NAPLES AREA BOARD OF REALTORS® MAGAZINE Q2 2023 REMARKABLE RESILIENCY EVIDENT AS COUNTY RECOVERS Life After Ian Winner of two 2022 Florida Magazine Association Charlie Awards for Writing and Design

The most anticipated new address in Naples marks the final ownership opportunity in Pelican Bay.

ESTATES FROM OVER $6 MILLION | PENTHOUSE PRICING UPON REQUEST epiquepelicanbay.com | 239.598.9900 | 6885 Pelican Bay Boulevard Private Dining Club

of

Dining Club, Epique

Featuring a limited collection of sixty-eight meticulously appointed Gulf-front residences and an extraordinary suite

amenities, including a Private

offers an elevated and exclusive lifestyle unrivaled in Naples. If You Can, You Should.

ORAL REPRESENTATIONS CANNOT BE RELIED UPON AS CORRECTLY STATING REPRESENTATIONS OF THE DEVELOPER. FOR CORRECT REPRESENTATIONS, MAKE REFERENCE TO THE DOCUMENTS REQUIRED BY SECTION 718.503, FLORIDA STATUTES, TO BE FURNISHED BY A DEVELOPER TO A BUYER OR LESSEE. Prices and availability subject to change without notice. The materials and features depicted in this rendering are based upon current development plans, which are subject to change without notice. All images, designs and features depicted herein are shown solely for illustrative purposes, and may differ in view, perspective or scale. No guarantees or representations are made that the materials and features depicted in this rendering will be provided, or if provided, will be of the same type, size or nature as depicted. This image may not depict the location, type, size and nature of certain items or their view, perspective or scale, which may have been altered in this image for purposes of marketing and promotion. All furniture, appliances, fixtures, counters, soffits, floor coverings and other matters of detail, including items of finish and decoration, are not included unless expressly specified in the governing document or purchase agreement. Gulf Bay® Group of Companies. Creators of the Pelican Bay Skyline. Gulf Bay® Marketing Group, Inc. REALTORS®. ©Copyright 2023, Gulf Bay Development LV, LLC. All rights reserved.

RiverCreek is being developed and sold by Lee County Homes Associates IV, LLLP, a Florida limited liability limited partnership. This is not an offering in states where prior registration is required. Photography used in this brochure and/or any of the materials contained within this brochure, and in the sales and information center displays, may be stock photography and is used to depict the spirit of the lifestyles to be achieved rather than any that may exist or that may be proposed. Prices, terms, plans, specifications, features, elevations, designs, dimensions, and materials are subject to availability and change or substitution by Seller without notice. Illustrations of elevations and plans are only artist’s depictions and are not representations of any kind. In production, plans and elevations may vary in precise details and dimensions and may not be as shown. Landscaping depicted is not to scale and may vary as to type, maturity, location and number. Please see a Sales Associate for complete information. Equal Housing Opportunity. All rights reserved. ©2023 1100-779 Naples Realtor, Apr 2023 RIVERCREEK (239) 308-4600 | GLHOMES.com | Open Daily 9:30am - 5:30pm VISIT ESTERO’S HOTTEST NEW COMMUNITY TODAY Elegant new homes, a sought-after Estero location along Corkscrew Road, and an incredible resort lifestyle await at RiverCreek. Ranging in size from 1,900 to almost 4,400 air-conditioned square feet of pure luxury, the new homes at RiverCreek provide everything your clients need in a gorgeous new home. Visit today and learn how to take advantage of up to $17,500 in savings! An Excellent Selection of Well-Appointed New Home Designs Elegant Residences & Resort Lifestyle $500s-$800s SAVE UP TO $17,500 The Olympia 4 Beds, 5 Baths, Den - 3,694 a/c sq. ft. Resort-Style Amenities from the

Broker must accompany client during client’s initial visit to this community. Both the client and Broker must execute the Developer’s Registration Form on the initial visit. Broker must also execute the Developer’s Broker Participation Agreement. Broker bonus/commission subject to change without notice. Valencia Trails is being developed and sold by Naples Associates IV, LLLP, a Florida limited liability limited partnership. Valencia Trails is designed for residents aged 55 & older, and is intended to meet the exemption under the Federal Fair Housing Act. This is not an offering in states where prior registration is required. Prices subject to change without notice. Please see a sales associate for details. All rights reserved. ©2023 1100-779 Naples Realtor, Apr 2023 11256 Daphne Court, Naples, FL 34120 • Open Daily 9am-5pm (239) 262-4000 • GLHOMES.com On-Trend Home Designs Racquet Club Now Open! 43,000 Sq. Ft. Clubhouse Coming Soon 55+ Resort-Style Living in Naples from the $ 600s - $ 1M VALENCIA TRAILS GL Homes has brought its famous 55+ Valencia lifestyle to Naples, with exceptional resort-style amenities, miles of serene walking trails and incredible new homes that offer low-maintenance living at it’s finest. A spectacular 43,000 square-foot Clubhouse and over 10-acre recreation site offer endless opportunities for fun, fitness and relaxation - all designed just for 55+! Visit today to tour 12 stunning model homes and see the all-new Racquet Club, now open. just for 55+ Low-Maintenance Living & Amazing Lifestyle

CONTENTS FEATURES

32 Life After Ian

Remarkable resilience is evident as Collier County recovers, though impacts still linger for some facets of life, such as rentals, insurance, and community destinations.

38 Moving Inland

Will Hurricane Ian have a positive impact on communities in eastern Collier County?

DEPARTMENTS

12 Message from the President

16 For Openers

April is Fair Housing Month. No quick fix for insurance woes. Learn about the benefits of NABOR®’s role as the Ambassador Association to Costa Rica and doing business in the country. Highlights of the expanding hospitality scene. Creating work-life balance in a 24-hour industry. Fighting food insecurity in Collier County. In the NABOR® store. FOREWARN app.

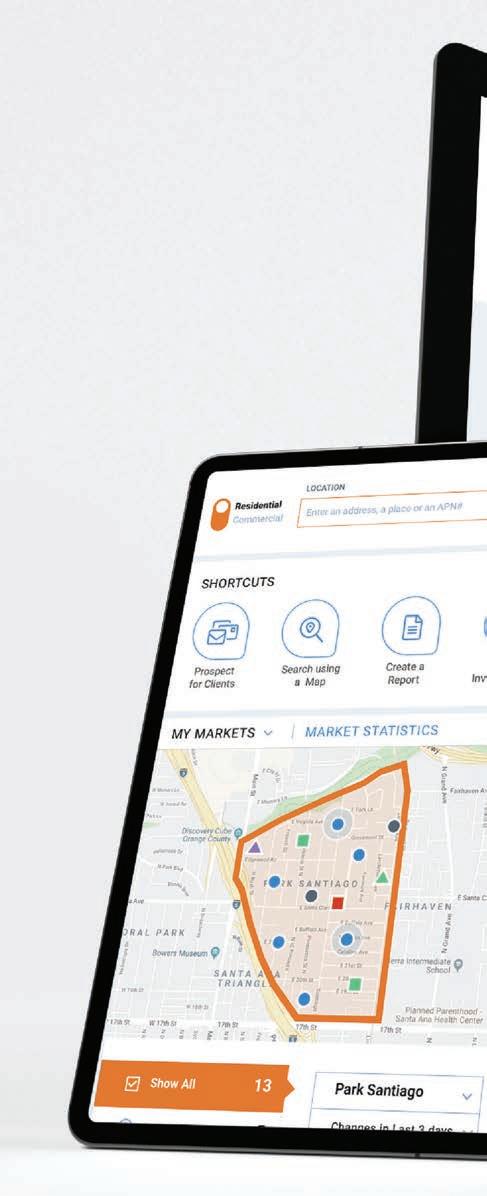

42 Get Smart

The importance of planning ahead for finding the best senior community. Preparing your relationship for life transitions. NAR’s free RPR program is more accurate and detailed than MLS. Closing costs: What to expect. 1031 Exchange property investments. Changes to NAR’s Code of Ethics. Six deadly sins of contract negotiations and drafting. Cooperating broker compensation. Learning is a snap with NABOR®’s educational videos.

62 Welcome New Members

64 NABORhood

Expo and Global Business Committees, social photos, and upcoming events.

70 The Close

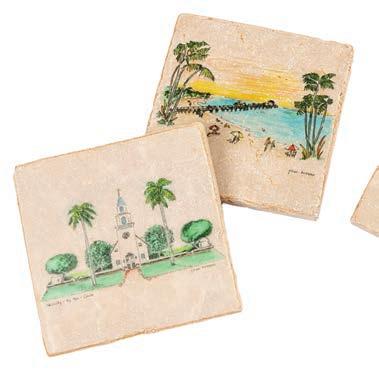

Shopping: Unique gifts with a Naples flare. Local Scene: Celebrate the construction of the Tamiami Trail.

32 42 72 FLORIDA STATE ARCHIVES 6 NAPLES REALTOR® Q2 2023

AVERAGE

AWARD FOR HIGHEST COMMISSIONS PAID

In 2022, Downing-Frye paid $49 Million+ in Commissions, with over 275 Downing-Frye Agents receiving awards for the Highest Commissions Paid in 2022.

