BARINGS has confirmed its commitment to private credit and the wider private finance sector following a turbulent few months which saw a number of key staff leave the firm, resulting in legal action.

The global investment management firm has made a series of new hires in recent weeks, designed to bolster and grow its private market division.

Alternative Credit Investor can reveal that since the departures, Barings has committed and closed more than $1bn (£790m) in new global private finance deals, according to a source familiar with the company, and is in the process of recruiting senior investment professionals in North America and Europe as it seeks to grow the capabilities of its global private finance business.

It has built a team of more than 80 investment

professionals across its private finance platform, including Bob Shettle, who returned to the global private finance group last month as a managing director. Shettle had previously spent more than 20 years at Barings before leaving to pursue new opportunities four years ago.

“Global private finance continues to

be a key strategic focus for Barings and we are confident that with the leadership team’s deep experience in the market, along with the support of the more than 80 investment professionals across our global private finance platform, we will remain well-positioned to drive long-term value for our clients,” a Barings spokesperson

told Alternative Credit Investor .

Earlier this year, the private credit world was shocked when Corinthia Global Management – a brand new investment platform backed by investment giant Nomura – poached a number of top executives from Barings’ private credit division. Ian Fowler and Adam Wheeler, who >> 4

Keep abreast of the latest news and updates on the fast-growing alternative credit market by connecting with Alternative Credit Investor magazine on social media.

Twitter/X: https://twitter.com/altcreditnews/

Facebook: https://www.facebook.com/alternativecreditinvestor/

LinkedIn: https://www.linkedin.com/company/ alternativecreditinvestor/

Instagram: https://www.instagram.com/ alternativecreditinvestor/

Access our website at alternativecreditinvestor.com.

124 City Road, London, EC1V 2NX info@royalcrescentpublishing.co.uk

EDITORIAL

Suzie Neuwirth Editor-in-Chief suzie@alternativecreditinvestor.com

Kathryn Gaw Contributing Editor kathryn@alternativecreditinvestor.com

Hannah Gannage-Stewart Reporter hannah@alternativecreditinvestor.com

Selin Bucak Reporter

PRODUCTION

Tim Parker Art Director

COMMERCIAL

Tehmeena Khan

Sales and Marketing Manager tehmeena@alternativecreditinvestor.com

SUBSCRIPTIONS AND DISTRIBUTION tehmeena@alternativecreditinvestor.com

Find our website at www.alternativecreditinvestor.com

Printed by 4-Print Limited ©No part of this publication may be reproduced without written permission from the publishers.

Alternative Credit Investor has been prepared solely for informational purposes, and is not a solicitation of an offer to buy or sell any private debt product, or any other security, product, service or investment. This publication does not purport to contain all relevant information which you may need to take into account before making a decision on any finance or investment matter. The opinions expressed in this publication do not constitute investment advice and independent advice should be sought where appropriate. Neither the information in this publication, nor any opinion contained in this publication constitutes a solicitation or offer to provide any investment advice or service.

Who are the shining stars of the alternative credit space?

This year’s Alternative Credit Awards will answer that very question, celebrating the most influential lenders and service providers shaping the industry into what it is today.

As you can see from the list of categories on page 18, we’re not just looking to commemorate the largest players in the sector but recognise the wide variety of firms contributing to the industry’s success.

Nominations are currently open, so please make sure to submit your entries by 14 June to be in with a chance of gaining an accolade.

We will unveil the winners at a glittering awards ceremony in Central London this autumn, with more details to come shortly.

Best of luck!

SUZIE NEUWIRTH EDITOR-IN-CHIEFcont. from page 1

were co-heads of the global private finance team at Barings, were among the departures.

Within a week of the news being announced, reports emerged that several private credit fund managers were circling the Barings loan book looking for opportunities.

However, Barings swiftly hit back and has doubled down on its commitment to its private credit business.

Immediately following the departures, Barings transitioned to new global private finance leadership, named permanent investment

committees, and has continued to deploy capital and to support sponsors across new transactions, refinancings, and addon acquisitions.

Barings has also pursued legal action against Corinthia and its former employees.

In March, a US court granted Barings an injunction against Corinthia which required all former staff to return any confidential information relating to Barings’ clients by the end of the month.

In mid-May, Corinthia representatives asked a

14 March 2024 – Corinthia Global Management is launched with Paul Weightman, chairman of Cromwell Property Group, at the helm. In a press release announcing the launch, Corinthia described itself as a “start-up led by [Weightman] and ex-Barings global private finance heads.”

15 March 2024 – The full extent of the Barings exodus becomes apparent. It is reported that Ian Fowler and Adam Wheeler, who were co-heads of the private credit team at Barings, have moved into new roles at Corinthia, along with approximately 20 other private credit specialists. Brian High is appointed head of global private finance at Barings, succeeding Fowler and Wheeler.

18 March 2024 – Barings begins

judge to dismiss Barings’ lawsuit stating that Barings has not proven that it suffered any harm from the staff departure.

However, Barings is confident that it will prevail once the case has been heard.

“We have commenced litigation against Corinthia and some of its new leadership as a result of the defendants’ blatant disregard of their fiduciary and contractual obligations to Barings and our clients, which goes against Barings’ codes of conduct and ethics,” said a Barings spokesperson.

“We have full

legal action against Corinthia, suing both the company itself as well as former employees Ian Fowler and Kelsey Tucker. The lawsuit accuses Corinthia of “one of the largest corporate raids at an asset manager in years” and alleges Fowler and Tucker of misusing confidential information to recruit Barings employees.

19 March 2024 – Barings briefly pauses all new private credit investments while it deals with the fallout of the staff departure.

25 March 2024 – It is reported that Barings’ competitors are taking advantage of the staff tumult by looking for opportunities in the Barings loan book.

26 March 2024 - A US court grants Barings an injunction

conviction in the merits of our suit and will not sit idly by and allow the defendants’ misconduct to occur.”

At the time of writing, the new Corinthia private credit team had agreed to comply with their contractual obligations to Barings and its clients, including restrictions on using confidential information, soliciting Barings’ clients, and poaching additional Barings employees.

The staff exit has been described as one of the largest corporate raids at an asset manager in years.

against Corinthia, which requires all former staff to return any confidential information relating to Barings’ business by 31 March.

5 April 2024 – Barings says it is seeing increased investor demand for private placements.

17 May 2024 – Corinthia files a motion to dismiss the Barings lawsuit, saying that there is no evidence that the staff departures caused harm.

