o Cost of living update

o Global supply chain news

o Weather conditions

o Key commodity updates

o What’s in season

o Cost of living update

o Global supply chain news

o Weather conditions

o Key commodity updates

o What’s in season

In this report, we provide the latest commodity market updates gathered from impartial market research, reliable news sources, and our team of supply chain experts.

We cover key price trends and recommend ways to mitigate price increases. We also look at product availability and what produce is in season, to help inform your purchasing.

The UK inflation rate continues its downward trend, dropping to 3.2%, alleviating some price pressure on the supply chain and consumers. This reduction in midApril aligns with more stable costs for food, beverages, and textiles compared to last year. However, it still signifies a rise in pricing compared to preSeptember 2021 metrics, but it is closer to the Bank of England's target.

This positive news raises hopes that the Bank of England will consider lowering the interest rate, which is currently at 5.25%, its highest in 16 years. A rate cut would directly affect mortgage and loan repayments. However, speculation suggests that the decrease to 3.2% may fall short of market expectations, tempering anticipation for interest rate cuts.

The early Easter period in the calendar has contributed to the improved economic position compared to last year. Total retail sales in March increased by 3.5%, with food sales rising by 6.8%

3.2%

Rate of inflation after repeated drops in 2023

year-on-year. These boosts in sales helped indicate an improved economic outlook and contributed to the decrease in inflation. Speculation suggests that this reduction may lead to a revised annual GDP forecast, potentially reducing growth to 0.5% for the year. The situation will become more apparent with the latest interest rate announcement.

In April, changes to energy pricing typically bring positive news following the introduction of the 3-month energy price cap. The latest announcement indicates a decrease of about 12% compared to the previous three months over winter.

This reduction is primarily attributed to lower demand and decreased production and storage costs. Unlike the shortages and price increases experienced during winter 2022, the UK energy sector is now more stable. Additionally, there is good news regarding increases to Universal Credit and the State Pension, providing further support to those without an income.

While the decrease in energy pricing brings relief to UK households, this relief is shortlived, followed by announcements of price hikes in various essential services. Reports

Alex Gess Business Supply Chain Analyst Pelican Procurement

Alex Gess Business Supply Chain Analyst Pelican Procurement

We’re here to help you. hello@pelicanprocurement.co.uk

indicate that phone and water service prices and vehicle and council taxes (excluding Scotland) will increase. Even the TV license fee is due for an increase.

These rising costs and stagnant or reduced services place UK households and families in a more challenging financial position than last year. Notably, these increases are not solely attributable to food inflation.

Extreme weather events, shifting weather patterns, and established seasonal conditions continue to impact crop planting, growing, and harvesting seasons globally.

Recent reports indicate significant disruption to the UK's spring planting season this year.

Flooded fields have left many farmers unable to plant essential crops like potatoes, carrots, and Brussels sprouts.

Moreover, existing crops are of poor quality or rotting due to unfavourable conditions, exacerbating the challenges faced by agricultural producers.

Poor or shifting weather conditions impact not only crops but also livestock farms. The wetter weather has led to a

higher-than-normal mortality rate for British lambs. It has also caused issues for milk-producing dairy cows, as they cannot be put out to pasture, reducing their milk yields.

These challenges reverberate throughout the supply chain, restricting the supply of domestic lamb and dairy products for export, thereby affecting the entire dairy supply chain.

The impacts of changing weather patterns are not limited to domestic farming. Across Europe, wet weather has resulted in the lowest wheat production levels in over a decade. Additionally, wildfires decimated the Spanish olive crop.

The Mediterranean region, crucial for exporting olives, peppers, apples, and pears, endured significant losses due to forest fires and drought, leading to price increases. With March 2024 marked as the hottest March on record, the tenth consecutive month of such heat, there are concerns that weather conditions will not improve this year.

These changes are not only affecting crop yields but are also prompting farmers to change what they grow and their land allocation. Potato farmers, for instance, have reduced their planting areas by up to 10%, and some have shifted to more resilient crops, ensuring greater yields and predictable incomes.

The UK may need to increase its imports from the continent to meet demand and avoid another increase in food inflation.

Unfortunately, the first months of this year have witnessed a surge in global conflicts. The ongoing conflict in Ukraine shows no signs of easing, and while trade routes are now established, its

repercussions on food availability across Europe persist.