RECORD NUMBER OF CLOSED TRANSACTIONAL SIDES

Since 2000, Downing-Frye Agents have closed over 71,000 Transactional Sides.

DOES

DOWNING-FRYE REALTY, INC. OFFICES : 8950 Fontana Del Sol Way #100, Naples, FL 34109 | 3620 Tamiami Trail N., Naples, FL 34103 27399 Riverview Center Blvd. #101, Bonita Springs, FL 34134 | 719 Bald Eagle Drive, Marco Island, FL 34145 For a confidential interview please call: df Does this describe your 2022 real estate activity? SALES RESULTS MIKE HUGHES, Vice President (239) 398-7572 MHughes@DFryeRealty.com JERRY MURPHY, Mgr. Bonita Springs (239) 877-2002 JMurphy@DFryeRealty.com WENDY MORELL, Recruiting Mgr. (239) 300-5979 Wendy@DFryeRealty.com

Sides for a Volume

$2

2022 CLOSED SALES PRICE = $848,000 Downing-Frye Agents closed 2,400+ Transactional

of

Billion+.

CALL US! WE OFFER YOU: • 100% COMMISSIONS • 4 Real Estate Trainers • 2 Technology Trainers • 4 Brokers • Mentoring Program ★

YOUR CAREER NEED A BOOST?

NAPLES REALTOR®

NABOR® Officers 2023

President Nick Bobzien

President Elect

PJ Smith

Vice President/Secretary

Terrilyn VanGorder Treasurer

Christine Citrano

NABOR® Directors 2023

Paula Angelopoulos Urbinati, Ryan Bleggi (Immediate Past President), Shaun Garry, David Puskaric, Marcie Roggow, Mary Waller, Izabela Wright

NABOR®

COMMITTEES 2023

Budget & Finance Chair

Christine Citrano

Commercial Chair

Cristin Madden

Vice Chair

Stuart Tackett

Community Involvement Chair

Nancy Bjork

Vice Chair

Spencer Rigsby

Diversity, Equity, & Inclusion

Chair

Paula Angelopoulos Urbinati

Vice Chair

Sandra Schlaupitz

Events for Networking Chair

Ben Boorom

Vice Chair

Shari de Ron Expo Chair

Julie Blanton

Vice Chair

Dave Antis

Economic Summit Chair

Gwen Davis-Gideon

Vice Chair

Lisa Rogstad

Facilities Management

Wes Kunkle

Global Business Chair

Brett Brown

Vice Chair

Carol Kairis

Governmental Issues Chair

Tom Regan

Vice Chair

Tina Muracco

Governmental Issues – Water Quality Chairs

Corey McCloskey, Adam Vellano

Grievance Chair

Courtney Smith

Vice Chair

Robert Nardi

Leadership Development Chair

Mariana Beckner

Vice Chair

Vicki Allen

Legal Resources Chair

Sam Saad

Vice Chair

Nick Bobzien

Media Relations

Chair

Nick Bobzien

Membership Chair

Perry DeSiato

Vice Chair

Nancy Golya

Membership – Broker Involvement Chair

Adam Vellano

NABOR® History Chair

Spencer Haynes

Vice Chair

Heather Haynes

NABOR® Magazine Chair

Mary Waller

MLS Chair

BC Cloutier

Vice Chair

Adam Vellano

Professional Development Chair

Rick Baranski

Vice Chair

Tina Falzarano

Professional Development – Instructor Advisory Council Chair

Adam Vellano

Professional Development – REALTOR® Safety Chair

Tim Guerrette

Professional Standards Chair

Carrie Lademan

Vice Chair

Will Watson RPAC Chair

Sara Brand Vice Chair

Debbie Zalewski

Young Professionals Network Chair

Allisa Pipes

Vice Chair

Kimberly Vargas

Naples REALTOR® Magazine Editorial Board

Chair

Mary Waller

Director of Marketing

Marcia Albert

Paula Angelopoulos Urbinati

Patricia Asencio

Heather Haynes

Paula King

Ruthie Morency

Nicole Porro

Bill Poteet

Dr. Ron Repice II

NABOR® Staff

Chief Executive Officer

Marty Manion

Chief Financial Officer

Carl Russell

Chief Administrative Officer

Corie Chase

Administrative Assistant to the Executive Committee

Deborah Linville

Assistant to Chief Financial Officer

Deb Joyner

Director of Engagement and Events

Melissa Bognaski

Director of Marketing

Marcia Albert

Director of Membership

Elizabeth Saggio

Director of MLS

Cindy Cornman

Director of Professional

Development Services

Michelle McKenna

Education Administrator

Jeanette O’Neill

Membership Administrators

Sherry Olson

Zamira Collado

MLS Compliance and Support Specialist

Cheyenne Chase

MLS Support Specialist

Allisson Gonzalez

Network Technician

Michael Bryant

REALTOR® Store Manager

Ann Mazzei

Receptionist

Joan Welsher

Supra and Store Administrative Assistant

Kathleen Gill

Vice President of Public Policy

Danielle Brazil Hudson

Videographer

Wade Mastro

8 NAPLES REALTOR® Q2 2023

A 10-minute jaunt to Naples or Marco Island, Fiddler’s Creek is nearly 4,000 acres surrounded by a million more. Private, gated, and convenient, a community with a top 100 golf course, a lavish beach venue with valet parking and a wet/dry marina. Incomparable amenities, homes and a lifestyle to match.

©2023, Fiddler’s Creek Realty, Inc. Licensed Real Estate Broker. ORAL REPRESENTATIONS CANNOT BE RELIED UPON AS CORRECTLY STATING REPRESENTATIONS OF THE BROKER, BUILDER OR SELLER. FOR CORRECT REPRESENTATIONS, MAKE REFERENCE TO THE DOCUMENTS REQUIRED BY FLORIDA LAW TO BE FURNISHED TO A BUYER OR LESSEE. All features, amenities, prices and availability are subject to change without notice. Ownership of property within Fiddler’s Creek does not entitle an Owner to any right, title, interest or otherwise to use all planned Club facilities, but rather an opportunity to join, subject to the payment of assessments, fees and applicable regulations. All club facilities as presently proposed are not constructed nor will all proposed facilities be located within the property encompassed in the Fiddler’s Creek PUD. Development and construction of these facilities is contingent upon receipt of all applicable governmental permits and approvals. wet & dry NEW SINGLE-FAMILY HOMES FROM OVER $2.5M NEW COACH HOMES FROM OVER $1.5M FiddlersCreek.com | 239.732.9300

Publisher Liz Goodman

Editorial Director Daphne Nikolopoulos

Editor Cathy Chestnut

Creative Director Olga M. Gustine

Art Directors Diana Ramírez, Jorge Marquez

CONTRIBUTING WRITERS

Lisa A. Beach, Gina Birch, Robin F. DeMattia, Karen Feldman, Dick Hogan, Beth Lubereckii, Michele Meyer, Nanci Theoret

CONTRIBUTING PHOTOGRAPHERS

Brett Brown, Michael Caronchi, Wade Mastro

ADVERTISING

Liz Goodman at 239-595-7269

Advertising Services Coordinator Elizabeth Hackney

Marketing Manager Rebecca Desir

PRODUCTION

Production Director Selene M. Ceballo

Production Manager Lourdes Linares

Digital Pre-Press Specialist George Davis

Production Coordinator Ileana Cabán

Digital Marketing Manager Tyler Sansone

Advertising Design Coordinators Anaely J. Perez Vargas, Je rey Rey

OPERATIONS

Chief Operating O icer Todd Schmidt

O ice Manager Tanya Gomez

Accounts Receivable Specialist Ana Coronel

Distribution Manager Judy Heflin

Logistics Manager Omar Morales

Circulation Manager Marjorie Leiva

Circulation Assistant Britney Stinson

Circulation Promotions Manager David Supple

IT Manager Keith Gonzalez

Group Publisher Terry Du y

SUBSCRIPTIONS

800-308-7346

In Memoriam Ronald J. Woods (1935-2013)

HOUR MEDIA, LLC

CEO Stefan Wanczyk

President John Balardo

Published by Palm Beach Media Group North P.O. Box 3344, Palm Beach, FL 33480 • 561-659-0210 • Fax: 561-659-1736 • palmbeachmedia.com Copyright 2023 Palm Beach Media Group North LLC. All rights reserved. PUBLISHERS OF Palm Beach Illustrated • Naples Illustrated • Fort Lauderdale Illustrated • Palm Beach Charity Register • Naples Charity Register • Florida Design • Florida Design Naples • Florida Design Miami • Florida Design Sourcebook • Palm Beach Relocation Guide • Southwest Florida Relocation Guide Fifth Avenue South • Palm Beach 100 • Naples 100 • Art & Culture: Cultural Council for Palm Beach County • Pinnacle: Jupiter Medical Center Foundation • Waypoints: Naples Yacht Club • Naples on the Gulf: Greater Naples Chamber • Jupiter • Stuart • Aventura • Vero Beach Magazine • Community Report: Collier Community Foundation • Advances: Tampa General Hospital • Naples REALTOR®: NABOR® • O cial XII FIP World Polo Championship Magazine 1,000 People Move to Florida Every Day Advertise in Naples REALTOR ® and put your business on the path to success. Contact Publisher Liz Goodman to find out more! 239-595-7269 Providing affordable options in today’s challenging market. PROTECTING THE DREAM YOU MADE A REALITY MyAgent@MikeHornInsurance.com | (239) 597-1694 Visit MikeHornInsurance.com today! Proud Partner 10 NAPLES REALTOR® Q2 2023

The Most Legendary Waterfront Lifestyle Has Arrived In Naples

For those who long for a home where captivating modern design and a stunning coastal location are just the beginning, The Ritz-Carlton Residences, Naples redefines elegant Southwest Florida living. Endless Gulf views, white-sand beaches, a marina-front lagoon, more than 50,000 square feet of curated amenities, chef-inspired dining, and legendary Ritz-Carlton service have all come together in one exclusive address limited to just 128 residences.