20 May 2024 – Barings announces that it has re-hired private credit veteran Bob Shettle to its private finance team, four years after he left the firm to pursue other opportunities. It is also revealed that Barings has grown its global private finance team to more than 80.

INSURERS and other institutional investors are increasingly seeking out investmentgrade private credit investments as interest in the sector grows.

According to a recent report from investment manager Voya, investment grade private credit is a $1tn (£0.78tn) market with issuance of between $100bn and $110bn per year. Voya has estimated that as many as 90 per cent of private placements are investment grade, with the majority of

issuances earning an equivalent credit score of between A- and BBB-.

Investment grades are assigned by independent ratings agencies such as Moody’s or S&P, and rank private credit instruments based on the quality of the underlying assets, the expertise of the investment team, and the likelihood of default.

Jeanine Arnold, senior vice president, leverage finance EMEA for Moody's Ratings, told Alternative Credit Investor that she has

seen rising demand for investment-grade private credit, particularly among insurance companies. In response, more private credit fund managers have begun intentionally structuring new products in a way that is intended to secure a higher investment grade.

“A lot of the direct lending emanated from smaller borrowers that were perhaps in competition with leverage finance,” she said.

“But the risk profile will probably improve in the

PRIVATE debt investors are showing a growing interest in the infrastructure sector, to help fund a proliferation of decarbonisation projects in need of capital.

In turn, this investor sentiment has been driving greater development of infrastructure capabilities among private credit asset managers.

Bridgepoint head of direct lending Andrew Cleland-Bogle said he has seen clear signs that investors are developing a greater interest in infrastructure.

“Currently I am hearing LPs, when I speak to them, talk about infrastructure more and more,” he said. “There's definitely more interest in infrastructure as an asset class.

“There are lots of reasons for that. One is the growth that will come in infrastructure investing as a result of global decarbonisation. Focusing on areas like that is a huge opportunity for a lot of people. The forecasted investment in that space is expected to reach $9tn (£7.1tn) a year through 2050. It has been growing and there’s no reason to think that won’t continue.”

In September 2023, Bridgepoint announced

its planned $20bn acquisition of North American infrastructure investor Energy Capital Partners (ECP) which has raised more than $30bn of capital since inception in 2005.

ECP is particularly focused on the energy transition sector, power generation, renewables, battery storage, environmental infrastructure and sustainability sectors.

And last month, Principal Asset Management announced the launch of its new private infrastructure debt capability, hiring MetLife veteran Mansi Patel to lead the new team.

Principal said the new unit would focus on thematic investments in globalisation, decarbonisation, and electrification.

sense that you won't just see private credit in what we would say is weaker Baa3 companies. They'll structure their products so that they can get an investment grade rating, precisely because they want to ensure that the insurance companies can participate.

“We're seeing a lot of private credit companies coming to us saying, how would you rate this? Could this be rated? And the objective is that they get an investment grade rating.”

“The launch of our private infrastructure debt capability comes at an opportune time for investors, given the powerful market forces driving tremendous capital needs across all infrastructure sectors,” Todd Everett, global head of private markets, said at the time.

Meanwhile, private credit giant Ares Management published a white paper on infrastructure debt in February which pointed to the “long-term, durable market tailwinds of the asset class”.

“Global infrastructure investment is expected to exceed $3.7tn a year through 2035, with a total gap of $5.5tn over the same period that is expected to be funded by private investors, whether via debt or equity,” Ares said.

PRIVATE credit valuations are “appropriately priced”, stakeholders have said, despite incoming regulatory scrutiny.

The industry has hit back at fears that the private credit market is overvalued, amid a flush of new retail investor money into the sector.

According to Preqin, the private credit sector is worth $1.7tn (£1.33tn), but JPMorgan recently suggested that the true value could be closer to $3tn.

Private credit funds have seen an influx of highnet-worth individuals (HNWIs) over the past year, drawing the attention of regulators on both sides of the Atlantic who have called for more transparency in the valuation processes.

However, Tim Warrick, head of alternative credit at Principal Asset

Management, has said that private credit “is appropriately priced, and there's a premium in the private credit market compared to the public market” despite tighter credit spreads.

“On the deals we're seeing, we're still seeing considerable value,” Warrick said. “We still think there's strong value when you consider not only valuations, but consider the structure with covenants on the deals we're looking at anyway, and lower leverage, which I think is maybe the most important thing in this consideration of risk-adjusted returns

of valuation.”

Laura Erwin, executive director, private asset valuations at S&P Global Market Intelligence, agreed, noting that private credit valuations are typically carried out by third parties such as ratings agencies, which apply rigorous analysis to each deal.

“Private credit valuations that are performed in accordance with industry best practices will appropriately value the positions in light of prevalent market conditions,” said Erwin.

“We hence encourage adoption of these valuation frameworks

across the private markets industry to help ensure the reliability of private credit valuations.”

The Financial Conduct Authority (FCA) has signalled that it will pay closer attention to private credit valuations in the future, as more and more HNWIs enter the space.

In a ‘Dear CEO’ letter sent earlier this year, the FCA confirmed that it will be conducting a multifirm review examining valuation practices for private assets. This will include “examining the personal accountabilities for valuation practices in firms, governance of valuation committees, the information reported to boards about valuations and the oversight by relevant boards of those practices”.

To read more about private credit valuations, go to page 10.

ELDRIDGE Industries, the investment house headed up by US financier Todd Boehly, is making inroads into the fast-growing private credit space.

Last month, it announced that it had launched a joint venture with Raymond James to offer private credit solutions to portfolio companies of

private equity firms.

Raymond James Private Credit will focus on four key sectors: consumer; diversified industrials; healthcare; and technology and services.

The announcement followed a Bloomberg report earlier in the month that Eldridge Industries is among the final bidders in talks to acquire private

credit firm Hayfin Capital Management. Hayfin specialises in European private credit deals and holds assets under management of more than €31bn (£26.4bn).

Boehly, Eldridge’s co-founder and chief executive, is a highprofile sports investor. He co-owns the Los

Angeles Dodgers baseball team and the LA Lakers basketball team.

In 2022, he led a group that bought Chelsea Football Club for £4.25bn.

The $1.7tn (£1.3tn) private credit sector is booming, with recent PitchBook analysis predicted that assets under management could soar as high as $2.7tn by 2028.

DIRECT lenders are taking an increasingly pragmatic look at lending to non-sponsor owned companies, as competition intensifies in the sponsorbacked market.