Sanctions imposed on Russia also affect Europe, leading to a constrained supply of fish and oil.

As a result, alternative routes and suppliers are being sought, albeit at higher costs and longer shipping times. Despite these challenges, Ukraine has consistently exported about 80% of its pre-conflict crop, including wheat, corn, and sunflower oil, thanks to protected trade routes that ensure stable food availability.

Additionally, the situation in Gaza has intensified since our last report, with other Middle Eastern nations, including Iran and Lebanon, becoming involved in the conflict in recent weeks.

The US and the UK have strongly emphasised their reluctance to be drawn into a broader conflict. Fortunately, our reliance on the region for crops and exports is limited. However, it remains a crucial part of one of the world's primary shipping routes.

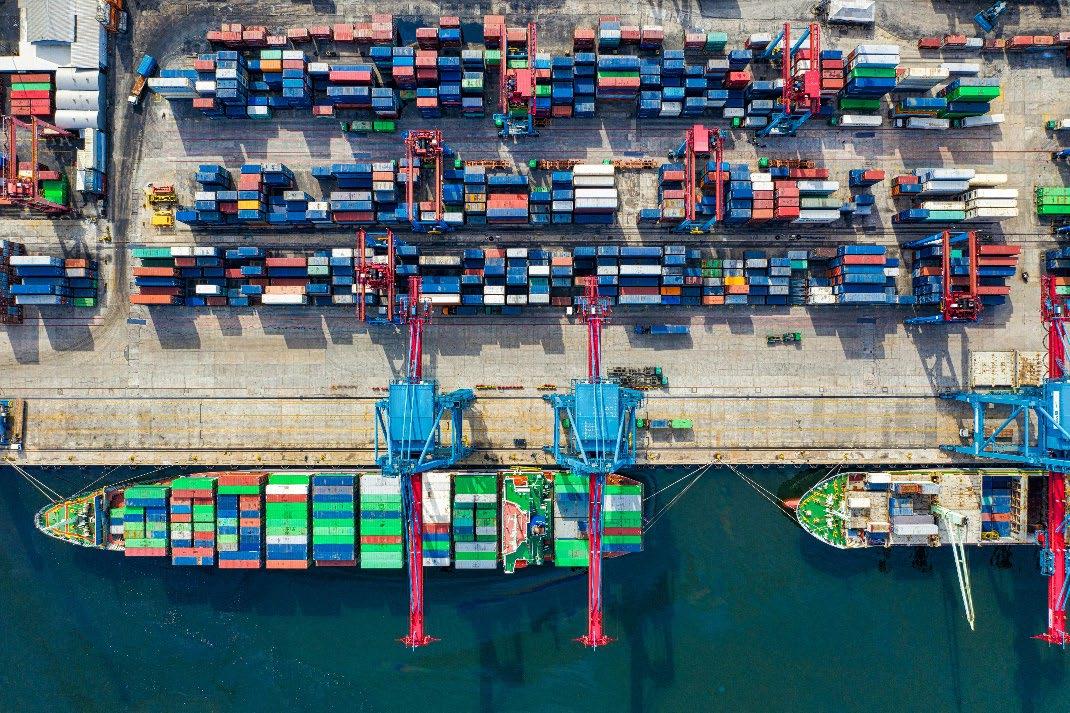

As discussed in our previous report, the attacks on shipping vessels in the Red Sea prompted many ship captains to change their routes, opting to sail around the Cape of Good Hope instead.

This decision added up to three weeks and £1 million in costs to each trip, which were passed down the supply chain.

The rate of ships passing through the Red Sea and Suez Canal in the first three months of the year dropped by 50%. This prolonged the time it takes for goods to reach their destination and directly impacted port schedules. As we witnessed during the COVID-19 pandemic, port backlogs and delayed ship offloading can have significant consequences.

The droughts experienced in parts of Middle and South America have directly impacted the ability of ships to pass through the Panama Canal.

We previously reported on the challenges transport ships face using this route, and since October 2023, the number of ships traversing the canal has decreased by 32%.

Restrictions on the number of vessels traveling through the canal have been implemented due to lower-than-usual water levels, which are now down by 25% compared to normal traffic levels. This sustained impact on global shipping shows no signs of reversing.

