P2P investors plan to keep on lending despite economy woes

THE MAJORITY of peer-to-peer lenders plan to continue investing in the sector, despite their diminishing confidence in macroeconomic conditions, exclusive research has found.

According to a new reader survey by Peer2Peer Finance News, 45.2 per cent of P2P investors feel less confident about the state of the economy than they did six months

ago. Just 12.9 per cent said that they feel more positive about the economy this year, while 41.9 per cent said their outlook is unchanged.

Yet despite pessimism around the macroeconomic environment, only one third (32.3 per cent) of P2P lenders said that they did not plan to continue investing in the sector going

forward, highlighting the resilience and opportunity in UK P2P.

More than half (55.2 per cent) said they planned to continue investing in P2P loans, while the remainder – 12.5 per cent – said they were not sure.

Peer2Peer Finance News polled thousands of individual investors subscribing to its e-newsletters last month and found that the vast majority fall into the high-net-worth (HNW) and sophisticated investor categories.

51.6 per cent defined themselves as sophisticated, while 45.2 per cent identified as HNW. Just 3.2 per cent categorised themselves as “restricted retail”. Notably, none of the respondents defined themselves as being advised, which could be a reflection of financial advisers’ reticence to engage with the sector, leaving investors to manage their

own P2P portfolio.

Reflecting this demographic split, just 12.9 per cent of the investors surveyed said that they held less than £10,000 in P2P loans.

Almost a quarter (22.6 per cent) of the investors surveyed said that they had between £10,000 and £50,000 invested in P2P.

38.7 per cent valued their P2P portfolio at between £50,000 and £100,000.

12.9 per cent had between £100,000 and £300,000 invested, and the remaining 12.9 per cent had between £300,000 and £500,000 invested in P2P.

The survey results found that investors are well diversified in their P2P portfolios, with a fifth (19.4 per cent) of lenders invested in at least six platforms simultaneously.

Just under half (48.4 per cent) were invested in between two and six platforms, while 32.2 per cent were invested in one to two. >>

4 ISSUE 83 | JULY 2023

SHOJIN MULLS NEW FUND Property lender in talks with private equity firms

CITY SLICKERS

>> >> 5 12

16

Institutional investors are looking at P2P again

Fasanara’s Daniele Guerini reveals his investment strategy

>>

Do you plan to continue investing in P2P loans?

Yes 55.20% No 32.30% Not sure 12.50%

Source: Peer2Peer Finance News

The next step of your career starts here...

Browse thousands of lending and finance jobs today.

Search Jobs

Published by Royal Crescent Publishing

124 City Road, London, EC1V 2NX info@royalcrescentpublishing.co.uk

EDITORIAL

Suzie Neuwirth

Editor-in-Chief suzie@p2pfinancenews.co.uk

Kathryn Gaw

Contributing Editor kathryn@p2pfinancenews.co.uk

Marc Shoffman Senior Reporter marc@p2pfinancenews.co.uk

PRODUCTION

Tim Parker

Art Director

COMMERCIAL

Tehmeena Khan Sales and Marketing Manager tehmeena@p2pfinancenews.co.uk

SUBSCRIPTIONS AND DISTRIBUTION tehmeena@p2pfinancenews.co.uk

Find our website at www.p2pfinancenews.co.uk

Printed by 4-Print Limited ©No part of this publication may be reproduced without written permission from the publishers.

Peer2Peer Finance News has been prepared solely for informational purposes, and is not a solicitation of an offer to buy or sell any peer-to-peer finance product, or any other security, product, service or investment. This publication does not purport to contain all relevant information which you may need to take into account before making a decision on any finance or investment matter. The opinions expressed in this publication do not constitute investment advice and independent advice should be sought where appropriate. Neither the information in this publication, nor any opinion contained in this publication constitutes a solicitation or offer to provide any investment advice or service.

How does peer-to-peer investing remain attractive in a highinterest-rate environment? That’s the question on everyone’s lips, after a series of Bank of England rate hikes pushed up savings account rates from record lows.

With some fixed saver accounts now offering up to nine per cent returns, many investors are looking for higher yields from P2P loans. But this is challenging for responsible P2P lending platforms, which need to manage default risk alongside investor returns.

On page 11 of this issue, Kuflink’s chief risk officer Hiran Patel predicts a rise in defaults across the sector, as borrowers grapple with higher costs.

And EstateGuru chief Mihkel Stamm recently warned that investor pressure to increase rates could lead to higher defaults, as higher rates “raise the burden on borrowers, affecting their affordability and cash flow and ability to repay the loan at maturity”.

With this in mind, savvy investors should do their own due diligence on their preferred platforms and find a suitable balance between risk and return. Listen to what management is saying about their approach to defaults and rates; look at their track record; and consider any security on offer.

Focusing purely on interest rates in these uncertain times is not sufficient when choosing how and where to invest.