The time has come to make your client’s life legendary.

The Ritz-Carlton Residences, Naples pricing from $4 million.

Sales Gallery now open 2355 Vanderbilt Beach Road Suite 106

Naples, Florida 34109 Phone 239-249-6260

RCRNaples.com

THE RITZ-CARLTON RESIDENCES, NAPLES ARE NOT OWNED, SOLD OR DEVELOPED BY THE RITZ-CARLTON HOTEL COMPANY, L.L.C. OR ITS AFFILIATES (“THE RITZ-CARLTON”). STOCK RESIDENCES, USES THE RITZ-CARLTON MARKS UNDER A LICENSE FROM THE RITZ-CARLTON, WHICH HAS NOT CONFIRMED THE ACCURACY OF ANY OF THE STATEMENTS OR REPRESENTATIONS MADE HEREIN. ORAL REPRESENTATION CANNOT BE RELIED

LESSEE. ALL RENDERINGS

PLANS

PROPOSED CONCEPTS SHOWN ONLY FOR MARKETING PURPOSES AND ARE BASED ON THE DEVELOPER’S CURRENT PRELIMINARY DEVELOPMENT PLAN. DEVELOPER RESERVES THE RIGHT TO MODIFY, REVISE OR WITHDRAW THE PROPOSED DEVELOPMENT PLAN IN DEVELOPER’S SOLE DISCRETION WITHOUT NOTICE. NOTHING HEREIN OR ANY OTHER COMMUNICATION SHALL BE DEEMED TO OBLIGATE THE DEVELOPER, OR ANY AFFILIATE OF DEVELOPER, TO CONSTRUCT THE PROJECT OR OFFER ANY OF THE PROJECT FOR SALE, AND NOTHING HEREIN SHALL BE DEEMED A GUARANTY OF ANY KIND. THIS IS NOT AN OFFER TO SALE OR SOLICITATIONS OF OFFERS TO BUY.

UPON AS CORRECTLY STATING THE REPRESENTATIONS OF THE DEVELOPER. FOR CORRECT REPRESENTATIONS REFERENCE SHOULD BE MADE TO THE DOCUMENTS REQUIRED BY SECTION 718.503, FLORIDA STATUTES, TO BE FURNISHED BY THE DEVELOPER TO A BUYER OR

AND

ARE

Kevin R. Lottes

Real Estate Corporate

239-552-4114

9132 Strada Place Suite 207

Naples, Florida

Kevin@LottesLaw.com

239-552-4178 (Fax)

A Florida Bar Board Certified Specialist in Real Estate Law, Kevin Lottes is proud to be named in the Best Lawyers in America for the eleventh year in a row. He credits these honors to his unwavering commitment to excellent client service.

FULL-STEAM INTO Q2

We began the year with tremendous momentum and a steadfast commitment to live out our mission of helping your real estate business grow.

As I re ect on my rst quarter as president, I am in awe of what volunteers and sta have accomplished on behalf of NABOR®. ey are executing our mission brilliantly and I am grateful for their contribution.

NABOR® held 31 classes in the rst quarter! e 100 series of Graduate, REALTOR® Institute (GRI) of classes was o ered. If you’re serious about boosting your income and career opportunities, complete the GRIdesignation and you’ll be recognized as a top-tier real estate professional.

e 2022 Year-End Real Estate Market Conference and the MLS Tech Conference gave attendees a professional advantage with the knowledge they gained. e Member Appreciation Night “Grease Party” brought light-hearted fun and entertainment to more than 100 well-deserving members. And members attending the RPAC Kicko Party invested in the REALTORS® Political Action Committee whose membership works on behalf of REALTORS® to protect the real estate industry and the dream of homeownership.

NABOR® will continue to provide all the tools you need to con dently compete and grow so you are well-prepared to assist homebuyers.

Best wishes for a successful second quarter,

Nick Bobzien NABOR® President

MESSAGE FROM THE PRESIDENT

12 NAPLES REALTOR® Q2 2023

The hiring of a lawyer is an important decision that should not be based solely on advertisement. Before you decide, please visit our website at www.lotteslaw.com to read about our qualifications and experience.

Welcome to a rare life within nature, nurtured by legendary service. With a private lagoon and aquatic preserve in your backyard. The Saltleaf marina and golf course in your neighborhood. And hospitality that frees you to enjoy it all. Select residences available from $2.8M, by London Bay Development. Sales gallery open daily. TheResidencesEsteroBay.com | 5000 Coconut Road, Bonita Springs, FL 34134 | 239.788.0155 WONDER OUTSIDE, WONDER INSIDE The Ritz-Carlton Residences, Estero Bay

or

by The Ritz-Carlton Hotel Company, L.L.C. or its affiliates (“The Ritz-Carlton”). LB Estero Bay Investments, LLC

The Ritz-Carlton marks under a license from The Ritz-Carlton, which has not confirmed the accuracy of any of the statements or representations made herein.

are not owned, sold

developed

uses

Your golfing friends at Eagle Creek invite you to

And tour our reimagined golf course and practice facilities, complete with new outdoor verandah. Visit JoinEagleCreek.com or contact Membership Director Laura Pelletier at 239-793-0500 for more details. Discover

Difference

the

A SANCTUARY ABOVE IT ALL

The Island at West Bay is setting a new standard of excellence in Southwest Florida with every aspect of its innovative design. Every residence enjoys a coveted corner position, with soaring 10' ceilings, designer finishes and wide terraces with optional summer kitchens complemented by breathtaking views as far as the eye can see. Ideally located within a prestigious gated community, residents will enjoy exceptional resort-style amenities along with a private beach club, in a setting winding through a world-class golf course — all recently updated.. Before you make your next move, we invite you to explore The Island’s boutique luxury lifestyle. For best selection and pricing, call the sales center at 239.948.9009.

ORAL REPRESENTATIONS CANNOT BE RELIED UPON AS CORRECTLY STATING REPRESENTATIONS OF THE DEVELOPER. FOR CORRECT REPRESENTATIONS, MAKE REFERENCE TO THE DOCUMENTS REQUIRED BY SECTION 718.503, FLORIDA STATUTES, TO BE FURNISHED BY A DEVELOPER TO A BUYER OR LESSEE. All artist’s renderings are proposed concepts shown only for marketing purposes and are based upon current development plans, which are subject to change by the developer, West Bay Hill, LLC, which reserves the right to make changes at its sole discretion, without prior notice or approval of purchaser. This project has been filed in the state of Florida and no other state. This is not an offer to sell or solicitation of offers to buy the condominium units in states where such offer or solicitation cannot be made. These plans do not constitute an offer where prior registration or other qualification is required. Prices, availability, plans, features, dimensions, specifications, and amenities are subject to change at any time without notice. All Rights Reserved, Equal Housing Opportunity. There are various methods for calculating the total square footage of a condominium unit and depending on the method of calculation, the quoted square footage may vary by more than a nominal amount. The dimensions stated in this brochure are measured to the exterior boundaries of the exterior walls and the centerline of interior demising walls and, in face, are larger than the dimensions of the “Unit” as defined in the Declaration of Condominium for The Island Condominium at West Bay Club, which are measured using interior measurements. All dimensions are approximate and all floor plans and development plans are subject to change.

ARTIST’S RENDERING

FOR OPENERS

FAIR HOUSING MONTH: 55 YEARS OF ENFORCING EQUALITY

Educational resources and training opportunities help REALTORS ® incorporate fair housing practices into their business and understand the importance of cultural diversity

BY BETH LUBERECKI

Signed into U.S. law in 1968, the Fair Housing Act aimed to put an end to discriminatory housing practices in real estate. The federal law prohibits discrimination related to the sale, rental, advertising, and financing of housing based on race, religion, national origin, sex, disability, and family status.

“People thought it was important for our country to acknowledge the importance of homeownership and the fact that everybody who could afford one should be able to own a home,” says Robert Morris, a National Association of REALTORS® director from Tennessee and an international speaker, certified instructor and trainer, and consultant.

Each April, the National Association of REALTORS® (NAR) and its more than 1.5 million members mark the passage of that significant piece of legislation during Fair Housing Month. Special events and educational opportunities offered during that month signify “a recommitment to expanding equal access to housing.”

That recommitment remains important: Even though more than 50 years have gone by since the Fair Housing Act became law, the needle hasn’t moved that far. Data from the U.S. Census Bureau shows that just over 45 percent of Black households owned their own homes in Q3 2022, compared with almost 75 percent of White households. That’s a 29-point gap—an even wider gap between Black and White homeownership than it was in 1960—years before the law was passed.