Despite continuous price increases for cuts of Beef over the last two years, there was an uptick in the amount of beef imported from Ireland during the January and February 2024 periods. This suggests a consistent demand. The domestic price and demand for beef in Ireland remain strong, so it's a valuable market for the UK to tap into. The price gap between the two markets for cattle has always been high, and with the increased imports, it's expected to remain the same.

Beef mince remains the top choice for consumers at home, primarily due to its affordability compared to other beef cuts and its versatility in creating costeffective and filling meals. However, there's an expectation that beef's popularity will decline. It's not only the priciest protein option but also the most environmentally harmful. As consumers become increasingly conscious of their carbon footprint, there's a growing trend towards seeking alternatives to beef.

The UK Pork and pig markets faced significant challenges over the last two years but there are now signs of recovery. Farmers' decisions to reduce livestock numbers have resulted in higher farmgate prices for pig products. With energy and feed prices stabilizing in 2023, the profit margins for pig farmers are becoming more sustainable. However, returning to preCOVID pork market conditions will take time. Prices reached record highs in the past two years, and the slaughter rate in

2023 was 11% lower than in previous years. This trend has continued into 2024, with a 4% reduction in the slaughter rate and an 18% reduction in herd size compared to two years ago.

All of this means the shortterm outlook for consumers remains challenging, but there's hope for improvement by year-end compared to both the current market conditions and previous years. European pig prices, which are approximately 13% lower than UK prices, have led to an increase in imported products, indicating a potential positive shift in the market dynamics.

We have already touched briefly on British Lamb and the challenges the market faces this year. In February, sheep production dropped by 8%, marking the lowest processing rate recorded since February 2020. Consequently, lamb prices have risen by 1.9% compared to last year. Despite these challenges, demand for lamb cuts has surged this year, particularly during Christmas, Valentine's Day, and the earlier

Easter period, leading to steady price increases.

All three of the proteins we have covered so far have been affected by this recent increase in the price of Feed, Fuel, and Fertiliser, which are essential inputs to animal farms. These prices have increased significantly due to global conflicts, weather changes in key growing regions, and disruptions to shipping routes. As a result, we may expect further price hikes for these core commodities soon

In a welcome development, the UK and Ireland have officially declared themselves free of Avian Influenza (Bird Flu) after nearly two years of outbreaks. While the disease still affects flocks in America and South America, the UK, Ireland, and much of Europe are now free from it, allowing the lifting of any temporary protections. Last month, the Lamb vs. previous+1.9%Year

government announced additional measures aimed at preventing future outbreaks from spreading rapidly across the country.

Factors in beef and pork markets, like price and availability, have led to an increased demand for chicken protein. Chicken's lower cost, versatility, and wide availability make it a popular choice. While red meat consumption at home has declined over the last four decades, chicken consumption has increased. This trend is expected to persist because pricing is a significant factor. However, with the percentage of imports into the EU, there are concerns that the supply may be affected again.

The significant development regarding Eggs at the start of 2024 was the increase in Salmonella cases in products imported from Poland. Over 200 cases were reported in the UK last year. In response, Swedish and Polish producers have taken measures to clean their production and processing areas extensively to address this issue.

At the beginning of this year, negotiations concluded to set fishing quotas in the Northern and Norwegian seas. The UK and Norway have established agreements to share catches and transfer stocks of various fish. The agreement aims to continue the partnership between the UK and Norway whilst ensuring a sustainable and profitable industry.

Since the invasion of Ukraine, white fish markets have experienced significant volatility. A considerable amount of Cod, Haddock, and Pollock originates from

Russian waters. Despite recent sanctions, approximately 9% of fish consumed in the UK is of Russian origin.

Pricing for Cod, Haddock, and Hake has remained stable over the last three months and has started to decrease again as normal fishing patterns for this time of year resume. This makes both frozen and fresh whitefish an excellent menu option at the moment. However, it's anticipated that prices of these fish will begin to rise again once the spawning season commences. Market restrictions on Russian whitefish persist, leading to continued shipping and purchasing from Asian markets to compensate for the shortfall.

The need for sustainability heavily impacts the fish market, and with catch rates in place, look for alternatives to the main fish species for your menus. For instance, Halibut serves as an excellent substitute for Haddock, while Pollock or Mackerel can be used in fish pies to maintain quality and taste while keeping costs down.

