10 essential software features that every feed and petfood producer needs

→ READ MORE ON PAGE 62

to stay competitive and profitable in feed and pet food production?

How

www.bestmix.com @bestmixsoftware 24

The smart alternative to propionic acid

Selko Fylax Grain is a microbial inhibitor that is highly efficacious at low dosage rates saving you money. It is less volatile than straight propionic acid making its effects longer lasting, and it has the added benefit that it also has an inhibitive effect on enterobacteria.

Low Cost

Highly efficacious at low dosage rates of 0.5-2kg / mT

Dual Action

Microbial inhibitor that also has an effect on enterobacteria

Longer Acting

Less volatile leading to longer-lasting treatment

Learn more at www.trouwnutrition.co.uk

RAW MATERIAL QUALITY

Feed Compounder March/april 2024 page 1 COMMENT Opinion: Why 1.52°C matters 2 Ryan Mounsey: Feed Production Update 4 Colin Ley: View from Europe 10 Matthew Wedzerai: Scientifically Speaking … 14 Christine Pedersen: Milk Matters 16 Robert Ashton: 10 Ways to Avoid Inertia 18 Green Pages 20 Feed Trade Topics From the Island of Ireland CFE and CPM Seminar 23 How to Stay Competitive and Profitable 24 with Bestmix Software Mycotoxins in UK and Irish Feed 26 dsm-firmenich World Mycotoxin Survey Results Driving Efficiency with Data-Drive Decisions 28 with CORE Tech Supplementing Copper in Calves 30 By Vet Leandro Royo and Dr Rahma Balegi Dairy Benchmarking Report Identifies Herd Targets 31 Discussing the 500-NMR KPI Report with Will Tulley Company Profile: Binary Consultants 34 Putting the Cream Back on Top at Turnout 36 With Nigel Airey, Debby Brown and Dr. Philip Ingram Glutamine: the Pivotal Amino Acid to Support Gut Health in Pig and Poultry 38 By Aude Simongiovanni and Herman Claassen Cargill 2023 Global Mycotoxin Report 41 Adams & Green Pioneering Excellence in Animal Nutrition and Sustainability 42 Feed Ingredients: Fats, Molasses & Sugars 45 Feed Ingredients: Sensory Products 48 In Brief 50 Computing: Formulation, Process Control, Mill Management 53 In Conversation 56 with Promtek’s Richard Key and Liam Barks People 58 Making the safe way the easy way… 61 With Dave Roberts Buyers’ Guide 62 COMPOUNDE R F EED Contents March/April 2024 Vol. 44 No. 2 SUBSCRIPTION RATES: One year: £80 Two years: £150 Three years: £200 ISSN 0950-771X Views expressed by contributors are not necessarily those of the Publisher. © Feed Compounder 2024 ADVERTISEMENT/SALES MANAGER: Fiona Mounsey ADMINISTRATIVE ASSISTANT: Sophie Mounsey EDITOR: Ryan Mounsey PUBLISHED BY: Pentlands Publishing Ltd Plas Y Coed Velfrey Road Whitland SA34 0RA United Kingdom Tel: +44 (0) 1994 240002 Web site: www.feedcompounder.com E-mail: mail@feedcompounder.com

WHY 1.52°C MATTERS

The rising impact of global warming appears to be even closer than was thought with the past 12 months yielding a global mean temperature of 1.52°C above the world’s 1850-1900 pre-industrial average. That’s the 1.5° rise everyone has been trying to avoid, of course, as enshrined in the 2015 Paris Agreement.

While clearly not what anyone wanted to hear in early 2024, the 1.52°C announcement by the EU’s Copernicus Climate Change Service doesn’t mean the temperature battle has already been lost forever or that there’s no going back. Scientists have been quick to point out there will be many temperature fluctuations in the years ahead, resulting in annual readings which will be both above and below the 1.5° limit.

In fact, total 1.5° failure will only be confirmed once there’s an average rise of that amount over a 20-year period. That’s according to the Intergovernmental Panel on Climate Change (IPCC), the UN climate body. Hardly a reason to rejoice certainly, but the fight goes on, with a bit of time left to focus on what this means for our industry in terms of sustainable crop production, raw material supplies, and the like.

An increased flow of climate-based research and analysis is already starting to hit the headlines, both positive and negative, to help businesses prepare for whatever the future holds.

One such project, carried out at Wageningen Economic Research in The Netherlands, has explored the possible impact of a climatedriven decline in pollinating insects, such as bees, hoverflies, and moths. The suggestion is that a decline in pollinators could cause a £1.2 billion reduction in annual Dutch farm output, equivalent to a fall of about 4%. The estimated reduction for German farmers was put at more than £1.5 billion.

This is because crops such as oilseed rape have a 25% dependence on pollinators. While this is a lot less than the 85% dependence registered by some food crops, such as apples and green beans, a 25% hit would still be worrying and costly, especially if growers had to replace the natural work of bees and insects with mechanical pollination processes.

The story is a little more positive in the UK, where the Dutch analysis puts the potential pollinator-inflicted reduction in production volumes at a less frightening 0-1.25%. In addition, while pollinator numbers are falling in Europe and other parts of the world, hence the Dutch research, Scotland has continued to enjoy a 30% increase in bees, etc., since 1970.

Staying with positive news, there was another item of climatelinked encouragement in February when a joint UN/FAO document was issued under the uplifting headline – ‘Nature is staging a comeback’.

The document featured seven so-called ‘World Restoration Flagships’ which, taken together, are forecast to be contributing to the restoration of nearly 40 million hectares of damaged and unproductive

land. These are areas which were harmed in the past by wildfires, drought, deforestation, and pollution.

The ultimate goal set for the Flagship programme is to prevent, halt, and reverse the degradation of ecosystems on every continent and in every ocean, leading to the restoration of one billion hectares of productive land. Having mourned the loss of valuable hectares in recent years, this has to be good news for anyone seeking to produce food or feed.

FAO Director-General QU Dongyu said the programme showed what can be achieved by addressing the impact of climate and biodiversity factors, adding that the seven flagship projects represented a ‘crucial step’ forward in the transformation of global agrifood systems, potentially making them efficient, inclusive, resilient, and sustainable.

The seven include a Mediterranean Forests Initiative, shared between Lebanon, Morocco, Tunisia, and Turkey, whose backers are targeting the restoration of over eight million hectares by 2030; the bringing of Pakistan’s Indus Basin back to full life by reinvigorating the country’s 3,180- km long Indus River which irrigates over 80% of the nation’s arable land; and a Regreening Africa initiative based on the use of proven agroforestry techniques to return five million hectares of land to its productive past, hopefully by 2030. There are also projects running in Asia, South America, Sri Lanka, and a second initiative in Africa, all designed to return damaged or neglected areas of land to active cropping.

Even if some of these locations may sound a bit remote from a UK/EU compound feed perspective, the initiatives surely have to be applauded. Producing tomorrow’s raw materials will require all the land resources the world has to offer. That will include farming restored hectares wherever they happen to be.

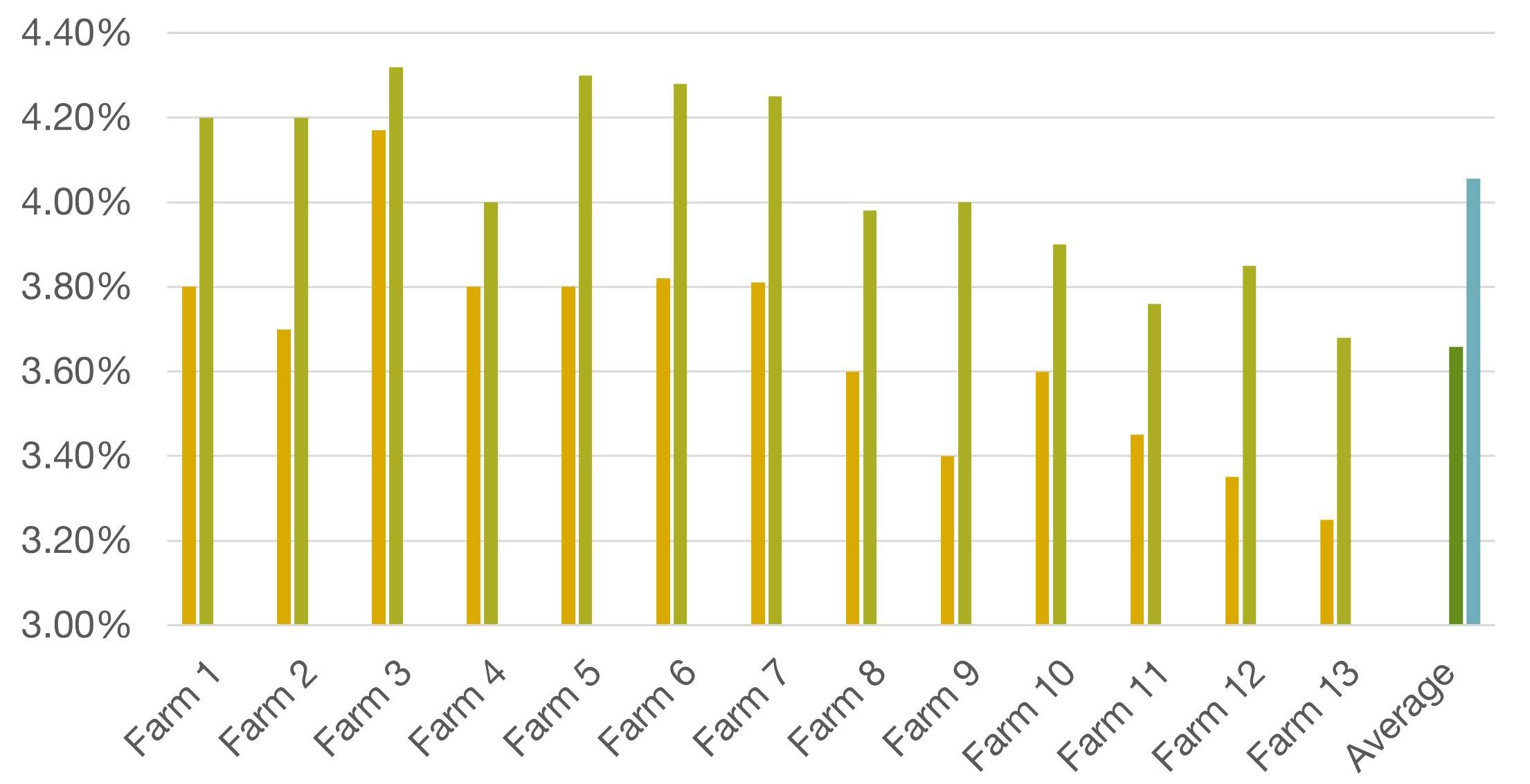

Our industry has long focused on the loss of productive land or the impact of weather-driven disruptions to planting and harvesting around the globe, blaming both factors for removing vital supplies at short notice and usually at considerable added cost. Bringing damaged areas of farmland back to life won’t solve all such issues but it can’t hurt either.

Focusing on the 1.52°C challenge, meanwhile, holds the hope of calmer and more predictable weather patterns emerging than those that have become standard in recent years. There will always be weather systems to face, of course, such as El Niño, etc., but something more settled would be good.

Hopefully, embarking on a 20-year watch of the world’s temperature curve, waiting to discover if we’re stuck with a 1.52°C gain or can secure a return to cooler times, will help concentrate minds on climate correction and the benefits this could bring, before it really is too late.

page 2 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com Opinion

GREAT BRITAIN

Feed Production Update

By Ryan Mounsey

Year End Overview

Total production of compounds, blends and concentrates, including integrated poultry units, during the year 2023 amounted to 12,952,800 tonnes, the lowest output for a calendar year since 2012 and a decrease from a year earlier of 474,000 tonnes or 3.5 per cent. Furthermore, the total under review was an even more significant 620,700 tonnes or 4.6 per cent down on the decade average for production in a year.

Total feed production during the year of 2023 was made up of: 45.7 per cent poultry feed; 30.5 per cent cattle and calf feed; 14.4 per cent pig feed; 5.6 per cent sheep feed; 1.5 per cent horse feed; and 2.2 per cent other feed.

