895 Haldeman builds Palm Cottage, today the city’s oldest home

1896 The Key Marco Cat is discovered on Marco Island

1919 Botanist and ornithologist Henry Nehrling plants the

death in 1939, Barron Collier was Florida’s largest landowner. His influence and legacy continue today with fourth-generation heirs operating development companies and the 7,721-acre Collier-Seminole State Park, founded in 1947, to share Collier’s love of the land with the public.

The advent of air conditioning and commercial aviation brought big changes in the mid-1900s, improving access and travel times from the north and relief for those who dared to take on sweltering humid summers. Naples also got an airport courtesy of Uncle Sam. The Naples America Airport, an Army airfield and flight training school for combat pilots activated in 1943 during World War II, was turned over to the city in 1947.

Many servicemen returned to Naples following the war, prompting the area’s

garden that will become the Naples Zoo and Caribbean Gardens

1923 Collier County, Naples, and Everglades City are established by state legislation

1923 The newly formed county commission meets at the Barron G. Collier-owned Rod & Gun Club

1925 The Naples Town Council holds its first meeting

1926 Electricity is introduced to Naples

1927 Naples’ first passenger train, the Seaboard Air Line’s Orange Blossom Special, marks the completion of the railroad

1928 Tamiami Trail is completed

1930 Collier County’s first U.S.

(Sources: Barron Collier Companies; Collier Museums; colliercountyfl.gov; Florida Dept. of Transportation; Naples Historical Society; Naples, Marco Island, Everglades Convention & Visitors Bureau; Third Street South Association)first real estate boom. John Glenn Sample also arrived around that time. A pioneer in radio advertising and an apparent fan of the Jamaican town steeped in pirate lore, he purchased two square miles of Naples’ southwestern tip, filling in marshland and dredging canals with the goal of creating another Port Royal as “the finest place to live.” Sample's venture foreshadowed Florida’s land rush in the 1950s and ‘60s when

Census records a population of 2,883

1947 Ownership of the Naples America Airport is transferred to the city

1947 Everglades National Park is dedicated

1949 Naples becomes an incorporated city and the Naples-on-the-Gulf Board of REALTORS® is chartered

developers converted the barrier island of Marco Island into a waterfront residential community—wining and dining potential home buyers with paid vacations and the opportunity to own a vacation home.

As the decades unfolded, Interstate-75 and a new international airport brought more tourists and residents. Wilderness Country Club introduced a new lifestyle in 1975 as Naples’ first private, gated golf community

with a membership of 13

1962 The county seat relocates from Everglades City to Naples

1968 The 78-mile Alligator Alley opens, connecting Florida’s two coasts

1975 Wilderness Country Club opens as the first gated golf community

1981 I-75 is extended from

selling two- and three-bedroom condos from $70,000 to $125,000—now from the mid-$700,000s to over $1.2 million. The 1985 opening of The Ritz-Carlton on the gulf forever elevated Naples’ cachet.

For local history, centennial events, and a photo gallery: colliercounty100.com. For official city happenings: naplesgov.com/ centennial.

Corkscrew Road in Estero to Immokalee Road in Collier County

1983 The Southwest Florida Regional Airport opens

1985 The Ritz-Carlton debuts on the beach

1989 The Philharmonic Center for the Arts announces its inaugural season

1993 The regional airport is

renamed Southwest Florida International Airport (RSW)

1997 Marco Island becomes an incorporated city

2005 A $400 million terminal is completed at RSW

1992 Waterside Shops introduces luxury specialty stores

2002 Naples becomes one of only a handful of destinations with two Ritz-Carltons

BY DICK HOGAN

BY DICK HOGAN

When Hurricane Ian brought its almost-Category 5 winds and storm surge to Southwest Florida on September 28, it created a worstcase scenario for thousands of homeowners who experienced record-breaking devastation wrought by flooding and roof and other property damage. By dawn the following day, residents and property owners immediately began picking up the pieces as several post-hurricane issues began to emerge.

Not surprisingly, one industry that’s been in overdrive in Ian’s aftermath is the insurance industry. By the end of October, David M. Arter, Jr, private lines department manager at Private Client Insurance Services, had handled nearly 2,000 Ian-related claims in four weeks. “There was a point when my daily goal was just to keep my voicemail from filling up,” he says.

Look at hard-hit areas in Lee County—Estero Island was covered by 15 feet of surge and Sanibel, Captiva, Matlacha, and Pine islands suffered brutal, widespread damages—and it’s easy to understand the volume of claims. One of Arter’s Sanibel clients reported that almost nine feet of water coursed through their home. When there is water damage, insurance adjusters use the high-water mark on walls to determine the difference between flood damage and water damage caused by wind.

