OPTIMISED PRODUCTION PROCESS

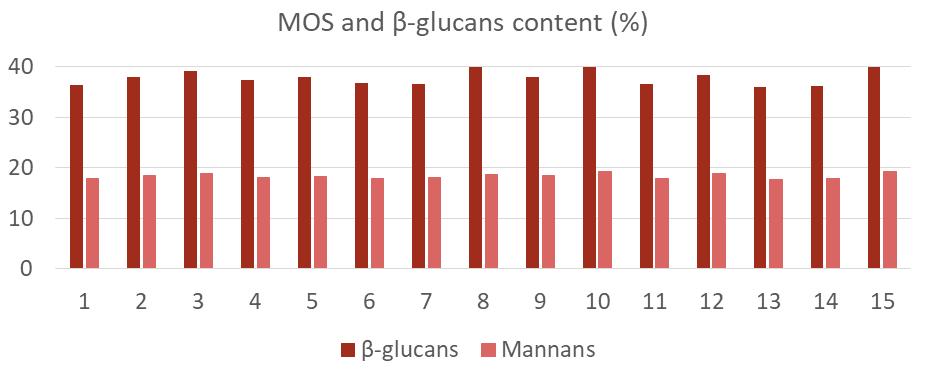

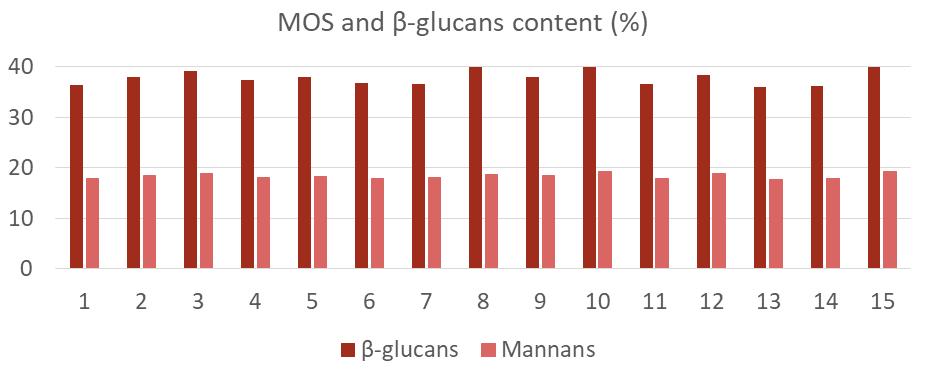

CONSISTENT CONTENT OF MANNANS AND β-GLUCANS

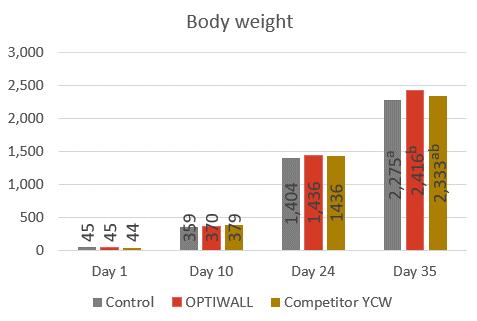

COST-EFFECTIVE GUT HEALTH SUPPORT

40 SPECIFIC R&D PROGRAM

Tel: 07827 228 161

SUSTAINABILITY:

The

us to discuss reducing your carbon footprint.

Contact

trouwnutrition.co.uk/sustainability

“At Trouw Nutrition we are committed to working with our customers to make dairy farming more sustainable. We have a range of products and programmes that can make a real difference.”

Dr Liz Homer

Nutrition

Ruminant Technical Development Manager Trouw

GB

BEYOND NET ZERO

opportunity to improve efficiency

Daily

Goal Stages Target Trouw Nutrition products & programmes Optimise Lifetime Daily Yield Calf 0-16 weeks EPIGENETICS Unlocking genetic potential ENERGIZED CALF MILK OSMOFIT Heifer 16 weeks to 6 weeks pre-calving DEVELOPMENT Age at First Calving 22-24 months MAXCARE NUTRIOPT: HEIFER INTELLIBOND OPTIMIN Transition Dry cow to calving RESILIENCE Reduced incidence of challenge REVIVA NUTRIOPT: DRY COW INTELLIBOND OPTIMIN AO MIX Milking cow Early lactation to 305 days PRODUCTIVITY Sustained peak yield reached at 50-70 DIM LACTIBUTE PRIME NUTRIOPT: DAIRY INTELLIBOND OPTIMIN FYTERA BALANCE Multiple lactations 5th lactation LONGEVITY Complete a healthy 5th lactation with minimal interventions

by optimising Lifetime

Yield

United Kingdom

Tel: +44 (0) 1994 240002

Web site: www.feedcompounder.com E-mail: mail@feedcompounder.com

CONSULTANT/RESEARCHER:

SUBSCRIPTION RATES:

Print and On-Line

One year: £80

Two years: £150

Three years: £200

On-Line Only (No Print Copy)

One year: £60

Two years: £114 Three

£153

Feed Compounder July/August 2023 PAge 1 Opinion: No Space For Weak Links 2 Ryan Mounsey: Feed Production Update 4 Colin Ley: View from Europe 10 Christine Pedersen: Milk Matters 14 Matthew Wedzerai: Scientifically Speaking … 16 Robert Ashton: 10 Ways to Get Results Without Getting Angry 18 Ruminations: 20 By Rob Daykin Green Pages 22 Feed Trade Topics From the Island of Ireland £4m Upgrade of Mole Valley Farmers’ Lifton Feed Mill 25 Copper in Ruminants 26 By Dr. Rahma Balegi & Leandro Royo New Yeast Cell Wall Product Promises Consistency 28 With Mark McFarland Alternatives to Antibiotics in Pig Production 30 By Ian Hands Poultry Vitamin Recommendations For Productive and Sustainable Farming 33 By José-María Hernández Solutions for Sustainable Pig and Poultry Producers 38 With Richard Remmer & Chloe Paine Early Grass Silages Show Impact of Growing Season 41 Supporting Sustainability Requires Holistic Individual Approach 42 By Norman Downey Spotlight on Feed Mill Process Engineering 44 Products Influencing Feed Characteristics 46 In Brief 50 Wynnstay Group Plc Reports Record Interim Results 51 People 52 Buyers’ Guide 54 COMMENT COMPOUNDE

EED Contents July/August 2023 Vol. 43 No. 4

R F

ISSN 0950-771X Views expressed by contributors are not necessarily

© Feed Compounder 2023 DEPUTY EDITOR: Ryan Mounsey

MANAGER: Fiona Mounsey EDITOR: Andrew Mounsey

years:

those of the Publisher.

ADVERTISEMENT/SALES

Roger W. Dean

PUBLISHED BY: Pentlands Publishing Ltd Plas Y Coed Velfrey Road Whitland SA34 0RA

NO SPACE FOR WEAK LINKS

The various links in the feed-to-food chain appear to be particularly reliant on the health and prosperity of each other at present as all parties battle together to emerge from tight raw material supplies, high inflation, rising interest rates, and stubborn cost-of-living pressures. It is easy to assume that today’s problems are the most damaging ever, or at least the most uncomfortable in a decade or so. Let’s settle, therefore, with the comment that this year’s woes are up there with the very worst many in the industry have seen and see where that takes us.

Keeping each and every member of a competitive supply chain satisfied is rarely achievable. Often, for example, if things are good for farmers, then agri-input providers or retailers will see their margins being squeezed. Equally, good returns at the input or retail ends of the chain will produce on-farm complaints that the people who are actually growing livestock are being short-changed.

In more ‘normal’ times than currently exist, there will inevitably be periods when input providers have to draw on their reserves to get them through a tough time. Farmers may need to do the same when the balance shifts against them, behaving much like under-fed dairy cows which are required to ‘live of their backs’ when producers decide to trim feed rations for a period. These are often short-term measures to keep businesses afloat for a little longer, but they happen, or have in the past.

The difference today, or so it would appear, is that business reserves and on-farm feed rations are already pretty close to their sustainable operating limits, which is why feed-to-food chain members are currently ultra-dependent on the economic health of each other.

Listening recently to a Dorset pig farmer talking about how his decision to cut sow numbers over the last few years has resulted in better sale prices for the pigs he still has, it was clear that his decision made perfect sense for him personally. It certainly doesn’t add up for domestic pig supplies in total, as referenced by the fact that homeproduced bacon in the UK is operating on a market share of below 55%. UK producers could and should be grasping more of their own market than that, to the benefit of all input providers, feed compounders included. The time for action on this, however, was before sows were put off in the first place, albeit for very sound economic reasons at the time. Building back numbers now is so much more challenging and costly.

The frustration, of course, is that the slimmed down Dorset pig herd would now be filling some profitable gaps in the local market if sow

numbers hadn’t been cut two or three years ago. Crisis point decisions to enable a business to survive long term can easily result in a ‘what if we hadn’t’ scenario when the market turns up again. By the same token, businesses that hold on too long when the figures don’t add up, as has often been the case for pig farmers in recent years, can find they’ve opened a door to bankruptcy which is impossible to close.

At the end of the day, selling fewer pigs is better than selling none. However, those fewer pigs will be eating less feed, on a herd basis, than in the past. Nobody wins, therefore: producer, input provider or retailer.

A similar warning on the need for action in dealing with future red meat breeding shortages was issued on the eve of the Royal Highland Show, near Edinburgh, by the Scottish Association of Meat Wholesalers (SAMW).

If cattle numbers keep dropping as they have done in recent years, Scotland will reach a point where there won’t be sufficient critical mass to sustain the number of abattoirs which currently exist across the country, according to SAMW President, Ian Bentley. He also said this could ultimately threaten the very existence of the Scotch brand, describing it as ‘a hard-earned global status which, once lost, will not be easy to revive’.

Suggesting there are probably no more than two to three years left to address the current cattle numbers’ decline, he added that without prompt action the industry will shrink. This will impact everyone involved in the feed-to-food chain.

There’s no need to search hard for evidence of feed company commitment to farmers, of course. It’s a given of good business. Mission statements abound in pledging support for the feed customer part of the chain. The challenge today is to drive that support home in such a way that the entire chain is strengthened by what the industry in total is going through, rather than weakened, as could so easily happen.

There will always be winners and losers in the sort of high-pressure global conditions which exist at present. This is part and parcel of the normal cut and thrust of business. But with Russia’s war on Ukraine continuing, complete with all the human and economic fall-out that generates, this remains a dangerous time for us all.

There is no scope whatsoever to allow any weak links in the feed-to-food chain to be created. As with reducing sow numbers and a Scottish cattle population decline which SAMW says is ‘entering its final phase’, damage done now will take a long time to repair.