For the third time in succession, total year-end poultry feed production had dropped below year previous levels. 2023’s output of 5,924,900 tonnes was 160,300 tonnes or 2.6 per cent lower than in 2022. The total under review was even greater 268,900 tonnes or 4.4 per cent below the 10 year average for the period.

Despite this considerable downturn, the production of integrated poultry units for the timeframe increased by 49,600 tonnes or 2.4 per cent to 2,152,900 tonnes. Turkey feed also bettered its year previous production, up 5,800 tonnes or 4.2 per cent to 105,900 tonnes, although this was its second lowest return since 1992. Broiler feed production for the year declined by 155,500 tonnes or 6.9 per cent to its lowest level for the timeframe since 2015 of 1,959,800 tonnes. Poultry breeding and rearing feed production, at 304,500 tonnes, was also at its lowest output for the calendar year since 2015, down 13,400 tonnes or 3.8 per cent on a year previous. A decrease in production of 80,400 tonnes or 6.8 per cent from 2022 levels brought layer feed

production down to 1,034,200 tonnes, while there was a proportionally smaller drop from the corresponding period a year previous in chick rearing feed production, which fell 2,500 tonnes or 1.5 per cent to 122,300 tonnes.

Total cattle and calf feed production decreased for the second year in a row but in this case by a minimal 25,100 tonnes or 0.6 per cent, to 3,954,000 tonnes. Although this was a very small decline, it was enough to keep the current output 144,500 tonnes or 3.6 per cent beneath the decade long average for the timeframe.

The production of blends for dairy cows during the period under review bettered its year earlier counterpart by 23,900 tonnes or 2.9 per cent, rising to 786,000 tonnes. All other cattle blends also produced a higher amount of feed than in the preceding year; its current total was up 4,200 tonnes or 1.3 per cent to 293,700 tonnes. Production from the sector’s largest element, compounds for dairy cows, was also at similar levels in 2023 to a year earlier, falling 11,300 tonnes or 0.5 per cent to 2.098,400 tonnes. There were larger declines displayed in both the all other cattle feed and cattle protein concentrates subsectors which fell by 32,300 tonnes or 5.6 per cent to 514,300 tonnes and by 5,600 tonnes or 5.8 per cent to 85,800 tonnes respectively. At 176,00 tonnes, all other calf feed output had declined by 3,700 tonnes or 1.9 per cent to its lowest level for the period under review since 2011.

Total pig feed production fell below two million tonnes for a calendar year for the first time since 2019. The current output of 1,866,500 tonnes was a sizeable 187,300 tonnes or 8.9 per cent down on a year previous. Moreover, the current total was 49,200 tonnes or 2.6 per cent below the decade long average for a year.

Production from all pig feed subsectors dropped below their respective year earlier counterparts. Pig finishing feed fell by 108,900 tonnes or 9.8 per cent from a year earlier to 1,035,900 tonnes, however, this was still the third highest yearly total on record. In contrast, the pig growing feed, pig starters and creep feed and pig protein concentrate subsectors were all at their lowest levels for the period since records were kept in their current form. Pig growing feed output had dropped by 23,300 tonnes or 6.3 per cent to 305,000 tonnes; pig starters and creep feed production fell 12,400 tonnes or 23.8 per cent to 36,100 tonnes; and pig protein concentrates declined from a year earlier by 1,900 tonnes or 31.1 per cent to 2,700 tonnes. Finally, both pig breeding feed and pig link and early grower feed production had fallen below their year earlier output for the third year in succession: the former did so by 14,300 tonnes or 3.2 per cent to 405,900 tonnes and the latter by 26,800 tonnes or 24.5 per cent to 81,000 tonnes.

A sizeable 77,100 tonnes or 9.1 per cent drop brought total year end sheep feed production down to 726,300 tonnes, its lowest total for the period since 2015. As a result of this fall, the total under review was 56,900 tonnes or 7.5 per cent below the decade long average for the time frame.

page 4 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Cattle Pig Poultry Sheep Horse Other Total 2022 3979.1 2053.8 6085.2 803.4 208.0 296.7 13426.8 2023 3954.0 1866.5 5924.9 726.3 199.2 282.2 12952.8 10 year Average 4098.5 1915.7 6193.8 783.2 191.5 390.9 13573.5 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 11000 12000 13000 14000 '000 Tonnes Great Britain Year End Feed Production

> Feed Phosphates > Magnesium Oxide > Feed Grade Urea > Sodium Bicarbonate > Sodium Carbonate > Lithothamnium > Oyster Shell > Calcified Marine Shells FEED INGREDIENT SPECIALISTS PROCESSING Raw material is processed into finished product. SHIPPING Chartered vessels transport products into the UK and Ireland. STORAGE Products stored in strategic locations across both territories. TRANSPORT Bulk and packed material delivered to mill MILL OR FARM Deliveries of any size direct to end user. UK +44 1477 544400 Ireland +353 21 206 9855 sales@westendagri.com www.westendagri.com

Compounds for breeding sheep production for 2023 fell from a year previous by 29,700 tonnes or 10.1 per cent to 226,100 tonnes, its lowest total for the period on record. Output of blends for breeding sheep dropped by a substantial 9,900 tonnes or 30.1 per cent to 22,300 tonnes and production from the sector’s largest category, compounds for growing and finishing sheep, declined from its 2022 return by 42,500 tonnes or 9.5 per cent to 401,400 tonnes. In contrast, blends for growing and finishing sheep surpassed its year earlier counterpart by 4,100 tonnes or 6.0 per cent and rose to its second highest total for a calendar year on record of 70,600 tonnes. Protein concentrates for sheep and lambs during 2023 also increased from a year previous, doing so by 800 tones or 11.6 per cent up to 6,000 tonnes of output.

Total horse feed production during the calendar year, at 199,200 tonnes, was 8,800 tonnes or 4.4 per cent lower than in the corresponding period a year previously. However, due to the recent increases in horse feed production, the current total had still outstripped the decade long calendar year average by 7,700 tonnes or 3.9 per cent.

At 282,200 tonnes, total other feed production for the period had declined for the fifth year in succession. The current fall in output of 14,500 tonnes or 4.0 per cent brought the total an even great amount under the 10 year average for the period, which it was now a notable 108,700 tonnes or 32.3 per cent below.

Total Great British animal feed production was at its lowest level for a calendar year in 11 years and moreover, considerably below the decade long average for the period. The downturn was apparent across the board with every feed production sector down on their returns from a year previous and all bar the horse feed production sector below the average output for the past 10 years. Only in the months of July and November did production outpace its year earlier counterpart. However, with production for the fourth quarter falling just 2,600 tonnes below the levels recorded in 2022, there may be signs an upturn in feed production as we enter 2024.

GREAT BRITAIN

January Production Overview

Before beginning to analyse the January production figures for Great Britain, it is worth noting that there are 53 weeks in the statistical year for 2024. In order to incorporate the change, January 24 was increased to a 5 week period compared to 4 weeks in 2023.

Total production of compounds, blends and concentrates, including integrated poultry units, during the month of January 2024 increased by 171,500 tonnes or 16.6 per cent from a year previous to 1,205,400 tonnes, the second highest total for the month on record. In addition, the total under review was 111,500 tonnes or 9.3 per cent in excess of the decade long average for the month.

Total feed production during the month of January 2024 was made up of: 43.6 per cent poultry feed, 31.3 per cent cattle and calf feed, 14.1 per cent pig feed, 7.6 per cent sheep feed, 1.8 per cent horse feed and 1.6 per cent other feed.

At 525,500 tonnes of output, total poultry feed production was at its second highest level for January and 89,200 tonnes or 20.4 per cent greater than a year previous. The current total also outstripped the decade long average for the month by 44,600 tonnes or 8.9 per cent.

The sector’s two largest components, broiler feed and integrated poultry units, both surpassed their year earlier totals by a significant margin. The former rose by 14,440 tonnes or 9.1 per cent to 172,000 tonnes and the latter did so by 56,500 tonnes or 36.4 per cent to 211,800 tonnes. There was a remarkable increase in the production of turkey feed from a year previous of 4,200 tonnes or 144.8 per cent to 7,100 tonnes. This was the highest total for the subsector in four years but also the fifth lowest total on record for the month. All remaining poultry feed categories bettered their year previous returns: layers compounds output grew by 6,800 tonnes or 8.4 per cent to 87,700 tonnes; poultry breed and rearing compounds did so by 2,800 tonnes or 11.6 per cent to 27,000 tonnes; and chick rearing compounds production grew by 2,600 tonnes or 29.5 per cent to 11,400 tonnes.

After three year-on-year declines in production, total January cattle feed output surpassed its year earlier return by 40,700 tonnes or 12.1 per cent and rose to 377,700 tonnes. Moreover, the total under review was 19,800 tonnes or 5.4 per cent in advance of the 10 year average for January.

All cattle and calf subsectors had bettered their corresponding year previous returns. Compounds for dairy cows output rose for the second January in succession, up 18,400 tonnes or 11.1 per cent to 184,700 tonnes. The same pattern was displayed in the production of blends for dairy cows which increased from a year earlier by 6,800 tonnes or 9.4 per cent to 78,800 tonnes. Total calf feed production, at 17,000 tonnes, was 2,300 tonnes or 15.6 per cent in advance of a year previous and all other cattle compounds, at 54,000 tonnes of output for the month, had increased from a year previous by 5,900 tonnes or 12.3 per cent. All other cattle blends were at their highest output for January since 2014 of 34,400 tonnes, up 7,200 tonnes or 26.5 per cent from 2023. Lastly, cattle protein concentrates production was up 200 tonnes or 2.3 per cent on a year previous, to 8,900 tonnes.

Following a sizeable fall in production in the January of 2023, total pig feed production for the month grew by 27,800 tonnes or 19.6 per cent to 169,500 tonnes. Despite this total being lower than three of the past five years it was nevertheless 10,300 tonnes or 6.3 per cent in advance of the 10 year average.

Despite both the sector wide upturn and the extra statistical week, two pig feed subsectors fell below their year previous counterparts. Pig link and early grower feed output dropped by 2,200 tonnes or 29.3 per cent to 5,300 tonnes, its lowest January level since 2011.

page 6 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Furthermore, pig starters and creep feed production declined by 100 tonnes or 3.4 per cent to 2,800 tonnes, its fourth successive fall for January. In contrast, the remaining pig feed subsectors all rose sharply from year previous levels: pig finishing compounds did so by 14,900 tonnes or 18.7 per cent, up to 94,600 tonnes; pig breeding feed compounds did so by 5,700 tonnes or 18.3 per cent, up to 36,900 tonnes; and finally; pig growing compounds did so by 9,600 tonnes or 47.8 per cent, up to 29,700 tonnes.

Total sheep feed production for the January under review had surpassed its year previous total by 7,300 tonnes or 8.6 per cent, rising to 91,900 tonnes. However, this total was the fourth lowest of the past decade and was more or less in line with the decade long average which it climbed 200 tonnes above.

Compounds for growing and finishing sheep were at their highest level for the month at 45,900 tonnes, up 2,700 tonnes or 6.3 per cent from a year earlier. Similarly, blends for growing and finishing sheep were at their second highest total on record for the month at 6,700 tonnes, 600 tonnes or 9.8 per cent greater than in 2023. In contrast, at 35,400 tonnes of output, compounds for breeding sheep were at their second lowest level since 1993 despite bettering its year previous return by 3,700 tonnes or 11.7 per cent. Finally, blends for breeding sheep output increased by 100 tonnes or 3.2 per cent to 3,200 tonnes.

Total horse feed production was at its highest level in four years and the third highest level on record for the month at 21,100 tonnes, a rise of 2,200 tonnes or 11.6 per cent from a year previous. Additionally, the current total outstripped the decade long average for January by 2,300 tonnes or 11.5 per cent.

After four successive falls in January output, total other feed production increased by a significant 4,300 tonnes or 27.9 per cent. However, due to much greater outputs in the first half of the preceding decade, the total under review was 7,000 tonnes or 30.1 per cent lower than the 10 year January average.

Given the difference in the statistical periods, there is little that can be said in terms of comparison between the production of January 2024 & 2023. However, as this is a phenomena that happens every five to six years, the fact that production is at its second highest level for the month on record would suggest that production levels were trending somewhat upwards from the historically low levels of 2023.