Standard homeowner insurance policies do not cover flood damage, so homeowners who live in a Federal Emergency Management Agency (FEMA)designated flood zone can buy separate flood insurance. People who own their homes without a mortgage are not required to buy flood insurance, though those who have mortgages must have flood coverage.

According to the Insurance Information Institute, only 18 percent—1 in 5—of Florida's 10 million homes are covered by flood insurance. Eighty percent of flood insurance policies in the state are from the National Flood Insurance Program (NFIP), which is managed by FEMA. Congress created NFIP in 1968 “to share the financial risks of flood and restrict development in floodplains. Even for those who have NFIP, however, payouts may not be enough to cover their losses.”

Flood insurance coverage through the NFIP covers: Single-family homes and two- to four-family residential structures are limited to $250,000 in damages. Other residential buildings and non-residential buildings are capped at $500,000. For contents-only policies, residences are limited to $100,000 in damages, while the contents of commercial and other structures are capped at $500,000.

Home insurance policies offer windstorm coverage, but it is not mandatory if you own your home and many choose not to pay extra for the coverage or a separate windstorm policy that covers water damage that was “wind-driven” or caused by wind,

This historic storm brought with it several attendant issues

such as a punctured roof or window or rapid stormwater run-off that causes overflowing swales. The cost of wind insurance in Florida varies depending on several factors, including a home’s value, location, and how it was built. Policies are more expensive in coastal areas.

State law requires insurance companies to offer discounted windstorm insurance rates to residents who buy homes with wind mitigation features or install them. To qualify for discounts, a certified inspector must make sure certain wind-resistant features are installed, such as: Impact-resistant doors and windows, roof truss clips, hurricane straps, and storm shutters. (Florida owners of single-family homes with an insured value of $500,000 or less and a homestead exemption are eligible for credits toward a free inspection.)

Many in Southwest Florida recognize that Fort Myers Beach on Estero Island was ground zero for Ian’s storm surge with thousands of houses swept away. Throughout the region, people were scrambling for another place to live. “You’ve got a lot of people who were displaced, and the rental market was very tight even before the hurricane,” says Mike Hughes, vice president and general manager for Downing-Frye Realty. “After the hurricane, it was worse. Where are people

Standard flood insurance policies don’t include money for housing. And homeowners insurance will only pay for temporary housing up to 10 or 20 percent of the amount for which your dwelling is insured if there is a wind declaration —and the homeowner can prove their dwelling is uninhabitable because of wind, not water. “It’s looked at as ‘reasonable expenses,’” Arter says. “If you’re living in a small, modest home, they don’t expect you to be staying at The Ritz-Carlton. It’s got to be reasonable.”

Further complicating the issue is a drastic shortage of rental housing in Southwest Florida—and escalating rent costs. As a result, some people displaced after Ian are simply packing up and leaving.

Collier County experienced less displacement than Lee but for businesses throughout Southwest Florida, the problem is regional, says Greater Naples Chamber President/CEO Michael Dalby. “It’s not a secret that a good part of our workforce lives in Lee County,” Dalby says. “And the scale of the damage and impacts in Lee County, combined with the impacts in Collier County, have certainly led to a significant number of displaced workers.”

Some have managed to stay in the area, “but there’s also a number of them that have left the area. It remains to be seen if those

After the federal disaster declaration for Hurricane Ian, Collier County residents had received more than $61.6 million in federal funds as of October 31:

$25.8 MILLION in U.S. Small Business Administration (SBA) low-interest disaster loans approved for homeowners, renters, and businesses

$35.8 MILLION in FEMA grants to 12,991 homeowners and renters through its Individuals and Households Program. This includes:

→ $23,950,263 in housing assistance for home repair or replacement, and/or rental assistance

→ $11,900,333 in “other needs” assistance to replace essential household items and for other critical disaster-related expenses

→ 2,681 homeowners and renters approved for rental assistance

→ 7,159 home inspections issued; 6,992 completed

→ 4,579 households in Collier County visited by Disaster Survivor Assistance agents

(Source: Florida Attorney General’s Office)

individuals will be coming back,” Dalby says. “Certainly, we have heard from employers that Ian only made it tougher to regain employees and to attract new employees into the area.”

Especially in demand, Dalby reports, are “skilled tradesmen and credentialed professionals—any field where you’ve got to have a certified worker. We were already tight in that labor market and it’s only gotten tighter.”