PAge 2 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com opinion

£13,035* increase in production profitability 647-tonne* CO2e reduction 3% improvement in feed efficiency 21% saving on soybean meal use Optigen® is a superior non-protein nitrogen source that can help you overcome the protein challenge by managing fluctuating feed costs and improving the sustainability of your business. Backed by more than two decades of research, Optigen enables partial replacement of plant protein sources in ruminant rations. Ask Alltech how Optigen can help you get the most out of your protein. Boosting of your protein stocks * within a 1,000-cow dairy herd (Salami et al., 2021) the limits Call: 01780 764512 Alltech.com/uk RUMEN FUNCTION

Feed Production Update

By Ryan Mounsey

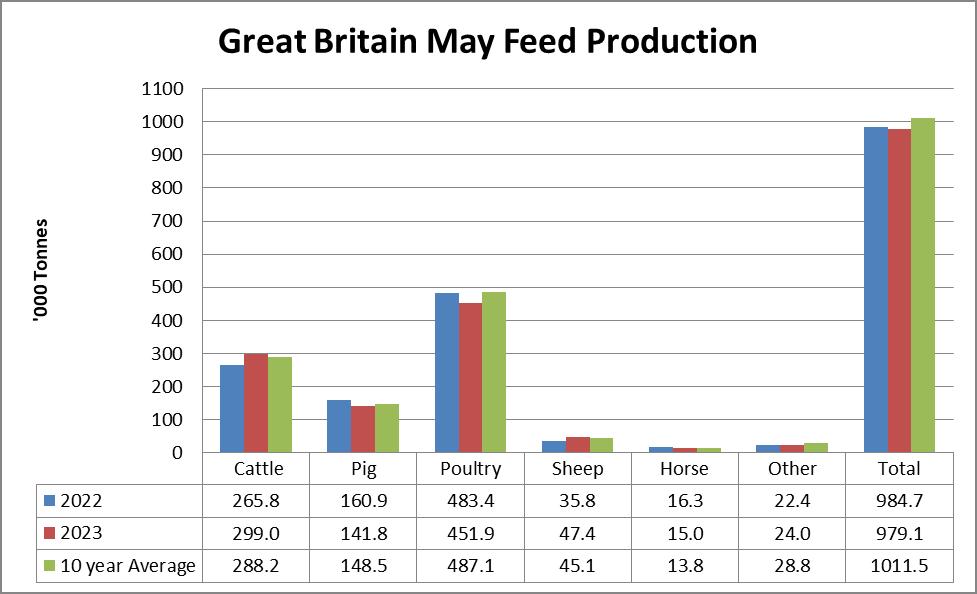

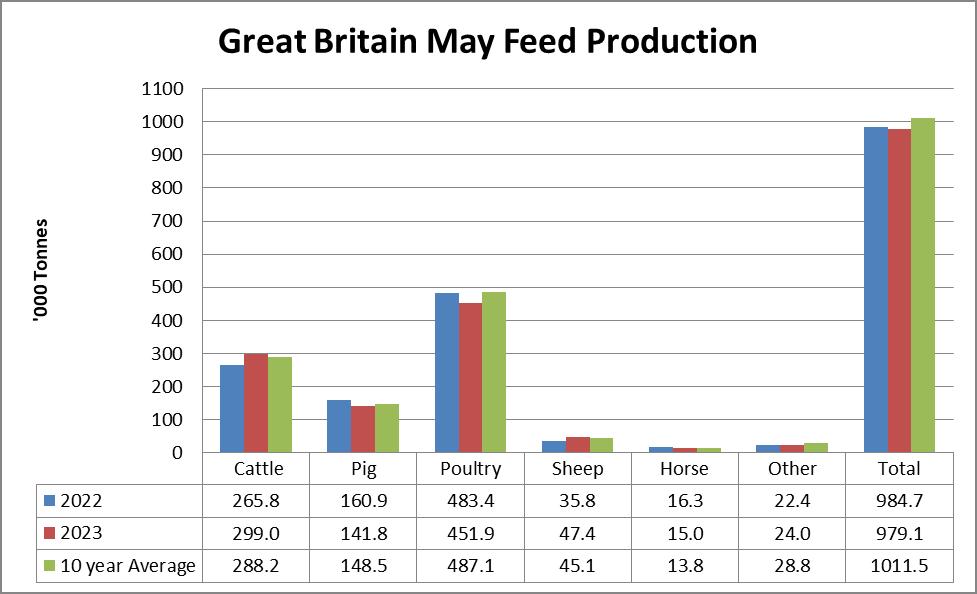

GREAT BRITAIN Monthly Update – May

Total production of compounds, blends and concentrates, including integrated poultry units, during the month of May 2023 declined for the second year in succession to 979,100 tonnes, a decrease from the corresponding month a year earlier of 5,600 tonnes or 0.6 per cent. Moreover, this reduction dropped the current production even further below the 10 year average for the month which it fell 32,400 tonnes or 3.3 per cent below.

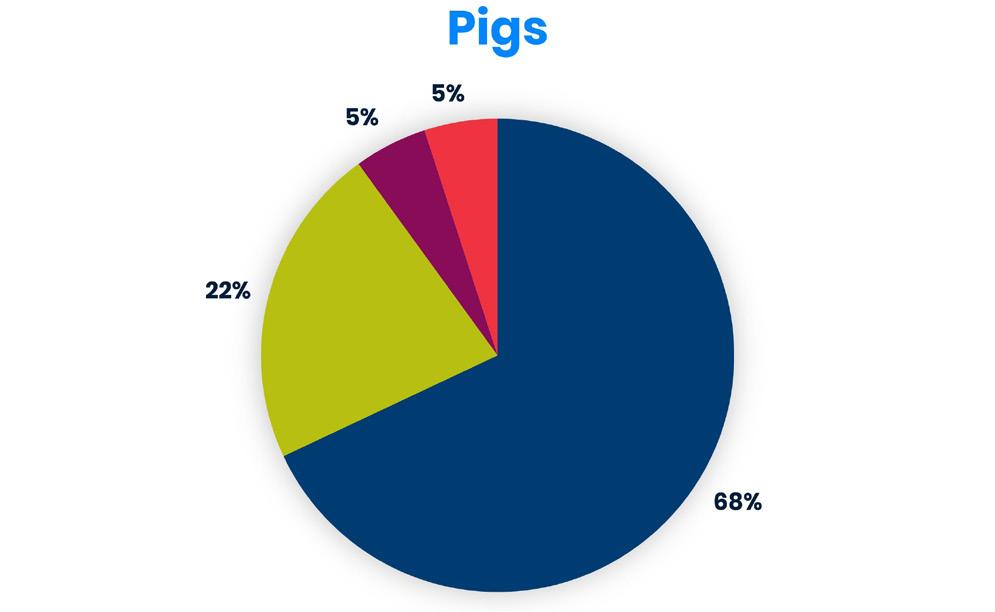

Total feed production during the month of May 2023 was made up of: 46.2 per cent poultry feed, 30.5 per cent cattle and calf feed, 14.5 per cent pig feed, 4.8 per cent sheep feed, 1.5 per cent horse feed and 2.5 per cent other feed.

After reaching a record high for the month in the May of 2021, total poultry feed production has fallen year on year. The current total, of 459,100 tonnes, was 31,500 tonnes or 7.0 per cent down on a year previous and the lowest output for the month since 2009. Furthermore, the total under review was 28,000 tonnes or 5.9 per cent lower than the decade long average for May.

Apart from the production of integrated poultry units, which rose from a year previous by 500 tonnes or 0.5 per cent to 161,500 tonnes, and turkey compounds, which increased by 500 tonnes or 10.6 per cent, all poultry feed subsectors fell below their year earlier returns. Output of broiler chicken compounds fell markedly from 2022 levels to 144,700 tonnes, a drop of 26,100 tonnes or 15.3 per cent; chick rearing compounds fell 1,500 tonnes or 13.4 per cent to its lowest May return since 2006 of 9,700 tonnes. Both layer compounds and poultry breeding and rearing compounds also declined notably from year earlier levels, the former did so by 8,700 tonnes or 9.7 per cent to 81,400 tonnes and the latter by 2,100 tonnes or 8.6 per cent to 22,400 tonnes. Once again, there were no statistics provided for the all other poultry compounds

and poultry protein concentrates subsectors.

For the first time in 13 months, total cattle and calf feed surpassed its year previous output. May cattle and calf feed production bettered its corresponding 2022 return by 33,200 tonnes or 12.5 per cent and rose to 299,000 tonnes, the fifth highest for the month on record. In addition, this increase resulted in the current total outpacing the 10 year average for the month by 10,800 tonnes or 3.7 per cent.

The entire cattle and calf feed sector bettered their year earlier returns. Cattle protein concentrates, at 6,900 tonnes, were at their highest output for the month since 2001 and 700 tonnes or 11.3 per cent up on a year previous. In addition, the production of blends for dairy cows were at their highest level since 2015 of 54,500 tonnes, an increase of 9,600 tonnes or 21.4 per cent from a year earlier. Following a significant reduction in output a year previously, production from the sector’s largest element, compounds for dairy cows, increased by a substantial 15,400 tonnes or 10.0 per cent to 169,300 tonnes. Total calf feed followed a similar pattern and its current May production of 12,500 tonnes was 700 tonnes or 5.9 per cent greater than a year previous. The two remaining sectors both also outstripped their year previous counterparts by considerable amounts: all other cattle compounds rose by 3,800 tonnes or 11.9 per cent to 35,600 tonnes, and all other cattle blends grew by 3,000 tonnes or 17.4 per cent to 20,200 tonnes.

At 141,800 tonnes, total pig feed production was at its lowest level for the month under review since 2013. Current production was 19,100 tonnes or 11.9 per cent down on a year previous and 6,700 tonnes or 4.6 per cent below the 10 year average for May.

Despite this sizeable downturn, pig protein concentrates matched their year earlier output of 300 tonnes but this was the only category to do so. Pig starters and creep feed, at 3,500 tonnes, and pig growing compounds, at 21,400 tonnes, were both at their lowest levels for the month since records were kept in their current form, following respective declines of 300 tonnes or 7.9 per cent and 5,900 tonnes or 21.6 per cent. Production of pig breeding compounds was also at a historically low level for May of 31,200 tonnes, its lowest return for the month since 2009 and 2,300 tonnes or 6.9 per cent lower than a year previous. Although pig finishing feed for the month under review was 9,800 tonnes or 11.2 per cent down on its corresponding year earlier production, its output of 77,900 tonnes was nevertheless the second highest on record for May. Pig link and early grower feed had also fallen from a record high output for the month from a year earlier, doing so by 1,000 tonnes or 11.9 per cent to 7,400 tonnes.

An 11,600 tonnes or 32.4 per cent increase from the historically low May production of a year previous brought total sheep feed output up to 47,400 tonnes. This caused the total under review to rise 2,300 tonnes or 5.0 per cent above the decade long average for May.