SUZIE NEUWIRTH EDITOR-IN-CHIEF

We hope you’re enjoying the latest edition of Peer2Peer Finance News! We have now moved to a paid-for subscription model. If you would like to continue reading the magazine, please go to www.p2pfinancenews.co.uk/subscribe/ to find out about subscription options.

03 EDITOR’S LETTER

cont. from page 1

Property was by far the most popular segment for investors, with 87.1 per cent of those surveyed saying that they had investments in P2P property lenders.

Mike Bristow, chief executive of CrowdProperty, said that these results were unsurprising, given the breadth and track record of the property segment.

“Property, and in particular residential property, has a relatively robust value to formally secure against when compared to business or consumer lending,” he said.

“However it does require deep asset class expertise at the core of a well resourced lender that is fully focused on property in order to do attract, underwrite, secure, manage and redeem loans to best effect.

“Investors will naturally continue to invest in

this asset class given these factors - but more and more so with the most experienced, best resourced and most proven lenders where a well diversified portfolio can easily be built.”

“Property has always been a secure investment, whatever the economic landscape,” agreed Paul Auger, chief operating officer at P2P property platform Kuflink.

“Property values fluctuate and may even decrease, but over the medium and long term they still offer good returns, and are considered a safe investment. It would be very rare for an investor to lose their entire capital as can happen with some other asset classes.”

35.5 per cent of the investors surveyed expressed a preference for small- and mediumsized enterprise loans, while 25.8 per cent said

Are you feeling more or less confident about the UK economy than you did six months ago?

that they like to invest in consumer loans.

When asked to list the top three most important factors when choosing P2P loans, more than 80 per cent of investors said they look at the platform’s default rates, while 71 per cent said interest rates were one of the most important issues. The third most popular investment

factor was tied between platform security and the quality of the platform’s management team.

Just 9.7 per cent of investors said that environmental, social and governance (ESG) factors were a top consideration, despite an industry-wide push to improve the ESG credentials of financial services firms.

NEWS 04

More 12.90% Less 45.20% Same 41.90%

Source: Peer2Peer Finance News

How much do you have invested in P2P loans?

12.90% 22.60% 38.70% 12.90% 12.90% Less than £10,000 £10,000 - £50,000 £50,000 - £100,000 £100,000 - £300,000 £300,000 - £500,000

Source: Peer2Peer Finance News

Shojin in talks with private equity firms over new fund

SHOJIN is in talks with several private equity firms about raising a new fund for junior lending, Peer2Peer Finance News can reveal.

The peer-topeer lender, which specialises in property development, said that talks are in the early stages at the moment.

Jatin Ondhia, chief executive and cofounder of Shojin, said that the platform has not historically done much work with

institutions such as private equity firms.

“We deal mostly with family offices in the institutional space,” he said. “Family offices are always on the lookout for alternative products with good returns and well managed risk so we're growing rapidly in that space, while continuing to grow the retail platform.”

He added that Shojin’s investor split is approximately 70 per cent retail versus 30 per cent institutional, and

said that the platform does not intend to move away from its retail base.

“We are keen to make the retail platform work because that is the huge opportunity in fintech,” Ondhia said.

“A lot of firms end up moving away from retail and into the institutional space because it's easier, which is fine from a business perspective, but then they are the same as hundreds of other firms and are not really changing anything in the

world. We want to stay heavily focussed on retail.”

Last year, Shojin announced plans to launch a Jerseyincorporated fund as part of its plan to expand its core offerings.

The platform has been on a global expansion push over the past year, inking partnerships in India and the Middle East. In its most recent financial report, Shojin reported an 85 per cent increase in profits, and a 133 per cent rise in turnover.

Lenders forecast more demand for bridging loans

PEER-TO-PEER

lending platforms are anticipating increased interest in bridging loans, as developers need more funds to finish projects in a highinflation environment.

The property development sector is currently battling a variety of headwinds. High energy bills have made it more expensive to run projects, while building materials have increased in price. Additionally, labour shortages and falling sales demand can create delays.

“We are seeing a significant increase for development exit finance due to delays with sales,” said Filip Karadaghi, chief executive of LandlordInvest.

“Development exit finance is a bridging loan, which most borrowers would probably rather avoid, but have to take them out so that the initial development facility that they used to complete a project, does not go into default.”

He said every platform has their own niche of borrowers, while spreads vary considerably between platforms, which he claims often does not reflect the risk of the borrower.

“Lenders should always look to platforms with lower spreads, as they get better compensated for the risk they are taking,” added Karadaghi.

Alan Fletcher, partnership director at Invest & Fund, agrees that bridging finance could become more popular in the P2P sector.

“Our core product is residential development finance, and the demand for that is increasing as traditional banks increase their rates and tighten their

risk profiling,” he said.

“It is a fair assumption that bridging as a marketing solution to successfully accomplish a client's scheme will be increasingly visible in the broader market as a standalone product. Successfully dovetailing from one project to the next is essential to a functioning smalland medium-sized developer market.

“We are happy to offer it as part of our suite of products, but we only facilitate with sensible leverage headroom, our core risk tolerances aren't diminished in that scenario, so it provides the same level of protection and returns our investors would expect.”