“We’ve made small strides in certain places and some bigger strides in other places,” says

Morris. “But we can’t necessarily say we’ve come a long way…as REALTORS®, we’ve got a lot of work to do.”

Educational Opportunities and Professional Certifications

Education plays a vital role in bringing about change, and NAR offers a variety of resources and training opportunities in that realm. The At Home With Diversity (AHWD) certification helps participants strengthen their understanding of fair housing laws and the importance of diversity in communities and develop skills and guidelines

uses real stories to help REALTORS® work through scenarios illustrating housing discrimination and practice how to respond to them. “It’s one of the best online simulations I’ve ever seen,” says Morris. “And it is free.”

Bias Override: Overcoming Barriers to Fair Housing is a new certificate course from the NAR that teaches REALTORS® about concepts like stereotypical thinking, identity, and implicit bias so they can learn how to combat problematic ways of thinking.

“It’s about understanding that we have personal biases, and we also have implicit biases,” says Morris. “Bias Override helps us

for working with multicultural customers.

“We try to offer the AHWD certification every year, and this year we are offering a certification course on Thursday, April 13, during Fair Housing Month,” says Paula Angelopoulos Urbinati, Naples Area Board of REALTORS® (NABOR®) Diversity, Equity, and Inclusion Committee Director and Chair. “We’re trying to share with our 8,000-plus members that we need to be conscious of words, and that words affect others.”

In 2020, NAR introduced Fairhaven, a fair housing simulation training. The simulation

with the understanding that we have these, and they play a huge part in how we treat one another. It doesn’t mean you can’t have personal feelings, but it means your personal feelings should not overflow into you doing a job of equal representation to all individuals.”

To gain a better understanding about fair housing, REALTORS® can attend two classes—Bias Override and Getting Up Close and Personal with Fair Housing with Robert Morris—as well as a reception.

The NABOR® Diversity, Equity, and Inclusion Committee is working to ensure

16 NAPLES R EALTOR® Q2 2023

There’s an even wider gap between Black and White homeownership than it was in 1960—eight years before the Fair Housing Act was passed.

that all the association’s members feel a sense of belonging—that all have a seat at the table. The committee currently has 15 members who actively chose to serve on the committee rather than being appointed to the role.

“I think that is wonderful,” says Angelopoulos Urbinati. “Asking someone to be on a committee that they maybe don’t feel comfortable with is not the same as someone who is excited.”

Striving to prevent discrimination and ensure equal access to housing for everyone,

along with working to create industry associations that are inclusive and welcoming to all, benefits the entire community in which REALTORS® live and work.

“Different people bring different perspectives to the table,” says Morris. “Different people have different thoughts and ideas and different exposures, and therefore you get a culmination of the best that comes together. If you don’t have different perspectives being interjected, you never expand and you never grow. There is immense value to having diversification in any group, no matter where it is.”

NA PLES AREA BOARD OF REALTORS® 17

Robert Morris

FOR OPENERS

NO QUICK FIX FOR INSURANCE WOES

BY BETH LUBERECKI

It looks like another challenging year ahead for the homeowners insurance market. That means REALTORS® will need to continue helping their customers navigate the difficult situation.

Rates are expected to remain high. “Rate increases of anywhere between 10 percent to 20 percent are what I foresee,” says certified insurance counselor Kimberly Vargas, agent/owner of Strategic Insurance Group.

Rates had already been on the rise, primarily due to what the Florida Association of Insurance Agents has called “unnecessary lawsuits from third-party contractors,” typically the abuse of assignment of benefits clauses. Almost 80 percent of all homeowners insurance lawsuits over claims filed across the United States are based in Florida. Add to that the damage from several hurricanes that have hit the state since 2016 and it’s easy to understand the turmoil in the Florida insurance market.

As a result, availability of insurance will remain limited, as carriers continue to be extremely selective in writing new policies in Florida or have stopped doing so altogether. But agents hope that new legislation signed into law in 2022 will help the situation.

Senate Bill 2D includes additional provisions related to assignment of benefits reform. It also says that insurers can’t refuse to write or renew policies on homes with roofs less than 15 years old solely because of the roof’s age.

Senate Bill 2A establishes the Florida Optional Reinsurance Assistance Program for the 2023 hurricane season. This bill:

∙ Helps insurance companies purchase reinsurance at reasonable or near-market rates so they can keep rates down for homeowners.

∙ Sets new deadlines for filing claims.

∙ Reduces the time allowed for companies to pay or deny a claim.

∙ Prohibits the assigning of benefits to a third

party for insurance policies issued on or after January 1, 2023.

These are all moves in the right direction, but it will take time for homeowners to feel the effects. “It’s going to take probably a few years for those changes to really have an impact on the market,” says Shannon Morgan, agent/co-owner of Prestige Insurance Consultants. “We didn’t get into this problem overnight, and it’s not going to be fixed overnight.”

Getting carriers back in the Florida insurance game is the goal. “A healthy environment of having multiple carriers willing to offer terms helps drive the cost down,” says Andrea Pelletier, client advisor, private risk services at Gulfshore Insurance.

Assisting Buyers

In the meantime, REALTORS® will need to continue to help educate their customers about the realities of the current insurance market, especially out-of-state buyers who may not be familiar with the Sunshine State’s insurance challenges. “Consumers for the most part are educated and seem to be aware of the struggles we’re having in Florida around insurance,” says Pelletier. “But there are still a few people who are not prepared for the insurance pricing.”

REALTORS® should ensure that buyers know the importance of wind mitigation and four-point inspections for getting the best possible rates (especially for older homes), and that it’s important to start the process of finding insurance as soon as possible. “Tell buyers that they need to start shopping for their insurance as soon as the contract is signed,” says Morgan. “Don’t wait until a week before closing. The benefit of shopping early is if someone tells you they don’t have anything, you can try another agent.”

When shopping for a policy, Pelletier says it’s important to understand the coverage terms and

The market for homeowners insurance will remain challenging for 2023

Andrea Pelletier

Kim Vargas

18 NAPLES R EALTOR® Q2 2023

Shannon Morgan

conditions and carrier’s nancial stability. “Price is important, because rates are expensive, but you always want to look at the carrier’s nancial stability rating, too,” she says. “A combination of an AM Best–rated policy, broad policy terms, and competitive pricing would be ideal.”

REALTORS® also can help their customers understand whether a property is in a ood zone and encourage them to consider ood insurance even if they

aren’t required to get it. (Senate Bill 2A requires Citizens Property Insurance Corp. policyholders to obtain ood insurance as a condition for eligibility.) “In Florida, we’re surrounded by water,” says Vargas. “Whether you’re in a ood zone or not, everyone should have ood insurance. at’s just the reality.”

If a seller already has ood insurance on the property, getting a copy of the declarations page for that policy can help the buyer get favorable rates for their policy. “It

helps buyers save on ood insurance if there already is a policy on the property, and it’s something that’s not usually asked for,” says Vargas.

In the end, Vargas sees the cost of insurance as something of a trade-o for easy access to the beach and the Florida sunshine. “People say we live in paradise, but everything does have a price unfortunately,” she says. “Compared to a lot of other states, we de nitely are more at risk here.”

NAPLES AREA BOARD OF REALTORS® 19

STERLING “R”

Joanne

Rick

CRYSTAL “R”

Matt

GOLDEN “R” P.

Smith

Jeff

Marcie

Scott Kish Carol

Nikki

Naples Area Board of REALTORS� Jayne

Izabela

Jacquie

David

Cheryl

Platinum “R” Brett

CIRCLE Paula

Golden “R” PRESIDENT’S CIRCLE Corey

Platinum “R” Phil

Platinum “R” Golden “R”

CIRCLE Crystal

Sterling “R”

Golden

Golden

Crystal

Golden

HALL OF FAME

Golden

Ron Abboud Rick Baranski David Arter Claudine Auclair Brenda Fioretti Ray Gonzalez Nancy Haroian-Wry

Chando Danielle Hudson Maurice Cossairt

Fioretti Renee Beechler

Marty Manion

Goodwin Mike Hughes Karin Thomas Dominic Pallini Jim Pilon

J.

Al DiNicola Gwen Davis-Gideon

Jones

Roggow

Kairis

Wood

Malinowski

Wright Debbie Zvibleman

Walter Tahlia Urbinati

Puskaric

Poteet Pat Pitocchi Allisa Pipes

Brown PRESIDENT’S

Angelopoulos Urbinati

McCloskey

Wood

Ryan Bleggi PRESIDENT’S

“R” Sara Brand PRESIDENT’S CIRCLE

Jeannette Batten PRESIDENT’S CIRCLE Christine Citrano

“R” PRESIDENT’S CIRCLE Nick Bobzien

“R” PRESIDENT’S CIRCLE Terrilyn VanGorder

“R” PRESIDENT’S CIRCLE Bill Poteet

“R” PRESIDENT’S CIRCLE

The Naples Area Board of Realtors® would like to thank the dedicated professionals who work hard to promote and protect the American dream of homeownership. Sponsored by Realtors® Political Advocacy Committee. Deborah Zalewski

“R” PRESIDENT’S CIRCLE

FOR OPENERS

EMISSARIES—FROM ONE PARADISE TO ANOTHER

Learn the benefits of NABOR ® ’s role as the Ambassador Association to Costa Rica and some of the ins and outs of referring customers to the country, which boasts a new multiple listing service

BY CATHY CHESTNUT

Allen Lungo has been living the expat life since 2004 in Costa Rica, where he has been deeply involved in property management and real estate for almost two decades.