Production of compounds for breeding sheep, at 10,800 tonnes, had more than doubled from the historically low output of a year previous, outstripping it by 5,600 tonnes or 107.7 per cent. Similarly, the output of blends for growing and finishing sheep rebounded from its second lowest May total in the past decade by 1,600 tonnes or 45.7 per cent to 5,100 tonnes. Blends for breeding sheep were at their

PAge 4 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

UK & IRELAND PREMIER SUPPLIER

- Feed Phosphates

- Feed Grade Urea

- Sodium Bicarbonate

- Oyster Shell Grits

- Magnesium Oxide

- Emulsifiers

- Caustic Soda Pearl

- Cubicle Liners

- Protected Fats

highest level for May in five years of 1,200 tonnes, an increase of 300 tonnes or 33.3 per cent from a year earlier. Finally, at 29,900 tonnes of production, compounds for growing and finishing sheep were at their fourth highest level for the month under review having surpassed its year previous return by 3,900 tonnes or 15.0 per cent.

Total horse feed production for May had fallen 1,300 tonnes or 8.0 per cent from the record high output for the month from a year previous to 15,000 tonnes of production. However, the current total was still 1,200 tonnes or 8.3 per cent in excess of the 10 year average for the month.

At 24,000 tonnes, total other feed production surpassed its year earlier output for May by 1,600 tonnes or 7.1 per cent. Nevertheless, in spite of this upturn, the current total was still 4,800 tonnes or 18.2 per cent lower than the decade long average for month under review.

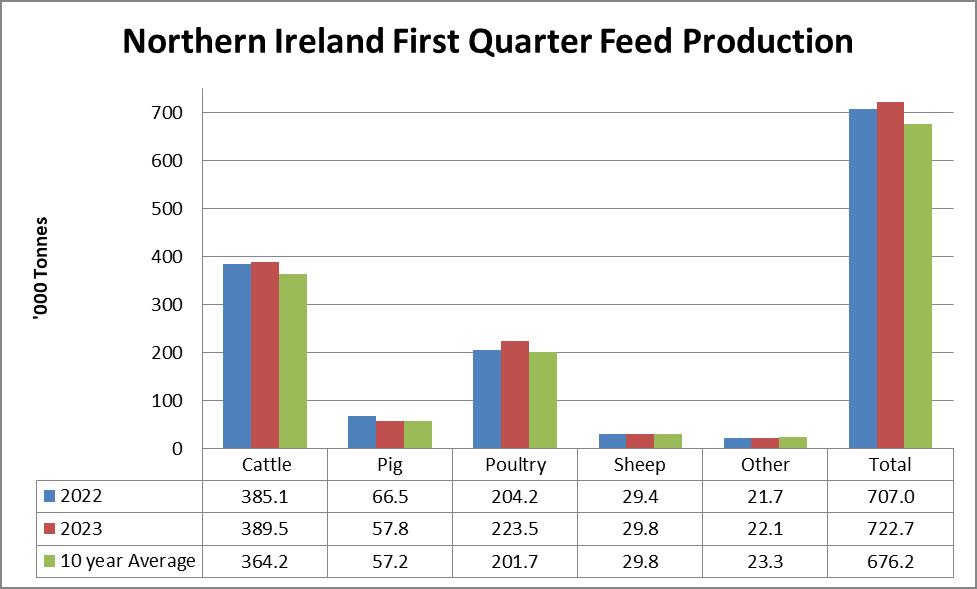

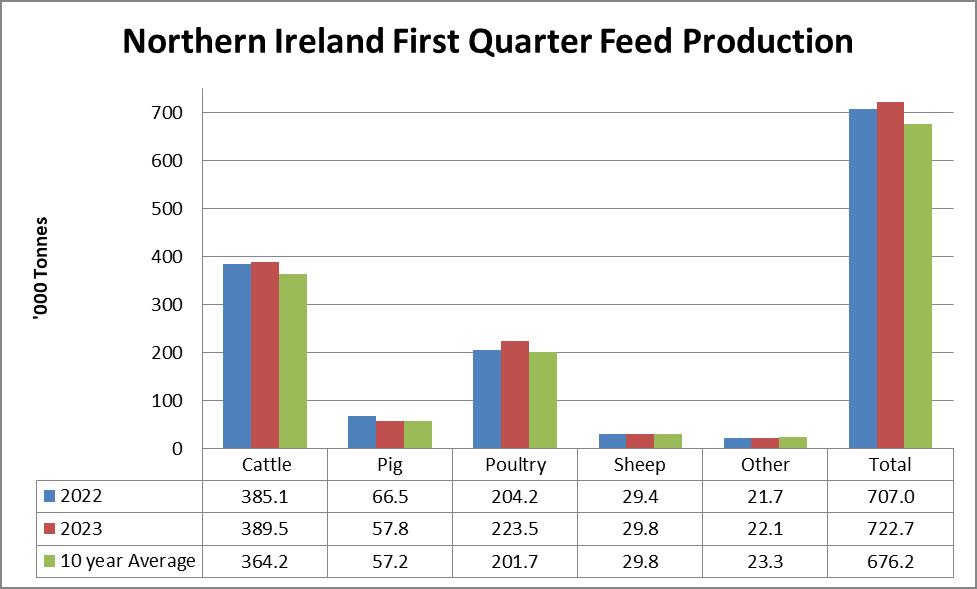

NORTHERN IRELAND First Quarter Overview

Total production of compounds, blends and concentrates during the first quarter of 2023 in Northern Ireland increased from the corresponding period a year earlier by 15,700 tonnes or 2.2 per cent to 722,700 tonnes, a record high for the timeframe. Moreover, the total under review was 46,500 tonnes or 6.9 per cent in excess of the decade long average for the timeframe.

Total feed production during the first quarter of 2023 was made up of: 53.9 per cent cattle and calf feed, 30.9 per cent poultry feed, 8.0 per cent pig feed, 4.1 per cent sheep feed and 3.1 per cent other feed.

At 389,500 tonnes, total first quarter cattle and calf feed was also at record levels for the timeframe under review. The current total surpassed its year previous output by 4,400 tonnes or 1.1 per cent and bettered the 10 year Q1 average by 25,300 tonnes or 6.9 per cent.

There was a distinct split between the beef and dairy sectors in terms of first quarter feed outputs. Production of both beef coarse mixes or blends and beef cattle compounds fell significantly from year previous levels: the former decreased by 7,500 tonnes or 10.0 per cent to 67,900 tonnes and the latter by 5,700 tonnes or 12.1 per cent to 41,600 tonnes. All other cattle compounds output also fell below its corresponding year earlier return by 200 tonnes or 15.1 per cent to 1,400 tonnes; similarly, production of protein concentrates for cattle and calves, at 800 tonnes of production for the quarter, was 200 tonnes or 20.0 per cent down on a year previous. In contrast, the sector’s largest element, dairy cow compounds, had surpassed its year

previous production by 7,100 tonnes or 4.4 per cent to a record high of 170,000 tonnes. Furthermore, dairy coarse mixes or blends were also at an unparalleled output for the quarter of 81,800 tonnes which was 9,000 tonnes or 23.0 per cent in excess of the production for the period from a year earlier. Production of all other calf compounds had increased from the Q1 a year previous by 2,000 tonnes or 8.3 per cent to another record first quarter total of 26,000 tonnes.

For the second first quarter in succession, total poultry feed surpassed its year previous output. The current output for the period of 223,500 tonnes was a significant 19,400 tonnes or 9.5 per cent in excess of its 2022 return and a record high for Q1. Additionally, the total under review outpaced the decade long average for the timeframe by 21,800 tonnes or 10.8 per cent.

All poultry subsectors exceeded their previous totals for the quarter and half of them were also at unmatched levels for the period. Both layer and breeder feed production, at 87,800 tonnes, and chick rearing feed, at 7,700 tonnes, were at record levels for the timeframe, bettering their year earlier returns by 2,700 tonnes or 3.2 per cent and 600 tonnes or 8.0 per cent respectively. Broiler feed output for the first quarter of 2023 surpassed its year previous output by 12,400 tonnes or 11.4 per cent and rose to 121,200 tonnes, the second highest total since records were kept in their current form. Turkey and other poultry feed Q1 output more than doubled from a year earlier to 6,900 tonnes, an increase of 3,600 tonnes or 110.8 per cent.

Having been at roughly the same level of production over the past three first quarters, total pig feed production decreased by 8,700 tonnes or 13.1 per cent from a year earlier to 57,800 tonnes. Despite the sizeable drop, the current output was 600 tonnes or 1.1 per cent in excess of the decade long average for the timeframe.

The downturn in first quarter production was consistent throughout the entirety of the sector. First quarter production of pig breeding feed had fallen by 1,100 tonnes or 13.0 per cent to its lowest return for the period since 2013 of 7,400 tonnes. Moreover, pig finishing feed and pig growing feed had both fallen for the second Q1 in succession with the former declining from the corresponding period a year previous by 2,600 tonnes or 9.4 per cent to 24,100 tonnes of output, and the latter by 2,000 tonnes or 15.7 per cent to 10,500 tonnes. Having recorded an all-time high output in the period under review in 2022, pig link and early grower feed output dropped by 1,400 tonnes or 13.7 per cent to 9,000 tonnes. Pig starter and creep feed production also fell sharply from a year previously to 6,700 tonnes, a decline of 1,600 tonnes or 19.3 per cent.

At 29,800 tonnes, total Q1 sheep feed output marginally bettered its year earlier return by 400 tonnes or 1.3 per cent. This increase also brought the total under review above the decade long average for the quarter by 100 tonnes 0.2 per cent.

There was a mixed picture presented from across the sheep feed production sector; breeding sheep feed compounds output decreased sharply for the second first quarter in a row to 15,300 tonnes, a drop of 1,300 tonnes or 7.9 per cent, whereas production of coarse mixes or blends for sheep increased markedly from a year previous to 6,500

PAge 6 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

BECAUSE IT’S ABOUT FEED COST

Fully charged, healthy growth!

GuanAMINO® is the best supplemental creatine source which ensures optimized nutrient utilization and feed costs. Furthermore, it spares metabolic energy and works towards an optimized amino acid metabolism. GuanAMINO® supplementation enables improved feed conversion, healthy muscle growth and resilience, and leads to higher income over feed costs.

Sciencing the global food challenge. | evonik.com/guanamino

tonnes for the quarter, up 1,600 tonnes or 32.3 per cent from a year previous to its highest Q1 level in 5 years. Lastly, growing and finishing compounds for sheep grew from its respective total a year earlier by 100 tonnes or 1.5 per cent to 8,000 tonnes of output for the period.

A 300 tonnes or 1.5 per cent increase in total first quarter other feed production from a year previous brought output for the timeframe under review up to 22,100 tonnes. This increase, however, was not great enough to bring the current total above the decade long Q1 average, of which it was 1,300 tonnes or 5.5 per cent short.