05 NEWS

•

The world’s leading resource on peer-to-peer lending Subscribe today for full online access Peer2Peer Finance News (p2pfinancenews.co.uk) is the premier source of in-depth news, analysis, and insights on the fast-growing peer to peer lending industry. As a subscriber, you’ll have access to:

High-quality coverage of key topics impacting the P2P industry and its investors.

•

Up-to-the-minute news, features and opinions from P2P lending experts and industry professionals.

Daily news and analysis from Monday to Friday, and daily and weekly newsletters. Subscribe for just £1 for the first three months!* £9.99/month thereafter. Cancel anytime. Go to https://p2pfinancenews.co.uk/subscribe to sign up now.

•

How platforms have adapted to the variable economy

THE UK economy has wreaked havoc with the plans of many financial services firms, including peer-to-peer lenders. Amid rising interest rates and higher inflation, many P2P platforms have been forced to adapt to the new macroeconomic environment.

Folk2Folk recently announced that it has revised its three-year plan, implementing a new loan management system and modifying its strategy to focus primarily on the retail investment market.

“Folk2Folk continues to keep an eye on the future and we revised our three-year strategic plan to reflect the changing environment,” said Folk2Folk director Louis Mathers.

“Our proactive portfolio management minimises unexpected shocks. However, there are significant external economic issues that continue with us into 2023, including rising interest rates, inflation and global instability. While we are confident of the continued strength of Folk2Folk, these factors will impact our growth in 2023 as indicated last year.

“We have strengthened our credit skills to ensure we make well informed decisions and we are ever more cautious about refinance proposals

being passed to us.”

Kuflink has also strengthened its credit processes in recent months in order to reduce the impact of late payments. The P2P property lender has appointed a team of solicitors to contact borrowers six weeks before the loan term is up in order to head off any potential repayment delays. Where a loan term is extended and additional interest is charged, investors will receive higher returns.

Paul Auger, chief operating officer said the platform appreciates that lenders are seeing an increase in arrears.

“Our loans are completed either on a retained or rolled interest basis, meaning we do not collect monthly payments, what we have seen over the past months is an increase in requests for loan extensions,” he said.

“As a prudent lender, trusted by thousands of investors, we constantly monitor the market and

economic climate to ensure that we amend our criteria for new applications, loan re-term requests, as well as changing processes, where required, to ensure we continue to protect our investors, to the best of our ability.”

CrowdProperty also noted the impact of current market conditions on the property lending industry, with a number of developers exceeding their contract end date as a result.

“Property development projects are complex by nature – schemes tend to either complete early or run late,” said Mike Bristow, chief executive of CrowdProperty.

“When a loan goes late, it is typically best that the site is progressed and completed by the principle to whom we have lent to.”

CrowdProperty said the first charge security it holds on all projects is only enforced as a last resort. In case of receivership when the first charge is enforced, receiver fees

are due as a priority from any capital received and securing the site incurs monthly expense, so the platform ensures that it uses all options ahead of this, Bristow said.

As of May 2023, of the £190m CrowdProperty has paid back to investors, 45 per cent repaid in full earlier than the contract end date and 55 per cent repaid in full after the contract end date.

“We always aim for projects to be repaid on time and appreciate the frustration when this is exceeded, which is why investors receive a higher interest rate during any late period,” Bristow added.

A number of P2P platforms have opted to raise their rates for both borrowers and investors, in line with the rising base rate. CrowdProperty, Loanpad, easyMoney and Assetz Exchange have all increased investor and borrower returns in recent months. Meanwhile, SoMo has focused on borrower health, pledging to refund borrowers one month interest upon repayment of the loan in an effort to discourage extensions.

The Bank of England has steadily increased interest rates over the past 18 months, in a bid to tame high inflation. The base rate was 4.5 per cent as of 20 June, with further rate hikes on the horizon.

07 NEWS ANALYSIS

These are extraordinary times and our team is working hard to keep you informed about how the UK’s P2P sector is responding and what new trends are starting to emerge.

If you want to be the first to learn about the latest developments in the world of P2P, please purchase a subscription today.

We offer a range of subscription options, starting at just £9.99 a month. Please go to www.p2pfinancenews.co.uk/subscribe to buy a subscription today, so that you can enjoy unlimited digital access to P2PFN, with the option of a monthly print magazine.

For more information on subscriptions, including overseas queries, please email tehmeena@p2pfinancenews.co.uk.

It has never been more important to keep up to date with the latest peer-to-peer lending news.

Average P2P rates on the continent pass 10pc

THE AVERAGE European peerto-peer lending platform is offering annual returns of more than 10 per cent, Peer2Peer Finance News can exclusively reveal.

According to a new internal analysis of crowdlending platforms across mainland Europe, the average target returns being advertised as of May 2023 were 10.07 per cent. This is slightly higher than the most recent analysis of the target returns being offered by UK-

based P2P lending platforms.