Christophe Rust, co-head of European credit opportunities at investment manager NinetyOne, told Alternative Credit Investor that the asset manager’s private debt portfolio consists purely of nonsponsor owned firms.

While many asset managers feel that sponsor-backed lending is less risky than nonsponsor, Rust said that for firms with the expertise and contacts required to originate the loans, non-sponsored presents a relatively untapped opportunity.

“We're not allergic to lending to sponsored borrowers,” he said. “But rather, what we are allergic to is partaking in competitive processes where we are price takers and where we are takers in terms.

“Our job is to pick the right credit. Whilst there are many non-sponsored borrowers that maybe aren't great, equally, there are many that are superb.”

He admitted that loan origination in the non-sponsor space is considerably more

difficult. It involves building a network of professionals who can refer borrowers, and then having the time and expertise to do thorough due diligence.

Rust estimates that of the approximately $1.7tn (£1.3tn) of assets in the private credit markets, around 70 per cent is currently with sponsorowned borrowers.

Another private credit fund manager, with a roughly 80 per cent sponsor-backed portfolio, told Alternative Credit Investor that he was making a concerted effort to attract more non-sponsor business as a point of differentiation in the market.

He agreed that the opportunity was often overlooked by asset managers that did not want to, or were unable to, originate loans in the non-sponsor space but disputed that private equity-backed companies were inherently less risky.

Meanwhile, Bridgepoint head of direct lending Andrew ClelandBogle said that 95 per cent of his portfolio comprises sponsorbacked companies.

While Cleland-Bogle was able to highlight two non-sponsor loans that made brilliant returns, he said that it was generally prohibitively onerous to source and diligence non-sponsor businesses. In contrast, Bridgepoint’s strong network of private equity-backed businesses provides a reliable pipeline of originations.

However, Cleland-Bogle is clear that non-sponsor is not fundamentally unsuitable for direct lending. “There’s some fantastic risk/return on offer in that market,” he explained. “We have financed businesses of that size, and we will do that where they’re growing fast, and we can see them on the cusp of graduating into the middle market, but they're

not just quite there yet.”

Blair Faulstich, senior managing director at alternative asset manager Benefit Street Partners, said that it is important for credit managers to differentiate their portfolio construction and highlighted that sponsor-backed lending should not be seen as a guaranteed way to mitigate risk.

“There’s an assumption with investors that sponsors will write incremental equity checks when a company is off plan, but that’s not how it always works,” he said.

Moody’s senior vice president Jeanine Arnold said that risk could not be calculated purely on the basis on whether a company was sponsor or non-sponsor owned.

“Ownership is important, but you cannot generalise at the end of the day,” she said. “When you're thinking about risk in this new environment of low growth, high rates for longer, contested valuations, you need to think about debt affordability, cash flow, which is back to fundamental credit analysis. And I’m pretty sure that is what asset managers lenders will be looking at. It's good, old fashioned credit analysis.”

Richard Roberts, head of origination and M&A at Arrow Global, explains how managers with a nuanced, local, and socially responsible approach can capitalise on opportunities in the real estate credit sector

TRANSITION FROM an era of cheap credit to one characterised by elevated base rates has reshaped the investment landscape. In this new environment, our real estate lending strategies offering flexible financing solutions appeal to investors as they benefit from the floating-rate nature of most loans. Our commitment to collaborating with strong sponsors to consistently deliver innovative, solutions-orientated investments throughout market cycles positions us well amongst lenders.

The withdrawal of banks from certain types of lending, driven by the capital demands of the Basel 3.1 regulations, has opened up new avenues for the private credit markets. These banks now prioritise either mass market lending in the form of residential mortgages, personal loans and credit cards, or services for large, platinum clients, leaving a gap that private credit is uniquely positioned to fill. Our strength lies in our local presence and expertise, allowing us to step into areas that require an intimate understanding of the market intricacies and operational complexity.

Geographically, in the diverse landscape of European private debt, the role of private credit varies significantly across regions.

In Southern Europe, for example, where banks are grappling with financial hurdles and balance sheet constraints, private credit becomes a good alternative to assist with client relationships without overextending their capabilities. Conversely, in Northern Europe, the focus is on optimising costincome ratios and asset efficiency, with banks often avoiding the operationally intensive lending required in sectors like agriculture, construction or small business lending. Here, private credit steps in to handle the ‘last mile’ of lending, supported by wholesale financing

area, the significance of localised insight and asset specialisation cannot be overstated. At Arrow Global, our approach to real estate lending and opportunistic credit is rooted in a deep understanding of local markets. This understanding enables us to opportunistically harvest investment opportunities in granular, off-market transactions. Central to our local understanding is our ownership and operation of 20 servicing platforms, managing approximately €80bn (£69bn) of third-party assets. This franchise not only provides us with a proprietary view of the market dynamics,

“ The sources of deal flow in today’s market are as diverse as they are dynamic”

from banks. This interplay between banks and private credit managers has become a cornerstone of the European financial ecosystem, with private lenders playing a crucial role in various capacities – be it as primary lenders in some regions or as partners in managing overflow lending or acquiring distressed assets in others.

In the growing but fragmented landscape of European private credit, with over 4,500 monetary financial institutions in the euro

but also uniquely positions us to identify and act on opportunities with precision and depth benefiting from a deep knowledge of local courts, banks, notaries, developers, service providers, and the tax and regulatory frameworks.

The sources of deal flow in today’s market are as diverse as they are dynamic. While the spotlight often falls on the commercial real estate sector, or large publicly traded non-performing loans, we opt to focus our attention on sectors where

our strengths can be fully utilised. Living sector assets, especially in regions like southern Europe, present value-add opportunities, particularly in hospitality credit, where our expertise runs deep.

In our lending business, we target sectors with strong underlying fundamentals, preferring liquid residential collateral, where there is a chronic undersupply across our markets. This focus supports long-term price resilience, enabling us to engage in attractively priced business ventures that benefit from favourable covenants and collateral, offering robust protection across all market cycles. The provision of conservative 60 per cent loanto-value senior financing on properties like an apartment block in Rotterdam’s up-and-coming Katendrecht district or Manchester’s fashionable Northern Quarter reflects our confidence in these types of investments, independent

of broader economic sentiment.