With production from the first three months of 2023 at record highs, the industry’s two largest sectors also at unparalleled levels for the timeframe and sheep feed production above both its year previous return and long term average, 2023 looks on course to be a significant year for Northern Irish feed production especially when viewed in the global context of widespread decline in feed production. Only pig feed production appears to be consolidating but this is perhaps unsurprising given the exceptional returns it has posted in recent years.

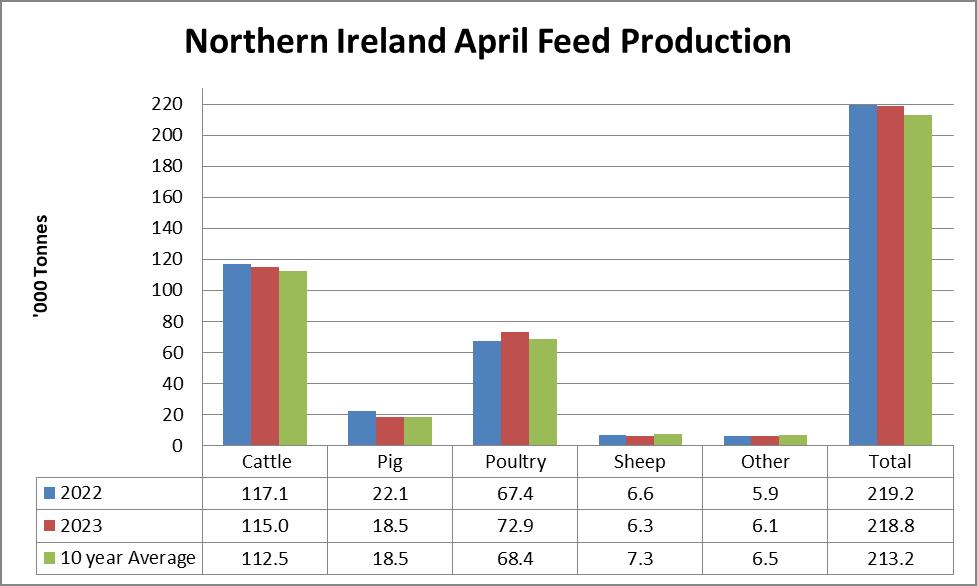

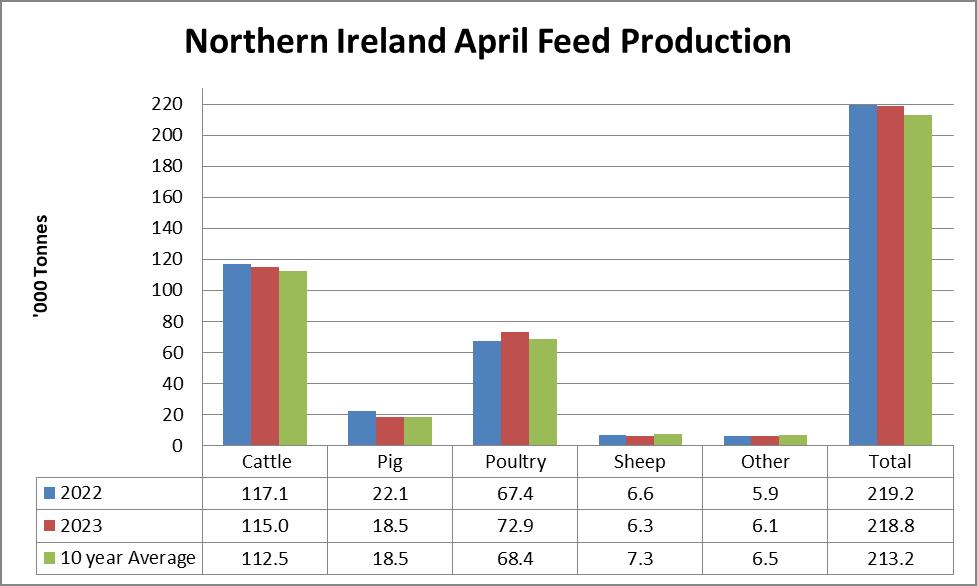

NORTHERN IRELAND Monthly Update – April

Total production of compounds, blends and concentrates during April 2023 in Northern Ireland dropped 400 tonnes or 0.2 per cent from the corresponding month a year previously to 218,800 tonnes. This was the second April in succession where production had fallen below its year earlier level and yet the output under review was still 5,600 tonnes or 2.6 per cent in excess of the decade long average for the month.

Total feed production during April 2023 was made up of: 52.6 per cent cattle and calf feed, 33.3 per cent poultry feed, 8.5 per cent pig feed, 2.9 per cent sheep feed and 2.8 per cent other feed.

A 2,100 tonnes or 1.8 per cent decrease in total cattle and calf feed output from a year earlier brought production down to 115,000 tonnes. However, the current output was 2,500 tonnes or 2.3 per cent greater than the 10 year average for April.

Despite the drop in production from the sector overall, other calf compounds were at their highest ever level for the month of 8,400 tonnes, an increase of 1,300 tonnes or 18.8 per cent from a year previous. Dairy coarse mixes or blends were also up significantly from a year earlier, rising by 2,600 tonnes or 12.8 per cent to 22,700 tonnes. In contrast, the sector’s largest element, dairy cow compounds dropped 1,100 tonnes or 2.1 per cent from its year previous level to

54,300 tonnes. Both beef categories also fell below their year earlier returns, beef coarse mixes or blends did so for the second April in succession, in this instance by 2,900 tonnes or 13.5 per cent to 18,300 tonnes, and beef cattle compounds did so by 1,900 tonnes or 14.7 per cent to 10,800 tonnes. Finally, all other cattle compounds, at 300 tonnes declined by 100 tonnes or 31.8 per cent.

At 72,900 tonnes, total poultry feed production was at its highest recorded level for April, surpassing 2022’s total by 5,500 tonnes or 8.2 per cent. Additionally, the total under review outstripped the decade long average for the month by 4,500 tonnes or 6.5 per cent.

Only layer and breeder feed output fell below that of a year earlier, it dropped 500 tonnes or 1.6 per cent below the record total for the month from a year previous to 28,500 tonnes. On the other hand, turkey and other poultry feed rose sharply from the record low output of a year earlier to 2,200 tonnes, an increase of 1,600 tonnes or 294.9 per cent. Broiler feed, at 39,700 tonnes surpassed its year previous output by 4,200 tonnes or 11.7 per cent. Lastly, chick rearing feed output rose from that of the corresponding month a year previously by 200 tonnes or 9.4 per cent to 2,500 tonnes.

Total pig feed production for April had fallen by 3,600 tonnes or 16.4 per cent from a year previous to 18,500 tonnes of output, its lowest level for the month since 2019. As a result of this drop, the production under review was directly in line with 10 year average for the month.

All pig feed subsectors fell below their respective year previous returns. At 3,200 tonnes of production, pig growing feed declined from its output a year earlier by the largest amount across the sector, doing so by 1,300 tonnes or 29.9 per cent. Additionally, pig finishing feed production decreased by 900 tonnes or 9.9 per cent from its second highest return for the April a year previous, to 7,800 tonnes of output. Production from the remaining categories all fell sharply from their 2022 levels. Pig breeding feed did so by 600 tonnes or 20.4 per cent to 2,400 tonnes; pig link and early grower feed by 500 tonnes or 15.2 per cent to 2,900 tonnes; and pig starter and creep feed did so by 300 tonnes or 11.4 per cent to 2,200 tonnes.

For the second April in a row, total sheep feed output had dropped below its year previous level, in this instance, output had declined by 400 tonnes or 5.4 per cent to 6,300 tonnes. Due to the much greater outputs posted in the first half of the preceding decade, the total under review was an even greater 1,000 tonnes or 13.4 per cent below the 10 year April average.

Breeding sheep compounds had also fallen for the second April in succession, dropping by 300 tonnes or 9.9 per cent to 2,700 tonnes. The output of growing and finishing compounds for sheep was also down on a year previous, declining by 200 tonnes or 7.4 per cent to 2,300 tonnes. On the other hand, coarse mixes or blends for sheep rose by 100 tonnes or 10.5 per cent to 1,300 tonnes of production.

Following a sharp fall in output a year earlier, total other feed production increased by 200 tonnes or 2.8 per cent to 6,100 tonnes. Despite this rise, production was 400 tonnes or 6.2 per cent down on the decade long average for the period.

PAge 8 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Mycofix ® Deactivate mycotoxins Activate performance Powered by science to actively defend against multiple mycotoxins* With 3 combined strategies *Authorized by EU Regulation 1060/2013, 2017/913, 2017/930, 2018/1568 and 2021/363. If not us, who? If not now, WE MAKE IT POSSIBLE ADSORPTION BIOTRANSFORMATION BIOPROTECTION Follow us on: www.dsm.com/anh

View From Europe

By Colin Ley

Make the most of Brussels shutdown

If you’re waiting for the European Commission (EC) to sort something out, then it’s time to resign yourself to the reality of the imminent Brussels shutdown.

I’m being disrespectful, of course, given that there is always a skeleton staff in place to deal with any issues that arise, but the truth is that the EC in August is for emergencies only and the second half of July tends to resemble a very long Friday afternoon. If you’re going to disrespect, why bother being subtle about it.

My personal EC holiday experience came during a period when I was running a farm business online news site and needed something new to report each day. Normally, when I hit a quiet 24 hours on the news front, I would trawl various government sites, searching for a hint of a story. For most of the year, the EC would always be saying something, except in August. I wouldn’t have minded so much if the Commission newsroom hadn’t carefully sent me the names of their specially selected skeletons for the month, along with a link to follow their daily outpourings. I gave up after a week of reading that the said skeleton had ‘nothing to report’.

My sympathies, however, if your August frustration is actually about something important. I, after all, could always write about the potential development of three-legged ducks or two-headed sheep to get me through everyone else’s holiday month.

Unfinished business

Looking back, as Brussels starts to slow, there are clearly some unfinished items of business to be addressed once the autumn programme is launched.

Picking up on FEFAC’s 30th Congress report from Sweden, for example, I note that Copa-Cogeca Secretary-General, Pekka Pesonen is concerned that the EU Green Deal’s policy objectives risk reducing or pushing out the European livestock sector, a development he said which will undermine EU food security and the whole rural economy.

Dirk Jacobs, FoodDrinkEurope Director General, focused his congress attention on urging the ‘upcoming’ EC to allocate funds for a sustainable food investment plan under the next EU legislature’s budget, adding that such action was needed to enable the feed industry’s potential to prevent nutrient losses across the food chain.

FEFAC’s immediate past President, Asbjørn Børsting, used his congress platform to call for an EU regulatory framework that would support the development and uptake of the sorts of innovation that help boost sustainability. This would, or should, involve new genomic techniques and the ‘legal possibility’ to harvest cover crops for bio-refining purposes.