Earlier this year, exclusive research by Peer2Peer Finance News found that a fully diversified Innovative Finance ISA (IFISA)

The biggest platforms and their rates

1. Mintos

More than €8.9bn has been invested into the company’s loan originators, while €397m has been traded on its secondary market. Investors have earned an average return of 12.5 per cent by investing in Mintos’ notes.

2. PeerBerry

Like Mintos, PeerBerry works with a number of global loan originators, and has lent out €1.75bn to date. The platform is currently advertising investor returns of up to 12.5 per cent.

3. Twino

Twino also works with loan originators to source and deliver lending opportunities for its retail investors. The Latvian platform has processed more than €1.3bn of lending to date, and is currently advertising returns of between 12 and 14 per cent.

4. CG24 Group

Swiss lender CG24 Group was launched in 2015, with more than CHF1.15bn (€1.18bn or £1bn) funded to date. Its target returns range from three to eight per

cent, depending on the type of loan chosen.

5. October

French business lender October is rapidly approaching its €1bn investment milestone, making it the fifth largest P2P lending platform in Europe. Its target returns range between seven and 12 per cent.

6. Bondora

Since it was founded in 2008, 220,214 people have invested over €805m and earned €96m from Estonian platform Bondora. While returns can range from between 7.04 and 15.04 per cent, Bondora has recently been focused on promoting its autoinvesting service ‘Go & Grow’, which offers a fixed rate of up to four per cent per year.

7. EstateGuru

EstateGuru is another Estonian P2P lending platform, which has funded more than €709m in real estate and business loans, from more than 155,000 retail investors. EstateGuru is currently advertising annual returns of 10.88 per cent.

portfolio spread across all 41 available providers would return an average of 8.83 per cent.

While there is no IFISA equivalent for mainland European P2P investing, investors in some jurisdictions do benefit from their own tax breaks and investment protections. However, for comparison’s sake, our headline figure takes into account only the raw data which has been drawn from publicly available data from 113 active P2P lending platforms from across Europe which are currently open to retail investors. Where a range of different returns was being advertised, a mean value was calculated.

Consumer loans appear to be the most profitable for investors at present, with European consumer lenders advertising average returns of 10.8 per cent to their users. Meanwhile, platforms which specialise in business loans are currently advertising target rates of 9.18 per cent on average.

Real estate is by far the most popular lending segment in the European P2P market, and offers average returns of 10.4 per cent. Almost a third (31 per cent) of the platforms analysed specialise in real estate debt.

The remaining platforms on our list work with a network of international loan originators to generate average returns of between seven and 15 per cent.

Of course, all P2P investments come with the risk of capital loss due to borrower defaults. In some cases, default rates for European platforms are as high as 15 per cent. This risk should always be factored into any new investment decision.

09 NEWS ANALYSIS

Secured

Secondary market available

Operating since 2016 with Zero Investor losses to date

IF-ISA Tax wrapper available *Don’t

p.a. * †

9.73%

Earn Up to

Kuflink invests up to 5% with you

against UK property*

invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. † Gross annual interest equivalent rate (compounded annually (Pool) / monthly (Select)) £260M Invested Over Visit kuflink.com or Call us at 01474 334488

Kuflink Ltd (Company Number 08460508) is authorised and regulated by the Financial Conduct Authority since 2017 (Firm Registration Number 724890). Kuflink Ltd has its registered office at 21 West Street, Gravesend, Kent DA11 0BF, United Kingdom.

2023

Kuflink predicts rise in defaults

KUFLINK HAS PREDICTED a rise in defaults across the peer-to-peer lending sector and financial services industry, as interest rates continue to rise and the cost of doing business increases.

The property lender is particularly aware of the issues faced by property developers, who are dealing with higher development and operational costs, alongside higher capital costs and lower valuations.

These concerns have led the platform to implement some new risk management processes, designed to identify default risk at the earliest possible stage and maintain Kuflink’s record of zero investor losses.

“Our criteria is tailored to our risk appetite, and our risk appetite is always to mitigate risk by protecting the money invested by our investors who have incurred zero losses to date,” says Hiran Patel (pictured), chief risk officer at Kuflink.

“We are constantly reviewing external risks such as market conditions including the Bank of England rate rises and will consider all applications on their own merit, looking at property location, property type, suitable loan-to-value, property condition and the borrower’s exit strategy and whether it is feasible.

“Each loan application goes through a stringent underwriting process and in summary, the three key principles being reviewed for each loan are borrower, property and exit.”

Kuflink recently made a new addition to its tried-and-tested risk management approach.

Six weeks before a loan’s expiry date, a law firm that specialises in mortgage and debt recovery will make contact with the borrower to ensure that they are aware of the redemption process. This is also an opportunity to check in on the likelihood of the loan being repaid on time.

“This process has now gone live,” confirms Patel.

“Where extensions are being requested by borrowers, we are looking at these requests on a case-by-case basis subject to being provided with sufficient evidence showing an exit to repay our loan is in progress.”