NORTHERN IRELAND

November Production Overview

Total production of compounds, blends and concentrates during November 2023 in Northern Ireland, at 229,000 tonnes, surpassed its year earlier return by 4,000 tonnes or 1.8 per cent. This was the second highest November total on record and outpaced the decade long average for the month by 16,900 tonnes or 7.7 per cent.

Total feed production during November 2023 was made up of:

54.2 per cent cattle and calf feed, 32.4 per cent poultry feed, 8.6 per cent pig feed, 1.8 per cent sheep feed and 3.1 per cent other feed.

At 124,000 tonnes, total cattle and calf feed production was at its second highest level since records were kept in their current form, 4,300 tonnes or 3.6 per cent up on a year previous. Moreover, the current total was 9,900 tonnes or 8.6 per cent in advance of the decade long average for November.

Despite the sector wide upturn from a year previous, both all other cattle compounds and protein concentrates for cattle and calves declined from year previous levels, with the former falling by just under 200 tonnes or 37.8 per cent to 300 tonnes and the latter by just over 100 tonnes or 28.1 per cent to 300 tonnes. In addition, beef cattle compounds output remained at its year earlier level of 14,000 tonnes. Elsewhere in beef feed production, the beef coarse mixes or blends subsector rose by 3,500 tonnes or 14.5 per cent to 27,500 tonnes. The sector’s largest element, dairy cow compounds, rose to its second highest total on record of 51,000 tonnes after a 100 tonnes or 0.2 per cent increase from a year previous. Dairy coarse mixes or blends surpassed its year previous output by 600 tonnes or 2.6 per cent and rose to 23,900 tonnes and finally, other calf compounds, increased to 6,900 tonnes, up 400 tonnes or 5.9 per cent from 2022.

For the fourth consecutive year, November poultry feed production bettered it year previous production, in this case, rising by 1,000 tonnes or 1.4 per cent to 74,200 tonnes, its highest level for the month on record. Furthermore, the total under review also outpaced the decade long average by 6,600 tonnes or 9.8 per cent.

In contrast to the overall trend, turkey and other poultry feed production decreased from a year previous for the seventh year in succession to 3,300 tonnes, a fall of 400 tonnes or 12.0 per cent from the corresponding month of 2022. Layer and breeder feed output also dropped below year previous levels to 27,500 tonnes, down 800 tonnes or 2.8 per cent. However, broiler feed reached record highs for the month under review, of 40,800 tonnes, bettering the previous record by 2,000 tonnes or 5.1 per cent. Lastly, chick rearing feed production rose 300 tonnes or 14.2 per cent from a year previous to 2,600 tonnes.

Total pig feed production for November decreased by 800 tonnes or 4.0 per cent from a year earlier to 19,700 tonnes. In spite of this

page 8 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Cattle Pig Poultry Sheep Horse Other Total 2023 337.0 141.7 436.3 84.6 18.9 15.4 1033.9 2024 377.7 169.5 525.5 91.9 21.1 19.7 1205.4 10 year Average 357.9 159.2 480.9 91.7 18.8 26.7 1138.9 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 '000 Tonnes Great Britain January Feed Production

drop, the total under review was 200 tonnes or 0.8 per cent greater than the decade long average for the month.

Output of pig growing feed, at 3,100 tonnes, and pig breeding feed, at 2,400 tonnes, both fell to their lowest level since 2012, a drop from a year previous of 400 tonnes or 12.1 per cent and 200 tonnes or 7.7 per cent respectively. Additionally, pig finishing feed production declined from a year earlier by 600 tonnes or 6.7 per cent to 8,100 tonnes. On the other hand, pig starter and creep feed surpassed its year previous counterpart by 300 tonnes or 11.3 per cent, rising to 2,700 tonnes of output, while pig link and early grower feed production increased by 100 tonnes or 3.8 per cent to 3,400 tonnes.

At 4,000 tonnes, total sheep feed output had risen by a notable 900 tonnes or 28.5 per cent from a year previous. As a result of this upturn, the total under review outpaced the 10 year average for November by 600 tonnes or 16.4 per cent.

Growing compounds for finishing sheep were at their highest level for the month since 2002 at 2,700 tonnes, up 700 tonnes or 35.0 per cent from a year earlier. Both coarse mixes and blends for sheep and breeding sheep compounds bettered their corresponding 2022 outputs by 100 tonnes, with the former rising 18.9 per cent to 800 tonnes and the latter by 12.6 per cent to 500 tonnes.

Total other feed was only the second sector to fall below its year previous return in November and it did so significantly, with production decreasing by 1,500 tonnes or 17.3 per cent to 7,000 tonnes of output. In addition, this decline had dropped the total under review 300 tonnes or 4.1 per cent below the decade long average for the month.

Northern Irish animal feed production had never been higher at this stage of the year than in 2023. The continually strong outputs of the cattle and calf feed sector and poultry feed sector, which was a record high for November, suggest that this trend will continue into December and result in a record year.

Feed Compounder March/april 2024 page 9

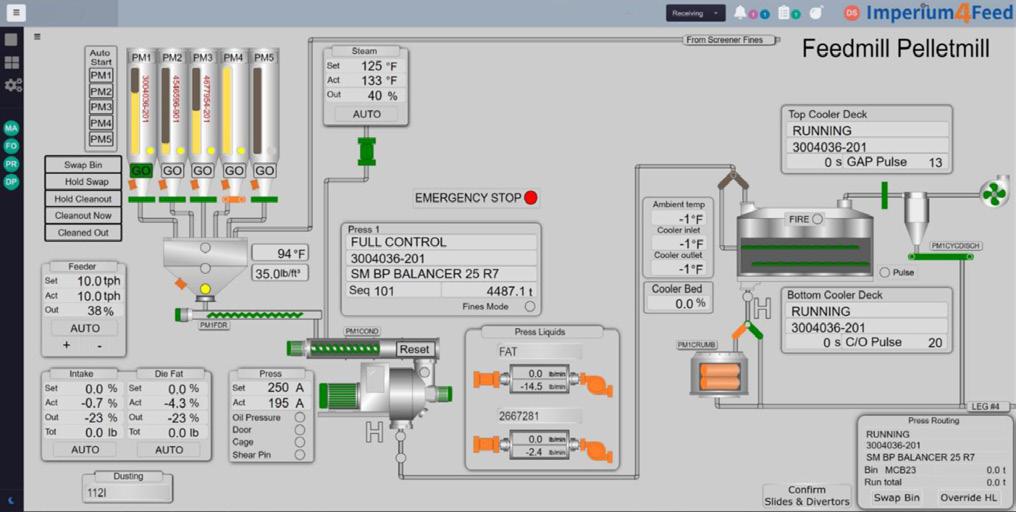

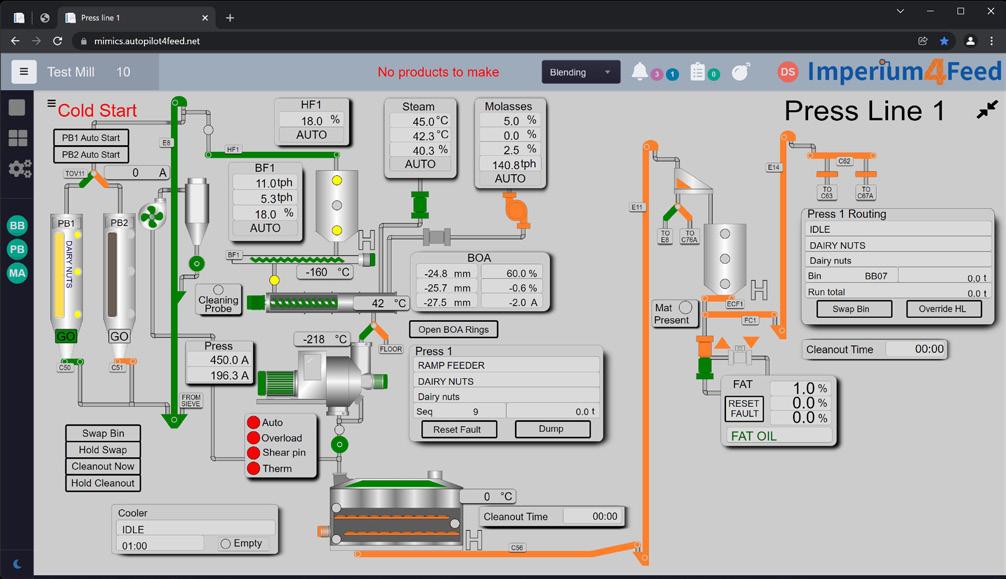

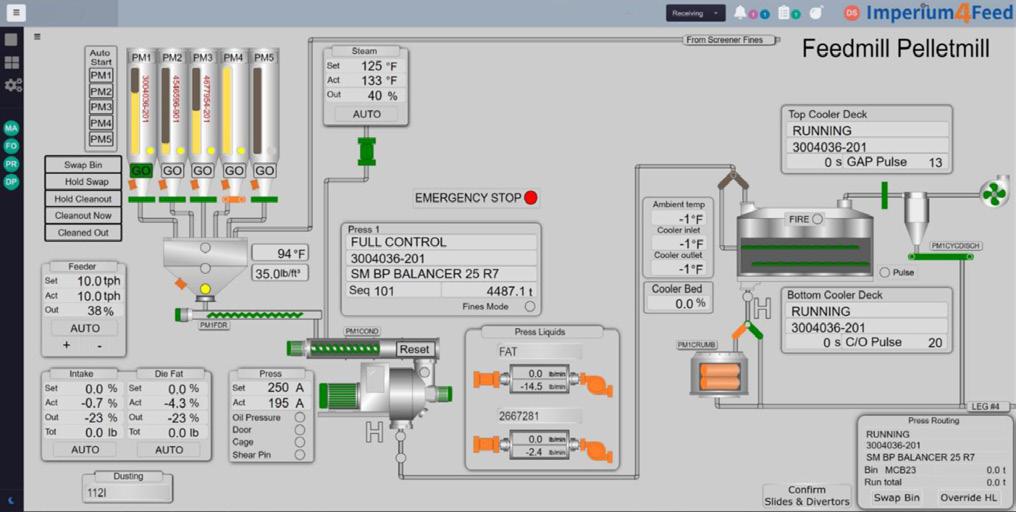

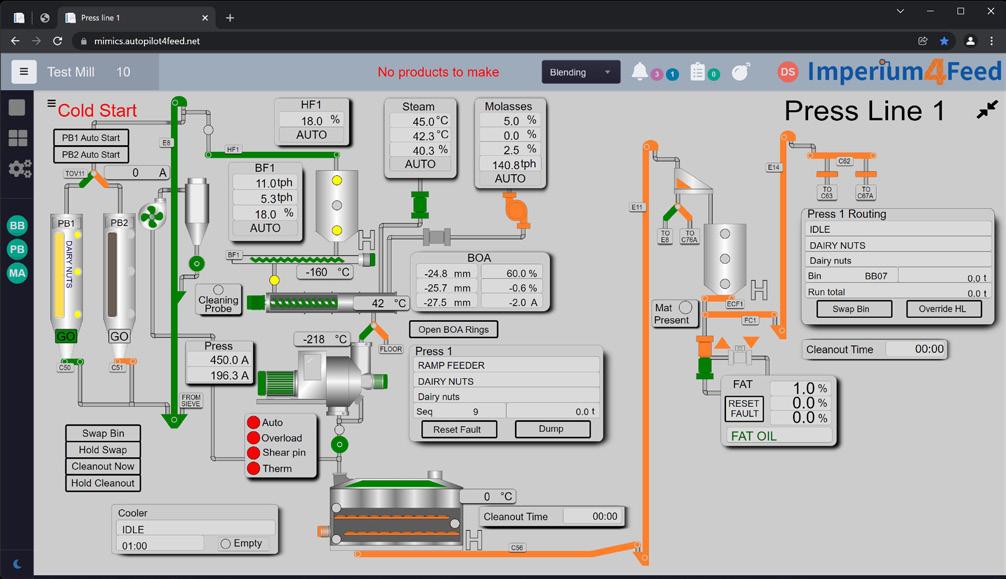

Tel: +44 (0)1159813700 Email: sales@dsl-systems.com Web: dsl-systems.com Member of the Valsoft group Tel: +44 (0)1260 277025 Email: sales@datastorsystems.com Web: datastorsystems.com • Software for life • Optimise processes • Reduce labour • User friendly • 24/7 support • Performance monitoring • Flexible and configurable • Stock control and traceability Advanced control, planning and information software for feed and grain plants Winner of the New Product Showcase IPPE 2023 Best of the Best in Animal Feed www.imperium4.com

Cattle Pig Poultry Sheep Other Total 2022 119.7 20.6 73.1 3.1 8.5 225.0 2023 124.0 19.7 74.2 4.0 7.0 229.0 10 year Average 114.2 19.6 67.6 3.4 7.3 212.1 0 20 40 60 80 100 120 140 160 180 200 220 240 '000 Tonnes Northern Ireland November Feed Production

View From Europe

By Colin Ley

Tough start to 2024 but should get better

First economic impressions of 2024 could be better on several fronts, although the year could still produce some worthwhile European upsides for the feed sector. The best advice at this point is the stay positive and progressive in a glass half-full rather than half-empty context.