Plenty there for the EC to focus on from September onwards, certainly, when the presidency of the Council of the EU is held by Spain. Starting on July 1 and running to the end of December, it’s a presidency with has to contend with both August and the Christmas/New Year period. At least this might concentrate Spanish efforts, whose already declared four presidency priorities are to redustrialise the EU; advance the green transition; promote social and economic justice; and strengthen European unity.

Refocusing on European businesses

Looking closer at the details of the Spanish plan, a major concern is that while it is perceived that the last 70 years of ‘international openness’ has been mostly beneficial for the EU, enabling strong levels of economic growth and social welfare, this same openness has ‘facilitated the offshoring of industries in strategic sectors’. This, according to Spanish analysis, has made the EU ‘excessively dependent on third countries in areas such as energy, health, digital technologies and food’.

To attempt a reset, the Spanish Presidency is committed to ‘fostering the development of strategic industries and technologies in Europe, the expansion and diversification of its trade relations, and the strengthening of its supply chains, giving special attention to Latin America’. This includes focusing closely on the EU-CELAC Summit, a heads of state and government event which is due to be held in Brussels later this month when European, Latin American and Caribbean leaders will seek to ‘renew and strengthen relations’.

As for advancing the green transition, the Spanish pledge is to give the programme its full backing, stating that successful transition will allow the EU to drastically reduce its dependence on energy and raw materials, lower electricity costs and generally make the EU27 companies more competitive. All of which sounds good.

And now ‘breathe’ or in Brussels-speak, take a month off. Sorry, disrespectful again.

Kick-start September

The commercial challenge in all this is to make sure your arguments are made prior to the end of July and that you’re ready to hit the ground running when September comes. In that context there are some excellent kick-start events to get you going in the early autumn.

My favourite post-holiday boost in recent years has been to attend SPACE, a genuine top-level exhibition and conference gathering centred on everything involving livestock production. This year’s happening will take place from September 12 to 14 within the Rennes Parc-Expo, in north-west France. The organisers claim to attract 1,200 exhibitors and over 100,000 professional visitors each year with no fewer than 12,000 international visitors drawn from 120 countries. Having been there several time, I don’t dispute the figures.

This is the 37th edition of SPACE, so the processes behind the event definitely work. In the Parc-Expo itself, there are countless conference and symposium sessions, a genetics hub with 750 animals, and easy access to all the latest innovative contenders.

Away from Rennes, delegates get the chance to visit selected local

PAge 10 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

• Reduce costs and prevent risks

• Optimize your entire product chain

• Guarantee higher-quality products

BESTMIX® Feed Formulation, Quality Control, Ration Calculation and ERP solution

Peace of mind:

No bearings, seals or service down time … Guaranteed for 5 YEARS for UK

Single V-Belt drive; High inertia, smooth and efficient No oil leaks into feed or on press floor

Designed, fabricated and built in Italy

Support:

Design, installation and project management services

UK based stock and engineers

2-3 day Die and roll refurbishment

Dies held in stock on request

Experience:

Sales technicians who understand the day-to-day requirements of a busy mill

>50 years manufacturing experience at La Meccanica Condex Ltd - established in 1980

Condex

not

buying a pellet

At

you’re

just

mill:

www.lameccanica.it …… Contact us to discuss your requirements WHITE CROSS, LANCASTER, LA1 4XQ Tel: 01524 61601 Email: info@condex.co.uk Web: www.condex.co.uk

www.bestmix.com

Scan to learn more:

in

BESTMIX® Software: The best solution

challenging times

farms to get a taste of all forms of livestock, with a definite nod towards the part compound animal feed and on-farm feed processing play in successful businesses.

It’s easy never to drag yourself away from the Parc-Expo, of course, but it’s worthwhile if you take the plunge. One year, I sat on a SPACE bus, returning from an impressive Brittany pig farm chatting to a young Kenyan farmer about how he was attempting to develop his business and how that chimed with what we’d just seen.

From a media perspective, SPACE was a good way to relaunch my autumn programme, getting some essential cash into the bank into the process. I also picked up some key contacts along the way, a few of which led to long-term working contracts. I would think the potential benefits for commercial visitors will be equally rewarding.

It’s only too easy to be downcast about the state of our industry at present, given the political and economic pressures we’re locked into. At SPACE (other events exist of course!) the feeling is generally upbeat and progressive. Everything is about what’s coming next. How to produce more. How to grow businesses. How to survive and prosper. Frankly, it’s a good way to drive forward into September.

AI and feed compounding

There’s an enormous amount of chatter about the role which Artificial Intelligence (AI) will play in our future, mainly focused on concerns over how ‘out of control’ AI units may impact our personal lives. In the midst of this, however, it’s more likely we’ll see AI impacting our lives first in a commercial sense, certainly in the short-to-medium term.

I was recently looking, for example, at plans for a major salmon farming development in the UK, the prospectus for which included a strong plug for the project being designed to maximise the potential of AI. A good headline for the general media, but when I asked for the sort of details that would interest industry readers, the information was kept ‘under wraps’ for reasons of commercial security.

In reality, even a development which is ready to be exposed to the planning regulators, will have a somewhat open file on AI potential. The sector is moving so fast at present that ‘just-in-time’ decisions will deliver a greater reward if you get it right and a more limiting return if you jump too soon. Choosing between competing new technologies is always difficult, although at some point you do have to pull the trigger.

Black Sea Initiative

Back in the here and now, and very much so, the extension of the Black Sea Initiative is rapidly approaching its renewal date of July 17. That has implications for us all.

According to a new summary produced by the UK’s Agricultural and Horticultural Development Board (AHDB), Russia has restated demands for their state agricultural bank to be reconnected to SWIFT, to ‘avert the collapse of the deal’. This follows news that the EU was considering a proposal for the Russian agricultural bank to set up a subsidiary to reconnect to SWIFT. This was dismissed by a Russian Foreign Ministry spokesperson, reported AHDB, saying it would take many months to set up a subsidiary and connect. A UN attempt to create an alternative payment

channel with JP Morgan has also been reportedly rejected, according to the Russian spokesperson.

Asking what all this means for the deal, AHDB added that Britain’s UN Ambassador said as recently as July 3 that she was ‘not confident’ the grain deal would be renewed.

Although we’ve been here before, this is clearly something that will demand maximum attention over the next few weeks.

Ukraine remains optimistic that the grain flow will continue, added AHDB, while also warning that as the renewal date gets closer, global grain prices are ‘likely to see some volatility’. Something of an understatement I suspect.

Food waste

Fresh into my inbox, is a statement from the European Former Foodstuff Processor’s Association (EFFPA), effectively welcoming the EU’s new food waste reduction targets. Food waste is another part of the feed-tofood chain that needs to be carefully managed. This is also an area where political thought, and therefore potential funding, is currently well focused and therefore worth an extra look.

The EC published its food waste reduction targets on July 5, with the declared aim of stimulating the sustainable use of key natural resources. This is against an estimated 59 million tonnes of food being wasted in the EU each year at a market value of €132 billion More than half of this waste (53%) is generated by households, followed by the processing and manufacturing sector (20%).

As a result, the EC’s targets concern food processing operations, the retail sector, and households. In order to make a significant impact, the EU wants to reduce food waste generation by 10%, in processing and manufacturing, and by 30% (per capita), jointly at retail and consumption (restaurants, food services and households).

EFFPA’s stance is that this is an opportunity for the food value chain to ‘engage with the former foodstuffs processing sector to benefit from the animal feed solution to prevent food waste’

The Association further stated that the former foodstuff processing sector can make a significant contribution towards the successful implementation of the EC’s targets through the processing of food losses into safe ingredients destined for use in animal feed. As such, EFFPA’s ambition is to strengthen cooperation with authorities, food business operators, as well as retailers, to ‘reduce avoidable food losses in the chain through animal feed’

Food waste – the future

Finally, and sticking with the food waste theme, a brief shout out to the team of students who won the Dutch-based Nature-based Future Challenge run by Wageningen University & Research (WUR).

The winning idea centred on converting agricultural food waste into a source of protein with the help of fungi, a pitch which earned the students €6,000 and the promise of professional support to further develop their idea into a real start-up.

It’s always been said there is money in muck. Clearly, there is money in food waste today and we certainly have more than enough to go round.

PAge 12 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Feed Compounder July/August 2023 PAge 13 With products for every kind of mycotoxin, B.I.O.Tox® Mycotoxin Binders can protect your animals from clinical and subclinical intoxications and performance drops. B.I.O.Tox® Activ8 is specially formulated with activated substances and natural detoxifiers to boost health, performance, and liver function. It is scientifically proven to have a superior binding capacity of Fusarium toxins, especially Deoxynivalenol Contact us: caiger-smith@biochem.net . +44 7722 019727 biochem.net Revitalize Performance. Protect Your Animals. It’s Time to Detox! SODIUM BICARBONATE SODIUM CARBONATE CALCINED MAGNESITE PHOSPHATES A NEW BULK SUPPLY CHAIN FACILITY NEWPORT FEEDS +44 (0)20 8332 2519 +44 (0)20 8940 6691 sales@newport-industries.com Contact us:

Milk Matters

By Christine Pedersen Senior Dairy Business Consultant The Dairy Group christine.pedersen@thedairygroup.co.uk www.thedairygroup.co.uk

MANAGING BUSINESS VOLATILITY

It is hard to recall a period of such volatility in milk price, which is bound to be a challenge to manage in the coming months on top of the difficult weather conditions this spring and early summer. The milk price is largely out of dairy producer’s control and the weather certainly is, so the focus should be on things that can be controlled:

Milk income is related to the dairy market and weak supply from autumn 2021 led to the milk price increasing by 13.7ppl (+42%) comparing the year to March 2023 with the previous year. Following the June milk price cuts, the price reduction in the current year (to March 2024) is 18% to 39ppl average depending on future price developments. Even with the current milk price and lower feed costs, the margin over purchased feed is likely to fall by £350/cow in the year to March 2024, equivalent to £70,000 for a 200-cow herd.

cover of clover can fix 250 to 300 kg of Nitrogen a year so saving fertiliser costs, reducing greenhouse gas emissions and reducing the need for purchased protein, whilst supporting pollinators and increasing drought tolerance.

Furthermore, the recently announced Sustainable Farming Incentive (SFI) 2023 (England) includes an option to establish and maintain legumes on temporary grassland or improved permanent grassland for a payment of £102 per hectare per year.

Climate change promises both more drought and more rain. On affected land introducing other species of grass and broad-leafed “herbs” offers resilience. Many herbs are deep rooting and tolerate drought, whilst also mining minerals and offering some health benefits to animals, such as anthelmintic properties. Farms might benefit from introducing one or two additional species as opposed to full “herbal ley” mixtures.