When a loan term is extended, investors will now receive a higher rate of interest, if the rate to the borrower is increased.

“The risk of default is with any lender and is not solely restricted to P2P,” explains Patel.

“But I believe that P2P remains an attractive option for investors as the loans are secured against property, and as an investor you are still achieving good rates of returns offered by Kuflink which

in comparison is more than what is currently being offered by your typical high street lender who is a lot slower at increasing rates for savings products but very quick to increase the rates on lending products.”

Kuflink - along with most other P2P platforms and high street lenders - is expecting uncertain market conditions over the next year, not just within the alternative lending community but in the financial services sector as a whole.

“I think this is expected for all financial institutions that lend money to consumers,” Patel says. “The key to managing this will be down to the processes and criteria lenders have in place when a loan is being underwritten and then managed through to repayment and whether they are as agile as Kuflink in implementing changes quickly to adapt to the changing marketplace.

“One of Kuflink’s key values is ‘transparency through open communication’ so it is very important to openly communicate to manage expectations for both borrowers and our investors.”

With further base rate rises predicted, Patel believes that all lenders should review their current processes and criteria to reflect their risk appetite, and consider carrying out a root cause analysis to identify any potential patterns that may lead to amendments in their lending criteria.

By taking a proactive approach to its own risk management processes, Kuflink aims to stay ahead of any issues so that it can maintain its impressive record despite economic turmoil.

11 JOINT VENTURE

Eyes on the prize

After a brief drought, institutional investors are circling the peer-to-peer lending sector once more. Kathryn Gaw explores the current institutional landscape…

SPARE A THOUGHT FOR the one per cent. After years of economic turmoil, even the wealthiest investors are being forced to tighten their purse strings and revisit their portfolios.

According to a recent report from PwC, asset managers and wealth managers have been undergoing “massive transformation” in response to macroeconomic challenges such as market volatility, rising interest rates and inflation. This has led many to reassess

their investment strategies, and adjust their portfolios with a tilt towards alternatives.

And it’s about time too. Ever since the disastrous mini-budget of October 2022, institutional investors have been noticeably absent from the news pages of Peer2Peer Finance News. On 28 September 2022, property lender CapitalRise agreed a new funding line with investment manager Downing for an undisclosed amount. The P2P sector would not see another institutional

funding announcement until April 2023, when CrowdProperty inked two deals with British Business Investments and an unnamed UK bank, in quick succession.

“It has become increasingly more difficult to attract institutional funding, especially since the minibudget of last year, increased even more by the uncertainty and rising rates,” said Paul Auger, chief operating officer at Kuflink.

Auger’s views have been echoed across the sector.

12 INSTITUTIONAL INVESTMENT

“In the current interest rate environment I would expect institutions to be pulling back,” says Lee Birkett, chief executive and founder of JustUs.

“Higher rates bring higher risks from a borrower serviceability perspective, requiring additional pledges of security from the borrowers.”

Meanwhile, in its recent annual report, Folk2Folk – the UK’s largest P2P lending platform –said that “institutional funding continued to be a challenge in 2022”, causing the platform to revise its three-year growth plan.

The UK’s P2P sector has historically swayed between institutional and retail funding, depending on the investor appetite. This flexibility has been key to the sector’s success, allowing platforms to benefit from both large-scale institutional funds, and stickier retail money. But since December 2019, there has been a marked shift towards institutional money as retail investing has come under increasing scrutiny by the regulator.

For the past three-and-a-half years, platforms have been required to work within increasingly strict parameters when dealing with retail investors. Visible risk warnings must now appear on all P2P lender websites, and all new investors must pass an appropriateness test before being allowed to access P2P loan opportunities. Restrictions on marketing materials mean that P2P brands have all but disappeared from the mainstream.

As a result, some of the largest P2P platforms have opted to leave the retail market altogether in favour of institutional funds. ThinCats and Landbay were among the first to exit retail P2P for institutional money in December

2019. Zopa confirmed in December 2021 that it was leaving the P2P space to focus on its digital bank, and Funding Circle closed its retail lending business in March 2022, citing “proposed regulatory changes and broader market dynamics.” By the end of 2022, Assetz Capital had also left the retail space to focus entirely on institutional investment.

Together, ThinCats, Landbay, Zopa, Funding Circle, and Assetz Capital had accumulated more than £10bn in retail funds before leaving the sector. While many retail P2P investors have been able to simply move their money into other platforms, institutional investors have arguably been the big winners of the recent regulatory crackdown. It is these big investors who can now benefit from the long track record and inflation-beating returns of one-time P2P lending giants.

These institutions range from asset managers, to state-backed banks, pension funds, high street banks, and family offices. Each entity has its own list of requirements which must be met before any funds are handed over.

“Family offices are always on the lookout for alternative products with good returns and well managed risk so we're growing rapidly in that space, while continuing to grow the retail platform,” says Jatin Ondhia, chief executive and cofounder of property lender Shojin.