Starting with the reality of the European economy, however, the year began on a ‘weaker footing than expected’, according to the European Commission’s Winter Interim Forecast. Having endured ‘subdued growth’ in 2023, it didn’t seem unreasonable to expect a brighter start to 2024, but that’s not the case, certainly not so far.

As a result, EU growth this year is projected to be 0.9%. That’s a significant downgrade from the 1.3% projection contained in the EC’s 2023 Autumn Forecast.

It’s not all gloom, though. Looking beyond the immediate period, EU economic activity is expected to ‘accelerate gradually’ as the year progresses. Such optimism is based on an expectation of inflation continuing to fall, accompanied by a degree of real wage growth and a resilient labour market, both factors which are forecast to help support a ‘rebound in consumption’.

The Winter Forecast also suggests that investment is set to benefit from a gradual easing of credit conditions in 2024 while trade with foreign partners is expected to normalise, after a weak performance last year.

All of which amounts to a sobering dose of economic reality, followed by the promise of jam tomorrow, for those who survive that is.

Shop around

Another team of forecasters, this time attached to the UK’s Agricultural and Horticultural Development Board (AHDB), has also been examining the year ahead, including taking a close look at future pricing patterns for feed ingredients and compound feed.

Their conclusion, published in February this year, is that it is ‘appropriate’ to anticipate that compound feed prices will continue to fall (this year) in line with the main trend of raw material costs.

Stating that there are ‘glimmers of things returning to normal’ after the economic shockwaves created by Russia’s invasion of Ukraine, the AHDB view is that there are already some signs of new (food and farming) growth starting to emerge.

As such, they add, recent declines in feed demand and production suggests there is likely to be a surplus of feed production capacity in Britain (in 2024). This leads into the point, however, that, for commercial, technical, and regulatory reasons, feed producers won’t be able to easily switch between the livestock sectors they serve, thus creating a surplus of feed production capacity as compounders are ‘driven to recapture demand’.

With the AHDB team gearing its content towards farmers, who paid

their wages after all, the Board’s headline message for 2024 is to ‘shop around more than normal to ensure the best-value feed can be found’.

With conventional wisdom dictating that profits are made when markets rise and fall, not when they’re static, there is also clearly the potential for losses to result from pricing and production changes, certainly of the type we’ve seen over the last couple of years.

By the same process, farmers who are focused on applying ‘shop around’ principles to their 2024 feed purchases will inevitably create both winners and losers across our own sector as the year progresses.

Veganuary decline & petfood boost

Okay, time for a couple of positive items to balance this tough intro.

First, news of a small boost from a meat-eating perspective, courtesy of a Kantar Worldpanel report on Irish consumer trends in January.

It appears that while many in Ireland cut back on their alcohol consumption in January, spending 8.6% less on beer, wine and spirits during the month, compared to January 2023, the same wasn’t true of Veganuary, that great vegan invention.

Kantar’s figures show that while nearly 38% of Irish households purchased chilled or frozen plant-based products during the month, Veganuary sales still fell by 2.6% in comparison to January 2023, a decline of €200,000 in value terms.

Second, I also thought I’d pass on a brief piece of non-Europe information relating to the pet food sector.

Once again based on work commissioned by Kantar, the item in question concerns a 3.7% growth in dog food sales in the past year in Central America. Equally encouraging, is the conclusion reached by the analysts involved that the pet food category has not yet reached its full potential.

The ‘further growth’ view is based on the fact that some households with dogs, bought in the last year, are still giving homemade food to their pets while others are following a mixed homemade/processed feed process.

According to a Kantar survey, in fact, 6 out of 10 Central American households are currently following a mixed feed approach.

The company also reported that, by the end of 2023, more and more shoppers were considering snacks and wet food to ‘pamper’ their dogs.

“There is, therefore, a clear opportunity for brands to continue gaining space in the pet products market if they know how to communicate about the benefits that our pets have when consuming products specially designed for them,” said Kantar.

Hopefully, what happens there will travel here in due course. It usually does.

US breakthrough

Staying with the pet food sector, and the other side of the Atlantic (in part), congratulations to the Association of American Feed Control Officials (AAFCO) for finally granting the French insect protein company, Ÿnsect, its first authorisation for the commercialisation of defatted mealworm proteins (Protein70) in the United States.

The European Food Safety Authority (EFSA) published its scientific opinion to the effect that insect proteins were no riskier than other types of protein way back in 2015. This marked a turning point for Europe’s insect industry, serving as the basis for the partial and progressive lifting

page 10 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Service, Support & Maintenance

NEWPORT FEEDS

of the continent’s previous feed-ban rules. As a result, insect proteins were duly authorised for use in European aquaculture in 2016, followed by clearance for pigs and poultry in 2021.

The fact that the US has now started to catch up is good news for Ÿnsect, of course, who say AAFCO’s decision will open ‘strong prospects’ for pet food sales into the American pet food market, which the French company states was worth in excess of $42 billion in total in 2022, according to the latest available figures.

For once, what happened here has finally travelled across the Atlantic, and hopefully to our own industry’s benefit.

Regulatory tsunami

It won’t have escaped attention that Europe’s farmers have been exercising their right to protest in recent weeks, and not only in France, where go-slow tractor convoys and the burning of imported meat lorries have a long term history.

While being careful not to support any protests which have overstepped the mark in early 2024, the farmer and farm co-operative body, Copa-Cogeca, penned a sharply-worded open letter in late February to EC president, Ursula Von der Leyen, and Alexander De Croo, Belgium’s Prime Minister and current holder of the Council presidency.

Stating that the European Green Deal, which was designed to drive key emission reduction targets, has been a ‘regulatory tsunami’ for farmers, the letter writers complained of too many rushed consultations, top-down targets lacking assessment, and proposals pushed through without feasibility studies.

The letter went on: “The increasing number of legitimate farming protests in recent weeks and months highlights the pressing necessity for the EU to shift the focus back to rural areas, agriculture, and forestry

“Our farmers, forest owners and agri-cooperatives need stability, visibility and predictability to be able to look to the future with confidence. A competitive cooperative model aimed at improving the bargaining power of farmers in the food supply chain, facilitating joint investments to allow farmers to obtain more added value for their products and encouraging farmers’ economic, social, and environmental sustainability must be promoted.”

The letter concluded with a challenge for the EC to focus on four

The next EU budget must reflect the many challenges facing

The trade policy agenda must be consistent with the ambition set within the internal market while guaranteeing robust reciprocity measures and ensuring attention to sensitive EU productions.

3. Any new agri-related proposals must be backed up by a feasibility study, discussed with stakeholders.

4. A Commissioner for Agriculture and Rural Areas with a key role as Vice-President of the European Commission is needed.

And, just in case EU leaders and MEPs weren’t already listening, Copa-Cogeca ended with a ‘little reminder’ that the clock is counting down to the next ‘pivotal elections’ for the European Parliament which are now only a few months away. Never a bad way to end a letter to a group of politicians.

page 12 March/april 2024 Feed Compounder

section is sponsored by Compound Feed Engineering Ltd

Comment

www.cfegroup.com

SODIUM BICARBONATE SODIUM CARBONATE CALCINED

PHOSPHATES

NEW BULK SUPPLY CHAIN FACILITY

MAGNESITE

A

+44 (0)20 8332 2519 +44 (0)20 8940 6691 sales@newport-industries.com Contact us:

Weather forecast improvement

For businesses which rely on raw materials whose production and cost is highly weather-dependent, as many of our products are, the prospect of improved seasonal weather predictions has definite appeal. The sooner you know what’s coming on the price and volume horizon, the quicker your buying teams can react, which is why new research taking place at the UK Universities of Lincoln, Sheffield, and Reading looks interesting.

Backed by £650,000 of UK Government grant funding, the three universities are working together on an AI and Machine Learning development which they believe will allow them to improve the predicting of seasonal weather conditions across the UK and Northwest Europe.

While current forecasts depend on expensive supercomputers, the researchers are exploring the potential for an AI/Machine Learning method to be added into the advanced weather mix. Known as NARMAX (Nonlinear AutoRegressive Moving Average models with eXogenous inputs) the new process is apparently capable of predicting the state of the North Atlantic jet stream and atmospheric circulation, both of which are strongly linked to surface air temperature and precipitation anomalies.

Already used successfully in delivering early predictions for both summer and winter conditions in the North Atlantic region, the claim is that NARMAX will ‘improve’ on recent supercomputer-based forecasts, which have tended to ‘underestimate’ year-to-year variations for both seasons.

Ultimately, they say, providing more accurate seasonal forecasts will help give farmers a better idea of likely yields for the season ahead, enabling them to plan how to optimise crop systems and prepare for harvest requirements. Hopefully, better forecasting will help us as well.

Coffee for sheep and cows

Finally, the results of an EU-backed project to assess the potential for converting spent coffee grounds (SCGs) into livestock feed are to be given a public airing at the end of March.

The project, called LIFE ECOFEED, has been running since 2020 with support from the European Commission’s Life Environment and Resource Efficiency programme. The launch theory was that with European coffee consumption averaging more than 2.6 million tonnes a year, the waste produced should be put to the best possible use.

Now, according to new information published by the EC’s European Climate, Infrastructure and Environment Executive Agency, the researchers behind the project are ready to talk about their ‘positive’ findings.

Working with 21 tonnes of SCG and 1.5 tonnes of coffee capsules, the research team have produced 80 tonnes of experimental feed, reports the agency, all of which has been fed to sheep and dairy cattle in controlled diet trials.

Admittedly, 80 tonnes doesn’t sound like a lot on which to base your future. However, more detailed information on the LIFE ECOFFEED project, including the results obtained so far, are due to be unveiled at the World Rural Forum’s global conference which takes place in VitoriaGasteiz, Spain, from March 19-21. This will include a demonstration workshop on March 21, specifically dedicated to the coffee feed project.

Definitely worth following, especially during a year when things are only set to get better as the months roll by.

Contact:

Oliver Caiger-Smith Technical Sales Manager

Caiger-Smith@biochem.net

Mobile: +447722 019727

SMALL INPUT – GREAT EFFECT

Bioavailable combination of metal and glycine

Successfully tested in various animal species

Safe trace mineral supply for high performance

Feed Compounder March/april 2024 page 13

MULTI SPECIES

www.biochem.net

Feed Safety for Food Safety®

E.C.O.TRACE

19-04-15 HW Anzeige - E.C.O.Trace - 86x254 mm.indd 1 23.04.2019 14:49:24

®

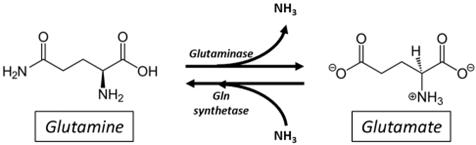

Scientifically Speaking …

By Matthew Wedzerai

Curcumin: A natural colourant with performance and health benefits for pigs

Most research work has focused on additives for weaning piglets. Interestingly, researchers of a current study turned the focus to finishing pigs. Their study, recently published in the Frontiers in Veterinary Science journal, demonstrates the potential of dietary curcumin (in nanoparticle form) as an effective feed additive for improving the performance and health status of finishing pigs.