In England there are three stewardship options that involve herbal leys: GS4 (conventional) and OP4 (organic) (both available via Countryside Stewardship) and SAM 3 (available via SF 2023). The recommended numbers of species under different options are as follows:

GS4 OP4 SFI SAM 3

Cost of production

Our own cost tracker estimates the cost of production in the year to March 2023 at 45ppl (including rent, finance and family labour), with the biggest increases in feed, fertiliser, labour and power. With most accounts ending 31 st March and yearends now completed, there is an opportunity for dairy producers to benchmark their technical performance and cost of production.

Cash is king and having sufficient cash keeps producers in control of their own businesses. Whilst feed, fuel and fertiliser costs are now reducing, there are more cost increases feeding through including finance costs resulting from the base rate increase to 5%, which means most businesses on variable rates are now paying around 7.5% interest. Another factor will be tax to pay in 2023, with many farms bringing forward much needed re-investment to make use of capital allowances, but now faced with less cash to pay the tax. Every business has its unique circumstances, and the start of the 2023/24 financial year is a key opportunity to look at the forward cash flow and understand cash needs and peak borrowing requirements taking into account likely tax liabilities from the year ending March 2023.

GRASS ESTABLISHMENT

For decades, perennial ryegrass (PRG) swards have suited most dairy farmers. There are reasons now to introduce other species beginning with legumes, especially clover. A sward with 30% ground

The aim for all three (against which inspections will be conducted), is to establish a sward with a diverse mixture of grasses, legumes and herbs. Mixtures should be farm focused, taking soils, climate, systems, skill and objectives into account. There is little point in sowing 15 species if 7 of them won’t thrive.

Whether including clover, different grasses or herbs, it is important to consider that compared to pure PRG, the seeds in mixtures vary greatly in shape and size, from less than 1 mm to over 5 mm. Drilling won’t suit many seeds. Broadcasting is preferred but

PAge 14 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

species

species 4 3 Not specified

species 4 3

specified

Grass

5 5 Not specified Legume

Herb

Not

seeds of varying shape and weight are flung un-evenly and light seeds are blown about on windy days. It is best to evenly drop seeds near the ground on a well-rolled seed bed. A pneumatic seeder fitted to a grass-harrow works well or a drill carried with the coulters just above the ground. Rolling (better double rolling) after seeding is essential to ensure soil contact for all seeds.

Spring re-seeds generally favour legume establishment, but drought-prone farms should establish in late Summer and before the 31 st of August to give smaller seeds time to establish.

If seed mixtures are undersown, the seed rate of the cereal crop should be reduced and the crop must be taken off by the end of June, typically as silage. Otherwise, the ley will be patchy and legume establishment poor due to a lack of light and competition for nutrients. The establishment of the ley, which should last for 5 years or more, must be the priority. Direct seeding without under-sowing should be considered.

Herbicides are of limited use when legumes and “herbs” are included. Weed control begins at establishment by creating a clean, level, firm seedbed. False seedbeds can be used but in dry conditions it may be better to sow immediately into a moist seedbed. Annual weeds can be mown out in the early summer or taken off with silage, but perennial weeds present a greater challenge. A summer fallow can be used to desiccate perennial weeds, followed by an

Autumn re-seed. The unproductive few months of fallow must be weighed against the long-term benefit of an improved ley.

Finally soil samples should be taken well ahead of time so that pH (6.5 to 7), P (index 2) and K (index 2) can be adjusted ahead of establishment. This is especially important for legumes.

DANISH DAIRYING

I am planning two short (2-3 day) tours to Denmark this autumn, the first focusing on organic dairying and the second on conventional systems including robots. Take-home messages from previous visits to high yielding, organic and conventional herds include:

• Produce and feed lots of excellent quality grazing and conserved forage (grass/clover leys (up to 4 cuts), wholecrop and maize silage, > 60% forage in the TMR) and carefully evaluate concentrate inputs,

• Do not compromise heifer growth rates – feed them to grow to calve at 22 – 24 months,

• Breed cows capable of high dry matter intakes (> 28 kg/head/ day) and high production and feed them!

• Health and nutrition go hand in hand, you need both to achieve high levels of performance.

Please feel free to contact me for further details of these trips.

Feed Compounder July/August 2023 PAge 15

Scientifically Speaking …

By Matthew Wedzerai

How does climate change impact mycotoxins?

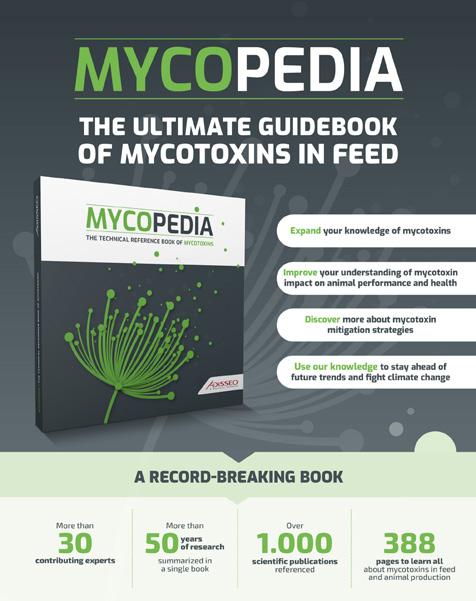

With climate change impacting everything on this planet, mycotoxins, one of the main challenges in feed production, are no exception. In this new study, researchers predict the impact of climate change on today’s major mycotoxins.

The occurring environmental changes are slowly shaping the balance between plant growth and related fungal diseases. Climate represents the most important agroecosystem factor influencing the life cycle stages of fungi and their ability to colonize crops, survive, and produce toxins. The ability of mycotoxigenic fungi to respond to climate change may induce a shift in their geographical distribution and in the pattern of mycotoxin occurrence.

The present study examines the available evidence on the impact of climate change factors on growth and mycotoxin production by the key mycotoxigenic fungi belonging to the genera Aspergillus, Penicillium, and Fusarium, which include several species producing mycotoxins of the greatest concern worldwide: aflatoxins, ochratoxins, and fumonisins.

Effect on fungal distribution

According to the researchers, increased temperatures will observe an overall increase in mycotoxigenic fungi suited to higher temperatures, such as aflatoxin-producing Aspergillus species, which represent an important hazard to human and animal health. Aspergillus spp. (Aflatoxin and Ochratoxin A producers) have been shown to occupy primarily tropical/subtropical regions growing at high temperatures and lowered water activity (aw). Comparing other mycotoxin-producing species,

studies show indicate that in hotter climatic scenarios A. niger may also gain more prevalence over A. carbonarius, as the former is better adapted to high temperatures and drier conditions than the latter. As reported in previous studies, changes in mycotoxigenic fungi due to climate change are already observed; examples of modified weather regimes impacting mycotoxins were demonstrated by the 2003, 2004, and 2012 summer seasons in Italy, where dry and hot weather (>35 ◦ C) contributed to an outbreak of A. flavus on crops, previously uncommon, by out-competing the more common Fusarium species and fumonisins contamination and causing an increase in Aflatoxin B1 (AFB1). Similarly, in France in 2015, an exceptionally hot and dry year, A. flavus was isolated from maize samples, with a high percentage of 69%.

Climate change on mycotoxin contamination

Aflatoxins

Aflatoxins are one of the most toxic mycotoxins known. The dominant aflatoxin produced (AFB1) is the most powerful naturally occurring carcinogen. Hence, it is of particular importance to understand how levels of this mycotoxin may shift with the climate change that agriculture will experience. Aflatoxins are produced in different crops by several species of Aspergillus, predominantly A. flavus and A. parasiticus, both characterized by the ability to persist in the most extreme climate warming conditions, as highlighted by their high optimum temperature.

Studies in vitro and on stored maize grain showed that AFB1 production is significantly stimulated under the three-way interacting climate change-related factors (temperature, CO2, and water activity (aw)), as demonstrated by the increase in the relative expression levels of structural and regulatory biosynthetic genes involved in aflatoxin production. Studies show that more recently, there has been a widespread incidence of aflatoxin contamination in countries not previously considered at risk resulting from persistent drought conditions and rising temperatures. A survey conducted by the European Food Safety Authority (EFSA) established the emerging issue of potential aflatoxin contamination in areas of Southern Europe in maize, wheat, and rice linked to the subtropical climate and the numerous hot and dry seasons that have occurred in the last years. In addition, a shift in traditional occurrence areas of aflatoxins is also expected.

PAge 16 July/August 2023 Feed Compounder

Engineering your feed solutions www.orffa.com - Follow us on EXCENTIAL SELENIUM

The new generation of

4000

organic selenium Sam Phelps Technical Commercial Manager +44 7761 758 284 phelps@orffa.com

Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

“Excential Selenium 4000 is the first and only dust free organic selenium source in the market guaranteeing workers safety!”

All selenium is

in the most effectiveorganicform (=L-Selenomethionine)

Roseanna Barclay Technical Commercial Manager

+44 7947 171 823 barclay@orffa.com

Ochratoxin A

Ochratoxin A (OTA) is produced by Penicillium verrucosum and several Aspergillus species, including A. ochraceus, A. alliaceus, A. carbonarius , and A. niger . This mycotoxin has been found in a variety of crops such as barley, grapes, rye, wheat, and coffee. An essential condition for OTA production is the availability of water.

An a w > 0.95 is considered too humid and can favour other fungi, including yeast, which may limit OTA-producing fungi colonization; an aw < 0.80 is considered too dry and OTA-producing fungi are unable to produce the mycotoxin. In a study on maize grains, at 30 C, the production of OTA by A. ochraceus was significantly higher at 0.95 than at 0.99 a w. Alternatively, on barley grains, the optimal growth and toxin production were registered at 30 ◦ C and 0.99 a w

Fumonisins

Fusarium is a genus that includes plant-pathogenic fungi responsible for a variety of diseases on several different crops and with known potential in producing mycotoxins capable of adverse effects in humans and animals. Studies show Fusarium species can tolerate a wide range of temperatures and pH levels, require a relatively high aw for growing, are usually well established in a crop before harvesting, and may cause problems in grains following a late harvest after a rainy summer. Fumonisins are produced in cereals mainly by Fusarium verticillioides and Fusarium proliferatum . Fumonisins contamination is strictly associated with agroclimatic conditions and is prevalent in maize and maize sub-products compared with other grains and related derivatives. The researchers stated: “The growth of F. verticillioides occurs at a minimum temperature of 4 ◦ C and has a favourable temperature of 25 ◦ C, meaning climate change may easily jeopardise the growth of F. verticillioides.”

Conclusion

Overall, the evidence suggests climate change will negatively affect crops worldwide in terms of loss of suitable cultivation areas and an increase in mycotoxin contamination. Global warming will make growing crops in some areas impossible and, where growing crops will be possible, plants will be subjected to suboptimal climatic conditions, resulting in increased susceptibility to fungal contamination. Furthermore, warmer climates will favour thermotolerant species, leading to, for example, the prevalence of Aspergillus over Penicillium species.