Milk prices initially continued a downward trend in early 2024, albeit not as steep as the previous year. This was supported by increased deliveries and a stable herd size despite challenges with grazing and sending dairy cows out to pasture due to adverse weather conditions mentioned earlier.

During this spring flush, there's a significant focus on production volumes, with expectations pointing to a poor year for milk yields as we move further into it. In 2023, UK milk production benefited from high prices at the end of

2022 and a wetter-thannormal summer, ensuring an ample feed supply.

The Easter period witnessed an uptick in demand for baking staples like eggs and butter, resulting in a slight price increase for Butter during the first three months of the year. Despite concerns about lower milk production volumes, butter stocks remain robust for now, largely due to prioritizing butter production. However, there might be challenges later in the year if milk availability becomes scarce.

Similarly, the pricing of UK domestic Cheese experienced modest increases at the beginning of the year. However, the market remains resilient, offering ample product choices and pricing options. To mitigate the impact of rising living costs, consumers are shifting from premium lines to own-brand products while valuing cheese as a staple in UK households. Additionally, European cheeses face challenges due to new import levies imposed postBrexit, affecting cheese imports.

Early reports suggest it could be another extremely tough year for the Potato harvest in 2024. The past two years have yielded low harvests, with 2023 marking one of the worst on record due to a combination of wetter-than-normal planting seasons and drierthan-usual summers.

Consequently, many farmers have reduced their potatogrowing areas. This trend, unless supplemented by European exports, could lead to a shortage of supply in the UK

Concerns about food shortages this year extend beyond potatoes. Recent reports indicate that various domestically and Europeangrown vegetables may face challenges due to shifting weather patterns. As we've discussed, increased rainfall during planting and harvesting seasons has already impacted Carrots and Brussels sprouts, with parsnips also reportedly affected.

The simplest solution would be to import more fruit and vegetables from Europe, but they're facing challenges closely tied to environmental shifts. France, for example, is grappling with a difficult start to the Wheat growing season due to cold and wet weather, further complicating matters amid lower volumes from Ukraine.

Once more, the Mediterranean and North African regions will play a significant role in supplying our produce. Approximately a third of our tomatoes and two-thirds of our raspberries come from Morocco, which is currently grappling with a severe drought. The situation has reached a critical point, with

the second-largest reservoir drying up, making crop irrigation challenging in the region. While the severity of droughts and wildfires in Italy, Spain, and Greece remains uncertain this year, these areas are crucial for producing peppers, cucumbers, olives, and other essential food items. Consequently, we anticipate further shortages in this region's produce supply.

Last year, Olive Oil faced significant shortages due to a combination of drought, fire, and hailstorms that devastated Greek and Spanish Olive groves and resulted in recordlow crop yields.

Prices soared, reaching as high as £22 for 500ml. Unfortunately, we may encounter similar challenges this year, as there have been no significant improvements in the conditions that led to the shortage. These shortages have led to increased demand for alternative cooking oils, resulting in an 8% increase in the overall category compared to last year. While there is a steady supply of Sunflower Oil, primarily sourced from

pressings in Ukraine, heightened demand could strain availability.

In 2023, Sugar prices surged by +11% compared to the previous year due to export bans imposed by Thailand and India. With limited market availability, we've become increasingly reliant on sugar cane production in Brazil. However, adverse weather conditions in South America and restrictions on the Panama Canal have hampered both sugar yields and availability, driving prices up further.

Increase in the price of Sugar over a year +11%

While the situation has remained challenging into early 2024, there is optimism that improved weather conditions and a projected good harvest will lead to a decrease in sugar prices in the second half of the year, potentially stabilizing prices.

The Coffee industry is facing challenges due to extreme weather conditions in key growing regions, leading to lower yields. Arabica beans have surged by 60% since October 2023, while Robusta prices have risen by 50% in 2024 alone. Shipping delays in the Red Sea further exacerbate market shortages, contributing to price hikes.

Similarly, Cocoa, grown in comparable regions, has seen wholesale prices soar by as much as 120% this year. With all these factors at play, the cost of small luxuries like coffee, cakes, and chocolate is expected to remain high for much of the year.