Among other leadership positions in the industry, Lungo was president from 2011 to 2021 of the Costa Rica Global Association of REALTORS®, which has a bilateral agreement with National Association of REALTORS® (NAR).

Lungo is quite familiar with the Naples Area Board of REALTORS® (NABOR®), which has been NAR’s Ambassador Association to Costa Rica since 2018. rough this prestigious ambassadorship, NABOR® promotes business and global real estate relationships with the country and fosters cultural understanding.

With a primary goal of learning from each other, NABOR® shares best practices with Costa Rican colleagues, o ering guidance on ethics, professional standards, and licensing. NABOR® organizes an annual trade mission to Costa Rica that interested NABOR® members are eager to attend. It also o ers the NAR Certi ed International Property Specialist designation courses to International REALTORS®. Lungo has hosted the courses for 11 years and held the largest class in 2022 with instructor Brett Brown, NABOR® Global Business Committee Chair 2023.

Brown is proud of the partnership. “ is whole country knows where Naples is and what we do here,” he says.

Brown consistently receives inquiries from local REALTORS® and helps them connect with licensed professionals in Costa Rica who are members of the two NAR bilateral partners. “It’s amazing how many people here have a connection to Costa Rica,” notes Brown.

Even though Costa Rica is a popular place for Americans to visit, buy a vacation or investment property, and retire, it was lacking a multiple listing system—until now. Earlier attempts to establish listing platforms were limited and short-lived, but a comprehensive and standardized country-wide system launched this year that is generating excitement. “Only members of our professional organization, as well as those referrals from members that are a liated with us, will have access to this system,” says Rebecca Clower, president of Costa Rica Global Association of REALTORS®. “We are very excited to nally have a true, viable MLS system in Costa Rica.”

Brown stresses that it’s important to work with an International REALTOR® Member of NAR who subscribes to a Code of Ethics. ere are more than 500 International REALTOR® Members in Costa Rica, which is one of NAR’s largest bilateral partners.

22 NAPLES REALTOR® Q2 2023

PHOTOS PROVIDED BY BRETT BROWN

Why is it the Rich Coast?

Why are people attracted to Costa Rica? For a host of reasons, says Lungo. Among them:

∙ Low cost of living

∙ Stable democracy with a multiparty political system

∙ E cient, universal health care system

∙ Natural beauty featuring rainforests, beaches, and volcanoes; roughly a quarter of the Central American country is made up of jungle

∙ Temperate weather with two microclimates

∙ Two diverse coastlines along the Caribbean and Paci c

∙ Modern infrastructure, including internet interconnectivity, marinas, roadways, shipping ports, and two international airports

∙ A friendly populace where human rights and privacy are respected

∙ Culturally rich capital of San Jose

∙ Is working toward 100 percent reliance on renewable energy

What Local REALTORS® Need to Know

∙ NABOR® is planning a joint trade mission with the Chicago Association of REALTORS® from July 26 to August 1. e Certi ed International Property Specialist (CIPS) designation courses will be o ered from July 31 to August 5. Last year, more than 40 agents (from six states and four countries) attended the CIPS training. “ e networking was phenomenal,” says Brown. Check nabor.com for details.

∙ Only residents of Costa Rica can list and sell property in the country; otherwise, it is illegal. ere are various avenues to achieving residency and “it takes time and e ort,” says Lungo.

“Until then, we welcome all the referrals you send.” However, if you do not have a tax basis in Costa Rica, 15 percent of the referral commission earned is held back for taxes.

∙ REALTORS® in the United States are advised to work with an International REALTOR® Member who abides by the NAR Code of Ethics.

∙ All Costa Rican property transaction documents and contracts are in English.

∙ ere is a at property tax of one quarter of one percent per year.

∙ ere are two NAR bilateral partners in the country: the Costa Rica Global Association of REALTORS® and the Camara Costarricense de Corredores de Bienes Raices (CCCBR), also known as the Costa Rica Chamber of Real Estate Brokers Board.

NABOR® organizes an annual trade mission to Costa Rica that interested members are invited to attend.

NABOR® organizes an annual trade mission to Costa Rica that interested members are invited to attend.

NAPLES AREA BOARD OF REALTORS® 23

Left: Property tours during the 2022 trade mission in the Guanacasta area. Center below: PJ Smith, President Elect 2023; Marty Manion, NABOR® CEO; Nick Bobzien, President 2023; and Brett Brown, Global Business Committee Chair 2023, during the 2022 trade mission.

Inn Place

BY ROBIN F. DEMATTIA

Tourism is not only the largest industry in Collier County—it’s often the first step a future homeowner takes before contacting a REALTOR®.

“Someone will come down here on vacation and look around and realize that there are people who live here year-round, and they could, too,” says Paul Beirnes, executive director of the Naples, Marco Island, Everglades Convention & Visitors Bureau (CVB). “It is a migration protocol to this beautiful destination.”

Beirnes notes that 1.6 million people visit Collier County annually and that recent changes in the local hospitality industry—

from new owners updating properties to luxury resort properties opening—are attracting more affluent travelers. In January, the average cost of lodging tipped just over $310 per night, according to the CVB. Several new hotel rooms plus travelers willing to pay more to stay and play in Naples is good news for REALTORS® when tourists evolve into prospective customers.

Old Naples Hotel: Inspired by Local History

The Delray Beach-based Ocean Properties partnered with the Camalier family, Naples residents since 1964 and owners of significant properties in Naples and the Third Street shopping district to build the Old Naples Hotel at Gordon Drive, Broad Avenue, and Third Street South. The Cameliers say they were inspired by the town’s original Naples Hotel, which opened in 1889, and served guests for nearly 90 years. “The Old Naples Hotel will offer numerous amenities also open to its neighbors: a café/bar with outdoor dining, picturesque courtyard, hotel sundry shop, spa, and a small retail commercial space.”

New hotels and resorts are opening soon while others are being upgraded, drawing affluent visitors who come to play but may eventually decide to stay in Naples

24 NAPLES REALTOR® Q2 2023

Paul Beirnes

Renewal for The Ritz-Carltons

e Ritz-Carlton, Naples was being renovated top to bottom and expanding with new condominiums when it temporarily closed after Hurricane Ian. e original beach resort is one of the oldest properties in the Ritz family and has undergone several upgrades over its 35-year history. Among an impressive host of upgrades in what it calls the “Evolution of an Icon,” 35 guest suites are being renovated and 57 new ones are being built, bringing the total to 474. e project also includes a new lobby and lobby bar, an expansive Ritz-Carlton Club Lounge, three new dining outlets, ve pools (with some featuring luxury bungalows and cabanas), and a revamped spa. It is expected to reopen in this summer. e RitzCarlton Naples, Tiburón dropped “golf resort” from its name and introduced its new name in December to re ect its reinvention as a family destination with a miniature water park.

Naples Beach Club: A Historic Property Transformation

e former Naples Beach Hotel & Golf Club property is being transformed into

Naples Beach Club by the Athens Group and MSD Partners. e 125-acre resort with 1,000 feet of beachfront and a 216room Four Seasons resort with 20 luxury condominium units. e project will be developed in three phases; the rst phase is expected to be completed in 2024. It will include the hotel and residences, conference center, and Market Square, which will be anchored by a new restaurant, bowling alley, spa, and tness facility. e popular restaurants HB’s on the Gulf and the Sunset Beach Bar are being renovated.

Fresh Adventures: Great Wolf Lodge is 20-acre complex—the rst Florida location for the chain—is scheduled to open by summer 2024. It is being built on City Gate Boulevard near the Paradise Coast Sports Complex o Exit 101 of I-75, providing easy access to East Coast visitors and the regional airport. e resort will have 500 rooms, a 100,000-square-foot indoor water park, and 62,000 square feet of attractions, including an adventure park, dining, and event space.

The Ellington Planned to Open This Year is 10-story, 125-room luxury hotel with 24 condos and upscale dining is under construction at the corner of Tamiami Trail and Davis Boulevard. e developer, Indigo Road Hospitality Group, expects completion in late 2023.

Downtown Gateway: AC Hotel Naples by Marriott is 150-room hotel is rising next to the Gulfshore Playhouse cultural campus along Goodlette-Frank Road o the Tamiami Trail. Both major developments at the eastern gateway to downtown Naples are expected to be completed by the end of the year. “Construction is progressing well on the AC Hotel Naples, despite some delays caused by Hurricane Ian,” says Todd Turner, CEO of OTO Development. Local rms MHK Architecture & Planning and general contractor DeAngelis Diamond are partners on the project. “ e nished product will be stunning both inside and out,” says Turner. e three-story hotel will include a ground- oor café, 2,500 square feet of meeting space, and the Limón Rooftop Bar with indoor and outdoor seating.

New Names or New Owners

Several long-time landmarks have changed hands or names:

∙ e Naples Ramada was renovated with a contemporary touch and tropical décor and renamed to the Collins Hotel.

∙ e Trianon Old Naples, sold in November, is now the Capri Inn. It is part of the Opal Collection, one of 20 properties (including the Edgewater Beach Hotel) owned by Ocean Properties.