Recent research findings emphasise the use of phytogenic compounds in the form of nanocapsules or nanoparticles as most phytogenic materials have poor bioavailability in biological systems. The natural colourant curcumin is a polyphenolic bioactive compound extracted from the turmeric plant, Curcuma longa, which has phytotherapeutic potential owing to its antimicrobial, antioxidant, anti-inflammatory, and immunostimulatory properties. To increase its solubility and bioavailability, nano-formulation of native curcumin is a better option in animal diets. Previous studies have shown that the encapsulation of phytogenic compounds enhances intracellular uptake and improves delivery in the target organs through surface area modification of the phytogenics.

The curcumin study

In this study, researchers investigated the effects of nano-curcumin nanospheres on growth performance, serum biochemistry, meat quality, and gut health in finishing pigs. Crossbred pigs with an average initial body weight of 73.8 kg were assigned three diets for a 40-day-long study as follows:

• Control diet: no additive

• NC-1 diet: diet supplemented with nano-curcumin (NC) 1.0 mL/kg diet

• NC-2 diet: diet supplemented with nano-curcumin (NC) 2.0 mL/kg diet

Enhancing growth performance

The results of the study showed a positive outcome of dietary nano-curcumin through enhanced growth and feed utilisation (Table 1). Supplementation with nano-curcumin showed significant improvements in average daily gain (ADG) and feed conversion ratio (FCR) which were more pronounced with increasing dosage. The

Item

treatments

growth improvements were attributed to the observed improvements in gut health that are described in subsequent sections of this report.

Meat and carcass quality

Nano-curcumin improved the lightness, redness, and yellowness of both neck muscle and longissimus muscle. The carcass weight and backfat thickness of pigs fed the higher NC supplemented (2.0 ml/kg diet) diet were higher than those of the control and low-concentration NC groups, which endorsed the beneficial effects of nano-curcumin supplementation on weight gain, following the slaughtering of pigs. In addition, the grading percentage (1+) of pork meat also increased with dietary supplementation of NC, which was attributed to the improvement in meat quality in pigs fed nano-curcumin-incorporated diets; higher-class meat grade (1+) and lower-class meat grade (2) was 37% and 20% for the 2.0 ml/kg NC diet compared to the control diet that had 23% and 40%, respectively.

Improving gut health

Histological measures on the intestine, the modulation of microbiota, and intestinal immune response all determine gut health and help establish the health status of pigs.

Histological changes

Gut morphology can serve as an important tool to evaluate the absorption and utilisation of a feed additive in the intestine, which ultimately affects the growth and health status of animals. Abnormalities or changes in GIT especially in the small intestine as the major site for nutrient absorption may influence the overall growth of the animals. In the current study, pigs fed the NC-supplemented diets showed remarkably enhanced villus length, crypt depth, and goblet cell number in the jejunal part of the intestine, which was attributed to the higher surface area of the intestine for absorption of curcumin.

page 14 March/april 2024 Feed Compounder

Dietary

Control (no NC) NC-1 (1.0 ml/ kg) NC-2 (2.0 ml/ kg) Days 1–28 ADG (kg/d) 0.67 0.73 0.78 ADFI (kg/d/pig) 1.9 1.9 1.7 FCR 2.8 2.6 2.1 Days 29–40 ADG (kg/d) 0.83 1.24 1.26 ADFI (kg/d/pig) 2.0 2.2 2.1 FCR 2.4 1.8 1.7 Days 1–40 ADG (kg/d) 0.72 0.88 0.92 ADFI (kg/d/pig) 2.7 2.8 2.5 FCR 2.7 2.2 1.9

Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Table 1 — Dietary nano-curcumin (NC) on performance and feed utilisation in finishing pigs

The number of goblet cells per villus was significantly higher (4% and 5% higher) in pigs fed the NC-1 diet and NC-2 diet, respectively, compared to pigs fed the unsupplemented diet.

Intestinal bacteria content

In this study, researchers reported the effects of dietary supplementation with nano-curcumin on the pathogenic and beneficial bacterial contents in faecal and intestinal samples collected from finishing pigs at the end of the experimental period. The intestinal (jejunum) bacteria, Lactobacillus spp., E. coli and Salmonella spp. were not altered by nano-curcumin, however, the supplementation of both levels of nano-curcumin resulted in lower faecal E. coli and Lactobacillus spp contents than observed with the control diet.

Intestinal immune response

Immunohistochemistry of jejunum sections of the intestine of finishing pigs demonstrated that the expression of the pro-inflammatory cytokine, tumour necrosis factor (TNF- α ) is reduced in the NCsupplemented diet compared to the control diet group. On the other hand, the expression of IgA and CD3 proteins was increased in the jejunal intestine of pigs fed NC diets, which was attributed to the enhancement of gut immunity and intestinal permeability of curcumin in finishing pigs.

As we all know, the GIT of animals is composed of the outermost cellular barrier and the innermost immune functional barrier systems

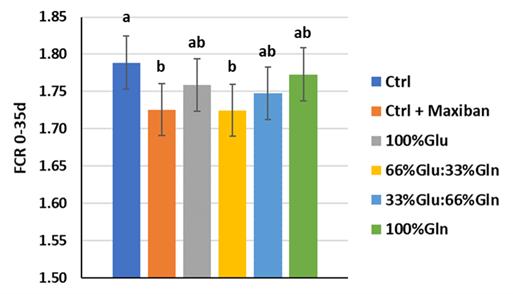

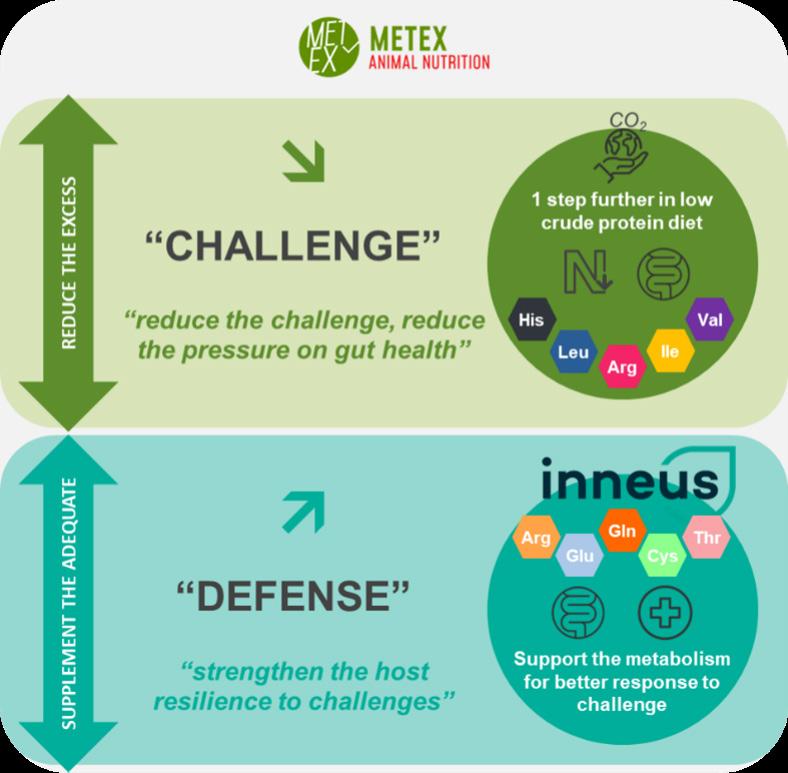

BEYOND NUTRITION, THINK FUNCTION

Inneus® is the first solution highlighting the functionality of amino acids for animal nutrition in European Union.

Inneus® is part of the new Metex Animal Nutrition solutions, dedicated to intestinal health and welfare.

Several scientific trials have shown the ability of Inneus® solutions to enhance piglets or birds’ resilience against various physiological and sanitary challenges.

For the intestinal epithelial cell barrier functions, tight junction proteins such as claudins, occludin and zona occludin-1 are key proteins that create a physiological and immunological barrier in the intestine. A similar study conducted in piglets found that dietary supplementation of curcumin improves intestinal permeability by increasing the mRNA expression of the tight junction proteins occludin, claudin-1 and zonula occludin-1.

Serological indices and ammonia emissions

Serological information of blood is an important tool for ascertaining the health status of animals. In this study, glutamic-pyruvic transaminase, glutamic-oxaloacetic transaminase, triglycerides, and cholesterol levels decreased significantly at the end of the finishing stage in pigs fed nano-curcumin-incorporated diets, which was attributed to the immunomodulation effects of dietary curcumin in improving the health condition of pigs. Another benefit of supplementing nano-curcumin was a reduction in the emission of ammonia; both curcumin levels showed a 65% reduction in faecal ammonia gas emission compared to the unsupplemented diet.

The researchers concluded that dietary supplementation with nano-curcumin can enhance growth performance, immunity, meat quality, and gut health while reducing the emission of ammonia in finishing pigs.

Feed Compounder March/april 2024 page 15 Inneus_multispecies_ADhp_Eng_202403

metexanimalnutrition.com Tailored for animal, inspired by nature

Milk Matters

By Christine Pedersen Senior Dairy Business Consultant

The Dairy Group

christine.pedersen@thedairygroup.co.uk

www.thedairygroup.co.uk

PROSPECTS FOR MILK PRICES AS WE HEAD INTO THE SPRING FLUSH.

The dairy market has been in the doldrums throughout February with Cream, Mild Cheddar and SMP slipping by 1-2% whereas Butter increased by 2%,” says my colleague Nick Holt-Martyn of The Dairy Group. He goes on to say “the excitement with Butter is through EU markets which in the last 2 weeks jumped 3% to suggest March will see an uplift in the UK market.