So far, he’s seen no signs that supply chain issues with construction materials worsened. “There were already challenges getting things like faucets and appliances; I haven’t heard that Ian impacted that.”

In the long term, Dalby’s optimistic there will be a strong economic recovery. “Southwest Florida has proven to be incredibly resilient, and it’s a place where people still want to be,” Dalby says.

After a hurricane, people tend to move fast to clean up yard debris. With the severity of Ian, they were also hauling sodden household contents to the curb, followed by demolition materials, such as drywall, cabinetry, and

appliances wrecked in floodwaters. Long-time residents who’ve experienced post-hurricane life probably knew that there are rules that guide debris separation and curb placement. But those who got to work and piled it all together, or in the wrong place, were deflated to learn afterwards that their piles may not be picked up.

Collier County has specific guidelines in place for any storm. Residents are asked to place all yard debris curbside in the right-ofway as soon as possible. The right-of-way is the area of residential property that extends from the street to the sidewalk, ditch, utility pole, or easement. It’s also important to prevent debris from clogging drainage swales and driveway culverts, which can create blockages and more drainage problems.

Collier County Solid & Hazardous Waste Division debris separation rules state:

→ Place storm-related yard waste in a separate pile. Do not mix yard waste with household trash or construction/demolition debris. Yard waste must be kept in a separate pile. Piles of yard debris mixed with other waste will not be collected.

→ Do not put yard waste in bags. Only loose debris will be collected. Keep vegetative debris (such as limbs, extracted stumps and shrubbery) separated from construction and demolition debris, as it will be.

→ Household hazardous waste (paints, solvents, etc.) cannot be mixed with household debris.

→ Do not stack or lean debris near or on trees, utility poles, or other structures, including fire hydrants, water meters, or backflow prevention devices as that makes removal difficult and could lead to property damage. Place the debris at the edge of your property before the curb.

→ Avoid blocking the road, driveways, sidewalks, mailboxes, water meters, fire hydrants, and utility poles.

Hurricane Ian hu ed and pu ed and blew some of Collier County’s houses down—but a month later, prices hadn’t budged an inch.

e median home price in October was $555,000, exactly the same as it was in September, according to the Naples Area Board of REALTORS® (NABOR®) October 2022 Market Statistics Report.

“I think, right now, if you have a house that’s ready to sell, it’s still a seller’s market,” Mike Hughes, Downing-Frye Realty vice president and general manager, said four weeks after the Category 4 storm made landfall in Lee County on September 28. “I’m more concerned about rising interest rates.”

Still, that doesn’t mean that robust prices are not vulnerable—just that Ian’s likely not to blame. “I do think we’re headed towards a buyer’s market,” Hughes predicted.

NABOR®’s October numbers showed that Ian didn’t keep homes o the market or discourage interest by buyers.

Overall, inventory rose from 2,146 in September to 2,325 in October. Pending sales were up from 619 to 673 with new listings jumping from 694 to 908.

If past is prologue, Ian’s longer-term e ects won’t upend the thriving Naples-area real estate market, experts say. Past storms indicate otherwise.

Statistics assembled and analyzed by Florida Realtors ® Chief Economist Brad O’Connor, PhD, show that major storms haven’t always been followed by a long-term decline in home sales or prices. ree months after Hurricane Michael struck Bay County in the Panhandle in October 2018, “sales were back to prestorm level”—except for a one-month blip in December re ecting closings delayed by the

storm—according to O’Connor. And prices continued to remain stable.

Similar results occurred in the supercharged 2004 and 2005 hurricane seasons and in the aftermath of both Hurricane Andrew in Miami in 1992 and Hurricane Opal in Pensacola in 1995. “ at doesn’t guarantee that it will be the same for Ian, but it is encouraging nonetheless,” O’Connor said at a presentation following Ian.

NABOR®’s September 2022 Market Statistics Report showed a cooling market. While the single-family home median closed price was up 22 percent year over year, inventory, pending sales, new listings, and closed sales were all down.

After a major storm has passed, Hughes says, “initially there’s a very short window

where the price might actually hold up fairly well.” Eventually, though, the inventory will likely grow as people for whom the hurricane was “the trigger point for them making the decision” put their houses on the market.

Appraiser Cindy S. Carroll of Carroll & Carroll Real Estate Appraisers & Consultants says that by late October she was seeing “very encouraging activity in the Old Naples market in terms of land values because properties within three blocks of the beach are still in demand and in short supply.”

One older house on the beach with damage had “at least two parties interested in buying,” along with “two or three cases on ird Street South or east of ird Street that came on

the market and were picked up very quickly,” Carroll reports.