∙ e Inn of Naples kept its name but transitioned into the Tapestry Collection by Hilton, a portfolio of 90 independent hotels.

Clockwise from left: A rendering of the future Naples Beach Club; Great Wolf Lodge experiences coming to Collier County; a rendering of the expanded and upgraded The Ritz-Carlton, Naples, expected to open this summer; a rendering of AC Hotel Naples by Marriott rising near downtown Naples.

THE CRAFT

OTO DEVELOPMENT

Clockwise from left: A rendering of the future Naples Beach Club; Great Wolf Lodge experiences coming to Collier County; a rendering of the expanded and upgraded The Ritz-Carlton, Naples, expected to open this summer; a rendering of AC Hotel Naples by Marriott rising near downtown Naples.

THE CRAFT

OTO DEVELOPMENT

NAPLES AREA BOARD OF REALTORS® 25

THE RITZ-CARLTON RESORTS OF NAPLEST GREAT WOLF RESORTS

FOR OPENERS

26 NAPLES REALTOR® Q2 2023

Work-Life Harmony

Conquering stress in a 24/7 career

BY MICHELE MEYER

Run yourself ragged and you may unravel. We all need a work-life balance, but for driven entrepreneurs in the real estate world where buyers expect to shop 24/7, that can seem as elusive as a $25 million listing.

“You’ve got to gure out what’s o -kilter, then you can address your speci c issue and rebalance your life,” says Deb Logan, M.Ed., a registered dietitian nutritionist who is executive director of the Naples area’s Blue Zones Project SWFL, a wellness initiative found in 71 communities nationwide.

Here are eight tips—from Logan and Karen P. Forman, MBA, a psychotherapist with master’s degree in social work at Better y Counseling Services in Cape Coral—for gaining an even keel when you are feeling time-crunched or overwhelmed.

STRESSOR: “ When fear drives you, stress is constantly under the surface,” Forman says.

REALITY: Unaddressed, anxiety erodes resilience and zest.

RX: As musicians say, take ve. Schedule an hourly break to tune in to your body with mini-meditation sessions or deep belly breaths.

“Doing something unrelated to work helps you recoup,” Forman says. Solve a Sudoku, take a stroll, look at photos, or try deep breathing (counting to four as you inhale and longer as you exhale).

Need a well-being coach? Blue Zones

Project has a free “Power 9” website that delves into the nine lifestyle habits of the world’s longest-living, healthiest people and o ers a four-week plan for making these principles part of your lifestyle: bluezones. com/blue-zones-life

STRESSOR: e misconception that if you work harder, you’ll get more bang for your buck.

REALITY: You may miss details of contracts or double-book showings.

RX: Don’t be shy about utilizing your rm’s

assistants, Logan says. Rotate weekends and o hours or hire additional personnel.

State your limits—and stick to them, Forman says. ose include alerting clients and coworkers to when you’ll return calls— and when you’re unavailable.

Consider a separate email and phone for work. Vow to answer them at set times— which don’t include hours devoted to rest.

STRESSOR: You’re on the runand running on empty, so you skip meals, grab fast food, or eat cookies you’d set out for clients.

REALITY: You can store your own string cheese, cut veggies, and other snacks in the o ce refrigerator.

RX: Carry snack bars or packets of nuts and dried fruit in your car. Get a small cooler so “you can chill a salad or sandwich from a grocery store’s grab-and-go section,” Logan says.

STRESSOR: Resentment builds when you miss holidays or special moments due to work.

REALITY: “ ere’s no reason why you can’t pick a day and treat it like it’s a holiday,” Logan says.

RX: Gather friends for a feast or take a halfday or weekend to play tourist in town with a family member.

STRESSOR: You’re always waiting, whether it’s for clients to show or stalled tra c to move.

REALITY: Appreciate the break from constantly being “on.” “Downtime is so helpful,” Logan says.

RX: Rather than stew, disconnect mentally while waiting. Listen to music, do deepbreathing exercises, or write in a gratitude journal. “When we think about or write about what we’re grateful for, our brain releases feel-good dopamine hormones,” Logan says. “With gratitude, things look brighter.”

Also squeeze in a little exercise, “which is

a form of antidepressant,” Forman says. “Get to a showing 10 minutes early and walk the block or neighborhood.

STRESSOR: You do it all.

REALITY: You can’t be everything to everyone—you’ll burn out.

RX: “ Prioritize things you do best,” Forman says. “You’ll have more energy and passion— and that will enhance your credibility.”

STRESSOR: Me time? What’s that? It’s been forever since you’ve had any.

REALITY: Taking time out to recharge our batteries is imperative for well-being. Being exhausted makes us prone to error and frustration.

RX: Call, rather than text, friends. “If you can schedule an hour with friends, commit to it, even if it’s two weeks out,” Logan says. A round of golf or side-by-side pedicure with a friend combines self-care with socialization.

Find a “tribe” outside your profession and family, Logan says. You might join a Blue Zones walking group, form a healthycooking club, or volunteer for a cause. Don’t know where to begin? Start your search at Volunteer Collier (volunteercollier.com). Go to the beach to watch the sun set, Logan says. “ e gentle sound of waves makes you breathe di erently—and quiets the chatter in your head,” she says.

STRESSOR: You’re on your laptop searching for leads and clients before napping or going to bed for the night.

REALITY: e blue light from your laptop hampers and delays sleep, Forman says. RX: Avoid blue light an hour before bed, unless you’re wearing blue blocker glasses. Also create a sleep ritual. Take a calming bath or shower or sign up for Calm, Paci ca, Headspace, or another app that o ers sleep-inducing music or meditations. Avoid co ee after midday or alcohol three hours before bedtime.

NAPLES AREA BOARD OF REALTORS® 27

FOR OPENERS

Fighting Hunger in Collier County

BY GINA BIRCH

Collier County is home to some of the region’s most posh, high-end restaurants where one steak can cost triple digits— and there’s no shortage of patrons lining up to pay. It’s almost hard to imagine that more than 10 percent of Collier’s population, and nearly 20 percent of children, don’t know where their next meal is coming from, according to the Collier Community Foundation.

The number of food insecure residents spiked at the onset of the coronavirus pandemic with mass layoffs and furloughs. On its heels came supply chain delays, inflation, and, most recently, Hurricane Ian. Community leaders say the combination of these challenges has made it difficult for many to rebound financially.

The Collier Community Foundation distributes grants to local nonprofits combating hunger— totaling $1.68 million in 2022. In

the first six weeks following Hurricane Ian, the foundation provided $172,500 in emergency food assistance grants from the Collier Comes Together Fund, according to Cindi Withorn, the foundation’s senior director of marketing and public relations.

Helping residents living paycheck-topaycheck with the basic necessity of food can mean the difference between their ability to pay rent or eviction. That’s why local nonprofits are working diligently to assuage food insecurity, though leaders in the field don’t believe that the demand will go back to pre-pandemic levels anytime soon.

A HAND-UP TO SENIORS, CHILDREN, THE WORKING POOR

Harry Chapin Food Bank of Southwest Florida is the regional nexus for food distribution, supplying more than 150 partner agencies with nonperishables, fresh

produce, and other supplies to provide in their communities. Some 12.9 million pounds of food was supplied by Harry Chapin Food Bank to soup kitchens, church pantries, and other organizations in Collier County in 2021-2022. This is a significant increase over the pre-pandemic 5.65 million pounds distributed in 2018-2019.

St. Matthew’s House, one of the beneficiaries, saw a tenfold increase in need in March 2020, at the onset of the pandemic shutdown—providing groceries to 400 families each month before it skyrocketed to 4,000 families, according to St. Matthew’s House CEO Steven Brooder. “It just kept growing,” he says. It peaked at 25,000 families in April 2022.

After Hurricane Ian, the number of families aided dropped in half because distribution sites were damaged and closed. Brooder projects “13,000 to 15,000 households served

Nonprofits are working diligently to help the food insecure meet dynamic, unexpected challenges as the need continues to rise

28 NAPLES REALTOR® Q2 2023

per month” as sites reopened.

A typical pantry bag from St. Matthew’s contains enough dry goods, protein, and produce to feed a family of four for several days. Our Daily Bread, a Marco Island food pantry that’s also supported by Harry Chapin, distributes similar bags, as well as pet food. It’s not uncommon for financially struggling people to skip meals to feed their pets, notes executive director Amanda Nelson.

Although the general perception of Marco Island is of a wealthy community, Our Daily Bread was established in 2016 to serve island families and seniors, as well as the working poor living in East Naples. “Many people had no idea there was a need on Marco, but kids were coming to school hungry,” says Nelson.

Last year, it served almost 195,000 people from 16 sites “and the need continues,” Nelson says. Every Thursday and Friday, volunteers canvass about a dozen sites in

Naples and Marco, distributing food as well as hygiene items through Our Daily Bread’s mobile pantry, Al’s Pals.

Feed Thy Neighbor also canvasses Collier communities, feeding homebound elderly residents and the homeless, from families living in cars to those fighting addiction and sheltering in the woods.