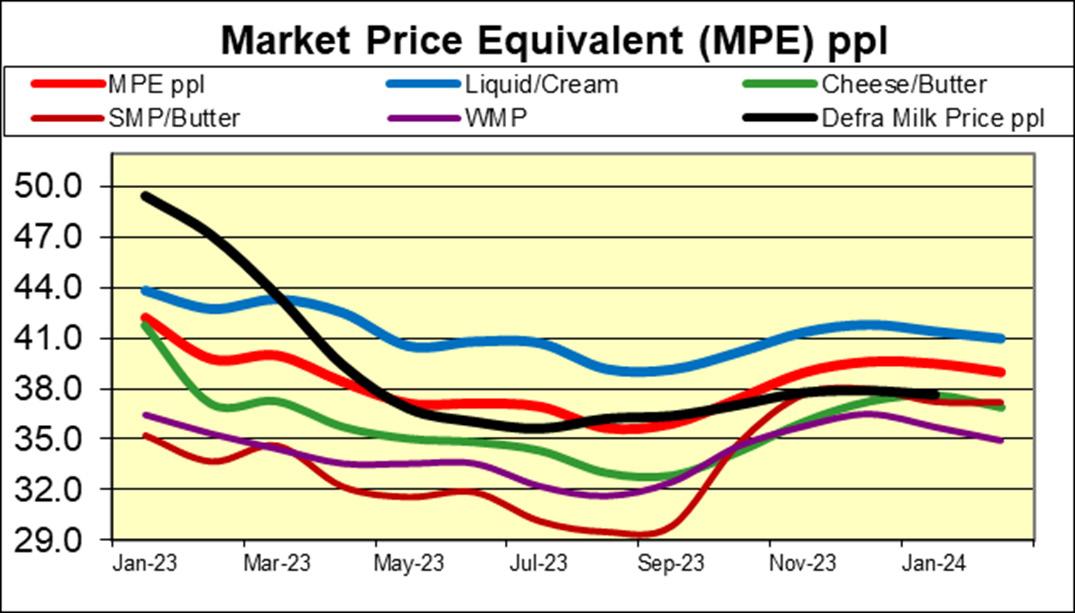

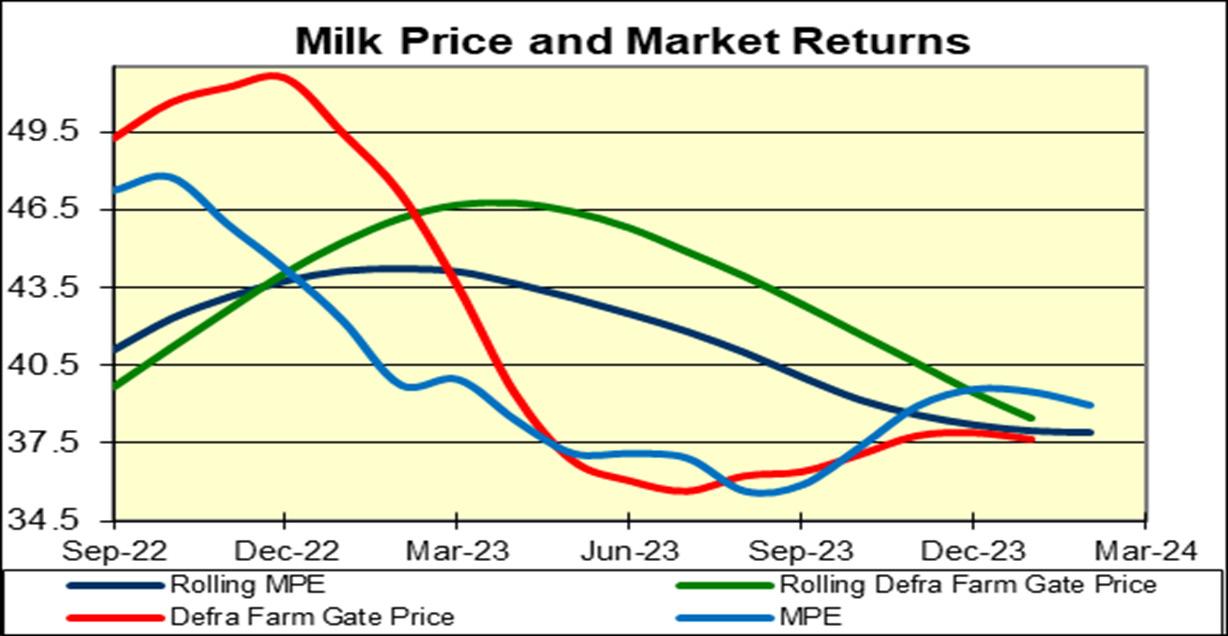

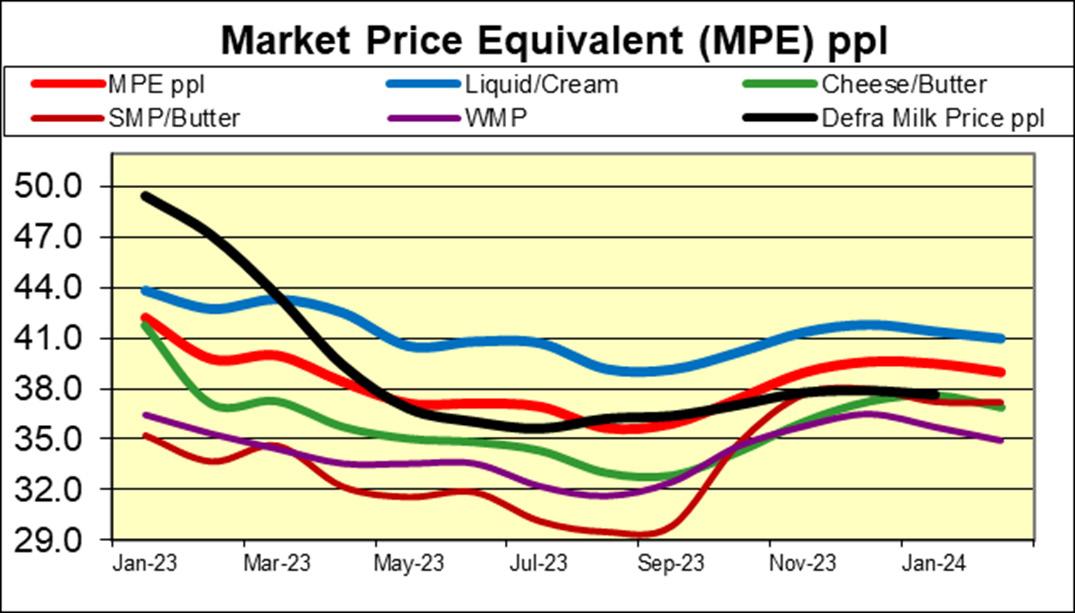

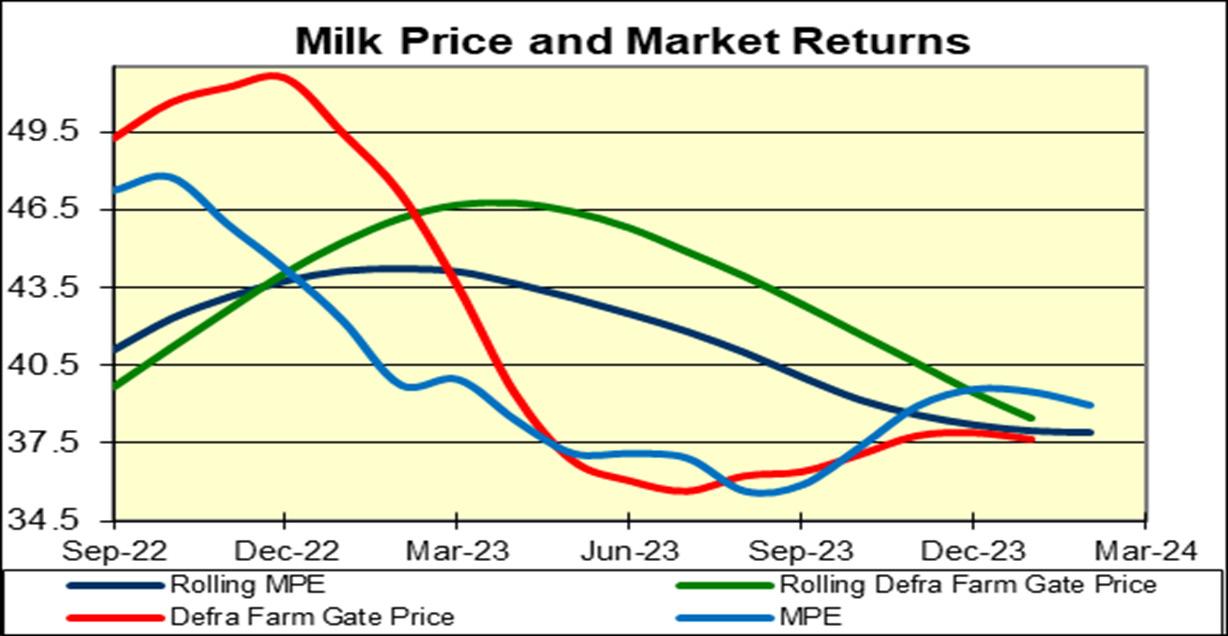

Graph 1 shows the UK market returns through 2023 based on the milk utilisations as reported by Defra. The downward trend that set in through autumn 2022 continued until autumn 2023 when the decline in autumn milk supply caused markets to stage a partial recovery. There has been a slow easing in markets from December 2023 as the Christmas seasonal effects receded.

With Easter in March this year, the recent rally in the butterfat market could just be another seasonal effect. Overall market returns and as a

result farmgate prices have been flat through the late autumn and winter with February continuing that trend.

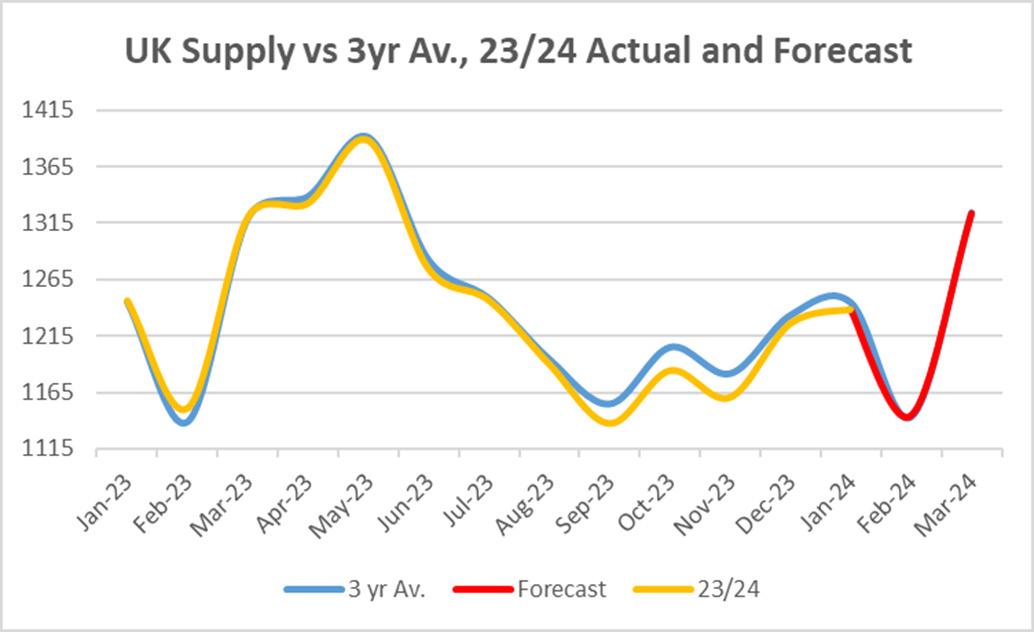

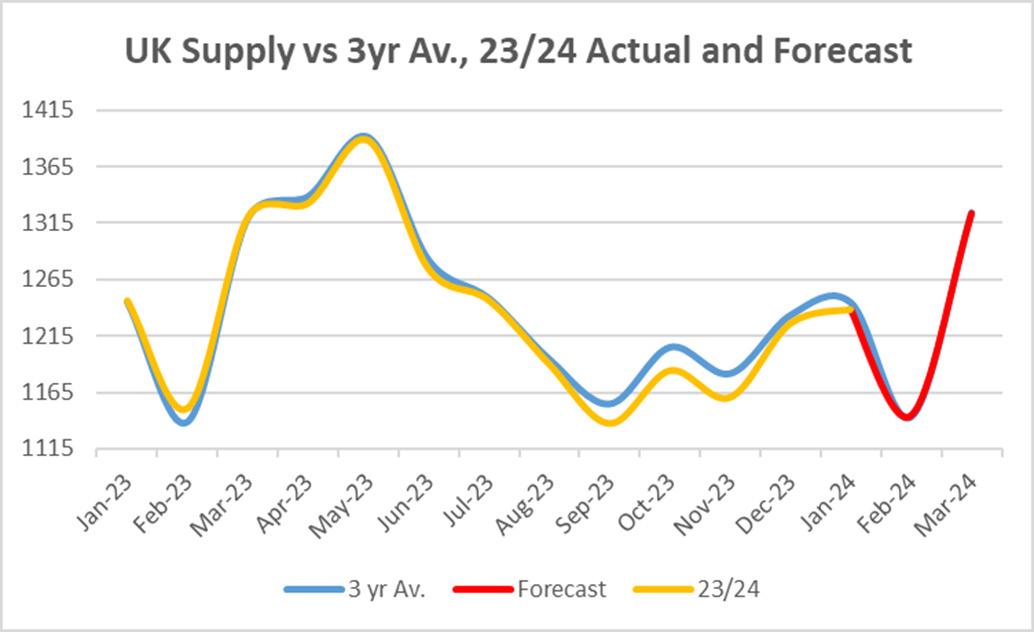

The following graph shows the deviation in supply from the 3 year average through autumn 2023 and the recovery towards the average in 2024. The sluggish start to spring however will dampen expectations of a strong spring flush and help to support markets with a flagging supply. With supply close to the 3 and 5 year average and European economies flirting with recession, thereby holding back demand, there is little sign of a change unless supply drops behind. Spring weather holds the key to spring and summer market returns and farmgate prices.