William Dukes, senior mortgage loan o cer of Naples-based Summit Mortgage Corp., a mortgage lender, was expecting prospective homebuyers looking to relocate will rush in during Ian’s aftermath, hoping for a bargain. But they likely won’t nd one, especially for the more desirable properties, he says.

“When Charley hit Punta Gorda in 2004, the prevailing thought was that it was going to lead to a big reduction in price. People came down looking for a deal but found the locals were standing fast,” Dukes recalls. “Nine months after Charley hit, when all was said and done, the price in Punta Gorda actually increased by 7 percent.”

But the story didn’t end there—many bargain-seekers eventually decided to meet stubborn locals’ asking prices, Dukes remembers. “ ey said, ‘‘You know what? We’re not going to get rock bottom. But we like it here a lot. We’re still going to buy.’”

Even high interest rates don’t deter someone who’s made a rm decision to come, Dukes says, like his recent customers from New York who purchased a home in rural Moore Haven. “ ey work from home and couldn’t wait to get here; they were ecstatic,” he says. He also notes that some buyers embrace the real estate industry adage “marry the house, date the rate,” which suggests that a mortgage can be re nanced down the road if or when interest rates drop.

Flood regulations often force property owners in low-lying and coastal areas to measure the costs of rebuilding—or walk away—after storm inundation

BY DICK HOGANIn the wake of Hurricane Ian, a little-known federal regulation has some of the area’s most nancially vulnerable residents suddenly faced with losing their badly damaged older homes if they try to make repairs.

Experts are warning that the issue may force some essential workers to leave the area just as they’re needed most in Collier County’s perennially tight workforce.

e problem regulation is called the Federal Emergency Management Agency’s (FEMA) “50 Percent Rule,” which prohibits repairs to a structure in a ood zone if the repairs cost more than 50 percent of the building’s value—unless the entire structure is brought into full compliance with current FEMA ood regulations.

Although this rule is federal, it is administered by local municipalities. As a result, each locality has its own procedures for implementing the rule. Property owners in the disaster area who sustained major damage received letters from county or city o cials informing them that their property may have to meet the 50 Percent Rule guidelines and provide documentation to show how much they paid for repairs.

Appraiser Ray Carroll of Carroll & Carroll is a certi ed oodplain manager. He is one of the few with the training to deal with the intricacies of the rule. Before Hurricane Ian, 50 Percent appraisals were 10 percent of his

workload—after the storm, they consumed the bulk of his services.

When the 50 Percent Rule is triggered, the cost to repair can be prohibitively expensive for some home owners, and the house is simply torn down.

Compliance usually means raising the entire structure to meet modern elevation codes or demolishing the existing structure to build a code-compliant house, some owners may nd the repairs would cost more than the house’s replacement value, says Carroll. “Older, modest homes are the most di cult to pass the 50 Percent Rule test because they represent less expensive construction,” he says.

Sometimes the owner can a ord to walk away from a house that would cost more than it’s worth to bring up to code, but that’s not always the case. Carroll says the “hardest calls” he receives are from working-class and cost-burdened owners living paycheckto-paycheck who have houses dating from the 1960s and older in low-lying areas. “If the house comes down, then the only thing that can replace it is new, code-compliant construction, which will cost much, much more and will change that to another kind of housing,” Carroll says. “ at family will probably not go back into that neighborhood in new construction.” e result: Modestpriced homes are replaced by newer ones that can be sold for more than the original.

A building’s value is determined by calculating what it would cost to reproduce it exactly as it originally was constructed. e

problem has been compounded by higher construction costs, which went up 10 to 15 percent higher than they were on September 27, the day before the strong Category 4 storm arrived. Experts say this typically occurs after catastrophic natural disasters, but it makes repair costs substantially higher as a percentage of the building’s value, Carroll says. “For a $100,000 house, the e ective rule isn’t a 50 Percent Rule, it’s a 40 or 30 Percent Rule.”

The rule requires the owner to determine what the repairs would have cost at the time of the damage, so Carroll uses Sept. 27 for his pricing benchmark. The applicant for a permit can use the adjusted tax assessment of the property but for a big project, “the appraisal almost always yields a higher building value,” says Carroll. (The tax assessment for condominiums is done by individual condo units.)

Charles Whittington, a real estate attorney with Grant Fridkin Pearson, says there’s often no palatable solution for those who can’t avoid the 50 Percent Rule. He says, often, it means demolition and starting over. The other option is to stagger the work if the jurisdiction you’re in will allow that, Whittington says. “You would do just enough to make the house habitable and then

you come back a year later and finish it. It’s not very palatable but it’s possible.”