Our opportunistic credit strategies benefit immensely from our local platforms, which provide unparalleled insight into non-performing loans, distressed opportunities, and specialist credit situations. We excel in identifying and capitalising on deals backed by tangible assets including real estate backed credit and cash in court, where our on-the-ground presence enables us to value, access and liquidate, or add value to the underlying collateral. Such enhancements while holding the assets may include, for example, updating planning permissions, licencing a hotel to a leading operator brand, and making wholesale improvements to accommodation and leisure facilities. If the European market was entirely efficient, these strategies might not yield such interesting returns. However, the reality is a highly fragmented market, ripe with local, granular opportunities. This deep fragmentation is best illustrated by the fact that Europe has multiple languages, supervisory authorities, legal frameworks, judicial systems and tax regimes, as well as different cultures, customer behaviours and business practices.

The resilience of credit quality within private debt portfolios amidst current economic conditions is a testament to the improved lending standards since the global financial crisis and is reflected in investor confidence in the asset class with 91 per cent expecting it to perform better or the same this year. While higher performance is a function of higher interest rates, it also suggests impairments and defaults are not an issue for investors.

Institutional investors are increasingly recognising the strategic value of private debt in refinancing scenarios, especially as the landscape shifts away from traditional bank financing. They understand that it’s a good time to provide senior secured capital to borrowers who are delivering assets that are in short supply. Our locally driven model, which underscores local relationships and operational depth, aligns well with investors in search of reliable and insightful investment partners.

Beyond financial metrics, a successful investment programme must also address broader societal and environmental concerns. Our commitments to ESG principles, guided by the Principles of Responsible Investment and validated through standards such as GRESB, which assesses ESG performance data and peer benchmarks, is integral to our investment decisions. This reflects our dedication to make a positive impact on the communities and markets we operate in.

As we look to the future, the landscape for real estate lending and opportunistic credit in Europe is set to grow further, with an emphasis on specialisation, deep market knowledge and a commitment to sustainable and ethical investment practices. In this evolving landscape, our localised approach and strategic focus on niche sectors equip us to continue delivering value to our investors while delivering positive societal impacts.

More broadly, managers who embrace a nuanced, local, and socially responsible approach will be best positioned to capitalise on the European credit opportunity, thereby delivering substantial value to investors.

Is the private credit sector overvalued? As regulators circle, Kathryn Gaw reports on the hidden side of private market valuations

you ask, the private credit sector is worth between $1.7tn (£1.34tn) and $40tn. These figures are based on the assumed cumulative values of all private credit funds – values which have been meticulously calculated and independently verified. But in a persistently high interest rate environment, with ongoing economic instability on both sides of the pond, questions have been raised about the reliability of private credit valuations.

Leading these questions are the regulators. In the UK, the Financial Conduct Authority (FCA) has confirmed that it plans to undertake a review of private

opinion or valuation opinion.”

Meanwhile, a report from the International Organization of Securities Commissions has warned that the global private capital sector is too complacent about possible risks, including interest rate risk. Higher rates can cause stress for borrowers, and could lead to higher defaults further down the line, which could then impact on investor returns.

To the untrained eye, the valuation process for unlisted assets is far less transparent and therefore far more risky than public funds. However, industry insiders are adamant that their existing valuations processes are every bit as detailed and reliable as their public

“ We still think private credit is appropriately priced, and there's a premium in the private credit market compared to the public market”

market valuations. Last year, the US Securities and Exchange Commission (SEC) introduced new rules to improve the transparency of private market funds. These rules require all registered private fund advisers to “obtain and distribute to investors an annual financial statement audit of each private fund it advises and, in connection with an adviser-led secondary transaction, a fairness

counterparts. They are simply carried out behind closed doors.

“We compare the valuation of the private credit market to the public markets, and how credit risks should be priced based on the economic cycle and underlying credit issues along all the borrowers,” says Tim Warrick, head of alternative credit at Principal Asset Management.

“We still think private credit

is appropriately priced, and there's a premium in the private credit market compared to the public market.”

In the UK and the EU currently, the valuation of assets does not have to be carried out independently for UK and EU alternative investment funds. Most private credit managers carry out their own valuations. However, for some private credit offers, the type of analysis required can vary considerably and requires a high degree of expertise, which is typically provided by

the likes of S&P or Moody’s.

“Illiquid valuations are opinionbased with subjective inputs and assumptions,” explains Laura Erwin, executive director, private asset valuations at S&P Global Market Intelligence.

“Valuations of the same security may vary between investors based on valuation policy, investment insights and information rights. This valuation uncertainty is frequently captured through a valuation range provided for each position.”

S&P’s credit risk assessments

might involve scenario analysis and stress testing for more material positions. Valuations are also assessed through an annual audit cycle to ensure they have been performed in accordance with best practice standards, such as the International Private Equity and Venture Capital Valuation (IPEV) guidelines, and those set by the American Institute of Certified Public Accountants (AICPA).

“Any changes in credit health should be documented and appropriate adjustments made to

the discount rate,” says Erwin. Key risk factors include the quality of the borrower, the spread duration, and the overall spreads in the market at any given time. However, private credit managers are quick to point out that these risks are not new, and in many cases have already been priced into valuations.

“We still think there's strong value when you consider not only valuations, but consider the structure with covenants on the deals we're looking at anyway, and lower leverage, which I think is maybe the most important thing in this consideration of risk-adjusted returns of valuation,” says Warrick. Warrick believes that the leverage profile of these companies is much more attractive than it would have been two years ago in a lower rate environment. This means that companies will be in a better position to withstand uncertainty in economic conditions going ahead, even if the rate environment remains elevated for some time, given the lower leverage attachment and the fact that there is more equity in these transactions.

“Market risk is a vital component of the valuations process and is typically captured using an appropriate market benchmark,” explains Erwin.

However, market risks are evolving rapidly. The rising rates environment has started to test global credit fundamentals, and average leverage has been creeping upwards while interest coverage is compressing, limiting downside headroom. This makes valuation testing even more important across private credit portfolios which may be disproportionately exposed to higher-risk sectors such as consumer credit and real estate debt.

“I think we're starting to see an environment change, and we've started to see dispersion in performance as a consequence,” says Christina Padgett, associate managing director and head of leveraged finance research and analytics at Moody's Investors Service.

“And so I think it will be easier to see who's been complacent and who hasn't, who has created the right protections or the right structures.”

Moody’s’ expectation is that rates will come down this year. However, Jeanine Arnold, senior vice president, leverage finance EMEA for Moody's Ratings, believes that a more significant risk could be related to spreads.

“Spreads are very tight,” says Arnold. “And what is more of a risk is that the banks are now providing financing where spreads are exceptionally tight and private credit is having to react to that and having to bring their overall yield down, because the interest rate might be the same, but the spread has to come down in order for them to be competitive on a basis.”