Milk production in the USA is slipping back while both the EU and New Zealand are volatile, with negative months being followed by positive months. The EU supply position through the spring will be as important as the UK domestic supply in setting the direction of UK pricing. Very often the weather does not discriminate and affects the UK, Ireland and the dairy nations of northern EU to a greater or lesser extent. Globally milk production is still drifting down, but as yet markets are showing little concern about future milk supply. Milk production costs are still high despite weakening feed prices. Oil prices have risen throughout the last 3 months helping to keep inflation above the long term average. Fixed costs have remained much higher than 2 years ago and will keep rising on the back of higher inflation. The rising fixed costs maintain the higher cost of production and the need for higher milk prices for milk production to be profitable. There is the expectation of higher feed and straw prices in 2024/2025 as land is taken out of cereal production due to adverse weather and margins. There is anecdotal evidence of land being diverted into high-value SFI actions instead of cereals, a risk compounded by the

page 16 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Elensis For Feed Industry since 1964 SECURES ENERGY +1.2 LITRES across different context of production A COST-EFFECTIVE WAY TO IMPROVE AND SECURE PERFORMANCES IN CHALLENGING CONDITIONS The most efficient VFA for improving energy efficiency INCREASES PROPIONATE Works throughout the digestive tract to enhance energy efficiency IMPROVES TOTAL STARCH DIGESTIBILITY -5 % of methane for less environmental impact REDUCES METHANE Contact for more information: JAMIE-LEIGH DOUGLAS on +44 7586 323955

Graph 1: Source - The Dairy Group, EU Milk Market Observatory & AHDB

wet weather through the autumn and winter. The combination of weak supply, weak margins and weak markets suggest something is going to change soon or farmers will look seriously at the alternatives.

MARKET PRICES

The Market Price Equivalent (MPE) reduced in February to 39.0ppl (-1.3%), up 3.3 ppl (9.3%) in the last 6 months and down 0.8ppl (-2.0%) year on year. Liquid retail prices slipped to 65.0ppl, down 12.0% on the year and 1.4% in the last 6 months. UK supply reduced by 0.6% in January and is forecast to be down 0.8% in February (leap year adjusted). EU weekly commodity prices rose in February with Butter up (3.7%), SMP sectors rose to 6.0ppl from Liquid to WMP despite the weak market tone.

up (0.8%) and Whey (1.2%), even Cheddar managed to rise up 1.1%. The UK commodities were mixed with only Butter up 2.1% and the rest falling 1-2% with Mild Cheddar dropping 2.0%. The range across the

Farm Gate Price was provisionally up to 37.9ppl (+0.3%) for December but reduced in January to 37.7ppl (-0.6%). The farm gate price continues to track the MPE which has eased back from 39.6ppl in November to 39.0 in January. UK Milk quality seasonally eased back from the record levels in November and December to 4.32% Butterfat and 3.45% Protein in January. Our latest milk price forecast, based on current prices and the latest market returns, suggests the Defra farm gate price will rise to 38.7ppl in February, 39.0ppl in March and at 39.0ppl in April.

Landscape_124x178.qxp_Layout 1 21/12/2021 14:33 Page 1

Production in December was confirmed at 1226 M litres (-0.2%) and January was provisionally 1239 M litres (-0.6%). Our forecast for February is 1145 M litres (-0.8%) (1186 M litres due to the leap year) and March 1323 M litres (0.1%). The forecast for 2023/24 stays at 14.85 B litres (-0.4%). The weather changed its mind and reverted to record breaking wet conditions and yet again a drier forecast is now in place for March (we hope!).

THE UK flavour manufacturer supporting British & Irish agriculture

Unlock the possibilities

To find out more about our unique Tastetite and other feed enhancement technologies visit our website at www.inroadsintl.com email info@inroadsintl.co.uk or call us on +44 (0)1939 236 555.

Feed Compounder March/april 2024 page 17

10461_Inroads_Feed Compounder Ad_Half

Ten Ways … to avoid inertia

By Robert Ashton

I’ve been a charity trustee for more than 30 years, and the fact that only in exceptional circumstances can you serve more than two, three year terms is good. It stops trustee Boards getting stale and bringing in new people should mean that long held assumptions can be challenged and new ideas tried.

But it’s still far too easy for trustees to see themselves as custodians and simply mark time, before passing the baton on to the next generation of trustees, who may be equally reluctant to innovate or encourage change. Let me give you an example.

One charity of which I’m a trustee sits on an endowed fund of around £800,000 from which it has become almost impossible to make grants. The money was left, for the support of impoverished Quakers, by a Quaker brewer in 1740, when the world was a very different place.

I have recently become the point of contact for grant applicants, and with only around 800 potential beneficiaries, I’m not likely to be kept busy processing applications.

For centuries, trustees have diligently managed the investment, but none, until now has explored negotiating widening the scope of the trust with the charity commission, so that more grants can be made. I’ll let you know if we succeed, but what is important is to make an effort. This is why I am reflecting on the importance of avoiding inertia. Here are ten things you might do to avoid failing into the inertia trap.

1. Believe that you can – Let’s be honest. The fear of failure is one of the main reasons we chose to sit on the fence rather than try to do something different. Yes, doing nothing is safe, but it’s also rather boring. Try being bold and be pleasantly surprised by what you can actually do.

2. Don’t take no for an answer – I’m afraid that the more people tell me something is impossible, the more determined I become to prove them wrong. Oddly, when someone says something cannot be done, it usually means that it can, but only if approached differently. Go on, give it a try!

3. Accept less than perfect – I’ve always been haunted by the phrase ‘fit for purpose’, which essentially means just good enough. Too often over the years I’ve strived for perfection, wasting effort in making things better than they need to be. Settle for good enough and you’ll get more done, in less time.

4. Sell the alternative – In my years of consultancy, I was often challenged to achieve something that had defeated the in-house team. It’s not easy, or wise to tell someone they’ve been going about something the wrong way, so always sell the idea that an alternative approach might just work. And please don’t gloat

if your solution does work. Old challenges are always more imaginatively viewed through a fresh pair of eyes.

5. Get off the sofa – personal inertia can inhibit us from tackling organisational inertia. In my experience, doing something is almost always better than doing nothing, so don’t despair and languish at your desk or in front of the TV. Get out and at least try to make your world a better place!

6. Practice change – Doing things differently gets easier the more you try it, and the more you discover that it can actually work. In fact I’d go so far as to say that seeing and doing things differently can become a way of life – a vocation even. You might even develop a reputation for being someone who can!

7. Step into the unknown – Of course you have to be aware of the risk of failure and the very real danger of making things worse, in your attempt to make them better. It’s always good to reflect on what could go wrong, before you embark on an attempt to make them better. Make sure too, that your motives are sound and can withstand critical scrutiny. That will help you if things don’t go as planned. Stepping into the unknown is good, providing you are prepared.

8. Look for examples you can learn from – There really is little new in the world, and much can be gained from taking what works in one context, then applying it in another. One of my favourite examples is how 19th century Suffolk engineer Richard Garrett got talking with American gunsmith Samuel Colt at the 1851 Great Exhibition. When he got home he built a production line, building steam engines in a similar way to how Colt made pistols. This delivered a fivefold increase in output from his factory.

9. Break habits and routines – How often have your heard someone say; ‘but we always do it this way’? Times change, technology changes, yet too often, people and practices don’t evolve to keep up. Make a habit of breaking habits; in fact make a habit of breaking habits!

10. Lead by example – All the most effective managers lead by example. Show people that you’re not afraid to take risks and not prepared to give up too easily. Creating a team culture where failures are considered learning opportunities rather than prompting a public telling off will also help.

While I started this month’s column writing about how a 280 year old endowed fund needed refocusing to remain useful, I’ll end by reflecting on how future generations might view the decisions we make today. It is perhaps a quirk of human nature that while we’re comfortable thinking about the time before we were born, thinking about how the world will continue to evolve after we have died can make us feel uncomfortable.

You only have to think back to your childhood to realise how much attitudes, behaviours and technology have changed. My work career for example began before computers were common or mobile phones invented. There’s little doubt that the next 40 years will see things change more than they did in the last 40. Let’s think and plan more adventurously.

page 18 March/april 2024 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

At Condex you’re not just buying a pellet mill: Peace of mind: No bearings, seals or service down time … Guaranteed for 5 YEARS for UK Single V-Belt drive; High inertia, smooth and efficient No oil leaks into feed or on press floor Designed, fabricated and built in Italy Support: Design, installation and project management services UK based stock and engineers 2-3 day Die and roll refurbishment Dies held in stock on request Experience: Sales technicians who understand the day-to-day requirements of a busy mill >50 years manufacturing experience at La Meccanica Condex Ltd - established in 1980 www.lameccanica.it …… Contact us to discuss your requirements WHITE CROSS, LANCASTER, LA1 4XQ Tel: 01524 61601 Email: info@condex.co.uk Web: www.condex.co.uk 01829 741119 admin@croston-engineering co uk Supporting manufacturers since 1976 with solutions in bulk handling, storage, and pneumatic and mechanical conveying, we have a wealth of experience for you to rely upon. croston-engineering.co.uk Design and Implementation New system solutions Modifications to systems Software improvements Minor ingredient additions Water dosing solutions Ongoing Support Critical Spares and Parts Emergency repairs DSEAR Reports Site surveys Fault finding Servicing and Maintainance Equipment Servicing Silo and pipeline cleaning Infestation works Calibration and certification Continuity and Earth testing

Green Pages Feed Trade Topics from the Island of Ireland

OPPORTUNITY BECKONS FOR IRELAND’S MALTING BARLEY SECTOR

Diageo and Boortmalt are both confirming their growing commitment to Ireland’s malting barley sector.

The backdrop for these developments was the 2024 Diageo / Boortmalt Malting Barley Awards.

Peter Nallen is chief operations & agriculture officer at Boortmalt. He confirmed that further investment is planned for the company’s malting facility at Athy in Co Kildare, adding:

“The new development programme will further enhance the capacity of Athy up to 200,000t per annum.

“When completed this will constitute a doubling of the site’s capacity, relative to 2010 when Boortmalt took control of the site.

“Our two passions for the business are innovation and sustainability.

“With this in mind, I can also confirm that our expansion for Athy will be carbon neutral.

“This is being achieved with the development of some very innovative technologies, focussing on the use of heat pumps. All of these have been developed in-house and are now patented.

According to Nallen, the spring barley season in 2023 was extremely challenging.

He cited the major split in the planting season with the months that followed throwing up major challenges with regard to crop yields and quality.

“But despite all of these problems, growers and the rest of the supply chain still managed to do what is needed.”

Nallen also referenced Boortmalt’s ongoing commitment to a transparent pricing model for malting barley growers.

He said: “We believe the current pricing system to be very fair. It is very transparent, giving farmers direct control over the pricing of the grain that they produce.”

Meanwhile, Diageo is confirming that its commitment to develop a new €200M brewery at Newbridge in Co Kildare remains a priority.

Aidan Crowe, the operations director at Saint James’ Gate Brewery, also spoke at the Malting Barley Awards ceremony. He confirmed that Diageo remains committed to reducing the carbon footprint of its entire operation in every sense.

According to Crowe, the adoption of regenerative agricultural practices by farmers will be a key part of this strategy moving forward.

He added: “Our farm trials in this area continue apace. It is our intention to make the results of this work widely available.”

Reflecting on the quality of the barley produced courtesy of the 2023 harvest, Crowe confirmed its total suitability from a brewing perspective.

“This is despite all the challenges that confronted growers last year.

We are currently using a 50:50 mix of 2022 and 2023 barley. And, so far, everything has gone according to plan.

Last year 1.3 billion pints of Guinness were brewed at St James’s Gate in Dublin.

FANE VALLEY TO PARTNER WITH NUFFIELD FARMING SCHOLARSHIPS

Fane Valley Co-op will partner with the Nuffield Farming Scholarships Trust in delivering, possibly, one of the most significant agricultural events taking place on the island of Ireland this year.

Belfast will host the 2024 Nuffield Farming Conference over three days between Tuesday 19 November and Thursday 21 November.

The event, which will include presentations from around 30 Nuffield Scholars, looks set to attract 400 plus delegates from across the UK and Ireland.

Fane Valley Co-op will partner with the Nuffield Farming Scholarships Trust in delivering the 2024 Nuffield Farming Conference. Belfast will host the event in November.