“We have seen no change in appetite from institutions recently, although we deal mostly with family offices in the institutional space, not much with institutions like private equity.”

Having said this, Shojin is currently in talks with several private equity firms about

13 INSTITUTIONAL INVESTMENT

“

A lot of firms end up moving away from retail and into the institutional space because it’s easier”

raising a new fund for junior lending, in an expansion of its existing institutional investor reach. However, the platform still maintains a 70/30 investor split in favour of retail.

P2P lenders such as Shojin could benefit from the ongoing economic uncertainty which is driving institutions to broaden their horizons and seek out new opportunities in the alternatives space.

Peer2Peer Finance News is aware of at least two more institutional funding deals worth tens of millions of pounds which are in the works at the moment. However, while institutional money has the power to transform a platform’s balance sheet overnight, it is hard earned.

Influential institutions

One of the aforementioned deals has been pending for eight months so far, with no end in sight.

In the meantime, platforms are being careful to maintain their retail investor base alongside their institutional aspirations. While it has become harder to market to retail investors, they are considered to be much more loyal. What’s more, they are investing everincreasing amounts of money. A recent investor survey by Peer2Peer Finance News found that 45.2 per cent identified as high net worth (HNW), while 64.5 per cent of those surveyed said that they had more than £50,000 invested in their P2P portfolio. Courting these HNW retail investors has become more of a focus for some

Who are the most high-profile institutional investors in the sector?

Varengold Bank

Varengold has invested in alternative lenders such as EstateGuru, Assetz Capital, MarketFinance and LendInvest. The German bank has an office in London and pitches itself as a ‘partner of fintechs’ such as marketplace lenders and P2P platforms.

Fasanara Capital

Fasanara Capital has previously invested in UK P2P platforms including FundOurselves. The London-based asset manager is one of the largest fintech-focused capital providers globally, and has a particular interest in small business lending and consumer lending.

British Business Investment (BBI)

BBI is the commercial arm of state-backed lender the British Business Bank. Over the past few years it has provided funding to Folk2Folk, former P2P lender Assetz Capital and – most recently – CrowdProperty. During the 2021/22 financial year, BBI made a “record” £350m in commitments.

Downing

The £1.8bn investment manager funds its own crowd bonds platform – Downing Crowd - but it has also agreed funding lines with alternative lenders such as CapitalRise. The institutional investor is a certified B Corporation firm which is focused on “creating a sustainable future” through investments in renewable energy, infrastructure, property and healthcare.

platforms, representing a sort of middle ground between restricted retail and institutional money.

JustUs recently increased its minimum investment threshold from £100 to £10,000 in an effort to attract more HNWs, and Birkett has been adamant that he will not go down the institutional route.

“Institutions are predominantly matrix-driven without any personal involvement and are short term focussed - the opposite of long-

14 INSTITUTIONAL INVESTMENT

“ There is demand out there from the institutional market for P2P lenders”

term, loyal P2P investors,” he says.

Filip Karadaghi, managing director of LandlordInvest, is also holding off on institutional funding in favour of the flexibility of retail investors.

“We only have private individuals as lenders and are satisfied with that,” says Karadaghi. “We'd engage institutions should we feel that we would benefit from such co-operation.”

And Kuflink’s loan book continues to be 100 per cent funded by retail investors, with any institutional funding done via a separate funding agreement.

Meanwhile, Shojin’s Ondhia says that he is keen to make the retail platform work because “that is the huge opportunity in fintech.”

“A lot of firms end up moving away from retail and into the institutional space because it's easier, which is fine from a business perspective,” he adds.

“But then they are the same as hundreds of other firms and are not really changing anything in the world.

“We want to stay heavily focussed on retail.”

P2P lending platforms have a long track record with good returns and low defaults, and as private debt specialists they are not closely correlated with the main stock market movements. This makes them particularly attractive to institutional investors who are eyeing up the alternatives sector.

According to Ondhia, institutions

are looking for good deal flow, solid risk management, and superior risk-adjusted returns from alternative lenders, all of which P2P platforms can provide. It is therefore not surprising to see more and more institutions orbiting the sector in search of opportunity.

Mike Carter, head of platform lending at Innovate Finance, believes that CrowdProperty’s recent institutional investments show that “a healthy funding market is out there for good names, and also illustrates a P2P platform that is ensuring it has diversified funding sources, which is key for any alternative lender.”

“There is demand out there from the institutional market for P2P lenders,” he adds.

The demand is certainly there, but the seasonal nature of institutional funding acts as a reminder for platforms to diversify their funding streams.

The institutional plus retail equation has helped the industry to keep growing during times of economic stability and chaos. But while institutional interest is now returning to the P2P sector, this is no guarantee of future funding. Make hay while the sun shines, but remember, there is no P2P without retail investment.

15 INSTITUTIONAL INVESTMENT

“ It has become increasingly more difficult to attract institutional funding, especially since the mini-budget of last year”

Credit where it’s due

Fasanara’s Daniele Guerini gives Marc Shoffman his view of the peer-to-peer lending market

ALTERNATIVE CREDIT and venture capital investor Fasanara has backed more than 130 platforms across the world including peer-to-peer lenders.