Private credit managers have begun to talk more openly about the possibility of rising defaults this year as a result of these challenges. Yet defaults are still expected to remain below four per cent, even after all of these various risk factors have been accounted for.

“We expect some demand destruction,” says Warrick. “Some industries will experience flatter growth or potentially some contraction in certain industries, and that will put some pressure on the underlying borrowers.”

There will always be valuation uncertainty associated with private credit investments, as the value of the underlying assets will inevitably be affected by macroeconomic issues. Quarterly valuation updates are now the industry standard, but there has been a recent push to increase the frequency of valuation updates. Alternative Credit Investor is aware of one private credit manager which is currently planning to launch a fund with daily valuations. This fund

“ We expect some demand destruction”

will have a high level of exposure to middle market direct lending loans, and will be aimed at both institutional and high-net-worth individual (HNWI) investors.

Over the past couple of years, private credit funds have been increasingly targeting HNWIs in an effort to tap into the lucrative retail market. Retail investors are used to a certain level of transparency in their public market investments, and there is a growing sense that incoming regulation may be influenced by this new investor demographic.

One private markets expert, who asked to remain anonymous,

told Alternative Credit Investor that valuation regulations are seen as a way of protecting retail investors and educating them on the risks of private credit, ahead of an expected influx of retail cash in the coming years. They noted that the IPEV guidelines have been regulating private credit valuations for years. Therefore, if new regulation is introduced, it must be an education issue rather than a cause for concern.

“Private markets have been growing rapidly over the last several years,” notes Erwin. “With that level of growth comes increased scrutiny from investors

and regulators globally.”

Unsurprisingly, this level of oversight is not always welcome.

“We already have a lot of scrutiny and oversight from external auditors,” says Warrick.

“We don't believe there's any need for additional regulation. But we do believe it will become more and more transparent through time as more and more investors gain access to the asset class.”

Regulation appears inevitable, and it is likely to have an immediate impact on the private credit industry. For example, more compliance

professionals may be required to deliver the data that is requested by the regulators.

“If there are more compliance roles coming then there will be more data scientists required,” predicts Karen Sands, chief operating officer, private equity at Federated Hermes.

“The demands that we’re going to put on individuals mean that they’ll need to be multi-skilled.”

The higher cost of regulation could also impact investor yields.

“Regulation may have more of a purview as to ensuring that transparency is provided and consistency across managers,” says Warrick.

“But I don't think it's going to be burdensome or overly impactful. Right now the market is already evolving. Managers are already delivering what clients and investors are requesting and wanting to see. And that just naturally raises the game for all of our peers to provide the same level of transparency that we're providing.”

Incoming retail investors may request a higher level of transparency in private credit valuations, but the institutional investors who fund the majority of these deals do not appear to be too concerned about hidden risks. Over the past year, multiple institutions have either carved out new allocations for private debt or increased their existing allocations, in a vote of confidence which has seen private market investment values soar.

Regulation may create a few headaches for compliance departments, but as long as demand for private credit is booming, the value of the sector is likely to remain robust.

The growth and return opportunities for direct lending in Europe’s mid-market are highly attractive. With banks continuing to reduce lending volumes and increased market volatility reducing the predictability of public financing markets, private credit has emerged as a robust solution for borrowers and LPs alike.

However, direct lending portfolios have been tested by slower economic growth, the impact of higher rates, inflation, supply chain disruption and changes in the geopolitical landscape. Through a blend of scale, expertise, local market insight and disciplined investment processes, private credit managers in the European mid-market can capture this opportunity and create significant value through the cycle for both borrowers and LPs.

TO RECENT OECD

projections, euro area GDP growth is projected to be +0.7 per cent in 2024, with a pickup to 1.5 per cent in 2025 driven by wage increases in tight labour markets, increasing real incomes as inflation recedes, a gradual easing of credit conditions and ongoing disbursement of the Recovery and Resilience Facility funds.

This low, but positive, growth environment with improving conditions for private consumption and business investment will be supportive for credit, albeit with differences across industries. Many companies have significantly reduced costs, which should benefit margins as volumes grow. Improving supply chains and a reduction in rates from current cyclical

highs will feed through into stronger cashflow generation. Many industries in Europe are still in the early phases of consolidation, which provides further value creation levers for management teams and private equity shareholders. By building scale, geographic reach and product diversification, companies can drive profit growth and multiple expansion even in a lower growth environment. This trend has supported deployment volumes in more volatile markets. An easing macro backdrop will further accelerate this M&A trend going forward. Within this environment, identifying the strongest sectors and positioning to lend to the strongest companies requires a full-scale investment platform led by experienced investment professionals.

Local markets expertise: A cornerstone of success

Each of Europe’s main countries have a distinct local landscape, legal framework and set of regulations. Successfully navigating each market for LPs requires deep local knowledge, strong relationships and dedicated local presence. Local presence is a key enabler to seeing and accessing the best new investment opportunities.

It enriches the investment process with local insights and establishes a local point of contact with sponsors and management teams for ongoing oversight. Through maintaining close, local contact during the full investment lifecycle, lenders can address any borrower needs early and protect LP capital. However, establishing this level of depth and breadth takes time. Pemberton was built with this in

mind. Today, our nine European office network and a substantial investment team with extensive experience in credit markets are the foundation for our strong relationships with advisors, private equity sponsors, and borrowers enabling timely access

and alignment with LPs.

Pemberton’s investment process incorporates a combination of relative value analysis, comprehensive due diligence, detailed financial scenario modelling, in house legal expertise for documentation, and industry

“ A broad footprint and a substantial investment team are a key enabler to accessing the best new investment opportunities”

to new opportunities and engage in proactive portfolio monitoring. Combined, these elements help enhance the quality of both deployment and returns for LPs.

As businesses increasingly seek to scale across Europe, Pemberton’s role as a strategic financing partner with local expertise becomes even more critical. Our partnership approach provides long-term capital to businesses backed by leading private equity sponsors and ambitious business leaders for buyouts, growth financing, add-on acquisitions and other general corporate purposes.

Strategic Investment:

Approach and process

To help drive fund performance throughout the cycle and maximize value for LPs, our investment process is both rigorous and disciplined. Led by seasoned credit professionals, it incorporates multiple stages of critical evaluation to ensure the highest standards of due diligence and strategic decision-making. Upholding stringent documentation standards and proactive management ensures consistent asset selection over time and cultivates a clear risk profile, while also fostering transparent relationships

leading ESG engagement.