Adding to the significance of the conference coming to Belfast is the fact that Northern Ireland has been used to pilot Nuffield’s NextGen Scholarship programme.

This is an exciting initiative that will provide two young people from Northern Ireland, aged between 18 and 24 years of age, with a unique opportunity to study the UK’s dairy industry.

Full details of how the scholars progressed will also be profiled at the November conference.

Speaking at the launch of the sponsorship agreement, Fane Valley Group Chief Executive, Trevor Lockhart MBE, commented: “Fane Valley is delighted to partner with the Nuffield Farming Scholarships Trust in support of the organisation’s annual national Nuffield Farming Conference, to be held in Belfast later this year.

page 20 March/april 2024 Feed Compounder

“As an agricultural cooperative, we embrace collaboration, innovation, and the advancement of agriculture, and we believe the lifechanging and life-shaping scholarships available through Nuffieldare making a very positive contribution to the development of the next generation in our sector.”

He continued: “For over seventy years Nuffield has been committed to the education and up-skilling of Scholars, enabling them to study farming systems, techniques and new technologies across the world and bring this knowledge back home, to their respective roles.

Fane Valley applauds those passionate individuals seeking to develop, both personally and professionally, through their scholarships.

“Fane Valley is privileged to promote and support the work of Nuffield and their efforts in advancing agriculture.”

Wyn Owen, chair of the Nuffield Farming Scholarships Trust, has welcomed Fane Valley’s substantial commitment to the Belfast conference.

He commented: “Belfast is a fitting location for the 2024 Nuffield Farming Conference, and we’re delighted to be coming back to such an important region to UK agriculture.

“We are proud to partner with Fane Valley, an iconic name in Northern Ireland, and will deliver a conference to remember with their support.”

Tom Rawson, vice-chair of the Nuffield Farming Scholarships Trust, added: “Nuffield Farming’s return to Belfast is especially distinctive after launching the pilot for our Next-Gen Scholarship programme to the region’s dairy sector.”

He concluded: “Our first Next-Gen Scholars will share their experiences from their dairy sector study tour at Belfast 2024, and we hope the programme will go on to develop young talent in the industry nationwide for many years to come.”

Fane Valley Co-operative Society is a progressive agricultural and food processing business with interests in animal feed manufacturing, agricultural supplies, livestock identification and the provision of agronomy & forage services, porridge oats & breakfast cereals, the production of beef drippings, the processing of edible offals and fully integrated duck processing and production.

The business operates across multiple locations in both the UK and Ireland.

Formed in 1903 Fane Valley remains 100% farmer owned. The business, which employs almost 1,000 people, continues to develop through a strategy of organic growth and targeted acquisitions.

FORTRESS FOOD PROGRAMME CONTINUES TO DELIVER FOR IRELAND’S COMPOUND FEED SECTOR

Robin Irvine is the director of the Northern Ireland Food Fortress programme, recognised internationally as a world-leading risk management and feed quality assurance scheme.

The initiative has a footprint that now encompasses the animal feed compounding sector, operating across the island of Ireland.

Irvine spoke at a recent mycotoxins seminar hosted by Alltech, Queen’s University Belfast and the Agri-Food and Biosciences Institute.

Courtesy of his presentation, he reminded delegates of the crises created by the dioxin in pigmeat crisis of 2008 and the subsequent challenges created by aflatoxin residues detected in dairy products, produced in Ireland.

Both issues were the result of mycotoxin-contaminated animal feed.

The scale of the dioxin crisis was more than significant. It resulted in 30,000 tonnes of pig meat product being recalled and destroyed.

Additionally, over 170,000 pigs and 5,700 cattle from farms that received contaminated product were culled on a precautionary basis.

The contamination was eventually detected by the national monitoring programme leading to multiple farm closures, major animal welfare issues and a global recall of Irish pork, resulting in the loss of an estimated 1,800 jobs.

The incident was estimated to have cost the Irish economy over €120,000,000.

Robin Irvine commented: “The required lessons were quickly learnt. The end result was a decision taken by feed compounders in Northern Ireland, committing the industry to a comprehensive system of checks and state-of-the-art analysis, where all raw materials and compound feeds are concerned.

“This has evolved into the Food Fortress system that we have in place today. It has been fully operational for the past decade.

“Over the years, the scheme has evolved to include raw material importers and feed compounders in the Republic of Ireland.

“All are contributing to a risk management system, that is recognised as best in class the world over.”

The Food Fortress representative confirmed that Northern Ireland’s agri food sector generates an annual turnover in the region of £6 billion.

Feed Compounder March/april 2024 page 21 Alltech.com/ireland AlltechNaturally @Alltech Sarney | Summerhill Road | Dunboyne | Co. Meath Choose the proven leader for all of your feed additive needs

“Approximately 75% of this output is exported. Two thirds of this produce is destined for Great Britain with one third exported to the European Union and beyond.

“All of this represents a major contribution to Northern Ireland’s economy, both in terms of the monies generated and the jobs created.”

According to Robin Irvine, 72 feed compounders in Northern Ireland and seven raw material importers are fully aligned to Food Fortress.

He further explained.

“The comprehensive analysis of raw materials and compound feeds takes place on a regular and ongoing basis.

“Key to making this happen is the

“Taking this approach has allowed feed compounders to manage the risk, where mycotoxins in rations are concerned. “

Looking ahead, Robin Irvine also predicted the introduction of tougher regulatory standards, where mycotoxin contamination levels in compound feeds are concerned.

He concluded: “However, the very real, on-farm, challenge caused by mycotoxins when present at well below guideline limits must be actively addressed by the feed industry.”

INCOME STABILISATION SCHEME TO BE PROPOSED FOR IRISH TILLAGE FARMERS

An income stabilisation scheme will underpin the final proposals put forward by Ireland’s Food Vision Tillage Group.

Farm Minister Charlie McConalogue has already indicated his potential support for such a measure and has asked for full details of a potential scheme to be fleshed out over the coming weeks.

The Tillage Vision Group is chaired by former Irish Farmers’ Journal editor Matt Dempsey.

He has confirmed that the proposed income stabilisation scheme would mirror similar support measures currently operating in the United States.

Dempsey explained: “The full detail has yet to be worked through. Our plan is to publish the final Vision Group report over the coming weeks.”

The Tillage Vision Group chair has specifically highlighted the extremely low carbon footprint of Ireland’s arable sector.

Current figures indicate that greenhouse gas emission values linked to crop production in Ireland are 15% of the rate for dairy farms and 25% of that for beef farms.

“On that basis alone, tillage farmers would be justified in receiving an area payment of between €75 and €100/ac,” said Dempsey.

The Vision Group representative also confirmed that the Irish government will commit to support schemes that underpin a sustained tillage area of 400,000ha.

Matt Dempsey again:

“The money is there to help make this happen.”

Other proposals that can be expected from the Tillage Vision Group will include calls for the establishment of an oilseed rape crushing plant in Ireland and the provision of capital support measures to facilitate the greater use of ‘home grown’ beans in compound feed rations.”

IN MY OPINION...............RICHARD HALLERON

Crop insurance has to be looked at as a safety net option for tillage.

Irish tillage farmers must look at the feasibility of crop insurance as a future safety net option for the sector.

They can’t continue to go cap in hand to the government, every time we get a poor growing season.

The reality is that crop insurance works in countries like the United States. So there is no reason why a similar system cannot work in this part of the world.

Ireland is not the only country to experience extremes of weather. Here excessive rain is, invariably, the issue. In the rest of the world, drought can wreak untold damage on growing crops.

The question then becomes the following: who pays?

The obvious vehicle to promote a debate on crop insurance is the Tillage Vision Group.Its membership can both endorse the principle involved and come up with proposals on how best to pay for it all.

Obvious contributors in this regard include the European Union and the Irish government.

But should Irish growers also be included in the funding mix?

I think so, on the basis that a bespoke scheme for Irish tillage can be delivered.

The proposed measure would add to the support schemes already in place through the Common Agricultural Policy. And it would only kick in when specific crop failures can be identified.

Everyone agrees that the Irish tillage sector must be expanded. This principle is already enshrined within the government’s response to climate change.

But this will only happen if tillage farmers have certainty that they can survive the ebbs and flows of the Irish weather.

The events of the last 24 months make this point perfectly. Harvest 2022 was one of the best on record. Growers secured excellent yields and comparable prices. Fast forward 12 months and the polar opposite scenario was unfolding: disappointing yields and extremely weak farm gate prices.

In my opinion, a crop insurance scheme would take the extremes out of the tillage equation, giving growers an opportunity to plan for the future with a degree of certainty.

So much for the future: what about the here and now?

There has been a general welcome for the €7M tillage support scheme, confirmed by Ireland’s farm minister, Charlie McConalogue, in the wake of the disastrous 2023 harvest. And rightly so!

The Co Donegal man gets a fair amount of stick from any number of agri-stakeholder groups on an almost daily basis. So it’s only right that he should get the plaudit when that extra mile is secured on behalf of Irish farmers.

page 22 March/april 2024 Feed Compounder

CFE and CPM Seminar

Highlighting Advancements in Pellet Milling Technologies, Operations and Industry Insights

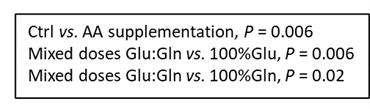

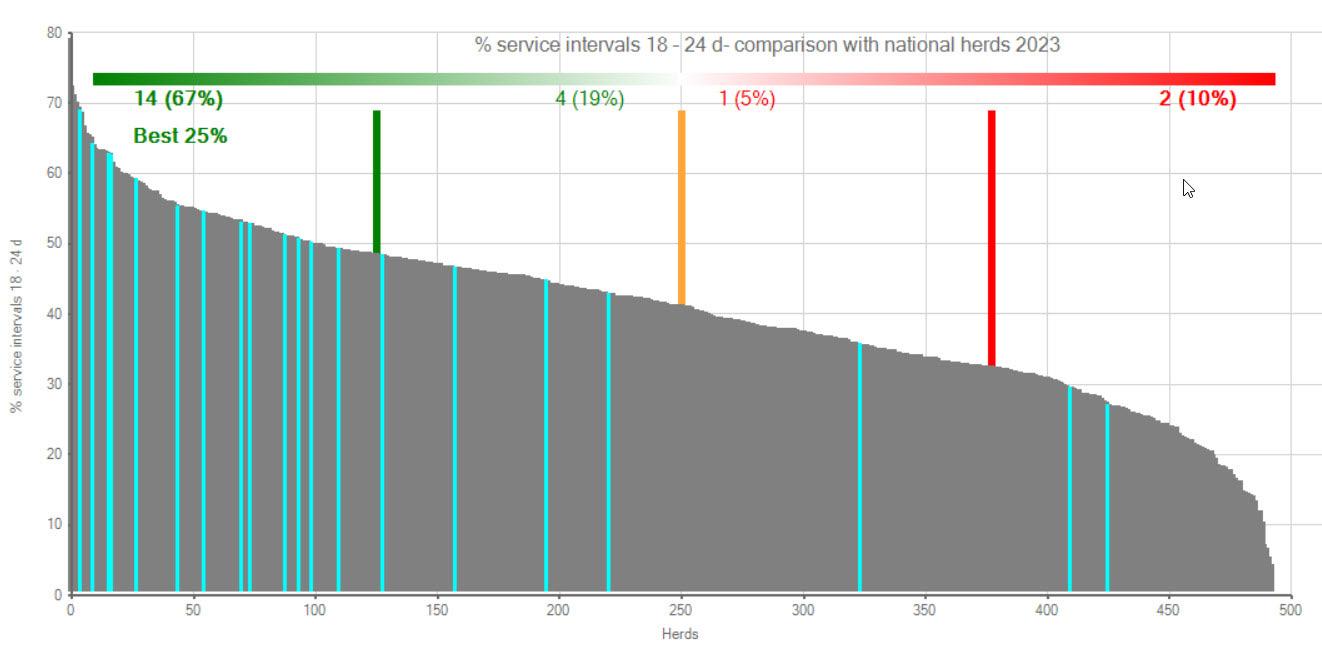

On Wednesday, 24th and Thursday, 25th April, CFE Group and CPM will hold an industry Seminar at the Mercure Hotel in Haydock, U.K.