Anthony Mansolillo founded Feed Thy Neighbor during the pandemic while trading recipes with an online group. A wheelchairbound woman in the group shared her recipe for stuffed peppers. “She said, ‘Boy, I wish I could still cook,’” Mansolillo remembers, so he made extra to deliver to her. The next day, a group member recovering from surgery asked for some peppers.

“In two weeks, I was up to 100 meals, and it just kept growing,” he says. Today, Feed Thy Neighbor operates out of kitchens at St. Monica’s Episcopal Church in Naples and

the Fort Myers Lion’s Club, serving 3,000 meals a week.

Meals of Hope also sprung from feeding the elderly in 2007, opening its first food pantry at Golden Gate Senior Center. Now the organization has 15 mobile pantries serving 4,000 families each week, according to president/CEO Stephen Popper. The pantries rotate locations targeting food deserts, where it’s difficult to buy affordable or good-quality fresh food. “A family shouldn’t go hungry just because they can’t get transportation to a pantry,” says Popper.

The day after Hurricane Ian, Meals of Hope teamed with World Central Kitchen, then as part of a coordinated effort overseen by the Collier Community Foundation. There has been an increase in the need for food following Ian, but Popper attributes the increasing need to “the inflationary costs of products” that’s difficult to bridge on a fixed income.

Several local nonprofits are on the feeding front lines, including Our Daily Bread and St. Matthew’s House (above). They assist families living paycheck to paycheck to keep roofs over their heads, homebound seniors, and residents constrained by fixed incomes in the face of inflation, among others.

NA PLES AREA BOARD OF REALTORS® 29

PHOTOS: COLLIER COMMUNITY FOUNDATION, ST. MATTHEW’S HOUSE

Home to MORE

At Ave Maria, more is an invitation and a promise.

More full days of getting out and about, without ever getting into a car.

More shopping, golf rounds, fishing trips, and bike rides in nature.

More of the impromptu, spontaneous fun that turns up the joy in life.

And with four renowned builders and an array of home designs from the $200s, you’ve got a lengthy list of reasons to come see us. Need

FOR OPENERS CAR MAGNETS

IN STORE FOR YOU

BY ANN MAZZEI, NABOR® STORE MANAGER

IN STORE FOR YOU

BY ANN MAZZEI, NABOR® STORE MANAGER

Turn your car into a mobile billboard! Car magnets are a great way to draw attention to your brand. Coste ective and long-lasting.

Member Price: $5.95-$7.95 Pick one up at the REALTOR® Store.

we say more?

WATER PARK PUBLIX® GROCERY STORE F rom the $200s – $800s | 239.352.3903 AveMaria.com 2 CHAMPIONSHIP GOLF COURSES TOWN CENTER OVER 25 MODEL HOMES ©2023 Ave Maria COMMISSION UP TO 3% 30 NAPLES REALTOR® Q2 2023

FOREWARN FOR REALTOR® SAFETY

A real-time information solution for real estate agents that takes the guesswork out of interactions with potential clients

Despite the continued expansion of information technology, the real estate industry remains dependent on personal interactions with costumers that they have zero or little veri ed background information about. FOREWARN provides instant knowledge, prior to a face-toface engagement, with a customer. According to the maker of the app, “Most real estate agents and brokers may now see between 40 to 50 percent of inquiries coming from unrepresented, unknown buyers.” Now you can research an individual by simply inputting their phone number and receiving critical information—property addresses, vehicle information, bankruptcies, liens, and criminal history—giving the REALTOR® a heads-up prior to doing business with that individual.

Cost: $20/month for one agent license. Discount brokerage and association accounts are available; the cost is dependent on the number of agents or members. FOREWARN is available both online and through a mobile app: forewarn.com

FOR OPENERS

COOL APP

Now Open in Naples, Florida (239) 734-2400 1421 Pine Ridge Road, Ste. 110 Naples, Florida 34109 VentureTitleServices.com We're Not Your Typical Title Company Our innovative approach, cutting edge technology, relaxed culture, and outstanding customer service set us apart. NAPLES AREA BOARD OF REALTORS® 31

REMARKABLE RESILIENCY EVIDENT AS COUNTY RECOVERS

BY KAREN FELDMAN

eptember 28, 2022 is a date indelibly etched into the minds of Southwest Floridians who experienced the fury of Hurricane Ian and its aftermath.

LIFE AFTER IAN S

The Category 4 storm that lashed the coast with 155 mph winds and storm surges of up to 15 feet devastated parts of Collier County, especially the Old Naples area. Yet within five months, the county had made remarkable strides in resurrecting the community and economy. Most businesses had reopened, homes were being repaired, residents were putting their lives back together, and tourists had returned in robust numbers. Another positive sign: The real estate market kept rolling as buyers continued to invest in the greater Naples area. According to the Naples Area Board of REALTORS® (NABOR®) December 2022 Market Overview, the median closed price in December was 13 percent higher than December 2021.

The community’s resilience “shocked everyone and impressed me beyond compare,” says Paul Beirnes, executive director of the Naples, Marco Island, Everglades Convention & Visitors Bureau. “The sense of rebound and resolve—whether it was neighbors helping neighbors or passionate customers of restaurants rolling up their sleeves to help dry out dining rooms—it was highly impressive.”

Nonetheless, that doesn’t mean it’s business as usual. Landmarks such as The Ritz-Carlton, Naples, sustained major damage and are being painstakingly restored. While the beach resort plans to reopen in mid-summer, others, such as Delnor-Wiggins Pass State Park, are closed indefinitely for repair. The partially opened Naples Pier stands testament to the hard work ahead.

32 NAPLES REALTOR® Q2 2023

NA PLES AREA BOARD OF REALTORS® 33

Here’s a look at some aspects of life and business in Collier County, five months after Hurricane Ian.

LAY OF THE LAND

Long after tons of storm debris were collected and blue-tarped roofs returned to shingled, issues linger. The Vanderbilt Beach neighborhood along Gulf Shore Boulevard was hard hit by the storm. Christa Carrera, a certified floodplain manager who operates Paradise Flood Solutions, found herself spending a lot of time in that area working with older condominiums built in the 1960s and ‘70s, prior to the adoption of stricter building codes and flood-elevation standards.

Carrera has been helping condo association boards make their way through the permitting process to repair damaged

buildings. The problem for many, she says, is “they are below the required flood-elevation standards and don’t meet code.”

Those that are deemed to be at least 50 percent destroyed are required to be torn down rather than repaired, a regulation that’s been around for a long time but isn’t widely known. Those older structures, especially the one-and two-story buildings, “will have a problem trying to rebuild” and, if they do manage to do so, are likely to find that insurance rates will be astronomically high. “That’s going to be a huge issue,” Carrera says.

She advises homeowners planning to buy a property— and for the REALTORS® assisting them in the process—to do their due diligence on the location, elevation, and insurance requirements of their potential purchase. “You live in a state surrounded by water,” Carrera warns. “Be informed.”

The iconic Naples Pier has been rebuilt several times since it was originally built in 1888.

34 NAPLES REALTOR® Q2 2023

Following Hurricane Ian's destruction, it was repaired and reopened to 100 feet west of the stairs. City leaders are planning a redesign and retrofits to make it more storm resilient.

INSURANCE WOES

The matter of coverage—which companies will be writing policies, what’s covered, the requirements for obtaining that coverage, and what it will cost—remains in flux.

“Everybody in Florida insurance was hoping 2023 was going to look so bright. The sun was going to shine,” says Rodiana Andis, owner of Andis Insurance Agency in Naples. “We were five years past (Hurricane) Irma, there seemed to be new availability and maybe some price decreases, then—bam!— Ian came, then [Tropical Storm] Nicole.”

The result, she says, is that “many companies have yet to write new policies.

Those currently writing are very limited and everyone wants to insure brand new homes.”

Andrea Pelletier, private client adviser at Gulfshore Insurance, says immediately following the storm there were fewer options overall, but for higher-end properties “a lot of the markets are opening up. Policies have been more expensive, and terms may be less favorable than before Ian” but it’s possible to write policies for them.

For clients who have coverage, “we are encouraging them to stay with their current insurer,” Pelletier says. “If you have a good carrier that is not pulling out of the state and you got a renewal that’s a 20 percent increase over last year, we recommend renewing it because you are probably not going to get anything better.”

And, although she wishes she had better news, she says it’s likely premiums will continue to rise as insurers calculate their losses from Ian, a process that will take years, not months.

Although it announced the move prior to the storm, United Property & Casualty, one of the largest home insurers in Florida, will leave the state May 31, cancelling 140,000 policies. In 2022, United Property & Casualty was one of 13 home insurers that announced plans to leave the Florida market, placed a moratorium on new policies, or went insolvent, according to the Insurance Information Institute.

Going forward, companies still writing policies will have stricter requirements for doing so. Andis says new guidelines will depreciate roofs so that the amount homeowners will receive on roof claims will decrease each year as their roofs age.

Older homes—that means anything built prior to 2002 when building codes were strengthened—will likely be harder to insure and will have to undergo both wind mitigation and four-point inspections, in which the condition of the home’s roofing, electrical, plumbing, and HVAC systems are assessed. The result of these inspections “determines whether they want to underwrite the policy or not,” Andis says.

That’s something Joe Nugent knows well. As owner of Joe the Home Pro, he and his team are working seven days a week,

completing 30 wind mitigation and fourpoint inspections weekly.