The next step urgently needed is to use the models to give directions for adaptation to climate change to assure mycotoxin levels in grains stay below legal limits for raw materials and derived feed and food, and to safeguard feed and food safety. The researchers suggested that if mycotoxin forecasting models were linked to land use models such as the iCLUE model and crop phenology models, such scenarios could be investigated and used to give directions on the use of our land and cultivation of crops in such a way that safe feed and food can be produced under the estimated climate change effects.

IS NOT A BETTING GAME

MYCOTOXIN MANAGEMENT IT’S A MATTER OF EXPERTISE

Identify your risk and adopt the most efficient strategy

At Adisseo, we have developed a comprehensive approach to the management of mycotoxins. Our MycoMan range of services allows the mycotoxin risk to be identified and optimal strategies to be built thanks to the mycotoxin prediction tool, the harvest bulletin, quick or laboratory tests and, finally, our mobile app. Moreover, Adisseo has also developed a portfolio of products composed of Unike ® Plus, Toxy-Nil ® Plus and Toxy-Nil ® in order to propose the best-suited solution to a specific challenge.

Feed Compounder July/August 2023 PAge 17

www.adisseo.com

www.adisseo.com

Ten Ways … to get results without getting angry

By Robert Ashton

I’ve just taken delivery of my first electric car, and am enjoying its silence, performance and especially the way it recharges the battery when slowing down; I hardly ever need to use the brakes. I’ve also found it easy to find a public charging point, with my favourites being at Snape Maltings where I can charge my car while attending a concert.

But had my electricity provider done as they’d promised, and fitted a 3-phase meter to the new supply we’ve had installed at our new home 10 weeks ago, I’d have been able to charge it quickly and cheaply there. We had two dates booked for the installation, and both times, no engineer appeared. It would have been so easy to get angry and shout at people, but that would not have helped.

Finally, another clerical error meant the engineer had the right meter, the right day, but the wrong address, but after a few phone calls, he was able to fit the meter and now our electrician has installed our 22kW car charging point. This experience prompts me to share with you my 10 ways to get things done without getting angry!

1. Be realistic – Are you getting angry because you want an organisation to move faster than it usually does? Perhaps you did not place your order soon enough, and now are trying to push things along. Accept that if you’re chasing because you’ve left it late to place your order, it is actually your problem, not someone else’s. If this is the case, a little humility will take you a long way.

2. Beat the bot – It is pointless trying to describe anything but obvious requests to the A1 bot that these days always seems to be how utilities companies answer calls. They are programmed to recognise a few words, and can quickly divert your call to the wrong queue. My favourite way to beat the bot is to say; ‘I want to make a complaint.’ That gets you connected to a real person who is usually better trained than most in sorting our problems.

3. Speak slowly and clearly – I think and talk quickly, but as often or not, the person you end up talking to does not speak English as their first language. As with the bot, they will have a limited number of options that they can offer. If they say they cannot connect you to the team you want to speak with, it’s no good pushing, and remember to speak slowly and clearly.

4. Wait until 10am before calling – If you need to talk to someone senior, they won’t start work before nine in the morning, so ringing at eight just wastes everyone’s time. And as all the

angry people will ring just after nine, you’re friendly but firm approach a little later will be welcomed.

5. Tweet! – Twitter is a wonderful platform where all public facing corporations have a small team who respond quickly to frustrated customers. But don’t make your tweet a 280 character rant. Instead, make it factual and provide just enough information so that the person responding can check with their colleagues first, to see what’s gone wrong.

6. Agree deadlines - Always ask when you can expect the person handling your issue to come back to you, even if only with an update. Then, give them a further 24 hours before you chase them up. This gives them a little more time; it also gives you time to cool down!

7. Delegate - Sometimes, you’re just too close to an issue to deal with it calmly and without emotion. Delegating to a staff member, or if you’re older as I am, an adult child, can be effective. Often, when called by someone other than the customer, the assumption is made that you are somehow vulnerable, and that can help to move your job up the list.

8. Sympathise – Working in a call centre dealing with aggrieved customers is a thankless task. It could be an IT help desk, a breakdown recovery service, your doctor’s surgery, or as in my case, a utilities company. Showing some empathy and understanding will always help as if the call handler is on your side, they might just be able to shorten your wait.

9. Find a connection – They say there are no more than six degrees of separation between any two people on the planet. When you narrow that down to people in the same country, in management roles that are perhaps similar to your own, you’ll often find that you are just one or two degrees apart from a senior decision maker in the firm you’re trying to influence. Identify your target, then search your LinkedIn connections and see what that reveals. Then use your network to engage them in your quest.

10. Write a news release – Because I’m a writer, with a background in marketing and communications, when I failed to get the result I wanted using some of the techniques listed, I drafted a news release. This gave me the opportunity to objectively set out the context to my case, and the details of what had gone wrong. I then sent the draft to the press team at the electricity company that was failing to deliver my 3-phase meter, inviting them to provide a comment, and explaining that I was going to distribute it to local media in two days’ time. That gave the press team time to investigate my complaint, and the next day I had a phone call, followed up by an email, from someone in the chief executive’s office. This meant I was given a date for the installation that I knew would be kept.

One final tip is to always be positive and stress that your goal is to provide a positive review or testimonial, and that complaining and making a fuss is not in your nature. That too always helps.

PAge 18 July/August 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

ConverMax® Cargill Animal Nutrition Dalton Airfield Industrial Estate Thirsk, North Yorkshire, YO7 3HE 01845 578125 customerservices_dalton@cargill.com www.provimi.eu/uk-convermax ConverMax® is a blend of botanical extracts and mineral sources mixed into feed for grower-finisher pigs. The secret recipe to grow more with less. Reduce FCR by 0.1 01829 741119 admin@croston-engineering co uk Supporting manufacturers since 1976 with solutions in bulk handling, storage, and pneumatic and mechanical conveying, we have a wealth of experience for you to rely upon. croston-engineering.co.uk Design and Implementation New system solutions Modifications to systems Software improvements Minor ingredient additions Water dosing solutions Ongoing Support Critical Spares and Parts Emergency repairs DSEAR Reports Site surveys Fault finding Servicing and Maintainance Equipment Servicing Silo and pipeline cleaning Infestation works Calibration and certification Continuity and Earth testing

RUMINATIONS

By Rob Daykin of Daykin Partnership

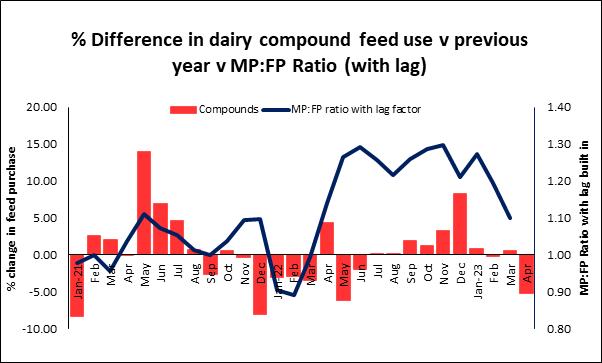

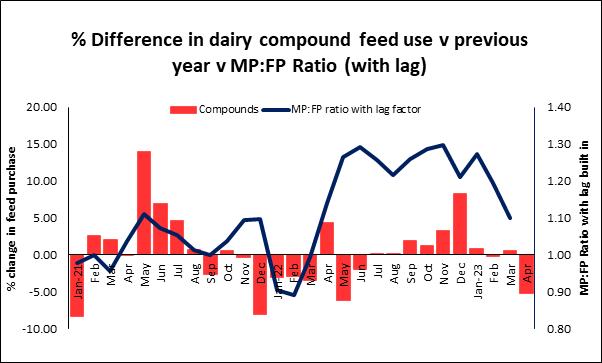

FEED DEMAND TO DROP AS MILK PRICE: FEED PRICE RATIO CRASHES

In the last issue some two months ago now I wrote of the worrying decline in milk prices and the fall in the Milk Price: Feed Price Ratio. At the time the weather was cold and wet, and we were worried about milk volumes being affected because the silage season had got off to a very shaky start.

So how have things changed since then?

Well as we know it stopped raining for weeks, and the land started to dry up very quickly indeed in May. By early to mid-June farmers up and down the country were screaming for rain. The grass had stopped growing, pastures were browning over and there were fears for some increasingly parched maize crops. Then – happily! – the rains came in abundance for many and a much-needed drink was given to many parts of the country.

But it was just what the market, or at least sellers, didn’t need! Hopes that the dry weather would also dry-up milk volumes, and thus help to turn prices, pretty much vanished. As it is, commodity prices did turn… but not in the direction that is needed. If one or two buyers were starting to get fidgety about milk supply (as opposed to being very jittery on demand) then those emotions were also put to bed. And as if this wasn’t enough, then came news from New Zealand that its May volumes had hit a record high, which followed April’s record. Cue another hit to sentiment.

Since then, there has been more data released about milk volumes in the UK, which shows volumes are dropping at the normal rate for the time of year and in line with the usual decline after the flush. Traders are only going to be concerned if they were dropping at a much faster rate. But they aren’t.

Two months ago, the perceived wisdom was that Q2 and Q3 commodity prices and thus milk prices would remain flat, but Q4 prices might lift. While that still might be the case, the far out Q4 prices aren’t going to make a significant difference to milk prices –certainly not enough to close the gap between current prices in the mid to low 30p range and the estimated cost of production which is over the 40p threshold still.

And this week we have seen more price cuts announced, although Arla has held its price, bar a slight currency decrease. Muller dropped another 1p to 37p. Two processors – Saputo and Barbers have increased their price, but the former was for political reasons relating to its farmers and the latter through an environmental bonus.

All-in-all the average non-aligned milk price is now 35.4p, which

is the lowest price since February 2022. Farmers supplying the supermarket pools are once again sitting pretty, with an average price of over 40p. Organic farmers, meanwhile, received a boost from Muller in that their price didn’t drop like the conventional price and held at 48p. OMSCo’s price is still 49p, but Arla’s is 10p down on that.

With feed prices dipping slightly, but not significantly because manufacturers are still working through stocks bought at much higher prices, the decline in the milk price means more pressure on the Milk Price: Feed Price Ratio, and this will lead to fewer compound and blend sales, as can be seen in the graph. It is, therefore, not looking good for forward sales for animal feed manufacturers.

We now look forward to seeing what the harvest brings in the UK and Ireland, the rest of Europe and elsewhere in the world to see if that brings any major reductions in cereal and other raw material prices to rebalance that Milk Price: Feed Price Ratio, and stimulate demand.

Personally, I’m not holding my breath!