Before Hurricane Ian, the 50 Percent Rule usually came up when homeowners or house flippers were trying to make significant home improvements—known in the regulatory world as “substantial improvement.” he says. “I never in my wildest dreams thought it would come into play how it’s coming into play” amid the duress of a natural disaster.

BY KAREN FELDMAN

BY KAREN FELDMAN

You’re racing from showing to closing to open house to your son’s basketball game. Somewhere in there you need to t in dinner. So why add a nonmandatory event into the lineup?

Because:

A. You might learn something.

B. You might meet someone who could bene t your career.

C. You might have fun.

Any or all of those are likely to happen when you attend Naples Area Board of REALTORS® (NABOR®) events.

ere are classes, social events, appreciation nights, and events for the community.

“We plan a range of events to appeal to the di erent types of personalities in NABOR®,” says NABOR® Board Vice President/Secretary Terrilyn VanGorder.

Some recent classes and events included: “Body Language and Other Negotiation Skills,” “Working with Canadians,” “Bingo Night,” “NABOR® Sales Contracts Seminar,” “Cyber Security Update 2022,” and “New Member Orientation Class.”

“It’s a great way to socialize with other people in our industry. REALTORS® are unique because we work daily with our competitors, and it is valuable to build that relationship. Attending events allows us to have relationships with competitors,” says VanGorder. “It helps facilitate deals more easily when you know the other person.”

It’s also a good way to meet allied and a liate members, such as title brokers and attorneys, so that you can comfortably call upon them when you need them. ere are events that focus on NABOR®’s appreciation of members “to thank them for what they do, for those who volunteer and participate,” VanGorder says.

Some events are open to the entire community, such as the annual Family Fun Day and family-friendly Halloween Trunk and Treat held at NABOR®. Adults o ered candylled trunks and costumed children could trick or treat from trunk to trunk.

“At the end of the day, attending events helps people do business,” she says.

One of the most important tools in the REALTOR® toolbox is the real estate sign. Signs do their work on two levels. First, they help advertise a property for sale. e right For Sale sign can do wonders to grab attention and draw in potential buyers. Second, they help potential customers make contact with a REALTOR®. A smartly laid out sign with clear information is a REALTOR®’s gateway to the public.

Within Collier County and the City of Naples, speci c regulations guide the dimensions, placement, and usage of real estate signs. We’ve compiled a roundup of what agents must keep in mind when posting their real estate signs. Remember, there are separate and distinct ordinances for real estate signs in the City of Naples and unincorporated Collier County. A complete description of the rules governing signage in both the city and county can be found on the Municode website (library.municode.com).

In addition, each individual gated community has its own rules. Check with a community’s guidelines before posting a sign.

All Naples-area REALTORS® are urged to adhere to signage guidelines. “It’s extremely important that we follow the rules,” says Bill Poteet, Naples Area Board of REALTORS® (NABOR) board member and President 2012. “If we’re not respectful, then the city and county might change the rules to be more restrictive.”

∙ Maximum size: 12 by 18 inches

∙ Maximum height: ree feet above the ground. is can be extended to four feet if visibility is otherwise obstructed.

∙ Color is allowed.

∙ No portion of the sign may be closer than 15 feet to a paved roadway.

∙ Signs must be placed parallel to the roadway.

∙ O -site and Sold signs are not permitted.

∙ One For Sale sign is permitted per parcel.

∙ One Open House sign is allowed per parcel during supervised open houses.

Signs that don’t adhere to these regulations will be removed by Code Enforcement o cers and agents who break the rules may be ned. To avoid having to pay nes or losing valuable real estate signs, make sure to avoid these most common violations:

∙ Using signs that are too large

∙ Placing signs perpendicular to the roadway

∙ Staking more than one For Sale sign per parcel

e most common complaints Code Enforcement o cers receive are about perpendicular signs placed too close to the road. If a REALTOR® discovers their signs missing, then they most likely have violated one of these provisions. Missing signs can be retrieved at the o ce of Code Enforcement. For any questions regarding signage within the city, Code Enforcement can be reached by calling 239-213-5030.

∙ One sign per street frontage for each parcel

∙ For parcels less than one acre: One ground sign with a maximum height of six feet and a maximum area of four square feet per street frontage. e sign must not be located closer than 10 feet from an adjacent real estate property and may be placed up to the property line abutting a right of way,

provided it is a minimum of 10 feet from the edge of the road. No building permit is required.

∙ For parcels between one and 10 acres: One ground sign with a maximum height of eight feet and a maximum area of 12 square feet per street frontage. No building permit is required.