His company also performs mold inspections and can help homeowners pinpoint problems that may prevent them from getting insurance or cause health problems. “The insurance industry is dropping people right and left. People are in a tight spot,” he says. “They need to get insurance and we are trying to be that comfort for them.”

Even when the homes pass inspection, rates are on the rise due to a host of factors, including increasing home values, inflation, and extreme weather events throughout the country that have resulted in unprecedented claims.

Ardis is acutely aware it’s placing a strain on her clients, most of whom live east of the city and in Golden Gate Estates. “When they get the bill, it’s shocking,” she says. “Nobody can budget for that on a fixed income. Taxes have gone up. Insurance went up, association fees went up, flood insurance went up, cost of living and inflation have gone up. Our wealthier clients are doing all right, but the majority of consumers are struggling.” (See page 18 for more on insurance.)

STATE OF REAL ESTATE

The news isn’t all doom and gloom. When it comes to the dream of owning a place in the sun, even a hurricane the size of Ian can’t destroy it. People are still buying, including northerners looking for a winter escape or a warmer year-round residence.

“The frenzy we experienced in 2021 has slowed down, but it has not gone away. This is still a desirable place to be, especially in the wintertime. We still have low inventory— about two months’ worth—it’s still a seller’s market,” says Corey McCloskey, vice president of operations at John R. Wood Properties. “If REALTORS® are assisting sellers and listing appropriately, homes are still selling in a fast manner. It’s all about pricing.”

When potential buyers from elsewhere ask if an Ian-sized hurricane might happen again, McCloskey says, “No one has a crystal ball, but virtually all parts of the country are prone to natural disasters.”

NA PLES AREA BOARD OF REALTORS® 35

She points out that Southwest Florida’s geographic positioning gives it more protection from direct strikes than some parts of the state. Beyond that, she says, “It’s not like an earthquake or a tornado. At least we have a good amount of warning.”

Kyle Knight, D.R. Horton Southwest Florida vice president of operations, reports that demand for homes is strong and the division “is back to a normal sales pace for this time of year after experiencing a reduction in sales for approximately 60 days post-storm.”

While the company has resumed normal operations, it is experiencing some difficulties obtaining drywall and finding enough employees. “A large percentage of labor is focused on storm-related work, which tends to pay more in the short term,” he says.

Margaret Hodge, a certified appraiser and owner of Longview Appraisals, says from her perspective, the market is active and healthy. She isn’t doing as many appraisals as she did last year at this time but she attributes that to higher interest rates which might be leading to more cash transactions because they don’t require an appraisal. “There are still really good deals out there, including some homes that had some damage,” Hodge says. “It just depends on what you are looking for.”

FHA MORTGAGE INSURANCE FOR DISASTER VICTIMS

The Federal Housing Administration (FHA) Section 203(h) loan program for natural disaster assistance provides mortgage insurance to protect lenders against the risk of default on mortgages to qualified disaster victims to help those who have lost their home and are in the process of rebuilding or buying another home. Under 203(h), the owner of a primary residence that’s no longer habitable can get an FHA loan with nothing down rather than the required 3 percent down for a typical FHA loan. Insured mortgages may be used to finance the purchase or reconstruction of a one-family home that will be the principal residence of the homeowner. There are limits on the dollar value of the mortgage to ensure that it is serving low- and moderate-income people. (Learn more at hud.gov.)

MOVING FORWARD

McCloskey oversees the education, relocation, and technology groups at John R. Wood Properties in addition to selling real estate, so she is in a good position to advise other REALTORS® about how to move forward recover personally and professionally from the post-Ian tumult.

“If you weren’t affected that much, you tended to go back to business as normal,” she says. “But for those significantly affected, that leaves a different scar. They need help. Maybe they needed to leave their homes. We need to realize people need more support.”

To help support its members, NABOR® offered in-person and virtual events that addressed ways to cope with the emotional fallout for REALTORS® and their customers. “We’re not mental health professionals. We deal with the ups and downs of transactions. We’re not really equipped to handle things like that,” McCloskey acknowledges. “We wanted to support our members so they can support their customers.”

A program produced after the storm with NABOR® Helps, the organization’s charitable arm, they reminded participants to focus on what’s the most important: “You are

what needs to be rebuilt first.”

Even though work is hectic and can be all-consuming, McCloskey reminds REALTORS® to make sure they are caring for themselves and their families. “We went from a crazy market to COVID to crazy high sales to a hurricane,” McCloskey says. “For a couple of years, we’ve been running on adrenalin. We need to be taking care of ourselves. I hope people take more time for themselves—really invest in themselves.”

FINDING RENTALS

While homes for sale may remain plentiful, finding rentals became another matter because they were in high demand.

Anna Karras and her husband weren’t displaced by the hurricane, but it caused them problems, nonetheless. The couple planned to remodel their condo and moved out in July, renting a furnished place through September. When their contractor got backed up and the work was delayed, they extended the lease through November.

The hurricane delayed the project even more, but they couldn’t extend the lease on the rental. By then, rental properties at affordable prices were scarce to non-existent because of the storm.

36 NAPLES R EALTOR® Q2 2023

“A neighbor found us a place for a month, but the people who lived there were coming back so we had to move again,” says Karras, marketing coordinator for the Wilson G. Bradshaw Library at Florida Gulf Coast University.

They found a small house in an iffy neighborhood for January but “it has no internet and no cable,” she says. “My husband is retired, and we have one car, so he was stuck there with nothing to do.”

With the condo still not done, they looked yet again for a place to rent and couldn’t find anything for less than $4,200 a month, well above their budget. So, they moved— for a third time in three months—into a 960-square-foot condo with her father until their condo was done.

While work was finally happening, Karras says the delay was caused, in part, by the storm. “We heard from the contractor that the storm slowed things down further because their employees left to go to Fort Myers Beach where they could make more money,” she says.

VISITORS RETURNING

While restoration will take a long time, Naples and vicinity are open to visitors and the word appears to be out. That’s due, in

large measure, to the swift work of Beirnes and his CVB team.

In the weeks following the storm, they conducted daily calls with their representatives in places stretching from the United Kingdom and Germany to Latin America, spreading the word about what was happening here.

“We didn’t candy coat it,” Beirnes says. “But within two weeks we realized that restaurants on Fifth Avenue South and Third Street South were quickly able to rebound.”

His team videotaped unscripted testimonials showing people plucking up shells on Marco Island and others hanging holiday decorations in Naples, showing that normalcy was swiftly returning.

November visitor numbers looked promising, Beirnes says, with the traditional slowdown between Thanksgiving and Christmas. But January took off, with hotel occupancy rates exceeding those of 2019, even with The Ritz-Carlton, Naples, JW Marriott Marco Island Beach Resort, and LaPlaya Beach & Golf Resort closed for repairs. Visiting tourists were “saying it looks like nothing happened,” he says. “We’re the first to say it did, though, and we appreciate them coming back.”

Beirnes believes that the Naples area has “a very distinct obligation, not just for Collier County, but for all of Southwest Florida” to keep visitors coming to the area.

“It’s too easy to create a new tradition in Melbourne or Myrtle Beach,” he says. “We have an obligation to stem that vacation bleed. It would impact businesses, the workforce, flights into RSW (Southwest Florida International Airport). Tourism supports 35,000 jobs in this area. We are one big community.”

Beirnes says the message tourism officials are sending to potential visitors is that the best way to help the area recover is to continue visiting. Have that meeting or wedding or family reunion here.

“I think 2023 will be a banner year,” Beirnes predicts. “Despite that last quarter hiccup of last year, we ended 2022 on a record with 1.63 million visitors versus 1.5 million in 2021.”

The hurricane may have disrupted life Southwest Florida, but it didn’t rob the area of its inherent charms. “We have 30 miles of sand beaches, eco-adventures, wide open space,” Beirnes says. “We have what we’ve always had: We are a coastal, cultural, culinary, ecological gem.”

Left: Debris piled high along Gulf Shore Boulevard in the storm's aftermath. Below: The luxury coastal community of Barefoot Beach in North Naples was hard hit by Hurricane Ian's storm surge. A beach access point recently reopened though Bonita Beach Preserve isn't expected to reopen until 2024.

NA PLES AREA BOARD OF REALTORS® 37

MOVING INLAND

WILL HURRICANE IAN HAVE A POSITIVE IMPACT ON COMMUNITIES IN EASTERN COLLIER COUNTY?

BY DICK HOGAN

38 NAPLES REALTOR® Q2 2023

Eastern Collier County came through Hurricane Ian relatively unscathed compared to harder-hit areas to the west. There are early reports that some coastal residents headed east to rent or buy at least temporary shelter in the storm’s aftermath. How would a migration east affect the market?

“We have heard of people whose houses were damaged by the storm surge west of U.S. 41 temporarily renting or possibly even buying property east of 41 until their property was fixed up,” says Mike Hughes, vice president and general manager of Downing-Frye Realty. “I don’t know that I could say it’s been a huge windfall. It’s helped but I can’t tell you to what extent.”

So far, Shannon Lefevre, a REALTOR® with John R. Wood Properties, hasn’t seen an exodus from the coast. “I feel like Pelican Bay, Park Shore, Moorings, Coquina Sands, Port Royal— there’s an attraction to those areas for a reason,” she says.