Investment decisions are made by a committee of experienced leveraged finance origination, credit, and portfolio management professionals with extensive backgrounds in deal structuring, underwriting, monitoring and workouts.

Central to Pemberton’s platform and our flagship strategy is our mid-market debt strategy, which provides first lien, senior secured loans to leading borrowers in the core mid-market segment, targeting leading businesses with €15m (£12.8m) to €75m in EBITDA.

The first lien focus creates significant cushion across the

The majority of Pemberton’s direct lending supports private equity owned businesses, either financing a new buyout or providing incremental financing to a portfolio company that is making an acquisition to build scale. In our experience, private equity shareholders can provide significant operational and financial support to borrowers and can also help ensure governance and ESG structures are in line with best practice.

Lender protection and safeguarding capital

Building in appropriate lender protections on each investment in the form of maintenance covenants, limitations on additional debt and restrictions on value leakage are important to ensure borrowers operate within acceptable parameters.

In instances where borrower performance deviates from expectations, an anticipated or actual covenant breach presents an opportunity to reassess risk pricing or adjust leverage as necessary. Lenders must be ready to act swiftly in such scenarios to safeguard LP capital and a robust monitoring process bolsters the ability to

“ Private credit is maturing and proving itself as a strong asset class”

portfolio to absorb any changes in valuation over the life of the fund, and the core mid-market focus reduces competition with other financing providers such as the syndicated market. These elements collectively contribute to a successful investment approach and process, with consistent returns and minimal realised losses.

proactively detect potential issues.

As the sole or lead lender to most portfolio companies, Pemberton is able to promptly take necessary actions to drive outcomes in the best interest of our LPs.

Senior members of our investment team have significant experience leading workouts and restructurings across a wide range of market

conditions, enabling us to deliver the necessary expertise and support to portfolio companies.

The outlook for private credit in Europe remains promising, characterized by attractive returns, lower risk metrics, and

a revitalised M&A landscape. The overall opportunity set is growing as a result of industry consolidation, banks continuing to scale back lending to mid-market companies and increased private equity capital raised in Europe. Private credit is also maturing and proving itself as a strong

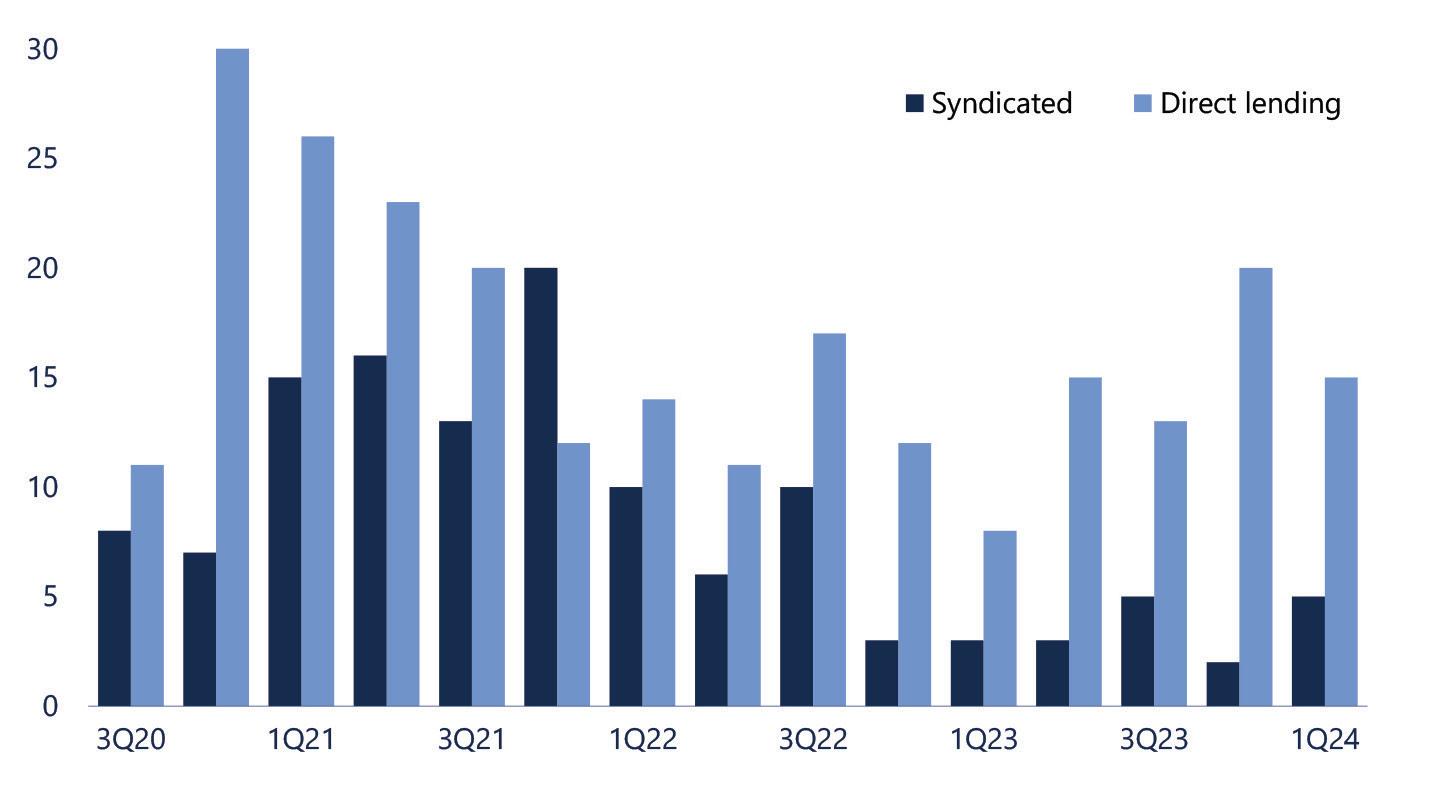

Source: PitchBook – Data through 31 March, 2024. Data reflects cumulative buyout dry powder. European count of LBOs financed via BSL vs direct lending

|

18

asset class. Expected returns have increased, with Pemberton’s recent mid-market debt investments averaging approximately 12 per cent in gross expected yield – an increase of 200-300 basis points compared to our historical targets.