Its initial focus was invoice finance but it has now expanded to other assets such as consumer loans and even sports lending.

Daniele Guerini, Fasanara’s head of fintech, origination and due diligence explains how the firm weighs up investment opportunities and reveals his outlook for P2P lenders.

Marc Shoffman (MS): What does your role involve?

Daniele Guerini (DG): I have been working in finance for more than 20 years in various roles across mergers and acquisitions, private equity and family offices, before joining Fasanara in 2019.

I knew Fasanara’s founder Francesco Filia before the business started. I met him in 2010 when he worked for Merrill Lynch. I had been involved on the credit side of Fasanara previously, as the family office I worked for was the largest investor in the fund.

MS: What is Fasanara’s history with P2P lenders?

DG: We started investing in the sector in 2014 in the original Fasanara fund, by looking at invoice financing marketplaces.

They included companies such as Kriya – formerly MarketFinance

– and Workinvoice in Italy. Then things generally opened to other asset classes such as real estate development loans. Over the years we have covered the vast majority of the underlying assets. Invoice financing is our bread and

butter but we also do real estate, business and consumer loans as well as investing in balance sheet lenders and areas such as buynow-pay later. Ideally we pick platforms that are not reliant on large amounts of investors.

16 PROFILE

MS: How do you choose who to invest in?

DG: When we focus on P2P lenders we need to understand our position. P2P lending is tricky. You need to work on both sides of the equation, the origination and finding investors.

That doubles your effort for a business providing the same kind of return as those working with one debt provider.

We need to understand how strong and robust the target is on sourcing capital and how reliant they are on repaying investors, which is a source of capital that is very volatile.

We want to establish relationships where ultimately we become the main provider of capital, if not the exclusive one, as that is the way we can move to the ramp-up phase.

We want platforms that really want to scale their loan books. Most of the platforms we work with now are balance sheet lenders.

We have noticed a trend over time, where the ones able to scale want a reliable source of funding for the bulk of their needs and then top it up with high-net-worth investors and old legacy sources of funding.

Balance sheet lending is a lot more predictable than P2P lending. With pure P2P lending there is an ongoing exercise of luring new investors and substituting investors who leave.

That is the big difference and that’s why once you reach a certain scale, the preference tends to go towards one debt provider who can cover everything.

MS: What sort of terms do you seek?

DG: We like to have an alignment

of interest. Most of the alternative credit providers have deals with an equity component, that is a function of our role. If we provide a lot of capital or are early in the game, then participation in the equity side is higher.

We have patient capital. We know the time horizon is many years. Now we have a track record of understanding how quickly or slowly these companies grow and set out expectations accordingly. We want to be seen as as a long term partner on the debt and equity side.

MS: How has the sector evolved?

DG: The move to balance sheet lending is a significant one. I don’t just mean on their own balance assets, it could be a special purpose vehicle funded by third parties. There has also been a trend of fintech companies to move towards this approach.

We don’t see many new P2P firms but we have seen something happening in software as a service financing, it is huge in the US but is smaller in Europe and taking longer to scale.

Regulation has had a significant impact. We have not been too focused on the P2P model but clearly the constraints that have been placed on the sector have been one of the reasons why some of them are coming to us and saying we are looking for a more reliable funding source.

The two things can co-exist. We have seen good models where you have a combination of institutional and retail P2P lending. CrowdProperty is a good example of this. They work on the basis of a good combination of private capital and institutions. But private capital

has become more challenging and more expensive once you consider all the associated costs.

MS: Is there still space for retail P2P lending?

DG: There is a bit of space, not a huge amount. Going to P2P companies that have one or more institutional-grade debt provider is a sign that retail investors should decide which ones to back as they at least know someone has done due diligence of the counterparty.

Retail investors don’t have access to information to do proper due diligence, they many not know much about the operational risks. All of those things are relevant today. Knowing there is someone who has access to the data can help.

MS: What is your outlook for the alternative lending market?

DG: I am very positive about fintech gaining market share from traditional financial services providers with very specialised offers and niche products. The biggest challenge is scale. There are too many companies being started and not enough mergers. It is a market fuelled by a lot of equity capital. Merging will help companies breakeven.

On P2P lending, the outlook is a bit tougher. If it is difficult for traditional fintech to break even on a traditional balance sheet model, then it will be tougher for P2P which needs to manage two sides of the marketplace.

That means hybrid strategies with a combination of retail and institutions is probably going to be the way to go in order to scale over time or focusing on tremendous quality. If you have tremendous quality and a good track record then the money will come.