WHO WE ARE

Daykin Partnership has over 30 years of experience in agriculture, expertise in estate management, product development and logistics. We work hard to provide up to the minute news and information as well as the latest and most innovative products from across the industry. Our extensive network covers every aspect of modern dairy farming from supply chains, market information and raw material sourcing to budgeting, staff training and ration formulation.

www.daykinpartnership.co.uk

PAge 20 July/August

2023 Feed Compounder

Feed Compounder July/August 2023 PAge 21 THE UK flavour manufacturer supporting British & Irish agriculture Unlock the possibilities To find out more about our unique Tastetite and other feed enhancement technologies visit our website at www.inroadsintl.com email info@inroadsintl.co.uk or call us on +44 (0)1939 236 555. 10461_Inroads_Feed Compounder Ad_Half Landscape_124x178.qxp_Layout 1 21/12/2021 14:33 Page 1 Tel: +44 (0)1159813700 Email: sales@dsl-systems.com Web: dsl-systems.com Member of the Valsoft group Tel: +44 (0)1260 277025 Email: sales@datastorsystems.com Web: datastorsystems.com • Software for life • Optimise processes • Reduce labour • User friendly • 24/7 support • Performance monitoring • Flexible and configurable • Stock control and traceability Advanced control, planning and information software for feed and grain plants Winner of the New Product Showcase IPPE 2023 Best of the Best in Animal Feed www.imperium4.com

Green Pages

Feed Trade Topics from the Island of Ireland

IRELAND’S TILLAGE SECTOR HAS LOST OUR UNDER NEW CAP MEASURES

Ireland’s agriculture minister, Charlie McConalogue TD, has acknowledged that Ireland’s tillage sector has lost out under the new Common Agricultural Policy (CAP) regime.

The admission was made in response to intense questioning from Irish Grain Growers Group (IGGG) president, Ollie Whyte, at a meeting in Co Meath recently.

According to the minister, the tillage sector has been negatively impacted by the fall-out, which has seen Ireland opting an 85% Pillar 1 payment convergence rate under the new CAP measures.

In mitigation, he said that two European Union (EU) member states had already reached a 100% convergence level, adding: “I am totally committed to the Irish tillage sector. I want to see it adequately supported. The scope to expand the industry on a sustainable basis is also immense. I want to see all of this potential realised.”

McConalogue pointed to the introduction of the protein payment scheme, the straw incorporation measure and the tillage incentive scheme as examples of the Irish government’s commitment to the crops’ sector.

The minister spoke at a recent meeting hosted by the Hoard family, who farm on the outskirts of Bellewstown in Co Meath. The event was attended by large numbers of IGGG members from the Dublin/ Louth/Meath region.

Reflecting back on the negotiations that took place in the run-up to the last CAP settlement, McConalogue confirmed that the pressure to cut the overall support budget for farming was immense. He added: “Ireland fought hard to have a budget agreed that was maintained at previous levels. But this, in itself, is a cut in real terms. However, this restriction relates to Pillar 1 payments only: there is scope for individual member states to invest national funds into Pillar 2 schemes.

“With this in mind the Irish government will be doubling its commitment to these measures over the next five years.”

McConalogue confirmed that the out working of the EU Nitrates’ directive is causing friction between Irish farmers within the different agricultural sectors. He said that Ireland’s retention of its current nitrates’ derogation should be regarded as a gesture made by the vast majority of EU member states, indicating that only three regions of Europe now ‘enjoy’ this status: Ireland, Denmark and parts of Belgium.

He continued: “The mid-term of the nitrates’ directive takes place at the end of this year. And Ireland will be pushing to secure maximum flexibility in this regard.”

But the minister’s words also came with a stark warming, which

is this: if Ireland cannot demonstrate a significant improvement in water quality, in tandem with a fall-off in fertiliser nitrogen usage, the possibility of getting the current nitrates’ derogation extended are very minimal.

McConalogue firmly believes that Ireland can maintain its current food output levels, while still meeting its climate change obligations. Driving this process will be a requirement to boost farm efficiency levels. And, according to McConallogue, this is already happening.

He said: “Ireland is starting off from a very strong place in this regard. The carbon footprint associated with the food we produce is already at an internationally low level. And we can build on this for the future.

“A combination of improved efficiency at farm level and the advent of new technologies will be at the heart of this process.”

THE INCREASE IN BREAK CROP AREA WILL HELP BOOST IRISH GRAIN YIELDS IN 2024

The increasing break crop area available to Irish cereal growers this autumn should act to boost grain yields in 2024.

This was one of the key messages delivered by Seedtech’s Tim O’Donovan at the company’s recent variety trials’ event, held in Co Waterford.

He added: “We have seen a significant increase in the areas of maize and winter oilseed rape over the last number of years. It is estimated that the break crop area available to cereal growers has increased by around 15,000ha, year-on-year.

“In turn, this is providing cereal growers with the opportunity to come in with a first wheat or a very productive winter barley option this autumn.”

According to O’Donovan, the increase in the spring bean, maize and winter oilseed rape area of recent years has brought the Irish break crop acreage close to what it was when sugar beet was a viable option.

He continued: “Seedtech is looking at the overall sustainability of tillage farms in Ireland. This principle can be distilled down to three factors: people, profit and the environment.

“In our case, we are producing varieties that are more sustainable. They will also deliver more profit while also keeping people in the industry. This latter point is crucially important.

“The Minister for Agriculture, Charlie McConalogue, has asked the tillage industry to come up with solutions.

“The new vision group, which the Irish Seed Trade feeds into, has been asked to take on this work.

PAge 22 July/August 2023 Feed Compounder

O’Donovan went on to highlight the role that plant breeding will play in this context, highlighting the challenge of barley yellow dwarf virus (BYDV) as a case in point.”

IRISH SEED TRADE WANTS BLACKGRASS ADDED TO REGISTERED LIST OF ‘NOXIOUS WEEDS’

The Irish Seed Trade Association (ISTA) has formally requested that blackgrass be added to Ireland’s register of noxious weeds.

The issue was first raised by ISTA courtesy of correspondence with Ireland’s farm minister, Charlie McConalogue, last autumn. By taking this approach, it is hoped that the issue of blackgrass resistance will be more widely profiled.

In addition, Department of Agriculture inspectors have the power to inspect land that is heavily infested with noxious weeds and enforce their destruction.

ISTA represents multipliers and assemblers of Irish certified seed. A spokesperson for the association commented: “We work with growers under contract to submit crops for certification by the seed certification division of The Department of Agriculture. Irish cereal seed adheres to a higher voluntary standard than current EU legislation requires and has a zero tolerance to blackgrass. This highlights the threat that blackgrass poses to the seed and of course wider tillage industry.”

According to ISTA, a total of 8 incidences of blackgrass occurred in crops submitted for certification in 2022. All of these crops were rejected outright, as per the ISTA voluntary standard. There were no incidences in 2021 and only two in 2020.

The ISTA representative continued: “The 2022 increase merited immediate action by all involved. These crops have been lost to the industry from grower right up the line and will require a commitment, investment and change of cropping and practice to get the weed under control on these lands.

“Blackgrass cannot currently be effectively controlled by plant protection products in a crop.”

Several incidences of blackgrass in commercial crops have been identified this year by agronomists.

Making blackgrass a noxious weed will serve to increase much needed awareness among tillage farmers and others. It will also give power to DAFM officials to enter on land to confirm presence of or order destruction of the plants or sections of affected crops should it be necessary.

As a further measure, ISTA members have committed to a higher voluntary standard (HVS) with regard to the assembling and certification

or importing of straights and mixes for cover crops, wild bird measures & arable margins.

This HVS is a further example of the Irish Seed Trade’s commitment to play its part in the control of grass weeds.

The vast majority of seeds (straights) for cover crops, wild bird measures and other arable margins are imported. Where possible, ISTA members will use Irish certified seed. ISTA members assembling or importing cover crop mixes or straights will now have each seed lot tested.

This is an internationally-recognised ‘Orange Certificate’ for presentation to department of agriculture officials, ahead of sale or certification in the Republic of Ireland.

The official search will include blackgrass, wild oats and sterile brome. Only ingredient lots with zero blackgrass test results assembled or imported by ISTA members will be used in mixtures for sale to Irish farmers.

The ISTA spokesperson concluded: “Farmers and amenity users of these mixes should be aware of the availability of this HVS seed.

“They should also check the label of any products they are considering purchasing, so that they have undergone testing for blackgrass, wild oats and sterile brome.”

CARBON STEERING GROUP LAUNCHED IN NORTHERN IRELAND

The Northern Ireland (NI) Carbon Steering Group is a pioneering alliance set up to represent farmers and the agri-food industry, and progress with the carbon element of the sustainability agenda.

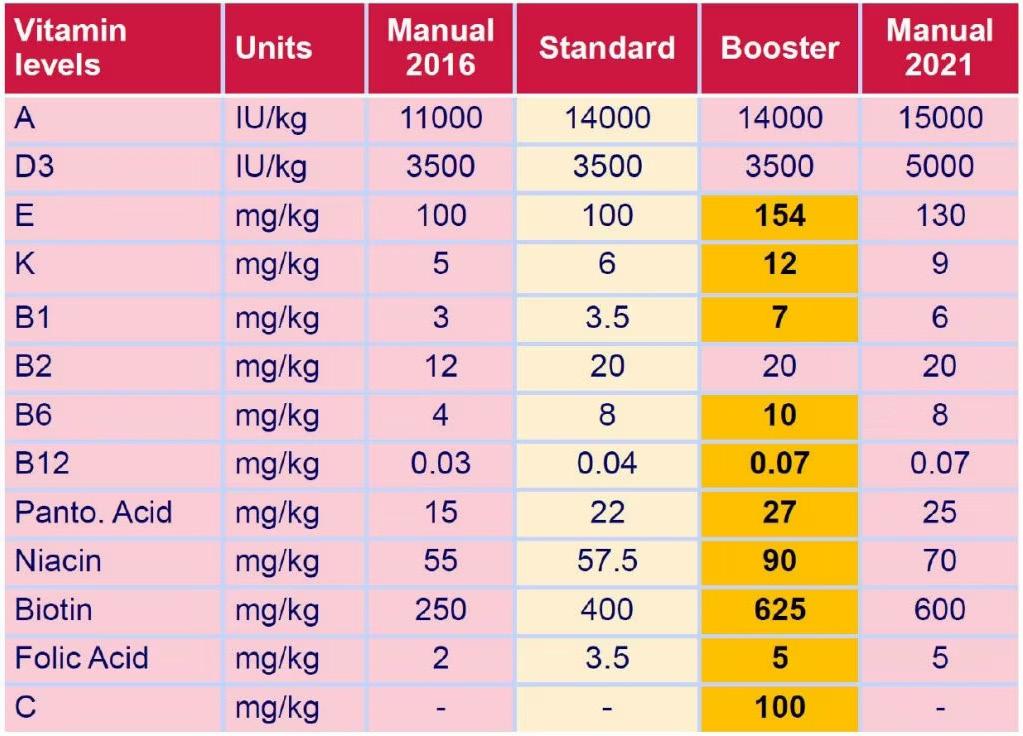

The collaboration has been built on the recognition that an industry wide co-ordinated approach is the most effective way to ensure the industry is heard and that the best solutions are achieved for everyone in NI.