We have also seen leverage levels come down, with the average leverage in recent investments at ca. 4.0x – 4.5x EBITDA (ca. 0.5x – 1.0x lower than historical levels) while loan-to-value ratios are around 45 per cent (ca. 5 – 10 per cent lower than historical targets). This combination of reduced leverage, higher equity cushions, and enhanced returns demonstrates highly attractive performance on both an absolute and a risk-adjusted basis. Despite the challenges created by the macroeconomic backdrop and the market-wide M&A slowdown in 2023, we continue to experience a surplus of investment opportunities, a trend we expect to continue as M&A volumes increase. This supply/demand imbalance allows us to maintain a high level of selectivity when making new investments. Historically, only around 10 per cent of investment opportunities have made it through our initial investment committee and into the detailed due diligence phase, a trend we expect to continue. We also expect private equity sponsors in the mid-market to continue to look first to private credit for M&A financing given the execution certainty, confidentiality, and follow-on capital that direct lenders can provide.

This communication is provided for information purposes only. Pemberton Asset Management group of companies (collectively, Pemberton Asset Management) may provide the direct lending that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but Pemberton Asset Management does not warrant its completeness or accuracy except with respect to any disclosures relative to Pemberton Asset Management and an analyst’s involvement with any company (or security, other financial productor other asset class) that may be the subject of this communication. Investments of a direct lending nature are likely to be long term and of an illiquid nature. Such investments are also likely to involve an above average level of risk. This document does not purport to identify the risk factors associated with such investments and prospective investors need to make their own assessment. There is no guarantee of trading performance and past or projected performance is no indication of current or future performance/results. The value of investments may fall as well as rise.

An investment in direct lending is suitable for sophisticated investors only and requires the financial ability and willingness to accept for an indefinite period of time the risks and lack of liquidity inherent in the market.

Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument or direct lending opportunities.

Our research does not provide individually tailored investment advice. Any opinions and recommendations herein do not consider individual client circumstances, objectives, or needs and are not intended as recommendations of particular finance transactions, investments or strategies to particular clients. You must make your own independent decisions regarding any finance transactions, investment or strategies mentioned or related to the information herein. Any opinions expressed in this document do not constitute legal or tax or investment advice and can therefore not be relied upon as such.

Periodic updates may be provided on companies, borrowers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, Pemberton Asset Management may be restricted from updating information contained in this communication for regulatory or other reasons. This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Pemberton Asset Management. Any unauthorised use or disclosure is prohibited.

Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorised officer of Pemberton Asset Management. This document has been prepared and issued for use in the UK and all countries outside of the European Union and Middle East by Pemberton Capital Advisors LLP. Pemberton Capital Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”) and entered on the FCA Register with the firm reference number 561640 and is registered in

England and Wales at 5 Howick Place, London SW1P 1WG, United Kingdom. Registered with the US. Securities and Exchange Commission as an investment adviser under the U.S. Investment Advisers Act of 1940 with CRD No. 282621 and SEC File No. 801-107757. Tel: +44(0) 207 993 9300.

This document has been prepared and issued for use in the European Union by Pemberton Asset Management

S.A. Pemberton Asset Management

S.A. is authorised and regulated by the Commission de Surveillance du Secteur Financier (“CSSF”) and entered on the CSSF Register with the firm reference numbers A1013 & A1342 and is registered in Grand Duchy of Luxembourg at 70 route d’Esch, L 1470. Pemberton reports to the US. Securities and Exchange Commission as a reporting exempt investment adviser under the U.S. Investment Advisers Act of 1940 with CRD 282865 and SEC File No. 802-107832. Tel: +352 26468360.

This material is being distributed/ issued in the Middle East by Pemberton Capital Advisors LLP (DIFC Branch) (“PCA DIFC”). PCA DIFC is regulated by the Dubai Financial Services Authority (“DFSA”).

This document is intended only for Professional Clients or Market Counterparties as defined by the DFSA and no other person should act upon it. Please note that this Fund is not based in the Dubai International Financial Centre (“DIFC”).

This material relates to a Fund which is not subject to any form of regulation or approval by the DFSA.

www.pembertonam.com

Pemberton is a registered trademark. © Pemberton

Contact us to find out more: +44 (0) 20 7993 9300 | info@pembertonam.com

We are delighted to announce that nominations for the Alternative Credit Awards are now open, celebrating the best and brightest in the alternative credit industry.

We are commemorating a wide variety of lenders and service providers at this year’s awards. Please see the full list of categories below:

• Senior lender of the year

• Mezzanine lender of the year

• Junior lender of the year

• Lower mid-market lender of the year

• Fund manager of the year

• Real estate debt manager of the year

• Infrastructure debt manager of the year

• Distressed debt manager of the year

• Special situations debt manager of the year

• Venture debt manager of the year

• Impact fund manager of the year

• Climate transition fund manager of the year

• Innovative fund of the year (Sub $1bn)

• Innovative fund of the year ($1bn+)

• Fund of the year (Sub $1bn)

• Fund of the year ($1bn+)

• LTAF of the year

Go to the awards section of the Alternative Credit Investor website for more information on how to submit your entries.

You can apply for as many categories as you like. All submissions will be kept confidential.

The deadline for all nominations is Friday 14 June.

The shortlist and winners will be decided by Alternative Credit Investor‘s editorial team and a panel of independent judges. The winners will be announced at a glittering awards ceremony in Central London this October, more details to come shortly.

• ELTIF of the year

• Private credit CLO deal of the year – fund manager

• Private credit secondaries fund of the year

• LP/Investor of the year

• Market commentator of the year

• Bank partnership of the year

• Wealth market proposition of the year

• Pensions solution of the year

• Performance of the year (Sub $1bn)

• Performance of the year ($1bn+)

UK small to mid-cap finance providers:

• UK property development lender of the year (sub£1bn)

• UK bridging lender of the year (sub-£1bn)

• UK SME finance provider of the year (sub-£1bn)

• P2P lender of the year

• IFISA provider of the year

Service providers:

• Audit

• Compliance service

• Custodian

• Credit consultants

• Cyber security solution

• Data provider

• Executive search firm

• Fund administrator

• FX solution

• Insurance

• Law firm of the year –transactions

• Law firm – fund structuring

• Private credit CLO deal of the year – law firm

• Placement agent

• Ratings provider

• Tax adviser

• Valuations service of the year

COLLECTIONS ARE A vital part of the peer-topeer lending ecosystem. They offer a final safety net to investors once all other avenues for repayment have been exhausted. However, for many lenders collections will only become a consideration at the very end of the loan term. By contrast, Kuflink’s collections process begins from the moment that a new loan is agreed.