17 PROFILE

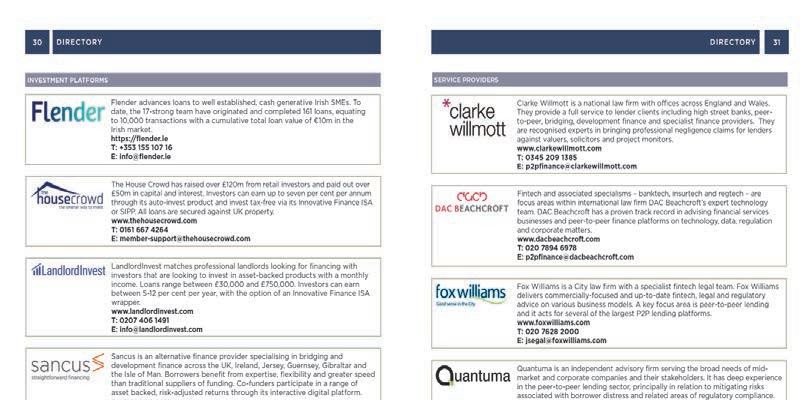

INVESTMENT PLATFORMS

Assetz Exchange is a property investment platform delivering long term stable income for investors, primarily through the purchase and leasing of housing for social good. Regulated by the FCA, it provides the opportunity for investors to create a diversified property portfolio and alternative funding options for the housing sector.

www.assetzexchange.co.uk

T: 03330 119830

E: info@assetzexchange.co.uk

easyMoney is a peer-to-peer property lending platform that is fully authorised by the Financial Conduct Authority #231680. It has £164m+ in investor funds currently deployed and £280m+ in total loans written to date. It has had no borrower defaults and no investor has ever made a loss. Among P2P firms surveyed by Peer2Peer Finance News it has the largest active Innovative Finance ISA portfolio, with over £65m currently invested. easyMoney.com

T: 0203 858 7269

E: contactus@easymoney.com

Folk2Folk is a profitable UK lending and investment platform. More than half a billion pounds has been invested via the platform with no investor losses to date. Loans are a maximum of five years, secured against land/property at a maximum 60 per cent LTV, with a fixed rate of between 7.5 and 9.5 per cent, per annum.

www.folk2folk.com

T: 01566 773296

E: enquiries@folk2folk.com

Invest & Fund is an established alternative finance platform that has deployed over £220m on clients' behalf and has repaid over £140m to lenders with zero per cent bad debts written off. Lenders can achieve a diversified, asset-backed portfolio with gross yields averaging from 6.75 per cent per annum with an option to lend through an ISA or a SIPP for tax-free returns.

www.investandfund.com

T: 01424 717564

E: lending@investandfund.com

JustUs is an innovative peer-to-peer lender that provides a range of consumer and property-backed loans. It has lent out more than £25m and paid more than £1.7m in interest to lenders to date. Investors can enjoy returns of up to 10.29 per cent, with all products eligible to be held in an Innovative Finance ISA for tax-free earnings.

www.justus.co

T: 01625 750034

E: support@justus.co

Kuflink is an award-winning lender and online investment platform. With over £260m invested through the platform, investors can customise their own portfolio investing in specific loans or in a pool of loans diversified across a number of opportunities. Earn up to 9.73 per cent (compounded) per annum, with an IFISA available.

www.kuflink.com

T: 01474 33 44 88

E: hello@kuflink.com

18 DIRECTORY

LANDE is a crowdfunding platform that gives investors access to secured agricultural loans. It has created a unique scoring model, accessible infrastructure, and a variety of products so that farmers are able to access financing quickly and easily. With LANDE and its investors as partners, farmers can become more independent and sustainable, while improving their yield, efficiency and profitability. Projects offer interest rates of up to 14 per cent per annum.

https://lande.finance

T: +371 20381802

E: info@lande.finance

Lendwise is the UK’s only peer-to-peer lender that is dedicated to impact investing in education finance. Investors finance education for borrowers at universities and business schools across the UK and globally. Investors define their own risk appetite and use Lendwise’s AutoLend feature to diversify their strategy across a pool of loans, which can be invested in an IFISA wrapper earning average returns of up to nine per cent per annum.

www.lendwise.com

T: 0203 890 7270

E: lenders@lendwise.com

SERVICE PROVIDERS AND INDUSTRY ORGANISATIONS

The European Crowdfunding Network (EuroCrowd) is an independent, professional business network promoting adequate transparency, regulation and governance in digital finance while offering a combined voice in policy discussion and public opinion building. It executes initiatives aimed at innovating, representing, promoting and protecting the European crowdfunding industry. www.eurocrowd.org

E: info@eurocrowd.org

Q2 creates simple, smart, end-to-end lending experiences that make you an indispensable partner on your customers' financial journeys. Its modular platform gives you the ability to manage lending simply throughout the entire loan lifecycle, from application, onboarding, servicing to collections. The result is a better experience for both borrowers and lenders.

https://eu.q2.com

T: 020 3823 2300

E: info@Q2.com

Our magazine is read by peer-to-peer lending professionals, investors and more. If you'd like to be included in our directory, please email Tehmeena Khan on tehmeena@p2pfinancenews.co.uk for details and pricing. 19 DIRECTORY