The platform follows an eight-step process (see box-out) to ensure that recovery action can be avoided. This approach is clearly working for the P2P lender. During the first four months of 2024, approximately £4.5m was redeemed per month across 60 loans due to Kuflink’s current loan management processes. And despite ongoing macroeconomic volatility, Kuflink

has not yet seen an increase in recovery activity.

“We update our investors as soon as we are made aware a loan will not repay on time and thereafter, we provide updates at least on a monthly basis,” says Hiran Patel, chief risk officer at Kuflink.

“If we were aware that our investors may incur a loss, we would let them know as soon as possible

Step one: Each approved borrower receives a welcome letter outlining any associated loan conditions, which are imposed by the underwriting team to be completed within certain timeframes once the loan went live.

Step two: Kuflink ensures that communication with borrowers is ongoing until these conditions are met.

Step three: At the loan’s midpoint, a reminder is sent to borrowers to address loan conditions and discuss potential exit strategies.

Step four: 12 weeks before the loan’s expiry date, borrowers are contacted to ensure steps have been taken to achieve repayment of the loan, such as refinancing or the sale of the property.

Step five: Eight weeks before expiry, there is a follow-up to ensure borrowers are progressing with repayment plans.

Step six: Six weeks before the expiry of the loan term, Kuflink’s solicitor is instructed and contacts the borrower with redemption instructions.

Step seven: Four weeks before expiry, there is another check-in to ensure repayment plans are on track.

Step eight: Two weeks before expiry, further contact is made to confirm progress in the exit strategy, such as evidence of refinancing.

but, to date, our investors have not had to incur any losses.”

By 31 March 2024, two per cent of Kuflink’s loans were overdue by less then 30 days, and 12 per cent were overdue by less than 180 days. 15 per cent of the platforms’ loans were with a recovery agent.

“If repayment isn’t achieved by the expiry date, the collections process entails negotiating repayment plans and, if necessary, legal action,” explains Patel.

“Kuflink has a dedicated team for collections and loan management to minimise investor losses.”

Nattalie Weeks, head of portfolio at Kuflink, says that building relationships with borrowers has proven beneficial for Kuflink over the past few years and allows the platform to anticipate payment delays and work with the borrower to achieve the best outcome. This is particularly important during periods of economic volatility.

“During economic uncertainty like recessions, collections processes may intensify to address higher default rates,” explains Weeks.

“Kuflink might implement stricter lending criteria such as reducing our loan to values, increase borrower communication to assess financial situations, and expedite collections to minimise losses.”

Patel and Weeks would like to see more borrower screening in the P2P landscape, as well as more proactive collections strategies. Early payment issue detection technology, and increased support for financially struggling borrowers could soon become the norm, especially if there is a rise in defaults across the industry this year. Until then, Kuflink will continue doing what it does best, and prioritise a rigorous collections process which benefits both borrowers and investors.

Assetz Exchange is a property investment platform delivering long term stable income for investors, primarily through the purchase and leasing of housing for social good. Regulated by the FCA, it provides the opportunity for investors to create a diversified property portfolio and alternative funding options for the housing sector.

www.assetzexchange.co.uk

T: 03330 119830

E: info@assetzexchange.co.uk

easyMoney is a peer-to-peer property lending platform that is fully authorised by the Financial Conduct Authority #231680. It has £164m+ in investor funds currently deployed and £280m+ in total loans written to date. It has had no borrower defaults and no investor has ever made a loss. Among P2P firms surveyed by Alternative Credit Investor it has the largest active Innovative Finance ISA portfolio, with over £66m currently invested.

easyMoney.com

T: 0203 858 7269

E: contactus@easymoney.com

Folk2Folk is a profitable UK lending and investment platform. More than half a billion pounds has been invested via the platform with no investor losses to date. Loans are a maximum of five years, secured against land/property at a maximum 60 per cent LTV, with a fixed rate of between 7.5 and 9.5 per cent, per annum.

www.folk2folk.com

T: 01566 773296

E: enquiries@folk2folk.com

JustUs is an innovative peer-to-peer lender that provides a range of consumer and property-backed loans. It has lent out more than £25m and paid more than £1.7m in interest to lenders to date. Investors can enjoy returns of up to 10.98 per cent, with all products eligible to be held in an Innovative Finance ISA for tax-free earnings.

www.justus.co

T: 01625 750034

E: support@justus.co

Kuflink is an award-winning lender and online investment platform. With over £280m invested through the platform, investors can customise their own portfolio investing in specific loans or in a pool of loans diversified across a number of opportunities. Earn up to 9.73 per cent (compounded) per annum, with an IFISA available.

www.kuflink.com

T: 01474 33 44 88

E: hello@kuflink.com

LANDE is a crowdfunding platform that gives investors access to secured agricultural loans. It has created a unique scoring model, accessible infrastructure, and a variety of products so that farmers are able to access financing quickly and easily. With LANDE and its investors as partners, farmers can become more independent and sustainable, while improving their yield, efficiency and profitability. Projects offer interest rates of up to 14 per cent per annum.

https://lande.finance

T: +371 20381802

E: info@lande.finance

Lendwise is the UK’s only peer-to-peer lender that is dedicated to impact investing in education finance. Investors finance education for borrowers at universities and business schools across the UK and globally. Investors define their own risk appetite and use Lendwise’s AutoLend feature to diversify their strategy across a pool of loans, which can be invested in an IFISA wrapper earning average returns of up to nine per cent per annum.

www.lendwise.com

T: 0203 890 7270

E: lenders@lendwise.com

Lending for over eight years, Somo is a seasoned bridging lender specialising in providing short-term secured loans against UK property. Somo gives its lenders the opportunity to tailor their investments according to their risk tolerance, selecting interest rates and loan-to-value ratios that align with their preferences, with a minimum investment of £5,000.

W: www.somo.co.uk/how-it-works

T: 0161 312 5656

E: investors@somo.co.uk

The European Crowdfunding Network (EuroCrowd) is an independent, professional business network promoting adequate transparency, regulation and governance in digital finance while offering a combined voice in policy discussion and public opinion building. It executes initiatives aimed at innovating, representing, promoting and protecting the European crowdfunding industry. www.eurocrowd.org

E: info@eurocrowd.org

Q2 creates simple, smart, end-to-end lending experiences that make you an indispensable partner on your customers' financial journeys. Its modular platform gives you the ability to manage lending simply throughout the entire loan lifecycle, from application, onboarding, servicing to collections. The result is a better experience for both borrowers and lenders.

https://eu.q2.com

T: 020 3823 2300

E: info@Q2.com

Scan to Celebrate with Us!